#also. marshall and gary saying they’re ’supposed to be together’

Explore tagged Tumblr posts

Text

i’ve seen someone complain about like. why is the only universe where bonnie and marcy have a good relationship the one where they’re both guys (which, not true — bonnie and marcy are very happy together in the main universe now, they just went through a bit of a. rough patch)

but like. gary and marshall live(d) inside simon’s head. of course they’re gonna be all cutesy and lovey with each other, simon’s an old romantic and one of the number one things he always wanted was for marceline to be happy. it’s been pretty clearly shown that simon’s subconscious and the world around him had an effect on fionnaworld while it was still stuck in his dome

#.txt#fionna and cake#the star being the most obvious example#it felt like his brain was trying to autocorrect that bonnie and marcy’s relationship#by having marshall and gary get closer#like a big WRONG *incorrect buzzer noise* and then it made marshall happy#does that make sense#also. marshall and gary saying they’re ’supposed to be together’#simon already Knows that and that’s why they Are together#because bonnie and marcy are supposed to be together too#i feel like i’m getting rambly while also not getting my point across as well as i want to lol#so i’m just gonna stop and hope this all makes sense

29 notes

·

View notes

Note

(Gumlee is literally just Bubbline when they first met but genderswapped)"

No.

https://www.tumblr.com/grendelsmilf/729178891664736256/calling-gary-and-marshall-bubbline-yaoi-doesnt?source=share

Yeah I probably could’ve worded that better in my post bc they aren’t exact copies of Marcy and Pb, obviously, but I still think Gumlee in Fionna and Cake is supposed to be at least a parallel to Bubbline before they broke up

Like you can’t just say “well it’s not TECHNICALLY Bubbline so it sucks” bc that’s STILL Marcy and Pb from a different universe and is in the show paralleling things other Marcy’s and Pb’s are doing. They are showing that Bubbline is inevitable, if they can know each other they will be together in some way

So yeah they are basically genderbent pre break up Bubbline but with the differences that come with them being humans in a non magical world. If we did get to see Bubbline before they’re break up they would’ve been similar to this. They didn’t start their relationship as bitter exes who secretly miss each other, that’s just where we the viewers started seeing them. They would’ve had fluffy, domestic moments like Gumlee does that are making people scream “ITS NOT INTERESTING IF THEY ARENT EXES!!!”

Also that post is just someone saying “nuh uh they aren’t similar” it has no proof of them being completely different, unrelated, or having no connections to each other at all other than “human Hudson isn’t white” which isn’t the proof you think it is since he’s literally a demon in the og show and has no human skin tone. Unless he has a canonical human design I forgot about

They literally said “the parallels in The Star are iffy bc I think the ships boring”

^ tags from that post

20 notes

·

View notes

Photo

LCDrarry 2020 Master List

Dear lovely Participants, Creators, Alpha and Beta Readers, Commentors, Cheerleaders, Readers and Fans of our fest,

Our 2nd installment of LCDrarry is coming to an end, and we'd like to thank you all for taking part in our little fest, for creating so many amazing new Drarry works for us all to enjoy, for commenting on your favourite creations, for sharing and recommending the LCDrarry gems with your friends and blog followers, and for making this fest another amazing experience for us mods.

We hope we could bring you some joy and diversion in these trying times and send you lots of love, strength and perseverance wherever you are :*

Under the cut, you can find out who created what ;D The works are listed in the order they posted during the fest.

Happy reading & squeeing & don’t forget to follow your favourite creators!

~Your LCDrarry Mods Tami @celilasart and Suzi @erin-riwen

PS: Reblogs are very much appreciated <3

***

Love, Actually, is All Around

Prompt: #180 | "Love, Actually" - 2003 - Richard Curtis Author: punk_rock_yuppie Word Count: 9,975 words Rating: Teen and Up Warnings: Wizarding Politics, Discriminiation, Slight power imbalance

Summary: It's Christmastime, and Harry has just started as the new Minister of Magic. It just so happens that Draco happens to work in his office as well, a holdover from Kingsley's tenure. Naturally, love is in the air.

Read "Love, Actually, is All Around" now on AO3.

***

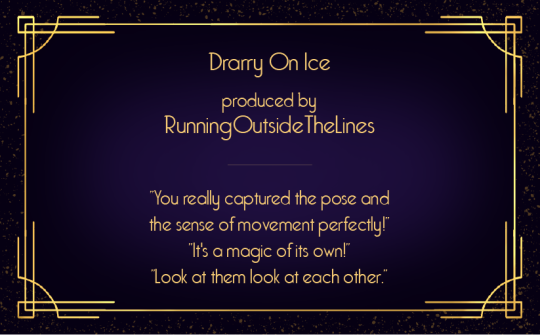

Drarry on Ice

Prompt: #150 | '"Yuuri!!! On Ice" - 2016 - Series Artist: RunningOutsideTheLines Art Medium: Traditional Art Rating: General Warnings: none

Summary: Harry and Draco find love on the ice. I love Yuuri on Ice and Harry and Draco seem like such a perfect fit for Victor and Yuuri. I'll leave it up to your imagination as far as which is which. This image is from the final scene when the two of them do a exhibition skate together.

View "Drarry on Ice" now on AO3.

***

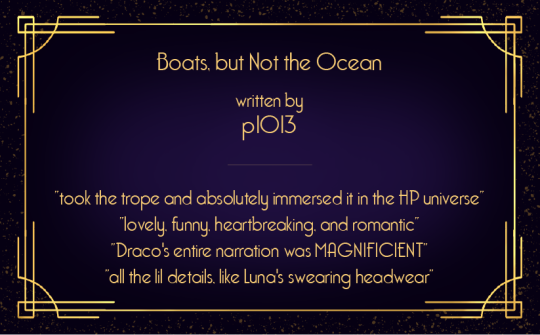

Boats, but Not the Ocean

Prompt: #203 | "Groundhog Day" - 1993 - Harold Ramis Author: p1013 Word Count: 15,551 words Rating: Explicit Warnings: Very minor mention of suicide, some mild horror

Summary: If Draco ever gets his hands on this Bill Murray character, he's going to kill him.

Read "Boats, but Not the Ocean" now on AO3.

***

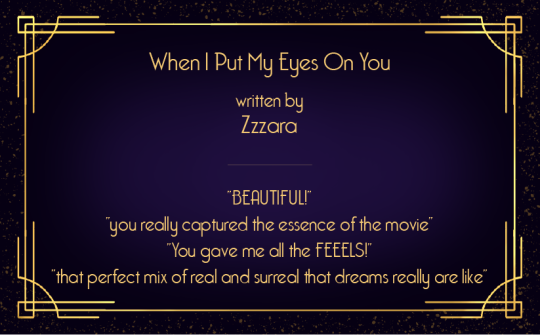

When I Put My Eyes On You

Prompt: #193 | "The Way He Looks" - 2014 - Daniel Ribeiro Author: Zzzara Word Count: 31,155 words Rating: Explicit Warnings: No Archive Warnings Apply

Summary: When a hero defeats a villain, there's supposed to be a happily-ever-after... but when did anything ever happen to Harry Potter the way it was supposed to? Having sacrificed himself to the greater good, Harry is left alone in the darkness, blindly groping for the shreds of the life he knew. When the enemies meet, how is the story supposed to go, once they learn there's more to it than the eye can see? A story of pain, hope and things we discover, once we stop looking for them with our eyes.

Read "When I Put My Eyes On You" now on AO3.

***

Spellbound

Prompt: #113 | "Overboard" - 1987 - Garry Marshall Author: mortenavida Word Count: 15,878 words Rating: Teen and up Warnings: Amnesiac Draco Malfoy, Widowed Harry Potter, past Harry Potter/Ginny Weasley, Dub-Con due to Amnesia (Only Kissing)

Summary: It’s been years since Harry left with Ginny to get away from the bad memories of war. The small town of Elk Cove, Oregon, had been a perfect place to raise their children. Now widowed, Harry works hard to make sure his children never want for anything. When an old rival steps into his life, everything changes and Harry finds the perfect opportunity to get back at Malfoy for everything the Slytherin did to him -- if he doesn’t regret falling for him first.

Read "Spellbound" now on AO3.

***

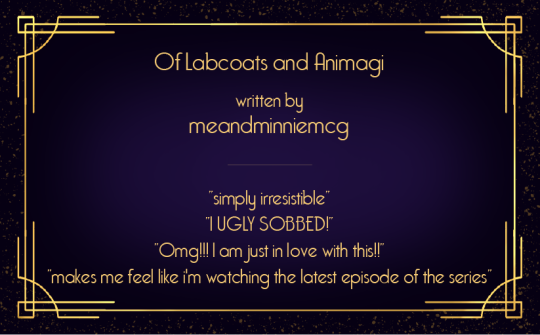

Of Labcoats and Animagi

Prompt: #97 | "Queer Eye" - 2017 - Series Author: meandminniemcg Word Count: 10,868 words Rating: Mature Warnings: mention of past abuse, panic attack (tw at beginning of chapter, can be skipped)

Summary: Fashion icon Draco? That's long past. After the war, he never bought any new clothes and lives in his labcoats. When he doesn't feel confident enough to meet his pen friend Prongs in real life, Luna decides to stage an intervention with a little help from the Fab Five.

