#and Rental Construction Equipment Market

Explore tagged Tumblr posts

Text

Gcc New, Pre-Owned, And Rental Construction Equipment Market Report 2024-2032: Industry Overview, Size, Share, Trends, Growth and Forecast

GCC new, pre-owned, and rental construction equipment market size is projected to exhibit a growth rate (CAGR) of 5.50% during 2024-2032. The introduction of flexible rental agreements, along with the widespread adoption of efficient, safe, and eco-friendly machinery, is primarily augmenting the regional market.

0 notes

Text

Construction Equipment Rental Market Trends Growth in Urbanization and Infrastructure Projects

The construction equipment rental market is undergoing significant transformations due to rising construction activities, cost constraints, and technological innovations. Companies and contractors are increasingly preferring rentals over purchasing heavy machinery to minimize capital expenditures. This shift is fostering growth in the rental market, reshaping its landscape globally.

Construction Equipment Rental Market Trends: Adoption of Advanced Technology

One of the key trends in the market is the adoption of advanced technologies like telematics, GPS tracking, and real-time monitoring systems. These innovations help rental companies enhance operational efficiency, monitor equipment usage, and provide predictive maintenance solutions, improving customer satisfaction and operational reliability.

Construction Equipment Rental Market Trends: Growth in Urbanization and Infrastructure Projects

Urbanization and large-scale infrastructure projects are driving the demand for construction equipment rentals. As cities expand and new transportation, housing, and commercial projects emerge, contractors are increasingly turning to rental services to meet their short-term equipment needs while managing project budgets effectively.

Construction Equipment Rental Market Trends: Increasing Demand for Sustainable Equipment

Sustainability has become a major focus in the construction sector. There is a growing demand for eco-friendly equipment, such as electric and hybrid machinery. Rental companies are expanding their green equipment portfolios to cater to environmentally conscious clients and comply with stringent emission regulations.

Construction Equipment Rental Market Trends: Expansion of Rental Service Networks

To capture a larger market share, companies are expanding their rental service networks, especially in underserved regions. Enhanced accessibility and availability of rental equipment are helping businesses fulfill diverse project requirements, making it easier for contractors to access equipment on-demand.

Construction Equipment Rental Market Trends: Role of Digital Platforms in Equipment Leasing

Digital platforms are revolutionizing the construction equipment rental market. Online marketplaces and mobile apps enable contractors to browse, compare, and book equipment seamlessly. This digital transformation enhances transparency, improves user experience, and fosters competition among rental service providers.

Construction Equipment Rental Market Trends: Shift from Ownership to Rental Models

The rising cost of equipment ownership, including maintenance, storage, and depreciation, is prompting contractors to adopt rental models. Renting allows businesses to use the latest machinery without long-term financial commitments, offering flexibility to scale up or down based on project needs.

Construction Equipment Rental Market Trends: Customization and Specialized Equipment

The demand for specialized and customized equipment is growing in niche markets like renewable energy, tunneling, and demolition. Rental companies are increasingly offering tailored solutions to cater to these specific requirements, providing businesses with the tools they need to execute unique projects efficiently.

Construction Equipment Rental Market Trends: Impact of Government Regulations and Policies

Government regulations and policies regarding emissions, safety, and construction practices are shaping the rental market. Companies are ensuring compliance by investing in updated equipment and training. These regulations also drive the adoption of greener machinery, aligning with global environmental objectives.

Construction Equipment Rental Market Trends: Integration of Telemetry and IoT

The integration of telemetry and Internet of Things (IoT) solutions is transforming the rental industry. These technologies allow real-time monitoring of equipment performance, location tracking, and efficient utilization, leading to cost savings and optimized operations for both providers and renters.

Construction Equipment Rental Market Trends: Opportunities in Emerging Markets

Emerging markets present lucrative opportunities for the construction equipment rental industry. Rapid urbanization, industrialization, and infrastructure development in regions like Asia-Pacific, Africa, and Latin America are fueling demand for rental services. Companies are capitalizing on these opportunities by establishing their presence in these growing markets.

Conclusion

The construction equipment rental market is witnessing dynamic growth, driven by technological advancements, increased urbanization, and evolving customer preferences. The shift towards greener, smarter, and more flexible rental solutions highlights the market's adaptability. By embracing these trends, rental companies can unlock new opportunities and solidify their position in a competitive global landscape.

#Construction Equipment Rental Market#Construction Equipment Rental#Construction Equipment#Construction Equipment services#Construction#rental Equipment#Construction Equipment usages

0 notes

Text

Global Construction Equipment Rental Market is expected to reach US$ 152.79 Bn. by 2030, at a CAGR of 4.2% throughout the forecast period.

#Construction Equipment Rental Market#Construction Equipment Rental Market size#Construction Equipment Rental Market growth#Construction Equipment Rental Market share#Construction Equipment Rental Market demand#Construction Equipment Rental Market industry

0 notes

Text

Construction Equipment Rental Market Size, Share, Trends, Key Drivers, Growth Opportunities and Competitive Outlook

Global Construction Equipment Rental Market' the new research report adds in Data Bridge Market Research's reports database. This Research Report spread across 329 Page, 53 No of Tables, And 244 No of Figures with summarizing Top companies, with tables and figures. The Construction Equipment Rental market research report presents a comprehensive study on production capacity, consumption, import and export for all the major regions across the world. By keeping in mind the end user's point of view, a team of researchers, forecasters, analysts and industry expert's work in-depth to formulate this Construction Equipment Rental market research report.

Construction Equipment Rental Market research report provides data and information about the scenario of industry which makes it easy to be ahead of the competition in today's speedily altering business environment. Analytical study of this market report aids in formulating growth strategies to augment sales and build brand image in the market. The report underlines historic data along with future forecast and detailed analysis on a global, local and regional level. The winning Construction Equipment Rental Market report also takes into account an analysis of existing major challenges faced by the business and the probable future challenges that the business may have to face while operating in this market.

Global construction equipment rental market was valued at USD 98.22 billion in 2021 and is expected to reach USD 140.75 billion by 2029, registering a CAGR of 4.60% during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Access Full 350 Pages PDF Report @

Key points covered in the report: -

The pivotal aspect considered in the global Construction Equipment Rental Market report consists of the major competitors functioning in the global market.

The report includes profiles of companies with prominent positions in the global market.

The sales, corporate strategies and technical capabilities of key manufacturers are also mentioned in the report.

The driving factors for the growth of the global Construction Equipment Rental Market are thoroughly explained along with in-depth descriptions of the industry end users.

The report also elucidates important application segments of the global market to readers/users.

This report performs a SWOT analysis of the market. In the final section, the report recalls the sentiments and perspectives of industry-prepared and trained experts.

The experts also evaluate the export/import policies that might propel the growth of the Global Construction Equipment Rental Market.

The Global Construction Equipment Rental Market report provides valuable information for policymakers, investors, stakeholders, service providers, producers, suppliers, and organizations operating in the industry and looking to purchase this research document.

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Construction Equipment Rental Market Landscape

Part 04: Global Construction Equipment Rental Market Sizing

Part 05: Global Construction Equipment Rental Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

The investment made in the study would provide you access to information such as:

Construction Equipment Rental Market [Global – Broken-down into regions]

Regional level split [North America, Europe, Asia Pacific, South America, Middle East & Africa]

Country-wise Market Size Split [of important countries with major market share]

Market Share and Revenue/Sales by leading players

Market Trends – Emerging Technologies/products/start-ups, PESTEL Analysis, SWOT Analysis, Porter’s Five Forces, etc.

Market Size

Market Size by application/industry verticals

Market Projections/Forecast

Some of the major players operating in the construction equipment rental market are:

H&E Equipment Services, Inc (U.S.)

Cramo Group (Finland)

Ramirent (Finland)

Maxim Crane Works, L.P. (U.S.)

Kiloutou Group (France)

Sarens NV (Belgium)

Taiyokenki Rental Co., Ltd. (Japan)

Boels Rentals (Netherlands)

Speedy Hire Plc (UK)

United Rentals Inc. (U.S.)

Ashtead Group Plc (UK)

Loxam (Paris)

Herc Holdings Inc. (U.S.)

Aktio Corporation (Japan)

Nishio Rent All Co. Ltd. (Japan)

Kanamoto Co. Ltd. (Japan)

Nishio Rent All Co. Ltd (Japan)

Mitsubishi Corporation (Japan)

Ahern Rentals (U.S.)

Browse Trending Reports:

Waste to Energy Market Size, Share, Trends, Growth Opportunities and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-waste-to-energy-market

Green Concrete Market Size, Share, Trends, Growth and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-green-concrete-market

Polylactic Acid (PLA) Market Size, Share, Trends, Global Demand, Growth and Opportunity Analysis https://www.databridgemarketresearch.com/reports/global-polylactic-acid-pla-market

Plastic Compounding Market Size, Share, Trends, Opportunities, Key Drivers and Growth Prospectus https://www.databridgemarketresearch.com/reports/global-plastic-compounding-market

Olefins Market Size, Share, Trends, Industry Growth and Competitive Analysis https://www.databridgemarketresearch.com/reports/global-olefins-market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#Construction Equipment Rental Market Size#Share#Trends#Key Drivers#Growth Opportunities and Competitive Outlook#market share#market analysis#market research#market trends#market report#marketresearch#market size#markettrends

0 notes

Text

Construction Equipment Rental Market Size Worth USD 168.20 Billion in 2030

Rental construction equipment is increasingly being opted for by end user construction companies and infrastructure development service providers, especially in a number of developing economies, as the option aids in the expansion of construction activities, enables companies to secure construction projects and contracts – government and privately funded – and reduces cost of projects to a significant extent. In addition, use of upgraded and technologically advanced equipment can help lower need for manual labor as well as related expenses, and facilitate tracking of work process at various levels. Incorporation of new technologies into construction equipment on the other hand, comes at a price that small builders and contractors may not be able to ideally afford, and therefore, many such firms prefer to rent required equipment and reduce costs and financial constraints.

0 notes

Text

The Indonesia Construction Equipment Rental Market size was valued at around USD 3.03 billion in 2022 & is projected to grow at a CAGR of about 4.82% during the forecast period, i.e., 2023-28, owing to the rising construction of residential, commercial, and public infrastructures. The development of commercial buildings such as 5-star & 7-star hotels, resorts, and retail malls have risen due to the growing tourism in Indonesia, which further ignited the construction activities & hence led to the considerable demand for construction equipment rental such as earthmoving, concrete & masonry, crane, etc.

