#are funded by a specific municipality or county

Explore tagged Tumblr posts

Text

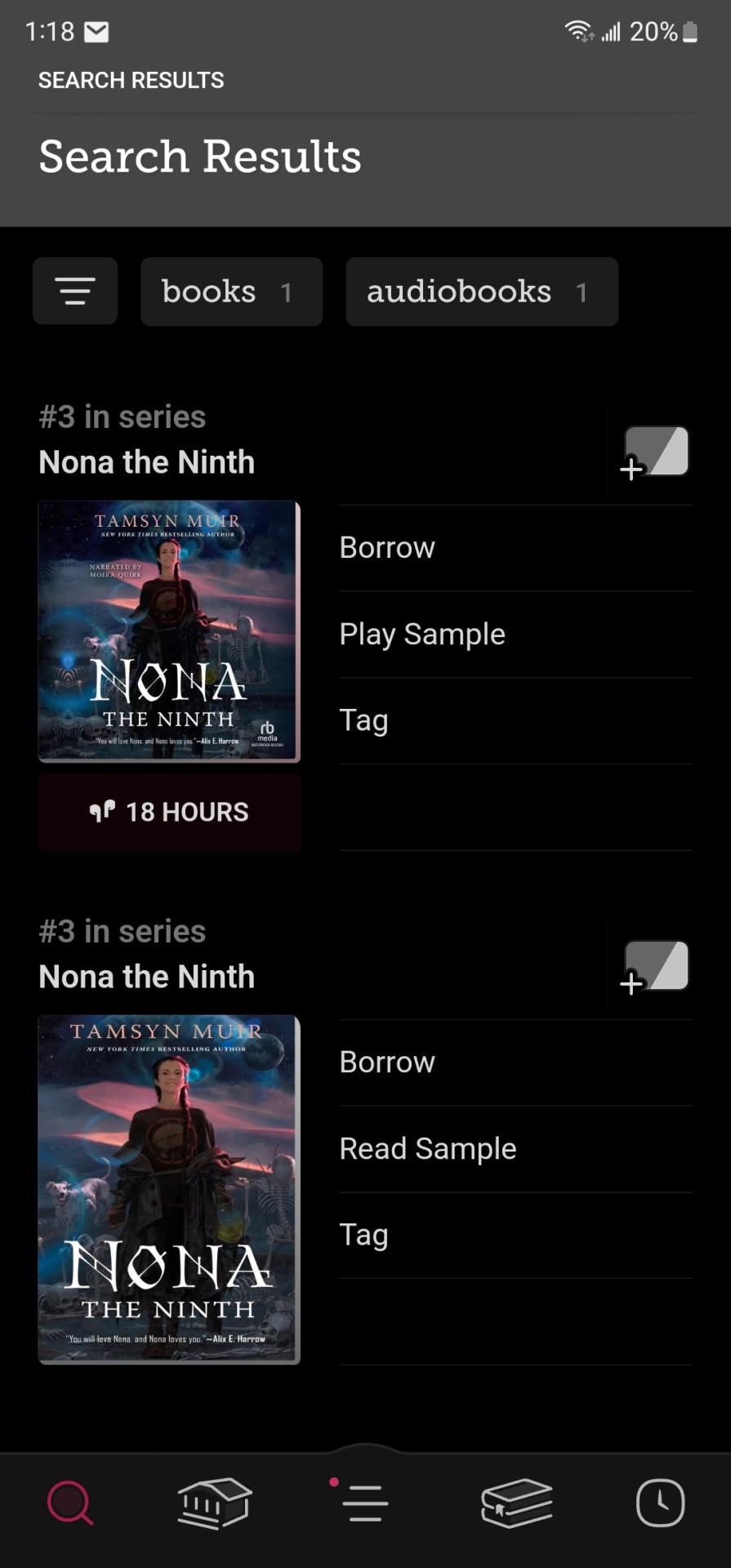

Libby also has a feature called Notify Me--if you search for a book and Libby can find it in their database but it's not available to borrow from your library, hit Notify Me. Not only will you be notified if the book becomes available, but your library will be notified that there is A Reader who is looking for this book, so that they can buy it if that's possible for them--without you having to make a direct request!

libby app guide

aka how to support libraries and get books and audiobooks for free without pirating them.

disclaimer: this is so easy. it is also really fun.

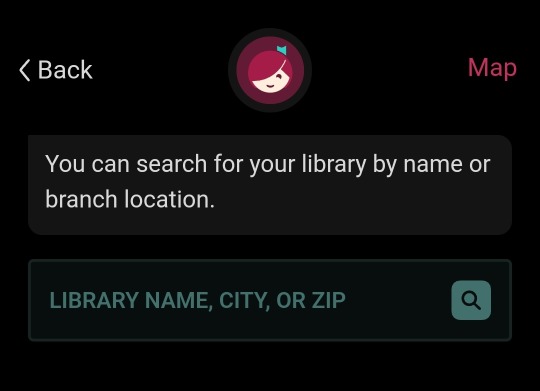

one: download the libby app. you'll open it and it'll ask you to add a library.

two: get a library card. don't have one? good news, it's really easy and i am saying this as the laziest person on earth. it varies what you need to have to get a card library to library but almost all libraries will let you get one online. i have a card for my home town and for the town i moved to. sometimes you only need an email address, sometimes you need an area code. to get mine it took me about 5 minutes of lying on the couch aimlessly tapping on my phone. follow your heart. you can get cards for places you don't currently live. i will leave the ethics of that up to you but it's probably better than pirating and either way you're creating traffic for libraries which is what they need to exist.

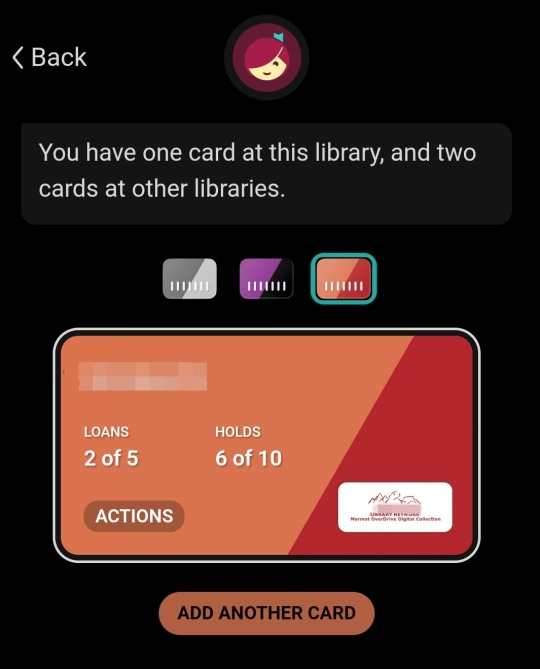

three: add your card. you can add multiple cards for multiple libraries. you need the number. i have never had libby fail to recognize a valid account.

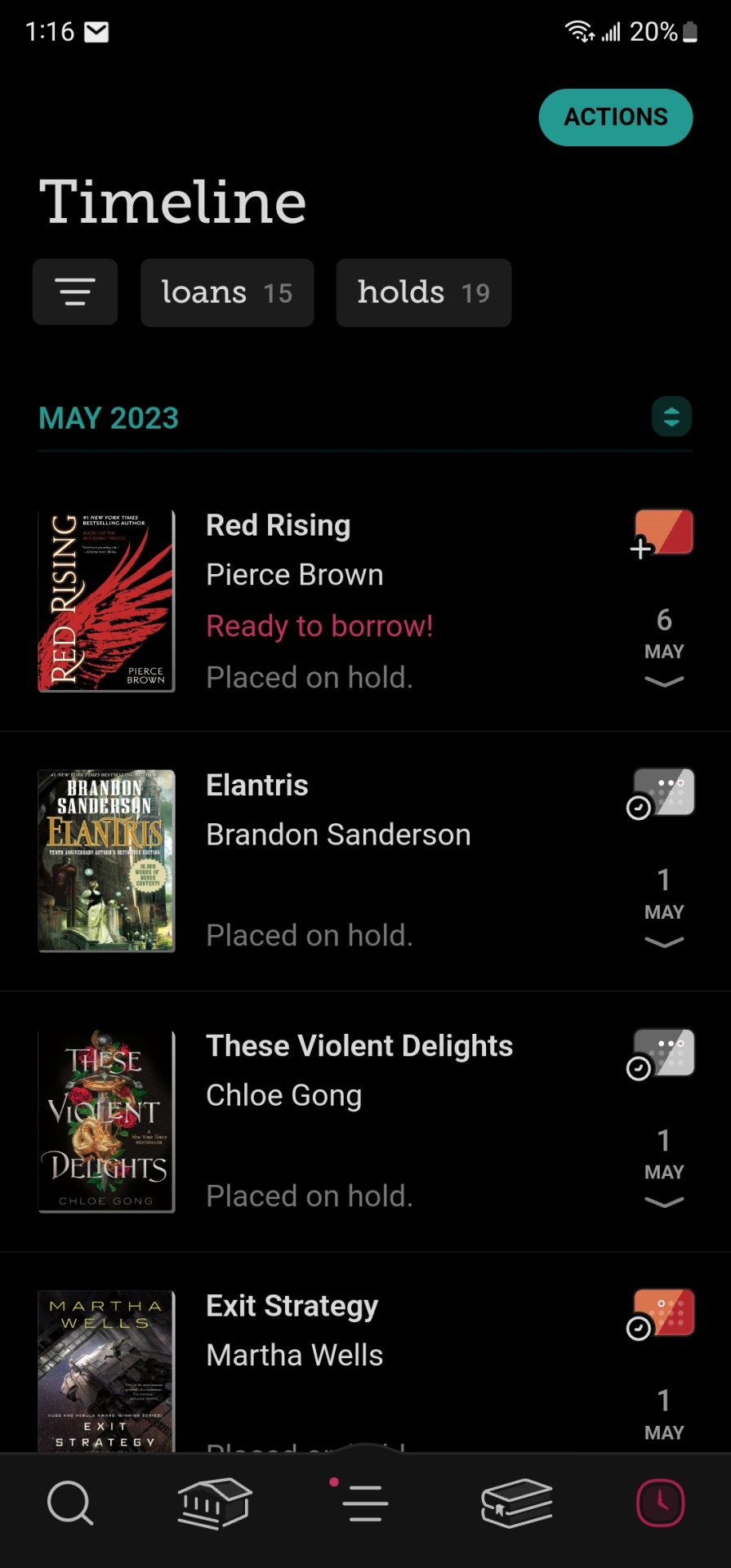

four: search for your book! some will be ready to borrow right away. others have an estimated delivery time. libby will always pick the one that's the fastest from the options available at all the libraries you have cards at. you can borrow audiobooks and ebooks. libby will send you a notification when you're book is ready to borrow. in my experience it's a lot faster than the estimate. if you aren't ready to read it, you can ask to be skipped over in line so you keep your place at the front but let someone else read it first.

five: read it!!! kindle is the most common way to do this. you can go to your loan and click read with kindle. it'll download it to all your devices where you have kindle. as long as you have the loan, it'll act like your book. when the loan ends, if the device is connected to the internet, it'll automatically be returned. it will save all your notes and highlights. (if you disconnect your device from the internet, it won't return the book. weewoo.)

anyway in case anyone else has been wondering about it, i really love it. is a nice surprise to see what i'm going to get and it's cut my reading costs down big time! it's also neat because i get to synch my books between devices unlike downloading books through cough cough other means. good luck!

#libby#ebooks#public libraries#library solutions#don't know what libraries op is getting cards from that let you get a card without verifying a local address#but hey if that's their policy that's their policy i guess#most of the ones i'm familiar with#are funded by a specific municipality or county#and need to verify that you actually live in that municipality or county#so you're gonna need ID with a qualifying address#or a lease or a utility bill or something#libby is great though#don't pirate books#get a librarian to buy them for you

27K notes

·

View notes

Text

From Idea to Entity: Mastering the Art of Company Incorporation

Turning a brilliant idea into a thriving business involves a series of carefully planned steps, with company incorporation being a pivotal moment in this journey. Incorporating a company isn't just a formality—it's a fundamental process that can affect everything from legal protection to tax implications. This article explores the essentials of company incorporation, guiding you from the initial idea stage to becoming a fully-fledged legal entity.

1.Company Incorporation

Incorporation is the process of legally forming a corporation or company. It transforms your business idea from a concept into a legally recognized entity that can operate independently from its owners. This process provides a distinct legal identity, granting business rights and responsibilities like an individual.

2.Why Incorporate?

Incorporation offers several advantages:

-Limited Liability: Shareholders are typically not personally liable for the company's debts and liabilities.

-Credibility: Being a registered entity can enhance your business's credibility with clients, suppliers, and investors.

-Access to Capital: Corporations can issue shares to raise funds, potentially attracting more investors.

-Perpetual Existence: Unlike sole proprietorships or partnerships, corporations can continue indefinitely, beyond the life of their founders.

3.Choosing the Right Structure

Before incorporating, you must decide which type of business structure suits your goals:

-Sole Proprietorship: Simplest form, owned by one person, but does not provide personal liability protection.

-Partnership: Involves two or more people, sharing profits and liabilities, with limited protection against personal liability.

-Limited Liability Company (LLC): Offers flexibility in management and tax benefits, protecting personal assets.

-Corporation: More complex structure providing strong liability protection and potentially favorable tax treatment.

4.Naming Your Company

Choosing a name for your company is more than just a branding decision. The name must be unique and comply with state or national regulations. It should also reflect your business's values and services. Here’s how to ensure your name is appropriate:

-Check Availability: Conduct a name search to ensure the name is not already in use.

-Compliance: Ensure the name meets legal requirements and does not infringe on trademarks.

-Domain Name: Consider securing a matching domain name for your website.

5.Filing the Incorporation Documents

The core of incorporation involves filing specific documents with the appropriate government authorities:

-Articles of Incorporation: This document includes basic information about your company, such as its name, purpose, and the number of shares it can issue.

-Bylaws: Outline the internal rules and procedures for managing the company.

-Registered Agent: Designate an individual or service to receive legal documents on behalf of the company.

6.Obtaining Necessary Licenses and Permits

Depending on your industry and location, you may need various licenses and permits to operate legally. These can include:

-Business License: Required for operating a business within a municipality or county.

-Federal Employer Identification Number (EIN): Needed for tax purposes and hiring employees.

-State-specific Licenses: Vary depending on the state and the type of business.

7.Organizing Your Initial Board of Directors

Incorporation requires establishing a board of directors who will oversee the company's major decisions and governance. This board is responsible for appointing officers and ensuring the company adheres to legal and regulatory standards. Board members are usually elected by the shareholders and should possess diverse skills and experience to guide the company effectively.

8.Setting Up Corporate Records

Once incorporated, it’s crucial to maintain accurate and up-to-date corporate records:

-Minutes of Meetings: Document the decisions made at board meetings and shareholder meetings.

-Shareholder Records: Track ownership of shares and transactions.

-Financial Records: Keep detailed financial records for compliance and management purposes.

9.Ongoing Obligations

Incorporated businesses have ongoing legal and administrative obligations:

-Annual Reports: Most jurisdictions require corporations to file annual reports detailing their business activities and financial status.

-Tax Filings: Corporations must file tax returns and may be subject to various local, state, and federal taxes.

-Compliance: Adhere to industry regulations, labor laws, and corporate governance standards.

10.Seeking Professional Guidance

The incorporation process can be complex. It’s often wise to consult with professionals:

-Legal Advisors: They can assist with drafting and filing documents and ensuring compliance with legal requirements.

-Accountants: Offer guidance on tax implications and financial record-keeping.

-Business Consultants: Provide strategic advice on structuring and operational matters.

Conclusion

Incorporating your company is a significant milestone that transitions your idea into a recognized, functioning entity. It’s a process that demands careful planning, compliance with legal requirements, and ongoing management and also help in company registration. By each step—from choosing the right structure to meeting ongoing obligations—you set a solid foundation for your business’s success and growth.

Mastering the art of incorporation not only protects your personal assets but also positions your business to attract investment, build credibility, and operate with greater efficiency. As you embark on this journey, remember that seeking professional advice can streamline the process and ensure you meet all legal requirements.

0 notes

Text

North Olmsted Old Town Hall

5186 Dover Center Rd.

North Olmsted , OH

The first mayor of North Olmstead, Ohio, George S. Willet, was elected December 8, 1908. No municipal buildings existed, instead the council met at the mayor’s home. On August 19, 1912 legislation was approved to purchase land on Dover Center Road from Dr. F.A. Rice on which to build a town hall. Successive legislation approved expenditures to design, construct and furnish the building, which was ready for occupancy by the end of 1914. Since that time when Town Hall was furnished, it served as the seat of municipal government for a small village that peaked in population of approximately 34,500 around 1980. All legislation necessary to operate a city government was enacted here. As additional office space was needed, other buildings were either purchased or built, but the original offices still remain, only slightly changed.

