#Tax Reduction Packages

Explore tagged Tumblr posts

Text

Maximizing Savings: Exploring Tax Reduction Packages

Tax reduction packages are designed to help individuals and businesses minimize their tax liabilities and maximize savings. Understanding the benefits and strategies behind these packages can lead to significant financial advantages. Let's delve into the world of tax reduction packages and how they can help you optimize your tax situation.

What are Tax Reduction Packages?

Tax reduction packages are comprehensive sets of strategies, deductions, credits, and incentives that individuals and businesses can leverage to lower their tax bills. These packages are tailored to specific circumstances and goals, aiming to legally reduce taxable income and take advantage of available tax breaks. By utilizing tax reduction packages effectively, taxpayers can keep more of their hard-earned money and achieve financial goals more efficiently.

Strategies for Individuals

For individuals, tax reduction packages often include strategies such as maximizing retirement contributions, taking advantage of tax credits for education expenses, utilizing health savings accounts, and optimizing charitable donations. By strategically planning and structuring their finances, individuals can reduce their taxable income and qualify for various deductions that lead to lower tax bills.

Benefits for Businesses

Businesses can benefit from tax reduction packages by implementing strategies like accelerated depreciation, utilizing research and development tax credits, taking advantage of small business deductions, and optimizing employee benefits. These strategies not only reduce the tax burden on businesses but also promote growth, innovation, and sustainability by freeing up capital for investment and expansion.

Professional Guidance

Navigating the complexities of tax reduction packages can be challenging, which is why seeking professional guidance from tax advisors, accountants, or financial planners is crucial. These experts can help individuals and businesses identify opportunities for tax savings, optimize their financial structures, and ensure compliance with tax laws and regulations. Working with professionals ensures that tax reduction strategies are implemented effectively and in alignment with your financial goals.

Long-Term Financial Planning

Tax reduction packages are not just about saving money in the short term; they also play a vital role in long-term financial planning. By incorporating tax-efficient strategies into your financial plan, you can build wealth, secure your financial future, and achieve financial independence. Tax reduction packages are an essential component of a comprehensive financial strategy that aims to maximize savings and minimize tax liabilities over time.

Conclusion

Tax reduction packages offer individuals and businesses valuable opportunities to lower their tax bills, optimize their financial situations, and achieve long-term financial goals. By understanding the strategies, benefits, and importance of tax reduction packages, you can take proactive steps to minimize your tax liabilities, maximize savings, and build a solid financial foundation for the future. Explore the possibilities of tax reduction packages and unlock the potential for significant financial advantages.

0 notes

Text

Practical Japanese Vocab: Coupons

I got some coupons from 7-Eleven yesterday so here's some vocab from them:

目印(めじるし)mark (for quick identification)

対象(たいしょう)target, coverage, subject (of taxation etc)

対象外(たいしょうがい)not covered by, not subject to

標準価格(ひょうじゅんかかく)normal price

税抜(ぜいぬき)tax excluded

値引き(ねびき)price reduction, discount

併用(へいよう)combined with, using together

本券(ほんけん)this ticket

該当(がいとう)corresponding to, applicable to, relevant to, coming under, qualifying for

販売(はんばい)sales, selling, marketing

店舗(てんぽ)store, establishment, restaurant

取り扱い(とりあつかい)treatment, service, handling

異なる(ことなる)to differ, to be different

地域(ちいき)region, area, district, locality

Sentences:

このロゴが目印 Marked with this logo

ご予約弁当も対象です。Also covers certain (targeted) bentos.

セブンプレミアムは対象外です。Seven Premium (products) are not covered.

標準価格(税抜)からの値引きとなります。Discount is from standard price (excluding tax)

他のクーポンとの併用はできません。Cannot be used together with other coupons

本券1枚につき該当商品いずれか1コ。Each voucher is for one qualifying product.

カウンター内で販売している揚げ物・フランクが対象です。Applies to fried foods and frankfurters sold at the counter.

店舗により取り扱いの無い場合がございます。Depending on store, products may not be available.

地域により商品名・価格・商品パッケートは異なる場合がおざいます。Product names, prices and packaging my vary depending on region.

#nutcracker nihongo#practical japanese#japanese langblr#learning japanese#it's pretty cool that i'm now at a level where i'm not intimidated by reading japanese like this#sure there are a lot of new words but it's a lot of kanji i recognise and i could largely work out the meaning based on that#野生の日本語

293 notes

·

View notes

Text

On Sunday, Speaker of the House Mike Johnson went on television and mixed up Iran and Israel. “We passed the support for Iran many months ago,” he told Meet the Press, erroneously referring to an aid package for the Jewish state. Last night, the Fox News prime-time host Jesse Watters introduced South Dakota Governor Kristi Noem as hailing from South Carolina. I once joined a cable-news panel where one of the participants kept confusing then–Attorney General Jeff Sessions with Representative Pete Sessions of Texas. I don’t hold these errors against anyone, as they are some of the most common miscues made by people who talk for a living—and I’m sure my time will come.

Yesterday, President Joe Biden added another example to this list. In response to a question about Gaza, he referred to the Egyptian leader Abdel Fattah al-Sisi as the president of Mexico. The substance of Biden’s answer was perfectly cogent. The off-the-cuff response included geographic and policy details not just about Egypt, but about multiple Middle Eastern players that most Americans probably couldn’t even name. The president clearly knew whom and what he was talking about; he just slipped up the same way Johnson and so many others have. But the flub could not have come at a worse time. Because the press conference had been called to respond to Special Counsel Robert Hur’s report on Biden’s handling of classified documents, which dubbed the president an “elderly man with a poor memory,” the Mexico gaffe was immediately cast by critics as confirmation of Biden’s cognitive collapse.

But the truth is, mistakes like these are nothing new for Biden, who has been mixing up names and places for his entire political career. Back in 2008, he infamously introduced his running mate as “the next president of the United States, Barack America.” At the time, Biden’s well-known propensity for bizarre tangents, ahistorical riffs, and malapropisms compelled Slate to publish an entire column explaining “why Joe Biden’s gaffes don’t hurt him much.” The article included such gems as the time that then-Senator Biden told the journalist Katie Couric that “when the markets crashed in 1929, ‘Franklin Roosevelt got on the television and didn’t just talk about the princes of greed. He said, “Look, here’s what happened.”’” The only problem with this story, Slate laconically noted, was that “FDR wasn’t president then, nor did television exist.”

