#aircraft seating market size

Explore tagged Tumblr posts

Text

Aircraft Seating, Seat Cover, Amenities and Auxiliaries Market - Forecast(2024 - 2030)

Sample Report:

The global commercial aircraft seating market revenues are expected to increase from $3.1bn in 2014 to around $4.2bn in 2020. The demand for Aircraft Seating services is growing at a steady pace across the globe as a direct beneficiary of the growing seats market. The global refurbishment cycle for aircraft seating is around 1 to 2 years and the retrofit cycle is 4 to 8 years. These markets are also partially but significantly impacting the overall market growth trends. According to FAA regulations, seat covers for example cannot be used after 9 washings because they lose their fire retardant quality.

Inquiry before buying:

The global aircraft seating market is also highly regulated with various standards from bodies like FAA, CASA, SAE, EASA etc. Standards and tests are conducted to determine their flame retardant capabilities, density, gravity performance etc. Static load, dynamic load testing, windmill, abuse, reliability testing are performed on the seats.

The report segments the aircraft seating market based on the seat type into suite class, first class, business class, premium economy class and economy class. The market is also segmented based on the type of seat cover into fabric, leather, and synthetic among others. The number of seats in an aircraft varies on the type of aircraft. On the basis of type of aircraft the seating market is segmented into very large aircraft, wide body aircraft, narrow body aircraft and regional transportation jets.

Schedule a Call:

The overall market has also been presented from the perspective of different geographical locations into standard geographic regions and key economies in the market. Competitive landscape for each of the segments is highlighted and market players are profiled with attributes of company overview, financial overview, business strategies, product portfolio and recent developments. The market shares for the key players in 2014 are also provided.

Buy now :

Sample Companies Profiled in this Report are:

Zodiac Aerospace,

B/E Aerospace,

Recaro Aircraft Seating,

Aviointeriors,

10+.

The report contains the most detailed and in-depth segmentation of the Aircraft seating market.

#aircraft seating market#aircraft seating market size#aircraft seating market report#aircraft seating market share

0 notes

Text

Aircraft Seat Material Market size is forecast to reach $150.1 million by 2026, after growing at a CAGR of 3.5% during 2021-2026. The components used to build the seating arrangement for comfortable passenger accommodation on a flight are known as aircraft seating materials.

👉 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://tinyurl.com/49437t2d

Report Coverage

The report: “Aircraft Seat Material Market – Forecast (2021-2026)”, by IndustryARC, covers an in-depth analysis of the following segments of the Aircraft Seat Material Market.

By Material Type: Structure (Aluminum Frames, Carbon-Fiber Composites, Steels, Fiberglass, Kevlar, and Others), Cushion Filling (Polyurethane, Neoprene, Silicone, Polyethylene, Fire-Blocking Textiles, Ethafoam, and Others), Upholsteries (Polyester, Polyamide/Nylon, Leather, FR Cotton, Wool Blend, and Others), and Plastic Molding (Polycarbonate, ABS, Decorative Vinyl’s, and Plastazote).

By Seat Class: Suite Class, First Class, Business Class, Premium Economy Class, and Economy Class.

By Aircraft Type: Wide Body Aircraft (Large Wide Body Aircraft, Medium Wide Body Aircraft, and Small Wide Body Aircraft), Single Aisle Aircraft, and Regional Transport Aircraft.

By Geography: North America (U.S., Canada, and Mexico), Europe (U.K., Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia & New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East, and Africa).

#Aircraft Seat Material Market Share#Aircraft Seat Material Market Size#Aircraft Seat Material Market Forecast#Aircraft Seat Material Market Research#Aircraft Seat Material Market Treads#Aircraft Seat Material Market Application#Aircraft Seat Material Market Growth#Aircraft Seat Material Market Price

0 notes

Text

Aircraft Seat Material Market size is forecast to reach $150.1 million by 2026, after growing at a CAGR of 3.5% during 2021-2026.

#Aircraft Seat Material Market#Aircraft Seat Material Market share#Aircraft Seat Material Market size

0 notes

Text

Aircraft Seat Material Market size is forecast to reach $150.1 million by 2026, after growing at a CAGR of 3.5% during 2021-2026.

#Aircraft Seat Material Marketshare#Aircraft Seat Material Market size#Aircraft Seat Material Market Trends

0 notes

Text

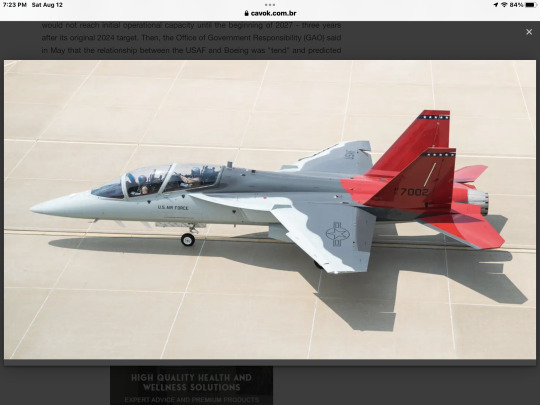

USAF is ready to accept the T-7s, flight tests start in the 'next few weeks'

Fernando Valduga By Fernando Valduga 12/08/2023 - 20:01in Military

The U.S. Air Force will officially take ownership of its first production T-7A training jet “in the coming weeks” and will quickly move on to flight tests at the Boeing contractor's facility in St. Louis, a service officer said last week.

After that, the first two Red Hawks will be transferred to Edwards Air Base, California, within "September" to continue testing, T-7 division chief Colonel Kirt Cassell told reporters at the Life Cycle Industry Days conference on July 31.

In April, U.S. Air Force procurement executive Andrew Hunter announced that the T-7 would not reach initial operational capacity until the beginning of 2027 - three years after its original 2024 target. Then, the Office of Government Responsibility (GAO) said in May that the relationship between the USAF and Boeing was "tend" and predicted that Boeing might not even meet the revised 2027 schedule.

Cassell said that the U.S. Air Force and Boeing have redefined their relationship since then. “There were leadership changes,” he said. "At the PEO level and at my level within Boeing, they reorganized the attack. ... And then there were many changes, which actually just gave us a new set of eyes. I have a new deputy who joined the program. So, we have a new pair of eyes and we really just invigorate our relationship."

In May and June, the first T-7 production representative began to undergo taxi tests and then made his first official flight with a USAF pilot.

Behind the scenes, Cassell said, the U.S. Air Force and Boeing have been working together to ensure that flight tests can begin as soon as the first jet, dubbed the T-2 or ATP-2, is officially transferred to the U.S. Air Force.

"The team, collectively Boeing and the U.S. Air Force, has been working overtime," Cassell said. "As if I wasn't joking, working overtime, until late at night, to overcome acceptance. We should accept this aircraft here in the next few weeks. Once completed, we worked hard to prepare for the flight tests. We have completed the appropriate test readiness reviews, these are completed. We have completed the appropriate test planning requirements."

Soon after ATP-2 is accepted by the U.S. Air Force, the service expects to appropriate a second aircraft, called T-1 or ATP-1. The two fuselages will test different factors - flight sciences and charges, respectively, Cassell said.

"There is little or nothing on our way to get this jet, ATP-2, up and running," Cassell said. "Let's start flight tests in St. Louis. And then, around September, that's when we'll transition from APT-2 and then APT-1 to Edwards for continuous flight testing."

Putting the T-7 back on track and avoiding further delays will likely be crucial to satisfy lawmakers who have expressed concerns about the program. Acclaimed at its launch for proving how engineering and digital design are innovative technologies to accelerate the launch of the product on the market, the first aircraft representative of production went from the clipboard to the first flight in 36 months.

Digital design is “completely transforming the way we do systems engineering,” said General Duke Z. Richardson, head of the Air Force Material Command, in 2022. Boeing and Saab employees predicted that this would "revolutionize" the way aircraft are designed and built.

Then came the delays. In 2021, the U.S. Air Force said that the T-7 suffered from vortex detachment at high angles of attack, making it unstable on the rolling axis. Problems arose with the jet's flight control software, and then doubts arose about the coach's ejection seat system - which was necessary to accommodate a wide range of body sizes. The USAF and Boeing discussed the test data and how to interpret it.

In May, USAF Secretary Frank Kendall suggested that digital engineering had been "exaggerated" as a way to reduce development time and cost, warning that there are no shortcuts to testing in the real world.

Boeing and the U.S. Air Force now say that the T-7 problems have been largely fixed. But the legislators are skeptical. A provision in the House version of the National Defense Authorization bill would require the Air Force to assess the "risks associated with the overlap of the development, testing and production phases of the program and risks related to the management of contractors". It is not yet known whether this provision will survive the House-Senate conference to reconcile the versions of the House and Senate bill.

Source: Air Force & Space Magazine

Tags: Military AviationBoeing T-7A Red HawkUSAF - United States Air Force / U.S. Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work around the world of aviation.

Related news

INTERCEPTIONS

RAF Typhoons intercepted 50 Russian aircraft during air policing mission in Estonia

12/08/2023 - 13:47

HELICOPTERS

Germany will have NATO's second largest fleet of helicopters

12/08/2023 - 12:12

MILITARY

Ukrainian Air Force lost 62 planes in 2022. So far, in 2023, he has lost only seven.

11/08/2023 - 19:35

MILITARY

Russian Aerospace Forces received new batch of modernized MiG-31 interceptor fighters

11/08/2023 - 16:00

MILITARY

Tunisia receives its latest T-6 Texan II training aircraft

11/08/2023 - 13:00

MILITARY

VIDEO: Finnish Air Force demonstrates takeoff and landing on the highway

3 notes

·

View notes

Text

Aircraft Cabin Interior Market Size, Share Analysis Key Companies & Growth Trends by 2032

The global aircraft cabin interior market share was valued at USD 32.07 billion in 2023. The market is set to expand from USD 36.37 billion in 2024 to USD 74.14 billion by 2032, exhibiting a CAGR of 9.31% over the estimated period. The expansion is propelled by the escalating demand for various advanced components such as LED cabin lights, lightweight cushion structures, and wireless in-flight entertainment systems & connectivity.

This information is provided by Fortune Business Insights™ in its research report, titled “Aircraft Cabin Interior Market, 2024-2032”.

Informational Source:

https://www.fortunebusinessinsights.com/industry-reports/aircraft-cabin-interior-market-101814

List of Key Players Mentioned in the Report:

Astronics Corporation (U.S.)

Cobham PLC (U.K.)

Collins Aerospace (United Technologies Corporation) (U.S.)

Diehl Stiftung & Co. Kg (Germany)

Haeco Americas (U.S.)

Honeywell International Inc. (U.S.)

Jamco Corporation (Japan)

JCB Aero (France)

Panasonic Corporation (Japan)

Safran (France)

Thales Group (France)

The Boeing Company (U.S.)

Segments:

Seats Segment to Depict Lucrative Growth Owing to Rising Commercial Aircraft Demand

By component, the market is classified into seats, cabin lighting, windows & windshields, galley & lavatory, in-flight entertainment & connectivity, stowage bins, and interior panels. The seats segment is expected to record high demand over the study period. The escalation is due to the increasing demand for commercial aircraft.

Economy Class Segment to Gain Notable Traction Impelled by Soaring Comfortable Seating Demand

Based on class, the market is categorized into business class, first class, premium economy class, and economy class. The economy class segment is poised to account for a dominating share in the market. The escalation is due to the increasing demand for comfortable seating and growing net worth of individuals.

Narrow Body Aircraft Segment to Register Substantial Expansion Owing to Rising Product Demand

By aircraft type, the market for aircraft cabin interiors is segmented into wide body, narrow body, business jets, and regional transport aircraft. The narrow body segment held a dominating share in the market due to increasing product demand.

OEM Segment to Emerge Prominent Impelled by Rising Production of Commercial Aircraft

By end-user, the market is segmented into after market and OEM. The OEM segment is expected to have the highest market share over the estimated period. The expansion is impelled by the surging demand for renewed and new aircraft.

Based on geography, the market has been studied across North America, Europe, Asia Pacific, the Middle East, and the rest of the world.

Report Coverage:

The report gives a substantial coverage of the pivotal trends boosting the global business scenario over the forthcoming years. It further offers an insight into the key factors impelling industry expansion throughout the forecast period. The report also provides an account of the major steps undertaken by leading companies for strengthening their positions in the market.

Drivers and Restraints:

Soaring Demand for Regional Aviation Transport and Long-Haul Flights to Propel Industry Expansion

One of the pivotal factors impelling aircraft cabin interior market growth is the escalating demand for long-haul flights. The industry expansion is further propelled by the surging demand for regional aviation transport in various regions.

However, delayed certifications and stringent regulatory policies associated with the weight of the aircraft are anticipated to propel market growth amid the pandemic period.

Regional Insights:

North America to Emerge Prominent Impelled by Presence of Leading Companies

The North America aircraft cabin interior market share is slated to grow at a commendable pace over the study period. The rise is driven by the presence of leading manufacturers in the region.

The Asia Pacific market is expected to expand at the highest CAGR over the estimated period. The upsurge is due to the increasing number of OEMs in the region.

Competitive Landscape:

Key Companies Enter into Partnership Deals to Strengthen Industry Position

Major industry participants are formulating and adopting a range of deals for strengthening their positions in the market. These include partnerships, collaborations, and merger agreements. Additional initiatives comprise a rise in trade conferences and growing participation in trade activities.

Key Industry Development:

October 2022 – Jet Aviation launched a new solution with three certified 55-inch curved OLED screens. The development marked the latest addition to the company’s aircraft cabin interior.