#Indonesia Construction Equipment Rental Market#Indonesia Construction Equipment Rental Market News#Indonesia Construction Equipment Rental Market Share#Indonesia Construction Equipment Rental Market growth

0 notes

Text

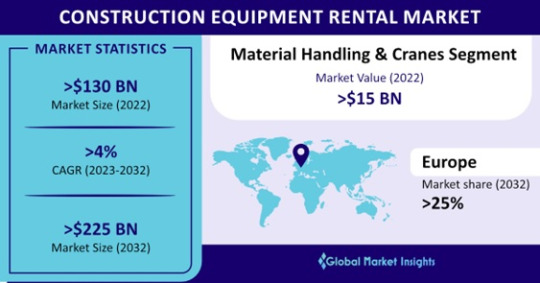

Construction Equipment Rental Market is Poised to Achieve Continuing Growth During Forecast Period 2023-2032

Construction Equipment Rental Market is expected to demonstrate a positive growth trajectory through 2032. The market escalation is expected to come from the rising demand for tech innovations in construction equipment for implementing the latest smart city technologies such as IoT, AI & ML, and electromobility into infrastructures.

Besides, increasing mining and construction initiatives in Latin America are driving the adoption of construction equipment. Organizations in this industry lease out or rent construction equipment such as cranes, scaffolding, crane lorries, work platforms, graders, bulldozers, and excavators to carry out building activities. In addition, growing mineral consumption throughout Peru, Chile, and Argentina will prompt the demand for mining trucks, excavators, loaders, and dozers throughout the region.

Get sample copy of this research report @ https://www.gminsights.com/request-sample/detail/773

Key providers in the market are engaging in strategic initiatives such as partnerships, mergers and acquisitions, R&D investments, and new product launches to gain a competitive edge in the industry. For instance, in January 2023, Al Faris Group recently extended its portfolio with addition of 24 Liebherr mobile cranes to its fleet. The delivery includes a range of models with lifting capacities from 110 to 700 tonnes, including four LTM 1500-8.1s with a lifting capacity of 500 tonnes.

Overall, the construction equipment rental market is segmented in terms of product and region.

Based on product, the concrete equipment product segment is anticipated to depict over 5% CAGR during the forecast timespan. The rising preference for high-capacity, innovative batching plants will drive the demand for such equipment. The mounting use of rental concrete equipment in construction industry has evolved owing to the production requirements. Modern concrete construction equipment producers use cutting-edge technologies to eliminate raw material waste and storage space. In addition, the constantly rising construction projects, reduction in completion times, and end-users needs for customized solutions are some of the key factors slated to assist the segment in growing.

Regionally, the North America construction equipment rental market was valued at over USD 45 billion in 2022. The regional market growth can be credited to the rise in construction, mining, and agricultural activities in the American economies. According to the Government of Canada, the value of Canada's mineral production reached USD 55.5 billion in 2021, depicting 20% year-over-year surge.

Request for customization @ https://www.gminsights.com/roc/773

Product innovations to define the competitive landscape

Purchasing new construction equipment with features such as lift assistance, preventive maintenance systems, and 360-degree cameras is expensive. This has resulted in rising demand for rental services, especially in North America, which is estimated to positively influence the overall regional outlook.

Table of Contents (ToC) of the report:

Chapter 1 Methodology & Scope

1.1 Market scope & definitions

1.2 Base estimates & forecast

1.3 Forecast calculations

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

1.5 Glossary

Chapter 2 Executive Summary

2.1 Construction equipment rental market 360º synopsis, 2018 – 2032

2.2 Business trends

2.2.1 Total Addressable Market (TAM)

2.3 Regional trends

2.4 Product trends

Browse complete Table of Contents (ToC) of this research report @ https://www.gminsights.com/toc/detail/construction-equipment-rental-market

HVAC & Construction Research Reports

Ice Maker Market

Rubber Conveyor Belt Market

Lawn & Garden Equipment Market

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: 1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

#Construction Equipment Rental Market Analysis#Construction Equipment Rental Market by Type#Construction Equipment Rental Market Share#Construction Equipment Rental Market Development#Construction Equipment Rental Market Growth

0 notes

Text

Real Estate Evolution In India!

Real estate, a constantly changing market, has a rich history and complex evolution. Although understanding its journey is challenging due to numerous factors, I will attempt to provide a simplified overview of the real estate sector in India. Let's explore its fascinating evolution without further ado!

Early years:

The real estate sector in India underwent significant transformations during the post-independence period. The government played a crucial role by implementing policies and undertaking various projects to meet the housing demands of the population. Special residential houses and colonies were constructed to cater specifically to government employees, equipped with essential amenities like schools, parks, and hospitals.

Another noteworthy development during this era was the introduction of public housing projects. As there was a shortage of residential spaces in major cities, the government initiated these projects, which greatly improved the living conditions for people. Additionally, land reforms were implemented in the 1950s and 1960s to benefit farmers and enhance rural life. These reforms included land allocation to landless farmers.

In summary, the post-independence period in India witnessed the establishment of government housing for employees, public housing projects, and land reforms aimed at improving housing conditions and supporting agricultural communities.

