#Vanguard International Semiconductor Company

Explore tagged Tumblr posts

Text

#Vanguard International Semiconductor Company#semiconductor_manufacturing#automotive_and_industrial#semiconductors#development#next_generation#electronicsnews#technologynews

0 notes

Text

Deutsch Semiconductor Foundry Service Marktgröße, Anteil, Anwendungsanalyse, regionaler Ausblick, Wachstumstrends, Hauptakteure, Wettbewerbsstrategien und Prognosen bis 2028

<strong>Marktübersicht</strong> Der Bericht hebt die Markteintrittspolitik für verschiedene auf dem Markt tätige Schlüsselunternehmen hervor. Bei der Erstellung des Berichts wurden verschiedene grafische Präsentationstechniken wie Diagramme, Grafiken, Tabellen und Bilder verwendet. Der Semiconductor Foundry Service -Marktbericht unterstützt statistische Analysen in Bezug auf Schlüsselfaktoren, einschließlich der wichtigsten Treiber, Herausforderungen, Chancen und Einschränkungen, die voraussichtlich einen erheblichen Einfluss auf den Marktfortschritt haben werden. Darüber hinaus enthält der nächste Abschnitt des Berichts eine Markteinschätzung von oben nach unten zusammen mit Schlüsselmustern, Hauptakteuren, Herausforderungen, Anordnungsmustern, Eröffnungen, einem professionellen Überblick und einem zukünftigen Leitfaden. Die Marktstudie vermittelt außerdem wesentliche Rahmenbedingungen der Branche sowie wichtige Entwicklungsstrategien und -richtlinien. Auch Marktwachstumstrends und Marketingkanäle werden analysiert. Dann bietet es eine Untersuchung der vorgelagerten Rohstoffe, der nachgelagerten Nachfrage und der aktuellen Marktdynamik.

<strong> <a href=https://www.statistifymarketresearch.com/reports/semiconductor-foundry-service-market/sample-request-64193>Request For View Sample Semiconductor Foundry Service Market Report </a></strong>

<strong>Methodik</strong> Der Bericht basiert auf zwei Forschungsansätzen – primär und sekundär. Zu den Hauptquellen gehören Pressemitteilungen, Jahresberichte, Regierungswebsites usw. verschiedener Unternehmen, die in dieser Branche tätig sind, sowie Ansichten verschiedener Analysten, Experten und Forscher. Sekundäre Quellen umfassen wirtschaftliche, politische, soziale und andere Szenarien des Marktbereichs. Verschiedene Quellen tragen zusammen zur Erstellung dieses entsprechenden Berichts bei, um das Marktwachstum zu verbessern. Die Berichtsforschung enthält verschiedene Ausblicke auf die verschiedenen Marktsegmente.

<strong>Berichtszusammenfassung</strong> Berichte sind für jede Art von Kommunikation auf Organisationsebene äußerst wichtig. Die in diesen Berichten zum Ausdruck gebrachten Erkenntnisse werden regelmäßig als Nährboden für Entscheidungen genutzt, die sowohl die kurz- als auch die langfristige Planung des Unternehmens betreffen. Obwohl die Anforderungen und der Inhalt eines Berichts für verschiedene Unternehmen unterschiedlich sein können, besteht der unkomplizierte Ansatz darin, Fakten und gesammelte Daten darzustellen, um dem Leser nützliche Informationen zur Verfügung zu stellen, um eine vernünftige Entscheidungsfindung zu fördern. Es soll umfassend über alle Hindernisse und Leistungen des Unternehmens Rechenschaft ablegen. Der von unserem Team erstellte Bericht hilft der Geschäftsführung der Organisation, Fortschritte und Wachstum zu verfolgen, Trends oder Unregelmäßigkeiten zu erkennen, die möglicherweise weiter untersucht werden müssen.

<strong>Marktsegmentierung</strong> Um einen strategischen Vorteil zu erzielen und eine bessere Geschäftsstrategie zu gestalten, ist es wichtig, die operative Hauptstrategie der Wettbewerber, den Markterfolg in der Vergangenheit sowie das Produkt- und Serviceportfolio zu berücksichtigen. Die Recherche wird mit der richtigen Marktsegmentierung viel einfacher und detaillierter. Die Studie bietet eine detaillierte Segmentierung des globalen Semiconductor Foundry Service -Marktes basierend auf Umsatz, Umsatz, Wachstumsrate und Marktanteil jedes Segments. Die primär analysierten Segmente sind Software, Endbenutzer und Land. Es ermöglicht den Stakeholdern, jeden Teilmarkt strategisch in Bezug auf den individuellen Wachstumstrend und den Marktbeitrag jedes Teilmarktes zu bestimmen und wettbewerbsfähige Erweiterungen, Allianzen, neue Produkteinführungen und Akquisitionen des Marktes zu schaffen. Die Datentabellen und die zugehörigen Grafiken im Bericht machen die Forschung leicht verständlich.

<strong>Globaler Semiconductor Foundry Service -Markt nach Produkttyp und nach Anwendungen:</strong>

By Application ( Communication, PCs/Desktops, Consumer Goods, Automotive, Industrial, Defense & Aerospace, Other,)

By Type ( Only Foundry Service, Non-Only Foundry Service,)

<strong>Top gelistete Unternehmen:</strong> TSMC,<br> Globalfoundries,<br> UMC,<br> SMIC,<br> Samsung,<br> Dongbu HiTek,<br> Fujitsu Semiconductor,<br> Hua Hong Semiconductor,<br> MagnaChip Semiconductor,<br> Powerchip Technology,<br> STMicroelectronics,<br> TowerJazz,<br> Vanguard International Semiconductor,<br> WIN Semiconductors,<br> X-FAB Silicon Foundries,<br>

<strong>Gründe, diesen Bericht zu kaufen:</strong> Es bietet eine deskriptive Analyse der Nachfrage-Lieferkette im Semiconductor Foundry Service Markt. Der Bericht enthält eine statistische Analyse einiger bedeutender wirtschaftlicher Fakten. Verschiedene Daten im Bericht wurden in Form von Zahlen, Diagrammen, Grafiken und Bildern dargestellt, um den Markt klar zu beschreiben. Der Bericht enthält die Marktdefinition des Semiconductor Foundry Service -Marktes sowie die Analyse verschiedener Variablen, die den Markt beeinflussen, z. B. Treiber, Beschränkungen und Chancen.

<strong> <a href=https://www.statistifymarketresearch.com/checkout/?currency=USD&type=single_user_license&report_id=64193>Do Inquiry Before Purchasing Semiconductor Foundry Service Market Report</a></strong>

<strong>Die Forschung liefert Antworten auf die folgenden zentralen Fragen</strong> Was sind die größten Bedrohungen und Herausforderungen, die das Wachstum des Semiconductor Foundry Service -Marktes voraussichtlich behindern werden? Auf welche großen Chancen können sich die Marktführer verlassen, um Erfolg und Profitabilität zu erzielen? Wie wird die Fortschrittsrate des Semiconductor Foundry Service -Marktes für den Vermutungszeitraum 2021–2028 sein? Was sind die wichtigsten Faktoren für den Semiconductor Foundry Service -Markt in verschiedenen Regionen? Wer sind die größten Anbieter, die die Semiconductor Foundry Service -Branche dominieren, und welche Erfolgsstrategien verfolgen sie?

<strong>Regionale Analyse</strong> Statistify Market Research bietet Syndizierungsberichte von Marktforschern aus der ganzen Welt. Ready-to-buy Syndication Marktforschungsstudien helfen Ihnen, die relevantesten Business Intelligence zu finden. Unser Research Analyst bietet Geschäftseinblicke und Marktforschungsberichte für große und kleine Unternehmen. Das Unternehmen hilft seinen Kunden, Geschäftsrichtlinien zu entwickeln und in diesem Marktbereich zu wachsen. Statistify Market Research interessiert sich nicht nur für Branchenberichte zu den Themen Halbleiter und Elektronik, Maschinenbau, Informations- und Kommunikationstechnologie, Automobil und Automobil, Chemie und Material, Verpackung, Lebensmittel und Getränke etc., sondern auch Ihre Unternehmensdaten, Länderprofile, Trends , Informationen und Analysen zu Ihrem Interessensbereich.

<strong>Anpassung des Berichts:</strong> Den maßgeschneiderten Bericht erhalten Sie von unserer Beratungsfirma zu einem günstigen Preis. Wir liefern aktualisierte Informationen entsprechend den Anforderungen der Kunden in der Marktwelt.

<strong>Leistungen:</strong> 1. Gut aktualisierte Informationen. 2. Statistischer Bericht bereitgestellt. 3. Rabattangebot in der Anpassung. 4. Service auf globaler Ebene. 5. Unternehmensforschungsbericht zur Verfügung gestellt.

<strong>Dienstleistungen:</strong> 1. Fachkundige Analysten zu Ihren Diensten. 2. Service nach Ihren Bedürfnissen 3. Klärung Ihrer Anfragen. 4. Ganztägiger Service 5. Gut aktualisierter Bericht.

