#Trade Based Money Laundering red flag automation

Explore tagged Tumblr posts

Text

ClearTrade®: A Comprehensive Solution for Trade Finance

ClearTrade from Cleareye.ai is an innovative platform that automates trade finance operations using OCR, ML, and NLP technologies. This advanced solution improves accuracy and efficiency in trade document management.

Trade Finance Challenges Today

Trade finance is crucial for global trade but is plagued by challenges. Regulatory compliance, preventing trade-based money laundering (TBML), and detecting dual-use goods are major concerns. The need for reliable document examination software and sanctions screening tools adds further complexity to trade operations.

Significance and Impact of Challenges

These challenges have a significant impact on trade finance operations, leading to higher costs and inefficiencies. Non-compliance can result in severe penalties, while manual processes introduce errors and delays. Addressing these issues is essential for maintaining smooth and cost-effective operations.

ClearTrade Solutions

ClearTrade offers comprehensive solutions to these challenges:

Trade Finance Automation: Streamlines document processing, enhancing efficiency and reducing errors.

Trade Compliance Solutions: Ensures adherence to regulatory requirements, mitigating legal risks.

Document Examination Software: Facilitates accurate classification and extraction of trade documents.

Sanctions Screening Tools: Identifies and mitigates potential risks, ensuring secure transactions.

Trade Based Money Laundering Red Flag Automation: Detects and prevents TBML activities, safeguarding financial institutions.

Conclusion

ClearTrade® stands out as the optimal solution for trade finance operations, offering significant operational savings and ensuring regulatory compliance. To explore how ClearTrade can transform your trade finance operations, visit ClearTrade.

#trade finance automation#document examination software#sanctions screening tools#Trade Based Money Laundering red flag automation#Trade Operational Challenges#Trade Standardization#sanctions screening tool#detection of dual-use goods#Cleareye#ClearTrade#Cleareye.ai#Trade Finance

0 notes

Text

Transforming Trade Finance: How Cleareye.ai Addresses Industry Challenges with Advanced AI Solutions

The trade finance industry is a vital component of global commerce, facilitating the movement of goods and services across borders. However, it is also an industry beset with challenges. From operational inefficiencies and compliance scrutiny to workforce shortages and rising costs, trade finance institutions face numerous hurdles. Cleareye.ai offers advanced AI-driven solutions to address these challenges, revolutionizing the way financial institutions operate and ensuring they remain competitive in an increasingly complex environment.

Operational Challenges: Overcoming Inefficiencies

The trade finance industry has long been burdened by manual processes and paper-based workflows. These traditional methods lead to significant inefficiencies and increase the risk of human error. Tasks such as data entry, document examination, and decision-making are labor-intensive and prone to mistakes. As a result, financial institutions face potential losses and delays, impacting their ability to serve clients effectively.

Cleareye.ai’s Digitization module offers a powerful solution to these operational challenges. By leveraging advanced Optical Character Recognition (OCR), Machine Learning (ML), and Natural Language Processing (NLP) algorithms, Cleareye.ai automates the classification and extraction of unstructured data from trade documents. This automation reduces errors, improves efficiency, and enables faster, more accurate transaction processing. With Cleareye.ai, financial institutions can streamline their operations, reduce manual workloads, and enhance overall productivity.

Compliance Challenges: Navigating Regulatory Complexities

Compliance is a critical aspect of trade finance, with financial institutions facing an ever-changing and increasingly complex regulatory landscape. Manual processes struggle to keep up with the demands of thorough compliance and auditability. The risk of non-compliance is high, with severe penalties and reputational damage at stake.

Cleareye.ai addresses these compliance challenges through its Compliance & Trade Based Money Laundering (TBML) module. This module automates the identification of TBML red flags, fair price, dual-use, and high-risk goods. Additionally, the Sanctions Screening module enhances compliance by using comprehensive noun extraction and eliminating duplicates, ensuring efficient and accurate sanctions screening. By automating these critical processes, Cleareye.ai helps financial institutions stay ahead of regulatory requirements and mitigate compliance risks.

Workforce Challenges: Bridging the Talent Gap

The trade finance industry is also grappling with a shrinking workforce. High turnover rates and the retirement of experienced professionals have created a talent gap. Those who remain possess specialized skills that are difficult to replace, making it challenging for institutions to maintain consistent and accurate operations.

Cleareye.ai’s Automated Document Examination module offers a solution to this workforce challenge. By automating document checks and enforcing examination rules, Cleareye.ai reduces dependency on human expertise. The module leverages a dynamic rules engine that adheres to industry standards such as UCP, ISBP, URC, and URDG rules. This ensures consistent and accurate document handling, even with a reduced workforce. Financial institutions can rely on Cleareye.ai to maintain high standards of document examination without being constrained by workforce limitations.

Cost Challenges: Managing Rising Costs

Rising costs are a significant concern for trade finance institutions. Maintaining manual compliance screening teams and managing manual processes come with substantial expenses. As the cost base increases, it becomes increasingly challenging for institutions to remain competitive and profitable.

Cleareye.ai’s modular design allows for seamless integration of various solutions, including Digitization, Sanctions Screening, Compliance, TBML, and Auto Document Examination. This integration reduces costs by streamlining operations and enhancing efficiency. By automating labor-intensive tasks and reducing the need for large manual compliance teams, Cleareye.ai helps financial institutions control costs and improve their bottom line. Institutions can achieve greater operational efficiency while maintaining high standards of compliance and risk management.

Cleareye.ai: The Differentiators

Cleareye.ai stands out in the trade finance industry due to several key differentiators that set it apart from other solutions. These differentiators highlight the unique capabilities and advantages of Cleareye.ai, making it the ideal choice for financial institutions seeking to overcome industry challenges.

Streamlined Modular Design: Cleareye.ai's solutions are designed for seamless integration with existing systems. The modular approach allows financial institutions to adopt specific solutions based on their needs, ensuring a smooth transition and minimal disruption to operations. Whether it’s Digitization, Sanctions Screening, Compliance, TBML, or Auto Document Examination, Cleareye.ai’s modules work cohesively with existing infrastructure.

Comprehensive TBML Module: The TBML module is empowered with multiple checks for enhanced maritime intelligence, detection of dual-use goods, embargoes, and automated transactional red flags. This comprehensive approach ensures thorough monitoring and mitigation of trade-based money laundering risks, enhancing the institution’s overall compliance posture.

Intelligent Noun Extraction Process: Cleareye.ai employs an intelligent noun extraction process that drives sanctions screening efficiency by reducing false hits by up to 70%. This process ensures more accurate and reliable results, minimizing the risk of overlooking critical sanctions-related information and improving overall screening effectiveness.

Dynamic Rules Engine: Cleareye.ai’s dynamic rules engine adheres to International Chamber of Commerce (ICC) defined rules for various trade products. It allows for customization of bank-specific business rules by operational users, ensuring flexibility and alignment with specific institutional requirements. The engine ensures that all transactions are processed according to industry standards and best practices.

Intelligent Interpretation: Cleareye.ai’s solutions recognize and interpret Letter of Credit (LC) clauses (46A, 47A) and cross-verify them against ICC rules and associated documents. This intelligent interpretation ensures compliance with industry standards and reduces the risk of errors in document processing and transaction execution.

Seamless Integration Capabilities: Cleareye.ai's solutions are designed for easy integration with core banking systems, trade finance platforms, and other workflow systems within the bank. This seamless integration capability ensures that financial institutions can leverage Cleareye.ai’s advanced solutions without significant changes to their existing infrastructure.

Conclusion

The trade finance industry is at a critical juncture, facing significant challenges that require innovative solutions. Cleareye.ai is leading the transformation of trade finance with its advanced AI-driven solutions. By addressing operational inefficiencies, ensuring regulatory compliance, bridging the workforce talent gap, and managing rising costs, Cleareye.ai empowers financial institutions to streamline their operations and remain competitive.

Cleareye.ai’s unique differentiators, including its streamlined modular design, comprehensive TBML module, intelligent noun extraction process, dynamic rules engine, intelligent interpretation, and seamless integration capabilities, make it the ideal choice for financial institutions seeking to overcome industry challenges. As the trade finance landscape continues to evolve, Cleareye.ai remains at the forefront, driving innovation and efficiency.

In an industry where accuracy, efficiency, and compliance are paramount, Cleareye.ai solutions offer a strategic advantage. Financial institutions can rely on Cleareye.ai to enhance their operations, mitigate risks, and achieve sustainable growth. With Cleareye.ai, the future of trade finance is not just promising—it’s transformative.

#trade finance#cleareye#cleareye.ai#trade finance automation#cleartrade#clear trade#simplified banking#simplifying trade finance

0 notes

Text

Common Anti-Money Laundering Compliance Challenges in The UAE

The UAE's financial oasis glitters with opportunity but also attracts those seeking to "wash" dirty money. Businesses here face unique AML hurdles:

High-volume transactions and cash-loving industries: From dazzling diamonds to desert getaways, the UAE thrives on big numbers. But these can cloak illicit funds, making it tough to spot suspicious activity amidst the bustle.

Murky ownership structures: With free zones galore and company registers scattered across emirates, uncovering true owners can be like digging for hidden treasure. This hinders thorough KYC checks and identifying risky Politically Exposed Persons (PEPs).

