#TCS share price

Explore tagged Tumblr posts

Text

TCS Stock in Focus: How the Vantage Towers Partnership Impacts Investors

Tata Consultancy Services (TCS) is poised to capture investor attention following its landmark collaboration with Vantage Towers, Europe’s second-largest telecom tower operator, to launch a digital service platform aimed at revolutionizing landlord engagement across the continent. Announced on March 5, this partnership underscores TCS’s growing influence in Europe’s telecom infrastructure sector and highlights its ability to drive digital innovation for large-scale operational challenges. As a result, investors are closely tracking TCS share price, anticipating potential gains from this strategic expansion.

A Digital Leap for Telecom Infrastructure

The newly unveiled platform, powered by TCS Crystallus for Telecom, a tailored industry solution, aims to streamline service processes for property owners leasing land for telecom tower installations. By integrating advanced digital workflows, the system will provide landlords across eight European markets with 24/7 personalized customer support via their preferred channels, fostering transparency and efficiency. For Vantage Towers, which manages 86,000 sites, the initiative is critical to retaining property partners, accelerating network expansion, and solidifying its position as a leader in sustainable telecom infrastructure.

Meanwhile, traders and investors keeping a close watch on the Live Stock Market are analyzing how this collaboration may impact TCS stock price today, particularly in the context of growing demand for digital infrastructure solutions.

Why This Partnership Matters

Enhanced Landlord Experience: Property owners gain real-time access to support and critical information through a unified portal, reducing friction in site management.

Operational Agility for Vantage Towers: Agents and stakeholders can seamlessly access centralized data, enabling faster decision-making and improved service delivery.

Long-Term Network Growth: By converting landlords into advocates, Vantage Towers aims to secure stable partnerships essential for Europe’s 5G rollout and digital transformation.

Technology at the Core

TCS’s collaboration with ServiceNow, a leader in digital workflow solutions, will amplify the platform’s capabilities. The integration of TCS Crystallus ensures scalability and agility, aligning with Vantage Towers’ vision for seamless site operations.

Akhilesh Tiwari, President of TCS’s Communications, Media, and Information Services division, emphasized the strategic alignment: "This initiative transforms landlord experience while driving business agility. Our partnership with ServiceNow ensures sustained innovation to meet Vantage Towers’ growth imperatives."

Echoing this sentiment, Tobias Steinig, Chief Digital Officer at Vantage Towers, highlighted the win-win nature of the collaboration: "Stable landlord relationships are foundational to Europe’s network expansion. This project reinforces our commitment to operational excellence and transparency."

Broader Implications for TCS

The deal builds on a longstanding relationship between TCS and Vantage Towers, signaling deeper trust in the IT giant’s ability to deliver transformative solutions. For TCS, this partnership strengthens its foothold in Europe’s telecom sector—a strategic market as global enterprises prioritize digital infrastructure upgrades. Investors engaged in stock market trading are closely monitoring how this collaboration translates into revenue growth and client retention for TCS, particularly amid rising demand for cloud and AI-driven solutions.

Additionally, retail investors looking to capitalize on TCS’s growth trajectory should consider trading account opening to actively participate in market movements surrounding the company’s stock performance.

Looking Ahead

As telecom operators across Europe race to meet connectivity demands, TCS’s role as an enabler of scalable, user-centric platforms positions it as a key player in the ecosystem. The Vantage Towers partnership not only highlights TCS’s technical prowess but also its capacity to drive tangible value for clients through innovation. With TCS share price in focus post-announcement, the market will watch for early indicators of success, such as improved landlord retention rates or accelerated site deployments.

For now, TCS’s latest move reinforces its reputation as a global IT leader—one that turns complex challenges into opportunities for growth. Investors and traders tracking TCS stock price today will be eager to see how this development plays out in the broader Live Stock Market.

For more information, visit https://www.indiratrade.com/

#TCS share price#TCS stock price today#stock market trading#Live Stock Market#trading account opening#Tata Consultancy Services#Vantage Towers partnership#telecom infrastructure#stock market news#best Indian stock broker#stock brokerage firms in India

0 notes

Text

Tata Consultancy Services (TCS) is one of India’s largest and most reputable IT services companies, with a significant presence in global markets. As a part of the Tata Group, TCS has become a preferred choice for investors looking to tap into the growing IT services sector. In this article, we will dive into TCS share price, its historical performance, and what you need to know about investing in this stock in 2025. Whether you're a seasoned investor or a newcomer to the stock market, understanding TCS's share price movements can help guide your investment decisions.

0 notes

Note

Im laughing so much rn. Somehow the starscram blokee came in first when it shipped way after megatron and shockwave. Did this boy really speedrun the mail system? 😭

Can't wait to put him together (on my tree)

Nice! I think TC and Skywarp are supposed to arrive today while I’m at work. I almost regret telling y’all about the figures, cause the price for singles on EBay went from about $13 each to $24 or more now. 🥲 JK- buy the Blokees so they release more characters

Even If It Kills Me Pt 9

Armada Starscream x Reader

• Servos cupping over you as you kick out a leg, twisting in his grip to make Runway lift his head with a tired warble. How many times does this make this week alone? When you’ve struggled, fighting against a dream. Or a nightmare and he has no idea how to fix it. How to help, but those small sounds of pain go straight to his spark, make him remember his own tormentor. Because that must be what’s haunting you. Even if it’s over and you’re safe now, the fear is still there, probably always will be. Venting tiredly, he strokes a servo against your spine. Aware of his mini-cons all watching now, upset that you’re upset. And optics shuttering, he begins murmuring at you. Singing in his gruff voice an old Seeker lullaby about bright, endless skies.

• Curling into yourself as you startle awake, you’re aware of a low humming, of guttural, strange sounds and intonations. He’s singing. Afraid to move in case he stops, you relax and listen to him, hearing an aching longing there even though you can’t understand the words. That ache calls to you and you remember the way he’d looked at you when he’d sat on the floor with you and the mini-cons. Like he’d wanted something. Wondering now if he’d wanted you to join him. Sit with him and share a meal. Realizing, you want that even if you know better. Know that hoping for a place to belong can only hurt you.

• Singing faltering when you shift on top of him and he allows you to sit up, he looks down at you. “Please,” you say, those haunted eyes making his spark ache unexpectedly. “Please, don’t stop.” Watching you reach up and scrub at your eyes, he presses the tips of his servos against your spine, feeling the beat of your heart. And even though he knows his voice isn’t meant for this, isn’t soft and soothing, he sings for you and feels you twist slightly to curl yourself against his palm. So softly, he nearly misses it, you hum along to a song you can’t understand, your little voice lifting and becoming haunting. The song becoming about loss and hope, your voices twining together.

• When the song fades, he reaches up to touch your cheek, those big hands so gentle. “You should rest. I have you,” he says, tone gentle despite how gruff his voice is. And you want to believe him. Want to hope this can last, that you’re safe. That you won’t somehow ruin this, even if you don’t deserve to have this. Standing and slowly picking your way over his chassis, aware of his servos hovering to catch you if you stumble, he frowns at you. Laying a palm on his chin, you lean against his face to press a kiss against his cheek. See his optics widen slightly as though shocked that you’d done that.

• “You’re a sweetheart,” you say, smiling at him even though your expression is still so sad. Spark warming, he watches you make your way back to his chassis and lay down again. Draping his servos over you, he lays there listening until your breathing evens out before reaching up to touch his face where your soft mouth had brushed against him. Venting softly, he stares at the ceiling and thinks about broken things. If they can ever really be fixed or if those broken edges will always remain. If you’re both too broken to even begin trying to fix each other.

Previous

Next

But I’m too tired to go to sleep tonight

And I’m too weak to follow dreams tonight

For the first time in a long time I can say

That I want to try to get better and

Overcome each moment

In my own way

I’m not saying that I’m giving up

I’m just trying not to think as much as I used to

Cause "never" is a lonely little messed up word

Maybe I’ll get it right some day

For the first time in a long time I can say

That I want to try

I feel helpless for the most part

But I’m learning to open my eyes

And the sad truth of the matter is

I’ll never get over it

But I’m gonna try

To get better and overcome each moment

In my own way

206 notes

·

View notes

Text

reply roundup!

reminder that there's actual rewards on the [patreon] again, making button pins is actually really fun more people should sign up so I have an excuse to make more of them lol (still unfortunately US only tho due to shipping cost, even domestic shipping takes up a third of the price by itself)

readmore for length as usual

on [keyboard] @ceylonsilvergirl said: me tryna find the function buttons on the computer

so real, I type like a pro but I never know which function key is where when I need it lol

on [tantrum] @kingdedede8 said: just like me fr fr, i think we should be able to throw a fit more as adults. as a treat

sometimes a healthy expression of emotion is calmly telling someone "hey dude that was super uncool when you said that hurtful thing." sometimes it is going to a quiet room and dramatically flinging yourself to the ground.

on [shopping] @macro-microcosm said: dang prev you've perfectly captured my mood in the ttrpg and tc game space

if I'm gonna be collecting cards, I want them to be visually appealing!! if I'm gonna be playing a game, I want it to be fun!!! (also I did get the lorcana starter set but we've only played a few games, I do like the split focus thing of being able to work towards the win condition without having to wipe out all your opponent's characters first)

anonymous asked: Blows up his pancakes with mind.

I can't believe you've done this

on [yakuza] @joekingv1 said: *hands the Gorb of Dojima a Staminan XX*

*wastes it immediately losing the first round of an underground tournament*

on [pomegranate] @kingdedede8 said: i always love the little stories you put in the tags :)))

lol I'm glad, sometimes I got a lot of thoughts about fruit that I wanna share!

on [whap] @eepydreamygenie said: i kinda want to print this and then i can use sticky notes so he can whap different things and possibly things that annoy me

that is such a fun idea, just whatever the irritant of the day is lol (@ceylonsilvergirl had a [similar] thought)

on [above] @theraphos said: me asking you to put the lid back on the soup pot please you are letting all the warm out (i am in the soup pot) (in case that was unclear) (i'm soup)

please. you are letting all the warm out. (this is a delightful set of thoughts lol)

on [bath] @ceylonsilvergirl said: I want to fall asleep in a too hot bathtub without waking in cold water or potentially drowning

bro. did you know that they make bath tubs that self heat to the exact temp you want and can maintain that temp and even self-fill to just the right volume with just a button press. standard american bathtubs are Pathetic in comparison. whenever we finally get a permanent home I'm gonna demand a fancy japanese bath. (they're super common in manga, but that does not mean they are common in reality lol) (can't help you with the drowning part tho)

anonymous asked: hi! just wanted to say that this blog brings me so much joy💕 ur drawings are so cute & i love them so much

thank you! highly recommend regularly drawing A Little Guy

on [ono] @mostgeniusone said: I thought that was a weird upside down smile for a second.

I mean like, you're not wrong lol. pleasantly optimistic perhaps

#text#title text#reply roundup#asks answered#ceylonsilvergirl#kingdedede8#macro-microcosm#anonymous#joekingv1#eepydreamygenie#theraphos#mostgeniusone#readmore#long post

8 notes

·

View notes

Note

With everything going on now and seeing people getting confused and tired i thought if antihero. Then someone posted the connection between coffin taylor’s shirt colors and their dresses last night so i thought i’d share.

‘I should not be left to my own devices

They come with prices and vices

I end up in crisis (tale as old as time)

I wake up screaming from dreaming

One day I'll watch as you're leaving

'Cause you got tired of my scheming

(For the last time)

It must be exhausting always rooting for the anti-hero’

Like she knew people will get tired and confused. Like the people fighting over her in the funeral in antihero mv. And her children kinda remind me of her newish NFL peeps right??? People said Chad looks like TC and the daughter in law looks like BM??? And they’re the ones starting the fight. Being betrayed.

Another note: we see many 3 easter eggs in videos and jewelry. 3 evil stepsisters, 3 circles in labyrinth mv, 3 taylors in antihero mv.Not sure what it means but adding if someone can find a connection.

14 notes

·

View notes

Note

"share their worst noob moment(s)" my first may (last year) i got a combo based groupie and sold her for 500sb 💀 i also never checked tc prices on ANYTHING and i was consistently under pricing decor (10sb each for decent pieces bc i dont use decor and assumed its all worthless) and almost heired a random inbred tree cub :')

.

5 notes

·

View notes

Text

kapil sharma PS-1 extras

(bear in mind, not fully fluent in hindi here!)

youtube

[0:17]

kapil: a big round of applause for our guests!

my question is to all of you. [to the audience] you might already know, they're making a big-budget film.

[to the actors] so when you found out that the budget is so big, did you tell your actual price to the producers or did you add some ten thousand to it, like it's fine, it's already so expensive, let us ask for a little more as well? or did the producers say, we're making PS-1 now, there will be PS-2,3,4,5 so please lower your rate a little?

i heard from [somebody] that those who weren't lowering their rates would be dying in the war scenes in the film. is it true, sir?

vikram: yeah, yeah, definitely.

-

vikram: you can say amitabh sir's dialogue; "i can talk english, i can walk english, i can speak english" (dialogue from the movie 'namak halaal' in 1982; i think they cut to when they're talking about kapil's english)

archana: [kapil] can flirt english! anytime!

kapil: i can what?

archana: you can flirt english. hindi, punjabi, sindhi, marathi, all!

kapil: thanks, thanks, pleasure. okay, you know that this film is based on kalki's novel and it's a 2600 page novel. so did you read the script or read the novel? and if you read the novel, how many days did it take you to read such a long novel?

sobhita: there are five books, each of them this thick.

kapil: you read the whole thing?

sobhita: yes.

vikram: half payment is for reading the novel.

kapil: for [a book] that long, actually yeah!

vikram: and exercise also with that.

kapil: you read the book in seven days.

-

archana: about trisha, do you know this?

trisha: so actually, my first film in telugu, "nee manasu naku telusu" ('i know your heart/mind'), in that film, archana ji was my mother; and she's very hot, and the role was of a hot mom, so…

kapil: until now, there's no one in the industry who has said they haven't worked with archana ji.

trisha: that's true.

kapil: some people were saying that when the british left in 1947, she was standing at the main gate to see them off.

-

[2:24] to [8:11] is the game, as per this post.

-

from [8:12]

kapil: karthi sir posted this photo.

[reads comments]

"it looks like they're pulling the TC (ticket collector for trains) aside to confirm their ticket on the waiting list"

(reply to above) "hey, that's not the TC, that's the director; they're confirming their roles"

please show more.

"karthi sir's smile is telling that his next scene is a romantic one"

"director be like: you're doing all the romance scenes; what share are we getting? take out a couple thousand [rupees]"

please show more.

[trisha's post]

"it seems like the producer is coming to discuss the budget, so she's taken out all the awards and put them there"

[another trisha post]

"by standing on that cake, you could even fix the ceiling fan"

[another trisha post]

"madam, a question: in horse riding, does the horse burn calories or does the person sitting on the horse burn calories?"

"you give your helmet to the horse and put on the horse's ears on yourself, then your height will be as much as the horse; free advice, there's no fees"

[jayam's post]

jayam sir posted a photo; back to doing what i do best. please show the comments below.

"i can also drive a tractor well; you are a good actor also"

"seeing the lion behind you, i remembered i have to (not sure what the word means exactly but i'm assuming it's some type of consumption) drink two bottles of glucose"

"sir, i have to shift my house, will you give your tractor? dm me the charges"

"he's also waiting for the ride; it won't move forward until the trolley is full (of people)"

please show more.

[sobhita's post]

oh this is anurag sir? (a filmmaker) show the comments.

sobhita: i'm feeling scared.

kapil: "boys are like this only. even if their own leg is broken, they are always ready to give a support to a girl" (referring to the fact that in the picture, anurag's leg is in a cast, and he's letting sobhita lean against him)

"sobhita ji, from looking at your shoes, it seems like you came straight from school"

(reply to above) "in that sense, then anurag ji looks like he just came after getting beat up"

please show more.

karthi: it's scary when it scrolls, huh?

kapil: "it looks like whoever they trusted and came to france, that person isn't picking up their phone" (because it looks like they're stranded somewhere)

"i have also sat like this is a foreign country; people started giving me money"

-

7 notes

·

View notes

Text

TCS and Infosys leap after brokerage Bernstein updates goals for the largest IT companies

Shares of Infosys and Tata Consultancy Services (TCS) saw an increase on Tuesday, November 21, following the publication of divergent target prices for the IT companies’ stocks by brokerage Bernstein. At 10:09 am on Monday, the BSE saw a 0.22 percent increase in TCS shares, or Rs 7.70, at Rs 3527.00 a share, and a 0.52 percent increase in Infosys stock, or Rs 7.40, at Rs 1443.70.

View On WordPress

2 notes

·

View notes

Text

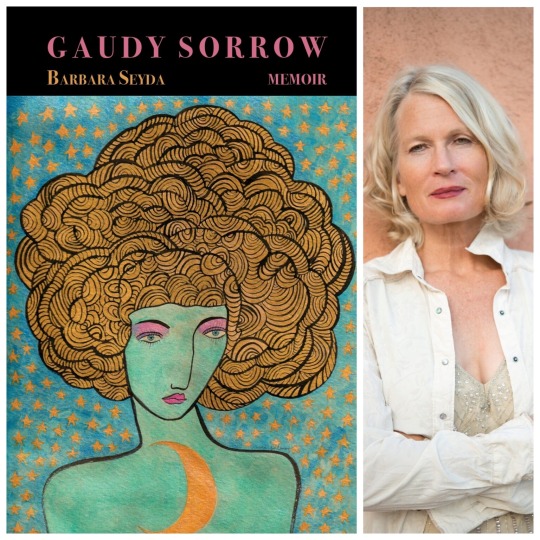

FLP MEMOIR BOOK OF THE DAY: GAUDY SORROW – MEMOIR by Barbara Seyda

On SALE now! Pre-order Price Guarantee: https://www.finishinglinepress.com/product/gaudy-sorrow-memoir-by-barbara-seyda/

Barbara Seyda‘s GAUDY SORROW is a surreal, epistolary #memoir about her Basque friend who died of Covid on Christmas Eve. A rant elegy swerving like a euphoric requiem, over 200 short, blunt letters catapult us into an epic odyssey. Rowdy and transcendent, we zig zag through tightly-braided random moments, street slang, Shakespeare, Spanglish and over-wrought metaphors. This queer Covid narrative spews sexy rage and body parts like a swamp monster of grief – a hydra sprouting infinite heads from fresh wounds for the beloved. A female-centric opera and hybrid text, GAUDY SORROW flickers like a dead lightbulb, dazzling and bereft.

Barbara Seyda is a queer, Polish-American playwright and screenwriter. Her published books are Women in Love (Bulfinch/Little Brown) winner of a Lambda Literary Award, Nomads of a Desert City (University of Arizona Press) and Celia, A Slave (Yale University Press) winner of the Yale Drama Prize. Seyda lives in Tucson, on the Sonoran Desert home of the Tohono O’odham people.

PRAISE FOR GAUDY SORROW – MEMOIR by Barbara Seyda

Gaudy Sorrow is a kaleidoscopic tapestry that spirals the reader into a personal journey-rant of rich textures. Barbara Seyda’s tender probing, in-your-face, funny, raw swirl through grief, grasping, and wonder is a careening mouthful of orgasmic words placed just so. Reading Gaudy Sorrowshould not be rushed, but savored the way a 19th century naturalist would explore her first jungle canopy. The way one would “floss teeth with trumpet vines,” as Seyda says. This jewel of a journey is thrilling, violent, confessional, and beautiful; we want to go with Seyda as she “drives though LA with a megaphone clamped to the top of a stolen Volkswagen bug. Blasting a non-stop transient grief monologue.” I am grateful for this rant and will continue to revisit it over and over again.

–Shelly Hubman, Writer, Intuitive Healer

Barbara Seyda’s searing tale of sex, love, and grief is like a glimmering sequined dress—one minute we’re dancing wildly and aglow; the next we’re stripped bare, lying in a heap on the floor, waiting for morning sunlight. This, after all, is a chronicle of human intimacy, a place only those willing to face blood and balm dare to go. With its breathy, exquisite prose and cutting candor, Gaudy Sorrow left me sweating, gasping, and fully alive.

–Kimi Eisele, The Lightest Object in the Universe

Sylvia Plath warned that ‘poetry, at its best, can do you a lot of harm’ and maybe that’s why I return to it. The same can be said for loving. Which is to say living is truly treacherous work. Make no mistake about it, you dirty human miracle, Barbara Seyda’s GAUDY SORROW will hurt you. It will tie you up. Hurl you into a carnival of ruin with a locked-up staggering beast. Then slap you for not saying fuck you. Here, glue-gunning our fingers together becomes an expression of gratitude; this is poetry for the un-furred, the grief-scored. Don’t miss your chance to stare straight into the eclipse, you who are a private bomb with a heart.

–TC Tolbert, The Quiet Practices, Gephyromania

Please share/please repost #flpauthor #preorder #AwesomeCoverArt #book #read #memoir

1 note

·

View note

Text

Click for better quality Fun fact: Mothra’s theme song is my favorite of all the kaiju, it’s so majestic Once again, lore is below the cut!

Ight Mikey time! It is highly recommended that you read the lore I put in the comments on Raph’s post before reading this! So, in this au, Mikey takes place of Mothra. This was actually quite challenging figuring out how to blend box turtle AND moth anatomy but I’m pretty happy with the result. I made it so Mikey’s shell has natural holes where his wings connect to her shoulder blades. Some notes about design to add is that I based the wing design purely on Mothra’s wing design plus some tiger moth images (you do not wanna know the amount of moth references I have saved). Plus I made Mikey’s limbs more parallel with Mothra including the claws Mothra has on her front limbs but made Mikey’s front most limbs his usual hands.

Just to clear some confusion before I start lore rambling: like most kaiju in this au, Mikey’s species is intersex and reproduces asexually. She uses any and all pronouns in this au. Also, I know some people ship Mothra and Godzilla, but Mikey and Raph are still considered siblings here so please do not ship them (aka tc*st DNI), thank you.

Of his siblings, Mikey is smallest, weakest (physically), and youngest of the four kaiju turtles. But that’s not say he should be underestimated. Xe is still ancient compared to human civilizations. They are only younger than the twins by a 100 years and younger than Raph by 2,000 years (that’s not a lot considering titan lifespans). Mikey’s body was built for grace and speed while air borne, but not for front on attacks. Mikey’s wings or body could easily be torn or damaged in battles with other kaiju if she isn’t careful. Although, not to worry because Mikey sports Mothra’s signature ability: the ability to be reborn but in a more different way. Instead of Mothra’s ability to simply hatch from previously laid egg and go through larval plus cocoon stages (though they can lay an egg for his next of kin), Mikey has a phoenix regeneration ability. In the event that Mikey is severely injured or killed, xer body will burst into flames until she is a giant pile of mystic ash. During this period, Mikey’s soul is in a sort of limbo between life and death until they naturally regenerate enough mystic energy to reform himself from the ashes.

That’s another thing to note: that while Mikey may not be physically strong, he is the most connected to their ninpo powers than his siblings. Through her ninpo, Mikey has the ability to summon a numerous amount of mystic chains at a time, shoot mystic fire, reduce the weight of objects while chains are wrapped around them, and perform a “God Ray” ability. The “God Ray” ability (also affectionately dubbed “the living sun” by humans) makes Mikey’s wings light up to an extreme amount for a few seconds. It’s so bright that it would be the equivalent to staring at the sun. This ability is effective for blinding opponents temporarily so that the opponent will be rendered off guard to a following attack, but this move does take a lot of ninpo energy to pull off.

Smaller kaiju, like Mikey’s species, have the special ability to create mystic symbiotic bonds with kaiju larger and physically stronger than them. A symbiotic bond means ninpo (which I should’ve probably mentioned before is mystical atomic power that all kaiju possess) and emotions can be shared between the bonded kaiju. This bond does come with the price though: the death of one bond means the surviving bond must live their life with the phantom pain. While Mikey can regenerate from fatal injuries (which does not count as death in the symbiotic bond because xer soul is still intact), other kaiju cannot. It is common for kaiju in a bond to simply off themself after the death of their bond partner to avoid this fate. Mikey’s parent and predecessor, Mosura, had a symbiotic relationship with Dagon (if you remember, this is Raph’s parent) and ended her life alongside Dagon. Mikey, soon after Raph dawned the title of alpha titan, created a symbiotic bond with Raph that Raph readily agreed to. Mikey would later extend the bond to Leo and Donnie.

As human civilizations started appearing over time, Mikey was the one who was the most involved with them. Xe was fascinated by the complexity of these small intelligent creatures and would sometimes communicate telepathically with humans through directing his ninpo to flow through the human xe was try to talk to. (All kaiju communicate telepathically. Humans just can’t understand them because they don’t have ninpo.) Because of this, ancient civilizations gave him the name Michelangelo which means “the messenger who is like God”.

When Mikey is awoken by Raph from hibernation in 2019 to defeat the Shredder, he meets April who is the daughter of one of lead scientists. Mikey attempts to talk to April telepathically, but the base is soon infiltrated by the eco-terrorist organization and Mikey flies away. She is surprised by the human developments during their hibernation, but more so amazed by human’s innovative inventions that remind him of Donnie’s ninpo. Mikey firmly believes in cooperative coexistence with humans where most kaiju, including her own siblings, are skeptical of humans. Once the battle with Shredder in Boston is over and Mikey regenerates, xe seeks out April through the small amount of ninpo he left on her. Mikey and April form a friendship to which April becomes a human ambassador to titans for Monarch.

Damn this section was longer than the first so hope you understood all that ahaaa. Again, I will add more lore as I finish more ref sheets.

#art#digital art#fanart#my art#rise of the ancient kaiju turtles#rotakt au#alternate universe#au#rottmnt#rise of the teenage mutant ninja turtles#rottmnt au#rottmnt mikey#procreate#procreate art#au lore#lore#mothra#legendary monsterverse#monsterverse au#mosura#repost from instagram

6 notes

·

View notes

Text

Order Win Boost: Stocks Surge After Securing Contracts Worth ₹4,263 Crore

The Indian stock market witnessed a sharp rally in select stocks after multiple companies announced significant order wins, with contract values reaching up to ₹4,263 crore. These developments have fueled investor optimism, particularly in sectors like infrastructure, defense, and technology, which are driving economic growth.

Major Contract Wins and Their Market Impact

Several companies across industries have secured high-value contracts, leading to increased trading volumes and price surges. The order wins indicate strong business growth potential, reinforcing investor confidence.

Infrastructure & Construction Companies Lead the Way

Infrastructure and EPC (Engineering, Procurement, and Construction) companies have been the biggest beneficiaries of recent government tenders and private sector contracts. Some of the notable contract wins include:

Larsen & Toubro (L&T): The engineering giant secured multiple orders in its core segments, including roadways, metro projects, and power transmission, strengthening its backlog of projects.

GR Infraprojects: The company won a major highway development project, driving its stock price higher as analysts foresee robust revenue visibility.

IRCON International: The rail infrastructure firm bagged a multi-crore railway electrification contract, pushing its shares up by over 4%.

Defense & Aerospace Sector Gains Momentum

India’s push for self-reliance in defense has led to multiple contract allocations to domestic players. Key stocks in focus include:

Hindustan Aeronautics Ltd (HAL): The company secured a defense contract worth ₹1,500 crore, leading to bullish sentiment in defense stocks.

Bharat Electronics Limited (BEL): The PSU electronics manufacturer won an order for advanced radar systems, causing a spike in its share price.

Technology & IT Sector Order Wins

The IT sector also saw companies benefiting from global contracts:

Tata Consultancy Services (TCS): Secured a multi-year digital transformation contract from a global banking giant.

Wipro & Infosys: Both IT giants bagged large-scale projects in cloud computing and cybersecurity, strengthening their international market presence.

Investor Sentiment and Market Outlook

The announcement of these order wins has boosted market confidence, especially in sectors linked to India’s infrastructure growth and digital transformation. Investors are closely monitoring the execution timelines, profitability, and revenue impact of these contracts.

With strong order inflows, analysts expect sustained growth in these sectors, reinforcing the positive outlook for India's equity markets.

0 notes

Text

Best Web and Mobile Application Development Services Companies

With the current digital age, companies and startups are dependent on strong web and mobile applications to improve user experience and simplify operations. The selection of the right development company is essential to guarantee success, as it decides the quality, efficiency, and scalability of the end product.In this article, we review some of the top companies that provide web and mobile application development services.

Key Points to Consider While Selecting a Development Company

Here are the points which distinguish a development company before moving on to the list of the best companies:

Technical Expertise – Knowledge about various technologies like React, Flutter, Swift, Kotlin, and Node.js.

Portfolio and Experience – Strong portfolio of previous work and subject matter knowledge.

Client Feedback and Rating – Positive ratings on websites like Clutch, GoodFirms, and Google.

Cost-Effectiveness – Low charges without a loss of quality.

Scalability and Support – Maintenance and upgradation services post-launch.

Customization and Innovation – Offering customized solutions with emerging technologies like AI, blockchain, and IoT.

Best Web and Mobile App Development Companies

1. TCS (Tata Consultancy Services)

One of the world's biggest IT services and digital transformation companies.

Strong expertise in AI, cloud, and enterprise solutions.

Strong presence in various industries such as healthcare, finance, and retail.

2. Infosys

Well-established company with emphasis on innovation.

Offers flexible software development practices.

Experts in digital transformation as well as cloud solutions.

3. WillowTree

Leading app development agency in the USA.

Works with top brands like HBO, PepsiCo, and National Geographic.

Native and cross-platform application development skills.

4. Fueled

Top app development company with innovative approach.

Masterminds behind high-performance applications for startups along with enterprise-grade solutions.

First-rate UX/UI design and product strategy skills.

5. Hyperlink InfoSystem

One of USA and India's top app development companies.

AR/VR, blockchain development, and IoT expertise.

Strong client base with competitive pricing.

6. Cognizant

Worldwide IT services company renowned for digital innovation.

Providing customized software development and artificial intelligence solutions.

Excellent cloud computing and cybersecurity skills.

7. Zco Corporation

Established mobile and web app development company with years of experience.

Excels in enterprise solutions, mobile gaming, and augmented reality.

Provides scalable applications for enterprises of all sizes.

8. Intellectsoft

Specializes in digital transformation and enterprise software solutions.

Expertise in IoT, blockchain, AI, and cloud computing.

Servicing Fortune 500 corporations and startups.

9. Konstant Infosolutions

Top-rated web and mobile application development firm.

Expertise in developing scalable and secure apps.

Expertise in PHP, AngularJS, React, and Laravel.

10. Fuel Digi Marketing

Global leader in mobile application development.

Offers end-to-end digital solutions from UI/UX to testing.

Provides services to leading brands in diversified industries.

New Technologies of Web & Mobile App Development

Artificial Intelligence & Machine Learning – Provides customized suggestions to enhance user experience.

Blockchain Technology – Guarantees security in data sharing and transactions.

Augmented Reality (AR) & Virtual Reality (VR) – Offers immersive user experiences.

Internet of Things (IoT) – Interconnects devices and enhances smart applications.

5G Technology – Offers quicker, real-time processing for mobile applications.

Conclusion

Selecting the correct web and mobile app development company is based on your project need, budget, and business objective. The above-mentioned companies have a long history of success in delivering top-notch applications across various sectors. If you want a customized solution for your startup or an enterprise-level application, these companies provide best-in-class development services using the latest technology.

#digitalmarketing#seo#digitalmarketingcompany#marketing#seoagency#seocompany#digitalmarketingagency#ecommerce#digitalmarketingstrategy

0 notes

Text

TCS Share Price Analysis: A Comprehensive Guide for Investors

Thank you for reading this article. We hope you have enjoyed it and learned something new. Please share your feedback, questions, or comments below. We would love to hear from you and answer your queries.

Time To Read TCS Share Price Analysis Tata Consultancy Services (TCS) is one of the leading IT services providers in the world, offering a range of solutions and services to various industries and sectors. TCS is also one of the most valuable companies in India, with a market capitalization of over 13 trillion rupees as of November 2023. TCS shares are traded on the Bombay Stock Exchange (BSE)…

View On WordPress

#TCS#TCS share price#TCS share price analysis#TCS share price buy or sell#TCS share price dividends#TCS share price factors#TCS share price history#TCS share price investing#TCS share price predictions#TCS share price strategies

0 notes

Text

Gurgaon Real Estate Find Your Dream Property with Gurgaon Properties Hub

Gurgaon or Gurugram is one of India's top cities to purchase houses and offices. It is home to new buildings, broad roads, malls, and top companies. Many people and businesses are investing in Gurgaon real estate because it offers great living spaces and strong business opportunities. At Gurgaon Properties Hub, we assist you in finding the ideal houses and offices at an affordable price.

Why Invest in Gurgaon Real Estate?

Gurgaon is one of the fastest-growing cities in India. It has numerous advantages for business owners and home buyers.

Prime Location – Gurgaon is near Delhi and easily accessible by metro, highways, and airport.

Business Hub – Several large companies such as Google, Microsoft, and TCS have offices here, so it is an excellent location for professionals and investors.

High Returns – Gurgaon real estate property prices continue to rise, making it a wise investment option.

Luxury Lifestyle – The city boasts of contemporary houses, shopping malls, fine restaurants, and entertainment.

Best Types of Properties in Gurgaon

We assist you in finding the ideal property at Gurgaon Properties Hub that suits your budget and requirements.

Homes in Gurgaon

If you are searching for a house, there are plenty of options available in Gurgaon such as:

Luxury Apartments – Ideal for professionals and families, with security, parking, gyms, and parks.

Independent Villas – Big houses with gardens and private pools, providing a luxurious lifestyle.

Affordable Homes – Reasonably priced apartments with all the basic amenities such as schools, hospitals, and transport within proximity.

Office Spaces in Gurgaon

We provide the following if you are starting a new business or require a new office:

Corporate Offices – High-end offices with internet connectivity, parking, and meeting rooms.

Co-working Spaces – Shared offices for start-ups, freelancers, and small businesses.

Retail Shops – Suitable for cafes, boutiques, and showrooms.

Exclusive Offers & Expert Guidance by Gurgaon Properties Hub

While investing in Gurgaon real estate is the right decision is crucial. At Gurgaon Properties Hub, we provide:

Best Deals – Exclusive access to the best properties at reasonable prices before they are listed for others.

Expert Advice – Our experts assist you through each step of purchasing your dream home or office.

Verified Properties – We verify all listings are genuine, RERA-approved, and from reputed builders.

Future Growth Areas – We assist you in investing in areas with high appreciation value.

Now is the time to invest in Gurgaon real estate! Property rates continue to increase, and a lot of new projects are being launched with attractive offers. Whether you are looking for a house to reside in or an office for business, early investment will ensure that you receive high returns in the future.

Conclusion

At Gurgaon Properties Hub, we facilitate easy buying of homes and offices. Through our expert guidance, best property listings, and amazing deals, we assist you in making the smartest investment. If you seek reliable real estate professionals in Gurgaon, get in touch with us now and discover your ideal property.

0 notes

Text

2032, Delay Pedal Market Forecast and Trends, Size, Share Report by Reports and Insights

The Reports and Insights, a leading market research company, has recently releases report titled “Delay Pedal Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Delay Pedal Market, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Delay Pedal Market?

The delay pedal market is expected to grow at a CAGR of 4.3% during the forecast period of 2024 to 2032.

What are Delay Pedal?

A delay pedal is an effects device used by musicians to produce an echo effect by replaying an audio signal with a set time delay. It captures the incoming signal, briefly stores it, and then plays it back after a predetermined period, which can be adjusted to achieve different delay times. This effect adds depth, dimension, and rhythmic texture to music, making it a fundamental tool in both live performances and studio recordings. Delay pedals are widely used by guitarists, keyboardists, and other musicians to enhance their sound with repeating echoes or to create atmospheric and ambient effects.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1933

What are the growth prospects and trends in the Delay Pedal industry?

The delay pedal market growth is driven by various factors and trends. The delay pedal market is expanding as musicians and audio engineers increasingly seek versatile and customizable sound effects. These pedals are crucial for creating echo and rhythmic delays, adding depth and ambiance to performances and recordings. Growth in the market is fueled by technological advancements, such as digital delay effects and innovative features, alongside the rising popularity of live shows and home studios. As artists across various genres look to enrich their sound and explore creative possibilities, the delay pedal market is diversifying with a wide range of models and price options to meet the needs of both hobbyists and professionals. Hence, all these factors contribute to delay pedal market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Product Type:

Analog Delay Pedals

Digital Delay Pedals

Tape Delay Pedals

Multi-Effect Delay Pedals

By Connectivity:

Wired Delay Pedals

Wireless Delay Pedals

By Power Source:

Battery-Powered Delay Pedals

AC-Powered Delay Pedals

USB-Powered Delay Pedals

By Material:

Metal Casing Delay Pedals

Plastic Casing Delay Pedals

By End-Use:

Guitarists

Bassists

Keyboardists

Studio Professionals

By Distribution Channel:

Online Retail

Offline Retail

Market Segmentation By Region:

North America

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Boss (Roland Corporation)

Electro-Harmonix

Strymon

TC Electronic

Eventide

MXR (Jim Dunlop)

Digitech (Harman International Industries)

Line 6 (Yamaha Corporation)

Walrus Audio

JHS Pedals

Wampler Pedals

EarthQuaker Devices

Source Audio

Fulltone

Catalinbread

View Full Report: https://www.reportsandinsights.com/report/Delay Pedal-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: sales@reportsandinsights.com Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes

Text

[ad_1] The launch took centre stage at myTrident’s stunning “SAMAY – Through the Ages” showcase at Bharat Tex 2025, a captivating exploration of home décor’s evolution over time. Neha Dhupia launches myTrident’s super luxury collection LUXEHOME from the house of myTrident at Bharat Tex Designed for the new Indian consumer, the LUXEHOME collection is a symphony of timeless design, sustainability, and indulgent comfort. Every piece is crafted to elevate everyday living into an extraordinary experience. Featuring 600 TC 100% Cotton bedsheets, the 500 TC Egyptian Cotton Lyocell, the 300 TC Cotton Bamboo bedsheets, the Cotton Bamboo 600 GSM and the Turkish 800 GSM towels that provide spa-like indulgence. Each piece redefines home luxury, setting new standards for sophistication and sustainability. Celebrating this milestone, Neha Gupta Bector, Chairperson, myTrident, shared, "Luxury is not just about aesthetics—it’s about how it feels, breathes, and transforms a space. With LUXEHOME, we have curated an experience that combines age-old craftsmanship with cutting-edge sustainability. Our focus is on building the best in the world and bringing it to India at an affordable price." Adding to the excitement, Neha Dhupia, who unveiled the collection, said: "My home is adorned with myTrident and LUXEHOME products and every time I look at the pieces I have collected, it brings a smile to my face as the quality, craftsmanship is unmatched. I’m honoured to be a part of this journey." Alongside the luxury launch, myTrident’s "SAMAY – Through the Ages" showcase took audiences on an artistic journey through time, from historic artisanry to futuristic innovations. Standout collections journeyed through the Puratan Yug, Veer Yug, Poorv Aaduhnik Yug, and Unnati Yug. This journey culminated in the grand unveiling of the Spring Summer '25 collection, a celebration of contemporary design that harmonizes heritage, artistry, and innovation. Among the standout collections is the Prakriti collection, deeply inspired by Ayurvedic principles. It offers designs that harmonize the mind, body, and spirit by aligning with the doshas for a nurturing sleep experience. The Classic - Threads of India is a fresh take on the existing Sanskriti collection, featuring beautiful new Ajarak and Phulkari designs that are exuberant and crafted with a higher thread count. This collection pays homage to India’s cultural legacy, blending traditional artistry with everyday functionality. Following the massive success of the Shivan and Narresh collection, the duo unites with myTrident to bring the Spring-Summer 2025 colours and palette to your doorstep. The Nectarsoft Italian Retreat collection draws inspiration from the elegance of Italy, with baroque patterns and Tuscan palettes that bring Venetian sophistication to modern bedrooms. The Home Essential - Vasant Collection, the brightest of them all, captures the vibrant essence of spring and festivals across India, weaving intricate patterns that evoke ancient harvest tales and the warmth of togetherness. With this grand unveiling at Bharat Tex 2025, myTrident continues to lead the way in luxury, sustainability, and innovation. As the brand steps into the high-end segment with LUXEHOME, it cements its place as a global pioneer, redefining luxury living for the modern world. About myTrident myTrident is Trident Group’s flagship brand specializing in luxurious & premium home furnishings. The company caters to all segments across luxury, premium to everyday. From designs, innovation and sustainability, the brand has been setting benchmarks in the home textile industry. With a sharp focus on customer demands, myTrident offers a range of exquisite products including bed sheets, towels, luxury rugs, bathrobes and much more. Each item is crafted with precision and attention to detail, to offer customers an unparalleled sense of comfort, style, and elegance.

myTrident products can be found across all leading hotels of the country. The brand also offers an easy online shopping experience at www.mytrident.com. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes