#Top 10 Pharmaceutical Companies in 2023

Explore tagged Tumblr posts

Text

Top 10 Pharmaceutical Companies in 2023: How COVID-19 Reshaped the Industry

See how COVID-19 impacted the pharmaceutical industry in 2023. This article explores the top ten pharma companies by revenue, including how established players fared and how new product approvals influenced rankings.

In the dynamic landscape of the pharmaceutical industry, certain companies stand out as leaders, driving innovation, and shaping the future of healthcare. As we delve into the year 2023, let's take a closer look at the top ten pharmaceutical giants that continue to influence the global market.

1. Pfizer

With a rich history of breakthroughs, Pfizer maintains its position as a powerhouse in the pharmaceutical world. From vaccines to therapeutics, the company's innovative portfolio remains at the forefront of healthcare advancements.

2. Roche

Renowned for its expertise in oncology and diagnostics, Roche continues to make strides in personalized medicine. Through strategic partnerships and cutting-edge research, the company remains a key player in cancer treatment and detection.

3. Johnson & Johnson

As a diversified healthcare conglomerate, Johnson & Johnson boasts a robust portfolio spanning pharmaceuticals, medical devices, and consumer health products. With a commitment to innovation and sustainability, the company maintains its status as a global leader.

4. Novartis

Driven by a mission to reimagine medicine, Novartis focuses on developing transformative therapies for a range of diseases. From innovative gene therapies to breakthrough treatments, the company remains a frontrunner in healthcare innovation.

5. Merck & Co.

Merck & Co. continues to make significant contributions to global health with its portfolio of vaccines, pharmaceuticals, and animal health products. Through strategic acquisitions and research collaborations, the company remains a driving force in the fight against infectious diseases and chronic conditions.

6. AstraZeneca

With a dedication to advancing science and delivering life-changing medicines, AstraZeneca remains a key player in the pharmaceutical landscape. From cardiovascular treatments to respiratory therapies, the company's diverse portfolio addresses some of the most pressing healthcare challenges.

7. GlaxoSmithKline

Known for its commitment to innovation and global health initiatives, GlaxoSmithKline continues to make a positive impact on patient care. Through strategic investments in research and development, the company remains at the forefront of vaccine development and infectious disease management.

0 notes

Text

Oct. 3 (UPI) -- Ten U.S. drug manufacturers have agreed to participate in the initial round of the first-ever pricing negotiations between Medicare and the nation's pharmaceutical giants, the Biden administration announced Tuesday.

The highly anticipated Medicare Drug Price Negotiation Program was set to enter its next phase after the Centers for Medicare & Medicaid Services invited the drugmakers to voluntarily join the program in August.

The move comes as President Joe Biden seeks to fulfill a campaign promise to make prescription medicines more affordable for millions of aging Americans.

The drugs on the list are among the most commonly used to treat everything from heart failure, blood clots, diabetes, arthritis, and Crohn's disease, however, average Americans often cannot afford to buy the drugs, Biden said in August when the drug cost reform effort kicked off.

Previously, the White House said the drugs are among the top 50 prescription medications that seniors fill the most at retail pharmacies under Medicare Part D.

The companies electing to participate include Bristol Myers Squibb, Boehringer Ingelheim, Janssen Pharmaceuticals, Merck Sharp Dohme, AstraZeneca, Novartis, Immunex, Pharmacyclics LLC, Jannsen Biotech and Novo Nordisk.

Collectively, the companies' drugs brought in $50.5 billion from prescriptions covered under Part D between June 1, 2022, and May 31, 2023, with consumers paying $3.4 billion in out-of-pocket costs, according to a statement from the Department of Health and Human Services.

"Drug companies that manufacture these drugs have indicated that they will participate in negotiations with Medicare during the remainder of 2023 and in 2024, and any agreed-upon negotiated prices will become effective beginning in 2026," the statement said.

The pricing program is being funded through the Inflation Reduction Act of 2022, which expanded Medicare's authority to negotiate out-of-pocket drug costs, including a $2 monthly cap on certain generic drugs used to treat chronic conditions, as well as a $35 price cap on insulin.

The pandemic-era legislation contains a broad range of actions to mitigate high drug prices, including a plan that adds commercial health insurers to a requirement that forces drug companies to pay rebates to Medicare whenever medicine prices rise faster than inflation.

Merck and Johnson & Johnson have filed multiple lawsuits in an effort to declare Biden's plan unconstitutional.

Biden has vowed to continue to pursue lower drug costs, arguing his pricing plan was working to help struggling Americans while the pharmaceutical industry raked in billions in record profits.

"There is no reason why Americans should be forced to pay more than any developed nation for life-saving prescriptions just to pad Big Pharma's pockets," Biden said at the time.

When the pricing negotiations conclude, the Centers for Medicare & Medicaid Services will announce the prices of the selected drugs on or before September 2024, however, the new drug prices won't go into effect until 2026.

From there, the government will select up to 15 more drugs covered under Part D for 2027, and up to 15 more drugs for 2028, including drugs covered under Part B and Part D.

The program will add up to 20 more drugs each year after that, as required by the Inflation Reduction Act.

6 notes

·

View notes

Text

Full list of Forbes’ 25 world billionaires in 2023

American business magazine, Forbes, in its 2023 list of 25 richest people in the world, featured Bernard Arnault on the No. 1 spot, followed by Twitter Chief Executive Officer, Elon Musk.

In its previous list in 2022, Musk was on the No. 1 spot.

Forbes described the drop of Musk from the top spot as ” this year’s second-biggest loser”, adding that “Elon Musk, had it worse.”

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

So This Happened (202) Reviews Lagos Bizman’s Arraignment Over Wife’s Death, Others | Punch

Musk lost his title of the world’s richest person after his pricey purchase of Twitter, which he funded in part by the sale of Tesla shares, helping to spook investors. Musk, who is worth $39 billion less than a year ago, is now No. 2.

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

Also, among the top 25, two billionaires — Zhang Yiming, Changpeng Zhao lost their spots and were unable to make it on the list for this year.

Yiming, the founder of Tik Tok-parent Bytedance, dropped one place, from No. 25 to No. 26, as his embattled company has taken a haircut from investors while Zhao, Binance founder, known as CZ, fell from No. 19 last year all the way to No. 167 amid the crypto winter.

Below are the list of Forbes 25 richest people in the world in 2023 with their net worth

1. Bernard Arnault & family

(Net worth: $211 Billion | Source of Wealth: LVMH | Age: 74 | Citizenship: France)

2. Elon Musk

(Net worth: $180 Billion | Source of Wealth: Tesla, SpaceX | Age: 51 | Citizenship: U.S.)

3. Jeff Bezos

(Net worth: $114 Billion | Source of Wealth: Amazon | Age: 59 | Citizenship: U.S.)

4. Larry Ellison

(Net worth: $107 Billion | Source of Wealth: Oracle | Age: 78 | Citizenship: U.S.)

5. Warren Buffett

(Net worth: $106 Billion | Source of Wealth: Berkshire Hathaway | Age: 92 | Citizenship: U.S.)

6. Bill Gates

(Net worth: $104 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

7. Michael Bloomberg

(Net worth: $94.5 Billion | Source of Wealth: Bloomberg LP | Age:81

8. Carlos Slim Helú & family

(Net worth: $93 Billion | Source of Wealth: Telecom | Age: 83 | Citizenship: Mexico)

9. Mukesh Ambani

(Net worth: $83.4 Billion | Source of Wealth: Diversified| Age: 65 | Citizenship: India)

10. Steve Ballmer

(Net worth: $80.7 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

11. Françoise Bettencourt Meyers & family

(Net worth: $80.5 Billion | Source of Wealth: L’Oréal | Age: 69 | Citizenship: France)

12. Larry Page

(Net worth: $79.2 Billion | Source of Wealth: Google | Age: 50 | Citizenship: U.S.)

13. Amancio Ortega

(Net worth: $77.3 Billion | Source of Wealth: Zara | Age: 87 | Citizenship: Spain)

14. Sergey Brin

(Net worth: $76 Billion | Source of Wealth: Google | Age: 49 | Citizenship: U.S.)

15. Zhong Shanshan

(Net worth: $68 Billion | Source of Wealth: Beverages, pharmaceuticals | Age: 68 | Citizenship: China)

16. Mark Zuckerberg

(Net worth: $64.4 Billion | Source of Wealth: Facebook | Age: 38 | Citizenship: U.S.)

17. Charles Koch

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 87 | Citizenship: U.S.)

18. Julia Koch & family

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 60 | Citizenship: U.S.)

19. Jim Walton

(Net worth: $58.8 Billion | Source of Wealth: Walmart | Age: 74 | Citizenship: U.S.)

20. Rob Walton

(Net worth: $57.6 Billion | Source of Wealth: Walmart | Age: 78 | Citizenship: U.S.)

21. Alice Walton

(Net worth: $56.7 Billion | Source of Wealth: Walmart | Age: 73 | Citizenship: U.S.)

22. David Thomson & family

(Net worth: $54.4 Billion | Source of Wealth: Media | Age: 65 | Citizenship: Canada)

23. Michael Dell

(Net worth: $50.1 Billion | Source of Wealth: Dell Technologies | Age: 58 | Citizenship: U.S.)

24. Gautam Adani

(Net worth: $47.2 Billion | Source of Wealth: Infrastructure, commodities | Age: 60 | Citizenship: India)

25. Phil Knight & family

(Net worth: $45.1 Billion | Source of Wealth: Nike | Age: 85 | Citizenship: U.S.)

3 notes

·

View notes

Text

A strange thing happened in the eurozone economy at the end of last year. Despite widespread forecasts that the common currency area would plunge into recession and register negative growth in the last quarter of 2022, it managed to eke out a small gain of 0.1 percent. What is remarkable is not that Europe beat expectations, but that it was one small country—Ireland—whose surging economy single-handedly prevented the eurozone from slipping into the red.

Almost unbelievably, little Ireland, with a population of only 5 million, now has the economic scale to shift the growth statistics of the entire eurozone and its 343 million inhabitants. In 2022, Irish GDP growth of 12.2 percent compared to 3.5 percent in the eurozone as a whole. In absolute numbers, only Germany, France, and Italy contributed more than Ireland to eurozone GDP growth in 2021 and 2022. Ireland’s economic boom has enabled the country’s government to post a budget surplus of 1.6 percent of GDP, even as eurozone countries struggled with an average deficit of more than 3 percent.

Honestly, who wouldn’t want this luck of the Irish?

Look closely, however, and Ireland’s so-called economic miracle looks more than a little odd. The country’s growth is simultaneously both real and artificial. Much of it is driven by a handful of U.S. multinationals, which continue to route global sales and profits through their Irish operations to take advantage of Dublin’s lower business taxes. Although difficult and complex to calculate, Apple’s shifting of intellectual property assets to Ireland is estimated to have contributed half of Ireland’s miraculous 26 percent GDP growth in 2016. That bizarre fact inspired New York Times columnist Paul Krugman to ridicule Ireland’s “leprechaun economics”—and the Irish statistics office to move away from using GDP as a measure of economic growth.

Yet the surge of U.S. investment in Ireland is also real. In particular, Ireland’s role as a pharmaceuticals manufacturing hub dramatically increased during the COVID-19 pandemic. Nine out of the world’s top 10 drug companies have significant production facilities in Ireland. The U.S. State Department thinks the corporate build-out in Ireland will continue, given Ireland’s status as the only remaining English-speaking European Union country following Britain’s departure. That makes it easy for international companies to operate and enjoy barrier-free access to the EU’s single market.

It’s hard to exaggerate Ireland’s dependence on U.S. tech and pharma companies for investment and taxes. Corporate tax receipts are now the second-largest source of tax revenue (after income tax) for the Irish state: 27 percent of all tax income in 2022. The average was just 9 percent in the 38 member countries of the Organisation for Economic Co-operation and Development (OECD) in 2020, the last year for which data is available. This, in turn, is fueling an unprecedented torrent of tax income for the Irish government. Corporate tax revenues were up nearly 50 percent in 2022 alone.

Just 10 multinationals—all of them U.S.-based tech and pharmaceutical companies—now pay nearly 60 percent of Ireland’s corporate tax. Directly and indirectly, U.S. multinationals employ more than 375,000 people in Ireland, approximately 15 percent of the country’s labor force. Driven by investment from the United States, foreign multinationals now account for 53 percent of all payroll taxes paid by corporate employers.

Driven by the windfall in corporate tax receipts, the Irish government’s budget surplus is expected to swell further, to 10 billion euros in 2023 and 16 billion euros in 2024. Relative to the size of the economy, this would be equivalent to a U.S. budget surplus of more than 1 trillion dollars in 2024.

The problem for Ireland is that this singular dependence exposes the country to growing risks. Take the tech sector: As multinationals like Google, Microsoft, Meta, and Amazon see their profits shrink and slash jobs worldwide, it will not only hurt the Irish economy, but deprive Dublin of tax income as well.

What’s more, the threat to Ireland’s stability from its overdependence on U.S. companies is about to be multiplied. In 2021, nearly 140 tax jurisdictions, including Ireland, agreed to a major reform of how multinationals companies will be taxed in the future. Pillar 2 of these reforms—a minimum corporate tax rate of 15 percent for large companies—is already coming into effect. In 2024, Ireland’s corporate tax rate is due to increase to 15 percent from its current level of 12.5 percent, reducing its attractiveness as a tax haven compared to other countries. The United States also approved the minimum tax plan in August 2022, despite significant private sector and political opposition.

However, it is Pillar 1 of the OECD’s reforms that will dramatically erode Ireland’s future income from corporate taxes. This reform will reallocate a share of company profits to where sales (or users) are actually located. Previously, tax liability was calculated on where the company or its subsidiary was legally based, no matter how many profits it rerouted from other parts of the world for tax-avoiding purposes. For Ireland, the consequences are obvious: U.S. multinationals operating in the EU will be forced to divide some of their sales by member state, thus significantly reducing the amount of sales and profits that can be “booked” through Ireland. This reform is due to come into force in 2024. The end of Ireland’s windfall is therefore only a matter of time.

The Irish Department of Finance estimated in January that around half of Ireland’s corporate tax receipts—$10 billion—are “transitionary” and will be lost as the new tax rules are implemented. That translates to more than 10 percent of total government spending in 2022—more than the entire Irish education budget. This is putting the Irish government on the precipice of another financial disaster, little more than a decade after it had to be bailed out of impending bankruptcy by the European Commission, European Central Bank, and the International Monetary Fund. That disaster left Ireland with one of the highest per capita public debt levels in the world.

Regardless of the impending financial train wreck, however, Dublin is unlikely to wake up from its American dream anytime soon. Diversifying its economy and revenue sources away from U.S. multinationals would require Ireland to shift its economic and geopolitical orientation, downgrade (in Dublin’s eyes) its deep relationship with the United States, and seek greater integration into the EU economy and its myriad rules.

That’s because Ireland’s dependence on U.S. multinationals is just another expression of the country’s affinity with the United States—the “shared heritage” referenced by U.S. presidents from John F. Kennedy to Ronald Reagan to Joe Biden. These ties to the United States long precede Dublin’s embrace of European integration and make it unlikely that Ireland will ever have the same intensity of economic, cultural, and other ties to France, Germany, or the rest of the EU.

The approaching economic and fiscal train wreck resulting from the new tax rules requires a fundamental change of mindset from Irish policymakers. Squaring the circle—holding on to its deep U.S. ties while integrating more closely with the EU to diversify its economy—means Dublin must give a little (and lose a little) to both sides. Yet Ireland’s ability to navigate this conundrum is doubtful. Even though the coming changes have been plain for all to see, Dublin’s current Trade and Investment Strategy does not contain any concrete policies to mitigate the overdependence on U.S. investment flows. Although the document acknowledges that EU market opportunities are underutilized, it again recognizes the importance “markets such as the UK and the US, which offer familiarity with language and culture.”

If there is no short-term solution to Ireland’s financial vulnerabilities, a few longer-term needs stand out. Dublin should ensure that its current budget surplus is invested wisely to help diversify its drivers of growth. One such driver would be significant increases in public investment in housing and public transport infrastructure to bring the country closer to Western European standards. Ireland’s tax base should be widened to allow for a wider distribution of income sources. For example, In 2021, Ireland gained just 5 percent of its tax receipts from property taxes, compared to more than 11 percent in both Britain and the United States.

Most importantly, Ireland must deepen its trading relationships outside the English-speaking world. Notwithstanding the country’s 50-year membership of the EU, a dearth of foreign language teaching has created a monolingual business culture, which priorities existing links with the United States over the development of new markets, both within and outside the EU. This needs to change if Ireland is to build a sustainable economic model.

Biden—whose family, like so many in the United States, has Irish roots—said in 2021 that “everything between Ireland and the United States runs deep.” This is Ireland’s economic reality today. As the corporate tax boom ebbs, Ireland should ensure that its American dream doesn’t become a recurring economic and financial nightmare.

2 notes

·

View notes

Text

Hydrocolloids Market Size Analysis: A Comprehensive Forecast for 2031

Hydrocolloids was recorded at USD 10.83 billion in 2023, which is predicted to be at USD 11.47 billion in 2024 and projected to reach USD 17.32 billion by 2031, rising at a CAGR of 6.06% between 2024 and 2031.

The market is expected to grow rapidly, driven by the rising demand for processed foods and innovative applications. Key players are actively enhancing their product offerings, expanding production capacities, and entering strategic partnerships to capitalize on emerging opportunities and meet evolving consumer demands

Get Report Details with TOC @ https://www.kingsresearch.com/hydrocolloids-market-780

Top 10 Key Companies in Hydrocolloids Industry:

ADM, AGARMEX SA DE CV, Ashland, Braun SE, Cargill Incorporated, CP Kelco U.S. Inc, Ingredion Incorporated, F. Hydrocolloids Inc, NOREVO, Tate & Lyle

Regional Market Insights:

Europe: Holding a 32.17% market share in 2023, Europe is a significant player in the hydrocolloids market, driven by its robust food and beverage industry and consumer preference for natural, clean-label products. The region's increasing demand for plant-based and vegan products has spurred the use of plant-derived hydrocolloids like pectin and guar gum.

Asia-Pacific:Expected to be the fastest-growing region with a CAGR of 6.86%, the Asia-Pacific market benefits from the expanding food and beverage sector in countries like China, India, Japan, and South Korea. The rising demand for convenience and processed foods, coupled with a burgeoning pharmaceutical industry, propels the growth of hydrocolloids in this region.

Key Market Drivers:

Rising Demand in Food and Beverage Industry: Hydrocolloids are extensively used in the food and beverage industry to improve texture, stability, and shelf-life of products. The growing consumer preference for convenience foods and the increasing awareness of healthy eating are major factors contributing to the market growth.

Advancements in Pharmaceutical Applications: In the pharmaceutical sector, hydrocolloids are used in drug delivery systems, wound care, and encapsulation of active ingredients. The ongoing research and development activities aimed at enhancing the efficacy of hydrocolloids in medical applications are expected to fuel market expansion.

Personal Care and Cosmetics: The personal care industry is another significant end-user of hydrocolloids, particularly in products such as lotions, creams, and shampoos. The rising consumer demand for natural and organic personal care products is driving the adoption of hydrocolloids derived from natural sources.

Future Outlook:

The future of the hydrocolloids market looks promising, with continuous advancements in technology and growing applications across various industries. The shift towards sustainable and plant-based hydrocolloids is a trend to watch, as manufacturers seek to meet the rising consumer demand for eco-friendly products.

Swati J., a healthcare research analyst at Kings Research, emphasized the importance of ongoing innovation in the hydrocolloids market: "The hydrocolloids market is evolving rapidly, with new developments aimed at enhancing product performance and sustainability. Companies that invest in R&D and adapt to changing consumer preferences will be well-positioned to capitalize on the market's growth potential."

About Us:

Kings Research stands as a renowned global market research firm. With a collaborative approach, we work closely with industry leaders, conducting thorough assessments of trends and developments. Our primary objective is to provide decision-makers with tailored research reports that align with their unique business objectives. Through our comprehensive research studies, we strive to empower leaders to make informed decisions.

Our team comprises individuals with diverse backgrounds and a wealth of knowledge in various industries. At Kings Research, we offer a comprehensive range of services aimed at assisting you in formulating efficient strategies to achieve your desired outcomes. Our objective is to significantly enhance your long-term progress through these tailored solutions.

Contact Us:

Kings Research

Website: https://www.kingsresearch.com

E-mail: [email protected]

Phone: (+1) 888 328 2189

1 note

·

View note

Text

Top Universities for PhD in Biotechnology in the US

Introduction

Pursuing a PhD in Biotechnology in the USA is a transformative journey that can significantly enhance your career prospects in the field of biotechnology. The USA is home to some of the world's leading universities, renowned for their cutting-edge research, exceptional faculty, and extensive resources. This blog provides a detailed overview of the top universities offering PhD programs in biotechnology, including essential information such as location, QS ranking, course duration, programs offered, application dates, financial aid options, costs, and insights into university placements.

Top Universities for PhD in Biotechnology in the USA

1. Massachusetts Institute of Technology (MIT)

Location: Cambridge, MA

QS Ranking: 1 (2023)

Course Duration: 5-6 years

Programs: Biological Engineering, Microbiology

Application Date: December 15

Financial Aid: Available

Cost: Approximately $53,790/year

University Insights: MIT is renowned for its innovative research and entrepreneurial spirit, making it a hub for biotechnological advancements.

Placements: Graduates often find positions in top biotech firms, pharmaceutical companies, and research institutions, with many securing roles in leadership and research.

2. Stanford University

Location: Stanford, CA

QS Ranking: 2 (2023)

Course Duration: 5-6 years

Programs: Bioengineering, Genetics

Application Date: December 1

Financial Aid: Available

Cost: Approximately $56,169/year

University Insights: Stanford emphasizes interdisciplinary collaboration, integrating biotechnology with engineering and medicine.

Placements: Alumni have gone on to work at leading companies in Silicon Valley and beyond, often in research and development roles.

3. University of California, Berkeley

Location: Berkeley, CA

QS Ranking: 4 (2023)

Course Duration: 5-6 years

Programs: Molecular and Cell Biology

Application Date: December 1

Financial Aid: Available

Cost: Approximately $14,226/year (in-state), $29,346/year (out-of-state)

University Insights: UC Berkeley is known for its strong emphasis on research and public service, with numerous labs focused on biotechnology.

Placements: Graduates are well-prepared for careers in academia, government, and industry, often landing roles in biotech startups and established firms.

4. Johns Hopkins University

Location: Baltimore, MD

QS Ranking: 10 (2023)

Course Duration: 5-6 years

Programs: Biotechnology, Biomedical Engineering

Application Date: December 1

Financial Aid: Available

Cost: Approximately $60,480/year

University Insights: Johns Hopkins is a leader in biomedical research, providing students with access to cutting-edge facilities and resources.

Placements: Graduates frequently secure positions in healthcare, pharmaceuticals, and research organizations, with many involved in pioneering medical research.

5. California Institute of Technology (Caltech)

Location: Pasadena, CA

QS Ranking: 6 (2023)

Course Duration: 5-6 years

Programs: Bioengineering

Application Date: December 15

Financial Aid: Available

Cost: Approximately $59,364/year

University Insights: Caltech is known for its rigorous academic environment and focus on scientific research, particularly in biotechnology.

Placements: Alumni often move into influential roles in academia, industry research, and innovation-driven companies.

6. University of Michigan, Ann Arbor

Location: Ann Arbor, MI

QS Ranking: 23 (2023)

Course Duration: 5-6 years

Programs: Biomedical Engineering, Microbiology

Application Date: December 1

Financial Aid: Available

Cost: Approximately $26,370/year (in-state), $53,580/year (out-of-state)

University Insights: The University of Michigan is recognized for its comprehensive research programs and collaborative environment.

Placements: Graduates find opportunities in various sectors, including pharmaceuticals, healthcare, and academia, often in high-demand roles.

7. University of California, San Diego (UCSD)

Location: La Jolla, CA

QS Ranking: 14 (2023)

Course Duration: 5-6 years

Programs: Bioengineering, Molecular Biology

Application Date: December 1

Financial Aid: Available

Cost: Approximately $14,227/year (in-state), $29,347/year (out-of-state)

University Insights: UCSD is known for its strong emphasis on research and innovation, particularly in biological sciences.

Placements: Graduates often secure positions in biotech companies, research institutions, and governmental agencies.

8. Northwestern University

Location: Evanston, IL

QS Ranking: 30 (2023)

Course Duration: 5-6 years

Programs: Biomedical Engineering, Biotechnology

Application Date: December 1

Financial Aid: Available

Cost: Approximately $58,440/year

University Insights: Northwestern combines a strong engineering program with a focus on life sciences, fostering interdisciplinary research.

Placements: Alumni frequently enter roles in biotech firms, healthcare organizations, and academic institutions.

9. University of Illinois at Urbana-Champaign

Location: Urbana and Champaign, IL

QS Ranking: 48 (2023)

Course Duration: 5-6 years

Programs: Bioengineering, Molecular and Cellular Biology

Application Date: December 1

Financial Aid: Available

Cost: Approximately $16,866/year (in-state), $34,056/year (out-of-state)

University Insights: Known for its research output, UIUC offers a collaborative environment for biotechnology students.

Placements: Graduates are well-positioned for careers in research, industry, and academia, often securing roles in leading biotech companies.

10. Duke University

Location: Durham, NC

QS Ranking: 28 (2023)

Course Duration: 5-6 years

Programs: Biomedical Engineering, Molecular Genetics

Application Date: December 15

Financial Aid: Available

Cost: Approximately $60,000/year

University Insights: Duke is recognized for its interdisciplinary approach and strong emphasis on research in biotechnology and medicine.

Placements: Graduates often secure competitive positions in pharmaceuticals, biotech firms, and academic research.

Conclusion

Choosing the right university for your PhD in Biotechnology in the USA is crucial for your academic and professional development. The institutions listed above not only provide excellent educational opportunities but also foster an environment of research and innovation. With various financial aid options available, aspiring students can find the right program that fits their academic and financial needs. Moreover, the strong placement records of these universities indicate that graduates are well-prepared to enter the workforce and make significant contributions to the field of biotechnology. Whether you are looking to work in academia, industry, or research, these universities offer the resources and connections necessary for a successful career. Study in USA

0 notes

Text

Top 10 Imports from India to Canada in 2023: Key Insights and Economic Impact

Canada and India share a growing trade relationship that has expanded notably in recent years. With Canada’s increasing reliance on imports to meet domestic demands, goods from India have become essential across multiple sectors, including pharmaceuticals, machinery, and consumer goods. In 2023, Canada imported a total of $5.58 billion worth of products from India, reflecting the ongoing trade growth between these two economies. This article delves into the top imports from India to Canada, examines the role of key Canadian importers, and highlights the impact of these imports on Canada’s economy.

1. Pharmaceutical Products

India is one of the largest exporters of affordable, high-quality pharmaceutical products worldwide, and Canada’s reliance on these imports has grown significantly. In 2023-24, Canada imported pharmaceutical goods valued at approximately $425.33 million from India, marking it as the top import category. Canadian healthcare benefits from the competitive pricing and accessibility of Indian medications, which also ensure the availability of a wide range of drugs for the Canadian population. This partnership supports Canada's healthcare industry by providing access to essential and innovative treatments, making Indian pharmaceutical imports a vital aspect of Canada’s healthcare strategy.

2. Machinery, Nuclear Reactors, and Boilers

Canada’s demand for industrial machinery, nuclear reactors, and boilers from India amounted to $283.28 million. This import category includes machinery used in manufacturing, construction, and energy sectors, providing Canada with technologically advanced and cost-effective alternatives. These imports are crucial for supporting various industries in Canada, particularly as the country looks to modernize its infrastructure and industrial capabilities. Additionally, affordable machinery imports help Canadian businesses enhance productivity and competitiveness on a global scale.

3. Articles of Iron or Steel

Articles of iron or steel, worth $246.21 million, make up another significant category of imports from India. These items include steel pipes, construction materials, and various machinery components required for Canada’s construction, automotive, and energy sectors. The availability of Indian iron and steel products supports Canadian infrastructure development and allows the country to meet the demands of its growing industrial sector, while also managing costs by sourcing competitively from India.

4. Electrical and Electronic Equipment

Canada imported electrical and electronic equipment worth $242.11 million from India in 2023. These products include advanced machinery used in manufacturing, consumer electronics, and components essential for the telecommunications industry. Importing these high-quality electronic products from India provides Canada access to modern technology at competitive prices, helping meet both industrial and consumer demands.

5. Pearls, Precious Stones, Metals, and Coins

With a trade value of $186.83 million, India’s exports of precious metals and gems like gold and diamonds hold a significant position in Canadian imports. These products are essential for Canada’s jewelry and electronics industries. As demand for luxury items and high-quality materials rises, Canadian importers rely on India’s well-established gemstone and precious metals industry to supply products for commercial use and consumer markets.

6. Organic Chemicals

India supplies a substantial amount of organic chemicals, with $179.86 million worth imported by Canada in 2023. These chemicals serve as raw materials for Canada’s chemical, pharmaceutical, and agricultural industries. Importing organic chemicals from India enables Canadian companies to manufacture diverse products, from medicines to fertilizers, supporting industrial growth and the agricultural sector.

7. Optical, Photographic, Technical, and Medical Apparatus

Canada imported approximately $116.52 million worth of optical, photographic, technical, and medical apparatus from India. These include healthcare appliances, surgical instruments, and diagnostic equipment that support Canada’s medical infrastructure. By importing these medical devices, Canada enhances its healthcare facilities with modern, reliable equipment, providing crucial support for patient care and medical research.

8. Rubber Products

With imports totaling $115.35 million, rubber products from India are essential for various Canadian industries. Rubber is widely used in manufacturing and automotive applications, including tires, gaskets, and other industrial components. This continuous demand for rubber products reinforces the trade relationship between Canada and India, contributing to the resilience of Canada’s manufacturing and automotive sectors.

9. Plastics

Canada imported $113.82 million worth of plastics from India in 2023. Plastics play a pivotal role in consumer and industrial products, from packaging materials to building supplies. By importing these items, Canada ensures a steady supply of affordable plastics for both everyday use and specialized industrial applications. This access to cost-effective plastics supports diverse sectors, including construction, healthcare, and consumer goods manufacturing.

10. Coffee, Tea, Mate, and Spices

India is a well-known supplier of tea, coffee, spices, and other aromatic products, and Canada imported $80.21 million worth of these items in 2023. The popularity of Indian tea and spices among Canadian consumers highlights Canada’s multicultural and diverse taste preferences. These imports also reflect the importance of India as a supplier of high-quality, exotic food products that cater to Canada’s culinary and cultural diversity.

Canada’s Import Economy and the Role of Indian Goods

Canada’s economy is robust and diverse, with a strong service sector and significant reliance on imports to meet domestic needs. In 2023, Canada’s imports of goods and services accounted for 33.71% of its GDP, underscoring the importance of trade in the country’s economic structure. While Canada’s primary trading partners include the United States, China, Mexico, and Germany, India has carved out a vital role, providing a variety of products that support Canada’s industrial, healthcare, and consumer sectors.

Canadian Importers from India

A range of prominent Canadian companies sources goods from India, ensuring that local markets have access to high-quality imported products. Some of these top importers include:

20/20 Accessory Source Ltd.

Amazon.com, Inc.

Canadian Tire Corporation Limited

First Chemical Limited

Belkin, Inc.

Globe Commercial Products Inc.

These companies help meet the increasing demand for Indian products in Canada, ranging from pharmaceuticals and machinery to consumer electronics and household goods.

How to Find Importers in Canada

For businesses looking to enter the Canadian market, having access to reliable import data and a list of Canadian importers is essential. Specialized databases, such as those provided by Exportimportdata.in, offer detailed trade information, including HS codes and updated lists of Canadian importers. By utilizing these resources, companies can stay informed about market trends, compliance with trade regulations, and specific Canadian demand for imported goods.

Final Thoughts

The economic relationship between Canada and India is characterized by a steady flow of diverse goods that supports both nations’ economies. Canada’s reliance on imports from India across multiple sectors demonstrates the mutually beneficial nature of this trade relationship. Products such as pharmaceuticals, machinery, and electronic equipment from India not only help to meet Canada’s industrial and consumer demands but also contribute to Canada’s economic resilience and growth.

As Canadian industries continue to require affordable and reliable resources, India remains a crucial trade partner. Importing goods from India supports various sectors within Canada, from healthcare to manufacturing, by providing access to high-quality products at competitive prices. This trend reflects the broader dynamics of global trade, where strategic partnerships and a reliance on international supply chains play a pivotal role in strengthening national economies.

For companies and businesses interested in Canadian import data or looking to establish trade relationships with Canadian importers, resources like Exportimportdata.in provide valuable insights and up-to-date information on the Canadian market, ensuring that businesses remain informed and ready to leverage new opportunities in international trade.

#Canada imports from India#import from India to Canada#list of export items from india to Canada#products imported from India to Canada#export items from india to Canada#importing goods from india to Canada#importing clothes from india to Canada

0 notes

Photo

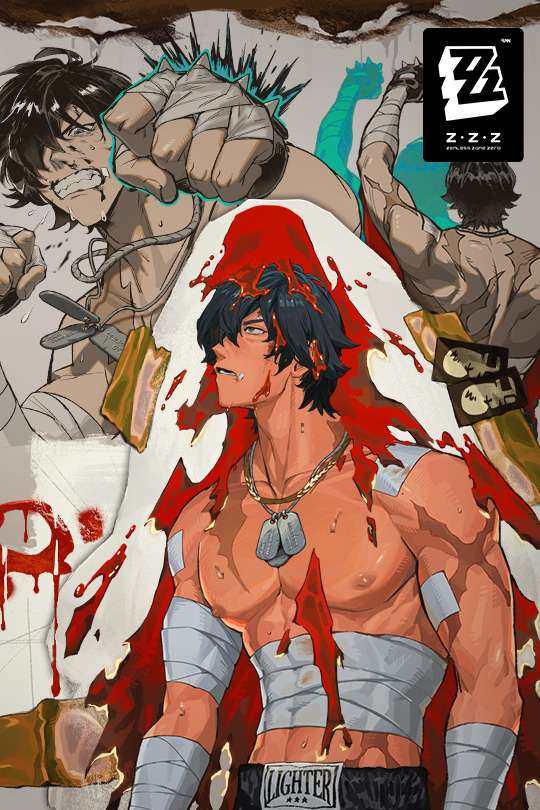

You feelin' fired up now? Make way for the undefeated Champion! —Welcome to New Eridu!— PS5™/iOS/Android/PC | Version 1.3 "Virtual Revenge" of Zenless Zone Zero, HoYoverse's urban fantasy ARPG, is out now

232 notes

·

View notes

Text

Top 10 Pharmaceutical Companies in India

* The Top 10 Pharmaceutical Companies in India are ranked by their revenue and market capitalization.

* India is the largest provider of generic medicines, holding a market share of 25% of the global supply by volume and meeting 61% of the vaccine requirement worldwide.

* Indian Pharmaceutical companies also supply 81% of antiretroviral medications (HIV/AIDS) in the worldwide markets.

* The international pharmaceutical market is anticipated to surpass USD 1.27 trillion by 2023. India is one most suitable states in this worldwide pharma market. India provides more than 55% of the worldwide purpose for different vaccines and 45% of the demand for generic medicines in the United States. India’s pharmaceuticals demanded to expand at 11% CAGR during 2023 to reach 33 Billion US dollars.

1. Sun Pharmaceutical Industries Ltd * Sun Pharmaceutical Industries Ltd is an Indian multinational pharmaceutical company founded by Dilip Shanghvi in 1983, Vapi, Headquarters Goregaon, Mumbai, India, And Subsidiaries of Ranbaxy Laboratories, etc. It produces and sells pharmaceutical formulations and active pharmaceutical ingredients (APIs) in India also the United States. It provides formulations in psychiatry, cardiology, dialectology, neurology, and gastroenterology. * Sun Pharma supplies APIs such as etodolac, clorazepate, carbamazepine, warfarin, anti-cancer drugs, peptides, steroids, sex hormones, etc. It supplies more than 2000 formulations and also exports to various other countries. * The main features of Sun Pharma are research and development facilities and its own APIs. It supplies more than 2000 formulations and also exports to various other countries. The main features of Sun Pharmaceuticals are research and development facilities and its own APIs.

2. Dr Reddy’s Laboratories Ltd Dr Reddy’s Laboratories is an Indian multinational pharmaceutical company founded by Kallam Anji Reddy in 1984, in Hyderabad, India. The company produces pharmaceutical formulations and active pharmaceutical ingredients (APIs) in India and other countries and more than 195 drugs, and 65 APIs for drug, and biotechnology products. DRL has six API units(CTO)and four Formulation(FTO) manufacturing plants across India. Its main focus research and development centres are Integrated Product Development Organization (IPDO) and Custom Pharmaceutical Services (CPS) located in Hyderabad, India.

3. Divi’s Laboratories Ltd Divis Labs is an Indian pharmaceutical company founded by Murali Divi in 1990, in Hyderabad, India. It manufactures APIs, Intermediates, and Nutraceutical ingredients. Divis Labs have three manufacturing units located at Chouttal, Hyderabad, Chippada, Andhra Pradesh, and 3 Research and development centres. The Company exports the products to the USA, Europe, Japan, South Africa, Australia, and the Philippines.

4. Cipla Ltd * Cipla is an Indian multinational pharmaceutical company founded by Khwaja Abdul Hamied in 1935, with Headquarters in Mumbai, India, And supplies top-quality generic medicines in India. * The company supplies a wide range of medicines. It has a prominent position in the Indian market and global market and in more than 150 countries. The company provides quality products worldwide received approvals from major regulatory agencies and more than 2000 formulations cover areas like neurology and nephrology. It has a global focus on the important markets of India, the US, and South Africa.

5. Aurobindo Pharma Ltd * Aurobindo Pharma is an Indian pharmaceutical company founded by Nityananda Reddy started operations in 1988 with a single unit manufacturing Synthetic Penicillin at Pondicherry and became a public company in 1992 headquartered in HITEC City, Hyderabad, India. The company has provided key therapeutics like cardiovascular, antibiotics, gastroenterology, anti-diabetics, and anti-Allergics. APL exports products to more than 160 nations in the world. Aurobindo Pharma has production, research, and development and Subsidiary units are Novagen Pharma, AuroZymes Ltd, etc.

6 Torrent Pharmaceuticals Ltd * Torrent Pharma is an Indian pharmaceutical company founded by Uttambhai NathalalMehta in 1959 Headquarters in Ahmedabad, India. started as Trinity Laboratories Ltd, and renamed Torrent Pharmaceuticals Ltd, nowadays. It is ranked the leader in the therapeutic sector of women’s health care, cardiovascular, CNS, gastrointestinal, diabetology, oncology, gynaecology, and anti-infective. They have first-class manufacturing units, R & D facilities, and a prevalent international presence in more than 50 nations. The company had procured Elder Pharma’s Indian company, Zyg Pharma, the API plant of Glochem Industries, Unichem’s Sikkim Plant, Bio-Pharm Inc., generic pharmaceuticals, etc. 7. Lupin Ltd * Lupin is a multinational pharmaceutical company founded by Desh Bandhu Gupta in 1968 in Mumbai, India. A large range of products like Branded & Generic Formulations, Biotechnology Products, APIs, and manufacturing centres are across India, Japan, Brazil, Mexico, and the United States. Subsidiaries are Novel Laboratories, Polynova Industries, and GAVIS Pharmaceuticals. The company is in the treatment areas of Non-Steroidal Anti-Inflammatory Drugs, Cardiovascular, Gynaecology, Asthma, Paediatric, Diabetology, Gastro-Intestinal, and Anti-Infective drugs, Anti-TB and Cephalosporins sectors. The company has moved around more than 100 countries. It supplies top-quality medications. The company is in the treatment areas of Non-Steroidal Anti-Inflammatory Drugs, Cardiovascular, Gynaecology, Asthma, Paediatric, Diabetology, Gastro-Intestinal, and Anti-Infective drugs, Anti-TB and Cephalosporins sectors. The company has moved around more than 100 countries. It supplies top-quality medications.

8. Zydus Cadila Healthcare Ltd * Zydus Cadila is a fully integrated Indian Pharmaceutical company founded by Ramanbhai B. Patel in 1952 in Ahmedabad, Gujarat India. It provides Active pharmaceutical ingredients, formulations, and animal healthcare products to wellness products. The company’s research and development facilities are in Gujarat, Maharashtra, Goa, Himachal, and Sikkim as well as research units in the US and Brazil. It has 1400 researchers across 20 sites, working on medicines and exploring various ideas from NCEs to vaccines, and bio-similar products. The company’s global business has regulated markets in the United States, Europe, South Africa, Latin America, and also 30 other national markets in the world.

9. Abbott Pharma India Ltd * Abbott India Limited is a Pharmaceutical company founded by Dr Wallace Calvin Abbott in 1944, in Mumbai, India, and a subsidiary of Abbott Laboratories United States. It manufactures pharmaceutical drugs, therapeutics for Women’s Health, Neurology, Thyroid, Gastroenterology, Anti-Infective, Diabetes, Urology, Pain, Vitamins, etc., and a plant at Verna, Goa. It has to produce high-quality formulations, branded generic pharmaceuticals, diagnostics, medical devices, and nutrition.

10. Alkem Laboratories Ltd * Alkem Laboratories is a Pharmaceutical company founded by Samprada Singh in 1973, in Mumbai, India. It provides quality branded generics, generic medications, APIs, and nutraceuticals in India, and more than 60 countries worldwide. Alkem has been ranked as the No.1 Anti-infective company in India for more than ten years and also has therapeutic segments for gastrointestinal, Vitamins, Minerals, Nutrients, and pain management.

Conclusion: * These are the Top 10 Pharmaceutical Companies in India and supply worldwide Pharmaceutical Products. The ranking of the Pharma companies changes every year and depends upon the revenue and Market Capitalizations.

0 notes

Text

[ad_1] Corporate India is expected to offer a salary hike of 9.5 per cent in 2025 (Photo: Shutterstock)3 min read Last Updated : Oct 15 2024 | 1:37 PM IST Corporate India is expected to offer a salary hike of 9.5 per cent in 2025, similar to the 2024 actual salary increase, as companies are balancing optimism with caution, a report said on Tuesday. According to WTW's latest Salary Budget Planning Report, the median salary increase in India is forecasted to rise by 9.5 per cent in 2025, similar to the 2024 actual salary increase of 9.5 per cent. Click here to connect with us on WhatsApp Salary increases in India continue to be the highest across the region. Markets such as Vietnam (7.6 per cent), Indonesia (6.5 per cent), the Philippines (5.6 per cent), China (5 per cent) and Thailand (5 per cent) are also projected to maintain a strong salary increase for next year. The Salary Budget Planning Report is compiled by WTW's Rewards Data Intelligence practice. The survey was conducted in April and June 2024. Approximately 32,000 responses were received from companies across 168 countries worldwide. The survey had 709 participants from India. "While companies in India are optimistic about growth, they are balancing optimism with caution. The era of 'Great resignation' is behind us, both employers and employees are now seeking stability and the market sentiment is notably steadier," Rajul Mathur, Consulting Leader, Work and Rewards, WTW India said. In 2025, salary increases across industries such as the Pharmaceuticals (10 per cent), Manufacturing (9.9 per cent), Insurance (9.7 per cent), Captives and SSO sectors (9.7 per cent) and Retail (9.6 per cent) are likely to be above the general industry salary median, whereas software and Business Services at 9 per cent are projected below the general industry median of 9.5 per cent. "India's captive sector is thriving, with a forecasted jump from around 1,500 captives in 2023 to 2,000 by 2025. As the home to nearly half of the world's global capability centres, the country's rich pool of skilled talent is driving innovation and boosting projected salary increases, Mathur added. In 2025, variable payouts are projected to remain consistent at 12.5 per cent, following 2024's 12.6 per cent. As organisations prioritise performance, they are assigning larger portions of their variable pay budgets to top and above-average performers, ensuring talent is recognised and suitably rewarded. "Organisations are placing a stronger emphasis on performance-based pay differentiation. This trend sees top performers potentially earning salary increments three times that of average performers, while above-average performers are expected to receive about 1.2 times the increment of an average performer," Mathur said. In terms of hiring, almost 28 per cent of companies plan to add headcount in the next 12 months, while 68 per cent companies plan to maintain their headcount in 2025 as compared to the previous year. With higher growth rates anticipated, India's voluntary attrition rate continues to be one of the highest in the region. However, it is observed that the voluntary attrition rates in India have reduced slightly from 11 per cent in 2023 to 10.8 per cent in 2024. In addition, around 46 per cent of companies in India expect that their salary increase budgets for 2025 will be similar to 2024, while 28 per cent said that the budgets are likely to be lower than projected. Concerns related to cost management, inflationary pressures, anticipated recession and a tighter labour market are the major factors influencing budget projections for 2025, the report said. (Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)First Published: Oct 15 2024 | 1:37 PM IST [ad_2] Source link

0 notes

Text

[ad_1] Corporate India is expected to offer a salary hike of 9.5 per cent in 2025 (Photo: Shutterstock)3 min read Last Updated : Oct 15 2024 | 1:37 PM IST Corporate India is expected to offer a salary hike of 9.5 per cent in 2025, similar to the 2024 actual salary increase, as companies are balancing optimism with caution, a report said on Tuesday. According to WTW's latest Salary Budget Planning Report, the median salary increase in India is forecasted to rise by 9.5 per cent in 2025, similar to the 2024 actual salary increase of 9.5 per cent. Click here to connect with us on WhatsApp Salary increases in India continue to be the highest across the region. Markets such as Vietnam (7.6 per cent), Indonesia (6.5 per cent), the Philippines (5.6 per cent), China (5 per cent) and Thailand (5 per cent) are also projected to maintain a strong salary increase for next year. The Salary Budget Planning Report is compiled by WTW's Rewards Data Intelligence practice. The survey was conducted in April and June 2024. Approximately 32,000 responses were received from companies across 168 countries worldwide. The survey had 709 participants from India. "While companies in India are optimistic about growth, they are balancing optimism with caution. The era of 'Great resignation' is behind us, both employers and employees are now seeking stability and the market sentiment is notably steadier," Rajul Mathur, Consulting Leader, Work and Rewards, WTW India said. In 2025, salary increases across industries such as the Pharmaceuticals (10 per cent), Manufacturing (9.9 per cent), Insurance (9.7 per cent), Captives and SSO sectors (9.7 per cent) and Retail (9.6 per cent) are likely to be above the general industry salary median, whereas software and Business Services at 9 per cent are projected below the general industry median of 9.5 per cent. "India's captive sector is thriving, with a forecasted jump from around 1,500 captives in 2023 to 2,000 by 2025. As the home to nearly half of the world's global capability centres, the country's rich pool of skilled talent is driving innovation and boosting projected salary increases, Mathur added. In 2025, variable payouts are projected to remain consistent at 12.5 per cent, following 2024's 12.6 per cent. As organisations prioritise performance, they are assigning larger portions of their variable pay budgets to top and above-average performers, ensuring talent is recognised and suitably rewarded. "Organisations are placing a stronger emphasis on performance-based pay differentiation. This trend sees top performers potentially earning salary increments three times that of average performers, while above-average performers are expected to receive about 1.2 times the increment of an average performer," Mathur said. In terms of hiring, almost 28 per cent of companies plan to add headcount in the next 12 months, while 68 per cent companies plan to maintain their headcount in 2025 as compared to the previous year. With higher growth rates anticipated, India's voluntary attrition rate continues to be one of the highest in the region. However, it is observed that the voluntary attrition rates in India have reduced slightly from 11 per cent in 2023 to 10.8 per cent in 2024. In addition, around 46 per cent of companies in India expect that their salary increase budgets for 2025 will be similar to 2024, while 28 per cent said that the budgets are likely to be lower than projected. Concerns related to cost management, inflationary pressures, anticipated recession and a tighter labour market are the major factors influencing budget projections for 2025, the report said. (Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)First Published: Oct 15 2024 | 1:37 PM IST [ad_2] Source link

0 notes

Text

Vindcare Lifesciences is one of the Top 10 PCD Pharma Franchise Companies List 2023. We provide high-quality goods that have been approved by the GMP and WHO organisations. According to prescription medications as well as drug formulations, our products are 100% genuine. More than 250 products make up our product line, and we currently have more than 300 happy customers across PAN India.

#pcd pharma company#pcd pharma franchise#Top 10 PCD Pharma Franchise Companies List 2023#pharmaceutical

0 notes

Text

Symbiosis Institute of Business Management Pune: Courses, Fees, Placements, and Scholarships

Symbiosis Institute of Business Management (SIBM), Pune, is one of India’s leading B-schools, renowned for its exceptional management programs, state-of-the-art facilities, and strong industry connections. SIBM Pune has consistently been ranked among the top 10 management institutes in India, offering students a comprehensive business education that focuses on both theoretical and practical skills.

SIBM Pune Fees Structure

The SIBM Pune fees structure is competitive compared to other top management schools in India, making it an attractive option for students seeking quality education. Here’s an overview of the fees for the MBA program:

MBA Fees (2024-2026): ₹23,32,000 (for two years)

Tuition Fees: ₹19,60,000

Institute Deposit (Refundable): ₹20,000

Hostel Fees: ₹2,30,000 (for two years)

Mess Fees: ₹1,22,000 (for two years)

This fee structure includes academic costs, accommodation, and meals, offering a comprehensive package for students.

MBA Courses at SIBM Pune

Symbiosis Institute of Business Management Pune offers a diverse range of management programs designed to cater to various business domains. The courses offered include:

MBA (Flagship Program): A two-year, full-time residential program that offers specializations in:

Marketing

Finance

Human Resource Management

Operations & Supply Chain Management

MBA (Innovation and Entrepreneurship): This program aims to develop entrepreneurial mindsets and innovative skills in students, preparing them for leadership roles in emerging business areas.

Executive MBA: A part-time program designed for working professionals, focusing on advanced business strategies and leadership skills.

PG Diploma Programs: These are short-term diploma programs in various management fields.

Placement and Recruiters

SIBM Pune boasts an excellent placement record, with top companies from various sectors recruiting its students every year. The institute's placement process is well-organized, with students receiving pre-placement offers (PPOs) and internships from prestigious organizations.

Key Placement Highlights (2023):

Highest Package (International): ₹62.11 LPA

Highest Package (Domestic): ₹35.05 LPA

Average Package: ₹26.77 LPA

Median Package: ₹24 LPA

Top Recruiters:

Consulting: Boston Consulting Group, Accenture, Deloitte, PwC

FMCG: Hindustan Unilever, ITC, Nestle, Coca-Cola

Banking and Finance: JP Morgan, HSBC, ICICI Bank, HDFC

Technology: Microsoft, Google, Infosys, TCS

Pharmaceuticals: Cipla, Pfizer, GSK

These top-notch recruiters highlight SIBM Pune’s strong industry interface, ensuring that students are well-placed in leadership roles across sectors.

Scholarships at SIBM Pune

SIBM Pune offers several scholarship options to meritorious and deserving students to support their education financially. Some of the key scholarships include:

Symbiosis International University (SIU) Scholarship: Awarded to students based on their academic performance in the first semester.

SC/ST Scholarship: Provided to students from reserved categories as per government norms.

Symbiosis Foundation Scholarship: Based on merit, this scholarship covers a portion of the tuition fees.

Sports Scholarship: For students excelling in sports at the national or international levels.

Students can also avail education loans through various banks associated with the institution.

Selection Criteria

The SIBM Pune selection process is rigorous, ensuring that only the most deserving candidates secure admission. The primary criteria for admission include:

Eligibility:

Graduates with at least 50% marks (45% for SC/ST) from a recognized university.

Final-year students awaiting results are also eligible to apply.

Entrance Exam (SNAP):

Applicants must clear the Symbiosis National Aptitude Test (SNAP), the official entrance exam for Symbiosis institutes.

Shortlisting:

Candidates are shortlisted based on their SNAP score and called for the GE-PIWAT (Group Exercise, Personal Interview, and Written Ability Test).

Final Selection:

The final merit list is prepared considering the SNAP score, GE-PIWAT performance, academic achievements, and work experience (if any).

Why Choose SIBM Pune?

SIBM Pune stands out for several reasons:

Reputation and Ranking: Consistently ranked among the top B-schools in India, SIBM Pune offers a prestigious MBA degree that is recognized globally.

Comprehensive Learning Experience: The curriculum blends classroom learning with practical exposure, offering students a well-rounded education.

Industry Connections: Strong industry interface through live projects, internships, and guest lectures by industry experts.

Alumni Network: A vast and influential alumni network that supports students in career growth and mentorship.

Conclusion

If you're looking for an esteemed institute offering a holistic education, Symbiosis Institute of Business Management Pune is an excellent choice. With its competitive SIBM Pune fees, robust placement opportunities, and scholarship options, SIBM Pune paves the way for students to achieve their professional goals in the business world.

0 notes

Text

Are you a recent graduate looking to kickstart your career in the pharmaceutical industry? Amneal Pharmaceuticals, a global leader in the pharmaceutical sector, is offering an exciting opportunity for freshers to join their Production and Packing departments. With a strong commitment to innovation and quality, Amneal provides a dynamic work environment where you can grow and develop your skills. Read on to learn more about this fantastic opportunity and how you can become a part of Amneal's mission to make healthy possible. About Amneal Pharmaceuticals Amneal Pharmaceuticals, Inc. (NYSE: AMRX) is a renowned global pharmaceutical company dedicated to developing, manufacturing, and distributing a diverse portfolio of over 270 high-quality medicines. With a workforce of over 7,500 colleagues, Amneal is committed to improving healthcare worldwide by providing affordable and accessible medications. Job Openings: Production & Packing (Freshers Welcome) Position: Departments: Production (Sterile Manufacturing) & Packing Location: Amneal Pharmaceuticals, Ahmedabad, Gujarat Qualifications: Diploma/B Tech, B.E./B Pharmacy Eligibility: Freshers from the 2023-2024 pass-out batch (Note: Candidates who have already completed an apprenticeship are not eligible) Amneal Pharmaceuticals is looking for enthusiastic and dedicated freshers to join their regulated Formulation Manufacturing plants in Ahmedabad. This is a golden opportunity to gain hands-on experience in one of the top pharmaceutical companies globally. [caption id="attachment_49554" align="aligncenter" width="930"] Amneal Pharmaceuticals Hiring for Production & Packing (Freshers Welcome)[/caption] Walk-In Interview Details Date: 30th August 2024 (Friday) Time: 10:00 AM to 01:00 PM Venue: Gujarat Technological University, Nr. Vishwakarma Government Engineering College, Nr. Visat Three Roads, Visat - Gandhinagar Highway, Chandkheda, Ahmedabad, Gujarat-382424 Note: Women candidates are highly encouraged to apply. If you are unable to attend the interview, you can share your CV at [email protected].

0 notes

Text

Top 10 pharmaceutical companies in Hyderabad

Top 10 pharmaceutical companies in Hyderabad: Are You New to the Pharma Business and Looking to Invest in the Best? Discover High-Margin Profits Here. Stop Googling “Best PCD Pharma Franchise in Hyderabad” because you're in the right place! Hyderabad, the “Pharma Hub of India,” is the ideal destination for anyone looking to make a mark in the pharmaceutical industry. This city is the hub of most reputable medicine companies that not only offer quality products but also genuine business opportunities with high-margin profits. If you're aiming for success, partnering with the listed Top 10 Pharma Companies in Hyderabad 2024 For Business. Known for their product quality, respected positions in the market, and proven track records, these companies are the giants of Hyderabad's pharma industry.

Soigner Pharma

Welcome To Soigner Pharma, a proud ISO and GMP-certified Best PCD Pharma Franchise Company in Hyderabad 2024 that deals in DCGI approved low-cost but high-quality medicines. They offer the best franchise business opportunity to dedicated and interested entrepreneurs with unique monopoly rights. You can join them at low capital investment and enjoy high margin profit.

Established: 2007

CEO: Umesh Karla

Number of Products: 1000+

Pharma Range: Tablets, Capsules, Injections, Syrup, Sachet, Protein Powder, Ointment, Cream, Drops, Soap, Gel

Global Presence: Over 5 countries

Employees: 100+

Connected Entrepreneurs: Over 500+

Address: Sco-6, Near Sunpark Hotel, Wadhwa Nagar, Sas Nagar., Zirakpur- 140603, Punjab, India

Dr. Reddy's Laboratories

One of the Top 10 Pharma Companies in Hyderabad 2024 For Business, Dr Reddy’s Labortories is famous for its high-quality medicine list and franchise business opportunities in Hyderabad. They offer the best support to linked entrepreneurs.

Established: 1984

CEO: Erez Israeli

Global Presence: Over 50 countries

Revenue (FY 2023): ₹25,000 crores (approx.)

Employees: 21,650+

Address: 8-2-337, Road No. 3, Banjara Hills, Hyderabad - 500034, Telangana, India

Aurobindo Pharma

Aurobindo Pharma, a well-known PCD Pharma Franchise company in Hyderabad famous for its genuine business opportunity. They go along with ethical business module to run business smoothly in the pharma industry.

Established: 1986

CEO: N. Govindarajan

Global Presence: Over 150 countries

Revenue (FY 2023): ₹24,774 crores (approx.)

Employees: 23,000+

Address: Plot No. 2, Maitrivihar, Ameerpet, Hyderabad - 500038, Telangana, India

Divi's Laboratories

Established: 1990

CEO: Murali K. Divi

Global Presence: Products in over 95 countries

Revenue (FY 2023): ₹8,960 crores (approx.)

Employees: 16,500+

Address: 1-72/23(P)/DIVIS/303, Divi Towers, Cyber Hills, Gachibowli, Hyderabad - 500032, Telangana, India

Gland Pharma

Established: 1978

CEO: Srinivas Sadu

Global Presence: Major presence in the U.S., Europe, India

Revenue (FY 2023): ₹4,970 crores (approx.)

Employees: 4,000+

Address: Sy. No. 143-148, Near Gandimaisamma ‘X’ Roads, D.P. Pally, Dundigal, Hyderabad - 500043, Telangana, India

Granules India

Established: 1984

CEO: Krishna Prasad Chigurupati

Global Presence: 300+ customers across 60 countries

Revenue (FY 2023): ₹3,540 crores (approx.)

Employees: 8,000+

Address: 2nd Floor, Block III, My Home Hub, Madhapur, Hyderabad - 500081, Telangana, India

Biological E. Limited

Established: 1953

CEO: Mahima Datla

Global Presence: Vaccines distributed in over 100 countries

Revenue (FY 2023): ₹2,500 crores (approx.)

Employees: 5,000+

Address: 18/1 & 3, Azamabad, Hyderabad - 500020, Telangana, India

Hetero Drugs

Established: 1993

CEO: B. Parthasaradhi Reddy

Global Presence: Over 126 countries

Revenue (FY 2023): ₹8,000 crores (approx.)

Employees: 21,000+

Address: 7-2-A2, Industrial Estate, Sanath Nagar, Hyderabad - 500018, Telangana, India

Natco Pharma

Established: 1981

CEO: Rajeev Nannapaneni

Global Presence: Products in over 40 countries

Revenue (FY 2023): ₹2,200 crores (approx.)

Employees: 5,000+

Address: Natco House, Road No. 2, Banjara Hills, Hyderabad - 500034, Telangana, India

Shanta Biotechnics (A Sanofi Company)

Established: 1993

Founder: Dr. K. I. Varaprasad Reddy (Sanofi acquired Shanta)

Global Presence: Focus on emerging markets

Revenue (FY 2023): ₹500 crores (approx.)

Employees: 1,000+

Address: Medchal Mandal, Qutubullapur Municipality, Hyderabad - 500054, Telangana, India

0 notes

Text

Top Stock Picks of 2024: Insights from WikiStock

Top Stock Picks of 2024: Insights from WikiStock As we move into 2024, investors are keen to identify the best stock picks that promise robust returns. WikiStock has provided valuable insights into the top-performing stocks for the year. This article delves into some of the most promising stocks, highlighting their potential and the factors driving their performance.To get more news about WikiStock, you can visit our official website.

1. Super Micro Computer (SMCI) Super Micro Computer (SMCI) has been a standout performer in 2024, riding the wave of artificial intelligence (AI) advancements. The company’s focus on high-performance computing solutions has positioned it well to capitalize on the growing demand for AI and machine learning applications. With a strong balance sheet and innovative product offerings, SMCI is poised for continued growth1.

2. Constellation Energy (CEG) Constellation Energy (CEG) has emerged as a top pick due to its strategic investments in renewable energy. As the world shifts towards sustainable energy sources, CEG’s portfolio of clean energy assets, including wind and solar, has gained significant traction. The company’s commitment to reducing carbon emissions and its robust financial performance make it a compelling investment.

3. Nvidia (NVDA) Nvidia (NVDA) continues to be a favorite among investors, thanks to its leadership in the graphics processing unit (GPU) market. The company’s GPUs are essential for AI, gaming, and data centers, driving strong revenue growth. Nvidia’s strategic acquisitions and partnerships further enhance its competitive edge, making it a top stock pick for 2024.

4. Anglo American (AAL) Anglo American (AAL) presents an attractive value proposition for 2024. Despite concerns about the Chinese economy and commodity demand, the diversified miner is priced for a scenario much worse than expected. With a PE ratio of just 5x trailing earnings, Anglo American is likely to see a rerate as market conditions improve.

5. Ashtead Group (AHT) Ashtead Group (AHT) has been one of the FTSE 100’s best performers over the past decade. The plant hire company’s substantial infrastructure spending in North America and strategic acquisitions have driven its growth. Although sales growth slowed in 2023, Ashtead’s cash-rich position and acquisition strategy make it a promising stock for 2024.

6. NextEnergy Solar Fund (NESF) NextEnergy Solar Fund (NESF) is an excellent example of a renewable energy asset offering both capital appreciation and a robust dividend yield. The trust invests in solar energy generation assets and has a diverse portfolio across the globe. As interest rates stabilize, the trust’s valuation is expected to improve, making it an attractive investment.

7. Tekcapital (TEK) Tekcapital (TEK) is a technology investment company set for a promising 2024. The company is preparing to list its portfolio company, MicroSalt, which has secured contracts with major snack food businesses. Tekcapital’s focus on early-stage companies with high growth potential makes it a top stock pick for the year.

8. Meta Platforms (META) Meta Platforms (META) remains a strong contender in the tech sector. The company’s investments in the metaverse and virtual reality (VR) technologies are expected to drive future growth. With a solid user base and innovative product pipeline, Meta Platforms is well-positioned for continued success in 2024.

9. Johnson & Johnson (JNJ) Johnson & Johnson (JNJ) is a reliable choice for investors seeking stability and growth. The company’s diverse product portfolio, including pharmaceuticals, medical devices, and consumer health products, provides a steady revenue stream. JNJ’s strong financial performance and commitment to innovation make it a top pick for 2024.

10. Costco Wholesale Corp (COST) Costco Wholesale Corp (COST) continues to be a favorite among investors due to its strong business model and loyal customer base. The company’s focus on providing high-quality products at competitive prices has driven consistent revenue growth. Costco’s expansion plans and efficient operations make it a compelling investment for 2024.

Conclusion The stock market in 2024 presents numerous opportunities for investors. The stocks highlighted in this article, based on insights from WikiStock, offer a mix of growth potential, stability, and innovation. Whether you are a seasoned investor or just starting, these top stock picks provide a solid foundation for building a successful investment portfolio.

0 notes

Text

Cloud-based Contact Center Market Precise, Powerful, & Measurable Forecast 2031

Kings Research™ presents this information in its report titled, Cloud-based Contact Center & Industry Analysis, By Component (Solutions, Services), By Deployment (Public, Private, Hybrid), By Organization Size (Large Enterprises, Small and Medium Enterprises) By Vertical and Regional Analysis, 2024-2031"

Cloud-Based Contact Center Market was valued at USD 22.83 billion in 2023 and is projected to reach USD 124.85 billion by 2031, growing at a CAGR of 24.08% from 2024 to 2031.

Cloud-based contact centers, also known as virtual or hosted contact centers, are customer service platforms where all the necessary infrastructure, software, and tools are hosted and managed in the cloud by a third-party provider. Instead of running on-premises hardware and software, these contact centers operate entirely over the internet.

Browse More Information @ https://www.kingsresearch.com/cloud-based-contact-center-market-595

Key Players and Innovations:

Amazon Connect, Amazon Web Services' cloud-based contact center product, now includes advanced generative AI functionality. These advancements help organizations of all Shares to elevate client experiences while optimizing operating costs.

Top 10 Companies in Cloud-based Contact Center Market:

Genesys

Ameyo

Aircall

RingCentral, Inc.

Microsoft

Vocalcom

Cisco Systems, Inc.

Five9, Inc.

Oracle

TCN, Inc.

Avaya LLC

North America had the largest market share of 36.08% in 2023, with a worth of USD 8.24 billion. Several factors contribute to this supremacy, including the region's early embrace of cloud technology, strong digital infrastructure, and a highly established customer service industry.

The Rise of Cloud-based Contact Centers:

Traditional on-premises contact center solutions are giving way to cloud-based alternatives, driven by several factors. The scalability, flexibility, and cost-effectiveness of cloud-based models make them an attractive option for businesses of all Shares. With cloud-based solutions, companies can scale resources up or down based on demand, access advanced features and functionalities, and benefit from lower upfront costs and simplified management

Market Trends and Dynamics:

Customers expect seamless interactions across multiple channels. Cloud-based contact centers facilitate omnichannel communication by integrating voice, email, chat, social media, and messaging apps into a unified platform

Artificial intelligence (AI) and automation are transforming contact center operations. Cloud-based solutions leverage AI for tasks like chatbots, virtual assistants, sentiment analysis, and predictive analytics, enhancing efficiency and personalization.

Applications and Future Outlook:

Rapid Technological Advancements: Continued advancements in technology, including AI, machine learning, natural language processing, and automation, will further enhance the capabilities of cloud-based contact centers. These technologies will enable more personalized, efficient, and intelligent customer interactions.

Integration with AI & Analytics: Integration with AI-driven analytics tools will become standard in cloud-based contact center solutions, enabling businesses to gain deeper insights into customer behavior, agent performance, and operational efficiency. AI-powered features such as chatbots, virtual assistants, and predictive analytics will become more sophisticated and widely adopted.

Segmentation Analysis of the cloud-based contact center market involves dividing the market into distinct segments based on various factors to better understand customer needs, preferences, and behaviors.

Company Share:

Small and Medium-Shared Enterprises (SMEs)

Mid-market companies

Large Enterprises

Industry Vertical:

Finance and Banking

Healthcare and Pharmaceuticals

Retail and E-commerce

Telecommunications

Deployment Model:

Public Cloud

Private Cloud

Hybrid Cloud

Contact Us:

Kings Research

Phone: (+1) 888 328 2189

1 note

·

View note