#What is Liquid Restaking What is Liquid Restaking in Blockchain

Explore tagged Tumblr posts

Text

2024 Guide to Liquid Restaking: Everything Beginners Should Know

The advent of liquid restaking is significantly altering the dynamics of the DeFi ecosystem by allowing stakers to reallocate their assets across multiple protocols without the need to un-stake. This innovative approach enhances both liquidity and flexibility, enabling users to maximize their staking rewards by participating in several staking opportunities simultaneously. By diversifying staking activities, liquid restaking mitigates risks associated with exposure to a single protocol and enhances overall security. It also improves liquidity, making it easier for users to trade and transfer their restaked assets, a flexibility not afforded by traditional staking methods.

Liquid restaking's seamless integration with DeFi platforms facilitates the use of staked assets in various financial products, thereby opening up a plethora of innovative use cases, such as collateralized lending and synthetic asset creation. This integration supports the decentralization ethos of blockchain technology by allowing more participants to engage in staking without the constraints of locked assets. As the DeFi sector continues to evolve, liquid restaking is poised to become a foundational component, driving greater innovation and user participation.

EigenLayer exemplifies the benefits of liquid restaking by enabling users to maximize their staking rewards while securing multiple blockchains. This approach not only enhances capital efficiency but also fosters new opportunities within the DeFi space.

For those looking to leverage these advantages, Intellisync provides advanced liquid restaking solutions, ensuring your assets remain accessible and continuously productive. Join the Intellisync revolution today and optimize Learn more....

#Benefits of Liquid Restaking#Benefits of Liquid Restaking for Beginners#Blockchain Development Solution Intelisync#Future of Liquid Restaking#How can liquid restaking improve my staking yields#How does liquid restaking enhance liquidity in the DeFi ecosystem?#Intelisync Blockchain solution#Intelisync defi Liquid Restaking#Liquid Restaking#Risks Liquid Restaking#Risks in 2024 Liquid Restaking#Trends 2024 Liquid Restaking vs Traditional Staking#Unlock the Future of DeFi with InteliSync#What are AVS(Actively Validated Services)#What are the risks associated with liquid restaking?#What future potential does liquid restaking hold for DeFi participants?#What is EigenLayer#What is Liquid Restaking What is Liquid Restaking in Blockchain#Intelisync Blockchain Development Services#Intelisync Web3 Marketing Service#Web3 Marketing Solution#blockchain development companies#web3 development#metaverse development company#blockchain development services#metaverse game development#web 3.0 marketing#crypto app development#cryptocurrency development companies#build a blockchain and a cryptocurrency from scratch.

0 notes

Text

Understanding Crypto Farming on STON.fi: A Straightforward Guide for Everyone

When I first heard about crypto farming, it felt like trying to understand a foreign language. I thought, “Is this really worth my time?” But once I got the hang of it, I realized it’s one of the simplest ways to grow your crypto assets over time.

This isn’t another complex explanation; this is me sharing what I’ve learned about farming, farm pools, and why STON.fi is a game-changer. By the end of this, you’ll see that farming is not as complicated as it sounds.

What Is Crypto Farming? A Simple Explanation

Imagine you have some spare money. You could keep it in your wallet where it earns nothing, or you could put it in a bank that uses it to make loans and pays you interest in return. Crypto farming works on the same principle, but instead of a bank, you’re using a decentralized exchange (DEX).

In farming, you provide liquidity to a pool (basically, a pot of funds that helps facilitate trading on a platform). In return, you earn rewards in the form of tokens. It’s like planting seeds in a garden. Over time, those seeds grow into crops, and you get to harvest the rewards.

What Are Farm Pools, and Why Should You Care?

Farm pools are where the magic happens. These are specific liquidity pools on a DEX where you can “deposit” pairs of tokens. Think of it like joining forces with others to run a small business—you contribute resources (your tokens), and in return, you get a share of the profits (rewards).

For example, if a trading pair like TON/uTON is in demand, and you provide liquidity for it, you’ll earn rewards when traders use your tokens for transactions. It’s a win-win: the platform gets liquidity, and you get compensated for your contribution.

Why Farming on STON.fi Is Worth Your Attention

STON.fi makes farming accessible for everyone, whether you’re a seasoned trader or just starting out. It’s a platform that doesn’t drown you in complicated jargon. Instead, it lays everything out clearly—what rewards you can expect, how long you need to commit, and what risks are involved.

Here’s why I think STON.fi stands out:

1. Transparent Information: You know exactly what you’re getting into, from rewards to lock-up periods.

2. Flexible Options: There’s a range of farm pools to suit different goals and risk levels.

3. Ecosystem Support: By farming on STON.fi, you’re supporting the TON blockchain, an innovative ecosystem in the crypto space.

Current Farming Opportunities on STON.fi

Let’s look at the farming pools available on STON.fi right now. Each pool is tailored for different types of users, so you can choose the one that fits your goals:

1. JETTON/USDt V2 Extended

Rewards: 22,500 JETTON (~$6,000)

Farming Period: Until December 30

Lock-Up: 15 days

This pool is linked to JetTon Games, a GameFi ecosystem on the TON Blockchain. It’s like supporting the future of gaming while earning rewards.

2. hTON/TON V2

Rewards: 30,866 HPO (~$777)

Farming Period: Until December 24

Lock-Up: None

This one feels like a flexible savings account. You provide liquidity, earn rewards, and can withdraw anytime.

3. HPO/hTON V2

Rewards: 61,733 HPO (~$1,600)

Farming Period: Until December 24

Lock-Up: None

If you’re looking for high rewards without locking up your tokens, this pool is a great choice.

