#The Outlook Real Estate Conference 2019

Explore tagged Tumblr posts

Text

NYC Office Space: Surpassing Pre-Pandemic Levels and Setting New Trends

New York City’s office market is not only rebounding—it’s thriving. Rudin Management Company, a leader in NYC real estate, reports that some of their office buildings are now physically more occupied than before the pandemic, a testament to both the resilience of NYC’s office scene and the firm’s commitment to innovation.

At CREtech New York 2024, Rudin’s leaders—Neil Gupta, Neal Mohammed, Sevinc Yuksel, and Hrisa Gatzoulis—shared their insights on commercial real estate trends. Gupta noted that foot traffic in some Rudin-managed properties is now exceeding 2019 levels, particularly on Park Avenue and the Plaza District, with leasing velocity nearly on par with pre-2020 figures. “Some of our buildings today are experiencing occupancy in excess of pre-pandemic levels,” Gupta highlighted, pointing to a strong NYC office recovery.

Meeting Modern Tenants’ Needs: Amenities and Workspaces

The demand for “newer or recently amended” office buildings is reshaping tenant expectations. Tenants now expect amenities that go beyond the traditional office. “Tenants want amenities,” Gupta explained, from conference centers to tech-based connections among tenants. In response, Rudin is adding features like outdoor spaces and open workstations, fostering an inviting environment that accommodates modern work habits.

This shift extends to workspaces as well. Yuksel shared that Rudin is embracing open workstation designs and adding tech-enhanced meeting spaces, catering to a collaborative, flexible work style that wasn’t prioritized before. “We’re seeing a lot more open workstations and new types of spaces,” Yuksel explained, as the concept of office space evolves.

Hybrid and Remote Work: Here to Stay

Though NYC office occupancy is high, remote and hybrid work aren’t disappearing. Recognizing this, Rudin is adapting its residential properties as well, incorporating co-working features into renovated apartments. Yuksel noted, “We think about co-working spaces when we renovate,” ensuring that residents have places for phone calls, entertaining, and more.

Looking Ahead: A Bullish Outlook

With NYC’s office occupancy rate already above the national average, Rudin’s success is a beacon for the future. The firm’s agile approach to changing demands in both office and residential spaces is a roadmap for resilient, innovative development in today’s market. For NYC developers and investors, the city’s office renaissance is a promising sign—one that highlights the importance of adapting and pushing the boundaries of what a workspace can be.

New York is back and better than ever, and Rudin is leading the charge in shaping the city’s office landscape for the next generation.

#new york#new york city#manhattan#nyc#office space#office#rto#return to office#remote work#real estate#investment#danielkaufmanrealestate#commercial real estate#economy#real estate investing#daniel kaufman

1 note

·

View note

Text

IMF grades China's 2023, 2024 GDP growth forecast

The International Monetary Fund revised its prior projection of 5% growth and projected that China's economy would grow by 5.4% this year after a "strong" post-COVID recovery. Next year, the IMF expects slower growth. The IMF noted that sustained instability in the real estate market and muted foreign demand might limit GDP growth to 4.6% in 2024, which was still higher than the 4.2% prediction in its October World Economic Outlook (WEO). The increased revision came after China decided to assist the economy by approving a 1 trillion yuan ($137 billion) national bond offering and allowing local governments to frontload a portion of their 2024 bond quotas. "We increased growth by 0.4." IMF First Deputy Managing Director Gita Gopinath stated in Beijing, "This represents percentage points in both years relative to our October WEO projections, reflecting stronger than expected growth in the third quarter and the new policy support that was recently announced." During the medium term, Gopinath stated during a press conference to commemorate the release of the fund's "Article IV" analysis of China's economic policies that growth would progressively decline to roughly 3.5% by 2028 due to headwinds from poor productivity and an ageing population. China has taken a number of steps to boost the real estate industry, but more is required, according to her, to ensure a quicker recovery and lower economic expenses to reduce its size to one that is more sustainable. "With regard to the real estate industry, this policy package will need, among other things, hastening the departure of unprofitable real estate developers, eliminating barriers to housing price adjustment, and augmenting central government investment for housing construction," said Gopinath. Economists predict that the housing market slump combined with the debt crisis facing local governments will eliminate most of China's capacity for long-term growth. Local debt increased from 62.2% in 2019 to 92 trillion yuan ($12.6 trillion) in 2022, or 76% of China's economic output. The Communist Party's highest decision-making body in China, the Politburo, announced in late July that it will take steps to lower the risks associated with local government debt. "To alleviate local government debt constraints, the central government should conduct coordinated fiscal framework changes and balance-sheet restructuring, including closing local government fiscal gaps and regulating the debt stream," Gopinath remarked. She said that in order to lower the debt burden of local government finance vehicles (LGFVs), China should also create a thorough restructuring plan. Although local governments established LGFVs to finance infrastructure projects, their cumulative debt has ballooned to almost $9 trillion, making them a significant risk to China's faltering economy. Gopinath cautioned that in order to stop new vulnerabilities from arising, "local governments must improve their fiscal transparency and risk monitoring, as financial stability risks are elevated and still rising." ($1 = 7.2833 yuan renminbi in China) ALSO READ: Russia leaves the post-Cold War treaty of European armed forces Read the full article

0 notes

Text

BCDA, Virlanie Foundation participate in Lamudi's Philippine Real Estate Conference 2019

BCDA, Virlanie Foundation participate in Lamudi’s Philippine Real Estate Conference 2019

Vince Dizon

Lamudisuccessfully held The Outlook Real Estate Conference 2019 at the Isabela Ballroom of Makati Shangri-La in Makati City, Metro Manila, Philippines on October 17, 2019. the Bases Conversion and Development Authority (BCDA) and Virlanie Foundation took part in the event, which brought together industry thought leaders from all over the Philippines to talk about the hot topics in the…

View On WordPress

#Cherish-A-Home Fundraising#Lamudi#The Outlook Real Estate Conference 2019#Vince Dizon#Virlanie Foundation

0 notes

Text

Lamudi's Philippine Real Estate Conference 2019: Shaping the Future of Real Estate

Lamudi’s Philippine Real Estate Conference 2019: Shaping the Future of Real Estate

Last October 17, 2019, Lamudi successfully held The Outlook Real Estate Conference 2019 at the Makati Shangri-La, bringing together industry thought leaders from all over the country to talk about the hot topics in the Philippine real estate sector.

The Outlook: Philippine Real Estate Conference 2019, with co-presenters Philippine Daily Inquirer Property and Holcim Philippines, provided an avenue…

View On WordPress

#LAMUDI PHILIPPINES#Real Estate Conference 2019#Real Estate Marketing#The Outlook Real Estate Conference 2019

0 notes

Text

Top 10 Things To Watch In Commercial Real Estate In 2022 according to Forbes

Published on December 1, 2021 I By Calvin Schnure I FORBES

The year ahead is likely to see further improvement in commercial real estate markets as the economy continues to recover from the Covid-19 pandemic. There are both upside and downside risks to the outlook. Here are the top ten developments to follow, ranked in order of increasing importance:

10. Commercial transactions volumes, property prices, and cap rates

Prediction: Property transactions will rise further in 2022 as the economic recovery gains momentum, and CRE prices will maintain growth in the mid-single digits. REIT mergers and acquisitions could top 2021 as well.

CRE markets rebounded in 2021. Transaction volumes in the first ten months of 2021 rose 64% from the comparable period in 2020, and were 12% above 2019. Purchases of industrial properties and apartments were more than 30% above 2019 levels, while retail and office market transactions lagged.

Prices of industrial and apartment properties rose at a double digit rate through the third quarter of 2021, according to the CoStar Commercial Repeat Sales Indices. Office and retail prices rose more slowly but have recovered from declines early in the pandemic. Cap rates are low, consistent with the low interest rate environment; cap rate spreads to Treasury yields are in line with the past decade.

9. Senior living and skilled nursing

Prediction: Progress against the pandemic, and especially the high vaccination rates among 65 and older, will drive further recovery in senior housing and skilled nursing in 2022. Full recovery, however, will not occur until 2023. The demographic wave of Baby Boomers will fuel longer-term demand.

Covid-19 infections adversely affected many residential health care facilities, including senior living and skilled nursing, limiting move-ins and causing a sharp drop in occupancy rates. Occupancy began to rise again in the second half of 2021, but remains several percentage points below pre-crisis levels.

8. Apartment and housing markets

Prediction: Limits to new construction will keep both rents and home prices strong. Affordability is creating growing challenges for many households, however, and is likely to limit both rent growth and home price appreciation.

The markets for apartment rentals and for home purchase usually move in opposite directions, with a strong housing market generally accompanied by soft rental markets, and vice versa. During the pandemic, however, the desire for more living space while people are working and studying from home has driven both rental and ownership markets to record highs.

7. Self-storage

Prediction: Ongoing strength in the housing and apartment markets will support another strong year for self-storage.

Self-storage REITs have been a star performer during the pandemic, as strong housing markets and home purchases have spurred demand for storage. Funds from operations (FFO), the most common metric for REIT earnings, was 42% higher in 2021:Q3 than prior to the pandemic, and stock market returns were 57% year-to-date through November. There may be some downside risk if a reduction in employees who are working from home decreases the need to clear out spare rooms in homes and apartments.

6. Business travel and conventions

Prediction: Hotels, restaurants, and entertainment that caters to business travelers will see an accelerating recovery as 2022 progresses.

Business travel has lagged the recovery in leisure travel as many meetings and business conventions remain online. Negotiating a major contract or selling a new product line often is more successful with a face-to-face meeting, however, and business travel and conventions are beginning to open up.

5. Digital real estate

Prediction: Digital real estate sectors—data centers, communications towers, and industrial REITs—will continue their strong growth in 2022.

Digital communications provided a lifeline during the pandemic, from online conference meetings for work to e-commerce purchases by consumers and streaming movies online for entertainment. Use of these conveniences has continued to rise even as the economy reopens, generating robust demand for digital real estate sectors like data centers, infrastructure/cell towers, and industrial/logistics facilities.

4. Interest rates, inflation, and the Fed

Prediction: Inflation will remain above trend during 2022, but will ease gradually as the year progresses. The Federal Reserve will likely begin slow, small increases in its target for short-term interest rates in the latter half of 2022. Long-term interest rates will remain low, providing attractive financing conditions for commercial real estate.

The 12-month change in CPI has risen to a 30-year high, but this time frame misses the large swings that took place over shorter periods during the pandemic. Core CPI inflation on a 3-month annualized change surged above 10% in June as supply chain problems intensified, but has subsequently slowed to 3%-4%.

The supply chain bottlenecks aren’t going away quickly, however, and shortages in key goods and commodities will continue to fuel price pressures in the medium term—but in the longer term, inflation rates are likely to cool.

3. Brick-and-mortar retail sales

Prediction: With a choice of online purchases or buying in a brick-and-mortar store, consumers are saying “more of both”. New leases from new tenants will reduce vacancy rates in the brick-and-mortar retail property sector.

Consumers bought a lot of goods online during the early months of the pandemic, while sales through brick-and-mortar channels declined as social distancing requirements were put in place. In-store sales rebounded strongly, however, to above pre-pandemic levels, as many consumers still prefer shopping in person for items where size, fit, and appearance are important. Over the past year, sales through both the online and in-store channels have risen.

2. Return-to-office

Prediction: The office will remain the hub of business activity, but flexible work-from-home will allow many employees the convenience of skipping the commute a few days a week.

Millions of employees are returning to the office each month, according to the Labor Department’s monthly employment report, yet many employers are embracing a flexible work-from-home model.

The key development to watch is not how many employees make the commute each month. Rather, keep an eye on the peak space needs for the days when all employees are in the office for teamwork and communication, as this will drive overall demand for office space. In addition, watch whether employers redesign the office space to eliminate individual office or work stations, or whether there is simply decreased density within the office on the days that employees work from home.

1. Covid-19

Prediction: The economy and CRE markets will continue to recover in 2022, and setbacks from flareups of Covid-19 will be short-lived.

The emergence of the new Omicron variant of Covid-19 in late November 2021 serves as a reminder that the threat of new waves of infection looms over all aspects of the global economy. Increasing vaccination rates and natural immunity due to prior infection may help contain these risks.

To read this article on Forbes https://www.forbes.com/sites/calvinschnure/2021/12/01/top-10-things-to-watch-in-commercial-real-estate-in-2022/?sh=4c8eb5183002

0 notes

Text

Helping farmers, fisherfolk weather Covid-19, ASF outbreaks

#PHnews: Helping farmers, fisherfolk weather Covid-19, ASF outbreaks

MANILA – The Department of Agriculture was banking on 2020 to be a rebound year after it experienced a major setback last year due to “birth pains" of the implementation of the Rice Tariffication Law (RTL).

“The year opened with rice prices at stable levels, inflation in check, and the full implementation of the Rice Competitiveness Enhancement Fund (RCEF), a component under RTL, in full swing. The ASF outbreaks were also manageable through heightened quarantine measures nationwide,” Agriculture Secretary William Dar said in a statement on Wednesday.

However, Dar said a series of unfortunate events occurred, “quite literally–beyond the control of man.”

Taal Volcano eruption

The country’s most active volcano has swept 15,970 hectares of agricultural areas when it erupted in January.

Coffee, cacao, pineapple, rice, coconut, and other high value crops in Calabarzon were damaged costing PHP3.06 billion, while the fisheries sector sustained PHP1.6 billion in losses.

The DA shouldered crop insurance, livelihood, seeds and seedlings, and farm machinery, among other donations, to the affected farmers and fisherfolk worth some PHP2.708 million.

DA said this is on top of the PHP160 million worth of interventions given to farm communities affected by the eruption.

African swine fever

The spread of the African swine fever (ASF) has penetrated parts of Mindanao despite the elevated quarantine measures.

DA said it engineered a multi-pronged approach to prevent and control the disease as well as the recovery of the industry.

“In testing, specifically, the government is making significant headway with the soon-to-be-launched locally developed test kit which has greater detection rate, and our recent opening of a modern animal disease diagnostic facility in Tarlac City,” Dar said.

Dar reported that the hog industry incurred PHP56 billion in losses due to ASF.

With a total budget of PHP280 million, the facilities will be put up in Magalang, Pampanga; in Tanauan and San Jose, Batangas; and in Malagos, Davao.

Record-high rice production

Despite the pandemic, the series of strong typhoons, and low farm gate prices, rice production even increased by 0.6 percent to 7.54 million metric tons in the fourth quarter compared to last year’s output of 7.49 million metric tons.

Around 322,041 metric tons of palay (unmilled rice) were lost due to the typhoons, equivalent to eight days of rice consumption.

Yield per hectare went up by 1.48 percent to 4.13 metric tons from 4.07 metric tons.

Rice production would have been higher at 19.86 MMT if it were not for the loss of 419,560 MT of palay due to the typhoons that hit the country.

For 2021, a conservative production of 20.48 MMT to a high of 20.66 MMT is targeted.

Corn production, on the other hand, increased by 1.2 percent to 1.68 million metric tons from 1.66 MMT recorded in 2019.

Yield per hectare went up 0.67 percent to 2.99 MT from 2.97 MT.

The gross value added of the agriculture sector went up 4.1 percent to PHP404.6 billion during the fourth quarter.

Food resiliency action plan

DA imposed a list of suggested retail prices (SRP) for agri-fishery commodities that will be covered by the price freeze.

“The action helped prevent spikes in prices of basic farm commodities during the protracted community quarantine. The agency also strengthened its Bantay Presyo Task Force to monitor prices of basic agricultural commodities, enforce the SRP policy, and go against cartels, hoarders, and profiteers,” Dar added.

DA also implemented the Duterte administration’s “Plant, Plant, Plant” program or “Ahon Lahat, Pagkaing Sapat (ALPAS) Laban sa Covid-19” program to benefit farmers, fishers and consumers.

Other projects that will be funded under this program are additional palay procurement fund of the National Food Authority; expanded SURE Aid and recovery project; expanded agriculture insurance project; social amelioration for farmers and farm workers; upscaling of KADIWA ni Ani at Kita direct marketing program; integrated livestock and corn resiliency project; expanded small ruminants and poultry project; coconut-based diversification project; fisheries resiliency project; revitalized urban agriculture and gulayan project; corn for food project; and strategic communications project.

Credit programs with flexible payment scheme

The Agricultural Credit and Policy Council (ACPC) responded to the financing needs of small farmers and fishers (SFFs) and agri and fishery-based micro and small enterprises (MSEs) to motivate upward movement in the industry despite the challenges.

To entice the youth and start-ups, the ACPC introduced Kapital Access for Young Agripreneurs (KAYA) and the AgriNegosyo (ANYO) Loan Program early this year.

In April 2020, it implemented the SURE Aid and Recovery Project (SURE COVID-19) for SFFs and MSEs whose livelihoods, agribusiness operations, and incomes were affected by the health crisis.

SURE COVID-19 is a component of the Bayanihan to Heal as One Act (Bayanihan 1) and the Bayanihan to Recover as One Act (Bayanihan 2).

Dar said ACPC’s 104 partner lending conduits released a total of PHP2.03 billion to 48,375 SFFs and 148 MSEs.

In addition, some PHP444.30 million loans were granted to 28,259 SFFs affected by the ASF, Taal Volcano eruption and typhoons; PHP151.21 million loans to 5,468 SFFs under the Production Loan Easy Access (PLEA) using program collections as revolving credit funds (reflows); and PHP19.50 million loans to four MSEs/Farmers & Fisherfolk Organizations (FFOs) under Capital Loan Easy Access (CLEA) and Agricultural Machineries and Equipment (AFME) Loan Programs which remained operational until subsumed under ANYO.

Engaging the IPs

As a way to hit two birds in one stone, Dar also kicked off the initiative to transform portions of vast ancestral lands nationwide into food production areas.

The National Commission on Indigenous Peoples (NCIP) said about 7.7 million hectares are owned by the Indigenous Peoples (IP), or about 26 percent of the country’s total land area of 30 million hectares.

As of 2019, the NCIP has issued 243 certificates of ancestral domain titles, with a total land area of 5.7 million hectares and a total of 1.3 million IPs as rights holders.

“Aside from profitable types of vegetables -- like onion, string beans, potato, carrots, pineapple, garlic, cauliflower, and watermelon -- our IPs can grow cacao, coffee, abaca or black pepper, or they may go into raising native pigs and free-range chicken. Other crops include bitter melon, asparagus, cabbage, cassava, garlic, ginger, mungbean, papaya, peanut, sweet potato, and tomato,” Dar said.

Coco levy fund

One of the welcoming reports this year, Dar said, was Congress’ passage on the third and final reading of House Bill 8136 or the proposed Coconut Farmers and Development Trust Fund Act.

DA is optimistic that the bicameral conference committee will swiftly approve the measure seeking to create a trust fund for the country’s coconut farmers before both chambers of Congress go on holiday recess this Christmas season.

Digital agriculture

Meanwhile, DA partnered with the Department of Trade and Industry (DTI) to launch Deliver-E, a modernized marketing process connecting food producers to consumers sans the unnecessary trading layers.

To help farmers recover, the Philippine Crop Insurance Corporation (PCIC) released about PHP347 million to help rebuild the lives and livelihoods of insured farmers and fisherfolk who have been heavily affected by extreme weather disturbances that hit the country.

The payment represents the initial payment on the PHP1.5-billion worth of estimated damages reported by PCIC’s clients in PCIC’s seven administrative regions.

Positive outlook

The Philippine Statistics Authority reported that the Philippines recorded a Gross Domestic Product (GDP) rate of -11.5 percent in the third quarter of 2020, compared with the previous quarter’s -16.9 percent.

The industries that contributed the least to the GDP were construction, -39.8 percent; real estate and ownership of dwellings, -22.5 percent; and manufacturing, -9.7 percent.

On the other hand, the top three industries that posted positive rates were: financial and insurance activities, 6.2 percent; public administration and defense, compulsory social activities, 4.5 percent; and agriculture, forestry, and fishing, at 1.2 percent.

It was the same picture in the second and first quarters of 2020.

GDP dropped by 16 percent in the second quarter of 2020, the lowest recorded quarterly growth, from the 1981 base year.

The main contributors to the decline were: manufacturing, -21.3 percent; construction, -33.5 percent; and transportation and storage, -59.2 percent.

Among the major economic sectors, only agriculture, forestry, and fishing increased with 1.6 percent growth.

Industry and services both decreased during the period by 22.9 percent and 15.8 percent, respectively.

For 2021, the DA targets to attain a "conservative" 2.5 percent growth.

"The COVID-19 pandemic wreaked havoc on the global and national economy. But no matter what happens, people must eat. For this reason alone, agriculture registered positive contributions to the economy compared to the other movers of the economy such as construction, real estate, and manufacturing," Dar said. (PNA)

***

References:

* Philippine News Agency. "Helping farmers, fisherfolk weather Covid-19, ASF outbreaks." Philippine News Agency. https://www.pna.gov.ph/articles/1126000 (accessed December 31, 2020 at 02:53AM UTC+14).

* Philippine News Agency. "Helping farmers, fisherfolk weather Covid-19, ASF outbreaks." Archive Today. https://archive.ph/?run=1&url=https://www.pna.gov.ph/articles/1126000 (archived).

0 notes

Text

GCC AIR PURIFIER MARKET ANALYSIS

GCC Air Purifier Market, By End-User (Commercial, Residential), By Technology (High-Efficiency Particulate Air (HEPA), Electrostatic Precipitator, Ion & Ozone Generators, Activated Carbon, Other Technologies), and By Region (UAE, KS,A Rest of GCC ) - Size, Share, Outlook, and Opportunity Analysis, 2020 – 2027

n air purifier is a type of air cleaner’s devices that are used to eliminate the contaminants from the air in the close room and also enhance the quality of the air. Air purifier comprises of filter, a fan that circulates and sucks that air, and multiple filters. The devices work by capturing pollutants and particles present in the air and the clean air is pushed back out into the living space. They trap the airborne contaminants such as dust mites, mold spores, chemicals, toxins, and odors. Ozone generators, electrostatic precipitators, ultraviolet light air purifiers, and activated carbon are some of the types of air purifiers. All these air purifiers remove all the harmful elements from the air while distributing fresh air in the room.

The GCC air purifier market is projected to surpass US$ 260 million by the end of 2027, in terms of revenue, growing at CAGR of 17.4% during the forecast period (2020 to 2027).

Drivers

Emerging non-oil sectors in the region such as healthcare services and offshore ship maintenance is another major factor expected to propel the market growth of the GCC air purifier. Diversification of the economy of GCC is generating numerous employment is accelerating economic growth and standard of living of consumers in the region. This is encouraging them to spend on advanced home appliances such as air purifier, thus propelling market growth.

Growth in the residential sectors across the GCC region is expected to fuel the market growth of air purifiers. Regulatory bodies in the region are focusing on developing residential infrastructure due to increasing populations which is expected to fuel the market growth of air purifiers. Expanding real estate sector due to growing disposable income of the population is another major factor expected to bolster the market growth of air purifiers over the forecast period.

Regionally, KSA dominated the GCC air purifier market in 2019, reporting 48% market share in terms of revenue, followed by UAE and Rest of GCC, respectively.

Figure 1. GCC Air Purifier Market, Revenue Share (%), By Region, 2019

Market Restraints

The high installment and maintenance cost of the air purifier is expected to hamper the market growth of the GCC air purifier. Moreover, lack of awareness regarding the disease caused by indoor contaminant air such as asthma and other respiratory disease is further expected to restrict the market growth of the GCC air purifier.

People in the GCC region do not consider as a necessity since they are unaware of the benefits of air purifiers. This is a major factor expected to restrict the adoption of air purifiers in the region. Thus, hindering the market growth of the GCC Air purifier.

Market Opportunities

Increasing installation of automation and computer system across commercial sectors which cause air pollution upon heating is expected to fuel the demand for air purifiers. Moreover, GCC countries are installing energy-efficient regulations and focusing on the source for producing cleaner energy technologies. This is further expected to propel the market growth of the air purifier in the GCC region over the forecast period.

Increasing focus of manufacturers of the GCC region in positioning the product in order to create brand awareness among the consumer is expected to foster the market growth of air purifiers. Various marketers are adopting promotional activities such as roadshows and radio campaigns for creating brand awareness and reaching the target consumers. All these factors are expected to offer potential growth opportunities to the GCC air purifier market.

Figure 2. GCC Air Purifier Market – Opportunity Analysis

Market Trends

Rising adoption of advanced technology such as high-efficiency particulate air (HEPA) in the region is expected to foster the market growth over the forecast period. High-Efficiency Particulate Air (HEPA) filters are highly advanced and efficient in terms of cleaning the indoor air by trapping airborne particles such as pollen, smoke, dust, and bio-contaminants. Thus, increasing adoption of advanced air purifier technology will favor the market growth.

Growth in the hospitals, offices, conference centers, educational centers, shopping malls, movie theaters, and other recreational facilities in the region is expected to augment the market growth of the air purifier. Increasing installation of air purifiers in the offices in order to maintain the quality of indoor air is also expected to foster the market growth of the air purifier. An increasing number of the power plant and other manufacturing facilities is further anticipated to foster market growth.

Figure 3. GCC Air Purifier Market, Revenue Share (%), By Technology, in 2019

On the basis of technology, high-efficiency particulate air (HEPA) dominated the GCC Air purifier market in 2019 with around 46% of market share in terms of revenue, followed by electrostatic precipitators and ion & ozone generators, respectively.

Competitive Section

Key players are operating in the GCC Air Purifier market are Sharp Corp., LG, Samsung, Hitachi, and Panasonic

Request sample report here: https://www.coherentmarketinsights.com/insight/request-sample/3884

Download PDF brochure here: https://www.coherentmarketinsights.com/insight/request-pdf/3884

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized market research service

Industry analysis services

Business consulting services

Market intelligence services

Long term engagement model

Country specific analysis

Contact Us:

Mr. shah

Coherent Market Insights Pvt. Ltd.

Address: Coherent Market Insights 1001 4th Ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

Source: https://www.coherentmarketinsights.com/market-insight/gcc-air-purifier-market-3884

0 notes

Text

RESIDENTIAL MARKET SHOWS RESILIENCE AS RENTAL YIELDS DECLINES

New Post has been published on https://newscheckz.com/residential-market-shows-resilience-rental-yields-declines/

RESIDENTIAL MARKET SHOWS RESILIENCE AS RENTAL YIELDS DECLINES

“WESTLANDS, RIDGEWAYS, AND DAGORETTI RECORD THE HIGHEST RETURNS TO INVESTORS IN H1’2020.

RESIDENTIAL MARKET SHOWS RESILIENCE WITH RENTAL YIELDS DECLINING BY 0.1% POINTS TO 5.1% IN H1’2020 FROM 5.2% IN Q1’2020.

WHILE OFFICE AND RETAIL SECTORS DECLINE BY 0.5% POINTS AND 0.3% POINTS, TO 7.3% AND 7.4%, RESPECTIVELY”

Cytonn Real Estate, the development affiliate of Cytonn Investments, has released their H1’2020 Markets Review.

The report highlights the current state of the real estate sector in terms of uptake, rental yields, capital appreciation, and hence, total investor returns.

According to the report, average rental yields softened across all sectors coming in at 7.4%, 7.3% and 5.1%, for retail, office and residential sectors, respectively, from 7.7%, 7.8% and 5.2% in Q1’2020.

The land sector recorded an overall annualized capital appreciation of 1.4%, with asking land prices in low rise residential areas recording the highest annual growth at 3.8% driven by the increased demand for affordable land.

ALSO READ: CBK Retains Standard Lending Rate at 7pc

According to the report, constrained financing, supply chain constraints, and reduced revenues arising from slow market uptake and downward pressure on prices and rents due to the ongoing COVID-19 pandemic are expected to remain as the main challenges facing the real estate sector.

“The residential sector remained relatively stable with most sectors softening in performance, albeit marginally. Dagoretti, Ridgeways and Westlands recorded the highest annual price appreciation at 3.1%, 3.0% and 1.6%, respectively”, said Wacu Mbugua, Research Analyst at Cytonn.

(All Values in Kshs Unless Stated Otherwise)

Apartments Market Performance: Top 5 Markets

Area

Average Price per SQM

Average Rent per SQM

Average Occupancy

Average Annual Uptake

Average Rental Yield

Average Annual Price Appreciation

Annual Total Returns

Dagoretti

101,335

500

85.0%

21.9%

5.8%

3.1%

8.8%

Thindigua

111,444

555

88.2%

22.0%

5.9%

1.2%

7.1%

Westlands

129,667

688

89.6%

23.9%

5.2%

1.6%

6.8%

Parklands

114,031

611

95.7%

17.1%

5.8%

0.3%

6.1%

South C

110,644

589

96.9%

22.7%

6.0%

0.1%

6.1%

(All Values in Kshs Unless Stated Otherwise)

Detached Units Market Performance H1’2020: Top 5 Markets

Area

Average Price per SQM

Average Rent per SQM

Average Occupancy

Average Annual Uptake

Average Rental Yield

Average Annual Price Appreciation

Annual Total Returns

Ridgeways

143,915

682

90.0%

17.8%

5.5%

3.0%

8.5%

Ruiru

86,160

392

67.3%

20.6%

5.5%

0.3%

5.8%

South B/C

120,061

556

94.9%

18.6%

5.2%

0.6%

5.8%

Langata

144,991

659

87.4%

17.8%

4.9%

0.9%

5.8%

Lavington

179,656

720

80.2%

18.8%

4.0%

1.6%

5.6%

Source: Cytonn Research

In commercial real estate, Gigiri, Karen and Westlands were the best performing office nodes in H1’2020 recording rental yields of 8.9%, 8.3%, and, 8.2%, respectively due to their superior locations and availability of top-quality offices, enabling them to charge a premium on rental prices, while in the retail sector, Westlands and Karen were the best performing retail nodes with average rental yields of 9.8% and 9.2%.

Below is a summary of the H1’2020 sectorial performance:

Of the six sectors, our outlook is positive for one; land; neutral for three residential, retail and hospitality; and negative for two office and listed real estate. Thus, our outlook for the real estate sector remains neutral.

Going forward, we expect the industrial sector, residential, land, and select office markets to continue holding up well in terms of performance, while retail and hospitality remain the most affected.

The sector’s performance should improve significantly towards the end of 2020 once economic activity regains momentum.

Key: Green – POSITIVE, Grey – NEUTRAL, Red – NEGATIVE highlights sectorial outlook

Theme

Thematic Performance and Outlook H1’2020

Residential

The detached units’ market recorded an average annual price appreciation of 0.3% compared to the apartment market’s (0.2%) attributable to less supply of standalone units coupled by growing demand by homebuyers.

We expect uptake to remain suppressed in 2020 as cash flows for investors and homebuyers come under pressure in light of the ongoing pandemic.

As such, the opportunity is in low-cost housing in Satellite Towns such as Thindigua and Ruaka which continue to exhibit high demand attributable to their proximity the key commercial nodes, and suburbs such as Westlands and South C for investors seeking attractive rental yields.

Office

The sector recorded a 0.5% and 1.7% points decline in average rental yields and occupancy rates, to 7.3% and 80.0% in H1’2020, from 7.8% and 81.7%, respectively in FY’2019, attributable to the ongoing COVID-19 pandemic which has led to reduced demand for office spaces as firms have put on hold expansion plans as they adopt a wait and see approach while others opt to scale down operations amidst declining revenues.

Our outlook for the commercial office sector is negative owing to the current market oversupply and the impact of COVID-19 on economic activities. We expect asking rental prices to continue dropping due to increased vacancy rates and downward pressure arising from the existing oversupply in the market. The investment opportunity is in differentiated concepts such as serviced offices that attract yields of up to 12.3%.

Retail

Performance softened recording a 0.3% points decline in rental yield to 7.4% in H1’ 2020 from 7.8% in Q1’2020 owing to an increase in vacancy rates in malls and constrained purchasing power.

The investment opportunity is in mixed-use concepts in areas such as Westlands and Karen, with attractive yields of 9.8% and 9.2%, respectively, as well as prime located retail developments which attract high footfall

Hospitality

The hospitality sector was significantly affected by the COVID- 19 pandemic which led to a slowdown of operations following the cancelling of meetings, conferences and events, the banning of all international flights and reduced local direct flights. However, we expect the sector’s recovery to commence in the near term on the back of government policies such as the budget allocation towards tourism marketing and support for hotel refurbishment through soft loans.

The sector has pockets of value in the serviced apartments in areas such as Westlands & Parklands, and Kilimani markets with rental yields of above 10.8% and 9.5%, respectively

Land

The land sector recorded an overall annualized capital appreciation of 1.4%, with asking land prices in low rise residential areas recording the highest annualized capital appreciation at 3.8%.

The investment opportunity lies in sub-markets such as Karen, Spring Valley and Kasarani which recorded relatively high annualized capital appreciation of 5.6%, 5.4% and 5.7%, respectively, and satellite towns such as Ruaka for un-serviced land, and Ruiru for site and service schemes, with average annualized capital appreciation of 5.2%, and 5.8%, respectively.

Listed Real Estate

The I-REIT continued to perform poorly during the period with the price per share dropping to lows of Kshs 5.5, the lowest since the I-REIT’s inception in 2015.

We expect listed real estate to continue performing poorly attributed to continued lack of investor interest in the instruments and the continued subdued performance of the real estate sector as it continues to grapple with the effects of the COVID-19 pandemic.

0 notes

Photo

How to Donate to Cherish-A-Home, a Fundraising Partnership by Lamudi and Virlanie https://ift.tt/2Ndke7Y

Virlanie Foundation, a private non-profit organization that was established in 1992 continues its mission to help enrich the lives of children in need in the Philippines with its partnership with Lamudi. The joint project, Cherish-A-Home Fundraising, was introduced at The Outlook: Real Estate Conference 2019 held at the Makati Shangri-la last October 17. The fundraising […]

The post How to Donate to Cherish-A-Home, a Fundraising Partnership by Lamudi and Virlanie appeared first on Lamudi.

0 notes

Text

The Chase Files Daily Newscap 9/11/2019

Good Morning #realdreamchasers. Here is your daily news cap for Wednesday, September 11th, 2019. There is a lot to read and digest so take your time. Remember you can read full articles via Barbados Today (BT), or by purchasing a Midweek Nation Newspaper (MWN).

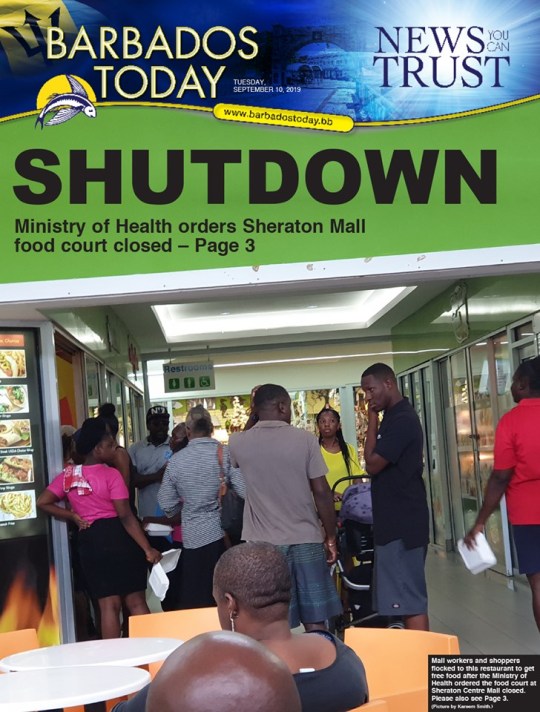

SHERATON FOOD COURT CLOSED – The food court at Sheraton Mall has been closed. This was confirmed by managing director Scott Oran, who said Ministry of Health officials said they needed to conduct urgent maintenance at the facility. The rest of the mall however remains open for business. (MWN)

WHEEL & COME AGAIN – Government has been advised to return to the drawing board with its proposals for a medical marijuana industry. Rastafarians, doctors, lawyers and scientists spoke to various sections of the Medicinal Cannabis Industry Bill, 2019 yesterday, raising several questions about the provisions, in submissions at the first meeting of the Joint Select Committee on the bill. It was held at the Lloyd Erskine Sandiford Centre.Rastafarians appealed for legalisation of cannabis across the board, while doctors queried provisions for their legal protection in the prescribing methods of cannabis medication. The lawyers sought to dissect the legal framework of the bill.Minister of Agriculture Indar Weir was elected chairman of the 12-member committee. The remaining morning session was taken up with procedural matters, as several members of the public waited outside. (MWN)

RISKY SELLING CLICOL LANDS - The Democratic Labour Party (DLP) is warning the Mia Amor Mottley administration that selling the vast acres of arable land of collapsed insurance company CLICO will put the agricultural sector at risk. Yesterday during a press conference at the DLP’s George Street Auditorium, spokesperson on agriculture, former senator Andre Worrell, slammed Government’s plan to sell the CLICO assets.In May, Director of Finance Ian Carrington announced Government would be selling assets to help pay off the expenses of CLICO’s court-sanctioned successor Resolution Life (ResLife), which was also being dissolved.In the last SUNDAY SUN, ResLife chairman Tony Hoyos announced that prime real estate owned by CLICO, including plantations owned in St John, would be going on the market. (MWN)

NURSES FRUSTRATED BY TRAINING LEAVE REFUSAL – At a time when the Government says it is desperately seeking to improve the quality of healthcare in Barbados, nurses are complaining that their attempts to improve their skills, through higher education, are being frustrated.

According to NUPW Deputy General Secretary Wayne Walrond, nurses trying to pursue the Diploma in Midwifery and the Bachelor of Science in the General Nursing Course at the Barbados Community College (BCC), have been unable to secure release from work. “Nurses who have been accepted by the BCC to pursue the general nursing programme commencing September 2, 2019, have been frustrated in their efforts to get the required release from work. This has occurred despite the fact that since 2011, several nurses have been applying to the Ministry of Health repeatedly each year for approved training,” Walrond said. The trade unionist also raised concerns regarding nurses who have already completed several semesters in the general nursing programme as continuing students, noting that they were now required to re-apply each academic year with no approval to date. He told Barbados TODAY that nurses are forced to work night shift as a condition to attend BCC nursing training. He contended that Government’s failure to put proper arrangements in place for these nurses would only result in many of them being unable to complete their course of study. Walrond revealed that in some cases the nurses went as far as applying for no-pay study leave, but even those requests were rejected. “A number of nurses who were accepted to do the Midwifery Course at the BCC had applied for no-pay study leave since they were unsuccessful in obtaining paid leave to attend the programme. Even the no-pay leave arrangement was rejected on the grounds that there was not enough time to grant such approval,” he lamented. Minister of Health Lieutenant Colonel Jeffrey Bostic could not be reached for comment Barbados has been plagued by a chronic shortage of nurses, caused primarily by many of those trained in the field taking up employment opportunities in metropolitan countries. This is compounded by the high failure rate of nurses taking the regional nursing examination. The problem has gotten so bad that the Government is in the process of recruiting 400 nurses from Ghana. However, Walrond warns that given the myriad issues within the sector, to add further frustration would only result in more nurses leaving for greener pastures. “The NUPW is of the view that this situation has added to the frustration of Government sector nurses who already have issues with being paid on time and not having a paid upgrade for the job they undertake. The union is concerned that this deep sense of frustration would potentially see a further exodus of nurses from Barbados,” said Walrond. He further noted, “We appeal to the Ministry of Health and Wellness and relevant agencies of Government to take every urgent action in permitting the nurses to pursue further training for their betterment and that of the country as a whole.” (BT)

GAY AGENDA –Yet another online petition has surfaced amid a raging debate on the implications of Lesbian Gay Bisexual and Transgender acceptance in schools. The most recent petition on change.org has taken aim at “the bullying of the Barbadian society into forcing the LGBT agenda on its children” and has been gaining support on social media. It was released hours after a petition uploaded by the parents of a 14-year-old transgender girl whose request to wear a female uniform to the private Providence School was reportedly denied. “There is a move afoot by LGBT activists and their supporters to bring their “gender identity” issues to the children of Barbados,” said an anonymous individual identified only as ‘Concerned Bajan’. Addressing the petition to Prime Minister Mia Mottley and other influencers, the petition states, “There is a major difference between sexuality and gender and the deliberate blurring of these lines is a part of the modus operandi. Gender IS NOT fluid, and young children SHOULD NOT be introduced to sexuality which involves making a decision on their choice or preference of the same.” The appeal continued: “Let the children be CHILDREN, and stop trying to force the warped LGBT agenda on impressionable youngsters. This has little to do with love, or hate, or inclusion; instead it is a selfish attempt to create a wide substructure to support and push the LGBT agenda, unquestionably resulting in the mental and emotional destruction of the very children activists claim they are trying to “free”. “Resist these perverse, bullying attempts to tarnish and confuse our children with issues adults themselves can’t resolve,” the anonymous protester concluded. While both petitions have failed to attract the desired 500 signatures, support for the petition leveled against Providence School has reached 423 signatures against a trailing 377 signatures from those lobbying against it. Since the discussion gained public attention, officials at the Providence Secondary School have been silent and Minister of Education, Technological and Vocational Training, Santia Bradshaw has dismissed it as a “private school” matter while well-known LGBT activist Alexa Hoffman has called on education authorities to address the issue while predicting the matter would likely find its way into the country’s schools. (BT)

JUDGES WELCOMED – The Barbados Bar Association (BBA) has responded with optimism at the recent appointment of ten new judges which is expected to go a long way in reducing the country’s huge judicial backlog.

But President of the association Rosalind Smith-Millar has also zeroed in on urgent legislative changes needed to streamline the Bar Association’s Disciplinary Committee in the interest of access to justice for citizens who have grievances with their lawyers. On the day observed as the start of the legal year, Smith-Millar told Barbados TODAYthe association would continue to closely monitor the situation at the court and the impact of ten new judges on the number of outstanding cases languishing in the judicial system. “We are extremely pleased that we have more judges on board to deal with the backlog as well as being able to spread the load perhaps a bit better now that they are more of them and bring court matters to a faster conclusion. That’s really our outlook on it. We hope that we can work with them,” Millar said. She also lauded increased transparency from authorities in the judge selection process, which is constitutionally assigned to the Prime Minister and praised authorities for bringing certain functions of the judicial system into the 21st century. “We are very happy that we have moved to a more transparent system of selecting judges in terms of having a selection committee to make recommendations, do the interviews and so on. For us that’s an improvement over the previous method,” Miller said. “You have more lawyers and more lawyers file more cases. So when you leave the infrastructure the same and increase the number of cases, there is going to be a backlog. Could the judges have done better? Maybe, but I’m glad that they’re more of them and time will tell if that makes a huge difference as we hope it will.” Turning her attention to matters surrounding the legal profession and its disciplinary structures that have been “hanging over from previous years”, the BBA president said these issues are reportedly dependent on Government’s decisiveness in amending the Barbados Bar Association Act, which governs the disciplinary committee. “If you have the same number of people on a committee like that which you had 40 or 50 years ago when they were half the number of lawyers than what we have now, you can’t expect them to operate with the same efficiency,” she argued. “The [disciplinary] committee carries out a quasi-judicial function, so if there are no reporters to provide transcripts and so on, then how fast can they work when they have to depend on somebody’s long-hand taking of notes?” she asked. “It’s a very serious matter and you can’t just rush through matters based on memory,” Smith-Millar noted. “We need the proper infrastructure for the committee to function. The committee is now bigger than it was 40 or 50 years ago, but there are a lot more lawyers and so potentially more complaints, some of which may be frivolous but still must be reviewed in all seriousness and some of which are very serious… But we can’t change that on our own. Parliament has to make the changes.” (BT)

WRONG WAY –A wrong turn on a one-way street while riding an unlicensed motorcycle landed a 28-year-old in trouble in with the law. And Daniel Demetrius Allain, of Halls Village No.2, St James threw his self at the mercy of the District ‘A’ Magistrates’ Court today when he realised that he could not afford to pay the forthwith fines attached to the traffic offences. Allain pleaded guilty before Magistrate Kristie Cuffy-Sargeant to operating the motorcycle S9819 on Broad Street on September 7 with fraudulent number plates, while he was not the holder of a driver’s licence and no insurance as well as while he was not in possession of a government-issued identification card or driver’s licence for examination as required to do so by a member of the police force. Police constable Victoria Taitt in outlining the facts said lawmen were on duty along Broad Street when Allain was seen coming from Shepard Street before turning left on Broad Street into one-way traffic.“I realised it ws a one-way road when I turned in the gap and see the cars coming,” Allain said when the prosecutor paused. “So when I turn police bound pun me. I buy the motorcycle. I took a chance because I take my friend to the hospital because she had a belly ache”. It was discovered that the number plates were fraudulent when checks were made. “That’s a plate I got on the ground on the road and I use it to make my little rounds so I could get my licence. I have a little $400,” the traffic offender interjected again. After hearing all the details of what had transpired from officer Taitt, the magistrate convicted, reprimanded and discharged Allain on three of the charges and imposed a $350 forthwith fine with an alternative of one month in prison on the no driver’s licence offence and $750 for the no insurance charge which also had to be paid forthwith and carried a six-week prison term if unpaid.“Ma’am I can’t pay that forthwith fine, I have $400 on me now. I will never do it again, never do it again. All my life I in jail since I was 17 years old and all these people unfair me. I don’t want to go back to jail please,’ Allain pleaded as he asked for time to pay the amount. Following his pleas the magistrate granted him two months to pay the total amount. He must return to the District ‘A’ Magistrates’ Court on November 8. However, Allain won’t be able to ride his motorcycle for the next 12 months as he has been disqualified from having or applying for a driver’s licence for that period.(BT)

REMANDED FOR 28 DAYS –A 19-year-old is currently on remand at HMP Dodds. Mitchell Sylvan Sonny, of Reed Street, St Michael was sent to the St Philip institution for 28 days after he appeared in the District ‘A’ Magistrates’ Court on the weekend on a theft charge. Sonny is accused of robbing Keanu Harris of $2,300 on August 30. He will make his next court appearance in the No. 2 District ‘A’ Magistrates’ Court on October 4(BT)

BANCROFT GOES HOME –Convict John Nathaniel Bancroft was allowed to go home today having been sentenced to time served. The Odessa McClean Drive, My Lords Hill resident had been on remand after pleading guilty to having a sponsored walk sheet bearing the stamp of the Family Care for the Disabled, a registered charity, for use in the course of criminal deception, while he has not at his home on June 14. The facts revealed that Bancroft was seen on Nursery Drive asking passersby for monetary donations. He was taken into custody and told police he got the fraudulent document from a woman. However, he snatched the sheet from police and destroyed it while being interviewed. The 43-year-old unemployed man returned before Magistrate Kristie Cuffy-Sargeant today where he disclosed that “a lady I know for years get me into this”.“Next month I will be 44 and I will not want to be in that again,” he said before he was sentenced to time served for the two months and 23 days he had spent on remand at Dodds.(BT)

BISHOP & DUJON BACK POLLARD - New West Indies white ball captain Kieron Pollard has the unequivocal backing of former Test stars Jeffrey Dujon and Ian Bishop. Both Dujon, the most accomplished wicketkeeper/batsman in the history of West Indies’ cricket and Bishop, one of the best fast bowlers of his era, are of the view it is time for a change.Dujon told THE NATION that the time had come to move in a new direction, adding that Pollard will bring a more dynamic and aggressive approach than Jason Holder and Carlos Brathwaite, the outgoing 50-overs and 20-overs captains.“Holder has had plenty of opportunity to prove himself and I don’t think he has. If we are going to move forward, we are going to need a difference tactically and more aggressive leadership,” he said. (MWN)

BOYCOTT’S KNIGHTHOOD CREATES CONTROVERSY – Geoffrey Boycott has said he “couldn’t give a toss” about criticism over Theresa May awarding him a knighthood in her resignation honours list. Domestic abuse charities and Labour said the honour should be removed from the ex-cricketer, who was convicted in a French court of beating his girlfriend in 1998. Boycott, who has always denied the assault, later questioned why the issue had been raised by the media. May’s list of 57 names was made up of mostly political figures. Every departing prime minister can draw up a resignation honours list.May announced her resignation in June after failing to get support for the withdrawal agreement she had negotiated for the UK to leave the EU. The former prime minister showed her love of cricket with knighthoods for Boycott and fellow former England captain Andrew Strauss. Boycott was fined £5,000 and given a three-month suspended sentence in 1998 after being convicted of beating his then-girlfriend Margaret Moore in a French Riviera hotel. During the trial, the court heard Boycott pinned Miss Moore down and punched her 20 times in the face before checking out and leaving her to pay the bill. Boycott denied the allegations, saying Miss Moore had slipped after flying into a rage when he refused to marry her. May, who introduced a landmark Domestic Abuse Bill to Parliament earlier this year, was accused of sending a “dangerous message” by Women’s Aid’s co-acting chief executive Adina Claire. She said the honour “should be taken away” from Boycott, adding that it sent “completely the wrong message” to survivors of domestic abuse. Asked about the criticism from Women’s Aid by presenter Martha Kearney on BBC Radio 4’s Today programme, Boycott responded: “I don’t give a toss about her (Claire), love. It was 25 years ago so you can take your political nature and do whatever you want with it.” The 78-year-old, who is part of the BBC’s cricket commentary team for the current Ashes series, added: “ . . . She [Moore] tried to blackmail me for £1million. I said no, because in England if you pay any money at all, we think: ‘Hang on, there must be something there.’ I said: ‘I’m not paying anything’ … I’m not sure I’d actually got a million at the time. “It’s a court case in France where you’re guilty, which is one of the reasons I [didn’t] vote to remain in Europe – because you’re guilty until you’re proved innocent. That’s totally the opposite from England and it’s very difficult to prove you’re innocent in another country and another language. “I have to live with it – and I do. I’m clear in my mind, and I think most people in England are, that it’s not true.” In a subsequent interview, Boycott said that the day had been “soured” by Radio 4 “setting me up”, saying the station’s agenda had been to talk about domestic violence and “make publicity”. He told BBC’s Look North Yorkshire: “Is that what interviewing is about – is it always to ask difficult questions? Shouldn’t it be just a nice day for me?” A spokesperson for the Today programme said the question was “entirely appropriate… given the concerns raised about Geoffrey Boycott’s knighthood by Women’s Aid and others”. The shadow minister for women and equalities, Dawn Butler, joined the call for Boycott’s knighthood to be rescinded. “Honouring a perpetrator of domestic violence just because he is the former prime minister’s favourite sportsman shows how out of touch and nepotistic the honours list is,” she said, adding that the whole system needed “radically overhauling”. May once compared her determination to delivering Brexit with the fighting spirit in Boycott’s batting marathons. (BT)

JANICE KEEPING ART ALIVE – However, unlike most children who grow up and put away the art books and interest in art, Janice Whittle’s love for the arts never left her. To this day, her love for painting, sculpture, fashion design – in fact, anything involving the fine arts – is as fresh as it was when she was a primary school student at Smith’s Preparatory School, located back then at River Road, on the outskirts of The City. Throughout her early days she was encouraged by her parents to hone her art skills. Art teachers in whose classes she sat at Queen’s College did the same. These included well established artists such as Joyce Davis and Goldie Spieler.“As a child I loved being able to invent. Art always enabled me to be inventive. Part of the art curriculum at Queen’s College included the history of art which I enjoyed,” she recalled.“Art history for me was like reading a detective novel. It taught me how to look at a work of art and see the influences of earlier artists, the society in which the artists lived as well as how to ‘read’ a work of art aesthetically. I also remember as a child how my dad, who lived in the United Kingdom for a while, would send me lots of magazines. I was always fascinated by the pictures.”Whittle is much more than an artist. She has been an art teacher for 20 years, is a mentor to budding artists, and has held the post of curator at Queen’s Park Art Gallery for the past 17 years. This gallery is run by the National Cultural Foundation (NCF), which has done outstanding work in developing the arts in Barbados.(MWN)

112days left in the year Shalom! Follow us on Twitter, Facebook & Instagram for your daily news. #thechasefiles #dailynewscaps #bajannewscaps #newsinanutshell

0 notes

Text

IMF grades China's 2023, 2024 GDP growth forecast

The International Monetary Fund revised its prior projection of 5% growth and projected that China's economy would grow by 5.4% this year after a "strong" post-COVID recovery. Next year, the IMF expects slower growth. The IMF noted that sustained instability in the real estate market and muted foreign demand might limit GDP growth to 4.6% in 2024, which was still higher than the 4.2% prediction in its October World Economic Outlook (WEO). The increased revision came after China decided to assist the economy by approving a 1 trillion yuan ($137 billion) national bond offering and allowing local governments to frontload a portion of their 2024 bond quotas. "We increased growth by 0.4." IMF First Deputy Managing Director Gita Gopinath stated in Beijing, "This represents percentage points in both years relative to our October WEO projections, reflecting stronger than expected growth in the third quarter and the new policy support that was recently announced." During the medium term, Gopinath stated during a press conference to commemorate the release of the fund's "Article IV" analysis of China's economic policies that growth would progressively decline to roughly 3.5% by 2028 due to headwinds from poor productivity and an ageing population. China has taken a number of steps to boost the real estate industry, but more is required, according to her, to ensure a quicker recovery and lower economic expenses to reduce its size to one that is more sustainable. "With regard to the real estate industry, this policy package will need, among other things, hastening the departure of unprofitable real estate developers, eliminating barriers to housing price adjustment, and augmenting central government investment for housing construction," said Gopinath. Economists predict that the housing market slump combined with the debt crisis facing local governments will eliminate most of China's capacity for long-term growth. Local debt increased from 62.2% in 2019 to 92 trillion yuan ($12.6 trillion) in 2022, or 76% of China's economic output. The Communist Party's highest decision-making body in China, the Politburo, announced in late July that it will take steps to lower the risks associated with local government debt. "To alleviate local government debt constraints, the central government should conduct coordinated fiscal framework changes and balance-sheet restructuring, including closing local government fiscal gaps and regulating the debt stream," Gopinath remarked. She said that in order to lower the debt burden of local government finance vehicles (LGFVs), China should also create a thorough restructuring plan. Although local governments established LGFVs to finance infrastructure projects, their cumulative debt has ballooned to almost $9 trillion, making them a significant risk to China's faltering economy. Gopinath cautioned that in order to stop new vulnerabilities from arising, "local governments must improve their fiscal transparency and risk monitoring, as financial stability risks are elevated and still rising." ($1 = 7.2833 yuan renminbi in China) ALSO READ: Russia leaves the post-Cold War treaty of European armed forces Read the full article

0 notes

Text

Lamudi's Philippine Real Estate Conference 2019: Startups' exploration of the sharing economy

Lamudi’s Philippine Real Estate Conference 2019: Startups’ exploration of the sharing economy

Eric Manuel, Jelmer Ikink, Nick Padilla, Paul Rivera, Lars Wittig

Lamudi successfully held The Outlook Real Estate Conference 2019 at the Isabela Ballroom of Makati Shangri-La in Makati City, Metro Manila, Philippines on October 17, 2019. The event brought together industry thought leaders from all over the Philippines to talk about the hot topics in the country’s real estate sector.

The Outlook…

View On WordPress

#Eric Manuel#International Workplace Group#Jelmer Ikink#Kahon.ph#Kalibrr#Lamudi#Lars Wittig#MyTown#Nick Padilla#Paul Rivera#real estate#The Outlook Real Estate Conference 2019

0 notes

Text

Examining Microsoft’s Data, Artificial Intelligence and Machine Learning Announcements in the Light of Day

Microsoft made a flurry of announcements at the recent Ignite conference. Each on its face is promising, but the true value of Microsoft's latest and (potentially) greatest requires a filter of context and time. ITPro Today reached out to a number of industry experts for their takes on Microsoft's newest wave of technology. Which ones really have the power to be widely embraced, or even transformative? Do any come with serious downsides that are more obvious in the light of day? And how will the announcements that came out of the event really change tech and the industries that rely on Microsoft’s offerings?

Here we provide insight into some of the main focus areas for Ignite: voice-to-text capabilities and chatbots, Ideas, Azure and Windows Server 2019.

Voice and Chat Capabilities

At (and out) of Ignite there was a lot of activity around AI and chatbots--specifically, around collaboration, meetings and communication. This creates a big opportunity for organizations, says Skip Chilcott, global head of product marketing at IR.

“These solutions streamline the ability to get meetings started using AI voice interaction with video conferencing technology and meeting solutions, which is currently a big pain point and productivity drain,” Chilcott said.

It’s a game-changer to have real-time voice-to-text translation across languages, he said, and productivity is improved when you can use chatbots instead of phone calls to accomplish certain tasks.

But as much as these technologies are increasingly a focus for tech companies, they do have downsides, Chilcott said, particularly in their removal of human interaction.

“People still need to talk to people, so I expect voice and video real-time communications and collaboration will remain as important in the future as it is today,” he said. “Organizations should not lose sight of this, so quality, experience, and performance of real-time voice and video communications should remain a high priority while introducing new AI technology into the workplace."

Windows Server 2019

At Ignite, Microsoft announced that Windows Server 2019 would be available in October. They were true to their word: The Windows Server 2019 platform is here, and it's poised to close the gap between on premise and public cloud computing.

“By including features such as cloud backup and disaster recovery directly into the most secure server operating system ever, Microsoft is making the divide between an on-premise environment and the public cloud much less visible,” says John Pontius, Microsoft Cloud Solution consultant and team lead at PCM.

Microsoft’s announcement of a new partnership with Adobe and SAP at Ignite was also exciting, Pontius said, especially considering that Adobe also announced a new open data initiative. It’s particularly welcome news for companies that want to unlock more insights from their data estates, he said.

“These three companies are going to create a single, portable data model that will help break down data silos that exist today and enable customers to truly own their data,” he said.

Windows Virtual Desktop, which offers managed services for hosting Windows desktops in Azure, makes for a big entrance in the desktop as a service, or DaaS, space for Microsoft, Pontius said: “By Offering both Windows 10 and Windows 7 virtualization, extended security features for Windows 7, and making the service free for customers with select M365 plans, this is going to be very attractive for enterprises that have been on the fence about moving to a DaaS solution,” he said.

Ideas

Microsoft’s BI products are already very popular in the business world, which gives the company a big advantage, says Jean-Luc Brisebois, chief marketing officer at Sharegate.

“With their deep expertise in that field, they are able to easily integrate their technology into their end user products such as Excel or PowerPoint,” said Brisebois, who attended the conference.

One proof point is Microsoft's announcement of Ideas for Microsoft Office, he said. The feature uses AI to suggest ideas and tips when creating documents in Office apps.

“Now that their technology is mature and that their machine learning algorithm is trained, they are rolling out into products with a massive user base,” he said.

Microsoft now has many more opportunities to integrate new artificial intelligence and machine learning technology into its software through products like Excel, Word and even Outlook, he added.

Azure

A lot of Microsoft’s announcements and presentations at Ignite focused on highlighting how Azure is being used by various organizations, but the company also focused on Azure’s security as a public cloud for organizations of varying sizes.

One of those announcements was that Microsoft will provide a Secure Score representing the overall health and security of a company’s environment for every organization on Azure, Pontius said. It’s smart to use Secure Score as a starting point to build secure and well-managed infrastructure in the cloud, he added.

Along those same lines, Microsoft recently updated Azure Policy, which helps companies ensure compliance with regulatory mandates, and Azure Blueprints, which enable the quick, repeatable creation of fully governed environments. In Blueprints, users can create environments in Azure that enforce policies, role-based access control and resource templates--it allows your cloud environments to be compliant right from the start, Pontius said.

“Organizations that have been looking at ways to enforce policies across multiple business units while still empowering their organizations to be agile and flexible will find Blueprints to be an invaluable tool,” he said.

This content was originally published here.

0 notes

Text

Is the Fed rate cut a precursor to a stock market crash?

On July 31st, the Federal Reserve announced a cut in the federal funds rate of 0.25%.

You might say, “so what?”

Although not a significant cut it is the first cut in 10 years.

The Fed’s stance has changed from projecting rate increases to rate cuts. So it is a significant swing in outlook.

One implication of the cut is interest rates for loans will go down, making lending more affordable.

The lower rate may mean it makes sense to refinance your home or investment. A refinance for a rental property could mean better cash flow.

My blog post at the following link discusses whether it is a good idea to refinance or not.

https://drpaulkeller.com/blog-refinance/

It also will bring a small relief for people with an adjustable-rate mortgage (ARM). These mortgages track the interest rate and the monthly payment decreases with the lower rate. Increasing interest rates was a serious issue for people who used ARMs in the 2008 financial crisis.

The rate cut indirectly reflects the uncertainty in the stock market and economy. Although GDP growth is about the same as 2018 and better than the forecast for 2019, there are threats to the favorable outlook, and so the FED proactively cut the funds rate.

The Trade War

To understand the underlying reasons for the rate cut, I watched the following link on the Fed press conference.

https://www.federalreserve.gov/monetarypolicy/fomcpresconf20190731.htm

From the video, I have found that the Fed mentions that they are concerned with weakening global growth, weak manufacturing, American trade policy and muted inflation (the inflation is below their 2% target). These concerns were the main reasons for the cut.

But the one concern that stood out to me the most in terms of stock market uncertainty was the trade policy issue.

Chairman Powell discusses the trade issue in the following exchange in the press conference:

STEVE LIESMAN….from CNBC

“I just want to follow up on that. Would you say we’re sort of, you guys have gotten into a new regime here? This is sort of an insurance cut and not a data-dependent cut, and are we now more in the realm of watching headlines of trade talks than we are watching unemployment rate and inflation numbers or and growth numbers? How do we know what you’re going to do next and why now in this new regime?”

CHAIRMAN POWELL

“…Trade is unusual. We don’t, you know, the thing is, there isn’t a lot of experience in responding to global trade tensions. So, it is a, it’s something that we haven’t faced before and that we’re learning by doing. And it is not, it’s not exactly the same as watching global growth where you see growth weakening, you see central banks and governments responding with fiscal policy, and you see growth strengthening, and you see a business cycle. With trade tensions, which do seem to be having a significant effect on financial market conditions and on the economy, they evolve in a different way, and we have to follow them. And by the way, I want to be clear here. We play no role whatsoever in assessing or evaluating trade policies other than as trade policy uncertainty has an effect on the U.S. economy in the short and medium term.”

Why does this catch my attention?

If you have read the book: Crash Proof Your Investment by Dr. Paul Keller, one of the warning signs of a stock market crash to look out for is new investment instruments that are not well understood.

“In 1929 and 2008 new investment instruments that were not fully understood contributed to the crashes. In 2008 the investment instruments lured investors into a false sense of security allowing them to become precariously leveraged. “ [1]

The investment instruments that caused issues were the investment trusts in 1929 and the mortgage-backed securities in 2008.

In this case, we have tariffs and a trade war which the Fed says they have little experience responding to it.

In fact, from 1980 until the Trump administration, the government policy was a push towards free trade and against economic barriers.

“During the Reagan and George H. W. Bush administrations Republicans abandoned protectionist policies, and came out against quotas and in favor of the GATT/WTO policy of minimal economic barriers to global trade. Free trade with Canada came about as a result of the Canada-U.S. Free Trade Agreement of 1987, which led in 1994 to the North American Free Trade Agreement (NAFTA). It was based on Reagan's plan to enlarge the scope of the market for American firms to include Canada and Mexico. President Bill Clinton, with strong Republican support in 1993, pushed NAFTA through Congress over the vehement objection of labor unions.” [6]

I wouldn’t call the tariff a new investment instrument, but it is a financial instrument that has quite an impact on the American economy and the stock market.

In fact, this week (Aug 2, 2019) stocks had their worst week of the year as fears over trade returned to the financial markets.

“Global stock markets plunged Friday after President Donald Trump’s surprise threat of tariff hikes on additional Chinese imports.

In early trading, London’s main index lost 2%, and Frankfurt fell 2.5%. Tokyo’s benchmark was off 2.1% and Hong Kong retreated 2.5%. Markets in Shanghai, Sydney, and Paris also fell.

Trump’s announcement of 10% tariffs on $300 billion of Chinese goods, due to take effect Sept. 1, surprised investors after the White House said Beijing promised to buy more farm goods. That came as their latest round of trade talks ended in Shanghai.” [2]

It seems that Trump’s tweets have effects on the market. His latest tweet about new tariffs seemed to bring the market down this week. Also, it works the other way where his tweet will cause the market to appreciate when it has fallen.

This protective floor is known as the Trump put [5]. A put is an option trade that can be set up to prevent loss in an investment. See my book for more info: Crash Proof Your Investment. In this case, the put is a tweet and not the derivative known as a put.

On the surface, it seems that the US has a strong negotiation position when it comes to tariffs.

“…U.S. exports to China were only $120 billion while imports from China were $540 billion. “[3]

America can place tariffs on 540 billion dollars of goods, whereas China can only put tariffs on 120 billion dollars worth of goods. It seems that America can not be affected much by tariffs from China.

But tariffs do mean higher prices for Americans which impacts the economy. It could mean an increase in inflation for America, and many investors fear that it could cause a recession.

However, based on the FED action, inflation does not seem to be the problem and currently, growth for 2019 so far is better than expected.

The tariffs for China, on the other hand, seem to be affecting their economy. Their economy has slowed to a 27 year low: