#accountpayables

Explore tagged Tumblr posts

Text

Best Financial Management Software | Odoo Reporting Software

Oodo is providing one of the best financial management software in the UK.Odoo is the best Financial Management Software for small businesses and manages your daily accounting easily. This software has features to save time, account receivable, get paid easily, account payables, pay bills, easy reconciliation, legal statements.

Website: https://akarigo.com/finance-management-software/

Contact: +44(0)203 951 0012

#odoo#odoopurchasingsoftware#odoopurchasingsoftwareinUK#purchasesoftware#purchaseorder#ordermanagement#automate#financialmanagementsoftware#bestfinancialmanagementsoftware#legalstatements#savetime#getpaideasily#accountpayables

0 notes

Text

youtube

1 note

·

View note

Text

Revolutionize Your Finances: Top 10 Game-Changers in Accounts Payable Services

In the fast-paced business world, managing accounts payable effectively is crucial for maintaining financial health and operational efficiency. Accounts payable services streamline the process of managing and processing invoices, payments, and vendor relationships. This blog highlights the top 10 companies in accounts payable services that are leading the industry with their innovative solutions and exceptional service.

1. Vee Technologies

Vee Technologies stands out as a premier provider of accounts payable services. Their comprehensive solutions include invoice processing, payment management, and vendor management, all designed to enhance efficiency and accuracy. Vee Technologies Accounts Payable Services utilize advanced technology and best practices to ensure that businesses can focus on their core operations while leaving the complexities of accounts payable to the experts.

2. AvidXchange

AvidXchange offers a robust platform for accounts payable services, combining automation with user-friendly interfaces. Their solutions cover everything from invoice capture to payment execution, helping businesses reduce manual effort and errors. Their cloud-based system integrates seamlessly with existing ERP systems, providing real-time visibility and control over accounts payable processes.

3. Bill.com

Bill.com is renowned for its user-friendly accounts payable services. The platform simplifies the invoice approval process, automates payments, and integrates with various accounting systems. Bill.com’s cloud-based approach enhances collaboration and ensures that all accounts payable activities are efficiently managed and tracked.

4. SAP Concur

SAP Concur provides a comprehensive suite of accounts payable services designed to streamline expense management and invoice processing. Their solutions offer automated workflows, compliance monitoring, and robust reporting tools, helping businesses optimize their accounts payable functions and improve financial oversight.

5. Tipalti

Tipalti is a leader in accounts payable automation, offering end-to-end solutions that cover invoice management, payment processing, and reconciliation. Their platform supports global payments and integrates with numerous financial systems, making it ideal for companies with diverse and complex accounts payable needs.

6. Coupa

Coupa delivers innovative accounts payable services with a focus on spend management and procurement. Their solutions provide visibility into spending patterns, automate invoice processing, and streamline payment approvals. Coupa’s platform helps organizations manage their accounts payable more effectively and reduce operational costs.

7. Tradeshift

Tradeshift’s accounts payable services leverage cloud technology to offer a unified platform for managing invoices, payments, and procurement. Their solutions facilitate faster processing, improve compliance, and enhance supplier relationships, making them a valuable partner for businesses looking to optimize their accounts payable processes.

8. Yooz

Yooz provides a cloud-based accounts payable solution that emphasizes automation and ease of use. Their platform handles everything from invoice capture to payment, with features like optical character recognition (OCR) and intelligent data extraction. Yooz’s focus on automation helps reduce manual work and improve accuracy in accounts payable management.

9. Infor

Infor offers a range of accounts payable services designed to integrate seamlessly with their enterprise resource planning (ERP) systems. Their solutions automate invoice processing, improve workflow efficiency, and provide detailed analytics to help businesses manage their accounts payable more effectively.

10. Ariba (an SAP Company)

Ariba, now part of SAP, provides comprehensive accounts payable services with a strong emphasis on procurement and supplier management. Their platform streamlines invoice processing, enhances visibility into spending, and supports global transactions, making it a powerful tool for managing accounts payable in complex environments.

Conclusion

In today’s dynamic business landscape, choosing the right accounts payable services provider is crucial for optimizing financial processes and ensuring operational efficiency. Companies like Vee Technologies Accounts Payable Services, AvidXchange, Bill.com, and others on this list offer a range of solutions designed to meet various business needs. Whether you’re looking for automation, integration, or global payment capabilities, these top 10 companies in accounts payable services provide the tools and expertise required to manage accounts payable effectively. By leveraging these services, businesses can enhance their financial management practices and focus on driving growth and innovation.

0 notes

Text

Series 3 - Hermes AP Automation Software Product Demo - Manage Rule Engine Settings Reports

A Rule Engine is a condition when a requirement is calculated based on some task. A rule engine is a sophisticated statement interpreter that decodes rules. If you are looking for an automated accounts payable process embedded with a rule engine, check out how Hermes Rule Engine executes automated processes with step-by-step procedures.

youtube

#calpion#accountspayable#apinvoiceprocessing#invoicemanagementsoftware#accountpayable#digitaltransformation#businessmanagement#accountspayablesoftware#invoicemanagement#apautomation#apautomationsolution#aputomationservices#apinvoiceautomationsoftware#hermes#hermesapautomation#softwaresolutions#softwareautomation#bookademo#demo#productdemo#invoiceautomation#CFO#CFOcommunity#accountspayableautomation#technology#automation#invoice#invoices#invoiceprocessing#ai

0 notes

Photo

Electronic Invoicing is to help ease of doing business and make the system more seamless. Organizations that use our Invoice and Account Payables automation no longer manually gather and input invoices into their ERP or accounting system: http://bit.ly/39eI3X5 Contact us: 1800-120-226226 #electronicinvoicing #einvoicing #gst #accountpayables #business #invoices #erp #accountingsystem #streamlining #process #accountancy #india #bills #dicentral (at Dicentral India) https://www.instagram.com/p/B9O5uYnJagq/?igshid=1uoncfg98f3j5

#electronicinvoicing#einvoicing#gst#accountpayables#business#invoices#erp#accountingsystem#streamlining#process#accountancy#india#bills#dicentral

0 notes

Photo

The Principle Group, a Global service provider now offers Back Office Service for more than a decade. We provide #BackOfficeServices include Payroll, Accounts Payable, Accounts Receivables, Debt Collections, and others.

www.theprinciplegrp.com

1 note

·

View note

Photo

DGCC Group, LLC is the only place you'll ever need for bookkeeping and accounting services in Temecula, CA and the surrounding area. As your professional bookkeeper and certified remote accountant, we can handle all of your needs remotely, ensuring that one simple call gets you the best financial services around.

At DGCC Group, LLC, we provide professional services to help alleviate your financial information and with over 20 years of experience and knowledge, we can handle all of your personal and business cash flow, accounting services, small business tax prep, account payable, account receivable, and anything in between!

With our help, you can stay up-to-date on all of your finances and can gain knowledge on all accounting complexities. We provide valuable information for you and your business to make better financial decisions going forward to ensure that you thrive. If you're looking for an accountant to take a look at your books, need assistance managing your balance sheets, or even need a financial consultant to help push your business to the next level, contact us at DGCC Group, LLC today!

https://temeculabookkeepingservice.com

#BookkeepingService#AccountingServices#AccountPayable#AccountReceivable#AccountingSoftware's#SmallBusinessTaxPrep#AccountingService#RemoteAccountant#CashFlow#TaxPreparationService

1 note

·

View note

Text

Will Accounts Payable Automation ever rule the world?

Good question! Ain’t it? As we all know, Today, more firms are starting to seek accounts payable solutions that automate invoicing and payments processes, as they look to cut costs, decrease fraud, improve efficiency, and gain more visibility into payment data. These changes are bringing a deluge of providers — including software companies, card networks and providers, banks, and payment networks — into the ecosystem. And this means that, there’s a tremendous necessity of Accounts Payable Automation.

What market says?

Now, let’s have a look at the terms of sheer market size, this segment is Huge and growing at an exponential rate. MarketsandMarkets report says that The global AP automation market size is expected to grow from $1.9 billion in 2019 to $ 3.2 billion by 2024. This attributes to an 11% CAGR growth rate owning a huge chunk to IT spending on the automation of the payable processes to enhance business growth and reduce losses.We all are evolving and moving towards globalization. Psst! And, that leads to a disgusting and time-consuming process.

Let me walk you through the problems in this process that industry has lived with for quite some time now.

What are day to day issues, faced by the industry?

1. High cost:

Just Imagine, you are a part of the Finance team of a relatively huge company. You have one day to sort 50 invoices coming to you in different formats like pdf, png or anything. Boring? isn’t it? Yes, indeed!. And, eventually, you start thinking that you are not adding any value to the company because you’re doing this every time, manually. There’s no system that could help you in managing invoices.

The process of receiving invoices from suppliers can be very complex. Suppliers usually send invoices in different formats and through different mediums like email and fax. Invoices can arrive in different formats like PDF, DOCX, XML, PNG, JPG, TIFF, fax files, and even conventional paper. This can be complex for most organizations. The problem is compounded when these invoices are to be sorted, classified into different categories and further managing the physical copies becomes more ambiguous. Any company that values its employees’ time shouldn’t do this manually.

2. No Transparency:

Once invoice sorting is done, you have to check and match the invoice and that too manually, Oh Gosh! Before paying an invoice for goods acquired through a purchase order (PO), the invoice must be matched against other relevant documents, including receiving reports, to ensure that only the correct invoices are processed and paid. It causes a lack of understanding, what all payables are upcoming.

3. Large turnaround times:

You spend your weekdays and weekends doing this. No weekends :(! That’s too bad.

Manual data entry is one of the most tedious accounts payable processes. It’s time-consuming, costly, error-prone, and downright boring. And after all, who likes delayed audit closures?

4. Manual Checks:

Even if you’re done with matching and data entry, still you can’t shout Yay, because there’s a lot to do yet. Before an invoice is processed, it must go through a series of approval for authorization. You also need to ascertain the invoice’s validity and accuracy. Without such assurances, it cannot be paid. These approval often occur at different stages handled by different people.

5. Late Payments:

Wait and Watch! That’s what you can do right now.The purchasing department might have to approve the invoice to confirm the suppliers’ billing is accurate. And just before payment is disbursed, someone in management, (say, the CFO) might have to give it a final approval to ensure that the correct amount is paid into the right account. For an invoice to be approved, it must go from approval to approval. If a company processes invoices manually, it means that a paper invoice would have to go from desk to desk for the series of approval. This is the major reason for the delay in payment processing in organizations.

6. Lack of Governance and Policy Controls:

It becomes difficult to control norms and check manual errors. Ensuring everyone is sticking to right and standard operating procedures, it is necessary to keep track of vendor terms, clauses and agreements. It is indeed important to adopt robust governance practices.

What is the process of Accounts Payable Automation(APA)?

After all these processes are done, you finally sit on your couch, passing your time on social media and Alas! You came across this blog, which is the story of yours and at the point, after doing all these processes, you come to know that there’s an automatic process to do this task. Now, these problems need to be solved and that can only be done by the boom of Accounts Payable Automation Industry. I know you must be thinking how does the rise of APA help in the resolution of these issues? Simple! Remove the redundant work in the system, standardize the process, fix the algorithms according to one’s requirement and you are there. You have figured out a crack to $ 3.2 Billion Industry.

Automation of the processes not only helps in reducing cost but increases efficiency, reduces the risk of fraud, gives more visibility and data insights into payments and helps in maintaining good vendor relations. (who doesn’t like money on time?)

But, What is Account Payable Automation aka APA? Who will explain it to you? How would you inculcate it? Why use it? Huh? Don’t worry, here’s the answer.

According to SAP Ariba, Accounts payable process automation is a method of minimizing human intervention and eliminating error-prone tasks from the accounts payable process. AP automation delivers greater efficiency and effectiveness. AP Automation enables companies to toothless process supplier invoices without any human intervention by providing a digital workflow to manage steps previously handled by staff members. Automated accounts payable systems can create a process that’s simpler, more accurate and highly efficient. It helps in reducing the business payment cycle, governs the financial policies, automates the approval mechanisms and stores the record in a digital archive — making the entire process paperless.

Yes, now you can sit and do this in minutes because disruptive technology has enabled accounting teams to eliminate a lot of unnecessary manual intervention that was dragging down operational efficiency. Accounts payable plays a crucial role in business operations in ways many companies are only just starting to realize. We all know that this job function is what keeps the lights on in your office, but it also has a direct impact on cash flow management. The APA industry is a great product-market fit, as it will play a very crucial role in making eternally successful fully automated organizations.

This certainly has the sound of ruling the corporate world which will definitely take your financial aspects to the next level.

Also, Could you think of the detailed steps and challenges involved in Accounts Payable ? Give it a thought until we meet next time. Get Going!

1 note

·

View note

Text

1 note

·

View note

Photo

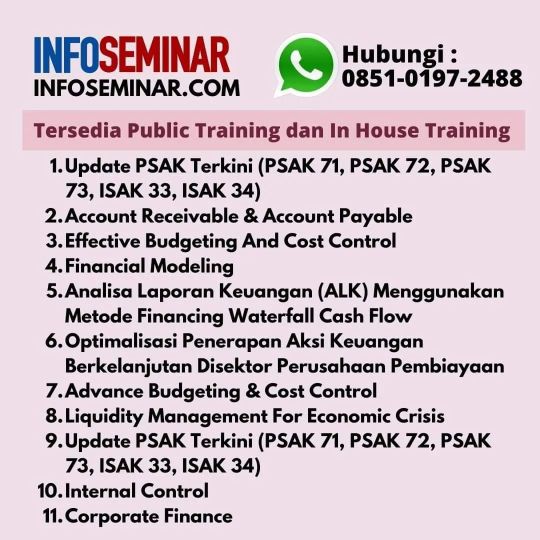

Info Seminar Accounting dan Finance Tahun 2023. Pelatihan Akuntansi dan Keuangan secara online dan offline untuk public training dan in house training. Topik materi training Accounting and Finance: 1. Update PSAK Terkini (PSAK 71, PSAK 72, PSAK 73, ISAK 33, ISAK 34) 2. Account Receivable & Account Payable 3. Effective Budgeting And Cost Control 4. Financial Modeling 5. Analisa Laporan Keuangan (ALK) Menggunakan Metode Financing Waterfall Cash Flow 6. Optimalisasi Penerapan Aksi Keuangan Berkelanjutan Disektor Perusahaan Pembiayaan 7. Advance Budgeting & Cost Control 8. Liquidity Management For Economic Crisis 9. Update PSAK Terkini (PSAK 71, PSAK 72, PSAK 73, ISAK 33, ISAK 34) 10. Internal Control 11. Corporate Finance Info seminar training lengkap: WA: 0851-0197-2488 Jadwal training lengkap: https://www.informasi-seminar.com #infoseminar #infotraining #infopelatihan #seminar #training #pelatihan #workshop #diklat #akuntansi #ekonomi #finance #accounting #keuangan #psak #isak #accountpayable #accountreceivable #budgeting #costcontrol #financialmodeling #analisalaporankeuangan #cashflow #economiccrisis #internalcontrol #corporatefinance https://www.instagram.com/p/Cm8IllQJw1M/?igshid=NGJjMDIxMWI=

#infoseminar#infotraining#infopelatihan#seminar#training#pelatihan#workshop#diklat#akuntansi#ekonomi#finance#accounting#keuangan#psak#isak#accountpayable#accountreceivable#budgeting#costcontrol#financialmodeling#analisalaporankeuangan#cashflow#economiccrisis#internalcontrol#corporatefinance

0 notes

Text

AP Automation Software: Finding the Right Fit for Your Business

There has been a broad shift underway in the accounts payable world in recent years. years. Where once paper invoices were processed strictly by hand, a cumbersome effort that could take weeks, if not months, companies are now opting en masse for AP automation software. It’s easy to see why this happens. Companies that look to AP automation software can expect quicker and cleaner approvals, at a lower cost per invoice.

That said, it’s not simply a matter of finding any old AP automation vendor to begin experiencing the many benefits. Here’s how to ensure your company finds a good partner.

Three Problems AP Automation Can Solve

AP automation software didn’t just arrive on the market because technology evolved. It also can solve a host of longstanding problems for AP departments.

Here are three to be mindful of.

Problem No. 1: Approvals Take Too Long Even in 2021, approval time remains the greatest challenge for AP departments. Stampli found in a recent white paper, “The How, the Why and the ROI of AP Automation” based on a January 2021 survey that more respondents than any other, 57%, saw faster invoice approval as a benefit of AP automation.

The good news is that the time it takes for companies to process an invoice has improved dramatically, from weeks or months to just days generally. But on the slow end, for companies still stuck on old manual processes, approval can drag for weeks, even months, with processing costs increasing steadily. In fact, some sources have suggested the savings can be as much as a whopping $26.50 per invoice.

Delays happen and processing costs increase because having to get invoice approvers on the phone or via email is tricky work, particularly during a pandemic when many executives are spending as little time in their companies’ offices as possible. But it doesn’t have to be like this.

How AP automation solves this problem: Centralized communication tools in AP automation platforms allow real-time collaboration and payment approvals on top of the invoice. The systems can also provide automated reminders, ability to approve invoices from anywhere at any time, and generally easier to use approver interfaces.

Problem No. 2: Data Entry and Three-Way Matching Kill Time (and Morale) The tediums of AP work can sink even the most dedicated workers in the field. Payables clerks might have to manually key in hundreds, even thousands of invoices per month, swallowing up incalculable amounts of staff time. It’s also a notorious morale killer, with a study in early 2020 ranking data entry among the most-hated workplace tasks.

A core part of AP is also grouping invoices with purchase orders and receipt reports, a process known as three-way matching that ensures goods were agreed to and received. Doing this reduces the risk of paying unnecessary or outright fraudulent bills and is vitally important. Done by hand, though, three-way matching, like data entry, is also no fun for accounting staff.

How AP automation solves this problem: The software can feature PDF invoice capture capabilities and data extraction and matching, via artificial intelligence, to general ledger coding. It goes without saying that this also improves storage and access to vendor invoices, purchase orders, and receipt reports for three-way matching.

Problem No. 3: Missed Discounts and Late Payments Businesses had to scrounge for every dollar they could in 2020 with the onset of the COVID-19 pandemic and resulting recession. All the same, far too many companies are still missing out on early payment discounts, which can run 2% to 3% for paying bills within certain timeframes. Worse, many companies are still sailing well past this and racking up unnecessary late charges with their vendors.

While cashflow can be a challenge for any business in these uncertain times, AP automation software makes it far easier for companies to avoid late fees and missed discounts.

How AP automation solves this problem: The software provides automated and customizable approval reminders, making it so AP clerks don’t just have to rely on memory. It also offers the ability to easily identify and track invoices that are late or those that are coming due in a Late Invoices tab.

1 note

·

View note

Text

4 Accounts Payable (AP) Tips for Small Businesses

Many small businesses are thinking: * We have a limited volume of invoices to process and manage. * We have a few vendors which our AP clerks can easily manage and support. * Why do we need to spend money on AP automation?

Read the blog to learn about the 4 important tips that every small business should know that will improve their current Accounts Payable process with automation and generate more business revenue.

#calpion#accountspayable#apinvoiceprocessing#invoicemanagementsoftware#accountpayable#digitaltransformation#businessmanagement#accountspayablesoftware#invoicemanagement#apautomation#apautomationsolution#aputomationservices#apinvoiceautomationsoftware#hermes#hermesapautomation#softwaresolutions#softwareautomation#US#USA#Canada#UK#UnitedKingdom#smartautomation#OCR#IDP#machinelanguage#intelligentautomation#invoiceautomation#invoice#invoices

0 notes

Text

5 Ways Controllers Benefit from AP Automation

Control, cash and compliance. These are the three ‘C’s’ that keep most controllers up at night.

But savvy controllers are resting easier by automating their accounts payable process with digital technologies such as intelligent data capture, workflow automation, robotic process automation (RPA), artificial intelligence, mobile and analytics. These digital transformation solutions automate the centralization, capture, validation, matching and posting of any paper or electronic invoice.

Digitally transforming accounts payable helps controllers manage their three ‘C’s’ in five ways:

#1. Greater operational efficiency and effectiveness Automating the extraction, validation and posting of data from invoices accelerates the delivery of information to the ERP application, while eliminating manual data-entry and the risk of errors.

Configurable business rules automatically match the header and line-item data captured from invoices with critical information stored in an ERP platform or accounting system, such as the purchase order number, invoice number, invoice date, vendor, quantity and amount. As a result, most invoices can be processed, matched and posted without human operator intervention.

#2. Faster resolution of exceptions There are lots of reasons that an invoice can result in an exception: wrong price, wrong quantity, missing tax amount, missing tax identification number, no requester name, no contact data, no contract and/or purchase order, missing purchase order number, no shipping notice, no order confirmation, net amount exceeds sub-total, invoice total exceeds contracted amount, missing ZIP code in address, incorrect spelling of a company name and no matching purchase order.

Digital technologies make it a snap for finance departments to quickly resolve invoice exceptions.

#3. Tighter tracking and control Automation enables financial controllers to enhance control over their accounts payable process by automating tasks such as validating and matching invoice data and posting approved invoices to an ERP, ensuring chain of custody and separation of duties, enforcing level of authority and approval and exceptions handling workflows, and automating image and data retention. With automation, most invoices can be posted directly to an ERP application, without human operator intervention.

And automated solutions log all actions taken on an invoice.

#4. Better working capital performance. Automated accounts payable solutions can help controllers improve working capital performance.

For instance, the faster invoice approval cycle times that businesses achieve with automation opens the door to more early payment discount opportunities. The Institute of Finance and Management’s (IOFM) AP Department Benchmark and Analysis found that moving to higher levels of automation enables businesses to pay a higher percentage of invoices within the early payment discount period.

#5. Enhanced visibility into operations, cash and risks Automation delivers the real-time visibility financial controllers need to increase the operational performance of the finance department, optimize cash, and ensure compliance, control and security.

Configurable graphical dashboards provide controllers with ready access to actionable information such as outstanding liabilities, on-time payment percentage, corporate spend and trends, category spend and volume, spend-to-supplier ratio, accounts payable value and volumes, accounts payables efficiency and early payment discount capture metrics. With these insights, controllers can determine when it is best to take advantage of early payment discount opportunities, reign in spending or make investments. A digital archive stores invoices and other accounts payables documents for records retention and audit purposes. Controllers and other authorized users can instantly and securely retrieve information at any time and from any location, via a personal computer, laptop or a mobile device with a web-browser. Configurable administrative controls ensure that only authorized users access stored images and data. And complete tracking of all activities within the system help fulfill audit and compliance requirements.

1 note

·

View note

Photo

Automating your accounts payable processes is about maximizing productivity within your AP department. Take the paper out of your AP process using EZ Cloud’s three-part cloud AP Automation system: Capture, Authorize, Pay.

1 note

·

View note

Text

We at Headwork are CPA & Accountant Services Firm in USA. We at Headwork provide Accounting Service Provider. The Most Experienced and Reliable Accounting Service Provider for Private, Trucking Industry and Commercial use. We'll be happy to connect with you when you need any of our services. So regarding any of our services you can directly contact us. Our Services in USA, #canada #australia : 👉 Accounting Services 👉 Account Billing Service 👉 Bookkeeping Services 👉 Account Receivable 👉 Account Payable 👉 Trucking Filing Service 👉 Compliance, Billing & Filings 👉 Reconciliation 👉 Budgeting & Forcasting 👉 Payroll 👉 MIS/Financial Statements Preparation Contact us : 📞 +1-2062572134 🌐 https://theheadwork.com Email ID : [email protected]

#payroll#payrollservices#taxfiling#accountpayable#accounting#usa#washington#canada#bookkeeping#australia#accountingservices

1 note

·

View note