#Canada small business financing

Explore tagged Tumblr posts

Text

The Ultimate Guide to Small Business Financing in Canada

For small business owners in Canada, securing the right financing is a crucial step toward growth and sustainability. Whether you're starting a new venture or expanding an existing one, understanding your options for Canada small business financing, business financing in Canada, Canadian small business loans, and small business finance can make a significant difference in achieving your goals.

1. Canada Small Business Financing: An Overview

Small business financing in Canada is designed to provide entrepreneurs with the capital needed to fund various business operations. This can include purchasing equipment, expanding inventory, or even covering operational expenses. The Canadian government and private lenders offer various programs tailored to the needs of small business owners.

Benefits of Small Business Financing in Canada:

Access to working capital for growth and stability.

Flexible repayment terms suited to your business model.

Opportunities to build business credit for future needs.

2. Types of Business Financing in Canada

Business financing in Canada comes in many forms. Here are some popular options:

1. Canadian Small Business Loans

These are structured loans provided by financial institutions and government-backed programs like the Canada Small Business Financing Program (CSBFP). These loans are ideal for purchasing real estate, equipment, or technology to grow your business.

Key Features:

Loan amounts up to $1 million, with $350,000 available for equipment and leasehold improvements.

Competitive interest rates and government-backed security.

Flexible repayment periods.

2. Business Lines of Credit

A business line of credit offers ongoing access to funds up to a specified limit. It’s a great option for managing cash flow and unexpected expenses.

3. Business Cash Advances

A business cash advance is a flexible financing solution for businesses with consistent revenue. Instead of a traditional loan, the advance is repaid through a percentage of daily credit card or debit card sales.

Advantages:

Fast approval and funding.

No fixed repayment schedule—repay as you earn.

Perfect for businesses with fluctuating cash flows.

4. Equipment Financing

If you need to purchase or upgrade equipment, this financing option allows you to spread the cost over time, reducing upfront expenses.

5. Government Grants and Subsidies

The Canadian government offers various grants and subsidies to support small businesses, especially those in tech, innovation, and green energy sectors.

3. How to Qualify for Canadian Small Business Loans

Securing financing requires preparation. Here’s how you can improve your chances of approval:

Prepare a Business Plan: A solid plan detailing your business goals, revenue projections, and repayment strategy.

Check Your Credit Score: A strong business or personal credit score increases your credibility with lenders.

Gather Financial Documents: Include tax returns, bank statements, and financial forecasts.

Demonstrate Cash Flow: Lenders want assurance that you can manage loan repayments effectively.

4. Why Consider a Business Cash Advance?

A business cash advance is gaining popularity due to its simplicity and speed. Unlike traditional loans, it doesn’t require extensive paperwork or collateral. Instead, repayments are tied directly to your sales, making it a great choice for seasonal businesses or those with variable income.

Who Should Consider It?

Retailers with steady credit/debit card sales.

Restaurants looking for quick funding to expand or renovate.

Service providers needing immediate cash for operational needs.

5. Tips for Managing Small Business Finance

Effective financial management is key to long-term success. Here are a few strategies:

Track Your Expenses: Use accounting software to monitor spending and identify cost-saving opportunities.

Maintain Emergency Funds: Set aside a portion of your revenue for unexpected expenses.

Reinvest Profits: Allocate a percentage of profits to growth initiatives like marketing or hiring.

Seek Professional Advice: Consult financial advisors or accountants to make informed decisions.

6. Choosing the Right Financing Option

The best financing option depends on your specific needs:

If you need a large sum for major investments, consider a Canadian small business loan.

For short-term working capital, a business cash advance might be ideal.

If flexibility is your priority, opt for a business line of credit.

Conclusion

Navigating the world of Canada small business financing, business financing in Canada, and Canadian small business loans can be overwhelming, but the right resources can help you achieve your business goals. From traditional loans to innovative solutions like business cash advances, there’s a financing option tailored to every business need.

Investing time in understanding your options and preparing your business for funding will set you on the path to success. Whether you’re launching a startup or expanding an existing venture, the right financial tools will empower your growth in Canada’s dynamic business landscape.

0 notes

Text

Canada Small Business Financing: Essential Options for Small Businesses

To qualify for small business financing in Canada, businesses must meet several criteria. Generally, they should be privately owned and operate primarily in Canada. The business must have been in operation for a certain period, often at least one year.

0 notes

Text

A Complete Guide to Factoring Services in Canada

The Role of Factoring Companies in Canada

Factoring companies in Canada serve as a vital financial resource for businesses seeking to maintain consistent cash flow. These companies specialize in converting unpaid invoices into immediate working capital, providing a financial bridge that helps businesses meet operational expenses. By working with factoring companies in Canada, businesses can avoid disruptions caused by delayed payments and focus on strategic growth.

The Benefits of Invoice Factoring in Canada

Invoice factoring in Canada is an essential tool for businesses managing long payment cycles. This service enables businesses to sell their accounts receivable at a discount, gaining instant access to the funds they need. Invoice factoring in Canada is particularly advantageous for businesses in industries with fluctuating revenue streams, as it provides reliable financial support without the need for traditional loans.

Exploring Accounts Receivable Financing Canada

Accounts receivable financing Canada is a flexible financial solution designed to address cash flow gaps. Unlike traditional credit options, accounts receivable financing focuses on the value of outstanding invoices rather than a company’s creditworthiness. This makes it an accessible option for businesses of all sizes, enabling them to sustain operations and invest in growth opportunities.

Factoring Services for Small Businesses: A Lifeline for Growth

Factoring services for small businesses provide the financial stability needed to navigate the challenges of scaling operations. For small businesses, managing cash flow can be a constant struggle, especially when dealing with extended payment terms from clients. Factoring services for small businesses eliminate this stress by offering immediate funds in exchange for unpaid invoices, ensuring that day-to-day operations remain unaffected.

Unlocking Opportunities With Invoice Factoring Canada

Invoice factoring Canada is more than a financial tool; it’s a strategic advantage. Businesses can use this service to free up capital tied in receivables, allowing them to reinvest in marketing, inventory, or other critical areas. Invoice factoring Canada also reduces the administrative burden associated with chasing payments, letting businesses focus on their core activities.

Comprehensive Factoring Services in Canada

Factoring services in Canada are tailored to meet the diverse needs of businesses across industries. From manufacturing to logistics, these services offer a customized approach to cash flow management. By partnering with providers of factoring services in Canada, businesses gain a competitive edge through improved liquidity, enhanced operational efficiency, and the ability to seize new market opportunities.

Why Factoring Is Essential for Canadian Businesses

Factoring is more than a temporary fix; it’s a cornerstone of sustainable financial planning for businesses in Canada. By utilizing solutions like factoring companies in Canada, invoice factoring in Canada, and accounts receivable financing Canada, businesses can overcome financial hurdles and position themselves for long-term success. These services ensure that businesses of all sizes remain agile, competitive, and prepared to tackle future challenges.

#factoring companies in canada#invoice factoring in Canada#accounts receivable financing Canada#factoring services for small businesses#invoice factoring canada#factoring services in canada

0 notes

Text

Choosing the Right Transport Equipment Finance Solution for Your Needs

It is frequently the right equipment that gives the success to transport businesses. For a small business owner or someone managing a larger enterprise, having the right vehicles and machinery can be everything to you. But the cost may be an insurmountable barrier. That is where the transport equipment finance comes to the aid of businesses by helping them procure assets they need without putting any pressure on their cash flow.