4. TON/uTON

Rewards: 411 STON + 345 uTON (~$3,700)

Farming Period: Until January 16

Lock-Up: None

This pool connects to Utonic, a platform offering staking and restaking options. It’s like earning cashback while contributing to a robust financial system.

Lessons I’ve Learned While Farming on STON.fi

When I started farming, I treated it like an experiment. I began small—just enough to get my feet wet. Over time, I started noticing how rewards trickled in, much like planting a tree and watching the first few leaves grow.

Here’s what I’ve realized:

Patience Pays Off: Farming isn’t a quick 1.money-making scheme. It’s a steady, long-term strategy.

Understand What You’re Committing To: Always check the lock-up periods and rewards before diving in.

2.Diversify Your Pools: Just like in traditional finance, spreading your investments across multiple pools helps reduce risk.

STON.fi made this process easy for me. The platform feels intuitive, and I didn’t feel overwhelmed even as a beginner.

How to Make Farming Work for You

If you’re new to farming, here are some practical tips to keep in mind:

1. Start Small: Don’t throw all your assets into one pool. Test the waters first.

2. Stay Informed: Farming pools and their rewards change over time. Stay updated to take advantage of new opportunities.

3. Think Long-Term: Farming is like planting an orchard, not picking wild berries. The real rewards come with time.

Why Crypto Farming Matters

At its core, farming is about creating value in a decentralized financial system. By participating in farm pools, you’re not just earning passive income—you’re contributing to a system that empowers users and reduces reliance on traditional banks.

Imagine this: instead of your money sitting idle in a bank, it’s out there working for you, generating rewards and supporting the growth of innovative blockchain ecosystems like TON. That’s what farming offers—a chance to be part of something bigger while securing your financial future.

Final Thoughts: Farming with Confidence

Crypto farming on STON.fi is one of the most straightforward ways to dip your toes into decentralized finance. Whether you’re here to earn passive income or support a growing ecosystem, farming offers a rewarding experience.

The best part? It’s accessible to everyone, no matter your level of expertise. So, if you’ve been hesitating, now’s the time to explore. Start small, stay informed, and enjoy the journey of growing your crypto assets.

Remember, farming isn’t just about the rewards—it’s about being part of a financial revolution that puts control back in your hands. Happy farming!

5 notes

·

View notes

Text

XBANKING (XB): Transforming Passive Earnings in DeFi

In the fast-paced world of decentralized finance (DeFi), XBANKING (XB) stands out by implementing a revenue sharing approach that resembles traditional stock dividends, enhanced by blockchain’s transparency and adaptability.

This forward-thinking model positions XB as an appealing choice for investors aiming for reliable, long-term passive income within Web3.

Structured to provide steady returns, XB redefines DeFi tokens, offering a model akin to dividend stocks but with amplified growth potential.

An Innovative Dividend Model in DeFi.

XB token holders benefit from a revenue-sharing structure that allocates a portion of XBANKING’s earnings to the community, creating a valuable earnings stream directly tied to the platform’s success.

Unlike conventional DeFi platforms, where profits remain internal, XBANKING distributes earnings proportionally to token holders.

This approach not only builds loyalty but fosters a decentralized, community-centric environment.

By calculating dividends based on each holder’s share of the circulating supply, XB offers a consistent, transparent way for investors to earn without giving up control of their assets.

Multiple Earnings Avenues for XB HoldersIn addition to dividends, XBANKING provides extra incentives that attract a broad spectrum of DeFi participants.

XB holders enjoy various perks, such as airdrops, NFT distributions, and staking bonuses with a competitive 16% APR.

This layered rewards approach distinguishes XB from standard staking options, offering diverse income sources that can accumulate over time.

This reward variety makes XBANKING an adaptable choice for those looking to optimize their returns in the DeFi sector.

Empowering the Community through Participation and Early AccessXBANKING values community involvement by granting governance rights to XB token holders.

This enables the community to contribute to major platform decisions, fostering a sense of ownership and alignment with the project’s long-term objectives.

Additionally, XB holders receive early access to new products, giving dedicated members an advantage in navigating market trends. These features create a loyal, informed community that actively influences the platform’s direction.

Increased Growth Potential through CompoundingA key feature of XBANKING is its focus on compounding growth, where earnings can be reinvested to acquire additional XB tokens over time.

This compounding effect boosts both token holdings and future returns for users.

As XBANKING expands, the value of the XB token is also expected to rise, enabling holders to benefit from both capital gains and revenue sharing distributions.

This combination positions XB as a promising asset with a balance of passive income and long term growth prospects.

Promoting Stability through Liquidity CommitmentsXB token holders are required to join the XBANKING liquidity pool for a minimum of 30 days, which helps maintain a stable ecosystem and curbs market fluctuations.

This liquidity requirement aligns the community’s interests with the platform’s enduring stability and progress.

By encouraging consistent liquidity, XBANKING is able to deliver ongoing rewards, supporting its vision of offering reliable, revenue-sharing returns in DeFi.In summary, XBANKING (XB) elevates DeFi tokens beyond traditional formats by introducing a revenue-sharing structure inspired by dividend-paying stocks, presenting Web3 investors with a familiar yet enhanced model for creating passive income.

With a comprehensive rewards system, governance options, and a commitment to growth, XBANKING reimagines what DeFi tokens can offer. By combining dividend-like returns with the capabilities of blockchain, XB fulfills its goal of being “like stocks, but better.”