In other words, even a cursory history of Biden’s bungling shows that he is the same person he has always been, just older and slower—a gaffe-prone, middling public speaker with above-average emotional intelligence and an instinct for legislative horse-trading. This is why Biden’s signature moments as a politician have been not set-piece speeches, but off-the-cuff encounters, such as when he knelt to engage elderly Holocaust survivors in Israel so they would not have to stand, and when he befriended a security guard in an elevator at The New York Times on his way to a meeting with the paper’s editorial board, which declined to endorse him. And it’s why Biden’s key accomplishments—such as the landmark climate-change provisions of the Inflation Reduction Act, the country’s first gun-control bill in decades, and the expected expansion of the child tax credit—have come through Congress. The president’s strength is not orating, but legislating; not inspiring a crowd, but connecting with individuals.

That said, although Biden’s Mexico mistake might not be a demonstration of dementia, it is a warning sign of a different sort that his campaign would be wise to heed. Recently, the White House declined to have Biden participate in the traditional pre–Super Bowl interview this coming Sunday. The administration framed this decision as part of a broader strategy favoring nontraditional media, but it was reasonably seen as an attempt to shield the candidate from scrutiny. The president’s staff is understandably reluctant to put Biden front and center, knowing that his slower speed and inevitable gaffes—both real and fabricated—will feed the mental-acuity narrative. But in actuality, the bar for Biden has been set so laughably low that he can’t help but vault over it simply by showing up. By contrast, limiting his appearances ensures that the public mostly encounters the president through decontextualized social-media clips of his slipups.

As Slate observed in 2008, the frequency of Biden’s rhetorical miscues helped neutralize them in the eyes of the public. In 2024, Biden will have an assist from another source: Donald Trump. Among other recent lapses, the former president has called Hungarian Prime Minister Viktor Orbán “the leader of Turkey,” confused Nancy Pelosi and Nikki Haley, and repeatedly expressed the strange belief that he won the 2020 election. With an opponent prone to vastly worse feats of viscous verbosity, Biden can’t help but look better by comparison, especially if he starts playing offense instead of defense.

But none of this will happen by itself. If the president and his campaign want the headlines to be something other than “Yes, Biden Knows Who the President of Egypt Is,” they’ll have to start making news, not reacting to it.

57 notes

·

View notes

Text

"Trump tax package will exacerbate a fiscal crisis for programs like Social Security and Medicare. This is a choice between two fundamentally different visions for our country. If the Trump tax cuts are extended — which Steve Scalise, the Republican House majority leader, recently said he would seek to do in the first one hundred days of a second Trump term — and the corporate tax reductions left undisturbed, our elected leaders will have locked in place priorities that a large majority of Americans say they oppose. Worse, the Trump tax package will exacerbate a fiscal crisis for programs like Social Security and Medicare that are highly popular, including among Republicans."

8 notes

·

View notes

Text

Should Social Security Payments Be Taxed?

Back in August, former President Donald Trump issued a proclamation to voters on Truth Social, “seniors should not pay tax on social security!”

In layman terms, the statement from Trump implies that current retirees should get to keep more money at the expense of future retirees who would receive more painful reductions to benefits in eight years rather than nine.

While that trade-off may or may not appeal to voters in November, the taxation of Social Security benefits needs to be discussed before voters reach the polls in the coming election.

These rules date back 30 years, and Congress hasn't monitored the rules as closely as it should.

On one hand, the taxation of benefits is a vital source of revenue for Social Security. It will generate nearly $60 billion in revenue this year for Social Security, which approximates the contribution of nearly nine million workers who will never collect benefits. Moreover, that revenue is projected to double over the next 10 years.

At the same time, we can’t justify a tax simply because the revenue is important.

For a bit of background, the taxation of benefits was added in 1983 as a compromise to generate income that would be needed to pay benefits far in the future. The policy option accounted for about 33 percent of the total effectiveness of the legislative package, which stabilized the program's projected finances from 2030 through 2057.

Four decades later, the tax reaches an ever-increasing number of people for two reasons.

First, the threshold that triggers the levy is not adjusted for inflation, so the definition of “substantial outside income” falls in real terms every year.

Separately, the components of “outside income” are rising faster than inflation, particularly wages paid to people who are working during retirement.

As a consequence of these factors, more than 50 percent of beneficiaries who file taxes pay a levy on some portion of their benefits. An average worker in the United States working 30 hours per week, would generally expose his or her benefits to a marginal tax rate of more than 40 percent.

4 notes

·

View notes

Text

The IRS says it has collected an additional $360 million in overdue taxes from delinquent millionaires as the agency’s leadership tries to promote the latest work it has done to modernize the agency with Inflation Reduction Act funding that Republicans are threatening to chip away. Leadership from the federal tax collector held a call with reporters Thursday to give updates on how the agency has used a portion of the tens of billions of dollars allocated to the agency through Democrats’ Inflation Reduction Act, signed into law in August 2022. Along with the $122 million collected from delinquent millionaires last October, now nearly half a billion dollars in back taxes from rich tax cheats has been recouped, IRS leaders say. The announcement comes as the IRS braces for a more severe round of funding cuts. The agency cuts previously agreed upon by the White House and congressional Republicans in the debt ceiling and budget cuts package passed by Congress last year — which included $20 billion rescinded from the IRS over two years — would be frontloaded as part of the overall spending package for the current fiscal year that could help avoid a partial government shutdown later this month. IRS Commissioner Daniel Werfel said that “the impact of the rescission that’s being discussed as part of the current budget will not impact our efforts until the later years.” He said the agency would still spend its now-$60 billion allocation over the next 10 years and spread the need for more funding into later years. “Our intent is to spend the money to have maximum impact in helping taxpayers,” he said, “to have maximum impact now and in the immediate future.” “My hope is that as we demonstrate the positive impact that IRA funding is having for all taxpayers, that there will be a need and a desire amongst policymakers at that time to restore IRS funding so that we can continue the momentum that’s having a very positive impact,” Werfel said. As of December, the IRS says it opened 76 examinations into the largest partnerships in the U.S. that include hedge funds, real estate investment partnerships and large law firms. “It’s clear the Inflation Reduction Act funding is making a difference for taxpayers,” Werfel said. “For progress to continue we must maintain a reliable, consistent annual appropriations for our agency.”

