#msme payments

Explore tagged Tumblr posts

Text

The Micro, Small, and Medium Enterprises (MSME) sector is a cornerstone of the Indian economy, contributing significantly to GDP and employment. The MSMED Act, 2006 addresses long-standing challenges faced by MSMEs, particularly delayed payments. Key provisions include mandatory payment timelines of 45 days (Section 15), deemed acceptance of transactions within 15 days (Section 2(b)), and compound interest on delayed payments (Section 16).

The Micro and Small Enterprise Facilitation Council (MSEFC) ensures speedy dispute resolution within 90 days through Alternative Dispute Resolution mechanisms. Recent initiatives like the Samadhaan Scheme provide an online platform for filing payment complaints, while government schemes under Atma Nirbhar Bharat enhance liquidity. Judicial decisions, such as Maa Alloys Pvt. Ltd. and Gupta Power Infrastructure Ltd., have upheld MSME rights, setting strong precedents.

With proposed legal reforms and increasing awareness, the MSMED Act is driving positive change, safeguarding MSMEs, and securing their vital role in India's economic growth.

TO know more:https://www.amlawfirm.in/post/msme-act-2006-legal-framework-and-key-judicial-developments

#amlawfirm#family law#law#lawfirminchennai#bagee#law-frim#criminal law#bestlawfirminchennai#bageerathan#writs#MSME payment recovery#MSME legal rights in India#Samadhaan Scheme for MSMEs#Atma Nirbhar Bharat MSME support#MSME delayed payments#MSM#Micro and Small Enterprise Facilitation Council#ED Act 2006

0 notes

Text

India MSME Payment Risk Management Solutions Market Trends and Forecast 2024-2032

India MSME Payment Risk Management Solutions refers to the sharing of technology that provides ease of payment solutions and reduces the chances of deferred payments. Micro Small and Medium Enterprises hold a sizable share in the GDP of the country. These enterprises apart from their high relevance often face difficulty in receiving payments and identifying certain fraudulent customers due to which the requirement for the companies offering various security and payment tracking services has become crucial. In order to address these issues certain centralized systems, blacklist systems, blockchain-based smart contracts, etc., are being implemented which would alleviate the cases of fraudulent activities and help MSMEs to operate smoothly.

According to the UnivDatos Market Insights Analysis, growing investments in the MSME sector will drive the Indian scenario of the “India MSME Payment Risk Management Solutions Market” report; the market was valued at USD 253.46 million in 2023, growing at a CAGR of 12.21 % during the forecast period from 2024 - 2032.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=67013

MSME Payment Risk Management Solutions Market Overview in North India:

North India region has held a sizable market share in India MSME Payment Risk Management Solution Market. With the increasing number of MSMEs present in the region as well as a high number of investments of the central as well as the state governments towards offering loans to establish micro, small, and medium enterprises in the region the demand for payment-related solutions has extensively grown. Additionally, the region has also experienced a higher demand for e-commerce and manufacturing-related MSME payment solutions. Many of the leading states as Uttar Pradesh, Delhi NCR region, Haryana, etc., have planned to double their GDP in the next five to six years of which the centre of focus is the expansion of MSME industries especially in the manufacturing, e-commerce, and apparel industry.

Considering these shifts the demand for India MSME Payment Risk Management Solutions in the North India region would notably grow. Other regions as West India and South India have also shown significant growth in recent years with the MSME expansion and requirement for payment-related services.

Growing Demand and Industry Trends:

The adoption of blockchain and smart contracts is emerging as a trend among payment risk management solution providers. These technological changes have helped industries such as finance, supply chain, etc., to optimize their payment-related issues. Blockchain technology offers increased efficiency, transparency, and upgraded security solutions. Various benefits such as transparency and trust, enhanced security, increased efficiency, cost reduction, real-time settlement, automation process, etc.

The adoption of blockchain and smart contracts also offers automated payments and settlements once the material/goods are being shipped to the client. The blockchain technology also helps in providing decentralized credit score to the MSMEs to help make them informed decisions. Additionally, these technologies also help to enhance the security of payments.

Related Reports-

AI Data Center Market: Current Analysis and Forecast (2024-2032)

Millimeter Wave Technology Market: Current Analysis and Forecast (2024-2032)

Future Prospects and Opportunities:

As the number of MSMEs in the country is increasing the need for robust centralized systems to identify the defaulters and improve the credit repayments by the customers.

Additionally, the requirement for various types of services such as payment tracking solutions, credit risk assessment tools, fraud detection and prevention software, debt collection solutions, etc., by the MSMEs the demand for payment risk management solutions has increased.

Additionally, with the rising government support in terms of regulatory and monetary assistance, the MSMEs in the country would exponentially grow in the coming years further promoting the need for payment risk management solutions. Furthermore, with the increasing number of MSMEs in the country as well as the increase in the sheer number of payments in the country through MSMEs the demand for reducing delayed payments both intentional and unintentional category would require robust solutions to reduce the payment-related issues.

Considering the changes the demand for MSME payment risk management solutions would further increase during the forecasted year i.e., 2024-2032.

For more information about this report visit- https://univdatos.com/report/india-msme-payment-risk-management-solution-market/

Conclusion:

In conclusion, the North India MSME Payment Risk Management Solutions market reflects a dynamic and evolving landscape supported by government investment, industry collaboration, and technological innovation. As the region continues strengthening its GDP growth through the development of MSMEs through extensive investment, regulatory support, and strategic partnerships, it is well-positioned to navigate challenges and capitalize on emerging opportunities in the debt collection industry.

#India MSME Payment Risk Management Solutions Market#India MSME Payment Risk Management Solutions Market Size#India MSME Payment Risk Management Solutions Market Share#India MSME Payment Risk Management Solutions Market Growth

0 notes

Text

Navigating The MSME Loan Government Scheme: A Comprehensive Guide

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in the economic growth and development of countries around the world. In recognition of their importance, governments have introduced various schemes to support these enterprises, including the MSME loan government scheme. This comprehensive guide aims to help business owners understand the intricacies of this scheme, including eligibility criteria, application processes, and available subsidies.

Understanding the MSME Loan Government Scheme

The MSME loan government scheme is designed to provide financial support to small and medium enterprises. This support comes in various forms, including loans, grants, and subsidies for MSMEs. These initiatives help businesses overcome financial hurdles, expand operations, and achieve sustainable growth.

Key components of the MSME loan government scheme

1. MSME business loan eligibility

To qualify for an MSME loan, businesses must meet specific criteria. These include the size of the business, annual turnover, and the nature of the enterprise. Understanding the MSME business loan eligibility criteria is essential for applicants to ensure their application stands a good chance of approval. Typically, businesses must be registered under the MSME category and adhere to the defined limits for investment in plant and machinery or equipment.

2. Unsecured business loan for MSME

One of the significant advantages of the MSME loan government scheme is the provision for unsecured business loans. Unlike traditional loans that require collateral, unsecured business loans for MSMEs provide access to capital without the need to pledge assets. This is particularly beneficial for small businesses that may not have significant assets to offer as collateral.

3. MSME subsidies and grants

The government offers various subsidies and grants to MSMEs to reduce the financial burden and encourage business growth. These MSME subsidies can cover aspects such as technology upgrades, quality improvement, and market development. Applying for an MSME grant can provide businesses with the necessary funds to innovate and compete in the market.

4. Govt scheme for small scale industry

There are numerous government schemes tailored specifically for small scale industries. These schemes provide a mix of financial support, training, and advisory services to help small businesses thrive. By taking advantage of a govt scheme for small scale industry, business owners can access resources that might otherwise be out of reach.

5. MSME loan process

The MSME loan process involves several steps, from application to approval. Business owners need to prepare detailed documentation, including business plans, financial statements, and proof of business registration. Understanding the MSME loan process helps ensure that applications are complete and submitted correctly, increasing the likelihood of approval.

6. MSME guidelines for payment

MSME guidelines for payment are designed to ensure timely and fair transactions within the sector. These guidelines protect small businesses from delayed payments and ensure they have a steady cash flow to support operations. Adhering to these guidelines is crucial for maintaining financial health and building trust with partners and suppliers.

How to apply for an MSME loan government scheme

1. Prepare necessary documentation: Gather all required documents, such as business registration certificates, financial statements, and business plans. This preparation is essential for a smooth application process.

2. Choose the right scheme: Identify the most suitable MSME loan government scheme based on your business needs. Whether it's an unsecured business loan for MSME or a specific grant, choosing the right scheme can significantly impact your business's success.

3. Submit the application: Fill out the application form accurately and submit it along with the required documents. Ensure that all information is correct and complete to avoid delays.

4. Follow up: After submission, regularly follow up on the application status. This proactive approach can help address any issues promptly and keep the process moving.

Benefits of the MSME loan government scheme

1. Financial support: Access to necessary funds without the need for significant collateral, thanks to unsecured business loans for MSMEs.

2. Growth opportunities: Subsidies for MSMEs and grants enable businesses to invest in growth opportunities, such as technology upgrades and market expansion.

3. Enhanced competitiveness: Government schemes help small businesses improve their products and services, making them more competitive in the market.

4. Improved cash flow: MSME guidelines for payment ensure timely transactions, helping businesses maintain a healthy cash flow.

Conclusion

Navigating the MSME loan government scheme requires a thorough understanding of the eligibility criteria, application process, and available benefits. One noteworthy example is Klub, a platform that focuses on revenue-based financing, providing startups with growth capital without requiring equity.By leveraging these schemes, small and medium enterprises can access essential financial support, drive growth, and contribute significantly to the economy. Whether seeking an unsecured business loan for MSME or applying for an MSME grant, these government initiatives provide invaluable resources for business success.

#msme guidelines for payment#msme business loan eligibility#govt scheme for small scale industry#msme subsidies#subsidies for msme#msme loan process

0 notes

Text

How MSME Suppliers Can Recover Delayed Payment?

"MSME Suppliers Recover Delayed Payment" refers to initiatives and strategies aimed at ensuring Micro, Small, and Medium Enterprises receive overdue payments from clients promptly. This can include legal actions, government support programs, or innovative financial solutions to improve cash flow and business stability.

0 notes

Text

Traditional banking and financial frameworks have historically catered to the wealthy. However, the 2023 narrative has always been about the grassroots. If we drill down further, the importance of the MSME sector in India’s economic growth is self-evident.

With over 630 lakh MSMEs employing over 1100 lakh people staggered across services&the manufacturing sector, the sector contributes nearly 30% to the country’s GDP.

True financial inclusion will require bringing India’s 60 million micro, small, and medium enterprises (MSMEs) into this payments’ infrastructure, especially the micro-enterprises.

The rising generation of fintech companies is leveraging enhanced technology and broader reach to help smaller enterprises get ahead by offering financial services to the unbanked and finding innovative ways to lend and support a growing gig economy. Read More

0 notes

Text

Leading Export Factoring Services in India to Boost International Sales

Export factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (invoices) to a third party (the factor) at a discount. This arrangement provides the business with immediate funds, typically a percentage of the value of the receivables, which can help improve cash flow and mitigate the risks associated with international trade. Export factoring is particularly beneficial for businesses engaged in exporting goods or services to international markets.

For expert finance consultancy for this visit:

https://www.myforexeye.com/export-factoring

#export factoring#Export Factoring in India#export bill factoring#domestic and export factoring#Export factoring companies in india#Bill Discounting#factoring service#International Factoring#MSMEs export finance#Purchase of receivables#Funding#Financing#Export invoices#Credit insurance#Payment instrument#Export financing#Export transactions#International trade

1 note

·

View note

Text

Recover your payments effortlessly with our user-friendly platform, specially crafted for Micro, Small, and Medium Enterprises (MSMEs). No more chasing overdue payments or navigating complex processes. We understand the importance of your cash flow, and our system ensures a swift and efficient recovery. Don't let delayed payments hinder your progress. Choose the MSME Payment Recovery System today and experience a new era of financial control. Your payments are waiting – claim them now!

