#Ubs software Singapore

Explore tagged Tumblr posts

Text

Significant Needs of Using UBS Accounting Software in Singapore

UBS Accounting is well-known for its user-friendly interface and comprehensive financial management capabilities. It automates bookkeeping, invoicing, payroll, and financial reporting. UBS Accounting is a vital tool for small and medium-sized firms since it helps them accurate financial records and make informed decisions. Convenience To discover why it is so natural to use Singapore Accounting software we tried the accounting software ourselves by opening a business account. During the enrollment process, UBS Accounting Singapore collects some information about your company so that they may present an adapted dashboard that is generally useful for your type of business. Without missing a beat, we were pleased with how simple it was to start and add fresh data. There was no need to fiddle with numerous menus or walk around and around to find our way; for example, it was extremely simple to interface financial balances and credit directly from the dashboard, as well as functional information like merchant data, freshness, and so on. The enchantment takes place on the dashboard itself. Singapore Accounting software updates its web-based dashboard on a regular basis, providing a more intuitive user interface. The path is straightforward, with a top route bar and a side menu. The dashboard moreover depicts your financial position, with data like pay, late and paid solicitations, expenses, advantages and disadvantages, and, shockingly, a to-do gadget. This suggests that you can see your company's "well being" as soon as you sign in. To try Singapore Accounting software for yourself, you can also view videos and demos to see how simple it is to use Singapore Online bookkeeping software. Efficient highlights At the point when we asked entrepreneurs what the “great” book keep in programming is like, there was one resonating prerequisite in all cases The best bookkeeping programming saves entrepreneurs time and doesn’t add to the generally unpleasant nature of private company bookkeeping. We’ve found that Singapore Accounting programming effectively satisfies that hope. Singapore Accounting programming is tied in with robotizing errands, making bookkeeping less tedious and most certainly less unpleasant for entrepreneurs. The product can computerized all that from repeating solicitations and bill instalments to the synchronization of information across the bank and Visa exchanges. You can likewise consequently accommodate and arrange costs, wiping out the drawn-out, tedious errand of physically doing as such for each and every exchange. Singapore Accounting programming can likewise Customer service Client care is an essential component of any organisation arrangement, and Singapore Accounting programs handle it flawlessly. Contacting a Singapore Accounting programming agent was also a pleasant experience. We asked a long list of questions, and the representative cheerfully answered each one thoroughly. In the meantime, he asked us some questions about our business and then recommended the best Singapore Accounting programming things and strategies for our specific needs.

0 notes

Text

Streamline Business Accounts With UBS Accounting Software Singapore

Are you looking for a means to handle your company's accounts?

UBS Accounting Singapore Software is an easy-to-use program that makes keeping track of your finances simple in Singapore. Tool for income tracking and generating reports.

Here it is: UBS Accounting Software Singapore streamlines your business accounting.

Even if you have no prior expertise handling accounts, UBS Accounting Software Singapore allows you to manage and simplify your business finances with simplicity.UBS Accounting Software is critical for any company that needs detailed reporting on their daily accounting operations. It allows you to generate financial and profit margin reports at any moment.

Sage UBS accounting software enables you to effortlessly produce and customize invoices, manage payments, and issue late payment reminders.

Furthermore, it will enable you to set up recurring bills for regular clients, saving you time and effort. You can assure compliance using invoicing and billing capabilities.

It also helps you to keep track of and categorize all of your company spendings, from office supplies to travel expenses, for tax purposes.

Get PSG 70% Grant Accounting Software and easily manage your business Accounting.

0 notes

Text

Private Wealth Management Software Market Unidentified Segments – The Biggest Opportunity Of 2023

Latest added Private Wealth Management Software Market research study by AMA Research offers detailed outlook and elaborates market review till 2027. The market Study is segmented by key regions that are accelerating the marketization. At present, the market players are strategizing and overcoming challenges of current scenario; some of the key players in the study are Sage Intacct, Inc. (United States)

Avaloq (Switzerland)

Comarch (Poland)

CREALOGIX (Switzerland)

Contemi (Singapore)

Jacobi Capital Management LLC (United States)

AdvisorEngine, Inc. (United States)

InStream, LLC (United States)

FinFolio (United States)

Wells Fargo (United States)

Merrill Private Wealth Management (United States)

Morgan Stanley (United States)

UBS (Switzerland)

JP Morgan Asset Management (United States)

SAP Ariba (United States)

William Blair (United States)

Advisor Group (United States)

State Street Global Advisors (United States)

etc.

Private wealth management is investment advisory practises which incorporates financial planning, portfolio management and number of financial services. Private wealth management involve solving financial situation and achieving financial goals with the help of financial advisor. It is primarily useful for high-net-worth individuals. Several types of institutions, large banks, trading advisory offers private wealth management. Geographically, North America region is expected to grow with the highest market share over the forecast period followed by Europe and Asia Pacific. Presence of leading market players creating hub for Private Wealth Management Software providers impacting on market profitability in better manner.

Influencing Trend: Higher Adoption of Private Wealth Management Software for Capital Preservation

Challenges: Lack of Awareness about Private Wealth Management Offerings

Opportunities: Growing Financial Planning Awareness and Portfolio Management

Rising Technological Advancements like use of AI in Software for Streamline Financial Modelling

Market Growth Drivers: Increasing High Net worth (HNWIs) Population

Digitalization and Process Automation Optimizes Wealth Management Practices

The Global Private Wealth Management Software segments and Market Data Break Down by Type (Cloud, On Premise), Application (Financial Advice Management, Asset Protection & Capital Preservation, Tax Management, Risk & Compliance Management, Portfolio Management, Estate Planning, Mortgage Planning, Others (Billing and Benchmarking)), Enterprise Size (SMEs, Large Enterprise), Providers (Banks, Brokerage Firms, Boutique Advisory Firms, Fintech Advisory, Others)

Presented By

AMA Research & Media LLP

1 note

·

View note

Text

Sage Ubs Inventory | Accounting Software Singapore

Sage UBS Point of Sales (POS) is designed specifically for rental and counter-sale activity management by small to large businesses. Using the POS keyboard and scanner, all transactions will be recorded at the checkout counter. You can obtain the following data by employing this software. These include information on the most recent inventory level, an analysis of the performance of sales staff, a loyalty program, an analysis of the peak customer period, an analysis of product versus margins, and an analysis of receivables.

If you are looking for Sage Ubs Inventory accounting software in Singapore, here is Ezaccounting offers the best Sage Ubs accounting Software with all functionalities.

The features of Sage UBS Point of Sales (POS) include the ability to view reports, print bar-code labels, and reprint cash receipts.

You can manage the database's visibility through security management.

Accurate records are kept of each sale. With the Sage UBS point of sale software, you can get complete information about the cashier counters, salespeople, product items, indicated POS counter, and mode of payment. You can track sales transactions to get information on deposits and withdrawals from your cash drawer. Simply enter the unique code, description, and other necessary information for each cashier, supervisor, credit card payment group, category, item, or counter in your maintenance level using this information.

Benefits of Sage UBS Point of Sales Retail management relies heavily on the software from Sage UBS Point of Sales. Retailers have access to the most important and relevant data they need to run their businesses effectively thanks to this software.

This software speeds up sales transactions and allows for customer trend analysis. It stores historical data.

0 notes

Text

Inventory Control Benefits

To meet your customer demands you have to maintain inventory properly. Through this post, you will know about the inventory control benefits and how the inventory management system helps you in stock control. The inventory management system is mainly used to make a plan for the arrival of a new supply to prevent shortages. This is the best cost-effective way to meet customer demand. Then the inventory management system is the best choice for retail business. This system also includes following features such as historical sales data analysis and replenishment recommendations

Read our blog to know the inventory management best practices.

Managing an organizational structure

By handling the inventory properly you can able to hold the safety stocks as per your supply-demand. IF you managing inventory manually you can make mistakes in calculations and not to mention some lost transactions and delays etc.

To avoid such mistakes you can go for automation. By using the automation process, errors are reduced and the system automatically restocks the inventory as required.

Automated data collection

Data collection is automated in the inventory control system. That saves your time and reduces the errors compared to the manual process.

Inventory management system always assigns a serial number for receiving, issuing or assembling items. Based on that serial number you can simply track the inventory. To that serial number, you can provide some specific valuations to track costs.

Real-time data access

The inventory management system provides different levels of accesses to access the organization’s live information. So everyone has visibility and control across your supply chain. Based on the access you can get some idea about purchasing decision from your employees.

For the best result, you have to choose perfect inventory management software for your business that should save your time and money.

The best inventory management system improve your business profitability in the following ways

Without hiring new staff, process a higher number of goods

Stock level optimization

Simply access stock and move it faster

Generating packing slips

Generating invoice

The stock release was done in bulk

These are the benefits of proper inventory controls. To know more about the inventory software read our blog posts. For further queries, you can email us [email protected] or call us + 65 6227 1797 / +65 6746 2613 to get instant solution.

#Accounting Software#Accounting Software Singapore#Best Accounting Software Singapore#Singapore Accounting Software#Ubs Software#Myob Software#PSG Grant#PSG Grant Singapore#Ubs Software Singapore

0 notes

Text

Cloud-Based Accounting Software Security Concerns

In the accounting software world, cloud accounting software is the latest technology. Because that software has lots of features such as easy to access, Mobile access, able to integrate with accounting software. A major advantage is security. Some other considerations to be put in mind while outsourcing accounting such as

Lack of physical control of servers

Data transmission

May affected by loopholes and exploits etc

Most important security concerns are

Physical hardware security

User account access

Multi-tenancy

Physical hardware security

The cloud service provider hosts the application and data on location. To access these data you have to connect the cloud accounting application via app or browser. If you don’t have physical access to control the security, you have to contact the cloud service provider to know about the data center security, data redundancy, back up procedures and processes. Do you want to know more about cloud accounting software? Visit the Cloud Accounting software Page.

User account access

User can able to access the data and functions present in the cloud-based application. Before using the cloud-based accounting software you have to know whether the accounts are audited, is it hard to disable accounts, etc. Cloud accounting software always provides custom user access levels to control data security. If you want identification point for user access, it is available as a beneficial feature to leverage.

Multi-tenancy

Cloud service providers share the hardware for hosting. This means they provide share space for multiple clients it may cause some hacking issues. If the hacker hacks another Company, your data also caught in the crossfire. So you have to contact the cloud service provider to keep your sensitive data in the private cloud. You can also use the API (Application Programming Interfaces) for security purpose. By using the API you can customize the cloud accounting experience.

These are the major security concerns with the cloud accounting software. Do you want to know more about cloud accounting software? Keep in touch with us!! We (User Basic Software) are the best accounting software provider in Singapore. We are offering various accounting software such as payroll software, POS Software, Custom solution software, Sage UBS Accounting software, MYOB software, etc. Book your software now!! Call us on +65-6746 2613 or +65-6227 1797 (9 Lines) and Email us on [email protected] to get your software live demo!!

#Accounting Software#Accounting Software Singapore#Best Accounting Software Singapore#Singapore Accounting Software#PSG Grant Software#POS Software Singapore#Myob Software#Myob Software Singapore#Myob Singapore#Myob Accounting#Ubs Software#Ubs Software Singapore#PSG Grant Singapore#PSG Grant#Ubs Inventory Singapore#Ubs Inventory Software

0 notes

Text

Why do business human beings select MYOB software?

MYOB permits small business owners to track income, expenses, creditors, borrowers, purchases, inventory, jobs, time billing jobs, etc. In the course of an honest interface that makes it is easy to manipulate the whole thing simultaneously.

Paintings thru the capabilities. You may download product demos for both MYOB accounting internet websites. If you have any idiosyncratic wishes that aren’t general to commercial enterprise, take a look at the demos to peer which product plays high-quality. As an example, non-profit or network businesses will likely locate that the superior budget functions in MYOB software suit them great, however, agencies with inventory in multiple places will in all likelihood be better steerage towards MYOB.

If evaluating the cost of every product, factor inside the modern cost of annual assistance and annual upgrades. In case you’re comparing the fees of different MYOB (they alternate all of the time so you’ll want to store round to get the present-day charges), do not forget to the component inside the fee of the annual guide. Assist is crucial, especially at the start, and help that’s handiest ever a telephone name away can be a lifesaver. Sometimes, the annual guide is sort of identical to the purchase price of the software program, so it’s vital that you issue it in

Examine whether you want any add-ons. Just as you wouldn’t employ a secretary who best speaks French and a supervisor who best speaks pig Latin, you need to make certain that your accounting software can talk to the alternative computer packages for your office. For the MYOB software program, you could discover a listing of accessories by means of traveling to the MYOB add-ons page on this internet website. For QuickBooks, visit www.Quickbooks.Com.Au or contact their customer service line to ask about upload-on products.

Don't forget your running gadget. Talk to your accountant. If your accountant an awful lot prefers running with considered one other of these products in particular, you then probably decrease accounting fees by using following their recommendation.

Reflect on the consideration of who you’ll use as a consultant or for training. In the towns, each MYOB

Software programs have a superb community of running shoes. There are also masses of venues in which you could attend education guides. However, consultants get a lot extra scarce inside the bush, so it will pay to find out what the neighborhood support includes, and which product is supported first-class in your precise locality.

#myob accounting singapore#accounting software Singapore#psg grant singapore#ubs accounting singapore

0 notes

Text

HOW CAN A SMALL BUSINESS BENEFIT FROM CLOUD INVENTORY SOFTWARE?

Sage UBS Inventory Software allows easy stock control with the flexibility to handle all kinds of inventory control transactions and provides instant status.

Small businesses in Singapore that have one position or multiple locales, your business can always profit from pall-grounded force software.

Then are some amazing benefits of pall-grounded Inventory Management Software Completely Scalable Software. A long time before businesses had to make hard opinions about their functional software.

They could buy for their size and prognosticate the need for an upgrade. Luckily, the pall-grounded software has changed this by making force operating systems completely scalable.

As these results are virtual, they can be upgraded at any time. Functions may be added, removed, expanded, altered, or combined with other products. Faster Installation and Easier Hand Training The aged way of doing business needed to install software on each and every computer of the platoon members uses and have a devoted IT department to keep that software handling.

This cuts into gains laggardly down training time and increase work costs. Ubs inventory singapore doesn't have to need any redundant workers or particular tackle – you just log in and get to work. And there's no need for devoted in- person training to educate the staff how to use the new software.

1 note

·

View note

Link

If you are looking for a Sage Ubs Inventory accounting software in Singapore, here is Ezaccounting offers best Sage Ubs Software with all functionalities.

0 notes

Photo

How Accounting Software can help a Small Business to Grow?

Professional Best Accounting Software solution can help your small business grow multifold. Out of the several parameters that indicate the growth of any business, net earnings from the pivotal center ultimately decides whether a business is successfully recording positive growth.

#accounting software#Accounting software singapore#PSG Grant EZ Accounting#ubs accounting singapore#singapore accounting software#PSG Grant Singapore#PSG Grant#e-invoicing

0 notes

Text

Features Of Sage UBS Accounting Software

Sage UBS Accounting Software

Sage UBS Bookkeeping programming is the primary promoting programming in Singapore. This software gives you instant access to inventory status updates and helps you manage all inventory transactions. Invoices and delivery orders can be printed with an invoicing system. Accounts Payable, Accounts Receivable and General Ledger are all part of this software module. You can manage accounting period entries for 18 months using these modules. The Singapore payroll software is another option for accounting pay.

System Requirements for Sage UBS Accounting Software Pentium II 266 MHz Minimum 128 MB memory Minimum 800 MB or more disk space 1 floppy disk drive 1 CD Rom Drive Windows 7 Printer Features of Sage UBS Accounting Software With this software, you can handle multiple company transactions and speed up accounting functions. It is suitable for businesses such as trading companies, contractors, non-profit organizations, training institutions, retailers, restaurants, wholesalers, accounting firms, manufacturing companies, and cooperative societies.

Multiple currency functions, various levels of data access security, the ability to modify any transaction, and the ability to handle all transactions for up to 18 months. The ability to record advance and post-dated checks. The ease with which the previous month's omitted entries can be inserted. The ability to calculate sales commission for an agent.

Sage UBS Accounting Software serves as important to any company that requires detailed reporting of their daily accounts transaction needs.

Calculate Unrealized Gain/Loss Monthly profit/Loss and Balance Sheet report Consolidated Account Support USB Key Project account With the Singapore UBS Accounting software, you can easily get the following reports:

General reports like Delivery Order,

Invoices,

Case Sales,

Stock Aging reports Sales

Analysis Report and

Gross Profit Analysis Reports like Yearly sales & purchase reports,

Top 25 product sales by quantity, and sales value. We also offer training and a free demo to clients who ask.

0 notes

Text

Can you forecast which mutual funds will do better than others?

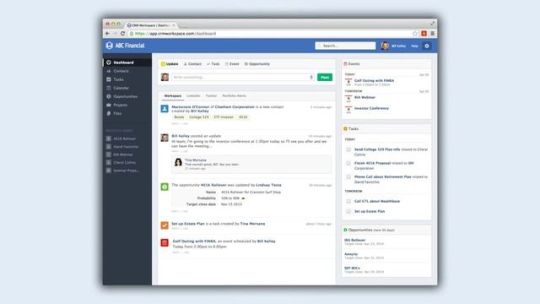

Can you anticipate which mutual funds will do better than others? It ends up you can. The number of investment products available for purchase increases every year. Wide item selection may produce issues, both for the advisor and the client. At Junxure, we've decided to develop an algorithm to deal with that issue. What we wanted We wished to offer necessary aid for clients and advisors, assuming that some mutual funds can bring systematic returns in provided market conditions. Depending upon a fund's strategy, techniques of management and product specifics, it may be a better suitable for purchase today, or stay more promising for the conditions of tomorrow-- in a various environment. In this vein, we decided to examine whether AI-based algorithm can find the best mutual funds utilizing affiliations hidden in product costs, macro signs, market indexes, FX rates and commodities. The twist was-- we did not attempt to decode these dependences however rather put them to work and see the actual results in item ranking. How we did that We collected macro indications of significant worldwide economies (United States, EU, China, Japan, LatAm, India), products rates, FX rates and significant indexes quotes. We employed price history for over 4000 mutual funds traded on NASDAQ. Our goal was to develop a ranking of the funds and determine which ones would score the highest rate of return in the next quarter. To create optimal environment for the algorithm, we required to prepare the data we had actually accumulated and run a lot of additional analyses (e.g. return and threat ratios, fund efficiency indications). The last thing to be done prior to the training started was to efficiently decrease information dimensions utilizing Principal Element Analysis (PCA). What brought the most assure The most promising results came from the ensemble maker finding out approach. It utilizes multiple discovering algorithms (lots best performing AI designs in our case) to acquire a much better predictive efficiency. For the results measurement, we came up with a Top-Bottom Analysis. In the analyzed group, we produced a ranking of mutual funds, arranged by the probability of accomplishing the greatest rate of return in the next quarter. We moved 3 months in the future and inspected whether we were right, particularly whether the leading 10% was considerably better than the bottom 10% from our ranking. To produce the most reasonable environment, we measured our outcomes using so called test data, which is a dataset which the algorithm has never ever "seen" prior to. It ensured that such results can be available in daily operations.

In order to assess a mutual fund ability to outshine its peer groups, our design took different criteria into account: fund risk and previous performance in various market conditions, return determination and repeatability, risk-adjusted performance ratios as well as systematic danger related to main market elements. The last one, in particular, is rather unclear: information-driven market motions which are quite unforeseeable, human behavior which doubts, adaptive and often repeatable, lastly the basic financial laws that ought to discuss dependencies between financial cycles and asset costs in a long term however not constantly do. We anticipated maker discovering to tell us more where the reality was-- comments Grzegorz Prosowicz, Consulting Director for Capital Markets at Advisor Engine. What the outcomes were The real results for the test dataset exceeded our expectations. The very best outcomes we have actually attained were 78% in Top-Bottom Analysis. It means that in 4 out of 5 cases we can forecast which funds would score a greater rate of return. The difference in rate of return in between leading and bottom funds amounted to 2,99 percentage points quarterly (12,51 p.p. CAGR). Simply put, consultant choosing items for their customer from available item universe for 1 year duration, might rely on 12,51 portion points better returns with the algorithm-- no matter how the markets perform. What's next? Envision having a service of that kind in your institution. Your advisors would lastly get a reliable help with picking the right items and end up being more productive. Your customers would score higher Return of investments and notice the competitive advantage you supply. Perhaps even you could produce model or robo-advisory portfolios instantly ... Junxure AI-based Ranking Algorithm can have many faces - that is for sure. Is the service going to reach a similar success in every country or circumstances? Is the service ready to introduce as cloud API in your institution or get checked by you in kind of evidence of idea? --------------------------------------------- Wealth management methods in the digital age The service digitization procedure which might be observed for more than a dozen (if not more than twenty) years does not skirt the financial sector. Both business and banks offering investment advisory services put importance on advanced software application targeted at facilitating the customers' wealth management. What should the wealth management service appear like in the digital transformation period and what strategies can be adopted by the institutions offering them? Digital wealth management technique-- difficulties Both the business and banks providing the wealth management service face a number of difficulties linked with the digital change. According to the "Swim or sink: Why Wealth Management Can't Manage to Miss the Digital Wave" report prepared by Advisor Engine, the wealth management service is presently one of the least innovative ones in terms of technology. age structure-- a high share of customers categorized into HNWI and UHNWI (Ultra High Net Worth People) groups are senior citizens who do not require any cutting edge services from banks or advisory business and who depend on direct contacts with the advisors, hostility to developments-- the richest customers think the verified wealth management techniques should be utilized and it is needless to present new services, technology limitations-- many banks keep utilizing older software application, the extension of which with brand-new functionalities is made complex and expensive. Despite the barriers which need to be overcome by banks and advisory business, the wealth management digital technique may produce measurable advantages. The authors of the report by McKinsey advisory business called "Secret Trends in Digital Wealth Management-- and What to Do about Them" observe the customers having access to the software facilitating wealth management report the 5 to 10 times greater satisfaction level than clients interacting with the consultants in a traditional way. Likewise the expenses are not irrelevant for the banks and advisory business. Using the robo-advisory channel makes it possible for to decrease them. Thanks to the algorithms, it is possible to provide prompt help to the consumers when making investment choices without substantial expenses-- such advisory services are much cheaper than the help provided by a human, knowledgeable advisor and work even in adverse market conditions. Junxure Wealth Management software Wealth management digital techniques The banks and advisory companies alike are aware that they can only gain utilizing the digital innovation potential. Entities with a long market presence buy the advanced solutions a growing number of often. There are lots of examples: Perpetual is a company providing the wealth management service with a more than 140 years' existence on the Australian market. It chose to make instant insight into investment portfolios and reports delivered by means of the chosen social media readily available to its consumers, Swiss UBS bank opened a robo-advisory channel for consumers with the wealth below 2 million pounds required to open a personal banking account, a Singapore branch of Citi offered their consumers the opportunity to utilize a bank chatbot through Facebook. It provides details e.g. about balances and deals on the bank accounts. The strategic wealth management may be largely automated. What is more, the specialized software application allows to collect information which can be evaluated then to adjust the adopted wealth management techniques. Advisors having access to the tools facilitating some daily tasks connected with wealth management gain likewise more time for discovering customers' needs. According to the research study performed by the advisory company Ernst & Young, among wealth management elements of specific significance for wealthy consumers is understanding their monetary objectives and supplying a broad access to financial investment products and tools to them. Strategic wealth management-- how to get ahead of competitors? Lots of banks and banks consider the wealth management digital technique to be the secret to get competitive advantage and consumers who do not want to base exclusively on their instinct and knowledge when it pertains to wealth management. To make sure the offered options correspond to the needs of their receivers, the banks and companies providing the wealth management service need to: 1. Take a look at the executed software application from the clients' point of view It is of particular importance the customer's frontend operation is user-friendly, allows to set investment goals, is equipped with a monetary planning application and allows to communicate with professionals and consultants. Multi-modular Junxure Wealth Management software uses a multi-channel consumer's frontend. financial advisor software utilizing this option have access to details on different devices, including smart devices, PCs and tablets. Consumers may use both the help of consultants and place orders themselves by means of the robo-advisory channels. 2. Define the target group of consumers Strategic wealth management is various for the affluent ones and for HNWI customers. The above-mentioned Junxure Wealth Management system allows to provide both complete and simplified advisory services. Junxure Wealth Management offers likewise financial and investment advisory services. Customers can be profiled and the advisor may carry out tailored strategic wealth management for each of them. 3. Enhance (broaden) their offering The wealth management digital strategy is perceived from the point of view of benefits as it e.g. allows to focus on the customer and their requirements more than in the past. Automating some activities assists in the whole advisory process. This, in turn, makes it possible for to expand the offer with brand-new investment products which might be of interest for a broader group of consumers. Using Junxure Wealth Management, banks and advisory business might perform various analyses, including the performance and threat ones, for their clients. Thanks to the control and methodical reporting, the consumer might count on thorough assistance and also execute the most lucrative wealth management strategies. What are the differentiating functions of Junxure Wealth Management? Junxure Wealth Management option was created to cater for the requirements of the wealth management clients and their consultants. This is a multi-modular wealth management system created for the private banking consumers. It supports the work of all employees having contacts with the capital transferred by the consumers and establishing wealth management methods, i.e.: advisors-- they might produce a risk profile for each client and make additional advisory choices based on it, consisting of offering tactical wealth management, managers-- they participate in the financial investment process, handling the consumers' financial investment portfolios, experts-- they are accountable for preparing analyses based on the collected data and acquired monetary outcomes. The system also supports the aftersales services of enormous value for additional cooperation of the bank (or the advisory company) and the customer. The consumer may depend on e.g. constant insight into their financial investment portfolio and receive reports. They enable the financier to find out the outcomes on various levels, including the classes of possessions or currencies. The software application developed by Junxure is adjusted likewise to the regulative requirements, consisting of e.g. MiFID II (Markets in Financial Instruments Instruction) which imposes information commitments on banks and companies using investment items. Thanks to that, the clients receive details about the risk connected with purchasing selected monetary instruments and expenses they will sustain in relation to using the consultant's help.

#Wealth Management Software#wealth manager software#financial advisor software#robo advisor#CRM for financial advisors#Financial CRM#wealth management crm software#advisor technology#RIA CRM

1 note

·

View note

Text

Can you predict which mutual funds will do better than others?

Can you anticipate which mutual funds will do better than others?

It turns out you can. The number of financial investment items readily available for purchase increases every year. Large item choice might produce issues, both for the client and the consultant. At Junxure, we've decided to construct an algorithm to deal with that concern. What we sought We wanted to supply necessary help for advisors and customers, presuming that some mutual funds can bring organized returns in given market conditions. Depending upon a fund's method, approaches of management and item specifics, it may be a better fit for purchase today, or remain more promising for the conditions of tomorrow-- in a various environment. In this vein, we chose to check whether AI-based algorithm can discover the best mutual funds using affiliations hidden in item costs, macro indications, market indexes, FX rates and commodities. The twist was-- we did not try to translate these reliances however rather put them to work and see the real results in product ranking. How we did that We collected macro indications of significant worldwide economies (US, EU, China, Japan, LatAm, India), commodities prices, FX rates and significant indexes quotes. Then, we used cost history for over 4000 mutual funds traded on NASDAQ. Our goal was to create a ranking of the funds and figure out which ones would score the highest rate of return in the next quarter. To produce optimum environment for the algorithm, we required to prepare the information we had accumulated and run a lot of additional analyses (e.g. return and threat ratios, fund performance signs). The last thing to be done before the training begun was to effectively decrease data dimensions using Principal Part Analysis (PCA). What carried the most guarantee The most appealing results came from the ensemble machine discovering technique. It utilizes several discovering algorithms (lots best performing AI models in our case) to obtain a much better predictive performance. For the results measurement, we created a Top-Bottom Analysis. In the analyzed group, we created a ranking of mutual funds, arranged by the probability of achieving the greatest rate of return in the next quarter. Then, we moved 3 months in the future and examined whether we were right, specifically whether the leading 10% was significantly better than the bottom 10% from our ranking. To produce the most sensible environment, we measured our outcomes utilizing so called test data, which is a dataset which the algorithm has actually never ever "seen" prior to. It ensured that such outcomes can be obtainable in daily operations. In order to assess a mutual fund capability to outperform its peer groups, our design took various specifications into account: fund threat and previous efficiency in different market conditions, return persistence and repeatability, risk-adjusted efficiency ratios as well as methodical risk related to main market elements. The last one, in particular, is somewhat vague: information-driven market movements which are quite unforeseeable, human behavior which is uncertain, adaptive and sometimes repeatable, finally the basic financial laws that should discuss reliances between economic cycles and possession prices in a long term but not constantly do. We anticipated device learning to tell us more where the fact was-- comments Grzegorz Prosowicz, Consulting Director for Capital Markets at Advisor Engine. What the outcomes were The actual results for the test dataset surpassed our expectations. The very best results we have achieved were 78% in Top-Bottom Analysis. It means that in 4 out of 5 cases we can predict which funds would score a greater rate of return. Additionally, the difference in rate of return between bottom and leading funds totaled up to 2,99 percentage points quarterly (12,51 p.p. CAGR). In other words, advisor picking products for their customer from readily available item universe for one-year period, could rely on 12,51 percentage points better returns with the algorithm-- no matter how the markets perform. What's next? Think of having a service of that kind in your institution. Your consultants would lastly get a reliable assistance with choosing the ideal items and become more productive. Is the service going to reach a similar success in every country or scenarios? Is the service all set to launch as cloud API in your organization or get checked by you in kind of proof of concept? --------------------------------------------- Wealth management techniques in the digital age The service digitization procedure which might be observed for more than a dozen (if not more than twenty) years does not skirt the financial sector. Both business and banks providing investment advisory services place significance on innovative software targeted at assisting in the customers' wealth management. What should the wealth management service appear like in the digital improvement age and what strategies can be adopted by the institutions using them? Digital wealth management technique-- challenges Both the banks and business offering the wealth management service deal with a number of difficulties connected with the digital transformation. According to the "Swim or sink: Why Wealth Management Can't Afford to Miss the Digital Wave" report prepared by Advisor Engine, the wealth management service is presently one of the least sophisticated ones in terms of technology. age structure-- a high share of clients classified into HNWI and UHNWI (Ultra High Net Worth People) groups are seniors who do not demand any cutting edge services from banks or advisory companies and who depend on direct contacts with the advisors, aversion to developments-- the wealthiest clients think the validated wealth management methods must be used and it is needless to introduce new options, innovation limitations-- lots of banks keep using older software, the extension of which with brand-new functionalities is made complex and costly. Despite the challenges which need to be overcome by banks and advisory companies, the wealth management digital method might produce quantifiable advantages. The authors of the report by McKinsey advisory company called "Secret Trends in Digital Wealth Management-- and What to Do about Them" observe the clients having access to the software helping with wealth management report the 5 to 10 times higher satisfaction level than customers communicating with the consultants in a conventional way. The costs are not irrelevant for the banks and advisory companies. Utilizing the robo-advisory channel allows to lessen them. Thanks to the algorithms, it is possible to use prompt help to the consumers when making investment choices without significant expenses-- such advisory services are more affordable than the support supplied by a human, experienced advisor and work even in negative market conditions. Junxure Wealth Management software Wealth management digital methods The banks and advisory companies alike know that they can just get using the digital technology potential. Entities with a long market existence buy the innovative options more and more frequently. There are many examples: Perpetual is a company using the wealth management service with a more than 140 years' existence on the Australian market. It decided to make instantaneous insight into financial investment portfolios and reports delivered by means of the chosen social media offered to its consumers, Swiss UBS bank opened a robo-advisory channel for consumers with the wealth listed below 2 million pounds required to open a personal banking account, a Singapore branch of Citi offered their customers the chance to utilize a bank chatbot via Facebook. It offers details e.g. about balances and transactions on the savings account. Carrying out brand-new options suggests advantages not just for consumers (who may acquire a quick insight into their investment portfolio), but likewise for financial institutions. The strategic wealth management might be mostly automated. Some activities may be performed without the consultant's participation. What is more, the specialized software application makes it possible for to gather information which can be examined then to change the embraced wealth management strategies. Advisors having access to the tools assisting in some daily tasks gotten in touch with wealth management gain also more time for discovering clients' needs. According to the research study performed by the advisory business Ernst & Young, one of wealth management parts of particular value for wealthy customers is comprehending their financial objectives and offering a broad access to investment products and tools to them. Strategic wealth management-- how to get ahead of rivals? Lots of financial institutions and banks think about the wealth management digital technique to be the key to obtain competitive advantage and customers who do not wish to base exclusively on their instinct and knowledge when it comes to wealth management. To ensure the provided services correspond to the requirements of their recipients, the business and banks using the wealth management service must: 1. Look at CRM for financial advisors implemented software application from the clients' perspective It is of specific significance the client's frontend operation is user-friendly, allows to set investment goals, is geared up with a monetary preparation application and makes it possible for to interact with specialists and consultants. Multi-modular Junxure Wealth Management software provides a multi-channel client's frontend. Individuals using this service have access to info on various gadgets, consisting of tablets, pcs and smart devices. Customers might use both the assistance of consultants and location orders themselves by means of the robo-advisory channels. 2. Define the target group of clients Strategic wealth management is various for the affluent ones and for HNWI customers. The software ought to be adjusted to the needs of the target client group. The picked option needs to support building the relationship in between the advisor and the consumer. Those Junxure Wealth Management system allows to offer both full and simplified advisory services. What is more, the customers might transfer the orders to the advisors quickly or perform them themselves. Junxure Wealth Management provides likewise monetary and investment advisory services. Customers can be profiled and the consultant might carry out customized tactical wealth management for each of them. 3. Improve (expand) their offering The wealth management digital method is viewed from the perspective of benefits as it e.g. enables to focus on the consumer and their requirements more than in the past. Automating some activities helps with the whole advisory procedure. This, in turn, makes it possible for to expand the offer with brand-new financial investment items which may be of interest for a wider group of consumers. Utilizing Junxure Wealth Management, banks and advisory companies may perform different analyses, including the efficiency and danger ones, for their consumers. Thanks to the control and systematic reporting, the consumer may rely on comprehensive support and likewise execute the most profitable wealth management methods. What are the identifying functions of Junxure Wealth Management? Junxure Wealth Management option was designed to cater for the requirements of the wealth management clients and their consultants. This is a multi-modular wealth management system created for the private banking consumers. It supports the work of all staff members having contacts with the capital transferred by the clients and establishing wealth management strategies, i.e.: consultants-- they might generate a risk profile for every single client and make additional advisory choices based upon it, consisting of offering strategic wealth management, managers-- they take part in the investment process, managing the clients' financial investment portfolios, analysts-- they are responsible for preparing analyses based on the collected information and obtained financial outcomes. The system likewise supports the aftersales services of tremendous importance for more cooperation of the bank (or the advisory business) and the consumer. The customer may count on e.g. consistent insight into their financial investment portfolio and receive reports. They enable the investor to learn the results on various levels, including the classes of assets or currencies. The software application developed by Junxure is adapted likewise to the regulative requirements, consisting of e.g. MiFID II (Markets in Financial Instruments Instruction) which imposes info responsibilities on banks and business using investment items. Thanks to that, the consumers get info about the danger connected with investing in chosen financial instruments and expenses they will incur in relation to utilizing the advisor's assistance.

#Wealth Management Software#wealth manager software#financial advisor software#robo advisor#CRM for financial advisors#Financial CRM#wealth management crm software#advisor technology#RIA CRM

1 note

·

View note

Text

Top 5 Business Accounting Mistakes

Top 5 Business Accounting Mistakes

Most of the entrepreneurs have an idea to start a new business. But 90 % of startup business fails within a few years. Improper financial handling is one of the big reason for startup fails. In this post, we discuss the top 5 business accounting mistakes.

Common Business Accounting Mistakes

Blur the Line between Personal and Business Finances

Lax Accounting Practices

Declaring Revenue before…

View On WordPress

#accounting software#Accounting Software Singapore#Accpac accounting#Accpac Singapore#Myob software#Myob software Singapore#PSG Grant#PSG Grant Singapore#Singapore Accounting Software#Ubs accounting#Ubs software#Ubs software Singapore

0 notes

Text

Track Time and Integrate With Accounting Software

Employ time tracking is a difficult task for business people. Business people need proper time tracking system to know how the employees spend their time in business hours to complete the single task or multiple tasks. If the time is not tracked properly they may lead to productivity issues, poor company morale, etc.

First, give a brief explanation about the time tracking to employees

Implementing the time tracking system in business is a critical task. So you have to clearly explain the benefits of the time tracking system. Such as

Improves the company workflow

Helps in recognitions

Big data for future strategy

Helps in finding the spot areas to capitalize on productivity

Then select the perfect time tracking program

Time tracking apps available with a lot of features such as integration, remote check, etc. Before purchasing the time tracking system for your business you have to ensure that the time tracking system can able to integrate with the accounting software.

Through the time tracking system you can simply manage the projects and analyze the profitability.

By tracking the time you know how much time is spent on the project and you can measure whether the specific project is profitable, costly to your company. You can also able to track the hung up situations in the project.

Time tracking APP provides notes to update the project status, expected and unexpected issues. Through these notes, you can analyze your client projects simply. This system also automates the payroll process.

This system helps in company workflow such as

You can able to understand your business functioning

Able to measure the employees’ performance based on their effort

Able to get the business overview

Based on these benefits you can simply do your decision making or reach your goals etc.

These features help you to find the unnecessary cost in their budget.

Do you want to integrate the time tracking system with your accounting software? Just schedule the appointment with us!! We also are providing the best accounting software for business people. That software is MYOB Accounting software, ERP Accounting software, Quicken software, Payroll software, Point of sale software, Sage UBS Accounting software, etc. Get your software live demo!! Ping us on + 65 6227 1797 / +65 6746 2613 and Email us on [email protected]

#Accounting Software#Accounting software singapore#Best Accounting Software#Singapore Accounting Software#Myob Software#Myob Software Singapore#Myob Singapore#Ubs Software Singapore#Ubs Accounting#Ubs Software#Myob Accounting#PSG Grant#PSG Grant Singapore#PSG Grant Software

0 notes

Text

SMEs Business Software in Singapore

When looking for business software in Singapore, you need a program that works with you and grows with your business. Out with the conventional systems and in with the 21st century.

Running a small business is a thrilling endeavour. Yet the tediousness of getting your financial books, payroll and inventory in order. Often tasked to employees, its saps all creativity and excitement out of entrepreneurship. Yet, without concrete data and you’re essentially steering a ship without instrumentation. You run the risk of hitting the proverbial iceberg.

That’s why as entrepreneurs, we bite the bullet and diligently keep up with it. It doesn’t have to be so painful though. The beauty of business software is that automation takes away the repetitive nature of entries.

0 notes