#Verification Solution

Explore tagged Tumblr posts

Text

SprintVerify

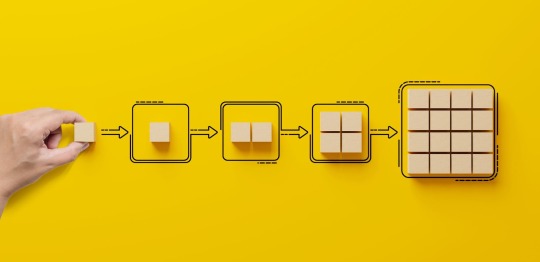

Customer verification is the process of verifying the identity of a customer before granting them access to an account or providing them with a service.

The process of customer verification can involve collecting and verifying personal information and documentation from the customer, such as their name, address, and government-issued identification. This information is used to confirm that the person trying to access an account or service is who they claim to be. Various methods can be used for customer verification, including document verification, biometric authentication, database checks, and two-factor authentication (2FA).

Customer verification has become increasingly important in recent years, as more transactions and interactions are taking place online. This has created new opportunities for fraudsters to steal personal information and engage in illegal activities. By implementing customer verification processes, businesses can protect themselves and their customers from these risks.

In addition to providing security benefits, customer verification can also enhance the customer experience by providing peace of mind and building trust between the customer and the business. By ensuring that only authorized individuals have access to accounts and services, businesses can also reduce the risk of fraudulent chargebacks and improve the overall efficiency of their operations.

By implementing customer verification processes, businesses can improve security, reduce risk, and provide a better customer experience.

The use and benefits of customer verification include:

Enhanced security: Customer verification helps to ensure that the person accessing an account or making a transaction is who they claim to be, reducing the risk of unauthorized access, fraud, and identity theft.

Regulatory compliance: Many industries, such as finance, require businesses to comply with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Customer verification can help businesses meet these requirements.

Reduced risk of chargebacks: By verifying customer identities, businesses can reduce the risk of fraudulent chargebacks, which occur when a customer disputes a transaction they did not make.

Improved customer experience: While customer verification can add an extra step to the account registration or login process, it can also provide customers with greater peace of mind knowing that their accounts and data are secure.

Increased trust: Customer verification can help to establish trust between businesses and their customers, which can lead to increased loyalty and repeat business.

Overall, customer verification is an important tool for businesses that want to improve security, comply with regulations, reduce risk, and build trust with their customers. By implementing a customer verification solution, businesses can protect their customers' data and improve the overall customer experience.

There are many customer verification platforms available, each with its own strengths and weaknesses. The best platform for customer verification depends on the specific needs of a business, such as the level of security required, the type of verification methods needed, and the budget available.

There are several methods that businesses can use to verify their customers, depending on their specific needs and requirements. Some common methods include:

Document verification: This involves verifying the authenticity of a government-issued ID, such as a passport or driver's license, by comparing it to a database or using computer vision technology to scan and analyze the document.

Biometric authentication: This involves verifying a customer's identity using biometric data, such as facial recognition, fingerprints, or voice recognition.

Database checks: This involves verifying a customer's identity by checking their personal information against public or private databases, such as credit bureaus or government records.

Two-factor authentication (2FA): This involves requiring customers to provide two forms of identification, such as a password and a one-time code sent via text message or email.

In-person verification: This involves verifying a customer's identity in person, such as by asking them to provide identification and taking a photo or video of them.

It's important to note that businesses should only collect and use customer data for verification purposes that are necessary and relevant to the services provided. Additionally, businesses should comply with applicable laws and regulations, such as those related to data privacy and protection.

SprintVerify, is a No-Code Document Verification Platform, designed to democratise the verification process for the masses. Through its revolutionary “Click2Verify” characteristic, it greatly eases the otherwise tedious process of verifying documents & onboarding partners, customers or users.

Verify all major documents in real-time, with just a click! Our easy-to-use platform enables fast onboarding through online document verification.

SprintVerify delivers a first-of-its-kind, A.I-Powered Document Verification experience that is Fast, Secure & Reliable.

SprintVerify ’s Sandbox lets you test all the Verification products on our platform for free! Just sign up to access it & avail your free credits now.

Notable SprintVerify products are Aadhaar Verification API, PAN Verification API, GST Verification API, Passport Verification API & RC Verification API among many more.

#Online Documentation Platform#Online Verification Platform#KYC Solutions#Authentication Platform#Identity Verification Platform#Documentation#Document Verification#ID Verification#Verification Solution#Verification API#Customer Verification

0 notes

Text

#kyc uk#kyc solution#kyc api#kyc software#background checks#background check companies#kyc aml solution#identity verification solution#background verification#kyc providers#fraud prevention

2 notes

·

View notes

Text

Sweden's Exemplary Anti-Corruption Stand: A Deep Dive into KYC and AML Practices

In the realm of global integrity and transparency, Sweden stands tall as the paragon of virtue, earning the coveted title of the world's least corrupt country, as per the Corruption Perceptions Index (CPI). Behind this remarkable achievement lies Sweden's unwavering commitment to combat corruption through robust Anti-Money Laundering (AML) laws, particularly focusing on stringent Know Your Customer (KYC) protocols. These protocols require financial institutions to verify the identity of their customers and any transactions they make. Furthermore, Sweden has implemented measures to protect whistleblowers and to ensure that any instances of corruption are investigated and prosecuted.

The Pillars of Trust: KYC in Sweden

Sweden's success in maintaining its reputation for integrity is deeply rooted in its proactive approach to KYC. The KYC process, an integral part of financial and business operations, plays a pivotal role in preventing corruption and money laundering by ensuring thorough identification and verification of customers. Sweden has invested heavily in its KYC system, building a comprehensive database of customer information. It has also implemented strict regulations requiring companies to report suspicious activity to the government. As a result, Sweden has become a world leader in the fight against financial crime.

KYC Solutions: More than a Mandate

KYC in Sweden goes beyond mere compliance; it serves as a comprehensive solution to safeguard the financial ecosystem. The emphasis on accurate customer identification, risk assessment, and ongoing monitoring establishes a formidable defense against illicit financial activities. Sweden's KYC system also promotes customer trust and increases customer convenience. By streamlining the onboarding process, customers can easily open an account and start trading. Additionally, the KYC system provides customers with better control over their money, as they can easily monitor their account activity.

Compliance at the Core

Sweden's commitment to compliance is evident in its KYC practices. Striking a delicate balance between stringent regulations and practical implementation, the country has fostered an environment where businesses operate with transparency and adhere to the highest ethical standards. Sweden's KYC regulations are designed to prevent money laundering and financial crime. The country has put in place a comprehensive set of measures, including customer due diligence, to ensure that businesses comply with the law. Additionally, Sweden has implemented a reporting system that allows authorities to track suspicious activity in real time.

AML Laws in Sweden: A Global Benchmark

Sweden's AML laws are not just a legal requirement but a testament to its commitment to global financial integrity. The country's legal framework provides a solid foundation for detecting and preventing money laundering activities, contributing significantly to its stellar position on the CPI. Sweden also has a strong commitment to international cooperation and information sharing, which helps to further strengthen the AML legal framework. Additionally, the country has implemented strict regulations on financial institutions, including requirements to report suspicious transactions.

KYC Service Providers – KYC Sweden Leading the Way

Sweden has emerged as a frontrunner in KYC solutions, with a focus on providing efficient and reliable services. KYC service providers in Sweden leverage advanced technologies and methodologies to offer the best-in-class identification and verification processes, setting the gold standard for global counterparts. Swedish KYC providers also provide the highest level of security, protecting customer data and complying with all local regulations. Furthermore, Swedish KYC providers offer a wide range of services, including onboarding, identity verification, and fraud prevention.

KYC for Swedish Businesses: A Necessity, not an Option

For businesses operating in Sweden, KYC is not merely a regulatory checkbox but a fundamental practice. The stringent KYC requirements ensure that businesses are well-acquainted with their clients, mitigating the risk of involvement in any illicit or corrupt activities. It also helps to protect the rights of customers, as it ensures that they are aware of who is handling their data. KYC also helps businesses to identify any potential risks associated with doing business with a particular customer.

Global Impact: KYC Sweden's Ripple Effect

Sweden's commitment to KYC and AML has a ripple effect beyond its borders. Businesses operating globally, including Swedish enterprises with international footprints, benefit from the robust KYC measures in place. This not only safeguards these businesses but also contributes to the overall global effort against corruption. As a result, other countries and organizations are encouraged to implement strong KYC and AML measures, which help to create a safer business environment for everyone. Additionally, these measures help to protect consumers from malicious actors and financial crimes.

Conclusion

Sweden's standing as the world's least corrupt country is a testament to its meticulous implementation of KYC and AML laws. By placing compliance, integrity, and transparency at the forefront of its financial practices, Sweden has set a precedent for nations worldwide. As businesses and governments grapple with the challenges of maintaining trust and financial integrity, KYC Sweden's model of KYC and AML serves as an exemplary beacon guiding the way forward. The integration of KYC solutions is not just a legal requirement for Sweden; it is a proactive strategy that continues to fortify its position as a global leader in the fight against corruption.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity#kyc sweden

2 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

KYC Provider Canada

KYC is a mandatory process that financial institutions and other businesses follow to authenticate the identities of their customers. KYC Providers help and provide KYC API to verify users' and business identities. KYC Providers in the Canada also use various methods to verify identities, like id, document, and address verification.

#KYC Canada#KYC Providers#KYC API#KYC Services provider#KYC Solutions Provider#KYC Software#kyc verification#KYC verification Solutions#KYC Platform#KYC Solution#fiance#crypto#blockchain#bitcoin#insurance#finance#fintech#healthcare#business

4 notes

·

View notes

Text

How Our Identity Verification API Helps Businesses Stay Secure

An identity verification API (Application Programming Interface) is a software tool that allows developers to integrate identity verification services into their applications or websites. Identity verification APIs provide a way for businesses to verify the identity of their customers, users, or clients, typically by comparing the information provided by the individual with data from a trusted source, such as a government database or credit bureau.

There are several identity verification APIs available in the market, offered by companies such as RPACPC GST VERIFICATION API, PAN STATUS, 206AB Compliance Check among others. These APIs typically provide a range of identity verification services, such as document verification, biometric authentication, and fraud detection.

To use an identity verification API, a developer would need to integrate the API into their application or website, typically by making API calls to the service provider's servers. The API would then return a response indicating whether the identity verification was successful or not, along with any relevant data or insights about the individual's identity.

Overall, identity verification APIs provide a way for businesses to strengthen their identity verification process, reduce fraud, and improve the user experience by making the verification process more efficient and seamless.

Identity verification is a crucial process that many businesses need to perform to ensure that their customers or users are who they claim to be.

This process helps to prevent fraud, protect against financial losses, and comply with regulatory requirements. However, performing identity verification manually can be time-consuming and error-prone, especially as more and more businesses move online. Fortunately, with the advent of identity verification APIs, businesses can now automate this process and make it more efficient and accurate.

The benefits of using an identity verification API are many. First and foremost, it provides a faster and more efficient way to verify identities. Instead of manually checking documents and cross-referencing information, businesses can automate the process and get instant results. This helps to reduce the time and effort required to perform identity verification, enabling businesses to onboard customers or users more quickly and easily.

Secondly, identity verification APIs provide a more accurate way to verify identities. APIs use a range of data sources to verify an individual's identity, such as government databases, credit bureaus, and social media platforms. This enables them to cross-reference multiple sources and detect any inconsistencies or red flags that may indicate fraudulent activity. By using an API, businesses can reduce the risk of identity fraud and protect themselves from financial losses.

Thirdly, identity verification APIs help to improve the user experience. By automating the verification process, businesses can provide a seamless and frictionless onboarding experience for their customers or users.

This helps to reduce the drop-off rate during the onboarding process and increases the likelihood of conversion.

Finally, identity verification APIs can help businesses comply with regulatory requirements. Many industries, such as banking and finance, have strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations that require them to perform identity verification on their customers. By using an API, businesses can automate this process and ensure that they comply with regulatory requirements. APIs also provide a more auditable and transparent way to perform identity verification, which can help businesses demonstrate compliance to regulators.

In conclusion, identity verification APIs provide a faster, more accurate, and more convenient way for businesses to verify the identity of their customers or users. By automating the identity verification process, businesses can reduce the risk of fraud, protect against financial losses, and comply with regulatory requirements. With the increasing importance of online identity verification, businesses that use identity verification APIs are better positioned to provide a secure and seamless user experience.

#Identity Verification#Identity Verification API#identity verification services#identity verification solutions#online identity verification service#online identity verification solutions

2 notes

·

View notes

Text

Achieving Success Through Supply Chain Management Training in Bangladesh

Bangladesh is a country of immense potential, but it has struggled to leverage that potential due to inadequate supply chain management training. As the world globalizes, supply chain management has become increasingly important for businesses in both developed and developing countries. For Bangladesh, this opens up opportunities to create jobs, increase exports and nurture economic growth.

But what does it take for Bangladesh to become a leader in the field of supply chain management? In this blog post, we will explore how training and education can help drive forward success in this area and help grow the economy of Bangladesh.

What is Supply Chain Management?

Supply chain management (SCM) is the process of planning, implementing, and controlling the operations of a company's supply chain. The main goal of SCM is to ensure that the company's products are delivered to customers in a timely and efficient manner.

SCM training can help Bangladesh-based companies improve their supply chains and achieve success. Through SCM training, companies can learn how to better plan and control their supply chains, which can lead to improved customer satisfaction and increased profits.

The Importance of Supply Chain Management Training

The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is committed to ensuring that its members are able to access the best possible supply chain management training. In order to achieve this, the BGMEA has partnered with a number of leading international organizations to offer a range of courses which cover all aspects of supply chain management.

The BGMEA recognizes that an efficient and effective supply chain is essential to the success of the garment industry in Bangladesh. In order to keep up with the ever-changing requirements of the global market, it is essential that Bangladeshi manufacturers have access to the latest information and techniques. The courses offered by the BGMEA will ensure that members are able to stay ahead of the competition and continue to meet the demands of buyers.

The courses on offer include:

- An Introduction to Supply Chain Management

- Principles of Supply Chain Management

- Fundamentals of Purchasing and Procurement

- Supply Chain Management for Apparel Brands and Retailers

- Sourcing Strategies for Apparel Manufacturers

- Lean Manufacturing for Apparel factories

- Quality Control and Assurance in Apparel Production

Each course is designed to provide participants with the knowledge and skills they need to improve their operations and contribute to the success of their company. The courses are delivered by experienced instructors who are experts in their field, and who use a variety of teaching methods including lectures, case studies, group work, and individual tutorials.

The Current State of Supply Chain Management in Bangladesh

The current state of supply chain management in Bangladesh can be best described as fledgling. Despite the fact that the country has been making strides in recent years to improve its logistics infrastructure, the overall level of development is still relatively low. This is particularly true when compared to other countries in the region such as India and China.

However, it is important to note that there are some bright spots. In particular, the Bangladeshi government has been investing heavily in training programs for supply chain management. These programs are designed to help improve the skills of those working in the logistics industry and to raise awareness about best practices.

There is still a long way to go before Bangladesh can claim to have a world-class supply chain management system. However, with continued investment and commitment from both the public and private sectors, it is certainly possible that the country will be able to make significant progress in this area in the years to come.

The Benefits of Supply Chain Management Training in Bangladesh

The benefits of supply chain management training in Bangladesh are numerous. Perhaps most importantly, it helps to improve communication and coordination between different parts of the supply chain, which can lead to improved efficiencies and cost savings. In addition, supply chain management training can help to improve supplier relationships, as well as customer service and satisfaction levels.

In today's business environment, having a well-trained and efficient supply chain management team is critical to success. By investing in quality training for your team, you can ensure that your company is able to keep up with the competition and maintain a high level of customer satisfaction.

The Different Types of Supply Chain Management Training in Bangladesh

Supply chain management (SCM) is becoming increasingly important in today's globalized world, particularly for firms in the developing world. Bangladesh is no exception; training in SCM is necessary to keep up with the challenges of an ever-changing business landscape. This article will discuss the different types of SCM training available in Bangladesh, and how each of these courses can help organizations improve their performance.

1. Traditional supply chain management training: This type of training covers the basic concepts and methods of supply chain management. It is typically delivered in a classroom setting, and may include lectures, case studies, and group discussions.

2. Online supply chain management training: This type of training is delivered online, and can be self-paced or synchronous (taught in real-time with a live instructor). It may include videos, readings, quizzes, and simulations.

3. Supply chain management certification programs: These programs provide comprehensive training in supply chain management principles and practices. They often include an exam at the end, and successful completion can lead to professional certification.

4. On-the-job training: Many organizations offer on-the-job training programs for their employees. This type of training can be tailored to the specific needs of the organization, and allows employees to learn while they are working.

The Challenges of Implementing Supply Chain Management Training in Bangladesh

In Bangladesh, the challenges of implementing supply chain management training are many and varied. The first challenge is the lack of awareness of the importance of supply chain management among the general population. This is compounded by the fact that there is no formal education or training available in Bangladesh on this topic. As a result, there are few people who are knowledgeable about supply chain management and its potential benefits.

The second challenge is the lack of infrastructure and resources to support supply chain management training. In Bangladesh, most businesses operate on a small scale and do not have the necessary resources to invest in training their employees on supply chain management. Additionally, there is a lack of qualified trainers who are able to provide quality training on this topic.

The third challenge is the cultural barriers to implementing supply chain management training in Bangladesh. The culture in Bangladesh places a high value on personal relationships and networking. This can make it difficult to implement changes within an organization, such as introducing new processes or technologies related to supply chain management. Additionally, the hierarchical nature of Bangladeshi society can make it difficult to get buy-in from all levels of an organization for new initiatives.

Despite these challenges, there are also opportunities for successful implementation of supply chain management training in Bangladesh. One opportunity lies in the increasing globalization of business and trade. As more businesses operate internationally, they will need employees who are trained in international standards and practices related to supply chain management. Additionally, the growth of the Bangladesh economy provides opportunities

Tips for Successful Supply Chain Management Training

Having an effective supply chain management training program can be a great resource for any organization. It is essential to ensure that proper training is conducted in order to maximize efficiency and productivity. With the right guidance and resources, companies can build a successful supply chain management program that benefits the entire organization. Below we will discuss some tips for successful supply chain management training that can help you get started on the right track.

1. Define your goals: What do you hope to achieve through supply chain management training? Is it to improve your knowledge of the subject so that you can be more effective in your current role? Or are you looking to advance your career and move into a managerial position? Once you know what your goals are, you can tailor your training accordingly.

2. Do your research: There are many different types of supply chain management training programs out there. Before enrolling in one, do some research to make sure it's a good fit for you. Ask yourself what the program covers, how long it is, and whether it's offered online or in-person.

3. Consider your schedule: Supply chain management training can be intensive, so make sure you have the time to commit to it. If you're working full-time while taking classes, consider an online program that offers more flexibility.

4. Set aside time for study: In addition to attending classes, you'll need to set aside time for independent study. Make sure you're prepared to commit the necessary time to reading textbooks and other course materials, as well as completing assignments.

5. Stay organized: Supply chain management involves a lot of moving parts, so it's important to stay organized throughout your training. Keep track of deadlines and due dates, and create a system for organizing course materials so that you can easily find what you need when you need it.

How to Overcome the Challenges of Supply Chain Management Training in Bangladesh

In order to overcome the challenges of supply chain management training in Bangladesh, it is important to first understand the specific challenges that exist within the country. One of the biggest challenges is the lack of a centralized government body or institution that can provide cohesive and standardized training. This often results in a fragmented approach to training, with different organizations and companies using their own methods, which can make it difficult for employees to receive a consistent education.