0 notes

Link

0 notes

Text

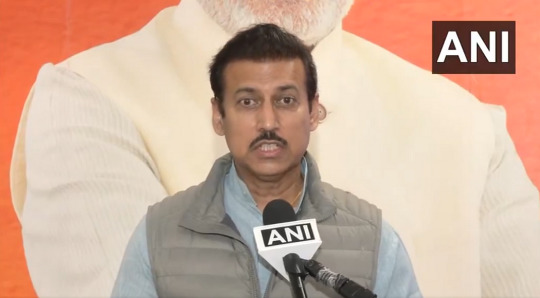

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

Leading Supplier of Jindal GI ERW Pipe

In the world of construction and infrastructure, the choice of piping material can significantly impact the durability and efficiency of a project. Jindal GI ERW pipes (Galvanized Iron Electric Resistance Welded pipes) have emerged as a preferred choice due to their strength, resistance to corrosion, and ease of installation. As a leading supplier of Jindal GI ERW pipes, Udhhyog is committed to delivering high-quality products that meet the diverse needs of various industries.

What are Jindal GI ERW Pipes?

Jindal GI ERW pipes are manufactured using the electric resistance welding process, which ensures uniformity and strength. These pipes are coated with a layer of zinc, providing excellent protection against rust and corrosion. They are widely used in water supply, gas distribution, plumbing, and structural applications.

Key Features of Jindal GI ERW Pipes

Corrosion Resistance: The galvanization process protects the pipes from rust and corrosion, making them suitable for both indoor and outdoor applications.

High Strength: Jindal GI ERW pipes are known for their tensile strength, making them ideal for high-pressure applications.

Lightweight and Easy to Handle: These pipes are easier to transport and install compared to heavier alternatives, reducing overall labor costs.

Cost-Effective: With their durability and low maintenance requirements, Jindal GI ERW pipes offer a cost-effective solution for various piping needs.

Versatile Applications: They are used in numerous sectors, including agriculture, construction, and industrial applications.

Udhhyog: Your Trusted Supplier

As a prominent supplier of Jindal GI ERW pipes, Udhhyog prioritizes quality and customer satisfaction. Here are some reasons why Udhhyog stands out in the industry:

Quality Assurance: Udhhyog sources its GI ERW pipes directly from Jindal, ensuring that every product meets the highest industry standards.

Competitive Pricing: Committed to providing the best prices in India, Udhhyog ensures that customers receive value for their investments.

Extensive Inventory: With a wide range of sizes and specifications available, Udhhyog caters to diverse industrial needs, ensuring timely delivery and convenience.

Expert Support: Udhhyog’s experienced team is always available to provide expert guidance and assist customers in selecting the right products for their projects.

Flexible Payment Terms: Udhhyog offers flexible credit terms to support MSMEs in managing their procurement efficiently.

#JindalGI#ERWPipes#Udhhyog#PipingSolutions#ConstructionMaterials#IndustrialSupplies#QualityPipes#CorrosionResistant#AffordablePiping#B2BProcurement

5 notes

·

View notes

Text

Understanding the Importance of Credit Ratings for SMEs, MSMEs, and Startups in India

In the ever-evolving landscape of the Indian economy, Small and Medium Enterprises (SMEs), Micro, Small and Medium Enterprises (MSMEs), and startups play a pivotal role. These entities not only drive innovation but also create significant employment opportunities and contribute extensively to the GDP. However, one of the fundamental challenges they face is access to capital. This is where the importance of a robust credit rating comes into play.

Why is Credit Rating Crucial?

1. Access to Finance: Credit ratings determine the creditworthiness of a business. A high credit rating reassures lenders of the lower risk involved in extending credit to the business. This can lead to easier access to loans, lower interest rates, and more favorable repayment terms. For SMEs, MSMEs, and startups, which typically face higher scrutiny from financial institutions, a good credit rating can open doors to essential funding.

2. Credibility with Suppliers: A strong credit rating not only helps in securing finance but also enhances the business's credibility in the eyes of suppliers. Companies with better credit ratings can negotiate better credit terms such as longer payment durations and bulk order discounts, which can significantly improve cash flow management.

3. Competitive Advantage: In a market teeming with competition, a good credit rating can serve as a badge of reliability and sound financial health. This can be particularly beneficial in tendering processes where the financial stability of a business is a key consideration.

4. Lower Borrowing Costs: Businesses with higher credit ratings can secure loans at lower interest rates. Lower borrowing costs mean that the business can invest more in its growth and development, improving profitability and sustainability over time. This is especially critical for SMEs, MSMEs, and startups, where financial leverage can determine market positioning and long-term success.

How to Improve Your Credit Rating?

Improving and maintaining a good credit rating requires a strategic approach, including timely repayment of loans, prudent financial management, maintaining a balanced debt-to-income ratio, and regular monitoring of credit reports for any discrepancies.

Need Expert Guidance?

Understanding the nuances of credit ratings and effectively managing them can be complex. This is where expert financial advisory services, such as those offered by Finnova Advisory, come into play. Finnova Advisory specializes in providing tailored financial solutions that cater specifically to the unique needs of SMEs, MSMEs, and startups in India.

Whether you are looking to improve your credit score, secure funding, or streamline your financial strategies, connecting with the experts at Finnova Advisory can provide you with the insights and support you need to thrive in a competitive marketplace.

To learn more about how Finnova Advisory can assist your business in achieving financial excellence, visit their website or reach out directly for a personalized consultation. Remember, a robust credit rating is your gateway to not only securing finance but also establishing a strong foundation for your business's future growth and success.

5 notes

·

View notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below *Adhaar Address Update *Adhaar download *Adaar PVC card apply *Adhaar Update History *Adhaar Card Slot Booking *Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services * New Pan Card Apply *Pan card Corrections *Instant Pan card *Minor Pan Card *Duplicate Pan Card

4.Micro& Mini ATM Services *Cash withdrawal *Fund transfer *Cash Deposit *Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines: 1.Adhaar card photo 2.Pan Card photo 3.Phone number 4.Email Id 5.Live Location to be shared 6.2-4 Sec video Recording by holding adhaar /pan 7.Any other person reference contact number and ID proof 8.bank passbook photo 9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339 Note : Registration fees non Refundable

2 notes

·

View notes

Photo

#D2CTech Conference by Instamojo

Reserve your seat: https://justithosting.com/justit/d2ctech-conference-by-instamojo/ Visit Instamojo: https://justithosting.com/justit/instamojo/ https://justithosting.com/

The industry's best and brightest brains will convene over three days to give their two cents on nurturing and growing D2C brands and the tools, technology and platforms that power this growth.

#webinar #D2CTech #instamojo #conference #conference2023 #cootalks #businessowner #startuplife #payments #invoices #checkitout #paymentgateway #paymentprocessing #paymnetapp #paymentsolutions #payments #startups #startupbusiness #startupideas #startuptips #startupindia #startuplife #business #businessindia #smallbiz #SMB #MSME #msmeindia #MSMERegistration #webagency #webdevelopment #webdeveloper #webdevelopers #webdevelopmentcompany #websitedeals #wwwdeals #wwwoffer #webdesign #webdesigner #webdesigning #webdesignagency #webdesigncompany #webdesigners #webdesigntrends #webdesignanddevelopment #webdesigns #webdesignservices #webdevelopmentservices #webdev #webdevelopmentagency #webdevelopmentservice #webdevelopmentindia

4 notes

·

View notes

Text

Best Business Loan Services in Davanagere, Karnataka

Davanagere, Karnataka, is an emerging business hub with a growing industrial sector, making it an ideal place for entrepreneurs and business owners to establish and expand their ventures. Whether you're a small business owner, a startup, or an established company, securing a business loan can be a crucial step in scaling operations, managing cash flow, or investing in new opportunities. Understanding the best business loan services in Davanagere, Karnataka can help you make informed financial decisions.

Importance of Business Loans in Davanagere

Davanagere is known for its thriving textile, agricultural, and manufacturing industries. With increasing business opportunities, access to the right funding options can significantly impact business growth. Business loans provide essential financial assistance to entrepreneurs by offering capital for purchasing machinery, inventory, expanding premises, or handling working capital requirements.

Types of Business Loans Available

Business owners in Davanagere can access different types of business loans depending on their needs and financial conditions. Here are some common types of business loans available:

1. Term Loans

Term loans are one of the most common financing options for businesses. These loans are offered for a fixed tenure, with repayment done in monthly installments. They can be either short-term or long-term, based on the business’s financial requirements.

2. Working Capital Loans

Businesses often require funds to meet their daily operational expenses. Working capital loans help maintain liquidity, manage payroll, and cover other short-term costs without affecting the cash flow.

3. Machinery and Equipment Loans

For manufacturing and production-based businesses in Davanagere, machinery loans are crucial. These loans allow businesses to purchase new equipment or upgrade existing machinery to improve efficiency and productivity.

4. Invoice Financing

This loan type is beneficial for businesses dealing with delayed payments from clients. Invoice financing helps companies get immediate cash by leveraging unpaid invoices, ensuring smooth operations.

5. Government-Supported Business Loans

The government of Karnataka, along with national financial institutions, offers various schemes under Mudra Loans, MSME loans, and Startup India programs to support small and medium businesses.

Factors to Consider When Choosing a Business Loan Service

Before selecting a business loan provider in Davanagere, consider these essential factors:

1. Interest Rates and Processing Fees

Different lenders offer varied interest rates and processing fees. Compare multiple options to find the most cost-effective loan that suits your business needs.

2. Loan Amount and Tenure

Determine the loan amount required and choose a lender that provides flexible repayment terms aligning with your financial stability.

3. Eligibility Criteria

Each financial institution has its own eligibility requirements based on turnover, credit score, business vintage, and repayment capacity. Ensure that you meet the criteria before applying.

4. Loan Disbursement Speed

Time is crucial in business. Look for lenders who provide quick loan approvals and disburse funds without unnecessary delays.

5. Collateral Requirements

Some business loans require collateral, while others are unsecured. Choose a loan type that best fits your asset availability and risk appetite.

6. Customer Support and Flexibility

Opt for financial institutions that offer excellent customer support and flexibility in repayment options, ensuring a smooth borrowing experience.

How to Apply for a Business Loan in Davanagere

Applying for a business loan in Davanagere involves several steps. Here’s a simplified guide to help you through the process:

Step 1: Determine Your Loan Requirement

Analyze your business needs and decide on the loan amount, tenure, and type of loan suitable for your operations.

Step 2: Check Eligibility

Review the eligibility criteria of different lenders to ensure that you qualify for a business loan.

Step 3: Gather Required Documents

Commonly required documents include:

Business registration certificate

Financial statements (Profit & Loss and Balance Sheet)

Income tax returns

Bank statements

KYC documents (Aadhar, PAN, etc.)

Step 4: Compare Loan Offers

Research different lenders, compare interest rates, processing fees, and other terms to find the most suitable business loan service.

Step 5: Submit Application

Apply online or visit the lender’s branch to submit your loan application along with necessary documents.

Step 6: Loan Approval and Disbursement

Once the lender verifies your documents and eligibility, the loan is approved, and funds are disbursed to your business account.

Conclusion

Accessing the best business loan services in Davanagere, Karnataka can provide much-needed financial support for businesses to grow and sustain their operations. Whether you are looking for working capital, expanding your business, or purchasing machinery, choosing the right loan service ensures smooth financial management. By comparing different loan options, checking eligibility criteria, and selecting a reliable lender, businesses in Davanagere can secure the funds they need to thrive in today’s competitive market.

0 notes