Read "Of Labcoats and Animagi" now on AO3.

***

Title of Their Sex Tape

Prompt: #112 | "Brooklyn Nine Nine" - 2013 - Series Author: Cibee Word Count: 12,428 words Rating: Teen and up Warnings: None

Summary: What are the Wizarding world's most elite law enforcers doing when they aren't catching criminals? It seems Auror Malfoy is often caught throwing food into Auror Potter's mouth when he's mid-yawn. This story isn't about Draco throwing food at Harry. What it does have is: Undercover! Heists! Draco pining for Harry! Harry being oblivious, but also can't help noticing how good Draco smells! Banters and jokes! That's about it.

Read "Title of Their Sex Tape" now on AO3.

***

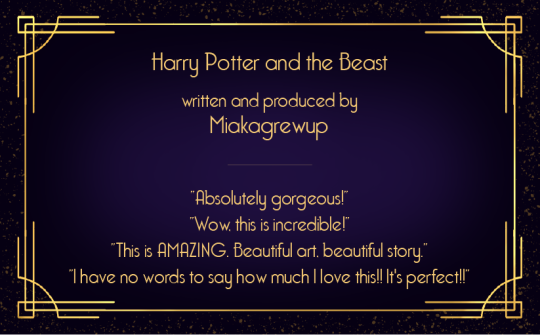

Harry Potter and the Beast

Prompt: #204 | "Beauty and the Beast" - 1991 - Gary Trousdale Author/Artist: Miakagrewup Word Count/Art Medium: 5,655 words/31 illustrated pages Rating: General Warnings: None

Summary: Arrogant prince Draco is cursed to live as a terrifying beast until he finds true love. This fairy tale consists of 31 fully illustrated pages.

Read "Harry Potter and the Beast" now on AO3.

***

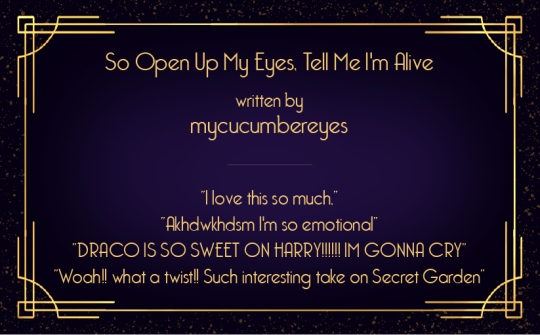

So Open Up My Eyes, Tell Me I'm Alive

Prompt: #191 | "Secret Garden" - 1993 - Agnieszka Holland Author: mycucumbereyes Word Count: 12,865 words Rating: Teen and up Warnings: trauma, canon typical violence, homophobia, use of f-g/f----t, mention of suicidal thoughts, character with a disability

Summary: When Draco Malfoy comes to live at Godric’s Hollow, he finds it full of secrets. One night he hears the sound of crying…

Read "So Open Up My Eyes, Tell Me I'm Alive" now on AO3.

***

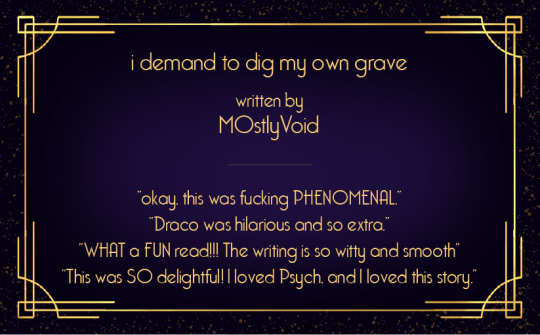

i demand to dig my own grave

Prompt: #10 | "Psych" - 2006 - Series Author: M0stlyVoid Word Count: 20,836 words Rating: Mature Warnings: None

Summary: Draco finds himself in hot water with the Aurors, and in a burst of panicked inspiration manages to wiggle out of it by claiming to be a Seer. There's just one little problem– Senior Auror Harry Potter, the Prat Who Lived, who's known him for a decade, knows full well Draco doesn't have a single psychic bone in his body and seems determined to pull him up for it. Now, the Department is demanding he help them solve cases, Potter's looming over his shoulder at every turn, and worst of all, he hasn't had a shag in weeks because of all this bother. What's a pseudo-Seer to do?

Read "i demand to dig my own grave" now on AO3.

***

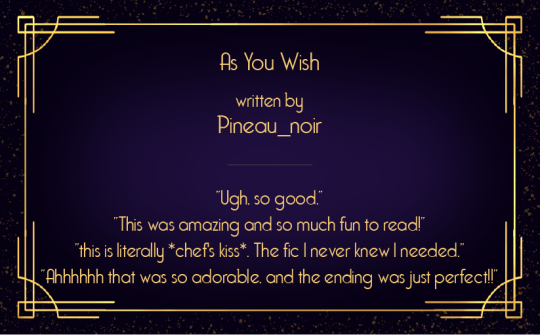

As You Wish

Prompt: #37 | "The Princess Bride" - 1987 - Rob Reiner Author: Pineau_noir Word Count: 21,917 words Rating: Teen and up Warnings: Canon-typical (Harry Potter and The Princess Bride) violence, mention of suicide, canon-typical character death

Summary: Draco was raised on a farm in the small country of Witshire; his favourite pastimes were flying on his broom and tormenting the hired farm boy. Though his name was Harry, Draco never called him that. On Harry's forehead there was a scar shaped like a lightning bolt, so Draco called him Scarhead. Nothing gave Draco as much pleasure as ordering Harry around.

Or a story about fencing, fighting, torture, revenge, giants, monsters, chases, escapes, True Love, and miracles.

Read "As You Wish" now on AO3.

***

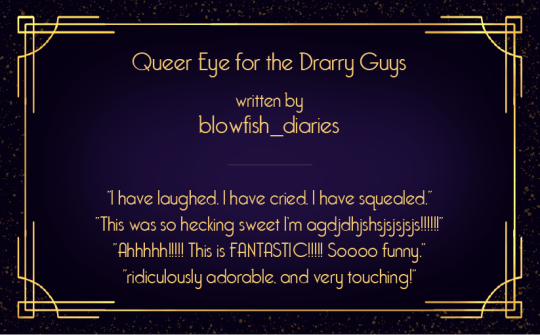

Queer Eye for the Drarry Guys

Prompt: #97 | "Queer Eye"- 2017 - Series Author: blowfish_diaries Word Count: 18,201 words Rating: Teen and up Warnings: none

Summary: Teddy's dads are great! Really! They just need a little push from five *fabulous* gays to get them to see what's right in front of them.

Read "Queer Eye for the Drarry Guys" now on AO3.

***

Casecation

Prompt: #112 | "Brooklyn Nine Nine" - 2013 - Series Author: Mfingenius Word Count: 4,293 words Rating: Teen and up Warnings: AU, canon-typical discussion of heavy topics, discussion of mpreg

Summary: "Draco Malfoy, I swear to God-” Hermione snaps under her breath, causing Draco to laugh lowly as he ducks under a hanging plant pot. “Draco Potter, ‘Mione,” Harry murmurs with a helpless grin; they’re not really supposed to be speaking – they're walking through the halls of Antonin Dolohov’s beach house, on their way to arrest him – but Harry can’t help marking the difference, even a year after they got married. “Be quiet,” Ginny says, rolling her eyes. “If he hears us and escapes-” Draco signals at them, and they all steel themselves for when he throws the door of the bedroom open. “Shit!”

Read "Casecation" now on AO3.

***

Don't Blink!

Prompt: #179 | "Dr Who" - 2007 - Series Author/Artist: Gnarf Art Medium: Digital art Rating: General Warnings: None

Summary: Harry had always had exceptionally bad timing. It's not different this time.

Read "Don't Blink!" now on AO3.

***

A Demon and an Angel Visit the Ritz

Prompt: #167 | “Good Omens” - 2019 - Series Artist: ravenclawkward Art Medium: Digital Oil Painting Rating: General Warnings: None

Summary: Harry the demon and Draco the angel just finished saving the world. They've earned their celebration, wouldn't you say?

Read "A Demon and an Angel Visit the Ritz" now on AO3.

***

Change on the Horizon

Prompt: #57 | "Shameless (US)" - 2011 - Series Author: static_abyss Word Count: 118,645 words Rating: Explicit Warnings: Character with depression, mentions of not wanting to exist and lethargy, though no actual suicide or mentions of suicide. Unhealthy coping mechanisms, specifically not taking prescribed medication for depression. Internalized homophobia, and general homophobia from parental figures, though there is a happy ending. Casual relationships.

Summary: A canon AU drarry fic based on the relationship between Mickey and Ian from Shameless. A story about the aftereffects of the Second Wizarding War and how Draco and Harry come together and break apart over and over. How maybe, somewhere along the way, they find a way to live with themselves.

Read "Change on the Horizon" now on AO3.

***

The Thrill of the Chase Moves in Mysterious Ways

Prompt: #192 | "Miss Fisher's Murder Mysteries" - 2012 - Series Author: VeelaWings Word Count: 32,569 words Rating: Explicit Warnings: Heavy Drinking, Smoking Cigars, Implied/Referenced Child Abuse, Implied/Referenced Minor Character Death, Implied/Referenced Abuse, Implied/Referenced Kidnapping, Non-Graphic Violence, Gun Violence, Poisoning

Summary:

“Do you have a personal interest in this case, Malfoy?” Harry asked, arms crossed and blocking the view of the body behind him.

“Not at all.” Draco smiled sweetly, cuddled into the side of tonight’s date. “Although I did briefly own that painting until it proved to be stolen.” He helpfully pointed to the Renaissance portrait a few metres to their left.

“Why is it always so complicated with you?”

+++++

Some people might argue that Draco didn’t have very good ideas. That was a lie. Draco had fantastic ideas, however, due to mankind having free will, the planning and execution of those ideas didn’t always pan out in his favor.

(Or — Draco solves crimes that don’t technically belong to him and Harry tries not to fall in love. Co-Starring: Hermione, High Heels, and Hiccups along the way. #dat 1920s lyfe)

Read "The Thrill of the Chase Moves in Mysterious Ways” now on AO3.

***

Burn Your Life Down (but look back to me)

Prompt: #202 | Casablanca - 1942 - Michael Curtiz Author: Triggerlil Word Count: 35,910 words Rating: Teen and Up Audiences Warnings: Alternate Universe - World War II, Film Noir, Self-Medication, Alcohol, Infidelity (not between Harry and Draco), Smoking, Mention of Slavery and Human Trafficking

Summary:

It's been years since destiny walked into an apartment on Rue Azais, and Harry is over it. Really, he is. He has Blaise, he has his work, and if necessary, he still has his memories. But with the onset of WWII, the foundations of his life are crumbling, and suddenly a certain blond man is walking back into his life, asking Harry to make important, and dangerous, choices.

Read “Burn Your Life Down (but look back to me)” now on AO3.

***

Super Rich Kids

Prompt: #24 | "The Bling Ring" - 2013 - Sofia Coppola Author: Thusspoketrish Word Count: 81,000 words Rating: Explicit Warnings: Thriller, Murder, Dark Humour, Angst, Depression, Nihilism, Existenialism, Jealousy, Hurt/Comfort, Gaslighting, Very Brief Instance of Suicidal Ideation, Immorality, Implied/Referenced Domestic Violence (not between Harry and Draco), Abusive Drug Use, Manipulative Behaviour, Heterosexual Sex, Threesomes, Candaulism, Possible Infidelity Due to Unclear Relationship Status (please read the tags on AO3 carefully, this list is not exhaustive)

Summary:

Draco Malfoy has become disillusioned by the glitz and glamour of the scandalous lives of the Post-Second Wizarding War Pureblood Elite. Enter: one existential crisis, one group of cynical friends, and several terrible, terrible decisions.

Read “Super Rich Kids” now on AO3.

***

We Built This Right

Prompt: #48 | "Yuri on ice" - 2016 - Series Author: remy_writes5 Word Count: 15,344 words Rating: Explicit Warnings: Homophobic Language, Anxiety, Strained Relationship with Parents

Summary:

At last year's Grand Prix Final, Harry had an accident that left him with a lightning scar on his forehead, a concussion and a twisted ankle. Now everyone is waiting to see if his career is over - including former rival, Draco Malfoy.

Read "We Built This Right” now on AO3.

***

Please help promote the fest by sharing your favourite submissions, so more people can enjoy all the amazing new Drarry works of LCDrarry. Thank you!

#lcdrarry#lights camera drarry#lights camera drarry 2020#lcdrarry 2020 master list#lcdrarry masterlist#lcdrarry2020#lcdrarry reveals#hpevent#hp event#hp fest#hpfests#hp fests#hpfest#drarry#drarry squad#drarry fic rec#drarry fic recs#drarry fanart#drarry fanart rec#harry potter#draco malfoy

245 notes

·

View notes

Text

111: How to Stay Out of Entrepreneurial Hell – Interview w/ Paul Moore

Today we’re talking with Paul Moore. Paul has found great success in multiple domains as an entrepreneur, including but not limited to the real estate investing business.

Paul has flipped over 50 homes and 25 high-end waterfront lots, appeared on HGTV’s House Hunters, rehabbed and managed rental properties, built a number of new homes, developed a subdivision, and started two successful online real estate marketing firms. After helping with three successful developments, including assisting with the development of a Hyatt hotel and a very successful multifamily project, Paul ventured into the commercial multifamily arena.

With decades of experience and an impressive resumé, Paul offers a fresh perspective on creative real estate investing and philanthropy in 2021.

Links and Resources

WellingsCapital.com (Paul’s Website)

How to Lose Money Podcast

The Fast (and Slow) Roadmap for Real Estate Investors

The One Things by Gary Keller

Who Was George Muller?

Malachi 3:10

Memos From the Head Office by Perry Marshall

Compassion International

World Vision

Anthropoid Film

Paperstac

Share Your Thoughts

Leave your thoughts about this episode on the REtipster forum!

Share this episode on Twitter, Facebook, or LinkedIn (social sharing buttons below!)

Help out the show!

Leave an honest review on Apple Podcasts Your ratings and reviews really help (and I read each one).

Subscribe on Apple Podcasts

Subscribe on Spotify

Subscribe on Stitcher

Thanks again for listening!

Episode 111 Transcription

Seth: Hey, everybody. How’s it going? It’s Seth Williams here and Jaren Barnes and you’re listening to the REtipster podcast. Today we’re talking with Paul Moore. I first heard about Paul and saw his stuff, just some YouTube videos he had put together for BiggerPockets years ago. He has always just stood out as an authoritative guy who knows a lot of stuff.

Just a little bit of background about Paul. He began his career at Ford Motor Company after earning an MBA from Ohio State. And after five years of working at Ford, Paul started a staffing company with a partner. Paul and his partner sold it to a publicly traded firm five years later for $2.9 million. And along the way, Paul was a finalist for Ernst & Young Michigan Entrepreneur of the Year two years straight.

Paul later got into the real estate sector where he flipped over 50 homes and 25 high-end waterfront lots. He appeared on HGTV’s House Hunters. He has rehabbed and managed rental properties, built a number of new homes, developed a subdivision, and started two successful online real estate marketing firms.

After helping with three successful developments, including assisting with the development of a Hyatt hotel and a very successful multifamily project, Paul ventured into the commercial multifamily arena.

With decades of experience and an impressive resume, Paul offers a fresh perspective on creative real estate investing and philanthropy in 2021. Paul also is an experienced podcast guest, having appeared on over 60 shows and counting. And we’re just really glad to have him here. So, Paul, welcome to the show. How are you doing?

Paul Moore: Hey, it’s great to be here, guys. Thanks for having me on.

Seth: I know we discovered a lot in that intro, but it almost makes you wonder just right off the bat with all the stuff you’ve done since… Was it like in the mid-nineties when you got into real estate and was that your first foray into real estate?

Paul Moore: I invested in commercial real estate passively in 1999, but I really started full-time into real estate in the year 2000.

Seth: With all of this stuff you’ve seen, all the different market changes, times when real estate has been in the tank and other times when real estate has been really hot, kind of like right now, what would you say are some of the lessons you’ve learned? Anything super important standout about how to handle yourself when the market is constantly changing and the rules are different from year to year?

Paul Moore: Yeah. One thing that stands out, it came from my bio and that is, I got tired and kind of bored listening to you read it. I actually used to think, I remember years ago, I’ve got this drawer in my desk where I keep all my business cards. And I’ve got business cards, I, unfortunately, don’t have one from the staffing company, but from over a dozen different things I’ve done since then, I thought I’m going to put a serial entrepreneur on the card. And another time I thought I’m going to put a full-time investor on it.

And you know what? Being a serial entrepreneur is not cool. And I’m sorry if I’m offending you guys or anybody else, it can be, Elon Musk has done it really well, but he hasn’t actually done marriage and parenting as well from what I’ve heard. At risk, as I told you before the show of the same thing, because when you’re always chasing two rabbits as Gary Keller quotes, then the one thing, you’ll probably catch neither one.

And I chased shiny objects for years, and I would be down the road with a startup and see a new opportunity and go turn my attention to that. And Barry, my business partner, who actually was in Indiana for many years and Michigan. And I know you guys both are from both those places. But Barry said, once he ran for governor of Colorado a few years ago, he said I rubbed shoulders with some billionaires and really successful people recently. He said the most successful people took Gary Keller’s advice and stayed on one thing for decades. And they became very, very good at it. And that might’ve even been boring or looked boring, but boring is cool.