Understanding Transport Equipment Finance

However, transport equipment finance refers to a form of funding aimed at assisting businesses in purchasing the vehicles and machinery necessary for their operations. It can involve trucks, vans, forklifts or any other critical equipment that is very relevant to your business sector. Instead of having to pay the entire amount in advance, firms can choose between various payment options and thereby divide the cost into many convenient installments.

Benefits of Transport Equipment Finance

Preserving Capital: Transport equipment finance allows the firms to forgo initial high costs. This maintains the capital for other daily requirements to ensure a healthy cash flow.

Flexible Repayment Plans: Transport equipment financing presents repayment options that match the financial standing of your business. Whether you like monthly, quarterly plans or even personalized schedules one plan suits your needs.

Tax Advantages: In most instances, the interest charged on financing the transport equipment is tax-deductible. This can help your business realize huge savings that can make the financing option even more economical.

Identifying the Best Transport Equipment Finance Solution

Before moving on to transport equipment finance, identifying your specific business needs carefully is important. Get to know the nature of the equipment you require, its life cycle and also how it enhances operations.

Find reliable lenders that focus on transport equipment loans. Assess their history, track record of customer reviews and the conditions they offer. Such a lender can have an intimate understanding of all your particular requirements. Lenders may provide different rates and also terms. Compare these factors as you have enough time to find a financing solution that fits well your budget and financial objectives.

Selecting the optimal transport equipment finance solution is one of the most important steps that allow you to empower your company for development. Through an analysis of your needs, the search for credible lenders and making a thoughtful selection out of various options that are available to you, financing that keeps your business afloat becomes yours.

#transport equipment finance#transport equipment#canada#equipment#loans#transport loans#small business#lease and financing

0 notes

Text

"In some cities, as many as one in four office spaces are vacant. Some start-ups are giving them a second life – as indoor farms growing crops as varied as kale, cucumber and herbs.

Since its 1967 construction, Canada's "Calgary Tower", a 190m (623ft) concrete-and-steel observation tower in Calgary, Alberta, has been home to an observation deck, panoramic restaurants and souvenir shops. Last year, it welcomed a different kind of business: a fully functioning indoor farm.

Sprawling across 6,000sq m (65,000 sq ft), the farm, which produces dozens of crops including strawberries, kale and cucumber, is a striking example of the search for city-grown food. But it's hardly alone. From Japan to Singapore to Dubai, vertical indoor farms – where crops can be grown in climate-controlled environments with hydroponics, aquaponics or aeroponics techniques – have been popping up around the world.

While indoor farming had been on the rise for years, a watershed moment came during the Covid-19 pandemic, when disruptions to the food supply chain underscored the need for local solutions. In 2021, $6bn (£4.8bn) in vertical farming deals were registered globally – the peak year for vertical farming investment. As the global economy entered its post-pandemic phase, some high-profile startups like Fifth Season went out of business, and others including Planted Detroit and AeroFarms running into a period of financial difficulty. Some commentators questioned whether a "vertical farming bubble" had popped.

But a new, post-pandemic trend may give the sector a boost. In countries including Canada and Australia, landlords are struggling to fill vacant office spaces as companies embrace remote and hybrid work. In the US, the office vacancy rate is more than 20%.

"Vertical farms may prove to be a cost-effective way to fill in vacant office buildings," says Warren Seay, Jr, a real estate finance partner in the Washington DC offices of US law firm ArentFox Schiff, who authored an article on urban farm reconversions.

There are other reasons for the interest in urban farms, too. Though supply chains have largely recovered post-Covid-19, other global shocks, including climate change, geopolitical turmoil and farmers' strikes, mean that they continue to be vulnerable – driving more cities to look for local food production options...

Thanks to artificial light and controlled temperatures, offices are proving surprisingly good environments for indoor agriculture, spurring some companies to convert part of their facilities into small farms. Since 2022, Australia's start-up Greenspace has worked with clients like Deloitte and Commonwealth Bank to turn "dead zones", like the space between lifts and meeting rooms, into 2m (6ft) tall hydroponic cabinets growing leafy greens.

On top of being adaptable to indoor farm operations, vacant office buildings offer the advantage of proximity to final consumers.

In a former paper storage warehouse in Arlington, about a mile outside of Washington DC, Jacqueline Potter and the team at Area 2 Farms are growing over 180 organic varieties of lettuce, greens, root vegetables, herbs and micro-greens. By serving consumers 10 miles away or less, the company has driven down transport costs and associated greenhouse emissions.

This also frees the team up to grow other types of food that can be hard to find elsewhere – such as edible flower species like buzz buttons and nasturtium. "Most crops are now selected to be grown because of their ability to withstand a 1,500-mile journey," Potter says, referring to the average distance covered by crops in the US before reaching customers. "In our farm, we can select crops for other properties like their nutritional value or taste."

Overall, vertical farms have the potential to outperform regular farms on several environmental sustainability metrics like water usage, says Evan Fraser, professor of geography at the University of Guelph in Ontario, Canada and the director of the Arell Food Institute, a research centre on sustainable food production. Most indoor farms report using a tiny fraction of the water that outdoor farms use. Indoor farms also report greater output per square mile than regular farms.

Energy use, however, is the "Achilles heel" of this sector, says Fraser: vertical farms need a lot of electricity to run lighting and ventilation systems, smart sensors and automated harvesting technologies. But if energy is sourced from renewable sources, they can outperform regular farms on this metric too, he says.

Because of variations in operational setup, it is hard to make a general assessment of the environmental, social and economic sustainability of indoor farms, says Jiangxiao Qiu, a landscape ecologist at the University of Florida and author of a study on urban agriculture's role in sustainability. Still, he agrees with Fraser: in general, urban indoor farms have higher crop yield per square foot, greater water and nutrient-use efficiency, better resistance to pests and shorter distance to market. Downsides include high energy use due to lighting, ventilation and air conditioning.

They face other challenges, too. As Seay notes, zoning laws often do not allow for agricultural activity within urban areas (although some cities like Arlington, Virginia, and Cincinnati, Ohio, have recently updated zoning to allow indoor farms). And, for now, indoor farms have limited crop range. It is hard to produce staple crops like wheat, corn or rice indoors, says Fraser. Aside from leafy greens, most indoor facilities cannot yet produce other types of crops at scale.

But as long as the post-pandemic trends of remote work and corporate downsizing will last, indoor farms may keep popping up in cities around the world, Seay says.

"One thing cities dislike more than anything is unused spaces that don't drive economic growth," he says. "If indoor farm conversions in cities like Arlington prove successful, others may follow suit.""

-via BBC, January 27, 2025

1K notes

·

View notes

Text

Automotive Financing for Small Business Owners: A Comprehensive Guide

As a small business owner in Canada, you understand how important it is to have reliable transportation for your daily operations. Whether you need a fleet of vehicles for your employees or a single company car, financing your automotive needs can be a challenge. In this comprehensive guide, we will explore the various automotive financing options available for small business owners in Canada, provide tips for securing the best financing terms, and offer advice for startups seeking automotive financing.

Understanding Your Financing Options

As a small business owner, you have a variety of financing options available to you when it comes to purchasing vehicles for your company. It's important to understand the differences between these options in order to choose the one that's right for your business.

Business Vehicle Loans vs. Commercial Auto Loans

One financing option to consider is a business vehicle loan. This type of loan is specifically designed for small businesses and can be used to purchase a single vehicle or a fleet of vehicles. Business vehicle loans typically have lower interest rates than commercial auto loans, making them a more affordable option for small businesses.

Another option to consider is a commercial auto loan. Commercial auto loans are designed for larger businesses that need to finance the purchase of multiple vehicles. These loans typically have higher interest rates than business vehicle loans, but they also offer more flexibility in terms of the types of vehicles that can be financed.

Business Vehicle Leasing vs. Commercial Vehicle Leasing

Another option for small businesses is to lease their vehicles rather than purchase them. Business vehicle leasing is a popular option for small businesses because it offers lower monthly payments than purchasing a vehicle outright. Additionally, leasing allows small businesses to upgrade their vehicles more frequently, which can be beneficial for businesses that rely on having the latest technology and features.

Commercial vehicle leasing is another option to consider for larger businesses. Commercial vehicle leasing typically requires a larger down payment than business vehicle leasing, but it also offers more flexibility in terms of the types of vehicles that can be leased.

Equipment Financing for Business Vehicles

In addition to financing the purchase or lease of vehicles, small businesses may also need to finance the equipment necessary to operate those vehicles. Equipment financing can be used to purchase items like GPS systems, refrigeration units, and other specialized equipment needed to operate vehicles for your business. Equipment financing for business vehicles is a type of loan that allows small business owners to purchase or lease vehicles for their operations. This type of financing can be used to purchase a single vehicle or an entire fleet of vehicles, and it can be secured or unsecured.

Understanding Equipment Financing for Business Vehicles

When considering equipment financing for business vehicles, it's important to understand the different types of financing available. The two main types of equipment financing are secured and unsecured loans.

Secured loans require collateral, such as the vehicles being purchased, to secure the loan. This can make it easier to obtain financing and can also result in lower interest rates. Unsecured loans, on the other hand, do not require collateral but may have higher interest rates and more stringent eligibility requirements.

Another factor to consider when choosing equipment financing for business vehicles is the repayment terms. Some loans may require a down payment, while others may offer 100% financing. Additionally, repayment terms can range from a few months to several years, depending on the lender and the amount being financed.

Fleet Financing Options for Small Businesses

Fleet financing options for small businesses involve obtaining funding for a fleet of vehicles, typically for the purpose of conducting day-to-day business operations. It is a type of financing that enables small businesses to acquire multiple vehicles at once, rather than financing individual vehicles separately.

Understanding Fleet Financing Options for Small Businesses

When it comes to fleet financing options for small businesses, there are a few different types of financing available. One common option is a lease, which allows businesses to use the vehicles without actually owning them. Leasing can be a cost-effective option for small businesses because it typically requires lower upfront costs and offers lower monthly payments than purchasing.

Another option is a loan, which can be secured or unsecured. A secured loan requires collateral, such as the fleet of vehicles being financed, and may offer lower interest rates than an unsecured loan. An unsecured loan does not require collateral but may have higher interest rates and stricter eligibility requirements.

Small businesses can also explore government-backed financing options, such as the Canada Small Business Financing Program (CSBFP). The CSBFP is a loan program that helps small businesses secure financing to purchase or improve assets, including fleets of vehicles.

Examples of Fleet Financing Options for Small Businesses

Let's consider a few examples to better understand fleet financing options for small businesses:

Qualifying for Automotive Financing

Once you've determined the type of financing that's right for your business, the next step is to qualify for that financing. In order to qualify for automotive financing, you'll need to meet certain requirements.

Credit Scores and Auto Financing for Small Businesses

One of the most important factors that lenders consider when approving automotive financing is your credit score. As a small business owner, your personal credit score will often be used to determine your eligibility for financing. A good credit score is typically considered to be 700 or higher.

If your credit score is lower than 700, you may still be able to qualify for automotive financing, but you may need to pay a higher interest rate or make a larger down payment. In some cases, you may need to work on improving your credit score before you can qualify for financing.

What Lenders Look for in Small Business Auto Loan Applications

In addition to your credit score, lenders will also look at other factors when determining your eligibility for automotive financing. Some of the factors that lenders may consider include:

Business credit score: If your business has been operating for a while, it may have its own credit score. Lenders may consider your business credit score in addition to your personal credit score when evaluating your loan application.

Cash flow: Lenders will want to see that your business has enough cash flow to make the loan payments. If your business has a history of strong cash flow, you may be more likely to be approved for financing.

Collateral: If you're applying for a secured loan, lenders will want to know what type of collateral you're offering to secure the loan. This can include the vehicles that you're purchasing or other assets that your business owns.

Business plan: If you're applying for financing for a startup business, lenders may want to see a detailed business plan that outlines your strategy for success.

Tips for Securing the Best Financing Terms

Once you've determined the type of financing that's right for your business and you've met the eligibility requirements, the next step is to secure the best financing terms possible. Here are some tips to help you do that:

Shop around: Don't accept the first financing offer that you receive. Shop around and compare rates and terms from multiple lenders to ensure that you're getting the best deal possible.

Negotiate: If you're working with a dealership or other type of lender, don't be afraid to negotiate for better terms. You may be able to negotiate a lower interest rate, a longer repayment term, or other favorable terms.

Make a larger down payment: If you're able to make a larger down payment, you may be able to secure a lower interest rate or more favorable loan terms.

Consider working with a broker: A financing broker can help you navigate the complex world of automotive financing and connect you with lenders who offer the best terms for your specific needs.

Conclusion

In conclusion, fleet financing options for small businesses provide a practical solution for companies that require a fleet of vehicles to carry out their day-to-day operations. By understanding the different types of financing available, small businesses can make informed decisions about how to finance their vehicle purchases.

Leasing, secured loans, unsecured loans, and government-backed financing options such as the Canada Small Business Financing Program (CSBFP) are all available to small businesses looking to finance a fleet of vehicles. Each option has its own advantages and disadvantages, depending on the needs and financial situation of the small business.

Fleet financing options can help small businesses acquire the vehicles they need while minimizing the financial burden of purchasing multiple vehicles at once. This is particularly helpful for companies that may not have the capital to finance the purchase of a fleet of vehicles outright.

Overall, with the demand for fleet financing options on the rise in Canada, small businesses can benefit from exploring these options to help grow their operations. By understanding the options available and choosing the right financing solution, small businesses can achieve their goals while minimizing financial risk.

Automotive Financing for Small Business Owners: A Comprehensive Guide

As a small business owner in Canada, you understand how important it is to have reliable transportation for your daily operations. Whether you need a fleet of vehicles for your employees or a single company car, financing your automotive needs can be a challenge. In this comprehensive guide, we will explore the various automotive financing options available for small business owners in Canada, provide tips for securing the best financing terms, and offer advice for startups seeking automotive financing.

Understanding Your Financing Options

As a small business owner, you have a variety of financing options available to you when it comes to purchasing vehicles for your company. It's important to understand the differences between these options in order to choose the one that's right for your business.

Business Vehicle Loans vs. Commercial Auto Loans

One financing option to consider is a business vehicle loan. This type of loan is specifically designed for small businesses and can be used to purchase a single vehicle or a fleet of vehicles. Business vehicle loans typically have lower interest rates than commercial auto loans, making them a more affordable option for small businesses.

Another option to consider is a commercial auto loan. Commercial auto loans are designed for larger businesses that need to finance the purchase of multiple vehicles. These loans typically have higher interest rates than business vehicle loans, but they also offer more flexibility in terms of the types of vehicles that can be financed.

Business Vehicle Leasing vs. Commercial Vehicle Leasing

Another option for small businesses is to lease their vehicles rather than purchase them. Business vehicle leasing is a popular option for small businesses because it offers lower monthly payments than purchasing a vehicle outright. Additionally, leasing allows small businesses to upgrade their vehicles more frequently, which can be beneficial for businesses that rely on having the latest technology and features.

Commercial vehicle leasing is another option to consider for larger businesses. Commercial vehicle leasing typically requires a larger down payment than business vehicle leasing, but it also offers more flexibility in terms of the types of vehicles that can be leased.

Equipment Financing for Business Vehicles

In addition to financing the purchase or lease of vehicles, small businesses may also need to finance the equipment necessary to operate those vehicles. Equipment financing can be used to purchase items like GPS systems, refrigeration units, and other specialized equipment needed to operate vehicles for your business. Equipment financing for business vehicles is a type of loan that allows small business owners to purchase or lease vehicles for their operations. This type of financing can be used to purchase a single vehicle or an entire fleet of vehicles, and it can be secured or unsecured.

Understanding Equipment Financing for Business Vehicles

When considering equipment financing for business vehicles, it's important to understand the different types of financing available. The two main types of equipment financing are secured and unsecured loans.

Secured loans require collateral, such as the vehicles being purchased, to secure the loan. This can make it easier to obtain financing and can also result in lower interest rates. Unsecured loans, on the other hand, do not require collateral but may have higher interest rates and more stringent eligibility requirements.

Another factor to consider when choosing equipment financing for business vehicles is the repayment terms. Some loans may require a down payment, while others may offer 100% financing. Additionally, repayment terms can range from a few months to several years, depending on the lender and the amount being financed.

Fleet Financing Options for Small Businesses

Fleet financing options for small businesses involve obtaining funding for a fleet of vehicles, typically for the purpose of conducting day-to-day business operations. It is a type of financing that enables small businesses to acquire multiple vehicles at once, rather than financing individual vehicles separately.

Understanding Fleet Financing Options for Small Businesses

When it comes to fleet financing options for small businesses, there are a few different types of financing available. One common option is a lease, which allows businesses to use the vehicles without actually owning them. Leasing can be a cost-effective option for small businesses because it typically requires lower upfront costs and offers lower monthly payments than purchasing.

Another option is a loan, which can be secured or unsecured. A secured loan requires collateral, such as the fleet of vehicles being financed, and may offer lower interest rates than an unsecured loan. An unsecured loan does not require collateral but may have higher interest rates and stricter eligibility requirements.

Small businesses can also explore government-backed financing options, such as the Canada Small Business Financing Program (CSBFP). The CSBFP is a loan program that helps small businesses secure financing to purchase or improve assets, including fleets of vehicles.

Examples of Fleet Financing Options for Small Businesses

Let's consider a few examples to better understand fleet financing options for small businesses:

Qualifying for Automotive Financing

Once you've determined the type of financing that's right for your business, the next step is to qualify for that financing. In order to qualify for automotive financing, you'll need to meet certain requirements.

Credit Scores and Auto Financing for Small Businesses

One of the most important factors that lenders consider when approving automotive financing is your credit score. As a small business owner, your personal credit score will often be used to determine your eligibility for financing. A good credit score is typically considered to be 700 or higher.

If your credit score is lower than 700, you may still be able to qualify for automotive financing, but you may need to pay a higher interest rate or make a larger down payment. In some cases, you may need to work on improving your credit score before you can qualify for financing.

What Lenders Look for in Small Business Auto Loan Applications

In addition to your credit score, lenders will also look at other factors when determining your eligibility for automotive financing. Some of the factors that lenders may consider include:

Business credit score: If your business has been operating for a while, it may have its own credit score. Lenders may consider your business credit score in addition to your personal credit score when evaluating your loan application.

Cash flow: Lenders will want to see that your business has enough cash flow to make the loan payments. If your business has a history of strong cash flow, you may be more likely to be approved for financing.

Collateral: If you're applying for a secured loan, lenders will want to know what type of collateral you're offering to secure the loan. This can include the vehicles that you're purchasing or other assets that your business owns.

Business plan: If you're applying for financing for a startup business, lenders may want to see a detailed business plan that outlines your strategy for success.

Tips for Securing the Best Financing Terms

Once you've determined the type of financing that's right for your business and you've met the eligibility requirements, the next step is to secure the best financing terms possible. Here are some tips to help you do that:

Shop around: Don't accept the first financing offer that you receive. Shop around and compare rates and terms from multiple lenders to ensure that you're getting the best deal possible.

Negotiate: If you're working with a dealership or other type of lender, don't be afraid to negotiate for better terms. You may be able to negotiate a lower interest rate, a longer repayment term, or other favorable terms.

Make a larger down payment: If you're able to make a larger down payment, you may be able to secure a lower interest rate or more favorable loan terms.

Consider working with a broker: A financing broker can help you navigate the complex world of automotive financing and connect you with lenders who offer the best terms for your specific needs.

Conclusion

In conclusion, fleet financing options for small businesses provide a practical solution for companies that require a fleet of vehicles to carry out their day-to-day operations. By understanding the different types of financing available, small businesses can make informed decisions about how to finance their vehicle purchases.

Leasing, secured loans, unsecured loans, and government-backed financing options such as the Canada Small Business Financing Program (CSBFP) are all available to small businesses looking to finance a fleet of vehicles. Each option has its own advantages and disadvantages, depending on the needs and financial situation of the small business.

Fleet financing options can help small businesses acquire the vehicles they need while minimizing the financial burden of purchasing multiple vehicles at once. This is particularly helpful for companies that may not have the capital to finance the purchase of a fleet of vehicles outright.

Overall, with the demand for fleet financing options on the rise in Canada, small businesses can benefit from exploring these options to help grow their operations. By understanding the options available and choosing the right financing solution, small businesses can achieve their goals while minimizing financial risk.

#Fleet financing#Small business financing#Business vehicles#Equipment financing#Canada Small Business Financing Program

1 note

·

View note

Text

Denise Hearn and Vass Bednar’s “The Big Fix”

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/05/ted-rogers-is-a-dope/#galen-weston-is-even-worse

The Canadian national identity involves a lot of sneering at the US, but when it comes to oligarchy, Canada makes America look positively amateurish.

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/05/ted-rogers-is-a-dope/#galen-weston-is-even-worse

Canada's monopolists may be big fish in a small pond, but holy moly are they big, compared to the size of that pond. In their new book, The Big Fix: How Companies Capture Markets and Harm Canadians, Denise Hearn and Vass Bednar lay bare the price-gouging, policy-corrupting ripoff machines that run the Great White North:

https://sutherlandhousebooks.com/product/the-big-fix/

From telecoms to groceries to pharmacies to the resource sector, Canada is a playground for a handful of supremely powerful men from dynastic families, who have bought their way to dominance, consuming small businesses by the hundreds and periodically merging with one another.

Hearn and Bednar tell this story and explain all the ways that Canadian firms use their market power to reduce quality, raise prices, abuse workers and starve suppliers, even as they capture the government and the regulators who are supposed to be overseeing them.

The odd thing is that Canada has been in the antitrust game for a long time: Canada passed its first antitrust law in 1889, a year before the USA got around to inaugurating its trustbusting era with the passage of the Sherman Act. But despite this early start, Canada's ultra-rich have successfully used the threat of American corporate juggernauts to defend the idea of Made-in-Canada monopolies, as homegrown King Kongs that will keep the nation safe from Yankee Godzillas.

Canada's Competition Bureau is underfunded and underpowered. In its entire history, the agency has never prevented a merger – not even once. This set the stage for Canada's dominant businesses to become many-tentacled conglomerates, like Canadian Tire, which owns Mark's Work Warehouse, Helly Hansen, SportChek, Nevada Bob's Golf, The Fitness Source, Party City, and, of course, a bank.

A surprising number of Canadian conglomerates end up turning into banks: Loblaw has a bank. So does Rogers. Why do these corrupt, price-gouging companies all go into "financial services?" As Hearn and Bednar explain, owning a bank is the key to financialization, with the company's finances disappearing into a black box that absorbs taxation attempts and liabilities like a black hole eating a solar system.

Of course, the neat packaging up of vast swathes of Canada's economy into these financialized and inscrutable mega-firms makes them awfully convenient acquisition targets for US and offshore private equity firms. When the Competition Bureau (inevitably) fails to block those acquisitions, whole chunks of the Canadian economy disappear into foreign hands.

This is a short book, but it's packed with a lot of easily digested detail about how these scams work: how monopolies use cross-subsidies (when one profitable business is used to prop up an unprofitable business in order to kill potential competitors) and market power to rip Canadians off and screw workers.

But the title of the book is The Big Fix, so it's not all doom and gloom. Hearn and Bednar note that Canadians and their elected reps are getting sick of this shit, and a bill to substantially beefed up Canadian competition law passed Parliament unanimously last year.

This is part of a wave of antitrust fever that's sweeping the world's governments, notably the US under Biden, where antitrust enforcers did more in the past four years than their predecessors accomplished over the previous 40 years.

Hearn and Bednar propose a follow-on agenda for Canadian lawmakers and bureaucrats: they call for a "whole of government" approach to dismantling Canada's monopolies, whereby each ministry would be charged with combing through its enabling legislation to find latent powers that could be mobilized against monopolies, and then using those powers.

The authors freely admit that this is an American import, modeled on Biden's July 2021 Executive Order on monopolies, which set out 72 action items for different parts of the administration, virtually all of which were accomplished:

https://www.eff.org/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

What the authors don't mention is that this plan was actually cooked up by a Canadian: Columbia law professor Tim Wu, who served in the White House as Biden's tech antitrust czar, and who grew up in Toronto (we've known each other since elementary school!).

Wu's plan has been field tested. It worked. It was exciting and effective. There's something weirdly fitting about finding the answer to Canada's monopoly problems coming from America, but only because a Canadian had to go there to find a receptive audience for it.

The Big Fix is a fantastic primer on the uniquely Canadian monopoly problem, a fast read that transcends being a mere economics primer or history lesson. It's a book that will fire you up, make you angry, make you determined, and explain what comes next.

160 notes

·

View notes

Text

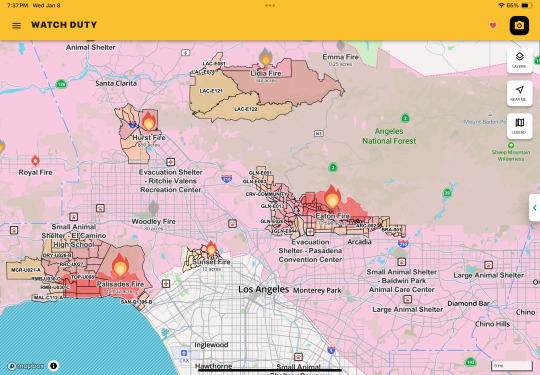

Hello Tumblr friends, from Southern California.

I am fine, I’m on the far right of this map, out of danger of the current fires, close enough to see their smoke plumes across the basin and I should probably wear a mask if I go out because the smoke is just hanging over us all now. There is dirt and fine ash that will need to be swept up, probably tomorrow. We have another wind event predicted for Monday and Tuesday, but probably not as fierce as the one on Tuesday. Oh, this screenshot is a day old, the acreage is out of date now.

This is one photo of one area of Pacific Palisades. This does not look like a war zone or any other thing you might compare it to, it looks exactly like a fast moving wildfire fed by 80 - 100 mile an hour winds ripping through vegetation that hasn’t seen a drop of rain since April, or maybe it was March, and it grew thick in ‘22 and ‘23 when we did get rain. I have lived somewhere in California, north or south, since I was four. We always get wildfires in October, until the rain comes in December or January, but they have been made exponentially worse because of climate change. Do not listen to tin hats and tangerine guy cultists who will try to blame everything and everyone under the sun, they don’t live here, they don’t know what we deal with. This is climate change. Repeat ad nauseam.

You may have heard about the celebrities that have lost their homes, but I promise you they are probably only 1% of the population that is suffering. The majority of the homes lost in Pacific Palisades and Altadena belonged to middle class families and the elderly who bought them decades ago. They were passed down to adult children instead of being sold, they were kept in families who could not afford to enter the market at current prices. Many small business owners have also lost their livelihoods, restaurants, salons, shops, etc, and they may not be able to relocate or rebuild. The early estimate is more than 5000 structures have been lost, that includes schools, churches, grocery stores, private museums, and other types of places that help build communities and connect people.

If you are someone who thinks “ha ha LA deserves it” for some reason, first, fuck you, and second, if you really believe that, then stop consuming our products, including Disney, Netflix, and network TV, anything filmed here, any game developed here, anything written here, anything financed here, anything grown here, etc, etc.

So far, I am personally adjacent to a few people that I know have lost their homes: the man who designed and handmade a few pieces of jewelry that I own including the teapot and tea cup necklace you may have seen me wear if we’ve ever met in person, and the woman whose workouts I used to subscribe to years ago. I’ve met Mandy Moore a few times in the past, I’m quite fond of her, and like many, I followed along as she remodeled her home before moving in to it. She’ll be fine, her home is mostly intact, but I feel for her husband losing his studio and the instruments he had collected throughout his life.

Before you reply to this post, please look around your home and imagine it gone, except for a backpack that you were able to fill before you ran out. Imagine your neighborhood gone, your community gone, your friends and neighbors scattered all over the region seeking out shelter and assistance. Please spare a thought for those who have lost everything in Los Angeles, North Carolina, Florida, etc, because we are all in this together and it isn’t a natural disaster competition. I know there are places all over the world suffering, this is all I have the capacity for right now. I am bracing for more to come next week.

Thank you for making it this far. Please reblog or reply with compassion. Take your BS elsewhere. Thank you.

Edit to add: special thanks to Canada and Mexico, two sovereign nations, for sending firefighters and Super scooper planes.

13 notes

·

View notes

Text

complaining/ self-indulgent misery about the job market/ economy/ how much life sucks these days if you’re disabled, especially in canada under the cut

no longer doing sex work because i hit a point of extreme burnout on it circa 2019/2020 has meant losing… just so much income

and like. the only thing scarier than what that burnout meant for my finances is that now i’m at a point of just emotionally not having the bandwidth for a remote job any more (working on the computer: i do bookkeeping, medical billing, run a remote office (medical), and some freelance graphic and web design and social media support for small businesses (mostly non-doctor health clinics and registered clinical counsellors, by referral)

but like. i’m so tired of working alone. i want to work around people again but my disability/ pinched nerve & muscle weakness stuff definitely means i don’t have the capacity to do manual labour again or even just like… a coffee shop or cook job (RIP—food & bev service is what i did pre-pro domme stuff. and i loved it)

like, uh, what does anyone do to make money these days????

i’m tired of being broke/ poor. i’m tired of relying on the goodwill of family for housing (even if i know i’m so very lucky to have the option—the goodwill comes with strings attached). i’m tired of not having extended health care, so i have to decide between things like medication vs. food and transport

i’m physically not able to do any kind of heavy lifting or a job where i stand all day. most customer service jobs won’t hire you if you have a physical disability (ask me how i know)

like i am GREAT at customer service. but i just need to be able to sit periodically and can’t always lift 50lbs (an application requirement at most jobs). on a good day i can lift 150lbs or more. on a bad day? I can’t even lift 10lbs

i am so good with people and v good at selling things—i just need to be allowed to sit sometimes (and i live in a capitalist hellscape (canada) where you cannot sit if you work in a shop. because corporations and even small business owners are stupid as fuck and don’t understand how productivity works)

there’s no way i have it in me (emotionally, physically) to go back to the labour of sex work (the emotional labour of online, or the emotional AND physical labour of in-person)

and i don’t have a degree. turns out completing somewhere between 2/3rds to 3/4ths of a BA before dropping out due to chronic pain & a deeply ableist and inaccessible university culture does NOT give you anything to show for it

life and livelihood just feels increasingly untenable and having an entire ‘career’ that is just… multiple ‘side’ hustles that make me increasingly less money (thanks, fiverr, big tech, and AI for completely devaluing my labour and expertise by saturating the market with undervalued/ underpaid or free options that will do the only work i’m capable of for pennies. yay!)

i’m so goddamn tired. and i’m scared of staying alive in a world that is so fucking unforgiving when you are disabled & broke

the irony is that for the first time ever i am no longer suicidal. and honestly? that’s WORSE than when i was. before i could at least tell myself “well if this becomes unbearable, i can always die”

but now things feel unbearable AND death doesn’t seem appealing at all

people will say shit like “tired of being broke/ poor? just get a job”

but like. WHERE? get a job HOW?

I live in a small-er town. there are no jobs

and no one wants to hire you if you’re a fucking cripple

“no one wants to work” NO. WRONG. it’s just that no one wants to pay a living wage to so-called “unskilled” workers and they especially do not want to pay a living wage to disabled people

“go on disability” disability wouldn’t even cover the cost of my medications, let alone food. and I make enough money from freelancing (like $1000/month) that I wouldn’t even qualify for full disability. the one thing disability would give me is money to pay family for the housing they let me have at like $2400 less than the market rate (because a 300sqft above-garage apartment like mine rents for about $2800/ month where I live)

i’m already on the “fair” (sic) pharmacare plan (for low income people) in my province. it doesn’t cover dental (my mouth is KILLING me. I have a toothache 24/7 and there is NOTHING i can do about it without ~$600, which i do not have to spare)

I can’t currently go get my diabetes medication because until I reach my annual deductible ($500), my meds will cost $300/ monthly—which i currently just don’t have, until i wrap up a contract job I’m currently working on and get paid

i just…. Fuck. Fuck fuck fuck. I hate it here

and because it’s canada we don’t even have options like venmo or cashapp or whatever to ask friends for money—that’s an american only thing

even if i did? I wouldn’t feel all that comfortable doing so. everyone I know is just as bad off if not worse. i’m not taking money from anyone else living hand to mouth like I am

especially not because if i was willing to eat my pride and ask for more support from my parents they’d try to give it, if begrudgingly/ with shaming attached

i just… wish i lived in a country with an actual fucking safety net

we hear all the time about how good we have it in canada. but I’m sick of needing to drive three hours just to see a family doctor/ PCP/ general practitioner

sick of living in a small town where there is no fucking lab that does bloodwork outside of the hospital lab which is overrun and overtaxed because most of the labs are privately owned and it just… isn’t profitable to offer lab work in a smaller rural town ????? as if profit is more important than making sure people can get diagnostic tests in a timely manner?????

“oh at least you have healthcare!” what fucking healthcare? the bus between here and the city costs $30 round trip. there’s no public transit between here and there and the private coach company charges a lot. there are almost no specialists (gyne, endocrinologists, etc) in town because, again, it’s not cost-effective to have them in a small town and we’re only a 1.5 hour drive from the city

“everyone can afford a car, right?” NO. gas costs fucking $1.89/ L right now at the pump and insurance is like… $400 a month. my car doesn’t have winter fucking tires and while they do have Mud & Snow all seasons, the snow is two feet high outside and those tires are 5 years old. i am not taking the highway on them—plus i need a jump start probably after the cold snap

and even if i was gonna drive down to the city to see a doctor all they’d do is prescribe me more medicine that my “fair” pharmacare plan might or might not cover (if it isn’t the first line treatment then it costs $$$)

i hate it here. i hate this country so fucking much with its “at least we’re not the usa” bullshit. canadian exceptionalism is just “we’re better than america”

get the fuck out of here with that

the healthcare system fucking sucks actually. minimal medication coverage, no access to psychotherapeutic care that isn’t just… the worst and most ineffectual group cbt you can possibly imagine, no dental (well, dental in a year or so—thus far state-funded dental coverage has only been rolled out to senior citizens and children of low-income families. not low-income adults)

if you don’t live in vancouver, toronto, or montreal or the immediate metro areas of those cities the transit is a fucking joke

cost of living is insanely high in smaller towns

cost of rent is… also a nightmare

like… all of our taxpayer dollars just go to the police/ the rcmp

so many of the roads in my town are not paved or filled with potholes but if there’s a protest downtown sometimes there’s a cop to protester ratio of 1:5. why do we need a police force with hundreds of Mounties, each with their own massive police truck, for a town with 22 thousand people and virtually no crime????

public university costs less than the usa i guess. if you can get in

oh, you got into one of the handful of public unis? well congrats. hope you’re not disabled and that you don’t want any accommodations beyond an extra hour on tests and being able to withdraw late in the semester from courses (with a W on your transcript so everyone knows that even though you didn’t *technically* fail that course, you *are* a quitter. oh, the private colleges will expunge the course entirely with a doctors note after a late withdrawal? too bad you’re disabled AND too poor for college!)

and culturally just like… fuck. it is so goddamn lonely here. Canadians are nice but they sure aren’t kind

everyone’s out for themselves. there’s no community, unless you want to join a church and then there’s just… abusive cult-y community

i’m so fucking tired

i’m so tired

and i want a job, i guess. because i’m literally not going to survive without one

but idk how to find one that isn’t actively making me depressed, stressed, and so lonely and isolated that I want to break down sobbing at the end of each day

like what the fuck, actually

this is the bad place (for real for real)

but what kills me is it doesn’t have to be. like it is actually possible to have a functional healthcare system, to cover dental and medications for patients

to cover psychotherapy

it’s possible to actually support pwd, too. and not with just a pittance that ensures they will always be hungry and on the brink of losing their housing (of course that would make it really hard to convince us to kill ourselves via MAiD, but canada would rather pay for disabled suicide than pay for disabled people to eat food and wear clothes and have a roof over their head! neat! yay! eugenics!)

it’s possible to have mutual aid and a culture where people genuinely care for each other

it’s just that white people and the wealthy/ powerful have no compassion or solidarity with others and settler colonial nation states despise basic human decency

i’m so sick of kindness and food being luxury goods

so fucking sick of housing being treated like an investment before it’s treated like a human right

and i’m so sick of the fact that any taxes in this country just… line the pockets of corporations or pay the salary of cops who brutalize the public

our grocery stores are pretty much all owned and run by three companies that have a de-facto monopoly and a long history of price fixing and price gouging—the government did a whole big inquiry into it and then just wrapped it up with a “well you should fix that, we guess” no fines. no new legislation. no response.

rampant corruption is just… what canada is. what it’s always been

and watching the land die around me because of negligence and active hatred of nature is also so goddamn depressing. seeing how low the creek is this January. how dry and brown the evergreens are even in winter. watching the sky turn orange in the summer with forest fire haze and the grass dry to a crisp and the leaves on the trees get coated with mildew because they’re weak due to lack of nutrients and moisture in the soil

smelling the humus in the forests dry up

hearing that the local golf club owner shot a bear because it kept wandering onto the course

i’m so tired of the complete disregard settlers have for the land and its creatures. it’s their land, more than it is ours

one of the major climate activists in my province was just deported on bullshit justifications that he had “disturbed the peace” at a protest by resisting a cop that was being excessively violent when he cuffed him (an instinctive response, to “fight back” by struggling when a cop is fucking putting their whole weight on your back and hitting you) and that meant his visa was revokable

i just. it’s so important to have hope

but this is such a goddamn hopeless country

they keep us so small here. i feel so so small today

I don’t even want to think about what is going to happen with the election this year (fuck pierre polievre and fuck the Liberals who have just… destroyed this country utterly and are now proposing austerity as a “fix” for an economy they broke)

i REALLY don’t want to think about the trade war trump & the republicans/ the US just launched and what that will mean for the cost of living, especially groceries

i just want to go to sleep and never wake up (unless i wake up in a better world, or at the very least one in which i’m employable and have enough money to afford basic “luxuries” like food and housing and medication and keeping the heat on, and maybe, idk, a bit of fun every now and again that isn’t just pirated media consumption)

2 notes

·

View notes

Text

Can I Start a Soap Packaging Business from Home in Canada?

Starting a soap packaging business from home in Canada is not only feasible but also a potentially lucrative venture. With the rise in the popularity of artisanal and small-batch soaps, the demand for unique, high-quality packaging is growing. If you're considering diving into this industry, here's a comprehensive guide to help you navigate the process.

1. Understanding the Market

Before launching your soap packaging business, it's crucial to research the market. Identify the types of soap products you want to cater to—whether it's handmade artisanal soaps, organic soaps, or luxury bath products. Understand the packaging needs of these different types of soaps and the preferences of your target customers. This will help you tailor your offerings and stand out in a competitive market.

2. Legal and Regulatory Requirements

Starting a home-based business in Canada requires adherence to several legal and regulatory standards. Here are some key steps:

Business Registration: Register your business name with your provincial or territorial government. You may also need to register for a GST/HST number if your revenue exceeds the threshold for small suppliers.

Home-Based Business Regulations: Check local zoning laws and homeowners' association rules to ensure you can legally operate a business from your home.

Health and Safety Compliance: Ensure that your packaging materials comply with Canadian regulations for health and safety. For instance, if you plan to use materials that come into direct contact with soap, ensure they are safe and non-toxic.

3. Setting Up Your Home Workspace

Creating an efficient workspace is crucial for a successful packaging business. Designate a specific area in your home for packaging activities. This space should be clean, organized, and suitable for the tasks you'll perform, such as cutting, folding, and assembling packaging materials.

Invest in essential tools and equipment like cutting machines, label printers, and sealing devices. Ensure your workspace adheres to health and safety standards to prevent contamination and ensure product quality.

4. Sourcing Packaging Materials

The quality of your packaging materials is critical. Source high-quality, eco-friendly materials to appeal to environmentally-conscious customers. Consider various options like biodegradable wrappers, recyclable boxes, and attractive labels. Establish relationships with reliable suppliers to ensure you get the best materials at competitive prices.

5. Developing Your Brand

Branding is key to differentiating your packaging business from competitors. Develop a unique brand identity that reflects the quality and style of your packaging. Create a memorable logo, design eye-catching packaging, and build a cohesive brand image that resonates with your target market.

6. Marketing and Sales

Effective marketing strategies are essential for attracting clients to your packaging business. Leverage digital marketing platforms such as social media, email campaigns, and a professional website to showcase your packaging designs. Participate in local trade shows, craft fairs, and networking events to connect with potential clients in the soap industry.

Offer samples to soap manufacturers and retailers to demonstrate the quality and appeal of your packaging. Building strong relationships with your clients can lead to repeat business and referrals.

7. Financial Management

Proper financial management is crucial for the sustainability of your business. Keep track of all expenses, including materials, equipment, and marketing costs. Set competitive prices for your packaging solutions while ensuring they cover costs and provide a profit margin. Consider using accounting software or hiring a financial advisor to manage your finances effectively.

8. Scaling Your Business

As your business grows, you may consider scaling up operations. This could involve expanding your product line, investing in advanced packaging machinery, or hiring additional staff. Continuously assess market trends and customer feedback to adapt and improve your offerings.

Conclusion

Starting a soap packaging business from home in Canada is a viable and rewarding opportunity for entrepreneurs with a passion for design and a keen eye for detail. By understanding the market, adhering to regulations, and focusing on quality and branding, you can build a successful business that meets the needs of soap makers and appeals to consumers. With careful planning and strategic execution, your home-based packaging business can thrive in the dynamic Canadian market.

3 notes

·

View notes

Text

Unlocking Opportunities: A Guide to Small Business Financing in Canada

Starting or expanding a small business in Canada requires not just vision and strategy but also financial resources. For entrepreneurs and small business owners, understanding the various financing options is crucial. This guide delves into the essentials of Canada small business financing, business financing in Canada, Canadian small business loans, and small business finance options, helping you navigate the financial landscape.

Why Small Business Financing Matters

Canada's small businesses form the backbone of its economy, accounting for nearly 98% of all businesses. Financing is a critical component of their success, enabling entrepreneurs to purchase equipment, hire staff, market their services, or manage cash flow during lean times. However, finding the right financial support can often be challenging.

Canada Small Business Financing Program (CSBFP)

The Canada Small Business Financing Program (CSBFP), a government-backed initiative, is designed to assist small businesses in obtaining loans from financial institutions. Key features include:

Loan Amount: Up to $1,000,000 for eligible businesses, with $350,000 available for leasehold improvements or equipment.

Eligibility: Small businesses with annual gross revenues of $10 million or less.

Usage: Funds can be used for purchasing equipment, improving leased property, or financing commercial property.

This program reduces risk for lenders, making it easier for small businesses to access financing.

Types of Business Financing in Canada

Term LoansTerm loans are one of the most common types of business financing in Canada. They provide a lump sum upfront, which is repaid over time with interest. These loans are ideal for funding large projects or purchasing equipment.

Line of CreditA line of credit offers flexibility, allowing businesses to withdraw funds as needed up to a predetermined limit. It’s a great solution for managing cash flow and covering short-term expenses.

Equipment FinancingIf your business requires specialized machinery or technology, equipment financing can help. Loans or leases specifically for equipment acquisition ensure your business has the tools it needs to thrive.

Invoice FinancingFor businesses facing delayed payments from clients, invoice financing provides immediate cash based on unpaid invoices, improving liquidity without waiting for customer payments.

Benefits of Canadian Small Business Loans

Accessing a Canadian small business loan can offer the following benefits:

Affordable Interest Rates: Canadian lenders often offer competitive interest rates for small business loans.

Customizable Terms: Loans can be tailored to meet specific business needs, whether for expansion, operations, or asset acquisition.

Credit Building: Successfully repaying a business loan improves your credit score, enhancing future borrowing opportunities.

How to Apply for Small Business Financing in Canada

Securing the right financing requires preparation. Here’s a step-by-step guide:

Assess Your Needs: Identify how much funding you need and the purpose. Be clear about whether the financing is for operations, equipment, or growth.

Create a Business Plan: A solid business plan demonstrates your goals, revenue projections, and repayment strategy.

Check Eligibility: Different lenders have varying eligibility criteria. Ensure your business qualifies before applying.

Gather Documentation: Commonly required documents include financial statements, tax returns, and proof of business registration.

Compare Lenders: Research financial institutions, including banks, credit unions, and alternative lenders, to find the best terms.

Top Lenders for Small Business Finance in Canada

Banks and Credit Unions: Major banks like RBC, TD, and BMO, as well as local credit unions, offer a range of small business loan products.

Government-Backed Programs: In addition to the CSBFP, regional development agencies provide grants and loans to small businesses.

Online Lenders: Companies like Clearco and OnDeck provide fast, flexible financing solutions tailored to small businesses.

Tips for Successful Financing

Maintain Good Credit: A strong credit score improves your chances of loan approval and better interest rates.

Keep Financial Records Updated: Accurate records demonstrate financial stability and build lender confidence.

Leverage Government Programs: Explore grants and subsidies available for your industry or location.

Conclusion

For Canadian entrepreneurs, accessing the right small business finance can be a game-changer. Whether through government-backed loans, bank financing, or alternative lenders, there are diverse options to support your business's unique needs. By understanding the opportunities available and preparing thoroughly, you can secure the financing needed to turn your business dreams into reality.

1 note

·

View note

Text

Ladies please share this with any women you know starting their own business or non-profit

Business grants for women can help you grow your business for free, as opposed to small-business loans or other types of debt-based funding that you must pay back. But competition for small-business grants is fierce, and it takes considerable time and effort to win them.

If you’re up for the challenge, though, grants can be a great way to fund your new or existing business. Here are 18 places women entrepreneurs can look for small-business grants and other free financial resources.

Private small-business grants for women

Some private corporations and organizations offer business grants for women. Here are six to consider:

1. Amber Grant

Every month, WomensNet awards a $10,000 Amber Grant to a woman-owned business in a specific, rotating category. The categories for 2023 are as follows:

January: Skilled trades

February: Health & fitness

March: Food & beverage

April: Sustainability

May: Mental & emotional support

June: Business support service

July: Animal services

August: Hair care & skincare

September: Education & child care

October: Creative arts

November: Technology

December: Fashion & interior designers

On top of that, the organization awards a second $10,000 monthly grant to a woman-owned business and a quarterly $10,000 grant to one startup and one nonprofit.

At the end of each year, two of the 12 general grant winners and one of the industry-specific grant winners are awarded an additional $25,000.

The application is relatively simple: Explain your business, describe what you’d do with the grant money and pay a $15 application fee. The foundation’s advisory board chooses the winners, looking for women with passion and a good story. Businesses operating in the U.S. and Canada are eligible.

Because there’s no time in business requirement, companies seeking startup business grants for women may want to prioritize the Amber Grant.

2. IFundWomen Universal Grant Application Database

IFundWomen is a grant marketplace that specializes in funding and coaching for women-owned businesses. You can submit one application and when IFundWomen adds a grant from an enterprise partner, it will match the partner’s grant criteria to applications within the database.

If your business is a match, you’ll receive a notification and invitation to apply. Previous grant partners have included companies like Visa, Neutrogena and American Express.

3. SoGal Black Founder Startup Grant

The SoGal Foundation — along with company sponsors like Bluemercury, Twilio and others — offer startup grants to businesses owned by Black women or Black nonbinary entrepreneurs. Grants are available in amounts of either $5,000 or $10,000.

Awardees also receive fundraising advice, with a focus on investor financing, and lifetime access to the SoGal Foundation team. Applications are accepted on a rolling basis, so you can apply on the SoGal website at any time.

4. Fearless Strivers Grant Contest

The Fearless Fund, in collaboration with Mastercard, offers $20,000 grants to businesses owned by Black women through the Fearless Strivers Grant Contest. The winners also receive digital tools to help them get and sustain their businesses online and one-on-one mentorship with a Mastercard small-business mentor.

The Fearless Fund runs a national grant program, as well as city-specific grant contests in Atlanta; Birmingham, Alabama; Dayton, Ohio; Los Angeles; New Orleans; New York City; and St. Louis. To qualify for this small-business grant, you must have a U.S.-based business, 50 or fewer employees and have made $3 million or less in annual revenue in the past year.

» MORE: Best business grants for Black women entrepreneurs

5. Cartier Women's Initiative Awards

Every year, Cartier awards three grants to women-owned businesses in nine different regions around the world. The Cartier Women’s Initiative Awards program is designed to support early-stage businesses that are focused on a range of social, economic and environmental development issues.

The first-place business is awarded a $100,000 grant, second place receives $60,000 and third place gets $30,000. Winners also receive executive coaching and the opportunity to participate in a variety of training workshops.

6. Comcast RISE

Comcast awards $10,000 grants to businesses owned by women and people of color several times per year. Each Comcast RISE Investment Fund application cycle is open to entrepreneurs in specific target cities. You can also apply for “marketing services and tech makeovers,” which don’t include cash prizes but can still help your business grow.

7. High Five Grant for Moms

The Mama Ladder organization — along with co-hosts Proof, Belly Bandit and Caden Concepts — offer an annual small-business grant specifically for moms. This grant, called the High Five Grant, is designed to support women caregivers with child(ren) of all ages, including first-time expecting moms, stepmoms and foster moms.

Entrepreneurs can submit an application online and share the story behind their business on social media. Finalists will be chosen by a panel of judges and then a public vote will determine the top three winners. The top business will receive a $25,000 grant, the runner up will receive a $10,000 grant and the third place finalist will receive $5,000.

Additional private business grant options

Although these options aren’t specifically for women, they’re good small-business grants to consider for any entrepreneur.

8. FedEx Small Business Grant

FedEx awards up to $30,000 apiece to 10 small businesses annually. One veteran-owned business from among those 10 winners can receive an additional $20,000 from USAA Small Business Insurance. Winners also receive money to use toward FedEx Office print and business services.

The application requires an explanation of your business, how you’d use the money, photos of your business and — this part is optional — a short video explaining your business. To be eligible, you must operate a for-profit business with fewer than 99 employees and at least six months of operating history.

9. National Association for the Self-Employed Growth Grant

Every quarter, the NASE awards up to $4,000 to up to four small businesses via its growth grants. These funds can be used for a variety of business needs, including marketing, advertising and hiring employees.

To apply for this grant, you must be a NASE member in good standing for at least three months. Annual members can apply at any time.

10. Halstead Grant

The Halstead Grant is an annual award for entrepreneurs looking to break into the silver jewelry industry. The winner receives a $7,500 startup grant, as well as $1,000 in jewelry merchandise. Five finalists and semi-finalists also receive $250 or $500 and help with promoting their businesses.

Both men and women-owned businesses are eligible for this small-business grant. To apply, you must answer 15 business-related questions and submit a design portfolio. Applications are due August 1 each year.

11. Fast Break for Small Businesses

These $10,000 grants — funded by LegalZoom, the NBA, WNBA and NBA G League and managed by the Accion Opportunity Fund — are available twice a year. Winners also receive LegalZoom services worth up to $500. You can sign up on LegalZoom’s website to be notified when applications open.

Federal small-business grants for women

Some federal government grants for small-business owners are designated for specific purposes, such as research and development projects, or for businesses in rural areas. Government grants typically can’t be used for startup costs or day-to-day expenses.

12. Grants.gov

Grants.gov is a database of federally sponsored grants, including grants for small businesses. Although these grants are not exclusive to women-owned businesses, this database is a great place to start if you’re looking for free financing.

To apply, you must obtain a Unique Entity ID for your business (a 12-character alphanumeric identification number), register to do business with the U.S. government through its System for Award Management website and create an account at Grants.gov.