#and equity

Explore tagged Tumblr posts

Text

We celebrate the purported geniuses who discovered the cure--but we don't acknowledge that discovering a cure means nothing unless and until we get the cure to the people who need it--an enterprise we've failed at to a remarkable degree over the last 70 years.

26K notes

·

View notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

#class war#class warfare#classism#capitalism#red lobster#toys r us#aeropostale#sears#private equity#parasites

3K notes

·

View notes

Text

Black Birder Wrongfully Accused in Central Park Used his Fame to Make Bird Watching Show-Now it Wins Emmy https://www.goodnewsnetwork.org/emmy-award-goes-to-black-man-who-was-wrongfully-accused-in-central-park-and-his-brilliant-birding-show/

His name is Christian Cooper.

—

A devoted birdwatcher who landed a show on National Geographic after making headlines during a racial profiling incident has turned his fame into an Emmy Award after overcoming adversity.

It’s a beautiful culmination of four years of creative work spawned in the wake of the “Central Park Karen” incident, that has seen Mr. Christian Cooper produce a book, television show, and graphic novel series.

To readers for whom the 24-hour news cycle has swept this story under the rug, in 2020 Christian Cooper was in a wooded area of NYC’s Central Park called The Ramble, enjoying his lifelong passion for birdwatching when a woman threatened to call 911 on him after he asked her to put her dog back on its leash, as per the park rules.

Becoming irate, the woman called the police and said there was an African-American man threatening her life, all while the Harvard-educated Cooper recorded the dreadful stunt on his smartphone.

On June 8th, he became a Daytime Emmy Award winner in the Outstanding Daytime Personality category for his show, Extraordinary Birder, which took viewers all over the Western Hemisphere exploring the nature and character of birds and Cooper’s lifelong hobby.

With birding rapidly advancing on his old career as a writer, for which he contributed to the Marvel universe, he combined the two in order to produce the critically acclaimed Better Living Through Birding: Notes from a Black Man in the Natural World, published by Penguin-Random House.

#bird watching#equity#birding#new york#racism#environmentalism#science#environment#nature#animals#usa

3K notes

·

View notes

Text

any of y’all got some feminist/Black blogs abt rights to rec?? i’m deciding to expand my talking points

#it’s been all abt veganism#which applies to all social movements#especially MY veganism which include Black rights#and equity#but i need to have more things abt feminism and racism etc

0 notes

Text

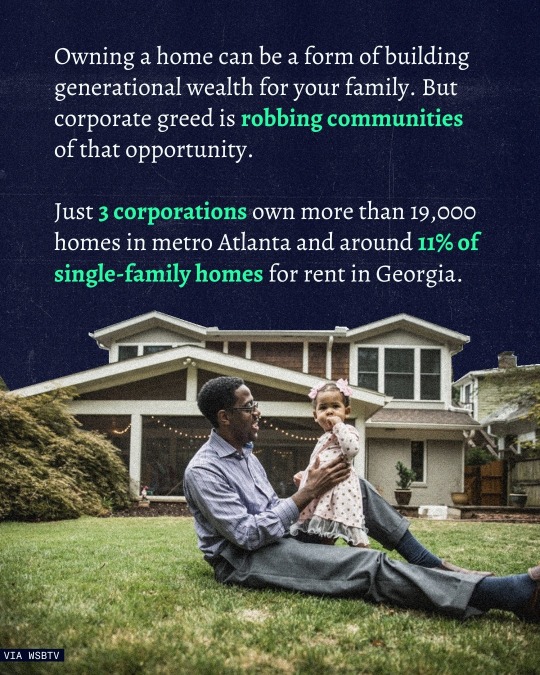

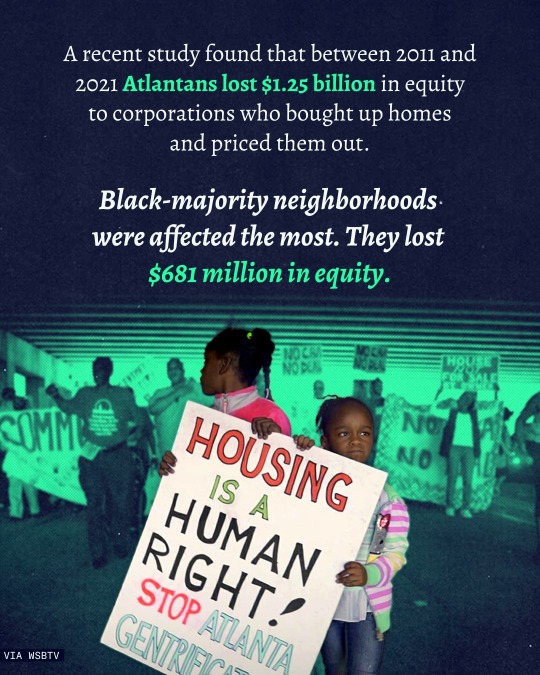

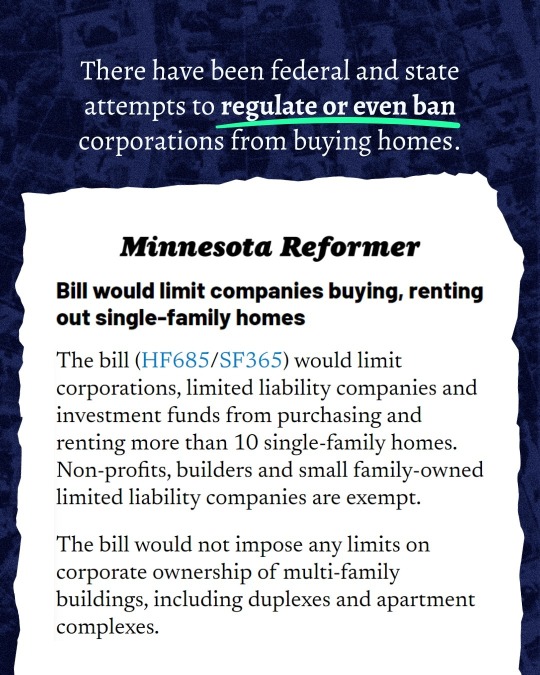

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

Ryan Adamczeski at The Advocate:

Donald Trump claims he has "nothing to do" with Project 2025, but he has a playbook of his own that would be devastating for LGBTQ+ Americans and other marginalized communities. The former president's reelection website features a section entitled Agenda 47, which hosts dozens of videos of Trump outlining his policies for if he returns to office. Several policies threaten the LGBTQ+ community, spanning across education, health care, and the military. In one video titled "President Trump's Plan to Protect Children From Left-Wing Gender Insanity," Trump promised to outlaw gender-affirming care for minors at the federal level, and “cease all programs that promote the concept of sex and gender transition at any age.” He also promised to ban transgender athletes from competing on teams that match their gender identity.

Trump stated that he "will ask Congress to pass a bill establishing that the only genders recognized by the United States government are male and female — and they are assigned at birth.” He then claimed that being transgender was "invented" by the "radical left," though he did not use the term "transgender" once throughout Agenda 47. “No serious country should be telling its children that they were born with the wrong gender — a concept that was never heard of in all of human history — nobody’s ever heard of this, what’s happening today," Trump rambled. "It was all when the radical left invented it just a few years ago.”

[...] As for public education, Trump vowed to "cut federal funding for any school or program pushing critical race theory, gender ideology, or other inappropriate racial, sexual, or political content on our children." He also promised to "create a new credentialing body to certify teachers who embrace patriotic values."

