#Tenders Of United Bank Of India

Explore tagged Tumblr posts

Text

Demonetization of the Indian Currency - Effect on the Economy

“A recent move of the Central Government exercising its powers u/s 26(2) of the Reserve Bank of India Act, 1934, to withdraw the legal tender character of existing bank notes in denominations of ₹ 500 and ₹ 1000 issued by Reserve Bank of India (RBI) is unprecedented. The demonetization of ₹ 500 and ₹ 1000 banknotes was a policy enacted by the Government of India on 8th November, 2016. All ₹ 500 and ₹ 1000 banknotes of the Mahatma Gandhi Series ceased to be legal tender in India from 9th November, 2016”

What is Currency Demonetization?

It is a radical financial step in which a currency unit’s status as a legal tender is declared invalid. This move is usually executed when old currencies have to be replaced by new one’s or whenever there is a change of national currency.

In a historical move that may record strength in the fight against corruption, black money, money laundering, terrorism and financing of terrorists as well as counterfeit notes, the Government of India decided that 500 and 1000 notes will no longer be legal tender from midnight, 8th November, 2016.

The Government of India has taken this step of demonetization of ₹ 500 and ₹ 1000 banknotes with the intention to curb financing of terrorism through the proceeds of Fake Indian Currency Notes (FICN) and use of such funds for subversive activities such as espionage, smuggling of arms, drugs and other contrabands into India, and for eliminating unaccounted Money which casts a long shadow of parallel economy on our real economy, effect has taken place from the expiry of the 8th November, 2016.

The banknote denominations of ₹ 100, ₹ 50, ₹ 20, ₹ 10 and ₹ 5 of the Mahatma Gandhi Series continued to remain as legal tender and were unaffected by the policy.

History and Background:

Erstwhile Government had taken similar measures in the past for demonetization of currency. In January 1946, currency notes of 1000 and 10,000 rupees were withdrawn and new notes of 1000, 5000 and 10,000 rupees were introduced in 1954. The Janata Party coalition government had again demonetised notes of 1000, 5000 and 10,000 rupees on 16 January 1978 to curb counterfeit money and black money.

On 28th October, 2016 the total currency in circulation in India was Rs. 17.77 Lakh crore (US$ 260 billion). In terms of value, the annual report of Reserve Bank of India (RBI) of 31st March, 2016 stated that total bank notes in circulation valued to Rs. 16.42 lakh crore (US$ 240 billion) of which nearly 86% (around ₹ 14.18 lakh crore (US$ 210 billion)) was ₹ 500 and ₹ 1000 banknotes. In terms of volume, the report stated that 24% (around 2203 crore) of the total 9026.6 crore banknotes were in circulation.

After the official announcement by Prime Minister Modi, the Governor of the Reserve Bank of India, Urjit Patel, and Economic Affairs secretary, Shaktikanta Das explained in a press conference that while the supply of notes of all denominations had increased by 40% between 2011 and 2016, the ₹500 and ₹1000 banknotes increased by 76% and 109% respectively in this period owing to forgery. This forged cash was then used to fund terrorist activities against India. As a result the decision to eliminate the notes had been taken.

Brief Overview of the Demonetization Scheme:

The Reserve Bank of India laid down a detailed procedure for the exchange of the demonetized banknotes with new ₹ 500 and ₹ 2000 banknotes of the Mahatma Gandhi New Series and ₹ 100 banknotes of the…

Read more: https://www.acquisory.com/ArticleDetails/23/Demonetization-of-the-Indian-Currency--Effect-on-the-Economy

#financial consultant#demonetization in india#demonetization#indian economy#indian currency#financial reporting#financial consulting services#financial freedom

0 notes

Text

GeM Registration in India: Streamlining Public Procurement for Businesses

India’s public procurement system plays a critical role in the country's economic landscape, as government departments and agencies rely heavily on the purchase of goods and services from various suppliers. In an effort to modernize and streamline this process, the Government of India launched the Government e-Marketplace (GeM) in 2016. GeM is an online portal designed to facilitate transparent, efficient, and speedy procurement by various government entities. It allows sellers, including small and medium enterprises (SMEs), startups, and large businesses, to register and supply their goods and services to government buyers.

In this article, we will provide a detailed overview of GeM registration in India, including its importance, benefits, eligibility, and the step-by-step process to register as a seller on the platform.

What is GeM Registration?

GeM registration refers to the process by which businesses, manufacturers, and service providers register on the Government e-Marketplace to become eligible to supply goods or services to various government departments, organizations, and public sector undertakings. The platform covers a wide array of categories, from everyday consumables like office supplies to high-value products such as medical equipment, machinery, and even IT services.

The GeM platform is designed to improve transparency in public procurement, reduce corruption, and promote fair competition among suppliers. It ensures that the government gets the best value for its purchases while giving businesses an equal opportunity to access the vast government procurement market.

Importance of GeM Registration

GeM registration is an important opportunity for businesses seeking to expand their market reach by tapping into government procurement. The platform is widely used by central and state government departments, public sector units, and autonomous bodies for procuring goods and services.

Here’s why GeM registration holds importance for businesses:

Access to a Huge Market: Government entities are one of the largest buyers of goods and services in India. By registering on GeM, businesses can directly supply to central and state government agencies, significantly expanding their customer base.

Transparency and Fair Competition: GeM is designed to eliminate the need for middlemen and ensure direct dealings between buyers and sellers. The platform uses a reverse auction mechanism that encourages competitive pricing, ensuring a fair and transparent procurement process.

Ease of Doing Business: The platform simplifies the procurement process by offering a one-stop solution where businesses can register, showcase their products, and participate in bids for government tenders. This helps businesses streamline their operations and easily navigate public procurement.

Timely Payments: GeM ensures that sellers receive timely payments for their supplies, making it easier for businesses, especially small and medium enterprises, to manage their cash flow effectively.

Eligibility Criteria for GeM Registration

GeM registration is open to a wide range of suppliers. The eligibility criteria for registering as a seller on GeM include:

Manufacturers: Businesses engaged in the production of goods.

Service Providers: Businesses offering services such as IT support, maintenance, consulting, etc.

Dealers/Resellers: Businesses that supply goods on behalf of manufacturers or distributors.

Startups and MSMEs: New businesses and Micro, Small, and Medium Enterprises (MSMEs) can also register on the GeM platform.

Public Sector Undertakings (PSUs) and government agencies are also eligible to sell products on the platform.

Additionally, businesses must have a valid PAN (Permanent Account Number), GST registration, and bank account details to complete the registration process.

Steps for GeM Registration

GeM registration is an entirely online process, and businesses can complete it by following these steps:

Step 1: Visit the GeM Portal

The first step is to visit the official Government e-Marketplace portal at https://gemregister.org/ . The website offers a seller registration option, and businesses must click on the "Seller" option to begin the process.

Step 2: Enter Business Details

Once the registration page opens, sellers are required to fill in basic details about their business. This includes:

Business name and type (e.g., manufacturer, service provider, reseller)

PAN card number

GST number

Bank account details

Sellers must ensure that all details entered match official records to avoid any delays in the verification process.

Step 3: Upload Documents

After entering business details, sellers need to upload supporting documents such as:

PAN card

GST registration certificate

Bank account information

Udyam Registration (for MSMEs, if applicable)

These documents will be verified by the GeM authorities to confirm the authenticity of the business.

Step 4: Product/Service Listing

Once the registration and document verification are complete, sellers can begin listing their products or services on the platform. Sellers must provide accurate descriptions, prices, and specifications for each item. They can also upload images and other relevant details to showcase their offerings effectively.

Step 5: Participation in Bidding

After the product or service listing is live, sellers can participate in tenders and bids for government orders. The GeM platform uses a reverse auction mechanism, where sellers can place their bids, and government buyers choose the best offer.

Benefits of GeM Registration

Registering on the GeM platform offers several advantages for businesses:

Increased Business Opportunities: GeM opens the door to a large pool of government buyers, offering significant business growth opportunities for registered sellers.

Lower Marketing Costs: Businesses do not need to spend heavily on marketing or sales efforts to reach government buyers. The GeM platform itself acts as a marketplace where sellers can showcase their products and services.

Efficient Procurement Process: The GeM portal automates the entire procurement process, from listing products to payment processing, making it hassle-free for both buyers and sellers.

Digital Payment Integration: GeM ensures prompt payments through digital means, reducing the delays that are often associated with traditional procurement channels.

Equal Opportunities for Small Businesses: GeM ensures that even small and medium enterprises can compete on a level playing field with larger corporations, thanks to its transparent bidding process.

Conclusion

GeM registration in India is a game-changer for businesses aiming to engage in public procurement. By providing a transparent, efficient, and accessible platform, the Government e-Marketplace has revolutionized the way government entities procure goods and services. With its ease of use, fair competition, and prompt payments, GeM offers businesses an excellent opportunity to expand their market reach and grow sustainably. For any business looking to tap into the vast potential of government contracts, GeM registration is a crucial step.

#gem registration#gem portal registration#gem portal#gem registration online#gem registration portal

0 notes

Text

Comprehensive Guide to Udyog Aadhar Registration

Comprehensive Guide to Udyog Aadhar Registration

Introduction

In India, small and medium enterprises (SMEs) are pivotal to the country's economic growth, contributing significantly to employment and innovation. Recognizing the importance of these businesses, the Indian government has introduced various initiatives to simplify processes and support their development. One such initiative is Udyog Aadhar, a registration system designed to streamline the process of business registration for micro, small, and medium enterprises (MSMEs). This article provides a detailed guide on Udyog Aadhar registration, its benefits, and the step-by-step process to obtain it.

What is Udyog Aadhar?

Udyog Aadhar, now known as Udyam Registration, is a single-window registration process introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) to facilitate the establishment of MSMEs in India. This system aims to simplify the registration process, making it more accessible for small businesses. The Udyog Aadhar number is a unique identification number provided to enterprises, helping them avail themselves of various government schemes and benefits tailored for MSMEs.

Eligibility Criteria

To be eligible for Udyog Aadhar registration, a business must fall under the category of micro, small, or medium enterprises as defined by the Government of India. The classification is based on the investment in plant and machinery and the annual turnover of the enterprise:

Micro Enterprises:

Investment in plant and machinery: Up to ₹1 crore.

Annual turnover: Up to ₹5 crore.

Small Enterprises:

Annual turnover: Up to ₹50 crore.

Medium Enterprises:

Investment in plant and machinery: Up to ₹50 crore.

Annual turnover: Up to ₹250 crore.

Benefits of Udyog Aadhar Registration

Udyog Aadhar, now known as Udyam Registration, provides several advantages for micro, small, and medium enterprises (MSMEs) in India. This registration is more than just a formal procedure; it opens doors to numerous opportunities and benefits designed to support and enhance the growth of small businesses. Here’s a detailed look at the benefits of Udyog Aadhar registration:

1. Access to Financial Support and Credit Facilities

Easier Access to Loans: Udyog Aadhar registration simplifies the process of obtaining loans from banks and financial institutions. Registered MSMEs are often eligible for various loan schemes with favorable terms, including lower interest rates and easier repayment options.

Credit Guarantee Scheme: Businesses registered under Udyog Aadhar can benefit from the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme, which provides a guarantee against loans.

2. Eligibility for Government Schemes and Subsidies

Subsidies and Incentives: Udyog Aadhar registration qualifies businesses for numerous subsidies and incentives provided by the government, including those for technology upgradation, infrastructure development, and energy conservation.

Special Schemes: Registered enterprises can access specific government schemes such as the PMEGP (Prime Minister’s Employment Generation Programme) and MUDRA (Micro Units Development & Refinance Agency) loans.

3. Tax Benefits

Tax Exemptions: Registered MSMEs can avail themselves of various tax exemptions and deductions under different tax laws, including benefits under the Income Tax Act and GST regulations.

Easy Compliance: Udyog Aadhar facilitates smoother compliance with tax regulations, potentially reducing the administrative burden and related costs.

4. Access to Government Tenders

Tender Participation: Businesses with Udyog Aadhar registration are eligible to participate in government tenders. This opens up opportunities for contracts with government departments and public sector enterprises, which can be a significant source of revenue.

Preference in Bidding: Registered MSMEs often receive preferential treatment in government procurement processes, giving them a competitive edge.

5. Enhanced Business Credibility and Recognition

Increased Trust: Having a Udyog Aadhar number adds a layer of credibility to a business. It serves as proof of registration and can help build trust with potential clients, suppliers, and partners.

Professional Image: Being registered enhances the professional image of the business, which can positively impact its reputation and customer perception.

6. Protection Against Delays and Legal Hurdles

Smooth Process: Udyog Aadhar registration helps in streamlining various bureaucratic processes and reduces delays associated with business operations and approvals.

Legal Recognition: Registered enterprises receive official recognition, which can help in resolving legal and regulatory issues more efficiently.

7. Market Expansion and Business Opportunities

Access to New Markets: Udyog Aadhar registration can provide access to new market opportunities through various government and private sector initiatives aimed at supporting MSMEs.

Partnerships and Collaborations: Registered businesses are better positioned to form partnerships and collaborations with other firms, including larger corporations and international entities.

Step-by-Step Guide to Udyog Aadhar Registration

Preparation of Documents:

PAN Card of the business owner or the business entity.

Business address proof.

Bank account details of the business.

Details of the business activity and investment.

Visit the Udyam Registration Portal:

The Udyam Registration portal can be accessed through the official MSME website or directly via http://udyog-adhaar.in/. Ensure you are using the official government website to avoid fraudulent sites.

Register on the Portal:

On the Udyam Registration portal, click on the 'For New Entrepreneurs who are not Registered yet as MSME' option.

Enter your Aadhaar number and verify it using an OTP sent to your registered mobile number.

Fill in the Application Form:

Provide the required details such as business name, type of organization (proprietorship, partnership, LLP, etc.), business address, and nature of the business.

Enter details about the investment in plant and machinery and annual turnover.

Submit the Application:

Review all the information entered in the application form. Make sure everything is accurate and complete.

Submit the application for processing. You will receive a confirmation message and application number for future reference.

Receive Udyam Registration Number:

Upon successful verification of the details and documents, the Udyam Registration number will be generated and sent to your registered email and mobile number.

Print and Preserve the Certificate:

. This certificate serves as proof of your registration and can be used to avail yourself of various benefits.

Note:- Apply For Udyam Re-Registration Through Udyam Portal

Conclusion

Udyog Aadhar (Udyam Registration) is a valuable tool for small and medium enterprises in India, providing a streamlined process for business registration and access to numerous government benefits. By following the outlined steps and ensuring the correct documentation, businesses can easily register and take advantage of the opportunities available. This registration not only helps in legitimizing the business but also opens doors to financial support, subsidies, and market expansion, contributing to the overall growth and success of the enterprise.

As the business landscape continues to evolve, staying informed about government schemes and leveraging tools like Udyog Aadhar can significantly enhance the operational efficiency and growth potential of MSMEs.

0 notes

Text

The Impact of Udyog Aadhar on MSMEs

Introduction

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy, contributing significantly to employment, GDP, and industrial output. Recognizing the importance of these enterprises, the Government of India introduced the Udyog Aadhar Registration to simplify the process for MSMEs to register and avail various benefits. This blog delves into the impact of Udyog Aadhar on MSMEs, exploring its benefits, challenges, and overall significance.

What is Udyog Aadhar?

Udyog aadhar is a 12-digit unique identification number issued by the Ministry of Micro, Small and Medium Enterprises (MSME) to small and medium enterprises in India. The registration process is simple, requiring basic details about the enterprise, and can be completed online. The aim is to streamline the registration process and provide MSMEs with a single-page registration certificate, replacing the earlier complex and time-consuming procedures.

Benefits of Udyog aadhar for MSMEs

1. Easy Access to Government Schemes

One of the primary benefits of Udyog aadhar is the easy access to various government schemes and subsidies designed to support MSMEs. These schemes include financial assistance, subsidies on power tariffs, exemption from direct taxes, and protection against delayed payments from buyers. Registered MSMEs can also avail benefits under various programs like the Credit Linked Capital Subsidy Scheme, Prime Minister's Employment Generation Programme, and many others.

2. Simplified Registration Process

The Udyog aadhar registration process is straightforward and free of cost. Entrepreneurs can register their business online by providing basic information such as the aadhar number, name of the business, address, bank details, and other relevant information. This simplified process saves time and reduces the administrative burden on small business owners.

3. Enhanced Credit Facilities

MSMEs registered under Udyog aadhar can avail of various credit facilities and financial assistance from banks and other financial institutions. This includes priority sector lending, which mandates banks to provide a certain percentage of their loans to MSMEs. Additionally, registered MSMEs can benefit from lower interest rates and easier access to loans due to their verified status.

4.Protection Against Delayed Payments

One of the significant challenges faced by MSMEs is delayed payments from buyers, which can severely impact their cash flow and operations. Udyog aadhar provides a level of protection against this issue by enabling MSMEs to file complaints and seek resolution through the Micro and Small Enterprises Facilitation Council (MSEFC). This ensures timely payments and reduces financial stress on small businesses.

5. Access to Market Opportunities

Udyog aadhar registration helps MSMEs gain better market visibility and opportunities. Registered MSMEs can participate in various government tenders and procurements, which are often reserved for small and medium enterprises. Additionally, being registered enhances the credibility of MSMEs, making it easier for them to form business partnerships and collaborations.

Challenges Faced by MSMEs with Udyog aadhar

Despite the numerous benefits, MSMEs also face certain challenges with Udyog aadhar registration. These challenges include a lack of awareness about the registration process and its benefits, technical issues during online registration, and difficulties in understanding and complying with the documentation requirements. Moreover, there are instances where MSMEs, especially in rural areas, face challenges in accessing the internet and digital infrastructure, making it difficult for them to register online.

Case Studies

Success Stories

Many MSMEs have benefited significantly from Udyog aadhar registration. For instance, a small textile manufacturing unit in Gujarat reported a substantial increase in their business after registering for Udyog aadhar. The enterprise was able to access government subsidies and financial assistance, which helped them expand their operations and increase their workforce. Another example is a handicraft business in Rajasthan that gained better market access and visibility after registering, leading to an increase in sales and revenue.

Areas of Improvement

While there are success stories, there are also areas that need improvement. For example, some MSMEs have reported delays in receiving the benefits and subsidies promised under various schemes. Additionally, there is a need for better awareness and education programs to ensure that more MSMEs can benefit from Udyog aadhar registration.

NOTE : Update Udyam Registration Certificate

Conclusion

The Udyog Aadhar registration has undoubtedly had a positive impact on MSMEs in India by simplifying the registration process and providing access to various benefits and schemes. It has helped enhance the creditworthiness of MSMEs, provided protection against delayed payments, and opened up new market opportunities. However, there is still a need to address the challenges faced by MSMEs, particularly in terms of awareness and access to digital infrastructure. Overall, Udyog Aadhar is a significant step towards empowering MSMEs and fostering their growth and development in the Indian economy.

1 note

·

View note

Text

Table of ContentsIntroductionGlobal Legal Landscape of Bitcoin: An OverviewRegulatory Frameworks for Bitcoin: A Country-by-Country AnalysisThe Future of Bitcoin Regulation: Emerging Trends and ChallengesQ&AConclusionNavigating the Legal Landscape of Bitcoin: A Comprehensive GuideIntroduction**Introduction: Is Bitcoin Legal? Global Legality and Regulations** Bitcoin, the decentralized digital currency, has gained significant traction in recent years. However, its legal status varies widely across jurisdictions, raising questions about its legality and the regulatory frameworks governing its use. This introduction explores the global legality and regulations surrounding Bitcoin, examining the legal landscape in different countries and the implications for its adoption and use.Global Legal Landscape of Bitcoin: An Overview**Is Bitcoin Legal? Global Legality and Regulations** The legality of Bitcoin, the world's first decentralized cryptocurrency, varies significantly across jurisdictions. While some countries have embraced Bitcoin and established clear regulatory frameworks, others have adopted a more cautious approach or even outright banned its use. In the United States, Bitcoin is considered a commodity by the Securities and Exchange Commission (SEC) and is subject to certain regulations. The Internal Revenue Service (IRS) treats Bitcoin as property for tax purposes. However, the regulatory landscape is still evolving, and the SEC has recently taken enforcement actions against companies involved in cryptocurrency offerings. In the European Union, Bitcoin is generally recognized as a legal form of payment. The European Central Bank (ECB) has stated that Bitcoin is not a currency but rather a "virtual currency." The EU has also implemented anti-money laundering and counter-terrorism financing regulations that apply to cryptocurrency exchanges and other service providers. In Japan, Bitcoin is recognized as a legal payment method and is regulated by the Financial Services Agency (FSA). The FSA has established licensing requirements for cryptocurrency exchanges and has taken steps to prevent money laundering and other illicit activities. In China, Bitcoin is not recognized as a legal currency and its use is restricted. The People's Bank of China (PBOC) has banned financial institutions from dealing in Bitcoin and has cracked down on cryptocurrency exchanges. In India, the Reserve Bank of India (RBI) has issued a circular stating that it does not recognize Bitcoin as a legal tender. However, the RBI has not explicitly banned Bitcoin and has allowed cryptocurrency exchanges to operate. In many other countries, the legal status of Bitcoin is still unclear. Some countries, such as El Salvador, have adopted Bitcoin as legal tender, while others, such as Russia, have proposed banning its use. The global regulatory landscape for Bitcoin is complex and constantly evolving. As the cryptocurrency market matures, governments and regulators are grappling with the challenges of balancing innovation with consumer protection and financial stability. It is likely that the legal status of Bitcoin will continue to vary across jurisdictions for the foreseeable future.Regulatory Frameworks for Bitcoin: A Country-by-Country Analysis**Is Bitcoin Legal? Global Legality and Regulations** The legality of Bitcoin, the world's first decentralized cryptocurrency, varies significantly across jurisdictions. While some countries have embraced Bitcoin and established clear regulatory frameworks, others have adopted a more cautious approach or even outright banned its use. **Legal Status by Country** In the United States, Bitcoin is considered a commodity by the Securities and Exchange Commission (SEC) and is subject to certain regulations. Japan has recognized Bitcoin as a legal payment method, while the European Union has classified it as a virtual currency. In contrast, China has banned all cryptocurrency transactions and mining activities. India has

also taken a strict stance, with the Reserve Bank of India prohibiting banks from dealing in cryptocurrencies. **Regulatory Frameworks** Countries that have legalized Bitcoin have implemented varying regulatory frameworks to govern its use. These frameworks typically address issues such as: * **Anti-money laundering (AML) and know-your-customer (KYC) requirements:** To prevent the use of Bitcoin for illicit activities, many countries require cryptocurrency exchanges to implement AML and KYC measures. * **Taxation:** The tax treatment of Bitcoin differs from country to country. Some jurisdictions consider it a capital asset, while others classify it as a currency or commodity. * **Licensing and registration:** In some countries, cryptocurrency exchanges and other businesses dealing in Bitcoin must obtain licenses or register with regulatory authorities. **Challenges and Future Prospects** The global regulatory landscape for Bitcoin is constantly evolving. As the cryptocurrency gains wider adoption, governments are grappling with the challenges of balancing innovation with consumer protection and financial stability. Some countries are exploring the development of central bank digital currencies (CBDCs) as a potential alternative to private cryptocurrencies. CBDCs would be issued and backed by central banks, providing greater stability and regulatory oversight. The future of Bitcoin's legality and regulation remains uncertain. However, as the cryptocurrency continues to mature and gain acceptance, it is likely that more countries will adopt clear and comprehensive regulatory frameworks to govern its use.The Future of Bitcoin Regulation: Emerging Trends and Challenges**Is Bitcoin Legal? Global Legality and Regulations** The legality of Bitcoin, the world's first decentralized cryptocurrency, varies significantly across jurisdictions. While some countries have embraced Bitcoin and established clear regulatory frameworks, others have adopted a more cautious approach or even outright banned its use. In the United States, Bitcoin is considered a commodity by the Securities and Exchange Commission (SEC) and is subject to certain regulations. The Internal Revenue Service (IRS) treats Bitcoin as property for tax purposes. However, the regulatory landscape is still evolving, and there is ongoing debate about how to classify and regulate Bitcoin. In the European Union, Bitcoin is generally recognized as a legal form of payment. The European Central Bank (ECB) has stated that Bitcoin is not a currency but rather a "virtual currency." The EU has also implemented anti-money laundering and counter-terrorism financing regulations that apply to Bitcoin transactions. In Japan, Bitcoin is recognized as a legal payment method and is regulated by the Financial Services Agency (FSA). The FSA has established a licensing system for Bitcoin exchanges and has implemented measures to prevent money laundering and other illicit activities. In China, Bitcoin is not recognized as a legal currency and its use is restricted. The People's Bank of China (PBOC) has banned financial institutions from dealing in Bitcoin and has cracked down on Bitcoin exchanges. In India, the Reserve Bank of India (RBI) has issued a circular warning against the use of Bitcoin and other cryptocurrencies. The RBI has stated that Bitcoin is not a legal tender and that it does not regulate or endorse its use. The legal status of Bitcoin is constantly evolving as governments and regulatory bodies grapple with the challenges of regulating a decentralized and global digital currency. As Bitcoin gains wider adoption, it is likely that more countries will establish clear regulatory frameworks to address the risks and opportunities associated with its use. However, the decentralized nature of Bitcoin poses challenges for regulators. Unlike traditional financial institutions, Bitcoin transactions are not subject to the same level of oversight and control. This can make it difficult to prevent money laundering, terrorist financing, and other illicit activities.

Despite these challenges, the growing popularity of Bitcoin and other cryptocurrencies is forcing governments and regulators to reconsider their approach to digital currencies. It is likely that we will see a convergence of regulatory frameworks as countries seek to balance the need for innovation with the need to protect consumers and prevent financial crime.Q&A**Question 1:** Is Bitcoin legal in the United States? **Answer:** Yes, Bitcoin is legal in the United States. **Question 2:** Is Bitcoin legal in China? **Answer:** No, Bitcoin is not legal in China. **Question 3:** Is Bitcoin legal in the European Union? **Answer:** Yes, Bitcoin is legal in the European Union.Conclusion**Conclusion:** The legal status of Bitcoin varies significantly across jurisdictions worldwide. While some countries have fully legalized Bitcoin and other cryptocurrencies, others have imposed restrictions or outright bans. The regulatory landscape is constantly evolving, with governments and financial institutions seeking to balance innovation with consumer protection and financial stability. Despite the legal uncertainties, Bitcoin has gained widespread adoption as a decentralized digital currency. Its potential to disrupt traditional financial systems and facilitate cross-border transactions has attracted both investors and regulators. As the technology matures and governments develop more comprehensive regulatory frameworks, the legal status of Bitcoin is likely to become clearer and more consistent across jurisdictions.

0 notes

Text

‘To get truly cured with Yoga’

For yoga therapy to be fully effective,the initial treatment should be done away from home. Because at home, it may not be possible to relax deeply,and tension slows down the healing process. Also, at home,the conditions that created the health problems in the first place,are still there and may reduce yoga’s effects. Ideally the treatment center should be on the mountains for enhanced healing, as the concentration of prana is the maximum there. It has been seen that 300 cubic feet of the mountain air contains5,000 units of prana against 50 units of this energy in a city office. Sea shore and river banks are the next best alternative.

Furthermore, at home people have a limited time for yoga, and hence do only a part of hatha yoga, i.e. asanas and pranayama. Whereas in a different place one has the entire day to devote to other yogas which is necessary to eliminate the root cause of the disease. A disease manifests on the physical body but the causative factor may lie in any layer of the human personality such as the conscious mind, the subconscious, or the unconscious. Specific yogas were designed to normalize each of these aspects. Not just the ailing, according to Paramahamsa Swami Satyananda Saraswati, it is necessary for everybody to practise all the four main yogas. He says that if one does not

Practise RajaYoga (the yoga of concentration and meditation), one’s mind will jump like a drunken monkey; without KarmaYoga,(yoga of action,where one does physical labour without expecting any material gains), passion will run high; if one does not do BhaktiYoga, (the yoga Of devotion),the person will be frustrated; and if one does not do Gyana Yoga (the yoga of enquiry), one will not know why one is doing what he or she is doing.

Besides these four yogas, other yogas such as NadaYoga, MantraYoga and TantraYoga, contribute for better physical mental and psychological health.

The ancient wise of India knew the value of the combined yoga, and made a system that ensured people practise them from childhood and make it a habit for life . At the tender age of seven or eight, every child was sent to a gurukul,i.e. the abode of a guru, where, while learning their future professional skills, the children were made to do all the yogas. For GyanaYoga, they studied scriptures;for RajaYoga, they meditated, for Hatha yoga it was asanas and pranayamas; for BhaktiYoga, they performed religious rituals such as yagnyas and for KarmaYoga, it was hard physical labour.Whether one was a prince or a pauper, one had to do all the chores such

such as cleaning, cooking, drawing water, gardening, chopping wood, washing and much more.

Perhaps because of the disciplined yogic life the vedic man is said to live for at least a hundred years, spending the second half of his life in the forest, away from doctors nurses, hospitals and drugs, and catered to all their own various needs. One may not be able to do all yogas everyday, but one should at least do them all in the beginning and if possible periodically.Those who do that find it helpful to remain in the best of their health and face the challenges of life with equanimity. According to my guruji,it is like recharging one’s inner battery to withstand the vagaries of living in the complex society. The effect of a complete yogic programme is be experienced to believe.

#meditation#yogapractice#yogainspiration#love#yogalife#yogaeverydamnday#yogi#mindfulness#yogateacher#yogalove#workout#gym#yogaeveryday#motivation#pilates#namaste#health#wellness#yogagirl#yogaeverywhere#nature#yogachallenge#healthylifestyle#fitnessmotivation#yogapose#healing#fit#peace#yogamotivation

1 note

·

View note

Text

Best offers Of This Week!

Embark on a journey filled with extraordinary savings and unforgettable experiences with WhatsOn! Immerse yourself in a week of exhilarating adventures, from delectable dining to rejuvenating wellness treats. Click now to unveil exclusive offers and craft enduring memories. Seize the best the city has to offer and set sail on your personal voyage of enjoyment with WhatsOn today! Any workshop at Ann's Smart School of Cookery for one or two hours, starting at £25 Elevate your cooking skills with Ann's Smart School of Cookery. Immerse yourself in diverse cuisines, from the intricacies of sushi to the richness of Italian pasta. Opt for a quick one-hour taster session or delve into a comprehensive two-hour workshop. Led by expert chefs, these sessions promise a blend of learning, tasting, and hands-on experience. Unleash your inner chef and explore the world of culinary delights. Highlights: - Choose from various cuisines like Dim Sum, Italian, Thai, Indian, and more - Led by professional chefs for an immersive cooking experience - Options include one-hour taster sessions and two-hour in-depth workshops - Craft your own dishes and explore the art of culinary mastery Need to Know: - Voucher valid for a one or two-hour cooking class - Age limit: Over 18s only - Timetables published 8 weeks in advance, excluding bank holidays - Redeem online using the voucher code - Email a copy of your voucher to [email protected] - Valid until February 29, 2024 - Group experience with up to 16 participants - Equipment provided - 14-day cancellation policy with a £20 surcharge for non-compliance - Limited to one per person or two people, with an option to buy an additional one as a gift - Address: 7 Hertsmere Road, West India Quay, London E14 4AN Exclusive: 40%+ Off Men’s Grooming at The House of Keune by Bloom Indulge in a top-notch grooming experience at The House of Keune by Bloom. From a luxury shampoo to a tailored haircut or shave, enjoy a refreshing session including a massage and hot towel for that extra touch of sophistication. Highlights: - Located in Holborn - Bespoke haircut, beard trim, or expert shave by master barbers Need to Know: - Voucher valid for cut and style or grooming service - Availability: Monday to Saturday, check specific timings - Redeem via email or phone with clear voucher details - Valid until March 16, 2024 - New customers only, with specific stylists - Cancellation notice required within 48 hours - Location: Unit 1, 100 - 101 Museum Street, London WC1A 1PB. Personalized Children's Book for Just £9.99 – Over 50% Off! Watch your little ones beam with joy as they unwrap a personalized book designed just for them. Authored by Mike Molloy, choose from six stories crafted to guide and uplift during challenging times. Add their names, tweak characters, and ignite their love for reading. A unique literary treat for cherished moments. Highlights: - Add your child's name and personalize their character - Choose from six stories - Watch their joy as they open this unique, personalized treat Need to Know: - Voucher valid for a personalised children's book - Redeem online by adding the book to the cart and applying the voucher code at checkout - Valid until May 30, 2024 - Non-refundable and cannot be used with other offers A drink of prosecco and a three-course dinner at The Clermont Charing Cross cost £27.50. Experience the charm of The Clermont at Charing Cross, a swish London hotel in a prime location for sightseeing. After exploring iconic sights, enjoy three courses and a glass of bubbly for £27.50 (was £49). Highlights: - Starters: Salt and Pepper Squid, Smoked Salmon Roulade, Quinoa Salad, Buttermilk Chicken Tenders. - Mains: Spaghetti Carbonara, Caesar Salad (with optional salmon or chicken), Fish & Chips, The Clermont Burger, 10oz Ribeye Steak (£10 supplement). - Desserts: Vanilla Cheesecake, Apple Tarte Tatin. Need to Know: - Valid Mon-Sun, 5 pm to 9.30 pm. - Reservation required with voucher and security code. - Valid until March 31, 2024 (excludes Dec 18, 2023 – Jan 2, 2024). - Not valid for Sunday lunch or bank holidays. - Minimum booking for two people. Ages 18+. Read the full article

0 notes

Text

Understanding Cryptocurrency: Valuation, Blockchain and Workings

What Is Cryptocurrency?

Cryptocurrency is a kind of digital asset utilizing cryptography’s advanced encryption techniques to protect transactions and control the creation of new units. It functions independently from central banks and serves various purposes, including online shopping, investing, and even as a store of value.

These digital currencies operate on a decentralized network supported by a user community. This network is commonly known as a blockchain, a digital ledger of all transactions related to a particular cryptocurrency.

How Does It Work?

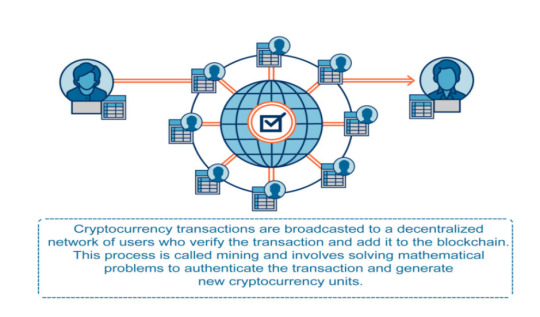

When a user initiates a transaction, the network of users broadcasts it to verify the transaction and include it in the blockchain. This process, called mining, involves solving intricate mathematical problems to authenticate the transaction and generate new cryptocurrency units.

Once a transaction is verified, it is added to a block, which is subsequently added to the blockchain. Each block in the chain carries a unique code or hash, produced through a cryptographic function. This ensures that each block is connected to the previous one in the chain, rendering the blockchain tamper-proof and secure. This process demands substantial energy and computing power, resulting in high production costs.

Understanding Blockchain:

Blockchain is a decentralized record-keeping ledger that securely and transparently logs transactions. It uses cryptography to protect and validate transactions before adding them to the blockchain as blocks. Once added, blocks cannot be altered or deleted, making the ledger secure and resistant to tampering.

Imagine blockchain as a towering stack of Lego bricks. Each block lists transactions, representing a Lego piece, and every block is connected to the one beneath it, just like a Lego stacked over another. Once added, blocks cannot be removed or modified, similar to how a Lego piece in the middle of the stack cannot be removed or changed once connected.

Various types of blockchain technologies exist, including public, private, and hybrid blockchains. Public blockchains, such as Bitcoin, are open to everyone, while private blockchains are restricted to specific users or organizations. Hybrid blockchains incorporate features from both public and private blockchains.

How Is Cryptocurrency Valued?

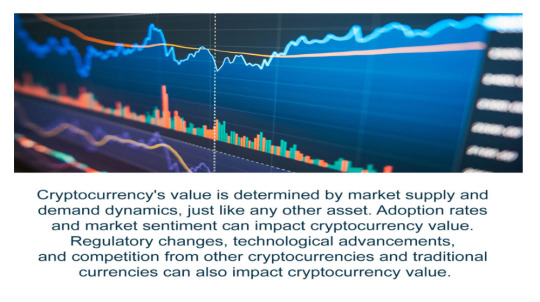

The market’s supply and demand dynamics determine a cryptocurrency’s value, much like any other asset. When more people buy than sell, the price increases, and when more people sell than buy, the price decreases.

Several factors influence their values. Adoption rates are crucial in determining a cryptocurrency’s value. As more people use a cryptocurrency, its demand increases, driving up the price. Market sentiment also affects cryptocurrency value, with positive sentiment leading to higher prices and negative sentiment leading to lower prices. Regulatory changes, technological advancements, and competition from other cryptocurrencies and traditional currencies can impact cryptocurrency value. It’s essential to research and understand these and other factors thoroughly before investing in cryptocurrencies.

Journey of Cryptocurrency in India

Cryptocurrency has evolved significantly in India since its inception. The Reserve Bank of India issued a warning against using cryptocurrencies in 2013, but the government didn’t officially declare cryptocurrencies as non-legal tender until 2018. Despite this, the cryptocurrency industry continued to grow in India, with many individuals and companies investing in it.

In 2021, the government proposed a new Crypto Bill that would effectively ban all private cryptocurrencies and establish a central bank digital currency (CBDC) called DigiRupee. However, the bill hasn’t been passed into law yet, and various stakeholders oppose it.

In 2022, the government proposed a new Finance Bill that includes a flat 30% tax

on the transfer of virtual assets, including NFTs and cryptocurrencies. To accommodate this, a new Section 115BBH was added to the Income-tax Act, 1961.

As a result, there is now a 30% tax, plus a surcharge and cess on the transfer of any virtual digital asset (VDA) such as Bitcoin or Ethereum under the Income Tax Act, of 1961. However, the legal status of cryptocurrencies remains uncertain.

Currently, cryptocurrencies in India are unregulated. The government has, however, started cracking down on illegal activities involving cryptocurrencies, such as money laundering and tax evasion.

Despite the ambiguity surrounding cryptocurrencies in India, many believe they have the potential to revolutionize the financial industry in the country. Cryptocurrency adoption could lead to increased financial inclusion and access to financial services for millions of people.

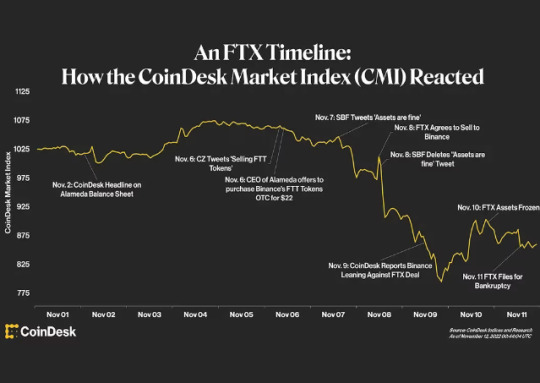

The Fall of FTX

The fall of FTX, a cryptocurrency exchange, has raised concerns about the stability and regulation of the cryptocurrency market. FTX filed for bankruptcy due to insufficient reserves to meet customer demand. The collapse has also affected academia, depriving researchers of grants and raising fears of forced repayment. Despite this setback, cryptocurrency continues to evolve globally, including in India, where the legal status of cryptocurrencies remains uncertain. Bitcoin, Ethereum, Dogecoin, and Binance Coin are some of the notable cryptocurrencies that have impacted the industry. Bitcoin and Ethereum differ in purpose and supply, but both are decentralized and rely on secure, transparent blockchains.

Downfall of Cryptocurrency

In 2022, the cryptocurrency market faced another major downturn, with many leading cryptocurrencies experiencing substantial drops in value. For example, Bitcoin, the largest and most well-known cryptocurrency, saw its value fall by over 50% from its all-time high in November 2021. Ethereum, another popular cryptocurrency, saw a similar decline, falling by approximately 40% from its peak. The total market capitalization of the cryptocurrency market also suffered a significant decline, losing over $1 trillion in value. Despite these setbacks, the industry continues to grow and evolve, with many investors and enthusiasts remaining optimistic about the potential of cryptocurrencies to revolutionize the financial landscape. As with any emerging market, it is important for investors to stay informed and understand the risks involved in investing in cryptocurrencies.

Notable Cryptocurrencies

1. Bitcoin: The first and most popular cryptocurrency, created in 2009 by an anonymous person/group using the pseudonym Satoshi Nakamoto. It operates on a decentralized network and uses a proof-of-work consensus algorithm.

2. Ethereum: a platform that operates in a decentralized manner and allows developers to build decentralized applications and execute smart contracts. Created in 2015 by Vitalik Buterin, it uses a proof-of-stake consensus algorithm and its own programming language, Solidity.

3. Dogecoin: A meme-inspired cryptocurrency created in 2013 by Billy Markus and Jackson Palmer. It features the Shiba Inu dog from the famous “Doge” meme and has gained a large following due to its community-driven and lighthearted nature

4. Binance Coin: A cryptocurrency created by the Binance exchange in 2017 means of exchange, while Ethereum was created as a platform for decentralized applications and smart contracts. This difference has resulted in the two cryptocurrencies having specific use cases and valuations.

Bitcoin vs Ethereum: Which one is Better?

Bitcoin and Ethereum are two renowned cryptocurrencies that have significantly impacted the development of the crypto industry. They differ in purpose and supply, but both are decentralized and rely on secure, transparent blockchains. Their values are driven by market forces and are prone to price changes.

Bitcoin utilizes a public blockchain, allowing anyone to join the network by running a node or mining Bitcoin. Transactions are confirmed by a network of nodes that verify the transaction and add it to the blockchain, creating a distributed ledger that records all Bitcoin transactions, ensuring security and transparency.

Ethereum, on the other hand, operates on a blockchain that enables developers to create decentralized applications and smart contracts. These applications function on the Ethereum Virtual Machine (EVM), a decentralized platform that runs code on the blockchain.

While Bitcoin was primarily designed as a store of value and medium of exchange, Ethereum was developed as a platform for decentralized applications and smart contracts. This distinction leads to different use cases and valuations for the two cryptocurrencies.

Bitcoin has a limited supply of 21 million coins, projected to be mined by 2140. In contrast, Ethereum’s supply is unlimited, with new coins generated through mining.

Despite their differences, Bitcoin and Ethereum share some common ground. Both are decentralized and function on secure, transparent blockchains. They are also subject to market dynamics, with their values determined by supply and demand.

In recent years, both cryptocurrencies have experienced notable price fluctuations. For instance, Bitcoin hit an all-time high of nearly $64,800 in April 2021, only to face a sharp decline in the following months. Likewise, Ethereum reached an all-time high of over $4,815 in November 2021 before undergoing a correction as well. Currently, the value of Bitcoin is $28,143 and Ethereum is $1,877.19.

Read more at: https://dsb.edu.in/understanding-cryptocurrency-valuation-blockchain-and-workings/?utm_source=Tumblr&utm_medium=Tumblr&utm_campaign=Cryptocurrency

0 notes

Text

How to start a limited liability company in Dubai?

A limited liability company formation in Dubai might be a complicated process, but with the right assistance, it can be completed without incident. Following are the instructions to follow in order to make an LLC in Dubai:

Choose a Business Activity: When making an LLC, you must first decide what kind of business activity you plan to engage in. Choose a business activity from among the many available in Dubai that best fits your interests and level of experience.'

2.Find a Local Sponsor: If you are a foreigner, you will require a regional sponsor to create your LLC. A national of the UAE who is a local sponsor will hold 51% of the company's shares. The required licenses and permits must also be obtained by them.

3.Reserve a Trade Name: As soon as you have a local sponsor, you must select a name for your LLC and have the Department of Economic Development approve it (DED).

4. Obtain an LLC License: The Dubai Economic Department (DED) will provide you an LLC license. You'll be able to run your business in Dubai with the help of the license.

5. Draft a Memorandum of Association (MOA): The MOA outlines the company's objectives, activities, and details of the shareholders. It must be signed by all the shareholders and notarized by a public notary in Dubai.

6. Rent an Office Space: In order to register an LLC in Dubai, you must rent an office space. The type of company activity you wish to do will decide the size of the office space. Rent an Office Space: In order to register an LLC in Dubai, you must rent an office space. The type of company activity you wish to do will decide the size of the office space.

7. Submit the necessary documents: You need to submit all the necessary documents, including the MOA, lease agreement, and LLC license Dubai, to the DED.

8. Obtain A Residency Visa: As a shareholder of an LLC, you are eligible for a residency visa in Dubai. You need to apply for a residency visa through the General Directorate of Residency and Foreigners Affairs (GDRFA).

9.Open a Corporate Bank Account: To complete, you must open a corporate bank account in Dubai in order to run business.

Also read about more: The Importance of Customer Service in Business

What Are the Benefits of Starting a Limited Liability Company in Dubai?

Starting a Limited Liability Company (LLC) in Dubai can be a great option for entrepreneurs looking to establish a business in the United Arab Emirates (UAE). Here are some of the benefits of starting an LLC in Dubai:

1.Limited liability protection: The main benefit of forming an LLC in Dubai is that the owners are protected from particular liabilities means that, beyond their investment in the business, the owners are not personally responsible for the debts and obligations of the firm.

2.100% ownership: As a foreigner showing an LLC in Dubai, you are entitled to 100% ownership of the company's stock. This is an important advantage because alternative business structures in the UAE, such partnerships, call for a local sponsor who holds 51% of the company's shares. 3.Flexible business structure: An LLC in Dubai offers a flexible corporate structure that enables shareholders to alter the ownership, management, and profit sharing of the enterprise. Due of their ability to customize the business structure to meet their unique demands, owners can.

4.Access to government tenders: Selecting an LLC in Dubai enables owners to submit bids for government contracts, which may be a powerful source of income for companies.

5. Tax advantages: Due to the absence of corporate and individual income taxes, Dubai is a desirable site for companies wishing to lower their tax responsibilities.

6.Proximity to emerging markets: Due to Dubai's strategic location in the Middle East, it is simple to reach the region's emerging markets including those in Africa, China, and India.

Conclusion Establishing a Dubai LLC Recorporate provides entrepreneurs with a wide range of benefits, including as tax advantages, limited liability protection, and adaptable business formats. Dubai is also a desirable destination for companies desiring to grow their operations in the Middle East and elsewhere due to its strategic position and well developed infrastructure. Call us at +971-58-586-5477 or send an email to [email protected] for more information.

Original Source: https://bit.ly/3JXOouQ

0 notes

Text

The Cryptocurrency Dilemma: Will India Ban It?

Being in the spotlight, Cryptocurrency is still a mystery for many. One cannot find a solid opinion in its favour or against it. Even after so many years of its existence, opinion is divided on the legitimacy of Cryptocurrency and its uses. On one hand, Crypto ignites the sparks among tech enthusiasts and young investors but on the other hand, it also raises suspicion among the governments of many countries about its credibility.

Countries like Bolivia, Qatar, Russia and Morocco banned Crypto from the country by highlighting its threat to financial stability. The Indian Government also does not seem to be in favour of crypto either. Is Cryptocurrency so dangerous that countries are banning it and taking steps against it?

If you are planning to invest in crypto, it is very important for you that you understand it thoroughly. In this article, we will start with the basic concept of understanding Cryptocurrency first and then we will proceed with why countries are banning it.

THE EVOLUTION OF CRYPTOCURRENCY

Cryptocurrency is a digital or virtual currency that is decentralised and makes payments secure by using blockchain technology. The origin of cryptocurrency was said to be in 2009. But it is recently that crypto gained its popularity and mainstream acceptance. Defying the traditional payment system, cryptocurrency is said to be the next big thing in the financial world.

A decentralised currency refers to a currency that cannot be controlled by any one organisation or governmental body. Many tech enthusiasts and investing experts believe that the cryptographic code and decentralised network of cryptocurrency give it the potential to rise as a safe, secure and fast mode of payment. It also has the potential to reach the untapped market of investment.

But if everything seems so perfect, why are some countries emphasising banning it? The governmental authorities are speculative about the volatility of bitcoins. Governments are of the opinion that the prices of bitcoin fluctuate very sharply because it depends majorly on investor speculation and media hype. The world has seen various crypto crash cases in which investors faced huge losses.

COUNTRIES WHERE CRYPTO IS BANNED

Facing the heat of criticism due to its volatile nature, many countries have imposed an implicit ban on bitcoins or any other cryptocurrency. The list of nations that banned cryptocurrency includes China, Russia, Algeria, Bangladesh, Bolivia, Colombia, Indonesia and many more.

The monetary authority of Singapore has broadened its regulations on crypto to keep it in check and prevent any financial crisis because of it. Currently, Singapore considers bitcoins as property but not as legal tender. The United States has also created a framework to expand the regulations on crypto further. Many American experts believe that crypto markets are not compatible with securities laws. Therefore, it is necessary to keep regulating it with strict measures.

INDIA’S TAKE ON CRYPTOCURRENCY

The journey of crypto started in 2013. It started getting popular in the Indian market but it did not get any support from the Central Government or the Reserve Bank Of India (RBI). In April 2018, RBI warned people about the use of crypto and stated that “virtual currencies are not legal tender in India”. The Finance Ministry of India also formed a committee to formulate a bill regarding cryptocurrency.

In 2019, a bill was passed according to which using, holding, mining, and transferring cryptocurrency comes under a punishable offence with a fine or imprisonment of up to 10 years or both in some cases. However, this ban was lifted in 2020 after the orders of the Supreme Court of India. Finance Minister, Nirmala Sitharaman notified in Rajya Sabha in 2021 that the government is not taking any concrete steps to ban crypto but working to create awareness about its uses.

And finally, in the Union Budget 2022-2023, the government of India levied a 30% tax on the transfer of any virtual currency. Many investors believe this is the first step by the government to recognise the legitimacy of crypto. But the government constantly denies its credibility and legitimacy.

The Governor of RBI, Shaktikanta Das is of the opinion that cryptocurrency should be completely banned from the country and it can just be called gambling. Shantikanta believes that the demand for crypto is based on the make-believe factor. In the words of Shantikanta, “Crypto is a form of gambling without any underlying value and is nothing but a 100 per cent speculation world.”

IS BANNING CRYPTOCURRENCY A SOLUTION?

Despite all the controversies, India is a budding market for cryptocurrency. The country has around 115 million crypto investors who are investing in the company. If the government bans crypto outrightly, then these investors would have to face huge losses. People are investing in crypto keeping high hopes that the government will legalise it soon and will accept it as a valid medium of financial exchange.

There is also the possibility that banning crypto in the country may also lead to the illegitimate use and black marketing of bitcoins. This is why the Finance Ministry of India is taking preventive measures to control the use of crypto while maintaining the sanity of the market.

#business news#bitcoin#bitcoin latest news#crypto latest news#cryptocurrency#cryptonews#cryptocurrencies

1 note

·

View note

Text

About World Bank

World bank Tenders from 100+ countries

To help simplify this process, Tendersinfo provides access to World Bank tenders from over 100 countries some countries are: India, Germany, Kyrgyzstan, Sri-Lanka, France, united states, etc. Users can easily search for tenders based on their desired sector, keywords, and products, making it easier to find the right opportunities for their business. find latest wb tenders, worlbank tenders, eprocurement notice by worldbank, world bank etendering and more.

Download Tender documents published by worldbank

In addition to searching for tenders, Tendersinfo also allows users to download tender documents that have been published by the World Bank. This makes it easy to access the latest information and updates on tenders from around the world.

Daily updates for latest world bank tenders

One of the key benefits of using Tendersinfo is that the database is updated on a regular basis. This means that users can always find the latest tenders and tender updates from the World Bank. This helps keep businesses informed and up-to-date with the latest opportunities available, giving them a competitive advantage.

Search right world bank Tenders with tendersinfo

Overall, Tendersinfo provides an efficient and effective way for businesses to find and apply for World Bank tenders. With access to tenders from over 100 countries and the ability to search based on specific criteria, users can easily find the tenders that are relevant to their business and increase their chances of success.

Related Keywords: wb tenders, world bank tenders, world bank eprocurement notice

0 notes

Text

Is the cryptocurrency epicenter moving away from East Asia? – Cointelegraph Magazine

It probably came as little surprise last year when crypto intelligence firm Chainalysis declared East Asia “the world’s largest cryptocurrency market,” accounting for 31% of all cryptocurrency transacted during the previous 12 months. The region has a broad base of retail users along with a solid foundation of crypto traders and institutions, and China alone was at the time mining around two-thirds of all the Bitcoin in the world.

In July 2021, Fidelity Digital Assets surveyed 1,100 institutional investors in the United States (408), Europe (393) and Asia (299) between December 2, 2020 and April 2, 2021. The study reinforced this idea, with the firm reporting that digital asset adoption rates are substantially higher in Asia (71%) than in Europe (56%) and the United States (33%). In March 2021, a Statista consumer survey of 74 countries on cryptocurrency ownership and usage determined that the Asian nations of Vietnam and the Philippines are ranked second and third globally, respectively.

But the past is not always a prelude to the future, and there is no guarantee that East Asia will remain the world’s center of gravity for crypto adoption. China’s attachment to crypto is tenuous at best, and Beijing’s rollout of its digital yuan could cause reverberations throughout the region.

When asked about the crypto prospects of East Asia, Kim Grauer, head of research at Chainalysis, tells Magazine that the region has recently experienced “a major decline in cryptocurrency adoption compared with other regions globally,” further adding:

“This drop-off is driven by a decline in Chinese activity beginning 6 months ago, which coincided with various crackdowns there including the mining ban and the halting of derivatives trading by major exchanges. We hypothesize that much of this activity has migrated to DeFi, but that hasn’t picked up enough that it makes up for the losses in the derivatives market yet.”

China’s dominance in Bitcoin mining made it “a natural marketplace for crypto,” says Lennard Neo, head of research at Stack Funds. But as reported, many rigs are moving elsewhere, including to Canada, Kazakhstan, Russia and the United States.

Asked if Asia is likely to maintain its crypto dominance, Eloisa Cadenas, CEO of Mexico-based financial services firm CryptoFintech, tells Magazine: “It is a difficult question to answer because, when we think of Asia, we automatically focus our attention on China which, as we know, has taken quite restrictive measures in relation to Bitcoin, crypto assets and of course, mining.”

China’s digital yuan is likely to have a big impact on the region, Cadenas says. Indeed, she anticipates that other Asian countries will try to replicate the digital yuan model, and “It is likely that there is also an intention to block or restrict the market for crypto assets in such a way that only the CBDCs of each country can proliferate.”

If that happens, the mass center of crypto adoption could move elsewhere — to Latin America or Africa, opines Cadenas. These are two regions where, according to her, there is “a greater possibility of adoption, since the economic, social and political context is different.”

Asia’s crypto crown could indeed be in play now, as Latin America and Africa aren’t the only contenders. Here’s who could potentially fill the void if and when Asia falters:

North America

Traditional “reticence” on the matter of digital assets is the result of three principal factors, according to another report by Fidelity Digital Assets: price volatility, concerns around market manipulation, and the lack of fundamentals to gauge appropriate value. But U.S. respondents appear to be coming to grips with digital assets, despite these shortcomings.

“The strength of concerns [in the U.S.] decreased notably vs. last year across most factors,” reported Fidelity Digital Assets. “Price volatility concern fell 13 points, concerns around market manipulation fell 6 points and lack of fundamentals fell 8 points.”

Elsewhere, some of the United States’ top legacy banks — including State Street, BNY Mellon, JPMorgan Chase, Citigroup and Goldman Sachs — have been making forays into the crypto space.

On the mining front, the U.S. was already the number-two mining nation before China’s May crackdown on crypto mining, albeit a distant second. Back in September 2019, China contributed 75.53% of the global Bitcoin hash rate. But more recently, China’s portion of the hash rate has ebbed to 46.04%, while the U.S. has broadened its share to 16.85% globally. Henri Arslanian, crypto leader and partner at advisory firm PwC, tells Magazine:

“The United States is probably the one country that has a lot of momentum now. The regulations are becoming clearer, there are numerous large crypto companies and there is a lot of capital flowing into crypto both from institutional investors and retail.”

Meanwhile, north of the U.S. border, Canada has been innovating on the crypto front. The Purpose Bitcoin ETF, North America’s first crypto-based exchange-traded fund, launched in February and has been a big hit by most accounts. It was followed in April by an Ether ETF, with strong volumes reported.

Many believe that it’s only a matter of time before Canada, with its vast hydroelectric resources, becomes a major player in crypto mining, particularly as more miners seek out renewable energy sources to power their rigs.

Latin America

The Latin American region could become a crypto adoption hotspot, and not only because El Salvador declared Bitcoin legal tender in June when it issued its Bitcoin Law — a historic move in the view of some.

Many regional economies are sustained by remittances — i.e., money sent home from workers abroad. They account for 23% of El Salvador’s gross domestic product, for instance. In Honduras, remittances also exceeded 20% of the gross national product in 2019, according to Pew Research Center. By comparison, Mexico saw only a 3% share of its GDP driven by remittances, but its gross numbers are high — $42.9 billion in 2020, according to the World Bank, which is a number behind only China and India. Crypto and blockchain technology potentially offer a more efficient way to transfer overseas payments.

The trend in Latin America “is toward retailers and unbanked users because with cryptocurrencies you can create cheaper financial products that, eventually, could promote greater financial inclusion,” CryptoFintech’s Cadenas tells Magazine.

There is also evidence that El Salvador’s dramatic action may be encouraging other countries in the region to devise their own crypto strategies. Paraguayan legislators introduced a cryptocurrency bill to the nation’s Congress in July, for instance.

“Where El Salvador has led, we can expect other developing countries to follow,” said Nigel Green, CEO and founder of financial service company deVere Group. “This is because low-income countries have long suffered because their currencies are weak and extremely vulnerable to market changes and that triggers rampant inflation,”

There isn’t much CBDC fervor in the region either, which means that Latin American countries are less likely to clamp down on crypto for competing with a government’s digital currency. “What I do see [in Latin America] is financial institutions creating alliances with crypto-asset companies to facilitate operations through crypto-assets, mainly with stablecoins,” Cadenas says.

Stack Funds’ Neo perceives some similarities between Latin America and Asia. The latter was historically home to a number of “restricted” currencies that were subject to government controls — such as the Chinese yuan, Indian rupee, Indonesian rupiah, Malaysian ringgit and Philippine peso — making them difficult to convert. These restrictions encouraged investors to turn to crypto “as a hedge against these limitations,” explains Neo. Similar tendencies may be emerging in Latin America where citizens increasingly appear to “prefer crypto over fiat [currencies], which are exacerbated by political turmoil.”

In its “2020 Geography of Cryptocurrency Report,” Chainalysis cites Venezuela — which ranked third globally out of 154 countries in its Global Crypto Adoption Index — as a stellar example “of what drives cryptocurrency adoption in developing countries and how citizens use it to mitigate economic instability,” adding that “Venezuelans use cryptocurrency more when the country’s native fiat currency is losing value to inflation, suggesting that Venezuelans turn to cryptocurrency to preserve savings they may otherwise lose.” Chainalysis saw the same pattern in other Latin American countries, as well as those in Africa and East Asia.

Cryptocurrency adoption in the region may not all go according to plan, of course. Eric Anziani, chief operating officer of cryptocurrency exchange Crypto.com, tells Magazine that “El Salvador officially accepted Bitcoin as legal tender, but this news is a two-edged sword. If the experiment is successful, then it will promote crypto in the region; otherwise, it could make local governments look at cryptocurrencies with greater skepticism.”

Europe

As in North America, institutional interest in crypto is growing in Europe. Today, nearly 80% of institutional investors “believe digital assets should be part of a portfolio,” according to Fidelity Digital Asset’s July report. And while “this belief is strongest in Asia,” it is also strong and growing in Europe: “More than three-quarters (77%) of European investors share this belief, up from two-thirds the prior year.”

The European Commission’s proposed Markets in Crypto Assets (MiCA) regulation, undergoing its first reading in the European Parliament, is expected to create a harmonized European crypto-asset market that “will definitely attract more and more large institutional investors — hedge funds, pension funds etc. — that have been wary of investing in this asset class due to regulatory concerns,” says Patrick Hansen, head of blockchain at Bitkom, an association of German companies in the digital economy.

When MiCA is implemented, a crypto firm receiving authorization from any one of the 27 European Union countries will be able to share its services across all the other EU states. Hansen also foresees greater mainstream adoption in the region and among its 450 million residents.

On the flip side, the European Central Bank is moving ahead with plans to introduce a digital euro that could be used by the 19 countries in the eurozone as “an alternative to third-party payment services and cryptocurrencies like Bitcoin,” reported Deutsche Welle, mainly because “Central bankers fear the widespread use of foreign or unregulated currencies could destabilize the economy.”

In other words, Europe’s crypto-wary central bankers could still have something to say about crypto adoption in the region.

Africa

When focusing on retail adoption, regions in the developing world such as Africa can’t be overlooked, Monica Singer, ConsenSys’ South Africa lead, tells Magazine. “Nigeria has one of the highest numbers of retail users of Bitcoin,” for instance — at least on a per capita basis. It ranks first among 74 countries in Statista’s March consumer adoption survey. She further adds:

“In countries where there is no trust in the fiat currency, and the population is young and mostly all have access to the internet, it is a natural progression that they will use cryptocurrencies to transact, in particular for remittances.”

Three African nations — Kenya, Nigeria and South Africa — made the top 10 in Chainalysis’ 2020 global crypto adoption index. “Remittances are an early use case for this developing cryptocurrency economy,” notes the report, adding that many of the region’s countries are also plagued by severe currency devaluation and instability, making them ripe for Bitcoin and its fixed, anti-inflationary supply.

Still, many African countries have restrictive policies with regard to currencies not backed by central banks, which could impede adoption, Singer tells Magazine. In early 2021, Nigeria’s central bank effectively banned commercial banks from providing account services to crypto exchanges.

The dominant mood is optimism, though, as epitomized by Cardano founder Charles Hoskinson’s keynote address at Blockchain Africa in which he compared Africa’s emerging economy to China in the 1980s — both offering case studies of new technologies leapfrogging legacy systems. Indeed, Hoskinson predicted: “There’s a great potential for that to be African nations — not Germany, not France, not England, not the United States, not China or Japan.”

East Asia

Of course, there are good reasons that nothing much may change at all — and East Asia remains crypto’s adoption epicenter. Asian countries have embraced digitalization, while their appetite for crypto was whetted by their early exposure to pioneering crypto firms. Indeed, by the end of 2020, six of the 10 largest crypto “unicorns” were Asia-based — including Bitmain, Binance, OKEx, Huobi, BitMEX and FTX.

Moreover, many East Asian nations that have embraced e-payments are used to public market investing and encourage STEM subjects in their school systems. Charles d’Haussy, managing director of the Asia-Pacific region at ConsenSys, tells Magazine that Asia’s “new wealth,” as well, is keener to embrace new asset classes, compared with “established wealth in the Western World which is more drawn to traditional asset classes.” For these reasons, he concludes that “Asia has a head start and will remain a leader [in crypto] for the decades to come.”

Even without China, Asia may be deep enough with regard to crypto adoption that it won’t lose its leadership position. Winston Ma, adjunct professor at New York University School of Law and author of The Digital War: How China’s Tech Power Shapes the Future of AI, Blockchain and Cyberspace, tells Magazine:

“Asian investors are used to inflation risk in their economies and high volatility in trading markets, and they embraced digital assets to hedge against the fiat money printing across the globe.”

“The lead may shift from China to Southeast Asian countries, as well as other countries with less restrictive regulations and laws with regard to crypto,” Yu Xiong, international associate dean at Surrey University and chair of business analytics at Surrey Business School, tells Magazine. In addition, Hansen notes that crypto-favorable regulatory frameworks have emerged in Singapore, Hong Kong and Japan.

Meanwhile, on the institutional front, “Regulatory clarity and tax treatment of crypto markets relative to their other options — stocks, derivatives, etc. — will matter a great deal more than it does for retail investors,” says Gina Pieters, assistant instructional professor in the Department of Economics at the University of Chicago. Here again, East Asia often seems further advanced than other regions. Pieters adds:

“Japan’s tax treatment of gains from crypto investment is much simpler than USA tax treatment, and so all else equal it would not be surprising to see higher adoption in Japan by institutional investors compared to the USA.”