<strong> <a href=https://www.statistifymarketresearch.com/semiconductor-foundry-service-market>Full Report Summary of Semiconductor Foundry Service Market </a></strong>

<strong>Über Statistify Market Research</strong> Statistify Market Research zielt darauf ab, perfekte Informationen bereitzustellen, die den tatsächlichen Stand der Handlungen unter Nutzung primärer sowie sekundärer Informationsquellen abbilden. Statistify Market Research arbeitet sehr unvoreingenommen und strukturiert und arbeitet nach einem geordneten Prozess und verfügt über qualitativ recherchierte Informationen zu den Verfahren. Die in jeder Phase befolgten Verfahren sind systematisch, gut dokumentiert und so weit wie möglich im Voraus geplant. Statistify Market Research verwendet die empirische Methode bei der Erhebung von Daten und wird untersucht, um das bisherige Konzept der Theorie zu überprüfen.

<strong>Company Name - Statistify Market Research</strong> Office Address - 156, Sector 9 Vasundhra Aptts Rohini, New Delhi 110085 IN Telephone Numbers - (+44) 162-237-1047 (+44) 162-237-1047 Email ID - <a href="mailto:[email protected]"><strong>[email protected]</strong></a> Contact Us – <a href="https://www.statistifymarketresearch.com/contact-us/"><strong>https://www.statistifymarketresearch.com/contact-us/</strong></a>

0 notes

Text

Bipolar-CMOS-DMOS(BCD) EUROPE Market Research Report 2021-2026

The Bipolar-CMOS-DMOS(BCD) market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product launches, area marketplace expanding, and technological innovations.

ALSO READ: http://www.marketwatch.com/story/bipolar-cmos-dmosbcd-market-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-news-2026-2021-07-18

Market segmentation Bipolar-CMOS-DMOS(BCD) market is split by Type and by Application. For the period 2016-2026, the growth among segments provide accurate calculations and forecasts for revenue by Type and by Application. This analysis can help you expand your business by targeting qualified niche markets.

ALSO READ: http://www.marketwatch.com/story/june-2021-report-on-global-commercial-hvac-chillers-market-share-value-and-competitive-landscape-2021-2021-06-17

Market segment by Type, covers 0.09µm 0.1µm-0.2µm 0.21µm-0.4µm 0.41µm-0.8µm More than 0.8µm

Market segment by Application, can be divided into LED Consumer Electronics Automotive Electronics Others

Market segment by players, this report covers STMicroelectronics Samsung United Microelectronics Corporation TSMC Tower Semiconductor axim Integrated Vanguard International Semiconductor Magnachip Atmel Texas Instruments NXP Semiconductors Huahong Semiconductor CR Micro Silan SMIC

ALSO READ: http://www.marketwatch.com/story/june-2021-report-on-global-limonite-ore-market-overview-size-share-and-trends-2021-2026-2021-06-17

Market segment by regions, regional analysis covers North America (United States, Canada, and Mexico) Europe (Germany, France, UK, Russia, Italy, and Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Australia, and Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of Middle East & Africa)

The content of the study subjects, includes a total of 12 chapters: Chapter 1, to describe Bipolar-CMOS-DMOS(BCD) product scope, market overview, market opportunities, market driving force and market risks. Chapter 2, to profile the top players of Bipolar-CMOS-DMOS(BCD), with revenue, gross margin and global market share of Bipolar-CMOS-DMOS(BCD) from 2019 to 2021. Chapter 3, the Bipolar-CMOS-DMOS(BCD) competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast. Chapter 4 and 5, to segment the market size by type and application, with revenue and growth rate by type, application, from 2016 to 2026. Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2016 to 2021.and Bipolar-CMOS-DMOS(BCD) market forecast, by regions, platform and application, with revenue, from 2021 to 2026. Chapter 11 and 12, to describe Bipolar-CMOS-DMOS(BCD) research findings and conclusion, appendix and data source.

ALSO READ: http://www.marketwatch.com/story/non-public-security-service-market-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-news-2021-2028-2021-06-21

Table of Contents

1 Market Overview 1.1 Product Overview and Scope of Bipolar-CMOS-DMOS(BCD) 1.2 Classification of Bipolar-CMOS-DMOS(BCD) by Platform 1.2.1 Overview: Global Bipolar-CMOS-DMOS(BCD) Market Size by Type: 2020 Versus 2021 Versus 2026 1.2.2 Global Bipolar-CMOS-DMOS(BCD) Revenue Market Share by Type in 2020 1.2.3 0.09µm 1.2.4 0.1µm-0.2µm 1.2.5 0.21µm-0.4µm 1.2.6 0.41µm-0.8µm 1.2.7 More than 0.8µm 1.3 Global Bipolar-CMOS-DMOS(BCD) Market by Application 1.3.1 Overview: Global Bipolar-CMOS-DMOS(BCD) Market Size by Application: 2020 Versus 2021 Versus 2026 1.3.2 LED 1.3.3 Consumer Electronics 1.3.4 Automotive Electronics 1.3.5 Others 1.4 Global Bipolar-CMOS-DMOS(BCD) Market Size & Forecast 1.5 Global Bipolar-CMOS-DMOS(BCD) Market Size and Forecast by Region 1.5.1 Global Bipolar-CMOS-DMOS(BCD) Market Size by Region: 2016 VS 2021 VS 2026 1.5.2 Global Bipolar-CMOS-DMOS(BCD) Market Size by Region, (2016-2021) 1.5.3 North America Bipolar-CMOS-DMOS(BCD) Market Size and Prospect (2016-2026) 1.5.4 Europe Bipolar-CMOS-DMOS(BCD) Market Size and Prospect (2016-2026) 1.5.5 Asia-Pacific Bipolar-CMOS-DMOS(BCD) Market Size and Prospect (2016-2026) 1.5.6 South America Bipolar-CMOS-DMOS(BCD) Market Size and Prospect (2016-2026) 1.5.7 Middle East and Africa Bipolar-CMOS-DMOS(BCD) Market Size and Prospect (2016-2026) 1.6 Market Drivers, Restraints and Trends 1.6.1 Bipolar-CMOS-DMOS(BCD) Market Drivers 1.6.2 Bipolar-CMOS-DMOS(BCD) Market Restraints 1.6.3 Bipolar-CMOS-DMOS(BCD) Trends Analysis

ALSO READ: http://www.marketwatch.com/story/pendant-lamps-market-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-news-2021-2026-2021-06-21

2 Company Profiles 2.1 STMicroelectronics 2.1.1 STMicroelectronics Details 2.1.2 STMicroelectronics Major Business 2.1.3 STMicroelectronics Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.1.4 STMicroelectronics Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.1.5 STMicroelectronics Recent Developments and Future Plans 2.2 Samsung 2.2.1 Samsung Details 2.2.2 Samsung Major Business 2.2.3 Samsung Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.2.4 Samsung Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.2.5 Samsung Recent Developments and Future Plans 2.3 United Microelectronics Corporation 2.3.1 United Microelectronics Corporation Details 2.3.2 United Microelectronics Corporation Major Business 2.3.3 United Microelectronics Corporation Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.3.4 United Microelectronics Corporation Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.3.5 United Microelectronics Corporation Recent Developments and Future Plans 2.4 TSMC 2.4.1 TSMC Details 2.4.2 TSMC Major Business 2.4.3 TSMC Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.4.4 TSMC Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.4.5 TSMC Recent Developments and Future Plans 2.5 Tower Semiconductor 2.5.1 Tower Semiconductor Details 2.5.2 Tower Semiconductor Major Business 2.5.3 Tower Semiconductor Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.5.4 Tower Semiconductor Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.5.5 Tower Semiconductor Recent Developments and Future Plans 2.6 axim Integrated 2.6.1 axim Integrated Details 2.6.2 axim Integrated Major Business 2.6.3 axim Integrated Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.6.4 axim Integrated Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.6.5 axim Integrated Recent Developments and Future Plans 2.7 Vanguard International Semiconductor 2.7.1 Vanguard International Semiconductor Details 2.7.2 Vanguard International Semiconductor Major Business 2.7.3 Vanguard International Semiconductor Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.7.4 Vanguard International Semiconductor Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.7.5 Vanguard International Semiconductor Recent Developments and Future Plans 2.8 Magnachip 2.8.1 Magnachip Details 2.8.2 Magnachip Major Business 2.8.3 Magnachip Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.8.4 Magnachip Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.8.5 Magnachip Recent Developments and Future Plans 2.9 Atmel 2.9.1 Atmel Details 2.9.2 Atmel Major Business 2.9.3 Atmel Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.9.4 Atmel Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.9.5 Atmel Recent Developments and Future Plans 2.10 Texas Instruments 2.10.1 Texas Instruments Details 2.10.2 Texas Instruments Major Business 2.10.3 Texas Instruments Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.10.4 Texas Instruments Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.10.5 Texas Instruments Recent Developments and Future Plans 2.11 NXP Semiconductors 2.11.1 NXP Semiconductors Details 2.11.2 NXP Semiconductors Major Business 2.11.3 NXP Semiconductors Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.11.4 NXP Semiconductors Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.11.5 NXP Semiconductors Recent Developments and Future Plans 2.12 Huahong Semiconductor 2.12.1 Huahong Semiconductor Details 2.12.2 Huahong Semiconductor Major Business 2.12.3 Huahong Semiconductor Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.12.4 Huahong Semiconductor Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.12.5 Huahong Semiconductor Recent Developments and Future Plans 2.13 CR Micro 2.13.1 CR Micro Details 2.13.2 CR Micro Major Business 2.13.3 CR Micro Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.13.4 CR Micro Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.13.5 CR Micro Recent Developments and Future Plans 2.14 Silan 2.14.1 Silan Details 2.14.2 Silan Major Business 2.14.3 Silan Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.14.4 Silan Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.14.5 Silan Recent Developments and Future Plans 2.15 SMIC 2.15.1 SMIC Details 2.15.2 SMIC Major Business 2.15.3 SMIC Bipolar-CMOS-DMOS(BCD) Product and Solutions 2.15.4 SMIC Bipolar-CMOS-DMOS(BCD) Revenue, Gross Margin and Market Share (2019-2021) 2.15.5 SMIC Recent Developments and Future Plans 3 Market Competition, by Players 3.1 Global Bipolar-CMOS-DMOS(BCD) Revenue and Share by Players (2019-2021) 3.2 Market Concentration Rate 3.2.1 Top 3 Bipolar-CMOS-DMOS(BCD) Players Market Share 3.2.2 Top 10 Bipolar-CMOS-DMOS(BCD) Players Market Share 3.2.3 Market Competition Trend 3.3 Bipolar-CMOS-DMOS(BCD) Players Head Office, Products and Services Provided 3.4 Mergers & Acquisitions 3.5 New Entrants and Expansion Plans 4 Market Size Segment by Type 4.1 Global Bipolar-CMOS-DMOS(BCD) Revenue and Market Share by Type (2016-2021) 4.2 Global Bipolar-CMOS-DMOS(BCD) Market Forecast by Type (2021-2026)

….CONTINUED

CONTACT DETAILS :

+44 203 500 2763

+1 62 825 80070

971 0503084105

0 notes

Photo

US-China tech war: Beijing’s secret chipmaking champions

Once a month, senior executives of Yangtze Memory Technologies Co fly to Beijing for a flurry of meetings with China’s top economic management bodies. They focus on the company’s efforts to build some of the world’s most advanced computer memory chips — and its progress on weaning itself off American technology.

Based in the central riverside city of Wuhan, Yangtze Memory is considered at the vanguard of the country’s efforts to create a domestic semiconductor industry, already mass-producing state of the art 64-layer and 128-layer Nand flash memory chips, used in most electronics from smartphones to servers to connected cars.

These marvels of nanoengineering stack tiny memory cells in ever-greater densities, rivalling industry leaders such as US-based Micron Technology and South Korea’s Samsung Electronics.

That would be hard enough for a company that only opened its doors in 2016. But added to the challenge is the ambitious, state-directed aim of weeding out the group’s American suppliers, along with those reliant on US technology. The equipment used to manufacture high-end computer chips is virtually an American global monopoly. Eighty per cent of the market in some chipmaking and design processes such as etching, ion implantation, electrochemical deposition, wafer inspection and design software is in the hands of US companies.

This article is from Nikkei Asia, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their views on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan.

Subscribe | Group subscriptions

It is a frustrating area of dependence for China, which imported $350bn worth of semiconductors last year, according to the China Semiconductor Industry Association. Removing this source of US leverage over its economy became a national priority two years ago, when Washington put sanctions on China’s biggest telecoms equipment maker, Huawei Technologies, amid spying allegations that the Chinese company has constantly denied.

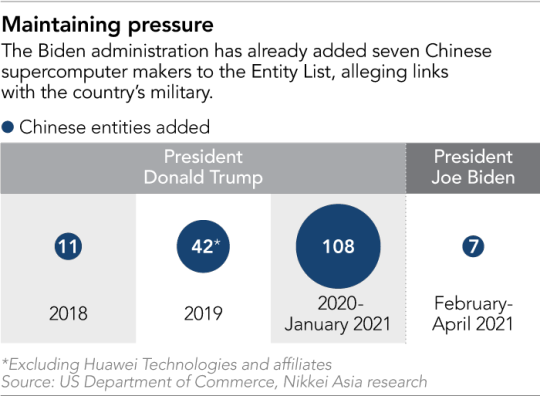

This was followed by sanctions on several other big Chinese technology companies, from its top contract chipmaker, Semiconductor Manufacturing International Co, to Hikvision, the world’s biggest surveillance camera maker. More than 100 companies in total have been placed on a trade blacklist prohibiting most US technology to be sold to them without a licence. That has spurred an aggressive effort by Beijing to identify and replace risky parts and suppliers.

The result has been an unprecedented flourishing of chip-related companies within China. Dozens of Chinese groups, with specialisations mirroring US incumbents in key areas from ion implantation to etching, have sprung into prominence over the past few years, accelerating as the state realises the enormity of the self-sufficiency project.

“The clock is ticking because they still know that the US could hit the local industry hard,” said Roger Sheng, a chip analyst at consultancy Gartner. “New chip competition is evolving as all the major economies, not just China, now recognise the importance of semiconductors.”

Plan B

So far, Yangtze Memory, also known as YMTC, has remained under the radar of the US government. But the company is taking no chances. With the guidance of Beijing, it has launched a massive review of its supply chain in an effort to find local suppliers — or, at least, non-US ones — to replace the dependence on American technology.

The collective effort has occupied more than 800 people, full time, and including staff from its multiple local suppliers, for two years. And they have not finished yet.

YMTC is seeking to learn as much as it can about the origin of everything that goes into its products, from production equipment and chemicals to the tiny lenses, screws, nuts and bearings in chipmaking machinery and production lines, multiple sources familiar with the matter said. The audit extends not only to YMTC’s own production lines, but also to suppliers, suppliers’ suppliers, and so on.

“The review is as meticulous as knowing where the screws and nuts are coming from, the lead time, and if those parts have alternatives,” one person familiar with the matter told Nikkei Asia.

Yangtze Memory’s plant in Wuhan © Yusho Cho

Each supplier is assigned a score for geopolitical risk, identified in many pages of documents detailing the components they use in their machines. YMTC has sent engineers to audit local equipment suppliers’ production sites to verify that the origins of parts have been truthfully reported, one of the people told Nikkei.

American-made parts are scored highest for risk, followed by parts bought from Japan, Europe and those made locally, the person said. Meanwhile, suppliers are asked to provide corrective action reports to explain how they can together diversify procurement and find alternatives.

“Previously, when China talked about self-sufficiency, they were thinking about starting to cultivate some viable chip developers that could compete with foreign chipmakers,” a chip industry executive told Nikkei. “However, they did not expect that they would need to do all that, starting from fundamentals.

“It’s like when you want to drink milk — but you not only need to own a whole farm, and learn how to breed dairy cows, and you have to build barns, fences, as well as grow hay, all by yourselves.”

It’s like when you want to drink milk — but you not only need to own a whole farm . . . breed dairy cows . . . build barns, fences . . . all by yourselves

The purge of YMTC’s supply chain has been handled with the spirit of a national emergency. Based in the city of Wuhan, the effort did not pause even when the virus centre was ravaged by Covid-19 last spring.

While the rest of the city endured a brutal quarantine, high-speed trains remained in service to ferry YMTC employees to its $24bn 3D Nand flash memory plant that began producing chips in 2019. All the while, delivery trucks for critical chipmaking materials drove to and from the production campus.

After Wuhan reopened last April, YMTC mobilised hundreds of engineers, including many from little-known emerging local semiconductor equipment suppliers. They were stationed inside the production campus, labouring for three shifts a day with the aim of overhauling all of its production processes and replacing as many foreign tools as possible, sources said.

“Senior management is raising targets of using locally built chip production machines almost every month, and they hope we could at least know what kind of alternatives we have and have a Plan B of the production line that will be free from US control,” one of the people told Nikkei.

YMTC declined multiple requests by Nikkei to interview the company about its supply chain reviews, progress and capacity expansion plans, as well as its localisation efforts.

‘Secure and controllable’

This effort to localise production has been the opportunity of a lifetime for a new generation of Chinese chip champions such as YMTC and their suppliers, whose fortunes have risen sharply following the start of the US-China trade war.

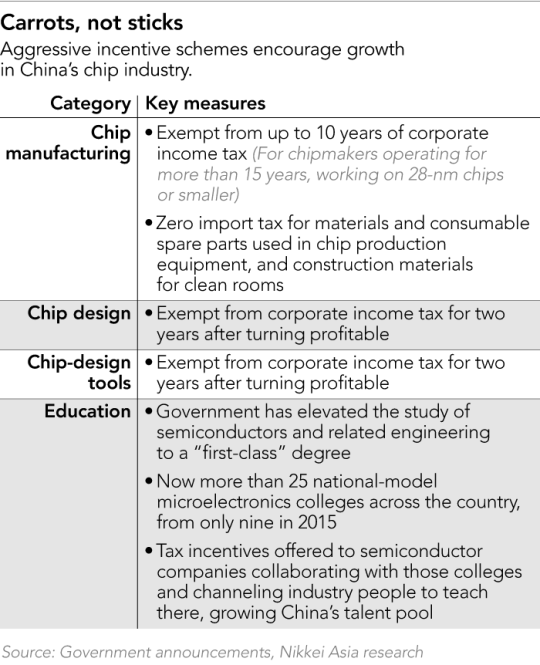

While the threat of sanctions hangs over them, so too does the largesse of state aid — subsidies and investment from local governments and the private sector have amounted to at least $170bn since 2014, according to the state-backed China Securities Journal. There are also guaranteed orders with other Chinese chipmakers and domestic tech giants such as Xiaomi, Oppo, Vivo and Lenovo.

