#and the portfolio isnt very helpful either

Explore tagged Tumblr posts

Text

Hiii

Sorry for the menacing silence after I said I would post stuff!! I ended up having too much work to do with my finals and I didn't have time to finish the stuff I wanted to.

Good news is that FINALS. ARE. DONE.

All exams are over!! I even got a 100% on the one I was most terrified of °A° ( I hate you matura ustna z polskiego )

I want to go back to posting stuff here but unfortunately I still have a lot of work left with my portfolio so it might be difficult. I'm almost done with it though so soon I'll be free of all my troubles. Hooray.

Here's a drawing of my oc that I had to make for my portfolio project ( I made some clay masks that were based on her ). I changed her design a little bit and I'm quite happy with how she looks!

That's all for now but I hope I'll be able to post normally soon!

#im honestly so exhausted from those finals#it was such a mental anguish for me#truly awful thing#and the portfolio isnt very helpful either#if i hear the word 'teczka' in my life ever again i think ill have a heart attack#digital art#digital illustration#character design#art#my art#original character#oc#muscaribrain#muscariart#muscariocs

28 notes

·

View notes

Note

if you had to pinpoint some kind of source, what caused you to "level up" in terms of art? like what do you think propelled you from being a beginner or intermediate artist to being a more advanced artist?

definitely more than one source!! but the two most important things are: study references and keep drawing!!

i dont do as many studies as i should 💀 but every time i do my eye definitely improves. using pose references, looking at photos for color palettes, studying shot composition of shows and movies i like. i really recommend doing quick gesture drawings to warm up. in class we would do 10 second, 30 second, 1 minute, 5 minutes, 10 minutes for warming up (i really need to get back to doing this 💀). portrait studies are also good for learning face structure

line of action is the site i use for gesture drawings. if you dont know what gesture drawings are its about focusing on the form and movement of the body without focusing on details too much. you want to keep your lines long and flowing no short sketchy lines. its why its a good way to warm up as well it encourages you to put your whole arm into it (as you should, its not good to draw from the wrist its bad for your wrist anyway)

but even more important than studies (which are Very important) is to just keep drawing!! you improve with every piece even if you hate what you drew (you hating it is you recognizing something isnt Right and maybe youll figure it out next time! this is when studies help). dont feel like you Have to draw a certain way either. ive basically eliminated line work from my art and im much happier for it (i prefer sketchier lines and its just made me a cleaner draftsman overall. my actual "sketches" now are basically just thumbnails so i dont get lost in the details (and if i do i end up liking the sketch more))

i feel like i really "leveled up" in the past couple years and that was because i was forced to do a lot of studies for my portfolio 💀 but also i just kept drawing and let myself experiment with how i Wanted to draw. as soon as i dropped any notions about what my art "had" to be it was like everything changed and now ive developed a style i feel comfortable and confident with :) and when i look back at my old art that i still like, i can see a version of my current style in there like it was always in there deep down and i finally just let it Be

good luck on your art journey anon!! be kind to yourself and just keep going! we all move at our own pace

12 notes

·

View notes

Text

My friends, please allow me to be a monumental buzzkill for just a moment. I’m really bothered by seeing animal-lovers unknowingly sharing staged, abusive, wildlife photography. Abusive photographers exploit people’s passion for these animals, and cause irreparable harm in doing so. You have definitely seen these photos: cute frogs and lizards pictured in sweet scenes with butterflies and garden snails. Lots of times they’re doing something silly like holding a leaf as an umbrella or “dancing” upright. Unfortunately, many people do not have the zoology background to recognize this behavior as unnatural and staged. Let’s take a look at three really popular ones from one photographer that you’ve probably seen around on the internet.

1- Frog with Snails. This image doesn’t raise any huge red flags aside from the “Too Good to be True” feeling that you get here. Those snails are perfectly placed and the frog is perfectly in focus staring at the camera. In an interview with DailyMail, the photographer stated that the frog is his pet and the encounter happened organically when “the snails appeared to want to play with the frog”. What a crazy coincidence- he has an almost identical shot of a Red-Eyed Crocodile Skink in his portfolio (worth noting: these skinks are notoriously elusive and distressed by human handling)

So yeah, no signs of overt abuse with the Princess Leia Frog, but almost certainly not the random whimsical encounter described by the artist

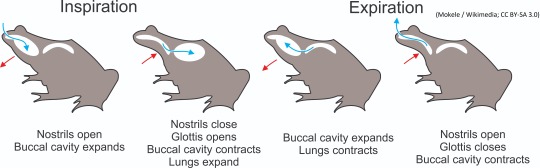

2- Big Froggy Grin. This is a Javan gliding tree frog and I have a few concerns about the way the animal in this image appears. Firstly, the way this frog is holding its mouth open appears very unnatural. Although frogs will sometimes open their mouths wide when shedding their skin, it’s usually only for a few moments and they can be seen actively using their limbs to help with the shed. It’s possible that the frog had JUST swallowed a large prey item but in that scenario you would expect the eyes to be closed or retracted inward, as anurans use their eyes to help push prey down their throat. Frogs breathe by a mechanism called “buccal pumping”, requires their mouth to be closed. A frog cannot breathe with its mouth open, which is why these “smiling” pictures always make me a little nervous! There is speculation that some photos like this are made by propping the frog’s mouth open with string, or even putting the animal in the refrigerator to slow it down, then posing it like a doll.

On top of that unnatural gaping mouth, this frog appears to have slight anisocoria, meaning one of his pupils is more dilated than the other. This can be a sign of serious neurological disease, inflammation, or head trauma. We can’t know if this is the case here, or even if this frog is unwell but it does worry me a little.

3- Crocodile Taxi. This one has been ALL over the internet in meme form and I just cringe a little bit every time I see it. The photographer said the frogs inexplicably all climbed aboard the juvenile crocodile at once and he just “had to wait a long time to see the frogs climb on to the crocodile's back. The key was to stay still and remain patient.” I am not buying this one either. These are Australian White’s tree frogs and nothing in their behavior patterns makes this make sense. The frogs are not in an amplexus position and the odds of all five of these frogs coincidentally climbing aboard is so unlikely. Not to mention this appears to be a juvenile Saltwater crocodile, whose habitat doesn’t really overlap with White’s tree frogs. The photographer risked these animals lives by placing them on top of a predator, all for a cute photo that he insists was not staged. It’s interesting though that what appears to be the very same crocodile seems to feature in many other images in his portfolio:

This is NOT normal frog behavior and to present it as such, while also endangering the frogs in question is pretty terrible.

Why does this matter? It isn’t just the fact that presenting these photos as organic encounters is dishonest (of course that’s bad enough) but the real issue is that this kind of photography harms animals. These images anthropomorphize wildlife in a way that promotes serious misunderstanding of animal behavior. It is incredibly unethical to manipulate animals like this just for the perfect shot. When we see photos like this, we MUST consider if any abuse or cruelty could have been involved in the creation of the scene. As any biologist can tell you- when humans anthropomorphize animals too much, it’s the animals that suffer for it. These pictures spread like wildfire across the internet because we love animals SO much, but it isn’t fair for us to only love a version of them that does not, in truth, exist. Here is a great article for a more in-depth investigation into the troubling phenomenon of staged wildlife photography: https://www.pbs.org/newshour/science/whimsical-wildlife-photography-isnt-seems

I would love to hear from other biologists, vets, herpetologists, etc about this matter. I am a veterinary student with a particular interest in reptiles and amphibians but I still have so much to learn, please weigh in if you think my assessment of these photos is missing something! What do you guys think about this? How can we better educate our friends online to see these seemingly cute images with a critical eye?

#long post#animal abuse#animal cruelty#photography#reptiles#reptiblr#amphibians#amphiblr#herpetology#herpblr#biology#vetblr#veterinary medicine#vet school#cute#frogs#frogblr#zoology#animal behavior#wildlife#wildlife photography#vet student#animal husbandry#whites tree frog#ecology#crocodile#anthropomorphism#animals#nature#anuran

10K notes

·

View notes

Text

Off on an Andventure with Roman Sionis

Part 1

Summary: Unexpected trip!

Warning: none Arthur’s Note: a serious step in direction of Reader and Roman becoming what they are later.

It had been a dismal spring. It cold and rain. Barely any sun, which for Gotham was normal but right now you were feeling particularly cooped up.

Sitting back from your drafting table you were sketching for some pieces to build up your portfolio. You had a few jobs in the fire but one was on vacation, the other was in Arkham. Both of them promised to get things started with you the first moment they had the chance.

Sighing, you looked around your studio. The spray-paint had long since painted over, your bolts of fabrics were tided up but sometimes a chill came over you being there. Maybe you should let Roman, help you find a new place. That could be the change you needed. And perhaps the busy work of it would help him.

You had noticed Roman had felt that way too. He had been pacing the penthouse and the club more than usual. Of course, the construction in the penthouse, was probably not helping his mood. His usual massages and even acupuncture treatments had not helped.

Harley was working on his last nerve these last few days, tonight instead of her causing a scene it might be him.

You would wear something pretty to distract him. You knew how much he loved being a good host, the best host. You did want that little annoyance getting the better of him.

Going, upstairs you changed into one of your favorite summer dresses. It was a cute retro cut, a style you had always enjoyed but this particular cut, Roman convinced you to try and it had turned out to be a great.

The light blue of this dress was like a sunny day! Letting, your hair down, and combed it out. You smiled at your reflection, you turned feeling lovely you took the next taxi to Roman’s.

*****

“Zsasz, where is she?” Roman paced, and shook his head. “Go and put our suitcases in the car.”

Zsasz, shrugged his shoulders. “Sure boss.”

Roman, looked down at his watch. What possibly could be keeping you. At least he had thought ahead. He packed the items, of yours here that he liked and bought all the rest. He ran his fingers through his hair, tugging a little in frustration. Going, to his bar he poured himself a scotch. He inhaled it. Leaning, there he debated about whether he should pour himself another.

Normally, he would have already have flown down. Most likely he’s lounging either on the beach or pool. He was grateful to have set that meeting. It was one of his biggest suppliers for alcohol and the finest foods.

He needed to get out of town! He also knew that you needed it too. You had been so on edge as of late.

Joker, had been really annoying you. One of these nights he could see him finally saying something and you would lose your cool. Which, to be honest it amused him. You were always so calm. You calmed him better than Zsasz ever did.

Maybe on the way to the airport, they’d swing by your studio. He knew that sometimes, you’d turn off your phone and work. That was probably why you had not called back of showed up.

The elevator dinged announcing it’s arrival. Breaking, into his thoughts. A pair of clicking heels, made a smile spread across his face. You were finally here! Now all of you could leave.

Coming out into the hall, seeing you he was very happy. He went up, easily lifted you and twirled you about. “Hi baby, about time!” He lowered you down. He pressed a kiss into your cheek. “Let’s go! Zsasz is putting the suitcases in the car.” He leaned over and pushed the button, it dinged and wrapping an arm around your waist he ushered you back into the elevator. Reaching into his pocket, he slipped his sunglasses on with a contented sigh. Time for a vacation of sorts to begin.

“Roman, it is so wonderful to see you this happy. But..” you grimaced. “what going on? I’m confused.”

“Baby, we’re about to fly off.”

“What?”

“I have a super important meeting and I’m bringing you with me!” He squeezed your hip. This was a big step for him, and he was incredibly excited if he really admitted it to himself that he was happy you would be at his side.

“Oh, this is great we need to get out of here!”

He smiled at you. “That was my thinking.”

Soon, they were down in the garage. “Get in the car baby, I need a word with Zsasz. He gave your bottom a pat.

Zsasz, was putting the last suitcase into the trunk.

“Zsas,” He took his glasses off. “Tell me something. Why did, Y/N not know about is leaving? I figured she would have at least checked her phone on the way here.”

Zsasz, he saw grow serious and grim. “Boss?”

“Yes.”

“I was so distracted by the suddenness of this. That I...umm forgot to message her.” He pressed his lips together, scratching the back of his head as he looked away.

“Zsasz...” Anger boiled up but then be swallowed it down and exhaled. It was a good thing they were about to leave. The rushing of the blood in his head calmed and slowed again. He inhaled before speaking. “Alright. We all make mistakes. She is here now and we can leave.”

“I’m sorry, boss.” He could see his regret.

“Ok. Let’s go.”

He turned and scooted into the Rolls beside you. He squeezed your thigh. “We will have a great time.” He said as Zsasz, came and closed the door.

*****

“Now as for you needing stuff.” He said to you, while he walked through the private part of the airport that led to the private jet. It belonged to his family. And he was grateful he could use it without fuss.

“Roman...” You cut him off in your excitement. “I could have packed super fast.”

He smirked and looked at you, his eyebrows raised above his sunglasses.

“What?”

“Baby, when I didn’t hear from you.” He tilted his head to one side smirking. “I went shopping. I bought you everything you could possibly need.”

“What!”

“I am sure you will love what I chose for you.” He smiled. “And we can always go shopping down there.”

The smile you gave him made him feel good. In this last two weeks of absolute frustration and irritation he realized more that he did enjoy having you about.

“Thank you, Roman.”

“Baby, nothing is too good for you.”

*****

Shock filled, never would you have expected this today. You glanced all around, this private portion of the airport. You had never seen it before.

You stopped for a moment, as you saw the plane. “Roman?” You swallowed.

He made a dismissive gesture. “Belongs to the family. Usually can’t always just use it. But my father is actually on good terms with this one particular partner of mine. So no issues, for once.”

“Ahh...well I...I..thank you for bringing me.” You gushed as he let you go up the steps to board first. You looked back down at him.

He smirked at you. “You think I could replace this view?” He chuckled. “Baby, you’re my girl. You’re the only one I want me with me.”

Zsasz, coughed behind Roman.

“We want you there too.” Roman, added. “You and I will some good hands at poker down there.”

“I’ve learned some new tricks, boss.”

“We’ll see about that.” Roman chuckled.

Getting up there then, Roman helped you to where the two of you would be seeing.

You looped your arm with his. “Roman, I am so excited. I’ve never done anything like this.” You kissed his cheek.

He took his sunglasses off and put them on the table in front of the two of you. “Get used to it. I got big plans, baby.”

@darling-i-read-it @spn-obession @vintagemichelle91 @xxxeatyourh3artoutxxx @ewanfuckingmcgregor @zodiyack @angel98624 @frenchgirlinlondon @nebulastarr @emyliabernstein @thepeachreads @itsknife2meetu @whyisgmora @theblackmaskclub @omghappilyuniquebouquetlove @nomnomnomnamja @poe-kadot26 @top-rumbelle-fan @babydoll97 @hazel-nuss @vcat55 @feelthemadnessinside @rosionis @queenofgotham800 @brookisbi @peachthatdrinkslemonade @johallzy @foreverhockeytrash @frostypenguinoz @guns-n-marvel @starwarsslytherin @proffesionalclown @chogisss @dance-like-russia-isnt-watching

#roman sionis x you#roman sionis pov#roman sionis imagine#roman sionis x reader#roman sionis fanfiction#roman sionis#ewan mcgregor#black mask x y/n#black mask#black mask fanfiction#black mask x you#black mask x reader#part 1#off on an andventure with roman sionis

25 notes

·

View notes

Note

just wanted to say I really admire how you set your boundaries of what you're passionate about and what you want to do for a paycheck. it's so powerful to not wholly capitalize on your interests, and embrace them on a personal/human level instead

thank u!

to be totally honest, i still think about selling zines & prints & misc handmade shit and one day professionally publishing a comic, but creatively & emotionally i’m not quite there yet. and that’s okay!

i struggled a lot internally towards the end of art school bc i didn’t know who i was yet. the work i put out was what i thought ppl expected of me, bc i was so debilitatingly self-conscious about showing work that i enjoyed making or thought was more representative of me as a person -- and then that “expectation” work ended up being mediocre anyway. it was all very self-defeating. my portfolio professors weren’t great teachers either, but im sure even the best teacher in the school wouldn’t have been able to help me bc of my mindset at the time.

its been good for me to graduate and get out of an environment where there was always pressure to immediately be a professional. im rebuilding my relationship with making art, which has been with me my whole life, and making art on my own terms without constantly worrying about what i can/should commercialize. maybe after i figure that out i’ll be ready to make money off of it, but at my own pace, and on my own terms.

(p.s. art school isnt necessarily objectively good or bad. your mileage may vary. i had classmates who did very well and continue to do very well, and i did learn a lot of skills)

anyway im sure u didnt ask for a whole ass personal essay but its something thats been on my mind a lot, especially when people ask me what i Do. thank u for this message. i think we could all use creative hobbies that just make us feel good, whether or not we’re “good” at them or can capitalize on them

8 notes

·

View notes

Text

ok here are my bird movie thoughts spoilers under cut

-you already have seen me say this but: my biggest criticism is that the casting department should have cast native actors as Theo and Audrey.

also Audrey’s role being so reduced was. not good.

-I really liked the portrayal of Hobie and Pippa they really stood out. But there should have been more of them not just by themselves but together!! (if there had just been a miniseries ...) I think it was kind of an interesting choice that Hobie knows about the painting earlier but I didnt quite mind that? And Im glad that the movie..did not try and show her aunts decision in a good light

-Its lol that critics complained about Theo not having chemistry with Pippa when that ....lol...... AND the scenes we do have with Pippa are really effective looks at HER as a person in her own right even if we could have had more. one of the complaints I’ve seen about the book is that people feel she’s a non character but I don’t think so and I think the film medium having her acted out by a person was helpful to understanding

-I really liked Kitsey, she was very nuanced and interesting. and the same actress will be the coach in Dare Me....A Portfolio.

-I enjoyed it. but I will say the editing kind of...?? and if I didn’t read the book I would have been confused. I think non linear storytelling is fine and so is not laying everything out and revealing things gradually is too. but this story would have worked better with a miniseries. a lot just felt for the film purpose underdeveloped and rushed and either left things out or almost understated them? I get that film is a different adaption but ... for example Theo’s addiction struggles definitely didnt have the same focus in the movie.

-Hobies earring, Xandra’s jacket, the kids’ shared cat shirt, thank you wardrobe department

-Hobie telling little Theo that he and Popchyk can stay and then Popchyk sleeping on Theo...Cinema

-what got the big laugh in the theater was when Chance just straight up asked tiny Theo if he wants a drink

-XANDRA....I thought there would be more of her( and more stuff in Vegas)? but her laugh/crying when she tells Theo he’s just like Larry (which I think having that face-to-face instead of the phone worked well) was so much and I think she was effective in the scenes she was in

-when baby Theo was being interrogated and was like ITS A REMBRANDT. kdjhfbhdg. the actor was really adorable and good

-the kids were good (BETTE...lol) and could maybe have been utilized more. I liked the scene that was like “when does it hit” and IMMEDIATELY cut to them lying down high out of their minds. and somehow them doing the kids-at-a-sleepover seriously telling secrets thing about their traumas right after that worked. it was mood whiplash but that fits with how it should be ig.

- “I’m not his ward” “whatever you are to him” I WAS LIKE OH NO HE FUCKING DIDNT......!!! HE FUCKING DIDNT !!!!!!

John Crowley: Theo isnt gay but I’m going to emphasize this textually explicitly gay man who threatens him about knowing his secrets, saying “ I KNOW WHO YOU ARE” like 3 times in a row. also Boris is straight but he can’t have a girlfriend or talk about spposedly having a wife or even work with a business associate who is a woman (Myriam being cut?? let her talk..) and he stares longingly at Theo and is cinematically positioned opposite Kitsey at the party like a homewrecker in an old movie

(I genuinely love the movie Brooklyn, but Crowley...??? )

-Boris Good

-adult Theo and his endless Cersei expressions/mannerisms legit was so fucking funny. EXPRESSIONS EXACTLY LIKE HER....”I socialize with people I despise” I know he and his mommy issues stan her! something that would happen in the book. he looked like he was gonna tell Everett “by the way there’s a 30 percent off sale on lawn furniture at Sears today.” which is maybe kind of different from book Theo who is ... not outwardly like that as much

-did you see how they made Nicole look like Laura Bush lol. not a criticism just saying. but she was really good in the movie and I liked the portrayal of Mrs B and I liked how the Barbour family was done. Andy was funny and enjoyable

-I liked the cinematography detail of Theo going back to his home and seeing front and center Audrey’s mug still with her lipstick mark on it, and then seeing her red sweater laid out (which looks like Boris’ sweater)

-another detail I thought was cool was kid Pippa’s ipod being an old model to show how it was in the 2000s

-little Boris had....the exact same mannerisms and clothing style as me when I was 15 but like as a boy hsbdfdsgh

-”Katy from civics....her mother’s bf” KOTKU??? IS THAT YOU??? IS THE BOYFRIEND THE HORRIBLE ABUSIVE ONE SHE RAN AWAY FROM OR IS THIS HOPEFULLY A NICE NEW ONE? in seriousness I think having Kotku in the medium of the film acted out by a person and not just filtered through Theos biased pov (she said she saw him as a little brother...) would have been cool

-I know this probably isnt what happened but I will Meme: Crowley took one look at the “Popchyk is a gay dog” line and said we HAVE to cut half that dogs scenes

4 notes

·

View notes

Text

I've been thinking lately about what it is that I want to do with my life. Things can be difficult when you process thoughts and stimuli in the way that I do. I love many things and want to be a master of all of them. Each concept I come into contact with, I want to be knowledgeable with and well-versed within.

All this isn't to say that other people don't also have troubles all their own, but rather to express myself. In some way.

Music could be an avenue, though I don't have connections to be able to find work in that place, though I've already made several pieces for soundtracking purposes. Animation is another place, though I don't have enough in my portfolio to get the interest of potential employers and partners in that craft. Research for history and documentation would be awesome, though I sincerely have no idea how to get into that kind of business! Ha, I probably sound like such a complainer...

It doesn't help that I have trouble justifying any of this as a way to sustain myself. All of it is very selfish, self absorbed and indulgence of my habits, rather than work. I want to work, but I have no idea how I get from here to... Anywhere. I feel frozen, foiled by frustration over recognizing those self-absorbed habits and seeing how others hardly even get the opportunity. How many of the people out there can't even devote time to their creativity. They work all the time, to survive, not because they have a choice to thrive.

A good way to articulate what I feel is through this song by Bo Burnham: "ART IS DEAD"

I am an artist and because of that I'm depressed, yet self absorbed, then frustrated over that fact and still, at the end of the day, want that attention. Some validation, some way to feel recognized. Do I want to be remembered? I'm not really sure honestly.

One thing I do know.. I love how good it feels to hear that song because for once I feel like I'm actually understood. Not just logically, but literally and emotionally.

Often I feel like I don't have enough titime. Always in a hurry like there's no time to experience it all, and yet I also just can't experience it all because I'm stuck at home.

I feel like many kids from my generation grew up feeling like they had to explain themselves. To justify their actions at every turn. It's like, there has to be a reason for every movement or step, otherwise it isn't worth it. I want to be able to take my steps, fall even, and not have to justify it to anybody. I suppose I could do that, though maybe not. More and more, people are expected to believe a certain way, to act a certain way to say this and to not say that. Identity is being lost and it scares me because I feel like it's drowning out meaning.

This obviously isnt entirely true but I'm not stupid. I see when people feel like they have to explain themselves to me about their choices. Sometimes for very minute things that don't matter. Or rather, to put it another way: that don't require such analytical, worded reasoning.

Sometimes, you just want something because, that's who you are. Because it's what you want. But so much judgement has been cast on everyone, as if to say, every corner of belief must be judged. People looking for attention are cast in a negative light constantly. People who favor sexual practices with other consenting adults are shamed and looked down on. People who follow religion are often considered countless negative things (Christianity and even Judaism especially) or believed to be somehow not all a good person.

Either way, these are the sorts of things I ponder. And, put simply, I don't want to be judged for everything I believe, but... I am. Everyone is. Whether it's good or bad judgment, it just... is.

Well, in the meantime, I'm going to look for work. Maybe I'll get lucky and find my niche. America is supposed to be the land of dreams, right? Until next update.

0 notes

Text

Your Career Is a Multimillion-Dollar Investment, So Manage It Wisely

Over the course of a 40-year career, the average American with a bachelors degree can expect to earn about $1.8 million. When viewed by gender, the cumulative earnings shift somewhat, with women taking home $1.4 million over four decades compared to an average of $2.1 million for men, according to estimates by theIndiana Business Research Center at Indiana Universitys Kelley School of Business, The substantial gender pay gap aside, when viewed in this way, it becomes far more obvious just how valuable ones career can be. And those figures are just the averages. For those who manage a career as actively and shrewdly as they might an investment portfolio, aggressively working to maximize its potential as a financial asset all along the way, a careers worth of earnings could be worth far, far more. The most important part of thinking of your job as an investment is actually pretty basic: realizing that you dont just have to make an investment, you have to manage it as well, says from Emmet Savage, chief investor at MyWallSt, a learning and investing app. What does that mean exactly? Here are some ways to help make the most of your career arc and the amount of financial gain, growth, and opportunity you realize over the course of a lifetime. Change Your Mindset In many ways, treating your career as a multimillion-dollar investment begins with altering the way you view work in general. For most people, a job is just that. Something they do as a must to pay bills without really thinking about their end goal or ideal outcomes, says 35-year-old Greg Dorban, chief marketing officer for Ledger Bennett. Dorban, however, never viewed work on such simplistic terms. In the space of just five years, he progressed from intern to co-owner of a multinational marketing agency that generates eight-figure revenues, a meteoric rise he attributes to starting out with a much broader view of work than merely making ends meet. Early on Dorban established a North Star for himself the goal of owning a business in short order. This shining beacon guided his subsequent steps, inspiring him to take actions to rise above the day to day hustle of earning a living, including consistently investing in himself and in the training needed to maximize his professional potential. Building the right skills will be the best investment you can make as the payoff positively impacts so many areas of your life, not just your wallet, says Dorban. The underlying message of his story, Dorban adds, is that when considering your career, allow yourself to think bigger than simply bringing home a paycheck to cover the next rent or mortgage payment. Then identify the training, new skills, or specific experiences and growth opportunities needed to reach that higher goal. Maximize the Benefits of Everything You Do The idea of always being on and bringing your professional A-game wherever you go can be off-putting to some, but theres something to be said for recognizing the potential of all situations, including the most ordinary of moments. Erica McCurdy, a certified master coach and managing member of McCurdy Solutions Group, calls this utilizing and maximizing the benefits of everything you do, which she says can accelerate the power of your time and efforts with regard to your career. This includes making sure to introduce yourself to everyone at a meeting and at every place you pause on the way to and from the meeting, says McCurdy. It also means collecting business cards, connecting with each person on LinkedIn, including a personal message, and scheduling coffee meetings with those people who pique your interest. Never forget to send thank you notes to those who helped make the day possible, adds McCurdy. Finish up the day by updating your career and contact log so you dont lose any valuable information. There are countless points along the way where you might come into contact with someone who can open a new door for you or somehow play a pivotal role in moving your career to the next level, so keep your eyes open to the possibilities. Dont Pass Up Free Money Maximizing your earnings over the course of a career also means taking some very practical steps as well with the financial opportunities your career presents. This includes being sure to enroll in an employer sponsored 401(k) plan, particularly if the employer matches your contributions, as that match is free money and can add up over the course of a lifetime. The first and best advice I give to new hires is to contribute the maximum to their 401(k), says careers analyst Laura Handrick of FitSmallBusiness.com. Many dont understand the concept of compound interest, so as an HR professional, its important to educate employees. Handrick also suggests that if your company offers financial planning workshops, be sure to attend. This is another opportunity to expand your financial skills at no cost to you. But 401(k) matches are merely one example of the financial opportunities available through your workplace. Take Advantage of Tuition Reimbursement Many companies offer tuition reimbursement programs to help cover the costs of continuing education for employees who want to go back to school and obtain degrees or certifications. Brent Michaels, a registered nurse and creator of the website Debt & Cupcakes, says these offers have financial value on multiple levels. I graduated from nursing school with minimal student loan debt and have been able to work toward my Bachelor of Science in nursing and other certifications without spending a dime, he explained. In addition, as I complete classes, I grow professionally and personally, and the knowledge from these courses helped me secure promotions and business opportunities that would not have been available to me otherwise. Even just earning certifications, says Michaels, allows him to stand out as a motivated employee, which pays off in spades over the long run. and On the Job Training Obtaining an advanced degree or certification isnt the only way to distinguish yourself and maximize career earning potential. Many employers offer on the job training related to specific tasks the organization deems important, said Michaels. Dont pass up this opportunity, either. You may also want to actively search out such opportunities if theyre not openly available. I knew that project management was needed for a promotion I was hoping to obtain in the future, but I had no experience. I intentionally volunteered to work on projects so that I could network with the project managers, he explained. I developed relationships and obtained free project management training. This cost nothing more than my time, and allowed me to secure a promotion a few years later that increased my salary by over 25 percent. Networking Your network is everything; use it to maximize your ROI. Lets face it, you can have the best resume, you can be the best employee out there, but having people of trust who can vouch for you is irreplaceable. Nothing can beat that, begins Peter Koch, creator of the site Seller at Heart, which is focused on how to save and make extra money. Koch is obviously on to something: As many as 85% of jobs are filled via networking,according to a LinkedIn survey. This means that when youre searching for new career opportunities to boost your pay, it really is who you know, continues Koch. If youre able to make good impressions on others in your field and provide value to them, theyll be happy to recommend you next time their company has an opening you could fill. Employers want to build a team of people they trust, and a personal recommendation from a colleague will always carry more weight than an unknown applicant emailing their resume. Need an added reason why networking is so important? Switching jobs is often a better way to increase your salary more significantly, as opposed to waiting for a raise at your current company. In fact, those who leave their employers to take a new job are realizing pay raises that are about one-third larger than those who stay put. As of this past July, wages for job hoppers grew 3.8% from a year earlier, compared with 2.9% for those who opted to stay with their current employer, according to data from the Federal Reserve Bank of Atlanta. Lean Out All of these tips and tactics really lead to what career coach Denise Riebman refers to as leaning out with your career.Ribeman recently gave a keynote speech about building your career capital heres what that means. Its really about doing a skill and knowledge gap analysis and asking where you do you want to go to in your career and investing in yourself to get there, she explains. See who is a couple chapters ahead of you and identify the gaps to get there. And like Koch, Riebman says a critical part of leaning out means actively expanding that professional network, or having what she calls an open network, which will ultimately help you to be more successful professionally and financially over the long term. Traditionally people like to stay in our tribes, among people we know, people we went to school with, said Riebman. The problem is that those people have same ideas and same information as you. Having an open network is about building your career capital. Mia Tayloris an award-winning journalist with more than two decades of experience. She has worked for some of the nations best-known news organizations, including the Atlanta Journal-Constitution and the San Diego Union-Tribune. Read more: https://www.thesimpledollar.com/your-career-is-a-multi-million-dollar-investment/

0 notes

Text

A.I. Helps Take Automated Contract Analysis to the Next Level

Legal Disruption

Digitally augmenting the work of lawyers and in-house counsels could be the next step in the vast field of contract review. In complex fast-paced economies, diverging interests collide and are balanced out by the law and the tools it provides for that purpose, such as the use of contracts.

Accordingly, contracts can become as thick as books. An entire industry of attorneys, counsels, paralegals, and consultants are busy trying to sort out the world, often accused of a dark art with complex terms and an impenetrable language of its own.

Courts are notoriously overwhelmed and expensive to the point where relying on a good contract can make the difference in getting along and ahead of the crowd. Hence the importance of being earnest and efficient when it comes down to drafting and reviewing your contracts.

Yet still, contract review processes have been petrified by the concept of billable hours—the traditional operating model of external counsel—and by the lack of innovation in in-house counseling. In short, the legal industry has left the door wide open for technology disruption.

Expect the Unexpected

Early players that walked in that door in the past have been providers of product and lifecycle management solutions that attempted to get a better grip on contracts. Soon thereafter, solutions for compiling customized contracts popped up that used standardized building blocks that the end user selects while navigating decision tree schemes. Other solutions facilitate the process on its fringes as shown by the wide use of electronic signature tools.

Now, new players are swooping in and tapping into the potential that advancements in computer science have made in artificial intelligence. Their cutting-edge solutions offer prediction technology, legal analytics, document automation, contract and IP portfolio management, online dispute resolution, e-discovery, online dispute resolution, and litigation funding.

The providers often turn to their clients in bringing alive the tools and algorithms they offer. These tools accelerate current processes and free up resources for focus and new terrain. It turns out that the clients simply know best how to repurpose generic tools for their proper ends. Their transversal expert teams propel the technology’s potential to levels of exploitation which even sector-specific tech providers hardly ever achieve on their own.

This holds especially true for contracts, which—no matter their level of standardization—are as diverse and stretched in scope as their users are. Consequently, customizing automation tools becomes an intrinsic act of successful deployment of a viable solution for expediting contract drafting and review.

Transform Legal Data into Actionable Information

The goal of contract review tools is to transform legal data and content into relevant and contextualized information. In other words, squeezing ambiguous groups of words into the pristine certainty of the binary code: 0 and 1.

But such goals are often wrongheaded. Contracts are part of the law which in turn is a discipline of the social sciences that are based on anything but categories of black and white. It’s all greyish. For the foreseeable future, automation in the field of contract review will need humans for what we are good at: Associating ideas, thinking out of the box, and giving sense where there is ambiguity.

However, and on the same note, reviewing contracts isn’t a dark art either. Most contracts, especially in business, drift to repeatedly use terms and a language that stand for ideas and concepts fixed by the law or judicial precedents.

If you add to this a familiar context—let’s say a specific business sector—you will have the proper grounds for automating parts of the work on a grand scale by:

Flagging documents as relevant to a particular case (e-discovery)

Recognizing and tagging clauses and legal concepts (contextualized search)

Detecting anomalies in documents by unusual language or undue omissions or additions (analysis)

Attributing a file to a contract type, to a region, a currency, a product (categorization)

All of the above can help to reduce the amount of time reviewing from top to bottom massive amounts of standard contracts.

Enable the Information-Driven Legal Organization

How is this possible? Let’s put it very simply: “It’s the search, stupid.”

The better your search tool is equipped to recognize relevant information, the better the outcome of the automated process will be. For that purpose, the automation tool must be able to understand context.

Unless your contract uses a specific or outlandish vernacular, it’s possible to define markers that are commonly used in contract language and script often mockingly referred to as “legalese” for expressing recurrent legal concepts. On top of that, and once your search tool is fit to find these concepts, you’ll need to tell if the findings correlate with what is the agreed standard, be it a preset standard or customized standard.

This is basically what the legal industry is mostly doing by hand. Instead, you can go further in helping your stakeholders by equipping the automation tools with the ability to compare the findings with the mass of similar files. If in doing that the tool were able to continuously and automatically recalibrate, it wouldn’t be much of an effort to have it also inferring recommendations or taking actions on its own, such as pushing forward a detected anomaly to a human reviewer.

At this point, you will have found a tool that combines basic search with machine learning algorithms at its core. From there on it’ll be up to you to unleash your creativity and facilitate the lives of lawyers, legal departments and all other stakeholders who’d benefit from reanimating deadlocked business models and impermeable structures.

I am expecting the unexpected.

The post A.I. Helps Take Automated Contract Analysis to the Next Level appeared first on Law Technology Today.

from https://ift.tt/2STnsU9 from https://eliaandponto1.tumblr.com/post/182956584207

0 notes

Text

Timing and why we’re all VCs

Timing is the single most valuable skill of the modern economy, but I would argue its’s the least understood and also the least practiced.

Capitalism is fundamentally about timing, since market competition is about finding opportunities before others. When should you start a company? What company should you start? When should a VC invest? When should you join a company? When should you switch industries? When should you back a candidate for public office?

Every single one of our professional decisions is about timing, and yet, we do so little to practice and perfect it. Most employees only make 3-4 major career decisions in their lifetimes — hardly enough feedback for this skill to mature. Anyone who has worked in a large company further knows that timing a product launch or a new marketing strategy has more to do with internal politics than reading market forces.

Most of us want to make more money and accelerate our careers, but the truth is that these opportunities are few and far between. Most jobs have limited growth potential. Most startups die. Most VCs don’t make money. Most political candidates fail to get elected. The difference between success and failure sometimes has to do with hard work and tenacity, but far more often with the strategy of timing.

It’s obvious that we can be too late to these decisions of course. We can miss the round of financing, we can start a company a year or two behind someone else and lose the first-mover advantage. But we can also be way too early, ahead of the market and losing out on alternative opportunities that might have been more valuable.

Now, some perceive that “timing” is synonymous with “luck.” There is some truth there, in the sense that life is random and sometimes — completely unintentionally — people stumble upon a treasure chest of gold.

Don’t be distracted by that, because there are also people who just seem to have timing nailed. There are engineers (I know because I have seen their recruiter profiles) who have joined three unicorns in a row in the first handful of employees. There are VCs who get a string of wins that is far from chance. There are CEOs that always seem to guide their companies to the right place at the right time and drive their stock valuations up.

We talked a lot about why we can’t build infrastructure in America yesterday. One of the challenges is simply timing: so many things have to happen at once for these projects to get off the ground, and most governors and mayors lack the timing skills required to get them over the finish line.

How can you practice timing? Start writing down predictions about people, companies, and markets. Check in with the companies you talked with a few years ago — how are they doing? Ditto people you met a while back. Start evaluating your predictions: were they correct? Were they too early or too late?

More importantly, start cultivating networks of friends who have a sense of pulse on the frontiers of the economy. That could mean someone at the edge of a new science (quantum computing or AI) or someone who gets marketing to new demographics, or someone who tracks new regulatory and legal changes. Find a peer group of people who get timing and practice it as a craft.

Between TechCrunch today and my former roles in venture capital, I’ve had the opportunity to practice timing a lot. I have a list of companies that I would have backed, and some have turned into unicorns while others have ended up on the ash heap of history. I’ve predicted some trends well, while flubbed others. I’ve been way too early (a huge bias for me), and sometimes stupidly late.

But all along, I am practicing that timing muscle. It’s the only way forward in capitalism, and it’s worth every investment you can make.

Mithril Capital, management fees, and VC strategic drift

Peter Kim via Getty Images

Theodore Schleifer at Recode reported a rare deep dive into the internal intrigue at a prominent VC firm, in this case Mithril Capital. From the article:

Mithril had its best moment yet last week when a portfolio company, Auris Health, sold to Johnson & Johnson for more than $3 billion — returning at least $500 million to the fund.

All appears well. But behind the scenes, a far different story has been unfolding.

The late-stage investment firm has been a slow-burning mess for the past several months, angering current and former employees, limited partners, and, crucially, [Peter] Thiel himself, sources say.

Among the issues is the firm’s huge management fee … and I guess lack of expenses?

The firm is likely collecting as much as $20 million a year in management fees, sources familiar with the figures say.

We don’t know exactly how much the firm spends, but people close to Mithril say they can’t imagine that the firm, given its staff size, is spending more than half of that on operational expenses. [Mithril Capital founder Ajay] Royan’s salary, like that of other venture capitalists, is not publicly disclosed.

One limited partner called the fees, given the size of Mithril’s staff, “outrageous.”

What? I don’t understand this line of reasoning at all. The firm negotiates a fairly standard agreement with its limited partners, and then the LPs are pissed because the firm isn’t spending the money on massive staff and large, expensive offices? The whole point of delegating investment decisions to a GP is to empower them to organize their firm to win deals and get stuff done. If — and it’s a big if of course — they can do that on the cheap, then why should an LP care at all? Burn the management fee in a fireplace if it makes the deals happen.

Ajay Royan told Bloomberg in 2017 that Mithril does not “charge excessive fees.” But he was not exactly known for being thrifty with management money. Former employees describe Friday catered lunches where costs could run over $100 per person, and Royan was known internally for a “book ordering problem” — a former employee said that “unbelievable amounts of books” would be delivered each week to the office by Amazon to maintain the firm’s extensive library.

Pro tip: take on the mantle of book editor for a major tech publication, and the publishers will mail you books for free. We get at least a dozen at the TC offices every week, which is why we write about books so often around here these days. Alas, no $100 catered lunches.

The wider story here though appears to be one of a firm completely strategically adrift. Mithril is struggling to compete against ferocious competition in the growth-stage equity market. The best deals are obvious to dozens of firms, and the ones that are less obvious have huge risks attached to them that make it hard to write the big checks required.

“[Royan] literally did not want to compete. If there was a process or bidding war or something resembling a competition, he would just walk,” the employee said. “And he would just say, ‘I don’t want to outbid.’”

Mithril is hardly the only VC firm that is strategically adrift. Every time I go back to SF, this seems to be the norm these days among venture capitalists. There is a huge amount of money sloshing around, and very few deals that are in that sweet spot between obvious and highly risky. Startups either get three dozen term sheets or none at all, since every firm is walking around with the same frameworks and metrics in their head.

It’s so rare to actually hear a VC strategy that isn’t generic capital, that has some differentiation on sourcing, and picking, and growing businesses beyond the “we invest in great companies.” VCs don’t like strategy because it means making choices, and making choices means saying no to certain things, and those things might be the next Facebook. So they do everything, all the time, which really means they do nothing. And so we get book ordering problems and expensive lunches and weirdly angry LPs. What a boring mess.

Quality tech news from around the web

Written by Arman Tabatabai

Carl Larson Photography via Getty Images

South California is also seeing declining seed investment

Today, the Los Angeles Economic Development Corporation (LAEDC) published its updated economic forecast for LA and the Southern California region. One interesting note in the report is an observed slow down in early-stage venture investing. The report highlighted that while growth-stage investments in CA were hitting record highs, total deal count and seed investing — both in terms of total seed dollars and seed deal count — were at their lowest points since 2012.

The data points in LA, Southern CA, and the rest of the state seem to follow the trend of declining seed rounds seen in the rest of the country. While the topic is one we’ve previously discussed and one which has heated up in recent weeks with commentary from Marc Suster, Fred Wilson, and others, it’s interesting to see the trend occurring even in more nascent startup markets.

Will “Diet CA-HSR” even get done as feds look to pull back California funding

The federal government announced that it would be pulling back $1 billion in funding that was slated for the California high-speed rail project through 2022, while also pursuing legal action to help recoup the $2.5 billion it has already coughed up. The Federal Railroad Administration is arguing that the state’s updated plan — completing only a route from Bakersfield to Merced — is starkly different from the plan for which the funds were originally allocated. Ouch.

As stock exchanges compete to attract IPOs, unicorns and investors win?

It might be getting easier for companies to go public around the world. With ample late-stage capital keeping more companies staying private for longer, looser rules from the SEC and the Hong Kong Stock Exchange may be on the way to help entice more IPOs.

In the US, the SEC proposed allowing all companies to market themselves to investors before announcing IPOs versus just those that fall under the agency’s “emerging growth” definition. Across the Pacific, Bloomberg reported that Chinese tech companies have been lobbying the HK Exchange for a number of more favorable rules, including allowing companies to maintain extra voting rights and letting major shareholders buy extra stock in the process. With a serious number of Chinese companies opting to list on foreign exchanges last year, the HK Exchange might be feeling pressure to cough up concessions that could help them win local listings — especially if the US moves forward with friendlier rules.

How Japan lost half its citizens with poor data

The Japanese government failed to pay out billions of yen in government benefits for years due to faulty data. If that wasn’t bad enough, Nikkei Asian Review reported yesterday that the government is struggling to even locate roughly half of those who are owed since they don’t have their current addresses on file.

As simple as it may seem, tracking the indebted is actually a tall task since citizens have changed residences, changed names, and since the Japanese government has historically destroyed benefit applications (containing address info) after the period required to maintain them. At this point, it’s unclear whether everyone who is owed will even end up getting paid, with the Japanese government now offering a prime example of how poor data maintenance and not just poor data collection can make a situation go from bad to a whole lot worse.

Can the race to build roads in Southeast Asia avoid development gridlock?

As we harp on our “Why can’t we build anything?” obsession, infrastructure development in Southeast Asia is continuing to heat up and everyone seems to want a piece of the pie. Japan announced plans to further accelerate investment into infrastructure and urban development in the region — where China is also actively engaged — with initial expansion talks focused on Cambodia and the Philippines. At the same time, a newly unveiled government budget in Singapore and the ongoing election in Indonesia have brought infrastructure development strategies into the spotlight, with open debate on how these projects have been and should be funded.

Obsessions

More discussion of megaprojects, infrastructure, and “why can’t we build things”

We are going to be talking India here, focused around the book “Billonnaire Raj” by James Crabtree

We have a lot to catch up on in the China world when the EC launch craziness dies down. Plus, we are covering The Next Factory of the World by Irene Yuan Sun.

Societal resilience and geoengineering are still top-of-mind

Some more on metrics design and quantification

Thanks

To every member of Extra Crunch: thank you. You allow us to get off the ad-laden media churn conveyor belt and spend quality time on amazing ideas, people, and companies. If I can ever be of assistance, hit reply, or send an email to [email protected].

This newsletter is written with the assistance of Arman Tabatabai from New York

source https://techcrunch.com/2019/02/20/timing-and-why-were-all-vcs/

0 notes

Text

Unilever: why I think it’s one of the best growth and dividend shares on the FTSE 100

I would suggest that there’s not many people on Planet Earth that haven’t encountered Unilever (LSE: ULVR) and its batallion of market-leading brands.

So vast is the FTSE 100 firm’s territorial footprint spanning both developed and emerging economies, and so wide is its collection of consumer goods products, I’d be shocked if you don’t have at least one of its premium products sitting in your kitchen or bathroom cupboards as you read this.

The ubiquity of its products is the secret to Unilever’s success and its position as a reliable profits grower year after year. Selling colossal volumes of the likes of Persil washing powder, Hellmann’s mayo, Magnum ice cream and Rexona deodorant is the name of the game, and the Anglo-Dutch business is very good at it.

Tipped for recovery

Like any business, though, it isn’t immune to trading troubles now and again. Right now, Unilever has a few problems to overcome. Indeed, new chief executive Alan Jope, who brought the curtain down on Paul Polman’s 10-year tenure at the top on January 1, is in for a baptism of fire as competitive markets in North America and Europe slow sales growth to a crawl.

These sales troubles aren’t expected to go away any time soon, either. Jope has said he expects “market conditions to remain challenging,” and that underlying sales growth in 2019 will register at the lower end of its medium-term target of between 3-5%. Sales on a comparable basis rose 3.1% last year.

I’m confident, though, that Unilever can overcome these tough economic conditions and keep growing profits at a terrific rate. It’s the reason I’ve put my money where my mouth is, and bought into the household goods goliath during the summer.

Striking earnings AND dividend growth

Year

2015

2016

2017

2018

Sales (€bn)

53.3

52.7

53.7

51

Pre-tax profit (€bn)

7.2

7.5

8.2

12.4

Basic earnings per share (cents)

173

183

216

350

Dividend per share (pence)

88.49

109.03

125.58

135.3

Source: Unilever company accounts

The table above shows how earnings and dividends at Unilever have ticked ever upwards in recent years. It’s easy to pick a hole in some of the numbers, and particularly so in 2018 when the €6.8bn divestment of its failing Spreads division hit sales. But the business significantly boosted headline profits and earnings per share.

On an underlying basis, then, last year’s earnings rocketed 5.2% to 236 euro cents per share. And this followed the 10.7% rise of the previous year when comparable earnings clocked in at 224 cents.

Even though conditions in its established territories are the most difficult they’ve been for many years, the company is still expected to keep profits growing in 2019.

This pays tribute to the popularity of its labels, which remain well-bought irrespective of difficult macroeconomic conditions and fierce competition, as well as the sterling work that its ‘Connected 4 Growth’ programme is helping to drive up margins. In 2018, underlying operating margins at Unilever leapt 90 basis points year-on-year to 18.4%.

The Footsie firm’s forward P/E ratio of 19.3 times may be a tad expensive on paper. But given its exceptional defensive characteristics that allow earnings and dividends to keep rising, I reckon Unilever is still a bargain at current prices. It’s a top buy in uncertain times like these, in my opinion.

You Really Could Make A Million

Of course, picking the right shares and the strategy to be successful in the stock market isn't easy. But you can get ahead of the herd by reading the Motley Fool's FREE guide, "10 Steps To Making A Million In The Market".

The Motley Fool's experts show how a seven-figure-sum stock portfolio is within the reach of many ordinary investors in this straightforward step-by-step guide. Simply click here for your free copy.

More reading

Two FTSE 100 dividend stocks I’d buy and hold for 20 years

Have £5k to invest? I think these FTSE 100 dividend stocks could pay you for life

Why I rate the Unilever share price as a top Brexit-beating investment

Relying on the cash ISA? I’d put my trust in these FTSE 100 dividend hikers instead

Why I’d consider Unilever shares amid more Brexit drama

Royston Wild owns shares of Unilever. The Motley Fool UK owns shares of and has recommended Unilever. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes

Text

The 3 Most Valuable Investing Lessons For 2019

New Post has been published on http://webhostingtop3.com/the-3-most-valuable-investing-lessons-for-2019/

The 3 Most Valuable Investing Lessons For 2019

(Source: imgflip)

What a year it’s been! In 2017 it was market heaven for most investors.

The S&P 500 (SPY) not just delivered more than double its historical return of 9.2%, but did so with a peak decline (from all-time highs) of just 3%. That’s compared to the average intra-year peak decline of 13.8% since 1980. It was one of the best years ever, with the lowest volatility in over half a century.

Well, volatility came roaring back with a vengeance in 2018, with the stock market experiencing not just one, but two corrections. In fact, here’s how the S&P 500, Dow Jones Industrial Average (DIA), Nasdaq (QQQ), and Russell 2000 (IWM) fared by their December 24th lows (so far).

^SPX data by YCharts

The Nasdaq and Russell 2000 (small caps) were both firmly in bear markets, while the Dow and S&P came within a stone’s throw of ending the longest bull market in US history (technically, it’s still alive).

What’s more, all four major indexes are now negative for the year, which means stocks are set for their worst performance since 2008.

SPY Total Return Price data by YCharts

(Source: Wealth Of Common Sense)

But my point here isn’t to point out what a crummy year it’s been for stock investors, but rather to point out three valuable lessons we need to learn from this crazy year. Lessons that can help us not just become better investors over time, but most importantly maximize the chances of achieving our long-term financial dreams.

1. Markets Can Be Far More Volatile Than You Expect

If it feels like this has been an especially volatile time for stocks, that’s because it has been. In fact two weeks ago we had the worst week for the market since 2008, and are currently on track for the worst December since 1931 (at the peak of the Great Depression).

But the thing about volatility is that it doesn’t just come and go over time. Since 1958 market volatility has been cyclical, but trending steadily higher.

S&P 500 Trailing 12-Month Daily Return Volatility

(Source: Ploutos Research)

As Blackstone’s Byron Wien explains, this is largely a function of both the increased popularity of passive investing as well as computerized trading (which is how passive funds invest their funds).

Recent research suggests that 60%-90% of daily equity trading is now performed by algorithmic trading, up from 25% in 2004. Meanwhile, passive exchange-traded funds have directed trillions of dollars into equity markets since 2009, and the percent of the U.S. equity market share captured by passive strategies has increased from 26% at the start of 2009 to 47% as of 3Q’18. All of these trends are likely to increase volatility moving forward.” – Byron Wien (emphasis added)

In addition to market cap weighted index funds causing periods of blind selling regardless of valuations and fundamentals, you also have robo trading programs that are designed to purely sell, or even short stocks, based on certain technical indicators (which also ignore valuations and fundamentals).

As Benjamin Graham, Buffett’s mentor and the father of modern value investing, famously said:

“In the short run, the market is like a voting machine – tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine – assessing the substance of a company.”

As December has shown us, even high-quality companies, with excellent fundamentals and strong growing cash flow, can become deeply unpopular with the market at times of extreme fear. And thanks to nearly half the market being invested in ETFs, and up to 90% of daily trading being run by computer (including based on headlines and even Trump tweets), the market can become incredibly stupid in the short-term, resulting in stock prices becoming completely disconnected from either their fundamentals or the fundamentals of the economy or overall corporate earnings.

As Albert Einstein said, “Two things are infinite, the universe and human stupidity, and I am not yet completely sure about the universe.” Well, this is also true of the market. When investors get scared enough, then the potent combination of blind ETF induced selling and computerized trading can lead to some truly shocking sharp and short-term declines.

Harvard finance professor Xavier Gabaix’s 2005 study Institutional Investors and Stock Market Volatility looked at the October 19th, 1987 (Black Monday) 22.6% stock market decline (the worst in US history). That kind of decline under standard probability theory should occur once every 4.6 billion years. However, the world is far more complex than standard deviation curves would have you believe (Black Monday was a 20 standard deviation event which is essentially impossible).

That’s why the Harvard study concluded that a Black Monday style crash (largely driven by computer trading) is actually likely to occur, on average, once every 104 years. Now that doesn’t mean that such a crash necessarily will occur with predictable frequency. As Mark Hulbert, the author of the Hulbert Financial Digest explains:

“Note carefully that this doesn’t mean a crash this big will occur every 104 years. This instead will be their average frequency over long periods. So it’s possible that we will not experience another 1987-magnitude crash in our lifetimes – or that another will occur today.” – Mark Hulbert

But while a 20+% one day crash (that plunges us instantly into a bear market) are extremely rare (but far more likely than most investors realize), severe 10% daily drops are to be expected, per Professor Gabaix, about every 13 years.

(Source: Market Watch)

5% market declines are likely to occur 61 times per century, or on average once every 1.6 years. As Hulbert points out, the last 5% one-day market decline was in August 2011, and the last 10% market decline was over 30 years ago. Thus we’re actually overdue for a single-day stock market decline that would instantly put us into a correction (or possibly a bear market).

But it’s not just wild one-day broad market declines that have investors spooked these days. Another lesson from 2018 is that even when the S&P 500 isn’t in a bear market, your portfolio might be.

2. Your Portfolio Isn’t The Stock Market And The Market Isn’t Your Portfolio

While the stock market never officially entered a bear market (defined as S&P 500 closing down 20% or more below its all-time high), on December 20th 60% of the S&P 500 companies were in one (a figure that rose to about 66% by December 24).

What’s more as far as quarters go, as of December 21st, the S&P was having its 14th worst quarter ever. On December 24th, the biggest Christmas Eve drop in history, the quarterly performance of the S&P 500 became the 9th worst ever.

S&P 500 Worst Quarters

(Source: Wealth Of Common Sense) – data as of Dec 23rd

But as bad as Q4 has been for the broader market, as we’ve just seen, individual stocks often faired far worse. On December 21st, the Russell 2000 (small caps) was suffering its fourth-worst quarter since its inception in 1979.

Russell 2000 Worst Quarters

(Source: Wealth Of Common Sense)

When the market appears to have bottomed December 24th (yet to be determined), it became the 3rd worst quarter ever for US small caps. The point is that, depending on what you actually own, even standard corrections can be far more painful at the individual level.

Which brings us to the most important lesson of all from this memorable 2018.

3. If Your Portfolio Has A Critical Point Of Failure, It Will Eventually Fail Critically

Let me be very clear that I am NOT trying to scare anyone out of long-term investing. That’s because the current economic and earnings fundamentals are still pointing to positive growth over the next year or two, and today’s valuations are extremely attractive.

(Source: FactSet Research)

For example, right now most analysts expect about 8% EPS growth for the S&P 500 next year. Even energy stocks, despite the fastest oil crash in decades (43% in two months), are expected to generate nearly double-digit earnings growth.

Today the S&P 500’s forward PE ratio is just 14.2, and most sectors are historically undervalued, especially compared to a year ago.

(Source: Fortune Financial Advisors)

What do today’s historically attractive valuations mean in terms of future returns? Well, over the short-term (1-year), it’s hard to know. But historically a forward PE of 14.2 has resulted in about 17% 12-month returns. But over the long-term (five years) total returns become far more predictable and today’s valuations point to roughly 15% returns.

Don’t trust forward PEs? Well, then let’s use trailing earnings. The S&P 500’s TTM PE is currently 19.1. The market’s 20-year average TTM PE is 19.4, which means that earnings growth next year should drive at least modest returns, even if stocks remain just fairly valued. And keep in mind that the stock market is actually one never-ending cycle of alternating greed and fear. This is why just as stocks tend to overshoot to the downside (as they just did), they also overshoot to the upside.

That’s why since 1926 the average 12-month post-correction rally (from the low) has been 34% (not counting dividends). In today’s market that would equate to a 36% total return for stocks by the end of 2019 (from December 24th close). Of course, that is merely a historical average. Historical data only shows what stocks are likely to do, and is not a guarantee of what they will do (no one can make such guarantees).

But remember those scary quarterly declines for both the S&P 500 and Russell 2000? Well, here’s the good news. After such a major shellacking, stocks almost always rally strong and hard in both the short- and long-term.

(Source: Wealth Of Common Sense)

With the exception of 2001 (9/11) and 2002 (tech bubble bursting), even small-cap stocks have never followed such a miserable quarter with a negative 12-month total return. And over three and five years periods following such quarters, negative returns have literally never happened. That’s not to say that such a thing is impossible, just highly improbable unless you get a perfect storm of events occurring. One possible catalyst for stocks to still be down in 12 months might be the US defaulting on its debt during a failed debt ceiling showdown which Goldman Sachs (GS) has warned is coming between August and October of next year.

But barring an extremely stupid and catastrophic blunder by our government, stocks are likely to be up in a year, potentially a lot, thanks to today’s highly attractive valuations.

But wait a second?! Didn’t I just warn investors that Wall Street, due to the infinite stupidity of investors and the dominance of trading by computers, can be crazy volatile? Didn’t I point out that we’re overdue for not just a 5% single market decline but even a 10% single day bloodbath? Indeed I did.

The final lesson of 2018 isn’t that investors can, or should, attempt to avoid volatility, but rather safeguard their portfolios against it.

(Source: Morningstar)

Believe it or not, stocks haven’t been the best-performing asset class in history despite gut-wrenching volatility but because of it. That’s because most of the market’s returns come from just a handful of its best single day gains, which are almost all clustered during times of peak downside volatility.

Missing just the market’s best 30 days over the past 20 years would mean that an investor in the S&P 500 would have given up all positive total returns. Miss just 50 of the best days and over 20 years, your portfolio would have declined by 60%. For context, the peak decline during the Great Recession was just 57%.

What this effectively means is that good market timing is essentially impossible, and one of the most destructive things you can try with your portfolio. Literally, billion-dollar hedge funds and large investment banks (like Goldman) have spent fortunes on trying to perfect market timing systems, including using an army of quants and AI-driven algorithms. None has yet succeeded in mastering market timing (if it had, it would own most of the world by now).

The key to harnessing the awesome wealth-building power of the stock market is not to avoid short-term volatility, but rather to avoid a large permanent loss of capital. Or as the infinitely quotable Warren Buffett put it, the key to good investing is to remember two important rules.

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No 1.” Now as always Buffettisms need to be clarified. The greatest investor in history isn’t literally saying that you can avoid losing money on every single investment you make. Rather he means all investors need to ensure their portfolios lack a critical point of failure, which results in disastrous mistakes, like selling perfectly good investments during a bear market, at ludicrously low valuations. Or to put another way, you need to avoid being a forced seller of quality stocks during a market decline.

There are two critical points of failure for most investors. The first is the use of margin. As the Oracle of Omaha explains:

“My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies and leverage…Now the truth is – the first two he just added because they started with L – it’s leverage… It is crazy in my view to borrow money on securities… It’s insane to risk what you have and need for something you don’t really need… You will not be way happier if you double your net worth.” – Warren Buffett (emphasis added)

Now I too have made the mistake of falling under the siren song of margin. In fact, that’s why for the next 15 months I’ll be unable to participate in the glorious bargains all around us because I have to eliminate my leverage to zero and start building up cash reserves. I’m very fortunate that my dangerous dabbling with leverage isn’t likely to actually force me to realize terrible losses on otherwise great stocks. My best friend wasn’t so lucky. In the last 2 weeks, margin calls have forced him to realize losses that wiped out two years’ worth of gains. The price I’m paying for my mistake is missed opportunity. His is being forced to lock in catastrophic paper losses on perfectly good and ridiculously undervalued blue-chip dividend growth stocks.

While margin isn’t necessarily of the devil, Buffett’s warning against it (which I now heartily endorse and will personally live by going forward) pertains to the vast majority of people. Remember that leverage amplifies not just losses and gains, but emotions. And it’s emotions, particularly severe fear during downturns, that is the greatest single enemy of most investors.

That’s why over the past two decades, the typical retail investor has underperformed every asset class, and barely stayed ahead of inflation.

Which brings me to the biggest point of failure for most people (even those who wisely avoid margin). That would be the wrong asset allocation.

Since WWII, the average correction has lasted (peak to peak) eight months, and the average bear market (82% of which occurs during recessions) 35 months.

Since the first rule of investing is to avoid a permanent loss of capital, you need to be able to avoid panic selling even when stocks fall to shockingly low levels (and with sometimes terrifying speed). This is where the right capital allocation comes in. Asset allocation simply means your portfolio’s mix of cash/bonds/stocks.