Trade's treacherous waters: The UAE's trade network can be exploited for "Trade-Based Money Laundering" (TBML). Fake invoices and smuggled goods are just a few tricks used to disguise dirty money as legitimate trade. Spotting these red flags requires sharp eyes and specialized know-how.

Resource ripples: Robust AML programs don't come cheap, demanding dedicated staff, sophisticated tech, and continuous training. For smaller businesses, this can be a hefty anchor, forcing them to choose between compliance and survival.

Shifting sands of regulation: Like desert dunes, AML regulations constantly reshape. Keeping up with these changes can be a whirlwind, leaving businesses vulnerable if their compliance programs get buried in the sand.

Building a Fortress against Financial Crime:

Conquering these challenges requires a strategic toolkit:

AI-powered tech: Let robots do the heavy lifting! Automated KYC/CDD checks, transaction monitoring, and PEP identification free up your team for more strategic tasks.

Invest in expertise: Build a team of AML ninjas or partner with consultants. Knowledge is power when it comes to navigating the complexities of financial crime.

Risk-based approach: Prioritize! Focus your resources on high-risk customers and transactions, leaving the low-risk sandcastles alone.

Information is key: Share intelligence and best practices with authorities and fellow businesses. Teamwork makes the AML dream work!

Stay ever-vigilant: Be a desert nomad, constantly adapting your compliance program to the shifting regulatory landscape.

By acknowledging the UAE's unique AML challenges and adopting these proactive measures, businesses can build a solid defense against financial crime. Remember, a robust AML program isn't just a box to tick, it's a shield protecting your business from the ever-evolving storm of financial crime.

0 notes

Text

MTFE Trading Review: Legit or Another Scam?

In the world of online trading, it is crucial to distinguish between legitimate brokers and fraudulent entities. One such broker that has garnered attention is MTFE Trading. In this post, we will be doing an MTFE Trading review and will examine its legitimacy and uncover the truth of whether MTFE Trading is real or fake.

What is MTFE?

MTFE Trading, also known as Metaverse Foreign Exchange Group, is a mobile platform that allows investors to trade various financial assets using automated artificial intelligence. The app is available for both Android and iOS devices and offers a range of features that make it an attractive tool for investors. In this review, we will take a closer look at MTFE and evaluate its legitimacy as a broker.

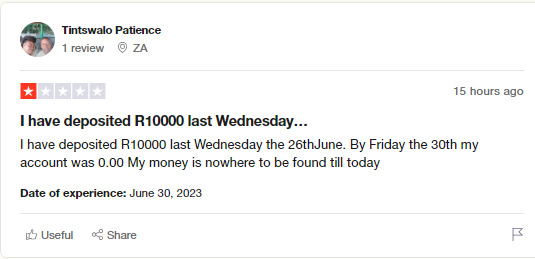

MTFE offers a range of trading options. Users can trade currencies on the Forex market, commodities, indices, stocks, and cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Dogecoin, Polkadot, Bitcoin Cash, and BNB. T he minimum deposit is $25. MTFE claims to be a regulated broker authorized by Fintrac, which is the Financial Transactions and Reports Analysis Centre of Canada. However, upon further investigation, it becomes clear that this claim is misleading. Fintrac is not a regulatory body for brokers or financial companies. Its primary role is to facilitate the detection, prevention, and deterrence of money laundering and the financing of terrorist activities. The MTFE app has around 1 million+ downloads on Google Play Store and the domain Mtfe.ca has around 170k+ monthly traffic. Read: Versobot.net Review Website Profile WebsiteMtfe.caKnown asMTFE (Metaverse Foreign Exchange Group)Site typeInvestment SchemeProducts OfferedTrading Domain registration date12 December 2021AddressOntario, CanadContact e-mailNot known Read: G7FX.com Review MTFE Review Based on our report and user review, it is found that the platform is not trustable. However many users gave a positive review about MTFE but still there are some major red flags to consider before investing in MTFE Trading. - Lack of authorization or proof of regulatory approval - Misleading claims about the regulatory status - High-risk investments or schemes - Suspicious and unregulated trading practices - Lack of transparency in operations and fees - Poor customer reviews on Trustpilot - Ponzi scheme model - Lack of transparency in the broker's ownership and management

These all red flags suggest that one should stay away from this scam. Read: Star-Clicks Review FAQs From Which Country MTFE is Operating?MTFE is based in Ontario, Canada.Is MTFE Trading legal in India?No, MTFE Trading is not legally authorized to operate in India. Is MTFE Trading safe?no MTFE Trading is not safe for investment. There are numerous red flags about this platform.Is MTFE Trading Real or Fake?No, MTFE Trading is not legitimate. However, the platform is still paying and operating without any fraud warning. Read: Rivera Vs Google Settlement Legit? Read the full article

0 notes