#USA accounting services

Explore tagged Tumblr posts

Text

#monthly bookkeeping services#bookkeeping services#bookkeeping services to USA#USA bookkeeping services#USA accounting services#bookkeeperlive#united states

0 notes

Text

Hey folks, friendly reminder that, even though I might be a queer leftist, I’m ALSO a born and raised country hick. If you’re out here posting that the folks out in west North Carolina (my home state) and the rest of Southern Appalachia somehow “deserved” the catastrophic damage that Helene brought, block me. I’m not asking you to block me for my own internet experience, I’m telling you that it is within your best interest to block me.

To the folks at home who are donating supplies, sharing links, or even just prayin’ or keeping those impacted in your hearts, I love you and appreciate your kindness. Please keep it up, if possible, this won’t be “fixed” in a week, in fact, it never will be. This is Katrina level, there are already 200 confirmed dead, and they haven’t even started looking for the deceased.

I hope everyone reading this has the day they deserve <3

#I apologize if there’s spelling mistakes#i wrote this real quick and it’s 4 am#also before anyone asks#so far my family is safe#the folks I know out west are mostly accounted for#and service is still down so i’m praying that the ones who aren’t just don’t have access to their phone right now#<3#helene#hurricane helene#helene aftermath#tropical storm helene#north carolina#southern appalachia#southern usa#yall means all#western north carolina#appalachia#my txt#important

36 notes

·

View notes

Text

https://iptvuniverse.store/

@onepiecegifs-blog @luffytarhoe

🏴☠️ Set Sail with One Piece – Now Streaming on Iptv Universe ⚓

Join Monkey D. Luffy and the Straw Hat Pirates on their epic adventure to find the legendary One Piece treasure and become the Pirate King! With unforgettable characters, jaw-dropping battles, and heartwarming moments, One Piece is the ultimate anime for fans of action, adventure, and friendship.

Why Watch One Piece on Iptv Universe ✅ All Episodes Available – Stream the entire saga, from East Blue to Wano, anytime you want. ✅ HD Quality Streaming – Watch every battle, transformation, and epic scene in stunning clarity. ✅ No Interruptions – Enjoy uninterrupted viewing with no ads. ✅ Affordable Pricing – Unlimited access to One Piece and thousands of other shows at unbeatable rates. ✅ Multi-Device Access – Stream on your phone, tablet, smart TV, or wherever you go.

⚔️ Don’t Miss the Adventure! Relive every iconic moment or start your journey from the beginning. One Piece is perfect for fans new and old!

📩 DM us or visit https://iptvuniverse.store/ to start streaming One Piece today!

#anime and manga#anime#anime manga#manga art#anime art#accounting#iptv subscription#arcane netflix#netflix series#netflix shows#tv shows#tv edits#tv series#iptv uk#best iptv#iptv usa#iptv service#netflix#one piece#one piece x reader#one piece luffy#monkey d luffy#manga#manga panel#shonen

4 notes

·

View notes

Text

Why Tax Advisory Services in USA Are Your Compass

The United States tax code is notoriously intricate, a labyrinth of rules and regulations that can leave even the most seasoned business owner or individual feeling lost. This is where tax advisory services in USA come in, acting as your trusted guide through the complexities of the tax landscape. Mercurius & Associates LLP (MAS), a leading provider of tax advisory services in USA, understands the unique challenges faced by individuals and businesses. We offer a comprehensive suite of services tailored to your specific needs, helping you:

Minimize Tax Burden: Our expert advisors analyze your financial situation and identify opportunities for tax optimization, ensuring you keep more of your hard-earned money. Stay Compliant: We navigate the ever-changing tax code on your behalf, ensuring your filings are accurate and timely, avoiding costly penalties and audits. Plan for the Future: Whether you're a growing startup or a seasoned entrepreneur, MAS helps you develop tax-efficient strategies for long-term success. Here are just a few ways MAS can assist you: International Tax Planning: We guide you through the complexities of cross-border transactions and investments, mitigating your global tax risk. Business Entity Structuring: We help you choose the optimal business structure for tax efficiency and asset protection. Mergers & Acquisitions: We advise on the tax implications of M&A transactions, ensuring a smooth and profitable process. Estate & Gift Tax Planning: We safeguard your legacy by developing strategies to minimize estate and gift taxes. But MAS goes beyond just numbers. We believe in building strong relationships with our clients, providing personalized attention and clear communication throughout the process. We're not just your tax advisors; we're your partners in financial success. Investing in tax advisory services in USA is an investment in your future. Choosing MAS means you gain access to a team of experienced professionals who are passionate about helping you achieve your financial goals. Ready to take control of your taxes and unlock your financial potential? Contact MAS today for a free consultation and discover how our Tax advisory services in USA can guide you through the maze of the US tax code.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Tax advisory services in USA

4 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

Top 3 Benefits of Outsourcing Accounting, USA - Centelli

Delegating accounting tasks to an expert accounting firm provides several advantages that alleviate the challenges of maintaining an internal department.

Here are the key benefits:

Cost-Effective: Outsourced accounting is often more economical than in-house operations. You save on hiring costs, salaries, benefits, office space, and administrative expenses, making it a resource-efficient choice.

Access to Diverse Expertise: Service providers offer access to a wide range of skilled experts, who handle tasks efficiently and accurately. Some accounting firms specialize in specific areas, offering tailored solutions to meet exact needs.

Optimize Internal Resources: Outsourcing frees up internal resources for key business activities like R&D and marketing. In-house employees can pursue innovation and strategic growth rather than get stuck in routine financial management tasks.

Contact us Now!

#Accounting Services#Outsourcing Services#Outsourced Accounting#Centelli#USA#Atlanta#QuickBooks Accounting#Sage Accounting#Accounting Firm

0 notes

Text

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

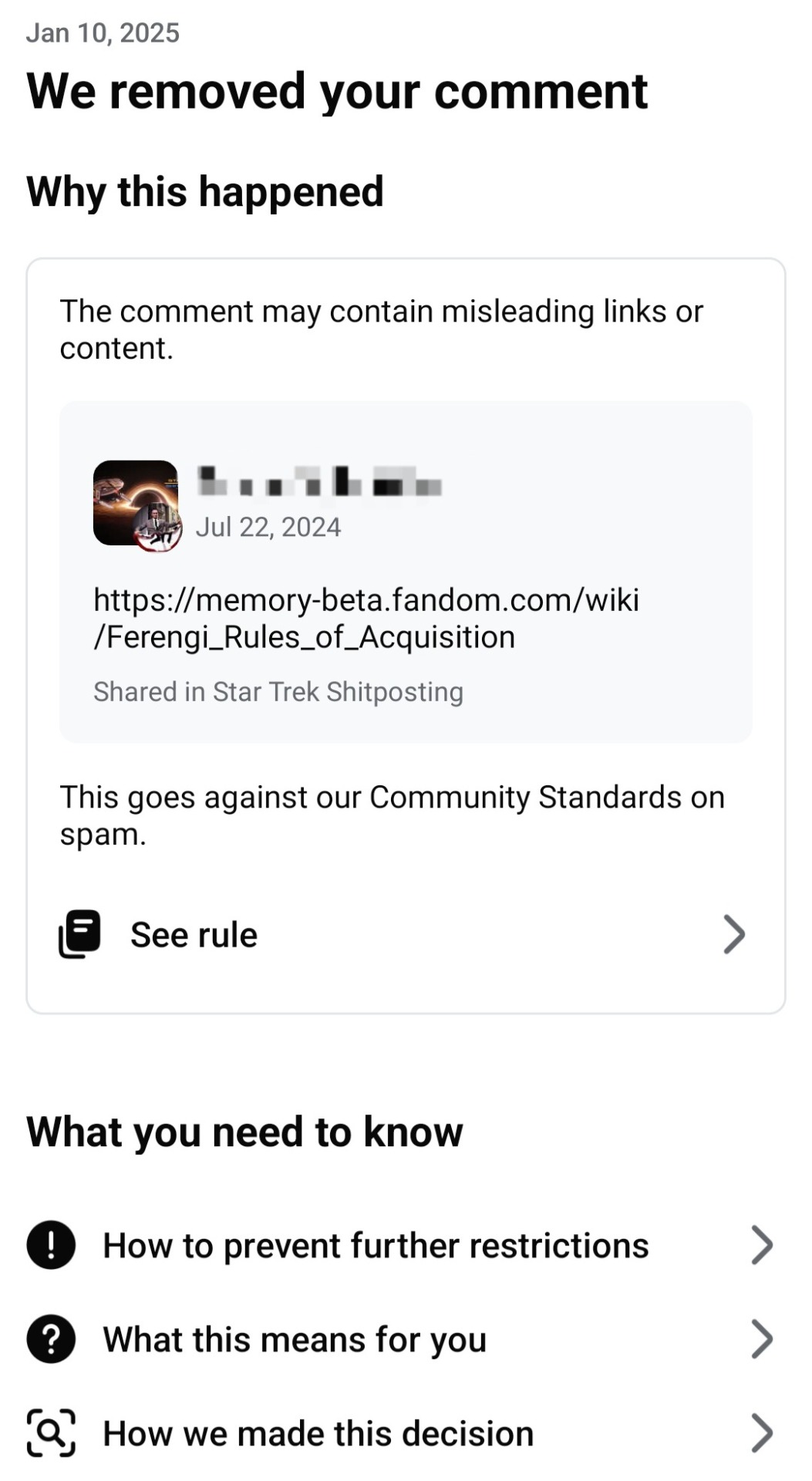

I don't have to explain the irony of this, surely

#its like one of those#jeff lee johnson#paintings where it just gets wilder the longer you look#like do i start with the fact it took then six months to find that comment#or do i start with the incredibly intense irony of “the rules of acquisition��� being against the meta terms of service somehow#or perhaps the fact that i linked to a star trek website in a star trek shitposting group so that's “spam”#but the ACTUAL SPAM is fine tho?????? ok#i'm in the process of downloading all my data actually in preparation for a full deletion#which sucks bc my account can legally drink alcohol in the usa now thats how old it is#FUCK YOU ZUC#star trek shitposting#is the only reason i was still there anyway so

0 notes

Text

Trusted Financial Management Outsourcing for Cost-Effective Business Success in the USA

Qualitas Accounting Inc has established itself as a trusted partner for businesses seeking exceptional accounting and financial solutions. With a team of seasoned professionals, the firm delivers a wide array of services tailored to meet the specific needs of clients across industries. From start-ups to established enterprises, Qualitas Accounting supports businesses on their financial journeys with precision, reliability, and innovation.

Their expertise lies in simplifying complex financial processes, ensuring compliance, and providing actionable insights to drive business growth. Whether it's optimizing daily bookkeeping tasks or offering strategic financial advice, their solutions are grounded in a deep understanding of modern business challenges. This commitment to quality and efficiency has made them a standout choice for businesses looking for personalized and dependable accounting services.

Professional Virtual CFO and Outsourced Bookkeeping Services for Scaling Small Businesses

Among their key offerings, Qualitas Accounting is recognized as one of the premier accounting firms Columbia MO, providing reliable services to support local businesses. For companies seeking efficient financial management, they serve as a leading bookkeeping outsourcing company USA, streamlining operations so organizations can focus on growth.

Expanding their reach across the nation, Qualitas Accounting excels in finance and accounting outsourcing USA, helping businesses achieve cost-effectiveness and improved productivity by leveraging their expertise. Additionally, they specialize in virtual CFO services USA, offering high-level strategic guidance and oversight for entrepreneurs who want to scale effectively while maintaining financial discipline.

Choosing Qualitas Accounting Inc means partnering with a firm dedicated to making your financial processes seamless and your goals achievable. With their comprehensive range of services and client-centric approach, Qualitas Accounting remains a trusted ally for businesses striving for financial success. Experience the difference with Qualitas Accounting Inc—reach out today to explore how their tailored solutions can elevate your business to new heights!

#accounting firms Columbia MO#bookkeeping outsourcing company USA#finance and accounting outsourcing USA#virtual CFO services USA

0 notes

Text

0 notes

Text

Optimize Your Business with Finance & Accounting Outsourcing Services (FAO) USA

Transform your financial operations with our expert finance and accounting outsourcing services USA. Our comprehensive FAO solutions are designed to enhance efficiency, reduce costs, and ensure accuracy in your financial processes. From bookkeeping and financial reporting to payroll management and tax compliance, we handle all aspects of finance and accounting.

Partner with us to streamline your financial workflows, improve cash flow management, and focus on your core business activities. Experience the benefits of professional finance and accounting outsourcing services today!

#FAO#Finance & Accounting#Finance & Accounting Outsourcing Services#USA#Business#business to business

0 notes

Text

Simplify Your Finances with Expert Accounting and Tax Consultancy

Managing your taxes and accounting can be overwhelming, especially with ever-changing regulations. Whether you're a business owner or an individual, hiring a professional tax consultant can save you time, money, and stress. From maximizing deductions to ensuring compliance, experts help streamline your financial journey.

If you're looking for reliable guidance, explore our services. Let us take the complexity out of taxes so you can focus on what matters most. To get the Best Tax consultant in USA please visit the link theaccountingandtax.com

#accounting#Tax consultant in Toronto#Best Tax consultant in Canada#Best Tax consultant in USA#Tax preparation expert in USA#Tax preparation expert in canada#Tax consultation service in Toronto#US Tax consultants in Toronto#Canadian Tax Consulting Service#International Tax Consultants in Toronto#Expats Tax Consultant in Toronto#tax consulting services

1 note

·

View note

Text

Forensic Accounting Services

Uncover hidden financial risks with Integrity One Solutions. We excel in investigations, finance, and regulations. So, we provide precise, tailored forensic accounting services. We help organizations protect their legal and reputational integrity with discretion and excellence. Contact us today to learn more.

#private investigator usa#private investigation services#certified forensic accountant#forensic accounting

1 note

·

View note

Text

How to File Taxes as a USA Citizen Living in Hyderabad

Introduction

As a US citizen living in Hyderabad, filing taxes can be a difficult but necessary task. Even if you live abroad, the United States government demands all citizens to disclose their worldwide income every year. Accelero Corporation specializes in providing USA Citizen Tax Services in Hyderabad, making it easy to manage this complex process while maintaining compliance and optimizing benefits. Here's a step-by-step method for filing taxes efficiently:

1. Determine Your Filing Requirement

If an individual's income exceeds the standard threshold for their filing status (single, married, head of household), they are required to file a tax return with the IRS. This includes all revenue earned in India. Self-employed people must file if they earn $400 or more each year.

2. Understand Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion (FEIE) allows U.S. expats to exclude up to $120,000 of foreign-earned income from taxable income, reducing double taxation. Eligibility requires meeting the Physical Presence or Bona Fide Residence Test criteria.

3. Claim the Foreign Tax Credit (FTC)

As an expat, you can also apply for the India Foreign Tax Credit in Hyderabad for taxes paid in India. This decreases your US tax responsibility, dollar for dollar, for taxes paid to the Indian government. Accelero Corporation ensures that you fully utilize this benefit while following to all requirements.

4. Report Foreign Bank Accounts

If the total value of your overseas financial accounts exceeds $10,000 at any point throughout the year, you must file an FBAR (overseas Bank Account Report) on FinCEN Form 114. Failure to comply can result in significant penalties.

5. Comply with FATCA Requirements

Under the Foreign Account Tax Compliance Act (FATCA), you may additionally be required to report certain financial assets on IRS Form 8938 if they exceed certain criteria.

6. Gather Required Documents

Prepare relevant paperwork, including

Form W-2 (if appropriate).

Form 1099 for Additional Income

Foreign income statements and Indian tax returns.

Bank Statements for FBAR Compliance

7. Seek Professional Help

Filing taxes as an American citizen living abroad requires education. Accelero Corporation provides complete USA Citizen Tax Services in Hyderabad to help you organize your documents. Our team ensures accurate reporting, compliance with US and Indian tax requirements, and maximizing tax benefits.

Conclusion

Filing taxes as a U.S. citizen in Hyderabad need not be a daunting task. Accelero Corporation is your trusted partner, streamlining the process and ensuring full compliance while optimizing benefits like the India Foreign Tax Credit. Contact us today to make tax season stress-free!

#USA INDIA Taxes#USA Citizen Tax Services in Hyderabad#Green Card Holder Taxes#Expat Tax Services#Expat Tax Services in Hyderabad#USA Tax Service In Hyderabad#USA Tax Filer In India#USA Tax filer In India Green Card Holder#India Foreign Tax Credit in Hyderabad#India Foreign Tax Credit Accounting Solution

0 notes

Text

Amazon DSP Solutions in USA: A Strategic Advantage for Delivery Service Partners

In today’s fast-paced logistics landscape, Amazon DSP Solutions in the USA have become essential for businesses looking to excel in the competitive delivery space. With Amazon's Delivery Service Partner (DSP) program, entrepreneurs across the country have been able to build and operate their own delivery fleets while benefiting from Amazon’s global reputation and established infrastructure. However, to effectively manage a growing delivery business, DSPs require robust, specialized solutions to handle the complexities of operations, workforce management, and financial planning.

This blog explores how Amazon DSP solutions in the USA are transforming the logistics industry by addressing the unique needs of DSP owners. From recruitment and payroll to accounting and operational efficiency, the right solutions can help DSPs streamline operations, minimize overhead costs, and drive long-term growth.

What Are Amazon DSP Solutions and Why Are They Crucial?

The Amazon DSP program provides entrepreneurs with the tools and support needed to manage last-mile delivery operations. As part of the program, DSP owners are responsible for managing a fleet of delivery vans, a team of drivers, and ensuring that deliveries are made on time. However, this can be a daunting task, especially for new business owners who may not have the expertise to manage large-scale operations.

Amazon DSP solutions help alleviate these challenges by offering a range of services that optimize business processes. These solutions include payroll management, HR recruitment, accounting software, and tools for route optimization. By incorporating these solutions, DSP owners can focus more on their core business operations and less on the administrative tasks that can be time-consuming and prone to errors.

Understanding the Core Components of Amazon DSP Solutions

1. Payroll Solutions for Amazon DSPs

Payroll management is a complex task, especially for DSP owners who employ a large number of drivers and support staff. Ensuring timely and accurate payments, complying with tax regulations, and managing employee benefits are just a few of the challenges DSPs face.

Amazon DSP solutions streamline payroll by automating calculations, managing taxes, and generating detailed reports for easy tracking. These systems help DSP owners reduce errors, minimize administrative overhead, and improve employee satisfaction by ensuring that workers are paid on time and in compliance with regulations.

2. HR and Recruitment Tools for Efficient Workforce Management

Recruiting and retaining a reliable team is a key factor in the success of an Amazon DSP. The recruitment process for delivery drivers, operations staff, and supervisors can be cumbersome, especially when dealing with a high turnover rate.

Amazon DSP HR solutions provide DSP owners with the tools to attract top talent, conduct interviews, manage employee onboarding, and ensure compliance with labor laws. By streamlining the recruitment process, DSPs can reduce the time spent on hiring and focus more on improving their service quality and growing their businesses.

3. Accounting and Financial Management Solutions

Managing finances is critical for any business, and for DSPs, it involves handling a multitude of expenses, from vehicle maintenance and fuel costs to employee wages and administrative overheads. Amazon DSP accounting solutions provide the tools to automate financial tasks, track cash flow, and ensure accurate bookkeeping.

With these solutions, DSP owners can generate financial reports, analyze profitability, and stay on top of tax obligations, ultimately leading to better decision-making and financial control. Additionally, automated invoicing and expense tracking reduce the risk of human error and improve operational efficiency.

4. Operational Efficiency and Route Optimization

Efficient route planning is essential for ensuring timely deliveries and minimizing operational costs. Amazon DSP owners can benefit from route optimization solutions that use real-time data and analytics to plan the most efficient delivery routes.

These systems consider factors such as traffic conditions, weather, and delivery windows to help DSP owners reduce fuel consumption, improve delivery times, and increase the overall productivity of their fleet. By optimizing delivery routes, DSPs can provide better customer service while minimizing operational costs.

Benefits of Amazon DSP Solutions in the USA

Implementing Amazon DSP solutions offers several advantages that can significantly enhance the operations of a delivery service provider:

1. Scalability and Growth

As your Amazon DSP business grows, the operational complexities increase. With the right solutions in place, DSPs can scale their operations quickly and efficiently. Whether it’s expanding your fleet, hiring more drivers, or managing a larger volume of deliveries, Amazon DSP solutions allow business owners to manage growth without facing overwhelming challenges.

2. Cost Reduction

By automating payroll, accounting, and HR tasks, DSP owners can reduce administrative costs and avoid errors that may result in financial penalties. Additionally, route optimization reduces fuel and vehicle maintenance costs, further improving the bottom line. These cost-saving measures allow DSPs to invest more in business growth and employee welfare.

3. Time Efficiency and Streamlined Operations

One of the primary benefits of Amazon DSP solutions is the amount of time saved in managing day-to-day operations. Automation of key processes like payroll and accounting frees up time for DSP owners to focus on other important aspects of their business, such as improving delivery efficiency, enhancing customer satisfaction, and managing business growth.

4. Enhanced Compliance

Compliance with local, state, and federal regulations is critical for any business, particularly in the transportation and logistics industry. Amazon DSP solutions help ensure that your business complies with tax laws, labor regulations, and safety standards. Automated reporting tools simplify compliance tasks, reducing the risk of fines or penalties.

Challenges Faced by DSPs and How Amazon DSP Solutions Help Overcome Them

Despite the numerous benefits, DSPs often face several challenges that can hinder their success. Some common obstacles include:

1. High Employee Turnover

Delivery businesses are prone to high turnover rates, particularly among drivers. However, implementing an efficient HR and recruitment system can help reduce turnover by attracting and retaining top talent.

2. Complex Payroll Management

Managing payroll for a large workforce is no easy task. Automated payroll systems provided by Amazon DSP solutions ensure accurate and timely payments, reducing the risk of errors and compliance issues.

3. Operational Inefficiencies

Inefficient delivery routes, underutilized vehicles, and unnecessary downtime can reduce profitability. Route optimization tools help DSP owners streamline operations, improving delivery efficiency and reducing costs.

4. Lack of Real-Time Data and Insights

Without access to real-time data, DSP owners may struggle to make informed decisions. Advanced tracking and reporting systems provide valuable insights into business performance, helping owners make data-driven decisions.

How to Choose the Right Amazon DSP Solutions Provider

Selecting the right solution provider for your Amazon DSP needs is crucial for the success of your business. Here are some factors to consider when choosing a provider:

1. Customization and Flexibility

Look for a provider that offers customizable solutions tailored to the specific needs of your business. Your solution should be able to grow with you as your business expands.

2. Technology and Integration

Ensure that the solution provider uses advanced technology that integrates seamlessly with your existing systems. This will make it easier to manage your operations and reduce downtime during the transition.

3. Customer Support and Training

Choose a provider that offers excellent customer support and training resources. You should be able to access help when needed, and your team should be trained to use the solutions effectively.

4. Reputation and Reviews

Research the provider’s reputation and customer reviews. Look for providers who have a proven track record of success and positive feedback from other Amazon DSP owners.

Conclusion: Empowering DSPs with the Right Solutions

Amazon DSP solutions in the USA provide critical support for delivery service partners, helping them manage the complexities of operations, payroll, recruitment, and financial management. By leveraging specialized tools and systems, DSP owners can improve efficiency, reduce costs, and scale their businesses more effectively.

From HR and payroll to route optimization and accounting, the right DSP solutions empower owners to navigate the challenges of running a delivery business with ease. By implementing these solutions, DSPs can focus on growth, customer satisfaction, and profitability, ultimately thriving in the competitive logistics industry.

FAQs

What services are included in Amazon DSP solutions?

Amazon DSP solutions include payroll management, HR recruitment, accounting, financial reporting, route optimization, and operational oversight tools.

How do Amazon DSP solutions improve efficiency?

These solutions automate tasks like payroll and accounting, streamline HR processes, and optimize delivery routes, allowing DSP owners to save time and reduce costs.

Can Amazon DSP solutions help me scale my business?

Yes, these solutions are scalable and customizable, allowing DSPs to expand their operations without overwhelming their resources.

What are the benefits of using automated payroll systems for Amazon DSPs?

Automated payroll systems reduce errors, ensure compliance, and save time, allowing DSP owners to focus on other important aspects of their business.

How do route optimization tools benefit my Amazon DSP business?

Route optimization tools improve delivery efficiency, reduce fuel costs, and enhance customer satisfaction by ensuring timely deliveries.

Also read: Amazon DSP Solutions in USA

#newfleet#amazondsp#accounting solutions#payroll#virtual cfo#virtual cfo services#amazon dsp#recruiting solutions#logistic#bpo services#amazon dsp solutions in usa

0 notes

Text

Benefits of Outsourcing Accounting Services in Atlanta, USA - Centelli

Top 3 Benefits of Outsourcing Accounting

Delegating accounting tasks to an expert accounting firm provides several advantages that alleviate the challenges of maintaining an internal department.

Here are the key benefits:

Cost-Effective: Outsourced accounting is often more economical than in-house operations. You save on hiring costs, salaries, benefits, office space, and administrative expenses, making it a resource-efficient choice.

Access to Diverse Expertise: Service providers offer access to a wide range of skilled experts, who handle tasks efficiently and accurately. Some accounting firms specialize in specific areas, offering tailored solutions to meet exact needs.

Optimize Internal Resources: Outsourcing frees up internal resources for key business activities like R&D and marketing. In-house employees can pursue innovation and strategic growth rather than get stuck in routine financial management tasks.

Signing Up Accounting Firms in Atlanta or Elsewhere!

Outsourcing accounting and bookkeeping enables businesses to focus on core activities, effectively redirecting resources toward innovation and revenue-generating tasks. Moreover, it prevents in-house teams from being overwhelmed while ensuring access to expert support.

Whether you’re considering outsourced accounting firms in Atlanta or elsewhere in the U.S., a skilled provider can lighten your workload, saving valuable time and effort in today’s fast-paced business climate.

In addition, outsourcing helps streamline your accounting costs, contributing to greater efficiency along the way!

#Accounting Services#Outsourcing Services#Outsourced Accounting#Centelli#Atlanta#USA#Hire Accountant#QuickBooks Services#Sage Services

0 notes