When Town Hall was built it was used for the entire village government operation. There was a Council Chambers, Mayor and Clerk’s office, vault, jail and general office which included the Justice of the Peace, Street Commissioner and Board of Education. The main floor of Town hall served as a community center. School plays, Grange meetings, church choir performances, graduations and dances were held in the auditorium. The small elevated stage was used for dramatic productions. Residents remember playing basketball in the auditorium in the 1930’s.

Architecturally, the building is an early twentieth century version of Colonial Revival style. The structure is reminiscent of colonial Virginia’s eighteenth century county town halls: simple, red brickwork, restrained wood details at doors, cornices, trim and proportioned fenestration, one main large room on the first floor and a pediment porch at the entry façade capped with a cupola which signifies its public purpose.

A 2023 Community Project Funding request for $1.4 million is tied to the rehabilitation of the historic Old Town Hall building. The building was listed the National Register of Historic Places on November 25, 1980, so there is a challenge to restore, because they have to be very specific in how they are attempting to rehabilitate the building. The needed restoration work includes roof and soffit repairs, new windows compliant with U.S. Department of the Interior Historic Preservation Standards, tuck pointing of the brick façade, ADA accessibility repairs, waterproofing the basement and foundation, and adding adequate HVAC equipment. When the work is completed, Old Town Hall is anticipated to provide an additional revenue stream as a rental property. The venue also would be home to the city’s local community theater scene.

0 notes

Text

Understanding Local Property Tax Rates: What You Need to Know.

Introduction

Local property taxes, often known as millage rates, are vital for funding crucial services in municipalities and counties, such as schools, roads, public safety, and infrastructure projects. In this blog, we'll delve into local property tax rates, their mechanics, and the factors influencing them, including a focus on 3BHK villas in Ranikhet, Uttarakhand, affiliated with the Armed Forces Welfare Organisation (AFWO).

Local Property Tax Rates Explained

Local property tax rates, expressed in mills, represent taxes imposed on real estate properties within a specific jurisdiction. A mill equals one-tenth of a cent or one-thousandth of a dollar. For instance, a property with a $100,000 assessed value at a millage rate of 10 mills would result in $1,000 in property taxes.

Factors Influencing Local Property Tax Rates

Several factors influence local property tax rates, including:

Local Budget Needs: The primary driver is the local government's budget, assessing the revenue required for essential services.

Property Values: Higher property values lead to higher taxes, with local assessors periodically evaluating property values.

Tax Base: The overall value of properties in a jurisdiction, the tax base, affects tax rates, with a broader base often resulting in lower rates.

Tax Caps and Limits: Some regions impose limits on annual tax increases to prevent sudden spikes in homeowners' tax bills.

Local Government Policies: Varying priorities affect tax rates, with some governments focusing on attracting residents or businesses while others prioritize specific projects or services.

State Laws and Regulations: State laws impact property taxes, influencing assessment methods, exemptions, and revenue usage.

Special Assessments: Homeowners might face additional assessments for specific services or projects.

Understanding Property Tax Assessments

To calculate property tax, know your property's assessed value and the millage rate. Assessors determine the assessed value, usually a percentage of the property's fair market value, while the millage rate, set by the local government, calculates the owed tax.

When considering 3BHK villas in Ranikhet, Uttarakhand, affiliated with the Armed Forces Welfare Organisation (AFWO), it's crucial to understand local property tax rates, which contribute to funding community services and infrastructure.

Conclusion

Local property tax rates are essential for community functioning. Understanding their dynamics and staying informed about local budget discussions and policy changes is crucial. This knowledge is valuable for property owners, and consulting with local tax professionals can offer insights into managing property tax obligations effectively.

1 note

·

View note

Text

Navigating the Tax Landscape: Property Taxes in Tennessee

Have you ever wondered about the intricacies of property taxes in the beautiful state of Tennessee? Understanding the tax landscape is crucial, as property taxes play a significant role in funding local services. In this brief overview, we'll touch upon key aspects of property taxes in Tennessee, shedding light on what you need to know.

Firstly, property taxes in Tennessee are a vital source of revenue for local governments. They fund essential services such as schools, road maintenance, public safety, and more. The property tax landscape in Tennessee is diverse, with variations across counties and municipalities.

The assessment process is a crucial element determining property taxes. The local assessor's office evaluates the market value of your property, considering factors like location, size, and amenities. Understanding this process is essential for property owners to comprehend how their taxes are calculated.

Now, let's delve into the specifics of property tax rates. Tennessee employs a tiered approach, with different rates for different types of properties. Residential, commercial, and industrial properties may have distinct tax rates. Navigating these rates is essential for property owners to anticipate their tax liabilities accurately.

If you're a homeowner in Tennessee, you might be eligible for various tax relief programs. These programs aim to provide financial assistance to certain groups, such as senior citizens or disabled individuals. Exploring these options can help you mitigate the financial impact of property taxes.

For a detailed exploration of property taxes in Tennessee, including current rates, relief programs, and the assessment process, check out our comprehensive guide here. What are the property taxes in Tennessee? Find the answers and more as you navigate the tax landscape in this vibrant state.

1 note

·

View note

Text

Public Purpose Bond: What It Is, How It Works

What Is a Public Purpose Bond?

A public purpose bond is a type of financial instrument issued by a government entity, such as a municipal, state, or federal government, to raise funds for specific projects or initiatives that serve a public or community purpose. These bonds are typically used to finance a wide range of projects and activities that benefit the public, including infrastructure development, education, healthcare, environmental conservation, and more. Public purpose bonds are a form of debt securities, and they play a crucial role in funding public projects and services.

Here are some key characteristics and features of public purpose bonds:

Purpose: The primary purpose of public purpose bonds is to raise capital for projects that have a direct or indirect benefit to the public. These projects can include building schools, hospitals, highways, parks, public transportation systems, and other essential infrastructure.

Issuer: Public purpose bonds are typically issued by government entities, such as cities, counties, states, or federal agencies. The specific government entity responsible for issuing the bonds depends on the nature and scope of the project.

Funding Source: The funds raised from the sale of public purpose bonds are used to finance the designated public projects. In some cases, the bonds may be backed by the government's taxing power or specific revenue streams generated by the project itself.

Interest Payments: Bondholders receive periodic interest payments (often semiannual or annual) based on the interest rate (coupon rate) specified in the bond offering. These interest payments are typically exempt from federal income tax and may also be exempt from state and local taxes, depending on the bond's characteristics.

Maturity: Public purpose bonds have a specified maturity date, at which point the issuer is required to repay the bond's face value (the principal) to the bondholders. Maturities can vary widely, ranging from a few years to several decades, depending on the bond's terms.

Creditworthiness: The creditworthiness of the government entity issuing the bonds can impact the interest rates offered and the overall attractiveness of the bonds to investors. Governments with strong credit ratings can typically secure lower interest rates, which reduces the cost of borrowing.

Investor Base: Public purpose bonds are often attractive to a wide range of investors, including individuals, institutions, and mutual funds, due to their relatively low risk compared to other types of investments. They are often seen as stable investments.

Local Impact: Public purpose bonds can have a direct and significant impact on local communities by funding critical projects that improve public services, create jobs, and enhance the quality of life for residents.

Tax Advantages: The interest income from certain types of public purpose bonds may be exempt from federal income taxes, making them particularly appealing to investors looking for tax-efficient investment options.

Public purpose bonds are a vital tool for governments to finance important public projects and services while spreading the cost of these projects over time. These bonds allow governments to raise capital from a broad base of investors and allocate resources to address community needs and infrastructure improvements.

How a Public Purpose Bond Works

A public purpose bond works by allowing a government entity to raise funds from investors to finance specific projects or initiatives that serve a public or community purpose. Here's how the process typically works:

Identification of Funding Need: The government entity identifies a need for funding to undertake a particular public project or initiative. This could include building a new school, upgrading transportation infrastructure, constructing a hospital, or funding environmental conservation efforts.

Planning and Budgeting: Once the funding need is identified, the government entity creates a detailed plan for the project, including estimated costs, timelines, and expected benefits to the community. A budget is established to determine how much capital is required.

Decision to Issue Bonds: The government entity decides to issue bonds as a means of raising the necessary capital. This decision is typically based on factors such as the project's importance, available funding sources, and the ability to repay the debt.

Bond Issuance: The government entity, often with the assistance of financial advisors and underwriters, prepares the necessary bond offering documents, including a bond prospectus or offering statement. These documents outline the terms and conditions of the bond issuance, including the purpose of the bonds, interest rate (coupon rate), maturity date, and repayment structure.

Market Auction or Sale: The government entity auctions or sells the bonds to investors. This process can involve competitive bidding or negotiations with underwriters, depending on the type of bond and market conditions. Investors purchase the bonds at a specific price.

Use of Proceeds: The funds raised from the sale of the bonds are used exclusively for the designated public project or purpose. This ensures that the capital raised directly supports the intended community benefit.

Interest Payments: Bondholders receive periodic interest payments based on the coupon rate specified in the bond offering. These payments are typically made semiannually or annually and serve as compensation to bondholders for lending their capital to the government entity.

Maturity and Repayment: Public purpose bonds have a predetermined maturity date, at which point the government entity is obligated to repay the bond's face value (the principal) to bondholders. Depending on the type of bond, the repayment may be backed by the government's taxing authority, specific project revenues, or a combination of both.

Creditworthiness: The government entity's creditworthiness plays a significant role in the bond issuance process. Entities with strong credit ratings can secure lower interest rates, which can result in lower borrowing costs.

Investor Benefits: Public purpose bonds are often attractive to a wide range of investors, including individuals, institutions, and mutual funds, due to their relatively low risk compared to other investments. The interest income from certain types of public purpose bonds may also be exempt from federal, state, and local income taxes, making them appealing to investors in higher tax brackets.

Local Impact: Public purpose bonds have a direct impact on local communities by funding essential projects that improve public services, create jobs, stimulate economic growth, and enhance the overall quality of life for residents.

Ongoing Monitoring: Throughout the life of the bond, the government entity monitors the progress of the project and ensures that funds are used for their intended purpose. Bondholders continue to receive interest payments as scheduled.

Public purpose bonds are a critical tool for governments to finance projects that benefit their communities. They allow governments to access capital from a broad pool of investors and spread the cost of projects over time, while providing investors with a relatively safe and predictable investment option.

Oversight of Public Purpose Bond Issues

The oversight of public purpose bond issues involves a combination of legal, regulatory, and administrative mechanisms designed to ensure that the bond issuance process is transparent, compliant with relevant laws, and accountable to the public. Oversight helps safeguard the interests of both investors and taxpayers. Here are key aspects of the oversight process for public purpose bond issues:

Legal Framework: Oversight begins with the legal framework governing bond issuances. Laws at the federal, state, and local levels establish the rules and requirements for issuing bonds. These laws often dictate how bonds are authorized, how funds can be used, and the disclosure requirements for bond offerings.

Authorization: Before issuing bonds, government entities must obtain authorization from the appropriate legislative or governing body. This authorization may come in the form of a resolution, ordinance, or other official action, depending on the jurisdiction's legal requirements.

Debt Limitations: Many jurisdictions have legal debt limitations that restrict the amount of debt a government entity can issue. These limitations are intended to prevent excessive borrowing and to ensure that debt remains manageable.

Disclosure and Transparency: Governments must provide detailed information about the bond issue to potential investors. This typically includes the preparation of bond offering documents, such as an official statement or prospectus, which outlines the terms and conditions of the bonds, the purpose of the issuance, the financial condition of the issuer, and the risks associated with the bonds. This information must be accurate and complete to ensure transparency.

Rating Agencies: Credit rating agencies assess the creditworthiness of government entities and their bond issues. These agencies provide credit ratings that reflect the issuer's ability to meet its debt obligations. While not a formal oversight mechanism, these ratings influence investor confidence and the interest rates that the issuer can secure.

Underwriters: Government entities often work with underwriting firms to market and sell the bonds to investors. Underwriters play a role in ensuring that the bond issuance complies with legal requirements and market standards.

Financial Advisor: Many issuers hire financial advisors to provide guidance on structuring the bond issue, selecting the appropriate financing mechanisms, and evaluating the cost of borrowing.

Bond Counsel: Bond counsel is legal counsel specializing in municipal finance. They help ensure that the bond issuance complies with all legal requirements, including tax regulations, and that the bonds are valid and enforceable.

Continuing Disclosure: After the bonds are issued, government entities are often required to provide ongoing disclosure to bondholders and the public. This includes annual financial reports, notices of material events, and other information that could impact the bond's value.

Independent Auditors: Many government entities undergo regular financial audits conducted by independent auditing firms. These audits help ensure that the government's financial statements are accurate and that funds are used appropriately, including bond proceeds.

Public Input and Accountability: Governments often engage in public hearings or community input processes to allow residents to voice concerns and opinions about proposed bond issuances. Accountability to the public is a fundamental aspect of bond oversight.

Regulatory Agencies: Various regulatory agencies, such as the U.S. Securities and Exchange Commission (SEC), oversee the municipal bond market at the federal level. They enforce rules related to disclosure, fraud prevention, and investor protection.

Market Practices: Issuers and underwriters are expected to adhere to market best practices and industry standards when conducting bond transactions. This includes fair pricing, competitive bidding, and adherence to legal and regulatory requirements.

Oversight of public purpose bond issues is essential to maintain the integrity of the municipal bond market, protect the interests of investors, and ensure that government entities use bond proceeds for their intended public purposes. Bond issuers, underwriters, and other stakeholders must collaborate to navigate the regulatory landscape and meet their legal obligations.

Public Purpose vs. Private Purpose Bonds

Public purpose bonds and private purpose bonds are two distinct categories of bonds that serve different purposes and have different characteristics. Here's a comparison of the two:

Public Purpose Bonds:

Purpose: Public purpose bonds are issued by government entities, such as municipalities, states, or federal agencies, to finance projects or initiatives that serve a public or community purpose. These projects typically benefit the general public and may include infrastructure development (e.g., schools, roads, hospitals), public services, or environmental conservation efforts.

Issuer: Government entities issue public purpose bonds to raise capital for projects that are considered in the public interest. The issuer is a government entity that has taxing or revenue-raising authority to support the bond repayment.

Tax Treatment: Interest income from public purpose bonds is often exempt from federal income tax and may also be exempt from state and local income taxes. This tax advantage can make these bonds appealing to investors.

Credit Risk: The creditworthiness of the issuer plays a significant role in determining the interest rates on public purpose bonds. Issuers with strong credit ratings typically offer lower yields because they are considered lower risk.

Investor Base: Public purpose bonds are typically attractive to a wide range of investors, including individuals, institutions, and mutual funds. They are often seen as relatively safe investments due to the backing of government entities.

Use of Proceeds: Funds raised from public purpose bonds are used exclusively for public projects and initiatives that benefit the community. The bond proceeds are dedicated to specific, well-defined purposes.

Oversight: The issuance and use of public purpose bonds are subject to legal and regulatory oversight to ensure transparency, compliance with laws, and accountability to the public.

Private Purpose Bonds:

Purpose: Private purpose bonds, also known as industrial development bonds (IDBs) or private activity bonds, are issued by government entities to finance projects undertaken by private, for-profit companies. These projects often serve private or commercial purposes, such as manufacturing facilities, affordable housing, or certain types of infrastructure.

Issuer: Government entities issue private purpose bonds, but the projects funded by these bonds typically serve private entities rather than the general public. These bonds are issued to encourage economic development, job creation, or specific private sector activities.

Tax Treatment: Interest income from private purpose bonds may or may not be tax-exempt, depending on the specific bond type and the project being financed. Some private purpose bonds, such as qualified small-issue bonds or qualified 501(c)(3) bonds, can be tax-exempt under certain conditions.

Credit Risk: The creditworthiness of the private entity benefiting from the bond proceeds can influence the interest rates and terms of private purpose bonds.

Investor Base: Private purpose bonds may attract investors seeking tax advantages or higher yields, depending on their tax-exempt status. However, they may also carry higher risk due to the private nature of the projects.

Use of Proceeds: Funds raised from private purpose bonds are directed toward private projects that may have specific requirements or restrictions associated with their use.

Oversight: Similar to public purpose bonds, private purpose bond issuances are subject to legal and regulatory oversight. However, the focus may be more on ensuring compliance with tax regulations and the specific requirements of the bond type.

In summary, the key distinction between public purpose bonds and private purpose bonds lies in their intended use and beneficiaries. Public purpose bonds finance projects for the public good and are typically tax-exempt. Private purpose bonds, on the other hand, finance projects undertaken by private entities and may or may not be tax-exempt, depending on the bond type and project characteristics.