Another challenge is the limited resources that are available for training. This includes both financial resources and skilled personnel. As a result, many supply chain management programs in Bangladesh are forced to operate on a shoestring budget, which can impact the quality of instruction and learning materials. In addition, there is often a shortage of qualified trainers, which can make it difficult to find someone with the necessary knowledge and experience to effectively teach employees.

Despite these challenges, there are also several opportunities that exist for those interested in pursuing supply chain management training in Bangladesh. One of the biggest advantages is the country's vast pool of potential workers. With over 160 million people living in Bangladesh, there is a large labor force that can be tapped into for supply chain management positions. In addition, Bangladesh has a rapidly growing economy and its manufacturing sector is expected to expand significantly in the coming years. This provides an opportunity for those with supply chain management training to find employment with companies that are looking to capitalize on this growth.

Overall, while there are some challenges associated with supply chain

Conclusion

In conclusion, supply chain management training in Bangladesh can help businesses achieve success. With proper training and resources, businesses can become more efficient and effective in their operations thus gaining a competitive edge over other companies. It is essential for organizations to invest in the right technology and personnel to ensure that they are well-prepared for the ever-evolving business environment. Ultimately, it is up to each business's leadership team to recognize the importance of having strong supply chain management processes and provide necessary support towards successful supply chain implementations.

#Enroute International Limited#Managed Service#People Outsourcing#Payroll Service#Facility Management#Events Activation#Recruitment Service#Talent Sourcing#Headhunting Solution#HR Consulting#Skills Recruitment#Pre-employment verification#Background Verification#Executive Education#Leadership Executive Coaching#Customized Program#Consultancy Service#Market Development Service#Digital Lab#Character Licensing#Capacity Development#BPO Company#Business Process Outsourcing Company#Business Process Outsourcing Organization#Business Process Outsourcing Bangladesh#E-learning#Open Training#Skills Training#Executive Coaching#Customized Training

5 notes

·

View notes

Text

Identity Verification Market Report 2024: Key Trends, Growth Drivers, and Future Opportunities

Identity Verification Market Report 2024: Key Trends, Growth Drivers, and Future Opportunities

Straits Research Unveils Comprehensive Report on the Identity Verification Market

Pune, India – December 13, 2024 – Straits Research, a leading market intelligence firm, has released an extensive report on the global Identity Verification Market, projecting significant growth and highlighting key trends, driving factors, and opportunities. According to the report, the global Identity Verification Market was valued at USD 11.4 billion in 2023 and is expected to reach USD 13.3 billion in 2024. The market is projected to grow to USD 44.6 billion by 2032, at a compound annual growth rate (CAGR) of 16.4% during the forecast period (2024–2032).

Request a Free Sample (Full Report Starting from USD 1850): https://straitsresearch.com/report/identity-verification-market/request-sample

Market Key Trends

The Identity Verification Market is undergoing rapid transformation, driven by several key trends:

Advancements in Technology: The integration of artificial intelligence (AI), machine learning (ML), and blockchain in identity verification solutions is enhancing accuracy, speed, and security.

Growing Cybersecurity Threats: Rising incidents of identity theft and fraud are propelling the demand for robust identity verification systems.

Regulatory Compliance: Stringent regulations and compliance requirements across various industries are mandating the adoption of identity verification solutions.

Digital Transformation: The global shift towards digitalization, especially in the financial and government sectors, is accelerating the need for identity verification solutions.

Driving Factors

Several factors are driving the growth of the Identity Verification Market:

Increasing Online Transactions: With the surge in online banking, e-commerce, and digital payments, the need for secure identity verification is paramount.

Rising Need for Fraud Prevention: Organizations are increasingly focusing on fraud prevention to protect sensitive information and maintain customer trust.

Government Initiatives: Governments worldwide are implementing digital identity programs to streamline citizen services and enhance security.

Opportunities

The Identity Verification Market presents numerous opportunities for growth and innovation:

Emerging Markets: Rapid economic growth and digital adoption in emerging markets offer significant opportunities for identity verification solution providers.

Technological Innovations: Continuous advancements in biometrics, AI, and blockchain are creating new avenues for product development and enhancement.

Partnerships and Collaborations: Strategic partnerships and collaborations between technology providers, financial institutions, and government agencies are driving market expansion.

Identity Verification Market Segmentation

The Identity Verification Market is segmented based on components, types, deployment modes, organization sizes, and verticals.

By Component

Solution: Comprehensive identity verification solutions integrating various technologies to ensure accurate and secure identity authentication.

Service: Professional services, including consulting, integration, and support, to assist organizations in deploying and managing identity verification systems.

By Type

Biometrics: Identity verification methods using biometric data such as fingerprints, facial recognition, and iris scans.

Non-biometrics: Traditional methods including document verification, knowledge-based authentication, and two-factor authentication.

By Deployment Mode

On-premises: Solutions deployed on the organization's local servers, offering control and customization.

Cloud: Cloud-based identity verification solutions providing scalability, flexibility, and remote access.

By Organization Size

SMEs: Small and Medium Enterprises leveraging identity verification solutions to enhance security and compliance.

Large Enterprises: Large organizations adopting advanced identity verification systems to manage large-scale operations and mitigate risks.

By Verticals

BFSI: Banks, financial institutions, and insurance companies utilizing identity verification to prevent fraud and comply with regulations.

Government and Defence: Government agencies and defense sectors implementing identity verification for secure access and citizen services.

Healthcare & Life Sciences: Hospitals and healthcare providers ensuring patient identity verification to maintain data security and compliance.

Retail and E-Commerce: E-commerce platforms and retailers adopting identity verification to secure transactions and enhance customer trust.

IT & ITES: IT and IT-enabled services companies using identity verification to protect sensitive information and prevent data breaches.

Energy and Utilities: Companies in the energy and utilities sector implementing identity verification for secure access to critical infrastructure.

Others: Additional sectors including education, travel, and gaming adopting identity verification to enhance security and user experience.For more details: https://straitsresearch.com/report/identity-verification-market/segmentation

List of Key Players in Identity Verification Market

Prominent players in the Identity Verification Market include:

Equifax, Inc.

Thales Group S.A.

Experian Plc

Acuant, Inc.

Mitek Systems, Inc.

TransUnion LLC.

GB Group PLC

IDEMIA

Intellicheck Inc.

Nuance Communications Inc.Detailed Table of Content of the Identity Verification Market Report: https://straitsresearch.com/report/identity-verification-market/toc

Conclusion

The Identity Verification Market is poised for substantial growth, driven by technological advancements, increasing cybersecurity threats, and regulatory compliance requirements. Straits Research's comprehensive report provides valuable insights and strategic recommendations to help businesses navigate this dynamic market landscape.

Purchase the Report: https://straitsresearch.com/buy-now/identity-verification-market

About Straits Research

Straits Research is a top provider of business intelligence, specializing in research, analytics, and advisory services, with a focus on delivering in-depth insights through comprehensive reports.

Contact Us:

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Phone: +1 646 905 0080 (US), +91 8087085354 (India), +44 203 695 0070 (UK)

#Identity Verification Market#2024 Market Report#Identity Verification Trends#Market Growth#Identity Verification Solutions#Straits Research

0 notes

Text

Precision is crucial when it comes to fingerprinting services. The accuracy of Livescan fingerprint in Laurel, Maryland ensures that background checks and identity verifications are both correct and reliable. Livescan technology allows for the digital capture of fingerprints, providing a much more precise method than traditional ink-based techniques. This accuracy is vital in various situations such as job screenings, security clearances, and legal matters. The precision of your fingerprints directly impacts the speed and reliability of the entire process.

0 notes

Text

Discover a new era of banking possibilities with Simplici

Simplify and elevate your banking operations with Simplici’s cutting-edge solutions. Our transformative technologies empower banks to stay ahead of the competition, deliver seamless experiences, and drive customer loyalty.

2 notes

·

View notes

Text

#medical billing and coding#medical billing services#medical billing solutions#Top Insurance Verification services

0 notes

Text

#kyc uk#age verification system#age verification software#age verification providers#age verification api#online gaming#age verification provider in uk#kyc solution#gaming industry

2 notes

·

View notes

Text

Five Tips for Enhancing Your KYC Compliance and AML Procedures

In today's rapidly evolving regulatory landscape, maintaining robust Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance processes is more crucial than ever for businesses. These processes go beyond mere regulatory requirements; they form the cornerstone of secure operations, global expansion, customer trust, and data-driven insights. In this article, we'll delve into five essential tips to optimize your KYC processes and ensure AML compliance.

Understanding KYC and AML Compliance

KYC, short for Know Your Customer, refers to the practice of verifying and assessing the identities and risk levels of your customers. This procedure is vital for adhering to regulatory mandates and mitigating risks associated with financial crimes like money laundering and fraud. KYC plays a pivotal role in maintaining a secure business environment and building trust with clients.

Non-compliance with KYC regulations can lead to severe repercussions such as hefty fines, legal actions, reputational damage, and business disruptions. Therefore, adhering to KYC regulations is not just a necessity; it's a protective measure for your business.

1. Screening Against Current Lists

Efficient KYC begins with screening customers against relevant, up-to-date lists. Utilizing comprehensive KYC solutions equipped with advanced technology and access to databases containing sanction lists, politically exposed persons (PEPs) databases, and other watchlists enhances the accuracy of your screening processes.

By incorporating these KYC screening tools, you minimize risks and ensure compliance while reducing false positives, which ultimately saves valuable time and resources.

2. Integration with Risk Assessment

Integrating KYC into your broader risk assessment framework is crucial for maintaining an effective process. Customer information can change rapidly, necessitating continuous monitoring. Regularly reviewing and updating KYC data enables you to adapt to shifting risk profiles and make informed decisions.

Furthermore, integrating KYC data into your risk assessment facilitates a seamless link to ongoing due diligence processes. For instance, if a customer's risk profile changes due to a new business venture, you can proactively adjust your risk mitigation strategies.

3. Establishing Scalability

Keeping up with new clients and evolving compliance requirements requires a flexible and scalable KYC process. Onboarding new clients, regardless of their type, should be a consistent and streamlined process rather than a burden.

Investing in a scalable KYC solution capable of handling increasing data volumes and simplifying onboarding processes is key. Such a solution enables instant screening and efficient onboarding, allowing you to focus on growth without hindrances.

4. Preparing for Regulatory Challenges

The landscape of AML and KYC compliance is continually evolving, with regulators worldwide tightening their grip on financial institutions. Preparing for these challenges by embracing technology-driven KYC solutions can lead to automation, enhanced accuracy, and improved customer experiences.

Automated KYC solutions provide the means to avoid the hefty fines and regulatory scrutiny associated with non-compliance. Staying ahead of regulatory changes through technology-driven approaches is a strategic move for safeguarding your business.

5. Seeking Expert Assistance

In the face of complex regulatory requirements and the ever-changing landscape of AML and KYC compliance, seeking expert assistance can prove invaluable. Companies like KYC Sweden offer AML platforms that seamlessly integrate KYC responses with transaction monitoring.

This integration allows for quick identification of unusual transaction behavior, reducing the risk of being unwittingly involved in money laundering or terrorist financing. Outsourcing transaction monitoring to experts through a Managed Service can streamline your compliance efforts.

In conclusion, optimizing your KYC and AML processes is not only about regulatory compliance but also about safeguarding your business and fostering trust with clients. By following these five tips, incorporating technology-driven solutions, and staying prepared for regulatory changes, you can streamline your KYC and AML compliance, ensuring a secure and successful business journey.

Is your business prepared for the potential consequences of regulatory audits? Have you integrated transaction monitoring with your KYC processes? If you seek further guidance on these crucial matters, don't hesitate to contact us at KYC Sweden.

#kyc sweden#kyc#kyc solutions#kyc services#kyc verification#kyc api#kyc compliance#kyc and aml compliance#compliance#digital identity#digital world

2 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes