#Myob software

Explore tagged Tumblr posts

Text

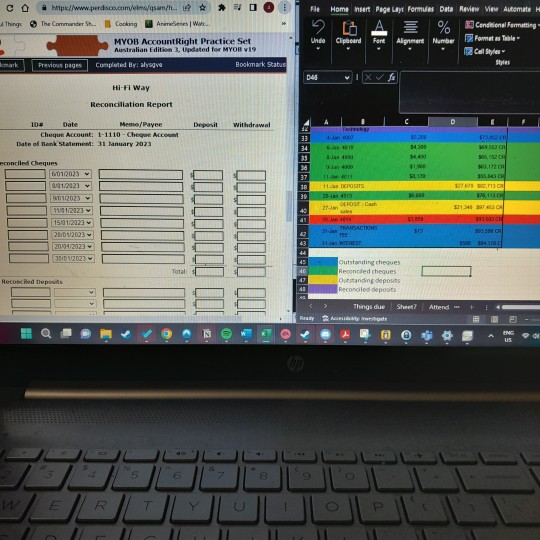

Nearly week 9 so here's my bagel from this week (haloumi egg and rocket) and a smoothie sesh in my kitchen last night. Feat. my MYOB struggles from today

4 notes

·

View notes

Text

How am I meant to sleep when I can't stop thinking about how the really guy wants the amount charged for ASIC returns ($640) credited to him when all he does is lodge them at the post office. There's so much ASIC nonsense that Colleen did to make up that amount in which no one is currently doing so

#I'm sorry for this post which makes sense to no one#it's this dumb thing that sophia gets me to do every week where i put the amounts of what was invoiced under each person#but the asic stuff i ignore because that was always Colleen#but now it's sort of really guy because he takes the pay slips to the post office and hands them over the counter with the company card???#i mean that's not really that hard????#the hardest part is knowing how to deregister a company and how to add another partner to a company on asic connect and#and doing 484 forms and knowing when they're due and#if he gets credited with that whole amount then he should do all the asic stuff#does he even know ASIC things????#get him to ring colleen for a crash course in asic#someone should do that#not me though I'm too scared to#I'm too annoying and terrified and don't want to bother her and#every time an accountant has a problem re the myob software or handitax i tell them to ring jenette#they don't even have Jenette's number lmao or even know who she is

0 notes

Text

A Beginner’s Guide to MYOB Stock Management for New Users

The effective management of inventory is an essential part of running a successful business. MYOB inventory management and its capabilities — New to MYOB, this powerful stock management solution provides inventory control, stock analysis, and improved efficiency. As a guide for beginners, What you need to know will do just that, showing you how to manage your stock including how to track stock, manage types of inventory and improve your customer experience.

So, What is MYOB Stock Management?

Use of MYOB inventory management software also includes MYOB stock management which allows to track and maintain stock values and quantities in real time. No matter if you’re managing a small selection of items, or a larger setup; MYOB gives you the tools to be able to track your inventory, create inventory reports, and uplift your optimal levels of inventory.

The periodic inventory and perpetual inventory methods are both supported by this system, enabling harmony with standard accounting practice. MYOB allows you to overcome issues like dead stock, keep the ideal safety stock and have enough stock at hand to fulfil customer orders.

Essential Characteristics of MYOB Stock Tracker

Real-Time Inventory Tracking

In particular, one of MYOB's most attractive aspects is its ability to track stock in real-time. That means you can keep track of your inventory levels as sales, purchases, and adjustments happen. With accurate tracking, you can make the right decisions and avoid overstocking and stockouts.

Inventory Reports

Detailed Inventory Reports MYOB creates detailed inventory reports for you delivering insight into stock levels, sales trends and product performance. Such reports are great to spot slow-moving goods, help with dead stock, and plan for future stock demand.

Safety Stock Management

To ensure you don’t run out of vital stock, MYOB enables you to set safety stock levels. For example, this guarantees that you always have some inventory on hand for unexpected demand, enhancing your customer experience and minimizing lost sales.

The difference between perpetual and periodic inventory systems

MYOB allows you to use either perpetual inventory (continuous tracking), or periodic inventory (tracking at intervals). This flexibility means that enterprises can execute either, depending on their operational requirements.

Dead Stock Identification

Dead stock is the stock of a store that is no longer selling or no longer follows trends. MYOB enables you to identify and manage dead stock, making space in your store and removing unnecessary expenses.

Advantage of MYOB for Stock Management

Improved Inventory Control

MYOB gives you total control over how much inventory you have. We can’t forget, the software allows you to keep your stock at ideal levels so that you have enough of your products available to meet demand without having too much and risking your company going under.

Enhanced Customer Experience

Proper Stock Quantity enables your orders to be shipped on time and avoid stockouts. This results in a better customer experience and customer loyalty.

Cost Savings

Good stock management helps to minimize costs related to overstocking, dead stock and stockouts. MYOB can help you optimise your inventory level, which saves money and increases profitability.

Real-Time Insights

MYOB also offers real-time tracking and reporting features to help you with insights into your inventory. Such insights help you to make informed decisions based on data and can assess changes in demand faster.

MYOB Stock Management Beginner's Guide

Set Up Your Inventory

In MYOB system, first you enter number of Items. Product data—This includes product name, SKU, and description, along with the stock level. Such systems reinforce successful inventory management;

Decide on Your Inventory Plan

You also need to determine whether you will implement standard inventory or periodic inventory. Businesses that need real-time updated information benefit from perpetual invoice while periodic inventory best suits those who update or track their stock within certain periods.

Define Safety Stock Levels

Use the information to calculate safety stock levels per item. This gives you a buffer to handle unexpected demand and avoid stockouts.

Track Stock Movements

MYOB will help you to track the stock as it comes in or out of your business. Sales, Purchases, Returns and Adjustments. You maintain your inventory levels through real-time tracking.

Train Inventory Optimization

The key is continuously monitoring and optimizing your inventory level to match customer demand while avoiding overstocking. MYOB’s tools can help you spot slow movers, allowing you to change your stock management strategy.

Tips for Effective MYOB Stock Management

Keep Your Inventory Updated Regularly

Regularly inputting data into MYOB will keep your inventory levels current. This covers sales, purchases, and any changes in your amount of stock.

Use Real-Time Tracking

Utilise MYOB’s real-time tracking features to the fullest extent. This feature enables you to keep track of the quantities of your stock and react fast according to demand fluctuations.

Analyze Inventory Reports

It becomes a habit to go and check the inventory reports regularly. These reports give you great information about your stock management performance and help you discover areas you may need to address.

Train Your Team

You may also want to ensure your staff are acquainted with MYOB’s inventory management software. It will enable them to adopt the system and help control inventory better with proper training.

