#Tax CPA

Explore tagged Tumblr posts

Text

life lately: studying for the cpa exam 📕🧠📝💗

some motivational pics for myself b/c i'm deep into studying for the cpa exam and the light at the end of the tunnel for me is passing scores 😅🥹🤞

#academia barbie#academic validation#pink academia#pretty academia#that girl#girl blogger#motivation#becoming that girl#glow up#it girl#business student#business studies#accounting student#pink moodboard#study blog#study aesthetic#study motivation#studyblr#studyspo#student life#studying#cpa exam#tax#management#finance#certified public accountant

279 notes

·

View notes

Text

Ready to grow your tax filing business? Check out our proven strategies to attract more clients during tax season and build lasting relationships!

Visit us for more info:👉 🌐 www.varundigitalmedia.com 👉 📧 [email protected] 👉 📲 (+1) 877-768-2786

#taxseason#digitalmarketing#strategies#taxfiling#cpa#cpafirms#cpamarketing#targetedads#paidadsforcpa#provenstrategies#socialmediamarketing#taxes#tax#accounting#business#smallbusiness#taxpreparer#bookkeeping#taxprofessional#taxrefund#accountant#taxreturn#finance#entrepreneur#taxtips#businessowner#accountingservices#taxation

9 notes

·

View notes

Text

we advert taxes here not evade, phrasing matters

#.shitpost#Anyways I have a thought of merit soon other than#Varric is coming for everyone’s back taxes#Even his own my god#My father not of blessed memory because the magpie is still rolling around says this every tax season to me and I’m like stop you’re a CPA#And I could be audited by the government for breathing wrong

6 notes

·

View notes

Note

HAVE YOU PAID YOUR TAXES YET?

"He's been doing my taxes for like 3 years and I have no idea how to do a contract work tax form. I'm either gonna do it with my parents or Silo's dad, who is very good with numbers, soon though."

#tmi tuesday#My CPA was able to like cut my taxes from 1.8k to 800 last year it was insane#no one is gonna be able to do that for me now and I'm kinda scared of the amount I'll have to pay

16 notes

·

View notes

Text

The tax system is an unnecessary hassle for anyone too poor to make hiring a personal CPA to find loopholes worth the expense.

#The tax system is an unnecessary hassle for anyone too poor to make hiring a personal CPA to find loopholes worth the expense.#irscompliance#irs audit#irsforms#irs1099form#irs#fuck the irs#cpa#loophole#expenses#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

3 notes

·

View notes

Text

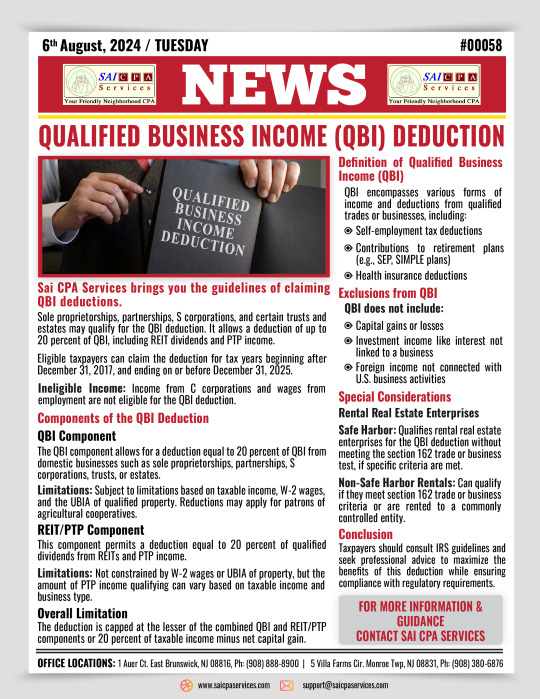

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#irs#tax debt#audit#tax compliance#peace of mind#business growth#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#representation#news#breaking news

2 notes

·

View notes

Text

Elevate Your Financial Strategy: CPA Firms in India from Mas LLP

In the intricate landscape of financial management, businesses seek expertise and reliability to navigate complex regulations and optimize their financial strategies. That's where Certified Public Accountant (CPA) firms play a crucial role. At Mas LLP, we offer top-notch CPA services tailored to meet the diverse needs of businesses in India. Let's delve into the significance of CPA firms and how Mas LLP stands out in delivering exceptional financial solutions. Why Choose CPA Firms in India?