In fact, I am thinking about writing a book called “The Boring Investor.” I’ve got 21 chapters outlined for it. And I started on a plane recently with this burst of inspiration. If you look at Warren Buffett’s life, guys, we couldn’t handle a week of his life. It’s so boring, seemingly. But Paul Samuelson, the first U.S. economist to win the Nobel peace prize said “Investing should be boring. It should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Jaren: Yeah. I just recently watched an interview with Ramit Sethi. He was saying the same thing. He was being interviewed by Tom Bilyeu on Impact Theory. And he was asking him about finances and Bitcoin and all these hot items as it were. And he said the same thing. He said the reality is if the majority of the time, the large hedge fund companies and all these big wigs on Wall Street don’t end up beating the market, statistically, you would be better off just parking your money in an ETF or mutual fund that just matches the market. He says the exact same thing that your finances should be boring because they’re supposed to give you the resources to go live an amazing life. They themselves are not supposed to be the end all be all.

Paul Moore: Right. That’s so true.

Seth: Yeah. I don’t mean to take us off course, but I just put together a blog post. I actually did it several months ago, but it just got published last week. It’s all about the fast and slow roadmap for real estate investors. And it was based on this thing that I heard a really smart person tell me a few years ago. He told me that you make your money in your business and you preserve your money in the market, not the other way around.

Paul Moore: Oh, I love that.

Seth: Yeah. If you equate that to real estate, it’s like, if you want to get there quickly investing in passive “buy and hold” investments and that kind of thing, that’s not the fast way to get there. That is the boring way.

Paul Moore: As an entrepreneur, as this high-energy serial entrepreneur that became a full-time investor at age 34 when I sold my company, guys, I blew it. I blew it. I wanted to keep investing like I entrepreneured. I just made that word up. But anyway, the point is I guess I became an entrepreneurial investor and it was a big mistake and I lost a lot of money doing it. I mean, I’ve got a podcast called “How to Lose Money” after all.

Seth: Maybe you can explain what you mean by that. What exactly did you do wrong? Were you trying to flip properties fast or something? Let’s pick that apart.

Paul Moore: Yeah. I just chase things with little due diligence. I heard about a guy who was doing foreign exchange investing and he was able to make a 3% profit a month and he would keep a 1% and give 2% to his investors. And you know what? I did due diligence, but not much. I just trusted what another guy told me about and I invested $100,000. I actually went to see him in Charlotte to take him another $100,000. And I got this sinking gut feeling that something was very wrong. And so rather than do what I should have and pulled the $100,000 out, at least I didn’t put another $100,000 with him because a few weeks later the FBI raided him. And he’s now in year, I think, like 20 of his 158-year prison time. It was a Ponzi scheme and he still won’t tell people where he’s kept the $18 million that he stole from 2,000 to 4,000 people. I’m not clear how many.

But I just didn’t do enough due diligence. Investing is when your principal’s generally safe and you’ve got a chance to make a return. Speculating is when your principal is not at all safe and you’ve got a chance to make a big return. And either one is okay. I mean, it’s okay to speculate in Google, if you’re the Stanford professor 20 years ago or whatever. Or it’s okay to speculate in Amazon, if you’re Jeff Bezos’s parents 27 years ago, who turned $300,000 into $30 billion or whatever.

But let’s face it. There’s a lot of other people who speculate are now driving pizza for Domino’s. And so, the sure path to wealth is slow and boring. Jeff Bezos asked Warren Buffet, “Why doesn’t everybody just imitate you? It’s not that complicated.” Buffett said, “People don’t want to get rich that slowly.”

Jaren: Hey, Paul, I want to go back to a point of conversation we were having a minute ago, because you said something really interesting to me. You were talking about how you as an entrepreneur for years got the shiny object syndrome and you would be pursuing all these different opportunities that presented themselves.

One of the things that I struggle with a lot is the fear that if I give my “yes” to something, I inherently have to give my notes to a bunch of other things. You even said earlier that the guys that are billionaires, your partner Barry, was rubbing shoulders with billionaires and they just stuck to one thing and made it work.

The thing that I really struggle with is I always doubt if I am actually doing the right one thing. Because that is the million-dollar question. If I give my life to building set adventures and it’s not good soil, it’s not a good place to see, then I could legitimately ruin my entire life and waste my entire life or waste all my potential.

Do you have any insight or any wisdom that you could speak to in that kind of predicament? Because I think that’s where a lot of entrepreneurs struggle. Without me kind of catching the shiny object syndrome and doing a deep dive for a couple of months in apartment syndications, I would never learn whether or not it’s for me or not.

Paul Moore: Yeah. It’s so true. And I don’t have a great answer. I remember Gary Keller in the book “The ONE Thing” said, “Just saying yes to your one thing means saying no to a thousand distractions.” And I would say more like 10,000 distractions along the way. And that can be on an hourly basis, a monthly basis, a lifetime basis. And it is hard. And wouldn’t it be terrible to get to the end of your life and realize that you were acting in a play so to speak, but you didn’t know the plot.

That’s why I love to step back from my business. And in fact, I like to step back every morning when I get up and take some time to journal, to pray, to meditate, and to really remind myself of the plot of my life.

It’s interesting, Jaren. Like I said, we’ve had a show called “How to Lose Money” for four years. We had interviewed 230-some guests and we learned tons of lessons, but two that stood out, one was “Don’t quit, persevere.” Like all the posters on the walls of your office. “Persevere, never quit.” The frog grabbing the pelican by the throat, “Never give up.”

The other lesson we learned that stood out was “Quit quickly.” You got to know to turn it and cash in your chips soon. We interviewed lots of people who told us about ways they didn’t stop soon enough. And as a result, they lost a lot of money. We invested almost $400,000 in a wireless internet company in North Dakota that I co-founded after doing this super successful multifamily deal in North Dakota in the same town.

And about $100,000 into the burn of that $400,000, we should have pulled the plug. We could have given investors. And I was the largest investor, backed three-quarters of their money. But instead, we burned it out for about seven years and it turned into zero. And if we would have just pulled the plug on that, the first winter, when the radios didn’t work, we would have been a lot smarter.

So, I think both are true. The question is, how do you know if you’re on the right path that you need to keep persevering on or barking up the wrong tree, so to speak. And I think the answer partially comes from wisdom. wisdom of mentors, wisdom of counselors and coaches, but also your own wisdom that you gain over decades. And a lot of that comes from pain. And that’s why we called the show “How to lose money.” We tried to give people an opportunity to learn from other people’s pain.

Jaren: Yeah, that’s really insightful. It’s really hard to figure out, man, because I can be very certain on some days are even an hour of a particular day. And then a few hours later, something can derail me, and then I’ll be second-guessing the decisions that I’ve made. For me, I guess it’s a form of FOMO.

Paul Moore: It is.

Jaren: I don’t know when you should quit versus when you should double down, get gritty and go hard because there are people in ditches on both paths. So, I guess it’s just one of those entrepreneurial conundrums.

Paul Moore: It’s really tough. There was a guy named Lance Wallnau that you might’ve heard of. And Lance Wallnau has a thing where he talks about when all your education, training, successes, failures, strengths, weaknesses, the things you enjoy, the things that give you life versus the things that feel like you’re going to die to have to do it, when they all come together and you just have this moment of clarity, he calls it convergence, and you can find stuff like that on YouTube and on Lance Wallnau’s website. But convergence is when that all comes together. And when that happens, you often can tell, “Oh yeah, I’m in the zone of convergence.”

Unfortunately, he says a lot of people don’t come to that moment of clarity until their fifties or sixties. And so, eat right, stay healthy because if you are like me and didn’t really come to that moment of convergence until my mid-fifties, you’re going to have a long road ahead because hey man, I can never retire.

Seth: Yeah, totally. Paul, I know just from your bio, it sounds like you’ve got some experience with investing in vacant land. Since that’s a big part of our audience and there are a lot of them who are interested in that and I’m interested in this too, what is your experience with that? What kind of land did you buy and invest in and what was involved with that?

Paul Moore: Yeah. When we sold our company to another company in Detroit when I was 33 and 34, I moved to a mountaintop in the Blue Ridge Mountains of Virginia. We tried to start a nonprofit organization. Our neighbor had 450 acres and he was very, very old. And we asked him if he wanted to sell. And he said, yeah. So, we actually spent like $6,000 or $7,000 getting the timber evaluated without a written contract with him.

He basically said, okay, I’ll sell it to you for a thousand dollars an acre. This is mountaintop land. And that’s about right. And while the timber was worth a thousand dollars an acre, we found out that it was in a bad market in 2000. And so, we went down the row with him, but his wife caught wind of it and she shut the whole thing down. We didn’t have a signed contract. I wouldn’t have wanted to hold it to him anyway and cause marital strife, he was a friend of mine.