15 notes

·

View notes

Text

Biden to Designate Monument Near Grand Canyon, Preventing Uranium Mining

Uranium extraction had already been restricted in the area, which Native tribes consider sacred, but the moratorium was set to expire in 2032. Mr. Biden’s designation will make it permanent.

(The New York Times, 8/8/23) President Biden will designate nearly a million acres of land near the Grand Canyon as a new national monument on Tuesday to protect the area from uranium mining, administration officials confirmed on Monday.

Mr. Biden’s visit to Arizona is part of a nationwide blitz by the White House to translate key policy victories to voters — including a law he signed last year to inject $370 billion in tax incentives into wind, solar and other renewable energy — as the 2024 campaign ramps up. Senior cabinet officials are also touring the country this week, highlighting his domestic agenda.

During his first stop of a three-state tour, Mr. Biden will announce that he is creating a national monument — the fifth such designation of his presidency — in an area sacred to Native American tribes, administration officials told reporters on Monday.

“The mining is off limits for future development in that area,” Ali Zaidi, Mr. Biden’s national climate adviser, told reporters on Air Force One. “It’s focused on preserving the historical resources” in the area.

Native tribes and environmental groups have long lobbied for the government to permanently protect the area around the Grand Canyon from uranium mining, which they say would damage the Colorado River watershed as well as areas with great cultural meaning for Native Americans.

Under the proposed designation, all new uranium mining will be blocked. Uranium mining has already been restricted in the area in question since 2012, but that Obama-era moratorium was set to expire in 2032. Mr. Biden’s designation would make the conditions permanent.

Mr. Biden’s visit to Arizona was also an effort to energize crucial constituency groups in the state, even as much of the American public remains skeptical of his domestic agenda.

Mr. Biden has called the Inflation Reduction Act — major legislation he signed last year that aims to cut planet-warming greenhouse gas emissions — “the largest investment ever in clean energy.” Yet 71 percent of Americans say they have heard “little” or “nothing at all” about the package one year later, according to a Washington Post-University of Maryland poll.

And most Americans — 57 percent — disapprove of his handling of climate change, according to the poll. Surveys show young voters, who turned out in force during the 2020 election, are particularly concerned about global warming.

Some environmental groups were left infuriated when Mr. Biden greenlit a drilling project known as Willow on pristine federal land in Alaska and mandated the sale of offshore drilling leases as part of a deal to pass the climate bill, undermining a campaign promise to ban drilling on federal lands.

“We know that polls don’t tell the entire story,” Karine Jean-Pierre, the White House press secretary, said on Monday when asked about why voters seemingly do not know what it is in Mr. Biden’s bills. As the administration continues to enact the various legislative packages, she said, “we’ll see Americans start to feel what we’ve been able to do in Washington.”

Native Americans were also a crucial voting bloc in Arizona in 2020, when the state voted for a Democratic presidential candidate for the first time since 1996. They made up 6 percent of Arizona’s electorate in 2020, larger than Mr. Biden’s margin for victory, according to the National Congress of American Indians.

More than 80 percent of Native American voters in 2020 agreed with the statement that “the federal government should return lands stolen from Native American tribes,” according to a 2022 poll conducted by the African American Research Collaborative.

“It is likely a strategic decision to focus on the Grand Canyon,” said Gabriel Sanchez, a fellow at the Brookings Institution who has researched voting trends among Native Americans.

“Many Native Americans do not vote based on party, but on which candidates will do the most to advance the interests of Native American communities.”

The National Mining Association called the monument designation “unwarranted” and said it would force the United States to rely on imported uranium from countries like Russia. Representative Bruce Westerman, Republican of Arkansas and the chairman of the House Committee on Natural Resources, blasted Mr. Biden for locking up domestic resources.

“This administration’s lack of reason knows no bounds, and their actions suggest that President Biden and his radical advisers won’t be satisfied until the entire federal estate is off limits and America is mired in dependency on our adversaries for our natural resources,” Mr. Westerman said in a statement.

The administration has argued that the proposed monument represents only 1.3 percent of the nation’s known uranium reserves.

“This is going to be a limit on future development in this space while being respectful of existing rights,” Mr. Zaidi said.

The area in question is called Baaj Nwaavjo I’tah Kukveni — Baaj Nwaavjo, meaning “where tribes roam,” for the Havasupai people, and I’tah Kukveni, or “our footprints,” for the Hopi tribe.

Earlier this year Mr. Biden created a new national monument, Spirit Mountain, in Nevada, insulating from development a half-million acres that are revered by Native Americans. He also restored and expanded protections for Bears Ears National Monument and Grand Staircase-Escalante in Utah, sites that are sacred to Native Americans and that had been opened to mining and drilling by the Trump administration.

In June, the Biden administration banned drilling for 20 years around Chaco Canyon in New Mexico, one of the nation’s oldest and most culturally significant Native American sites. (Source)

32 notes

·

View notes

Text

Mike Luckovich

* * * *

LETTERS FROM AN AMERICAN

May 8, 2024

HEATHER COX RICHARDSON

MAY 09, 2024

Today, in Racine, Wisconsin, President Joe Biden announced that Microsoft is investing $3.3 billion dollars to build a new data center that will help operate one of the most powerful artificial intelligence systems in the world. It is expected to create 2,300 union construction jobs and employ 2,000 permanent workers.

Microsoft has also partnered with Gateway Technical College to train and certify 200 students a year to fill new jobs in data and information technology. In addition, Microsoft is working with nearby high schools to train students for future jobs.

Speaking at Gateway Technical College’s Racine campus, Biden contrasted today’s investment with that made by Trump about the same site in 2018. In that year, Trump went to Wisconsin for the “groundbreaking” of a high-tech campus he claimed would be the “eighth wonder of the world.”

Under Republican governor Scott Walker, Wisconsin legislators approved a $3 billion subsidy and tax incentive package—ten times larger than any similar previous package in the state—to lure the Taiwan-based Foxconn electronics company. Once built, a new $10 billion campus that would focus on building large liquid-crystal display screens would bring 13,000 jobs to the area, they promised.

