#Working Capital Loans in Canada

Explore tagged Tumblr posts

Text

Secure Working Capital Loans in Toronto with CIK Capital

Are you seeking flexible working capital loans in Canada? Look no further than CIK Capital. Our customized financing solutions and competitive rates are designed to meet your business needs. Whether you're looking to expand, purchase inventory, or manage cash flow, we've got you covered. Call 8554035626 to discuss your options today and visit cikcapital.com for more details on our services.

#Equipment Financing in Canada#Working Capital Loans in Toronto#Working Capital Loans GTA#Woodworking and carpentry financing in Toronto#Industrial#Manufacturing and recycling machine financing in Toronto#Working Capital Loans in Canada#Forestry sawmills financing in Toronto

0 notes

Text

#paypal#paypal credit card#paypal credit#paypal business account#paypal account#paypal business#pay pal#paypal app#paypal sign up#paypal card#paypal canada#paypal working capital#paypal card reader#paypal debit card#paypal pay in 4#paypal com prepaid#paypal invoice#paypal uk#paypal mastercard#create paypal account#apply for paypal credit#paypal business credit card#paypal prepaid#paypal loans#paypal honey#paypal loanbuilder#paypal credit card apply#buy crypto with paypal#paypal merchant account#paypal app download

1 note

·

View note

Note

It's interesting how marxists claim they're the "compassionate" ones. Empathy isn't demanding other people give their things to other people while you make excuses about why you can't.

"Oh, we should invite all the refugees here, but I can't house them. You do that."

"Oh, I shouldn't have to pay off the loan I CHOSE TO GET AS AN ADULT WHO SHOULD BE ABLE TO UNDERSTAND WHAT CONSEQUENCES ARE. Let's get the people who actually work and make responsible life decisions do that and say the 'government' paid it off."

They complain about capitalism on devices made by capitalism from a country where our poor are so wealthy that many homeless people still have a phone. The impoverished have a higher quality of life here than they do in non-capitalist countries. Our healthcare system is messed up (thanks to government interference, which is something marxists advocate for), yet we have some of the highest quality of healthcare in the world. People travel from Canada and Europe to receive treatment here.

(Remember Alfie Evans from the UK? How the doctors pulled the plug because they thought he was brain dead? How he continued breathing anyway because he WASN'T dead? How they kept him under guard to prevent his parents from seeking treatment elsewhere? How they disconnected his feeding tube to starve him to death? How his parents weren't even allowed to bring him home to die with them? Such compassion.)

No, I will not listen to anyone who can say, unironically and with a straight face, that "true marxism (communism, socialism, etc) hasn't been tried" when they lecture me about compassion, because they are gullible fools who don't understand what consequences are, or they are liars, or they are both. (It doesn't help their case that they tend to support Hamas, a terrorist group that follows the ideology of a mufti who was an avid Hitler supporter. They support the grandchildren and great-grandchildren of people who fought for Hitler, which doesn't matter to me, but the left believes you're responsible for what your ancestors did.)

Say it louder for the commies in the back.

18 notes

·

View notes

Note

I don’t think I’ll ever be over how messed up imperialism and neocolonialism are. Like. Nearly every “developed” country aka the global north is developed because America gave them money/support to rebuild after WW2 ruined them (with the exception of Canada and Australia because they had no fighting on their soil) whilst ever since WW2 The West has made a point of actively screwing over the global south by via coups, invasions, predatory loans, and exploitative trade agreements… and then these global north countries have the AUDACITY to act as if the global south is underdeveloped and war-torn because the people living there are inferior? Like even Japan was rebuilt by America and yet they have their own far-right ethno-supremacist rhetoric??? When the only reason most of these countries are developed is because they have America’s favor and pose no threat to American global hegemony??? It’s messing with my mind tbh

This, this, and this. The toxic combination or capitalism and colonization among other internal factors have made the world unlivable for half its population. I'd recommend reading the works of Frantz Fanon, Aimé Césaire, Edward Said, and Ilan Pappé if you wanna dive more into your feelings on this. Colonialism—it's the nastiest "ism".

#frantz fanon#edward said#aime cesaire#ilan pappe#anti colonialism#anti imperialism#neocolonialism#global south#post colonialism

2 notes

·

View notes

Text

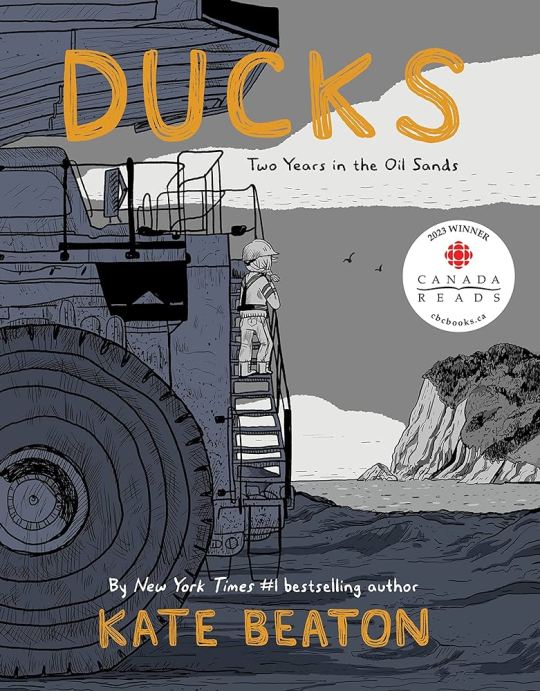

Ducks: Two Years in the Oil Sands. By Kate Beaton. Drawn and Quarterly, 2022.

Rating: 4.5/5 stars

Genre: graphic memoir

Series: N/A

Summary: Before there was Kate Beaton, New York Times bestselling cartoonist of Hark A Vagrant fame, there was Katie Beaton of the Cape Breton Beatons, specifically Mabou, a tight-knit seaside community where the lobster is as abundant as beaches, fiddles, and Gaelic folk songs. After university, Beaton heads out west to take advantage of Alberta’s oil rush, part of the long tradition of East Coasters who seek gainful employment elsewhere when they can't find it in the homeland they love so much. With the singular goal of paying off her student loans, what the journey will actually cost Beaton will be far more than she anticipates.

Arriving in Fort McMurray, Beaton finds work in the lucrative camps owned and operated by the world’s largest oil companies. Being one of the few women among thousands of men, the culture shock is palpable. It does not hit home until she moves to a spartan, isolated worksite for higher pay. She encounters the harsh reality of life in the oil sands where trauma is an everyday occurrence yet never discussed. Her wounds may never heal.

Beaton’s natural cartooning prowess is on full display as she draws colossal machinery and mammoth vehicles set against a sublime Albertan backdrop of wildlife, Northern Lights, and Rocky Mountains. Her first full-length graphic narrative, Ducks: Two Years in the Oil Sands is an untold story of Canada: a country that prides itself on its egalitarian ethos and natural beauty while simultaneously exploiting both the riches of its land and the humanity of its people.

***Full review below***

CONTENT WARNINGS: sexual harassment, rape

I was familiar with Kate Beaton's series Hark! A Vagrant before reading this book. I didn't know much about her or her life, but I was charmed by her comics, so I decided to pick up this memoir to see what she could do with a related genre (through still graphic in nature).

The first thing I was struck by was Beaton's masterful depiction of identity and community. Where a person is from in Canada matters more than I realized and is integral to one's sense of self, and I admire the way Beaton reflects that on the page through things like accent, music, etc.

Another thing that struck me was Beaton's sense of empathy. The camps, as she describes, are liminal spaces that wreak havoc on mental health, and I think Beaton portrayed that deftly without sensationalizing it. I was also touched by the way she portrayed trauma and how she portrays herself grappling with the after effects of her assaults, highlighting how people's lives can be changed in an instant.

I'm also glad that Beaton took the time to acknowledge the harm oil sands do to Indigenous communities. In her afterward, Beaton talks about how her experience was overwhelmingly male and white, and that it is just one way white supremacy/settler colonialism manifests.

Lastly, I think Beaton did a wonderful job integrating her personal art style with a structured narrative. I like the way Beaton's simple style delivers a lot of pathos through expressive body language, and the almost monochrome color palette creates a kind of hazy mood. Beaton also has a good sense of pacing and how to set up a scene, so the reading experience is fluid and easy to follow.

TL;DR: Ducks is a graphic memoir that takes a hard look at the effects capitalism has on the working class, noting how oil companies exploit itinerant workers and create both environmental and mental health problems.

5 notes

·

View notes

Text

Beyond the Initial $50: Financing the Future of Lawrence Cleaning Service

Starting Lawrence Cleaning Service, with just $50 has been an exciting challenge. However, if I go past this initial phase, securing additional financing will be essential for purchasing high-quality cleaning supplies, expanding marketing efforts, and potentially hiring staff or acquiring professional equipment. After reviewing the Business Development Bank of Canada’s (BDC) article, 4 Factors That Could Affect Financing My Start-Up, I’ve identified the best financial source for my business: bootstrapping with microloans or grants as a secondary option.

Bootstrapping or self-financing, works well with my business model because it allows me to grow at my own pace without being under the strain of having to repay a loan. Since a cleaning service has relatively low overhead costs, reinvesting profits from initial clients into better equipment and marketing can drive organic growth. Bootstrapping further permits full control over business decisions and eliminates debt-related financial risk.

If I decide to expand faster such as purchasing company vehicles or hiring people. I may consider small business microloans or grants.

Personal Investment – Since I started with my own money, lenders may see me as financially committed and responsible. This strengthens my case for microloans.

Working Capital & Cash Flow – I must demonstrate steady revenue and a sound business plan in order to be eligible for funding.

Management Experience – My hands-on experience in scheduling, customer service, and cleaning expertise will demonstrate my ability to manage funds effectively.

Market Potential – The increasing demand for residential and commercial cleaning services supports my business’s ability to scale profitably.

Potential Funding Sources

Microloans: Organizations like BDC offer small business loans with flexible repayment options.

Government Grants: Programs like the Canada Small Business Financing Program (CSBFP) may provide financial support.

Crowdfunding: If my brand becomes well-known, I might be able to finance a significant expansion using websites like Kickstarter.

Right now, the easiest way to maintain my business's flexibility and leanness is through bootstrapping. To guarantee sustainable growth, I will look into grants or microloans if I choose to scale.

1 note

·

View note

Text

TUMBLR POST: FINANCING FOR MY FUTURE BUSINESS START-UP

There is no doubt that the start-up $50 seed money for my micro business is not sufficient to get all the necessary things ready for start-up. Hence, additional financing is required. The Feasibility study for my micro business has been considered okay and viable including the business operation plan. So, adequate funding will facilitate the procurement of basic assets to take off the business. As a new business entering a competitive market, sufficient fund is needed to invest in aggressive marketing to enable me to penetrate the market. Having established this, the big question becomes "how do I get money? Personal savings amount is most readily available source of fund to put into the business. This amount is limited, being that I am still an international student.

Another common source of finance is through commercial bank Credit account in form of bank overdraft. But my credit score is still low to convince any bank to approve my request of about $100k.

Borrowing from my parents, siblings or friends is also a possible source of funds, bit a big rigorous. I will have to contact several people to raise different amounts. Crowdfunding and Business incubators sources of funding are not tailored to micro-business, rather big businesses.

However, the Business Development Bank of Canada (BDC) established since 1944 has been aiding small businesses to raise funds to start-up their businesses. This has facilitated growth of small businesses which have over the years develop into big businesses. There are 7 different sources of start-up Financing being offered by BDC for different business scenarios. These include the following:

1. Small Business loans (up to $100k to support small businesses).

2. Commercial Real Estate loan (supporting buying of lands/building, facilities upgrades, support construction costs etc).

3. Equipment Loan (covering purchase of new machinery, commercial vehicles, equipment, upgrades to improve productivity).

4. Purchase Order Financing (supporting buying of more inventories, penetration of new markets, quick suppliers' payment)

5. Working Capital Loan (supporting new products development as well as launching of new products.

6. Loan for Tech Equipment (covering investments is software, servers, networks or computers updates, digital marketing implementation and hiring of technical expert.

7. Loan for Tech Companies (supporting investments in sales, and marketing, new product development and accelerating Business owners' products.

After review of the BDC's 7 scenarios of Business start-up Financing listed above, I tend choosing the Small Business loan type. This category offers loan of up to $100k to small businesses like my Car Detailing Business. I have considered the following reasons:

. Easy application process on-line. There is also availability of online Finance advisor to provide help and answer any questions to clarify issues.

. For the first six months, only the loan interest is repayable. This allows me some initial relief from repayment pressure of the principal amount borrowed.

. No penalty for early repayments. The principal repayment is spaced out any time within the five-year duration of the loan.

. Flexible and friendly terms and conditions that offers the business owner better control over his business.

. The general requirement as set out by BDC are less strict.

. No application fees are required to apply for the small business loan.

The above conditions are favourable to any small business owner. I will go for it. I will be happy to sign a guarantee with the bank and demonstrate that I will not divert the loan for any personal needs. At least, my personal bank account statement will show the consistent upkeep allowance from my parents and some cash balance, I will surely invest the loan in purchasing all the necessary equipment I require to start up my Car Detailing Business. Also, the loan will help me sustain staff salaries for the initial months of the business. I will also deploy enough funds to intensive marketing campaign.