Urban Planning and Infrastructure:

During the post-independence period in India, there was a strong emphasis on the development and modernization of cities, which involved the implementation of infrastructure plans. These plans included the construction of bridges, ports, improved road networks, and other initiatives aimed at enhancing transportation and connectivity across the country. As a result, urban centers emerged, and the improved infrastructure contributed to the overall economic growth of India. Additionally, these developments created new employment opportunities in cities.

Basically, from the 1950s to the 1970s, the Indian government primarily focused on public housing as a key priority. However, in the subsequent years, there were significant shifts in priorities and approaches to the real estate sector.

1980s-1990s:

The 1980s to 1990s marked a significant shift in the Indian real estate sector. It witnessed the rise of private housing, attracting prominent businesses and entrepreneurs to the market. This era also saw the diversification of real estate into different sectors, including commercial and luxury properties. People began to view real estate as an investment opportunity, prioritizing their comfort and luxury.

During this time, several benefits of investing in real estate became evident:

Value Appreciation: Real estate investments had the potential for value appreciation over time, making it a favorable asset compared to other investment options.

Long-Term Security: Real estate provides stability and long-term security, offering a reliable and protected investment option.

Multiple Income Sources: Real estate investments could generate additional income through rental properties. The emergence of companies like Getsethome's 'Xtra Income Homes’, allowed property owners to earn rental income, with returns as high as 7%.

The 1980s to 1990s were transformative for the real estate industry in India, shaping the perception of real estate as an investment avenue and offering various advantages to investors. Let's now explore further developments in the subsequent years in the real estate realm.

Liberalization in the 1990s brought significant changes to the Indian real estate industry.

The government implemented measures to remove restrictive regulations, leading to rapid expansion and growth. This resulted in the emergence of large-scale real estate projects like IT parks, shopping malls, and commercial developments. The real estate landscape underwent a transformative shift, creating new avenues for development and prosperity.

Digitization has also played a crucial role in reshaping the real estate industry. Online platforms have made property search, buying, and selling more convenient and streamlined. Buyers can now easily access information about properties and make informed decisions.

The Real Estate (Regulation and Development) Act (RERA), introduced in 2016, has had a significant impact on the real estate sector. It aims to protect the rights of buyers and sellers and promote transparency in the industry.

The Covid-19 pandemic presented challenges to the real estate industry, but it also brought about unexpected positive outcomes. The experience of the pandemic shifted people's mindset towards the importance of homeownership, leading to increased interest in real estate investment. As a result, the industry quickly rebounded in 2022.

In conclusion, the real estate market is dynamic and continuously evolving. Real estate investment remains a reliable and secure option. If you are considering investing in real estate, it is advisable to take prompt action and secure your own property in this diverse and ever-changing industry.

#investment#investors#property investing#real estate#property#evolution#financial markets and investing

3 notes

·

View notes

Text

ARE MANUFACTURED HOMES A GOOD INVESTMENT IN 2023 || mysmartcousin

Title: Unveiling the Investment Potential: Exploring the Benefits of Manufactured Homes A GOOD INVESTMENT in 2023 mysmartcousin The real estate market is ever-evolving, and savvy investors are always on the lookout for promising opportunities. In this blog, we dive into the world of manufactured homes and examine whether they present a lucrative investment option in 2023. With insights from mysmartcousin, we'll explore the unique advantages and potential challenges of investing in manufactured homes, allowing you to make informed decisions and harness the potential returns in this dynamic market.

1. Understanding Manufactured Homes: To lay the foundation for our exploration, we'll start by understanding what manufactured homes are and how they differ from traditional site-built homes. Gain insights into the construction process, quality standards, and the flexibility these homes offer in terms of design, customization, and placement. By understanding the unique characteristics of manufactured homes, you'll be better equipped to assess their investment potential.

2. Affordability and Cost-Efficiency: One of the key advantages of manufactured homes is their affordability compared to site-built homes. We'll delve into the cost considerations associated with purchasing and owning manufactured homes, including lower upfront costs, potential savings on land expenses, and reduced property taxes. Explore how investing in manufactured homes can offer a more accessible entry point into the real estate market, enabling individuals to build wealth through strategic investments.

3. Rental Income Potential: Manufactured homes can be an attractive investment for generating rental income. We'll examine the rising demand for affordable housing options and the potential to earn consistent rental returns by investing in well-located manufactured home communities. Discover the benefits of owning and managing rental properties in this niche market, including tenant demographics, property management considerations, and the potential for long-term cash flow.

4. Market Trends and Appreciation Potential: While manufactured homes have historically been associated with lower appreciation rates, we'll assess the current market trends and explore whether this perception still holds true in 2023. Understand the factors that can influence the appreciation potential of manufactured homes, including location, community amenities, and the overall growth of the affordable housing market. Gain insights into strategies for maximizing appreciation and capitalizing on emerging trends.

5. Financing and Investment Strategies: Investing in manufactured homes requires a tailored approach to financing and investment strategies. We'll provide an overview of the financing options available for purchasing manufactured homes, including traditional mortgages, chattel loans, and alternative financing methods. Explore investment strategies, such as portfolio diversification, partnerships, and long-term planning, to optimize your investment returns and mitigate risks.

6. Regulatory Considerations and Due Diligence: Investing in manufactured homes comes with its own set of regulatory considerations. We'll highlight key regulations and guidelines that govern the manufactured housing industry, ensuring that you approach your investments with compliance and due diligence in mind. Understand the importance of conducting thorough property inspections, reviewing rental agreements, and staying informed about local zoning laws and regulations.

Conclusion:

Manufactured homes can offer a compelling investment opportunity in 2023, with the potential for affordability, rental income, and long-term appreciation. However, as with any investment, thorough research, due diligence, and a strategic approach are essential. Partnering with mysmartcousin can provide valuable guidance and insights throughout your investment journey. By carefully analyzing market trends, understanding financing options, and staying abreast of regulatory considerations, you can unlock the investment potential of manufactured homes and make informed decisions that align with your financial goals.

1 note

·

View note

Text

The problem this tweet in particular is referencing is actually a disaster of California policy.

See solar power w/out storage batteries is cheaper per kWh than fossil fuels, but it has a high upfront cost. So one way to promote its use is to have the government pay those upfront costs with low interest loans, which let's people avoid the high upfront cost and just pay per kilowatt hour. This makes solar power cheaper for homeowners to use than fossil fuels, which is a good thing. Now this policy is excessively homeowner centric, as many policies in California are, but there are elements to promote solar panels used for multi family housing and rental units too, which is better than nothing.

The problem is that solar panels plus storage batteries are more expensive per kilowatt hour than fossil fuels. And you can only get away with not having storage batteries so long as the production of solar panels never goes over power usage at any given hour. If it does, you get the problem mentioned above, and it can cause catastrophic power grid failure. Like, the kind you initiate blackouts to prevent because otherwise the grid will be down for months. I don't think most people realize how much disaster planning and prevention goes into making sure this kind of grid failure never happens, because that planning works, but the results would be apocalyptic.

So what the article was talking about, that the MIT technology review was referencing, was that California had done nothing to promote storage batteries at all. Only solar panels. And they kept promoting solar panels all way to the point where solar panels were overloading the grid at noon. Which had such serious potential consequences that California had to pay industrial companies to run power hungry equipment when they usually wouldn't, or to a greater degree than they usually would, to burn the excess power off. And they had to pay them to do it because that puts a lot of wear and tear on components.

(For reference on how much energy we're talking about, if you made a single light bulb which could somehow release all this energy, it would bake the ground into ash for kilometers. These are not small potatoes. It is actually very difficult to discharge that amount of energy safely.)

So what the article was talking about was that this is a failure of the overly market focused approach California was taking to solar panels. (You could even say it was a criticism of overly capitalism oriented state policy, how about that?) California was too focused on their free market success to heed the warnings of solar panel researchers (who were the people who wrote the article by the way) saying that the free market solution would be very effective in building up and initial interest and buy in for solar panels, but would not be able to compete with fossil fuels in the free market once enough of the power grid was solar panels to make storage batteries a concern. And furthermore, that there was a risk of grid failure if California persisted in its policy without allocating state funds for the construction of storage battery farms, or mandating that new solar panel owners purchase storage batteries.

But California hadn't listened to them, to the point where things were already so critically bad that California was having to pay industrial entities to burn off their excess power. A totally unsustainable and risky solution. Hence, solar panels were making energy prices go negative.

A very bad outcome!

This is a failure of thinking overly focused on market economics, but not in the hahaha lol sense, these idiot capitalists think negative energy prices are a bad thing. The negative energy prices are an extremely bad thing. Very very very bad. And the solution has to be a very serious debate about how we are going to deal with the fact that even after all of our development, solar panels and their requisite storage batteries are still more expensive than fossil fuels, and what state policies and additional tax burdens we are going to bear to wean ourselves off of our fossil fuel dependency.

Something which the "haha lol, these idiots think negative energy prices are bad" crowd doesn't like to think is necessary, instead preferring to believe that solar panels are cheaper than fossil fuels and that the only thing preventing us from making the jump is the greed of a few billionaires (not that billionaires aren't causing plenty of problems in this sphere). But there are serious difficulties with renewable technologies which are real, and which make universal adoption much more expensive than small-scale adoption. And if y'all were actually listening to the scientist researching this stuff, the very ones promoting renewable usage, you would know that these issues are real and difficult to overcome and will require significant coordinated effort to manage.

No more "haha lol, these idiots think negative energy prices are bad". This is the era of knuckling down and recognizing that clearing out counterproductive capitalist interests from the energy production space is only the beginning, and that the work which comes after that is also difficult and hard. Trust me, us researchers will be there giving you all the tools we can, but you have to listen to us when we tell you what their limitations are, and you have to put the collective organizing work in to use them.

Only capitalism could turn unlimited free electricity into a problem.

31K notes

·

View notes

Text

#GCC Heavy Construction Equipment Rental Market#GCC Heavy Construction Equipment Rental#GCC Heavy Construction Equipment#Heavy Construction Equipment Rental Market

0 notes

Text

10 Must-Know Benefits of Investing in Premium Residences in Bangalore

Bangalore, often referred to as the "Silicon Valley of India," has become a prime real estate destination due to its booming IT sector, world-class infrastructure, and high standard of living. Premium residences in Bangalore are increasingly in demand, offering investors and homeowners a blend of luxury, convenience, and high returns. Here are ten compelling reasons to invest in a premium residence in Bangalore.

1. Prime Locations

Luxury residences in Bangalore are strategically located in areas with excellent connectivity, top-tier schools, hospitals, and business hubs. Birla Ojasvi, for example, is situated in Rajarajeshwari Nagar, a well-developed area known for its green surroundings and proximity to major commercial zones. These locations ensure that homeowners enjoy both convenience and a peaceful environment.

2. High Appreciation Rates

Bangalore’s real estate market has shown consistent growth, with premium properties appreciating significantly over time. The combination of rising demand, rapid urbanization, and large-scale infrastructure projects like the Bangalore Metro expansion and Peripheral Ring Road ensures strong property value appreciation. Investors in luxury residences can expect excellent long-term returns.

3. World-Class Amenities

Premium residences come with top-tier amenities such as infinity pools, rooftop lounges, fully equipped gyms, co-working spaces, and private theaters. Projects like Sobha Indraprastha and Prestige Kingfisher Towers offer such ultra-modern facilities, enhancing the overall living experience.

4. Superior Quality Construction

Luxury homes in Bangalore are built with high-quality materials and cutting-edge architectural designs. Developers ensure earthquake-resistant structures, superior flooring, and high-end fittings, making these properties durable and aesthetically appealing.

5. Enhanced Security Measures

Security is a top priority in premium residential projects. Features such as 24/7 CCTV surveillance, biometric access, video door phones, and professional security personnel provide a safe and secure environment for residents. This makes luxury homes an excellent choice for families and expatriates.

6. Exclusive Community Living

Premium residences often cater to an elite clientele, offering residents a sophisticated and like-minded community. Living in a premium property enhances networking opportunities and provides an environment of exclusivity and prestige.

7. Proximity to Essential Services

One of the significant advantages of investing in a luxury residence is its closeness to top schools (such as Inventure Academy and The International School Bangalore), world-class hospitals (like Manipal and Fortis), and shopping destinations (Orion Mall, UB City). These locations offer residents a hassle-free lifestyle with everything they need within easy reach.

8. High Rental Yields

Bangalore attracts a large number of IT professionals, expatriates, and business executives who prefer luxury living. Properties in prime locations such as Whitefield, Koramangala, and Indiranagar offer excellent rental yields, making them an attractive investment for landlords.

9. Sustainable and Green Living

Many luxury residential projects in Bangalore focus on sustainability, incorporating features like rainwater harvesting, solar power, and green building certifications. This not only reduces the environmental impact but also provides residents with an energy-efficient and healthier living space.

10. Prestige and Status Symbol

Owning a premium residence is a reflection of success and high social status. These properties offer not just comfort but a lifestyle statement, making them a coveted asset among high-net-worth individuals.

Final Thoughts

Investing in a premium residence in Bangalore is more than just owning a home—it's about securing a valuable asset with high appreciation potential, excellent rental yields, and an unmatched lifestyle. With projects like Birla Ojasvi, Sobha Indraprastha, and Prestige Kingfisher Towers, homebuyers and investors have plenty of luxury options to explore in the city’s best locations.

0 notes

Text

SAMANA IVY GARDENS In DLRC By Samana Developers - Tesla Properties In Dubai Real Estate Market

Tesla Properties is a leading Real Estate Investment Dubai, providing unparalleled opportunities for those looking to rent, buy, or invest in prime properties across the emirate. Known for its high-quality services and dedication to its clients, Tesla Properties offers a diverse portfolio of residential and commercial properties in Dubai’s most sought-after locations. Whether you’re looking for an investment opportunity or the ideal property for your family, Tesla Properties can help you navigate Dubai real estate market with ease.

Dubai’s Top Locations for Investment

When it comes to real estate, location is everything, and Tesla Properties knows this better than anyone. They offer a broad range of properties in the most prestigious neighborhoods of Dubai, ensuring that you have access to the best that the city has to offer. From luxurious penthouses in Downtown Dubai to serene villas in Dubai Hills Estate, their portfolio boasts a variety of properties to suit every preference and budget.

In addition to ready-to-move-in homes, Tesla Properties also specializes in off-plan properties, giving investors access to newly developed residential units that promise both value appreciation and high rental yields. The company’s team of experts provides detailed insights into the market trends, helping you make well-informed decisions and maximize your investment potential.

Off-Plan Properties: A Lucrative Investment

Tesla Properties not only offers completed properties but also offers exclusive off-plan options. These developments present a fantastic opportunity for investors to secure properties at competitive prices, with the potential for significant returns once completed. One such property is the Samana IVY Gardens, a visionary residential development located within the Dubai Land Residence Complex (DLRC), designed by Samana Developers.

This project promises to redefine luxury living with a stunning blend of nature-inspired design and modern elegance. The Samana IVY Gardens is a 14-storey architectural masterpiece that includes a podium level and features 348 meticulously crafted units. This limited collection of homes consists of studios, 1, 2, and 3-bedroom apartments, each with its own private pool.

Samana IVY Gardens: A Vision of Luxury Living

The Samana IVY Gardens project is all about exclusivity and sophistication. Set in one of Dubai’s most vibrant and growing communities, this development offers an exceptional lifestyle for residents who desire a blend of urban convenience and serene surroundings. The units are designed to reflect modernity, elegance, and sustainability, with a special emphasis on integrating nature into the living spaces.

The units, ranging in size from 380 to 1,500 square feet, offer the perfect mix of privacy and luxury. Each apartment is equipped with its own private pool, allowing residents to indulge in an elevated lifestyle. The units are meticulously designed with high-end finishes, and the development offers ample green spaces that are perfect for relaxation and recreation.

Flexible Payment Plan for Investors

Tesla Properties offers a flexible and attractive payment plan for investors interested in the Samana IVY Gardens development. The payment structure is designed to make it easier for investors to secure their dream home or investment property:

On Booking: 20% of the total price

During Construction: 52% spread over the construction period

On Handover: 1% upon receiving the property

Post-Handover: 27% payable after handover

This flexible structure ensures that investors have ample time to manage their payments and take full advantage of the property’s potential. The handover is expected in May 2026, giving buyers ample time to plan their investments.

Amenities That Elevate the Living Experience

Samana IVY Gardens offers a range of world-class amenities that will redefine your living experience. Whether you’re enjoying the privacy of your own pool or taking advantage of the exceptional facilities, the development is designed to provide a high standard of living. Some of the standout amenities include:

Parking: Dedicated parking spaces for residents

Security: Round-the-clock security to ensure peace of mind

Swimming Pool: A luxury swimming pool for residents to unwind

Kid’s Pool: A shallow pool designed for children’s enjoyment

Balcony: Private balconies with select units, ideal for relaxing

Rooftop BBQ Area: Perfect for entertaining family and friends

Kid’s Play Area: A safe space for children to play and explore

Greenery: Lush landscaping that creates a tranquil, natural environment

Indoor & Outdoor Gym: Fully equipped gyms to maintain a healthy lifestyle

Rooftop Jogging Track: For those who enjoy outdoor fitness

Leisure Pool Deck: A place to relax and enjoy the views

Sauna & Steam Room: For ultimate relaxation

Private Pool: In each apartment for an exclusive experience

Sun Deck: A great place to soak up the Dubai sun

Outdoor Sitting Area: For residents to relax and socialize

Lobby: A welcoming and elegant entrance

Health Club: Promoting wellness and a balanced lifestyle

Smart Home System: Integrated technology for convenience and comfort

Equipped Kitchen: High-end, ready-to-use kitchens for residents

With such an extensive list of premium amenities, Samana IVY Gardens promises to deliver an exceptional living experience for all its residents. These features not only enhance comfort but also elevate the overall value of the property, making it a wise investment choice.

The Perfect Investment Opportunity

Samana IVY Gardens offers investors an incredible opportunity to secure a property that blends luxury, nature, and modernity. With its competitive starting price of AED 522,000, the development is accessible to a wide range of buyers, making it an ideal choice for those looking to enter the Dubai real estate market. The flexible payment plan, combined with the high-end amenities and the promise of long-term value appreciation, ensures that investing in Samana IVY Gardens is a smart decision.

Tesla Properties’ expertise in identifying lucrative investment opportunities, coupled with its strong presence in the Dubai real estate market, makes it an ideal partner for those looking to make sound property investments. Whether you are looking to property buy Dubai, or invest in Dubai real estate, Tesla Properties offers the solutions you need to achieve your goals.

Conclusion: Your Gateway to Dubai’s Real Estate Market

Tesla Properties is more than just a real estate agency—it’s a key player in Dubai’s thriving real estate sector, providing clients with access to a range of properties that suit various needs and investment goals. With their focus on providing top-tier properties in the best locations and offering off-plan developments like the Samana IVY Gardens, Tesla Properties ensures that their clients make informed, profitable investments.

For those looking to secure their future in Dubai’s real estate market, Tesla Properties offers the expertise, opportunities, and resources needed to succeed. Take the first step towards your property investment journey today and discover the potential of Dubai’s most exclusive residential developments.

TESLA PROPERTIES

https://teslaproperties.ae/

+971545536772

#dubai real estate#dubai#dubai properties#property investment in dubai#real estate#real estate investment#real estate investment company#apartment#villas#townhouse#DLRC#off plan properties#off plan projects in dubai#penthouse#property investment#Dubai Real Estate Market#Real Estate Investment Dubai#SAMANA IVY GARDENS#Samana Developers#property buy Dubai

0 notes

Text

JASON YAMAS | TWEAKERWORLD

"All fishies start small," he argues, "until they eat and eat some more because they don't know how to stop. And those who eat too much perish."

My eyes roll to the back of my skull.

Zander is the older brother I never had.

My querulous replies are equal parts obstinate and reverent.

I explain how I'm meant for this, how I've always been a pusher.

When I was ten, I started JRY Enterprises, a word-processing business, and convinced a local construction equipment rental company to commission my services in revamping its catalog.

I rolled those profits into a black-market Beanie Baby venture, wherein l'd buy a handful of Beanies from a Korean man at the farmers market who knew an insider at Ty, the company that produced them, who alerted him in advance which units Ty was about to "retire," which astronomically drove up their value.

The Korean merchant would tell me which six Beanies to buy in bulk, knowing only one was about to be retired.

I'd wait a few months to let scarcity enhance their value, then sell every retired unit (besides one) on eBay.

Sixth grade was the most profitable year of my life, until I made nearly $7,000 selling anti-Bush T-shirts during the Republican National Convention in New York during my first week at NYU when I was meant to be attending orientation.

"Just remember who you are," Zander says.

Zander advising me so sagaciously is further confirmation that we're meant to work together.

It's sweet and I'd like to say a tad surprising, but I detected his humanity under all those layers of defensiveness and Dior:

Little does he know, I'm already committed to remembering who I am.

Aside from being a hustler, I'm an actor and I'm a storyteller.

I've spent the past decade a stalwart champion for others' narratives, grinding so that my peers passion projects might prevail: the schizophrenic filmmaker, the narcissistic songwriter, the bipolar playwright.

If I've learned anything, it's that most artists need to be unhinged to be brilliant.

My turn.

"I'll make it a story," I tell him. "A screenplay!"

"It?" Zander bemusedly replies.

"Do you know about method acting?" I ask. "An actor preparing for a role as a car salesman might spend months actually selling cars.

They become the part in real life.

What writer has consciously become the protagonist of their own story simply by making a risky choice and allowing the arc to unfold?

It's reminiscent of Merce Cunningham!"

Zander's blank face reveals that he isn't familiar.

"The postmodernist choreographer." I continue.

"He'd roll a die to construct his dances, surrendering to chance, to the dance gods, as he called them."

Zander chuckles. "I've heard fucked-up tweaker logic in my time, but, honey, you take the cake."

"So," I ask, "you think it's a good idea?"

In a sardonic timbre, Zander replies, "Committing multiple felonies a day as research for a movie? Exposing every secret in our little bubble?

Oh, I think it's a splendid idea!"

0 notes

Text

1 BHK in Kurla East | Sayba Residency — Modern Homes

Mumbai, a city that never sleeps, offers diverse housing options to meet the needs of its dynamic population. Sayba Residency introduces a new standard of living with its contemporary residential project in Kurla East. If you are looking for a 1 BHK in Kurla East, Sayba Residency offers the perfect blend of modern amenities, strategic location, and affordable luxury.

Why Choose a 1 BHK in Kurla East?

Prime Location Benefits

Kurla East is one of Mumbai’s most rapidly developing areas, offering excellent connectivity and robust infrastructure. Investing in a 1 BHK in Kurla East ensures easy access to major business hubs, educational institutions, healthcare facilities, and entertainment centers. Key location highlights include:

Proximity to Bandra-Kurla Complex (BKC)

Excellent connectivity via Central and Harbour railway lines

Easy access to Eastern Express Highway

Upcoming Metro lines improving future connectivity

Sayba Residency: Redefining Modern Homes

Features of 1 BHK Apartments in Sayba Residency

World-Class Amenities

Sayba Residency is equipped with modern facilities that enhance the living experience:

Fully equipped gymnasium for fitness enthusiasts

Landscaped gardens for relaxation and leisure

Children’s play area for safe recreational activities

24/7 security with CCTV surveillance for peace of mind

High-speed elevators and ample parking spaces

Thoughtfully Designed Interiors

Every 1 BHK in Kurla East at Sayba Residency is thoughtfully designed to maximize space and comfort. The apartments feature:

Spacious living rooms with elegant finishes

Modern modular kitchens with premium fittings

Stylish bathrooms with top-quality sanitary ware

Balconies offering scenic city views

Benefits of Owning a 1 BHK in Kurla East

High Return on Investment (ROI)

Kurla East’s strategic location and continuous development make it a prime real estate investment. Purchasing a 1 BHK in Kurla East offers:

Attractive rental income due to high demand

Long-term capital appreciation as property values rise

Stable investment with consistent growth potential

Excellent Connectivity and Convenience

Living in Kurla East means enjoying seamless connectivity to:

Business hubs like BKC, Andheri, and Lower Parel

Renowned schools and colleges

Top-tier hospitals and healthcare facilities

Shopping malls, markets, and entertainment zones

Sustainable and Eco-Friendly Living

Sayba Residency promotes sustainable living through eco-friendly initiatives:

Rainwater harvesting systems

Energy-efficient lighting

Waste management and recycling programs

Sayba Group: A Name You Can Trust

Sayba Group has a proven track record of delivering high-quality residential projects in Mumbai. Known for their commitment to excellence, Sayba Group ensures that every project, including Sayba Residency, meets the highest standards of construction, design, and customer satisfaction.

Highlights of Sayba Residency

Timely project completion with superior quality standards

Innovative architectural designs blending functionality with aesthetics

Customer-centric approach ensuring a hassle-free buying process

Transparent dealings with complete legal compliance

How to Choose the Right 1 BHK in Kurla East

Assess Your Requirements

Before purchasing a 1 BHK in Kurla East, consider the following factors:

Budget and financing options

Proximity to workplace, schools, and hospitals

Preferred floor plans and apartment layouts

Property Evaluation

When visiting Sayba Residency, evaluate:

Construction quality and attention to detail

Available amenities and overall environment

Neighborhood safety and community vibe

Legal and Financial Considerations

Ensure the property includes:

Clear legal titles with proper documentation

Necessary approvals and compliance with RERA regulations

Transparent pricing with no hidden charges

Conclusion

Investing in a 1 BHK in Kurla East at Sayba Residency is a smart choice for individuals and families seeking modern, well-connected, and affordable homes in Mumbai. With world-class amenities, superior construction quality, and a strategic location, Sayba Residency offers an exceptional living experience.

Explore Sayba Residency today and discover your dream home in the heart of Mumbai!

Reach out to Sayba Group for expert real estate guidance and services

0 notes