#amr automated mobile robot

Explore tagged Tumblr posts

Text

Meet Your Warehouse’s Best Friend: The Agile AMR Robot

These days, warehouses are vibrant, dynamic spaces that require more accuracy and speed than ever before. And in the middle of this change? The Autonomous Mobile Robot, or AMR robot, is a surprisingly useful, clever, and nimble piece of warehouse handling equipment.

With the aid of sensors and intelligent mapping software, an AMR robot navigates aisles with ease rather than on fixed tracks. It can deliver parts, move totes, and pick up pallets without human supervision. This translates into a smoother flow of commodities, fewer bottlenecks, and less manual labour. Additionally, your staff may concentrate on strategy, quality assurance, or customer service areas where human brains still outperform machines when they are not burdened with tedious carrying duties.

Warehouses are falling in love with autonomous mobile robots for the following reasons:

Powerful plug-and-play: Do you need a robot or a different route? AMRs adapt without infrastructure changes, therefore there is no issue.

Team-centric design: AMRs, as opposed to conventional forklifts or conveyor spools, are made to collaborate with people, which improves morale and safety.

As your business expands, you can start with one and grow it to a fleet while maintaining central software coordination.

Data-first execution: You gain a data-driven advantage with every run, which produces real-time insights from journey times to path optimisation.

Cost-efficient outcomes: Reduced damage, fewer stoppages, and steady speed help companies achieve more dependable throughput and a quicker return on investment.

Additionally, manufacturers, clinics, and airports are all seeing the same benefits from AMR systems, so it's not just warehouses. AMR robots are the unsung heroes who carry out the heavy lifting (literally) because they are intelligent, flexible, and infinitely expandable.

To put it briefly, the AMR robot is the intelligent, amiable, and always available warehouse handling equipment of the future. Is your operation prepared to welcome this robotic teammate? Efficiency never seemed so practical.

0 notes

Text

What are the latest warehouse automation technologies?

Gone are the days of manual labour and static, inefficient operations. Today, we stand at the forefront of a revolution driven by the latest warehouse automation technologies. These innovations reshape how businesses handle inventory, fulfil orders, and optimize supply chains.

From autonomous robots and artificial intelligence to the Internet of Things (IoT) and advanced data analytics, we'll explore how these technologies enhance efficiency, reduce costs, and ensure seamless operations in modern warehouses.

1-Robotic Process Automation (RPA): RPA involves using software robots to automate repetitive tasks like data entry, order processing, and inventory tracking. The robots interact with various systems and applications to streamline workflows.

2-Autonomous Mobile Robots (AMRs): Robotic vehicles called AMRs navigate and operate in warehouses without fixed infrastructure, such as conveyor belts or tracks. They perform tasks like picking, packing, and transporting goods.

3-Automated Guided Vehicles (AGVs): AGVs are similar to AMRs but typically follow fixed paths or routes guided by physical markers or magnetic tape. They are commonly used for material transport in warehouses and distribution centres.

4-Goods-to-Person Systems: This approach involves bringing the items to the workers rather than having workers travel throughout the warehouse to pick items. Automated systems retrieve and deliver goods to a workstation, reducing walking time and improving efficiency.

5-Automated Storage and Retrieval Systems (AS/RS): AS/RS systems use robotics to store and retrieve items from racks or shelves automatically. These systems can significantly increase storage density and optimize space utilization.

6-Collaborative Robots (Cobots): Cobots are designed to work alongside human workers. They can assist with tasks like picking, packing and sorting, enhancing efficiency and safety.

7-Warehouse Management Systems (WMS): While not a physical automation technology, modern WMS software uses advanced algorithms and AI to optimize inventory management, order fulfilment, and warehouse processes.

8-Vision Systems and Machine Learning: Computer vision technology combined with machine learning can be utilized for tasks such as object recognition, inventory movement tracking, and quality control.

9-IoT and Sensor Networks: Internet of Things (IoT) devices and sensors collect real-time data on inventory levels, environmental conditions, equipment health, and more, enabling better decision-making and predictive maintenance.

10-Voice and Wearable Technologies: Wearable devices and voice-guided picking systems can provide workers with real-time information and instructions, improving accuracy and efficiency.11-Automated Packaging Solutions: These systems automate the packaging process by selecting the appropriate box size, sealing packages, and applying labels, reducing manual labour and ensuring consistent packaging quality.

1 note

·

View note

Text

Logistics Robots Market

As global commerce becomes faster and more complex, the Logistics Robots Market is rapidly emerging as a cornerstone of modern supply chains. From smart warehouses to last-mile delivery, robotics is redefining how goods move, sort, and ship in today’s hyperconnected world.

📦 Driving Forces Behind the Growth

Several key factors are propelling this market forward:

E-commerce Expansion: The explosive growth of online shopping demands faster, more accurate fulfillment, pushing companies to automate their warehouses with robotic systems.

Labor Shortages: Increasing difficulty in recruiting and retaining warehouse staff is driving investment in autonomous solutions.

Technological Advancements: Progress in AI, machine vision, and IoT has made robots smarter, safer, and more efficient than ever.

Need for Operational Efficiency: Robotics significantly reduces human error, improves order accuracy, and enhances throughput in high-demand environments.

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

⚙️ Market Applications & Impact

Logistics robots are now deployed across multiple sectors, including:

Retail & E-commerce: Automating picking, packing, and sorting in fulfillment centers.

Manufacturing & 3PL: Enhancing supply chain efficiency and minimizing downtime.

Healthcare & Pharmaceuticals: Ensuring precise handling and transport of sensitive materials.

Food & Beverage: Supporting cold chain logistics and timely deliveries.

These robots range from autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) to robotic arms and drones, depending on the specific task and environment.

🌍 Global Outlook

The Asia-Pacific region leads in both production and deployment, with major contributions from China, Japan, and South Korea. However, North America and Europe are rapidly catching up, driven by investments in smart warehousing and Industry 4.0 initiatives.

As of 2025, the Logistics Robots Market is projected to grow at a double-digit CAGR, with billions in revenue expected over the next five years. With scalability, precision, and speed at the core of logistics innovation, robots are becoming not just a luxury but a necessity for competitive global operations.

🔖 Key Takeaway

Logistics robots are no longer futuristic tools — they are today’s answer to tomorrow’s supply chain challenges. Companies that embrace automation will not only cut costs but also gain a strategic edge in an increasingly on-demand economy.

0 notes

Text

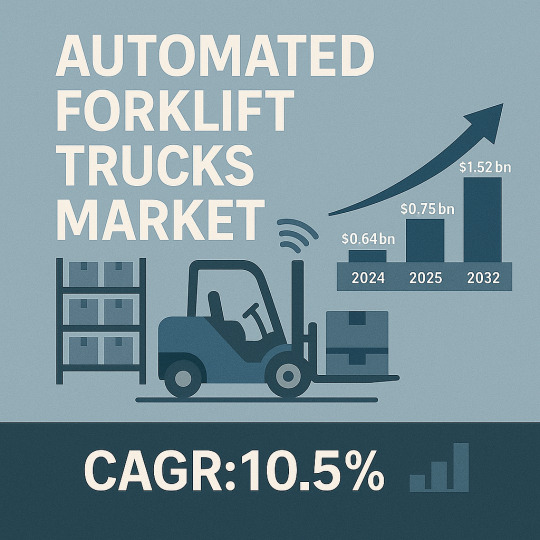

Automated Forklift Trucks Market Size, Trends & Forecast 2032

🚜🤖 The global automated forklift trucks market size was valued at USD 0.64 billion in 2024 and is projected to grow from USD 0.75 billion in 2025 to USD 1.52 billion by 2032, showcasing a healthy CAGR of 10.5% during the forecast period. 🌏 Asia Pacific dominated with a 37.5% share in 2024, reflecting rapid industrial automation and smart warehousing trends.

📌 Key Market Insights:

Market Size (2024): USD 0.64 billion

Forecast Size (2032): USD 1.52 billion

CAGR (2025–2032): 10.5%

Dominant Region: Asia Pacific held 37.5% in 2024

Growth Drivers: Rising demand for efficient material handling, labor cost savings, AMR navigation tech (Laser, Magnetic, Vision Guided), and booming e-commerce & F&B sectors.

🚀 Market Trends: Automated forklift trucks, also known as autonomous mobile robots (AMRs), are revolutionizing transportation, storage, assembly, and packaging in industries like automotive, food & beverage, and e-commerce. Expect more pallet movers, counterbalance, outriggers, and reach trucks with smarter navigation and IoT integration.

👉 Full report: https://www.fortunebusinessinsights.com/automated-forklift-trucks-market-102617

0 notes

Text

The Perfect ERP Stack for Logistics & Distribution Companies

In today’s global economy, logistics and distribution are no longer just about moving goods, they’re about orchestrating efficiency, minimizing waste, and maximizing visibility across complex, multi-layered supply chains.

Warehouses must talk to order management. Inventory should update in real-time. Transport delays must trigger instant rerouting. Customers now expect tracking links, not excuses. And all of it must be done faster, smarter, and cheaper.

That’s where an intelligent ERP stack steps in.

The perfect ERP stack for logistics and distribution isn’t a single piece of software, it’s an ecosystem of seamlessly integrated modules designed to deliver end-to-end control, from first mile to last-mile.

In this definitive guide, we break down exactly what your ERP stack needs to deliver competitive edge, real-time intelligence, and customer delight at scale.

The Growing Complexity of Logistics & Distribution

From hyperlocal delivery startups to international freight giants, every logistics company now deals with:

Multichannel order flows

Volatile demand

Fragmented supply chains

Rising customer expectations

Tight delivery SLAs (Service Level Agreements)

Cost pressures and razor-thin margins

And the post-pandemic world hasn’t helped. Disruptions are now a constant. Visibility gaps are costly. Spreadsheets? Obsolete.

Logistics ERP systems need to power:

Real-time coordination

Proactive decision-making

Predictive insights

Seamless collaboration

Why Traditional Systems Are Failing the Industry

Many logistics companies still rely on:

Legacy software with siloed data

Manual coordination across departments

Inflexible tools that can’t scale with new routes or partners

Fragmented warehouse management

Poor integration between customer portals and backend systems

This leads to:

Delays in fulfilment

Inventory mismatches

Routing inefficiencies

Increased operational costs

Unhappy customers

Modern ERP for logistics is the cure.

What Makes an ERP Stack “Perfect” for Logistics

A perfect ERP stack is:

Modular: Adaptable to the size and complexity of your operations

Integrated: Every module shares data — no silos, no sync delays

Scalable: From 1 warehouse to 100, without rebuilding everything

Real-Time: Live updates across inventory, transport, and demand

Cloud-Native: Accessible, flexible, and secure

AI-Powered: Smarter predictions, faster routing, automated alerts

Core Modules Every Logistics ERP Must Include

1.Warehouse Management System (WMS)

Bin-level inventory tracking

Put away optimization

Cycle counting automation

Barcode & RFID integration

2.Transportation Management System (TMS)

Route optimization

Carrier management

Freight audit

Real-time GPS tracking

3.Order Management

Omnichannel order orchestration

Returns handling

Order lifecycle visibility

4.Inventory Management

Stock forecasting

Dead stock alerts

Auto-replenishment

5.Finance & Billing

Automated invoicing

Freight cost reconciliation

Tax compliance

6.Customer Relationship Management (CRM)

Client order history

SLA monitoring

Issue tracking and resolution

Advanced Features to Look For in 2025

AI-based Demand Forecasting

Digital Twins for Warehouses

Autonomous Mobile Robots (AMRs) Integration

Blockchain-enabled Shipment Verification

Voice-enabled Pick-Pack Commands

Cold Chain Monitoring (IoT Sensors)

Carbon Footprint Tracking & Reporting

The future of logistics ERP is intelligent, adaptive, and sustainable.

How Real-Time Data Changes Everything

In logistics, lag equals loss. Real-time ERP platforms provide:

Live inventory updates

ETA recalculations with traffic/weather data

Dynamic re-routing of shipments

Instant alerts on exceptions

Dashboard views of every touchpoint from supplier to customer

Cloud ERP vs. On-Premises: What Works Best?

Cloud ERP is winning, and for good reason:

Lower upfront cost

Faster implementation

Scalable infrastructure

Anywhere access (critical for distributed teams)

Built-in disaster recovery

Seamless updates and AI enhancements

While on-prem may still serve legacy-heavy firms, cloud-native ERP is the future.

Integration with IoT, GPS, and Telematics

Modern ERP stacks thrive on data from connected devices:

IoT sensors track container temperature, humidity, or tilt

GPS integration feeds real-time location into dashboards

Vehicle telematics inform route efficiency and driver behaviour

Smart pallets and tags enhance warehouse throughput

This enables:

Predictive maintenance

Intelligent asset tracking

Shipment anomaly detection

Increased compliance

Warehouse Automation: When ERP Meets Robotics

Smart ERP platforms integrate with:

Conveyor belts and pick robots

AGVs (Automated Guided Vehicles)

AMRs for zone picking

Vision systems for damage detection

The result? → Faster fulfillment → Lower labour dependency → Improved accuracy → 24/7 operations

ERPONE, for instance, supports full robotic orchestration via API-ready architecture.

KPIs to Track with a Smart ERP Stack

OTIF (On-Time, In-Full)

Average Warehouse Throughput

Order Fulfilment Cycle Time

Transport Cost per Mile

Inventory Turnover Rate

Customer SLA Adherence

Returns Ratio

Carbon Emissions per Shipment

ERP dashboards let you track these in real time, empowering instant optimization.

Final Thoughts

The logistics sector is under pressure from consumers, competitors, and climate realities. The winners will be those who:

See what’s happening in real time

Automate what slows them down

Anticipate disruptions

Serve smarter and faster than anyone else

That’s the power of a perfect ERP stack.

It’s not about having more software, it’s about having the right ecosystem: cloud-native, AI-infused, fully integrated, and future-ready.

If your ERP can’t scale with your routes, connect with your assets, and learn from your data, you’re not ready for what’s next.

But with the right stack? You’ll deliver delight at every touchpoint, every time.

0 notes

Text

HAECO embraces robotics at Hong Kong MRO site

Engineering and maintenance provider HAECO has announced a partnership with the Logistics and Supply Chain MultiTech R&D Centre (LSCM) to implement Autonomous Mobile Robot (AMR) solutions at HAECO’s maintenance facility in Hong Kong. The collaboration represents a significant leap in technological applications and operational innovation for HAECO, as it leverages robotics automation to boost…

0 notes

Text

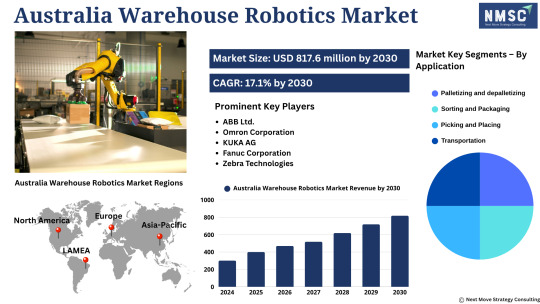

𝗗𝗼 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄 𝗪𝗵𝗮𝘁’𝘀 𝗣𝗼𝘄𝗲𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝗡𝗲𝘅𝘁 𝗕𝗶𝗹𝗹𝗶𝗼𝗻-𝗗𝗼𝗹𝗹𝗮𝗿 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗶𝗻 𝗔𝘂𝘀𝘁𝗿𝗮𝗹𝗶𝗮?

𝗔𝘂𝘀𝘁𝗿𝗮𝗹𝗶𝗮 𝗪𝗮𝗿𝗲𝗵𝗼𝘂𝘀𝗲 𝗥𝗼𝗯𝗼𝘁𝗶𝗰𝘀 𝗠𝗮𝗿𝗸𝗲𝘁 is not just growing — it's transforming the very backbone of modern supply chains.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

𝗛𝗲𝗿𝗲'𝘀 𝗪𝗵𝗮𝘁 𝗘𝘃𝗲𝗿𝘆 𝗙𝗼𝗿𝘄𝗮𝗿𝗱-𝗟𝗼𝗼𝗸𝗶𝗻𝗴 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿 𝗡𝗲𝗲𝗱𝘀 𝘁𝗼 𝗞𝗻𝗼𝘄:

Do you know that 𝗔𝘂𝘀𝘁𝗿𝗮𝗹𝗶𝗮 𝗪𝗮𝗿𝗲𝗵𝗼𝘂𝘀𝗲 𝗥𝗼𝗯𝗼𝘁𝗶𝗰𝘀 𝗠𝗮𝗿𝗸𝗲𝘁 is projected to grow at a 𝗖𝗔𝗚𝗥 𝗼𝗳 𝟭𝟳.𝟭% by 2030?

𝗗𝗿𝗶𝘃𝗲𝗻 𝗯𝘆:

Rising labor shortages & costs, pushing for automation

Government incentives backing industrial tech adoption

Heavy investments from logistics giants like Toll Group & Linfox

Autonomous Mobile Robots (AMRs), AGVs, robotic arms, and AI-powered picking systems are now standard, not optional — especially in high-demand sectors like FMCG, pharma, and third-party logistics (3PL).

𝗧𝗵𝗲 𝗥𝗲𝗮𝗹 𝗚𝗮𝗺𝗲𝗰𝗵𝗮𝗻𝗴𝗲𝗿?

Australia's "Smart Warehouse Revolution" is setting new benchmarks in operational efficiency — slashing order cycle times, minimizing errors, and maximizing ROI per square foot.

𝗞𝗲𝘆 𝗽𝗹𝗮𝘆𝗲𝗿𝘀 include ABB Ltd., Omron Corporation, KUKA AG, Fanuc Corporation, JBT Corporation, Geekplus Technology Co.Ltd. and others.

𝗪𝗵𝘆 𝗦𝗵𝗼𝘂𝗹𝗱 𝗬𝗼𝘂 𝗖𝗮𝗿𝗲?

Because the next warehouse unicorn could be born in Australia.

Because every $1M invested today could define logistics leadership tomorrow.

Early movers are already seeing 20–30% warehouse productivity gains.

Smart money is flowing in. Are you in the loop or out of the race?

𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

Investors, analysts, and supply chain visionaries — let’s talk numbers, opportunities, and strategic access. The future of fulfillment starts here.

#AustraliaRobotics#WarehouseAutomation#SmartLogistics#InvestorAlert#SupplyChainInnovation#EcommerceBoom#RoboticsMarket#TechInvestment#LogisticsTech#AIinLogistics#FutureofWarehousing

0 notes

Text

Robotic Sensors Market Size, Share & Trends Analysis growing at a CAGR of 8.1% from 2025 to 2033

The global robotic sensors market size was estimated at USD 1,819.4 million in 2024 and is projected to reach USD 3,625.8 million by 2033, growing at a CAGR of 8.1% from 2025 to 2033. This growth is primarily driven by the rising adoption of automation across industrial sectors, along with the increasing deployment of autonomous mobile robots (AMRs) and collaborative robots (cobots) for tasks…

0 notes

Text

The Future of Logistics: Why Autonomous Mobile Robots (AMR) Are a Game-Changer

In today’s fast-paced world of logistics and warehousing, autonomous mobile robots (AMRs) are quickly becoming the cornerstone of efficient operations. As industries strive for faster, more reliable supply chains, these mobile robots are playing a crucial role in meeting the ever-growing demand for automation. From reducing human error to optimising storage space, AMR robots are revolutionising how goods are stored, picked, and delivered, creating smarter and more agile supply chain solutions.

What Are Autonomous Mobile Robots (AMRs)?

At their core, autonomous mobile robots are self-guided machines designed to transport goods within a warehouse or manufacturing facility without human intervention. Unlike traditional mobile robots, which require tracks or predefined paths, AMRs navigate using advanced sensors, cameras, and onboard mapping technology to move freely and adapt to their surroundings. These robots can pick, pack, and transport goods with high precision, eliminating the need for manual labour in repetitive tasks and significantly improving operational efficiency.

The Growing Role of AMR Robots in Warehousing

Warehouses have always been hubs of activity, packed with inventory, constant movement, and tight deadlines. However, the rise of autonomous mobile robots has brought a fresh wave of innovation, transforming how goods are handled within these spaces. With the ability to perform various tasks, such as transporting heavy pallets, picking items from shelves, and even unloading containers, AMR robots are drastically improving productivity in warehouses.

One of the key benefits of AMR robots is their adaptability. These robots are equipped with sensors and AI algorithms that enable them to understand and map their environment, allowing them to navigate complex, dynamic spaces without bumping into obstacles or creating inefficiencies. This level of intelligence gives mobile robots the ability to optimize routes in real-time, ensuring that goods are moved with minimal delays, while avoiding congestion in busy warehouses.

How AMR Robots Improve Operational Efficiency

The introduction of autonomous mobile robots has proven to deliver substantial cost savings and efficiency gains. Here's how they work their magic:

Increased Speed and Precision AMRs can carry out repetitive tasks like transporting goods at a much higher speed than humans, with fewer errors. Their precise operations minimise mistakes, improving overall order accuracy and reducing the need for costly rework.

24/7 Operation Unlike human workers who need breaks, sleep, and days off, an AMR robot can operate continuously, driving efficiency and throughput around the clock. They also work at a consistent pace, eliminating fluctuations in output that often occur in human-run warehouses.

Optimised Space Usage Traditional warehouses are often designed with wide aisles to accommodate human-operated forklifts and pallets. With autonomous mobile robots, the need for large aisles is eliminated, as these robots can maneuver through narrower spaces, allowing more inventory to be stored in the same physical footprint. This leads to more effective use of warehouse space and, ultimately, greater storage capacity.

Reduced Labour Costs By automating tasks that were traditionally manual, mobile robots help reduce the dependency on human labour for low-value tasks. This allows human workers to focus on higher-value activities, like strategic planning and quality control, while the robots handle the heavy lifting.

How AMR Robots Support the Future of E-Commerce

The rise of e-commerce has drastically shifted consumer expectations, with customers demanding faster deliveries and better service than ever before. This is where autonomous mobile robots come into play. With AMR systems handling much of the physical labour within warehouses, e-commerce businesses can streamline their order fulfilment processes, accelerating the speed at which products are picked, packed, and shipped.

In addition to enhancing speed, AMR robots ensure better accuracy and consistency. This is crucial in the e-commerce industry, where one mistake in fulfilling an order can lead to customer dissatisfaction, returns, or lost revenue. By implementing mobile robots that are programmed to follow precise guidelines and workflows, e-commerce businesses can drastically reduce order errors and improve overall customer experience.

The Future of AMR Robots in Industry

As we move further into an age dominated by smart technology, the role of autonomous mobile robots is only expected to grow. With advancements in AI, machine learning, and real-time data processing, future AMRs will become even more efficient and intelligent. They will be able to perform even more complex tasks, such as sorting and categorising inventory or managing the entire supply chain from start to finish.

The potential applications of mobile robots extend beyond just warehouses. Industries like manufacturing, retail, and healthcare are already exploring the integration of AMR systems into their operations. From assembly lines to patient transport, the possibilities for autonomous mobile robots are endless.

A Smarter, More Efficient Future

The rise of autonomous mobile robots marks a significant shift in how logistics and supply chain operations are run. By improving speed, accuracy, safety, and scalability, the AMR robot is changing the game for businesses of all sizes. As these robots continue to evolve, we can expect them to play an even larger role in shaping the future of industries worldwide, driving efficiencies and unlocking new levels of productivity.

0 notes

Text

IEV Market Deep Dive: From Forklifts to Autonomous EVs in Industrial Settings

The global industrial electric vehicles market size was estimated at USD 5.47 billion in 2022 and is projected to reach USD 15.80 billion by 2030, expanding at a compound annual growth rate (CAGR) of 14.0% from 2023 to 2030. With increasing market competition and pressure on operational efficiency, businesses across industries are increasingly seeking ways to streamline operations, reduce operating costs, and enhance productivity—factors that are driving the growing adoption of industrial electric vehicles.

Industrial electric vehicles are used extensively in warehouses, factories, and manufacturing facilities to automate material handling, storage, and internal transportation. These vehicles significantly improve efficiency and output by minimizing manual labor, reducing human error, and optimizing space usage. The growing adoption of electric material handling equipment is also influenced by rising energy costs, environmental sustainability goals, and safety regulations.

Technological advancements have further propelled the growth of the market. Innovations in robotics, artificial intelligence (AI), and machine learning (ML) have led to the development of smarter, more adaptable industrial electric vehicles capable of handling a broader range of tasks and materials. For example, in September 2021, Locus Robotics acquired Waypoint Robotics, Inc., a manufacturer of automation machinery. This acquisition aimed to expand Locus’ product portfolio of autonomous mobile robots (AMRs) to accommodate a wide array of use cases, including case picking, e-commerce fulfillment, pallet picking, and handling heavier, bulkier payloads.

The demand for industrial electric vehicles has also increased in line with the expansion of warehouse infrastructure and the adoption of advanced manufacturing techniques. Modern warehouses require sophisticated material handling equipment to manage tasks such as stock placement, order fulfillment, and efficient movement of goods. As companies invest in automated storage and retrieval systems to improve their facilities and reduce labor dependency, the role of electric vehicles in these operations becomes increasingly vital.

Moreover, the growing shift from lead-acid batteries to lithium-ion batteries is a notable trend in the industrial electric vehicles market. Lithium-ion batteries offer multiple advantages such as faster charging times, higher energy density, longer operational lifespan, and greater efficiency. They are significantly smaller and lighter than lead-acid batteries and do not require watering or emit harmful gases, making them ideal for 24/7 industrial operations.

Key Market Trends & Insights

The North America veterinary diagnostics industry led the global industry in 2024, capturing the largest revenue share of 38.25%.

The U.S. veterinary infectious disease diagnostics industry is anticipated to grow significantly over the forecast period.

By product, the autonomous mobile robots (AMR) segment led the market in 2022, accounting for over 53% share of the global revenue.

Market Size & Forecast

2022 Market Size: USD 5.47 Billion

2030 Projected Market Size: USD 15.80 Billion

CAGR (2023-2030): 14.0%

Europe: Largest market in 2022

Asia Pacific: Fastest growing market

Order a free sample PDF of the Industrial Electric Vehicles Market Intelligence Study, published by Grand View Research.

Key Companies & Market Share Insights

Both well-established players and emerging startups are actively capitalizing on the opportunities within the fast-growing industrial electric vehicles sector. Companies are implementing a combination of organic strategies—such as expanding product portfolios, investing in cutting-edge technologies, and exploring new geographic regions—and inorganic strategies, including mergers, acquisitions, and strategic collaborations. These approaches enable firms to swiftly tap into new markets and integrate innovative capabilities.

For instance, in June 2023, Dematic, a leading manufacturer of industrial vehicles and material handling systems, launched its third-generation freezer-rated automated guided vehicles (AGVs). These AGVs feature enhanced navigation and sensor systems, designed to exceed global safety standards and improve performance in extreme cold environments. This launch highlights Dematic's dedication to improving the safety and efficiency of automated operations in specialized industrial settings.

Key Players

Swisslog Holding AG

Dematic

Daifuku Co., Ltd.

Bastian Solutions, Inc.

Toyota Industries Corporation

Hyster-Yale Materials Handling, Inc.

Balyo

John Bean Technologies Corporation (JBT)

Seegrid Corporation

Kuka AG

Jungheinrich AG

Schaefer Holding International GmbH

Browse Horizon Databook on Industrial Electric Vehicles Market Size & Outlook

Conclusion

The industrial electric vehicles market is experiencing rapid growth, driven by the increasing need for automation, efficiency, and sustainability across industrial environments. As businesses continue to modernize their operations with smart technologies and energy-efficient solutions, the demand for advanced electric vehicles is expected to escalate. The integration of robotics, AI, and lithium-ion battery systems positions industrial electric vehicles as a key enabler of the next generation of automated industrial infrastructure.

0 notes

Text

Autonomous Mobile Robot Market Driving Smart Automation in Logistics and Manufacturing

The global Autonomous Mobile Robot Market is rapidly evolving as industries push toward higher efficiency, flexibility, and intelligent automation. These robots are revolutionizing logistics, manufacturing, and healthcare by navigating environments independently, optimizing workflows, and enhancing productivity. Autonomous Mobile Robots (AMRs) combine AI, machine vision, and navigation sensors…

0 notes

Text

Revolutionizing Logistics: The Rise of Automated Warehouse Solutions

Introduction

In today's fast-paced, digitally driven economy, the demand for faster, more accurate, and scalable logistics is higher than ever. Businesses are turning to automated warehouse solutions to meet customer expectations while reducing operational costs. From robotics to AI-powered systems, warehouse automation is no longer the future—it's the present.

What Are Automated Warehouse Solutions?

Automated warehouse solutions refer to the use of technology—such as robotics, artificial intelligence (AI), conveyor systems, and software—to perform tasks traditionally handled by humans. These systems are designed to optimize inventory management, order fulfillment, storage, and shipping processes.

Key Components of Warehouse Automation

Automated Storage and Retrieval Systems (AS/RS): Mechanized systems that automatically place and retrieve goods from specific storage locations.

Robotic Picking Systems: Robots equipped with sensors and AI can identify and pick items, improving accuracy and reducing labor costs.

Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs): These vehicles transport goods throughout the warehouse without human intervention, using maps and real-time navigation.

Warehouse Management Systems (WMS): Software that provides real-time data on inventory, orders, and warehouse operations to streamline decision-making.

Conveyor and Sortation Systems: Move products quickly and efficiently through the warehouse, sorting them automatically based on size, weight, or destination.

Benefits of Automated Warehouse Solutions

Increased Efficiency: Automation reduces the time required for order picking, packing, and shipping.

Higher Accuracy: Fewer human errors mean better inventory tracking and order accuracy.

Scalability: Systems can adapt to growing business needs without a corresponding increase in labor costs.

24/7 Operation: Machines can work round-the-clock, ensuring continuous operations and faster fulfillment.

Safety: Reduces the risk of workplace injuries by taking over dangerous or repetitive tasks.

Industries Leveraging Warehouse Automation

E-commerce – Fast, error-free order fulfillment is critical.

Retail – Optimized inventory turnover and seasonal scalability.

Pharmaceuticals – Precision in storage and compliance is key.

Manufacturing – Efficient raw material and component handling.

Food & Beverage – Time-sensitive inventory and cold storage automation.

Challenges in Adopting Warehouse Automation

While the benefits are clear, the implementation of automated systems comes with challenges:

High Initial Investment

Integration with Legacy Systems

Employee Training & Change Management

Maintenance and Downtime Risk

However, the long-term ROI and competitive advantage often outweigh the initial hurdles.

The Future of Warehouse Automation

With advancements in AI, machine learning, and IoT, automated warehouses are becoming smarter and more autonomous. Predictive analytics, drone inventory checks, and AI-driven demand forecasting are setting new benchmarks for operational excellence.

Conclusion

Automated warehouse solutions are not just a trend—they're a necessity for businesses looking to scale efficiently, reduce costs, and stay competitive in a digital-first world. Whether you're a logistics company, retailer, or manufacturer, embracing automation can transform your supply chain from a bottleneck into a powerhouse.

0 notes

Text

Robust Growth Expected in AMH Market as Industry 4.0 Accelerates

The global automated material handling (AMH) market is poised for substantial growth over the coming decade, projected to reach a valuation of US$ 85.1 Bn by 2031, up from US$ 40.9 Bn in 2021, expanding at a CAGR of 8.3% from 2022 to 2031. The market is witnessing an uptick in demand across numerous sectors, notably e-commerce, 3PL, food and beverage, pharmaceuticals, and automotive, as companies seek to boost efficiency, reduce operational costs, and improve safety.

Market Overview

Automated material handling systems refer to equipment and software that aid in the movement, protection, storage, and control of materials and products in manufacturing, warehousing, and distribution. These systems are increasingly being adopted due to their ability to improve efficiency, reduce waste, and lower overall costs.

Analysts emphasize that industries are shifting toward automation to meet growing consumer demand, enhance accuracy, and streamline inventory and logistics. Integration of robotics, artificial intelligence (AI), and cloud-based software is transforming traditional storage operations into smart, responsive environments.

Market Drivers & Trends

E-commerce Expansion: With online shopping becoming the norm, warehouses are under pressure to fulfill orders quickly and accurately. Automated systems enable faster picking, sorting, and delivery.

3PL Adoption: Third-party logistics providers are heavily investing in automation to manage inventory, optimize warehousing, and ensure timely delivery.

Cloud-based WMS & TMS: Cloud platforms are replacing on-premise warehouse and transport management systems, offering scalability, data accessibility, and cost-effectiveness.

Cold Chain Automation: The rise in demand for frozen food, pharmaceuticals, and temperature-sensitive products has led to the increased use of AMH systems in cold storage facilities.

Labor Shortage: Automation helps address workforce challenges by reducing reliance on manual labor and minimizing human error.

Key Players and Industry Leaders

Leading market participants include:

Daifuku Co., Ltd.

Honeywell International Inc. (Honeywell Intelligrated)

KUKA AG

BEUMER GROUP

Murata Machinery, Ltd.

Jungheinrich AG

Blue Yonder Group, Inc.

Dematic

KNAPP AG

GreyOrange

Geekplus Technology Co., Ltd.

These players are focusing on strategic partnerships, product innovation, and mergers and acquisitions to expand their global footprint and cater to dynamic industry needs.

Gain a preview of important insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85326

Recent Developments

March 2022: RightHand Robotics launched a Partner Integrator Program to streamline robotic piece picking integration in warehouse operations.

February 2022: Murata Machinery expanded its AGV offerings by adding seven new standard models to cater to diverse industrial needs.

September 2021: Honeywell unveiled a robotic solution for automating pallet loading/unloading, helping reduce manual labor.

May 2018: Coca-Cola Amatil implemented KUKA AG’s robot-based ACPaQ solution in New Zealand to improve delivery quality and meet increasing demand.

Latest Market Trends

High Adoption of ASRS: Automated Storage and Retrieval Systems accounted for 26.5% market share in 2021 and are anticipated to grow at 10.5% CAGR. They improve space utilization and boost picking accuracy up to 99.9%.

Surge in AMRs and AGVs: Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) are increasingly used for material transport within warehouses.

Integration of AI and IoT: Advanced analytics, machine learning, and IoT-enabled systems provide real-time visibility and enhance predictive maintenance.

Market Opportunities

Emerging Markets in Asia Pacific: Countries like India, China, and Southeast Asian nations offer untapped potential due to rapid industrialization and government support for smart manufacturing.

Eastern and Central Europe: Nations such as Poland and Hungary present growing demand for automation in logistics and manufacturing, offering lucrative entry points for market players.

SME Adoption: Small and medium enterprises (SMEs) are increasingly embracing semi-automated systems to remain competitive and meet rising customer expectations.

Future Outlook

The automated material handling market is expected to witness robust growth through 2031, underpinned by digital transformation across supply chains. Increased investment in Industry 4.0 technologies, warehouse robotics, and cloud-based management platforms will redefine how goods are stored and moved globally. Stakeholders must focus on modular, scalable, and interoperable solutions to address evolving operational challenges.

