Don't wanna be here? Send us removal request.

Text

Insurance broker software plays a key role in unlocking new growth avenues for brokers, enhancing productivity and customer satisfaction.

0 notes

Text

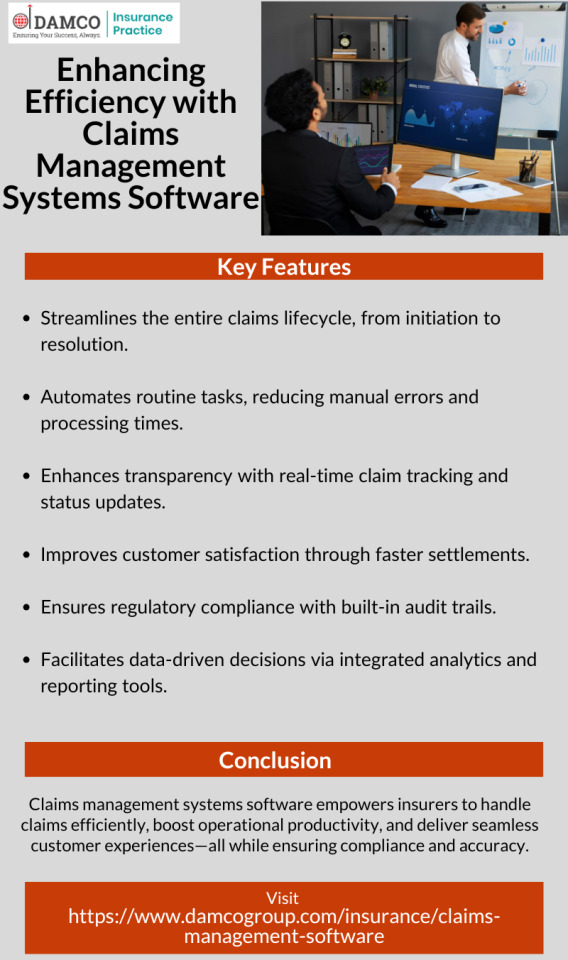

Discover how a smart insurance software system streamlines core operations, enhances customer engagement, and supports regulatory compliance. This infographic highlights key features that empower insurers to improve efficiency, mitigate risks, and deliver seamless policyholder experiences in a dynamic market.

0 notes

Text

Claims management systems software empowers insurers to handle claims efficiently, boost operational productivity, and deliver seamless customer experiences—all while ensuring compliance and accuracy.

0 notes

Text

Advantages of Efficient Insurance Broker Software

Efficient insurance broker software streamlines operations, enhances client servicing, and drives business growth. By automating routine tasks, enabling real-time policy tracking, and centralizing customer data, it empowers brokers to deliver faster, more personalized experiences. The software also supports regulatory compliance, improves communication with carriers, and offers analytics for informed decision-making. Ultimately, insurance broker software helps brokers increase productivity, reduce operational costs, and strengthen client relationships, making it a vital tool in today’s competitive insurance landscape.

0 notes

Text

Unlocking efficiency with insurance CRM software empowers insurers to streamline operations, enhance customer engagement, and drive growth. By automating routine tasks and providing a 360-degree view of client interactions, the software enables faster response times, improved service quality, and smarter decision-making.

0 notes

Text

Insurance broker management software boosts productivity by automating workflows, enhances client relationships through personalized services, and enables business scalability with efficient policy and data management.

0 notes

Text

Improving Customer Loyalty with Insurance CRM Software

Implementing a CRM for insurance brokers enhances efficiency, improves client relationships, and streamlines operations. A robust CRM centralizes customer data, automates policy management, and provides actionable insights for better decision-making. It simplifies lead management, boosts sales, and ensures compliance with industry regulations. Additionally, CRM tools enhance customer engagement through personalized communication and self-service options, leading to higher retention rates. By integrating advanced analytics and automation, a CRM for insurance brokers helps optimize workflows, reduce manual tasks, and drive business growth.

Read more — Why and How to Implement CRM for Insurance Agents?

0 notes

Text

AI/ML in Insurance: 4 Key Trends for Industry Leaders

The insurance industry is undergoing a major transformation, with AI and machine learning at the forefront. From automating underwriting to enhancing claims processing and risk assessment, these technologies are redefining operational efficiency and customer experience. How prepared are you to leverage AI-driven innovations and stay ahead in the evolving insurance landscape?

Read more — AI/ML in Insurance: 4 Key Trends for Industry Leaders

0 notes

Text

How Insurance Software Promotes Innovative Business Success

Insurance software is revolutionizing the industry by driving innovation and business success. By automating core operations, enhancing data analytics, and streamlining customer interactions, insurers can improve efficiency and decision-making. Advanced solutions, such as AI-powered underwriting and predictive analytics, help mitigate risks and personalize policy offerings. Cloud-based platforms and API integrations enable seamless collaboration across ecosystems, ensuring scalability and agility. Additionally, compliance management tools ensure regulatory adherence, reducing operational risks. With the right insurance software, companies can optimize workflows, boost customer satisfaction, and gain a competitive edge in an evolving market.

Read more — How Insurance Software Promotes Innovative Business Success

0 notes

Text

Optimize brokerage operations with advanced insurance broker software solutions that streamline workflows, enhance policy management, and improve customer engagement. By automating routine tasks, ensuring seamless communication, and providing real-time data insights, these solutions empower brokers to increase productivity and deliver superior client experiences.

0 notes

Text

ptimize policy lifecycle management with cutting-edge Policy Administration Systems. From underwriting to claims, ensure seamless operations, compliance, and customer satisfaction. Explore the top solutions for insurers today!

0 notes

Text

Enhance efficiency and accuracy with Damco's Healthcare Claims Processing Software. Automate claims intake, validation, and adjudication for quicker reimbursements and fewer errors. Explore now!

0 notes

Text

Optimizing Policy Administration with Insurance Policy Management Software

Insurance policy management software streamlines administration, ensures compliance, and enhances customer experience. With automation and analytics, insurers can boost efficiency, reduce errors, and stay competitive.

0 notes

Text

In 2025, insurance broker management software is a crucial tool for driving business growth. It streamlines operations, automates workflows, enhances customer relationships, and ensures regulatory compliance. With AI-driven insights, seamless integrations, and data analytics, brokers can improve decision-making and boost efficiency. Advanced CRM features and self-service portals enhance client interactions, leading to higher retention. Investing in the right insurance broker management software empowers brokers to scale operations, optimize productivity, and stay competitive in the evolving insurance landscape.

0 notes

Text

Discover cutting-edge AI-Based Insurance Solutions for the insurance industry with Damco Group. From intelligent claims processing to predictive analytics, our AI-powered innovations help insurers enhance efficiency, reduce risks, and deliver superior customer experiences. Explore how AI can transform your insurance operations.

0 notes

Text

Implementing Insurance Process Automation Solutions empowers insurers to enhance accuracy, speed, and customer satisfaction while driving business growth.

0 notes

Text

Looking to enhance efficiency in insurance operations? Discover how insurance process automation can revolutionize claims management, underwriting, policy administration, and customer service. By leveraging AI, RPA, and advanced analytics, insurers can minimize manual efforts, reduce errors, and accelerate workflows. Stay ahead in the competitive landscape with intelligent automation solutions

0 notes