My son never forgot that. And actually about 15, 16 years later in 2016, he started in that business full-time. And actually, that’s what he does. He buys land that has a variety of uses. I mean, he can subdivide it. He can rent it out for hunting land. He can rent it out to a cell tower company. He can rent it out for solar. He can do carbon tax credits though we don’t know exactly how to do that yet. I know people do it and he can also cut timber. He just bought a 201-acre parcel. He’s going to select, cut the largest trees off, and let the rest grow for 25 more years. What a great retirement plan for a 28-year-old.

So, that’s my main involvement in land. The other would be I bought and flipped about 30 or 40 waterfront lots over the years at Smith Mountain Lake in Virginia. And one of them was a five-acre parcel that I had to subdivide to make work. Talk about speculation. We were counting on the market to continue to go. Well, of course, everybody does that in a sense, but we were also counting on the Vita Virginia department of transportation granting us a public road in front of the lot. No speculation there.

And after two or three years of trying to hope that would happen—hope is not a business strategy—and so, we were not able to make that happen. That almost got me to the point of bankruptcy in 2008, but I ended up actually going from $2.5 million in debt to completely debt-free through a series of amazing events that happened through the year of 2008.

Jaren: Do you mind diving into a little bit of that? That’s a major cliffhanger.

Paul Moore: Yeah. I told you, I do this morning meditation thing and it was a Sunday morning, in November of 2007. And I was sitting there one morning realizing, man, I’m $2.5 million dollars in debt. 10 years ago, to the month, I had almost $2 million in the bank and now I’m $2.5 million in debt. But I didn’t feel scared. And it’s kind of odd to me now that I didn’t. I guess it’s because I didn’t know how bad the 2008 recession would be. Of course, nobody did.

And so, we’re about to hurdle down this black hole called the great financial crisis. And I was sitting there and I had this really strong impression like “What would George Müller do?” Well, for those of you who don’t know George Müller, which is probably most of your audience, he lived through the 1800s. And he actually was a hellion in Germany as a young man. And he went to England and he became sort of a saint, so to speak. He actually housed and cared for 10,000 orphans total over his lifetime and beyond in these large orphanages he built, using the model they had at the time for orphanages.

He actually was able to raise what we believe was around a quarter-billion dollars in today’s dollars, possibly up to half a billion. And he never ever asked for a penny from anybody or told anybody he had a need. He actually just believed if he was fully aligned with God, that God would provide him every cent he needed. And apparently, he did.

So, I thought, “What would George Müller do?” Well, he was really opinionated. Like he didn’t believe in marketing and sales and all kinds of things. But he also didn’t believe in debt. And I thought, well, George Müller wouldn’t be in debt, but if he was, he would do something really crazy and outlandish to get out of debt. And so, actually that morning, the pastor of my church talked about George Müller and I’d never heard him mention his name ever in like 14 years. And so, I thought, okay, I’m on the right track. And so, I went to my family and four young kids and my wife and I said, “Hey, family gather around. We’re in a lot of trouble. We’re going to start giving our way out of debt.” And then I met with two concerned friends, me and two others. And they said, “You’re going to obviously have to declare bankruptcy, right Paul?” And I said, “Well, it would seem, but I’m going to start giving my way out of debt.” That went over really well.

On January 1st, 2008 with no idea how we’d get out of this mess, we started giving aggressively to some nonprofits, charities, et cetera we were committed to. Four weeks later, I was in a Subway restaurant and had this random conversation seemingly with an experienced real estate developer who gave me an idea how to subdivide the five acres of land into five one-acre parcels, which was my goal all along.

And I said that won’t work because of this law. He said, well, think about it. And I have this incredible moment, like, “Oh, I know what to do.” And I got out of the Subway restaurant, called my surveyor, and explained it. He thought it was a terrible idea because he said that law prohibits you. And I said let’s go to the county planning and zoning office anyway. So, two days later we’re sitting there and he’s sitting there like embarrassed while I’m presenting this outlandish plan to use their law that prohibited subdividing to subdivide the land.

And the lady looked up at me and shook her head. She said “I’ve been working here for decades. No one has ever come up with such an outlandish plan, but you somehow found a loophole in the law. You’re right. You can do this.” And I still had a lot of work ahead. I had surveyors and attorneys and soil scientists. I had to find five buyers in the midst of the worst downturn since the great depression. But I did, it happened and I was completely debt-free in 13 months.

Jaren: That is awesome.

Seth: Wow. Maybe I missed it when you were talking, but in terms of giving your way out of debt, what else was involved with that? Were you giving to a certain cause or something beyond that?

Paul Moore: No, I guess I really believe and people all around the world, believe in what some people call karma. Some people call it the law of sowing and reaping. I was just giving, believing that that would actually matter. I didn’t know what would happen. I thought we could have ended up broke and bankrupt. And for some reason, I didn’t lose any sleep over that. I didn’t think we would, but I thought we might.

Oh, and I forgot to tell you. Right in the middle of all that, my business partner quit. He had half the debt and he handed it to me. And if he hadn’t quit, I couldn’t have become debt-free because when I sold those lots, I would have split the profit with him. And I told him, I’m going to figure this out. And he said, I got to quit anyway. And he missed out on some profit, but anyway, that’s what happened.

I just really believe that the universe, God, whatever you want to call it, will all align when we give generously. And when we give of our time, when we sacrifice money and somehow or another, things come to us that wouldn’t have come otherwise. George Müller believed that. And I tell you what, I do too. And I don’t think it’s a magic formula though. I don’t think I can just put a dollar in like a vending machine and get a soda pop out of a machine. I don’t think it’s a vending machine, I think it is just a principle that’s generally true.

Seth: Yeah. There is a Biblical basis for that. And all the atheist and agnostic listeners out there are probably going to roll their eyes at this. But Malachi 3:10 says “Bring all the tithes into the storehouse so there will be enough food in my temple. And if you do, I will open the windows of heaven for you. I will pour out a blessing so great that you won’t have enough room to take it in. Try it and put me to the test.”

God is actually challenging you. Like, see if I don’t come through for you. I think there is something to that. There’ve been a few times in my life. I wouldn���t say I was recklessly giving, but I intentionally gave to the point of inconvenience, like it hurt me to do so. It never stayed a negative thing. I don’t know where it comes from, but somehow you end up further ahead. And I think it probably has to do with giving with a cheerful heart and that kind of thing. But there is something to that. At least that has been my experience and I haven’t heard a lot of people who have done that and it hasn’t worked out for them.

Paul Moore: I know. And Seth, I’ll tell you. Actually, I shared this on a podcast a few months ago and the host said, check this out. And he showed me a study, I think it was a Catholic guy in New York. University of Syracuse did a study on this and proved that people who gave generously actually ended up wealthier. And they actually dove in deep because it didn’t make sense to him. He didn’t believe the results. He dove in deeper and pulled it apart and figured out “why”, some reasons why it could be true. And for anybody who’s listening, if you want to hear that message he gave about, it’s a short message, 35 minutes. He gave it at Brigham Young University. And I want to say 2009.

Seth: Yeah, it’s fascinating.

Jaren: It’s interesting how in life the principles of success are universal and sometimes they’re counterintuitive, but people from all different walks and all different stripes and colors and backgrounds and all of that, they all typically stumble across some version of the financial, like the tithing principle or whatever. It’s really, really interesting that even if you have no faith in God whatsoever, if you do this kingdom principle, it works and it works across the board.

Paul Moore: It’s true. AA – Alcoholics Anonymous, those principles work for people who have no faith at all. I will say that I think that there are probably deeper, longer-lasting and work better for people who really do have faith, but they do work. It’s amazing, it’s just like gravity. It works for everybody.

Jaren: Yeah. I like that. Paul, you’ve mentioned a couple of times about meditating and that’s really piqued my interest because if I’m honest, I don’t know what meditation is or what’s supposed to happen when you sit down and try to meditate. And I would love just some insight as to what your meditation practice looks like, if you have any pointers. I know that there’s a lot of diversity and all of that in wanting practices and what have you. And I’ve tried to do, there’s a really ancient type of Christian meditation called the Jesus prayer. And I’ve tried to do that and I’ve tried to do some other things, but I don’t know exactly what is supposed to be happening when I’m sitting there for 20 minutes or whatever. Can you dive into what that looks like for you and why you find it beneficial? I mean, if you’re committed to doing it every day, that’s a pretty big deal.

Paul Moore: Yeah. I’m going to show some weakness here. I don’t know what I really know. In an experiential way, the best way to do it, I sort of call it meditation. Well, I will say this. There is a form of Eastern meditation, which I’ve heard though I haven’t experienced it. It is emptying your mind of all thoughts. And I think that they’re the Western form or the Christian form would honestly be to fill my mind with thoughts, to set my gaze on heaven, and to set my gaze. I mentioned earlier, getting to the end of your life and not understanding the plot of the story. Just reading the lines as you went and not getting it.