Market Segmentation

By Offering

Hardware: ASRS, AGVs, AMRs, Palletizing Robots, RFID Scanners, Conveyors

Software: Warehouse Management System (WMS), Warehouse Execution System (WES), Transportation Management System (TMS)

Services

By Package Type

Pallet, Containers, Totes, Bulk Containers, Cartons, Others

By Industry Vertical

Food & Beverage

Cold Chain

Personal Care

Pharmaceuticals

Automotive

Retail & E-Commerce

3PL

Others (Healthcare, Airport Services)

Regional Insights

North America (33.5% market share in 2021): The U.S. leads in warehouse automation adoption, with major investments in smart logistics and AI-driven inventory management.

Europe (29.4% market share in 2021): Germany, France, and Austria dominate, but Poland and Nordic countries show growing interest due to expanding e-commerce and industrial automation.

Asia Pacific: Fastest-growing region with high demand in manufacturing and retail sectors. China, India, and Japan are driving the surge due to robust industrial activity and government incentives.

Middle East & Africa and South America: Emerging demand for automated solutions in logistics and food distribution.

Frequently Asked Questions

1. What is the size of the global automated material handling market? The market was valued at US$ 40.9 Bn in 2021 and is projected to reach US$ 85.1 Bn by 2031, growing at a CAGR of 8.3%.

2. What factors are driving the growth of this market? Key drivers include the rise in e-commerce, 3PL automation, cloud-based WMS/TMS adoption, and the need for labor efficiency and accuracy in logistics.

3. Which region is expected to offer the most growth potential? Asia Pacific is expected to grow the fastest due to industrial expansion and adoption of warehouse automation across major economies.

4. What is the role of ASRS in market growth? ASRS enhances warehouse efficiency, reduces storage costs, and increases accuracy and space utilization, making it a vital component of the market.

5. Who are the top players in the automated material handling market? Daifuku, Honeywell, KUKA, Dematic, Murata Machinery, and Geekplus are among the leading players.

6. What industries are the major adopters of AMH systems? Industries such as retail, e-commerce, pharmaceuticals, food & beverage, and automotive are major users of automated material handling solutions.

0 notes

Text

Warehouse Robotics Market Size, Share, Industry Trends 2032

Meticulous Research®, a leading global market research company, published a report titled ‘Warehouse Robotics Market—Global Opportunity Analysis and Industry Forecast (2025-2032)’. According to this latest publication, the warehouse robotics market is expected to reach $15.1 billion by 2032, at a CAGR of 14.4% from 2025 to 2032.

The growth of the warehouse robotics market is primarily driven by an increasing focus on optimizing warehouse operations for faster product delivery, the rising use of autonomous mobile robots, and the growing popularity of e-commerce shopping platforms. However, the high costs associated with warehouse setup and infrastructure development could constrain the market's growth.

Additionally, rapid advancements in robotics, AI, and machine learning technologies are expected to create significant growth opportunities for players in this market. However, the security risks associated with connected autonomous robots present challenges that could impact the growth of the warehouse robotics market.

The warehouse robotics market is segmented by product type, function, payload capacity, and end user. The report evaluates industry competitors and analyzes the market at the regional and country levels.

Among the product types studied in this report, the autonomous mobile robots segment is anticipated to hold the dominant position, with over 29% of the market share in 2025. The segment's dominance is driven by the rising demand for warehouse automation, the exponential growth of the e-commerce industry, and the increasing need for high-efficiency autonomous mobile robots to enhance industrial productivity. Additionally, the demand for customized AMRs designed to meet specific industry requirements, such as handling fragile goods, further contributes to this segment's dominance.

Among the functions studied in this report, the picking and placing segment is anticipated to hold the dominant position, with over 34% of the market share in 2025. The segment's dominance is attributed to the increasing need to optimize the picking process and maximize overall throughput in warehouses and distribution centers. Additionally, the growing emphasis on accurate inventory tracking, efficient replenishment, and timely reordering to prevent stockouts and backorders plays a significant role in this large market share.

Among the payload capacities studied in this report, the Below 20 Kg segment is anticipated to hold the dominant position, with over 26% of the market share in 2025. The segment's dominance is driven by the increased adoption of lower payload capacity robots in the consumer electronics and food and beverage industries, along with the rising popularity of e-commerce shopping. Additionally, the growing volume of lightweight and small packages that need to be managed in distribution centers further contributes to this large market share.

Among the end users studied in this report, the retail & e-commerce segment is anticipated to hold the dominant position, with over 22% of the market share in 2025. The segment's dominance is attributed to the increasing preference for online shopping, a growing demand for fast and efficient order fulfillment, and the need to enhance picking speed and order accuracy.

Among the geographies studied in this report, Asia-Pacific is anticipated to hold the dominant position, with over 52.7% of the market share in 2025. The presence of major warehouse robotics players, such as Daifuku Co., Ltd. (Japan), FANUC Corporation (Japan), Hikrobot Co., Ltd. (China), and Omron Corporation (Japan), is anticipated to significantly contribute to the high revenue share of this region. Additionally, the surge in e-commerce, an increased focus on optimizing warehouse operations for faster product delivery, technological advancements, and the growing adoption of warehouse robotics in the semiconductor, electronics, and automotive sectors are key factors driving the region's dominance.

Key Players

Some of the major players studied in this report are Daifuku Co., Ltd. (Japan), KUKA AG (Germany), ABB Ltd. (Switzerland), FUNUC Corporation (Japan), Toyota Material Handling India Pvt. Ltd.(India), Omron Corporation (Japan), Honeywell International Inc. (U.S.), Yaskawa Electric Corporation (Japan), Onward Robotics (U.S.), Zebra Technologies Corporation (U.S.), Hikrobot Co., Ltd. (China), SSI SCHÄFER - Fritz Schäfer GmbH (Germany), Onward Robotics (U.S.), TGW Logistics Group (Austria), and Addverb Technologies Limited. (India).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=6027

Key Questions Answered in the Report-

What is the value of revenue generated by the sale of warehouse robotics?

At what rate is the global demand for warehouse robotics projected to grow for the next five to seven years?

What is the historical market size and growth rate for the warehouse robotics market?

What are the major factors impacting the growth of this market at global and regional levels?

What are the major opportunities for existing players and new entrants in the market?

Which product type, function, payload capacity, and end user segments create major traction in this market?

What are the key geographical trends in this market? Which regions/countries are expected to offer significant growth opportunities for the manufacturers operating in the warehouse robotics market?

Who are the major players in the warehouse robotics market? What are their specific product offerings in this market?

What recent developments have taken place in the warehouse robotics market? What impact have these strategic developments created on the market?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Warehouse Robotics#Autonomous Mobile Robots#Automated Guided Vehicles#Articulated Robots#Collaborative Robots#SCARA Robots#Warehouse Robotics Market

0 notes

Text

Explore how AI-powered autonomous mobile robots (AMRs) are revolutionizing warehouse operations. From intelligent package handling to seamless logistics automation, this is the future of modern robotics. Designed for tech innovators and automation engineers seeking real-world robotics solutions. Learn more at www.auckam.com – your partner in smart robotics and intelligent automation.

#ModernRobotics#WarehouseAutomation#AutonomousRobots#SmartLogistics#AIinRobotics#RoboticsEngineering#AMR#IndustrialAutomation#IntelligentAutomation#TechInnovation#SmartWarehousing#RoboticsSolutions#EdgeAI#IoTInLogistics#RobotInWarehouse

0 notes

Text

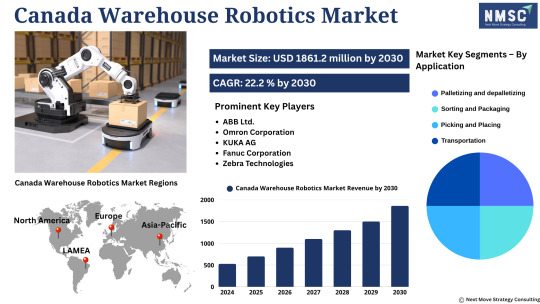

𝗜𝘀 𝗖𝗮𝗻𝗮𝗱𝗮 𝗤𝘂𝗶𝗲𝘁𝗹𝘆 𝗕𝗲𝗰𝗼𝗺𝗶𝗻𝗴 𝘁𝗵𝗲 𝗡𝗲𝘅𝘁 𝗕𝗶𝗴 𝗧𝗵𝗶𝗻𝗴 𝗶𝗻 𝗔𝘂𝘁𝗼𝗺𝗼𝘁𝗶𝘃𝗲 𝗪𝗮𝗿𝗲𝗵𝗼𝘂𝘀𝗲 𝗥𝗼𝗯𝗼𝘁𝗶𝗰𝘀?

𝗖𝗮𝗻𝗮𝗱𝗮 𝗪𝗮𝗿𝗲𝗵𝗼𝘂𝘀𝗲 𝗥𝗼𝗯𝗼𝘁𝗶𝗰𝘀 𝗠𝗮𝗿𝗸𝗲𝘁 is rapidly emerging as a strategic goldmine for investors and automation pioneers alike.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

𝗗𝗼 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? Canada is not just adopting robotics in automotive warehouses — it’s scaling innovation with AI-driven robotic systems, autonomous mobile robots (AMRs), and intelligent picking technologies that dramatically reduce downtime and operating costs.

With rising labor shortages, increasing EV production, and a strong push for supply chain resilience, automotive warehouses in Canada are hyper-automating at unprecedented speed.

𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀: The promising players operating in the Canada warehouse robotics industry includes ABB Ltd., Omron Corporation, KUKA AG, Fanuc Corporation, JBT Corporation, GreyOrange, Bastian Solutions, LLC, Zebra Technologies, Dematic, Honeywell International Inc, Vanderlande Industries B.V., Daifuku Co., Ltd., Murata Machinery, Ltd., Yaskawa electric corporation, SSI Schaefer and others.

𝗞𝗲𝘆 𝗗𝗿𝗶𝘃𝗲𝗿𝘀:

Government incentives for smart manufacturing

Growth in e-mobility vehicle parts logistics

Surge in demand for real-time inventory automation

Cross-border integration with U.S. logistics

𝗪𝗵𝗮𝘁 𝗱𝗼𝗲𝘀 𝘁𝗵𝗶𝘀 𝗺𝗲𝗮𝗻 𝗳𝗼𝗿 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀? Early movers in this space are already witnessing 2x to 5x ROI across robotics logistics portfolios. The market is positioned for double-digit CAGR growth through 2030 — and it's still early innings.

𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

𝗜𝗳 𝘆𝗼𝘂'𝗿𝗲 𝗹𝗼𝗼𝗸𝗶𝗻𝗴 𝗳𝗼𝗿 𝘆𝗼𝘂𝗿 𝗻𝗲𝘅𝘁 𝗵𝗶𝗴𝗵-𝗶𝗺𝗽𝗮𝗰𝘁 𝗶𝗻𝗱𝘂𝘀𝘁𝗿𝗶𝗮𝗹 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁…

𝗖𝗮𝗻𝗮𝗱𝗮’𝘀 𝗔𝘂𝘁𝗼𝗺𝗼𝘁𝗶𝘃𝗲 𝗪𝗮𝗿𝗲𝗵𝗼𝘂𝘀𝗲 𝗥𝗼𝗯𝗼𝘁𝗶𝗰𝘀 𝗯𝗼𝗼𝗺 𝗶𝘀 𝗼𝗻𝗲 𝗯𝗲𝘁 𝘆𝗼𝘂 𝘀𝗵𝗼𝘂𝗹𝗱𝗻’𝘁 𝗶𝗴𝗻𝗼𝗿𝗲.

#WarehouseRobotics#CanadaInvestment#AutomotiveInnovation#LogisticsTech#SmartWarehousing#RoboticsMarket#InvestorInsights#AMR#SupplyChainAutomation#LinkedInNews#NextBigThing

0 notes