#and we’re funding this. our tax dollars are funding this. american workers are building these weapons.

Explore tagged Tumblr posts

Text

Israel continues committing crimes against civilians and putting out propaganda to weakly justify their sieges on hospitals, now not only in Gaza, but the West Bank, too. They’re even committing precisely the crime they keep accusing Hamas of by using seized schools and health centers for military purposes.

Via Al Jazeera:

Israel’s defence minister claims ‘Hamas has lost control of Gaza’

Nov 13th, 18:30 GMT

Yoav Gallant says Hamas does not have the power to stop Israel’s military, saying Israeli forces have intensified operations against Hamas tunnels in Gaza.

“Hamas has lost control of Gaza. Terrorists are fleeing south. Civilians are looting Hamas bases,” he said.

Gallant said that “each day”, Israel kills more Hamas commanders and fighters, adding that Israel’s army continues to operate “in the heart of Gaza City”.

(Emphasis mine)

UNRWA says received reports Israel used school, health centres for military operations

Nov 13th, 20:50 GMT

The United Nations Relief and Works Agency for Palestine Refugees (UNRWA) said it received reports that Israeli forces “conducted interrogations and arrests” of internally displaced Palestinians in the installations in Gaza City.

They entered one school and two health centres with tanks, UNRWA said.

“In one health centre, five people were reportedly killed. According to the reports, IDPs [internally displaced persons] were subsequently forced to leave the UNRWA installations and move south towards Wadi Gaza. Witnesses reported that Israeli forces then struck the two health centres with artillery fire,” the agency said, adding that it was verifying the reports.

“If confirmed, the military use of UNRWA facilities raises serious concerns, as such use puts civilians at serious risk of harm. Directing attacks against civilian objects is a serious violation of international law. Health centres, in particular, are also afforded special protection against attack.”

Israeli military says ‘signs indicating’ captives were held at al-Rantisi Hospital

Nov 13th, 21:00 GMT

Israeli military spokesman Daniel Hagari has said “signs indicating hostages were held” in a basement room within al-Rantisi Hospital in north Gaza had been discovered.

Hagari made the claims in a video shot by Israeli forces in the children’s hospital.

In the video, Hagari pointed to women’s clothing, what appeared to be a rope on the leg of a chair, as well as an “improvised” toilet and other infrastructure.

He also pointed to what he called a “guardian list” on the wall, where he claimed fighters signed into shifts to watch the captives. He called the items evidence that captives had been held there.

(Emphasis mine)

Israeli forces stormed West Bank hospital, interrogated medical staff: Health ministry

Nov 13th, 21:15 GMT

The Palestinian health ministry said Israeli forces left after interrogating staff at an eye hospital in Turmus Ayya, near Ramallah.

In a post on social media, the ministry condemned the raid as a blatant violation of health institutions, similar to what Israel has been doing in Gaza.

#palestine#free palestine#al jazeera#and we’re funding this. our tax dollars are funding this. american workers are building these weapons.

93 notes

·

View notes

Text

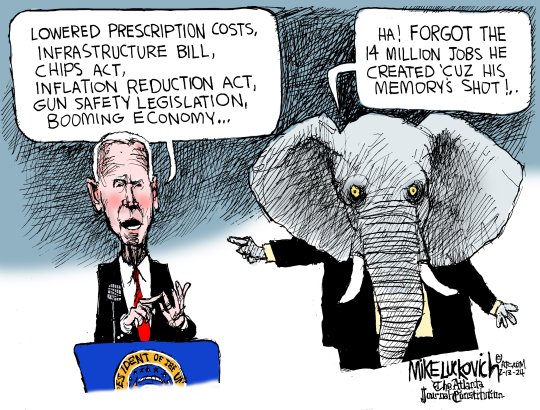

Mike Luckovich

* * * *

LETTERS FROM AN AMERICAN

May 8, 2024

HEATHER COX RICHARDSON

MAY 09, 2024

Today, in Racine, Wisconsin, President Joe Biden announced that Microsoft is investing $3.3 billion dollars to build a new data center that will help operate one of the most powerful artificial intelligence systems in the world. It is expected to create 2,300 union construction jobs and employ 2,000 permanent workers.

Microsoft has also partnered with Gateway Technical College to train and certify 200 students a year to fill new jobs in data and information technology. In addition, Microsoft is working with nearby high schools to train students for future jobs.

Speaking at Gateway Technical College’s Racine campus, Biden contrasted today’s investment with that made by Trump about the same site in 2018. In that year, Trump went to Wisconsin for the “groundbreaking” of a high-tech campus he claimed would be the “eighth wonder of the world.”

Under Republican governor Scott Walker, Wisconsin legislators approved a $3 billion subsidy and tax incentive package—ten times larger than any similar previous package in the state—to lure the Taiwan-based Foxconn electronics company. Once built, a new $10 billion campus that would focus on building large liquid-crystal display screens would bring 13,000 jobs to the area, they promised.

Foxconn built a number of buildings, but the larger plan never materialized, even after taxpayers had been locked into contracts worth hundreds of millions of dollars for upgrading roads, sewer system, electricity, and so on. When voters elected Democrat Tony Evers as governor in 2022, he dropped the tax incentives from $3 billion to $80 million, which depended on the hiring of only 1,454 workers, reflecting the corporation’s current plans. Foxconn dropped its capital investment from $10 billion to $672.8 million.

In November 2023, Microsoft announced it was buying some of the Foxconn properties in Wisconsin.

Today, Biden noted that rather than bringing jobs to Racine, Trump’s policies meant the city lost 1,000 manufacturing jobs during his term. Wisconsin as a whole lost 83,500. “Racine was once a manufacturing boomtown,” Biden recalled, “all the way through the 1960s, powering companies—invented and manufacturing Windex…portable vacuum cleaners, and so much more, and powered by middle-class jobs.

“And then came trickle-down economics [which] cut taxes for the very wealthy and biggest corporations…. We shipped American jobs overseas because labor was cheaper. We slashed public investment in education and innovation. And the result: We hollowed out the middle class. My predecessor and his administration doubled down on that failed trickle-down economics, along with the [trail] of broken promises.”

“But that’s not on my watch,” Biden said. “We’re determined to turn it around.” He noted that thanks to the Democrats’ policies, in the past three years, Racine has added nearly 4,000 jobs—hitting a record low unemployment rate—and Wisconsin as a whole has gained 178,000 new jobs.

The Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act have fueled “a historic boom in rebuilding our roads and bridges, developing and deploying clean energy, [and] revitalizing American manufacturing,” he said. That investment has attracted $866 billion in private-sector investment across the country, creating hundreds of thousands of jobs “building new semiconductor factories, electric vehicles and battery factories…here in America.”

The Biden administration has been scrupulous about making sure that money from the funds appropriated to rebuild the nation’s infrastructure and manufacturing base has gone to Republican-dominated districts; indeed, Republican-dominated states have gotten the bulk of those investments. “President Biden promised to be the president of all Americans—whether you voted for him or not. And that’s what this agenda is delivering,” White House deputy chief of staff Natalie Quillian told Matt Egan of CNN in February.

But there is, perhaps, a deeper national strategy behind that investment. Political philosophers studying the rise of authoritarianism note that strongmen rise by appealing to a population that has been dispossessed economically or otherwise. By bringing jobs back to those regions that have lost them over the past several decades and promising “the great comeback story all across…the entire country,” as he did today, Biden is striking at that sense of alienation.

“When folks see a new factory being built here in Wisconsin, people going to work making a really good wage in their hometowns, I hope they feel the pride that I feel,” Biden said. “Pride in their hometowns making a comeback. Pride in knowing we can get big things done in America still.”

That approach might be gaining traction. Last Friday, when Trump warned the audience of Fox 2 Detroit television that President’s Biden’s policies would cost jobs in Michigan, local host Roop Raj provided a “reality check,” noting that Michigan gained 24,000 jobs between January 2021, when Biden took office, and May 2023.

At Gateway Technical College, Biden thanked Wisconsin governor Tony Evers and Racine mayor Cory Mason, both Democrats, as well as Microsoft president Brad Smith and AFL-CIO president Liz Schuler.

The picture of Wisconsin state officials working with business and labor leaders, at a public college established in 1911, was an image straight from the Progressive Era, when the state was the birthplace of the so-called Wisconsin Idea. In the earliest years of the twentieth century, when the country reeled under industrial monopolies and labor strikes, Wisconsin governor Robert “Fighting Bob” La Follette and his colleagues advanced the idea that professors, lawmakers, and officials should work together to provide technical expertise to enable the state to mediate a fair relationship between workers and employers.

In his introduction to the 1912 book explaining the Wisconsin Idea, former president Theodore Roosevelt, a Republican, explained that the Wisconsin Idea turned the ideas of reformers into a workable plan, then set out to put those ideas into practice. Roosevelt approvingly quoted economist Simon Patten, who maintained that the world had adequate resources to feed, clothe, and educate everyone, if only people cared to achieve that end. Quoting Patten, Roosevelt wrote: “The real idealist is a pragmatist and an economist. He demands measurable results and reaches them by means made available by economic efficiency. Only in this way is social progress possible.”

Reformers must be able to envision a better future, Roosevelt wrote, but they must also find a way to turn those ideals into reality. That involved careful study and hard work to develop the machinery to achieve their ends.

Roosevelt compared people engaged in progressive reform to “that greatest of all democratic reformers, Abraham Lincoln.” Like Lincoln, he wrote, reformers “will be assailed on the one side by the reactionary, and on the other by that type of bubble reformer who is only anxious to go to extremes, and who always gets angry when he is asked what practical results he can show.” “[T]he true reformer,” Roosevelt wrote, “must study hard and work patiently.”

“It is no easy matter actually to insure, instead of merely talking about, a measurable equality of opportunity for all men,” Roosevelt wrote. “It is no easy matter to make this Republic genuinely an industrial as well as a political democracy. It is no easy matter to secure justice for those who in the past have not received it, and at the same time to see that no injustice is meted out to others in the process. It is no easy matter to keep the balance level and make it evident that we have set our faces like flint against seeing this government turned into either government by a plutocracy, or government by a mob. It is no easy matter to give the public their proper control over corporations and big business, and yet to prevent abuse of that control.”

“All through the Union we need to learn the Wisconsin lesson,” Roosevelt wrote in 1912.

“We’re the United States of America,” President Biden said today, “And there’s nothing beyond our capacity when we work together.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Biden Administration#election 2024#infrastructure#jobs#economic reality

7 notes

·

View notes

Video

youtube

The Truth Behind “Self-Made” Billionaires

Why do we glorify “self-made” billionaires?

Well, being “self-made” is a seductive idea —it suggests that anybody can get to the top if they're willing to work hard enough. It’s what the American Dream is all about.

If Kylie Jenner can become a “self-made” billionaire at age 21, so can you and I!

Even as wages stay stagnant and wealth inequality grows, it’s a comfort to think that we’re all simply one cosmetics company and some elbow grease away from fortune.

Unfortunately, a nice idea is all it is. Self-made billionaires are a myth. Just like unicorns.

The origins of self-made billionaires are often depicted as a “rags-to-riches” rise to the top fueled by nothing but personal grit and the courage to take risks — like dropping out of college, or starting a business in a garage.

But in reality, the origins of many billionaires aren’t so humble. They’re more “riches-to-even-more-riches” stories, rooted in upper-middle class upbringings.

How much risk did Bill Gates take on when his mother used her business connections to help Microsoft land a deal-making software for IBM?

Elon Musk came from a family that owned an emerald mine during the time of Apartheid South Africa.

Jeff Bezos’ garage-based start was funded by a quarter-million dollar investment from his parents.

If your safety net to joining the billionaire class is remaining upper class – that’s not pulling yourself up by your bootstraps.

Nor is failing to pay your fair share of taxes along the way.

Along with Musk and Bezos, Michael Bloomberg, George Soros, and Carl Icahn have all gotten away with paying ZERO federal income taxes some years. That’s a big helping hand, courtesy of legal loopholes and American taxpayers who pick up the tab, all while our tax dollars subsidize the corporations owned by these so-called “self-reliant” entrepreneurs.

Did you get a thank you card from any of them? I sure as hell didn’t.

Other common ways that billionaires build their coffers off the backs of others include paying garbage wages and subjecting workers to abusive labor conditions.

But portraying themselves as rugged individuals who overcame poverty or “did it on their own” remains an effective propaganda tool for the ultrawealthy. One that keeps workers from rising up collectively to demand fairer wages – and one that ultimately distracts from the role that billionaires play in fostering poverty in the first place.

Billionaires say their success proves they can spend money more wisely and efficiently than the government. Well they have no problem with government spending when it comes to corporate subsidies.

When arguing for even more tax breaks, they claim each “dollar the government takes from [them] is a dollar less” for their “critical” role in expanding prosperity for all Americans, through job creation and philanthropy. Well that’s rubbish.

50 years of tax cuts for the wealthy have failed to trickle down. As a result of Trump’s tax cuts, 2018 saw the 400 richest American families pay a lower tax rate than the middle class. And U.S. billionaire wealth grew by $2 trillion during the first two years of a pandemic that was economically catastrophic for just about everyone else. They want to have their cake, everyone else’s cake, and eat it, too.

Behind every ten-figure net worth is systemic inequality. Inherited wealth. Labor exploitation. Tax loopholes. And government subsidies.

To claim these fortunes are “self-made” is to perpetuate a myth that blames the wealth gap on the choices of everyday Americans.

Billionaires are not made by rugged individuals. They’re made by policy failures. And a system that rewards wealth over work.

Know the truth.

#youtube#video#videos#billionaires#money#wealth#inequality#economics#elon musk#jeff bezos#tesla#amazon

963 notes

·

View notes

Text

Taxes are for the little people

If you wanna do crimes, make them incredibly complicated and technical. Like the hustlers that came into the bookstore I worked at and spun these long-ass stories about why they needed money for a Greyhound ticket home.

Those guys shoulda studied the private equity sector.

Private equity's playbook is to borrow giant sums by putting up other peoples' companies as collateral (yes, really). Then they use that money to buy the company they mortgaged, and pay themselves a huge dividend.

Then they sell off the company's assets and pay themselves even more money. That leaves the company in a state of precarity - assets they once owned, like their buildings, they now rent. If the rent goes up, they have to find the money to cover it.

All of this forms a pretense for mass layoffs, defaulting on pension obligations, lowering product quality, stiffing suppliers and borrowing more money. If the company doesn't go bust, the PE looters can flip it to *another* PE company, that does it again.

Whenever you see something really terrible happening to a business that once offered useful products and services and paid decent wages, it's a safe bet that PE is behind it. Toys R Us, Sears, your local hospital - and that memestock favorite, AMC.

https://pluralistic.net/2020/04/12/mammon-worshippers/#silver-lake-partners

Private equity goons make their money in two ways: the first is by pocketing 20% of these special dividends and other extractive policies that hollow out business.

This is money at PE managers get paid for spending their investors' money. It's a wage, in other words.

But thanks to the "carried interest" loophole (a hangover from 16th-century sea captains that has nothing to do with "interest" on loans), they get to treat these wages as "capital gains" and pay far less tax on them.

The fact that we give preferential tax treatment to capital gains (money derived from gambling), while taxing wages (money derived from doing useful work) at higher rates really tells you everything you need to know about our economic priorities.

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

The carried interest loophole lets PE crooks treat their salaries as capital gains, are taxed at a much lower rate than the wages of the workers whose lives they're destroying.

On top of the 20% profit-share that PE bosses get every year, they also pocket a 2% "management fee" for all the "value" they add to the companies they've taken over.

This is *definitely* a wage. The 20% profit-share at least has an element of risk, but that 2% is guaranteed.

But PE bosses have spent more than a decade booking that 2% wage as a capital gain, using a tax-fraud tactic called "fee waivers." The details of how a fee waiver don't matter because it's all bullshit, like the tale of the needful Greyhound ticket.

All that matters is that a legal fiction allows people earning *eight- or nine-figure salaries* to treat *all* of those wages as capital gains and pay lower rates of tax on them than the janitors who clean their toilets or the workers whose jobs they will annihilate.