Well, in this way in meditation, I’m actually reframing myself every day to remember the bigger story. To remember that I’m not here just to make money or succeed in business. That I’ve got kids who need me. That I’ve got people I’m mentoring who really need time with me. And though I’m tempted to work till midnight tonight, I really do need to stop at dinner time and do these other things.

So, it’s reframing practically. I’ll tell you that my meditation looks like this. It looks like having the scriptures out and having a blank piece of page on a journal and just starting to write thoughts. And sometimes those random thoughts end up with some kind of brilliance that I wouldn’t have come to otherwise. For me, my mind is racing so fast with business ideas almost all the time, I would say.

This is my own theory. No one’s ever told me this, but when I’m writing, I feel like the effort that my brain must use to write actually somehow opens up a channel for me to actually hear from my inner brain. Maybe tapping into a comment that I heard on a podcast once or a book, a paragraph of a book I read, or a scripture. I feel like when I’m writing, I get ideas that I cannot even believe sometimes how brilliant they are. And then I remember that I heard that somewhere, but I wouldn’t have remembered it otherwise.

Jaren: Yeah. That’s really interesting. I don’t know if you’re familiar with a guy named Perry Marshall.

Paul Moore: Perry and I are friends. I love Perry and I’ve got his book right over here.

Jaren: Yeah. He just came out with a book called “Memos from the Head Office.” And I actually was at one of his seminars, and he was sharing how he actually got an academic published article for the 80/20 principle in Italy. And he actually in his journaling practice, wrote down verbatim 80/20 academic articles coming out published. It’s going to be published, like all this stuff. And he actually read it and he’s like, this happened, I don’t know what the timeline was, but let’s just say for sake of examples, like six months or a year before it was even on the radar. And so, he actually has gotten a lot of insights. This new book that he just came out with, it’s probably worth dropping in the show notes, Seth.

Paul Moore: I absolutely agree. “Memos from the Head Office,” I’ve got stories of my own like that as well, including the time I tried to invest in a deal and I got a fax. I kid you not. A fax from somebody advertising something that made me want to call the number, a fax. I kid you not. And I called the guy and it turned out he knew the guy I was going to invest with that day. And he told me he was a scam artist. And I found out later he was a scam. It was true. He was a scammer.

Because I called the guy before I wired him the money. I said, “Hey, one more question.” And I asked him and he practically hung up on me because it was true. Can you imagine that talk about a memo from the head office?

But Perry’s book, I’m looking at it here, I’m guessing it’s about 190 pages. I think it’s just shy of 200 pages and it’s full of stories like that. That is absolutely impossible to explain apart from supernatural intervention.

Seth: I got to check that out, it sounds fascinating.

Jaren: What’s really interesting about Perry’s world is that he’s not exclusively Christian. I’ve been to “Memos of the Head Office” and it was really fascinating because you have people that are getting memos from the head office that have no grid for God or are completely agnostic or whatever. And they go to these things and they get radically touched and they get life-altering words from the head office.

Paul Moore: What’s amazing about that is God actually cares about everybody. He cares about people. He cares about our civilization being better. I mean, I believe he probably gave Elon Musk his ideas, even if Elon Musk has no regard for him, from what I’ve heard. It makes sense because he cares. He really does.

Jaren: Yeah, he does.

Seth: Yeah. Paul, just to turn it a little bit and pivot into a different thing. Before we started recording here you mentioned something about how you’re using real estate to fight human trafficking. That sounds really interesting. How are you doing that? What is the connection there and how can real estate be used to end that?

Paul Moore: About six years ago, someone put in my hands a copy of a documentary called Nefarious from Exodus Cry and it shocked me. And what I learned was that human trafficking is a reality, a horrible reality in our world today. Did you know if you took the record profits, not the average, the record profits from General Motors, Nike, Starbucks, and Apple combined—their record profits together, triple that number, that’s the approximate revenue they believe is generated by human trafficking every year?

I thought about it and I thought man, if I were alive in the 1800s, I want to believe I would be abolitionists fighting against slavery like William Wilberforce. And I’d want to believe if I were an adult in the 1960s, I would have been fighting for civil rights. And while this is a civil right, it is slavery and it’s happening right under our nose. And so, our company Wellings Capital does our very best to vet. The best operators to give people an easy on-ramp into commercial real estate investing.

Well, we thought, wouldn’t it be great if we could vet the best non-profits and other organizations who are effectively fighting human trafficking? And so, we’re doing that right now. In fact, I’ve got an interview with a guy today about this and we’re vetting these organizations. Our goal is in a very short time to be able to tell investors, hey, you invested with us and we’re taking money out of our pocket from your investment to invest to free one slave. And we hope to be calling you within three to six months with the story of the raid that freed a slave and what’s her status right now, typically in Cambodia or Thailand or Belize or wherever. And then we’re going to give our investors a chance to get more involved if they choose to.

Jaren: That’s awesome.

Seth: Isn’t it that a lot of that human trafficking happen in the U.S.?

Paul Moore: Yeah, it really is.

Seth: I don’t know. I mean, I don’t fully grasp all of that, but from what I know of it, it’s some sick stuff. Just talk about the rotten parts of humanity and evil inflicted upon each other. It’s messed up. I don’t know how anybody who is involved with that in any way can live with themselves, but anything that can be done to fight that is worthwhile.

Paul Moore: It’s absolutely true. I’ve seen the devastating effects firsthand of people in my family who had one or two incidents in their past, and just the years and even decades it’s caused devastation in their lives. Some of these people, including a girl I heard about the other day, who was 17, I don’t even want to say the words on the show, but she had over a hundred incidents a day, for years, she claims. And she was rescued from New York City. It’s just unimaginable the torment and what she’s going to need to heal.

Jaren: It’s really inspirational to hear how you’ve been able to use your path in business and in real estate to make a social impact like that. Because for me, maybe it’s a matter of the season that I’m in or what have you, but it’s tough because you see a lot of injustice in the world and it’s really easy to just kind of default to “I don’t have any control over these things. I can’t really do anything.” But I always tell myself when I’m in those moments, well, if I doubled down and I become ultra-successful financially, then I’ll be in the position where I can actually do something about some of this catastrophe and evil things that happen in the world. And it’s just really inspirational. This side of the conversation, to see that you actually have done that. And it’s pretty awesome. So, thank you for what you’re doing and thanks for sharing.

Paul Moore: Yeah. Thanks for sharing that. That’s very kind of you. I would say that everybody can get involved at some level in some way, wherever they are.

Seth: I remember talking to my dad about that once. Just this idea of if I want to make an impact on the world of how I want my business to be more about me just making money and then I live my life and I die and it’s all over. If I really want to make that impact, one way to think of that is, well, someday in the future, when I have money, when I’ve gotten there, then I’ll start going nuts and doing that. My dad was just encouraging me to “No, do it now and do it then. Do it before you’re ready. Make sure you go out of your way to make a difference for every day that you’re alive. Any day could be your last. So, don’t let your life end without doing something meaningful like that.”

And it’s not really that hard. There are all kinds of organizations, world vision, compassion, you can sponsor kids. It’s not so much about ending human trafficking, but just about taking people in hopeless situations and giving them a chance. And it’s not that expensive. It’s kind of amazing what you can do to change a life through just giving $40 or less per month to that kind of cause. Pick something and make a difference and don’t wait on it.

Paul Moore: Yeah, I agree. That’s a good word right there.

Seth: I know something that a lot of real estate investors are going to have to be thinking about, and probably they always did, but even more so now with a lot of money being pumped into the system from the government is inflation. How do you use real estate as a hedge against inflation? What is just the general principle that you adhere to in terms of making sure that your money is protected through real estate?

Paul Moore: Yeah. I heard for years that real estate was a great inflation hedge, but I really didn’t think it through, until it started hitting again recently. This is a $10 trillion bill from Zimbabwe. And I don’t think the United States is going to go into that type of hyperinflation. I think there’s a lot of reasons we won’t, but obviously inflation is heating up and a lot of us believe it’s worse than the government is reporting.

It’s an amazing moment in history though, guys. When I was a kid, I remember gas lines in the 70s and grandparents and neighbors having their savings account and pensions ravaged. Somebody who got a pension check that would cover two months’ rent, now it only covers half a month. And that was real.

Well, at the same time as inflation in the late 70s and through the 70s and into the 80s, interest rates were often very, very high to match. And that was done intentionally. Well, we’re in a time where inflation is heating up, but the Fed and the government are boxed into a corner where they can’t raise interest rates very high. And so, interest rates are at roughly 5,000-year low. Yep. There’s actually studies on this 5,000-year low, but inflation is heating up.

The opportunity to buy 10- or 12- or even 30-year fixed debt at like 3% for a commercial loan right now, for a mobile home park we just invested in and then see inflation increase rents and therefore revenue over the next decade or two or three, it’s creating a huge potential as a hedge against inflation and a huge potential to actually increase wealth and to at least keep up or beat inflation along the way.

