#Top cryptocurrency services

Explore tagged Tumblr posts

Text

Best Cryptocurrencies and Top Cryptocurrency Services for 2024

Explore the best cryptocurrencies to invest in for 2024, including Bitcoin, Ethereum, and Solana. Learn about essential cryptocurrency services such as exchanges, wallets, DeFi platforms, and custodial services that help investors and businesses securely manage and grow their digital assets. Discover how to navigate the evolving crypto landscape with the right tools and strategies.

0 notes

Text

Crypto Tokens: The New Shade of Lifestyle

#Crypto tokens are digital assets that use cryptography to secure their transactions and to control the creation of new units. Crypto tokens#Crypto tokens are created through a process called “tokenization.” In tokenization#a company converts some of its assets into digital tokens that can be traded on a blockchain. These tokens can represent anything from the#Crypto power up the Dapps#Crypto tokens are often used to power dapps. Dapps are applications that are built on top of a blockchain platform. These applications use#a company might issue tokens that represent shares of its stock. These tokens can be traded on a blockchain and can be used to purchase pro#What are the benefits of using crypto tokens?#Crypto tokens offer a number of benefits over traditional cryptocurrencies. They are easier to use and can be integrated into a variety of#crypto tokens offer a number of benefits to businesses#including faster transactions and lower costs.#Tokens improve your lifestyle#In the modern world#people are always looking for new and innovative ways to improve their lifestyles. One of the latest trends in the use of crypto tokens to#including:#Paying for goods and services: Crypto tokens can be used to pay for goods and services#both online and offline. This makes it easy to purchase items without having to use a traditional currency.#Reducing transaction costs: The use of crypto tokens can help to reduce transaction costs#as there are no fees associated with the use of tokens. This can save you money when you are making purchases online or in-store.#Earning rewards: Many crypto tokens offer rewards for their users. This can include discounts on products or services or bonus points that#Improving security: One of the main advantages of using crypto tokens is the increased security that they offer. Tokens are stored on block#which is a secure and tamper-proof system. This makes it difficult for criminals to steal your tokens or access your information.#Choose the right token for your lifestyle#So#how can you start using crypto tokens to improve your lifestyle? There are a number of options available#so it’s important to do your research and find the right token for you.

3 notes

·

View notes

Text

Comparing Crypto Loans and Traditional Loans in a Crypto Exchange Platform

The financial landscape is evolving, and crypto exchange platforms now offer a range of services that go beyond simple trading. One of the most significant additions is crypto loans—a borrowing model that differs in many ways from traditional loans. Both crypto and traditional loans provide unique benefits, yet each caters to different borrower needs. This blog delves into the fundamental differences between crypto loans and traditional loans in the context of crypto exchange platform development, and how these options compare in terms of accessibility, security, and repayment.

Understanding Crypto Loans and Traditional Loans

Before comparing, it’s essential to understand the basics:

Crypto Loans: Issued through a crypto exchange platform or DeFi protocol, crypto loans allow users to borrow funds by using their crypto assets as collateral. These loans often don’t require credit checks and can be accessed globally. Borrowers pledge digital assets like Bitcoin or Ethereum and receive a loan in either cryptocurrency or fiat.

Traditional Loans: Offered by banks or financial institutions, traditional loans involve credit history checks, income verification, and asset-backed or unsecured loans. The approval process typically requires physical or documented assets as collateral or a solid credit profile for an unsecured loan.

Key Differences Between Crypto Loans and Traditional Loans on a Crypto Exchange Platform

1. Accessibility and Eligibility

Crypto LoansCrypto loans are highly accessible to anyone holding crypto assets. Thanks to crypto exchange platform development, users worldwide can access loans without needing credit checks, as the loan amount is based on the value of the pledged crypto. This global accessibility opens doors for users in underbanked regions or those lacking traditional financial credentials.

Traditional LoansTraditional loans require rigorous credit checks, income verification, and residency documentation. These criteria often restrict access, especially for those without a strong credit history. Furthermore, traditional loans are typically available only to residents in specific jurisdictions, limiting access for users without established banking relationships.

2. Collateral Requirements

Crypto LoansCrypto loans are secured through digital assets as collateral, which remains in the borrower’s control but is locked until repayment. If the borrower defaults, the platform may liquidate the crypto to recover funds. Major cryptocurrencies like Bitcoin and Ethereum are often accepted, and borrowers enjoy the flexibility of retaining ownership while leveraging their crypto.

Traditional LoansTraditional loans may require physical assets, such as property or vehicles, as collateral. Although some loans can be unsecured, they typically demand high credit scores and financial stability. Collateral types vary widely across institutions and can be tailored based on the borrower’s financial standing.

3. Approval Process

Crypto LoansCrypto loan approvals are quick and generally automated, thanks to smart contracts that assess collateral and approve the loan instantly. Crypto exchange platforms can disburse funds rapidly without the need for extensive documentation, making crypto loans attractive to those who need funds urgently.

Traditional LoansTraditional loans involve more thorough evaluations, including credit checks, financial statements, and employment verification. This process can be lengthy, taking days or even weeks, as it involves both automated and manual verification. While this offers more thorough risk assessment for lenders, it can be frustrating for borrowers needing immediate funds.

4. Interest Rates and Fees

Crypto LoansInterest rates for crypto loans are often competitive and vary based on collateral and market conditions. Crypto exchange platform development has enabled platforms to offer flexible terms for loans, particularly those backed by stablecoins. However, crypto’s volatile nature means that these loans can incur higher fees during market fluctuations.

Traditional LoansInterest rates on traditional loans largely depend on the borrower’s credit score, market conditions, and loan type. Well-qualified borrowers with high credit scores generally receive favorable rates, but lower scores may result in higher rates and additional fees. Traditional loans may also include fees such as origination, processing, and penalties for early repayment.

5. Loan Repayment and Liquidation Risk

Crypto LoansCrypto loans are often more flexible in repayment options, allowing borrowers to pay interest only or adjust repayment schedules. However, because cryptocurrencies are volatile, the collateral value can fluctuate. A drop in collateral value below a certain threshold (known as a margin call) may prompt liquidation, making it essential for borrowers to monitor their loan-to-value (LTV) ratios closely.

Traditional LoansTraditional loans offer structured repayment schedules, with fixed or variable monthly payments. Collateral liquidation is usually limited to default cases, providing borrowers a more stable repayment environment. Lenders offer flexible repayment terms, but they’re typically fixed and set at the start of the loan, which gives borrowers a clear repayment plan.

6. Security and Privacy

Crypto LoansOn a crypto exchange platform, loans are generally secured through smart contracts, which automate loan terms and reduce human involvement, enhancing privacy. Crypto exchange platform development prioritizes secure transaction handling on the blockchain, meaning personal data is often unnecessary for crypto loans, giving borrowers more privacy.

Traditional LoansTraditional loans require extensive personal information, from income details to residency, and store these on private servers. While banks employ strong security measures, centralization makes data more vulnerable to breaches. Although secure, traditional loans demand more user data, which can be a concern for privacy-focused borrowers.

7. Global Reach and Regulatory Compliance

Crypto LoansCrypto loans are accessible on global platforms without geographic restrictions. However, the decentralized nature of crypto loans means that regulatory compliance can vary. Developers in crypto exchange platform development must stay informed on international and regional regulations to ensure platform compliance across borders.

Traditional LoansTraditional loans are bound by local regulations, offering strong legal protections but limiting access to specific regions. This framework benefits borrowers in regulated environments, yet it restricts access for individuals outside the jurisdiction of the lender.

Which Loan Type is Right for You?

Choosing between a crypto loan and a traditional loan depends on personal financial needs and resources:

Crypto Loans: Ideal for crypto holders who need immediate funds, want global access, or prefer fewer credit checks. They offer flexibility, fast approvals, and privacy but come with liquidation risks due to crypto’s volatility.

Traditional Loans: Better suited for borrowers with strong credit scores and stable financial profiles, seeking predictable interest rates and repayment terms. Traditional loans offer the stability of regulated financial services, particularly beneficial for large, structured loans.

Conclusion

Crypto loans and traditional loans each offer unique benefits suited to different types of borrowers. Crypto loans, driven by advancements in crypto exchange platform development, provide flexibility, accessibility, and privacy that attract modern, global users. Meanwhile, traditional loans offer the security, structure, and reliability favored by those looking for long-term, stable borrowing solutions.

As financial technology evolves, crypto and traditional loans will continue to play essential roles, with crypto exchange platforms bridging the gap between these options. Whether you’re a seasoned crypto holder or prefer conventional financial services, understanding these differences can help you make informed borrowing decisions on a secure, compliant platform.

#crypto exchange development company#crypto exchange platform development company#White Label Crypto Exchange Development#Top Crypto Exchange Development Company#Crypto exchange developers in India#Cryptocurrency Exchange Development Service#crypto exchange platform development#crypto exchange software development

0 notes

Text

Top Cryptocurrency Startups in Canada

Discover Innovative Cryptocurrency Startups in Canada Learn about the top cryptocurrency firms in Canada that are thriving in industries like gaming, lending, trading, DeFi, and blockchain infrastructure. These forward-thinking businesses are influencing the direction of technology and digital finance by providing cutting-edge solutions that spur expansion and change the crypto scene in Canada and abroad. Leading Crypto Startups in Canada The blockchain business in Canada is growing, and its future is being shaped by creative startups. These enterprises provide businesses and consumers with innovative services. Launched in 2018, Ledn specializes in neglected markets such as Latin America and offers specialized loan and borrowing products in the crypto finance space. Another 2018 startup, VirgoCX, provides a safe and easy-to-use cryptocurrency trading platform that emphasizes security and openness. Asteroid 1 provides CAD-based trading and teaches Canadians about digital currencies, while Index Coop streamlines decentralized finance through controlled cryptocurrency indices. TrustSwap creates safe DeFi apps for investors of all stripes, including institutional clients. These firms demonstrate their broad reach by driving blockchain innovation and impacting industries like gaming. Innovative Blockchain Solutions for the Gaming Industry Thanks to cutting-edge blockchain solutions, the Canadian gaming industry is undergoing a major transformation. From traditional RPGs to the growing sector of online casinos in Canada, companies like Horizon Blockchain Games Inc. are leading the way by creating user-focused environments where players can control their digital assets and participate in transparent economies. This tactic gives players a true sense of ownership over their virtual in-game possessions in addition to improving their gaming experiences. Another well-known company based in Vancouver, Dapper Labs, is skilled at creating immersive blockchain-powered experiences that combine gameplay with real-world interactions. By utilizing state-of-the-art blockchain technology, Dapper Labs creates novel revenue streams and vibrant gaming communities. By establishing ground-breaking game markets based on real asset control through seamlessly integrated secondary marketplaces for player-to-player exchange of digital property, Mythical Games is also breaking new ground in the industry.

To Know More- top cryptocurrency startups in Canada

#top cryptocurrency startups in Canada#best crypto exchanges in Canada#Canadian blockchain companies#DeFi platforms#innovative crypto lending solutions#gaming blockchain startups#cross-border crypto payment solutions#digital asset management services

0 notes

Text

Achieve 100% Growth with Top Crypto PR Tactics

In the dynamic realm of cryptocurrency, effective PR strategies are crucial for startup success. Learn how targeted Crypto PR can propel your project to new heights.

Navigating the competitive landscape of blockchain and cryptocurrency requires a strategic approach to public relations. Crypto PR focuses on enhancing and managing your startup’s reputation through a variety of tactics. Central to this approach is crafting a compelling brand story that resonates with your audience and clearly communicates your startup’s mission, values, and achievements. This narrative not only sets you apart from competitors but also builds a strong connection with investors and partners.

Community engagement is a critical element of successful Crypto PR. By maintaining regular communication, hosting interactive events, and actively responding to feedback, you can build a dedicated and engaged community around your project. Establishing relationships with key influencers in the crypto space and participating in industry events further amplifies your startup’s reach and credibility. These efforts help in attracting investor interest and increasing your project’s visibility.

To maximize the impact of your PR efforts, it’s essential to measure and analyze performance metrics. Tracking media coverage, social media engagement, and community growth provides valuable insights that help in refining your strategies. By continuously adapting and optimizing your approach, you can ensure long-term success and significant growth for your blockchain startup.

Partner with Intelisync to implement innovative Crypto PR strategies tailored to your blockchain startup. Contact us to explore how our expertise can accelerate your growth and enhance your Learn more...

#7 Crypto PR Strategies#7 Crypto PR Strategies to Boost business#7 Crypto PR Strategies to Boost Startup#7 Crypto PR Strategies to Boost Startup Growth 100% in 2024#Best Top 7 Crypto PR tactics#Best Top 7 Crypto PR tactics for tech startups#building a Strong Community Engagement#conference#Create Effective Press Content#Crypto#Crypto PR#Crypto PR Strategies to Boost Startup#Establishing connections with media and cryptocurrency influencers#How can Intelisync help blockchain startups with their PR strategies?#How do I choose a reliable public relations firm?#How is Crypto PR Different From Traditional PR?#or Web3 Project?#Participate in Events#PR Strategies to Boost Startup Growth#Public Relations Important for Your Blockchain#Use Social Media and create Video Content#What is Crypto PR?#Why are PR strategies important for blockchain and crypto startups?#Why Is Public Relations Important#Why Is Public Relations Important for Your Blockchain#Write an Engaging Brand Story#intelisync web3 marketing service inteliysnc web3 marketing agency intelisync growth marketing

0 notes

Text

Audience targeting as a PR technique

Imagine a beautifully crafted message delivered to the wrong audience. No matter how compelling your content is, it's as good as shouting into the void if it doesn't resonate with the people you want to reach. This is where audience targeting comes into play, transforming your public relations efforts from a mere shot in the dark to a precise, data-driven strategy. Further, let's explore audience targeting as a PR technique, uncovering its significance in the realm of public relations in marketing and how it aligns with the offerings of public relations services. By the end, you'll appreciate the pivotal role audience targeting plays in achieving PR success. Power of Audience Targeting in PR: Precision in Messaging: Audience targeting allows PR professionals to craft messages tailored to specific demographics, interests, and pain points. This precision ensures that your message resonates with the right people, increasing the likelihood of engagement and conversion. Enhanced Brand Reputation: Effective audience targeting ensures that your brand's message reaches the right ears. By aligning your brand with the values and interests of your target audience, you can build a positive brand reputation, a cornerstone of public relations in marketing. Cost Efficiency: Public relations services often come with a cost, but audience targeting helps maximize your ROI. By focusing resources on the audience segments most likely to convert, you can optimize your PR campaigns and minimize wastage. Data-Driven Decision-Making: In today's digital age, data is king. Audience targeting relies on data analytics to identify and understand your audience. This data-driven approach not only ensures your messaging is on point but also enables you to make informed adjustments in real time. Audience Targeting in Public Relations Services Media Outreach: Public relations services leverage audience targeting to identify the most relevant media outlets, journalists, and influencers. This ensures that your brand's story reaches the right platforms, increasing the chances of coverage. Content Creation: Crafting compelling content is a core PR function, and audience targeting guides this process. Whether it's a press release, a blog post, or social media content, understanding your audience's preferences is crucial for success. Social Media Management: Social media is a powerful PR tool, and audience targeting plays a pivotal role in managing brand profiles. PR services use data to schedule posts, engage with the audience, and run targeted ad campaigns. Crisis Management: Even in times of crisis, audience targeting remains relevant. PR services use it to ensure that crisis communications are directed towards affected stakeholders, addressing their concerns and maintaining trust. TYC stands as a testament to excellence, where we not only provide public relations services but redefine them with an unwavering commitment to delivering the very best. Summing upAudience targeting is the linchpin that holds together the world of public relations in marketing and the services provided by PR professionals. Its ability to refine messaging, enhance brand reputation, and optimize resource allocation makes it an indispensable tool in the PR arsenal. As the marketing landscape continues to evolve, the importance of audience targeting will only grow. To stay ahead in the PR game, consider integrating audience targeting into your strategies or seeking the expertise of public relations services that understand its power.

#public relations in marketing#public relations services#media relations agency#digital PR company#PR firm in delhi#cryptocurrency PR agency#digital pr firm#top pr agencies

1 note

·

View note

Text

NFT Boost Scripts

NFTs are created on a blockchain, typically using the Ethereum network, which allows for the creation and tracking of digital assets. Each NFT is assigned a unique identifier that can be used to verify ownership and transfer of the asset.

#blockchaindevelopmentcompany#blockchain development#nft marketplace development company#smart contract developer#cryptocurrency exchange software development company#smart contract development company#nft token development company#top blockchain development companiesm#cryptocurrency wallet development services

0 notes

Text

Intuit: “Our fraud fights racism”

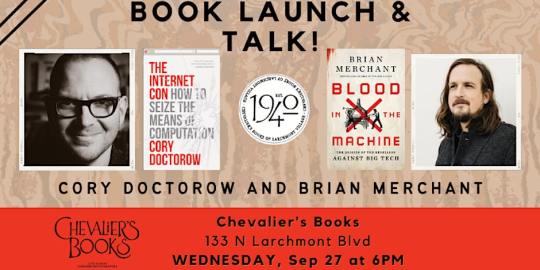

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

tuesday again 10/17/2023

started explaining why this one is a little lighter than last week's gallery wall behemoth bc of a uhhhh kind of dire week, personally and professionally speaking, but then realized when fic authors do that in front of chapters i don't actually care or require an excuse from them, im just delighted to have a new chapter.

listening

this is a deeply cheesy little folk song but the lyrics "man you name it and if we ain’t got it: we’ll get it" gave me a sensible chuckle.

youtube

now for a moment to expound upon houston: they truly have imported every possible food service establishment. the two chains i miss most from jersey, jersey mikes submarine sandwiches and 7-11 gas stations, are both here. i get that this is the fifth largest metro area in the US or whatever but both of these companies are SO niche. absolutely bonkers. spotify.

i think this started autoplaying after a playlist inspired by f/allout: new v/egas came on??

-

reading

i originally had a very mean-spirited graf about the utility of a pool in northwestern massachusetts and the kind of person who can comfortably lose $31k, but it is genuinely awful that there are no rules around zelle. that money goes into a black fucking hole and there's no way to get it back, which is not the case for any other kind of recognized money except cryptocurrency

Did we confront Gary Kruglitz [the pool contractor]? Yes we did. We marched right into his office and grilled him hard until he defeated us with a simple and probing question: What's a zelle? It defied belief, we quickly realized, that a man who had been trapped in technological amber since the Nixon era was running a cyberscam designed to come between us and our money out of an AOL account.

-

watching

Van Helsing (2004, dir. Sommers). this movie is horrible. this movie is terrific. i don't have anything to say about this movie bc i was distracted by equal opportunity tits and asses the entire time. the time of the “Kate Beckinsale in a corset” movie genre is long over but GOD. watched with my sister bc it's leaving tubi soon

playing

one week i will have the energy to try New Thing but until i do it’s genshin. there's a poetry event that has terribly boring minigames, but the story quest has finally tied a bow on a piece of folkore we came across in the very first release so that was fun!

wrapping up some stuff in sumeru bc im running out of map pins, this game has done one of the things i hate most: progress-locking one extremely long and tedious collectible hunt (the music gates) behind another extremely long and tedious collectible hunt (the robots locked in the vines). the next time i see one of those little fucking budget koroks i am going to drop kick it into the sun. what the fuck is the circumference of teyvat anyway. it feels like we have explored so little of this planet's surface

i have graphics turned down pretty low bc of performance issues on my elderly laptop and this is still such a remarkably pretty game. look at this big estuary leading off into the distance

-

making

i wildly overextended myself this week, partially bc im trying to take advantage of this brief post-covid heightened immunity. lot of dinners. lot of late nights. on top of that BOTH of my siblings were in town for unrelated professional reasons this week :) no overlap so we did not have a nice fambly dinner :( but did have pretty okay separate dinners :) if they could learn to fucking communicate their trave plans and the number of peope that will be showing up at my home that would also be pretty okay >:(

one of the party games i played this week asked the question “what could you give a 40-minute PowerPoint presentation on” and i started saying facts about the downfall of the penn central railroad and they very nicely let me continue saying facts about the downfall of the penn central railroad, the largest bankruptcy in US history until ENRON, until the round timer went off.

i have some thoughts about Train Guys and how it's very easy to fall into being a Train Guy, bc there's a very easy template to follow, and there's a lot of Train Guy content, and have i been doing this bc i actually like trains, or bc it's easy to listen to Well There's Your Problem on repeat bc it's familiar and comforting, or do i just really really really fucking hate flying?

who could possibly say.

mackintosh update: allowed herself to be scooped up by my brother (who she met at christmas and loves) but did NOT allow herself to be pet by the strangers in his company. did hang out in the middle of the floor observing tho. a regular little extroverted socialite!

24 notes

·

View notes

Text

Navigating the Forex Market with Top Forex Signals Services

In the world of forex trading, access to reliable and timely signals can significantly influence trading outcomes. Forex signals services provide traders with valuable insights and recommendations derived from comprehensive market analysis, helping them capitalize on opportunities and manage risks effectively. Whether you're new to forex trading or a seasoned investor, choosing the right signals service is crucial. Here’s an in-depth look at some of the leading forex signals services available today:

1. Forex Bank Signal

Forex Bank Signal is renowned for its accuracy and user-friendly interface, making it a preferred choice among traders.

Key Features:

High Accuracy: Forex Bank Signal delivers precise signals, allowing traders to execute trades with confidence.

User-Friendly Platform: The platform is designed to be intuitive and easy to navigate, catering to traders of all skill levels.

Real-Time Alerts: Traders receive instant alerts via SMS, email, or app notifications, ensuring they never miss a trading opportunity.

Educational Resources: Forex Bank Signal provides educational materials and market analysis to help traders understand the rationale behind signals.

With its commitment to accuracy and user accessibility, Forex Bank Signal supports traders in making informed decisions.

2. Learn 2 Trade

Learn 2 Trade offers a comprehensive forex signals service combined with extensive educational resources.

Key Features:

Diverse Signal Coverage: Signals cover forex, cryptocurrencies, and commodities, providing traders with diverse trading opportunities.

Educational Content: Learn 2 Trade offers guides, webinars, and tutorials to enhance traders’ knowledge and skills.

Community Interaction: Traders can engage in a supportive community to share insights and strategies, fostering collaborative learning.

Learn 2 Trade caters to both beginners seeking foundational knowledge and experienced traders looking to refine their strategies.

3. ForexSignals.com

ForexSignals.com stands out for its robust signals and mentorship from experienced traders, offering a comprehensive approach to forex education.

Key Features:

Expert Mentorship: Traders benefit from insights and guidance from seasoned professionals through live trading rooms and mentorship programs.

Comprehensive Signals: The service provides signals across various currency pairs, backed by thorough market analysis.

Customization Options: Traders can customize alerts to suit their trading preferences and risk tolerance.

With a focus on mentorship and comprehensive signals, ForexSignals.com empowers traders to improve their trading skills effectively.

4. Signal Skyline

Signal Skyline offers a straightforward forex signals service tailored for beginners entering the forex market.

Key Features:

User-Friendly Interface: The platform’s simplicity allows new traders to navigate and execute trades effortlessly.

Daily Signals: Traders receive multiple signals daily, covering major currency pairs, ensuring frequent trading opportunities.

Customer Support: Signal Skyline provides responsive customer support to assist traders with queries and technical issues.

Signal Skyline’s emphasis on simplicity and support makes it an ideal choice for novice traders gaining confidence in their trading decisions.

5. 1000pip Builder

1000pip Builder is recognized for its high-performance signals and transparent reporting, appealing to traders seeking proven trading strategies.

Key Features:

Proven Track Record: The service boasts a strong track record of successful signals, supported by detailed performance reports.

Multiple Communication Channels: Signals are delivered via email, SMS, and Telegram for quick and efficient trade execution.

Educational Insights: Traders gain insights into the rationale behind each signal, enhancing their understanding of market dynamics.

1000pip Builder’s focus on performance and transparency provides traders with confidence in their trading decisions.

Key Considerations When Choosing a Forex Signals Service

When evaluating forex signals services, consider these essential factors:

Accuracy and Reliability: Look for services with a proven track record of accurate signals and positive feedback from users.

User-Friendliness: Opt for platforms that are easy to use, especially if you’re new to trading.

Educational Resources: Access to educational materials can enhance your trading skills and understanding of market dynamics.

Customer Support: Responsive customer support ensures timely assistance with queries and technical issues.

Subscription Plans: Evaluate pricing structures and trial options to find a service that fits your budget and trading preferences.

Conclusion

Choosing the right forex signals service is crucial for success in the competitive forex market. Each of the mentioned services offers unique strengths tailored to diverse trading needs. By leveraging the insights and recommendations provided by these top forex signals services, traders can enhance their trading strategies, make informed decisions, and navigate the complexities of the forex market with confidence and proficiency.

#forex#forex broker#forex education#forex market#forex signal service#forex trading#forex signals#forexsignals#forextrading#forex signal provider#forexsignalsproviders#forexsignalsuk#forextradingsignals#forexpips#forexmarkets#tradesignals#freepips#freesignalsforex#forextrader#binaryexpert#tradingcharts#forexchart#tradingplan#forexchartanalysis#forexchartpatterns#forexcharts#technicolourcrafters#forexexpert#spreadbetting#learninghowtotrade

5 notes

·

View notes

Text

The Future of Bitcoin in the Global Economy: Ending the Dollar’s Reign

Bitcoin, the pioneering cryptocurrency, is gaining traction as a powerful force in the global economy. As the US dollar continues to dominate as the global reserve currency, it's worth exploring how Bitcoin could disrupt this dynamic and potentially lead to a more equitable economic landscape. In this blog post, we will examine the profound impact of the US dollar's hegemony and how Bitcoin could usher in a new era of global financial fairness.

The Hegemony of the US Dollar

Since World War II, the US dollar has held the prestigious position of being the world's reserve currency. This status has allowed the United States to enjoy significant economic advantages, including the ability to print money at will and run large deficits without immediate consequences. The "dollar milkshake theory" suggests that as global economies struggle, they need more dollars, which strengthens the US economy at the expense of others. This dynamic has allowed the US to skim off the top of the productive world, reaping benefits while other nations bear the costs.

The Global Cost of Dollar Dominance

The dominance of the US dollar has led to widespread economic challenges for many countries. As nations rely on the dollar for international trade and reserves, they become vulnerable to currency devaluation and economic instability. The ability of the US to print money devalues the savings and earnings of people worldwide, effectively destroying wealth across the globe. Examples of this can be seen in countries facing hyperinflation, such as Venezuela and Zimbabwe, where reliance on the dollar has exacerbated economic hardships.

Bitcoin as a Global Currency and Truth in Pricing

Enter Bitcoin, a decentralized digital currency with a fixed supply of 21 million coins. Unlike fiat currencies, Bitcoin cannot be printed or manipulated by any single entity. This feature makes it an attractive alternative to the US dollar, providing a more stable and transparent monetary system. Bitcoin's decentralized nature ensures that no single country or organization can control its value, making it a potential tool for achieving global economic balance. Importantly, Bitcoin represents truth in pricing. While anything denominated in US dollars can be deceptive due to inflation and monetary policy manipulation, Bitcoin provides a clear, unaltered measure of value.

The Impact of Bitcoin Adoption

If Bitcoin were to be widely adopted, it could shift the global economic power structure. Countries currently disadvantaged by the dollar system could benefit from a more stable and equitable currency. Bitcoin's transparency and fixed supply could reduce the likelihood of economic manipulation and provide a more predictable environment for international trade. This shift could lead to more equitable wealth distribution and true pricing of goods and services, as countries no longer have to bear the brunt of the US's economic policies.

Challenges and Considerations

Transitioning to Bitcoin as a global currency is not without challenges. Regulatory issues, technological barriers, and the need for international cooperation are significant hurdles. Additionally, infrastructure development is crucial to support widespread Bitcoin adoption. However, these challenges are not insurmountable, and with concerted effort, the global community can pave the way for a more stable and fair economic system.

Conclusion

The potential of Bitcoin to disrupt the current economic order is profound. By providing an alternative to the US dollar, Bitcoin could lead to a more equitable and stable global economy. Its nature as a truthful measure of value further enhances its appeal as a transformative force in the financial world. As we explore this possibility, it is essential to stay informed about Bitcoin and consider its implications for our financial future.

Call to Action

If you found this post insightful, subscribe to our blog for more updates and in-depth analyses on Bitcoin and the financial landscape. Share this post on social media to help spread awareness about the transformative potential of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#GlobalEconomy#FinancialFreedom#USDollar#EconomicRevolution#Decentralization#HardMoney#DigitalCurrency#Blockchain#MonetarySystem#BitcoinAdoption#EconomicStability#WealthDistribution#FinancialTruth#FutureOfMoney#CryptoCommunity#EconomicChange#BitcoinFuture#BTC#finance#financial experts#financial empowerment#unplugged financial#financial education

5 notes

·

View notes

Text

How Cryptocurrency Services Suppliers Enable Seamless Crypto Management

Discover the top cryptocurrency services, including leading exchanges, wallets, DeFi platforms, and payment processors. Learn how cryptocurrency banking services such as crypto lending, interest accounts, and crypto debit cards are reshaping the financial landscape for individuals and businesses in 2024. Stay informed and explore the best ways to manage and grow your digital assets securely.

0 notes

Text

Top Reasons Why Mint Tokens Are the Future of Digital Finance in 2024

Introduction

The world of digital finance is rapidly evolving, with innovations emerging at an unprecedented pace. One of the most promising developments in this space is the rise of mint tokens. These digital assets are redefining the way we think about finance, offering new opportunities for investment, transactions, and economic growth. As we look ahead to 2024, it’s clear that mint tokens are poised to play a crucial role in shaping the future of digital finance. In this blog, we’ll explore the top reasons why mint tokens are set to dominate the financial landscape in the coming year.

What Are Mint Tokens?

Understanding Mint Tokens

Mint tokens are digital assets created on a blockchain network. Unlike traditional cryptocurrencies like Bitcoin, which are mined through complex computational processes, mint tokens are typically created through a process called minting. This involves the issuance of new tokens directly on the blockchain, often by a centralized entity or through decentralized protocols.

Types of Mint Tokens

Mint tokens can serve various purposes, including utility tokens, security tokens, governance tokens, and even memecoins. Each type of token has its unique characteristics and use cases, contributing to the diverse ecosystem of digital finance.

1. Enhanced Security and Transparency

Blockchain Technology

One of the primary reasons mint tokens are gaining traction is their inherent security and transparency. Built on blockchain technology, these tokens benefit from decentralized and immutable ledgers, which record every transaction. This ensures that all token movements are transparent and verifiable, reducing the risk of fraud and enhancing trust among users.

Smart Contracts

Mint tokens often utilize smart contracts, which are self-executing contracts with the terms directly written into code. These contracts automatically enforce agreements and transactions, eliminating the need for intermediaries and further enhancing security and efficiency.

2. Accessibility and Inclusivity

Democratizing Finance

Mint tokens have the potential to democratize finance by providing access to financial services for individuals who are underserved by traditional banking systems. With just a smartphone and internet connection, anyone can participate in the digital economy, regardless of their location or socio-economic status.

Lower Barriers to Entry

Creating and trading mint tokens is often more accessible than traditional financial instruments. Platforms that facilitate the minting process have simplified the creation of new tokens, allowing users to launch their digital assets without extensive technical knowledge or significant capital investment.

3. Decentralized Finance (DeFi) Integration

Expanding the DeFi Ecosystem

Mint tokens are integral to the growth of decentralized finance (DeFi), a movement that aims to create an open and permissionless financial system. By integrating with DeFi protocols, mint tokens enable a wide range of financial activities, such as lending, borrowing, trading, and staking, without relying on centralized institutions.

Yield Farming and Liquidity Provision

One of the key features of DeFi is yield farming, where users earn rewards by providing liquidity to decentralized exchanges (DEXs) and other DeFi platforms. Mint tokens can be staked in liquidity pools, generating passive income for holders and contributing to the overall liquidity and stability of the DeFi ecosystem.