0 notes

Text

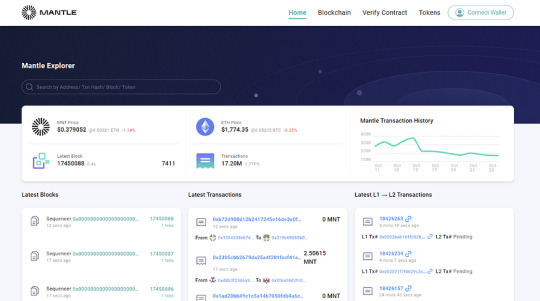

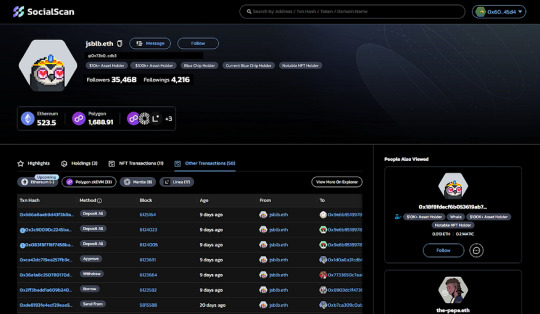

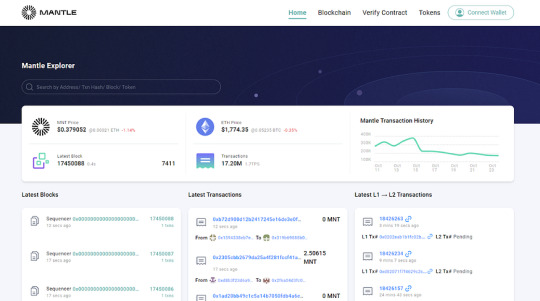

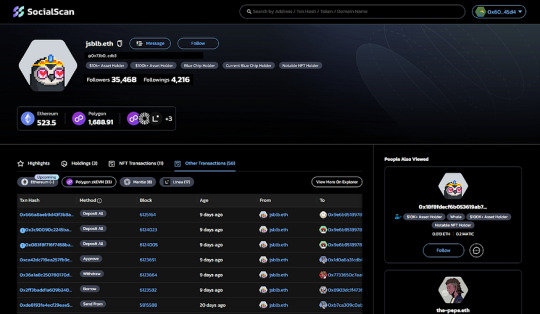

SocialScan Partners With Mantle Network for Innovative Blockchain Exploration

Blockchain explorers are essential developer tools for testing, referencing, and deploying smart contracts while serving as vital user interfaces for transaction validation. With the rise of rollup technology in Ethereum, numerous networks face a choice between costly monopolies and underperforming alternatives. In this landscape, SocialScan shines as a cost-effective, high-performance solution for all blockchains, empowering operators to optimize their developer tool investments.

Recognizing the need for a robust and efficient blockchain explorer to enhance platform performance and deliver a seamless user experience, Mantle Network selected the solution provided by SocialScan. This collaboration has resulted in several notable advantages:

Enhanced Scalability: Utilizing a distributed database, scalability has been greatly improved, accommodating a growing user base and increased transaction volume.

Solid Stability: The new explorer ensures consistent and stable performance, eliminating interruptions and disruptions.

High Availability: Multiple data replicas have enhanced data availability, reducing the risk of data loss and ensuring continuous operations.

Another remarkable accomplishment of this partnership was the rapid implementation, with SocialScan successfully launching the new explorer within just one week, effectively addressing Mantle Network’s immediate needs. However, our goals go beyond merely assisting Mantle Network in building an explorer. SocialScan is on a mission to accelerate the advent of data democratization by leveraging on-chain data to unlock web3 growth.

“Our partnership with Mantle Network exemplifies our commitment to driving innovation in the blockchain industry. By offering a solution that help address the challenges they faced and enhancing their exploration capabilities, we’re contributing to the growth of the blockchain ecosystem as a whole.”

- Alex Niu, Co-Founder & CRO of SocialScan

“The transformation brought about by SocialScan is remarkable. Our blockchain exploration experience has significantly improved, and we can now offer our users a more reliable and enjoyable platform. This collaboration represents a successful milestone for Mantle Network.”

- Arjun Kalsy, Head of Ecosystem at Mantle

This partnership between SocialScan and Mantle Network underscores the power of collaboration within the blockchain industry. Together, we are pushing the boundaries of what is achievable in blockchain exploration, forging a brighter future for blockchain enthusiasts and businesses alike.

About SocialScan

SocialScan is a revolutionary blockchain explorer built by W3W.ai, offering 20X+ cost reduction and 10X+ faster deployment time, all while maintaining the highest performance, serving developers’ needs in a more efficient and cost-effective manner, especially for the rollup and application-specific blockchain future.

Built by a team of data & AI experts, the core team members have years of experience from world-leading institutions including Stanford University, Google, Binance, TikTok, Meta, CMU, Cornell, Tsinghua, NTU, USTC etc. Learn more from our Twitter!

About Mantle Network

Mantle Ecosystem comprises an Ethereum layer 2 (L2) — Mantle Network, a decentralized autonomous organization (DAO) — Mantle Governance, one of the largest on-chain treasuries — Mantle Treasury, and an upcoming Ether (ETH) liquid staking product — Mantle LSP: all built on Ethereum.

Mantle’s first core product is Mantle Network, an L2 technology stack for scaling Ethereum. Mantle Network strives to be compatible with the Ethereum Virtual Machine. Mantle Network’s modular architecture separates transaction execution, data availability, and transaction finality into modules — which can be individually upgraded and adopt the latest innovations. Mantle Network is the first L2 to partner with ETH restaking protocol EigenLayer for the data availability module. By adopting a rollup architecture, Mantle Network is secured by Ethereum. As the world’s first DAO-spawned L2, Mantle Network is pioneering a vision for the mass adoption of token-governed technologies.

0 notes

Text

SocialScan Partners With Mantle Network for Innovative Blockchain Exploration

Blockchain explorers are essential developer tools for testing, referencing, and deploying smart contracts while serving as vital user interfaces for transaction validation. With the rise of rollup technology in Ethereum, numerous networks face a choice between costly monopolies and underperforming alternatives. In this landscape, SocialScan shines as a cost-effective, high-performance solution for all blockchains, empowering operators to optimize their developer tool investments.

Recognizing the need for a robust and efficient blockchain explorer to enhance platform performance and deliver a seamless user experience, Mantle Network selected the solution provided by SocialScan. This collaboration has resulted in several notable advantages:

Enhanced Scalability: Utilizing a distributed database, scalability has been greatly improved, accommodating a growing user base and increased transaction volume.

Solid Stability: The new explorer ensures consistent and stable performance, eliminating interruptions and disruptions.

High Availability: Multiple data replicas have enhanced data availability, reducing the risk of data loss and ensuring continuous operations.

Another remarkable accomplishment of this partnership was the rapid implementation, with SocialScan successfully launching the new explorer within just one week, effectively addressing Mantle Network’s immediate needs. However, our goals go beyond merely assisting Mantle Network in building an explorer. SocialScan is on a mission to accelerate the advent of data democratization by leveraging on-chain data to unlock web3 growth.

“Our partnership with Mantle Network exemplifies our commitment to driving innovation in the blockchain industry. By offering a solution that help address the challenges they faced and enhancing their exploration capabilities, we’re contributing to the growth of the blockchain ecosystem as a whole.”

- Alex Niu, Co-Founder & CRO of SocialScan

“The transformation brought about by SocialScan is remarkable. Our blockchain exploration experience has significantly improved, and we can now offer our users a more reliable and enjoyable platform. This collaboration represents a successful milestone for Mantle Network.”

- Arjun Kalsy, Head of Ecosystem at Mantle

This partnership between SocialScan and Mantle Network underscores the power of collaboration within the blockchain industry. Together, we are pushing the boundaries of what is achievable in blockchain exploration, forging a brighter future for blockchain enthusiasts and businesses alike.

About SocialScan

SocialScan is a revolutionary blockchain explorer built by W3W.ai, offering 20X+ cost reduction and 10X+ faster deployment time, all while maintaining the highest performance, serving developers’ needs in a more efficient and cost-effective manner, especially for the rollup and application-specific blockchain future.

Built by a team of data & AI experts, the core team members have years of experience from world-leading institutions including Stanford University, Google, Binance, TikTok, Meta, CMU, Cornell, Tsinghua, NTU, USTC etc. Learn more from our Twitter!

About Mantle Network

Mantle Ecosystem comprises an Ethereum layer 2 (L2) — Mantle Network, a decentralized autonomous organization (DAO) — Mantle Governance, one of the largest on-chain treasuries — Mantle Treasury, and an upcoming Ether (ETH) liquid staking product — Mantle LSP: all built on Ethereum.

Mantle’s first core product is Mantle Network, an L2 technology stack for scaling Ethereum. Mantle Network strives to be compatible with the Ethereum Virtual Machine. Mantle Network’s modular architecture separates transaction execution, data availability, and transaction finality into modules — which can be individually upgraded and adopt the latest innovations. Mantle Network is the first L2 to partner with ETH restaking protocol EigenLayer for the data availability module. By adopting a rollup architecture, Mantle Network is secured by Ethereum. As the world’s first DAO-spawned L2, Mantle Network is pioneering a vision for the mass adoption of token-governed technologies.

0 notes

Text

Table of Content Renowned decentralized finance (DeFi) company Ankr sat down with Crypto Daily to give us a breakdown of its revolutionary Liquid Staking feature and to discuss retaking on the EigenLayer. Crypto Daily is fortunate to have interviewed Tiago Pratas, DeFi lead at Ankr. Pratas has given us access to the nuances of Ankr's groundbreaking Liquid Staking protocol and to discuss EigenLayer's Ethereum restaking and safety features. Give us a quick breakdown of Ankr as a DeFi infrastructure. “Ankr is a prominent DeFi infrastructure company dedicated to making the decentralized world more accessible and user-friendly. We achieve this by providing a comprehensive Web3 infrastructure platform that caters to developers, enterprises, and end-users. Ankr's suite of services includes node hosting, staking, and developer-focused offerings such as RPC nodes and app chains. Our services are designed to be cost-effective, scalable, and secure, making it easier for developers to build decentralized applications (DApps) and for end-users to access and interact with the DeFi ecosystem. You probably already used some of our services without even knowing, and we partner with major DeFi projects like Aave, 1inch, SushiSwap, and several major L1's.” Staking is excellent for investors to earn rewards on their assets, but Liquid Staking offers the user many more benefits. In summary, please explain what Liquid Staking is, why it is so revolutionary, and the benefits of liquid staking over traditional staking. “Liquid Staking is a groundbreaking concept in the blockchain and DeFi space. Traditional staking involves locking up your assets in a smart contract to secure a network and earn staking rewards. However, this process renders your assets illiquid, meaning you can't readily use or trade them. Liquid Staking, on the other hand, provides a more flexible approach. When you stake your assets, you receive a token representing your staked assets, such as ankrETH. These tokens are tradable and can be used in various DeFi protocols, from providing liquidity to collateral for loans. The revolutionary aspect of Liquid Staking is that it combines the benefits of staking, such as earning the staking rewards while participating and boosting Ethereum network security, with the advantages being more capital efficient, more flexible for stakers, and easier to participate in the validation process of Ethereum and get access to the "risk-free rate" in the form of staking rewards.” How can users go about Liquid Staking through Ankr? “Liquid Staking through Ankr is a straightforward process. Users can visit Ankr's Liquid Staking Platform, select the assets they want to stake, connect their cryptocurrency wallet, and select the amount and stake! In return, users will receive Liquid Staking Tokens such as ankrETH,ankrBNB, etc., which represent their staked assets. These tokens can be used across DeFi platforms, providing liquidity and earning additional yields. The list of these DeFi opportunities can be found on our DeFi Dashboard.” Users are rewarded in ankrETH. What does ankrETH represent, and how is its value determined? “ankrETH represents the Ethereum deposited on the Validators with all the staking rewards that it has accrued. Therefore, ankrETH is a reward-bearing token, meaning that the fair value of 1 ankrETH token vs. ETH increases over time as staking rewards accumulate. Therefore, its market price is always tied to the amount of Ethereum you can redeem each ankrETH and the Ethereum price.” What benefits does holding ankrETH offer the user? “Firstly, High APRs, as AnkrETH boasts one of the best APRs in the market, thanks to the efficiency of our node operation and the distribution of MEV rewards. In addition to this, additional liquidity and capital efficiency of your assets as Unlike traditional staking, ankrETH maintains liquidity, allowing users to access their assets whenever needed while allowing you to participate in various DeFi protocols while still benefiting from staking rewards.

