#Top Private Equity Firms

Explore tagged Tumblr posts

Text

Transforming Healthcare in Malaysia: The Role of Top Private Equity Firms

Private equity investments in Malaysia's healthcare industry gained momentum in the early 2000s. These investments aim to modernize infrastructure, expand access, and integrate advanced technologies. Targeted healthcare companies often demonstrate robust growth potential, strong leadership, and a commitment to enhancing patient care.

Read More:

0 notes

Text

0 notes

Text

Getting your info on AI purely from tumblr communists will really warp your brain. And I don't just mean the anti-AI tumblr communists, which most of them are. Pro-AI tumblr communists will talk about AI like "This is a tool for the radical collective ownership of art. We are taking a stance against the opressive capitalistic system of copyright that abuses artists for the benefit of large corporations. Art is owned by no one. Art is owned by everyone." And then you step into the real world and AI is being used as a copyright grift to siphon money from creators using youtube's absolutely broken content id. Youtube, of course, being owned by google; the massive multi-trillion dollar company that is investing billions into AI.

youtube

#ai#copyright#anti-ai#tumblr users: *points at giant tech conglomerates* is this anti-establishment and communist?#i mean my mutuals on tumblr dot gov hate it so it MUST be an opressed and countercultural tool that i have to fight to protect#sorry but 'noooo you are criticizing big tech WRONGLY you have to be MORALLY PERFECT while critiqueing this multibillion dollar industry–#or else you are HARMING SOCIALISM' is just not a very convincing argument to me.#yeah yeah i'm sure this tumblr blog was actually very regressive in their criticism of ai#self-policing must be our top priority in this conversation#socialism thanks you. as well as the private equity firms pumping billioms into this technology. two things that are perfectly compatible.

11 notes

·

View notes

Text

Real Estate Legal Experts

Saraf and Partners are recognized as real estate legal experts, offering comprehensive legal services to clients in the real estate sector. Their expertise in real estate law ensures seamless transactions and mitigates potential legal challenges making Saraf and Partners the best Real Estate Law Firm.

#Top law firm in Delhi#Top law firm in India#Top lawyers in Delhi#Best law firm in India#Banking and finance lawyers#Banking & Finance Law firm#litigation and arbitration#Litigation firm in Delhi#M&A law firm#Best M&A lawyers#Restructuring and Insolvency Law#Legal Advice for Startups#Private equity law firm#Real Estate Law Firm#Real estate lawyers#legal services#Corporate law firm in Mumbai#Corporate law firm in Delhi

0 notes

Text

Global Star Capital founder Rich Cocovich recently met with principals in both New York City and Los Angeles California on a $5 Million USD entertainment sector project and bridged the gap of funding with a private California based investor. Since 1991, Cocovich has serviced clients in 126 countries and all 50 states in America as the top expert and private funding. Over 30 billion USD from private investors awaits the projects Global Star Capital and Rich Cocovich represent. If you are a solvent and prepared project principal who understands that high end, professional expertise is not free, not contingent, not pro bono, and not wrapped into a closing, then you are welcome to visit one of our two main websites www.globalstarcapital.com or www.globalstarcapital.international and begin in the Our Process Section. Our engagement process and fee structure is etched in stone and non-negotiable. Project principals who follow our protocol, including the mandatory face-to-face meeting steps, succeed in gaining the attention their project deserves. Within seven days of meeting Rich Cocovich in person, a greenlight from a private funding facilitator/investor will be established.

#richcocovich #globalstarcapital #privefunding #projectfunding #richcocovichreviews #globalstarcapitalreviews #cocovich #capitalraising #topconsultant #familyoffice #equity #equityfunding #projectequity #equityinvesting

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#rich cocovich customer comments#rich cocovich united states#rich cocovich references#rich cocovich top consultant in private funding#global star capital information#global star capital reviews#private funding intermediaries#private funding consultants#top private funding consulting firm#privateequity#private banking#private funding#private investors#private equity#equity investor#equity capital#equity investors#equity funding#equity financing#cocovich#richard cocovich and global star capital#richard cocovich review#rich cocovich review#rich cocovich client comments#rich cocovich and global star capital

1 note

·

View note

Text

Navigating Talent: Insights into Finance and Healthcare Recruitment Strategies

Recruitment within the finance and healthcare sectors is a dynamic and multifaceted endeavor, driven by a confluence of industry-specific trends, evolving skill requirements, and broader economic forces. In this section, we delve into the current landscape of recruitment in these critical fields, highlighting the key trends and the most sought-after skills and qualifications.

Current Trends in Finance and Healthcare Recruitment

The recruitment landscape in finance and healthcare is continuously shaped by several pivotal trends. In finance, technological advancements are revolutionizing the way organizations operate and recruit. The rise of ProSearchGroup, into financial systems have created a demand for professionals adept in these cutting-edge areas. Financial institutions are seeking candidates with not only traditional financial acumen but also the technical prowess to navigate and leverage these innovations.

Regulatory changes also play a significant role in shaping recruitment strategies in finance. As governments and regulatory bodies introduce new compliance requirements, there is an increased demand for professionals skilled in risk management, regulatory compliance, and ethical governance. These changes necessitate a workforce that is both adaptable and knowledgeable about the latest regulatory landscapes.

In the healthcare sector, the recruitment trends are equally compelling. The rapid advancements in medical technology, telemedicine, and electronic health records (EHRs) are driving the need for healthcare professionals who are tech-savvy and proficient in these new tools. Additionally, the ongoing global health challenges have highlighted the critical need for specialized healthcare practitioners, from epidemiologists to critical care nurses, underscoring the importance of a robust and responsive recruitment strategy.

Economic factors further influence recruitment in both sectors. Economic fluctuations can lead to varying levels of demand for financial services and healthcare, impacting hiring trends. In times of economic uncertainty, financial institutions might prioritize hiring risk analysts and financial strategists, while healthcare providers might focus on recruiting frontline medical staff to manage increased patient loads.

Skills and Qualifications in Demand

The evolving recruitment landscape has led to a distinct set of skills and qualifications that are highly sought after in finance and healthcare.

In the finance sector, there is a growing emphasis on data analysis and risk management. Professionals who can interpret complex data sets, identify trends, and provide actionable insights are in high demand. Expertise in financial modeling, forecasting, and strategic planning is also crucial as organizations strive to navigate volatile markets and economic conditions.

Moreover, the integration of AI and machine learning into financial operations requires a new breed of finance professionals who are not only proficient in traditional finance but also have a strong foundation in technology. Skills in programming, data science, and cybersecurity are becoming increasingly valuable as financial institutions seek to protect their assets and enhance their technological capabilities.

Healthcare, on the other hand, demands a unique blend of clinical expertise and technological proficiency. With the increasing adoption of telemedicine and digital health platforms, healthcare professionals must be comfortable using these technologies to provide patient care. Additionally, there is a significant demand for specialists in critical care, mental health, and geriatrics, reflecting the changing demographics and health needs of the population.

Interpersonal skills, empathy, and the ability to work under pressure remain paramount in healthcare. The ability to communicate effectively with patients, families, and interdisciplinary teams is essential for delivering high-quality care and ensuring positive patient outcomes.

In summary, navigating the recruitment landscape in finance and healthcare requires a keen understanding of current trends and the ability to identify and attract candidates with the requisite skills and qualifications. By staying abreast of industry developments and aligning recruitment strategies with these evolving demands, organizations can build a workforce capable of driving success in these critical sectors.

#executive search#human resources#executive search firms#interim executives#hiring process#top talent#success story#blue signal#united states#private equity#korn ferry#perfect fit#recruitment process#financial officers#interim talent#google reviews#staffing agency#scion staffing#professional services#contract employees#executive search firm#job search#search group#direct-hire recruiting#job seekers#global executive search#c-level executives#judge group#direct hire#artificial intelligence

0 notes

Text

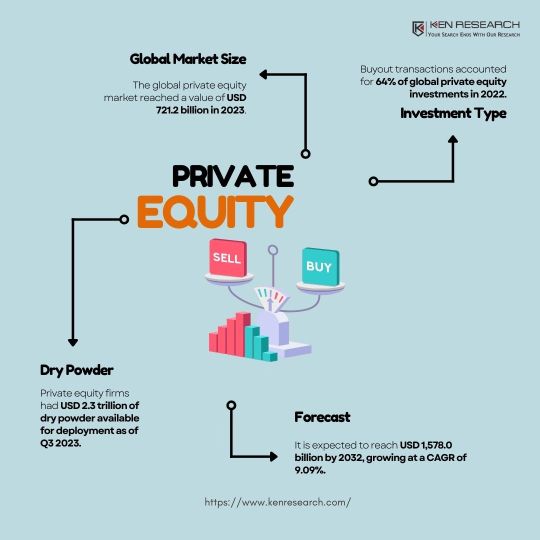

Unveiling the Dynamics: Private Equity Market Major Players

Delve into the intricacies of the private equity market, spotlighting major players that dictate industry trends. This in-depth analysis unveils their strategies, contributions, and influence, providing a panoramic view of the private equity industry.

#Largest Private Equity Firms#Private Equity Market#Private Equity Industry#Private Equity Market Major Players#Top Players in Private Equity Market#Emerging Players in Private Equity Market

0 notes

Text

Federal employees are seeking a temporary restraining order as part of a class action lawsuit accusing a group of Elon Musk’s associates of allegedly operating an illegally connected server from the fifth floor of the US Office of Personnel Management’s (OPM) headquarters in Washington, DC.

An attorney representing two federal workers—Jane Does 1 and 2—filed a motion this morning arguing that the server’s continued operation not only violates federal law but is potentially exposing vast quantities of government staffers’ personal information to hostile foreign adversaries through unencrypted email.

A copy of the motion, filed in the DC District Court by National Security Counselors, a Washington-area public-interest law firm, was obtained by WIRED exclusively in advance. WIRED previously reported that Musk had installed several lackeys in OPM’s top offices, including individuals with ties to xAI, Neuralink, and other companies he owns.

The initial lawsuit, filed on January 27, cites reports that Musk’s associates illegally connected a server to a government network for the purposes of harvesting information, including the names and email accounts of federal employees. The server was installed on the agency’s premises, the complaint alleges, without OPM—the government’s human resources department—conducting a mandatory privacy impact assessment required under federal law.

Under the 2002 E-Government Act, agencies are required to perform privacy assessments prior to making “substantial changes to existing information technology” when handling information “in identifiable form.” Notably, prior to the installation of the server, OPM did not have the technical capability to email the entire federal workforce from a single email account.

“[A]t some point after 20 January 2025, OPM allowed unknown individuals to simply bypass its existing systems and security protocols,” Tuesday’s motion claims, “for the stated purpose of being able to communicate directly with those individuals without involving other agencies. In short, the sole purpose of these new systems was expediency.”

OPM did not immediately respond to a request for comment.

If the motion is granted, OPM would be forced to disconnect the server until the assessment is done. As a consequence, the Trump administration’s plans to drastically reduce the size of the federal workforce would likely face delays. The email account linked to the server—[email protected]—is currently being used to gather information from federal workers accepting buyouts under the admin’s “deferred resignation program,” which is set to expire on February 6.

“Under the law, a temporary restraining order is an extraordinary remedy,” notes National Security Counselors’ executive director, Kel McClanahan. “But this is an extraordinary situation.”

Before issuing a restraining order, courts apply what’s known as the “balance of equities” doctrine, weighing the burdens and costs on both parties. In this case, however, McClanahan argues that the injunction would inflict “no hardship” on the government whatsoever. February 6 is an “arbitrary deadline,” he says, and the administration could simply continue to implement the resignation program “through preexisting channels.”

“We can't wait for the normal course of litigation when all that information is just sitting there in some system nobody knows about with who knows what protections,” McClanahan says. “In a normal case, we might be able to at least count on the inspector general to do something, but Trump fired her, so all bets are off.”

The motion further questions whether OPM violated the Administrative Procedure Act, which prohibits federal agencies from taking actions “not in accordance with the law.” Under the APA, courts may “compel agency action”—such as a private assessment—when it is “unlawfully withheld.”

Employees at various agencies were reportedly notified last month to be on the lookout for messages originating from the [email protected] account. McClanahan’s complaint points to a January 23 email from acting Homeland Security secretary Benjamine Huffman instructing DHS employees that the [email protected] account “can be considered trusted.” In the following days, emails were blasted out twice across the executive branch instructing federal workers to reply “Yes” in both cases.

The same account was later used to transmit the “Fork in the Road” missive promoting the Trump administration’s legally dubious “deferred resignation program,” which claims to offer federal workers the opportunity to quit but continue receiving paychecks through September. Workers who wished to participate in the program were instructed to reply to the email with “Resign.”

As WIRED has reported, even the new HR chief of DOGE, Musk’s task force, was unable to answer basic questions about the offer.

The legal authority underlying the program is unclear, and federal employee union leaders are warning workers not to blindly assume they will actually get paid. In a floor speech last week, Senator Tim Kaine advised workers not to be fooled: “There’s no budget line item to pay people who are not showing up for work.” Patty Murray, ranking Democrat on the Senate Appropriations Committee, similarly warned Monday: “There is no funding allocated to agencies to pay staff for this offer.”

McClanahan’s lawsuit highlights the government’s response to the OPM hack of 2015, which compromised personnel records on more than 22 million people, including some who’d undergone background checks to obtain security clearances. A congressional report authored by House Republicans following the breach pinned the incident on a “breakdown in communications” between OPM’s chief information officer and its inspector general: “The future effectiveness of the agency’s information technology and security efforts,” it says, “will depend on a strong relationship between these two entities moving forward.”

OPM’s inspector general, Krista Boyd, was fired by President Donald Trump in the midst of the “Friday night purge” on January 24—one day after the first [email protected] email was sent.

“We are witnessing an unprecedented exfiltration and seizure of the most sensitive kinds of information by unelected, unvetted people with no experience, responsibility, or right to it,” says Sean Vitka, policy director at the Demand Progress Education Fund, which is supporting the action. “Millions of Americans and the collective interests of the United States desperately need emergency intervention from the courts. The constitutional crisis is already here.”

205 notes

·

View notes

Text

When private equity destroys your hospital

I'm on tour with my new novel The Bezzle! Catch me TOMORROW in PHOENIX (Changing Hands, Feb 29) then Tucson (Mar 9-10), San Francisco (Mar 13), and more!

As someone who writes a lot of fiction about corporate crime, I naturally end up spending a lot of time being angry about corporate crime. It's pretty goddamned enraging. But the fiction writer in me is especially upset at how cartoonishly evil the perps are – routinely doing things that I couldn't ever get away with putting in a novel.

Beyond a doubt, the most cartoonishly evil characters are the private equity looters. And the most cartoonishly evil private equity looters are the ones who get involved in health care.

(Buckle up.)

Writing for The American Prospect, Maureen Tcacik details a national scandal: the collapse of PE-backed hospital chain Steward Health, a company that bought and looted hospitals up and down the country, starving them of everything from heart valves to prescription paper, ripping off suppliers, doctors and nurses, and callously exposing patients to deadly risk:

https://prospect.org/health/2024-02-27-scenes-from-bat-cave-steward-health-florida/

Steward occupies a very special place in the private equity looting cycle. Private equity companies arrange themselves on a continuum of indiscriminate depravity. At the start of the continuum are PE funds that buy productive and useful firms (everything from hospitals to car-washes) using "leveraged buyouts." That means that they borrow money to buy the company and use the company itself as collateral: it's like you getting a bank-loan to buy your neighbor's mortgage out from under them, and using your neighbor's house as collateral for that loan.

Once the buyout is done, the PE fund pays itself a "special dividend" (stealing money the business needs to survive) and then starts charging the business a "management fee" for the PE fund's expertise. To pay for all this, the PE bosses start to hack away at the company. Quality declines. So do wages. Prices go up. The company changes suppliers, opting for cheaper alternatives, often stiffing the old company. There are mass layoffs. The remaining employees end up doing three peoples' jobs, for lower wages, with fewer materials of lower quality.

Eventually, that top-feeding PE company finds a more desperate, more ham-fisted PE company to unload the business onto. That middle-feeding company also does a leveraged buyout, pays itself another special dividend, cuts wages, staffing and quality even further. They switch to even worse suppliers and stiff the last batch. Prices go up even higher.

Then – you guessed it – the middle-feeding PE company finds an even more awful PE bottom-feeder to unload the company onto. That bottom feeder does it all again, without even pretending to leave the business in condition to do its job. The company is a shambling zombie at this point, often producing literal garbage in place of the products that made its reputation. Employees' paychecks bounce, or don't show up at all. The company stops bothering to pay the lawyers that have been fending off its creditors. Those lawyers sue the company, too.

That's the kind of PE company Steward Health was, and, as the name suggests, Steward Health is in the business of stripping away the very last residue of value from community hospitals. As you might imagine, this gets pretty fucking ugly.

Steward owns 32 hospitals up and down the country, though its holdings are dwindling as the company walks away from its debt-burdened holdings, after years of neglect that have rendered them unfit for use as health facilities – or for any other purpose. Tcacik's piece offers a snapshot of one such hospital: Florida's Rockledge Regional Medical Center, just eight miles from Cape Canaveral.

Rockledge is a disaster. The fifth floor was, at one point, home to 5,000 bats.

Five.

Thousand.

Bats.

(Rockledge stiffed the exterminators.)

The bats were just the beginning. One of the internal sewage pipes ruptured. Whole sections of the hospital were literally full of shit, oozing out of the walls and ceiling, slopping over medical equipment.

That's an urgent situation for any hospital, but for Rockledge, it's catastrophic, because Rockledge is a hospital without any hospital supplies. Steward has stiffed the companies that supply "heart valves, urology lasers, Impella catheters, cardiac catheterization balloons, slings for lifting heavier patients, blood and urine test reagents, and most recently, prescription paper." Key medical equipment has been repossessed. So have the Pepsi machines. The hospital cafeteria had its supply of cold cuts repossessed:

https://www.reddit.com/r/massachusetts/comments/1agc1j4/comment/kolicqo/

It's not just Steward's nonpayments that reek of impending doom. Its payments also bear the hallmarks of a scam artist on the brink of blowing off the con. The company recently paid off a vendor with five separate checks for $1m, each drawn on "a random hospital in Utah" (Steward recently walked away from its Utah hospitals; its partners there are suing it for stealing $18m on their way out the door).

This company – which owns 32 hospitals! – has resorted to gambits like sending photos of fake checks to doctors it hasn't paid in months as "proof" that the money was coming (the checks arrived 22 days later).

Steward owes so much money to its employees – $1.66m to just one doctors' group. But the medical staff keep doing their jobs, and are reluctant to speak on the record, thanks to Steward's reputation for vicious retaliation. Those health workers keep showing up to take care of patients, even as the hospital crumbles around them. One clinician told Tcacik: "I watched a bed collapse underneath a [patient] who had just undergone hip surgery."

Rockledge has nine elevators, but only five of them work – the other four have been broken for a year. The hospital's fourth floor has been converted to "a graveyard of broken beds." The sinks are clogged, or filled with foul gunk. There's black mold. Nurses have noted on the maintenance tags that the repair service refuses to attend the hospital until their overdue bills are paid. The fifteen-person on-site maintenance team was cut to just two workers.

Steward is just the latest looting owner of Rockledge. After the Great Financial Crisis, private equity consultants helped sell it to Health Management Associates. The hospital's CEO took home a $10m bonus for that sale and exited; Health Management Associates then quickly became embroiled in a Medicare fraud and kickback scandal. Soon after, Rockledge was passed on to Community Health Systems, who then sold it on to Rockledge.

Steward, meanwhile, was at that time owned by an even bigger private equity giant, Cerberus, which then sold Steward off. That deal was performatively complex and hid all kinds of mischief. Prior to Cerberus's sell-off of Steward, they sold off Steward's real-estate. The buyer was Medical Properties Trust, who gave Cerberus $1.25b for the real-estate: three hospitals in Florida and three more in Ohio. Steward then contracted to operate these hospitals on MPT's behalf, and pay MPT rent for the real-estate.

This complex arrangement was key to siphoning value out of the hospital and to keeping angry creditors at bay – if you can't figure out who owes you money, it's a lot harder to collect on the debt. The scheme was masterminded by Steward founder/CEO Ralph de la Torre. De la Torre is notorious for taking a massive dividend out of the company while it owed $1.4b to its creditors. He bought a $40m yacht with the money.

De la Torre was once feted as a business genius who would "disrupt" healthcare. But as Steward's private jet hops around "Corfu, Santorini, St. Maarten and Antigua" as its hospitals literally crumble, he's becoming less popular. In Massachusetts, politicians have railed against Steward and de la Torre (Governor Healey wants the company to leave the state "as soon as possible").

Florida, by contrast, is much more friendly to Steward. The state Health and Human Services Committee chair Randy Fine is an ardent admirer of hospital privatization and is currently campaigning to sell off the last community hospital in Brevard County. The state inspectors are likewise remarkably tolerant of Steward's little peccadillos. The quasi-governmental agency that inspects hospitals has awarded this shit-and-bat-filled, elevator-free, understaffed rotting hulk "A" grades for quality.

These inspectors jointly represent a mismatched assortment of private and public agencies, dominated by a nonprofit called Leapfrog, the brainchild of Harvard public-health prof Lucian Leape, who founded it in 2000. Leapfrog likes to tout its "transparent" assessment criteria, and Steward are experts at hitting those criteria, spending the exact minimum to tick every box that Leapfrog inspectors use as proxies for overall quality and safety.

This is a pretty great example of Goodhart's Law: "every measurement eventually becomes a target, whereupon it ceases to be a good measurement":

https://xkcd.com/2899/

But despite Steward's increasingly furious creditors and its decaying facilities, the company remains bullish on its ability to continue operations. Medical Properties Trust – the real estate investment trust that is nominally a separate company from Steward – recently hosted a conference call to reassure Wall Street investors that it would be a going concern. When a Bank of America analyst asked MPT's CFO how this could possibly be, given the facility's dire condition and Steward's degraded state, the CFO blithely assured him that the company would get bailouts: "We own hospitals no one wants to see closed."

That's the thing about PE and health-care. The looters who buy out every health-care facility in a region understand that this makes them too big to fail: no matter how dangerous the companies they drain become, local governments will continue to prop them up. Look at dialysis, a market that's been cornered by private equity rollups. Today, if you need this lifesaving therapy, there's a good chance that every accessible facility is owned by a private equity fund that has fired all its qualified staff and ceased sterilizing its needles. Otherwise healthy people who visit these clinics sometimes die due to operator error. But they chug along, because no dialysis clinics is worse that "dialysis clinics where unqualified sadists sometimes kill you with dirty needles":

https://www.thebignewsletter.com/p/the-dirty-business-of-clean-blood

The bad news is that private equity has thoroughly colonized the entire medical system. They took hospitals, fired the doctors, then took over the doctors' groups that provided outsource staff to the hospital:

https://pluralistic.net/2020/04/04/a-mind-forever-voyaging/#prop-bets

It's illegal for private equity companies to own doctors' practices (doctors have to own these), but they obfuscated the crime with a paper-thin pretext that they got away with despite its obvious bullshittery:

https://pluralistic.net/2020/05/21/profitable-butchers/#looted

The financier who decides whether you live or die depends on an algorithm that literally sets a tolerable level of preventable deaths for the patients trapped in the practice:

https://pluralistic.net/2023/08/05/any-metric-becomes-a-target/#hca

Private equity also took over emergency rooms and boobytrapped them with "surprise billing" – junk fees that ran to thousands of dollars that you had to pay even if the hospital was in network with your insurer. They made billions from this, and spent a many millions from that booty keeping the scam alive with scare ads:

https://pluralistic.net/2020/04/21/all-in-it-together/#doctor-patient-unity

The whole health stack is colonized by private equity-backed monopolies. Even your hospital bed!

https://pluralistic.net/2022/01/05/hillrom/#baxter-international

Then there's residential care. Private equity cornered many regional markets on nursing homes and turned them into slaughterhouses, places where you go to die, not live:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

The palliative care sector is also captured by private equity. PE bosses hire vast teams of fast-talking salespeople who con vulnerable older people into entering an end-of-life system before they are ready to die. Thanks to loose regulation, the nation is filled with fake hospices that can rake in millions from Medicare while denying all care to their patients (hospice patients don't get life-extending medication or procedures, by definition):

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

If you survive this long enough, Medicare eventually tells the hospice that you're clearly not dying and you get kicked off their rolls. Now you have to go through the lengthy bureaucratic nightmare of convincing the system – which was previously informed that you were at death's door – that you are actually viable and need to start getting care again (good luck with that).

If that kills you, guess what? Private equity has rolled up funeral homes up and down the country, and they will scam your survivors just as hard as the medical system that killed you did:

https://pluralistic.net/2022/09/09/high-cost-of-dying/#memento-mori

The PE sector spent more than a trillion dollars over the past decade buying up healthcare companies, and it has trillions more in "dry powder" allocated for further medical acquisitions. Why not? As the CFO of Medical Properties Trust told that Bank of America analyst last week, when you "own hospitals no one wants to see closed." you literally can't fail, no matter how many people you murder.

The PE sector is a reminder that the crimes people commit for money far outstrip the crimes they commit for ideology. Even the most ideological killers are horrified by the murders their profit-motivated colleagues commit.

Last year, Tkacic wrote about the history of IG Farben, the German company that built Monowitz, a private slave-labor camp up the road from Auschwitz to make the materiel it was gouging Hitler's Wehrmacht on:

https://pluralistic.net/2023/06/02/plunderers/#farben

Farben bought the cheapest possible slaves from Auschwitz, preferentially sourcing women and children. These slaves were worked to death at a rate that put Auschwitz's wholesale murder in the shade. Farben's slaves died an average of just three months after starting work at Monowitz. The situation was so abominable, so unconscionable, that the SS officers who provided outsource guard-labor to Monowitz actually wrote to Berlin to complain about the cruelty.

The Nuremberg trials are famous for the Nazi officers who insisted that they were "just following order" but were nonetheless executed for their crimes. 24 Farben executives were also tried at Nuremberg, where they offered a very different defense: "We had a fiduciary duty to our shareholders to maximize our profits." 19 of the 24 were acquitted on that basis.

PE is committed to an ideology that is far worse than any form of racial animus or other bias. As a sector, it is committed to profit above all other values. As a result, its brutality knows no bounds, no decency, no compassion. Even the worst crimes we commit for hate are nothing compared to the crimes we commit for greed.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/28/5000-bats/retaliation#charnel-house

#pluralistic#Rockledge Regional Medical Center#private equity#looting#Steward Health#ponzis#maureen tcacik#Medical Properties Trust#Ralph de la Torre#Massachusetts#florida#Cerberus#too big to fail#pe#guillotine watch

342 notes

·

View notes

Text

Kenyan tea pickers are destroying machines brought in to replace them during violent protests that highlight the challenge faced by low-skilled workers as more agribusiness companies rely on automation to cut costs. At least 10 tea-plucking machines have been torched in multiple flashpoints in the past year, according to local media reports. Recent demonstrations have left one protester dead and several injured, including 23 police officers and farm workers. The Kenya Tea Growers Association (KTGA) estimated the cost of damaged machinery at $1.2 million (170 million Kenyan shillings) after nine machines belonging to Ekaterra, makers of the top-selling tea brand Lipton, were destroyed in May. In March, a local government taskforce recommended that tea companies in Kericho, the country’s largest tea-growing town, adopt a new 60:40 ratio of mechanized tea harvesting to hand-plucking. The taskforce also wants legislation passed to limit importation of tea harvesting machines. Nicholas Kirui, a member of the taskforce and former CEO of KTGA, told Semafor Africa 30,000 jobs had been lost to mechanization in Kericho county alone over the past decade. "We did public participation in all the wards and with all the different groups, and the overwhelming sentiment we were hearing was that the machines should go," Kirui said. In 2021, Kenya exported tea worth $1.2 billion, making it the third-largest tea exporter globally, behind China and Sri Lanka. Multinationals including Browns Investments, George Williamson and Ekaterra — which was sold by Unilever to a private equity firm in July 2022 — plant on an estimated 200,000 acres in Kericho and have all adopted mechanized harvesting. Some machines can reportedly replace 100 workers. Ekaterra's corporate affairs director in Kenya, Sammy Kirui, told Semafor Africa that mechanization was “critical” to the company’s operations and the global competitiveness of Kenyan tea. As the government taskforce established, one machine can bring the cost of harvesting tea down to 3 cents (4 Kenyan shillings) per kilogram from 11 cents (15.32 shillings) per kilogram with hand-plucking. Analysts partly attribute Kenya's unemployment rate — the highest in East Africa — to automation in industries, including banking and insurance. Some 13.9% of working age Kenyans (over 16) were out of work or long term unemployed in the final quarter of 2022.

362 notes

·

View notes

Text

ARTICLE: The Florida Man of Formula 1 (2023)

Source: Michael M. Grynbaum, The New York Times Series: F1, 2023

Logan Sargeant, the only American driver in Formula 1, is zipping around the narrow streets of Baku, Azerbaijan, at roughly 200 miles an hour. His head bounces inside the cockpit as a wheel shudders over a rumble strip. It’s hard to hear over the banshee shriek of his V6 engine, carrying three times the horsepower of a run-of-the-mill Porsche Carrera.

Then the noise stops, and Baku vanishes. We’re inside a low-slung brick building nestled in the Oxfordshire countryside. The track, projected onto a CinemaScope-sized wraparound screen, was a mirage, part of a sophisticated training simulator. (F1 rules prohibit driving the real cars between races.) Mr. Sargeant climbs out of a replica driver’s seat wearing athletic pants. He won’t need a fireproof suit until later.

In three weeks’ time, Mr. Sargeant will do this for real: wind whipping his visor, G-forces of up to six times his body weight pressing on his neck, the ever-present threat of a catastrophic crash as he is watched by roughly 70 million people around the world. For now, it’s time for lunch. “Is chili bad for you?” he asks, digging into a bowl at his team’s commissary. “I don’t think it’s that bad.”

Williams Racing, in Grove, England. It was founded in Oxfordshire in the 1970s, but it’s now an American subsidiary: a Manhattan private equity firm, Dorilton Capital, bought the company in 2020 for an estimated $200 million.

F1 teams employ hundreds of employees and spend hundreds of millions of dollars developing the world’s most sophisticated racecars.

Reaching Formula 1, the highest level of international motor sport, is a big step for Mr. Sargeant, 22, a South Florida native who began racing rudimentary cars known as karts at 6 years old and this year joined the Williams Racing team as the first full-time American F1 driver since 2007.

For Formula 1 itself, finding a hometown hero for American fans is a giant leap.

Although it is enormously popular in Europe, F1 struggled for decades to break into the United States. That began to change in 2016, when the sport was purchased for $4.4 billion by the Colorado-based Liberty Media, owned by the cable magnate John Malone. Liberty ramped up its social media — F1 had barely kept a YouTube page — and backed a popular Netflix documentary series, “Drive to Survive.” Once geared toward aging white men, F1 now has a younger and more diverse fan base. American TV viewership is up 220 percent from 2018, and the sport made $2.6 billion in revenue last year.

Still, a subset of F1 devotees complain about what they see as an overemphasis on entertainment and ginned-up drama. Under Liberty, they argue, pure racing is taking a back seat to cheap tricks to reel in casual viewers. And they often use a dirty word for it: Americanization. “It is becoming more and more like Formula Hollywood,” Bernie Ecclestone, the 92-year-old Briton who built F1 into a global business, griped last year. “F1 is being made more and more for the American market.”

The backlash reached a crescendo at last week’s Miami Grand Prix, which was added in 2022 as a showpiece for American fans. In a prizefight-style pre-race ceremony, the rapper LL Cool J introduced the 20 drivers one by one amid swirling smoke and a squad of cheerleaders. Nearby, Will.i.am conducted a live orchestra playing the rap song he recently recorded with Lil Wayne as part of a “global music collaboration” with Formula 1. (The lyrics rhyme “Max Verstappen,” the name of the sport’s top driver, with “your champion.”)

“Pandering to the American audience is killing @F1,” wrote one fan on Twitter, echoing criticism that bubbled up across numerous F1 websites. Even the racers complained: “None of the drivers like it,” groused Lando Norris, a Briton who drives for McLaren. Undeterred, Liberty announced that the bombastic pre-race sequence would be featured at several more grands prix this year.

In the United States, F1 has long been associated with a certain European mystique, most famously, the louche glamour of the Monaco Grand Prix.

In the United States, F1 has long been associated with a certain European mystique. Its drivers race across the Ardennes forest (Circuit de Spa-Francorchamps in Belgium), the plains of Lombardy (Italy’s Autodromo Nazionale di Monza) and, most famously, the louche glamour of the Monaco Grand Prix. The sport’s stateside image could be summed up by the 2006 comedy, “Talladega Nights: The Ballad of Ricky Bobby,” which featured Sacha Baron Cohen as a pretentious French F1 driver named Jean Girard, a snooty Eurotrash foil to Will Ferrell’s macho NASCAR cowboy.

In 2023, F1 can feel a bit more Ricky Bobby than Jean Girard. In Miami, drivers circled a track built in the parking lot of the Dolphins football stadium, past an artificial Monaco-style “harbor”: blue-painted asphalt topped with ersatz yachts. A new Las Vegas race in November will have cars zooming down the Strip past Caesars Palace. Meanwhile, traditional races in France and Germany are gone.

Katy Fairman, a journalist based in Brighton, England, who runs the F1 podcast “Small Torque,” said she was surprised by the spectacle when she attended a race in Austin, Texas. “There were girls with pompoms,” she said. “I remember watching it and thinking, Oh my gosh, this is so different from anything I’d seen F1 do in a long time.”

Ms. Fairman conceded that some Europeans find the American hullabaloo “tacky.” But she added: “When it’s something to do with America, I think Europeans are quite judgmental. I think it’s just a bit of lighthearted fun. You guys like to have a party.”

The arrival of Mr. Sargeant, who grew up about an hour’s drive from the Miami racetrack, has spurred new interest, including a profile and photo shoot in GQ, and he’s happy to play the part. “What’s up America, let’s bring that energy!” he shouted to the cameras after LL Cool J introduced him as “the local boy done good.”

But as with F1, there are growing pains. In Miami, Mr. Sargeant finished last, his race ruined on the first lap when he damaged a front wing. After the checkered flag, he apologized to his team, his voice barely a whisper: “I’m so sorry. I can’t believe it.”

Weeks earlier, in an interview in England, Mr. Sargeant had demurred about the pressure of wearing the stars and stripes. “I try not to get too caught up in the talk of the role of ‘first American,’” he said. “It’s still very early for me, and I have a lot to learn still.”

If Mr. Sargeant doesn’t perform, there are dozens of drivers eager to take his spot. “At the moment,” he said, “I just have to worry about staying here.”

For a globe-trotting athlete, Mr. Sargeant can be soft-spoken and endearingly self-conscious.

‘I just want to get back in the gym.’

Before his tough Miami weekend, Mr. Sargeant was asked how he would celebrate a top 10 finish. “Honestly, it might sound lame, but probably just go back to my house and get in my bed for another night before I go back to London,” he replied. “That’s all I want to do.”

For a wealthy, handsome, globe-trotting athlete, Mr. Sargeant can be soft-spoken and endearingly self-conscious. It’s not unusual for someone who, like a tennis prodigy or Olympian gymnast, has devoted their life since childhood to a sole pursuit.

Mr. Sargeant was 6 when he and his brother Dalton got a kart from their parents for Christmas. “No one in the family was really even that much into racing,” Logan said. “We just picked it up as a hobby, something to do on the weekend.” He began winning junior races around the country — too easily. To reach the next level and pursue Formula 1, he’d have to leave behind his friends and beloved fishing excursions for life on a different continent: “We just needed a higher level of competition, and at the end of the day, that was in Europe.”

Mr. Sargeant left Florida before his 13th birthday, bouncing between Italy, Switzerland and Britain as he raced on the European junior circuit; in 2015, he became the first American to win the Karting World Championship since 1978. “As a kid, it was tough,” he recalled. “Coming from Florida, being outdoors all the time on the water, great weather — it was literally vice versa.” He eventually settled in London, where he spends most days working out with a trainer. “I get away from a race weekend, and I just want to get back in the gym,” he said. “I hate that feeling of leaving slack on the table.”

It is incredibly difficult to nab a seat in Formula 1. Today’s drivers are physical dynamos trained to optimize their reflexes and performance levels down to how well they can withstand jet lag — critical in a sport that this year will include 23 grands prix spread over five continents. F1 teams employ hundreds of employees and spend hundreds of millions of dollars developing the world’s most sophisticated racecars. But it’s ultimately up to the driver to execute.

It also helps to have money. Lewis Hamilton, the seven-time world champion and F1’s only Black driver, is an exception, having grown up on a London council estate. Many F1 competitors are the sons of multimillionaires (and some billionaires) who can bankroll pricey travel and high-tech cars.

Mr. Sargeant falls into the scion category. He hails from a wealthy Florida asphalt shipping family. His uncle, Harry Sargeant III, is a former fighter pilot and onetime finance chair of Florida’s Republican Party who has been sued by the brother-in-law of King Abdullah II of Jordan and whose name turned up, tangentially, in the 2020 impeachment of former President Donald J. Trump. (Harry was not accused of any wrongdoing.)

Logan’s father, Daniel Sargeant, worked alongside Harry until the brothers had a falling out. In a 2013 lawsuit, Harry accused Daniel of misdirecting $6.5 million in corporate funds “for the purpose of advancing the international cart racing activities” of his sons, Logan and Dalton; that litigation was eventually settled.

In 2019, Daniel Sargeant pleaded guilty in federal court in New York to foreign bribery and money laundering charges related to his business dealings abroad. He is free on a $5 million bond and is awaiting sentencing. A Williams spokesman said that Logan Sargeant was not “in a position to comment” on any of the legal matters involving his family.

In F1, none of this particularly stands out. The mother of Mr. Sargeant’s Williams teammate, Alexander Albon, was jailed in Britain for swindling millions of pounds in fraudulent sales of high-end cars. A Russian racer, Nikita Mazepin, was booted from the sport after his oligarch father, a close ally of President Vladimir V. Putin, was sanctioned following the 2022 invasion of Ukraine.

James Vowles, the Williams team principal, said in an interview that he hired Mr. Sargeant for his speed, not his U.S. passport. “I’m incredibly pleased that the sport is growing in America, but I think it would be anything but disingenuous to say that Logan’s here for any other reason than I think he’s got this pure talent,” he said.

In his F1 debut in Bahrain in March, Mr. Sargeant finished 12th, outpacing this year’s two other rookies. “He has this insatiable desire to be better, to want more,” Mr. Vowles said. “He’s a perfectionist, and I like that in him.”

Tooting around in a Vauxhall Astra

Britain, where Formula 1 originated in 1950, remains the sport’s spiritual home, where most of its 10 teams are based. Williams was founded in Oxfordshire in the 1970s, but it’s now an American subsidiary: a Manhattan private equity firm, Dorilton Capital, bought the company in 2020 for an estimated $200 million.

It was an important cash infusion for a team that had struggled to keep up with rivals. Manufacturers like Mercedes-Benz pour enormous resources into their F1 teams, which double as an elaborate global marketing campaign and an in-house innovation farm; tech developed for F1, like engines that recycle braking energy as an accelerant, can trickle into consumer vehicles.

Formula 1 car simulators at the Williams Racing factory.

Formula 1 drivers practice on sophisticated training simulators.

The Williams campus is a humdrum brick pile that could be mistaken for an office park — a far cry from McLaren’s space-age complex an hour’s drive away. Many F1 teams provide their drivers with a high-end sports car for personal use; Mr. Sargeant commutes in a Vauxhall Astra, a compact.

Even the team’s sponsors are relatively down-market; whereas the official watch of Ferrari is Richard Mille (starting price: $60,000), Williams has a deal with Bremont, whose timepieces retail for significantly less. (On a recent visit, a Williams press aide was quick to extract a spare Bremont watch from his pocket and ensure Mr. Sargeant was wearing it whenever a photographer hovered.)

Given the huge costs, corporate partnerships are crucial to F1, part of the reason the American market, with its abundance of affluent consumers and wealthy brands, has proved so tempting. Gerald Donaldson, a journalist who has covered F1 for 45 years, recalled how cars were gradually taken over by corporate logos starting in the late 1960s.

“Marlboro paid all the Ferrari bills, including the drivers, for many years,” he said in an interview. “There are eager companies who want the publicity.” Mr. Sargeant’s car features ads for Michelob Ultra beer and an American financial firm, Stephens. In Miami last weekend, beachgoers spotted an airborne banner reading “Go Logan!” alongside the image of a Duracell battery.

Last year, the Miami race was viewed on ABC by 2.6 million people, the biggest American audience for a live F1 telecast. Ratings for this year’s race fell about 25 percent, perhaps a result of a duller-than-usual season dominated by one team, Red Bull.

Still, viewing data show that F1 is expanding beyond affluent cities associated with elite sports: In 2022, its top five American TV markets included Asheville, N.C., and Tulsa, Okla. ESPN is clearly betting on more growth. When the sports network renewed its broadcast rights last year, it agreed to pay $90 million annually — up from the $5 million-a-year deal it signed in 2019.

Liam Parker, a former adviser to Boris Johnson who now leads communications at F1, said the sport was intent on rectifying past mistakes. “We were too arrogant,” he said. “We couldn’t understand why the American fan base wasn’t falling in love with us.” But he also pushed back on the complaints that Liberty’s efforts to raise the entertainment factor had stripped F1 of something essential.

“This whole argument of ‘Americanization,’ it’s a very crude way to describe things,” he said. “We shouldn’t ignore things that can improve things for new and core fans. It’s about giving people more choices in the modern era. It’s modernization of access to everyone.”

Mr. Hamilton, arguably the biggest celebrity of the current F1 lineup, has offered his own endorsement of Liberty’s approach. “I mean jeez, I grew up listening to LL Cool J,” he told reporters in Miami. “I thought it was cool, wasn’t an issue to me.”

For all the debates over elitism, good taste and corporate rap collaborations, the core appeal of F1, when you get right down to it, may be something simpler — something Mr. Sargeant got at when asked in the interview if he had loved cars as a kid.

“I absolutely love driving, as you can imagine,” he said. “But to be honest, I’m not one of those people who studies cars and, you know, likes to know every detail of every single car. It doesn’t really interest me.”

“The part that interests me,” he concluded, “is driving them as fast as I can go.”

Eliza Shapiro contributed reporting from Miami. Kitty Bennett contributed research. Michael M. Grynbaum is a media correspondent covering the intersection of business, culture and politics. A version of this article appears in print on May 14, 2023, Section BU, Page 1 of the New York edition with the headline: The Florida Man Of Formula 1.

#logan sargeant#year:2023#source:newspaper#one of the best logan articles imo#feel free to message me if you want me to gift you a copy of this article from the NYT with my subscription

76 notes

·

View notes

Text

Healthcare Private Equity in Malaysia: What to Expect in 2025

While the outlook for private equity in Malaysia’s healthcare sector is largely positive, challenges remain. Regulatory uncertainties, rising operational costs, and the need for specialized expertise to manage healthcare investments could impact returns. Additionally, the potential imposition of equity caps might limit foreign ownership in certain sub-sectors, requiring strategic adjustments from international private equity firms.

Read More

0 notes

Text

Private equity firms are utilizing public trust in long-standing publications to sell every product under the sun

In a bid to replace falling ad revenue, publishing houses are selling their publications for parts to media groups that are quick to establish affiliate marketing deals.

Savvy SEOs at big media publishers (or third-party vendors hired by them) realized that they could create pages for ‘best of’ product recommendations without the need to invest any time or effort in actually testing and reviewing the products first. So, they peppered their pages with references to a ‘rigorous testing process,’ their ‘lab team,’ subject matter experts ‘they collaborated with,’ and complicated methodologies that seem impressive at a cursory look. Sometimes, they even added photos of ‘tests’ with products covered in Post-it notes, someone holding a tape measure, and people with very ‘scientific’ clipboards. There’s nothing wrong with wanting to show you’re doing the thing you’re supposed to be doing, but what happens when that’s as far as you go?

28 notes

·

View notes

Text

How Trump's billionaires are hijacking affordable housing

Thom Hartmann

October 24, 2024 8:52AM ET

Republican presidential nominee and former U.S. President Donald Trump attends the 79th annual Alfred E. Smith Memorial Foundation Dinner in New York City, U.S., October 17, 2024. REUTERS/Brendan McDermid

America’s morbidly rich billionaires are at it again, this time screwing the average family’s ability to have decent, affordable housing in their never-ending quest for more, more, more. Canada, New Zealand, Singapore, and Denmark have had enough and done something about it: we should, too.

There are a few things that are essential to “life, liberty, and the pursuit of happiness” that should never be purely left to the marketplace; these are the most important sectors where government intervention, regulation, and even subsidy are not just appropriate but essential. Housing is at the top of that list.

A few days ago I noted how, since the Reagan Revolution, the cost of housing has exploded in America, relative to working class income.

When my dad bought his home in the 1950s, for example, the median price of a single-family house was around 2.2 times the median American family income. Today the St. Louis Fed says the median house sells for $417,700 while the median American income is $40,480—a ratio of more than 10 to 1 between housing costs and annual income.

ALSO READ: He’s mentally ill:' NY laughs ahead of Trump's Madison Square Garden rally

In other words, housing is about five times more expensive (relative to income) than it was in the 1950s.

And now we���ve surged past a new tipping point, causing the homelessness that’s plagued America’s cities since George W. Bush’s deregulation-driven housing- and stock-market crash in 2008, exacerbated by Trump’s bungling America’s pandemic response.

And the principal cause of both that crash and today’s crisis of homelessness and housing affordability has one, single, primary cause: billionaires treating housing as an investment commodity.

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

— Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities. — Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily. (Emphasis theirs.)

It seems that everywhere you look in America you see the tragedy of the homelessness these billionaires are causing. Rarely, though, do you hear about the role of Wall Street and its billionaires in causing it.

The math, however, is irrefutable.

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper. That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

This trend is massive.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes young families can afford to buy, billionaires then begin raising rents to extract as much cash as they can from local working class communities.

In the Nashville suburb of Spring Hill, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street billionaire investor] landlords was about $1,773 a month…”

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street.”

It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

This all really took off around a decade ago following the Bush Crash, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

America should, too.

ALSO READ: Not even ‘Fox and Friends’ can hide Trump’s dementia

16 notes

·

View notes

Text

Best M&A Counsel

Saraf and Partners stand out as the best M&A counsel, renowned for their expertise and dedication to client success. Their meticulous approach and in-depth knowledge make them the preferred choice for clients seeking the best M&A lawyers.

#Top law firm in Delhi#Top law firm in India#Top lawyers in Delhi#Best law firm in India#Banking and finance lawyers#Banking & Finance Law firm#litigation and arbitration#Litigation firm in Delhi#M&A law firm#Best M&A lawyers#Restructuring and Insolvency Law#Legal Advice for Startups#Private equity law firm#Real Estate Law Firm#Real estate lawyers#legal services#Corporate law firm in Mumbai#Corporate law firm in Delhi

0 notes

Text

Global Star Capital founder Rich Cocovich recently met with new clients in Newport Beach California USA on a $5 Million project to bring a new alcohol spirit to market. Since 1991, Global Star Capital and Cocovich have assisted project principals in 126 Countries and all states in America to align private funding. If you are a solvent and prepared project principal who understands that high end professionals and their services are not free, not commission based, not contingent, not wrapped into a closing and not pro-bono, then you are welcome to apply at our main company website www.globalstarcapital.com beginning in the Our Process section. Our protocol is etched in stone and is non-negotiable. Over $30 Billion USD from private investors world wide awaits the projects we represent.

#richcocovichreviews #richcocovich #capitalraising #cocovich #globalstarcapitalreviews #globalstarcapital #projectfinance #projectfunding #equityinvesting #equityfunding

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#richcocovich#rich cocovich reviews#globalstarcapital#rich cocovich review#richard cocovich review#top private funding consulting firm#private equity#private funding#project funding#equity financing#equity investor#cocovich#rich cocovich top consultant in private funding

1 note

·

View note