#ai in insurance

Explore tagged Tumblr posts

Text

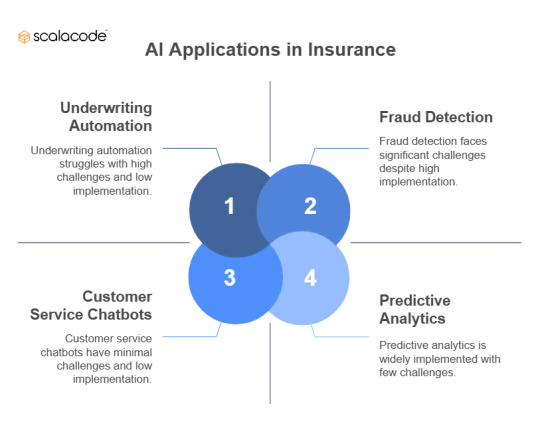

Discover how AI is revolutionizing the insurance industry by automating claims processing, enhancing risk assessment, and improving customer service. From AI-driven fraud detection to predictive analytics, insurers leverage artificial intelligence for smarter decision-making and operational efficiency. Explore the benefits of AI in underwriting, chatbots for policy support, and personalized insurance solutions. Stay ahead in the competitive market with AI-powered automation and data-driven insights. Learn how AI is shaping the future of insurance and delivering seamless customer experiences.

0 notes

Text

0 notes

Text

Revamping the Insurance Industry Using Artificial Intelligence

Explore how artificial intelligence is revolutionizing the insurance industry in this engaging blog. From faster claims processing to tailored policy recommendations, AI is reshaping customer experiences and boosting operational efficiency. Uncover the key applications and advantages driving innovation in insurance.

0 notes

Text

Unmasking Insurance Fraud: The Hidden Cost and How to Combat It.

Good Old Bandit. Good Old Bandit. Dive deep into the impact of insurance fraud, discover common schemes, and explore innovative solutions to protect your premiums and fight back. The Hidden Cost of Insurance Fraud: Why Every Policyholder Should Care Insurance fraud might sound like a distant issue, but it affects everyone. According to the North Carolina Insurance Department, a staggering 10…

#AI In Insurance#Blockchain In Insurance#Consumer Fraud Prevention#Fraudulent Claims#Good Old Bandit#Gud Ol Bandit#Insurance Fraud#Insurance Fraud Detection#News#Protecting Premiums#Sanjay K Mohindroo#Sanjay Kumar Mohindroo#Sanjay Mohindroo#Spotting Fraud#Technology In Fraud Prevention

0 notes

Text

Top 10 Insurance Business Problems AI Can Really Solve

In the insurance industry, we’ve got people in both extremes. Those who believe Artificial Intelligence (AI) is a magical entity that can do anything. And those who’ve been skeptical about AI since the days of The Terminator.

The reality lies somewhere between. The global AI in insurance is estimated at $8.13 billion in 2024. It’s predicted to reach $141.44 billion by 2034. The AI transformation is already underway, and now’s a critical time for businesses to adapt.

At the same time, simply jumping onto the hype train without having a clear idea of what AI can achieve.

In this blog, you’ll get a realistic overview of how AI in insurance can be beneficial.

AI in Insurance: Challenges in the Insurance Industry AI Can Solve

The insurance industry is not free from challenges. NavAI will tell you 10 insurance business problems you can “realistically” solve right now using AI. Let’s dive into the impact of AI on insurance!

1: Customer Churn

Was my love not enough?

It’s usually too late. The better question to ask is: When will my love stop being enough?

Customers leave for all kinds of reasons. What if you could see it coming? AI can.

AI in insurance can tell you precisely which customer will leave and why before they start packing their bags. It can analyze customer data and identify early signs of churn. Once you know that, you’ve got plenty of time to reach out and make things right.

And how should you reach out? AI’s got that covered too. It’ll give a personalized approach and pitch that’s sure to keep the customer interested.

2: Climate Variations and Calamities

“I’m not afraid of heights, I’m afraid of falling.”

AI can warn you of the cliff before you fall.

The insurance claims rise with the rising sea levels. Catastrophic events can make your business a sitting duck.

Some effects can be subtle, such as the degrading health of consumers. This makes it difficult to track and take preventive measures.

First, AI in insurance can help you identify these risks. It can analyze climate data and identify vulnerable areas.

Moreover, it can develop risk management strategies, adjust underwriting policies, and adapt pricing.

3: Low Conversion Rate

“Are you interested in GAP insurance?”

How many times have you hung up the phone after hearing that? It has become a part and parcel of the insurance sales game. But it doesn’t have to be this way.

In most cases, it’s not the pitch; it’s the product. The thing with GAP insurance is that most people don’t get it.

What if you could know exactly what insurance the person wants? That’s exactly what AI can tell you.

AI can analyze customer profiles and past behavior to predict exactly what the customer will want next. You can pitch the exact policy the prospect wants, thus increasing your conversion rate.

To read full article, click here: Impact of AI on Insurance

0 notes

Text

Stay competitive in insurance—check out our AI solutions today! Visit: https://www.damcogroup.com/insurance/ai-solutions

#insurance technology#insurance software#insurance solutions#ai in insurance underwriting#ai in insurance#AI solutions for Insurance companies

0 notes

Text

0 notes

Text

AI in Insurance: Ensuring Efficiency

From enhancing operational efficiency to reducing frauds and improving customer experience, AI is starting to become a game changer for the insurance sector. APAC News Network explores the opportunities, challenges and the future roadmap

The Indian insurance sector today is witnessing a lot of disruption due to generative AI. While AI per se has been a harbinger of innovation for the insurance industry, it has also revolutionized several traditional practices the sector used to follow. For one, it has streamlined the operational efficiency of the insurance providers; it has drastically improved different parameters on which customer experience is measured. Last but not the least, the effective leverage of analytics is gradually weeding out unnecessary data and making the insurance transactions more secure against frauds.

Also Read More Here : https://apacnewsnetwork.com/2024/04/ai-in-insurance-ensuring-efficiency/

#south korea medical cannabis market by derivative#edelweiss tokio life insurance#bajaj allianz general insurance#bandhan life insurance#ghosh babu#AI in Insurance Ensuring Efficiency#AI in Insurance#Ensuring Efficiency

0 notes

Text

0 notes

Text

Generative artificial intelligence (GenAI) is perhaps one of the most disruptive and biggest technological advancements since the launch of the iPhone. No matter who you are (unless you are living under a rock), the significance of GenAI and how it is creeping into our lives is evident. Every industry is evaluating ways to utilize this tech to simplify their operations and boost businesses, and the insurance industry is not far behind.

0 notes

Text

#car insurance#Car insurance app development#Insurance Industry#AI in insurance#Artificial IntelligenceIn Insurance#New Insurance Technology

0 notes

Text

Innovating Life Insurance Operations with Generative AI

Generative AI is transforming life insurance operations by automating underwriting, enhancing customer service, and streamlining claims processing. By leveraging advanced AI models, insurers can improve efficiency, reduce costs, and provide personalized experiences, ultimately driving innovation in the life insurance industry.

0 notes

Text

How AI and Deep Learning Are Revolutionizing Insurance

The use of artificial intelligence (AI) in the insurance industry has gained considerable momentum in recent years, revolutionizing various aspects of insurance operations and customer experience. AI technologies, such as machine learning, natural language processing, and predictive analytics, are being employed to streamline processes, enhance risk assessment, automate claims processing, detect fraud, and personalize policies, among other applications. By leveraging AI, insurance companies can make data-driven decisions, improve operational efficiency, mitigate risks, and deliver more tailored products and services to policyholders also utilizing AI in these insurance processes can enhance precision and result in cost savings.

However, there are some obstacles that currently make it difficult to fully integrate AI into existing insurance systems.

Challenges to incorporate AI into the insurance industry

Managing Data Quality and Availability: ML models and algorithms heavily rely on high-quality and diverse data. However, insurance companies may encounter challenges in ensuring the accuracy, completeness, and accessibility of data. Inconsistent or fragmented data sources can hinder models' effectiveness.

Data Privacy and Security: Data privacy and security pose concerns in the insurance industry due to the sensitive customer information involved. Integrating AI requires robust measures to protect data and comply with regulatory requirements, such as HIPAA and GDPR, to maintain trust and confidentiality.

Domain Expertise: Insurance-specific knowledge and expertise are required to label insurance-related documents and data correctly. It can be challenging to find labeling resources with deep understanding of insurance terminology, policies, and regulations.

Scalability and Volume: Insurance companies handle large volumes of data and documents that need to be labelled. Scaling labeling operations to handle such volumes while maintaining accuracy and efficiency can be a significant challenge.

Adapting to Evolving Insurance Requirements: Insurance practices, regulations, and products continuously evolve. Keeping the practices up to date and adaptable to changing insurance requirements can be a challenge. Continuous monitoring, feedback loops, and iterative improvements are essential to address evolving needs.

Managing the cost: Building infrastructure and technology costs, data acquisition and management expenses, talent acquisition, training and model development costs (the time and costs of labeling data, and slow iteration cycles)

Ethical and Bias Concerns: A growing challenge is the ethical considerations surrounding AI. The effectiveness of AI algorithms heavily relies on the quality of the data used for training, as biased data can result in biased outcomes that perpetuate discrimination and can impact the lives and financial security of people and their businesses.

Best practices to manage insurance AI projects

To overcome these challenges requires a combination of industry and domain expertise, quality control measures, and optimizing labeling processes to strike a balance between accuracy, cost-efficiency, and scalability of datasets

At Objectways we follow the Best Practices in labeling which include

Adherence to precise guidelines: We establish well-defined guidelines that outline the criteria and instructions for labeling data. Clearly communicate the labeling process, including the types of labels required, the context in which labels should be applied, and any specific rules or conventions to follow.

Executing KPT (Knowledge, Process, Test): Firstly, we establish a deep understanding of the insurance domain and its terminology to our team. Next, we define a standardized labeling process with clear guidelines for consistent and accurate labeling. Then there is regular testing and quality assurance to ensure the effectiveness of the process, allowing for continuous improvement and adaptation to changing insurance requirements.

Strong Team Organization: Our team has implemented a well-organized structure consisting of labeling personnel, spot Quality Assurance (QA) reviewers, and dedicated QA professionals. This framework promotes responsibility, streamlined workflow, and unwavering quality.

Performance Measures: We have established suitable quality indicators, including precision, recall, and F1 score, to evaluate the accuracy of labeling. We consistently monitor and analyse these measures to identify areas for enhancement and uphold exceptional quality standards.

Continuous Feedback Loop: We have implemented a system for providing consistent feedback to labeling teams regarding their performance. This facilitates the resolution of any discrepancies, clarifies guidelines, and enhances the overall accuracy of labeling.

Quality Control and Spot QA: By implementing robust quality control measures, including periodic spot QA reviews by experienced reviewers, helps identify and rectify any labeling errors, ensures adherence to guidelines, and maintains high labeling quality.

Data Security and Privacy: Data security and privacy are of paramount importance in the insurance industry, necessitating stringent measures to safeguard sensitive information and protect customer confidentiality. Therefore, to validate our commitment to security and privacy controls, we have obtained the following formal certifications SOC2 Type2, ISO 27001, HIPAA, and GDPR. These certifications affirm our dedication to safeguarding customer data and they continue to expand, adhering to Privacy by Design principles and incorporating industry standards and customer requirements from various sectors.

Below are some of the representative use cases for our clients:

Expediting and streamlining claims processing: Developing AI-powered claims processing and adjustment systems for insurance companies face challenges such as establishing human in the loop system, dealing with the time and cost-intensive process of labeling data, and facing slow iteration cycles. At Objectways we offer comprehensive support for all aspects of claims adjustment AI projects, offering solutions that enhance model performance and accelerate time to market, thereby helping insurers overcome these obstacles.

Accelerating insurance documents faster with AI and human in the loop: Expediting the processing of insurance documents by utilizing AI in combination with human expertise. AI technologies like OCR and NER enable efficient information retrieval, document understanding, and automated decision-making. Objectways human-in-the-loop workflows ensures accuracy, quality control, in the above cases, enabling faster processing while maintaining precision and compliance.

Fast and Precise Underwriting: By training computer vision models on geospatial data, underwriters can assess risks and property values without the need for human inspection. At Objectways we offer comprehensive support for geospatial data within all its products, enabling teams to visualize raw data, annotate information, and curate location data for spatial analysis. This native support empowers teams to leverage geospatial data effectively and make informed decisions based on accurate insights.

Driving language and text AI development: At Objectways we offer cutting-edge text labeling services to insurers, enabling them to harness the power of large language models for enhancing recommendations, chatbots (Providing automated customer service, answering frequently asked questions with personalization and empathy. Enabling multi-lingual customer service by translating customers queries and responding in the customers preferred language), risk assessments, and other applications. With our services, insurers can accelerate and optimize the development of NLP-based AI, propelling advancements in language and text processing.

Summary

At Objectways, our team consists of over 1000 experts specializing in Computer Vision, Natural Language Processing (NLP), and prompt engineering. They bring extensive experience in tasks like object detection, such as image segmentation and classification, as well as common language tasks like named entity recognition (NER), optical character recognition (OCR), and LLM prompt engineering.

In summary while there are challenges to fully integrating AI into the insurance industry, Objectways follows best practices in labeling to overcome these obstacles and ensure accuracy, cost-efficiency, and scalability of datasets. To learn more about how Objectways can revolutionize your insurance processes with AI, contact [email protected] to provide feedback or have any questions.

#artificial intelligence#data annotation#data labeling#data science#machine learning#objectways#Ai in Insurance#Artificial Intelligence in Insurance

1 note

·

View note

Text

“So how many suspects we got?”

“100 million.”

“Man, this is gonna be a long week.”

1K notes

·

View notes