While Donald Trump may claim to have “nothing to do” with Project 2025, it and Agenda 47 are practically like-for-like in many key policy areas. #Agenda47 #Project2025

#Agenda 47#Project 2025#Donald Trump#Fascism#Gender Affirming Healthcare#Criminalization of Trans Health#Transphobia#Anti Trans Extremism#Anti LGBTQ+ Extremism#Transgender Sports#Education#Schools#Colleges#DEI#Diversity Equity and Inclusion#Transgender Erasure

843 notes

·

View notes

Text

ok but stewy being canonically bi really makes everything about his relationship with kendall so much funnier like imagine being a beautiful bisexual stallion and your fate is to become best friends with and develop a 30 year crush on logan ‘homophobia’ roy’s prodigal son like. imagine having to do deal with kendall’s ‘no homo but my tongue is down your throat’ repressed bullshit for 30 years whilst also dodging the beam of mixed flavor racism homophobia his father directs at you every time he sees you within 5 feet of said prodigal son but also you feel a strange solidarity with this old man because he at least has also accurately clocked and acknowledges that his prodigal son is queer

#like no i dont think stewy is an out proud pride parade bisexual equity bro i think his own relationship to it all is its own thing but.#kendall just casually dropping ‘you kiss guys on molly’ like the most casual thing in the world to zero surprise from the sibs is like.#stewy being a canonical known gay presence in their lives is just so funny#succession#kenstewy#stewy hosseini#m

4K notes

·

View notes

Text

#diversity win! the private equity investor who gives shitty blowjobs also kept kendall roy from being ceo by being gay!#this being the actual canon ending to one of the most prestigious television dramas ever is... so funny#stewy hosseini#shiv roy#succession#kendall roy#kenstewy

3K notes

·

View notes

Text

hey gang, in the event of project 2025 coming about, make sure to archive media that will literally be illegal if it were to happen.

ARCHIVE

ARCHIVE

ARCHIVE

Please for the love of god archive

Now WHY should you archive? Well…

according to page 36-37 of project 2025 it states the following

To quote, “P*rnography should be outlawed. The people who produce and distribute it should be imprisoned. Educators and public librarians who purvey it should be classed as registered sex offenders. And telecommunications and technology firms that facilitate its spread should be shuttered”

ok…well what constitutes as p*rn? The answer is

THEY DONT GIVE ONE

so please archive media

#trans#nonbinary#transgender#gay#lgbt#lgbtq#queer#queer music#queer media#lesbian#sapphic#homosexual#this goes for shit thats considered woke too#like things discussing the following#abortion#diversity#equity#inclusion#race#drag#drag race#also#asexual#aroace#aromantic#project 2025#pronouns#bisexual#media archive#preservation

443 notes

·

View notes

Text

can you spot all seven bunnies?

Digital illustration of a woman pushing a wheelbarrow of fresh fruits and vegetables. Around the wheelbarrow are bunnies, and there's a sign that reads, 'everyone deserves access to fresh nutritious food.'

#art#food insecurity#food deserts#food access#poverty#social justice#bunnies#animals#health justice#health equity#food is a human right

305 notes

·

View notes

Text

The reason you can’t buy a car is the same reason that your health insurer let hackers dox you

On July 14, I'm giving the closing keynote for the fifteenth HACKERS ON PLANET EARTH, in QUEENS, NY. Happy Bastille Day! On July 20, I'm appearing in CHICAGO at Exile in Bookville.

In 2017, Equifax suffered the worst data-breach in world history, leaking the deep, nonconsensual dossiers it had compiled on 148m Americans and 15m Britons, (and 19k Canadians) into the world, to form an immortal, undeletable reservoir of kompromat and premade identity-theft kits:

https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Equifax knew the breach was coming. It wasn't just that their top execs liquidated their stock in Equifax before the announcement of the breach – it was also that they ignored years of increasingly urgent warnings from IT staff about the problems with their server security.

Things didn't improve after the breach. Indeed, the 2017 Equifax breach was the starting gun for a string of more breaches, because Equifax's servers didn't just have one fubared system – it was composed of pure, refined fubar. After one group of hackers breached the main Equifax system, other groups breached other Equifax systems, over and over, and over:

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Doesn't this remind you of Boeing? It reminds me of Boeing. The spectacular 737 Max failures in 2018 weren't the end of the scandal. They weren't even the scandal's start – they were the tipping point, the moment in which a long history of lethally defective planes "breached" from the world of aviation wonks and into the wider public consciousness:

https://en.wikipedia.org/wiki/List_of_accidents_and_incidents_involving_the_Boeing_737

Just like with Equifax, the 737 Max disasters tipped Boeing into a string of increasingly grim catastrophes. Each fresh disaster landed with the grim inevitability of your general contractor texting you that he's just opened up your ceiling and discovered that all your joists had rotted out – and that he won't be able to deal with that until he deals with the termites he found last week, and that they'll have to wait until he gets to the cracks in the foundation slab from the week before, and that those will have to wait until he gets to the asbestos he just discovered in the walls.

Drip, drip, drip, as you realize that the most expensive thing you own – which is also the thing you had hoped to shelter for the rest of your life – isn't even a teardown, it's just a pure liability. Even if you razed the structure, you couldn't start over, because the soil is full of PCBs. It's not a toxic asset, because it's not an asset. It's just toxic.

Equifax isn't just a company: it's infrastructure. It started out as an engine for racial, political and sexual discrimination, paying snoops to collect gossip from nosy neighbors, which was assembled into vast warehouses full of binders that told bank officers which loan applicants should be denied for being queer, or leftists, or, you know, Black:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

This witch-hunts-as-a-service morphed into an official part of the economy, the backbone of the credit industry, with a license to secretly destroy your life with haphazardly assembled "facts" about your life that you had the most minimal, grudging right to appeal (or even see). Turns out there are a lot of customers for this kind of service, and the capital markets showered Equifax with the cash needed to buy almost all of its rivals, in mergers that were waved through by a generation of Reaganomics-sedated antitrust regulators.

There's a direct line from that acquisition spree to the Equifax breach(es). First of all, companies like Equifax were early adopters of technology. They're a database company, so they were the crash-test dummies for ever generation of database. These bug-riddled, heavily patched systems were overlaid with subsequent layers of new tech, with new defects to be patched and then overlaid with the next generation.

These systems are intrinsically fragile, because things fall apart at the seams, and these systems are all seams. They are tech-debt personified. Now, every kind of enterprise will eventually reach this state if it keeps going long enough, but the early digitizers are the bow-wave of that coming infopocalypse, both because they got there first and because the bottom tiers of their systems are composed of layers of punchcards and COBOL, crumbling under the geological stresses of seventy years of subsequent technology.

The single best account of this phenomenon is the British Library's postmortem of their ransomware attack, which is also in the running for "best hard-eyed assessment of how fucked things are":

https://www.bl.uk/home/british-library-cyber-incident-review-8-march-2024.pdf

There's a reason libraries, cities, insurance companies, and other giant institutions keep getting breached: they started accumulating tech debt before anyone else, so they've got more asbestos in the walls, more sagging joists, more foundation cracks and more termites.

That was the starting point for Equifax – a company with a massive tech debt that it would struggle to pay down under the most ideal circumstances.

Then, Equifax deliberately made this situation infinitely worse through a series of mergers in which it bought dozens of other companies that all had their own version of this problem, and duct-taped their failing, fucked up IT systems to its own. The more seams an IT system has, the more brittle and insecure it is. Equifax deliberately added so many seams that you need to be able to visualized additional spatial dimensions to grasp them – they had fractal seams.

But wait, there's more! The reason to merge with your competitors is to create a monopoly position, and the value of a monopoly position is that it makes a company too big to fail, which makes it too big to jail, which makes it too big to care. Each Equifax acquisition took a piece off the game board, making it that much harder to replace Equifax if it fucked up. That, in turn, made it harder to punish Equifax if it fucked up. And that meant that Equifax didn't have to care if it fucked up.

Which is why the increasingly desperate pleas for more resources to shore up Equifax's crumbling IT and security infrastructure went unheeded. Top management could see that they were steaming directly into an iceberg, but they also knew that they had a guaranteed spot on the lifeboats, and that someone else would be responsible for fishing the dead passengers out of the sea. Why turn the wheel?

That's what happened to Boeing, too: the company acquired new layers of technical complexity by merging with rivals (principally McDonnell-Douglas), and then starved the departments that would have to deal with that complexity because it was being managed by execs whose driving passion was to run a company that was too big to care. Those execs then added more complexity by chasing lower costs by firing unionized, competent, senior staff and replacing them with untrained scabs in jurisdictions chosen for their lax labor and environmental enforcement regimes.

(The biggest difference was that Boeing once had a useful, high-quality product, whereas Equifax started off as an irredeemably terrible, if efficient, discrimination machine, and grew to become an equally terrible, but also ferociously incompetent, enterprise.)

This is the American story of the past four decades: accumulate tech debt, merge to monopoly, exponentially compound your tech debt by combining barely functional IT systems. Every corporate behemoth is locked in a race between the eventual discovery of its irreparable structural defects and its ability to become so enmeshed in our lives that we have to assume the costs of fixing those defects. It's a contest between "too rotten to stand" and "too big to care."

Remember last February, when we all discovered that there was a company called Change Healthcare, and that they were key to processing virtually every prescription filled in America? Remember how we discovered this? Change was hacked, went down, ransomed, and no one could fill a scrip in America for more than a week, until they paid the hackers $22m in Bitcoin?

https://en.wikipedia.org/wiki/2024_Change_Healthcare_ransomware_attack

How did we end up with Change Healthcare as the linchpin of the entire American prescription system? Well, first Unitedhealthcare became the largest health insurer in America by buying all its competitors in a series of mergers that comatose antitrust regulators failed to block. Then it combined all those other companies' IT systems into a cosmic-scale dog's breakfast that barely ran. Then it bought Change and used its monopoly power to ensure that every Rx ran through Change's servers, which were part of that asbestos-filled, termite-infested, crack-foundationed, sag-joisted teardown. Then, it got hacked.

United's execs are the kind of execs on a relentless quest to be too big to care, and so they don't care. Which is why their they had to subsequently announce that they had suffered a breach that turned the complete medical histories of one third of Americans into immortal Darknet kompromat that is – even now – being combined with breach data from Equifax and force-fed to the slaves in Cambodia and Laos's pig-butchering factories:

https://www.cnn.com/2024/05/01/politics/data-stolen-healthcare-hack/index.html

Those slaves are beaten, tortured, and punitively raped in compounds to force them to drain the life's savings of everyone in Canada, Australia, Singapore, the UK and Europe. Remember that they are downstream of the forseeable, inevitable IT failures of companies that set out to be too big to care that this was going to happen.

Failures like Ticketmaster's, which flushed 500 million users' personal information into the identity-theft mills just last month. Ticketmaster, you'll recall, grew to its current scale through (you guessed it), a series of mergers en route to "too big to care" status, that resulted in its IT systems being combined with those of Ticketron, Live Nation, and dozens of others:

https://www.nytimes.com/2024/05/31/business/ticketmaster-hack-data-breach.html

But enough about that. Let's go car-shopping!

Good luck with that. There's a company you've never heard. It's called CDK Global. They provide "dealer management software." They are a monopolist. They got that way after being bought by a private equity fund called Brookfield. You can't complete a car purchase without their systems, and their systems have been hacked. No one can buy a car:

https://www.cnn.com/2024/06/27/business/cdk-global-cyber-attack-update/index.html

Writing for his BIG newsletter, Matt Stoller tells the all-too-familiar story of how CDK Global filled the walls of the nation's auto-dealers with the IT equivalent of termites and asbestos, and lays the blame where it belongs: with a legal and economics establishment that wanted it this way:

https://www.thebignewsletter.com/p/a-supreme-court-justice-is-why-you

The CDK story follows the Equifax/Boeing/Change Healthcare/Ticketmaster pattern, but with an important difference. As CDK was amassing its monopoly power, one of its execs, Dan McCray, told a competitor, Authenticom founder Steve Cottrell that if he didn't sell to CDK that he would "fucking destroy" Authenticom by illegally colluding with the number two dealer management company Reynolds.

Rather than selling out, Cottrell blew the whistle, using Cottrell's own words to convince a district court that CDK had violated antitrust law. The court agreed, and ordered CDK and Reynolds – who controlled 90% of the market – to continue to allow Authenticom to participate in the DMS market.