Foxconn built a number of buildings, but the larger plan never materialized, even after taxpayers had been locked into contracts worth hundreds of millions of dollars for upgrading roads, sewer system, electricity, and so on. When voters elected Democrat Tony Evers as governor in 2022, he dropped the tax incentives from $3 billion to $80 million, which depended on the hiring of only 1,454 workers, reflecting the corporation’s current plans. Foxconn dropped its capital investment from $10 billion to $672.8 million.

In November 2023, Microsoft announced it was buying some of the Foxconn properties in Wisconsin.

Today, Biden noted that rather than bringing jobs to Racine, Trump’s policies meant the city lost 1,000 manufacturing jobs during his term. Wisconsin as a whole lost 83,500. “Racine was once a manufacturing boomtown,” Biden recalled, “all the way through the 1960s, powering companies—invented and manufacturing Windex…portable vacuum cleaners, and so much more, and powered by middle-class jobs.

“And then came trickle-down economics [which] cut taxes for the very wealthy and biggest corporations…. We shipped American jobs overseas because labor was cheaper. We slashed public investment in education and innovation. And the result: We hollowed out the middle class. My predecessor and his administration doubled down on that failed trickle-down economics, along with the [trail] of broken promises.”

“But that’s not on my watch,” Biden said. “We’re determined to turn it around.” He noted that thanks to the Democrats’ policies, in the past three years, Racine has added nearly 4,000 jobs—hitting a record low unemployment rate—and Wisconsin as a whole has gained 178,000 new jobs.

The Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act have fueled “a historic boom in rebuilding our roads and bridges, developing and deploying clean energy, [and] revitalizing American manufacturing,” he said. That investment has attracted $866 billion in private-sector investment across the country, creating hundreds of thousands of jobs “building new semiconductor factories, electric vehicles and battery factories…here in America.”

The Biden administration has been scrupulous about making sure that money from the funds appropriated to rebuild the nation’s infrastructure and manufacturing base has gone to Republican-dominated districts; indeed, Republican-dominated states have gotten the bulk of those investments. “President Biden promised to be the president of all Americans—whether you voted for him or not. And that’s what this agenda is delivering,” White House deputy chief of staff Natalie Quillian told Matt Egan of CNN in February.

But there is, perhaps, a deeper national strategy behind that investment. Political philosophers studying the rise of authoritarianism note that strongmen rise by appealing to a population that has been dispossessed economically or otherwise. By bringing jobs back to those regions that have lost them over the past several decades and promising “the great comeback story all across…the entire country,” as he did today, Biden is striking at that sense of alienation.

“When folks see a new factory being built here in Wisconsin, people going to work making a really good wage in their hometowns, I hope they feel the pride that I feel,” Biden said. “Pride in their hometowns making a comeback. Pride in knowing we can get big things done in America still.”

That approach might be gaining traction. Last Friday, when Trump warned the audience of Fox 2 Detroit television that President’s Biden’s policies would cost jobs in Michigan, local host Roop Raj provided a “reality check,” noting that Michigan gained 24,000 jobs between January 2021, when Biden took office, and May 2023.

At Gateway Technical College, Biden thanked Wisconsin governor Tony Evers and Racine mayor Cory Mason, both Democrats, as well as Microsoft president Brad Smith and AFL-CIO president Liz Schuler.

The picture of Wisconsin state officials working with business and labor leaders, at a public college established in 1911, was an image straight from the Progressive Era, when the state was the birthplace of the so-called Wisconsin Idea. In the earliest years of the twentieth century, when the country reeled under industrial monopolies and labor strikes, Wisconsin governor Robert “Fighting Bob” La Follette and his colleagues advanced the idea that professors, lawmakers, and officials should work together to provide technical expertise to enable the state to mediate a fair relationship between workers and employers.

In his introduction to the 1912 book explaining the Wisconsin Idea, former president Theodore Roosevelt, a Republican, explained that the Wisconsin Idea turned the ideas of reformers into a workable plan, then set out to put those ideas into practice. Roosevelt approvingly quoted economist Simon Patten, who maintained that the world had adequate resources to feed, clothe, and educate everyone, if only people cared to achieve that end. Quoting Patten, Roosevelt wrote: “The real idealist is a pragmatist and an economist. He demands measurable results and reaches them by means made available by economic efficiency. Only in this way is social progress possible.”

Reformers must be able to envision a better future, Roosevelt wrote, but they must also find a way to turn those ideals into reality. That involved careful study and hard work to develop the machinery to achieve their ends.

Roosevelt compared people engaged in progressive reform to “that greatest of all democratic reformers, Abraham Lincoln.” Like Lincoln, he wrote, reformers “will be assailed on the one side by the reactionary, and on the other by that type of bubble reformer who is only anxious to go to extremes, and who always gets angry when he is asked what practical results he can show.” “[T]he true reformer,” Roosevelt wrote, “must study hard and work patiently.”

“It is no easy matter actually to insure, instead of merely talking about, a measurable equality of opportunity for all men,” Roosevelt wrote. “It is no easy matter to make this Republic genuinely an industrial as well as a political democracy. It is no easy matter to secure justice for those who in the past have not received it, and at the same time to see that no injustice is meted out to others in the process. It is no easy matter to keep the balance level and make it evident that we have set our faces like flint against seeing this government turned into either government by a plutocracy, or government by a mob. It is no easy matter to give the public their proper control over corporations and big business, and yet to prevent abuse of that control.”

“All through the Union we need to learn the Wisconsin lesson,” Roosevelt wrote in 1912.

“We’re the United States of America,” President Biden said today, “And there’s nothing beyond our capacity when we work together.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Biden Administration#election 2024#infrastructure#jobs#economic reality

7 notes

·

View notes

Text

"Donald Trump's Plan for America is called "Agenda47" and it's a helluva thing.

Here are the top ten worst agenda items:

#1 Agenda47: President Trump Calls for Death Penalty for Human Traffickers President Donald J. Trump pledged to end the scourge of human trafficking and defend the dignity of human life.

This is the worst. Firstly, capital punishment is reserved for people who have committed murder (eye for an eye) of the most horrible and horrific crimes, involving mass casualties, rape, torture and/or mutilation. Human trafficking is not that, but honestly, if someone was murdered during the process of human trafficking that would probably already be covered. This standard is supported by SCOTUS case law, so without murder, it might not even be possible legally.

Secondly, this reminds me of Trump's call for the death penalty against the Exonerated Central Part 5 who were children at the time. He wanted them executed even though the victim, who was assaulted and raped, survived the attack. She was hurt badly but it simply wasn't a capital offense, and the judicial murder of children is an international crime.