“It’s not like it has been written down on a public posting or an official announcement,” another Chinese chip executive told Nikkei, “but everyone in the industry now has a mutual understanding that if anyone is building a new chip plant or expanding a semiconductor manufacturing line, at least 30 per cent of production tools must be from local vendors.”

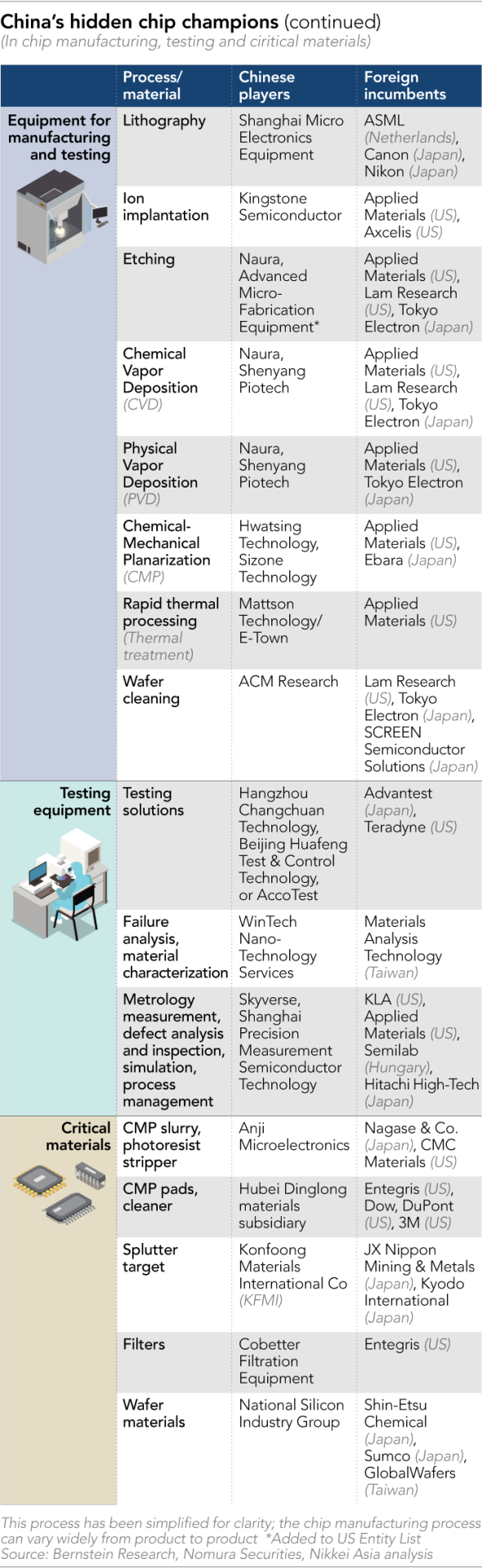

Every US market leader in the computer chip industry now has a Chinese doppelgänger that is being positioned to take its place as a vendor to the Chinese chip industry. YMTC, for example, is strikingly similar in its approach and strategy to Boise, Idaho-based Micron, while Beijing-based Naura Technology Group represents China’s hope to later challenge Applied Materials, which is based in Santa Clara, California, and makes a wide range of chip production equipment.

Shanghai’s Advanced Micro-Fabrication Equipment (AMEC) is China’s version of Lam Research of the US, renowned for building essential etching machines. Tianjin-based Hwatsing Technology produces cutting-edge chemical-mechanical planarisation equipment and is set to break Applied Materials’ monopoly on the technology.

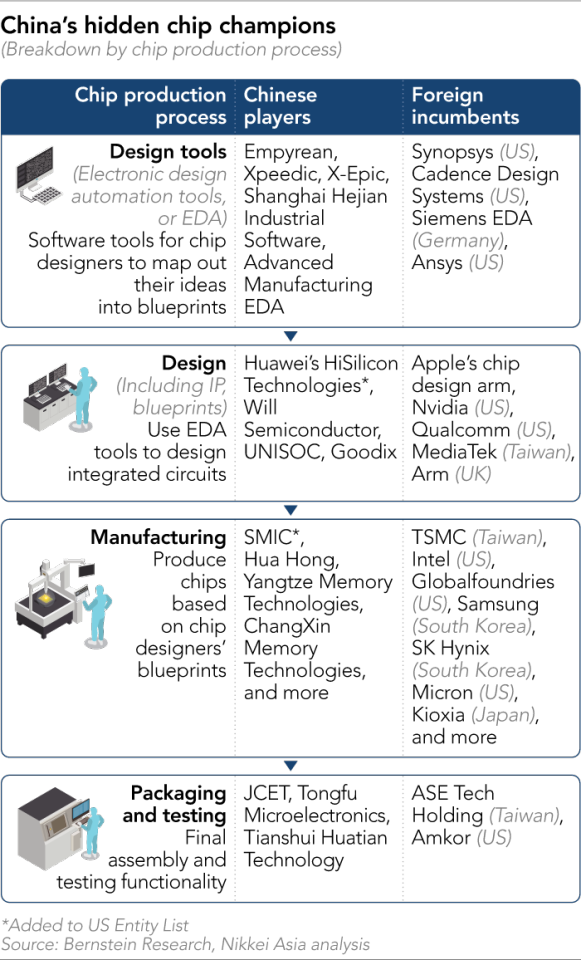

See the full graphic at the end of this article for more of China’s upcoming chipmakers.

These and dozens of other state and private companies have become the focus of an industrial policy known by the slogan “secure and controllable”, which has found its way on to posters and into speeches, backed up by immense state investment and guaranteed contracts.

“We have to strengthen self-innovation and to make breakthroughs in some core technologies as soon as possible,” China’s President Xi Jinping told a group of economic and social experts in remarks published in January.

YMTC, for one, is followed closely by China’s leadership, supervised by officials in the State Council — the country’s top administrative authority — as well as the China Integrated Circuit Industry Investment Fund, the nation’s premium seed fund for the semiconductor industry, which also owns a 24 per cent stake, two people with direct knowledge told Nikkei.

“We are not sure how fast and how well they could build their own independent semiconductor industry, but certainly they will try,” said Chad Bown, a senior fellow with Peterson Institute for International Economics.

‘The whole country is rooting for this.’

In fact, the US trade war and Huawei sanctions have arguably given China’s government the necessary cover for something it has long desired. Since the revelations by Edward Snowden in 2013 that detailed the participation of American tech companies in US government surveillance, Beijing has seen dependence on American technology as a national security threat.

But grand plans to end this dependency have been made in the past, and, despite massive injections of state investment, progress has been slow. For example, when China’s State Council set out its “Made in China 2025” industrial policy in 2015, aimed at promoting China’s high-tech exports, it set a goal of 70 per cent self-sufficiency in semiconductors by 2025.

But the industry has so far fallen short of this goal, according to US-based research firm IC Insights. In 2020, China-based chip production accounted for only 15.9 per cent of the domestic market, the firm estimated in January, predicting it would reach just 19.4 per cent in 2025. Of the 2020 total, China-based companies accounted for only 5.9 per cent of domestic sales, while foreign companies with their headquarters in China accounted for the rest of the China-based sales.

Under threat: cameras near the headquarters of Chinese video surveillance firm Hikvision in Hangzhou © Bloomberg

However, the US sanctions may have removed the main domestic obstacle to the goal of China’s chip self-sufficiency effort, which is the lack of co-operation by China’s own local buyers. They have always preferred buying from tried-and-tested foreign vendors rather than inexperienced local companies. But that, crucially, has now changed.

“Previously, domestic chip manufacturers only used leading production equipment that all the other top global chipmakers like Samsung and Intel also use in their production lines,” another manager with a China-based chipmaker told Nikkei, preferring not to be named. “Who would bother to use and try these local-made machines that could possibly affect production quality?”

As the threat of sanctions hits close to home, however, these same producers are increasingly exploring domestic-made alternatives to the top-end US-made technology, the manager said. “That also means these local players finally have a chance to practice and really upgrade their products in an atmosphere that the whole country is rooting for this,” he said.

Sheng of Gartner told Nikkei that US-China tensions have consolidated industry opinion around the necessity to localise production. “It’s the whole country’s consensus now that building a viable semiconductor industry and boosting self-reliance is the top priority . . . The top policymakers know, company executives know and even local people know,” said Sheng.

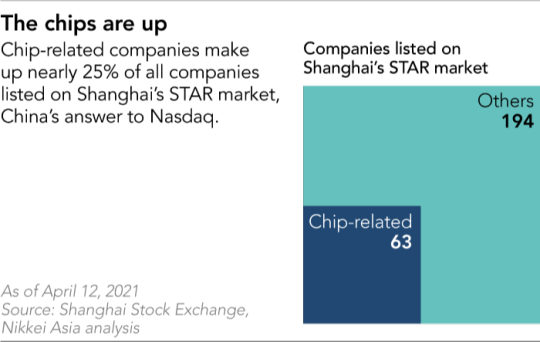

Chip related companies make up nearly 25% of all groups listed on Shanghai’s STAR market

For Chinese chipmaking tool and material makers — mostly little known, with limited presence in the industry — the trade disputes serve as the once-in-a-lifetime opportunity to expand business, a chip executive with Kingstone Semiconductor Joint Stock Co, a local ion implanter maker, told Nikkei.

“Not only is our production capacity fully booked for 2021 and needs to expand . . . but also many of our peers’ capacities are fully reserved,” the executive said.

Other domestic champions have done similarly well. Naura Technology Group, China’s largest chip equipment maker, generated a record profit in 2020, up more than 73 per cent from a year earlier. Meanwhile, despite being added to the US trade blacklist in late 2020, the earnings for AMEC, the etching machines maker, hit a record high last year.

Previously a third choice at best, Hwatsing Technology’s chemical-mechanical planarisation equipment has already been widely adopted by Chinese chipmakers such as SMIC, Hua Hong Semiconductor Group and YMTC, according to the prospectus it released late last year as it filed an application to list on Shanghai Star stock market, China’s version of the Nasdaq.

Shanghai Micro Electronics Equipment, under majority control by the Shanghai government, has been cemented as a key local participant that China’s government hopes to one day compete against global chip lithography machine builders of ASML, Nikon and Canon, several people with knowledge told Nikkei.

Employees of ASML working on the final assembly of semiconductor lithography tools in Veldhoven, Netherlands © Bloomberg

For now, China’s global market share in the advanced chip fabrication equipment sector is 2 per cent at most. Bernstein Research estimated, while its self-sufficiency rate is about 10 per cent — a very low figure, but one that suggests massive room for future growth.

Crashing the market?

This new push by China has already begun to make waves in the global semiconductor industry, threatening to disrupt the delicate equilibrium between supply and demand. A global chip shortage has swept many industries partly due to “panic buying” by Chinese companies, spooked by the risk of US sanctions, said Eric Xu, the current rotating chair of Huawei, in remarks last month.

One example is that YMTC and other domestic chip companies, such as China’s top contract chipmaker, Semiconductor Manufacturing International Co, have begun to stockpile “at-risk” parts in a jointly owned warehouse that just went into operation this year, sources told Nikkei Asia.

At the same time as they are braced for shortages, however, the global chip industry is simultaneously making preparations for a massive glut of chips as Chinese companies such as YMTC hit their stride.

The Wuhan-based national champion, for example, plans to double its monthly output of memory chips to 100,000 wafers by the second half of 2021, giving it 7 per cent of the global Nand flash memory market measured in wafers, two people with knowledge of the matter told Nikkei.

Measured in gigabit equivalent terms, Taipei-based consultancy Trendforce predicted YMTC would take 3.8 per cent of the global market share in Nand flash memory for 2021 and likely expand its share to 6.7 per cent in 2022 — a precipitous climb, considering it was close to zero two years ago. Samsung, the leader, has a 34 per cent share.

“We expect YMTC will start to affect the overall Nand flash market price by next year and the market may also face some oversupply issues,” said Avril Wu, an analyst with Trendforce.

Yangtze’s chief executive Simon Yang has tried to allay fears of a massive glut of chips. “We want to tell everyone that we are not here to crash the market, and we hope that the industry could be sustainable and healthy,” he told a business forum in 2018, when the company started producing 64-layer Nand flash memory chips.

Despite shortages, the global chip industry is preparing for a massive glut as companies like Yangtze Memory hit their stride

Anticipating just such an oversupply, however, Intel — the world’s biggest microprocessor maker and sixth-largest Nand flash maker — sold its Dalian-based Nand flash memory plant to SK Hynix last year, bowing out in the face of future competition.

The vertiginous rise of YMTC has shown just what China is capable of in the chip industry. It started operations in 2016 and within four years was mass producing some of the most advanced 3D Nand flash memory chips in the world. Memory chips used to be flat wafers with one layer of memory cells, but recently “3D stacking” chips have become the cutting-edge standard for almost all electronics from computers and smartphones to servers and connected cars, with memory cells layered on top of each other in ever-higher stacks.

In 2017, chipmaker Western Digital introduced the “skyscraper,” a 64-layer chip, while Micron last year announced the 176-layer chip, the proportions of which it compared to the Burj Khalifa in Dubai.

YMTC has been mass-producing 64-layer chips for two years and has just started mass-producing 128-layer chips at its Nand flash memory factory in Wuhan. It is said to be in the process of developing a 192-layer chip that one industry analyst referred to as the “Himalaya”. The company declined to comment.

‘Neck-choking’ technology

In reality, though, the massive growth scenarios for YMTC and the rest of China’s semiconductor industry remain predicated on continued access to western chips and other key equipment. For all the patriotism and rhetoric surrounding self-sufficiency, few believe 100 per cent “de-Americanisation” is a genuinely realistic goal in the near future.

“If Yangtze Memory could continue to buy from US suppliers, they will definitely do that,” Mark Li, a veteran chip analyst with Bernstein Research, told Nikkei. “We all know that it’s an irreversible trend that China is keen to have their own version of everything,” Li said. “However, in reality, it will take a lot of time and great execution and we don’t expect to see them cut significantly from the amount of chipmaking equipment procurement from the US very soon.”

YMTC’s own supply chain audit, for example, found that many vital processes were not immediately replaceable with domestic vendors: high-end lenses, precision bearings, quality vacuum chambers, and motors, radio frequency components and programmable chips all still come from foreign manufacturers in the US, Japan and Europe, people briefed on the matter told Nikkei.

Meanwhile, the entire industry is still reliant on foreign equipment for lithography, ion implantation, etching, and chemical and physical vapour deposition and chemical-mechanical planarisation — all indispensable in manufacturing chips, experts say.

The Chinese government refers to such technologies as “neck-choking,” referring to potential points of US pressure. To build advanced semiconductors, there is presently no way around the leading American participants. Applied Materials, for example, leads the world in chip production technology such as ion implantation, physical and chemical vapour deposition, and chemical-mechanical polishing; Lam Research makes etching, chemical vapour deposition and wafer-cleaning equipment.

California-based KLA and Boston-based Teradyne specialise in providing testing and measuring equipment for defect analysis and failure inspection. Aside from tools, materials suppliers Dow, DuPont and 3M and other US companies also dominate the supplies of special chemical formulas used in advanced chip production.

They collectively control the global market share of more than 80 per cent in equipment and materials for some vital steps in building advanced semiconductors, said Li of Bernstein. In some specialised segments such as electrochemical deposition and gate stack tools, the US share could be almost 100 per cent.

Another key vulnerability in China’s ecosystem was exposed when Huawei’s chip-designing arm HiSilicon — China’s number one chip developer — lost access to technical support and software updates for electronic design automation tools owing to sanctions. That restricted the software used by HiSilicon to lay out blueprints for integrated circuits as well as printed circuit boards and other electronic systems. These tools are 90 per cent-dominated by US companies such as Synopsys, Cadence Design Systems, Ansys and Siemens EDA (which, before its acquisition, was known as Mentor Graphics and is still located in America).

On China’s part, it has been gearing up to cultivate its own participants by luring many talented former employees of Synopsys and Cadence. But Chinese efforts remain far short of the required standard.

“We have gained some business because of China’s de-Americanisation campaign,” a manager of Empyrean Technology, China’s biggest local chip design toolmaker, told Nikkei. “However, asking us to fully replace Synopsys and Cadence is like coming to carmakers and asking to build rockets.”

In some crucial areas, such as the field-programmable gate array — a type of programmable semiconductor component essential for satellites and advanced jet fighters — the market leaders are Xilinx or Intel’s Altera, while for China, this space is largely still blank. In central processing units, the US maintains a tight grip, with leaders including Intel and Advanced Micro Devices that dominate more than 90 per cent of the global market.

This virtual monopoly on chip design and chipmaking equipment sectors has given the US vast powers to control the flow of technology to China, even from non-US companies. Industry leaders such as Samsung Electronics, Taiwan Semiconductor Manufacturing Co, Infineon Technologies, SK Hynix and Sony, all still use massive amounts of American technologies on their production lines and in their development processes, giving Washington a veto over their product sales.

“Once the US names anyone on a trade blacklist, most of the Asian suppliers will see it as a serious warning, and even if legally they could continue to ship to the blacklisted entities, they will self-censor to stop shipping due to political pressure, or consider stopping,” a chip industry legal director told Nikkei. “No one wants to openly and publicly violate Washington’s will . . . That could be dangerous, and your own company could become a target too.”

Europe’s biggest chipmaking tool maker, ASML of the Netherlands, is the exclusive supplier of extreme ultraviolet (EUV) lithography machines — the world’s most costly but top-notch tool essential to producing the world’s most advanced chips, including Apple’s latest iPhone core processors.

ASML has a production plant in the US, and about one-fifth of the components that ASML needs to build its machines are also made at its US plant in Connecticut, Nikkei has learned. The Netherlands has halted shipments of China’s first orders of the EUV machine amid US pressure since 2019, Nikkei Asia first reported in November of that year.

For Chinese companies, therefore, localisation efforts must be carried out quietly. By far the most preferred course of action is not to fall into Washington’s crosshairs.

“We have to recognise and realise that we are still far lagging behind instead of thinking that we could quickly rock the world . . . The best way, under the geopolitical climate, is to keep our head low and do our work and grow silently,” said a chip executive with ChangXin Memory Technologies, another of China’s key memory chipmakers, based in Hefei, Anhui Province.

Localisation efforts must be carried out quietly. By far the most preferred course of action is not to fall into Washington’s crosshairs

While it pursues its Plan B of self-sufficiency, YMTC still sees it as extremely unrealistic to strip all foreign equipment from its production site. It still hopes to maintain good relationships with American, Japanese and European suppliers, according to people familiar with the company’s thinking. In parallel to its localisation efforts, YMTC keeps building production lines that use American equipment and parts to facilitate its expansion.

“It’s really an irreversible trend that China wants to switch to local suppliers,” said Li of Bernstein, “but in reality and in real practices, there are still hurdles and [it] could still take a lot of time. If they want to grow faster and quickly gain more business, it’s more practical that they still use the tools and equipment that all of the foreign market leaders also use.”

In an effort to fend off future sanctions, meanwhile, the Chinese company has also boosted its legal compliance team since 2019, citing the “highly challenging, complex and changing environment in the chip industry” — a step aimed at giving the US no excuses to make it a target.

Martijn Rasser, a senior fellow of the technology and national security programme at the Center for a New American Security, told Nikkei: “China’s goal of total self-sufficiency in semiconductors is unrealistic. It is unaffordable to create a China-only supply chain, and there will almost certainly be some reliance on foreign technology and expertise. What it can do is build a globally competitive industry, and that is something that US policymakers are eyeing closely.”

Decoupling do’s and don’ts

Despite China’s considerable efforts, few experts believe that its chip sector will ever be genuinely free of US parts. However, most also believe that the doomsday scenario — a complete blockade of China’s tech and semiconductor industries — is not realistic, either.

The world’s two largest economies are still interconnected, and they are also the two biggest semiconductor markets: China accounts for at least 25 per cent of the sales of most US chip companies, according to a January report by the Brookings Institution, and few want to see that market disappear.

Bown of the Peterson Institute, said the Biden administration’s approach on China is not yet clear. On the one hand, the US expects China to buy more chips as promised in recent trade talks but has also continued restricting its use of American technologies.

“It’s likely that we are looking at more precisely confined export controls at some areas such as military uses and areas that are really linked to national security,” Bown said. “After all, it’s a trade-off. China is a massive consumer market, and if you restrict a lot of semiconductor shipment, many US companies will be hurt too.”

‘Neck choking’ technology: US president Joe Biden holds a chip before signing an executive order aimed at addressing a global semiconductor shortage in February © AFP via Getty Images

So far, the Biden administration has not yet softened on China’s technological advancement. A total of 162 Chinese entities had been sanctioned by the Trump administration since 2018, while in April, the US Department of Commerce added a further seven Chinese supercomputer makers to the so-called Entity List to restrict their use of American technologies, citing alleged links with the Chinese military.

On April 12, the White House hosted a virtual CEO summit on semiconductor and supply chain resilience, which included the world’s top three chip producers — Intel, Samsung and TSMC — as well as executives from carmakers, including Ford Motor and General Motors, to discuss how to maintain US leadership in the global semiconductor industry.

The Chinese Communist party “aggressively plans to reorient and dominate the semiconductor supply chain,” President Joe Biden said in opening remarks to the summit, quoting a bipartisan letter from 23 senators. “China and the rest of the world is not waiting, and there’s no reason why Americans should wait,” he said.

The administration has also proposed a $50bn funding programme for chip manufacturing, and research and development, mirroring China’s efforts.

The Committee on Foreign Investment in the United States, or Cfius, last year tightened the rules for examining the national security risks posed by foreign deals, followed by the Taiwanese government’s Investment Commission announcing a new set of rules to intensify screening of Chinese investments in Taiwanese tech companies. Meanwhile, the Italian government rejected a takeover bid for a Milan-based semiconductor equipment provider by a Shenzhen-based Chinese investment company.

South Korea and Taiwan — two leading Asian chipmaking economies — all face growing pressure to help the US boost local chip manufacturing. TSMC, the world’s largest contract chipmaker, based in Taiwan, and South Korea’s Samsung, the world’s biggest memory chipmaker, were both forced to cut off supplies to once-big customer Huawei after the US sanctions.

TSMC’s share of revenue from China plunged to 6 per cent in the January-March period from 22 per cent the same time a year earlier. Samsung also saw its revenue from China trending down in the past three quarters.

Most of the global chip developers and manufacturers will still have to side with the US, as American technologies still prevail in their products or services, said Su Tzu-yun, senior analyst at the Institute for National Defense and Security Research. “They have to choose what are their best interests if they get caught between the world’s two biggest economies.”

However, it is still hard to fully decouple the semiconductor supply, involving thousands of suppliers from around the world that have been tightly intertwined for decades. China can try to reduce its reliance on the US, but without American technology sources, it can hardly speed up its technological advancement.

Neither is it practical for the US to exclude China from all of its supply chains, as the country is still a big source of critical raw materials and rare-earth elements used in semiconductors and electronic components, according to a recent report by the Semiconductor Industry Association, an American industry organisation.

“In the short term, due to geopolitical uncertainties, China’s tech development could be slowed a bit,” said Miin Wu, founder and chair of Macronix International, a leading memory chipmaker in Taiwan that serves Apple, Sony and Nintendo. “However, in the longer run, from China’s perspective, it will definitely hope to build a competitive industry. It’s a trend that is hard to resist, and there is no turning back.”

A version of this article was first published by Nikkei Asia on May 5 2021. ©2021 Nikkei Inc. All rights reserved

Related stories

0 notes

Link

A Tiny Part’s Big Ripple: Global Chip Shortage Hobbles the Auto Industry Around the world, auto assembly lines are going quiet, workers are idle and dealership parking lots are looking bare. A shortage of semiconductors, the tiny but critical chips used to calibrate cars’ fuel injection, run infotainment systems or provide the brains for cruise control, has sent a shudder through the automaking world. A General Motors plant in Kansas City closed in February for lack of chips, and still hasn’t reopened. Mercedes-Benz has begun to hoard its chips for expensive models and is temporarily shutting down factories that produce lower-priced C-Class sedans. Porsche warned dealers in the United States this month that customers might have to wait an extra 12 weeks to get their cars, because they lack a chip used to monitor tire pressure. The French automaker Peugeot, part of the newly formed Stellantis automaking empire, has gone so far as to substitute old-fashioned analog speedometers for digital units in some models. The disruption could not come at a worse time. Demand for cars has bounced back strongly from the pandemic slump, with consumers ready to spend money they saved over the past year, eager to avoid airplanes by taking road trips. The supply of semiconductors is depriving carmakers of a chance to make up sales they lost. “We have already a robust demand situation being more held back by the semiconductor issue than anything else,” Ola Källenius, the chief executive of Daimler, said in an interview. Some automakers, such as Renault, have begun to triage their chips, reserving them for more costly models that bring more profit. “We’re trying to find an intelligent way to prioritize cars with the higher margins,” Clotilde Delbos, Renault’s deputy chief executive, told analysts on Thursday. Some buyers may be lucky enough to take home a new car, but it may lack options that use specialized chips. Porsche has told U.S. dealers that for several months it won’t be able to deliver high-end seats in the Macan S.U.V. that can be adjusted 18 different ways, a popular upgrade. The necessary chips are unavailable. One big reason automakers can’t find enough chips is that semiconductor manufacturers have given priority to manufacturers of smartphones, video game consoles and other consumer electronics, which tend to be more lucrative customers. A modern car can easily have more than 3,000 chips. But cars account for a tiny share of chip demand. Taiwan Semiconductor Manufacturing Company, or TSMC, is one of the few makers of a variety of chips vital to auto manufacturing, but in 2020 carmakers generated only 3 percent of the company’s sales, according to Roland Berger, a German consulting firm. TSMC’s most important customers are smartphone makers, which accounted for half of sales. Smartphones outnumber cars by a wide margin. In 2019, before the pandemic disrupted global economies, auto factories churned out 93 million vehicles compared with smartphone production of 1.4 billion units. Over all, the chip shortage and other supply chain snarls curtailed production by 1.3 million vehicles in the first three months of the year, according to IHS Markit, a consultancy. The problem has become a concern for political leaders in Washington and other capitals. Peter Altmaier, the German economics minister, recently appealed to his counterpart in Taiwan, a global center for semiconductor manufacturers, asking in so many words whether the Taiwanese minister couldn’t help shake loose a few chips urgently needed by German carmakers. The chip shortage “has become a serious problem for manufacturers, especially the auto industry,” a group of German economic research institutes warned in a joint report this month. Today in Business Updated April 23, 2021, 10:07 a.m. ET The crisis has exposed not only how dependent the car industry is on a few suppliers, but also how vulnerable it is to disruptions. Supply chain managers shuddered last month when an early-morning fire knocked out production at a factory owned by Renesas Electronics in Hitachinaka, Japan, north of Tokyo. Renesas is a crucial supplier of chips used to monitor brake functioning, control power steering, trigger airbags and in many other tasks. Weather has also played a role. Storms in Texas earlier in the year temporarily forced the shutdown of three semiconductor factories. And Taiwan is in the midst of a severe drought, analysts at IHS Markit warned in a recent report. Chip manufacturing requires large amounts of very pure water. Even without a pandemic and supply chain disruptions, the auto industry is in turmoil. In the United States, sales have been basically flat since the early 2000s. Profit margins are slim. Some big automakers may not survive the shift to electric cars. “If I were a chip manufacturer I wouldn’t start investing in a new plant unless I got free money from the government,” said ManMohan S. Sodhi, who teaches supply chain management at the business school at City, University of London. Free money may be on the way. The White House held a summit on the chip shortage this month, and has proposed allocating $50 billion in infrastructure funds to reverse a decline in the share of chip manufacturing that takes place on American shores. But new chip factories can’t be built fast enough to solve the immediate shortage. And unless government subsidies persuade them otherwise, semiconductor makers and other suppliers are likely to build any new factories in or near China, which is the biggest car market and, unlike the United States and Europe, is growing steadily. It’s not at all clear how long the chip famine could last. Mr. Sodhi said that he suspected chip makers were exaggerating the shortage to pry subsidies from governments, and that the crisis could be over in a month. Auto industry consultants at Roland Berger are more pessimistic, saying the shortage could last all year. On Thursday, Ms. Delbos of Renault said “the visibility is deteriorating” for determining an end to the chip crisis, “as news is changing by the day.” In the meantime, automakers are improvising to try to minimize the damage. Daimler’s Mercedes unit is allocating scarce chips to its priciest models, like the EQS electric luxury sedan the company unveiled this month, which is expected to start at around $100,000. The triage prompted Daimler to temporarily shut down factories in Germany that produce lower-priced C-Class sedans. Most of the 18,500 workers at the plants are furloughed until the end of April, though they will continue to receive government subsidized “short work” pay. Along the same lines, Volkswagen has cut production at plants in Germany that make sedans and other internal combustion models, and one in Mexico where the company makes Tiguan S.U.V.s for the American market. But a factory in Zwickau, Germany, that produces ID.3 sedans and ID.4 S.U.V.s, the vanguard of Volkswagen’s drive to dominate the emerging market for electric cars, has not been affected, according to the company. General Motors, which has had to halt production temporarily at a half-dozen plants since the beginning of the year, has in some cases been producing cars without electrical components and parking them until the parts are available. Ford Motor said Wednesday that it would keep several U.S. plants idle longer than expected because of the chip shortage. The auto industry has been paralyzed by supply chain disruptions before. Mr. Källenius recalled an episode when a hurricane struck Puerto Rico and shut down production at a factory that, to his surprise and pretty much everyone else’s, was the only source of a coating essential to some kinds of auto electronics. Automobiles have tens of thousands of parts and so many layers of suppliers and sub-suppliers and sub-sub-suppliers that even carmakers have trouble keeping track of every component’s provenance. The economics of the industry are such that only suppliers with the highest volume survive. Smaller suppliers tend to die out because they can’t produce parts or materials as cheaply as the big players, leaving the industry dependent on one or two manufacturers of high-pressure fuel lines, for example, or a certain specialized plastic. The current semiconductor shortage may not be the last. The auto industry’s need for semiconductors is expected to explode in coming years because of autonomous driving features and the increasing popularity of electric vehicles, which are more reliant on software than internal combustion engines. Mr. Källenius said, though, that the most sophisticated chips were not the ones currently giving him headaches. “We are missing the most simple of chips, that maybe only cost cents or dollars,” he said. “That’s holding us up from building a product that costs $75,000.” Source link Orbem News #Auto #Big #Chip #Global #Hobbles #Industry #parts #Ripple #shortage #tiny