Read more: https://computertricks.net/public-purpose-bond-what-it-is-how-it-works/

1 note

·

View note

Text

it's also more complicated than “mass transit is county and police are municipal” – in many places, mass transit is funded from a combination of sources, including county, state, federal, and municipal budgets, and in some cases, transit-specific districts with the authority to levy taxes. and even where public transit is organized at a level higher than the city, city governments still can have a lot of influence over transit within the city. city transportation departments are responsible for most of the roads and sidewalks within their jurisdiction, so a city government could, for example, designate bus lanes and build bus shelters, if they had the will and the budget to do so. and for another example, boston mayor michelle wu has instituted free fares on a couple mbta bus routes, using the city budget

and while police are generally municipal, there are also county sheriffs, which serve the a supporting role in municipalities with their own police departments, and serve the same role as police would in parts of the county that don't have their own cops.

Don't worry, You can trust me with the city budget, just let me in there. Come on, just let me have the budget. I will totally not gut the police budget to build a centralized mass transit network and new libraries. I will definitely not do that, just let me in there please. Come on let me have access to the city budget for 5 minutes. That's all I ask.

46K notes

·

View notes

Text

What Home Improvements Increase Property Taxes in Illinois So High?

What Home Improvements Increase Property Taxes in Illinois So High?

Introduction

Home improvements can significantly enhance the aesthetics or functionality and overall value of your property. However it is essential to be aware that these improvements can increase property taxes particularly if you live in Illinois. Property taxes in Illinois are based on the assessed value of home and any improvements.

For more: What Home Improvements Increase Property Taxes in Illinois So High?

Increasing this value can result in higher property tax bills. In Illinois property taxes play a crucial part in funding local services such as schools and public safety and infrastructure maintenance and more. The tax assessors evaluate your property periodically to determine its assessed value.

Which is a key aspect in calculating your home tax bill. When you make substantial improvements to your home. It can raise its assessed value which in turn.

Additionally we will explore strategies to manage and mitigate the increase in property taxes that can result from these improvements.

What is a home improvement exemption in Illinois?

As of my ultimate expertise, I will be replaced in September 2021. I don’t have specific information about a home improvement exemption in Illinois. Property tax laws and exemptions by state can change over time.

It is possible that such an exemption may be introduced or modified after my last update. However I can provide you with information on common property tax exemptions and incentives related to home improvements. That was applicable in Illinois as of that time. Please note that you should check with Illinois. Department of Revenue or a local tax authority for the most current and accurate information regarding property tax exemptions and incentives in the state.

Home Improvement Exemption:

In some states, including Illinois when you make improvements to your home. The assessed value of those improvements from property taxation for a specified period. The purpose of this exemption is to encourage owners to invest in their homes.

Homeowner’s Exemption:

Illinois offers a homeowner’s exemption that reduces. The taxable cost of an asset via way of means of a sure amount. To qualify you must live in the property your primary residence cannot be used for commercial purposes. While this exemption does not specifically apply to home improvements. It can help offset the overall property tax burden.

Senior Citizen Assessment Freeze:

Illinois has a Senior Citizen Assessment Freeze Homestead Exemption program for eligible seniors. It freezes the assessed cost of a senior’s property. Preventing it from increasing due to rising property values. While not directly related to home improvements. It can provide some relief for seniors on fixed incomes who may be affected by increased property taxes resulting from improvements.

Historic Preservation Exemptions:

Some local municipalities in Illinois offer property tax incentives for property owners. Who undertakes the preservation or restoration of historic properties. These incentives may include reduced property tax rates or exemptions. The increased value is attributable to the improvements made to the historic property.

Energy Efficiency Improvements:

Some states, including Illinois, offer tax incentives or rebates for homeowners. Who make energy-efficient improvements to their homes. While these incentives may not directly affect property taxes. They can lead to savings on energy costs. Which indirectly reduces the overall financial homeownership.

It is important to remember property tax laws can be complex subject to change.It is advisable to consult with a local professional or the county assessor’s office in your area. They can offer you facts on any exemptions or incentives or packages which can be observed in your particular situation. Additionally they can help you navigate the application process for any applicable exemptions or incentives.

What determines property tax in Illinois?

Property tax in Illinois is determined by a combination of factors primarily centered around. The assessed charge of your property. The local tax rates set by various taxing authorities and any applicable exemptions or deductions. The process begins assessment of your property’s value. The county assessor’s office and this assessed value serves as the foundation calculating your property tax bill.

Assessed Value:

The assessed value of your property is a critical factor in determining your property tax. It represents the anticipated marketplace cost of your home as decided with the aid of using the county assessor.The assessment process typically involves periodic reevaluations of properties in the jurisdiction.

If you’re making large upgrades on your property. Such as home renovations or additions this can result in an increase. Its assessed cost in the end caused better assets taxes.

Equalization Factor:

In Illinois the assessed value of properties may be subject to an equalization factor. Also known as a multiplier which aims to bring assessed values in different counties up to a similar standard. This factor can vary by county and is applied by the Illinois Department of Revenue. It can impact your property tax liability.

Tax Rates:

The property tax rates are determined by various taxing authorities including school districts and municipalities or counties and other local entities. These authorities establish their tax levies based on their budgetary needs. The tax charges are generally expressed and percent of your assessed value. Higher tax costs bring about better assets tax bills.

Exemptions and Deductions:

Illinois offers various exemptions and deductions that can reduce your property’s taxable value and consequently your property tax liability. Common exemptions include the General Homestead Exemption for owner occupied properties or Senior Citizens Homestead Exemption for eligible seniors. The Disabled Veterans’ Standard Homestead Exemption for qualifying veterans with service related disabilities. These exemptions can provide significant relief for eligible homeowners.

Tax Cap Legislation:

Illinois has tax cap legislation in place that limits. The annual growth in property tax revenue for most taxing authorities. While this can provide some predictability in property tax increases. It may also lead to shifting tax burdens as some property owners see. Their tax rates rise while others see them decrease.

For more: What Home Improvements Increase Property Taxes in Illinois So High?

0 notes

Text

The Duty of Count Me 2020 in Recording the State's Rich Tapestry

California is understood for its own sensational scenery, coastlines, and sunshine, however what actually prepares it apart is its own variety. With numerous individuals calling it home, California is a fusion of lifestyle, language, and also heritage. Count Me 2020 is an effort that is actually participating in a vital part in recording a complete picture of this range and guaranteeing that everybody is actually mattered in the upcoming US Census. In this particular article, we will definitely cover the importance of Count Me 2020 as well as exactly how it is capturing the State's rich tapestry.

The Usefulness of an Accurate Census Count

A federal census is actually performed in the US every one decade. The information collected aids to identify funding, political depiction, and statistical evaluation of social patterns. Basically, it is actually a considerable tool to make certain that areas, specifically marginalized ones, obtain their reasonable reveal of resources. It may miss out on vital financing for crucial programs such as education, medical care, as well as structure if a location is under-counted. This is actually where Count Me 2020 plays a significant role.

The Duty of Count Me 2020

Consider Me 2020 is a project that combines community-based institutions, municipality, and also gifting to ensure that everybody is considered in the 2020 Census. It focuses on hard-to-count populations-- individuals that may certainly not fill out the census from language barricades, worry, shortage of info, or privacy concerns. Hard-to-count populaces may consist of minorities, low-income households, immigrants, and children under 5. Count Me 2020 companions along with community-based companies to connect to these teams and give sources as well as assistance to motivate their participation.

Count Me 2020 Alliances

Among the absolute most significant parts of Count Me 2020 is its partnerships. It unites over 300 community-based organizations, and 50 area and also local government throughout California. Through collaborating, Count Me 2020 has constructed a coalition that guarantees an unified effort throughout the State. The effort uses information to its companions, varying from instruction to modern technology. It also provides funding to community-based institutions, which permits all of them to execute their outreach plans. You may discover helpful info about Count Me 2020 census at https://uwsd.org/blog/california-state-census-office-awards-1-6m-to-count-me-2020-coalition-to-reach-hard-to-count-communities-in-san-diego-and-imperial-counties/ site.

Impact on California's Range

California's range beams brilliant, along with over 70 foreign languages talked and also a rich multicultural ancestry. Count Me 2020 is actually playing an essential function in grabbing the complete degree of the range, making certain that it is actually acknowledged in the census Count. As stated, hard-to-count populaces may fail the fractures, triggering an unreliable picture of the State. Count Me 2020 is functioning to prevent this. The project is deploying outreach techniques that exceed traditional procedures, including text messages, social media sites, as well as radio advertisements. Through doing this, Count Me 2020 wish to reach out to as lots of people as possible and also motivate their participation in the census campaign.

Last Words

California is diverse, and Count Me 2020 is functioning to guarantee that it is actually identified in the census Count. An exact Count is important as it determines critical backing and political portrayal. Count Me 2020 is carrying out extraordinary work through partnering with community-based organizations as well as municipality to reach out to hard-to-count populaces. By doing this, they are actually taking people away from the shadows and also making certain that every person possesses an equal opportunity to participate. Permit's cooperate to reinforce the Count Me 2020 effort as well as make sure a full picture of California's drapery.

0 notes

Text

Job Opportunities Comal County Careers

In a given area, however, they typically do not change drastically year to year. Proceeds from the Comal County Personal Property Tax are used domestically to fund faculty districts, public transport, infrastructure, and other municipal authorities initiatives. Property tax revenue is almost always used for local projects and services, and does not go to the federal or state finances. You will be supplied with a property tax enchantment form, on which you will provide the tax assessor's present appraisal of your property as properly as your proposed appraisal and an outline of why you consider your appraisal is more accurate. Statistics present that about 25% of properties in America are unfairly overassessed, and pay a mean of $1,346 too much in property taxes every year. Because Comal County uses a sophisticated formula to determine the property tax owed on any individual property, it is not attainable to condense it to a simple tax fee, like you can with an income or sales tax.

In addition, you shall be solely liable for the legality, accuracy and completeness of all information, information, and information offered, submitted, or uploaded by you in reference to this Terms of Use or use of the Services. Notwithstanding the foregoing, we are not liable for screening, policing, enhancing, or monitoring postings and encourage all users to use reasonable discretion and caution in evaluating or reviewing any publish. We assume no liability for any action or inaction regarding transmissions, communications, or content supplied by any user or third get together. We haven't any liability or duty to anybody for efficiency or nonperformance of the actions described in this part. To ship unsolicited mail or e-mail, make unsolicited phone calls or ship unsolicited texts, tweets or faxes promoting and/or promoting products or services to any user, or contact any users that have specifically requested not to be contacted by you. For the unlawful use of any personally identifiable info of different customers of which you'll be uncovered to.

My objective is to make it as straightforward and environment friendly as potential on your loved ones, to be able to get back to doing... FileViewer provides access to scanned indexes and images of the historic handwritten, and present documents, indexes and plats for Real Property, and Oil and Gas data comal property taxes in Texas and New Mexico. Needs to review the security of your connection before continuing. Rounding out the highest three is ZIP code 78070, which is house to Spring Branch and two golf courses. Property values elevated by 103 percent, from $255,000 to $516,500.

When families seek for the perfect location for his or her new residence, a quantity of factors come into consideration. Some of the extra widespread objects are proximity to work and handy access to necessities like grocery shops and other purchasing. For households with school-aged children, high quality of education is on the top of the list.

In such cases, you are solely answerable for such personal information. Contact preferences data together with marketing content preferences, and the standing of whether or not you opted-out of our marketing notices. Manage and track your preferences for communications you receive from us, identify tendencies within the interactions with our Services, and measure the efficiency of our communications. You can now apply on-line by clicking on the job title you have an interest in and clicking on the "Apply" link! If this is the primary time you might be applying utilizing our online job application, you will need to create an account and select a Username and Password. After your account has been established, you can upload from a saved document or manually enter your private data.

Your knowledge rights for personal data the place we're the information controller. During your use of the Services, you might have the opportunity to go to or link to other websites, including websites by third parties unaffiliated with us. We haven't any relationship or management over unaffiliated web sites. These web sites would possibly gather personal knowledge about you, and you should evaluation the privateness comal county property taxes insurance policies of such different websites to see how they treat your personal data. Transaction and billing data including the Service bought, billing details, financial information corresponding to your chosen technique of cost (e.g. a credit card or a checking account number). To facilitate your cost and billing for Services, facilitate payroll and tax Services for our Customers, and detect and forestall fraud.

In most counties, you must specifically submit a homestead exemption software to your county tax assessor so as to enjoy the tax discount and different advantages available. To get a duplicate of the Comal County Homestead Exemption Application, name comal county property tax the Comal County Assessor's Office and ask for particulars on the homestead exemption program. You also can ask about other exemptions which will exist for veterans, seniors, low-income households, or property used for sure functions such as farmland or open space.

1 note

·

View note

Text

Once bitten, twice shy. It’s an old adage that explains why Jason Schneider, the elected reeve of Vulcan County, Alta., is jittery about the renewable energy boom underway in his province.

Like many in rural Alberta, Schneider is still smarting over being left holding the bag when an oil price crash nearly a decade ago resulted in billions of dollars of unfunded liabilities left behind by bankrupt fossil fuel companies. In Vulcan County alone, the landscape is littered with hundreds of wells with no owners that need to be cleaned up, and the municipality itself is owed more than $9 million in back taxes left unpaid by insolvent oil and gas firms.

So Schneider has a hard time looking at acre upon acre of massive wind turbines or solar panels without fearing a repeat of Alberta’s orphan well crisis or wondering if he should fix everything if something goes wrong.

Across rural Alberta, concerns are growing about the long-term implications of the province’s renewable energy boom, the speed and scale of which have been nothing short of stunning. Alberta, which not that long ago was largely reliant on coal for electricity, is now home to more than 3,800 MW of wind and solar capacity, 1,350 of which came online in just the last 12 months. An additional 1,800 MW of capacity is currently under construction, putting the province on track to meet or exceed its goal set in 2016 to generate 30 percent of its total electricity from renewable sources by 2030.

In Schneider’s Vulcan County, which is home to both the country’s largest solar farm and one of Western Canada’s largest wind farms, renewable energy developments now account for more than 40 percent of the local tax base, displacing oil and gas as the number one source of revenue for the local municipal government. But while many in rural Alberta welcome the economic activity and farmers and ranchers enjoy the extra income that playing host to solar panels or wind turbines can bring, others are sounding the alarm.

For example, the Rural Municipalities of Alberta recently passed a resolution calling on the provincial government to protect taxpayers from incurring costs associated with the potential decommissioning of renewable energy infrastructure.

Specifically, the association wants to see the government mandate the collection of securities for reclamation from developers before a project goes ahead so that taxpayers won’t be footing the bill if a developer becomes insolvent and walks away.

In Alberta, the Orphan Well Association is an industry-funded organization tasked with decommissioning old oil and gas infrastructure and returning the land to its owners, with funding from the federal government in 2020 and $335 million in loans from the province. But there’s no equivalent for the renewable energy industry; renewable energy companies provide an overview of how they plan to cover decommissioning and reclamation costs before getting the go-ahead for their project.

However, a wind or solar lease is entirely voluntary. That’s very different from oil and gas, where under Alberta law, property owners are not allowed to refuse companies seeking to develop the fossil fuels that lie under the surface of their land. Evan Wilson, director of policy and government affairs for the Canadian Renewable Energy Association, said that because solar and wind leases remain private civil contracts between the developer and the landowner, the onus is on the landowner to ensure the inclusion of some kind of provision to mitigate risks associated with the project’s end-of-life.

But he added that many companies have a reclamation commitment, either a letter of credit or a bond.

Sara Hastings-Simon, an energy, innovation, and climate policy expert at the University of Calgary’s School of Public Policy, said it’s understandable that municipalities have concerns.

However, she said it’s odd that there’s a push to enforce new regulations for the renewable sector when the scope of the orphan well problem shows the oil and gas regulatory system could also use an overhaul.

According to the Alberta Energy Regulator, more than 83,000 inactive oil and gas wells are in the province, and close to 90,000 more have been sealed and taken out of service but have not yet been fully remediated.

A report released last year by the Parliamentary Budget Officer estimated that the cost of orphan well cleanup in Canada will reach $1.1 billion by 2025.

0 notes

Text

I am a public librarian (though not in the state of Missouri) so I want to add a little information just in the interests of correctly calibrating the level of upset here.

Public libraries in Missouri, as I believe in most of the US, are organized on a local level--municipalities, counties, or groups of municipalities or counties united into a library district.

The vast majority of public library funding comes from taxes levied in the locality that that library serves.

State aid to libraries typically constitutes a pretty small fraction of a library's funding--there are about 400 public libraries in Missouri, so that $4.5 million cited above would work out to about $11,000 each, which certainly isn't keeping any given library running.

The loss of all state aid to public libraries will probably have a greater impact on very small libraries, but this does not mean a total end of funding for any public library. The state does not control the majority of funding for public libraries.

You know who controls the majority of funding for public libraries? Local voters.

Vote in your city and county elections to elect the people who set the budget for your library if it doesn't have its own special tax!

Vote in library board elections to choose the people who will determine the library's budget (and respond to book challenges) if your library does have its own tax!

And for the love of god, VOTE YES ANY TIME YOUR LIBRARY HAS A MILLAGE ON THE BALLOT. That's the specific tax that directly funds your local library! THAT is how you keep your local library going!

Welp, the Missouri House of Legislatures just voted to defund public libraries.

I’m honestly shocked and dismayed and heartbroken. Like, I knew things were bad, but I didn’t think it was this bad already.

I’m also quite frankly shocked at how small the state budget for libraries was in the first place ($4.5 million). I’ve visited so many quality libraries all across Missouri that do so much for their communities. When I was a social worker, the local library was always the first place I’d visit in the communities I worked in, because I knew they had good services to offer and could help me get connected to other local supports. Like, even from just a heartless financial standpoint, I can guarantee public libraries are worth the money.

I’m just really sad right now.

#missouri#public libraries#librarian problems#us politics#no idea how this works in any other country but this should more or less apply anywhere in the us

13K notes

·

View notes

Photo

Support for Kenosha, WI protestors against police!

On 8/23/2020, police officers shot an unarmed Black man named Jacob Blake in the back, 7 times, in close range, and in front of his children. As of 5AM 8/24, Jacob Blake's relatives reported that he was alive, out of ICU and surgery, but still fighting for his life. Witnesses report Blake was breaking up a fight between two women when police tazed and shot him.

Kenosha Police have called a citywide curfew, and are reportedly attacking protestors with chemical weapons and using unmarked vehicles (thread with police scanner activity here). Gov Tony Evers deployed the National Guard against protestors while claiming to stand against excessive force and escalation against Black people in WI. The Milwaukee Freedom Fund made a statement on on FB around midnight, extending legal support to all Kenosha protestors.

Wisconsin Legal Aid:

Milwaukee Freedom Fund: Legal Support Request

Phone numbers for locating arrested people in Milwaukee County

Contact [email protected] if you receive a curfew ticket

Attorney Kimberley Motley http://www.motleylegal.com/about.html can help with municipal citations.

Legal Action of Wisconsin can take municipal citation cases in Kenosha for folks who meet their income guidelines. Intake # is 855-947-2529.

If you believe someone has been detained over 24-hrs: Search for them as an inmate here or call the County Non-Emergency Number at (414) 278-4788

Latest MFF post (8/24)

ACLU: How to file report/evidence against specific cops

Donate to the Milwaukee Freedom Fund here!

Wisconsin numbers to call here!

UPDATE 8/24: Donate to support Jacob & his family here!

Please protect the identities of protestors in news you share (especially in images/video), and, if you are not Black, do not further traumatize Black people by spreading video of the attack without adequate warnings.

[Image Description: A photo of a 29 year-old Black Man, Jacob Blake, with a goatee and shoulder-length braids, hugging his 4 children and smiling next to a fountain or monument at night. 2 screencaps of a Milwaukee Freedom Fund Facebook post made around midnight on 8/23/20. They read as follows:

We are saddened and angered to hear of the police once again shooting a young Black man, especially a young father that is reported to have stopped a fight from escalating before being gunned down. Milwaukee Freedom Fund wants to extend our support to protesters in Kenosha. Our request help form is here: https://bit.ly/MFFArrestHelp. We help with bail/tickets/connecting protesters to lawyers. Info for protesters:

Make sure there is someone outside of protesting that knows your legal name and birthday so we can look you up if we need to.

If you are arrested- DO NOT TALK about what happened while in jail unless you are talking to your lawyer. Phones and visiting rooms are recorded.

You have the right to remain silent and ask for a lawyer.

Most arrested protesters are ticketed and released that process can take hours. If someone is detained, their bail is set and charges are read usually the first time they see a judge. In Milwaukee, that’s been a few days. Once bail is set we can help pay it, if you’re given a ticket for protesting we can help pay that too, if you need a lawyer we can do our best to set you up with one. *We are not lawyers and we cannot go to precincts directly. We are volunteers who will help the best we can.

Edited to include: This post has gotten a lot of attention and some folks may be unfamiliar with MFF. Please know we do not reserve calls for justice for “perfect victims” and we see bringing out a person’s history as attempts to silence and minimize. If several police officers can’t arrest a person without shooting them several times then that is the issue we need to address. The police are not meant to be judge, jury and executioner. Keep focused. Info we have on what happened: The young man with his children is a 29 year old father named Jacob Blake. He was tasered and shot in the back 7 times today by police officers in Kenosha, Wisconsin. There is a video of the entire incident, but we will not be posting that footage here. There was no point and time that a firearm should have been pulled, let alone this man be shot 7 times, in the back, while trapped by his vehicle. His condition is unclear. Varying reports at this time. If there are additional actions to show up for or links to support his family please let us know. https://facebook.com/events/s/community-unity-accountability/710234002864196/?ti=icl]

#kenosha#jacob blake#milwaukee freedom fund#defundpolice#abolish police#police brutality#protest resources#l3 host post

4K notes

·

View notes

Text

Big Box stores' other shoe drops

Since the start of this century, small and mid-sized towns have courted big box stores, using tax revenues to fund expensive road, sewer and electric expansions to lure large corporate chains to town.

These companies promised jobs and tax revenues, and, technically speaking, they delivered both, but only if you do some very funny math. National chains pay little or no federal income tax, and often secure state tax abatements.

This gives them a 30–40% advantage over small, homegrown businesses operated by locals who can’t afford the huge sums needed to pay corrupt tax-experts to establish fictional headquarters on offshore financial secrecy haves.

Large national chains also have commanding bargaining power when they negotiate with suppliers, which means they pay less for their merchandise than locally owned businesses.

Given the tax and purchasing advantages, the arrival of a big box store doesn’t really create jobs. Sure, they hire locals to work in their stores, but at the cost of a boarded-up main street where the only businesses that survive are dollar stores.

When a local government spends public funds to lure in a big box store, they actually cost the town net jobs, and the funds they spend to kill those jobs come from the workers whose jobs were lost and the businesses that provided those jobs.

But at least big boxes pay local taxes, right?

Well…

In Michigan, Lowes pioneered an aggressive tactic of lowering its tax bills. It’s called the “dark store” gambit, and it’s so successful that towns are refunding millions to big box stores.

https://ilsr.org/dark-store-tax-tactic-makes-big-box-stores-terrible-deal-for-cities/

In her breakdown for ILSR, Olivia LaVecchia explains how the “dark store” hustle works. First, a big box store files an appeal on its tax assessment, arguing that the town or county have overvalued its property.

Instead of opting for the usual assessment formula (building costs minus depreciation), they demand assessment based on the sale price of “comparable” properties.

Then, they argue that the relevant “comparable” properties are shuttered, abandoned big box stores.

Big box stores are built to order, heavily customized to the retailer’s specific requirements. They are designed to be fast to erect and disposable, and when they are put up for sale, restrictive covenants are added to the deed to block a competitor from moving in.

These restrictions are incredibly specific (and restrictive), listing individual items that may never be sold by anyone who buys the property, for the rest of time.

Unsurprisingly, the resale value of a cheaply built, white-elephant structure that can’t be used to sell common items is very, very low. Lowe’s argues that the taxes on its property should reflect this incredibly low valuation.

That’s how the Lowe’s in Marquette, MI retroactively slashed the assessed value of the store it built for $10m from $5.2m to $2.4m (in 2010), $2m (in 2011) and $1.5m (in 2012).

Based on the new assessment, Marquette was on the hook to refund $755,828 to Lowe’s, a company with $50b in net annual sales.

To pay for the refund, Marquette slashed its library, police and fire-department budgets.

Lowe’s is a trailblazer. After a corporate-friendly state tax tribunal and supreme court sided with Lowe’s 12 more big-box stores in Marquette appealed their historical tax assessments, seeking comparable refunds from the city.

Marquette isn’t an outlier. Ottawa City, MI is on the hook to refund $14.8m to its big box parasites. Statewide, the “dark store” gambit has netted $47m, so far — and it’s spreading to Indiana, with Meijer hitting Marion County, IN for $2.4m.

Indiana is projecting a $120m tax shortfall for towns and counties as “dark store” reassessments sweep the state. Big box stores already destroy local businesses and jobs and erode the local tax-base, but it’s about to get much worse.

Thanks to the sky-high costs they impose on local governments, big box stores already cost municipalities $0.44/sqft/year ($80k/year for a Walmart Supercenter). That’s before dark-store reassessment.

https://ilsr.org/key-studies-why-local-matters/#7

The myth of big box prosperity sent money gushing out of the public spigots: by 2014, big boxes had sucked up more than $2.4b in direct subsidies from local governments.

https://www.goodjobsfirst.org/taxbreaksandinequality

The dark-store hustle has all the hallmarks of a long con. In a long con, the crook lets the mark win a little money at first, as a convincer. Then, having lulled the mark into complacency, the crook takes them for everything.

