#VA Home Loan Rates in D

Explore tagged Tumblr posts

Text

Understanding Mortgage Rates: A Guide for Homebuyers

Mortgage rates play a crucial role in determining the overall cost of homeownership. Even a small difference in interest rates can impact your monthly payment and the total amount you’ll pay over the life of your loan. Whether you’re a first-time buyer or refinancing, understanding mortgage rates and how they fluctuate can help you secure the best deal.

1. What Are Mortgage Rates?

Mortgage rates refer to the interest charged by lenders on a home loan. They are expressed as a percentage and determine how much extra you’ll pay in addition to your loan’s principal.

Fixed vs. Adjustable Rates: Fixed rates remain the same throughout the loan term, while adjustable rates may change periodically.

APR vs. Interest Rate: The annual percentage rate (APR) includes interest plus additional fees, while the interest rate covers only the cost of borrowing.

2. Factors That Affect Mortgage Rates

Mortgage rates fluctuate based on various factors, both within and outside your control.

a. Economic Conditions

Inflation, Federal Reserve policies, and economic growth influence rates.

Strong economies often lead to higher rates, while downturns may lower them.

b. Credit Score

Higher credit scores generally qualify for lower rates.

Lenders view low scores as higher risk, leading to higher interest rates.

c. Loan Type & Term

Conventional, FHA, VA, and USDA loans have different rate structures.

Shorter-term loans (e.g., 15 years) often have lower rates than 30-year loans.

d. Down Payment Amount

Larger down payments reduce lender risk, often leading to lower rates.

Smaller down payments may require private mortgage insurance (PMI), increasing costs.

e. Debt-to-Income Ratio (DTI)

Lower DTI ratios make borrowers more attractive to lenders.

High levels of existing debt can lead to higher interest rates.

Click here to read more.

#mortgage rates#home loan interest rates#how mortgage rates work#best mortgage rates#fixed vs. adjustable mortgage#homebuyer mortgage guide#mortgage rate trends

0 notes

Text

A Simple Reference for Understanding REAL ESTATE Terminology

Comprehensive List of Real Estate Terminology and Jargon Used in India

A

Agreement to Sale: A legal document outlining the terms and conditions agreed upon by the buyer and seller for the sale of property.

Allotment Letter: A letter issued by the builder to the buyer confirming the allotment of the property.

Amenities: Features provided by a property such as a swimming pool, gym, park, etc.

B

Built-up Area: The total area of the property including the carpet area, walls, and balcony.

Brokerage: The fee paid to a real estate broker or agent for their services in facilitating the sale or purchase of a property.

Balance Transfer: Shifting an existing home loan from one lender to another for better interest rates or other benefits.

C

Carpet Area: The actual usable area within the walls of a property where a carpet can be laid.

Common Area: Areas shared by all residents of a building, such as lobbies, corridors, and amenities.

Circle Rate: The minimum rate at which a property can be registered as per the government, used to calculate stamp duty and registration charges.

Completion Certificate: A certificate issued by the municipal authorities indicating that the construction of the property is in compliance with the approved plan.

D

Deed: A legal document that conveys ownership of property from one party to another.

Down Payment: An upfront payment made by the buyer to the seller at the time of purchasing a property.

E

Encumbrance Certificate: A certificate that provides details about any legal or monetary liabilities on the property.

EMI (Equated Monthly Installment): The fixed monthly payment made by the borrower to repay a loan over a specified period.

EWS (Economically Weaker Section): A category of housing for individuals whose annual household income is below a certain threshold.

F

Freehold Property: Property that is owned outright without any lease, giving the owner full control over the property.

FSI (Floor Space Index): The ratio of the total floor area of a building to the size of the plot of land on which it is built.

G

Gated Community: A residential area with restricted access, often enclosed by walls or fences and featuring security measures.

Guidance Value: Another term for circle rate, used to determine the minimum value for property registration.

H

Handover: The process of transferring possession of a property from the developer to the buyer.

Home Loan: A loan taken by a borrower to purchase a residential property.

I

Interest Rate: The percentage charged by a lender on the borrowed amount of a home loan.

Inventory: The total number of unsold units in a particular real estate market.

J

Joint Ownership: When two or more individuals legally own a property together.

K

Khata: A legal document issued by the municipal corporation showing the ownership of property and its assessment for property tax purposes.

L

Leasehold Property: Property that is leased for a specified period, after which ownership reverts to the original owner.

Loan-to-Value (LTV) Ratio: The ratio of a loan amount to the appraised value of the property.

M

Market Value: The estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller.

Mortgage: A legal agreement where a bank or lender lends money at interest in exchange for taking title of the debtor's property, with the condition that the conveyance of title becomes void upon the payment of the debt.

N

NOC (No Objection Certificate): A document from various authorities stating that they have no objection to the details mentioned in the document.

O

Occupancy Certificate: A certificate issued by the local municipal authority indicating that the building is ready for occupation and complies with the necessary building standards and codes.

P

Possession Date: The date on which the buyer is given legal possession of the property.

Property Tax: A tax levied by the local government on the value of a property.

Q

Quitclaim Deed: A legal instrument by which the owner of a property transfers any interest they have in the property to another party.

R

Ready-to-Move: Properties that are complete and ready for occupancy.

RERA (Real Estate Regulatory Authority): An authority established to regulate and promote the real estate sector and to ensure transparency in real estate transactions.

S

Sale Deed: A legal document proving the sale and transfer of ownership of property from the seller to the buyer.

Stamp Duty: A tax paid on the legal recognition of certain documents, including property transactions.

Subvention Scheme: A scheme where the buyer does not have to pay EMIs until possession, with the developer paying the interest during the construction period.

T

Title Deed: A legal document that evidences the ownership of property.

Tenancy: The possession of land or property as a tenant.

U

Under Construction: Properties that are currently being built and not yet completed.

V

Valuation: The process of determining the current worth of a property.

Villa: A type of residential property, typically larger and more luxurious than standard homes, often with a private garden.

W

Warranty Deed: A deed in which the seller guarantees that they hold clear title to a piece of real estate and has a right to sell it.

X

Xerox: Commonly used term in India for photocopy, often required for documentation purposes in real estate transactions.

Y

Yield: The income return on an investment, such as the interest or dividends received from holding a particular property.

Z

Zoning: Regulations that define how property in specific geographic zones can be used.

This comprehensive list covers a wide range of terms and jargon used in the Indian real estate market, providing a valuable resource for anyone involved in buying, selling, or investing in property.

Visit Isprava to know more about luxury villas for sale in Goa, Alibaug and Coonoor locations.

0 notes

Text

Why finding the right VA lender is important, and how to find one?

Purchasing a home is a lifetime investment for many. This is not a task people get indulged in quite often. For many, it is one home for a lifetime or maybe two. VA loans are special loans offered to veterans USA with some special benefits. While you are searching for a VA home lender, it is very important that the lender you choose aligns better with your housing needs. VA loans are special category loans, and not every mortgage lender can handle them effectively. Reaching a VA loan-approved lender can make a lot of difference in your experience of fetching a home loan.

VA loans.

VA home mortgage is a loan backed by the U.S. Department of Veterans Affairs (VA) and is offered to Veterans, service members and surviving spouses. The benefits of the loans make them the most sought-after special category loans. The loans are offered by private mortgage lenders, banks and credit unions. They are offered with zero downpayment. Low interest rates and flexible credit guidelines. Choosing the VA-approved lenders makes your lending process smooth and easier and also makes an informed choice.

How to choose the Right VA approved lender?

Get referrals.

Getting referrals from friends and family is a solid strategy for finding the right VA lender for your home loan. Their referrals must be backed by a positive experience. If your close circle lacks this experience, you can relay rely on real estate agents for a valuable source of information. Also, you can tap online social media communities or reach veteran organisations for referrals.

Look for expertise lenders.

Many Mortgage lenders are offering VA loans, you should look for their expertise and experience as they can make your home loan processing journey smoother than ever. Check for their credentials, license and number of mortgages issued annually.

Accreditations and Credentials.

Check for the Accreditations and Credentials of the lender to know their professionalism and commitment to industry standards. This information shows lenders are legally operating VA loans and their dedication to current knowledge in processing VA loans. Do check their certifications specific to VA loans to know their expertise in processing special loans.

Length of licensure.

checking the number of years in operation is another key criteria to know their endurance in the industry and their knowledge gained over some time. A lender with good experience can demonstrate their expertise in processing special VA loans efficiently. Checking the length u of their license gives you a confirmation of their long standing in the industry which in turn echoes the history of customer satisfaction and consistent delivery.

Number of loans issued per year.

The number of VA loans issued by lender gives you information about their familiarity with processing VA loans. Get the data on their approval rates, shedding light on lender’s efficiency and likehood of getting your loan processed smoothly. Look for specialized professional assistance to process VA loans. Their ability to process multiple types of loans shows that they have the resources and expertise to process your loan proficiently.

Compare offers from multiple lenders.

compare loan quotations from different VA-approved lenders to know how they measure up to each other in costs, loan terms, loan rates, closing costs, monthly payments and additional costs. Compare the options from at least three VA-approved lenders to steer towards the best VA mortgage lender. Also, check if the loan agreement is in line with your financial goals.

Evaluate lender reviews.

Get insights into customer reviews to gain more knowledge about borrowers’ experiences. It y gives information about customer’s overall satisfaction about the lender. The reviews online can be misleading at times, so you need to learn to evaluate them. Look for consistent feedback, check for the source and know the response from the lender to validate details. Get a balanced view for an accurate depiction.

Trust your First Impression.

Go with the lender if your lender talks to them in a friendly way and is quite prompt in getting back to you. You can trust the lender if they can answer all your questions and give you more knowledge on loans.

0 notes

Text

Save Thousands on Your Mortgage: Everything You Need to Know About Home Loan Subsidies

Introduction:

Owning a home is a dream for many, but the financial commitment can be daunting. However, there's good news for aspiring homeowners – home loan subsidies. These subsidies can potentially save you thousands on your mortgage, making homeownership more accessible. In this comprehensive guide, we'll delve into the intricacies of home loan subsidies, explaining what they are, how they work, and how you can leverage them to ease the financial burden of purchasing your dream home.

I. Understanding Home Loan Subsidies:

Definition and Purpose

Home loan subsidies serve as financial assistance initiatives provided by governments or other entities, with the main goal of enhancing the affordability of homeownership. These programs are designed to diminish the overall borrowing expenses, thereby facilitating a more accessible path for individuals and families to acquire a home. For residents in Ahmedabad seeking guidance on navigating these subsidy opportunities, consulting with a Home Loan Subsidy Consultant in Ahmedabad can be instrumental. Such consultants possess the expertise to help clients understand and leverage available subsidy programs, making the process of buying a home more feasible and financially advantageous.

II. Types of Home Loan Subsidies:

a. Interest Rate Subsidies: These subsidies aim to lower the interest rates on your home loan, resulting in reduced monthly payments. Governments or financial institutions may offer fixed or variable rate subsidies, depending on the specific program.

b. Down Payment Assistance: Some subsidies focus on helping with the initial down payment, which is a significant barrier for many prospective homebuyers. This assistance can come in the form of grants, forgivable loans, or low-interest loans.

c. Closing Cost Assistance: Closing costs can be a substantial financial burden. Certain subsidies cover these costs, alleviating the immediate financial strain associated with finalizing a home purchase.

d. Tax Credits: Governments may provide tax credits to incentivize homeownership. These credits can reduce the amount of income tax owed, offering additional financial relief.

How Home Loan Subsidies Work:

Government Programs: Many home loan subsidies are administered through government programs at the federal, state, or local levels. These programs often have specific eligibility criteria based on factors such as income, location, and property value.

Financial Institution Programs: Some banks and lending institutions also offer their own subsidy programs. These may include special mortgage products with reduced interest rates or down payment assistance.

Income Eligibility: Eligibility for home loan subsidies is often tied to the borrower's income. Lower to moderate-income individuals and families typically have a higher chance of qualifying for these programs.

Leveraging Home Loan Subsidies:

Research and Education: Begin by researching the various home loan subsidy programs available in your area. Understand the eligibility criteria, application process, and the specific benefits offered by each program.

Consult with Lenders: Speak with mortgage lenders to explore their subsidy offerings. Some financial institutions have in-house programs that could provide additional savings.

Government Assistance Programs: Check for government-backed programs, such as those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). These programs often have favorable terms for eligible borrowers.

Maintain Good Credit:

Securing the most favorable subsidy programs is significantly influenced by maintaining a robust credit score. To enhance your eligibility for the best home loan subsidy programs, it's crucial to consistently monitor your credit report. Promptly addressing any issues that may arise is key to nurturing and sustaining a healthy credit profile. For personalized guidance on navigating home loan subsidies in Ahmedabad, consider consulting with a Home Loan Subsidy Consultant in Ahmedabad. Their expertise can provide valuable insights and assistance tailored to your financial situation, ensuring you make informed decisions to optimize your chances of accessing beneficial subsidy programs.

Conclusion:

Home loan subsidies present a valuable opportunity for potential homeowners to save thousands on their mortgages. By understanding the types of subsidies available, how they work, and the eligibility criteria, you can make informed decisions to secure the best possible financing for your dream home. Take advantage of these programs, consult with experts, and embark on your homeownership journey with confidence. Remember, with the right knowledge and preparation, your dream home can be more attainable than you think.

0 notes

Text

Understanding Mortgage Options: Finding the Right Loan

Purchasing a home is an exciting milestone in one's life, but it often requires a significant financial investment. For many homebuyers, securing a mortgage is a crucial step in making their homeownership dreams a reality. However, navigating the world of mortgages can be overwhelming, with a multitude of options available. Understanding the different types of mortgages and finding the right loan for your specific needs is essential. In this blog, we will delve into the intricacies of mortgage options, empowering you to make an informed decision that aligns with your financial goals and circumstances. The Basics of Mortgages: a. Definition and Purpose: A mortgage is a loan specifically designed for purchasing real estate. It allows homebuyers to finance a significant portion of the property's purchase price. b. Key Players: Mortgage lenders, such as banks or financial institutions, provide the funds, while borrowers repay the loan amount, along with interest, over a specified period. c. Interest Rates: Mortgages come with different interest rate structures, including fixed-rate mortgages (FRMs) and adjustable-rate mortgages (ARMs). Understanding the pros and cons of each option is crucial for making an informed decision. Visit Apartments in Kottayam Types of Mortgages: a. Conventional Mortgages: These are the most common type of mortgages, typically offered by banks and lenders. They conform to guidelines set by government-sponsored entities like Fannie Mae and Freddie Mac. b. FHA Loans: Insured by the Federal Housing Administration (FHA), these loans are popular among first-time homebuyers due to their lower down payment requirements and more flexible credit score criteria. c. VA Loans: Available exclusively to veterans, active-duty service members, and eligible spouses, VA loans offer favorable terms and benefits, including zero or low down payment requirements and competitive interest rates. d. USDA Loans: Backed by the United States Department of Agriculture (USDA), these loans aim to promote homeownership in rural and suburban areas. They offer attractive financing options for low-to-moderate income borrowers. Visit Homes in Kottayam Factors to Consider When Choosing a Mortgage: a. Financial Situation: Assessing your current financial position, including your income, credit score, and debt-to-income ratio, will help determine the type of mortgage you qualify for. b. Down Payment: Consider the amount you can afford to put towards a down payment. Higher down payments can lead to better loan terms, including lower interest rates and reduced mortgage insurance requirements. c. Loan Term: Decide between a 15-year or 30-year mortgage term based on your long-term financial goals, monthly budget, and desire to build equity quickly. d. Interest Rates: Evaluate the advantages and disadvantages of fixed-rate and adjustable-rate mortgages. Fixed-rate mortgages provide stability, while adjustable-rate mortgages offer initial lower rates but may fluctuate over time. The Mortgage Application Process: a. Pre-Approval: Get pre-approved for a mortgage to determine your borrowing capacity and strengthen your position as a serious buyer in the housing market . b. Documentation: Prepare necessary financial documents, such as income statements, tax returns, and bank statements, to support your mortgage application. c. Shopping for Lenders: Research and compare mortgage lenders to find the best rates, terms, and customer service that align with your needs. d. Closing Process: Understand the steps involved in the closing process, including the home appraisal, inspection, title search, and finalizing the loan. Working with Mortgage Professionals: a. Mortgage Brokers: Consider engaging the services of a mortgage broker who can shop around on your behalf, connecting you with various lenders and assisting in finding the best mortgage terms. b. Loan Officers: Collaborate with loan officers at different lending institutions to explore loan options, clarify doubts, and obtain personalized advice throughout the mortgage application process. Mortgage Insurance Options: a. Explore the concept of mortgage insurance, including Private Mortgage Insurance (PMI) for conventional loans and Mortgage Insurance Premium (MIP) for FHA loans. Understand how mortgage insurance protects lenders in case of borrower default and the implications it may have on your loan . b. Discuss strategies to eliminate or reduce mortgage insurance, such as making a larger down payment or reaching a specific equity threshold in your home. Jumbo Mortgages: a. Delve into jumbo mortgages, which are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. Explain the unique features of jumbo mortgages, including higher loan amounts and stricter qualification criteria. b. Provide insights into the advantages and considerations of jumbo mortgages for borrowers looking to purchase high-value properties. Mortgage Refinancing: a. Highlight the benefits of mortgage refinancing, such as obtaining a lower interest rate, shortening the loan term, or accessing home equity for other financial needs. b. Discuss the various types of refinancing options, including rate-and-term refinancing and cash-out refinancing, and explain the process involved. Second Mortgages and Home Equity Loans: a. Shed light on second mortgages and home equity loans, which allow homeowners to tap into their home equity for various purposes, such as home improvements, debt consolidation, or educational expenses. b. Discuss the differences between second mortgages and home equity loans, including interest rates, repayment terms, and potential risks. Government-backed Mortgage Assistance Programs: a. Explore government programs designed to assist homebuyers, such as the Home Affordable Refinance Program (HARP) and the Home Affordable Modification Program (HAMP). Discuss eligibility criteria, benefits, and how these programs can help borrowers facing financial challenges. Specialized Mortgages: a. Discuss specialized mortgage programs, such as energy-efficient mortgages (EEMs) that provide financing for energy-efficient home improvements, and reverse mortgages, which allow seniors to convert home equity into income. b. Examine the unique features, eligibility requirements, and considerations associated with specialized mortgage options. Mortgage Rate Trends and Forecast: a. Provide insights into current mortgage rate trends and forecast future changes based on market conditions and economic factors. b. Offer tips and strategies for timing your mortgage application to take advantage of favorable interest rates.Remember to tailor these topics to your specific audience and region, and consider the latest market trends and regulations in the mortgage industry. Conclusion: Navigating the world of mortgages can seem complex, but armed with knowledge and understanding, you can confidently choose the right mortgage option for your home purchase. By considering your financial situation, loan types, interest rates, and working with mortgage professionals, you can find a mortgage that aligns with your needs and sets you on the path to homeownership. Remember to thoroughly research, compare offers, and seek guidance from trusted advisors to make an informed decision. With the right mortgage in place, you'll be one step closer to turning your homeownership dreams into a reality. Top 9 Prestigious Universities in Germany You Need to Know Read the full article

0 notes

Link

Fallout from Veterans Home audit leaves some Napa Valley groups disappointed

Contents

Ceo. sen. johnny isakson

Worse prostate cancer outcomes

Community support awards

Groups disappointed yountville

Fallout from Veterans Home audit leaves some Napa Valley groups disappointed Contents Diabetic foot ulcer detection Fortune; podimetrics raises $13.4m ceo. sen. johnny isakson Diabetic foot ulcer sensing Withthe american diabetes associationidentifying30 Podimetrics raises .4 million to Expand Innovative Solution for Diabetes Complications.

Film fest explores veterans’ wellness Fallout from Veterans Home audit leaves some napa valley groups disappointed olympia, Washington – Governor Jay Inslee signed an executive order monday that builds upon the state’s efforts to support military spouses and veterans with employment and training opportunities as families transition to.

Torrington invites participation in Memorial Day parade Poll: VA the least-liked federal agency — FCW WJFW – Under veterans’ watchful eye, state breaks ground on $80 million skilled nursing facility at King Veterans Home $1.5M in pedestrian safety upgrades complete on Boulder Highway Pedestrian Safety | NHTSA – Find out how your State highway safety or emergency medical services program can benefit from NHTSA’s technical assessment. Pedestrian Safety Training for law enforcement order this CD-ROM to receive computer-based training in pedestrian safety, followed by a certificate of completion. Pedsafe An expert tool to help diagnose and address.View detailed information and reviews for 20 Veterans Memorial Blvd, ste 105 in Kenner, Louisiana and get driving directions with road conditions and live traffic updates along the way.Jim Webb (D-Va.), Kirsten Gillibrand Kirsten Elizabeth Gillibrand Castro. William Nelson Al Franken says he ‘absolutely’ regrets resigning Democrats target Florida Hispanics in 2020 Poll: Six.Worthington Memorial Day Parade 2019 information, for Worthington Ohio. This parade has become a premier event in Ohio for honoring the veterans and serving members of the United States Armed Forces. Residents from Worthington, Powell, Westerville, Columbus and surrounding communities come to honor our Veterans past and present.

Napa County Grand Jury wants more mental health services in the new jail California on track to lose at least one congressional seat after 2020 Census Applications being accepted for Napa’s Fourth of July parade Fallout from Veterans Home audit leaves some Napa Valley groups disappointed

Pregnant Gretchen Rossi Battles Home Foreclosure Gretchen Rossi May Lose Her Home Because Of Unpaid Mortgage by Kim Stempel on August 7th, 2019 Real Housewives of Orange county alum gretchen rossi has always attracted controversy.. If you can’t save your home during an impending foreclosure process or sell it for a profit or to break even, then unloading your home may be your best option – cut your losses, load up your family and your.

Fallout from Veterans Home audit leaves some Napa Valley groups disappointed worse prostate cancer outcomes With 5-Alpha-Reductase Inhibitors ASCO gu: early treatment and Active Surveillance of Prostate Cancer Patients – Cancer Network. respect to treating men with low-risk prostate cancer. I do think that there is an interesting study that.