Seth: Yeah. Basically, you just don’t want to hold too much cash. That is kind of the bottom line. It’s going to rapidly lose value as long as it’s in cash form versus real estate or something else that’s going up in value to beat inflation.

Paul Moore: That’s right. But the problem is, as we all know, it’s really, really hard to find deals that make sense right now in multifamily with people paying 10%, 20%, even 30% more than the sensible value of an asset. Residential, single-family, not much better. And so we’ve got to really figure out a way or partner with people who have an inside track on deals that have a lot of meat on the bone, a lot of value add left in them, or it’s going to be really, really tough to make a profit unless inflation does keep up and inflates away the risk, if you will. Which is possible.

Jaren: Yeah. That’s one of the reasons why I’m super thankful for the land flipping business. I hear from my wholesaler friends that do houses and I hear from people from a number of different types of strategies and what have you, that it’s just really, really, really tough. But in land, I’m sure in some areas, some counties, competition might be increasing or whatever, but it’s still very predictable and very feasible to get deals. Property does take a little bit longer to sell compared to some other asset classes, but it’s pretty awesome.

Paul Moore: Yeah. I don’t think there’s a better time I’ve ever seen to be in the land business because you’ve still got people who are sitting on inherited land or whatever, that it’s just a pain to them and they just love to get rid of it. At the same time, the demand for semi-rural and rural land is just off the charts. So, what a great time to be in the land business.

Jaren: Yeah, it’s really interesting because my primary market is Florida. And you just described to the T the exact situation of the Florida market, you have a bunch of people that have land out there, or have even property out there that was a secondary home, or it was intended for that, but life got in the way and they’re just wanting to get rid of it. But at the same time, you have this huge influx of people moving there. So, it’s just this weird discrepancy that is pretty easy to capitalize on.

Paul Moore: Yeah, that’s awesome.

Seth: Paul, I don’t know if you fancy yourself an expert who makes predictions about market trends and that kind of stuff, but do you think it’s going to get back to normal or whatever that is anytime soon? Or do you think this is going to continue throughout 2022? Do you have any insights on the next year or two on where things are going?

Paul Moore: Yeah. I was reading Howard Mark’s “Mastering the Market Cycle: Getting the Odds on Your Side” and also some stuff from Buffet. They refuse to make predictions, but they actually say it’s more important to behave rationally for where you can see that you are in the cycle. So, that’s my first goal is just to behave rationally for where we are, where we seem to be in the cycle.

That said, I don’t necessarily think things are going to go back to normal anytime soon. I was actually sitting in an airport in Belize, a tiny little airport getting ready to go to the real estate guys summit on sand recently. And the guy sitting next to me, I can just tell he looks smarter, successful, or something.

So, I started talking to him, it turned out it was Doug Duncan, the chief economist of Fannie Mae. And I said, “What do you really believe?” He said, “I really believe what I publish. That we’re going to see inflation of 5.5% or so this year, and back down to like 3.8% next year.” And I said, “Why do you think so low?” And he’s like, Paul. He actually didn’t say Paul. He didn’t know my name. He said, “3.8% is really, really high.” I said, “Really?” He said, “Yeah, that’s double the Fed’s target.” He reminded me of 1.9% or so he said 3.8 it’s double. He said, “That is really, really high. And I think that’s where it’ll go.” And he gave me all these reasons.

But he did say that the housing market, since 2014, he’s been crying out that there was a massive housing shortage and a growing discrepancy between the number of people wanting to buy houses and the actual number of houses. And that would include multifamily and all that as well. And so, he said, he thinks the building boom is going to go on for years, which makes me think that the inflated prices of lumber and other construction materials and construction, labor, and all that is going to continue for years as well.

Jaren: Yeah. I got a buddy who works more in the Wall Street world and he has his ear to the ground of what’s going on. He’s kind of at the forefront of the moving trends. I mean, that’s what he gets paid to do is figure out where to make people money and all that. And he says something really similar. He says there are some things that could sideswipe what his prediction is, but by and large, he thinks that the data is showing that we actually are going to be doing well for the next seven to eight-plus years. And there might be a reckoning that happens. History might be repeating itself. We might be sitting in a situation with COVID where it’s parallel to the Spanish flu or whatever. And we had the roaring 20s and then we had the great depression in 1928.

Paul Moore: It’s the roaring 20s again. Right?

Jaren: Yeah. I mean, that might be the situation. Who knows though? Who knows?

Seth: Do you ever find it frustrating Paul when you got to relearn the rules? I find it frustrating sometimes because when I first jumped into real estate seriously, it was the 2008 crash. And that was kind of a world I got to know originally where everything is cheap. No, you can’t sell real estate. It’s hard. And now it’s the total opposite and you got to just relearn what normal is and what normal prices are and competition and all this stuff.

Given how much you’ve seen in your history, is it easy for you to see the opportunity when things change, or do you get frustrated where you’re like, “Ah, man, I got to relearn all this stuff all over again”? What is your thought process there?

Paul Moore: Well, I think that that has been true overall for me over the last 20 years or so, or actually I could even say 29 years of being an entrepreneur. But actually, I think we’ve tapped into a formula that has worked really, really well. And I feel like it is sort of recession-resistant.

My company is actually investing with companies who have a long track record as in before the great recession of finding mom and pop deals. It’s sort of like what you’re doing with land. Finding mom-and-pop-owned deals where the current owner doesn’t have the desire or the knowledge or the resources to improve the income and therefore significantly improve the value.

And of course, with commercial real estate, the value is not based on emotions. It’s based on math. It’s based on a simple formula, which is sort of like the PE ratio in stocks. The value or the value change is the net operating income divided by the rate of return. So, the net income is divided by the cap rate.

And therefore, because it’s based on math, these operators are really skilled at finding opportunities where the net operating income is significantly under what it could be. Sort of like what Warren Buffet saw in Apple, when it was trading for $28 a share. And he started snatching it en masse in 2015 I believe even though he didn’t like investing in technology and he made a fortune for his investors.

While we’re doing something a little similar, we’re investing with these operators who were able to see intrinsic value where other people would just see a worn-out-looking mobile home park. Because of that, we think we’ve tapped into something that is going to do well in almost any economic cycle. For that reason, I can tell you pretty confidently that’s the track I plan to stay on for the rest of the foreseeable future.

Seth: Gotcha.

Jaren: That’s a good place to be.

Seth: Yeah. I know we haven’t gotten into a lot of the nitty-gritty of your past, like all the different projects. I’m sure we could talk for several hours about all that stuff. But when you look at everything you’ve done and everything you’ve seen, is there anything that stands out to you like, “I never should have done that. That was a bad idea. I shouldn’t have gone down that road.” And if so, what would that be and why?

Paul Moore: How many hours do we have again?

Seth: We’ll have to do a part two on that.

Paul Moore: Yeah. How to lose money again and again with Paul Moore. There were a lot of things like that. A lot of them were based on times when I didn’t do thorough due diligence. I invested based on a friend’s recommendation who I really trusted, but found out that they didn’t do enough due diligence or maybe the due diligence was done and somebody just didn’t figure out something.

Like I mentioned, the Bakken oil in North Dakota. Listen, the guy we invested with should have been as wealthy as Bill Gates right now. And I mean that literally. He had come up with a way to tap into oil reserves that nobody else had figured out yet. And that’s a fact. I have a petroleum engineering degree. It doesn’t mean I can correctly evaluate that, but that was my original degree.

I understood what they were talking about. It made total sense. He hits six out of six oil wells, these massive untapped oil reserves. Six out of six with some of the money, a bunch of us put up and he never produced a gallon of oil because it turned the tar somehow in the pipe in the 10,500 feet between below ground and the surface.

So, you never know. The due diligence was right on that one and it just didn’t work out. It had to be viewed as speculation, no matter how certain it looked. And geologists to this day say he hit it right on the nose. He did come up with some special way of doing it.

Sometimes it’s not that. Sometimes it’s just the fact that you’re out of your game. I used to try to talk to investors like these private equity firms. This was like years and years ago, building a multifamily in North Dakota over a decade ago. And they’d say, “Well, we’re not into multifamily. – Yeah, but can you see this opportunity? – Yeah. But that’s just not something we know about. We like to stay in our lane.”

Well, here I am, 11 years later, guys. I so believe in that. I know a guy right now doing an Airbnb play. He’s making a killing. He wanted me to invest with him. I believe you, but I just don’t know much about that. And I don’t want to go have to learn. People need to stay in their lane.

Jaren: But again, going back to my question at the beginning of our conversation. If you take that approach, you are inherently missing an opportunity. I guess if your current opportunity is good enough to make it worthwhile to double down and say, focus on that then cool. But for a lot of people that are just getting started in their pursuit of financial freedom, or what have you, they’re just starting their real estate journey, or investing journey, financial education. Really for those in the beginning stages to some degree, it’s like this Catch-22 thing, stay focused and stay in your lane. But on the other side, you also have to be exposed to know what your one thing is or should be.

