#Vs:

Explore tagged Tumblr posts

Text

Rhaenyra Winning King’s Landing (Excluding Some Events in B/T)

Quote Prime

Quote #1

Quote #2

Quote #3

Quote #4

#daemon targaryen#daemon vs aemond#aemond targaryen#rhaenyra targaryen#rhaenyra and daemon#alicent hightower#aegon ii#Fire and Blood#storage#fire and blood characters#rhaenyra's characterization#alicent's characterization#aemond's characterization#rhaenyra in KL

3 notes

·

View notes

Text

Umbrella Company Vs PAYE

New Post has been published on https://www.fastaccountant.co.uk/umbrella-company-vs-paye/

Umbrella Company Vs PAYE

Are you torn between opting for an umbrella company vs PAYE (Pay As You Earn) setup? If so, this article will help shed light on the pros and cons of both options. Whether you’re an independent contractor, freelancer, or considering a career shift, understanding the differences between these two employment models is essential. By exploring the benefits and drawbacks of umbrella companies and PAYE, you’ll gain valuable insights to make an informed decision that aligns with your financial goals and lifestyle. So, let’s dive in and discover which employment arrangement suits you best!

Definition of Umbrella Company

Explanation of an umbrella company

An umbrella company is a type of employment intermediary that allows individuals to work as contractors or freelancers while providing them with the benefits and support of being an employee. It acts as the employer for these contractors, handling administrative tasks such as payroll, invoicing, and tax obligations. Essentially, an umbrella company acts as a middleman between contractors and their clients, offering a hassle-free solution for managing freelance work.

How an umbrella company works

When you join an umbrella company, you become an employee of that company, even though you work on a contract basis for various clients. Instead of dealing with the administrative burdens of self-employment, such as invoicing, chasing payments, and calculating taxes, the umbrella company takes care of these tasks for you. They handle your payroll, ensuring that you receive your agreed-upon rate for each assignment, and then deducting the appropriate taxes and national insurance contributions (NICs) before transferring the remaining funds to you.

Benefits of working through an umbrella company

Working through an umbrella company offers a range of benefits. Firstly, it provides you with the flexibility of being a contractor while enjoying the benefits and security of being an employee. You have the freedom to choose your assignments and work with multiple clients, while the umbrella company takes care of your employment-related obligations. Additionally, umbrella companies have the necessary expertise to handle payroll, taxes, and compliance matters, relieving you of administrative burdens. They also often provide access to employee benefits such as pensions, holiday pay, and statutory rights, which are typically not available to self-employed contractors.

youtube

Definition of PAYE

Explanation of PAYE

PAYE stands for Pay As You Earn, and it is the system used in the United Kingdom to collect income tax and national insurance contributions from employees’ salaries. Under this system, your employer calculates and deducts the tax and NICs from your wages or salary before paying you. The PAYE system ensures that your tax and NI contributions are collected throughout the tax year, rather than in a lump sum at the end.

How PAYE works

When you are on PAYE, your employer will provide you with a payslip that breaks down your earnings, tax deductions, and national insurance contributions. Your employer is responsible for accurately calculating and deducting the appropriate amounts, taking into account your tax code and any allowances or deductions to which you may be entitled. The deducted amounts are then sent to HM Revenue and Customs (HMRC) on your behalf.

Benefits of being on PAYE

Being on PAYE offers certain advantages. First and foremost, it simplifies the tax payment process since the burden of calculating tax and NICs is shifted from you to your employer. You don’t have to worry about fulfilling your tax obligations independently or making large lump sum tax payments. Moreover, being on PAYE may also make it easier to access certain financial products, such as mortgages, as lenders often prefer borrowers who have a regular, stable income through PAYE employment.

Employment Status

Contractor or employee

Determining your employment status is crucial as it determines your tax obligations, employment rights, and benefits entitlement. As a contractor, you are typically self-employed and responsible for managing your own taxes and finances. On the other hand, as an employee, you have certain rights and entitlements, such as holiday pay, sick pay, and protection against unfair dismissal.

Determining employment status

Employment status can be determined by various factors, including the degree of control the worker has over their work, the level of financial risk they bear, and the level of integration into the client’s business. For contractors, being genuinely self-employed means having autonomy and control over how they complete their work, being able to work for multiple clients, and not being integrated into one particular organization.

Implications for tax and NI contributions

Your employment status has direct implications for your tax and national insurance contributions. As a self-employed contractor, you are responsible for registering for self-employment with HMRC, completing annual tax returns, and paying your own taxes and NICs. However, if you work through an umbrella company, you are classified as an employee, and the corresponding taxes and NICs are deducted by the umbrella company on your behalf.

Financial Considerations

Take-home pay

One of the key financial considerations when working through an umbrella company or on PAYE is your take-home pay. Take-home pay refers to the amount of money you receive after taxes, national insurance contributions, and other deductions have been taken out. When working through an umbrella company, your take-home pay will typically be lower than your gross income due to the deductions made for taxes and necessary expenses.

Expenses and tax relief

Working through an umbrella company or on PAYE may have implications for the tax relief you can claim on your expenses. As an umbrella company employee, you may be able to claim certain business expenses, such as travel costs or professional subscriptions, if they are legitimate and directly related to your work. On the other hand, if you are on PAYE, the expenses you can claim tax relief on may be limited. It is essential to understand what expenses you can claim and to keep proper records to ensure compliance with tax regulations.

Administrative Responsibilities

Managing invoices and payments

When working through an umbrella company, you are relieved of the administrative task of managing invoices and payments. The umbrella company handles this process, generating and sending invoices to your clients and ensuring timely payment. This not only saves you time and effort but also improves cash flow as the umbrella company typically pays you once they receive payment from clients.

Tax calculations and submissions

Another significant administrative responsibility handled by umbrella companies is tax calculations and submissions. They keep track of your income, expenses, taxes, and national insurance contributions, ensuring compliance with tax regulations. The umbrella company will calculate and deduct the correct amount of tax and NICs from your earnings, and submit the necessary reports and payments to HMRC on your behalf.

Record-keeping and compliance

Proper record-keeping and compliance with tax and employment regulations are essential for contractors. An umbrella company takes care of these responsibilities, maintaining records of your earnings, expenses, and tax deductions. This ensures that you meet your legal obligations, simplifies the process of filing tax returns, and provides you with peace of mind knowing that your records are in order.

Flexibility of Work

Contract length and termination

Working through an umbrella company offers flexibility in terms of contract length and termination. As a contractor, you have the freedom to choose short-term or long-term contracts, depending on your preferences and availability. If a contract ends or you decide to terminate it, you can easily move on to the next assignment without the burden of legal responsibilities or contractual obligations.

Working with multiple clients

One advantage of working through an umbrella company is the ability to work with multiple clients simultaneously. As an employee of the umbrella company, you can undertake assignments from different clients and diversify your income streams. This versatility allows you to explore various industries, gain diverse experience, and potentially increase your earning potential.

Control over work assignments

While working through an umbrella company, you still have control over your work assignments. You can negotiate contracts directly with clients and agree on the terms and conditions that suit your skills, availability, and desired income. However, it’s essential to consider that some clients may have preferences or requirements when it comes to engaging contractors through an umbrella company, so it is crucial to be aware of these factors when pursuing opportunities.

Employment Rights and Benefits

Statutory employment rights

Being an employee on PAYE entitles you to certain statutory employment rights that are typically not available to those working through an umbrella company. These rights include protection against unfair dismissal, the right to receive the National Minimum Wage, paid holiday and sick leave, and access to maternity or paternity leave. These rights help create a more stable and secure working environment for employees.

Service Charges and Fees

Understanding umbrella company fees

Umbrella companies charge fees for their services, which cover the administrative tasks, payroll services, and support they provide to contractors. These fees can vary between umbrella companies, so it’s important to carefully review and understand the breakdown of costs before joining an umbrella company. Some umbrella companies charge a fixed weekly or monthly fee, while others may have a percentage-based fee structure.

Transparent pricing and understanding

When choosing an umbrella company or considering PAYE employment, it’s vital to seek transparency regarding pricing and understand the associated costs. Remember to ask for a clear breakdown of fees, deductions, and any additional costs that may apply. This way, you can make an informed decision based on your financial situation, priorities, and the level of support and benefits offered by the umbrella company or employer.