4. Enhanced Interoperability

Cross-Chain Compatibility

As the blockchain ecosystem grows, interoperability between different networks becomes increasingly important. Mint tokens are often designed to be cross-chain compatible, allowing them to move seamlessly between various blockchains. This enhances their utility and opens up new possibilities for decentralized applications (dApps) and financial services.

Bridging Traditional and Digital Finance

Mint tokens can also serve as a bridge between traditional financial systems and the emerging digital economy. By tokenizing real-world assets such as stocks, bonds, and real estate, mint tokens enable fractional ownership and easier transfer of these assets, making them more accessible and liquid.

5. Innovation in Tokenomics

Dynamic Supply Mechanisms

Mint tokens offer innovative tokenomics models that can adapt to changing market conditions. For example, some mint tokens have dynamic supply mechanisms that adjust the token supply based on demand, helping to stabilize prices and incentivize user participation.

Incentive Structures

Many mint tokens incorporate incentive structures to encourage long-term holding and active participation in the ecosystem. These incentives can include staking rewards, governance rights, and access to exclusive services or benefits, driving user engagement and loyalty.

6. Environmental Considerations

Energy Efficiency

Traditional proof-of-work (PoW) mining methods used by cryptocurrencies like Bitcoin are often criticized for their high energy consumption. In contrast, mint tokens typically use more energy-efficient consensus mechanisms, such as proof-of-stake (PoS) or delegated proof-of-stake (DPoS), reducing their environmental impact.

Sustainable Growth

As the world becomes more conscious of environmental issues, the sustainability of financial systems is gaining importance. Mint tokens, with their lower energy requirements and innovative approaches to consensus, align with the growing demand for environmentally friendly financial solutions.

7. Regulatory Compliance

Aligning with Regulations

As the cryptocurrency market matures, regulatory compliance is becoming a critical factor for the long-term success of digital assets. Mint tokens can be designed to comply with regulatory requirements, providing greater assurance to investors and facilitating wider adoption.

Enhancing Investor Confidence

Regulatory compliance enhances investor confidence by ensuring that mint tokens adhere to established legal and financial standards. This can attract institutional investors and contribute to the overall legitimacy and stability of the digital finance ecosystem.

8. Increased Adoption and Market Growth

Expanding Use Cases

The versatility of mint tokens is driving their adoption across various industries, from finance and gaming to supply chain management and healthcare. As more use cases emerge, the demand for mint tokens is expected to grow, further solidifying their position in the digital economy.

Mainstream Acceptance

Mint tokens are gaining mainstream acceptance as more businesses and individuals recognize their potential benefits. High-profile endorsements, partnerships, and integrations with established platforms are helping to drive awareness and adoption, paving the way for widespread use.

Conclusion

Mint tokens are poised to revolutionize digital finance in 2024, offering enhanced security, accessibility, and innovation. Their integration with DeFi, cross-chain compatibility, and environmentally friendly features make them a compelling choice for investors and users alike. As the digital finance landscape continues to evolve, mint tokens are set to play a pivotal role in shaping the future of the economy.

By understanding the unique advantages of mint tokens and staying informed about the latest developments, investors can position themselves to capitalize on the opportunities presented by this exciting and transformative technology. Whether you are a seasoned investor or new to the world of digital finance, mint tokens offer a promising avenue for growth and innovation in the years to come.

3 notes

·

View notes

Text

Best Crypto Exchange – Exploring the World of Cryptocurrency Trading in 2025

The world of cryptocurrency trading has evolved rapidly over the last decade, from a niche investment option to a mainstream financial asset. As we look ahead to 2025, the landscape of crypto trading is set to change even further. The evolution of technology, regulatory frameworks, and user demands will shape the future of crypto exchanges. In this article, we will explore the key trends that will define the best crypto exchanges in 2025 and how crypto exchange software development plays a crucial role in this transformation.

The Rise of Advanced Crypto Exchange Features

By 2025, we can expect crypto exchanges to offer a host of new and advanced features that improve user experience, security, and overall functionality. Crypto exchanges will continue to evolve beyond just offering trading pairs and charts. Key features that will define top-tier platforms include:

Decentralized Finance (DeFi) Integration: Many crypto exchanges will integrate decentralized finance services, allowing users to trade and invest without relying on intermediaries. DeFi-based exchanges will be a major disruptor in the market, giving users full control over their assets.

Multi-Currency Support: The number of cryptocurrencies continues to grow, and exchanges that support a wide range of digital assets will have a competitive edge. In 2025, we expect to see platforms that offer everything from Bitcoin and Ethereum to new and innovative tokens, including stablecoins and digital fiat currencies.

Cross-Chain Compatibility: Interoperability will be critical in 2025 as the crypto ecosystem becomes more diverse. A crypto exchange that enables cross-chain trading will allow users to trade assets across different blockchains seamlessly, improving liquidity and trading volume.

AI-Driven Analytics and Trading Bots: Artificial intelligence (AI) and machine learning will play a significant role in enhancing crypto exchanges. AI-powered trading bots and analytics tools will help traders make more informed decisions, whether they are beginners or experts.

The Role of Security in Crypto Exchange Development

Security has always been one of the most important aspects of any crypto exchange. In 2025, as cyber threats become more sophisticated, the best crypto exchanges will incorporate state-of-the-art security features to protect user assets. These security features will include:

Advanced Encryption: End-to-end encryption will be the standard, ensuring that user data and transaction details are protected at all times.

Two-Factor Authentication (2FA): Multi-factor authentication will be a mandatory feature for all users to add an additional layer of protection when accessing accounts.

Cold Storage Solutions: A significant portion of digital assets will be stored offline in cold wallets, minimizing the risk of hacks and online breaches.

AI and Blockchain for Fraud Detection: Machine learning algorithms will be integrated into exchange platforms to detect suspicious activity in real-time. Blockchain technology will help ensure that all transactions are transparent, traceable, and tamper-proof.

User-Friendly Experience and Seamless Interfaces

One of the biggest challenges for crypto exchanges in the past has been providing an intuitive user interface. While many exchanges offer a host of features, these platforms are often complicated for new users. In 2025, crypto exchanges will prioritize user experience (UX) and simplicity.

The best crypto exchanges will be designed for both beginners and experienced traders, offering:

Customizable Dashboards: Users will have the ability to personalize their dashboards, focusing on the tools and features they use most often.

Mobile Accessibility: The demand for mobile crypto trading will continue to rise. In 2025, crypto exchanges will need to offer seamless mobile trading platforms with responsive design and easy-to-use interfaces.

Educational Resources: With the growing interest in cryptocurrency, new users will need educational resources to help them understand the basics of trading and investing. Leading exchanges will offer tutorials, webinars, and articles to guide their users.