This is also meaningful as users still get exposure to Ethereum's Growth. As the price of Ethereum rises, so does the intrinsic value of ankrETH, offering users the potential for significant capital appreciation. Last but not least, knowing that they are contributing to network Security of Ethereum since by staking with Ankr, users actively contribute to the security and decentralization of the Ethereum network, further enhancing its robustness and reliability.” We know that EigenLayer is a middleware protocol that allows for restaking. Explain to us what EigenLayer's Ethereum restaking platform is designed to do and what benefits it offers the user. “EigenLayer enables users to restake their ETH and extend cryptoeconomic security of Ethereum to additional applications on the network. EigenLayer's Ethereum restaking platform is designed to automate the process of restaking staking rewards for users, providing several significant benefits. It simplifies the compounding of staking rewards by automatically reinvesting them, resulting in exponential growth of staked assets over time. This automation makes the process hassle-free and accessible, even for those new to DeFi. Users benefit from maximized returns due to the compounding effect, potentially achieving higher returns compared to traditional staking or holding strategies. This can lead to multiple innovations built on top of EigenLayer. From Infracture products like oracles, bridges, or L2's to more yield-focused products like Liquid Staking tokens with higher yields.” How will Ankr utilize EigenLayer's restaking platform? “We love innovation and pay close attention to all the new things are happening in the market, especially when it comes to Liquid Staking! So far Ankr has proposed the EigenLayer DAO to list ankrEtH, but we also are playing close attention to the liquid staking protocols that are being built on top.” Ankr recently announced three new services to increase the security of its liquid staking service and provide more functionality and transparency for its users. Of particular interest is the ETH validator hub. Tell us more about this feature and how it will address slashing as one of the most significant risks associated with liquid staking. “ETH Validator hub will become an open marketplace that will act as a transparent way for users to choose which nodes they want to delegate their assets to. Our focus will be on Ethereum but will expand to other networks soon. This marketplace will offer enhanced versatility and empowerment to users concerning their assets, enabling them to select nodes that align with their individual risk evaluations and APY objectives. In essence, this service delivers a delegate staking encounter for Ethereum stakers. Ankr places a strong emphasis on security and transparency, and the ETH validator hub is a key part of our efforts to address slashing risks associated with liquid staking while allowing for the introduction of restaking. This hub employs a rigorous validator selection process, considering factors like reputation and security measures. Slashing protection mechanisms are in place to minimize the risk of loss due to slashing events. The ETH validator hub operates with responsive governance, allowing the community to participate in decision-making bolstering accountability and trust.” What are Ankr's plans for the future? Can we expect exciting and innovative strategies to improve the DeFi sector soon? “Ankr's vision for the future revolves around continuous innovation and user-centric strategies to advance the web3 sector. We are committed to developing innovative DeFi products and services, including expanding our liquid staking offerings while providing core infrastructure to the web3 ecosystem. Our goal is to empower users by providing cutting-edge solutions that enhance their crypto experience. We'll continue to explore new avenues, partnerships, and technologies to contribute positively to the ecosystem. Expect exciting developments as we work tirelessly to improve and innovate!”

Tiago Pratas is a seasoned cryptocurrency professional with expertise in blockchain and DeFi. As the DeFi Lead at Ankr, he's played a key role in increasing TVL from $65 million to over $180 million. With a strong crypto trading and research background, Tiago is an expert in blockchain technology, DeFi strategies, and the broader crypto ecosystem.

0 notes

Text

[ad_1] Sreeram Kannan was a professor at the University of Washington, Seattle, when he started working for its blockchain research lab in 2017.It was there while working at the lab that he founded his company, EigenLabs, the organization behind EigenLayer – a blockchain protocol considered a pioneer in a just-now-arriving trend in the Ethereum ecosystem known as restaking. The idea is to repurpose ETH tokens staked on the Ethereum blockchain for double duty, using them to provide security for other applications.EigenLayer has been in the news lately, as the restaking ecosystem starts to take shape. Some top Ethereum figures have also raised flags about the risks; Ethereum co-founder Vitalik Buterin at one point cautioned that the new feature could ultimately pose systemic risks to the main blockchain’s stability.We spoke with Kannan last week, where we asked him questions about EigenLayer and restaking. Some highlights include:On Kannan’s response to Buterin’s concerns about staking: “Anything that restaking can do, already liquid staking can do.”On Ethereum’s plan to slow the rate of new validators coming on line, via the EIP-7514 proposal: “This is a super important thing for Ethereum to be conservative and not have an overflow.”On whether Ethereum will ever reach its maximum capacity for shared security: “There's absolutely a limit.”Q: I saw Vitalik’s blog post about overloading the consensus layer, and how restaking, in his view, could pose systemic risks to Ethereum. I'm curious to hear your take on his take?Kannan: One of the things I think he wants to kind of lay out is that, “Hey don't externalize, and don't create something that, assuming that if the protocol goes wrong, Ethereum is going to fork around it.”I think that is a pretty reasonable position from Ethereum, that you build protocols and the protocols have to internalize social consensus rather than externalize it to Ethereum.So I read it as to not overload Ethereum social consensus, which is used only for forking the chain. And don't assume that you can build a protocol that, and because you're too big to fail, Ethereum can fork around that. So that's how I read it.And I think it's a pretty obvious statement in our view. But I think it has to be said, somebody has to say it, so it's good that Vitalik went out and said it.Because what we don't want is for calls to deploy code that is not properly audited, doesn't have internal security controls, and then the Ethereum community has to now work hard to figure out how to retrieve it.I think a lot of people after reading the article have been talking a lot about restaking risks.I want to make it super clear: anything that restaking can do, already liquid staking can do, so I view restaking as a lesser risk than liquid staking.Q: Can you expand on that?Kannan: Basically, you can take a liquid staking token and then deposit it into complex DeFi protocols, or you could just deposit it into validating a new layer 2, or a new oracle or any of these things.So anything that restaking can do, liquid staking can already do. Because you know, you have the LSD [short for liquid staking derivative] token, and you can do anything with it. And one particular thing you could do with that is, of course, go and validate another network.So I view restaking as just one particular use case of liquid staking, but actually reducing the risk of that one particular use case.Q: Why do you think restaking is having a moment in the news?Kannan: I don't know. I'm glad people are talking about it. Of course, anything that adds new rewards to stakers is something interesting.I said anything that could be done with EigenLayer could be done with LSTs, but people didn't know what to do with these LSTs.They were doing exactly the same thing that people are doing with ether, which is lending, borrowing, the same set of DeFi parameters.I think one thing that EigenLayer did is by creating this new category, that validation, if I can borrow the Ethereum

trust network to do new things: I can build a new layer 1, I can build a new like oracle network, I can build a new data availability system, I can build any system on top of the Ethereum trust network, so it internalizes all the innovation back into Ethereum, or aggregates all the innovation back into Ethereum, rather than each innovation requiring a whole new system.So I think that narrative is quite attractive.Q: I was just reading the news about EIP-7514, which is a short term solution for solving the overcrowdedness of validators, by limiting entries of new validators. How does that affect an EigenLayer?Kannan: I think mostly, it means the same thing for EigenLayer that it means for liquid staking protocols, that there is going to be a smaller rate at which new validators can enter.There's a long entry queue right now, and people don't want to wait that long.And making it slower is going to just make the new growth of LSTs slower. But I understand fully that this is a super important thing for Ethereum to be conservative and not have an overflow of validators that may not be able to be handled by the consensus layer.But in the long term, if the total staking of Ethereum cannot grow, one of the things that happens is the total yield or the return that stakers are getting is bounded by the Ethereum staking, whereas in the presence of restaking there is a possibility for them to get some of these additional rewards. Other than that, it's pretty similar.Q: You were making the point that EigenDA is just like in-house AVS (actively validated service) – explain what it is:Kannan: What we decided is, in order to keep this system of shared security, in order to keep EigenLayer as decentralized as possible, we want to make sure that there is a highly scalable data system at its backbone. And that's what EigenDA is, it's a highly scalable data availability system, built on the same ideas that underpin the Ethereum roadmap, particularly what is called danksharding.Our view is that building an Ethereum-adjacent data availability layer requires first principles thinking, whereas Celestia and Avail are built to be chains by themselves.If you're building a data availability system adjacent to Ethereum, you'd want Ethereum validators to participate. So that's just one part of the story. Of course, EigenLayer enables that.But then you go beyond that, and then you see, “Oh, it's not just you want to get the Ethereum nodes to participate.”Ethereum already has consensus built in, and Ethereum gives you the ordering of the various transactions. So you should build the data availability system, which doesn't need its own ordering.Whereas all the existing other protocols like Celestia and Avail, are basically chains that have to do their own ordering; we built a system which doesn't have internal ordering; all ordering is done on Ethereum.Q: Liquid restaking tokens - once your liquid staking tokens are locked on EigenLayer, they become illiquid?Kannan: That’s correct, the problem that the liquidity staking tokens are trying to solve is, can I just have a restaked position, and then still keep it liquid. So you can take that receipt token of liquid restaking and then transfer it.We are not building this kind of liquid restaking but other people are building liquid restaking on top of them.Q: I think your comment was, you want to use the Ethereum shared security for as many things as possible. I'm curious, now that there's also people building on the back of what y'all are doing, is there a natural limit to how much that you know, Ethereum can support?Kannan: This is a similar kind of question that one could ask already at the application layer of Ethereum: How many applications on Ethereum are smart contracts and how many smart contracts can be built on top of Ethereum?So it's the same thing with EigenLayer because people staking and running new applications, but now they do it much more flexibly and programmably with these aliases on top of EigenLayer, all contribute back to Ethereum.

Their ETH staking increases rewards, ETH itself potentially increases in value because of all these additional use cases.So over time, this can start to accommodate more and more.But there's absolutely a limit. [ad_2] Source #EigenLayers #Sreeram #Kannan #Hot #Risky #Ethereum #Trend #Restaking

0 notes

Text

Bridgeswap: Bridging Defi & Web 3.0

What exactly is Dex? Understanding the Unique Opportunities Decentralized Exchanges Offer. Decentralized exchanges are blockchain-based applications that enable many users to trade tokens directly with one another. The capability of smart contracts makes this possible. Smart contracts are blockchain-based programs that execute predetermined actions automatically when certain conditions are satisfied.