Continued.

#2 Agenda47: Protecting Students from the Radical Left and Marxist Maniacs Infecting Educational Institutions For many years, tuition costs at colleges and universities have been exploding, and I mean absolutely exploding while academics have been obsessed with indoctrinating America's youth. The time has come to reclaim our once great educational institutions from the radical Left, and we will do that

This isn't about tuition costs, it's about the same cultural indoctrination, book-banning, censorship, harassment, intimidation, reverse-racism CRT and Trans panic that we've seen in Florida. Trump wants to take that crap national. He liked this idea so much, he listed it twice.

#3 Agenda47: Using Impoundment to Cut Waste, Stop Inflation, and Crush the Deep State I will use the president’s long-recognized Impoundment Power to squeeze the bloated federal bureaucracy for massive savings. This will be in the form of tax reductions for you. This will help quickly to stop inflation and slash the deficit.

This is about purging the government of his enemies and dissidents. Anyone who might impede or resist the agenda. Notice he doesn't mention anything about keeping the function and implementation of government in good quality. He doesn't care about whether government employees do their jobs well and efficiently - he just wants payback against the so-called "Deep state." It also won't lead to tax cuts because that would have to be separate legislation. And it's a laugh to expect that you would reduce the deficit with a job purge, people that aren't working don't pay taxes - so incoming receipts go down and the deficit goes up. Trump promised to "eliminate the debt" the first time, but in the end, his tax cuts increased the deficit by $400 Billion during his first 3 years, then another $2.2 Trillion with his 2 Covid recovery packages. He left office with a deficit of $3.3 Trillion.

#4 Agenda47: Ending the Scourge of Drug Addiction in America Too often, our public health establishment is too close to Big Pharma—they make a lot of money, Big Pharma—big corporations, and other special interests, and does not want to ask the tough questions about what is happening to our children’s health.

This is a laugh because the GOP would never let him undercut their donor base with massive cuts to pharma. Yes, they do make a lot of money - and they spend a lot of it on Congress, they aren't letting him destroy their cash cow. The GOP doesn't like that Medicare can negotiate with big Pharma now, they aren't letting everyone do it. However, the larger problem of actual *addiction* won't be solved by making drugs cheaper. It's pretty arrogant of him to think he can solve a problem he doesn't begin to understand.

#5 Agenda47: Day One Executive Order Ending Citizenship for Children of Illegals and Outlawing Birth Tourism As part of my plan to secure the border, on Day One of my new term in office, I will sign an executive order making clear to federal agencies that under the correct interpretation of the law, going forward, the future children of illegal aliens will not receive automatic U.S. citizenship

It's kinda cute and pathetic that he thinks he can reverse most of the 14th Amendment with an executive order. Who the fuck taught this guy "government?" Yeah, Let me just cross out the bit that reversed the Dred Scott decision that said that no one of African descent was a citizen using a Sharpie. Besides the Xenophobia of this "Anchor Baby" shit - just imagine the potential ethnic and racial abuse possible with something like this in place.

#6 Agenda47: Ending the Nightmare of the Homeless, Drug Addicts, and Dangerously Deranged For a small fraction of what we spend upon Ukraine, we could take care of every homeless veteran in America. Our veterans are being treated horribly.

You can end homelessness, drug addiction *and* mental illness for less than the cost of Ukraine? Wait I thought you already fixed drug addiction, why is that still a problem? it's simply amazing what you can accomplish with just 1/5th of the VA budget.

#7 Agenda47: Rescuing America’s Auto Industry from Joe Biden’s Disastrous Job-Killing Policies Joe Biden is waging war on the U.S. auto-industry with a series of crippling mandates designed to force Americans into expensive electric cars, even as thousands of electric cars are piling up on car lots all unsold,” President Trump said. “This ridiculous Green New Deal crusade is causing car prices to skyrocket while setting the stage for the destruction of American auto production.

The auto industry is doing fine and EV sales are expected to reach 35% of the market soon. The only really "expensive" EVs are Teslas [some of them], most of the rest of them and hybrids are completely affordable. Plus what you save on not buying gas which keeps us dependent on states like Saudi Arabia, Iran and Russia. The Green New Deal didn't pass. Also, jobs are doing fine also. Better than literally ever.

#8 Agenda47: Liberating America from Biden’s Regulatory Onslaught No longer will unelected members of the Washington Swamp be allowed to act as the fourth branch of our Republic

You mean like Train Safety regulations that could have prevented the East Palestine disaster? Or regulation that could have prevented Silicon Valley Bank from collapsing? Or the regulation rollback that led to the Great Recession? Or the ones that led to Enron? Cutting regulations is supposed to boost the market just like cutting taxes, but Trump's GDP never got near the 5% he predicted, it averaged at 1.7% pre-Covid and went negative after. Biden's first year had over 5% GDP.

#9 Agenda47: Rebuilding America’s Depleted Military In a new Agenda47 video, President Donald J. Trump announced his plan to rebuild America’s depleted military, address the military recruitment crisis, and restore the proud culture and honor of America’s armed forces.

The Military is simply not "depleted" - military spending went from $758 Billion in 2021 to $814 Billion in 2023. What he really means is that he's going to replenish the stock prices for Defense Contractors.

#10 Agenda47: Ending Biden’s War on the Suburbs That Pushes the American Dream Further From Reach President Donald J. Trump announced his plan to end Joe Biden’s war on America’s suburbs in a new Agenda47 video. Biden’s proposed rule that every state, county, and city submit “equity plans” to the federal government will push the American dream out of reach for countless American families.

So we're still suffering from decades of deliberate racial terrorism, redlining, spreading pollution, jobs deserts and education deserts - but let's not consider trying to *FIx* any of what was deliberately and purposefully broken over the last 2 centuries. Let's just leave it all fucked up. the way it already is.

White Power Y'all. Yeah, 'Murica!"

9 notes

·

View notes

Text

Boost Your Bottom Line: Exploring Tax Reduction Packages for Small Businesses

As a small business owner, navigating the intricate landscape of taxes can be daunting. However, the prospect of reducing your tax burden and increasing your bottom line is undoubtedly appealing. To achieve this goal, consider exploring tax reduction packages tailored for small businesses. These packages offer targeted strategies to optimize your financial position. Here are key components of effective tax reduction packages:

Depreciation and Expensing: Take advantage of tax laws that allow you to depreciate the cost of business assets over time. Additionally, consider expensing assets through Section 179, which permits immediate deductions for qualifying equipment and property purchases.

Tax Credits: Investigate available tax credits for small businesses. This may include credits for research and development, hiring certain types of employees, or providing access to disabled individuals.

Employee Benefits: Implementing tax-advantaged employee benefit programs can benefit both your business and your team. Health savings accounts (HSAs), flexible spending accounts (FSAs), and retirement plans can offer tax advantages for both employers and employees.

Work Opportunity Tax Credit (WOTC): If your business hires individuals from specific target groups facing barriers to employment, you may qualify for the WOTC. This credit encourages employers to hire individuals who may have difficulty finding work.

Energy-Efficient Upgrades: Explore tax incentives for making energy-efficient improvements to your business premises. Many governments offer tax breaks for investments in renewable energy, energy-efficient lighting, HVAC systems, and more.

Research and Development (R&D) Tax Credit: Encourage innovation within your business and potentially qualify for R&D tax credits. This credit is designed to reward businesses that invest in research to develop new products or improve existing ones.

State and Local Incentives: Don't overlook potential tax reduction opportunities at the state and local levels. Many regions offer specific incentives, grants, or tax breaks to encourage business growth and investment.

Consult a Tax Professional: Engaging with a tax professional or accountant who specializes in small business taxation is crucial. They can help you navigate the complex tax landscape, identify eligible deductions, and ensure compliance with changing tax laws.

By actively exploring and implementing these components of tax reduction packages, small business owners can strategically minimize their tax liability. This, in turn, frees up resources that can be reinvested in the business, fostering growth and sustainability. Remember, staying informed and seeking professional advice are essential steps in maximizing the benefits of tax reduction packages for your small business.

0 notes

Text

@beatrice-otter wrote this on May 26 (reposted with permission)

I want to push back on the battle "not being about progress?' Because Biden has accomplished a lot, actually, especially given a Republican-controlled House. One could argue that he hasn't gone far enough, but that's not the same as having accomplished nothing. So here's some things Biden has done:

1) Raised taxes on the wealthy and corporations.

2) Highest appointment of federal judges since Reagan. Reagan started a trend of Republicans packing federal courts with uber-conservative judges, and blocking Democrat appointments, which is how we ended up with our current Supreme Court. Biden is doing his absolute best to turn the scales back the other direction by appointing as many liberal and left-wing judges as he can, as fast as he can.

3) $1.2 trillion dollar infrastructure package that will pour federal money into things like public transit, high-speed internet in places that don't have it (which are overwhelmingly poor, and cut off from the rest of the world), and a whole lot of other basic things that make life easier for ordinary people.

4) Halted Federal executions. This doesn't affect state-level convictions, but it does affect federal-level executions; those are completely off the table for as long as he (or any other) Democrat is President. (13 people were executed under Trump)

5) Rejoining the Paris Climate Accords and pushing for other environmental care legislation,

6) Pushed through the "Inflation Reduction Act" (named that to get Republicans to be willing to allow it through). It's actually the largest climate bill in U.S. history and allows Medicare to negotiate the prices of certain prescription drugs for the first time. It includes 369 billion for a climate initiative to reduce greenhouse emissions and promote lean energy technologies. $300 billion in new revenue through a corporate tax increase. $80 billion for the Internal Revenue Service to hire new agents, modernize its technology, audit the wealthy and more. A $2,000 annual cap for out-of-pocket prescription drug costs for those insured by Medicare.

6) Overturned Trump's ban on transgender people serving in the military.

7) Re-authorized the Violence Against Women Act

8) Pardoned marijuana

9) Forgave student loan debt (this one the Republicans in congress managed to partially stymie, but that's not Biden's fault--it's the Republicans).

10) Managed to get a modest gun-safety bill through the gauntlet of Republican opposition. (The first one anyone's managed to get passed in decades.) It's far from perfect, or enough, but it did expand background checks on gun purchases and made it easier to prosecute illegal gun trafficking. And the reason it was as weak as it was, is because the Republicans have a majority in the House and they blocked anything stronger, it's the Republicans' fault. Not Biden's. If we want sensible nationwide gun control, we have GOT to get the House a Democrat majority.

11) Passed a long-stalled Post Office reform bill.

There's a lot there! And the things that he promised but didn't manage to achieve, he put them before Congress and the Republicans in the House stopped them. If Democrats controlled the House as well as the Senate, most of them would have passed and now be the law of the land! The problem is not Biden.

Biden may not be very exciting, and he may not be as far left as we want. But he's still got a lot done in the last three years.

8 notes

·

View notes

Text

Lula Cuts Car Taxes in Bid to Revive Brazil’s Ailing Auto Sector

President Luiz Inacio Lula da Silva rolled out a series of tax breaks to make low-priced vehicles more accessible for working families, as he looks to breathe fresh life into Brazil’s battered manufacturing sector.

The government on Thursday unveiled a package of tax reductions on vehicles that cost 120,000 reais ($23,875) or less, measures it projects will reduce sticker prices as much as 10.79%.

The reduction “will take into account the social aspect, it will not make discounts for an expensive car,” Vice President Geraldo Alckmin said at the presidential palace in Brasilia, after he and Lula met with automotive industry leaders.

The discounts are part of Lula’s efforts to resurrect Brazil’s once-mighty automotive industry, and with it his nation’s image as an economic heavyweight, as high interest rates deepen the challenges facing it.

Continue reading.

#brazil#politics#economy#auto industry#brazilian politics#mod nise da silveira#image description in alt

9 notes

·

View notes

Text

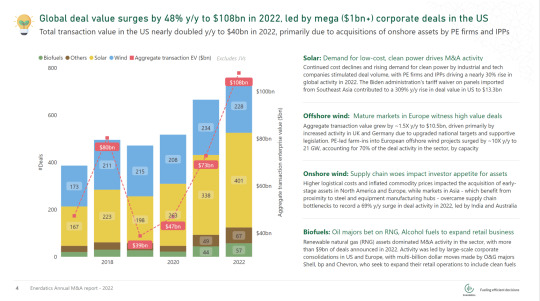

Renewable Energy M&A hits a record high of $100bn!

The global deal value surged by 48% y/y to $108bn in 2022; transacted capacity more than doubled to 740 GW. Corporate consolidations in the US and acquisitions of offshore wind assets in Europe were the major contributors to this rise.

Enerdatics has published its annual analysis of renewable energy transactions, globally. To access the full copy of this report, kindly visit enerdatics.com.

In the US, large, integrated power producers and oil majors expanded their presence in the onshore wind, solar and biofuels segments, fueled by incentives offered under the Inflation Reduction Act (IRA). The Biden administration’s waiver of import tariffs on solar panels from certain Southeast Asian countries improved the outlook for the US’s solar sector, contributing to a 309% y/y rise solar deal value during the year. Meanwhile, clean fuel tax credits and the rising demand to decarbonize domestic heating and power spurred billion-dollar investments in renewable natural gas (RNG) and alcohol fuels assets by bp and Chevron.

In Europe, private equity (PE)-led farm-ins in offshore wind assets, primarily in the UK and Germany accounted for ~40% of the region's transaction value. Ambitious government targets and supportive legislation, such as Germany’s Easter Package, drove deal activity. Further, the EU's plan to offset 3.5 billion cubic metres of Russian gas annually and efforts to decarbonize fossil fuel-based power and heating is spurring investments in renewable natural gas and energy-from-waste platforms. Shell and KKR led activity in the sector during the year.

APAC accounted for $19bn of transactions during the year, with India emerging as the premier market in the region. Onshore wind M&A activity surged by 69% y/y, as countries in the region overcame supply chain bottlenecks due to proximity to steel and equipment manufacturing hubs. Additionally, continued elevated prices of oil, coal, and LNG drove C&I customers to turn to corporate power purchase agreements, leading to a surge in interest for assets backed by bilateral contracts

LatAm deal value surged by 314% y/y, with Brazil accounting for 84% of the region’s transaction value. A 2021 regulation that allows companies to sign dollar-denominated PPAs incentivized foreign investment in Brazil's renewables sector by reducing forex risk. Meanwhile, Chile recorded $1bn of deals in 2022, however, transmission bottlenecks continue to impact investor appetite in the country.

PS: The above analysis is proprietary to Enerdatics’ energy analytics team, based on the current understanding of the available data. The information is subject to change and should not be taken to constitute professional advice or a recommendation.

12 notes

·

View notes

Photo

On this day in 2022, the Inflation Reduction Act — a sweeping economic package that aims to increase job creation, raise taxes on large corporations, lower the costs of some prescription drugs and invest in addressing climate change — was signed into law.

2 notes

·

View notes

Text

Matt Wuerker, Politico

* * * *

LETTERS FROM AN AMERICAN

October 30, 2023

HEATHER COX RICHARDSON

OCT 31, 2023

After three weeks without a speaker, the House today tackled one of the key items on its agenda: providing additional funding for Israel and Ukraine. Immediately, the majority under Speaker Mike Johnson (R-LA) made it clear that they have every intention of pushing their extremist agenda. Despite pressure from Republican Senate minority leader Mitch McConnell (R-KY), they have split funding for Israel away from the funding for Ukraine and funding for humanitarian assistance for Ukraine, Israel, and Gaza that President Biden has requested.

They have gone further, though, to push the far right’s agenda. The House Republicans’ $14.3 billion aid package for Israel claims that it will “offset” that spending by taking $14.3 billion from funding for the Internal Revenue Service (IRS) passed by Congress in the Inflation Reduction Act. But this “offset” is nothing of the sort: funding the IRS brings in significantly more than it costs. For each dollar spent auditing the top 1% of U.S. earners, the IRS brought in $3.18; for each dollar spent auditing the top 0.1%, it brought in $6.29.

In September the IRS noted that it recovered $38 million in delinquent taxes from 175 high-income taxpayers within a few months and would be increasing that effort. A 2021 study showed that people whose income is in the top 1% of earners fail to report more than 20% of their earnings to the IRS.

The House measure, providing aid for Israel only if Democrats agree to set aside Ukraine and Gaza and permit rich people to cheat on their taxes, will set up a fight with the Senate.

Tonight, White House press secretary Karine Jean-Pierre released a statement saying the Republicans’ politicization of our national security interests is a “nonstarter. Demanding offsets for meeting core national security needs of the United States—like supporting Israel and defending Ukraine from atrocities and Russian imperialism—would be a break with the normal, bipartisan process and could have devastating implications for our safety and alliances in the years ahead.”

She noted that there is strong bipartisan agreement that it is in our national security interest to stop the suffering of innocent people in Gaza, “help Ukraine defend its sovereignty against appalling crimes being committed by Russian forces against thousands of innocent civilians,” and invest more in border security.

“Threatening to undermine American national security unless House Republicans can help the wealthy and big corporations cheat on their taxes—which would increase the deficit—is the definition of backwards,” she said.

The chaos among the Republicans and the emergence of a Christian nationalist as their choice to lead the House seem to have drawn increased attention to the successes of the president.

Today, for example, the United Auto Workers announced a tentative deal with General Motors, marking the third such agreement in the union’s six-week strike against GM, Ford, and Stellantis. The agreements include a 25% raise in base wages over 4.5 years, after years in which workers’ pay did not keep up with inflation. The agreements will also protect workers against the conversion to electric vehicles, helping unionized workers to make the transition to a green economy, and reopen certain closed plants.

As Jeanne Whalen noted in the Washington Post, this agreement comes after United Parcel Service (UPS) workers this summer won their strongest contract in decades and 75,000 striking Kaiser healthcare workers won strong wage increases.

Biden was the first president to join a picket line when he stood with the UAW. Today, he said: “Today's historic agreement is yet another piece of good economic news showing something I have always believed: Worker power…is critical to building an economy from the middle out and the bottom up…. We’re finally beginning to build an economy that works for working people, for the middle class, for the entire…country, including the companies.

“Because when we do that, the poor have a ladder up, the middle class does well, and the wealthy still do very well. We all do well.”

As Michael Tomasky put it in The New Republic, “We have a president who takes seriously the fundamental economic fact of American life of the last 40 years, which is that trillions of dollars of wealth have been transferred from the lower and middle classes to the top 1 percent, and even to the top 0.1 percent. Moreover, it’s rivetingly clear that he thinks that it’s long past time to get that river flowing in the other direction.”

In The Bulwark, Jill Lawrence wrote that Biden has a “surprising focus on the future” as he “moves to meet U.S. challenges that former President Donald Trump largely ignored, failed at, or made worse.” She noted Biden’s achievement of infrastructure legislation after Trump failed, and contrasted Biden’s successful CHIPS and Science Act with the trade war of the Trump years, which cost as many as 245,000 jobs and so badly hurt midwestern farmers that 90% of the proceeds from Trump’s tariffs went to bail them out.

Biden also has looked forward by pushing and securing the Inflation Reduction Act, which invests in a transition to a green economy.

But Lawrence’s focus was primarily on today’s sweeping executive order on artificial intelligence, an order��Politico called “the most significant single effort to impose national order on a technology that has shocked many people with its rapid growth.” The administration has been working to establish responsible AI practices, recognizing the need to address discriminatory algorithms, data privacy violations, and deep fakes.

Today, Biden signed an executive order requiring companies to share safety information about their systems before allowing them to be used, in order to make sure they don’t pose a safety or a national security risk. It orders the Departments of Defense and Homeland Security to secure critical infrastructure. It will require AI-generated content to bear a watermark that clearly labels it. It will protect personal data, and Biden promised he would ask Congress for legislation to pass bipartisan legislation to stop technology companies from collecting the personal data of children and teenagers, to ban advertising directed at children, and to limit companies’ collection of personal data in general.

The Information Technology and Innovation Foundation, a technology think tank, applauded the order, saying its guidelines set “a clear course for the United States…. With this EO, the United States is demonstrating it takes AI oversight seriously.”

Vice President Kamala Harris will attend the two-day AI Safety Summit meeting in the United Kingdom on November 1–2 as the European Union closes in on laws about artificial intelligence that would enable the E.U. to shut down services that harm society. The E.U. has been ahead of the U.S. in its regulation of the internet: in August 2023 its Digital Services Act went into effect, requiring users to agree to the use of their personal data for targeted advertising and requiring digital platforms to police the disinformation on their platforms. Most of the companies it regulates are based in the United States.

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Clown Car Republicans#MAGA#crazy#Matt Wuerker#Letters from An American#Heather Cox Richardson#Biden Administration#Clown Congress#Bad Fatih Republicans#National Security

7 notes

·

View notes

Text

The landscape of plastic waste management in the UK faces an urgent call for transformation as the nation strives to achieve its ambitious recycling targets by 2035. Recent insights provided in collaboration with RECOUP outline a clear direction, shedding light on the essential changes required to meet set goals. Irina Ankudinova, the Sustainability & Circularity Manager at RECOUP, stresses that the BPF Recycling Roadmap serves as a vital framework for identifying both the opportunities and challenges that define the journey toward maximising plastic material circularity in the UK. In its latest edition, the roadmap paints a picture of a future with substantial potential. However, it simultaneously warns of the detrimental impacts of complacency. The call for collaboration is paramount; government, businesses, and citizens must unite to cultivate a plastic recycling system that can not only meet but exceed the expectations set forth. While the inaugural version of this roadmap surfaced in 2021, implementation of many critical changes remains elusive. The UK had initially aimed for a 69% plastic recycling rate by 2030; however, numerous delays in government policies and persistent economic challenges have hindered progress. This context underscores an urgent demand for concerted action from all stakeholders. One of the primary areas highlighted in the report is the pressing need for robust government support to improve the recycling infrastructure. Both mechanical and chemical recycling methods stand at a crossroads, requiring substantial investment to flourish. According to the report, projections indicate that the UK's capacity for chemical recycling by 2030 may fall short by a staggering 200,000 tonnes compared to earlier forecasts. However, the promise remains; with focused investment and crucial policy revisions—particularly regarding the clarification of mass balance methodology within the Plastic Packaging Tax—up to 400,000 tonnes of chemically recycled material could realistically be achieved by 2035. Despite these setbacks, the BPF remains cautiously optimistic. The potential to achieve a 70% plastic reuse and recycling rate by 2035 is still within reach. This includes an ambitious forecast indicating that 23% more plastic could be mechanically recycled and a further 6% subject to chemical recycling, significantly diminishing the reliance on energy recovery methods. Such progress would also contribute to a notable 15% reduction in plastic waste being sent to incineration, while an impressive 13% of total plastic waste could be reused effectively. These advancements could collectively lead to a reduction of approximately one million tonnes in carbon emissions when compared to the worst-case scenario. For the UK to realise these ambitious goals, the BPF outlines three critical actions that must be taken. First, enhancing public awareness and participation will play a vital role in the recycling landscape, inspiring individuals to take ownership of their waste. Second, establishing a clear regulatory framework will ensure businesses understand their responsibilities while allowing them to innovate. Finally, substantial investments must be funneled into recycling infrastructure to accommodate the required advancements. Helen Jordan, BPF Sustainability Manager, emphasized the significance of these forecasts, calling them milestones that are realistic yet deliberately ambitious. The BPF believes that the UK possesses the potential to rise as a leader in the sound management of plastic waste if a paradigm shift occurs in how society views plastic items that have completed their initial life cycle. “We must advocate for improvements to systems and legislation that nurture investment,” she explains. Furthermore, the roadmap not only addresses the technical aspects of recycling but also delves into necessary cultural shifts. As plastic waste becomes increasingly prominent in global discussions on sustainability, the responsibility to tackle this issue lies with all sectors of society.

Businesses, government bodies, and the public must cultivate a culture of recycling that sees waste not as an end, but as a resource waiting to be transformed. The quest for effective plastic recycling in the UK is undoubtedly a complex challenge. However, the commitment to a collaborative approach, supported by a robust framework such as the BPF Recycling Roadmap, can lay the groundwork for success. Each stakeholder has a role to play, ensuring that the UK not only reaches its targets but sets an inspiring precedent for others to follow. As the clock ticks towards 2035, it remains clear that the road to achieving a sustainable plastic recycling ecosystem requires innovative thinking, substantial investment, and unwavering collaboration. Only with a united effort can the UK cultivate a future where plastic waste is effectively managed and where circularity becomes the norm rather than the exception.

#Science#AesopCareersBeautyIndustrySustainabilityJobOpportunities#MicroplasticsSustainabilityRecyclingInnovationEnvironmentalImpactCircularEconomy#circulareconomy#plasticrecycling#wastemanagement

0 notes