#apps for investing in crypto

Explore tagged Tumblr posts

Text

The Art of Mastering the Digital Currency Financial Landscape

With the rise of cryptocurrencies, more and more investors are seeking opportunities to capitalize on the potential gains offered by digital assets. However, navigating the volatile and complex crypto market can be challenging, especially for those who are new to the space. This is where crypto investment platform come into play, offering a convenient and user-friendly way for investors to buy, sell, and manage their crypto portfolios.

The Importance of Professional Fund

Professional fund managers have the expertise and experience to analyze market trends, identify potential opportunities, and mitigate risks, helping investors achieve their financial goals with confidence. By entrusting their investments to professional fund managers, investors can benefit from expert guidance and portfolio management tailored to their specific needs and risk tolerance. Whether you're a seasoned investor looking to diversify your portfolio or a newcomer seeking guidance in the world of crypto investments, professional fund management services can provide peace of mind and potentially higher returns.

Choosing the Right Crypto Platform

When selecting a crypto investment platform, it's important to consider factors such as security, reliability, user interface, and available features. Look for platforms that offer robust security measures to protect your assets from cyber threats and hacking attempts. Additionally, consider platforms that provide access to a wide range of cryptocurrencies, as well as tools and resources to help you make informed investment decisions.

Furthermore, for investors seeking professional fund management services, it's essential to choose a platform that partners with reputable and experienced fund managers. Look for platforms that offer transparency regarding their fund managers' track records, investment strategies, and performance metrics. Additionally, consider platforms that provide comprehensive reporting and analytics tools to help you monitor your investments and track your portfolio's performance over time.

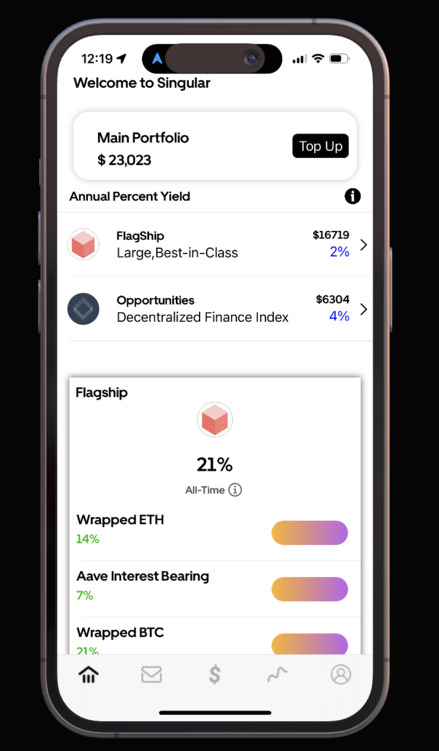

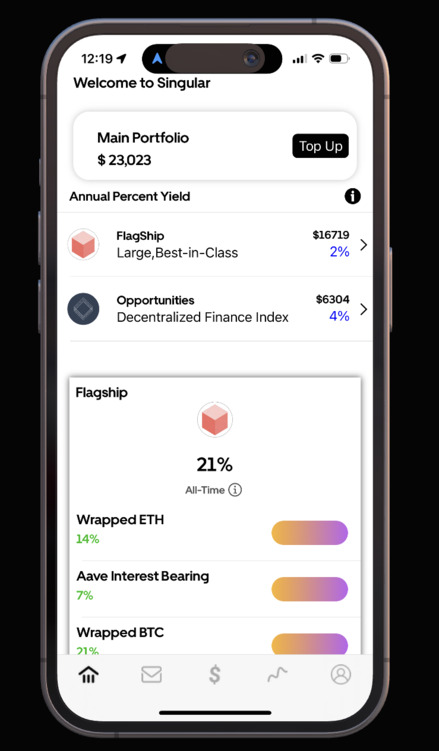

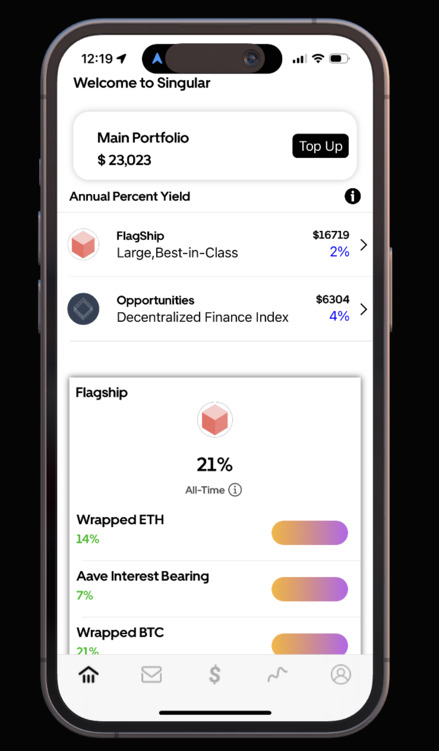

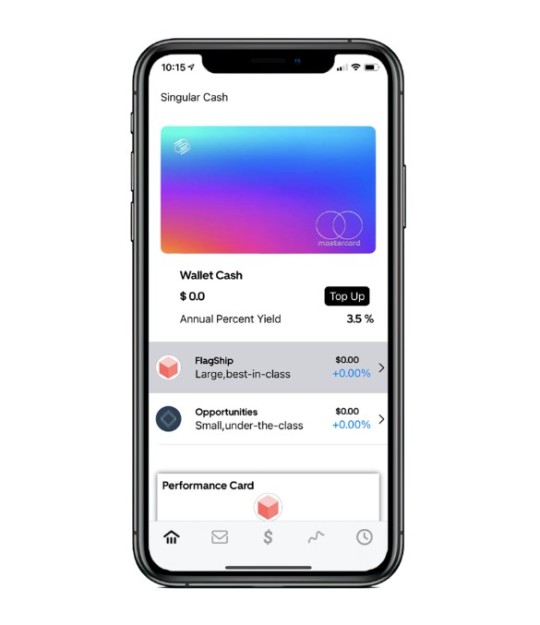

Your Partner in Crypto Investments

With a focus on security, transparency, and innovation, company provides investors with access to a wide range of cryptocurrencies and investment opportunities. Through singulardex's platform, investors can benefit from professional fund management services provided by experienced and reputable fund managers. With a track record of success and a commitment to delivering superior returns, singulardex's fund managers offer personalized investment strategies tailored to each investor's goals and risk tolerance.

Conclusion

Navigating the world of crypto investments requires careful research, strategic planning, and access to reliable resources. To explore singulardex's platform and learn more about their professional fund management services, visit singulardex.com today. With singulardex as your trusted partner in crypto investments, you can navigate the market with confidence and achieve your financial goals.

Blog Source URL:

#online investment platforms#best blockchain for defi#professional fund management#app to buy and trade crypto#online trading platform#apps for investing in crypto

0 notes

Text

DM or Ask if you really want to know more

#invest and make it#cash app#investment#commercial#สล็อต ฝากถอน true wallet เว็บตรง#investors#politica italiana#business#united states#toyota#blockchain#bitcoin#lunowallet#crypto#current events#captain america#travel#dandys world#worldwide privacy tour#sports#virginia woolf#walmart wallis#good morning america#rain world#work woes

4 notes

·

View notes

Text

Best Crypto Analysis Apps for Traders and Investors in 2025

The crypto market has witnessed tremendous growth in monetary value and popularity among enthusiasts in the past decade. Its ever-changing and dynamic nature causes fascination in the masses. This makes information & comprehension of market trends a critical tool for accurate navigation of the crypto world.

This is where crypto analysis apps come into the picture.

The wide availability of numerous such platforms can end up overwhelming any investor trying to discover the best crypto analysis app to stay ahead in the game.

If you, too, are one of them and unable to make a choice about which app to use, keep calm and be stress-free, because we’ve got you covered.

Here’s a list of the top 5 crypto analysis apps in 2025:

CryptoReach

CoinMarketCap

TradingView

Binance

CoinGecko

In this article, we’ll explore a list of the best crypto analysis apps out there, according to our research.

Top 5 Crypto Analysis Apps in 2025

CryptoReach

CryptoReach is the best crypto analysis app, widely recognized for its usability and reliability. It is the best app for crypto analysis as it employs many visual charts and graphs. It is designed conveniently for both the newbies and the pros of the crypto world.

Its key features are as follows:

CryptoReach’s User-Friendly Interface creates a unique user experience, making it easily navigable and convenient to use.

CryptoReach provides Advanced Technical Indicators and Charts to its users for detailed and in-depth analysis..

It provides Live Price Data for 1 hour, 24 hours, and 7 days through various charts and graphs.

The app provides a Great Technical UI/UX that is comprehensive and easy to understand.

Through Sentiment Analysis, CryptoReach helps users understand the public’s tonal viewpoint of a token or news.

Visit CryptoReach on the App Store & Play Store.

CoinMarketCap

CoinMarketCap is widely recognized for its comprehensiveness, making it feasible for both experienced and novice users. It is considered one of the best apps for crypto technical analysis.

Its key features are as follows:

Its User-Friendly Interface allows users to easily navigate the application with a visually appealing and comprehensive design.

The Portfolio Tracker feature of CoinMarketCap helps users to track their holdings and check for returns.

The app provides Extensive Data regarding crypto. Be it market trends, regulatory policies, or coin performance, you’ll have it all here.

Visit CoinMarketCap on the App Store & Play Store.

TradingView

TradingView is the best app for traders and professionals who are primarily concerned with advanced technical analysis. However, it is equally comprehensive for beginners as well, in many ways.

Its key features are as follows:

Its Advanced Charting helps traders to critically analyse coin performances in depth.

It lets its users Filter & Sort Watchlists for a customized and personalized experience.

CoinMarketCap has Active Communities sharing similar insights. This can help users in gathering valuable insights from traders across the platform.

Visit TradingView on the App Store & Play Store.

Binance

Binance is the biggest cryptocurrency exchange platform with the largest user base. It allows users to trade as well as analyse cryptocurrencies.

Its key features are as follows:

Its Comprehensive Charting Tools help users with detailed information regarding coin performances by making it understandable.

Binance provides Real-Time Market Data about the latest trends and regulations.

Binance follows a Tiered Trading Fee structure for its premium users.

Visit Binance on the App Store & Play Store.

CoinGecko

CoinGecko is popular for its real-time updates and data relevance to both newcomers and professional traders.

Its key features are as follows:

The app integrates various Technical Indicators that are useful for the accurate analysis of numeric monetary data.

CoinGecko’s User-friendly Interface makes app navigation easy and convenient.

Its API helps users access varied crypto data, metadata, and decentralized tools.

Visit CoinGecko on the App Store & Play Store.

What Makes a Good Crypto Analysis App?

A good crypto analysis app must have the following features:

Advanced Charts, Graphs, and Indicators help users conduct in-depth technical analysis of various cryptocurrencies and blockchain-related data.

Customizable Feeds help users to curate their feed with the topics they’re interested in.

A User-Friendly Interface is very important to retain users. Usage convenience helps users easily navigate various features of the app.

Easily Navigable UI/UX to ensure a unique and smooth user journey.

Sentiment Analysis is an important tool to understand the public’s emotion-driven opinions regarding a cryptocurrency or news.

Conclusion

A crypto analysis app is significant for examining real-time data for traders to make informed decisions. It helps them analyse, track, and manage their holdings in the crypto market.

0 notes

Text

Discovering the Best Cold Storage Wallet: ELLIPAL

In the ever-evolving world of cryptocurrency, securing your digital assets is paramount. One of the standout options in the hardware wallet industry is ELLIPAL, renowned for its commitment to security and user-friendly design.

The ELLIPAL wallet is recognized as one of the best cold storage wallets available. With its air-gapped technology, it ensures that your private keys are never exposed to the internet, significantly minimizing the risk of hacks. Additionally, the wallet features a sleek design and a user-friendly interface that makes it accessible for both beginners and seasoned crypto enthusiasts.

What sets ELLIPAL apart is its mobile app, which allows for easy management of your assets while maintaining top-notch security. Users can enjoy the peace of mind that comes with knowing their investments are safe, while still having the flexibility to manage their cryptocurrencies on the go.

In conclusion, if you're looking for a reliable and secure way to store your digital assets, ELLIPAL is an excellent choice. Embrace the future of cryptocurrency with confidence by choosing a top cold storage wallet on the market!

#cryptocurrency#mobile app#user-friendly#hardware wallet#crypto management#investment safety#security#digital assets

0 notes

Text

Earn Bitcoin on Everyday Purchases with Fold Card – The Ultimate Crypto Cashback Card!

Track your Bitcoin rewards in real-time with the Fold App! Watch your BTC balance grow with every purchase. Have you ever wished your everyday spending could help you stack Bitcoin? Imagine earning BTC on groceries, gas, dining out, or even paying bills—without changing your spending habits. Well, it’s not just a dream anymore. With Fold Card, you can earn Bitcoin rewards on every single…

#alternative investments#best debit cards#best rewards cards#Bitcoin earning#bitcoin rewards#Bitcoin rewards card#Bitcoin savings#Bitcoin stacking#budgeting tips#cashback rewards#cashback strategy#crypto cashback#crypto debit card#crypto passive income#crypto-friendly card#digital banking#earn Bitcoin#financial technology#fintech#Fold App#Fold Card#Fold Card review#investing in crypto#mobile payments#passive income#rewards program#save money#side hustle#smart spending#spend and earn

1 note

·

View note

Text

Crypto Portfolio Trackers

📊 Tracking your crypto investments made easy! Explore the top 5 #CryptoPortfolioTrackers: Blockfolio, Delta, CoinStats, CoinTracking & Kubera. Stay on top of your digital assets with the best tools. 📈💼 Read the full review now! #CryptoInvesting #Blockchain #CryptoTools

Crypto Portfolio Trackers, Keeping Tabs on Your Investments “An investment in knowledge pays the best interest.” – Benjamin Franklin In today’s fast-paced world of cryptocurrency, staying on top of your investments is crucial. With the rise of Crypto Portfolio Trackers, managing your digital assets has never been easier. But with so many options out there, which one should you choose? Let’s…

#Blockfolio Review#CoinStats Integration#CoinTracking Tax Reporting#Crypto Investment Tools#Crypto Investments#Crypto Portfolio Trackers#Cryptocurrency Management#Delta App Review#Digital Asset Tracking#Kubera Wealth Management

0 notes

Text

Unveiling the Future of Wealth: Cryptocurrency Trading and Professional Fund Management

In a world where financial markets constantly evolve, cryptocurrency trading has emerged as a beacon of innovation and opportunity. With the rise of digital currencies, investors seek lucrative returns and professional guidance to navigate the complexities of this burgeoning landscape. Enter professional fund management, where expertise meets cutting-edge technology to maximize profits and minimize risks.

Unlocking Potential through Expert Guidance:

Cryptocurrency trading platforms have democratized access to digital assets, allowing individuals worldwide to participate in this transformative market. However, the volatility and intricacies of cryptocurrencies demand a nuanced approach. Professional fund management offers a solution that combines the accessibility of trading platforms with the expertise of seasoned professionals. By entrusting funds to experienced hands, investors can harness the full potential of their assets while mitigating inherent risks.

Navigating Complexity with Precision Strategies:

Navigating the cryptocurrency market requires more than intuition; it demands strategic foresight and meticulous planning. Professional fund managers employ various strategies, from arbitrage and algorithmic trading to fundamental analysis and risk management. Through in-depth research and continuous monitoring, these experts adapt to market trends and seize lucrative opportunities, ensuring optimal performance for their clients.

Ensuring Security and Compliance:

As the cryptocurrency ecosystem matures, regulatory compliance and security become paramount concerns. Fund management addresses these challenges by adhering to strict regulatory standards and implementing robust security protocols. By safeguarding assets and adhering to industry best practices, fund managers instill confidence and trust among investors, fostering a secure environment for wealth creation.

Empowering Investors for Long-Term Success:

Beyond short-term gains, fund management focuses on sustainable growth and long-term wealth accumulation. By diversifying portfolios and adopting a disciplined investment approach, fund managers optimize risk-adjusted returns and safeguard against market fluctuations. Through transparent communication and personalized guidance, investors are empowered to confidently make informed decisions and achieve their financial goals.

The Synergy of Technology and Expertise:

In the digital age, technological advancements have revolutionized how we manage and invest our assets. Cryptocurrency trading platforms leverage blockchain technology to facilitate seamless transactions and provide real-time market data. Fund management harnesses the power of artificial intelligence and machine learning algorithms to analyze vast datasets and identify lucrative opportunities. By combining technological innovation with human expertise, investors gain a competitive edge in cryptocurrency trading.

Embracing Innovation:

As the demand for professional fund management services grows, they emerge as an industry trailblazer. Its user-friendly interface and comprehensive suite of tools empower investors to optimize their portfolios and maximize returns. Their platform sets the standard for professionalism and innovation in cryptocurrency fund management through its strategic partnerships and commitment to excellence.

Conclusion:

The future of wealth lies at the intersection of cryptocurrency trading platforms and professional fund management. By leveraging technology and expertise, investors can confidently navigate the complexities of the digital asset market and achieve their financial aspirations. With singulardex.com leading the way, the possibilities for wealth creation are limitless.

Blog Source URL:

#blockchain application#professional fund management#online investment platforms#decentralized crypto exchange#apps for investing in crypto

0 notes

Text

Introduction to Blockchain:

Blockchain is a decentralized, distributed digital ledger that securely records transactions across multiple computers, ensuring the data remains unalterable. Its main use is in cryptocurrencies such as Bitcoin and Ethereum, but it is also utilized in other industries such as finance, healthcare, and supply chains.

Main Attributes of Blockchain:

1. **Decentralization**: In contrast to conventional systems controlled by a single entity, blockchain disperses the information among various nodes (users), all of which maintain a full version of the record.

2. **Openness**: Every transaction is easily seen by all participants in the network, which promotes a strong level of transparency that can diminish fraud and enhance trust among users.

3. Data recorded on the blockchain is extremely difficult to alter or remove due to its immutability. This is ensured by using cryptographic methods, which ensure that the records are extremely safe.

4. **Agreement Mechanisms**: Blockchain networks employ certain algorithms, like Proof of Work or Proof of Stake, for transaction validation and consensus among members.

5. **Smart Contracts**: Using platforms such as Ethereum, smart contracts can be coded to carry out particular actions automatically after certain conditions are fulfilled, which helps in simplifying processes.

Uses of Blockchain Technology:-

**Cryptocurrency**: Allows for secure transactions between individuals without requiring middlemen.

**Enhanced Supply Chain Monitoring**: Enhances the ability to track and ensure responsibility of products as they progress along the supply chain.

**Voting Systems**: Offers secure and transparent voting procedures to deter tampering.

**Healthcare**: Enables safe handling of patient information, improving confidentiality and upholding consent regulations.

https://www.iilm.edu

#engineering college#engineering student#blockchain technology#blockchain development#blockchain voting#blockchain solutions#blockchain app development company#crypto#altcoin#investment#crypto market

0 notes

Text

The crypto market is expanding rapidly, with over 100 million active users, making it challenging to keep track of countless coins and trends. That’s where crypto news apps come in—they simplify everything, especially for young investors and beginners. These apps provide live updates, price alerts, expert insights, and educational content so users can understand and navigate the volatile crypto landscape with ease.

A crypto news app delivers essential features like breaking news, detailed market analysis, real-time price tracking, portfolio management, and customized price alerts. It’s a one-stop solution for staying informed and making smart investment decisions.

Among the top apps, CryptoReach stands out. It aggregates news from over 20,000 trusted sources including Coindesk, Binance, and Reddit, and supports over 12 languages. Users can personalize their news feeds, set alerts, and explore in-depth coin analysis including sentiment, popularity, technical trends, and fundamentals. The sleek interface allows quick access to trending coins, top gainers and losers, real-time charts, and informative whitepapers.

Whether you’re just starting or already deep into crypto, CryptoReach helps you stay ahead with reliable updates and smart tools—making crypto investing simpler, smarter, and more insightful than ever. It’s truly a must-have companion in the crypto journey.

Download the App Now!

1 note

·

View note

Text

#HTX#Huobi Global#cryptocurrency exchange#centralized exchange#spot trading#margin trading#futures trading#derivatives trading#staking#crypto loans#HTX Earn#high liquidity#advanced trading tools#crypto trading platform#KYC exchange#crypto security#mobile crypto app#trading fees#crypto exchange review#crypto trading 2025#crypto for beginners#crypto investment platform

0 notes

Text

Building in Public at NVSTly: What It Means and Why It Matters

Discover how NVSTly embraces "building in public" by rolling out updates quickly, collaborating with users for real-world feedback, and fostering transparency in our development process.

At NVSTly, we embrace the concept of "building in public." This approach shapes how we develop, test, and roll out features, with the goal of making NVSTly the best social trading platform for our users. But what exactly does building in public mean for NVSTly? Let’s break it down.

Updates as They’re Finished

Instead of waiting to bundle new features and fixes into big, infrequent releases, we push updates as they’re completed. This ensures users benefit from improvements as soon as possible. However, our agile development style means you might notice subtle changes before they’re officially included in a published changelog. These incremental updates allow us to iterate and enhance the platform quickly.

Internal Testing, Real-World Feedback

Before any update reaches the production environment, our team conducts internal testing to ensure the new feature or fix works as intended. For example, a recent update to allow stats and daily/weekly recap commands to function with usernames containing spaces was thoroughly tested internally. Unfortunately, this change inadvertently broke compatibility with Discord IDs, highlighting the challenges of anticipating every edge case.

This is where building in public comes into play: while we strive for thorough testing, some issues only emerge when updates meet real-world usage. That’s why we rely on our vibrant user base to help us identify bugs, unintended behaviors, and areas for improvement.

The Role of Our User Community

Our users play a critical role in the development process. By using NVSTly in their daily trading workflows, they encounter scenarios that internal testing might miss. When users report bugs, glitches, or other issues, it provides us with invaluable insights into how the platform performs under various conditions.

If you ever experience something on NVSTly that doesn’t seem to work as expected, we encourage you to report it to us. Unlike platforms that may identify and resolve issues passively over time, NVSTly relies directly on user feedback to detect and prioritize fixes. Every report helps us improve.

Changelogs: A Snapshot of Progress

Given our frequent updates, we publish changelogs only after accumulating several changes or introducing major features. This means that when you see a changelog, many of the updates listed might have been implemented days or even weeks earlier. While this approach helps us focus on building and refining the platform, it’s another example of how building in public keeps the development process transparent.

Why Building in Public Matters

By building in public, we:

Accelerate innovation: Continuous updates ensure the platform evolves rapidly.

Foster transparency: Users gain insight into what’s changing and how issues are addressed.

Strengthen collaboration: Feedback from users directly informs our priorities and solutions.

This approach isn’t without its challenges, but we believe the benefits far outweigh the risks. Building in public allows us to create a platform that truly meets the needs of our community — a community we’re proud to involve in the journey.

How You Can Help

If you notice a bug, glitch, or unintended behavior, please let us know right away. Your feedback is essential to making NVSTly better every day. Together, we’re not just building a platform; we’re building a community-driven experience that reflects the collective expertise and passion of its users.

Thank you for being part of the NVSTly journey. Let’s keep building — together.

NVSTly is available for free on web, mobile devices (iOS & Google Play), and is fully integrated with Discord via a unique bot- the only of it’s kind and available to any server or trading community on Discord. Or feel free to join a community of over 45,000 investors & traders on our Discod server.

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#stocks#startup#startups#development#developer#web development#web developers#app development#app developers#mobile app development#social media#social networks

1 note

·

View note

Text

"How To Get Rich With

Bitcoin Even If You

Have No Clue About Technology"

**Welcome to Crypto Quantum Leap!

**Unlock the Future of Finance with Quantum-Powered Cryptocurrency SolutionsAre you ready to embark on a journey into the next frontier of financial innovation? Look no further than Crypto Quantum Leap – your gateway to the world of quantum-powered cryptocurrency.

**What is Crypto Quantum Leap?**

Crypto Quantum Leap is a cutting-edge platform that harnesses the power of quantum computing to revolutionize the way we engage with cryptocurrency. By combining the principles of quantum mechanics with blockchain technology, we are paving the way for unprecedented security, scalability, and efficiency in the world of digital assets.

Click here https://tinyurl.com/ywm332j9

**Why Choose Crypto Quantum Leap?**

1. **Security:** Say goodbye to traditional cryptographic methods. With quantum-resistant algorithms, your assets are safeguarded against the threat of quantum attacks.

2. **Scalability:** Experience lightning-fast transaction speeds and accommodate a growing user base without compromising performance.

Click here https://tinyurl.com/ywm332j9

3. **Efficiency:** Our quantum-powered solutions optimize resource utilization, minimizing energy consumption and reducing transaction costs.

4. **Innovation:** Be at the forefront of technological advancement with our groundbreaking approach to cryptocurrency.

**Our Services**- **

Quantum-Resistant Wallet:** Securely store your digital assets with confidence, protected by state-of-the-art quantum-resistant encryption.

- **Quantum-Powered Transactions:** Enjoy near-instantaneous transactions with enhanced scalability, powered by quantum computing technology.

- **Decentralized Exchanges:** Trade with ease on our decentralized exchange platform, leveraging the speed and security of quantum computing.

- **Smart Contracts:** Execute self-executing contracts with unparalleled efficiency and reliability, enabled by our quantum-powered smart contract platform.

**Get Started Today!**

Click here https://tinyurl.com/ywm332j9

Join us on the journey to redefine the future of finance with Crypto Quantum Leap. Sign up now to gain access to our revolutionary platform and take the first step towards unlocking the full potential of cryptocurrency.

*Experience the power of quantum computing – join Crypto Quantum Leap today!*

0 notes

Text

Trading Signals

Step into the future of trading with the IndieCATR App for Trade Signals! Unleash the power of the first mobile-only platform offering AI-based timing signals for everyone. Elevate your trading experience and align yourself with professional technical traders for unparalleled success.

Embark on a revolutionary journey as we introduce a groundbreaking upgrade, seamlessly integrating cutting-edge technologies, including artificial intelligence, machine learning, and extensive backtesting. The IndieCATR App's fully-automated daily trading signals redefine the trading landscape, providing a gateway for the average trader to enhance accuracy and make well-informed entries and exits. This upgrade goes beyond, introducing refined risk management strategies, ensuring a comprehensive and user-friendly trading experience.

Our vision is clear—to empower amateur traders with the same technical signal analysis capabilities enjoyed by high-performance and professional traders worldwide. We believe in leveling the playing field, making advanced trading strategies accessible to everyone.

Key Features: • Mobile-Only Platform: Access AI-based timing signals conveniently on your mobile device. • Professional Insights: Align with the strategies of high-performance technical traders. • Cutting-Edge Technologies: Benefit from AI, machine learning, and extensive backtesting. • Fully-Automated Signals: Daily signals for accurate entries and exits, empowering every trader. • Risk Management: Refined strategies for a comprehensive and secure trading experience. Know more here Trading Signals

The IndieCATR App is not just an upgrade; it's a revolution in democratizing trading expertise. Join us in reshaping the future of trading—download now and unlock the potential for success in every trade!

#Trading Signals#Financial Insights#Market Alerts#Investment App#Stock Alerts#Crypto Signals#AI Trading#Market Predictions#Trading Tips#Market Analysis#Investment Signals#Algorithmic Insights#Smart Investing#Asset Signals#Stock Tips#Cryptocurrency Alerts#Market Guidance#Investment Tools

0 notes

Text

Unveiling the Future: Transformative Blockchain Applications and Apps for Investing in Crypto

In technological innovation, blockchain stands tall as a revolutionary force reshaping industry worldwide. Blockchain, a decentralized ledger technology, offers many applications beyond cryptocurrency. Its potential, from supply chain management to healthcare data security, knows no bounds. Entrepreneurs and enterprises are tapping into blockchain's transformative power to streamline operations, enhance transparency, and foster trust.

Empowering Investors with Cutting-Edge Apps:

The rise of cryptocurrencies has fueled a demand for intuitive and secure platforms to facilitate investment. Enter apps for investing in crypto to empower novice and seasoned investors with tools for navigating the dynamic digital asset landscape. These apps offer real-time market data, portfolio management, and secure transactions, providing users with unparalleled convenience and control over their investments.

Seizing Opportunities in Decentralized Finance (DeFi):

Decentralized finance, or DeFi, represents a paradigm shift in traditional financial services. Built on blockchain technology, DeFi platforms offer various financial services, including lending, borrowing, and trading, without intermediaries. This democratized approach to finance opens up new avenues for financial inclusion and innovation, allowing individuals worldwide to access previously out-of-reach financial services.

Embracing Innovation in Supply Chain Management:

Supply chain management is transforming thanks to blockchain technology. By leveraging blockchain's immutable ledger and innovative contract capabilities, companies can enhance transparency, traceability, and efficiency across the supply chain. From tracking the provenance of goods to optimizing inventory management, blockchain-based solutions are revolutionizing how businesses operate in an increasingly interconnected world.

Revolutionizing Healthcare with Secure Data Management:

In the healthcare industry, data security and privacy are paramount concerns. Blockchain offers a solution by providing a secure and transparent way to manage sensitive healthcare data. Through encrypted transactions and permission access, blockchain-based healthcare platforms ensure the integrity and confidentiality of patient information while facilitating interoperability among disparate systems.

Pioneering Solutions in Identity Management:

Identity theft and fraud remain pervasive challenges in the digital age. Blockchain presents a promising solution by enabling secure and verifiable identity management systems. By storing identity information on a decentralized ledger, individuals can maintain control over their digital identities while minimizing the risk of unauthorized access or tampering. Blockchain-based identity solutions have the potential to revolutionize how identities are managed and authenticated online.

Elevating Social Impact through Philanthropy:

Blockchain technology is not only reshaping industries but also driving positive social change. Philanthropic organizations are harnessing the transparency and traceability of blockchain to enhance accountability and impact in charitable giving. Through blockchain-based donation platforms, donors can track their contributions in real time, ensuring that funds are allocated efficiently and effectively to address pressing social challenges.

Navigating the Future of Blockchain and Crypto Investment Apps:

Staying informed and discerning is essential as we navigate the ever-evolving landscape of blockchain applications and apps for investing in crypto. Whether exploring innovative solutions in supply chain management or seeking to diversify your investment portfolio, embracing blockchain technology and crypto investment apps can unlock opportunities.

Conclusion:

The transformative potential of blockchain applications and apps for investing in crypto is undeniable. From revolutionizing industries to empowering individuals, blockchain technology is reshaping how we live, work, and invest. For those eager to explore this exciting frontier, platforms like singulardex.com offer a gateway to the future of finance and innovation. Let's seize the moment and embark on this journey of discovery together.

Blog Source URL:

#blockchain application#decentralized crypto exchange#online investment platforms#professional fund management#best blockchain for defi#apps for investing in crypto#online trading platform

0 notes

Text

Navigating the Future of Finance: A Guide to Crypto Coin and Fund Investments

The landscape of investment has undergone a seismic shift with the advent of cryptocurrencies. Gone are the days when stocks and bonds were the only options for investors. Today, we stand at the precipice of a new era, one dominated by digital currencies and blockchain technology. This article aims to shed light on two key investment avenues in this burgeoning field: crypto coin investment and crypto fund investment.

The Rise of Cryptocurrencies: A New Dawn for Investors

Cryptocurrencies, or digital currencies, have taken the world by storm. These decentralized forms of currency, secured by cryptography, offer a level of security and anonymity previously unseen in the financial world. The most well-known of these, Bitcoin, has become synonymous with the term "cryptocurrency." However, the crypto landscape is vast, with thousands of coins, each with its own unique features and potential for growth.

Understanding Crypto Coin Investment

Crypto coin investment refers to the direct purchase of individual cryptocurrencies. Investors buy coins with the hope that their value will increase over time, yielding significant returns. This form of investment is akin to buying stocks in a company, where the investor owns a piece of the entity. The allure of crypto coin investment lies in its potential for high returns. Stories of early Bitcoin investors becoming millionaires have fueled the popularity of this investment avenue.

Diversifying with Crypto Fund Investment

On the other hand, crypto fund investment offers a different approach. Crypto funds are pooled investment vehicles that hold a diversified portfolio of cryptocurrencies. This method provides investors with exposure to a range of digital assets, reducing the risk associated with investing in a single coin. Crypto funds are managed by professionals who make strategic decisions to maximize returns and mitigate risks. This makes crypto fund investment an attractive option for those who wish to invest in cryptocurrencies but need more expertise or time to manage their own portfolios.

Navigating the Volatile Waters of Crypto Investment

Investing in cryptocurrencies has its challenges. The market is known for its volatility, with prices fluctuating wildly in short periods. This unpredictability can be daunting for investors, especially those new to the crypto space. However, with proper research, risk management, and a long-term perspective, investors can navigate these turbulent waters and potentially reap substantial rewards.

The Future of Crypto Investment: A Promising Horizon

As the world becomes increasingly digital, the role of cryptocurrencies in the investment landscape is set to grow. With advancements in blockchain technology and increasing mainstream acceptance, the potential for crypto investments is vast. Whether through direct coin investment or diversified fund investment, the opportunities in this dynamic field are boundless.

Conclusion:

For those looking to embark on their crypto investment journey, choosing the right platform is crucial. singularvest.com offers a comprehensive suite of investment options, catering to both seasoned investors and beginners.

Blog Source URL:

#decentralized hedge fund#app for crypto investment#application for crypto trading#crypto coin trading app

0 notes

Text

CryptoReach is a powerful crypto news app that provides the latest news for 200+ crypto coins along with their detailed analysis.

Our Crypto News feature brings you the latest news in real-time from over 10,000+ worldwide crypto news sources. We cover everything from market trends to regulatory updates, ensuring you never miss any important news or events in the crypto industry.

0 notes