0 notes

Text

Taiwan government says semiconductor makers will prioritize auto chips amid shortage

Wang met executives from Taiwan Semiconductor Manufacturing Co, United Microelectronics Corp., Powerchip Semiconductor Manufacturing Corp. and Vanguard International Semiconductor Corp. Vanguard declined comment ahead of quarterly earnings next week but noted the company’s chairman had said this month he expects a 15 percent increase in demand for auto chips this year. The other three companies…

View On WordPress

0 notes

Text

Fluoroelastomer Market Latest Trends,Demand and Analysis 2025

Global Fluoroelatomer Market: Overview

Fluoroelatomer can be defined as fluorine-containing polymers which are known for their exceptional resistance to heat, weathering, and a wide assortment of fluids and chemicals, as well as for their exceptional sealing and mechanical properties. The fluoroelastomers are produced under the temperature range of -26°C to 205–230°C, whereas for the short working periods they can even be produced under temperatures. Some perfluorocarbon elastomer types can resist temperatures up to 327°C.

Read report Overview-

https://www.transparencymarketresearch.com/fluoroelastomer-market.html

The fluroelastomer has a wide chemical resistance and superior properties. It is usually used for high temperature applications of automotive, aerospace, oil and gas etc. Fluroelastomer is also called as fluorocarbon elastomer which has outstanding resistance properties to oxygen, ozone and heat. Fluoroelastomers have a high density and are swollen by ketones and ethers. Also, their low chemical reactivity helps in interlinking of the polymer chains which is necessary for the production of a rubbery material. Fluoroelastomers were developed in 1940’s and since then used as material of choice for use in aerospace and industrial equipment applications.

Request Brochure@

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=38828

Based on type, the global fluoroelastomer market can be classified into fluorocarbon elastomers, fluorosilicone elastomers, Perfluoroelastomers. Fluorocarbon elastomers are known for its exceptional resistance properties towards heat, weathering, wide variety of fluids and chemicals. They are also known for its excellent sealing and mechanical properties. This elastomers are widely used in the applications which needs high temperature range and where chemical attack is encountered.

As compared to other fluoroelastomers, fluorocarbon elastomers are expensive and has relatively different technology of compounding and curing. This fluorocarbon elastomers has high solvent resistance and has low resilience. Whereas fluorosilicone elastomers are inherently UV and ozone resistant and have a combination of fluorocarbon and silicone characteristics. They resist solvents, fuels, and oil similarly to fluorocarbons and have high- and low-temperature stability (usable up to 177°C and at temperatures as low as -73°C) similar to silicones.

REQUEST FOR COVID19 IMPACT ANALYSIS –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=38828

As compared to other elastomers fluorosilicone elastomers lack toughness and resistance in abrasion. Fluorosilicone elastomers are mostly used in aerospace fuel systems and in automotive industry to control fuel emissions. Fluorosilicone elastomers are also known as fluorovinylmethyl silicone rubber. Perfluoroelastomers can be defined as specialty high-performance elastomer along with exceptional chemical resistance properties and high-temperature stability. This fluoroelastomers are widely used in application such as paint and coating operations, oil and gas recovery, semiconductor manufacture, and in the pharmaceutical, chemical process, and aircraft and aerospace industries.

Read our Case study at :

https://www.transparencymarketresearch.com/casestudies/chemicals-and-materials-case-study

Based on application, the global fluoroelastomer market can be classified into automotive, aerospace, oil & gas, energy & power, semiconductors, pharmaceutical and food processing industries and others. Due to its superior sealing and mechanical properties the fluoroelastomer market has witnessed the rise in demand in automobile industry. Superior electrical insulation properties, favorable mechanical properties including resistance to extreme temperature and degradation has led to the usage of fluoroelastomer in aerospace industry.

Based on geography, the global fluoroelastomer market can be classified into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa. Asia Pacific is the major market for fluoroelastomers, led by the increasing in demand for the application such as automotive, pharmaceutical and food processing. High capital investments in fluoroelastomer market from the emerging economies like China, India, Japan etc. is also expected to boost the demand of fluoroelastomers in the region.

Major players operating in the global tire derived market are DuPont, 3M company, Honeywell International Inc., Asahi Glass company Ltd., Daikin Industries, Garlock, Lauren Manufacturing, Vanguard Products Corp. and others. These companies hold a significant share of the market. Thus, the fluoroelastomers market experiences intense competition.

0 notes

Text

#Vanguard International Semiconductor Company#VSMC#semiconductor#manufacturing#electronicsnews#technologynews#NXP

0 notes

Photo

New Post has been published on https://techcrunchapp.com/us-tech-bans-pandemic-no-match-for-asias-electronics-rebound/

US tech bans, pandemic no match for Asia’s electronics rebound

The electronics sector has found a way to thrive amid the global pandemic, with 5G demand helping the industry remain a rare catalyst for Asian factories.

South Korean computer sales surged 107% in August and semiconductor shipments grew for a third month in the past four, even as smartphone sales declined and overall exports fell 9.9% from a year earlier, figures out Sept 1 showed.

Taiwan’s manufacturing output rose 2.6% in July, while production of computers and integrated circuits climbed by double digits. Shipments of electronics products from Singapore rose in July for a third straight month.

The latest data bolster forecasts that this year’s electronics rebound will persist, even as a US ban on Huawei Technologies Co, further US-China trade tensions and an eventual tapering of demand for work-from-home equipment present obstacles for the industry.

Relentless demand for 5G-related applications, including infrastructure and smartphones, is poised to keep electronics production humming as other output struggles to recover from the pandemic. Even the latest technology bans on Huawei look to be just a stumbling block.

“It’s kind of a little bit of a bump,” Rajan Rajgopal, chief executive officer of Singapore-based DenseLight Semiconductors Pte, said in an Aug 28 interview.

Two areas of business especially have been booming since before the pandemic: data centres and 5G infrastructure, said Rajgopal, who’s worked in semiconductors for about 25 years. China accounts for about half of DenseLight’s customer base and could take an increasing share as it builds out its next-generation wireless infrastructure across the country – boosting demand for semiconductors that go into devices as diverse as street cameras and oil-pipeline sensors.

Global semiconductor industry revenue is set to slip by only 0.9% this year to US$415.4bil (RM1.7 trillion) amid pandemic-related disruptions, according to Gartner Inc estimates.

Still, significant risk factors are keeping electronics watchers on guard. US President Donald Trump’s potential re-election in November could mean more headaches for Asian supply chains, while it’s unclear how his rival for the White House, former Vice President Joe Biden, would alter US strategy toward China. And retailers across sectors are bracing for a holiday season that could disappoint if government stimulus wears off and labour markets worsen.

For now, though, companies expect the electronics boom to overcome the risks – with Taiwanese firms seeing themselves particularly well-placed to ride out the storm. Industry giant Taiwan Semiconductor Manufacturing Co is charting a “PC resurgence” amid Covid-19, CC Tsai, senior director of the company’s Asia-Pacific business, said in a video for a company symposium Aug 25.

Despite concerns that increased work-from-home orders for things like laptops and webcams would prove temporary, computer demand “continues to remain robust”, and many consumers spending more time at home are also upgrading their television sets, Chairman Fang Leuh of Vanguard International Semiconductor Corp, a TSMC affiliate that specialises in power management chips and display driver chips, told reporters Aug 29.

That matches the read of Quanta Computer Inc, which makes Apple Inc MacBooks, HP Inc notebooks and servers for Amazon.com Inc’s AWS and Google. Elton Yang, chief financial officer of Taiwan-based Quanta, says notebook shipments are expected to grow by double digits in the third quarter.

“Strong orders from our customers confirm shelter-in-place demand is long-term,” Quanta Chairman Barry Lam told reporters Aug 13. “We will create more products for the shelter-in-place economy to optimise our profitability. This is a big change. We will grab it and gain better opportunities.”

Industry executives acknowledge greater uncertainties around the trade war, US elections and Covid-19, while taking a longer view on the prospects for electronics.

Apple, for example, has asked suppliers to build at least 75 million 5G iPhones for later this year – roughly in line with last year’s launch – a sign that demand for the company’s most important product is holding up despite the pandemic and recession.

Vanguard’s Fang emphasised very strong demand into 2021 for the type of semiconductors his company makes, aided by rollout of 5G technologies. And even if Trump wins another four-year term, complicating DenseLight’s China business, Rajgopal sees a brighter outlook.

“The electronics industry is a lot more resilient than eight years,” he said. – Bloomberg

0 notes

Text

By 2026, Pharmaceutical Packaging Equipment Market To Surpass US$ 13.8 Billion- Coherent Market Insights

From 2018 – 2026, The global pharmaceutical packaging equipment market is expected to witness a CAGR of 8.2%

Request for Sample PDF Copy:

https://www.coherentmarketinsights.com/insight/request-pdf/2799

Description:

Global Pharmaceutical Packaging Equipment Market – Industry Insights

Pharmaceutical packaging and labeling is one of the vital requisite in the pharmaceutical industry to fulfill the need of safe delivery of products to the consumers providing reliable and speedy packaging solutions. It delivers quality products, product protection, patient comfort and also fulfills security needs. The recent innovation in the packaging solutions like child-resistant packs, blow fill seal (BFS) vials, anti-counterfeit measures, plasma impulse chemical vapor deposition (PICVD) coating technology, snap off ampoules and prefilled syringes like or two-in-one prefilled vials is bringing a boom in the industry.

Each individual product requires a precise measurement that makes one unit-dose size different than the other. Regardless of specific need, be it liquid or solid, pharmaceutical packaging machinery needs to be flexible enough to work within the needs of the manufacturing and packaging process for each unique situation.

High demand for generic and pharmaceutical products, growing contract pharmaceutical and offshore pharmaceutical manufacturing, and increasing need for flexible and integrated packaging equipment are some of the factors driving growth of the pharmaceutical packaging equipment market.

The global pharmaceutical packaging equipment market was valued at US$ 6.97 Bn in 2017, and is expected to witness a CAGR of 8.2% during the forecast period (2018 – 2026).

Global Pharmaceutical Packaging Equipment Market Share, By Product: 2018 & 2026

Pharmaceutical Packaging Equipment | Coherent Market Insights

Source: Coherent Market Insights (2019)

Growing Contract Manufacturing of Pharmaceutical Products is expected to drive the Market Growth during the Forecast Period

Contract manufacturing is one of the fastest growing segments in the pharmaceutical industry as it offers international standard quality at low cost. Contract manufacturing is increasingly seen as a strategic option by pharmaceutical players to increase their global market footprint, owing to increasing demand for generic drugs, patent expiration of major therapeutic brands, need for high-quality R & D facilities, and cost-effective production technologies that meet global regulatory guidelines.

A substantial lower cost of operation and production is enhances the multinational companies to enter emerging markets such as India to fulfill their outsourcing needs. This creates increasing demand for pharmaceutical and medical grade packaging materials and associated equipment in the developing countries over the forecast period.

Furthermore, the growth in the active pharmaceutical ingredient (API) is driven by several factors such as the increase in development of biological APIs, increase in demand for API packaging, upsurge in demand for abbreviated new drug applications (ANDA) and rise in drug master files (DMF) from Indian companies. This leads to upsurge the demand in the efficient and cost-effective packaging delivery of formulated products in the pharmaceutical industry.

Global Pharmaceutical Packaging Equipment Market Share, By Type: 2018 & 2026

Pharmaceutical Packaging Equipment | Coherent Market Insights

Source: Coherent Market Insights (2019)

Increasing Demand for Generic and Pharmaceutical Products is expected to Aid in the Market Growth

Price competitiveness and equivalent efficiency of generic drugs (compared to Branded drugs) increases demand for generic drugs. This increase in demand expected to raise the requirement of packaging for generic drugs which in turn will inhibit the growth of the market. For instance, according to IQVIA Medical Audit Data (MAT): March 2018, generic drugs play an important role in the healthcare sector in the U.S., accounting for over 90% of total prescriptions dispensed in the US. Moreover, increasing research and development activities in pharmaceutical segment and growing number of pharmaceutical players entering in this market, will lead generate increase demand for pharmaceutical packaging equipment in future.

Key pharmaceutical players are focused on increasing investments to gain generic product approvals and market the same, which is expected to propel demand for pharmaceutical packaging equipment over the forecast period.

Among regions, Asia Pacific is expected to be the fastest growing market over the forecast period, owing to the expertise of Asia Pacific countries such as China, India, and Japan in adopting new packaging technology in order to scale up the business operations. These countries offer vibrant business platform for start-up companies, R&D centers, and major pharmaceutical companies to deliver cutting edge technology solutions and service provider ecosystem in pharmaceutical packaging. This creates favorable environment for initiation of pharmaceutical packaging equipment players in the future.

Key players operating in the pharmaceutical packaging equipment market include, Robert Bosch GmbH, Industria Macchine Automatiche S.p.A., Marchesini Group S.p.A., Korber AG, MG2 s.r.l., Accutek Packaging Equipment Companies, Inc., Vanguard Pharmaceuticals Machinery, Inc., Romaco Pharmatechnik GmbH, Bausch + Ströbel Maschinenfabrik Ilshofen GmbH+Co. KG, and OPTIMA packaging group GmbH.

About Us: Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions. We are headquartered in India, having office at global financial capital in the U.S. Our client base includes players from across all business verticals in over 150 countries worldwide. We do offer wide range of services such as Industry analysis, Consulting services, Market Intelligence, Customized research services and much more. We have expertise in many fields such as healthcare, chemicals and materials, Automation, semiconductors, electronics, energy, food and beverage, packaging and many more. Visit our website to know more.

Buy Report Here:

https://www.coherentmarketinsights.com/market-insight/pharmaceutical-packaging-equipment-market-2799

Contact Us: Mr. Shah Coherent Market Insights 1001 4th Ave. #3200 Seattle, WA 98154 Tel: +1-206-701-6702 Email: [email protected]

0 notes

Text

Semiconductor Foundry Market SWOT Analysis by Proliferation from 2019-2025 | TSMC, Globalfoundries, UMC

Global Semiconductor Foundry market 2019-2025 in-depth study accumulated to supply latest insights concerning acute options. The report contains different predictions associated with Semiconductor Foundry market size, revenue, production, CAGR, consumption, profit margin, price, and different substantial factors. Whereas accentuation the key driving and Semiconductor Foundry restraining forces for this market, the report offers trends and developments. It additionally examines the role of the leading Semiconductor Foundry market players concerned within the business together with their company summary, monetary outline and SWOT analysis.

The objective of Semiconductor Foundry report is to outline, segment, and project the market on the idea of product types, application, and region, and to explain the factors concerning the factors influencing global Semiconductor Foundry market dynamics, policies, economics, and technology etc.

Request Sample Report at: http://www.marketresearchglobe.com/request-sample/1062825

By Key Players:

TSMC, Globalfoundries, UMC, SMIC, Samsung, Dongbu HiTek, Fujitsu Semiconductor, Hua Hong Semiconductor, MagnaChip Semiconductor, Powerchip Technology, STMicroelectronics, TowerJazz, Vanguard International Semiconductor, WIN Semiconductors, X-FAB Silicon Foundries

By Types Analysis:

Only Foundry Service

Non-Only Foundry Service

By Application Analysis:

Communication

PCs/Desktops

Consumer Goods

Automotive

Industrial

Defense & Aerospace