#Vancouver Accountants

Explore tagged Tumblr posts

Text

Payroll and Accounting Services Across Canada – Discover TaxlinkCPA

TaxlinkCPA provides trusted Payroll Services in Canada and comprehensive accounting support for businesses of all sizes. As one of the leading Accounting Firms in Vancouver, our team of skilled Vancouver Accountants offers a full suite of services, including payroll management, tax planning, and bookkeeping, all tailored to help your business thrive. With a focus on accuracy, compliance, and personalized support, TaxlinkCPA ensures your financial needs are met with the highest standards.

Learn more about our services at taxlinkcpa.ca/accounting-firms-vancouver/ and discover how we can support your business’s financial success.

0 notes

Text

Credit: thepenaltypodcast

🎥 Posted on tiktok by: @kaileysibley

*Please DM or comment for credit/removal!*

#hockey#nhl#thepenaltypodcast#jack hughes#quinn hughes#vancouver canucks#new jersey devils#I’m just a fan of this Instagram account#women in sports#hughes brothers

306 notes

·

View notes

Text

new favorite fancam just dropped

#it is quinn hughs world#nhl tiktok its jut a quinn fan account really#just girly yapping#hughes#hughes brothers#quinn hughes#vancouver canucks#canucks lb

38 notes

·

View notes

Text

Trout Lake, Vancouver - Oct. 27th, 2023. Golden Hour vs. Blue Hour.

#photo post#artists on tumblr#original photography#photographers on tumblr#photography#photographers of tumblr#vancouver photographer#my photography#photographers on lensblr#vancouver canada#vancouver bc#vancouver#pnw photography#pnw#mountains#golden hour photography#blue hour#nature photography#nature photoset#original photographer#i posted this on my personal account before i started my photography side blog but i decided to re-edit them to be less oversaturated

40 notes

·

View notes

Note

You're American?!

Anon, this is the expression I feel you had while you wrote that sentence.

Yes. Yes, I am American. What gave it away? Me stating all the time I'm American (rural Southwest, Catholic, bisexual, a slut, Hispanic/Black, a Leo, a vegetarian) or was it the way I spell "colors"?

For an aging millennial who knows better, I actually offer up way too much information in the tags. So . . . fuck it, let me offer up more - I was born in Japan due to America's strategic colonization in over 80 countries (aka my father was in the Air Force), so my first passport has a picture of a week-old me! Whenever I renew my license or fill out any type of legal paperwork, I have to present five documents to prove my American citizenship since I was born in a regular Japanese hospital instead of the one on the American base. When I travel, internationally or domestically, it never fails that I get held up because my passport is American, my place of birth is Japan, and my place of residency is . . . just know people don't realize it's an American state. I travel often, but I think about two years ago, I might have fucked an international criminal at a Canadian music festival because I got held up in the Montreal airport for hours trying to leave and since then, I always have to go to the counter to print out my boarding pass and I always get asked additional questions. Odd, but if the criminal was who I think it was, the sex was worth it.

#yo soy americana#o estadounidense#no me importa#in my defense he spoke French#I was not expecting that much French in Montreal#I'm used to Toronto and Vancouver#he said he was an accountant#the way TSA be acting toward me tells me otherwise#and yes it was AT the music festival#I wasn't going to miss the Swedish House Mafia set#I will not apologize for oversharing

63 notes

·

View notes

Text

jackhughes dreams to reality

#STOPPP THIS IS SO CUTE#as a fellow person who has a very good relationship w their sibling I EAT THIS SHIT UPP#also good choice of pictures they are all so cute here#(technically from jack AND lukes account)#quinn hughes#jack hughes#luke hughes#hughes brothers#nj devils#vancouver canucks#new jersey devils

100 notes

·

View notes

Text

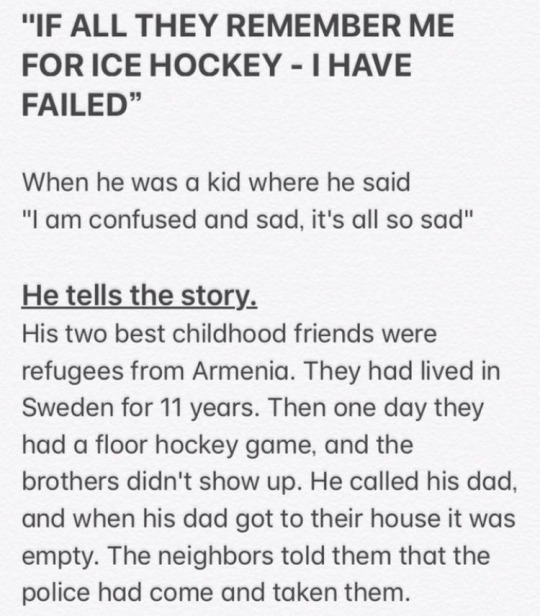

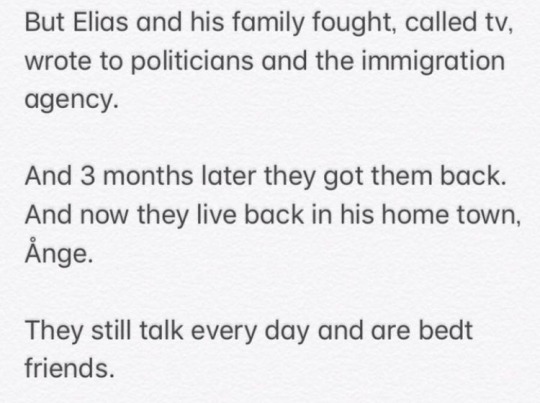

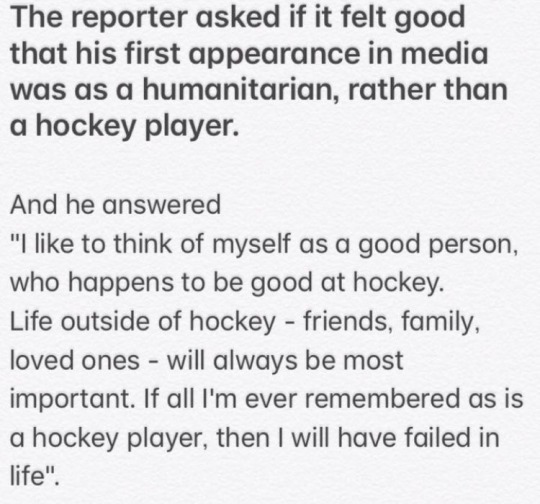

“If all they remember me for [is] ice hockey - I have failed”

Elias Pettersson, have I told you how much you mean to me?

Context below ⬇️

(This is a translation I found on instagram (the link) but there is a spelling mistake so please ignore that)

Link

#elias pettersson#shout of the the inactive tumblr account that I was scrolling through youre a real one 🫶#(the account has been inactive for 4 years so you know this so pretty old news but I never see people talk about it and…#…and there are a lot of new canucks fans so might as well bring it to your attention again if you already know)#vancouver canucks#canucks lb

28 notes

·

View notes

Text

the old rtc twitter account just retweeted anything from the cast

#the cast went to an aquarium in vancouver#and the account retweeted i think all of elliott's tweets about it#🎠#2011-2013#cast

2 notes

·

View notes

Text

-

#i wake up to being in the negatives in mmy bank account aftwr thinking im AT LEAST at $5.#frank.txt#commonplace experience bc disability has us living on like. $9 an hour wage#when vancouvers min wage is like $17.40 so that shows jsut how disabled ppl are dping here LMAO#i have 0 hope that theyre going to makw pwd a liveable wage here

4 notes

·

View notes

Text

Unlock Financial Success with Virtual CFO Services by Pivot Advantage Accounting and Advisory Inc.

youtube

In the dynamic landscape of modern business, staying ahead requires strategic financial management. Small and medium-sized enterprises (SMEs) often face challenges in accessing top-tier financial expertise, which can hinder their growth. Enter Pivot Advantage Accounting and Advisory Inc., a leading player in the industry offering Virtual CFO services tailored to empower businesses in their financial journey.

The Rise of Virtual CFO Services As businesses evolve, so do their financial needs. A Virtual CFO acts as a remote, outsourced chief financial officer, providing expert financial guidance without the need for a full-time, in-house CFO. This innovative approach is gaining traction among businesses of all sizes, offering a cost-effective solution and access to high-level financial expertise.

Why Choose Pivot Advantage Accounting and Advisory Inc.?

Customized Financial Strategies: Pivot Advantage understands that each business is unique. Their team of seasoned financial professionals works closely with clients to create customized financial strategies aligned with their specific goals and challenges. Whether it's optimizing cash flow, managing expenses, or planning for future growth, Pivot Advantage tailors its Virtual CFO services to meet the distinct needs of each client.

Strategic Decision Support: In the fast-paced business environment, timely and informed decision-making is crucial. Pivot Advantage's Virtual CFO services go beyond traditional financial reporting. They provide real-time insights and analysis, empowering business owners to make strategic decisions with confidence. This proactive approach ensures that clients stay ahead of the competition and navigate challenges effectively.

Cost Efficiency: Hiring a full-time CFO can be a significant financial burden for SMEs. Pivot Advantage's Virtual CFO services offer a cost-efficient alternative, allowing businesses to access top-tier financial expertise without the overhead costs associated with a full-time executive. This scalability ensures that businesses only pay for the services they need, optimizing their budget for maximum impact.

Technology Integration: Pivot Advantage leverages cutting-edge financial technology to streamline processes and enhance efficiency. By integrating the latest tools and software, they provide clients with real-time financial data and analytics, fostering transparency and accuracy in financial management. This commitment to technology ensures that clients are equipped with the tools needed to adapt to the ever-changing business landscape.

Risk Management: Navigating financial risks is a key aspect of business success. Pivot Advantage's Virtual CFO services include comprehensive risk management strategies. From identifying potential financial risks to implementing risk mitigation plans, their experts work diligently to safeguard the financial health of their clients' businesses.

How to Get Started Getting started with Pivot Advantage Accounting and Advisory Inc.'s Virtual CFO services is a seamless process. The first step involves a comprehensive consultation to understand the unique needs and goals of the client. From there, Pivot Advantage crafts a tailored plan that aligns with the client's business objectives.

Conclusion In the era of remote work and digital transformation, businesses need agile financial solutions that adapt to their evolving needs. Pivot Advantage Accounting and Advisory Inc.'s Virtual CFO services provide a strategic advantage, combining expertise, cost-efficiency, and technology integration. By partnering with Pivot Advantage, businesses can unlock their full financial potential and pave the way for sustained success in today's competitive market.

#Vancouver accounting company#virtual CFO by Pivot Advantage Accounting and Advisory Inc.#Pivot Advantage Accounting and Advisory Inc. part time CFO#Pivot Advantage Accounting and Advisory Inc. CFO service#online accounting firm in Vancouver#accountant#Youtube

3 notes

·

View notes

Text

TaxlinkCPA offers expert public accounting services in Surrey and Vancouver, providing tax planning, bookkeeping, and financial consulting to individuals and businesses. Trust us for reliable financial solutions.

0 notes

Note

VANCOUVERITES UNITE 🫂🫂

omg swaggy the vancouverite! we love to see it!

definitely missing all of vancouver rn, there’s no cherry blossoms, oceans or good sushi in southern ontario :( it’s ok tho i’ll be back when exams are done!

some cherry blossoms from the cherry blossom tree at my house in vancouver for you all 🥰

#bestie asks 🫶#honestly i feel like it’s pretty obvious i’m from vancouver considering like half my account is the vancouver canucks#and now bestie is from van!#missing the good east asian food tho i’ve been craving it since winter break when i was last at home

4 notes

·

View notes

Text

#vancouver

#seabusmemes is our friendly meme account#hes funny#the background image is Vancouver#its been a meh December tbh

170K notes

·

View notes

Text

Professional Bookkeeping Services for Vancouver's Small Businesses

Our Vancouver-based bookkeeping services are designed to keep your financial records accurate and up-to-date. We provide monthly financial statements, tax filing assistance, and year-end support to help your business thrive.

#bookkeeping vancouver#vancouver bookkeeping services#vancouver accounting services#vancouver bookkeeping#ecommerce bookkeeping

0 notes

Text

Chartered Professional Accountant in Vancouver: Your Key to Financial Success

When it comes to managing your finances, especially for small businesses, the expertise of a Chartered Professional Accountant in Vancouver can make all the difference. Whether you need help with small business accounting in Vancouver, tax planning, or preparation, having a skilled professional by your side ensures that you’re on the right track toward financial stability and growth. Chartered Professional Accountant, is a professional designation bestowed on experienced professionals in Canada . CPAs operate in a wide range of industries, including public accounting, government, education, and the not-for-profit sector.

The Importance of a Chartered Professional Accountant in Vancouver

Hiring a Chartered Professional Accountant (CPA) in Vancouver is one of the best decisions you can make for your business. a professional designation for accountants in Canada, signifying a high level of competency in the field, achieved by passing a rigorous exam and completing required education and practical experience, regulated by CPA Canada.

Expertise and Experience

A Chartered Professional Accountant in Vancouver brings years of education and experience to the table. They stay updated with the latest financial regulations and tax laws, ensuring your business complies with all local and federal requirements. With a CPA on your team, you’ll be able to focus on growing your business, knowing that your financial matters are in good hands.

Custom Solutions for Small Businesses

Small business owners often wear multiple hats. From managing operations to marketing, handling finances might not always take priority. However, proper small business accounting in Vancouver is crucial for your company's success. A CPA can offer tailored solutions that meet the unique needs of your business. From bookkeeping to payroll, tax filing, and more, a Chartered Professional Accountant in Vancouver ensures that your business finances are always in order, leaving you more time to focus on other aspects of growth.

Small Business Accounting in Vancouver: Key to Efficient Financial Management

Proper small business accounting in Vancouver is the foundation for any successful company. Without accurate financial records, it’s nearly impossible to make informed decisions that drive growth. That’s where a CPA comes in.

Bookkeeping Services

Bookkeeping is an essential part of small business accounting in Vancouver. Keeping track of your income, expenses, invoices, and receipts is vital for understanding your cash flow. A Chartered Professional Accountant in Vancouver will ensure that your books are always up to date, reducing the risk of errors and financial discrepancies. By maintaining accurate records, you can easily monitor your business’s financial health and make data-driven decisions.

Financial Statements and Reports

Financial statements are critical for assessing your business’s performance. Your CPA will generate detailed income statements, balance sheets, and cash flow reports, providing you with a clear picture of your company’s financial position. These reports are also essential for securing funding, whether through loans or investments, as lenders and investors require this information to evaluate your business’s potential.

Payroll Services

Managing payroll is another crucial aspect of small business accounting in Vancouver. Ensuring your employees are paid accurately and on time is not just a legal requirement but also a key part of maintaining employee satisfaction. A Chartered Professional Accountant in Vancouver can handle all aspects of payroll processing, including calculating wages, managing deductions, and filing necessary payroll taxes.

Tax Planning and Preparation in Vancouver: Maximize Your Savings

One of the most significant benefits of working with a Chartered Professional Accountant in Vancouver is their expertise in tax planning and preparation in Vancouver. Tax laws are constantly changing, and ensuring that your business complies with these regulations while minimizing tax liabilities is no easy task. A CPA can help you navigate the complexities of tax planning and preparation to ensure you're not paying more than you need to.

Effective Tax Planning

Proper tax planning and preparation in Vancouver requires a deep understanding of both your business’s finances and the current tax laws. A CPA will help you develop a strategy to reduce your tax burden through deductions, credits, and tax-efficient investments. By proactively planning your taxes, your CPA ensures that you don’t face unexpected surprises at year-end.

Tax Compliance and Filing

Tax compliance is non-negotiable for any business owner. A Chartered Professional Accountant in Vancouver will ensure that all your business tax returns are filed accurately and on time, minimizing the risk of penalties and fines. With their knowledge of federal, provincial, and municipal tax laws, they’ll ensure that your business is fully compliant with tax regulations.

Tax Savings Opportunities

With the right tax planning and preparation in Vancouver, you may be able to take advantage of various tax savings opportunities that could benefit your business in the long run. Whether it’s through tax credits, income splitting, or investment strategies, a CPA will work with you to identify opportunities that maximize your savings and reduce your overall tax liability.

How a Chartered Professional Accountant in Vancouver Can Help You Grow Your Business

The services provided by a Chartered Professional Accountant in Vancouver aren’t just about managing finances—they also play a crucial role in helping your business grow. By offering strategic advice, improving cash flow, and ensuring compliance, a CPA helps create a solid foundation for your company’s long-term success.

Financial Forecasting and Budgeting

A CPA can help you forecast your future financial needs by creating realistic budgets and financial projections. This enables you to make informed decisions about expenditures, investments, and savings, ensuring that your business operates within its financial means while planning for the future. Small business accounting in Vancouver isn’t just about tracking numbers; it’s about creating a financial strategy that supports your long-term goals.

Business Structuring Advice

Choosing the right business structure (sole proprietorship, partnership, corporation, etc.) can significantly impact your finances. A Chartered Professional Accountant in Vancouver will advise you on the most tax-efficient structure for your business based on your goals, industry, and long-term plans. This guidance ensures that you avoid costly mistakes and set up your business for growth.

Succession Planning and Exit Strategy

If you plan to eventually sell your business or pass it on to a family member, proper succession planning is critical. A CPA can help you develop a strategy for transitioning ownership, minimizing tax implications, and ensuring that your business continues to thrive after the transition. Effective small business accounting in Vancouver also helps make the business more attractive to potential buyers by demonstrating its financial health and stability.

Why Choose a Chartered Professional Accountant in Vancouver?

Working with a Chartered Professional Accountant in Vancouver is an investment in the future of your business. Their expert guidance, financial acumen, and comprehensive services can provide invaluable support at every stage of your business journey. From small business accounting in Vancouver to tax planning and preparation in Vancouver, a CPA ensures that your financial operations are running smoothly, allowing you to focus on what matters most: growing your business.

Personalized Services Tailored to Your Needs

Every business is different, and that’s why a Chartered Professional Accountant in Vancouver offers customized services designed to meet your unique needs. Whether you need help with budgeting, forecasting, or setting up a new accounting system, your CPA will work closely with you to develop solutions that align with your business’s specific goals.

Long-Term Financial Success

The expertise of a Chartered Professional Accountant in Vancouver can lead to long-term financial success. By providing strategic advice, ensuring tax compliance, and offering ongoing support, a CPA helps you navigate the challenges of running a business and seize opportunities for growth. With a strong financial foundation, you can confidently move forward with your business plans, knowing that your finances are in the best possible hands.

Take the Next Step: Partner with a Chartered Professional Accountant in Vancouver

If you’re ready to take control of your business finances, it’s time to partner with a Chartered Professional Accountant in Vancouver. Whether you’re a small business owner in need of small business accounting in Vancouver or seeking expert advice on tax planning and preparation in Vancouver, a CPA is the right choice to help you achieve your financial goals.

Don’t wait—reach out to a qualified Chartered Professional Accountant in Vancouver today and start building a solid financial foundation for your business. Their expertise will not only save you time and money but also set you on the path to long-term financial success.

By making the decision to work with a CPA, you’re investing in the future of your business. Let a Chartered Professional Accountant in Vancouver be your partner in financial growth and stability, helping you navigate the complexities of business accounting and taxation with confidence.

#Tax Planning and Preparation Vancouver#Small Business Accounting Vancouver#Bookkeeping Services West Vancouver#CPA North Vancouver#Chartered Professional#Accountant Vancouver

0 notes

Text

We’re Marvin Kaaka and Marco Kaaka, twin brothers and Submortgage Brokers registered under Dominion Lending Centres Mortgage Negotiators. While we share a love for real estate and finance, our true passion lies in helping people achieve their goals. Throughout our careers, we’ve built strong relationships, offered honest advice, and worked hard to ensure that every client feels valued.

Growing up, we always had each other’s backs, and we bring that same approach to our work. We treat every mortgage like it’s for a close friend or family member, taking the time to understand your unique needs and guiding you every step of the way.

It’s not just about securing the best rates (though we do that, too!). We focus on making sure you feel informed, confident, and supported throughout the process. Whether you’re a first-time homebuyer, new to Canada, or an experienced investor, we’ll guide you with honesty, transparency, and maybe even a bit of humor to keep things light.

Helping people achieve their homeownership dreams is what we love most about our work. We’d be honored to help you on your journey.

#twin mortgages#marco kaaka#marvin kaaka#mortgage brokers in vancouver#mortgage brokers in pitt meadows#mortgage brokers in langley#mortgage brokers in surrey#mortgage brokers in richmond#mortgage brokers in coquitlam#mortgage brokers in burnaby#mortgage brokers in nanaimo#mortgage brokers in kelowna#mortgage brokers in vernon#mortgage brokers in white rock#mortgage brokers in british columbia#entrepreneurs#accounting#money management#wealth#investment

1 note

·

View note