#Tax Saving

Explore tagged Tumblr posts

Text

The Complete Guide to Comprehensive Wealth Management Service

Money control can feel overwhelming, particularly whilst juggling a couple of investment debts, retirement plans, and financial dreams. This complexity explains why more people and households are turning to wealth management services for complete monetary guidance.

The Role of Wealth Management Services

Think of wealth control services as having a grasp conductor orchestrating every component of your monetary symphony. While every person can discover ways to play man or woman units—like shares, bonds, or actual estate investments—a professional wealth manager guarantees these kinds of elements paintings in best harmony.

The maximum professional portfolio management firms offer a way greater than basic funding advice. These specialists take a holistic approach, thinking about the whole thing, from tax performance and property planning to risk management and philanthropic giving. This comprehensive strategy facilitates protecting and developing wealth throughout more than one generation.

A Holistic Approach to Financial Planning

Consider how the best portfolio management services combine diverse economic components. When making funding choices, they factor in tax implications, destiny education charges, retirement goals, and even healthcare making plans. This interconnected approach prevents the commonplace pitfall of getting different monetary strategies working in opposition to each other.

The real fee of wealth control offerings becomes apparent during essential life transitions. Whether navigating an inheritance, selling a business, or planning for retirement, those specialists provide strategic guidance, which can save you expensive errors. They expect potential challenges and opportunities, allowing clients to make informed decisions in place of reactive ones.

Customized Investment Strategies

Portfolio control firms excel at growing custom-designed funding strategies. Rather than applying a one-length-fits-all method, they increase tailored portfolios that align with precise goals, danger tolerance, and time horizons. This personalization extends beyond simply funding choice—it encompasses tax optimization, estate-making plans, and threat management strategies.

Another widespread benefit of running with wealth control services is their capability to offer objective, emotionally indifferent recommendations. When markets end up unstable or financial decisions grow to be complicated by way of non-public factors, having an experienced expert guide can prevent impulsive choices that would damage long-term financial fitness.

Access to Advanced Financial Tools and Resources

The high-quality portfolio management offerings additionally convey state-of-the-art tools and assets that person traders commonly can't access. From superior portfolio analytics to unique investment opportunities, these firms leverage their institutional skills to advantage their clients. They can discover possibilities and dangers that won't be apparent to individual traders.

Long-Term Financial Security and Wealth Transfer

The dating with a wealth management provider frequently extends past the number one customer. These firms can assist in training their own family members approximately financial responsibility, facilitate circle of relatives meetings about wealth transfer, and ensure that economic values and know-how are passed easily among generations. This circle of relatives-oriented method allows for the maintenance of wealth and monetary knowledge across more than one generation.

Reducing Stress and Saving Time

One frequently disregarded gain is the time and pressure reduction that comes with expert wealth management. Instead of spending infinite hours studying investments, tracking marketplace changes, and handling numerous monetary bills, clients can focus on their careers, families, and private interests while understanding their economic future is in capable hands.

Looking Ahead: The Growing Importance of Wealth Management Services

Looking in advance, wealth control offerings turn into increasingly more critical as economic markets grow more complicated and interconnected. Those who partner with experienced wealth control experts position themselves to navigate destiny-demanding situations even as taking advantage of emerging opportunities inside the international economic landscape.

Final Thoughts

The selection to paint with a wealth management service represents an investment in economic fulfillment and peace of mind. By offering comprehensive, coordinated economic steerage, those specialists assist clients in acquiring their economic dreams at the same time as averting costly errors and missed possibilities.

#wealth management#portfolio firms#investment plans#asset growth#risk control#tax saving#retirement fund#estate planning#money growth#smart investing#wealth security#finance guide#financial tips#market trends#fund management#wealth success#profit strategy#capital gains#money control#financial plan

0 notes

Text

ふるさと納税が同日に届いた

20250110

0 notes

Text

Tax-Saving Strategies For Freelancers

Freelancers often face unique tax challenges, but there are strategies to minimize their tax burden. Deductions for home office expenses, equipment, software, and travel can significantly lower taxable income. Contributing to retirement plans like a SEP IRA can also provide tax benefits. For complex tax situations, experts offering small business tax planning services can help freelancers navigate deductions and ensure compliance with tax laws.

0 notes

Text

How to Save Taxes on Investments with Portfolio Management Services

Introduction

Navigating the world of investments can be challenging, especially when it comes to optimizing returns and minimizing tax liabilities. Fortunately, utilizing portfolio management services in India can be a game-changer. These services not only help in managing and growing your investment portfolio but also in strategically saving on taxes. Here’s a comprehensive guide on how to leverage investment portfolio management to save taxes effectively.

Understanding Portfolio Management Services

Portfolio management services (PMS) are specialized investment solutions offered by financial professionals or firms that help you manage your investment portfolio. These services are designed to align your investments with your financial goals while optimizing performance. Engaging a financial advisor or a portfolio management firm ensures that your investments are managed with a strategic approach, considering tax implications as part of the overall plan.

Why Tax Efficiency Matters

Taxes can significantly impact your investment returns. By employing a strategic approach to tax management within your portfolio, you can enhance your after-tax returns. Here’s how portfolio management services in India can assist you in this regard:

Tax-Loss Harvesting: This strategy involves selling investments at a loss to offset gains made elsewhere in your portfolio. A skilled portfolio management firm can identify opportunities to realize losses, thereby reducing your taxable income.

Capital Gains Management: Understanding the distinction between short-term and long-term capital gains is crucial. Investments held for over a year typically attract lower tax rates on gains. A financial advisor can guide you on maintaining investments for optimal periods to benefit from these tax advantages.

Dividend Taxation Planning: Dividends are often taxed differently than capital gains. Effective management of dividend-yielding investments can help you plan your tax liabilities better. Portfolio management services can provide insights into structuring your investments to minimize the impact of dividend taxes.

Utilizing Tax-Advantaged Accounts: In India, certain accounts like Equity Linked Savings Schemes (ELSS) or Public Provident Fund (PPF) offer tax benefits. A well-structured investment portfolio management strategy will incorporate these options to maximize tax savings.

Tax-Efficient Asset Allocation: Different types of investments have varying tax treatments. A portfolio management firm will optimize asset allocation across various tax-efficient investment vehicles, balancing between equity, debt, and other instruments to enhance overall tax efficiency.

Choosing the Top Portfolio Management Services

Selecting the right portfolio management services in India can make a significant difference in your tax savings. Here’s what to look for when choosing the top portfolio management services:

Expertise and Experience: Look for firms with a proven track record in managing portfolios with a focus on tax efficiency.

Customization: Ensure that the services are tailored to your specific financial situation and goals.

Transparency: Choose firms that offer clear and transparent fee structures and performance reporting.

Reputation: Research and select firms with positive reviews and a strong reputation in the industry.

The Role of a Financial Advisor

A financial advisor plays a pivotal role in your tax-saving strategy. They provide personalized advice on tax-efficient investment strategies and help implement these strategies effectively. Whether you’re looking to optimize your investment returns or manage tax liabilities, a knowledgeable advisor can make all the difference.

Conclusion

Incorporating tax-saving strategies into your investment portfolio management can significantly enhance your financial outcomes. By leveraging portfolio management services in India, you gain access to expert guidance on tax-efficient investment strategies. Whether it’s through tax-loss harvesting, capital gains management, or optimizing asset allocation, professional portfolio management can help you keep more of your investment returns.

For optimal tax-saving strategies and effective investment management, consider partnering with a reputable portfolio management firm or a financial advisor. Their expertise will ensure that your investment portfolio is not only growing but also optimized for tax efficiency.

Feel free to reach out for more insights on how portfolio management services can help you achieve your financial goals while maximizing tax savings.

#wealth management services#portfolio managers#portfolio management services in india#portfolio management#portfolio management services#wealth management company#portfolio manager#sharemarket#investment portfolio#investment portfolio management#tax saving#elss tax benefits#taxes

0 notes

Text

To start establish a savings account dedicated to taxes. Treat it like a payment to yourself. By setting aside a portion of your earnings you'll be ready when tax season arrives, review your withholding allowances regularly to ensure that you're not paying much or too little throughout the year. Make adjustments as needed to steer clear of any surprises when tax season rolls around.