1 note

·

View note

Text

Black History month (Canada edition)

Wesley Hall

As the chairman and founder of WeShall Investments, a private equity firm with a diverse portfolio of companies predominantly supporting BIPOC entrepreneurs, Wes Hall comes from humble beginnings in rural Jamaica.

He grew up in a plantation worker's shack as one of several children supported by his grandmother. Despite these challenges, his grandmother instilled in him the value of hard work, ambition, and industriousness. In 1985, Wes immigrated to Canada, where he set about to become the businessman you see today.

Dressed daily in a suit, Wes started as a mail clerk at a leading law firm in Toronto. His curiosity, intelligence, and ability to spot opportunities allowed him to turn a $100K loan from the bank to start his first business, Kingsdale Advisors, into becoming Canada's most preeminent shareholder advisory firm. Wes' expertise was invaluable on the complicated dispute between Toronto-based Goldcorp and Nevada-based Glamis Gold from 2004 to 2006, Xstrata PLC's USD 18-billion takeover of Falconbridge in 2006, and the $19-billion merger between Suncor and Petro-Canada in 2009.

A staunch philanthropist, Wes is deeply committed to community upliftment. He founded the ambitious and highly successful BlackNorth Initiative to help end systemic anti-Black racism in Canada. He has instructed Black Entrepreneurship and Leadership at the Rotman School of Management at the University of Toronto, a first-of-its-kind course in North America. Wes is the vice-chair of the Board of Governors at Huron University College, a member of the Capital Markets Modernization Taskforce, and sits on the board of directors for SickKids Foundation, TIFF, and Pathways to Education Canada.

In 2021, the Ontario Chamber of Commerce awarded him the Lifetime Achievement Award, and the Canadian Chamber of Commerce awarded him the Canadian Business Leader of 2022. Wes has received Honorary Doctorates from the University of West Indies, the University of Ottawa, Toronto Metropolitan University, Queen's University, the University of Toronto, and York University. He received the Medal of Distinction from Huron University in 2022 and the Nation Builder Award from the Empire Club in 2024. Wes was named one of Bay Street's top 40 most influential figures in the past 4 decades by the The Globe and Mail in 2024. Wes' other accomplishments include penning a bestselling memoir, "No Bootstraps When You're Barefoot," which was a finalist for the 2023 National Business Book Awards. He launched a podcast in partnership with the Toronto Star, "Between Us with Wes Hall," and is also on the hit CBC series, The Exchange Tower "Dragons' Den." Wes is also an in-demand speaker invited to speak across Canada and a frequent guest on BNN Bloomberg.

0 notes

Text

The Ultimate Guide to Small Business Financing in Canada

For small business owners in Canada, securing the right financing is a crucial step toward growth and sustainability. Whether you're starting a new venture or expanding an existing one, understanding your options for Canada small business financing, business financing in Canada, Canadian small business loans, and small business finance can make a significant difference in achieving your goals.

1. Canada Small Business Financing: An Overview

Small business financing in Canada is designed to provide entrepreneurs with the capital needed to fund various business operations. This can include purchasing equipment, expanding inventory, or even covering operational expenses. The Canadian government and private lenders offer various programs tailored to the needs of small business owners.

Benefits of Small Business Financing in Canada:

Access to working capital for growth and stability.

Flexible repayment terms suited to your business model.

Opportunities to build business credit for future needs.

2. Types of Business Financing in Canada

Business financing in Canada comes in many forms. Here are some popular options:

1. Canadian Small Business Loans

These are structured loans provided by financial institutions and government-backed programs like the Canada Small Business Financing Program (CSBFP). These loans are ideal for purchasing real estate, equipment, or technology to grow your business.

Key Features:

Loan amounts up to $1 million, with $350,000 available for equipment and leasehold improvements.

Competitive interest rates and government-backed security.

Flexible repayment periods.

2. Business Lines of Credit

A business line of credit offers ongoing access to funds up to a specified limit. It’s a great option for managing cash flow and unexpected expenses.

3. Business Cash Advances

A business cash advance is a flexible financing solution for businesses with consistent revenue. Instead of a traditional loan, the advance is repaid through a percentage of daily credit card or debit card sales.

Advantages:

Fast approval and funding.

No fixed repayment schedule—repay as you earn.

Perfect for businesses with fluctuating cash flows.

4. Equipment Financing

If you need to purchase or upgrade equipment, this financing option allows you to spread the cost over time, reducing upfront expenses.

5. Government Grants and Subsidies

The Canadian government offers various grants and subsidies to support small businesses, especially those in tech, innovation, and green energy sectors.

3. How to Qualify for Canadian Small Business Loans

Securing financing requires preparation. Here’s how you can improve your chances of approval:

Prepare a Business Plan: A solid plan detailing your business goals, revenue projections, and repayment strategy.

Check Your Credit Score: A strong business or personal credit score increases your credibility with lenders.

Gather Financial Documents: Include tax returns, bank statements, and financial forecasts.

Demonstrate Cash Flow: Lenders want assurance that you can manage loan repayments effectively.

4. Why Consider a Business Cash Advance?

A business cash advance is gaining popularity due to its simplicity and speed. Unlike traditional loans, it doesn’t require extensive paperwork or collateral. Instead, repayments are tied directly to your sales, making it a great choice for seasonal businesses or those with variable income.

Who Should Consider It?

Retailers with steady credit/debit card sales.

Restaurants looking for quick funding to expand or renovate.

Service providers needing immediate cash for operational needs.

5. Tips for Managing Small Business Finance

Effective financial management is key to long-term success. Here are a few strategies:

Track Your Expenses: Use accounting software to monitor spending and identify cost-saving opportunities.

Maintain Emergency Funds: Set aside a portion of your revenue for unexpected expenses.

Reinvest Profits: Allocate a percentage of profits to growth initiatives like marketing or hiring.

Seek Professional Advice: Consult financial advisors or accountants to make informed decisions.

6. Choosing the Right Financing Option

The best financing option depends on your specific needs:

If you need a large sum for major investments, consider a Canadian small business loan.

For short-term working capital, a business cash advance might be ideal.

If flexibility is your priority, opt for a business line of credit.

Conclusion

Navigating the world of Canada small business financing, business financing in Canada, and Canadian small business loans can be overwhelming, but the right resources can help you achieve your business goals. From traditional loans to innovative solutions like business cash advances, there’s a financing option tailored to every business need.

Investing time in understanding your options and preparing your business for funding will set you on the path to success. Whether you’re launching a startup or expanding an existing venture, the right financial tools will empower your growth in Canada’s dynamic business landscape.

0 notes

Text

Truck Financing Near Me

Truck Financing Near Me - Need truck financing options nearby? CIK Capital offers hassle-free solutions for all your commercial truck financing needs. Whether you're an owner-operator or a fleet manager, we provide flexible and competitive financing options. Call us at 855-403-5626 and let our team assist you in getting the best truck financing deal near your location.

#Woodworking and carpentry financing in Toronto#Industrial#Manufacturing and recycling machine financing in Toronto#Working Capital Loans in Canada#Forestry sawmills financing in Toronto#Truck Financing Near Me

0 notes

Text

A Complete Guide to Factoring Services in Canada

The Role of Factoring Companies in Canada

Factoring companies in Canada serve as a vital financial resource for businesses seeking to maintain consistent cash flow. These companies specialize in converting unpaid invoices into immediate working capital, providing a financial bridge that helps businesses meet operational expenses. By working with factoring companies in Canada, businesses can avoid disruptions caused by delayed payments and focus on strategic growth.

The Benefits of Invoice Factoring in Canada

Invoice factoring in Canada is an essential tool for businesses managing long payment cycles. This service enables businesses to sell their accounts receivable at a discount, gaining instant access to the funds they need. Invoice factoring in Canada is particularly advantageous for businesses in industries with fluctuating revenue streams, as it provides reliable financial support without the need for traditional loans.

Exploring Accounts Receivable Financing Canada

Accounts receivable financing Canada is a flexible financial solution designed to address cash flow gaps. Unlike traditional credit options, accounts receivable financing focuses on the value of outstanding invoices rather than a company’s creditworthiness. This makes it an accessible option for businesses of all sizes, enabling them to sustain operations and invest in growth opportunities.

Factoring Services for Small Businesses: A Lifeline for Growth

Factoring services for small businesses provide the financial stability needed to navigate the challenges of scaling operations. For small businesses, managing cash flow can be a constant struggle, especially when dealing with extended payment terms from clients. Factoring services for small businesses eliminate this stress by offering immediate funds in exchange for unpaid invoices, ensuring that day-to-day operations remain unaffected.