Local governments were able to pretend that somehow these big boxes would make up for the costs they imposed and the losses they triggered, because of the local tax bills they paid. That kept the subsidies and favors flowing.

Now that local governments are on their last legs, battered by the covid slump and anti-tax extremists in state government that cut spending, the fraudsters pull their switch, clawing back all the taxes they paid as convincers and setting themselves up for a tax-free future.

Image: City of Westminster Archives Centre (modified) https://commons.wikimedia.org/wiki/File:Hallam_Street_Blitz_Bomb_Damage.JPG

CC BY-SA: https://creativecommons.org/licenses/by-sa/3.0/deed.en

Image: Mike Mozart (modified) https://www.flickr.com/photos/jeepersmedia/13656574134

CC BY: https://creativecommons.org/licenses/by/2.0/

135 notes

·

View notes

Note

wrt your tags asking about what I do, at risk of over-explaining, because in my experience some people know how this stuff works better than I do and other people have absolutely no idea--

in the us (mostly universally although there is some variance by state), the land that a roadway is on and a certain distance to either side of it is owned by either some level of government agency (municipal, county, state/federal) or is privately owned (ie owned by an individual or a company, usually in the case of like, hunting land or industrial complexes). (I'm going to be talking about the public stuff, because private roads are weird.) that land that's owned by the gov is called "right of way" (and in addition to having roads on it, usually also conveys public utilities like water and sewer lines and other utilities like gas lines, power lines, etc).

the federal highway administration (in conjunction with other professional organizations, like AASHTO), sets the design and inspection standards for roadways and bridges and provides oversight and (a lot of) funding for the lower level government agencies. but they don't really do any engineering directly; the state govs handle that stuff on the whole. so county and city govs build and maintain their roads (usually via a highway department or public works department) on their ROW, and the state department of transportation (sometimes called something else, depends on the state) both builds and maintains state and US highways and interstates AND helps provide oversight/regulation on behalf of the fhwa.

that's the bit that I work in ^

I, personally, am not a bridge inspector, but I work for the part of the DOT in my state that oversees the bridge inspection program! the FHWA puts out bridge inspection standards and then we make sure the cities and counties and dot districts are doing what they're supposed to (while the fhwa looks over our shoulders making sure we AND they are doing our jobs right, lol)

working in electrical engineering in healthcare specifically sounds like hell I'm ngl. I imagined the kind of permitting you were talking about and I started sweating immediately 🤣🤣

👋👋 another batfam engineer hi!! (im electrical!) (to be totally normal i saw u in the tags of that one post about CivE duke)

(I figured)

yooooo we love to see it!!! I had to take an EE class and about died, so I admire you and your people greatly ✊😔

#lol yeah talking to other engineers is always like.#rhyming hat. not the same hat but it might as well be

9 notes

·

View notes

Text

What is the $10000 grant for homeowners in Florida?

What is the $10000 grant for homeowners in Florida?

Introduction

In an effort to provide financial relief and support to homeowners in the state of Florida. A notable initiative has emerged. The $10,000 Homeowners Grant. This program aimed at assisting eligible homeowners

For more: What is the $10000 grant for homeowners in Florida?

Seeks to address various homeownership related expenses and challenges. As we delve into the details. We will explore the eligibility criteria application process. The potential impact this grant can have on homeowners throughout the Sunshine State.

Whether you are a first-time homeowner or someone looking for financial assistance with home related expenses. This grant program could hold significant benefits. Join us as we unravel the key aspects of this valuable opportunity for homeowners in Florida.

How to claim Florida $10 000 grant for hurricane upgrades?

As of my remaining information, it will be replaced in September 2021. There was not a specific Florida grant program offering $10,000 for hurricane upgrades. However there are various programs and initiatives in Florida aimed at helping homeowners improve. Their homes withstand hurricanes and other severe weather events. These programs may offer financial assistance or incentives for hurricane upgrades. Here are steps you can take to explore and potentially claim such assistance.

Research Grant Programs:

Start by researching the most recent grant and assistance programs offered by the state of Florida and local governments and non profit organizations. These programs may change or be updated. so it is essential to stay informed about the latest opportunities.

Check the Eligibility:

Review the eligibility criteria for the programs you find. These criteria can vary depending on the program goals and funding sources. Ensure that you meet the specific requirements. Such as income limits or geographical location.

Apply for Relevant Programs:

Once you have identified a grant or assistance program. That aligns with your needs and eligibility. The application process outlined by the program administrators. This typically involves submitting an application form and providing necessary documentation.

Consult Local Authorities:

Contact your local government or building department for information on any local incentives or grants related to hurricane upgrades. Some counties or municipalities may have their own programs in addition to state-level initiatives.

Gather Documentation:

Be prepared to provide documentation related to your home. Such as proof of ownership, income verification and details about the planned hurricane upgrades or improvements.

Engage with Contractors:

If your application is approved and work closely with contractors or builders experienced in hurricane-resistant construction. Ensure that the upgrades or improvements are in compliance with local building codes and standards.

Monitor Deadlines and Requirements:

Stay informed about the program’s deadlines and any reporting or compliance requirements. Grants often have specific terms and conditions that must be met to receive funding.

Keep Records:

Maintain thorough records of all expenses and documentation related to the hurricane upgrades. This will help you fulfill reporting requirements and potentially claim tax benefits.

Please note that grant programs and their availability can change over time and new programs may emerge. To get the most current and detailed information on hurricane upgrade grants in Florida, I recommend contacting the Florida Division of Emergency Management or a local housing authority for assistance and guidance.

Are there any grants for homeowners

There are various grants and assistance programs available for homeowners. Although the availability and eligibility criteria can vary depending on your location or income and specific circumstances. Here are some common types of homeowner grants and assistance programs.

Home Repair and Rehabilitation Grants:

These programs provide financial assistance to homeowners for repairing and renovating. Their homes or especially if they are low-income or elderly. Examples include the Home Repair Grants and the Rural Housing Repair Loans and Grants.

Weatherization Assistance Program:

This federal program helps low-income homeowners improve.The power performance in their homes. Which can reduce utility bills and make homes more comfortable.

Homebuyer Assistance Programs:

These programs assist first-time homebuyers with down payment and closing cost expenses. They can be offered at the federal or state and local levels.

Disaster Relief Grants:

In the aftermath of natural disasters like hurricanes and floods or wildfires. There are often grant programs to help homeowners repair or rebuild. Their damaged properties. These programs are typically administered by other disaster relief agencies.

Energy-Efficiency Grants:

Some states and utility companies offer grants or incentives for homeowners. Who make energy-efficient upgrades to their homes. Such as installing solar panels or upgrading insulation or replacing windows and doors.

Historic Preservation Grants:

If you own a historic home. You may be eligible for grants or tax credits to help with the costs of preserving and maintaining. The historic character of your property community Development.

Block Grants:

Housing and community development activities are supported by funds provided to local governments and organizations. These grants can sometimes be used to assist homeowners with various needs including repairs and improvements.

Veterans’ Home Loans and Grants:

Veterans and active-duty service members may be eligible for home loans. Which often require no down payment. There are also grants available to disabled veterans to adapt their homes to accommodate disabilities.

Nonprofit and Charitable Organizations:

Some nonprofit organizations, such as Habitat for Humanity, offer housing assistance programs including grants and low-cost home repairs.

To find specific grants and assistance programs available to homeowners in your area. Research at the federal or state and local levels is essential. Start by contacting your housing agency and community development department.Start by contacting your state’s housing agency or development department.

They often administer many of these programs. Additionally explore the websites of relevant federal agencies. Like the U.S. Department of Housing and Urban Development or the U.S. Department of Agriculture for information on nationwide programs. It is important to keep in mind eligibility requirements or availability are subject to change. So staying with local resources is crucial.

What grants are available for homeowners?

There are various grants and financial assistance programs available to homeowners or aimed at helping them with a range of needs and circumstances. These grants can vary by location, government level and eligibility criteria.

Home Improvement Grants:

Many governments offer grants to homeowners for home improvement projects. That enhances energy efficiency and safety or accessibility. These grants can help cover the costs of projects such as installing solar panels and upgrading insulation. Making modifications for elderly or disabled residents.

For more: What is the $10000 grant for homeowners in Florida?

0 notes