0 notes

Text

0 notes

Text

0 notes

Text

The Global Aircraft Seating Market size is projected to grow from USD 6.3 billion in 2022 to USD 8.7 billion by 2027, at a CAGR of 6.8% from 2022 to 2027.

0 notes

Text

The Aircraft Cabin Interiors Market Size is projected to grow from USD 26.1 billion in 2024 to USD 31.6 billion by 2029, at a CAGR of 3.9% from 2024 to 2029. The aircraft cabin interiors market has rapidly evolved, becoming a crucial aspect of the airline industry. This market includes a wide range of comfortable seating and inflight entertainment options, along with other advanced comfortable and technology advanced options such as lighthing, galley, windows, lavatory, stowage bins and panels.

This chapter discusses the market dynamics, such as drivers, restraints, opportunities, and challenges pertaining to the Aircraft Cabin Interiors Industry, and how these factors are expected to influence the growth of the key market players, including Safran (France), Panasonic Avionics Corporation (US), Collins Aerospace (US), Gogo Business Aviation, LLC (US) and Honeywell International Inc. (US). As airlines seek to enhance passenger satisfaction and explore new revenue streams, the aircraft cabin interiors market remains a dynamic segment of the aviation industry.

#Aircraft Cabin Interiors#Aircraft Cabin Interiors Market#Aircraft Cabin Interiors Industry#Global Aircraft Cabin Interiors Market#Aircraft Cabin Interiors Market Companies#Aircraft Cabin Interiors Market Size#Aircraft Cabin Interiors Market Share#Aircraft Cabin Interiors Market Growth#Aircraft Cabin Interiors Market Statistics

0 notes

Text

0 notes

Link

0 notes

Text

Super Midsize Jet: The Ultimate Choice for Efficient Long-Distance Travel

When it comes to traveling efficiently over long distances, a super midsize jet strikes the perfect balance between luxury, speed, and practicality. These jets are designed to cover impressive distances without compromising on comfort, making them an excellent option for both business and leisure travelers.

What is a Super Midsize Jet?

A super midsize jet is a category of private aircraft that falls between midsize jets and large cabin jets. It offers greater range, speed, and cabin space than smaller jets, yet remains more cost-effective than larger models. These jets are built for travelers who need to fly longer distances non-stop while enjoying more space and enhanced amenities than a traditional midsize jet.

Some key characteristics include:

Larger cabins compared to midsize jets, typically accommodating 8–12 passengers.

Extended range of 3,000–4,000 miles, allowing for non-stop flights between continents.

Advanced technology and luxurious interiors tailored for a smooth and comfortable flight.

Why Choose a Super Midsize Jet for Your Next Flight?

If you're seeking comfort and efficiency on your journey, a super midsize jet delivers on both fronts. These jets are designed for longer trips, offering passengers the space and comfort needed to arrive refreshed, while still being nimble enough to access smaller airports.

Here are several reasons to choose a super midsize jet:

Extended Range: Travel across continents without stopping for refueling.

Spacious Cabins: Room for stretching out with more seating capacity and a luxurious interior.

Fuel Efficiency: Despite their size, these jets maintain cost-effective fuel consumption.

Accessibility: Capable of landing at smaller airports, providing more destination options.

Whether for business meetings across continents or luxurious leisure travel, super midsize jets ensure that you reach your destination in both style and comfort.

Performance Capabilities of a Super Midsize Jet

When it comes to performance, super midsize jets are known for their ability to fly long distances at high speeds. These jets can often reach altitudes of up to 45,000 feet, flying above commercial traffic and turbulence, which ensures a smoother flight.

Notable performance capabilities include:

Range: Up to 4,000 nautical miles, enabling non-stop flights from New York to London or Los Angeles to Hawaii.

Speed: Cruising speeds of 500–600 mph, saving time on long-distance travel.

Altitude: Higher altitude flights result in less turbulence and a smoother ride.

These performance features make super midsize jets an optimal choice for frequent flyers needing both comfort and efficiency.

Luxury and Comfort Inside a Super Midsize Jet

One of the most attractive aspects of a super midsize jet is the cabin environment. These jets are designed to offer an atmosphere that rivals first-class commercial travel, with added privacy and personalized services.

Expect the following luxuries onboard:

Spacious cabins: Typically designed with ample legroom and seating configurations that allow for reclining or even lie-flat seating.

Advanced technology: In-flight Wi-Fi, premium sound systems, and modern entertainment options.

Onboard services: Tailored catering and personalized services to meet passenger preferences.

Baggage space: More generous luggage capacity compared to smaller jets, perfect for extended trips or transporting larger items.

These features provide a comfortable and serene atmosphere, perfect for both work and relaxation on longer journeys.

Popular Super Midsize Jet Models

The market offers a variety of super midsize jet models, each known for specific advantages in performance, luxury, and cost-effectiveness. Some of the most popular models include:

Bombardier Challenger 350: Known for its large cabin, excellent range (3,200 nautical miles), and smooth ride.

Gulfstream G280: Offers impressive speed (up to 559 mph) and range (3,600 nautical miles), with advanced in-flight technology.

Cessna Citation Longitude: Renowned for its range (3,500 nautical miles) and quiet cabin, this jet is perfect for long-distance travel in comfort.

Each of these models offers unique benefits, allowing travelers to select the one that best suits their needs.

How Super Midsize Jets Compare to Other Jet Categories

Choosing between jet categories can be difficult, especially if you're unfamiliar with the differences. Super midsize jets offer a middle ground that balances cost and performance. Here’s how they compare to other jet categories:

Light Jets: Light jets are more affordable but limited in range (1,500 miles) and cabin space.

Midsize Jets: Midsize jets offer decent range (2,000 miles) but may lack the spacious cabins and extended flight range of a super midsize jet.

Large Cabin Jets: Larger jets provide more range and space but come at a much higher operating cost and may be unnecessary for medium-haul flights.

Super midsize jets combine the best of both worlds: they are more affordable than larger jets while still offering significant range and luxury.

Is a Super Midsize Jet the Right Choice for You?

A super midsize jet is ideal if you require:

Non-stop long-distance flights.

Room for 8–12 passengers in a spacious, comfortable cabin.

Luxury amenities and personalized services.

These jets are a top choice for business executives, large families, or luxury travelers seeking a private, seamless travel experience. For individuals or companies who frequently fly medium-to-long distances, they strike the perfect balance between performance, cost, and comfort.

Conclusion: Elevate Your Travel with a Super Midsize Jet

A super midsize jet offers an exceptional travel solution, providing long-distance range, luxurious comfort, and cost-effectiveness. Whether you’re flying for business or leisure, these jets are designed to ensure a comfortable and efficient journey. To book your next trip on a super midsize jet, visit Aircraft Charter and elevate your travel experience today.

0 notes

Text

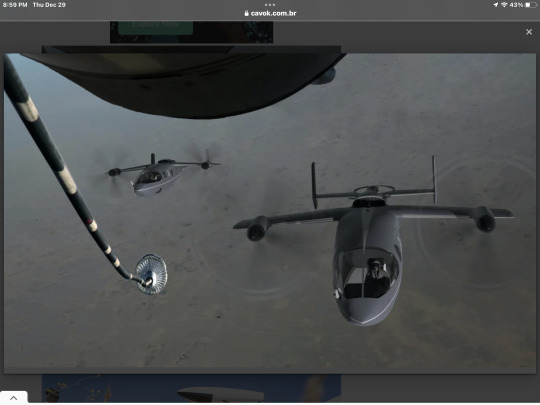

The Pentagon, in a technological war with China, is moving to launch its first electric aircraft

Fernando Valduga By Fernando Valduga 12/29/2022 - 22:08em eVTOL, Military

U.S. Air Force Major Jonathan Appleby (left) and Beta Technologies test pilot Camron Guthrie sit in the cockpit of Beta's Alia electric aircraft during a flight test on March 14 over Plattsburgh, N.Y. (Photo: Beta Technologies)

Share on Facebook

Share on Twitter

The U.S. government has taken a direct approach when it came to the development of consumer drones. Now, a single Chinese company, DJI, has conquered more than three quarters of the world market, and Washington fears that its drones may be a tool for Chinese espionage in the U.S. heavens.

To avoid a similar error and the alarming national security implications, the U.S. Air Force's Agility Prime program has channeled more than $100 million since 2020 into another promising but unproven innovation: battery-powered aircraft known as eVTOLs for "electric vertical takeoff and landing", which many companies are developing for civilian use as air taxis and cargo transportation.

The military's commitment helped U.S. eVTOL developers raise billions of dollars and made them more likely to survive to fight for an eventual civilian market.

“The involvement of the U.S. Air Force attests that these are real planes – not toys, not flying cars,” said Will Roper, who launched Agility Prime when he served as head of purchasing for the USAF during the Trump administration.

After decades of high development costs for military aircraft, Agility Prime is an experiment to see if the Pentagon can take advantage of advanced, cheaper and ready-to-use commercial technology. The military foresees the use of eVTOLs in utility functions to transport people and cargo away from the airstrips at a lower cost than conventional helicopters. Because they are silent, they can also be useful for placing troops behind enemy lines and conducting rescue operations.

The 15 companies participating in Agility Prime include creators of piloted eVTOLs, such as Joby Aviation and Beta Technologies, and startups that develop cargo drones such as Elroy Air and Talyn. The program provided not only funding, but government testing resources and the potential to earn revenue from military sales before the Federal Aviation Administration (FAA) gave the green light to start civil service.

The HEXA being prepared for loading on a C-130.

Lawmakers seem to like the program: in the defense appropriations bill passed by Congress on Friday, they gave Agility Prime $50 million more in funding for fiscal 2023 than the $73.9 million the Biden government had requested. However, they denied an order for $3.6 million to rent a handful of eVTOLs during the year for exploratory use, citing a “lack of clear acquisition or field strategy”.

Several companies participating in the program believe that the military will start acquiring their aircraft in 2024. The move to the acquisition would be a major milestone in the Department of Defense, according to Roper, who is currently a board member of Beta Technologies. "It's a different color of money," he said. Before the completion of the allocation bill, AFWERX, the U.S. Air Force technology accelerator that manages Agility Prime, said in a statement that the program “continues to evaluate the acquisition of eVTOL aircraft in Fiscal Year 2023”.

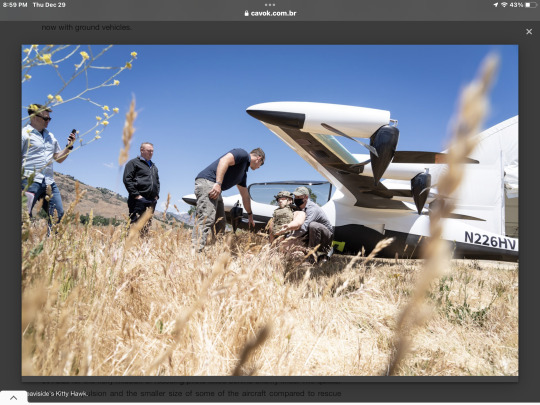

Among the first aircraft acquired is a small Lift Aircraft multicopter called HEXA - single-s seat partially closed on top by a circular structure with 18 rotors. The Lift says that the ship can fly up to 15 miles and carry a maximum of 300 pounds. The military is considering using the HEXA for search and rescue, transporting small loads around bases and emergency response. The company expected some form of acquisition of the U.S. Air Force in 2023, said founder and CEO Matt Chasen.

The HEXA weighs only 430 pounds and its small size means it is relatively affordable. Lift, based in Austin, Texas, offered the first models as recreational vehicles for $500,000. In comparison, Beta Technologies expects its electric aircraft, Alia, which can carry up to 1,250 pounds of cargo or four passengers in a maximum of 200 miles, will cost from $4 million to $5 million.

The HEXA from Lyft Technologies.

Other Agility Prime participants say they are progressing to put the aircraft into military service.

Joby, based in Northern California, which received contracts through Agility Prime worth up to $75 million to support R&D and unmanned flight testing, told investors last month that it is in negotiations to deliver aircraft to the military in 2024 - by disclosing that it postponed its target date to launch urban air taxi services by one year by 2025, blaming the pace of drafting federal Its electric tiltrotor for four passengers is designed to take off and land like a helicopter and spin its wings like an airplane for up to 150 miles.

President Paul Sciarra said that it is possible for the military to start receiving aircraft as early as next year, giving the company, which is starting to manufacture the titrotor in reduced numbers, "a really important exhaust valve to ensure that we have a productive and local revenue-generating environment for aircraft to go."

Major Victoria Snow of the 413st Flight Test Squadron remotely controls an HEXA elevator while Sergeant Master Tim Nissen monitors the aircraft's telemetry on November 16 at Eglin Air Base, Florida. It was the first flight of the HEXA controlled by the military. (Photo: U.S. Air Force)

Beta, based in Vermont, which aims to market Alia first as a cargo carrier, expects the Air Force to buy the aircraft in 2024, after test operations at the base in 2023. In March, Alia became the first electric aircraft controlled by U.S. Air Force pilots, with manned flight, but with landing and takeoff on a conventional runway. Beta received contracts worth up to US$ 44 million through Agility Prime.

An initial test mission that the U.S. Air Force is considering for electric aircraft is to move equipment and personnel around its test and training areas in the U.S., many of which are in remote areas with uneven roads. If eVTOLs perform well in this task, they will be tested to transport "illustrious visitors" on trips ranging from 30 to 90 one-way

Colonel Nathan Diller, who left the position of head of AFWERX earlier this month, said last year that the test and training areas are a perfect "low-risk" initial environment, with eVTOL aircraft expected to allow faster configuration and removal of communications and test equipment by fewer service members, which is usually done now with ground vehicles.

Another basic use: transporting small parts for repairs that would be a waste to carry in helicopters such as the Black Hawk or the V-22 Osprey, which cost thousands of dollars an hour to fly.

Heaviside's Kitty Hawk.

Another first-generation mission that Roper says is "acephalo" is to use eVTOLs for security in military bases, which can extend for hundreds of kilometers and are still patrolled from the World War II era by troops in land vehicles.

In the future, the U.S. Air Force is interested in using autonomous or remotely piloted eVTOLs for the risky mission of rescuing pilots killed behind enemy lines. The quieter electric propulsion and the smaller size of some of the aircraft compared to rescue helicopters can give them a better chance to get in and out without being seen. “You can send them to areas of higher risk without putting life or limbs at risk,” Diller said.

Agility Prime boasts of having helped the companies in the program raise $7.5 billion in funding, but as developers move from the prototype phase to the most expensive stage of civil security certification testing and expansion for manufacturing, not everyone will be able to find the money to continue. The pioneering eVTOL developer, Kitty Hawk, was the first company to conduct an operating year through Agility Prime in 2021. Billionaire investor Larry Page abruptly closed the company in October amid doubts about whether he would be able to bring his autonomous aircraft to market soon.

Roper believes that there will be a healthy civil market for the winners. With Air Force Secretary Frank Kendall supposedly skeptical of eVTOLs, Roper argues that the military needs to recognize that U.S. competition for primacy with China is taking place mainly in commercial technology, so focusing on how much the Pentagon benefits directly from electric aircraft is not the only decisive factor.

“The biggest impact of Agility Prime is that this is an emerging market that will probably be worth a lot in terms of value, in terms of jobs created, in terms of global impact,” Roper said. "It will be a market with a US zip code."

Source: Forbes

Tags: AFWERXAgility PrimeMilitary AviationeVTOLUSAF - United States Air Force / US Air Force

Sharing

tweet

Pin

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work in the world of aviation.

Related news

ARMAMENTS

Indian Su-30MKI jet fires extended-range BrahMos missile against ship used as target

29/12/2022 - 18:27

The current Russian hypersonic missile in use is the Kinzhal, in the photo on a MiG-31.

ARMAMENTS

Russia is developing hypersonic missile of nuclear attack

29/12/2022 - 16:00

The inauguration ceremony of the C-130 aircraft was held at the SGA facility in Rome, New York, on December 13. (Photo: L3Harris Technologies, Inc)

MILITARY

L3Harris and SGA introduce USAF's first C-130 aircraft for maintenance

29/12/2022 - 14:00

WAR ZONES

Ukrainian fighter pilot says F-16 planes will reveal the potential of Ukraine's combat pilots

29/12/2022 - 12:00

MILITARY

FAdeA delivers modernized C-130H to Argentine Air Force

29/12/2022 - 09:00

The DeFIANT X helicopter from Sikorsky/Boeing.

HELICOPTERS

Sikorsky protests against the concession of the U.S. Army FLRAA contract

29/12/2022 - 08:29

Cavok Twitter

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

2 notes

·

View notes

Text

Aero Engine Composite Material Market Size, Share, Business Strategies of Leading International Players by 2032

The global aero composite materials market size was worth $2.53 billion in 2021. It is expected to grow steadily, reaching $2.87 billion in 2022 and climbing to $5.17 billion by 2029, with an average annual growth rate of 8.76% during this period. In 2021, North America led the market, holding a 38.74% share.

Informational Source:

The aerospace industry has been undergoing a transformative phase, with composite materials playing a pivotal role in advancing performance, fuel efficiency, and sustainability. Aero composite materials, primarily used in manufacturing aircraft structures and components, have become indispensable due to their superior strength-to-weight ratio, corrosion resistance, and design flexibility. This article explores the latest developments, market trends, and future prospects of aero composite materials, emphasizing their applications, innovations, and market dynamics.

Key Companies Covered In Aero Engine Composite Material Market are:

Rolls Royce Holdings Plc (U.K.)

GE Aviation (U.S.)

Hexcel Corporation (U.S.)

Meggitt Plc (U.K.)

Albany International (U.S.)

Nexcelle LLC (U.S.)

Solvay (Belgium)

DuPont de Nemours, Inc. (U.S.)