Plan for Seasonal Demand

If your business is subject to seasonal variation, MYOB can help you anticipate changes in demand. Use it to fine tune your safety stock levels and your inventory level so you are ready for the peaks.

Common Issues and How to Address Them

Managing Dead Stock

Dead stock can be money and even real estate that can be used elsewhere. You may choose to look for slow-moving items through MYOB and try to get rid of dead stock with discount or special promotions.

Inaccurate Stock Levels Maintenance

Ideally, you shall process stock predictions and keep stock levels up to date, but this may result in overstocking or stockouts. Keep your MYOB inventory data up to date, and use its real-time tracking features to help maintain accuracy.

Balancing Safety Stock

Having the right levels of safety stock can be tricky. Leverage MYOB’s reporting tools to help you study demand patterns to decide the best amount stock to stock on hand.

Conclusion

MYOB stock management is a powerful tool for businesses looking to improve their inventory control and optimize their stock levels. By leveraging MYOB’s features, such as real-time tracking, inventory reports, and safety stock management, you can streamline your operations, reduce costs, and enhance your customer experience.

Whether you’re new to stock management or looking to upgrade your current system, MYOB provides the tools and insights you need to succeed. Start your journey with MYOB today and take the first step toward more efficient and effective managing your inventory.

1 note

·

View note

Text

The Ultimate Guide to Asset Management Software for Australian Trade Businesses

Managing assets efficiently is crucial for Australian trade businesses. From tracking equipment usage to scheduling maintenance, Asset Management Software helps businesses streamline operations and extend the lifespan of their assets.

In this comprehensive guide, we will explore how asset management software like FieldConnect can help Australian businesses optimize their asset tracking and management.

What is Asset Management Software?

Asset management software is a digital solution designed to track, maintain, and optimize the use of business assets. It helps organizations monitor asset performance, reduce downtime, and increase operational efficiency.

Key Features:

Asset Tracking – Keep a record of all assets, including location and condition.

Maintenance Scheduling – Plan preventive maintenance to avoid unexpected breakdowns.

Real-time Monitoring – Get updates on asset status and performance.

Depreciation Management – Track asset value over time for financial reporting.

Mobile Access – Manage assets from any device.

Why Australian Trade Businesses Need Asset Management Software

Trade businesses in Australia, including construction, plumbing, electrical, and HVAC, manage a variety of tools and equipment. FieldConnect provides a tailored solution to enhance asset control and business efficiency. Here’s why investing in asset management software is essential:

1. Increased Asset Utilization

Maximizing asset usage is key to operational efficiency. Asset management software helps ensure tools and equipment are properly allocated and utilized.

2. Reduced Maintenance Costs

Regular maintenance prevents costly repairs and extends asset lifespan. FieldConnect automates maintenance schedules, minimizing downtime and expenses.

3. Real-time Asset Tracking

Knowing the location and condition of your assets at all times improves operational planning. GPS and barcode scanning ensure assets are always accounted for.

4. Enhanced Compliance & Reporting

Trade businesses must comply with safety regulations and audits. FieldConnect provides accurate records of asset maintenance and usage history for compliance purposes.

5. Boosted Productivity & Profitability

By eliminating asset mismanagement, businesses can reduce losses, increase efficiency, and improve profitability.

Key Benefits of Using FieldConnect

FieldConnect is a leading asset management software tailored for Australian businesses. Here’s how it helps:

Cloud-Based Platform – Access asset data anytime, anywhere.

Automated Workflows – Reduce manual tracking and improve efficiency.

Integration with Accounting Software – Sync with Xero and MYOB.

Comprehensive Reporting – Gain insights into asset performance.

Mobile Compatibility – Manage assets on desktop, tablet, or mobile.

How to Choose the Right Asset Management Software

When selecting asset management software, consider the following factors:

Ease of Use – The software should be user-friendly for all staff.

Scalability – It should grow with your business as your asset portfolio expands.

Integration Capabilities – Look for software that integrates with accounting and ERP systems.

Customer Support – Reliable customer support ensures smooth implementation.

Cost-Effectiveness – Choose a solution that offers the best value for your business needs.

Implementation Tips for Maximum Efficiency

To ensure a smooth transition to asset management software, follow these steps:

Train Your Team: Ensure staff understand how to use the software effectively.

Customize Workflows: Adapt the system to match your business operations.

Monitor & Optimize: Regularly review asset reports and analytics.

Seek Support: Utilize customer support for troubleshooting and enhancements.

Conclusion

Investing in asset management software is a game-changer for Australian trade businesses. Whether you manage tools, machinery, or equipment, FieldConnect provides the perfect solution to streamline asset tracking, enhance maintenance scheduling, and boost profitability.

For a simple and powerful field service management solution, contact us today:

📍 Level 14, 333 Collins Street Melbourne, VIC 3000 📞 1300 973 888 📧 [email protected]

Start managing your assets efficiently with https://www.xrelements.com.au/products/fieldconnect/ and take your business to the next level!

0 notes

Text

Accountant in Melbourne: Your Guide to Smart Financial Management & Tax Success

Managing finances, tax obligations, and business accounts can be a challenge for anyone – whether you're an individual, freelancer, or business owner. This is where a professional accountant in Melbourne can make a big difference. With their expertise, you can navigate complex tax laws, maximize your deductions, and maintain financial stability.

Why Hiring an Accountant in Melbourne is Essential

Tax Compliance and Optimization: Tax laws are constantly evolving. A skilled tax accountant ensures your tax filings comply with the latest Australian Taxation Office (ATO) regulations. This helps you avoid penalties and ensures you take full advantage of any tax benefits.

Financial Planning and Budgeting: Planning for big life events, retirement, or business expansion can be daunting. A professional accountant offers strategic financial advice to help you set and reach your goals, ensuring you're prepared for the future.

Bookkeeping and Payroll Services: Managing income, expenses, and payroll can eat up valuable time. An experienced accountant can streamline your bookkeeping, ensuring accurate records and smooth payroll management, allowing you to focus on what you do best.

BAS & GST Lodgments: If your business is GST registered, submitting accurate Business Activity Statements (BAS) is crucial. An accountant will ensure your GST reporting is on point, keeping you compliant with Australian tax regulations.

Maximizing Tax Deductions:An accountant is well-versed in tax deductions, making sure you claim every possible expense related to your personal or business income to reduce your tax liability.

How to Choose the Right Accountant in Melbourne

When selecting an accountant, consider their experience, qualifications (look for a certified CPA or registered tax agent), and industry specialization. Check online reviews and ensure they use up-to-date accounting software like Xero, MYOB. Transparency in pricing is also important to ensure you know exactly what to expect.

Click Here: Tax Return Accountant Melbourne

0 notes

Text

Bookkeeping Services Melbourne: How to Find the Right Fit for Your Business

Finding the right bookkeeping service is crucial for the smooth operation of your business. In Melbourne, where businesses of all sizes thrive, choosing a bookkeeping service that aligns with your needs can save you time, money, and headaches. Whether you're a small startup or a growing enterprise, here’s how you can find the right bookkeeping service for your business.

1. Understand Your Business Needs

Before you begin searching for a bookkeeping service, take a moment to assess your business needs. What kind of bookkeeping tasks do you require? Do you need basic bookkeeping, like managing income and expenses, or more advanced services such as payroll, BAS (Business Activity Statements), and tax preparation? Knowing what you need will help you narrow down your options and ensure you get the right service.

2. Look for Experience and Expertise

When choosing a bookkeeping service, experience matters. Look for providers who have experience working with businesses of your size or industry. A bookkeeping service with a good understanding of your specific business needs will be more equipped to manage your financial tasks effectively. Don’t hesitate to ask about their qualifications, certifications, and track record in delivering quality services.

3. Check for Proper Accreditation

In Australia, bookkeepers are required to be registered with the Tax Practitioners Board (TPB) if they’re providing certain services, such as preparing BAS or offering tax advice. Ensure the bookkeeping service you choose is accredited and registered with the TPB. This gives you peace of mind that they’re following Australian regulations and industry standards.

4. Consider Software and Technology

Today, most businesses rely on accounting software to streamline bookkeeping tasks. Make sure the bookkeeping service you choose is familiar with the software you’re using (or plan to use) for your business. Popular options in Melbourne include Xero, MYOB, and QuickBooks. A tech-savvy bookkeeper can help you make the most of these tools to keep your finances organised.

5. Evaluate Communication and Responsiveness

Effective communication is essential when working with a bookkeeping service. The best bookkeeping services will keep you informed about your financial situation and respond promptly to your queries. During your initial discussions, evaluate how well they communicate and whether they’re responsive to your questions. You want to feel comfortable and confident in their ability to provide clear, timely updates.

6. Compare Pricing

Pricing for bookkeeping services can vary significantly based on the scope of work and the complexity of your needs. Be sure to get quotes from a few bookkeeping services to compare prices. While the cheapest option might seem appealing, remember that quality matters. Choose a service that offers a fair price for the level of expertise and service you require.

7. Ask for References or Reviews

A reliable bookkeeping service should have a good reputation in the Melbourne business community. Ask for client references or check online reviews to gauge their reputation and the satisfaction of their clients. Positive feedback can provide assurance that you’re choosing a trusted professional.

8. Ensure Flexibility and Scalability

As your business grows, your bookkeeping needs may change. Make sure the service you choose is flexible and can scale with your business. Whether it’s adding more services, accommodating increased transactions, or offering advice on financial management, having a bookkeeping partner who can grow with you is important.

9. Understand Their Reporting Process

A great bookkeeping service will provide you with regular reports on your business’s financial health. Ask how often they provide these reports, and ensure that the information is presented in a clear and understandable way. This will help you make informed decisions and stay on top of your finances.

10. Trust Your Instincts

Finally, trust your instincts when choosing a bookkeeping service. You should feel comfortable with the team and confident in their ability to manage your business’s finances. If something doesn’t feel right, it’s okay to keep looking until you find a service that feels like the right fit.

Conclusion

Finding the right bookkeeping service in Melbourne is about more than just numbers – it’s about finding a partner who can help your business stay financially healthy and organised. By understanding your needs, looking for qualified professionals, and ensuring the service is a good match for your business, you can set yourself up for financial success. Whether you need help with tax returns, reporting, or everyday bookkeeping, the right service will make all the difference.

#Bookkeeping Service Melbourne#Bookkeeping Services#Business Bookkeeping#Accounting Services#Financial Services#Melbourne Bookkeepers#Bookkeeper Melbourne#Find Bookkeeper#Bookkeeping Solutions

0 notes

Text

Demystifying Financial Statements: A Beginner's Guide for Victorians

For any layman, the financial statement would be something too difficult to understand, particularly if you are unaware of what terms and figures refer to. Yet, in managing a small business in Melbourne or just staying sane with regard to home finances, knowing how to read financial statements is one of those skills that any person can develop. Hence, this post shall detail a simple explanation of the basic financial statement for people from Victoria to gain a financial edge.

What are financial statements?

The official document summarizing the activities of money in an organization, or business is known as a financial statement. They indicate the performance how well someone is doing financially and what the trends are. There are three main types:

Balance Sheet: This sheet is sometimes referred to as the snapshot of one's financial health because it shows what a person owns or has (assets), what is owed to whom (liabilities), and the remainder in equity at any given time.

Income Statement: Sometimes known as a profit and loss statement, it is an income statement showing your income and expenses over a period; whether you are making a profit or loss.

Cash Flow Statement: This is the statement that tracks both inflow and outflow of cash, and hence it shows that you have sufficient liquidity for all your liability repayments.

Why Are Financial Statements Important?

Financial statements are more than just numbers on paper—they're tools for decision-making:

For Individuals: Understanding these statements can improve personal budgeting and investment decisions.

For Businesses: They help track growth, identify issues, and secure funding.

For Investors: They provide crucial data to assess the viability of an investment.

Common Terms Demystified

Assets: Things you own that have value, such as property, vehicles, or savings accounts.

Liabilities: Debts or obligations you owe, like loans or credit card balances.

Equity: Equity is the value that we get after deducting our liabilities from the assets.

Revenue: Money earned through sales, services, or investments.

Expenses: Expenses are the costs incurred to generate revenue, including salaries, bills, rent, and other utilities.

Practical Steps to Understand Financial Statements

Start With Basics: Focus on key figures—total assets, liabilities, and net income.

Look for Trends: Compare data across periods to identify patterns.

Seek Help if Needed: Don’t hesitate to consult a financial advisor or accountant for clarification.

Leverage Technology: Use accounting software or financial apps tailored for Australians, like MYOB or Xero.

Why This Matters for Victorians

Victoria has a great small business community, and business owners and residents need financial literacy to make smart choices about their future. Whether in the heart of Melbourne's CBD or in regional towns like Ballarat and Bendigo, knowledge of financial statements will empower individuals to make the best decisions about their financial future.

Final Thoughts

Financial statements can appear daunting at a glance, but breaking them up into manageable portions can be quite the world of difference. For those who are interested virtual cfo services in sharpening up their financial prowess, understanding such documents would mean a strong move toward financial freedom and growth.

Each number has its story to tell; learn it, and it will unlock insights into your own financial journey.

Find out more about workshops available in Victoria or contact a local advisor to start learning more about personal finance today!

1 note

·

View note

Text

MYOB Assignment Help provides expert guidance to students working on assignments related to MYOB software, a tool widely used for accounting, bookkeeping, and financial management. These services assist with tasks such as creating company files, managing payroll, preparing financial statements, and understanding tax systems. With professional help, students can gain hands-on experience with the software, improve their problem-solving skills, and ensure their assignments are accurate and well-structured. MYOB Assignment Help is ideal for students pursuing courses in accounting, finance, or business management.

0 notes

Text

Outsource MYOB Accounting Services with Modern Tools - MMC Books ensures precise accounting using MYOB’s advanced features.

In today’s competitive business environment, staying on top of your finances is crucial for sustained growth and success. However, accounting and bookkeeping can be time-consuming and complex, especially for small and medium-sized enterprises (SMEs). Fortunately, MMC Books offers a solution to streamline your accounting processes. By choosing to outsource MYOB accounting services with MMC Books, you can ensure that your financial records are accurate, compliant, and up-to-date, all while freeing up valuable time to focus on your business.

Why Outsource MYOB Accounting Services?

Managing your accounting tasks in-house often requires dedicated personnel, costly software investments, and extensive training. These resources can strain your budget and divert attention from your core operations. Outsourcing MYOB accounting services provides a cost-effective alternative by leveraging the expertise of professional accountants and the advanced capabilities of MYOB software.

MYOB (Mind Your Own Business) is a robust accounting platform designed to simplify financial management. Its features include efficient bookkeeping, payroll processing, and tax compliance. By outsourcing these services to MMC Books, you gain access to experienced professionals who utilize MYOB’s advanced tools to deliver precise and timely results.

Key Benefits of MMC Books’ MYOB Accounting Services

Accurate Bookkeeping: Proper bookkeeping is the foundation of sound financial management. MMC Books’ team ensures that all your financial transactions are recorded accurately and systematically. By using MYOB’s user-friendly interface and automation features, they minimize errors and maintain a clear audit trail.

Streamlined Payroll Management: Managing employee payroll can be complex, especially with ever-changing regulations. MMC Books leverages MYOB’s payroll capabilities to handle employee payments, tax deductions, superannuation, and more. This ensures timely and compliant payroll processing, keeping both your employees and regulators satisfied.

Tax Compliance Made Easy: Navigating tax laws and ensuring compliance can be daunting. MMC Books’ experts use MYOB’s tax compliance tools to prepare accurate tax returns, calculate GST, and stay updated on the latest regulatory changes. This reduces the risk of penalties and keeps your business in good standing with tax authorities.

Time and Cost Savings: Outsourcing your accounting tasks allows you to focus on growing your business without the burden of maintaining an in-house accounting team. MMC Books’ efficient use of MYOB ensures that you save time and reduce costs, providing a significant return on investment.

Customized Solutions: Every business is unique, and MMC Books understands this. They tailor their MYOB accounting services to meet your specific needs, ensuring a personalized approach that aligns with your goals and industry requirements.

How MMC Books Stands Out

MMC Books is a trusted provider of outsourced accounting services, known for its commitment to accuracy, reliability, and customer satisfaction. Their team of certified accountants is well-versed in MYOB software, ensuring seamless integration with your existing systems. With years of experience serving diverse industries, MMC Books has built a reputation for delivering high-quality results.

Additionally, MMC Books prioritizes data security and confidentiality. They implement robust measures to protect your financial information, giving you peace of mind when outsourcing your accounting tasks.

Steps to Get Started

Outsourcing your MYOB accounting services with MMC Books is a straightforward process:

Consultation: Begin with a detailed discussion about your accounting needs and business goals. MMC Books will assess your requirements and propose a tailored solution.

Setup and Integration: Their team will set up MYOB software and integrate it with your existing systems, ensuring a smooth transition.

Ongoing Support: MMC Books provides continuous support and regular updates on your financial status, keeping you informed and in control.

Conclusion

outsource MYOB accounting services to MMC Books and experience the benefits of professional expertise and advanced technology. Their team’s proficiency with MYOB software ensures accurate bookkeeping, efficient payroll management, and seamless tax compliance, all while saving you time and resources. Simplify your accounting tasks today and let MMC Books help you achieve financial clarity and success. Contact them to learn more about how their services can transform your business.

0 notes

Text

Hub:0895-6390-68080 magang SMK jurusan akuntansi di Kediri

Magang SMK Jurusan Akuntansi di Kediri: Peluang, Tantangan, dan Manfaat

Dalam dunia pendidikan vokasi, khususnya di Sekolah Menengah Kejuruan (SMK) jurusan Akuntansi, magang menjadi salah satu tahap penting untuk mengembangkan keterampilan praktis yang relevan dengan dunia kerja. Bagi siswa SMK jurusan Akuntansi, kesempatan magang bukan hanya sebagai kewajiban akademis, tetapi juga sebagai langkah awal untuk membekali diri dengan pengalaman berharga. Kediri, sebagai salah satu kota berkembang di Jawa Timur, menawarkan berbagai peluang magang yang sangat baik bagi siswa SMK yang tertarik di bidang akuntansi. Artikel ini akan mengupas berbagai aspek mengenai magang SMK jurusan akuntansi di Kediri, termasuk tempat magang yang tersedia, tantangan yang dihadapi, hingga tips untuk memaksimalkan pengalaman magang.

Pentingnya Magang bagi Siswa SMK Jurusan Akuntansi

Magang merupakan salah satu cara paling efektif untuk menghubungkan antara dunia pendidikan dan dunia kerja. Khusus bagi siswa SMK jurusan Akuntansi, magang memberikan berbagai manfaat yang tak ternilai. Beberapa di antaranya adalah:

1. Aplikasi Langsung dari Teori yang Dipelajari

Selama di bangku sekolah, siswa SMK jurusan Akuntansi mempelajari berbagai teori dan konsep dasar akuntansi, seperti pencatatan transaksi, penyusunan laporan keuangan, serta pengelolaan anggaran dan perpajakan. Namun, pada kenyataannya, dunia kerja mengharuskan mereka untuk bisa mengimplementasikan teori-teori tersebut dalam bentuk yang lebih kompleks. Magang memberi kesempatan bagi siswa untuk mengaplikasikan ilmu yang telah dipelajari di sekolah langsung di dunia industri, sehingga mereka memiliki pemahaman yang lebih mendalam tentang akuntansi yang sesungguhnya.

2. Peningkatan Keterampilan Praktis

Magang memberikan kesempatan bagi siswa untuk meningkatkan keterampilan teknis yang tak bisa dipelajari di ruang kelas. Sebagai contoh, siswa dapat mempelajari penggunaan software akuntansi seperti MYOB, SAP, atau QuickBooks, serta teknik penyusunan laporan keuangan yang lebih rinci dan sesuai dengan standar akuntansi yang berlaku. Pengalaman-pengalaman praktis ini menjadi bekal yang sangat penting ketika mereka mulai bekerja setelah lulus.

3. Pengenalan terhadap Dunia Kerja Profesional

Magang memberi wawasan tentang bagaimana dunia kerja yang sesungguhnya beroperasi. Di tempat magang, siswa SMK jurusan Akuntansi dapat belajar tentang budaya kerja di perusahaan, cara berkomunikasi dengan rekan kerja, dan bagaimana cara menghadapi berbagai situasi yang terjadi dalam kehidupan profesional. Pengalaman ini membuat siswa lebih siap dan percaya diri ketika terjun ke dunia kerja setelah menyelesaikan pendidikan.

4. Membangun Jejaring Profesional

Magang juga menjadi kesempatan yang baik untuk membangun jaringan profesional. Dalam dunia bisnis, koneksi yang baik sangat penting. Selama magang, siswa SMK jurusan Akuntansi berkesempatan untuk berinteraksi dengan profesional di bidang akuntansi, termasuk rekan kerja, manajer, bahkan klien. Jejaring ini dapat sangat bermanfaat di masa depan, terutama dalam mencari pekerjaan setelah mereka lulus dari SMK.

5. Meningkatkan Daya Saing di Pasar Kerja

Bagi siswa yang ingin segera memasuki dunia kerja setelah lulus, magang dapat menjadi nilai tambah di CV mereka. Banyak perusahaan yang lebih memilih calon karyawan yang sudah memiliki pengalaman magang karena mereka dianggap lebih siap untuk beradaptasi dan mengerjakan tugas yang diberikan. Pengalaman magang memberikan keunggulan kompetitif yang akan meningkatkan peluang mereka untuk diterima bekerja di perusahaan yang mereka tuju.

Tempat Magang SMK Jurusan Akuntansi di Kediri

Kediri, dengan sektor ekonomi yang terus berkembang, menawarkan banyak peluang bagi siswa SMK jurusan Akuntansi untuk mengembangkan keterampilan dan pengalaman melalui magang. Banyak perusahaan, baik di sektor swasta maupun pemerintah, yang membuka kesempatan magang bagi siswa SMK di Kediri. Berikut adalah beberapa tempat magang yang bisa dijadikan pilihan oleh siswa SMK jurusan Akuntansi:

1. Kantor Akuntan Publik (KAP)

Kantor Akuntan Publik di Kediri adalah salah satu tempat yang ideal bagi siswa SMK jurusan Akuntansi untuk menjalani magang. Di sini, siswa bisa belajar mengenai audit laporan keuangan, pembuatan laporan pajak, serta perencanaan keuangan untuk klien. Pengalaman magang di KAP sangat penting bagi mereka yang tertarik untuk menjadi auditor atau akuntan publik. Beberapa KAP di Kediri yang dapat dijadikan tempat magang antara lain:

KAP Pratama Kediri

KAP Sejahtera

KAP Cipta Mandiri

Di kantor-kantor akuntan ini, siswa dapat terlibat dalam berbagai kegiatan akuntansi yang berkaitan dengan audit, pembuatan laporan keuangan, serta pelaporan pajak.

2. Perusahaan Swasta

Perusahaan swasta yang berkembang pesat di Kediri juga menyediakan peluang magang bagi siswa SMK jurusan Akuntansi. Di perusahaan swasta, siswa bisa belajar tentang pengelolaan keuangan perusahaan, pembuatan anggaran, dan laporan keuangan bulanan. Beberapa perusahaan swasta yang membuka peluang magang di Kediri antara lain:

PT. Sumber Rejeki

CV. Kediri Makmur

PT. Abadi Sejahtera

Di perusahaan-perusahaan ini, siswa akan dilibatkan dalam pengelolaan transaksi, pencatatan jurnal, penyusunan laporan keuangan, serta analisis keuangan.

3. Instansi Pemerintah

Instansi pemerintah di Kediri juga memberikan peluang magang yang sangat baik bagi siswa SMK jurusan Akuntansi. Di sini, siswa dapat belajar mengenai pengelolaan anggaran daerah, serta memahami proses pelaporan keuangan yang harus dilakukan sesuai dengan peraturan yang berlaku. Magang di instansi pemerintah akan memberikan wawasan mengenai akuntansi sektor publik dan pengelolaan dana negara atau daerah.

Beberapa instansi yang dapat dijadikan tempat magang di Kediri antara lain:

Badan Pengelolaan Keuangan Daerah Kediri

Dinas Pendapatan dan Pengelolaan Keuangan Daerah

Badan Perencanaan Pembangunan Daerah (Bappeda)

Di instansi-instansi ini, siswa akan terlibat dalam penyusunan laporan keuangan publik, perencanaan anggaran daerah, serta kegiatan pengelolaan keuangan lainnya.

4. Bank dan Lembaga Keuangan

Bank dan lembaga keuangan lainnya juga menawarkan peluang magang yang menarik untuk siswa SMK jurusan Akuntansi. Di sektor perbankan, siswa dapat mempelajari proses transaksi keuangan, pengelolaan rekening, serta pembuatan laporan keuangan yang lebih kompleks. Pengalaman magang di bank akan memberi wawasan tentang bagaimana sistem akuntansi diterapkan dalam industri keuangan.

Beberapa bank di Kediri yang membuka kesempatan magang bagi siswa SMK jurusan Akuntansi antara lain:

Bank Jatim Kediri

Bank Mandiri Kediri

Bank Negara Indonesia (BNI) Kediri

Di bank-bank ini, siswa akan belajar tentang pengelolaan transaksi, rekonsiliasi laporan keuangan, serta analisis kredit.

Hub:0895-6390-68080: Sumber Informasi Magang di Kediri

Untuk siswa yang tertarik mencari peluang magang, informasi lebih lanjut mengenai tempat magang dapat diperoleh dengan menghubungi Hub:0895-6390-68080. Nomor ini dapat memberikan informasi tentang tempat magang yang tersedia, prosedur pendaftaran, serta persyaratan yang diperlukan untuk menjalani magang di Kediri. Hub:0895-6390-68080 menjadi salah satu sumber utama bagi siswa SMK yang ingin memulai perjalanan magangnya dengan langkah yang tepat.

Kesimpulan

Magang merupakan pengalaman yang sangat berharga bagi siswa SMK jurusan Akuntansi, karena selain memberikan kesempatan untuk mengaplikasikan teori yang telah dipelajari, juga membuka peluang untuk membangun keterampilan praktis yang sangat dibutuhkan di dunia kerja. Kediri, dengan berbagai tempat magang yang beragam, menawarkan peluang yang luas bagi siswa SMK untuk mengembangkan diri di bidang akuntansi. Dengan memanfaatkan peluang magang yang ada, siswa dapat mempersiapkan diri dengan baik untuk memasuki dunia kerja setelah lulus dari SMK.

FAQ

1. Apa saja manfaat magang bagi siswa SMK jurusan Akuntansi? Magang memberikan manfaat berupa penerapan langsung ilmu yang dipelajari di sekolah, peningkatan keterampilan praktis, pemahaman tentang dunia kerja, serta peluang membangun jejaring profesional yang dapat membantu karir di masa depan.

2. Di mana saya bisa magang sebagai siswa SMK jurusan Akuntansi di Kediri? Ada banyak tempat magang yang bisa dipilih di Kediri, seperti Kantor Akuntan Publik, perusahaan swasta, instansi pemerintah, dan bank. Beberapa tempat yang dapat dipertimbangkan adalah KAP Pratama Kediri, PT. Sumber Rejeki, dan Dinas Pendapatan Kediri.

3. Apakah magang di Kediri berbayar? Beberapa tempat magang memberikan kompensasi atau tunjangan, namun tidak semua tempat magang memberikan pembayaran. Pastikan untuk mengecek informasi mengenai hal ini sebelum mendaftar.

4. Berapa lama durasi magang di Kediri? Durasi magang bervariasi, umumnya antara 1 hingga 3 bulan, tergantung pada kebijakan tempat magang dan program magang yang diikuti siswa.

5. Bagaimana cara mendaftar untuk magang di Kediri? Siswa dapat mendaftar untuk magang dengan menghubungi tempat magang yang dipilih atau melalui Hub:0895-6390-68080 untuk mendapatkan informasi lebih lanjut mengenai prosedur

pendaftaran.

0 notes

Text

Streamline Your Finances with Collab Accounting's Expert Bookkeeping Services

Optimize your financial management with Collab Accounting's comprehensive bookkeeping services. From daily transaction processing to detailed financial reporting, our team ensures accuracy and efficiency using top-tier software like Xero, QuickBooks, and MYOB.

#bookkeeping services#financial management#transaction processing#financial reporting#account reconciliation#Collab Accounting

0 notes

Text

Learn Accounting in Ahmedabad - Perfect Computer Education

Empower your career in Accounting and stay ahead with Technology

Accounting is one of the most important activities for any company in the world. Gone are the days when accounting was nothing more than a stack of papers on a table! Accounting software such as Xero, myOB, tally, and QuickBooks has made it even simpler and more compact. If you want to Learn Accounting in Ahmedabad, get it at Perfect Education.

These software are already popular in countries like the U.S, U.K, Australia, etc. but with changing times, these accounting software have grown extremely popular in India.

Xero and MYOB (Mind Your Own Business) are cloud-based software that allows users to access data from anywhere, and this has proven to be beneficial to enterprises. MYOB helps your business with accounting, bookkeeping, payroll, customer relationship management (CRM), invoices, and billing, among other things. Depending on your partnership level, the Xero bookkeeping service offers you a variety of perks, like bronze, silver, and gold. Each partnership has several benefits, like a dedicated Xero manager, a digital marketing toolkit, access to accelerated programs, etc.

Based on your business or accounting requirements, you can Learn Accounting in Ahmedabad and earn certifications. Tally is an ERP (enterprise resource planning) accounting software package for recording a company's day-to-day business data.

The latest version of Tally is Tally ERP 9. QuickBooks is an online accounting software program developed by Intuit that is used by small and medium-sized businesses all over the world. It is well-known for its simple user interface and automated bookkeeping and accounting processes. It's offered as "Software as a Service," allowing you to access your data from anywhere at any time. It automates the processing of day-to-day transactions, such as invoicing, payment processing, sales tax, reporting, and payroll, among other things and is simple to utilize. It's a global platform. It backs up data in real-time.

Visit us now:- https://perfecteducation.net/learn-accounting-in-ahmedabad.php

#digital marketing course in ahmedabad#foreign accounting training#learn accounting in ahmedabad#usa accounting training#tally certification in ahmedabad#quickbook training ahmedabad#xero training in ahmedabad#foreign accounting and taxation training#myob training#learn foreign accounting ahmedabad

0 notes

Text

Bookkeeping Essentials: Strategies for Effective Financial Management

Efficient financial management is the cornerstone of a successful business. At its heart lies accurate and organized bookkeeping—a process that tracks and records financial transactions to ensure the smooth operation of your enterprise. Whether you’re a small business owner or running a larger operation, mastering bookkeeping essentials can save time, reduce stress, and provide a clear picture of your financial health.

At BTMH, we specialize in helping businesses streamline their bookkeeping processes for optimal efficiency.

Why is Bookkeeping Important?

Bookkeeping is more than just recording income and expenses. It provides the foundation for:

1: Informed Decision-Making

Accurate records help you understand your business’s financial position, enabling informed decisions about investments, growth, and cost management.

2: Compliance with Tax Regulations

Proper bookkeeping ensures you meet legal requirements, avoid penalties, and make tax time less stressful.

3: Cash Flow Management

By keeping track of income and expenses, you can maintain healthy cash flow, plan for future expenses, and avoid financial pitfalls.

Bookkeeping Essentials for Businesses

1: Choose the Right System

Decide between single-entry or double-entry bookkeeping based on your business size and complexity. Double-entry systems, though more detailed, provide a more accurate financial picture.

2: Use Accounting Software

Tools like Xero, QuickBooks, or MYOB can simplify bookkeeping tasks, offering features such as automatic transaction recording, invoicing, and real-time financial tracking.

3: Organize Financial Documents

Keep receipts, invoices, and bank statements organized. Use digital tools to scan and store documents securely, reducing the risk of loss and improving accessibility.

4: Separate Personal and Business Finances

Maintain separate accounts for personal and business transactions to avoid confusion and ensure accurate records.

5: Track Income and Expenses Regularly

Make it a habit to update your records weekly or monthly. This helps prevent data overload and ensures your books are always current.

6: Reconcile Bank Statements

Regularly match your books with bank statements to identify discrepancies and resolve them promptly.

7: Monitor Accounts Receivable and Payable

Keep track of payments owed to you and those you owe to vendors. Timely follow-ups ensure smooth cash flow.

8: Hire a Professional Bookkeeper

If bookkeeping feels overwhelming, consider outsourcing to experts like BTMH. Professionals ensure accuracy, save time, and provide peace of mind.

Benefits of Efficient Bookkeeping

Time-Saving: Organized books reduce time spent searching for information or correcting errors.

Better Financial Insights: Clear records reveal trends, helping you forecast and strategize effectively.

Tax Preparedness: Accurate records make tax filing seamless and minimize the risk of audits.

Reduced Stress: Staying on top of your finances eliminates last-minute scrambling during tax season.

How BTMH Can Help

At BTMH, we offer comprehensive bookkeeping services tailored to meet your business needs. From setting up efficient systems to managing day-to-day transactions, our experienced team ensures your financial records are accurate and up to date.

Partnering with BTMH means more than just outsourcing a task; it means gaining a trusted advisor dedicated to your success. Contact us today to streamline your bookkeeping process and focus on growing your business.

0 notes

Text

0852-2137-3290 - Tempat PKL Multimedia PT. Kinergi Makmur Sejahtera di Gempolsari Bandung

Magang SMK Akuntansi Bandung: Panduan Lengkap untuk Siswa

Magang atau Praktik Kerja Lapangan (PKL) adalah bagian penting dari pendidikan di SMK, termasuk bagi siswa jurusan akuntansi. Kegiatan ini memberikan siswa pengalaman langsung dalam dunia kerja, sekaligus menjadi momen untuk mengaplikasikan ilmu yang dipelajari di sekolah. Kota Bandung, sebagai salah satu pusat pendidikan dan industri di Indonesia, menawarkan banyak pilihan tempat PKL di Bandung 2024 yang relevan untuk siswa jurusan akuntansi.

Artikel ini akan membahas seluk-beluk PKL SMK jurusan akuntansi, dari cara memilih tempat yang tepat hingga manfaat yang dapat diperoleh, serta panduan membuat laporan PKL.

Mengapa PKL Penting untuk Siswa SMK Akuntansi?

PKL tidak hanya menjadi syarat kelulusan, tetapi juga memberikan manfaat jangka panjang bagi siswa. Berikut adalah beberapa alasan mengapa PKL menjadi momen penting:

Pengalaman Kerja Nyata PKL membantu siswa memahami bagaimana teori yang mereka pelajari diterapkan dalam pekerjaan sehari-hari.

Peningkatan Keterampilan Teknis Di tempat magang, siswa dapat mempelajari proses pencatatan keuangan, penyusunan laporan, hingga penggunaan software akuntansi seperti MYOB atau Accurate.

Peningkatan Keterampilan Soft Skills Selain keterampilan teknis, siswa juga belajar tentang komunikasi, manajemen waktu, dan kerja tim selama PKL.

Membuka Peluang Karier PKL sering menjadi langkah awal dalam membangun jaringan profesional, yang dapat berguna untuk karier di masa depan.

Rekomendasi Tempat Magang SMK Akuntansi di Bandung

Bandung memiliki berbagai tempat magang SMK jurusan akuntansi yang dapat dipilih siswa, mulai dari perusahaan jasa keuangan hingga organisasi non-profit. Berikut beberapa rekomendasinya:

1. Perusahaan Konsultan Keuangan

Banyak perusahaan konsultan keuangan di Bandung yang menerima siswa magang dari SMK jurusan akuntansi. Siswa akan belajar:

Penyusunan laporan keuangan perusahaan.

Analisis anggaran.

Penggunaan software akuntansi profesional.

2. Perbankan dan Lembaga Keuangan

Bank atau koperasi di Bandung juga membuka lowongan magang SMK jurusan akuntansi. Di sini, siswa dapat mempelajari pengelolaan data nasabah, pencatatan transaksi, hingga proses audit sederhana.

3. UKM dan Start-up Lokal

Usaha kecil dan menengah (UKM) serta start-up di Bandung sering membutuhkan tenaga magang. Lingkungan kerja yang dinamis memungkinkan siswa mempelajari berbagai aspek, termasuk:

Pencatatan arus kas.

Penyusunan neraca keuangan sederhana.

Pengelolaan inventaris.

4. Lembaga Pendidikan dan Organisasi Sosial

Beberapa lembaga pendidikan dan organisasi sosial di Bandung menerima siswa magang, terutama untuk tugas-tugas seperti pengelolaan anggaran proyek dan administrasi keuangan.

Cara Memilih Tempat PKL yang Baik

Memilih tempat PKL di Bandung 2024 yang sesuai memerlukan pertimbangan matang. Berikut adalah langkah-langkah yang dapat Anda ikuti:

1. Cocokkan dengan Tujuan Karier

Pastikan tempat PKL yang Anda pilih sesuai dengan bidang yang ingin Anda tekuni setelah lulus.

2. Cari Reputasi Tempat PKL

Lakukan riset tentang reputasi perusahaan atau organisasi tempat Anda akan magang. Pastikan mereka memiliki program yang terstruktur untuk siswa magang.

3. Perhatikan Lokasi dan Fasilitas

Pilih lokasi yang mudah dijangkau dan menyediakan fasilitas yang mendukung pembelajaran Anda selama PKL.

4. Konsultasikan dengan Guru Pembimbing

Diskusikan pilihan Anda dengan guru pembimbing untuk memastikan tempat tersebut relevan dengan kurikulum dan kebutuhan Anda.

Manfaat PKL bagi Siswa SMK Akuntansi

PKL memberikan berbagai manfaat yang signifikan, di antaranya:

1. Meningkatkan Pemahaman Praktis

PKL memungkinkan siswa untuk memahami bagaimana teori yang diajarkan di sekolah diterapkan dalam dunia kerja.

2. Membangun Rasa Percaya Diri

Dengan menjalani tugas-tugas nyata, siswa dapat meningkatkan kepercayaan diri mereka dalam menghadapi tantangan pekerjaan.

3. Meningkatkan Peluang Kerja

Pengalaman PKL dapat menjadi nilai tambah saat melamar pekerjaan di masa depan.

4. Membangun Jaringan Profesional

PKL memberikan kesempatan untuk bertemu dengan profesional di bidang akuntansi yang dapat menjadi mentor atau referensi di masa mendatang.

Cara Membuat Laporan PKL SMK

Laporan PKL adalah bagian penting dari proses magang. Berikut panduan untuk membuat laporan PKL yang baik:

1. Pahami Struktur Laporan

Laporan PKL biasanya terdiri dari:

Cover: Berisi judul, nama siswa, nama sekolah, dan tempat PKL.

Bab I - Pendahuluan: Latar belakang, tujuan, dan manfaat PKL.

Bab II - Profil Tempat PKL: Informasi tentang perusahaan atau organisasi tempat Anda magang.

Bab III - Kegiatan PKL: Penjelasan tentang tugas yang Anda kerjakan selama PKL.

Bab IV - Penutup: Kesimpulan dan saran untuk tempat PKL atau siswa di masa depan.

2. Gunakan Bahasa yang Formal dan Jelas

Pastikan bahasa yang digunakan dalam laporan mudah dipahami, dengan tata bahasa yang benar.

3. Sertakan Dokumen Pendukung

Dokumen seperti surat keterangan magang, foto kegiatan, dan contoh tugas yang telah Anda kerjakan dapat disertakan sebagai lampiran.

4. Periksa Ulang Sebelum Diajukan

Sebelum menyerahkan laporan, pastikan tidak ada kesalahan pengetikan atau data yang keliru.

FAQ: Pertanyaan Seputar PKL SMK

Bagaimana cara memilih tempat PKL yang baik?

Sesuaikan dengan jurusan dan minat Anda.

Cari tempat dengan lingkungan kerja yang mendukung pembelajaran.

Diskusikan dengan guru atau pihak sekolah untuk mendapatkan rekomendasi tempat PKL yang berkualitas.

Apa manfaat PKL bagi siswa SMK?

PKL memberikan pengalaman kerja nyata, meningkatkan keterampilan teknis dan soft skills, serta membantu siswa membangun jaringan profesional yang penting untuk karier masa depan.

Bagaimana cara membuat laporan PKL SMK?

Ikuti format laporan yang ditentukan oleh sekolah.

Tuliskan pengalaman dan tugas selama PKL dengan rinci.

Gunakan bahasa formal, dan tambahkan dokumen pendukung seperti foto kegiatan.

Kesimpulan

Magang atau PKL adalah salah satu komponen penting dalam pendidikan SMK, khususnya bagi jurusan akuntansi. Dengan memilih tempat PKL di Bandung 2024 yang tepat, siswa dapat memaksimalkan pengalaman belajar mereka, mendapatkan wawasan tentang dunia kerja, dan mempersiapkan diri untuk masa depan.

Pastikan untuk melakukan riset mendalam, mempersiapkan dokumen yang diperlukan, dan menjalani PKL dengan penuh semangat. Pengalaman ini bukan hanya syarat kelulusan, tetapi juga bekal untuk perjalanan karier yang sukses. Selamat mencoba, dan semoga sukses!

baca juga artikel sebelumnya

#Tempat PKL Multimedia Gempolsari Bandung#Tempat PKL Informatika Gempolsari Bandung#PKL RPL Gempolsari Bandung#Tempat PKL Jurusan RPL Gempolsari Bandung#Tempat PKL Jurusan Multimedia Gempolsari Bandung#Lokasi PKL Gempolsari Bandung#Tempat PKL RPL Gempolsari Bandung#Tempat PKL Untuk Jurusan Multimedia Gempolsari Bandung#Tempat PKL Untuk Jurusan RPL Gempolsari Bandung#Lowongan Magang SMK Gempolsari Bandung

0 notes

Text

MYOB Assignment Help in Australia

MYOB assignment help in Australia offers students expert assistance with their MYOB assignments. Professional tutors provide guidance on accounting software, financial reporting, and business management tasks. These services ensure high-quality, plagiarism-free work tailored to meet academic requirements. MYOB assignment helps students improve their understanding and achieve better grades in their coursework.

0 notes

Text

0852-5756-6933, Tempat Magang AKL Malang

Tempat Magang AKL Malang: Peluang Belajar Akuntansi dan Keuangan jurusan Akuntansi dan Keuangan Lembaga (AKL) adalah salah satu bidang yang memiliki prospek karier cerah di masa depan. Salah satu cara terbaik untuk mengasah keterampilan dan mendapatkan pengalaman di dunia nyata adalah melalui program magang. Bagi mahasiswa AKL, kota Malang menawarkan berbagai tempat magang yang relevan dengan bidang ini. Dari perusahaan swasta, kantor akuntan publik, hingga lembaga pemerintahan, Malang menyediakan peluang magang yang dapat meningkatkan kompetensimu dalam akuntansi dan keuangan.

Manfaat Magang di Bidang AKL 1. Penerapan Teori Akuntansi di Dunia Nyata Di tempat magang AKL Malang, kamu akan memiliki kesempatan untuk menerapkan teori yang telah dipelajari di kelas ke dalam situasi nyata. Menggunakan software akuntansi seperti MYOB, Zahir, atau Accurate untuk melakukan pencatatan keuangan, laporan laba rugi, hingga neraca perusahaan menjadi bagian penting dari pengalaman ini. 2. Pemahaman Sistem Keuangan Magang di bidang AKL juga akan membantu kamu memahami lebih dalam tentang bagaimana sebuah perusahaan mengelola keuangan mereka. Kamu bisa belajar mengenai pengelolaan pajak, audit, serta proses anggaran yang mendukung kelangsungan bisnis. 3. Memperluas Jaringan dan Peluang Karier Selama magang, kamu tidak hanya mendapatkan pengetahuan teknis, tetapi juga memiliki kesempatan untuk membangun jaringan dengan profesional di industri akuntansi dan keuangan. Jaringan ini dapat membuka pintu untuk kesempatan karier di masa depan, baik sebagai akuntan, auditor, atau analis keuangan. 4. Portofolio Profesional Setiap tugas yang kamu selesaikan selama magang akan menambah portofolio profesionalmu. Ini akan sangat membantu ketika melamar pekerjaan nanti, karena portofolio menunjukkan bukti nyata dari kemampuanmu dalam akuntansi dan keuangan. Tempat Magang AKL di Malang Ada banyak perusahaan dan lembaga di Malang yang menawarkan program magang untuk mahasiswa AKL. Berikut beberapa tempat magang yang bisa kamu pertimbangkan: • Kantor Akuntan Publik (KAP): KAP di Malang sering kali membuka kesempatan magang bagi mahasiswa yang ingin belajar tentang audit, laporan keuangan, dan perpajakan. Pengalaman magang di sini sangat berharga karena berhubungan langsung dengan klien dari berbagai industri. • Perusahaan Manufaktur: Banyak perusahaan manufaktur di Malang yang membutuhkan bantuan di departemen keuangan dan akuntansi mereka. Ini adalah tempat yang tepat untuk belajar mengenai pengelolaan inventaris, pencatatan biaya produksi, dan pelaporan keuangan. • Perusahaan Ritel: Ritel besar di Malang juga menawarkan posisi magang di bidang keuangan. Kamu bisa belajar tentang pengelolaan arus kas, analisis penjualan, dan pencatatan transaksi keuangan harian. • Lembaga Pemerintahan: Lembaga seperti Badan Pengelolaan Keuangan Daerah (BPKD) atau Dinas Keuangan Pemerintah Daerah Malang juga kerap menawarkan program magang bagi mahasiswa AKL yang tertarik pada akuntansi pemerintahan dan manajemen anggaran publik. Dengan menjalani magang di bidang AKL, kamu bisa mendapatkan pengalaman berharga yang akan mempersiapkan dirimu lebih baik untuk memasuki dunia kerja. Pastikan kamu memilih tempat magang yang sesuai dengan minat dan rencana kariermu, sehingga pengalaman ini dapat memberikan dampak maksimal pada perkembangan profesionalmu. IMPro Digital Telp/WA: 0852-5756-6933 Telp/WA: 0852-5756-6933 Website: https://magangdi.improduk.com

0 notes