#Top mutual fund investment in India#Best investment plan#best investment plan#investing#tax saving#tax deduction saving

0 notes

Text

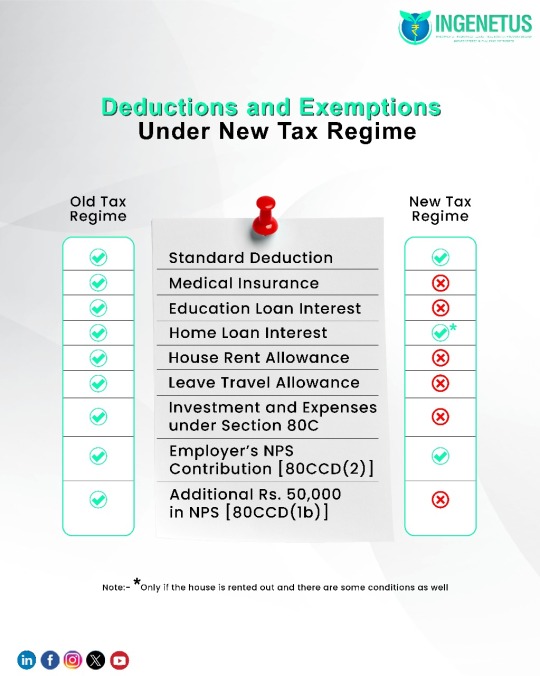

In the budget of 2023, revisions have been implemented to the tax slab rates, establishing the new tax regime as the default for FY 2023-24. Taxpayers have the option to revert to the old tax regime before filing their income tax returns by submitting Form 10-IEA. It needs to be submitted only If he has business income and this is not applicable if you are filing ITR 1 or 2.

0 notes

Text

#tax loss carryforwards#tax loss#tax saving#outsourcing accounting services#outsourcing bookkeeping services#tax preparation service#USA accounting#USA bookkeeping#united states

0 notes

Text

Discover top-notch accountancy services with Wills & Trusts Wealth. Our team of professional accountants provides comprehensive financial solutions tailored to your needs. From tax planning and auditing to financial advice, we ensure your financial health is in expert hands. Visit our accountancy services page to find out more about our accountancy services.

#Accountancy Services#Tax saving#Financial Security#Tax Planning#Trust Returns#Wealth Management#Professional Accountants#Personalised Accountancy Solutions

0 notes

Text

Navigating the World of Mutual Funds: Exploring the Value of Finology Recipe's Mutual Fund Reports

Introduction:

Mutual funds have become a popular choice for investors seeking diversification and professional management. As investors navigate the world of mutual funds, reliable and comprehensive information becomes crucial in making informed decisions. In this article, we explore the significance of mutual fund reports and how Finology Recipe serves as a valuable resource for investors seeking insightful analysis and detailed information on mutual funds.

Understanding the Importance of Mutual Fund Reports:

Mutual fund reports play a vital role in evaluating mutual fund performance, risks, and characteristics. These reports provide in-depth information about a fund's investment strategy, holdings, historical performance, fees, and other critical data necessary for investors to assess its potential. By understanding and analyzing this information, investors can make well-informed decisions aligned with their investment goals.

Exploring Finology Recipe's Mutual Fund Reports:

Finology Recipe stands out as a trusted platform that provides investors with valuable mutual fund reports. Let's delve into how Finology Recipe's mutual fund reports bring significant value to investors:

Unbiased and Objective Analysis:

Finology Recipe's mutual fund reports are designed to be unbiased, providing investors with objective analysis free from promotional biases. By relying on these reports, investors can access impartial information and insights into mutual funds, enabling them to make informed decisions based on reliable data.

Detailed Information:

Finology Recipe's mutual fund reports offer a wealth of information on various aspects of mutual funds. Investors can access comprehensive details about a fund's investment objectives, portfolio composition, fund managers, historical returns, fees, and much more. This comprehensive information allows investors to gain a deeper understanding of a fund's performance and investment strategy.

Comparative Analysis:

Finology Recipe facilitates comparative analysis of multiple mutual funds. This feature allows investors to compare funds side by side, evaluating important metrics such as performance, expenses, risk measures, and asset allocation. By having access to comparative analysis, investors can pinpoint funds that closely align with their investment preferences and objectives.

Risk Assessment and Fund Ratings:

Finology Recipe's mutual fund reports provide crucial risk assessment metrics and fund ratings. These metrics help investors evaluate a fund's risk profile and potential volatility, enabling them to select funds that align with their risk tolerance. Additionally, fund ratings from reputable agencies offer further guidance on a fund's quality and long-term performance, providing valuable insights for investors.

Educational Resources:

Finology Recipe recognizes the importance of investor education. Alongside mutual fund reports, the platform offers a range of educational resources aimed at enhancing investors' understanding of mutual funds, investment strategies, and risk management. This commitment to education empowers investors to make well-rounded and informed investment decisions.

Conclusion:

Mutual fund reports serve as invaluable tools for investors seeking meaningful insights into mutual funds. Finology Recipe's mutual fund reports go beyond providing comprehensive and unbiased analysis, offering investors access to detailed information, comparative analysis, risk metrics, fund ratings, and educational resources. By leveraging these resources, investors can navigate the world of mutual funds with confidence, making informed decisions aligned with their investment objectives. However, it's important for investors to remember that mutual fund reports are just one piece of the puzzle, and due diligence and consideration of other factors are crucial in making sound investment choices.

0 notes

Text

#Corporate Tax#UAE Corporate Tax Saving#Corporate Tax Saving#Corporate Tax Saving in uae#best Corporate Tax Saving#Corporate Tax Saving in dubai#Tax Saving

0 notes

Text

Learn how investors use cost segregation case study

Analyze how investors leverage cost segregation illustrated in a Cost segregation case study called to increase tax saving. Visit us now!

0 notes

Text

Quick Tax Wins: Top Tips for Savings

In India, tax-saving options are available under various sections of the Income Tax Act, providing opportunities for individuals and Hindu Undivided Families (HUFs) to reduce their tax liability. Here are some key points about tax-saving in India:

Section 80C Tax-Saving Options

Investments and expenses under Section 80C allow for deductions of up to Rs. 1.5 lakh in a financial year. Some popular options include:

5-Year Bank Fixed Deposit

Public Provident Fund (PPF)

National Savings Certificate

National Pension System (NPS)

ELSS Funds

Unit Linked Insurance Plan (ULIP)

Sukanya Samriddhi Yojana (SSY)

Senior Citizen Saving Scheme (SCSS)

Additional Tax-Saving Provisions

Apart from Section 80C, other provisions allow deductions:

Section 80D: for medical insurance premium

Section 80EE: for interest payment of home loan

Section 24: for interest deduction on housing loan

Section 80EEB: for interest deduction on vehicle loan for electric vehicles

Section 80G: for donations to charitable institutions

Section 80GG: for rent deduction

Section 80TTA: for interest received in a savings bank account

Section 54, 54F: for capital gain exemption

Tax-Saving Investments in India

Tax-saving investment options to consider:

ULIP and life insurance plans

NPS tier-I account

PPF

Senior Citizen Saving Scheme, among others

Maximizing Tax Savings

Starting tax-saving investments early in the financial year can help spread the investments and make informed decisions. It's crucial to consider the various tax-saving expenses and investments available under Section 80C to exhaust the limit effectively.

Tax-Exempt Investments

Investments such as Equity Linked Saving Scheme (ELSS) and Public Provident Fund (PPF) offer tax exemptions, making them attractive options for tax-saving

1 note

·

View note

Text

Curious about the best tax path?💸 Your financial journey awaits a savvy choice. Which regime suits your wallet better? Old vs New Tax Regime! 💼

0 notes

Text

I love how mqf's oficial description is something like: a good heart who wants to help others but then you read the novel and his reaction to lqg trapping ten infected men who are crying in panic is "great now I can start to work in my experiments with decomposed people to find a cure" and gets out a lot of needles, which makes the man cry even harder.

Even if we only get bits of the other Cang Qiong sect leader's we can reach the conclusion that no one there is normal, sqq is just biased.

#the other sects when they have to invite cang qiong: they're our brothers but for fuck's sake they're so weird#sqq is a drama queen married to the demon lord#lqg is an obsessed fighter with no survival instics#sqh is a spy married to ANOTHER demon that somehow is still in the sect doing taxes#qqq could kill you with a look but she also makes fun of tiny lbh in the extras#you know the emperor#so she has probably zero survival instics too#mqf is one step away from becoming a mad doctor#and they're lead by the n°1 apologizer#i love them let me meet the rest#svsss#scum villain self saving system#mu qingfang#liu qingge#shen qingqiu

4K notes

·

View notes

Text

How to Start Saving for Next Year and Earn Good Interest!

To start establish a savings account dedicated to taxes. Treat it like a payment to yourself. By setting aside a portion of your earnings you'll be ready when tax season arrives, review your withholding allowances regularly to ensure that you're not paying much or too little throughout the year. Make adjustments as needed to steer clear of any surprises when tax season rolls around.

#Top mutual fund investment in India#Best investment plan#best investment plan#investing#tax saving#tax deduction saving

0 notes