0 notes

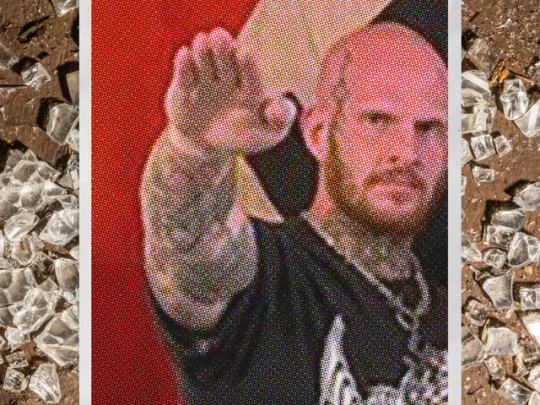

Photo

How Concerned Citizens Drove a Neo-Nazi Out of Rural Maine

Christopher Pohlhaus planned to build a fascist training compound in the woods of rural Maine. The local journalists, veterans, lumberjacks, and policymakers weren't having it.

Pohlhaus, 37, is a former U.S. marine, an itinerant tattoo artist, and a hardcore white-supremacist influencer. He is loud and hostile, and proud to be both. His voice is pitched surprisingly high, and he has a slight Southern drawl. He has a large body and small bald head; a blue-black tattoo crawls up the right side of his face, from his chin to his forehead. Over the years, Pohlhaus has collected thousands of social media followers, who know him by his nickname: Hammer.

Hammer had been living in Texas for a few years when, in March 2022, he bought the land in Maine. He told his followers that he was going to use it to build a haven, operational center, and training ground for white supremacists.

Check out our excerpt of The Atavist’s latest blockbuster story.

1K notes

·

View notes

Photo

PORTO ROCHA

878 notes

·

View notes

Photo

🧀🥪🌶️🥭 The Ravening War portraits 🧀🥪🌶️🥭

patreon * twitch * shop

[ID: a series of digitally illustrated portraits showing - top left to bottom right - Bishop Raphaniel Charlock (an old radish man with a big red head and large white eyebrows & a scraggly beard. he wears green and gold robes with symbols of the bulb and he smirks at the viewer) Karna Solara (a skinny young chili pepper woman with wavy green hair, freckled light green skin with red blooms on her cheeks. she wears a chili pepper hood lined with small pepper seeds and stares cagily ahead) Thane Delissandro Katzon (a muscular young beef man with bright pinkish skin with small skin variations to resemble pastrami and dark burgundy hair. he wears a bread headress with a swirl of rye covering his ears and he looks ahead, optimistic and determined) Queen Amangeaux Epicée du Peche (a bright mango woman with orange skin, big red hair adorned with a green laurel, and sparkling green/gold makeup. she wears large gold hoop earrings and a high leafy collar) and Colin Provolone (a scraggly cheese man with waxy yellow skin and dark slicked back hair and patchy dark facial hair. he wears a muted, ratty blue bandana around his neck and raises a scarred brow at the viewer with a smirk) End ID.)

#trw#the ravening war#dimension 20#acoc#trw fanart#ttrpg#dnd#bishop raphaniel charlock#karna solara#thane delissandro katzon#queen amangeaux epicee du peche#colin provolone

2K notes

·

View notes

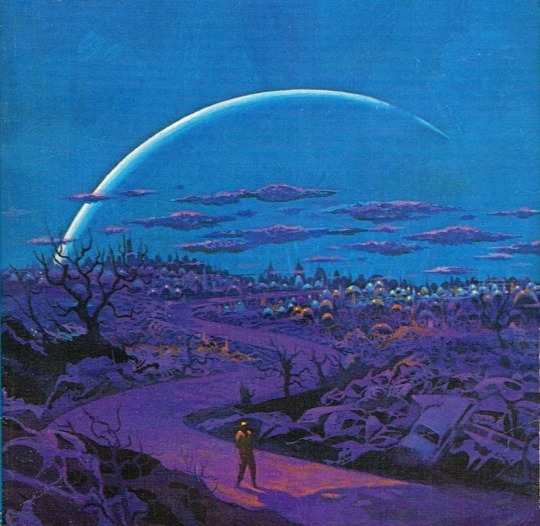

Photo

One of my favorites by Paul Lehr, used as a 1971 cover to "Earth Abides," by George R. Stewart. It's also in my upcoming art book!

1K notes

·

View notes

Quote

もともとは10年ほど前にTumblrにすごくハマっていて。いろんな人をフォローしたらかっこいい写真や色が洪水のように出てきて、もう自分で絵を描かなくて良いじゃん、ってなったんです。それで何年も画像を集めていって、そこで集まった色のイメージやモチーフ、レンズの距離感など画面構成を抽象化して、いまの感覚にアウトプットしています。画像の持つ情報量というものが作品の影響になっていますね。

映画『きみの色』山田尚子監督×はくいきしろい対談。嫉妬し合うふたりが語る、色と光の表現|Tokyo Art Beat

147 notes

·

View notes

Photo

#thistension

XO, KITTY — 1.09 “SNAFU”

#xokittyedit#tatbilbedit#kdramaedit#netflixedit#wlwedit#xokittydaily#asiancentral#cinemapix#cinematv#filmtvcentral#pocfiction#smallscreensource#teendramaedit#wlwgif#kitty song covey#yuri han#xo kitty#anna cathcart#gia kim#~#inspiration: romantic.#dynamic: ff.

1K notes

·

View notes

Photo

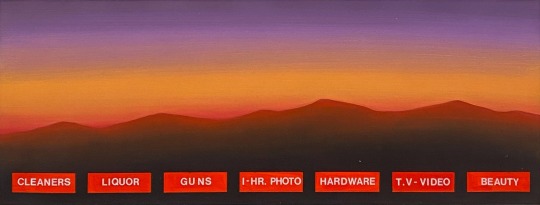

No one wants to be here and no one wants to leave, Dave Smith (because)

108 notes

·

View notes

Photo

Noodles with Lamb Sauce (Laghman, 新疆拌面) Xinjiang laghman features chewy noodles served with a bold and rich lamb and tomato sauce that is bursting with flavor.

Recipe: https://omnivorescookbook.com/recipes/uyghur-style-noodles-with-lamb-sauce

121 notes

·

View notes

Photo

CJ from Hello World (MSPFA) by phasedsun?

112 notes

·

View notes

Quote

よく「発明は1人でできる。製品化には10人かかる。量産化には100人かかる」とも言われますが、実際に、私はネオジム磁石を1人で発明しました。製品化、量産化については住友特殊金属の仲間たちと一緒に、短期間のうちに成功させました。82年に発明し、83年から生産が始まったのですから、非常に早いです。そしてネオジム磁石は、ハードディスクのVCM(ボイスコイルモーター)の部品などの電子機器を主な用途として大歓迎を受け、生産量も年々倍増して、2000年には世界で1万トンを超えました。

世界最強「ネオジム磁石はこうして見つけた」(佐川眞人 氏 / インターメタリックス株式会社 代表取締役社長) | Science Portal - 科学技術の最新情報サイト「サイエンスポータル」

81 notes

·

View notes

Photo

PORTO ROCHA

522 notes

·

View notes

Photo

HRH The Princess of Wales in Southport today, on her first engagement since completing chemotherapy. It’s so good to see her!❤️ --

#catherine elizabeth#princess catherine#princess of wales#princess catherine of wales#catherine the princess of wales#william arthur philip louis#prince william#prince of wales#prince william of wales#william the prince of wales#prince and princess of wales#william and catherine#kensington palace

112 notes

·

View notes

Photo

AGUST D : DAECHWITA (大吹打) & HAEGEUM (解禁) ⤷ movie posters | ig ; twt (click for hi-res)

#i'm back and ready to create again :'))#bts#bangtan#yoongi#agust d#suga#userbangtan#usersky#bangtanarmynet#hyunglinenetwork#dailybts#*latest#*posters#*gfx#btsgfx#idk if i wanna do an amygdala one#that one seems too personal to edit for me#so these will do for now

702 notes

·

View notes