How Crypto Exchange Software Development Powers the Future

The backbone of every successful crypto exchange is the software that powers it. Crypto exchange software development is crucial in creating a platform that can meet the needs of users while keeping pace with industry changes. Here are some key factors that drive the development of high-quality crypto exchange software:

Scalability: As the crypto market grows, exchanges need to be able to handle increased traffic and higher transaction volumes. Scalable software ensures that an exchange can handle spikes in demand, whether during a market rally or major events.

Security Features: The security of crypto exchanges is directly tied to the quality of the software. Robust coding, encryption, and regular security audits ensure that the exchange remains protected against potential attacks.

Customizability: The best crypto exchange platforms are tailored to meet the needs of their users. Software developers work closely with exchange operators to create a platform that aligns with their business model, whether they are focused on spot trading, derivatives, or DeFi solutions.

Integration with Blockchain Networks: Crypto exchange software needs to be able to integrate with various blockchain networks, enabling cross-chain trading and smooth transactions. Whether it’s Ethereum, Binance Smart Chain, or Solana, the ability to connect with multiple blockchains will be key for exchanges in 2025.

Regulatory Compliance: The regulatory landscape surrounding cryptocurrency is constantly evolving. In 2025, compliance will be a critical factor for crypto exchanges. Developers will need to create platforms that adhere to the regulations of various countries and regions, ensuring a legal and secure trading environment for users.

Conclusion

As we approach 2025, the cryptocurrency exchange landscape will continue to evolve, with innovative features, enhanced security, and a user-first approach driving the development of top-tier platforms. The best crypto exchanges will offer seamless trading experiences, multi-currency support, and advanced security measures to protect their users. Crypto exchange software development will remain at the core of this transformation, enabling exchanges to stay competitive and adapt to an ever-changing industry.

The future of cryptocurrency trading is bright, and businesses looking to make their mark in the market should consider investing in advanced, scalable, and secure crypto exchange software development to stay ahead of the curve.

#crypto exchange software development#cryptocurrency exchange development services#crypto exchange platform development#crypto exchange platform development company#white-label crypto exchange development#Crypto exchange developers in India#Top Crypto Exchange Development Company

0 notes

Text

The Darkweb: Exploring the hidden crimes of the Internet

The Dark Web is a complex and often misunderstood segment of the internet, shrouded in secrecy and notorious for its association with illegal activities. This hidden part of the web, accessible only through specialised software like Tor (The Onion Router), allows users to navigate anonymously, which has fostered both legitimate and illicit uses. The Dark Web is a subset of the Deep Web, which itself constitutes about 90% of the internet not indexed by traditional search engines. While most users interact with the Surface Web, the Deep Web includes private databases and secure sites, whereas the Dark Web is specifically designed for anonymity and privacy. The Dark Web emerged from projects aimed at ensuring secure communication, originally developed by the U.S. Department of Defence in the early 2000s. [1] [2]

Hidden Crimes in the Dark Web

The anonymity offered by the dark web has made it a hub for numerous forms of criminal activity. From illegal marketplaces to cybercrime forums, this underworld of the internet is teeming with hidden dangers.

Illicit Markets and Drug Trade

One of the most notorious aspects of the dark web is its marketplace for illegal goods. Websites like the now-defunct Silk Road offered a platform where users could buy and sell illegal drugs, firearms, stolen goods, and counterfeit documents. These black markets are often operated using cryptocurrencies such as Bitcoin to further mask identities and ensure untraceable transactions.According to a 2019 study by the European Monitoring Centre for Drugs and Drug Addiction, the dark web drug trade has grown exponentially, with millions of dollars' worth of drugs being sold monthly across various platforms . [3] [4]

2. Cybercrime and Hacking Services

The dark web also serves as a marketplace for cybercriminals. Hacking tools, ransomware-as-a-service, and stolen data are regularly exchanged in these hidden corners of the internet. Criminals offer services ranging from DDoS attacks to the sale of stolen credit card information and personal identities. Some forums even provide tutorials for novice hackers looking to learn cybercrime techniques. [5]

3. Human Trafficking and Exploitation

While less publicly discussed, the dark web has been linked to disturbing trends in human trafficking and child exploitation. Illegal forums allow criminals to sell services or even traffic victims, relying on the secrecy provided by encryption and anonymity transactions. These criminal activities often occur alongside other heinous content like child abuse imagery, which is tragically prevalent in certain corners of the dark web . [5]

4.Weapons and Assassination-for-Hire

Another dark aspect of the dark web is the sale of illegal firearms, explosives, and even assassination services. Websites provide arms to buyers without the restrictions and regulations of the surface web. Though some claims of hitmen-for-hire on the dark web have been debunked as scams, the sale of illicit firearms remains a significant concern for global law enforcement agencies .

Top 5 Notorious Cases on the Dark Web

(Content Warning: This list includes some horrifying incidents and scary dark web stories. We suggest you skip entries if you’re faint of heart or suffering from any type of anxiety or stress disorder.)

1. Banmeet Singh’s $100M+ dark web drug empire gets brought to light

Starting with a fairly recent case, Banmeet Singh of Haldwani, Northern India was sentenced to eight years in prison in late January 2024 after he was found to have created and led a multi-million dollar drug enterprise.The Indian national also forfeited $150 million in cryptocurrency. This proved to be illegal drug money that was laundered into cryptocurrency. Singh used various dark web marketplaces to create his drug empire. According to the U.S. Department of Justice, Singh shipped drugs from Europe to eight distribution centers in the US. After, these were transported to and sold in all 50 US states and other countries in the Americas. Singh was arrested in London, where he was residing in 2019. In 2023, he was extradited to the US. [7]

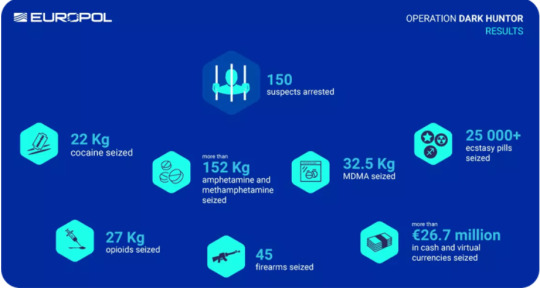

2. Operation Dark hunTor results in 150 arrests in nine countries

We’re moving from one multi-million-dollar illegal contraband case to the next. In 2021, Euro pol, Eurojust, and the police forces of nine countries conducted one of the biggest anti-crime operations the dark web has ever seen: Dark hunter. This operation resulted in 150 arrests across Australia, Bulgaria, France, Germany, Italy, the Netherlands, Switzerland, the United Kingdom, and the United States. All of the arrested were allegedly involved in buying or selling illegal goods on the dark web. The authorities found some articles in the possession of the arrested that strengthened their case: EUR 26.7 million (USD 31 million) in cash and virtual currencies, 234 kg of drugs, and 45 firearms.Italian authorities also managed to close down two dark web markets that boasted over 100,000 listings for illegal goods, DeepSea and Berlusconi. [7]

3. Operation DisrupTor exposes a dark web drugs distribution center

Amid the Covid pandemic, most businesses were struggling. Meanwhile, Operation DisrupTor suggests the drug business was still prospering. In February 2020, a group of FBI agents found 50 pounds of methamphetamine and thousands of Adderall pills in a storage shed in Los Angeles. The drugs, and the firearms that were also found, belonged to a crime network that had completed over 18,000 drug sales on the dark web. The criminal syndicate hid the drugs in a shed that they had made to look like a legitimate mail-order business. Their dark web drug sales included shipments to other dark net vendors, street dealers, and actual consumers. [7]

WATCH FULL VIDEO [8]

4. Attempt to hire a dark web hitman backfires

Now and then, crazy deep web stories pop up about how easy it is to hire a dark web hitman. One of these urban legends, however, turned out to be true. In February 2024, a woman from Canberra, Australia, pleaded guilty to inciting another to murder. The woman claimed to have contacted a dark web hitman (on the dark web marketplace Sinaloa Cartel) to murder her wealthy parents as part of an inheritance scheme. Supposedly, the total agreed-upon sum for the murder was $20,000, of which she had already paid $6,000 as a downpayment, using Bitcoin. It’s hard to say if the woman was actually talking to a contract killer or a scammer. Let’s just say we’re just happy the Australian court system was on to her before we could find out. While we don’t encourage anyone to go looking for a hitman on the dark web or elsewhere, this case goes to show that even on the dark web and while using crypto, many actions are retraceable. We always recommend people with good intentions to go for maximum privacy, as it’s no one’s business what they’re doing on the dark web. A great way to improve your privacy is by using NordVPN. NordVPN hides your IP address and encrypts your traffic, plus it blocks malicious links. [7]

5. No Love Deep Web takes dark web enthusiasts on a treasure hunt

Back in August of 2012, visitors on the dark web could find clues scattered on the network that led them through a fascinating alternate reality game. Much like Cicada 3031’s 4chan game, the clues led regular users through an array of clever clues set up like a treasure hunt. The dark web game employed a lot of encryption means to hide its hints, including the Caesar cipher, QR codes, Morse code, and a lot of other similar encryption methods. All of the clues were spread around dark websites, and one participant recounts the experience as quite thrilling:

So what was going on? Well, it wasn’t a secret government agency recruiting new members, and it wasn’t a feat of a group of cybercriminals.

Rather, the game was created by the experimental hip-hop group Death Grips to promote their new album, No Love Deep Web. [7]

READ MORE CASES [7]

Law Enforcement and the Fight Against Dark Web Crime

Despite the anonymity and encryption, law enforcement agencies around the world have made significant progress in cracking down on dark web criminality. In 2021, a multinational law enforcement effort, Operation Dark HunTor, led to the arrest of 150 individuals across multiple countries, targeting major drug vendors and illegal marketplaces on the dark web .

Undercover operations, improved digital forensics, and advances in cryptocurrency tracing have given authorities new tools to combat the hidden crimes of the dark web. However, for every takedown, new marketplaces and forums emerge, reflecting the cat-and-mouse dynamic between law enforcement and cybercriminals. [6]

Conclusion

While the dark web itself is not inherently evil, its secrecy has allowed criminals to thrive in ways that are difficult to regulate or even detect. From drug trafficking and cybercrime to human exploitation, the hidden crimes of the dark web reveal a darker side of digital anonymity. As law enforcement and technology continue to evolve, so too will the battle to uncover and combat these underground activities. Nonetheless, the dark web serves as a potent reminder that as technology advances, so too does the need for robust security measures and ethical oversight.

.

.

.

.

sources:

https://www.varutra.com/the-hidden-internet-exploring-the-secrets-of-the-dark-web/

2.https://sopa.tulane.edu/blog/everything-you-should-know-about-dark-web

3. https://www.unsw.edu.au/research/ndarc/news-events/blogs/2016/01/dark-net-drug-marketplaces-begin-to-emulate-organised-street-cri

4. https://www.euda.europa.eu/darknet_en

5. https://www.findlaw.com/criminal/criminal-charges/dark-web-crimes.html

6. https://syntheticdrugs.unodc.org/syntheticdrugs/en/cybercrime/detectandrespond/investigation/darknet.html

7. file:///D:/New%20folder/The%2013%20Most%20Notorious%20Cases%20on%20the%20Dark%20Web.html

8. https://youtu.be/d4NSfrOtMfU?feature=shared

#crime#cyberpunk 2077#cybersecurity#internet#dark web#criminal case#laws#murder mystery#mental health

4 notes

·

View notes

Text

Crypto Growth Hacks: 2024 Beginner's Guide to PPC Marketing

Effective marketing is paramount in the fast-moving cryptocurrency sector, and Pay-Per-Click (PPC) advertising stands out as a powerful strategy. PPC marketing provides immediate visibility and precise targeting, enabling crypto businesses to reach potential investors and users efficiently. Platforms such as Google Ads, Facebook Ads, and Twitter Ads offer advanced targeting capabilities, allowing for highly customized ad campaigns. By setting clear objectives, conducting detailed keyword research, and crafting engaging ad content, crypto companies can harness the power of PPC to drive traffic and boost conversions.

The crypto market presents unique challenges, including intense competition and shifting regulations, which make PPC marketing particularly advantageous. PPC allows for rapid traffic generation and real-time performance tracking, essential for maintaining a competitive edge. Regular monitoring and optimization, including A/B testing and keyword refinement, are key to sustained success. Additionally, embracing innovative trends like AI, video ads, and blockchain integration can significantly enhance PPC campaign effectiveness. Staying informed about industry trends and prioritizing user experience are also critical components of a successful PPC strategy.

Intelisync offers customized PPC marketing solutions tailored to the cryptocurrency industry. Our comprehensive services include keyword research, ad creation, and performance optimization, ensuring your campaigns are both compliant and effective. By partnering with Intelisync, you can leverage expert knowledge to navigate the complexities of the crypto market and achieve measurable results. Unlock your crypto business’s potential with Intelisync’s expert PPC solutions. Contact us today for Learn more...