Paul Moore: I totally agree. And the FOMO thing has been a plague for me since high school, the fear of missing out. I remember in high school, like this 12-string guitar, I got to have that one. I can’t wait until another one comes along. And I remember blowing my whole summer savings to buy that 12-string guitar.

It’s been a continual problem for me and I’ve had to learn to be disciplined. And one of the ways I did that was I brought on a business partner who was almost the extreme opposite for me. He’s very unemotional. He’s very rational. He bugs me and I say that with the dearest respect for him. Because I’ll go in with “You won’t believe what I have found.” He’ll be like, “Yeah, I will.” And I’m like, “Okay, thanks.”

But it’s really good for me because by submitting to him and by both of us mutually submitting to each other, it saves a lot of rabbit trails that I would be tempted to run down. And he also is pulled into a lot of things that are things that he would not have ever looked at. Like he didn’t want to look at self-storage and mobile home parks when we were deeply entrenched in multifamily for years. But you know what? That has been the best thing we ever did.

Jaren: Yeah. It seems like you just have to ride that tension where it’s like, I like that you have a partner that can come from the other side because then you can bring the new ideas and the opportunity and then he can shut down 90% of them and then ride the ones that are worth writing about. I like that. But when you don’t have a partner like that, it can be pretty hard to navigate those waters.

Paul Moore: I agree. When I was solo, and sometimes I’ve partnered with people who have my exact same personality. It was a lot harder.

Seth: Yeah. I can see that. Well, looking at the clock here, why don’t we navigate to our final three questions here? Paul, what we do here is at the end of a lot of our interviews like this, we go one step further beyond just real estate stuff and ask three little bit deeper questions about you and just how you think, how you operate. It just kind of gives us some more insight into your brain.

Paul Moore: Awesome.

Seth: The first question is what is your biggest fear?

Paul Moore: Amazingly Seth, when I had my back up against the wall and had $2.5 million dollars in debt, I don’t remember losing a bit of sleep over that, but I have lost sleep over the way my wife and I treat each other. And I fear that I’ll never be the husband and father that I know I’m called to be.

I’ve seen clearly what that looks like. I saw it in my dad, I’ve seen it in others and I am jealous of that. I fear that whether it’s through working too many hours, being distracted, chasing shiny objects in my personal life, whatever it is, I fear that at the end of my life, I will have not made the deep imprint on them as is evidenced by how hopefully their adult kids are going, how they’re doing. I fear that I won’t have been all I should have been in that realm. I think that’s my biggest fear.

I guess second to that would be a similar thought. And that would be that when I leave this earth, I won’t have left a history-making imprint on it. Even if it’s only with a handful of people, I want to make a difference in people’s lives.

Seth: Yeah. And difference meaning what exactly? What would you consider a good enough difference?

Paul Moore: Yeah. I just started a mentoring role at my church with six or seven other leaders. So, I’m going to be mentoring them. They are millennials, which I love. And they’re actually leaders of small groups. And those groups typically have anywhere from 6 to 12 or 15 people in them. And so, I want to leave a deep impression on them. I want to be somebody who role models being kind to the waiter or waitress, having a smile on my face when the bank account is almost empty. And not that that’s happening regularly, but it could.

I’m looking at a country that’s not the same country I grew up in, guys. I don’t know what’s going to happen next, but it doesn’t look super positive from my point of view. And I want to be somebody who boldly and bravely stands up for what I believe and doesn’t collapse in that. I just saw an amazing movie called “Anthropoid.” It’s not well-known. It should be. It’s the story of some heroes in the Czech Republic who stood up against Hitler. In the movie, the most poignant moment was when they quoted Shakespeare, I believe who was quoting Julius Caesar saying “A coward dies a thousand deaths; a hero or a brave man dies but once.”

Seth: Yeah, I know what you mean.

Jaren: I would bet money that Paul’s Enneagram is type three.

Paul Moore: It’s funny. My business partner in my former business, in the staffing company and he’s actually involved in our company Wellings Capital now. He’s an Enneagram three. I have a very good friend who’s in Enneagram three, but I can’t remember if I’m six or seven. I think I’m seven wings six, if that helps.

Jaren: Yeah. It’s just interesting. The way you are talking, it’s like you’re reading my heart. My internal dialogue and the things that I think about and value, I have the same fears.

Seth: Yeah. For sure.

Jaren: Paul, what is something that you’re most proud of?

Paul Moore: It’s so funny how similar this is going to be to the first question in my answer, I guess. And that is that even though my wife and I made a lot of mistakes in our marriage over 34 years, we have a strong marriage. And even though we made a lot of mistakes in child-raising over 28 years, 28 down to 16, four kids, they’re all doing well. And so, I’m really proud of those things. And even though my kids can readily tell me some of the mistakes we all made, me really, when they were younger, we still have a great relationship. And I just got off the phone with a friend a few hours ago who is agonizing. I would’ve said that his wife and he are better parents than us, but for some reason, their kids are really, really struggling in ways that I don’t understand. And so, I guess that would be it.

Seth: Cool. Yeah, that is something to be proud of for sure. What is the most important lesson you’ve ever learned?

Paul Moore: I think from a business point of view, it’s what I said earlier. I’m going to go back and highlight again, and that is the difference between investing and speculating. And the fact that true investing should not be entrepreneurial, it should be more on the boring side. And I think that’s most important for me, and there are so many others, of course. But that one just stands out because it has made a major difference in my investing and in my finances. And since I do a lot of podcasts, a lot of blogging, hopefully it’s helped a few other people along the way as well.

I’ll tell you, I learned that mainly from Warren Buffet. I’m actually writing a book called “Warren Buffett’s Rules for Real Estate Investors.” And I learned that concept mainly from him.

Seth: That is interesting because you never really know the future, even when you’ve done all your due diligence and you know everything front and back, you’re never a hundred percent. So, where do you think the line is between, “Okay, you’re officially speculating now”? How would you define that?

Paul Moore: If things go south, you could literally lose your money. Okay, sure. I get that that’s true. I get that Apple could go bankrupt tomorrow. It probably won’t, but General Motors. That’s one aspect of it. But I have another one that I think is a little easier to get my arms around.

And this is a little bit of a long answer, but what is true wealth? Well, true wealth is having assets that produce income. And if you have assets that produce income in a reliable way and you don’t over-leverage them, then you have true wealth. Well, I would say that the line between speculating investing is just as simple as whether it produces reliable predictable cash flow or not.

Bitcoin. I’m not against it at all, I have some. But Bitcoin doesn’t produce any reliable, predictable income. It doesn’t have any income at all unless you invest it in those certain types of ways where it somehow produces interest. So, I would say that that’s where my speculation line is, and that’s why I love commercial real estate and real estate in general.

Seth: Cool. Well, Paul, again, thanks a lot for coming to the show. It’s been awesome to talk to you and get to know you a little bit better. Hopefully, we can connect at some point in the future again. If people want to find out more about you, where should they go? What should they do?

Paul Moore: Yeah, they can go to wellingscapital.com. And I spent years, guys, trying to figure out how to get from residential into commercial real estate. And so, now I created a 60-page guide for people who want to do the same. You can get that at wellingscapital.com/resources.

Seth: We’re going to include the links to that and Paul’s website and his podcast and his books and a lot of other stuff we talked about in this conversation at retipster.com/111 because this is episode 111. So, Paul, thanks again. I appreciate you. And I wish you all the best with the stuff you’re working on and hopefully, our audience will become new raving fans to all the stuff you get.

Paul Moore: Awesome. Guys, it was really an honor to be here. Thanks, Seth. Thanks, Jaren.

Seth: All right, folks. There, you have it. That was an interview with Paul Moore. Did you have any closing thoughts on that, Jaren?

Jaren: To be honest, when I read the bio coming into the podcast today, I was like, “Oh, this is going to be just another one of those kinds of run-of-the-mill large apartment syndication kind of guys”, but he was a breath of fresh air for sure.

Seth: Yeah. It seems like there were a lot of different directions we could have gone with that. We didn’t even really get much into the land investing stuff that he or his son had done because they were just a lot of ground to cover there, but it sounds like the guy’s a wealth of information and hopefully, we can stay in touch with him in the future. Do you want to do one of our closing questions here?

Jaren: Let’s do it.

Seth: What is something that people think makes them look cool, but actually makes them look ridiculous? I guess this is probably like a fashion trend thing maybe. Maybe it’s not limited to that.

Jaren: Yeah. I don’t know. My brain just went to being braggadocious. That is where my brain went. Because you run into it a lot in the real estate world where people are just like, “Yeah, I’m the greatest thing ever.” And I think they do it to try and raise their level of the pecking order or whatever, but to me, and maybe I’m just weird and I’m like, I’m not a part of that pecking order or whatever. I just don’t operate in it. But to me, I see what they’re trying to do and I’m just like, “Dude, just calm down.”