Unlocking Opportunities With Invoice Factoring Canada

Invoice factoring Canada is more than a financial tool; it’s a strategic advantage. Businesses can use this service to free up capital tied in receivables, allowing them to reinvest in marketing, inventory, or other critical areas. Invoice factoring Canada also reduces the administrative burden associated with chasing payments, letting businesses focus on their core activities.

Comprehensive Factoring Services in Canada

Factoring services in Canada are tailored to meet the diverse needs of businesses across industries. From manufacturing to logistics, these services offer a customized approach to cash flow management. By partnering with providers of factoring services in Canada, businesses gain a competitive edge through improved liquidity, enhanced operational efficiency, and the ability to seize new market opportunities.

Why Factoring Is Essential for Canadian Businesses

Factoring is more than a temporary fix; it’s a cornerstone of sustainable financial planning for businesses in Canada. By utilizing solutions like factoring companies in Canada, invoice factoring in Canada, and accounts receivable financing Canada, businesses can overcome financial hurdles and position themselves for long-term success. These services ensure that businesses of all sizes remain agile, competitive, and prepared to tackle future challenges.

#factoring companies in canada#invoice factoring in Canada#accounts receivable financing Canada#factoring services for small businesses#invoice factoring canada#factoring services in canada

0 notes

Text

Future Financial Sources

As I think about how to grow my freelance marketing business beyond the initial $50 investment, there are several options in order to scale up to the next level if needed. Currently, my business is low-cost, but as I expand, taking on more clients, or even hiring a small team, I’ll need additional funds to sustain the business.

Here are some financial sources I would consider for future business growth:

Personal Savings

Using personal savings is often the simplest and most straightforward method of injecting funds into a startup business. This approach gives me full control over the business without incurring debt, paying interest or giving up ownership. However, it is undesirable to use personal savings for a business since there are no guarantees of success.

Small Business Loan

A more traditional route would be securing a small business loan from a bank or credit union. Many institutions offer non-objectionable interest rates and reasonable repayment schedules. Given the nature of my business, a small loan could help office space in the future or paying one or two employees. Small business loans are ideal if I want to maintain full control of my business but need a larger sum of money upfront for scaling quickly.

Other considerations:

Canada offers several grants for small business owners, especially for entrepreneurs in the creative, tech, and marketing fields. Angel investors are another consideration to keep in mind. They are individuals or groups who provide capital to startups in exchange for equity in the business. However, I have no idea how I would get in touch with such investors at the moment.

If the business grows beyond my ability to manage it alone, I could consider partnering with other professionals in complementary fields, such as graphic design, SEO, or web development. Working together with other experts in the field can help minimize financial risks.

1 note

·

View note

Link

0 notes

Text

How to Start a Trucking Company in Canada: The Importance of Driver Training Programs

Starting a trucking company in Canada is an ambitious and rewarding endeavor. However, with great opportunity comes significant responsibility, especially when it comes to ensuring the safety and efficiency of your operations. One of the most critical components in the early stages of establishing your trucking company is the implementation of comprehensive driver training programs. These programs not only enhance the skills of your drivers but also play a crucial role in the long-term success and reputation of your business. In this blog, we will explore how to start a trucking company in Canada and emphasize the importance of driver training programs in ensuring its success.

Understanding the Canadian Trucking Industry

Before diving into the logistics of starting your trucking company, it's essential to understand the landscape of the Canadian trucking industry. Canada has a vast and diverse geography, making trucking a vital component of the country's economy. According to the Canadian Trucking Alliance, the trucking industry is responsible for moving 70% of all freight transported in Canada. With this high demand, there's a substantial opportunity for new entrants into the market.

However, the Canadian trucking industry is also highly regulated, with strict guidelines around safety, driver qualifications, and vehicle maintenance. To successfully start a trucking company in Canada, you must navigate these regulations carefully while also building a strong foundation for your business.

Steps to Start a Trucking Company in Canada

. Develop a Business Plan: Like any other business, a trucking company requires a well-thought-out business plan. This plan should include your target market, financial projections, and a detailed overview of your services. It's essential to identify your niche, whether it's long-haul, regional, or specialized freight.

. Register Your Business: Choose a name for your trucking company and register it with the appropriate provincial or federal authorities. Depending on your location, you may need to register for various permits and licenses, including a National Safety Code (NSC) certificate.

. Secure Financing: Starting a trucking company requires significant upfront investment, including the purchase of trucks, insurance, and operating expenses. Explore financing options such as loans, leasing, or partnerships to ensure you have the necessary capital.

. Obtain Insurance: Insurance is a crucial aspect of operating a trucking company in Canada. You'll need coverage for your vehicles, cargo, and liability. Work with an insurance broker who specializes in the trucking industry to find the best policies for your business.

.Hire and Train Drivers: One of the most critical steps in starting your trucking company is hiring qualified drivers. This is where the importance of driver training programs comes into play.

The Importance of Driver Training Programs

When considering how to start a trucking company in Canada, the significance of driver training programs cannot be overstated. Here’s why:

. Safety Compliance: Canada has strict safety regulations for commercial trucking operations. Comprehensive driver training programs ensure that your drivers are well-versed in these regulations, reducing the risk of accidents and ensuring compliance with federal and provincial laws.

. Skill Enhancement: Even experienced drivers can benefit from ongoing training. Driver training programs help sharpen skills such as defensive driving, cargo handling, and fuel-efficient driving techniques. These skills not only enhance safety but also contribute to the overall efficiency of your operations.

. Reputation and Customer Trust: A well-trained team of drivers is a testament to your company’s commitment to safety and professionalism. This can significantly enhance your reputation in the industry and build trust with customers who rely on your services to transport their goods safely and on time.

. Cost Efficiency: Investing in driver training programs can lead to long-term cost savings. Properly trained drivers are less likely to be involved in accidents, which can reduce insurance premiums and minimize vehicle repair costs. Additionally, training on fuel-efficient driving can lower fuel consumption, one of the most significant expenses in the trucking industry.

. Driver Retention: The trucking industry in Canada, like many other countries, faces challenges in retaining qualified drivers. Providing ongoing training and development opportunities can help improve job satisfaction and retention rates among your drivers.

Starting a trucking company in Canada is a complex but rewarding venture. Among the many considerations, the importance of driver training programs stands out as a key factor in the success and longevity of your business. These programs not only ensure compliance with Canadian safety regulations but also enhance the skills of your drivers, improve your company's reputation, and lead to cost efficiencies.

If you're looking to start a trucking company in Canada, remember that investing in driver training programs is not just a regulatory requirement but a strategic move to position your business for success. At ELD Mandate, we understand the challenges of the trucking industry and are here to support your journey. Whether you're a new entrant or an established operator, our solutions can help you stay compliant and efficient as you grow your business.

0 notes

Text

Quartier Micro: Microlending to Cultivate a Thriving Local Economy

In the heart of a bustling urban center,installment loans in canada a grassroots initiative is quietly transforming the economic landscape. Quartier Micro, a community-driven organization, has pioneered an innovative microlending program that is empowering local entrepreneurs and nurturing a vibrant local economy.

The premise behind Quartier Micro is simple yet powerful: by providing accessible, low-interest loans to small businesses and aspiring entrepreneurs, the organization is helping to unlock the incredible potential that exists within the community. "We recognized that so many people in our neighborhood had fantastic ideas and the drive to succeed, but were held back by a lack of capital," explains Lucie Mercier, the co-founder of Quartier Micro. "Our microlending program is designed to address that gap and give them the boost they need to turn their dreams into reality."

Since its inception five years ago, Quartier Micro has disbursed over $1 million in microloans, supporting the launch and expansion of dozens of local enterprises. From a community bakery serving up artisanal sourdough to a bicycle repair shop that doubles as a popular gathering spot, these businesses are not only thriving, but also reinvesting their profits back into the local economy.

"The ripple effects of Quartier Micro's work are truly remarkable," says Sarah Dupont, a longtime resident of the neighborhood. "By empowering local entrepreneurs, they're creating jobs, strengthening community ties, and cultivating a sense of pride and ownership in this place we call home."

Indeed, the success of Quartier Micro's microlending program can be seen not only in the balance sheets of its borrowers, but also in the vibrancy of the community itself. Bustling storefronts, lively street markets, and a palpable sense of energy and innovation have all become hallmarks of this once-overlooked urban enclave.

"What Quartier Micro has accomplished is nothing short of inspirational," reflects Mercier. "We're not just lending money - we're investing in people, in ideas, and in the future of our community. And the returns we're seeing, both in economic and social terms, are truly extraordinary."

As the organization looks to the future, its leaders are exploring ways to expand their reach and replicate their model in other underserved communities.cash advance loans canada But for now, Quartier Micro remains firmly rooted in its local context, continuing to cultivate a thriving, self-sustaining ecosystem that is the envy of urban centers around the world.

0 notes

Text

BUSINESS OPERATION PLAN

My Car Detailing Business Operations Plan.

Introduction:

In fulfilment of the ENTR 1281 Entrepreneurship course requirement to engage in a term project which will enable me to learn from experience on starting and running a small business, I have chosen a Car Detailing business. Provision of Car detailing services is essentially a business of providing various degrees of car cleaning services to customers. This basically range from exterior/interior cleaning and touch-ups of car paintings.

In this blog post, I will be sharing the operations plan of my car detailing business which explains how I will run the business to realize a profit goals.

My Company Overview.

My business is called CHIAGOZIE Car Detailing. This is set up to acquire learning based on experiences generated from running a typical one within the 14 weeks of the course. We are currently in the last 9 weeks of the course.

My Management Team will be made up of myself as the Managing Director to coordinate the business, an admin secretary for keeping the company records/sales data and inquiries from customers and 4 number technicians/washermen that will be engaged in actual washing. My business will be offering static car detailing as well as the mobile car detailing services. Mobile services have become very attractive to customers who struggle with time to drive their cars to the service centers for detailing. I have completed a feasibility study for the business covering the potential location of the business, target market, Market potential, Competition, Estimated Sales and Expense Forecast and potential Risks, Issues and possible challenges related to the business. This milestone has been graded well.

My Target market

This is the group of vehicle users that desire driving clean cars, trucks or SUVs. From primary research, the vehicle users I have chosen as ideal customers are the Rideshare providers. This group operate on platforms like the Lyft and Uber. Their preferences around maintaining regular cleanliness of their vehicles to attract high ratings from their passengers have been duly identified. This has enabled me to map out appropriate marketing efforts for them.

Vision on what I need to launch my business.

I am already working with popular reliable vendors on timely procurement of the required basic equipment (Steam cleaner, shelving, Vacuum cleaner, Pressure Washer, brushes, towels and washing/waxing fluids etc), human, financial resources as well as necessary permits for the start-up of the business. This is seeming tough now. I have only lived in Canada for ten months and as a student, have not built-up sufficient credit score that can enable me to access enough bank financing for the business start-up. To minimize the initial take-off capital and investment for a full automated car detailing Centre, I will be starting the business with the manual type of car washing using pressurized jet washing. I have also solicited support from my parents to loan me additional take-off funds.

The estimated Sales revenue, and Expenses forecasts including revenue potential have been presented in Appendix 1.

Customer Service menu and booking system.

The administrative secretary will ensure that online booking system is downloaded every morning to schedule customers accordingly before start of work every day. This staff will also manage the invoices application.

Permits & Licenses

Necessary permits, such as License to Operate (LTO) and Environmental Waste Disposal permits will be secured before start-up.

Legal Requirements.

All applicable tax registrations must be completed for the tax returns compliance purpose. Also, the bank account for the business must be opened.

Marketing.

I will launch a user-friendly online website with clear details of my business offerings and show clear pictures of finished jobs. I will also advertise my business in social media and regularly update my business activities with clients. An effective online booking system and pricing will be maintained.

APPENDIX 1 -Sales Estimate, Expense forecast and Profit Potential.

Sales estimate for 9 weeks.

Take the unit prize of $60 for a typical internal & external deep cleaning per car.

From the survey I conducted, each car comes in for the deep cleaning once every month (4 weeks), the total number of cars that will be serviced will be 483 divided by 4 = 121 cars per week.

So, for the remaining 9 weeks of the course, the total perceived sales will be

9 times 121 times 60 = $65,340.00

Expense Forecast:

Below represents estimates of critical expenses for start-up and the 14-week duration of the business.

· Buying of cleaning materials, say $450/month i.e. $112.5 per week

· Insurance cost: $1000/year i.e. $19.23 per week

· Advertising & Marketing: $800/month i.e. $200 per week

· Licensing/Permit fees, $500/year i.e. $9.62 per week

· Administrative costs, $300/month i.e. $75 per wee.

· Depreciation costs $400/month i.e. $100 per week

· Vehicle fueling and Maintenance, $400/month i.e. 100 per week

· Property Rent, $12,000/month, i.e. $3000 per week

Total weekly costs =$3,616.35

Labor costs = 30% of 3,616.35 = 1,084.905 per week

Hence, total Expense Forecast = $3,616.35 + 1,084.905 = $4,701.26 per week

Expense forecast for the 9 weeks = 9 times $4,701.26 = $42,311.34

Hence, the profit potential = Sales minus Expenses

=$65,340 - $42,311.34 =$23,028.66

1 note

·

View note