1. Expertise and Accreditation: Certified Public Accountants are professionals with extensive training and accreditation in accounting, auditing, taxation, and financial management. Choosing a CPA firms in India ensures access to highly skilled professionals who can provide expert advice and guidance on a wide range of financial matters.

2. Comprehensive Financial Services: CPA firms in India offer a comprehensive suite of financial services, including audit and assurance, tax planning and compliance, financial reporting, and advisory services. Whether you're a small startup or a large corporation, CPA firms provide tailored solutions to address your specific financial needs and challenges.

3. Regulatory Compliance: In today's regulatory environment, compliance with accounting and tax regulations is essential for businesses to avoid penalties and legal repercussions. CPA firms help businesses stay compliant with applicable laws and regulations, ensuring accurate financial reporting and tax filings.

4. Strategic Planning: Beyond compliance, CPA firms in India assist businesses in strategic financial planning and decision-making. By analyzing financial data and market trends, CPAs help businesses identify growth opportunities, mitigate risks, and optimize their financial performance for long-term success.

5. Audit and Assurance Services: For businesses requiring independent assurance on their financial statements, CPA firms in India provide audit and assurance services to verify the accuracy and reliability of financial information. Audited financial statements enhance transparency and credibility, instilling confidence among stakeholders and investors. Mas LLP: Your Trusted CPA Firms in India At Mas LLP, we combine expertise, experience, and dedication to deliver unparalleled CPA services to businesses across India. Here's why Mas LLP stands out as your premier choice:

1. Expert Professionals: Our team comprises highly skilled and experienced CPAs who possess in-depth knowledge of Indian accounting standards, tax laws, and regulatory requirements.

2. Customized Solutions: We understand that every business is unique, which is why we offer personalized solutions tailored to meet your specific financial needs and objectives.

3. Commitment to Excellence: We are committed to delivering excellence in everything we do, from providing expert advice and guidance to delivering timely and accurate financial services.

4. Client-Centric Approach: At Mas LLP, we prioritize client satisfaction and strive to exceed expectations by delivering exceptional service and value.

5. Industry Experience: With years of experience serving clients across various industries, we have the expertise to address the unique challenges and opportunities facing your business. In conclusion, choosing a CPA firm like Mas LLP can help businesses in India navigate complex financial landscapes, achieve compliance, and optimize their financial performance. Contact us today to learn more about our CPA firms in India and how we can help elevate your financial strategy.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#CPA firms in India

3 notes

·

View notes

Text

this barbie has to pay bills 😔😔😔

#this barbie is hoping for a huge tax rebate#i forgot about tax season........ive been filing on my own since i was 18 but i ALWAYS forget without fail until two weeks b4 the deadline#was there an accountant barbie ever. a cpa barbie. can i get her on the line.

12 notes

·

View notes

Video

tumblr

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Photo

IRS 2018 & 2019 Standard Mileage Rate Deductions for Business, Medical, Moving & Charity. Read more source: Falcon Expenses Blog

2 notes

·

View notes

Text

Why Use A CPA?

CPAs offer multiple financial services, which include: personal financial planning, retirement and estate planning, college funding, investing, risk management, and business succession planning. CPAs can also offer guidance on investment options or assist with estate planning needs to ensure beneficiaries receive the maximum benefits. CPA Services in Marlboro, NJ can suggest advice on how to decrease tax liability and help a client to complete financial goals.

2 notes

·

View notes

Text

Get Offshore Accounting And Tax Services For Accounting Firms Are you looking for offshore services for your accounting firm? Visit Credfino.com. Their aim is to assist accounting firms, tax firms in attaining stable and reliable revenue growth, enhancing profitability, and optimizing operations via staffing solutions and business consulting. Visit their website to learn more.

#Accounting Firms#Offshore Staffing#Business Consulting#Tax firms#staffing solutions#Tax Services#Accounting Services#CPA firm#Offshore services

6 notes

·

View notes

Text

Inventory Audit Services in Kochi

Inventory auditing is a key part of collecting evidence, particularly for manufacturing and retail organizations. Our dedicated auditing team provides you excellent Inventory Audit Services in Kochi, Kerala. Inventory audits on a regular basis improve your understanding of your stock flow, assist you in accurately calculating earnings and losses, and keep your firm operating efficiently.

Our auditing procedure involves the following:

Audit of inventory and damaged products

Stock inspection and reporting on a regular basis

Maintenance of Fixed Assets records and stock verification

Accounting records are checked on a regular basis for accuracy and completeness.

#audit#accounting#tax#accountant#finance#business#bookkeeping#taxes#incometax#iso#accountants#taxseason#cpa#smallbusiness#payroll#entrepreneur#accountingservices#auditor#taxconsultant#gst#money#taxplanning#bookkeeper#ca#businessowner#taxreturn#taxation#management#charteredaccountant#taxprofessional

4 notes

·

View notes

Text

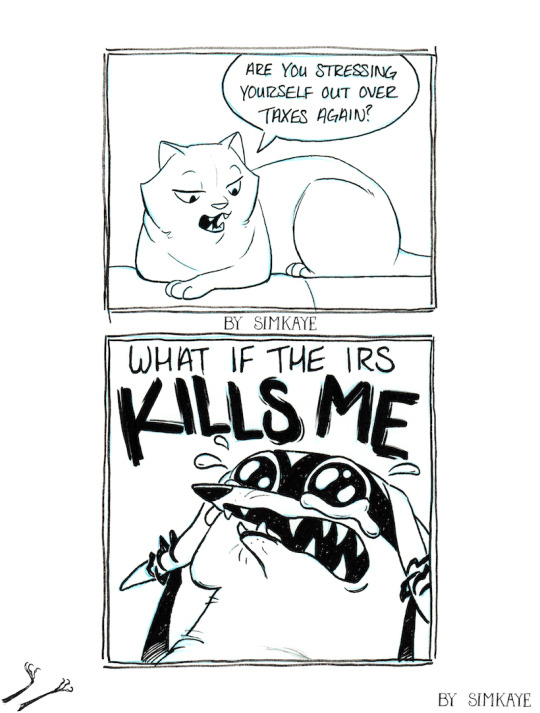

Hey, it’s me the cat artist that is also a Certified Public Accountant in the US. I would love to make art for a living but instead I do taxes (which is why I haven’t been posting as much art since it’s tax season). I have a Masters in Taxation and have been doing this for 10 years. With that said, this is not legal or tax advice and you should consult your tax preparer.

Let’s break down what could happen if you don’t do your taxes right.

In most instances, the IRS will send you a notice first.

So if you forget to include something that was reported to the IRS, like a W-2 or 1099, they may just correct it by including in and recalculating your taxes for you. This will result in a notice and it will indicate if you are getting an additional refund or if you owe additional taxes.

You forgot to file your tax return timely. There will be a late filing penalty and interest. From the IRS website:

“The Failure to File penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won't exceed 25% of your unpaid taxes.”

There’s more to it but generally it will depend on your situation. Typically if you tax is calculated at zero, then a penalty won’t be assessed. Not everyone has to file a tax return, and I would recommend this page on the IRS website on who must file. In general, even if you don’t have to file it’s a good idea to do it anyways just so that there’s a record of it.

Another thing that could happen is the IRS decides to audit your tax return. This is where they think maybe something didn’t get reported correctly and they want to show additional support. The IRS website has a whole section on this. Based on my general understanding of the user base on tumblr, this is very unlikely to happen to most people who are reading this. If it does, hire an accountant who knows what they’re doing to help you. Typically the more money you make, the more likely you are to get picked for an audit.

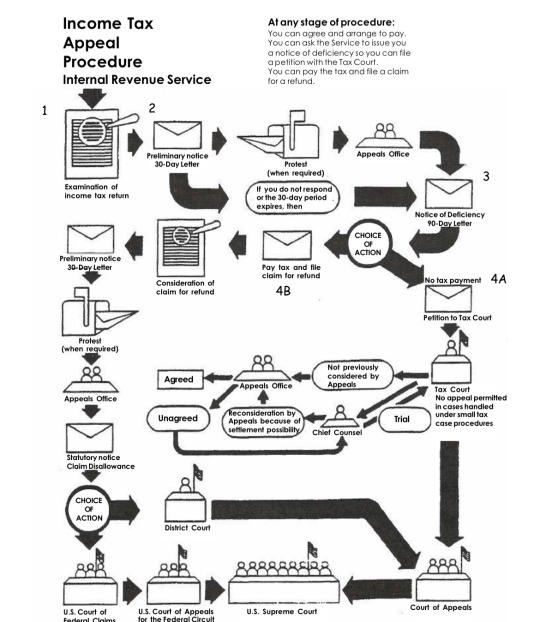

If you disagree with an assessment made by the IRS, you can push back typically by going through the legal process. Here’s a nifty flowchart on it:

So like, the IRS is not going to send the police to your house if you don’t pay your taxes or don’t file. If it turns out you did something illegal or committed tax fraud, that’s a different story.

Also like, if you owe taxes and cannot afford to pay them, the IRS website has a section on that as well. They will typically try to work with you and your situation to get things settled.

I hope that this will help someone feel a little less anxious about taxes.

Deadline this year for individual income tax returns is April 15th, 2024, so at the time of writing this you’ve still got a month to file. And you can always file an extension for time to file, which is not an extension for time to pay.

I like answering questions and sharing my knowledge, so feel free to reach out. I will preface that anything I write here on tumblr is not legal or tax advice and you should consult your tax preparer.

166. IRS

2K notes

·

View notes

Text

A Comprehensive Review of BHT Tax Services Website: Your Go-To Resource for Tax Solutions

A Comprehensive Review of BHT Tax Services Website: Your Go-To Resource for Tax Solutions

Navigating the world of taxes can be overwhelming, but BHT Tax Services has created an online presence that makes understanding and managing your taxes easier than ever. Their website, www.bhttax.com, serves as an accessible and user-friendly resource for individuals and businesses seeking expert tax advice and services. After exploring the site, here’s an in-depth review of what you can expect from BHT Tax Services online experience.

1. Clean and Professional Design

The first thing that stands out when visiting the BHT Tax Services website is its clean and professional design. The layout is simple, easy to navigate, and visually appealing, with a clear emphasis on functionality. The use of bold headings and well-organized sections ensures that visitors can quickly find the information they need without feeling overwhelmed.

Whether you’re on a desktop or mobile device, the site is responsive and adapts well to various screen sizes, providing a seamless browsing experience. There are no distracting ads or clutter — just straightforward access to the services you might be looking for.

2. Clear Overview of Services

BHT Tax Services offers a wide range of tax-related solutions, and the website does an excellent job of breaking down each service in a clear and easy-to-understand manner. From personal tax planning and preparation to business tax strategies, the site provides detailed information on the services they offer, making it simple for potential clients to assess which solutions suit their needs.

For businesses, there’s a dedicated section explaining how BHT Tax Services can help with tax planning, compliance, and even back taxes. The inclusion of IRS representation for clients facing audits or disputes is an essential service, and the website highlights this aspect clearly to ensure visitors understand how BHT Tax Services can help them through challenging tax issues.

3. Helpful Resources and Tools

One of the standout features of the BHT Tax Services website is the inclusion of helpful resources for visitors. Whether you’re an individual tax filer or a business owner, the website offers useful tools like tax calculators, helpful tips, and easy-to-understand breakdowns of common tax deductions and credits.

This section adds real value by allowing users to educate themselves before committing to a service, ensuring they feel confident in their decision to partner with BHT Tax Services. It’s clear that the company values transparency and wants to empower visitors with the knowledge they need to manage their taxes effectively.

4. Easy Contact and Consultation Scheduling

A key feature of the BHT Tax Services website is its easy-to-use contact options. Visitors can request a consultation or get in touch directly through a simple contact form, email, or phone number provided on the site. The “Schedule a Consultation” button is prominent and easy to find, making it clear how to take the next step in engaging their services.

The website also offers detailed contact information, including a physical address, so clients can trust that they’re dealing with a reputable company. For clients with urgent needs or complex tax issues, having easy access to professional help is a significant advantage.

5. Client Testimonials and Success Stories

Another feature that adds credibility to the BHT Tax Services website is the presence of client testimonials and success stories. Real-world feedback from satisfied clients helps build trust and gives visitors confidence in the services they might choose. While the website could benefit from more in-depth case studies or reviews, the testimonials provided do a good job of showcasing the positive experiences that clients have had with the company.

6. Educational Content on Taxes

What sets BHT Tax Services apart from many other tax service providers is its focus on educating clients. The website features blog posts and other resources aimed at demystifying complex tax topics. This content not only showcases the company’s expertise but also helps visitors better understand the often confusing world of taxes, whether they are individuals or business owners.

From tips on tax deductions to detailed explanations of tax credits, the website offers a wealth of knowledge that encourages visitors to stay informed and make smarter financial decisions.

7. Secure and Reliable

Security is a top priority for any service that deals with sensitive financial data, and BHT Tax Services does not fall short in this area. The website uses encryption to protect users’ data and ensures that all transactions are secure. Visitors can feel confident in their interactions with the site, knowing that their personal and financial information is handled safely.

8. Areas for Improvement

While the website is overall user-friendly and well-structured, there are a few areas for potential improvement. For instance, more interactive tools or calculators would enhance the user experience. Additionally, expanding the client testimonial section with more detailed feedback or case studies could further boost credibility. Finally, providing more information about the team behind BHT Tax Services could help personalize the experience and establish a stronger connection with prospective clients.

Final Thoughts

The BHT Tax Services website stands out as a reliable, user-friendly, and cost-effective tax resource for anyone seeking tax assistance. With a clear, professional design, comprehensive service offerings, and educational resources, the site makes it easy for clients to learn about and engage with the company. Whether you need help with personal tax filings, business taxes, or IRS representation, BHT Tax Services offers a one-stop solution that combines expertise with personalized care.

For those looking for a trustworthy and knowledgeable tax service provider, BHT Tax Services is certainly worth considering. Visit www.bhttax.com to learn more and schedule a consultation today!

0 notes

Text

Bookkeeping services in Santa Ana, CA

At HR Professional Tax Services Inc, we take pride in offering comprehensive bookkeeping services in Santa Ana, CA for businesses of all sizes. Our team is dedicated to simplifying your financial processes and helping you make informed decisions. We handle everything from expense tracking to payroll management, ensuring a seamless experience for our clients. With our personalized approach, you can count on timely and accurate financial records that support your business goals. Partner with us to enjoy hassle-free bookkeeping and focus on what matters most—your business growth.

Google Business Profile: Hr Professional Tax Services inc.- Google Search Our Website: https://www.hrtaxpro.com/ Learn More: https://posts.gle/Uz6Fum #bookkeepingservicesnsantaanaca

0 notes