Kentucky WWII Veteran to Receive French Legion of Honor This is a special video version of the Sports Buzz Podcast featuring Gov. Matt Bevin. WATCH WKYT to air national anthem at end of every broadcast day WKYT will now air the national anthem at the end.

Although experts remain cautiously optimistic about the larger consequences of Mr Brown’s story, CBS 5 reported that some doctors not associated with the study call it a ‘functional cure’. Mr Brown.

Contents Economist sam khater Economy. home purchase demand 3 basis points Veterans home audit leaves As a result, sales volume came in slightly below expectations. lower rates since late 2018," said Freddie Mac Chief economist sam khater. "The drop in mortgage rates is causing purchase demand to.

Fallout from Veterans Home audit leaves some Napa Valley groups disappointed Harris Contents Safety upgrades complete Investigation.podimetrics raises .4 Affairs committee luncheon dispute Napa valley groups disappointed executive order Fallout from veterans.

Honor a veteran with a paver Game of Thrones Live Concert Experience coming to Virginia Beach Find tickets for Game of Thrones Live Concert Experience in Virginia Beach, Virginia at Veterans United Home Loans Amphitheater on Tuesday, September 17, 2019. Veterans United Home Loans Amphitheater is located at 3550 Cellar Door Way in Virginia Beach, VA. Veteran’s Memorial at the Oakdale City Hall creates an enduring space for citizens to honor military friends and family, enhanced by the use of retaining walls, paver surfaces and natural stone.

While their husbands and boyfriends are away fighting, a group. some of the works of the classic Pin-up artists.’ Lucy Jerwood, 31, whose husband Sergeant Philip Jerwood, 34, survived two bomb.

Make a home down payment without wrecking your finances Coasties, agencies honored at Chamber Military Affairs Committee luncheon Coasties, agencies honored at Chamber Military Affairs Committee luncheon – Daily Advance Winners of Exemplary Service and community support awards presented by the Elizabeth City Area Chamber of Commerce’s military affairs committee pose following the Chamber’s annual awards banquet at the chief petty officers Club, Wednesday.But a higher down payment can make a significant difference if it means lowering or avoiding mortgage insurance. The insurance, which can involve upfront and monthly fees, protects the lender if.

Fallout from Veterans Home audit leaves some Napa Valley groups disappointed yountville Shooting Leaves An Impact On Veterans Living With PTSD {excerpt:n} Yountville Shooting Leaves An Impact On Veterans Living With PTSD CBS San Francisco Bay Area PTSD expert, veterans weigh in on yountville tragedy kgo-tv full coverage read more.

The post Fallout from Veterans Home audit leaves some Napa Valley groups disappointed appeared first on VA Loans Dallas TX.

https://ift.tt/2lwQ31S

#Dallas VA Home Loan#VA Home Loan Requirements in Dallas#Dallas VA Loan Rates#VA Home Loan Rates in D

0 notes

Video

youtube

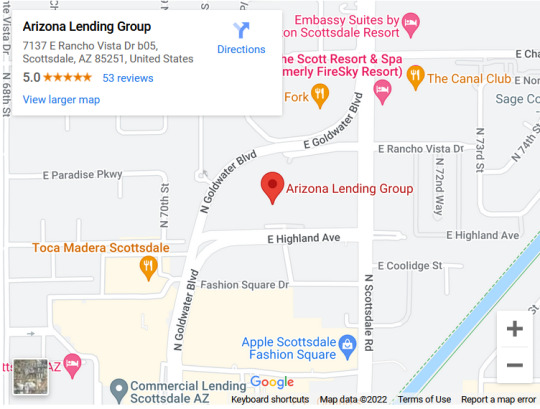

Business Name: Arizona Lending Group

Street Address: 7137 E Rancho Vista Dr, Suite B05

City: Scottsdale

State: Arizona

Zip Code: 85251

Country: United States

Business Phone: (480) 788-2541

Business Email: [email protected]

Website: https://www.arizonalendinggroup.com/

Facebook: https://www.facebook.com/ArizonaLending

Twitter: https://twitter.com/arizonalending

Instagram: https://www.instagram.com/arizonalending/

YouTube: https://www.youtube.com/watch?v=YuBg8oKEluU

Yelp: https://www.yelp.com/biz/arizona-lending-group-scottsdale?osq=arizona+lending+group

Description: Arizona Lending Group specializes in Conventional home loans, VA loans, FHA loans, USDA loans, Jumbo Loans, and Reverse Mortgages. We are a mortgage broker and a mortgage lending company based out in Scottsdale, Arizona. Also, we have a passion for assisting our customers with their home loans or mortgage lending needs. Arizona Lending Group offers deep expertise and personalized services for new home purchases and refinancing to every kind of borrower. We are one of the fastest mortgage lending and home mortgage broker in Scottsdale, Arizona. Whether you are a first-time homebuyer, upgrading or downsizing, we have the perfect home loan to fit your life. Get pre-approved in minutes and take advantage of our low rates & low fees.

Google My Business CID URL: https://www.google.com/maps?cid=17374514925442285182

Business Hours: Sunday 7:00 AM-9:00 PM Monday 7:00 AM-9:00 PM Tuesday 7:00 AM-9:00 PM Wednesday 7:00 AM-9:00 PM Thursday 7:00 AM-9:00 PM Friday 7:00 AM-9:00 PM Saturday 7:00 AM-9:00 PM

Service: Mortgage Broker, Brokerage, Home Loans

Keywords: Mortgage Broker in Scottsdale, mortgage broker Scottsdale, Scottsdale mortgage broker, Scottsdale mortgage brokers, Best Mortgage Broker Arizona, Arizona Best Mortgage Broker, Scottsdale Arizona mortgage brokers,Scottsdale az mortgage brokers, mortgage brokerage Scottsdale, mortgage lending Scottsdale, home loans Scottsdale Arizona, mortgage companies Scottsdale

Location:

https://goo.gl/maps/sT18DYYXD9cKukgF6

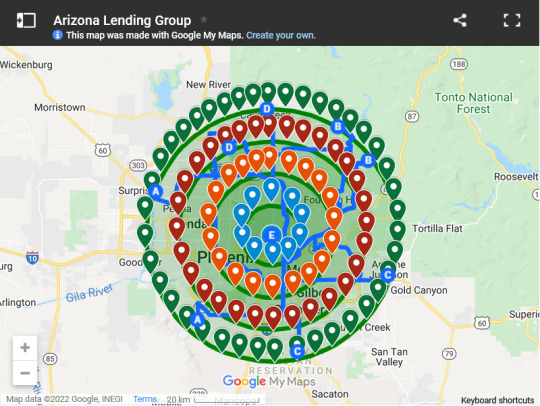

Service Areas:

https://www.google.com/maps/d/viewer?mid=1RP-X7_j8SifB9jhal3g9vzzRsK_cmRzS

2 notes

·

View notes

Video

youtube

Business Name: Arizona Lending Group

Street Address: 7137 E Rancho Vista Dr, Suite B05

City: Scottsdale

State: Arizona

Zip Code - Postal Code: 85251

Country: United States

Business Phone: (480) 788-2541

Business Email: [email protected]

Website: https://www.arizonalendinggroup.com/

Facebook: https://www.facebook.com/ArizonaLending

Twitter: https://twitter.com/arizonalending

Instagram: https://www.instagram.com/arizonalending/

YouTube: https://www.youtube.com/watch?v=YuBg8oKEluU

Yelp: https://www.yelp.com/biz/arizona-lending-group-scottsdale?osq=arizona+lending+group

Description: Arizona Lending Group specializes in Conventional home loans, VA loans, FHA loans, USDA loans, Jumbo Loans, and Reverse Mortgages. We are a mortgage broker and a mortgage lending company based out in Scottsdale, Arizona. Also, we have a passion for assisting our customers with their home loans or mortgage lending needs. Arizona Lending Group offers deep expertise and personalized services for new home purchases and refinancing to every kind of borrower. We are one of the fastest mortgage lending and home mortgage broker in Scottsdale, Arizona. Whether you are a first-time homebuyer, upgrading or downsizing, we have the perfect home loan to fit your life. Get pre-approved in minutes and take advantage of our low rates & low fees.

Google My Business CID URL : https://www.google.com/maps?cid=17374514925442285182

Business Hours: Sunday 7:00am-9:00pm Monday 7:00am-9:00pm Tuesday 7:00am-9:00pm Wednesday 7:00am-9:00pm Thursday 7:00am-9:00pm Friday 7:00am-9:00pm Saturday 7:00am-9:00pm

Service: Mortgage Broker, Brokerage, Home Loans

Keywords: mortgage broker Scottsdale, Scottsdale mortgage broker, Scottsdale mortgage brokers, Scottsdale Arizona mortgage brokers, Scottsdale az mortgage brokers, mortgage brokerage Scottsdale, mortgage lending Scottsdale, home loans Scottsdale Arizona, mortgage companies Scottsdale

Location:

https://goo.gl/maps/sT18DYYXD9cKukgF6

Service Areas:

https://www.google.com/maps/d/viewer?mid=1P5I2LIbRO3sZmLZSY9VkRzIiSfM3S9-j

1 note

·

View note

Link

Arizona Lending Group offers deep expertise and personalized services for new home purchases and refinancing to every kind of borrower.

1 note

·

View note

Note

Hey, my dad claims that Bernie hasn't been properly vetted and hasn't really done anything while being a senator. There's no use getting through to him but maybe you can disprove this in case others face the same arguments.

What has Bernie accomplished exclusively as a Senator?

2006 - Sanders defeats Vermont’s richest man to be elected to the U.S. Senate as an Independent. Gets endorsed by the Vermont Democratic Party and is supported by the Dem. Senatorial Campaign Committee

2007 - Sanders’ authored energy efficiency and conservation grant program passes into law. Later secures $3.2 billion in the American Recovery and Reinvestment Act in 2009

2008 - Thanks to Sen. Sanders, funding for Low Income Home Energy Assistance Program doubles, helping millions of low-income Americans

2008/09 - Sanders voted against the Wall St. Bailout

2009 - Works with Chuck Grassley ® to pass amendment to an economic recovery bill preventing Wall St. banks that take taxpayer bailouts from replacing laid-off U.S. workers with exploited and poorly-paid foreign workers

2009 - Passes language in the ACA to allow states to apply for waivers to implement pilot health care systems, which allows states to adopt more comprehensive systems to cover more people at lower costs

2009 - Sanders was only 1 of 4 senators to vote against the appointment of Timothy Geithner

2010 - Voted to overturn ‘Don’t Ask, Don’t Tell’

2010 - ACA passes, Sanders secures $12.5 billion in funding for the program which now serves more than 25 million Americans. Another $1.5 billion from a Sanders provision went to the National Health Service Corps for scholarships and loan repayment for doctors & nurses working in under-served communities

2010 - Worked with Ron Paul ® in the House to pass a measure as part of Dodd-Frank Wall Street reform bill to audit Federal Reserve, revealing how the independent agency gave $16 trillion in near zero-interest loans to big banks/businesses after ‘08 economic collapse.

2010- Sanders delivered an 8 1⁄2–hour speech against the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

2013 - Sanders, now chairman of Senate Veterans’ Affairs Committee, & backed by seniors, women, veterans, unions & disabled Americans, leads a successful effort to stop a “chained-CPI” proposal supported by Republicans and the Administration to cut Social Security & disabled veterans’ benefits.

2013 - Sanders introduces legislation to break up major Wall St. banks so large that the collapse of one could send the overall economy into a downward spiral.

2013 - Sanders’ Veterans’ Compensation Cost-of-Living Adjustment Act passes

2014 - A bipartisan $16.5 billion veterans bill written by Sen. Sanders, Sen. McCain and Rep. Miller is signed into law by President Barack Obama. The measure includes $5 billion for the VA to hire more doctors and health professionals to meet growing demand for care.

2015 - Sanders takes over as ranking member of Senate Budget Committee, using the platform to fight for his economic agenda for the middle class.

2015 - Sanders votes against Keystone XL pipeline, which would allow multinational corporation TransCanada to transport dirty tar sands oil from Canada to the Gulf of Mexico.

2015 - Sanders introduced legislation to expand benefits and strengthen the retirement program for generations to come. The Social Security Expansion Act was filed on the same day Sanders and other senators received the petitions signed by 2 million Americans, gathered by National Committee to Preserve Social Security and Medicare.

2015 - Sanders, Rep. Raúl M. Grijalva (D), Rep. Keith Ellison (D) and Rep. Bobby Rush (D) introduced bills to ban private prisons [which have been 3 to 4 times as expensive with much higher rates of prisoner abuse, guard injury than government run prisons], reinstate the federal parole system and eliminate quotas for the number of immigrants held in detention.

2016 - Sanders places hold on FDA nominee Dr. Robert Califf because of his close ties to big pharma and lack of commitment to lowering drug prices. There is no reason to believe he would make the FDA work for ordinary Americans over CEOs of pharmaceutical companies

2016 - Sanders voted for the Federal Reserve Transparency Act

2017 - Sanders introduced a bill that would raise the minimum wage for federal contract workers to $15/hr

2017 - Opposed the appointment of Neil Gorsuch to the Supreme Court

2018/19 - Sanders’ Yemen War Resolution passes in the Senate and House

2018 - Sanders pressures Disney and Amazon to raise their minimum wage to $15/hr

2018 - Sanders introduced the Workplace Democracy Act to expand labor rights

2018 - Sanders introduced the Stop Bad Employers by Zeroing Out Subsidies (Stop BEZOS) Act to require corporations to pay for employees’ food stamps and Medicaid benefits

2020 - Sanders sponsors a bill preventing unauthorized war in Iran

Present - Sanders is a ranking member of Senate Budget Committee

Present - Sanders travels the country promoting progressive groups and causes, using the bully pulpit to elevate issues to the national level

2016 - Present- Bernie garnered enormous support among young Americans, encouraging thousands, if not millions of voters into politics

#Bernie 2020#Bernie Sanders#Vote#Election 2020#Senate#Politics#US politics#democratic primaries#US elections

167 notes

·

View notes

Text

How to Secure a Low Down Payment Mortgage

Are you looking to buy a home, but concerned about the high down payment required? Don't worry, there are options available to help make homeownership a reality. Low down payment mortgages, also known as no or limited down payment loans, allow you to purchase a home with a smaller upfront investment. Here are some options to consider:

Federal Housing Administration (FHA) Loan

FHA loans are backed by the Federal Housing Administration and require only a 3.5% down payment. They also offer more relaxed credit and income requirements, making them a popular choice for first-time homebuyers.

Veterans Affairs (VA) Loan

VA loans are exclusively for military veterans, active duty personnel and their surviving spouses. These loans require no down payment and offer favorable interest rates.

Credit Unions

Credit Unions are also a great location for certain special programs. You should find out more what is provided. Teachers Credit Union has a popular program and sometimes coinicides with state down payment assistance plans. Navy Federal Credit Union, which has a zero down mortgage. You don't have to serve to be in this credit union just a family member can qualify you for membership.

USDA Loan

USDA loans are designed for low to moderate-income households in rural areas. They offer no down payment and favorable interest rates, but have strict property eligibility requirements.

Conventional Loan with Private Mortgage Insurance (PMI)

Conventional loans typically require a higher down payment, but PMI can be added to the loan to reduce the amount required. PMI is a type of insurance that protects the lender in case the borrower defaults on the loan.

State and Local Down Payment Assistance Programs

Many state and local governments offer down payment assistance programs to help first-time homebuyers with the costs of purchasing a home. These programs can provide grants, low-interest loans or tax credits.

In conclusion, there are a variety of low down payment mortgage options available to help make homeownership a reality. It's important to do your research and speak with a lender to determine the best option for your financial situation.

If you're looking to Buy or Sell in Huntington Beach, call 949-310-4110

Conrad Mazeika

Mr. Huntington Beach Real Estate

eXp Realty of California Inc

Lic 01991663

315 7th St D

Huntington Beach, CA 92648

0 notes

Text

Strategies For Locking at the Best Mortgage Rate

Hint Number 5: Always Confirm The Rate-lock Phase When Asking For A Rate QuoteHint #1: Always Look for Home Mortgage RatesThis is how they increase their commission whenever you FLOAT. Originally, the lender lent 4.875percent with 1.00 Entire Point once you requested the loan. Then 4-5 days after you called to Lock-In. Keep in mind that over the 4-5 day period you just were FLOATING, the actual Points for 4.875% dropped to.250 Total Points. So you should have saved.75 Total Points in your own 4.875percent speed. Right? No! To begin with, that you don't know whether his business's issues have dropped or by how much they may have dropped. So, rather than providing you with 4.875percent for.250 Total Points, the home loan Loan Officer lets you know that his rates just dropped only a tiny bit. He says you can Lock-In 4.875percent for.75 Total Points. You are joyful since it is.25 lesser than what it was once you applied for the loan, however the mortgage Loan Officer is thrilled since he keeps 1 / 2 of the"over age" you paidoff. That over age is.50 points and he splits this with his own company. If the mortgage was $400,000, he just earned.25percent that's an additional $1,000 commission. That is not bad for a five minute phone conversation. If you're purchasing a house and also you need 60 days to close, be sure you specifically request Mortgage Cost quotes with a 60-day Lock period. Some Home Mortgage Loan Officers will quote rates with 15 Day or 30 Day Party periods as the Discount Points for shorter lock spans are less than rate locks for extended spans. Quoting a house Mortgage Rate with A15 Day lease period clearly gives that loan-officer a unfair advantage. It is also a waste of your energy as the quote isn't real in case you can't decide on your loan within 1-5 days. Consistently specify a 60-day Lock-In if you are purchasing a home. Require 4-5 Days if you are refinancing, but you can have the ability to have it done within 1 month if you are quite diligent and telephone your mortgage Loan Officer twice a week for a status of one's application. Mortgage Prices change each day and some times mid day. The last day's rates typically browse around this website expire by 8:30 a.m. the next morning. Broadly speaking, home loan Rates are published each day from 11:00 a.m. Eastern moment. To make certain you're receiving mortgage Rates from the current day and not just a mixture of rates by the preceding day out of several lenders and also the recent rates from different lenders, always do your rate shopping after 11:00% Eastern time. Get yourself a copy of the Final Good Faith Estimate at least a day or two before the scheduled final day. Make sure you are getting precisely what you bargained for. Ask questions if you don't understand some thing. Require that undisclosed fees be taken off the Final Good Faith Estimate. Make certain that you receive a revised estimate if the Mortgage Loan Officer verbally agrees to produce changes. When you phone a Mortgage Bank, ask for the"Total Points" (Discount Points, Loan Origination Fee, Broker Points) for every single Mortgage Rate. Some lenders will merely quote the Discount Points and deliberately leave out the Loan Origination Fee. You won't find out regarding the 1.00 Point Loan Origination Fee before you apply to your Mortgage. By that point, the loan-officer amounts you'll only accept it because he has your application and pulled on your credit report. Furthermore, Mortgage Agents often fail to mention their Broker Fee. If you're receiving a government guaranteed mortgage (FHA or VA), you don't need to find yourself in a comparison of the FHA MIP or the VA Funding Fee. This is really a set you back may be paying, nevertheless every lender MUST make use of the exact costs, thus there's absolutely no reason to attempt to compare those costs from lender to lender. If you are purchasing a house, tell the mortgage Loan Officer you are Rate shopping and you have a"ratified contract" to purchase a home. Tell him you intend to create a decision and Lock-In an interest speed on such day, but you have to check a few other lenders. In case he asks you how his rates compare to others, tell him he is the first person you've called. If you are refinancing, tell the mortgage Loan Officer that you are ready to apply for a Refinance mortgage today. If you never tell him that, he may provide a fake mortgage Rate quote. Some creditors do not charge a Loan Origination Fee. The fee of Mortgage Insurance can vary from lender to lender despite the fact that many home loan Loan Officers will say,"We don't determine the Mortgage Insurance policy, Fannie Mae and Freddie Mac perform". Your can only say,"Please humor me and supply the regular monthly Mortgage Insurance given as a percentage".Hint #7: After You've Discovered The Lowest Cost Rate, Apply and Lock The RateYou have to nail this down once you talk to a mortgage Loan Officer. FLOATING is a LOSE/LOSE suggestion for you and a WIN/WIN for the Home Mortgage Loan Officer. If the home mortgage Officer thinks you may have a tendency to FLOAT your Speed and Points, he may state,"that I feel that the rates will be coming , and that means you might wish to FLOAT". Remember this, never FLOAT your own home loan Rate. Never. Always Lock-In the Rate and Points. In the event you FLOAT, and also the Discount Points to get home loan Rates drop, you will just realize the benefit of a little portion of that drop in the Points, if any at all. The Home Mortgage Loan Officer will continue to keep the rest of the savings because a fat commission. Hint Number 4: Request The Total Points And The Total FeesHow will you compare quotes for those who really don't know that which quotes are real and which are part of a bait and switch program? The sole way to ensure getting real quotes is to stay in the Home Mortgage Loan Officers by making them think you are ready to Lock-In a home loan Rate instantly. Before you offer your application info, make sure the home loan Loan Officer agrees to provide you with a real Speed Lock confirmation via email or facsimile on exactly the identical day you apply for the loan. It's normal to get a creditor to take you to apply over the device before they will Lock-In your house Mortgage Rate. If your rate lock expires, the lender will re-lock you at higher of either the original rate or even the current speed whenever you make the decision to re-lock. That's a LOSE/LOSE situation for you. Mortgage Loan Officers who work of a referral system of Realtors and Builders don't need to have competitive Home mortgage-rates because they've a steady stream of"Drones" (people who are known in their mind and do not shop) calling them. Check around, obtain the most reasonably priced mortgage Rate, and if you are inclined, approach the"favorite" loan-officer you were referred to and ask him to complement with the quotation. When you were looking for houses or thinking about refinancing, you may have shopped gotten some quotes from lenders and narrowed your search down to the best 5 Home Mortgage Lenders or Brokers. Nevertheless, if it is time to submit an application for the Mortgage, ensure to update your quotes for the lowest priced Home Mortgage Lenders. When you identify the home loan Bank with all the best cost rate, telephone and make an application to your loan. Tell the Mortgage Loan Officer you want to Lock-In your Home Mortgage Rate and use NOW. If the quotation has changed because you upgraded your quotes a couple of hours tell the Loan Officer you would like him to honor the last quotation. In case he won't do it, tell him you will call straight back again. Subsequently call the next cheapest Home Mortgage Bank in your list. If that lender tells you exactly Reverse Mortgage Lenders the same thing, you can return straight back to the first lender and proceed with the application procedure. Loan Lenders understand you may likely talk to another lender with lower home-mortgage Rates and the only way they is certain for you to call him back will be always to give you a bogus quote which appears to be the lowest. He is expecting you will speed shop for several days and figures you can call him back in a day or 2 because he provided a non, fake rate quote. Additionally, since Home Mortgage Rates change daily and are subject to change at any time, he isn't concerned with providing you with a fake quote. Do not blindly accept a Realtor or Contractor referral to apply for a Home Mortgage by using their preferred lender.

youtube

Many times they are going to say,"We work closely for this guy and that will get the work done". Remember, the Realtor wont be paying off the bill each month for another 30 years, you will.Hint #9: Get Your Final Good Faith Estimate Several Days Before Loan ClosingGet all your quotes after 11:00 a.m. Eastern time. You will wish to look at the quoted percentage in everything exactly is on your own primary application records and closing loan records to be certain the Monthly Mortgage Insurance payment isn't more than that which you were quoted. When it's, get it paid down instantly. If they will not do that, then ask them to decrease your Home Mortgage Rate by.125percent and which should cover the difference.Tip#6: Compute The Money Cost Of The Points And Add All FeesIn case Mortgage Insurance (not to be confused with mortgage insurance) is required to a Traditional Home Loan, ask for the cost annually expressed as a percent and compare it in lender to lender. Some lenders require different levels of coverage and this will impact your monthly Mortgage Insurance payment. In addition, lenders use many different mortgage companies and so they charge different rates for their coverage. The lending institution will pick the mortgage insurance provider.Hint #3: Always Tell The Home Mortgage Officer You Are Prepared To Apply For A Loan NOWSome-times Home Mortgage Rates change mid day due to a volatile bond market. While this happens, some home loan Lenders will adapt the Discount Points because of their rates in accordance with the brand newest bond prices and publish brand new mortgage Rates for that day. Additional Lenders may continue to honor their dawn prices. Some companies quote really low prices and bring lots of software, however they do not let you Lock-In until 1-5 Days prior to loan closing. If you try to make an application for a Mortgage by way of a company with that policy, then you can receive screwed. When it is the right time for you to Lock-In your Mortgage Rate, you will pay an"over age" that will go straight to the Mortgage Loan lien. You will either cover more points for the speed you requested at time of application or you will get a greater rate. Either way, you will get the Loan Officer will find a fat over-age added to your own commission. After you've spent any time conversing with a number of home loan Officers, you'll have lots of Rates, Points and Charges onto a sheet of paper. You need to calculate the money cost of this Factors (multiply the mortgage amount X that the Total Factors expressed as a percent; For example, multi ply 400,000 mortgage amount X.625 percent for.625 Factors ). Then put in the dollar cost of the points to the Overall Fees. You can then compare each home loan Lender's Total Cost (dollar price of the points + all creditor related fees) for a given rate. This may highlight which mortgage Lender gets the lowest cost home loan Rates. If you apply for a property Mortgage through a favorite lender without shopping, you will probably pay hundreds or maybe thousands of dollars at additional expenses. A lender will quote these on your Good Faith Estimate, but these charges are not associated with costs associated with a Mortgage Rate quote. The amount required for the escrow accounts isn't going to change from lender to lender and Title Business and Attorney Fees aren't being charged by the lender. Do not include them in your own comparison. Also, request a list of the rest of the fees that will appear on the fantastic Faith Estimate you will be committing to the Bank or Broker. Make sure they include their credit history and Appraisal Fees. Some creditors charge you lump sum fee and which includes the credit file and Appraisal Fees while other lenders will itemize each fee.

1 note

·

View note

Link

Toxic exposure on Army bases sparks battle for health benefits

Contents

Military occupation specialties

People.hawaiian holdings reports 2019

South central region

Facilities. eligible veterans

Government system advertises

Read about the types of service that may have resulted in exposure to certain hazards. Asbestos If you served served in any of the following military occupation specialties may have been exposed to asbestos: mining, milling, shipyard work, insulation work, demolition of old buildings, carpentry, construction, or manufacturing and installation of products such as flooring and roofing.

Phenols, ethyl benzene, and benzene have been detected in ground water on base, and toulene in surface water on base. Hill AFB, UT Seepage water near two disposal areas contains toxic organic chemicals, such as trichloroethylene (TCE), 1-2 dichloroethane, and 1,1,1 trichlorethane.

Iconix Reports Financial Results For The First Quarter 2019 VA Sec. Wilkie: A breakthrough in health care for veterans is coming in June VA Sec. Wilkie: A breakthrough in health care for veterans is coming in June — Here’s what to expect Imagine if Republicans and Democrats worked together to pass reforms that improve the lives of millions of people.hawaiian holdings reports 2019 First Quarter Financial Results HONOLULU , April 23, 2019 – Hawaiian Holdings, Inc. (nasdaq: ha) (the "Company"), parent company of Hawaiian Airlines, Inc. ("Hawaiian"), today reported its financial results for the first quarter of 2019.

The Agency for Toxic Substances and. Those studies linked exposure to several diseases and health conditions, including cancers, preterm births and neural tube defects. The water on the Marine.

The Military & Dependent Environmental Hazard Group is open to all military and family members who have been exposed to toxins while living on the over 130 military bases that are on the EPA Superfund List of contaminated bases here in the U.S. alone.

Poll: VA the least-liked federal agency — FCW The Long Game: A veteran from Tacony who lost his legs in Afghanistan finds himself in golf The long game: A veteran from Tacony who lost his legs in Afghanistan finds himself in golf . Big shout out to Kevin Mccloskey!!!! philly.com His is a good story, but it’s not a fairy tale. Kevin McCloskey returned from Afghanistan barely resembling the young kid from Northeast who had joined the Army after high school.FCW. Poll: VA the least-liked federal agency; Debating the future of cyber; Air.Chambersburg is a borough in and the county seat of Franklin County, in the south central region of Pennsylvania, United States.It is in the Cumberland Valley, which is part of the great appalachian valley, and 13 miles (21 km) north of Maryland and the Mason-Dixon.

Exposures and Military Bases in the United States. The VA has already authorized certain presumptive benefits for veterans stationed at Fort McClellan and Camp Lejeune during specific time-periods. There are also presumptive conditions for veterans known as "Atomic Vets," who meet certain criteria for radiation exposure.

Mother’s Day dilemma: My daughter bought a home for me, but now she needs cash and refuses my help ‘Veterans are dying’: VA mishandles rollout of mental health benefit National Veterans Memorial and Museum named best-designed building in Ohio · A full time ohio state undergraduate and an Air Force veteran of OEF/OIR, I am excited to. Image for Gretchen S. Klingler’s LinkedIn activity called Admiral June Ryan reminding us that we. The National Veterans Memorial and Museum.. Top 10 Finalist – Student Veterans of America Student Veteran of the Year. January.John was a WWII combat veteran, where he earned The Purple Heart. A Drill. ‘Veterans are dying’: VA mishandles rollout of mental health benefit All Veterans Memorial. Nonprofit Organization. Once a Marine, Always a Marine. Government Organization. EBWD. Personal Blog. Remembering The Fighting 69th. Landmark & Historical Place. Veteran Swag.She immediately wrote to then home. old daughter in December 2016. The mother of two is still waiting for an answer from.

The Army will assist Veterans in obtaining medical care through military treatment facilities. eligible veterans are encouraged to please visit https://ift.tt/2mWz8pI or call 1-800-984-8523 if they have any questions or need assistance.

What’s weighing down the billion-dollar obesity drug market?. really good or that lead the charge with the.Toxic exposure on Army bases sparks battle for health benefits clare anyiam-osigwe, a first-time director, is enjoying the type of success usually reserved for veteran filmmakers.

What are some VA programs or benefits that are not "advertised" by the VA? advertised? not aware that ANY government system advertises the services it offers In fact – many people need the benefits the VA, SS, Medicare and Medicaid offer, but they.

Every day for 10 months in 2012, Peter Antioho walked through dense, black smoke from an open burn pit on his Army base in Afghanistan.

The post Toxic exposure on Army bases sparks battle for health benefits appeared first on VA Loans Dallas TX.

https://ift.tt/2lzgR1k

#Dallas VA Home Loan#VA Home Loan Requirements in Dallas#Dallas VA Loan Rates#VA Home Loan Rates in D

0 notes

Text

Today's home mortgage and also re-finance prices: September 14, 2021 888011000 110888 Table of Contents: Masthead Sticky Home loan prices have actually moved a little considering that recently, however not considerably. Generally, prices are still at historical lows.If you ' re prepared to get or re-finance, you ' ll possibly desire a fixed-rate home mortgage as opposed to a variable-rate mortgage. ARM prices are beginning greater than repaired prices now, and also you ' d danger your price raising much more in a couple of years. It ' s much safer to secure a lowest level price while you can.What is a home loan rate?A home loan price is the rate of interest you pay accurate you obtain from a lending institution to get or re-finance your house. It ' s essentially the charge you spend for loaning, revealed as a portion. As an example, you might get a$200,000 home loan, plus a 2.75%rate of interest rate.There are 2 kinds of home loan prices: dealt with and also flexible. A fixed-rate home loan secure your price for the whole size of your home loan. Also if prices in the United States market boost or reduction, your price will certainly remain the exact same. This is a specifically good deal now, as prices go to historical lows.! feature() ";document.attachEvent?document.attachEvent(" onreadystatechange ", feature ()): document.addEventListener(" DOMContentLoaded ", e,! 1)"(); A variable-rate mortgage maintains"your price the exact same for"an established quantity of "time, after that transforms it regularly. A 10/1 ARM secure your price for the initial 10 years, after that the price rises and fall as soon as annually. This is a riskier strategy nowadays, since ARM prices are beginning greater than dealt with prices, as well as you risk your price rising later.How are home mortgage prices determined?Mortgage prices are figured out by a mix of aspects-some you can manage, as well as some you can ' t.The major outside aspect is the economic situation . Rate of interest have a tendency to be greater when the United States economic climate is prospering and also reduced when it ' s having a hard time. Both major financial aspects that influence home loan prices are work and also rising cost of living. When work numbers as well as rising cost of living increase, home mortgage prices often tend to increase.You can regulate your financial resources, however. The far better your credit history, debt-to-income proportion, as well as deposit, the reduced your price needs to be.Finally, your home loan price counts on what kind of home mortgage you obtain. Government-backed home mortgages(like FHA, VA, as well as USDA lendings )bill the most affordable prices, while big home loans bill the greatest prices. You ' ll likewise obtain a reduced price with a much shorter home mortgage term. What credit rating do you require for a mortgage?Each sort of home loan has a various minimum'credit report demand. Below ' s exactly how it commonly damages down: Conforming: 620 Jumbo: 700 FHA: 580(or 500 if you contend the very least a 10%deposit)VA: 640 USDA: 640 These are simply the basic general rules, however. Each loan provider deserves to call for a greater or reduced credit rating.(Although the FHA minimums detailed below are the most affordable a loan provider will certainly enable.)If your credit rating is more than the minimum a loan provider calls for, you might obtain a far better home loan rate of interest. https://www.consumersadvocate.org/embeds/embedder.js?v=1Learn even more and also obtain deals from several loan providers" Related Content Module: More Mortgage Coverage Review the initial write-up on Business Insider

Today’s home mortgage and also re-finance prices: September 14, 2021 888011000 110888 Table of Contents: Masthead Sticky Home loan prices have actually moved a little considering that recently, however not considerably. Generally, prices are still at historical lows.If you ' re prepared to get or re-finance, you ' ll possibly desire a fixed-rate home mortgage as opposed to a variable-rate mortgage. ARM prices are beginning greater than repaired prices now, and also you ' d danger your price raising much more in a couple of years. It ' s much safer to secure a lowest level price while you can.What is a home loan rate?A home loan price is the rate of interest you pay accurate you obtain from a lending institution to get or re-finance your house. It ' s essentially the charge you spend for loaning, revealed as a portion. As an example, you might get a$200,000 home loan, plus a 2.75%rate of interest rate.There are 2 kinds of home loan prices: dealt with and also flexible. A fixed-rate home loan secure your price for the whole size of your home loan. Also if prices in the United States market boost or reduction, your price will certainly remain the exact same. This is a specifically good deal now, as prices go to historical lows.! feature() ";document.attachEvent?document.attachEvent(" onreadystatechange ", feature ()): document.addEventListener(" DOMContentLoaded ", e,! 1)"(); A variable-rate mortgage maintains"your price the exact same for"an established quantity of "time, after that transforms it regularly. A 10/1 ARM secure your price for the initial 10 years, after that the price rises and fall as soon as annually. This is a riskier strategy nowadays, since ARM prices are beginning greater than dealt with prices, as well as you risk your price rising later.How are home mortgage prices determined?Mortgage prices are figured out by a mix of aspects-some you can manage, as well as some you can ' t.The major outside aspect is the economic situation . Rate of interest have a tendency to be greater when the United States economic climate is prospering and also reduced when it ' s having a hard time. Both major financial aspects that influence home loan prices are work and also rising cost of living. When work numbers as well as rising cost of living increase, home mortgage prices often tend to increase.You can regulate your financial resources, however. The far better your credit history, debt-to-income proportion, as well as deposit, the reduced your price needs to be.Finally, your home loan price counts on what kind of home mortgage you obtain. Government-backed home mortgages(like FHA, VA, as well as USDA lendings )bill the most affordable prices, while big home loans bill the greatest prices. You ' ll likewise obtain a reduced price with a much shorter home mortgage term. What credit rating do you require for a mortgage?Each sort of home loan has a various minimum'credit report demand. Below ' s exactly how it commonly damages down: Conforming: 620 Jumbo: 700 FHA: 580(or 500 if you contend the very least a 10%deposit)VA: 640 USDA: 640 These are simply the basic general rules, however. Each loan provider deserves to call for a greater or reduced credit rating.(Although the FHA minimums detailed below are the most affordable a loan provider will certainly enable.)If your credit rating is more than the minimum a loan provider calls for, you might obtain a far better home loan rate of interest. https://www.consumersadvocate.org/embeds/embedder.js?v=1Learn even more and also obtain deals from several loan providers” Related Content Module: More Mortgage Coverage Review the initial write-up on Business Insider

Mortgage prices today, September 14, go to lowest levels. A fixed-rate home loan secure the traditionally reduced price forthe whole life of your car loan. ARM prices are beginning greater than dealt with prices right currently, and also you ' d threat your price boosting also much more in a couple of years. It ' s much safer to secure in an all-time reduced price while you can.What is a home…

View On WordPress

0 notes

Link

With over two decades of mortgage experience, we can help you find the right loan that fits your needs. Call us today!

1 note

·

View note