Dealers cheered this on: CDK/Reynolds had been steadily hiking prices, while ingesting dealer data and using it to gouge the dealers on additional services, while denying dealers access to their own data. The services that Authenticom provided for $35/month cost $735/month from CDK/Reynolds (they justified this price hike by saying they needed the additional funds to cover the costs of increased information security!).

CDK/Reynolds appealed the judgment to the 7th Circuit, where a panel of economists weighed in. As Stoller writes, this panel included monopoly's most notorious (and well-compensated) cheerleader, Frank Easterbrook, and the "legendary" Democrat Diane Wood. They argued for CDK/Reynolds, demanding that the court release them from their obligations to share the market with Authenticom:

https://caselaw.findlaw.com/court/us-7th-circuit/1879150.html

The 7th Circuit bought the argument, overturning the lower court and paving the way for the CDK/Reynolds monopoly, which is how we ended up with one company's objectively shitty IT systems interwoven into the sale of every car, which meant that when Russian hackers looked at that crosseyed, it split wide open, allowing them to halt auto sales nationwide. What happens next is a near-certainty: CDK will pay a multimillion dollar ransom, and the hackers will reward them by breaching the personal details of everyone who's ever bought a car, and the slaves in Cambodian pig-butchering compounds will get a fresh supply of kompromat.

But on the plus side, the need to pay these huge ransoms is key to ensuring liquidity in the cryptocurrency markets, because ransoms are now the only nondiscretionary liability that can only be settled in crypto:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

When the 7th Circuit set up every American car owner to be pig-butchered, they cited one of the most important cases in antitrust history: the 2004 unanimous Supreme Court decision in Verizon v Trinko:

https://www.oyez.org/cases/2003/02-682

Trinko was a case about whether antitrust law could force Verizon, a telcoms monopolist, to share its lines with competitors, something it had been ordered to do and then cheated on. The decision was written by Antonin Scalia, and without it, Big Tech would never have been able to form. Scalia and Trinko gave us the modern, too-big-to-care versions of Google, Meta, Apple, Microsoft and the other tech baronies.

In his Trinko opinion, Scalia said that "possessing monopoly power" and "charging monopoly prices" was "not unlawful" – rather, it was "an important element of the free-market system." Scalia – writing on behalf of a unanimous court! – said that fighting monopolists "may lessen the incentive for the monopolist…to invest in those economically beneficial facilities."

In other words, in order to prevent monopolists from being too big to care, we have to let them have monopolies. No wonder Trinko is the Zelig of shitty antitrust rulings, from the decision to dismiss the antitrust case against Facebook and Apple's defense in its own ongoing case:

https://www.ftc.gov/system/files/documents/cases/073_2021.06.28_mtd_order_memo.pdf

Trinko is the origin node of too big to care. It's the reason that our whole economy is now composed of "infrastructure" that is made of splitting seams, asbestos, termites and dry rot. It's the reason that the entire automotive sector became dependent on companies like Reynolds, whose billionaire owner intentionally and illegally destroyed evidence of his company's crimes, before going on to commit the largest tax fraud in American history:

https://www.wsj.com/articles/billionaire-robert-brockman-accused-of-biggest-tax-fraud-in-u-s-history-dies-at-81-11660226505

Trinko begs companies to become too big to care. It ensures that they will exponentially increase their IT debt while becoming structurally important to whole swathes of the US economy. It guarantees that they will underinvest in IT security. It is the soil in which pig butchering grew.

It's why you can't buy a car.

Now, I am fond of quoting Stein's Law at moments like this: "anything that can't go on forever will eventually stop." As Stoller writes, after two decades of unchallenged rule, Trinko is looking awfully shaky. It was substantially narrowed in 2023 by the 10th Circuit, which had been briefed by Biden's antitrust division:

https://law.justia.com/cases/federal/appellate-courts/ca10/22-1164/22-1164-2023-08-21.html

And the cases of 2024 have something going for them that Trinko lacked in 2004: evidence of what a fucking disaster Trinko is. The wrongness of Trinko is so increasingly undeniable that there's a chance it will be overturned.

But it won't go down easy. As Stoller writes, Trinko didn't emerge from a vacuum: the economic theories that underpinned it come from some of the heroes of orthodox economics, like Joseph Schumpeter, who is positively worshipped. Schumpeter was antitrust's OG hater, who wrote extensively that antitrust law didn't need to exist because any harmful monopoly would be overturned by an inevitable market process dictated by iron laws of economics.

Schumpeter wrote that monopolies could only be sustained by "alertness and energy" – that there would never be a monopoly so secure that its owner became too big to care. But he went further, insisting that the promise of attaining a monopoly was key to investment in great new things, because monopolists had the economic power that let them plan and execute great feats of innovation.

The idea that monopolies are benevolent dictators has pervaded our economic tale for decades. Even today, critics who deplore Facebook and Google do so on the basis that they do not wield their power wisely (say, to stamp out harassment or disinformation). When confronted with the possibility of breaking up these companies or replacing them with smaller platforms, those critics recoil, insisting that without Big Tech's scale, no one will ever have the power to accomplish their goals:

https://pluralistic.net/2023/07/18/urban-wildlife-interface/#combustible-walled-gardens

But they misunderstand the relationship between corporate power and corporate conduct. The reason corporations accumulate power is so that they can be insulated from the consequences of the harms they wreak upon the rest of us. They don't inflict those harms out of sadism: rather, they do so in order to externalize the costs of running a good system, reaping the profits of scale while we pay its costs.

The only reason to accumulate corporate power is to grow too big to care. Any corporation that amasses enough power that it need not care about us will not care about it. You can't fix Facebook by replacing Zuck with a good unelected social media czar with total power over billions of peoples' lives. We need to abolish Zuck, not fix Zuck.

Zuck is not exceptional: there were a million sociopaths whom investors would have funded to monopolistic dominance if he had balked. A monopoly like Facebook has a Zuck-shaped hole at the top of its org chart, and only someone Zuck-shaped will ever fit through that hole.

Our whole economy is now composed of companies with sociopath-shaped holes at the tops of their org chart. The reason these companies can only be run by sociopaths is the same reason that they have become infrastructure that is crumbling due to sociopathic neglect. The reckless disregard for the risk of combining companies is the source of the market power these companies accumulated, and the market power let them neglect their systems to the point of collapse.

This is the system that Schumpeter, and Easterbrook, and Wood, and Scalia – and the entire Supreme Court of 2004 – set out to make. The fact that you can't buy a car is a feature, not a bug. The pig-butcherers, wallowing in an ocean of breach data, are a feature, not a bug. The point of the system was what it did: create unimaginable wealth for a tiny cohort of the worst people on Earth without regard to the collapse this would provoke, or the plight of those of us trapped and suffocating in the rubble.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/28/dealer-management-software/#antonin-scalia-stole-your-car

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#matt stoller#monopoly#automotive#trinko#antitrust#trustbusting#cdk global#brookfield#private equity#dms#dealer management software#blacksuit#infosec#Authenticom#Dan McCray#Steve Cottrell#Reynolds#frank easterbrook#schumpeter

994 notes

·

View notes

Text

A lot of people are radicalised by suffering, which is a valid and sadly all-too-common experience. But you wanna know what really radicalised me? Softness. Joy. Freedom. I spent so much of my adolescence deeply sad and uncomfortable in spaces that weren’t right for me, navigating a body that didn’t feel like home. Despite many many privileges, and lots of moments of genuine happiness, I often didn’t overall enjoy my life. But then I got gender-affirming surgery. I moved into my own modern, clean, comfortable flat in a friendly, walkable city full of nature and beautiful buildings. I started being able to take care of myself. I keyed into robust local social networks of people who shared my interests in nature, creativity and ameliorating the world. And I am deeply, thoroughly content. It has been incredibly radicalising to realise that, contrary to what I thought for so long, it is very easy for human beings to be happy if their material and emotional needs are fulfilled. So alongside my joy there’s this constant simmering rage. I deserve all the good things I have now, sure. But not any more or less than anyone else. The children being bombed deserve this too. So do the homeless people being moved on by police outside my local supermarket. So do the people starving in famines, imprisoned by immigration systems, brutalised by their employers, their families, the state. All I can do is fight for a world where everyone has these things. It’s a choice not to share them equitably.

#solarpunk#hopepunk#cottagepunk#environmentalism#social justice#community#optimism#bright future#climate justice#happiness#rage#equity#taking care of people#fairness#privilege#what radicalised you#joy

475 notes

·

View notes

Text

290 notes

·

View notes

Text

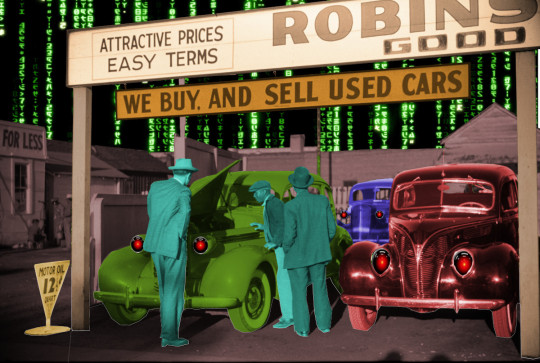

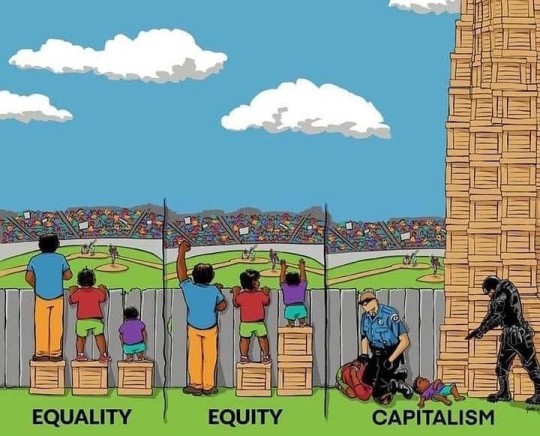

#equality#equity#capitalism#wealth inequality#one percent#economic justice#social inequality#economic exploitation#class divide#capitalism critique#systemic inequality#wealth hoarding#social justice#fairness#capitalism vs equality#equity vs equality#economic disparity#power imbalance#corporate greed#exploitation of labor#wealth concentration#capitalism failures#class oppression#socioeconomic inequality#rich vs poor#economic injustice#poverty trap#capitalism and inequality#wealth distribution

377 notes

·

View notes

Text

Women's rights activist Lilly Ledbetter has died, according to a family representative. She was 86. Ledbetter, best known for advocating for equal pay for women, died as a result of respiratory failure on Saturday night. She was in Alabama, where she was born and raised. “She was surrounded by her family and loved ones," her family said in a statement on Sunday. "Our mother lived an extraordinary life." Ledbetter's fight for equal pay started in the 1990s, when she received an anonymous letter that said she was being paid far less than her male colleagues who had similar, or less, seniority and experience at Goodyear Tire & Rubber Company in Gadsden, Alabama, where she worked as an area supervisor. “I took a job that had normally been considered a man’s job. I don’t agree with that term,” Ledbetter said in an interview with Forbes in 2019. “It’s a job. Whether it’s a man, African American, Latino, heavy, skinny, whatever. If they’re the best qualified for that job, they should get it, and they should get the money to go with it.” Thus began years of legal battles that climbed all the way to the Supreme Court. Ledbetter ultimately lost the lawsuit against Goodyear, with the high court ruling she had missed the deadline for filing her claim. But Democrats in Congress — urged on by a dissenting opinion from Justice Ruth Bader Ginsburg — fought to pass the Lilly Ledbetter Fair Pay Act. The act makes it easier for victims of pay discrimination to present a case, easing the statute of limitations that previously favored corporations. The Lilly Ledbetter Fair Pay Act became the first bill Barack Obama signed into law as president in 2009.

205 notes

·

View notes