Now, the IRS knows all about this. Whistleblowers came forward in 2011 to warn them about it. The Treasury even struck a committee to come up with new rules to fix it.

But Obama failed to make those rules stick, and then Trump put a former tax-cheat enabler in charge of redrafting them. The cheater-friendly rules became law on Jan 5, and handed PE bosses hundreds of millions in savings every year.

https://www.nytimes.com/2021/06/12/business/private-equity-taxes.html

The New York Times report on "fee waivers" goes through the rulemaking history, the technical details of the scam, and the gutting of the IRS, which can no longer afford to audit rich people and now makes its quotas by preferentially auditing low earners who can't afford lawyers.

But former securities lawyer Jerri-Lynn Scofield's breakdown of the Times piece on Naked Capitalism really connects the dots:

https://www.nakedcapitalism.com/2021/06/private-inequity-nyt-examines-how-the-private-equity-industry-avoids-taxes.html

As Scofield and Yves Smith point out, if Biden wanted to do one thing for tax justice, he could abolish preferential treatment for capital gains. If we want a society of makers and doers instead of owners and gamblers, we shouldn't penalize wages and reward rents.

There's an especial urgency to this right now. As the PE bosses themselves admit, they went on a buying spree during the pandemic (they call it "saving American businesses"). Larger and larger swathes of the productive economy are going into the PE meat-grinder.

Worse still, the PE industry has revived its most destructive tactic, the "club deal," whereby PE firms collaborate to take out whole economic sectors in one go:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

We're at an historic crossroads for tax justice. On the one hand, you have the blockbuster Propublica report on leaked IRS files that revealed that the net tax rate paid by America's billionaires is close to zero.

https://pluralistic.net/2021/06/08/leona-helmsley-was-a-pioneer/#eat-the-rich

This has left the Bootlicker-Industrial Complex in the bizarre position of arguing that anyone who suggests someone who amasses billions of dollars should pay more than $0 in tax is a radical socialist (so far, the go-to tactic is to make performative noises about privacy).

At the same time, the G7 has agreed to an historical tax deal that will see businesses taxed at least 15% on the revenue they make in each country, irrespective of the accounting fictions they use to claim that the profits are being earned in the middle of the Irish Sea.

That deal is historical, but the fact that it's being hailed as curbing corporate power reveals just how distorted our discourse about corporate taxes has become.

As Thomas Piketty writes, self-employed people pay 20-50% tax in countries that will tax the world's wealthiest companies a mere 15%: "For SMEs as well as for the working and middle classes, it is impossible to create a subsidiary to relocate its profits to a tax haven."

Piketty, like Gabriel Zucman, says that EU nations should charge multinationals a minimum of 25%, and like Zucman, he reminds us that the G7 deal does nothing to help the poorest countries in the Global South.

https://www.lemonde.fr/blog/piketty/2021/06/15/the-g7-legalizes-the-right-to-defraud/

These countries and the EU have something in common: they aren't "monetarily sovereign" (that is, they don't issue their own currencies *and* borrow in the currencies they issue).

Sovereign currency issuers (US, UK, Japan, Canada, Australia, etc) don't need to tax in order to pay for programs - first they spend new money into the economy and then they tax it back out again.

https://pluralistic.net/2020/06/10/compton-cowboys/#the-deficit-myth

These countries can run out of stuff to buy in their currency, but they can't run out of the currency itself. Monetarily sovereign countries don't tax to fund their operations.

Rather, they tax to fight inflation (if you spend money into the economy every year but don't take some of it out again through taxation, more and more money will chase the same goods and services and prices will go up).

And just as importantly, monetary sovereigns tax to reduce the spending power - and hence the political power - of the wealthy. The fact that PE bosses had billions of tax-free dollars at their disposal let them spend millions to distort tax policy to legalize fee waivers.

Taxing the money - and hence the power - of wage earners at higher rates than gamblers creates politics that value gambling above work, because gamblers get to spend the winnings they retain on political influence, including campaigns to rig the casino in their favor.

This discredits the whole system, shatters social cohesion and makes it hard to even imagine that we can build a better world - or avert the climate-wracked dystopia on the horizon.

But for Eurozone countries (whose monetary supply is controlled by technocrats at the ECB) and countries of the Global South (whom the IMF has forced into massive debts owed in US dollars, which they can only get by selling their national products), tax is even more urgent.

The US could fund its infrastructure needs just by creating money at the central bank.

EU and post-colonial lands can only fund programs with taxes, so for them, billionaires don't just distort their priorities and corrupt their system - they also starve their societies.

But that doesn't mean that monetary sovereigns can tolerate billionaires and their policy distortions. The UK is monetarily sovereign, in the G7, and its finance minister is briefing to have the City of London's banks exempted from the new tax deal.

https://www.bloomberg.com/news/articles/2021-06-08/u-k-pushes-for-city-of-london-exemption-from-global-tax-deal

Now, the City of London is one of the world's great financial crime-scenes, and its banks are responsible for an appreciable portion of the planet-destabilizing frauds of the past 100 years.

During the Great Financial Crisis AIG used its London subsidiary to commit crimes its US branch couldn't get away with. The City of London was the epicenter of the LIBOR fraud, the Greensill collapse - it's the Zelig of finance crime, the heart of every fraud.

UK Chancellor Rishi Sunak claims banks are already paying high global tax and can't afford to be part of the G7 tax deal. If that was true, it wouldn't change the fact that these banks are too big to jail and anything that shrinks them is a net benefit.

But it's not true.

As the tax justice campaigner Richard Murphy points out, the risk to banks like Barclays adds up to 0.8% of global turnover: "The big deal is that the 15% global minimum tax rate is much too low. Suinak has yet again spectacularly missed the point."

https://www.taxresearch.org.uk/Blog/2021/06/09/how-big-is-the-tax-hit-on-banks-from-the-g7-tax-deal-that-sunak-fears-really-going-to-be/

Image: Joshua Doubek (modified) https://commons.wikimedia.org/wiki/File:IRS_Sign.JPG

CC BY-SA: https://creativecommons.org/licenses/by-sa/3.0/deed.en

152 notes

·

View notes

Text

I’m not going to pretend that I know how to interpret the jobs and inflation data of the past few months. My view is that this is still an economy warped by the pandemic, and that the dynamics are so strange and so unstable that it will be some time before we know its true state. But the reaction to the early numbers and anecdotes has revealed something deeper and more constant in our politics.

The American economy runs on poverty, or at least the constant threat of it. Americans like their goods cheap and their services plentiful and the two of them, together, require a sprawling labor force willing to work tough jobs at crummy wages. On the right, the barest glimmer of worker power is treated as a policy emergency, and the whip of poverty, not the lure of higher wages, is the appropriate response.Reports that low-wage employers were having trouble filling open jobs sent Republican policymakers into a tizzy and led at least 25 Republican governors — and one Democratic governor — to announce plans to cut off expanded unemployment benefits early. Chipotle said that it would increase prices by about 4 percent to cover the cost of higher wages, prompting the National Republican Congressional Committee to issue a blistering response: “Democrats’ socialist stimulus bill caused a labor shortage, and now burrito lovers everywhere are footing the bill.” The Trumpist outlet The Federalist complained, “Restaurants have had to bribe current and prospective workers with fatter paychecks to lure them off their backsides and back to work.”But it’s not just the right. The financial press, the cable news squawkers and even many on the center-left greet news of labor shortages and price increases with an alarm they rarely bring to the ongoing agonies of poverty or low-wage toil.

As it happened, just as I was watching Republican governors try to immiserate low-wage workers who weren’t yet jumping at the chance to return to poorly ventilated kitchens for $9 an hour, I was sent “A Guaranteed Income for the 21st Century,” a plan that seeks to make poverty a thing of the past. The proposal, developed by Naomi Zewde, Kyle Strickland, Kelly Capatosto, Ari Glogower and Darrick Hamilton for the New School’s Institute on Race and Political Economy, would guarantee a $12,500 annual income for every adult and a $4,500 allowance for every child. It’s what wonks call a “negative income tax” plan — unlike a universal basic income, it phases out as households rise into the middle class.

“With poverty, to address it, you just eliminate it,” Hamilton told me. “You give people enough resources so they’re not poor.” Simple, but not cheap. The team estimates that its proposal would cost $876 billion annually. To give a sense of scale, total federal spending in 2019 was about $4.4 trillion, with $1 trillion of that financing Social Security payments and another $1.1 trillion support Medicaid, Medicare, the Affordable Care Act and the Children’s Health Insurance Program.

Beyond writing that the plan “would require new sources of revenue, additional borrowing or trade-offs with other government funding priorities,” Hamilton and his co-authors don’t say how they’d pay for it, and in our conversation, Hamilton was cagey. “There are many ways in which it can be paid for and deficit spending itself is not bad unless there are certain conditions,” he said. I’m less blasé about financing a program that would increase federal spending by almost 20 percent, but at the same time, it’s clearly possible. Even if the entire thing was funded by taxes, it would only bring America’s tax burden to roughly the average of our peer nations.

I suspect the real political problem for a guaranteed income isn’t the costs, but the benefits. A policy like this would give workers the power to make real choices. They could say no to a job they didn’t want, or quit one that exploited them. They could, and would, demand better wages, or take time off to attend school or simply to rest. When we spoke, Hamilton tried to sell it to me as a truer form of capitalism. “People can’t reap the returns of their effort without some baseline level of resources,” he said. “If you lack basic necessities with regards to economic well-being, you have no agency. You’re dictated to by others or live in a miserable state.”

But those in the economy with the power to do the dictating profit from the desperation of low-wage workers. One man’s misery is another man’s quick and affordable at-home lunch delivery. “It is a fact that when we pay workers less and don’t have social insurance programs that, say, cover Uber and Lyft drivers, we are able to consume goods and services at lower prices,” Hilary Hoynes, an economist at the University of California at Berkeley, where she also co-directs the Opportunity Lab, told me.

This is the conversation about poverty that we don’t like to have: We discuss the poor as a pity or a blight, but we rarely admit that America’s high rate of poverty is a policy choice, and there are reasons we choose it over and over again. We typically frame those reasons as questions of fairness (“Why should I have to pay for someone else’s laziness?”) or tough-minded paternalism (“Work is good for people, and if they can live on the dole, they would”). But there’s more to it than that.

It is true, of course, that some might use a guaranteed income to play video games or melt into Netflix. But why are they the center of this conversation? We know full well that America is full of hardworking people who are kept poor by very low wages and harsh circumstance. We know many who want a job can’t find one, and many of the jobs people can find are cruel in ways that would appall anyone sitting comfortably behind a desk. We know the absence of child care and affordable housing and decent public transit makes work, to say nothing of advancement, impossible for many. We know people lose jobs they value because of mental illness or physical disability or other factors beyond their control. We are not so naïve as to believe near-poverty and joblessness to be a comfortable condition or an attractive choice.

Most Americans don’t think of themselves as benefiting from the poverty of others, and I don’t think objections to a guaranteed income would manifest as arguments in favor of impoverishment. Instead, we would see much of what we’re seeing now, only magnified: Fears of inflation, lectures about how the government is subsidizing indolence, paeans to the character-building qualities of low-wage labor, worries that the economy will be strangled by taxes or deficits, anger that Uber and Lyft rides have gotten more expensive, sympathy for the struggling employers who can’t fill open roles rather than for the workers who had good reason not to take those jobs. These would reflect not America’s love of poverty but opposition to the inconveniences that would accompany its elimination.

Nor would these costs be merely imagined. Inflation would be a real risk, as prices often rise when wages rise, and some small businesses would shutter if they had to pay their workers more. There are services many of us enjoy now that would become rarer or costlier if workers had more bargaining power. We’d see more investments in automation and possibly in outsourcing. The truth of our politics lies in the risks we refuse to accept, and it is rising worker power, not continued poverty, that we treat as intolerable. You can see it happening right now, driven by policies far smaller and with effects far more modest than a guaranteed income.

Hamilton, to his credit, was honest about these trade-offs. “Progressives don’t like to talk about this,” he told me. “They want this kumbaya moment. They want to say equity is great for everyone when it’s not. We need to shift our values. The capitalist class stands to lose from this policy, that’s unambiguous. They will have better resourced workers they can’t exploit through wages. Their consumer products and services would be more expensive.”

For the most part, America finds the money to pay for the things it values. In recent decades, and despite deep gridlock in Washington, we have spent trillions of dollars on wars in the Middle East and tax cuts for the wealthy. We have also spent trillions of dollars on health insurance subsidies and coronavirus relief. It is in our power to wipe out poverty. It simply isn’t among our priorities.

“Ultimately, it’s about us as a society saying these privileges and luxuries and comforts that folks in the middle class — or however we describe these economic classes — have, how much are they worth to us?” Jamila Michener, co-director of the Cornell Center for Health Equity, told me. “And are they worth certain levels of deprivation or suffering or even just inequality among people who are living often very different lives from us? That’s a question we often don’t even ask ourselves.”

But we should.

Phroyd

33 notes

·

View notes

Text

The Plan Is to Save Capital and Let the People Die

Whether Americans know it or not, their government is not working for them. Their government is working on behalf of capital. Humans are now a mere second-order, instrumental factor to be considered based on how it affects capital.

Fantasize for a moment that we could set aside politics and operate based upon common sense. What would the federal government do to best mitigate the devastation that this pandemic will visit upon human beings? It would, first of all, provide free healthcare to everyone. It would distribute medical resources nationally based on the greatest need. Then, to protect people from the necessary economic deep freeze we are all in due to social distancing, the government would pursue measures that would get everyone through this time in one piece: It would subsidize the nation’s payrolls, so that workers could stay in their jobs and businesses could restart easily; it would suspend rent, for people and businesses alike; it would send everyone a monthly basic income to pay for necessities until this is over; and it would avoid allowing small businesses to go bankrupt, because those represent millions of jobs that people need to return to.

Those are all obvious steps to take if your goal was to protect humans. But imagine, instead, if you had an entirely different goal: protecting capital. What would you do then? Well, you would prioritize the health of corporate balance sheets, rather than human bodies. You would keep the healthcare industry, now booming, in private hands; you would stimulate consumer demand via unemployment benefits, rather than by keeping workers on existing payrolls, in order to create an enormous pool of cheap and desperate labor; you would pursue tax cuts for the investor class; you would welcome the opportunity to allow debt to pile up on individuals; and you wouldn’t be too sad about small businesses going bankrupt—they are, after all, just ceding market share to bigger, richer businesses. You would use this crisis to create a greater, not lesser, concentration of wealth. You would emerge on the other side with more, not less, inequality. The truth is, it would be easy.

Now, guess what the U.S. federal government is doing? It is allowing the unemployment rate to skyrocket, as tens of millions of workers are fired; it is allowing countless small businesses to go bankrupt, from incompetence and neglect; it has not even considered a national suspension of rent, nor a strong national policy of paid sick leave, much less a national system of free public healthcare; as millions of needy people struggle with decrepit and broken state unemployment systems and wait weeks or months for their emergency checks to come, and essential workers are forced to agitate or walk out to gain hazard pay, the administration plots a new bill featuring a capital gains tax cut and “a waiver that would clear businesses of liability from employees who contract the coronavirus on the job.”

We are told we’re a nation at war. In real wars, we have higher taxes on the rich. This time, we are giving investors a tax cut.

Whether Americans know it or not, their government is not working for them. Their government is working on behalf of capital. Humans are now a mere second-order, instrumental factor to be considered based on how it affects capital. In this perilous time, capital must be protected and nurtured, and we must draw resources from our entire society in order to help capital survive, in the same way that the body will draw blood from other organs to save the brain. People can be sacrificed—capital is irreplaceable. We are navigating our way through this so that capital comes out okay on the other side. It is no exaggeration to say that tens or hundreds of thousands of Americans will die because we are choosing this approach, rather than an approach that prioritizes human life. They will die because we did not dedicate resources before this pandemic to building an adequate system of public health care, and they will die because we made the decision during this pandemic to put the needs of capital first. We did not keep working people on payrolls, because that would be less advantageous for the owners of capital. We did not nationalize factories, nor pharmaceuticals, because that would be less advantageous to the owners of capital. And of course we did not release the prisoners in the jails being ravaged by this disease. What would that do for the stock market?

When this is all over, politicians will stand up and say that the heroes of this crisis were the doctors and the nurses and the grocery workers who kept going, because we needed them to. But that will not be true. Doctors are getting pay cuts because they are no longer making revenue for their employers with nonessential procedures; nurses are becoming sick and dying because we didn’t stockpile enough cheap plastic masks; grocery workers are forced to beg and plead and strike for a couple of dollars extra per hour, at the risk of their own lives. The true heroes of this crisis, from the perspective of those in charge, will be the private equity firms that rush in to buy up distressed businesses, and the hedge funds that pour money into cheap debt, and the investors that scoop up the homes that people will be evicted from. They are the ones that renew the blood of capital, you see. They are the ones that will rescue us. They are the ones who will shepherd our precious capital through this dangerous time, and into the promised land.

They will have earned their capital gains tax cut and legal protections and government bailout and their hefty profits. Where else do the ten million of you people who are now unemployed expect to get jobs after this? Hm? Be grateful. Your willingness to work for very little after this means that you may be valuable enough to make it profitable to not let you die. Congratulations.

https://www.commondreams.org/views/2020/04/09/plan-save-capital-and-let-people-die

2 notes

·

View notes

Text

Trump Promised Massive Infrastructure Projects—Instead We’ve Gotten Nothing

Digital Elixir Trump Promised Massive Infrastructure Projects—Instead We’ve Gotten Nothing

Yves here. In a bit of synchronicity, when a reader was graciously driving me to the Department of Motor Vehicles (a schlepp in the wilds of Shelby County), she mentioned she’d heard local media reports that trucks had had their weight limits lowered due to concern that some overpasses might not be able to handle the loads. Of course, a big reason infrastructure spending has plunged in the US is that it’s become an excuse for “public-private partnerships,” aka looting, when those deals take longer to get done and produce bad results so often that locals can sometimes block them.

By Tom Conway, the international president of the United Steelworkers Union (USW). Produced by the Independent Media Institute

Bad news about infrastructure is as ubiquitous as potholes. Failures in a 108-year-old railroad bridge and tunnel cost New York commuters thousands of hours in delays. Illinois doesn’t regularly inspect, let alone fix, decaying bridges. Flooding in Nebraska caused nearly half a billion dollars in road and bridge damage—just this year.

No problem, though. President Donald Trump promised to fix all this. The great dealmaker, the builder of eponymous buildings, the star of “The Apprentice,” Donald Trump, during his campaign, urged Americans to bet on him because he’d double what his opponent would spend on infrastructure. Double, he pledged!

So far, that wager has netted Americans nothing. No money. No deal. No bridges, roads or leadless water pipes. And there’s nothing on the horizon since Trump stormed out of the most recent meeting. That was a three-minute session in May with Democratic leaders at which Trump was supposed to discuss the $2 trillion he had proposed earlier to spend on infrastructure. In a press conference immediately afterward, Trump said if the Democrats continued to investigate him, he would refuse to keep his promises to the American people to repair the nation’s infrastructure.

The comedian Stephen Colbert described the situation best, saying Trump told the Democrats: “It’s my way or no highways.”

The situation, however, is no joke. Just ask the New York rail commuters held up for more than 2,000 hours over the past four years by bridge and tunnel breakdowns. Just ask the American Society of Civil Engineers, which gave the nation a D+ grade for infrastructure and estimated that if more than $1 trillion is not added to currently anticipated spending on infrastructure, “the economy is expected to lose almost $4 trillion in GDP, resulting in a loss of 2.5 million jobs in 2025.”

Candidate Donald Trump knew it was no joke. On the campaign trail, he said U.S. infrastructure was “a mess” and no better than that of a “third-world country. ”When an Amtrak train derailed in Philadelphia in 2015, killing eight and injuring about 200, he tweeted, “Our roads, airports, tunnels, bridges, electric grid—all falling apart.” Later, he tweeted, “The only one to fix the infrastructure of our country is me.”

Donald Trump promised to make America great again. And that wouldn’t be possible if America’s rail system, locks, dams and pipelines—that is, its vital organs—were “a mess.” Trump signed what he described as a contract with American voters to deliver an infrastructure plan within the first 100 days of his administration.

He mocked his Democratic opponent Hillary Clinton’s proposal to spend $275 billion. “Her number is a fraction of what we’re talking about. We need much more money to rebuild our infrastructure,” he told Fox News in 2016. “I would say at least double her numbers, and you’re going to really need a lot more than that.”

In August of 2016, he promised, “We will build the next generation of roads, bridges, railways, tunnels, seaports and airports that our country deserves. American cars will travel the roads, American planes will connect our cities, and American ships will patrol the seas. American steel will send new skyscrapers soaring. We will put new American metal into the spine of this nation.”

In his victory speech and both of his State of the Union addresses, he pledged again to be the master of infrastructure. “We are going to fix our inner cities and rebuild our highways, bridges, tunnels, airports, school, hospitals. … And we will put millions of our people to work,” he said the night he won.

That sounds excellent. That’s exactly what 75 percent of respondents to a Gallup poll said they wanted. That would create millions of family-supporting jobs making the steel, aluminum, concrete, pipes and construction vehicles necessary to accomplish infrastructure repair. That would stimulate the economy in ways that benefit the middle class and those who are struggling.

That contract Trump signed with American voters to produce an infrastructure plan in the first 100 days: worthless. It never happened. He gave Americans an Infrastructure Week in June of 2017, though, and at just about the 100-day mark, predicted infrastructure spending would “take off like a rocket ship.” Two more Infrastructure Weeks followed in the next two years, but no money.

Trump finally announced a plan in February of 2018, at a little over the 365-day mark,to spend $1.5 trillion on infrastructure. It went nowhere because it managed to annoy both Democrats and Republicans.

It was to be funded by only $200 billion in federal dollars—less than what Hillary Clinton proposed. The rest was to come from state and local governments and from foreign money interests and the private sector. Basically, the idea was to hand over to hedge fund managers the roads and bridges and pipelines originally built, owned and maintained by Americans. The fat cats at the hedge funds would pay for repairs but then toll the assets in perpetuity. Nobody liked it.

That was last year. This year, by which time the words Infrastructure Week had become a synonym for promises not kept, Trump met on April 30 with top Democratic leaders and recommended a $2 trillion infrastructure investment. Democrats praised Trump afterward for taking the challenge seriously and for agreeing to find the money.

“It couldn’t have gone any better,” Ways and Means Committee Chairman Richard E. Neal, D-Mass., told the Washington Post, even though Neal was investigating Trump for possible tax fraud.

Almost immediately, Trump began complaining that Democrats were trying to hoodwink him into raising taxes to pay for the $2 trillion he had offered to spend.

Trump and the Republicans relinquished one way to pay for infrastructure when they passed a tax cut for the rich and corporations in December of 2017. As a result, the rich and corporations pocketed hundreds of billions—$1 trillion over 10 years—and Trump doesn’t have that money to invest in infrastructure. Corporations spent their tax break money on stock buybacks, further enriching the already rich. They didn’t invest in American manufacturing or worker training or wage increases.

Three weeks afterthe April 30 meeting, Trump snubbed Democrats who returned to the White House hoping the president had found a way to keep his promise to raise $2 trillion for infrastructure. Trump dismissed them like naughty schoolchildren. He told them he wouldn’t countenance Democrats simultaneously investigating him and bargaining with him—even though Democrats were investigating him at the time of the April meeting and one of the investigators—Neal—had attended.

Promise not kept again.

Trump’s reelection motto, Keep America Great, doesn’t work for infrastructure. It’s still a mess. It’s the third year of his presidency, and he has done nothing about it. Apparently, he’s saving this pledge for his next term.

In May, he promised Louisianans a new bridge over Interstate 10—only if he is reelected. He said the administration would have it ready to go on “day one, right after the election.” Just like he said he’d produce an infrastructure plan within the first 100 days of his first term.

He’s doubling down on the infrastructure promises. His win would mean Americans get nothing again.

Trump Promised Massive Infrastructure Projects—Instead We’ve Gotten Nothing

from WordPress https://ift.tt/2Y88zzN via IFTTT

1 note

·

View note

Text

The Truth Behind “Self-Made” BillionairesWhy do we glorify...

New Post has been published on https://robertreich.org/post/695958318007664640

The Truth Behind “Self-Made” BillionairesWhy do we glorify...

youtube

The Truth Behind “Self-Made” Billionaires

Why do we glorify “self-made” billionaires?

Well, being “self-made” is a seductive idea —it suggests that anybody can get to the top if they’re willing to work hard enough. It’s what the American Dream is all about.

If Kylie Jenner can become a “self-made” billionaire at age 21, so can you and I!

Even as wages stay stagnant and wealth inequality grows, it’s a comfort to think that we’re all simply one cosmetics company and some elbow grease away from fortune.

Unfortunately, a nice idea is all it is. Self-made billionaires are a myth. Just like unicorns.

The origins of self-made billionaires are often depicted as a “rags-to-riches” rise to the top fueled by nothing but personal grit and the courage to take risks — like dropping out of college, or starting a business in a garage.

But in reality, the origins of many billionaires aren’t so humble. They’re more “riches-to-even-more-riches” stories, rooted in upper-middle class upbringings.

How much risk did Bill Gates take on when his mother used her business connections to help Microsoft land a deal-making software for IBM?

Elon Musk came from a family that owned an emerald mine in Apartheid South Africa.

Jeff Bezos’ garage-based start was funded by a quarter-million dollar investment from his parents.

If your safety net to joining the billionaire class is remaining upper class – that’s not pulling yourself up by your bootstraps.

Nor is failing to pay your fair share of taxes along the way.

Along with Musk and Bezos, Michael Bloomberg, George Soros, and Carl Icahn have all gotten away with paying ZERO federal income taxes some years. That’s a big helping hand, courtesy of legal loopholes and American taxpayers who pick up the tab, all while our tax dollars subsidize the corporations owned by these so-called “self-reliant” entrepreneurs.

Did you get a thank you card from any of them? I sure as hell didn’t.

Other common ways that billionaires build their coffers off the backs of others include paying garbage wages and subjecting workers to abusive labor conditions.

But portraying themselves as rugged individuals who overcame poverty or “did it on their own” remains an effective propaganda tool for the ultrawealthy. One that keeps workers from rising up collectively to demand fairer wages – and one that ultimately distracts from the role that billionaires play in fostering poverty in the first place.

Billionaires say their success proves they can spend money more wisely and efficiently than the government. Well they have no problem with government spending when it comes to corporate subsidies.

When arguing for even more tax breaks, they claim each “dollar the government takes from [them] is a dollar less” for their “critical” role in expanding prosperity for all Americans, through job creation and philanthropy. Well that’s rubbish.

50 years of tax cuts for the wealthy have failed to trickle down. As a result of Trump’s tax cuts, 2018 saw the 400 richest American families pay a lower tax rate than the middle class. And U.S. billionaire wealth grew by $2 trillion during the first two years of a pandemic that was economically catastrophic for just about everyone else. They want to have their cake, everyone else’s cake, and eat it, too.

Behind every ten-figure net worth is systemic inequality. Inherited wealth. Labor exploitation. Tax loopholes. And government subsidies.

To claim these fortunes are “self-made” is to perpetuate a myth that blames the wealth gap on the choices of everyday Americans.

Billionaires are not made by rugged individuals. They’re made by policy failures. And a system that rewards wealth over work.

Know the truth.

0 notes

Text

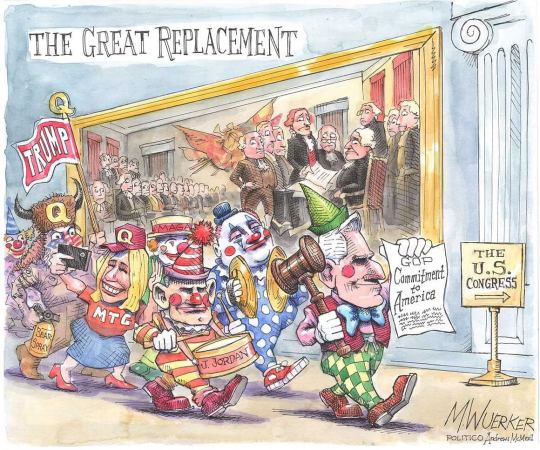

Matt Wuerker, Politico

* * * *

LETTERS FROM AN AMERICAN

October 30, 2023

HEATHER COX RICHARDSON

OCT 31, 2023

After three weeks without a speaker, the House today tackled one of the key items on its agenda: providing additional funding for Israel and Ukraine. Immediately, the majority under Speaker Mike Johnson (R-LA) made it clear that they have every intention of pushing their extremist agenda. Despite pressure from Republican Senate minority leader Mitch McConnell (R-KY), they have split funding for Israel away from the funding for Ukraine and funding for humanitarian assistance for Ukraine, Israel, and Gaza that President Biden has requested.

They have gone further, though, to push the far right’s agenda. The House Republicans’ $14.3 billion aid package for Israel claims that it will “offset” that spending by taking $14.3 billion from funding for the Internal Revenue Service (IRS) passed by Congress in the Inflation Reduction Act. But this “offset” is nothing of the sort: funding the IRS brings in significantly more than it costs. For each dollar spent auditing the top 1% of U.S. earners, the IRS brought in $3.18; for each dollar spent auditing the top 0.1%, it brought in $6.29.

In September the IRS noted that it recovered $38 million in delinquent taxes from 175 high-income taxpayers within a few months and would be increasing that effort. A 2021 study showed that people whose income is in the top 1% of earners fail to report more than 20% of their earnings to the IRS.

The House measure, providing aid for Israel only if Democrats agree to set aside Ukraine and Gaza and permit rich people to cheat on their taxes, will set up a fight with the Senate.

Tonight, White House press secretary Karine Jean-Pierre released a statement saying the Republicans’ politicization of our national security interests is a “nonstarter. Demanding offsets for meeting core national security needs of the United States—like supporting Israel and defending Ukraine from atrocities and Russian imperialism—would be a break with the normal, bipartisan process and could have devastating implications for our safety and alliances in the years ahead.”

She noted that there is strong bipartisan agreement that it is in our national security interest to stop the suffering of innocent people in Gaza, “help Ukraine defend its sovereignty against appalling crimes being committed by Russian forces against thousands of innocent civilians,” and invest more in border security.

“Threatening to undermine American national security unless House Republicans can help the wealthy and big corporations cheat on their taxes—which would increase the deficit—is the definition of backwards,” she said.

The chaos among the Republicans and the emergence of a Christian nationalist as their choice to lead the House seem to have drawn increased attention to the successes of the president.

Today, for example, the United Auto Workers announced a tentative deal with General Motors, marking the third such agreement in the union’s six-week strike against GM, Ford, and Stellantis. The agreements include a 25% raise in base wages over 4.5 years, after years in which workers’ pay did not keep up with inflation. The agreements will also protect workers against the conversion to electric vehicles, helping unionized workers to make the transition to a green economy, and reopen certain closed plants.

As Jeanne Whalen noted in the Washington Post, this agreement comes after United Parcel Service (UPS) workers this summer won their strongest contract in decades and 75,000 striking Kaiser healthcare workers won strong wage increases.

Biden was the first president to join a picket line when he stood with the UAW. Today, he said: “Today's historic agreement is yet another piece of good economic news showing something I have always believed: Worker power…is critical to building an economy from the middle out and the bottom up…. We’re finally beginning to build an economy that works for working people, for the middle class, for the entire…country, including the companies.

“Because when we do that, the poor have a ladder up, the middle class does well, and the wealthy still do very well. We all do well.”

As Michael Tomasky put it in The New Republic, “We have a president who takes seriously the fundamental economic fact of American life of the last 40 years, which is that trillions of dollars of wealth have been transferred from the lower and middle classes to the top 1 percent, and even to the top 0.1 percent. Moreover, it’s rivetingly clear that he thinks that it’s long past time to get that river flowing in the other direction.”

In The Bulwark, Jill Lawrence wrote that Biden has a “surprising focus on the future” as he “moves to meet U.S. challenges that former President Donald Trump largely ignored, failed at, or made worse.” She noted Biden’s achievement of infrastructure legislation after Trump failed, and contrasted Biden’s successful CHIPS and Science Act with the trade war of the Trump years, which cost as many as 245,000 jobs and so badly hurt midwestern farmers that 90% of the proceeds from Trump’s tariffs went to bail them out.

Biden also has looked forward by pushing and securing the Inflation Reduction Act, which invests in a transition to a green economy.

But Lawrence’s focus was primarily on today’s sweeping executive order on artificial intelligence, an order Politico called “the most significant single effort to impose national order on a technology that has shocked many people with its rapid growth.” The administration has been working to establish responsible AI practices, recognizing the need to address discriminatory algorithms, data privacy violations, and deep fakes.

Today, Biden signed an executive order requiring companies to share safety information about their systems before allowing them to be used, in order to make sure they don’t pose a safety or a national security risk. It orders the Departments of Defense and Homeland Security to secure critical infrastructure. It will require AI-generated content to bear a watermark that clearly labels it. It will protect personal data, and Biden promised he would ask Congress for legislation to pass bipartisan legislation to stop technology companies from collecting the personal data of children and teenagers, to ban advertising directed at children, and to limit companies’ collection of personal data in general.

The Information Technology and Innovation Foundation, a technology think tank, applauded the order, saying its guidelines set “a clear course for the United States…. With this EO, the United States is demonstrating it takes AI oversight seriously.”

Vice President Kamala Harris will attend the two-day AI Safety Summit meeting in the United Kingdom on November 1–2 as the European Union closes in on laws about artificial intelligence that would enable the E.U. to shut down services that harm society. The E.U. has been ahead of the U.S. in its regulation of the internet: in August 2023 its Digital Services Act went into effect, requiring users to agree to the use of their personal data for targeted advertising and requiring digital platforms to police the disinformation on their platforms. Most of the companies it regulates are based in the United States.

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Clown Car Republicans#MAGA#crazy#Matt Wuerker#Letters from An American#Heather Cox Richardson#Biden Administration#Clown Congress#Bad Fatih Republicans#National Security

7 notes

·

View notes

Video

youtube

How the Corporate Takeover of American Politics Began

The corporate takeover of American politics started with a man and a memo you've probably never heard of.

In 1971, the U.S. Chamber of Commerce asked Lewis Powell, a corporate attorney who would go on to become a Supreme Court justice, to draft a memo on the state of the country.

Powell’s memo argued that the American economic system was “under broad attack” from consumer, labor, and environmental groups.

In reality, these groups were doing nothing more than enforcing the implicit social contract that had emerged at the end of the Second World War. They wanted to ensure corporations were responsive to all their stakeholders — workers, consumers, and the environment — not just their shareholders.

But Powell and the Chamber saw it differently. In his memo, Powell urged businesses to mobilize for political combat, and stressed that the critical ingredients for success were joint organizing and funding.

The Chamber distributed the memo to leading CEOs, large businesses, and trade associations — hoping to persuade them that Big Business could dominate American politics in ways not seen since the Gilded Age.

It worked.

The Chamber’s call for a business crusade birthed a new corporate-political industry practically overnight. Tens of thousands of corporate lobbyists and political operatives descended on Washington and state capitals across the country.

I should know — I saw it happen with my own eyes.

In 1976, I worked at the Federal Trade Commission. Jimmy Carter had appointed consumer advocates to battle big corporations that for years had been deluding or injuring consumers.

Yet almost everything we initiated at the FTC was met by unexpectedly fierce political resistance from Congress. At one point, when we began examining advertising directed at children, Congress stopped funding the agency altogether, shutting it down for weeks.

I was dumbfounded. What had happened?

In three words, The Powell Memo.

Lobbyists and their allies in Congress, and eventually the Reagan administration, worked to defang agencies like the FTC — and to staff them with officials who would overlook corporate misbehavior.

Their influence led the FTC to stop seriously enforcing antitrust laws — among other things — allowing massive corporations to merge and concentrate their power even further.

Washington was transformed from a sleepy government town into a glittering center of corporate America — replete with elegant office buildings, fancy restaurants, and five-star hotels.

Meanwhile, Justice Lewis Powell used the Court to chip away at restrictions on corporate power in politics. His opinions in the 1970s and 80s laid the foundation for corporations to claim free speech rights in the form of financial contributions to political campaigns.

Put another way — without Lewis Powell, there would probably be no Citizens United — the case that threw out limits on corporate campaign spending as a violation of the “free speech” of corporations.

These actions have transformed our political system. Corporate money supports platoons of lawyers, often outgunning any state or federal attorneys who dare to stand in their way. Lobbying has become a $3.7 billion dollar industry.

Corporations regularly outspend labor unions and public interest groups during election years. And too many politicians in Washington represent the interests of corporations — not their constituents. As a result, corporate taxes have been cut, loopholes widened, and regulations gutted.

Corporate consolidation has also given companies unprecedented market power, allowing them to raise prices on everything from baby formula to gasoline. Their profits have jumped into the stratosphere — the highest in 70 years.

But despite the success of the Powell Memo, Big Business has not yet won. The people are beginning to fight back.

First, antitrust is making a comeback. Both at the Federal Trade Commission and the Justice Department we’re seeing a new willingness to take on corporate power.

Second, working people are standing up. Across the country workers are unionizing at a faster rate than we’ve seen in decades �� including at some of the biggest corporations in the world — and they’re winning.

Third, campaign finance reform is within reach. Millions of Americans are intent on limiting corporate money in politics – and politicians are starting to listen.

All of these tell me that now is our best opportunity in decades to take on corporate power — at the ballot box, in the workplace, and in Washington.

Let’s get it done.

#youtube#videos#video#powell memo#corporations#wall street#finance#corruption#politics#lobbying#government

1K notes

·

View notes

Text

#5yrsago Matt Taibbi's The Divide: incandescent indictment of the American justice-gap

Matt Taibbi's The Divide: American Injustice in the Age of the Wealth Gap is a scorching, brilliant, incandescent indictment of the widening gap in how American justice treats the rich and the poor. Taibbi's spectacular financial reporting for Rolling Stone set him out as the best running commentator on the financial crisis and its crimes, and The Divide -- beautifully illustrated by Molly Crabapple -- shows that at full length, he's even better. Cory Doctorow reviews The Divide.

Matt Taibbi's The Divide: American Injustice in the Age of the Wealth Gap is a scorching, brilliant, incandescent indictment of the widening gap in how American justice treats the rich and the poor. Taibbi's spectacular financial reporting for Rolling Stone set him out as the best running commentator on the financial crisis and its crimes, and The Divide -- beautifully illustrated by Molly Crabapple -- shows that at full length, he's even better.

(All illustrations courtesy of Molly Crabapple)

"We've put society on bureaucratic autopilot... a steel trap for losers and a greased pipeline to money, power and impunity for the winners."

Taibbi's core hypothesis is that, just like the widening wealth-gap, America has a terrible problem with a widening justice gap. Since the Clinton years, the American state has treated poverty as a crime, turning the receipt of state aid into a basis for the most invasive intrusions into your personal life, for a never-ending round of barked accusations and cruel threats to your freedom, your family, and your future. Meanwhile, Eric Holder's "Collateral Consequences" doctrine -- conceived under Clinton, revised under GWB, and perfected under Obama -- tells federal prosecutors to punish big companies carefully, even for the worst crimes imaginable, in order to protect the innocents who work for those companies and rely on them.

The net effect is a society where HSBC can be found guilty of laundering billions for brutal Mexican drug-cartels who torture and murder with impunity, pay a fine equal to a few weeks' profit, and partially defer bonuses for a few of its executives. But on the same day, across America, poor and mostly brown people are locked into inhumane prisons for selling a joint or two of the weed those cartels control.

"The two approaches to justice may individually make a kind of sense, but side by side they're a dystopia, where common courts become factories for turning poor people into prisoners, while federal prosecutors turn into overpriced garbage-men, who behind closed doors quietly dispose of the sins of the rich for a fee."

The key to the financialization of criminal impunity is that it is profoundly boring. Understanding how Barclays stole at least -- at least -- five billion dollars from the pension funds, small towns and individuals who were owed money by Lehman Brothers requires that you get ahold of a myriad of spectacularly dull esoteric financial concepts and long-winded legal wheezes. The actual smoking gun is a paragraph of legalese so stultifying it should come with a Surgeon General's warning and a tissue to soak up the cerebrospinal fluid that leaks out of the ears of anyone who tries to actually read it.

But Taibbi is a fantastic storyteller, and has a gift for making the technical material accessible. His key is to alternate between different kinds of explanation: whodunnit-style recounting of breathtaking financial crimes, personal profiles of sociopathic crooks, and informed speculation about the mentality and calculus that has sapped the spine of America's prosecutors and law enforcement officers.

"Because it's fueled by the irrepressibly rising vapor of our darkest hidden values, it attacks people without money, particularly nonwhite people, with a weirdly venomous kind of hatred, treating them like they're already guilty of something, which of course they are -- namely, being that which we're all afraid of becoming."

Of course, official corruption and impunity for the rich is only half the story. The other half is the increasingly vicious war on the poor. Taibbi's recounting of the unspeakable corruption of stop-and-frisk and other quota-driven, dragnet policing mechanisms have the power of classics like Upton Sinclair's 1906 The Jungle, but unlike Sinclair, Taibbi is telling the true stories of living people.

These are people who are routinely stopped, beaten, humiliated, jailed, and cleaned out by a system that can always find something that you're guilty of. Sometimes, it's the undocumented workers who hide in the shadows as small-town cops bust them for driving without a license, charge them $1000 (while citizens charged with the same offense pay nothing, so long as they promptly get the missing license), and then rip them from their families and deport them to Mexico, where many are kidnapped and tortured my members of drug cartels who understand that deportees have US relatives with cash.

Other times, it's people who commit the crime of being brown and/or poor while walking. In the NYC projects, you can be charged with obstructing pedestrian traffic for stopping in front of your own building at 1AM after a shift at work, resting briefly on an empty street after walking the dog. And your public defender will refuse to enter a plea of not guilty, and the judge will not understand why you want such a thing, and if, by some miracle, the cop who arrested you, beat you up, and jailed you admits that he falsified your arrest, you're let go -- and so is he.

"Increasingly, the people who make decisions about justice and punishment in this country see a meaningful difference between crime and merely breaking the law."

Here, too, Taibbi looks for the systemic causes of these attitudes, a familiar and depressing blend of political expedience (Clinton wooing disaffected Dixiecrats by promising to get tough on welfare fraud, no matter what the human or financial cost), regulatory corruption (private prisons beget lobbying for rules to put people in private prisons, and the poor and nonwhite are the easiest people to put in prison without much fuss), and the financial vacuum left behind by the supernova-scale frauds of the too-big-to-fail banks (your bankrupt town can treat terrorized undocumented migrants as ATMs, hitting them up for giant fines for offenses that the lucky documented among us walk away from, Scot-free).

The Divide is a book that is more enraging than depressing. Part of that is down to Taibbi's facility with language and plot, but it's also a function of his brilliant structural trick of rotating between the stories of the afflicted and the comfortable, details of the technical mechanisms of their respective plights, and cutting analysis of the system that created the mess.

"[The government] has never put together a task force to concentrate on corruption... The Financial Crisis Inquiry Committee was given a budget of $9.8m, 'roughly one-seventh of the budget for Oliver Stone's Wall Street: Money Never Sleeps.' ...The increase in the national drug enforcement budget for the year of the biggest financial crisis since the Depression was roughly 200 times the size of the sole executive branch effort at formally investigating the causes of financial corruption."

In some ways, Taibbi's worst villains are not the financial criminals, but the captured, conflicted milquetoaste prosecutors who let them get away with crimes again and again, using fines instead of jail time, effectively imposing a modest tax on crime that isn't a deterrent -- it's just a line-item on the budget.

The argument, which originated with Holder, is that banks that are too big to fail are too big to jail. If you brought the full force of the law to bear against the criminals who steal billions and abet the most heinous crimes, rapes, tortures, and murders imaginable, their institutions will fail and everyone who depends on them -- thousands of innocents, and possibly the whole global economy -- will suffer. The prosecutors argue that their "leverage" is best used to extract billions in fines (from companies that are often sitting on hundreds of billions in government handouts and contracts) is a better outcome for "society" than putting a couple of fat-cats in jail.

But Taibbi demolishes this argument. The billions in fines are hardly matched by the hundreds of billions in harm the companies do -- over and over and over. And if the state has leverage over a company that is too big to jail, then let them use that leverage to break up the company so that the next time it commits a crime, the entire C-suite can be thrown in the Hole and the key tossed out.

"As the...wealth divide gets bigger, it becomes less and less possible for law enforcement to imagine the jail-or-garbage option for [bankers from top firms] and more and more possible to imagine it for an ever-expanding population of Everyone Else."

Because, Taibbi argues, there's another systemic risk to allowing this corruption to run unchecked: it rots us. If two people who commit the same crime always face wildly different punishments based on how rich they are, there is no justice in the justice system. A cherished and fundamental value of democratic societies -- of the rule of law -- is eroded.

When the rich can't be arrested, it seems, the poor are arrested in their stead, and the pool of people who are eligible for a stop-and-frisk, for an unexpected descent into poverty and food stamps and a regime of surveillance that beggars the imagination in its petty cruelty, only grows. It might be you. It might be me. It certainly is more than a few ex-bankers, who were foolish enough to blow the whistle on their bosses' crimes and ended up broken and impoverished for their trouble.

"Makes small piles of money smaller and big piles of money bigger"

The justice gap isn't a phenomenon separate from the wealth gap: it is both a part of it and an accelerant for it. If you are poor and arrested, the associated fees -- paying for your own DNA sampling, for example -- will sink you into deeper poverty. If you are rich and you make yourself richer with crime, you will get richer still when the government decides that your newly swollen financial institution is the only thing big enough to handle the next round of bond issues, and you wax fatter still.

Taibbi's book is a must-read. It's the kind of thing that starts movements. Don't take my word for it -- read it yourself.

The Divide: American Injustice in the Age of the Wealth Gap

https://boingboing.net/2014/06/02/matt-taibbis-the-divide-inc.html

20 notes

·

View notes

Link

THE LETTER FROM the IRS is dated December 24, 2018, the Monday after the start of the government shutdown. The headline reads, “Notice of intent to seize (levy) your property or rights to property.” It describes how the recipient, Aaron Caddel, owner of a small chain of boutique bakeries called Mr. Holmes Bakehouse, has 30 days to pay the tens of thousands of dollars allegedly owed the government or face seizure of the funds from his company’s bank account.

Caddel, who has two stores in Los Angeles and one in San Francisco, insists that the entire issue is a misunderstanding, one he had been working with the IRS to resolve before the shutdown. But now, though, as computer-generated delinquency letters continue to get sent, Caddel can’t find a live human being at the IRS to respond to him and prevent the asset seizure. “Right now, we’re reaching dial tones,” Caddel said.

The Intercept called the phone number provided on the letter for recipients wishing to contest the seizure, and got the following message: “Welcome to the Internal Revenue Service. Live telephone assistance is not available at this time. Normal operations will resume as soon as possible. … We apologize for any inconvenience.”

The almost Kafka-esque situation, in which the IRS methodically moves forward with cash seizures and taxpayers struggle to find anyone available to stop them, is one of the more unique consequences of the government shutdown, which on Saturday became the largest in American history. The shutdown has hurt small businesses more directly through the halting of Small Business Administration loans. But potentially being whacked in tax disputes, seemingly without recourse, adds a twinge of unfairness into the mix.