The primary objective of the Decentralized exchange is to enable individuals to trade digital assets directly with one another, without the need for intermediaries as in traditional banking. Therefore, DEX grants ordinary people complete ownership over their digital assets, granting them the ability to conduct commerce with anyone at any moment.

When utilizing a DEX, users store their crypto assets in their own wallets, as opposed to the exchange's custodial wallet. When a user want to trade crypto assets on a DEX, he need merely connect his wallet to the DEX's pool of crypto assets. Once a transaction is complete, he disconnects his wallet from the Dex and stores the assets in his wallet.

The operation of DEX is diametrically opposed to that of CEX. Before trading on CEX, users must transfer their crypto assets to a CEX custodial wallet. Thus, the CEX holds the user's cryptocurrency asset. The user's crypto asset is stored in the CEX's central database.

On a CEX like as Coinbase and Binance, the traditional order book is utilized to match buyers and sellers based on order prices and volume. Book orders are not utilized in DEX. In lieu of this, liquidity pools are utilized. Liquidity pools are pools of crypto assets placed on the blockchain of a DEX. These liquidity pools are sourced by liquidity providers, who are independent investors. Providers of liquidity pools make a return in the form of transaction fees charged to pool users.

When a user executes a trade on a DEX, the smart contracts on the DEX blockchain automatically transfer the crypto asset from the liquidity pool to the user's wallet. The term for this notion is Automatic Market Making. Therefore, DEX operates as an automated Market Maker - AMM.

What exactly is Bridgeswap? Bridgeswap is a decentralized exchange that enables instantaneous crypto token swapping, liquidity provision, and yield-based reward staking. Bridgeswap aims to bridge Defi on Web 3.0 from traditional finance in a decentralized manner to establish a fair, sustainable, and community-driven DAO global economy. Bridgeswap has created four new products to achieve this goal: Bridgeswap trade, Bridgeswap farms, Bridgeswap pools, Bridgeswap Defi 2.0 zap, and Bridgeswap lottery.

Bridgeswap Trade.

Bridgeswap trade is a decentralized exchange that permits instantaneous exchange of Bep20 crypto tokens for another Bep20 using liquidity pools.

Bridgeswap Farms.

By contributing tokens to our liquidity pools, Bridgeswap farm lets you to earn rewards in the form of tokens and share in transaction fees.

BridgeSwap pools.

Bridgeswap pools allow you to stake Bris tokens to earn additional Bris tokens. This is an excellent method for generating passive revenue from your tokens. Instead of passively storing your tokens, you may put them to work in BridgeSwap pools to earn free tokens. Consider staking it if you wish to make your Bris tokens productive.

Bridegswap pool offers two opportunities to stake and earn additional Bris tokens.

Manual BRIS pools Auto BRIS pools Manual Bris Pool.

Manual Bris pool allows you to manually stake Bris tokens. This requires you to visit Bridegswap's website to restake or reinvest. This incurs a small transaction fee in the form of BNB.

Automatic Brispool

With Auto Bris pool, a wager is made once and then forgotten. The auto compounder function of Bridegswap reinvests your Bris tokens, minus a tiny charge. The Bris tokens you receive by staking are APY tokens.

Bridgeswap Defi 2.0 Zap . Our team designed Bridgeswap Defi 2.0 Zap as a one-of-a-kind system to provide a long-term solution to some of the most significant difficulties affecting the Defi and Farming protocols.

Problem Most Defi protocols struggle to obtain sufficient money for their operations. Therefore, there is a perpetual competition between multiple Defi protocols for liquidity for services such as yield farming, staking, etc. The operation of Defi protocols depends on the liquidity of their protocol users. They rent liquidity for their activities because they do not own it. This presents numerous obstacles.

Solution Bridegswap's remedy for this issue is the Defi 2.0 zap. This innovative new approach enables liquidity providers to exchange their liquidity pools for discounted Bris tokens. This technology provides Bridegswap with liquidity, so we do not need to rely entirely on liquidity suppliers for our liquidity pools. The Defi 2.0 zap proceeds are put in a designated wallet as a reserve. When necessary, Bridgeswap can rely on this liquidity. This accumulated cash assures liquidity longevity, hence avoiding the long-term liquidity issues seen by the majority of Defi protocols.

This approach also provides as an incentive for liquidity providers to acquire Bris tokens at a discount. If the price of the Bris token skyrockets, liquidity providers can sell these discounted tokens at much higher rates for substantial profits. Therefore, both liquidity sources and Bridgeswap stand to benefit.

Program of Bridgeswap Referrals Our Bridgeswap referral program is ideal for those who like to earn free Bris tokens. The fantastic thing about this service is that there is no token deposit requirement. You only need to refer individuals to Bridgeswap. Once the users you refer invest in Bridgeswap's pool and farms, you will receive 10% of their yields in perpetuity.

Visit our referral site to participate in this referral program and begin earning free $Bris tokens. After connecting your wallet, you must generate a unique referral link. Share your unique referral link with friends, family, and others to encourage them to join Bridgeswap pools and Farms. When your referred users withdraw or harvest from Bridgeswap pools, you receive 10% of their withdrawals or harvests.

Tokenomics Tokenomics is essential to the success of any cryptocurrency initiative. For the success of Bridgeswap, we have developed a functional and sustainable tokenomics. Let's examine Bridgeswap's Tokenomics in depth.

Token name: Bridgeswap

Token Symbol: BRIS

Contract Address:

Chain: BNB Smart Chain (BEP20)

Initial Total Supply: 2,200,000 BRIS tokens

Maximum Supply: No maximum Supply

Please visit the page below to learn more about Bridgeswap

Website: https://bridgeswap.app/ Gitbook: https://bridgeswap-exchange-1.gitbook.io/bridgeswap/ Twitter: https://twitter.com/bridgeswap_dex Telegram: https://t.me/bridgeswap Github: https://github.com/Bridgeswap-Dex Medium: https://bridgeswap.medium.com/

Author

Bitcointalk username : CollinsEdward56 Bitcointalk profile url : https://bitcointalk.org/index.php?action=profile;u=3401350 BEP-20 wallet address: 0x52E6a27bDA723424E88f6EDf5a4b3b335665232A

0 notes

Text

Liquid Staking for Novices: A 2024 Introductory Guide

Unlock the full potential of your cryptocurrency investments with liquid staking, where liquidity meets profitability.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols. This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols.

This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

The process of liquid staking involves depositing cryptocurrency into a staking contract, which then issues a liquid staking token representing the staked assets. These tokens can be utilized in decentralized exchanges, lending platforms, and yield farming protocols, providing users with the flexibility to optimize their investment strategies. This increased liquidity and flexibility allow users to respond quickly to market changes and new investment opportunities, making liquid staking a valuable tool in the crypto ecosystem.

Despite its benefits, liquid staking presents certain challenges, including the risk of validator penalties and smart contract vulnerabilities. Additionally, the regulatory environment for cryptocurrencies is continuously changing, which may impact staking practices. Nonetheless, liquid staking is poised to play a pivotal role in the future of blockchain finance, enhancing the value of crypto assets through improved accessibility and liquidity. Intelisync offers tailored blockchain solutions, including liquid staking, to help businesses Learn more.....

#Advantages of Liquid Staking Tokens#Can I lose my funds in liquid staking?#Challenges of Liquid Staking#How do I choose a liquid staking platform?#How Does Liquid Staking Work?#How Intelisync will help you to grow in the crypto world Liquid Staking#Understanding Staking and How Does Staking Work?#What cryptocurrencies support liquid staking?#What is Liquid Staking?#What is Restaking#What is the future of liquid staking?#Why Are LSTs Gaining Popularity?#intelisync blockchain development company intelisync bitcoin development services#intelisync web3 marketing services

0 notes

Text

[ad_1] Polygon, a scaling solution to the Ethereum blockchain, aims to “unify liquidity” of the various networks in its ecosystem as part of a new architecture under its rebrand as Polygon 2.0.The plan also provide for restaking tokens, allowing investors to simultaneously stake the same tokens on multiple projects. And Polygon plans to give developers the ability to "add new decentralized chains on demand," according to a statement – joining competitors including Arbitrum, Optimism and zkSync's Matter Labs that have made their networks easier to copy, in the pursuit of fostering broader ecosystems of specialized but compatible blockchains.Under the new tech stack, Polygon says it will link the various Polygon chains through a shared crypto bridge powered by zero-knowledge (ZK) proofs, one of this year’s hottest blockchain technologies. CoinDesk reported exclusively earlier this year that Polygon would emphasize ZK technology in its future project roadmap."Unified liquidity is the key to everything in Polygon 2.0,” said Brendan Farmer, the co-founder of Polygon in a press release. “We need to support unlimited scalability, but the entire Polygon 2.0 ecosystem must still feel like using a single chain. The validity of cross-chain transactions is guaranteed by ZK proofs posted to Ethereum, but we want bridging to feel seamless. We can’t make users wait for a chain to generate a proof or settle on Ethereum.”With the new architecture, a coordination layer would come to exist to confirm cross-chain transactions, while the shared bridge will be powered by ZK proofs.“With zero knowledge proofs, we can basically bridge or initiate cross-chain transactions in a way that's safe, and in a way that is instant,” Farmer told CoinDesk in an interview.“And so what we want is this coordination layer for the shared bridge that allows for like an unlimited number of chains, but for those chains to sort of behave in a unified way,” Farmer said. ”For a user, it feels like you're using a single chain.”Polygon provided this technical description of how it works: "Native Ethereum tokens will be deposited into a single contract on Ethereum, so when a user transacts across Polygon chains, the corresponding assets will be mapped to the tokens deposited on Ethereum. No need for wrapped tokens and the corresponding UX difficulties." UX stands for user experience.The proposal also calls for an emphasis on restaking, which allows users to repurpose their staked crypto to ensure the security of other applications on a blockchain. Many protocols, like Eigenlayer, have recently embraced restaking.Vitalik Buterin, the co-founder behind the Ethereum blockchain, has expressed reservations about restaking, fearing that it could create systemic risks for blockchains.“I think restaking is a really nice answer to that question where there will be validators that stake the token in order to validate chains on Polygon,” Farmer said. “They'll be able to not only validate one chain, but they'll be able to restake their tokens to actually serve as decentralized validators.”The announcement about Polygon’s new architecture and tech stack comes just a few days after it shared a proposal to upgrade its Polygon PoS chain to a zkEVM validium. Polygon has shared that it will also be releasing announcements over the next few weeks on its token, $MATIC, and its governance process.“I think one of the guiding principles behind Polygon 2.0 is we want to build this sort of foundational piece of the internet, the value layer for the internet,” Farmer said.Read more: Polygon Proposes POS Chain To Become ZK CompatibleEdited by Bradley Keoun. [ad_2] Source #Polygon #Roadmap #Calls #Unified #Liquidity #Restaking #Chains #Demand

0 notes