Safran SA (France)

FACC AG (Austria)

Overview of Aero Composite Materials

Aero composite materials are engineered substances composed of two or more distinct materials, such as fibers (reinforcement) and matrices (resin or metal). These materials are designed to combine the best properties of their constituents, making them ideal for the demanding conditions of aerospace applications. Commonly used composites include:

Carbon Fiber Reinforced Polymers (CFRP): Known for their lightweight and high strength, CFRPs are extensively used in aircraft fuselages, wings, and engine components.

Glass Fiber Reinforced Polymers (GFRP): Although less strong than CFRPs, GFRPs are cost-effective and widely used in secondary structures.

Ceramic Matrix Composites (CMC): These are primarily used in high-temperature environments, such as jet engine components.

Aramid Fiber Composites: Used in areas requiring high impact resistance, such as protective structures.

Key Market Drivers

Fuel Efficiency and Weight Reduction: Airlines and aircraft manufacturers prioritize fuel efficiency, leading to increased adoption of lightweight materials. Composite materials significantly reduce aircraft weight compared to traditional metals like aluminum and titanium.

Increased Aircraft Production: The rising demand for commercial and military aircraft globally has boosted the adoption of composite materials in new-generation aircraft, such as the Boeing 787 and Airbus A350, which use over 50% composites by weight.

Stringent Environmental Regulations: Governments and international organizations are enforcing stricter emissions standards. Composite materials help reduce fuel consumption and greenhouse gas emissions, aligning with sustainability goals.

Technological Advancements: Innovations in composite manufacturing processes, such as automated fiber placement (AFP), resin transfer molding (RTM), and 3D printing, have enhanced production efficiency and material properties.Applications of Aero Composite Materials

Aircraft Structures:

Fuselage and Wings: Composites enable lightweight and aerodynamically efficient designs, improving fuel efficiency.

Control Surfaces: Used in ailerons, flaps, and elevators for precise and responsive control.

Engine Components:

High-performance composites like CMCs are employed in fan blades, casings, and turbine components to withstand extreme temperatures and reduce weight.

Interior Components:

Cabin structures, seats, and overhead compartments benefit from composites for enhanced durability and weight savings.

Rotorcraft and UAVs:

Helicopter blades and unmanned aerial vehicle (UAV) structures rely heavily on composite materials for optimal performance and endurance.Recent Innovations and Developments

Next-Generation Composites:

Researchers are exploring hybrid composites combining multiple fibers (e.g., carbon and glass) to achieve tailored properties.

Self-healing composites are under development, capable of repairing damage autonomously, thus enhancing durability and reducing maintenance costs.

Sustainable Composites:

Bio-based resins and recyclable composites are gaining traction, aligning with the industry’s push for greener materials.

Advanced Manufacturing Techniques:

Automated fiber placement and additive manufacturing are enabling precise and scalable production of complex composite parts.

High-pressure resin transfer molding (HP-RTM) is reducing cycle times, making composites more cost-competitive.

Smart Composites:

Integration of sensors and actuators into composites allows real-time monitoring of structural health, enhancing safety and reliability.Challenges in the Aero Composite Materials Market

High Costs:

Composite materials and manufacturing processes are expensive compared to traditional materials, posing a challenge for widespread adoption.

Recycling and Disposal:

The industry faces challenges in recycling thermoset composites, which are commonly used in aerospace applications.

Complex Manufacturing Processes:

Advanced manufacturing methods require significant investment in infrastructure, skilled labor, and quality control.

Regulatory Compliance:

Aerospace composites must meet stringent safety and performance standards, which can prolong certification processes.Market Trends and Dynamics

Market Size and Growth:

The global aero composite materials market was valued at USD 2.53 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 8.76%, reaching USD 5.17 billion by 2029.

Regional Insights:

North America: Dominates the market with significant aerospace manufacturing hubs and leading composite material suppliers.

Europe: Home to major aircraft manufacturers like Airbus, Europe is a key market for aero composites.

Asia-Pacific: Rapidly emerging as a growth center due to increasing aircraft production and rising investments in aerospace infrastructure.

Competitive Landscape:

Leading players in the market include Hexcel Corporation, Solvay, Toray Industries, and SGL Carbon, among others. These companies are investing in R&D to develop advanced composite solutions.Future Outlook

The future of aero composite materials looks promising, driven by advancements in material science, manufacturing technologies, and the push for sustainability. Key trends to watch include:

Increased Use in Space Applications:

Composite materials are finding applications in satellite structures, rocket casings, and space exploration vehicles.

Collaborative R&D Efforts:

Partnerships between aerospace companies, research institutions, and material manufacturers are accelerating innovation.

Focus on Lifecycle Management:

Development of composites with better recyclability and longer lifecycles to reduce environmental impact.

0 notes