#TAX FREE ZONE

Explore tagged Tumblr posts

Text

Apply for your residence visa over a 5-min video call, just like getting a Dubai business license without visiting a center

In a fast-paced world where convenience and efficiency are paramount, the United Arab Emirates (UAE) has set the bar high by offering a hassle-free way to obtain your residence visa via a simple 5-minute video call. This innovative approach makes securing your UAE residence visa as easy as obtaining a Dubai business license, all without setting foot in a center. In this blog, we will walk you through the process and explore the benefits of a UAE residence visa and setting up a company in Dubai with a Meydan Free Zone license.

Benefits of Having a UAE Residence Visa

A UAE residence visa brings with it a plethora of advantages. Here are some of the key benefits:

Residency: A UAE residence visa provides you with legal residence status, allowing you to stay in the country without the need for frequent visa runs.

Stability: You gain long-term stability, which is attractive for families looking to settle in the UAE or individuals seeking to establish themselves in the region.

Business Opportunities: As a UAE resident, you can explore numerous business opportunities in a thriving economy with tax incentives and a business-friendly environment.

Access to Services: You gain access to various services, including healthcare, education, and banking, on par with citizens.

Global Mobility: UAE residence visa holders can enjoy simplified travel with access to the UAE’s extensive network of international flight connections.

How to Apply for a UAE Residency Visa via Video Call

The process is remarkably simple:

Consultation: A 5-minute video call, the General Directorate of Residency and Foreigners Affairs (GDRFA) will process your visa virtually They will guide you through the process.

Document Submission: Prepare the necessary documents, such as your passport, proof of address, and other supporting documents, which will be provided to the setup service.

Video Call Appointment: Schedule a convenient time for a 5-minute video call with the UAE immigration authorities. During the call, you will provide biometric data and have the opportunity to address any concerns.

Visa Approval: Upon successful completion of the video call, you will receive your UAE residence visa, which can be easily renewed.

Why Should You Set Up a Company in Dubai with a Meydan Free Zone License?

Meydan Free Zone offers unique advantages for businesses:

100% Ownership: You can have full ownership of your company without the need for a local sponsor or partner.

Tax Benefits: Enjoy zero corporate and personal income tax for a set period, with the possibility of tax exemptions in the long term.

Strategic Location: Meydan Free Zone is strategically located, providing access to global markets through state-of-the-art infrastructure.

World-Class Facilities: Benefit from modern office spaces, warehouses, and excellent amenities for your business operations.

How to Get a Meydan Free Zone Company License

Getting a Meydan Free Zone license is straightforward:

Select a Business Activity: Choose the business activity that aligns with your goals and market niche.

Company Registration: Work with a business setup service to complete the registration process, which includes submitting the necessary documents.

License Issuance: Once approved, your Meydan Free Zone license will be issued, and you can begin your operations.

How to Legally Work with Mainland Companies with a Trade License from Meydan Free Zone

With a Meydan Free Zone trade license, you can legally do business with mainland companies:

Local Service Agent: Appoint a local service agent to facilitate your business dealings with mainland companies. This agent is not a business partner but is essential for legal compliance.

Legal Framework: Ensure that your business operations follow UAE laws and regulations to maintain a strong and compliant business relationship with mainland entities.

In conclusion, applying for a UAE residence visa via video call and establishing a business in Dubai with a Meydan Free Zone license offer an innovative and efficient pathway to unlock the myriad opportunities in the UAE. This streamlined process not only simplifies the visa application but also opens doors to a vibrant business ecosystem. Make your move and enjoy the benefits of both a UAE residence visa and a Meydan Free Zone company license without the need for physical visits.

M.Hussnain

Private Wolf facebook Instagram Twitter Linkedin

#dubai#DUBAI RESIDENCE VISA#MEYDAN FREE ZONE LICENSE#MEYDAN LICENSE#TAX FREE ZONE#UAE RESIDENCE VISA#VIDEO CALL REDIDENCE VISA

0 notes

Text

25 ways to be a little more punk in 2025

Cut fast fashion - buy used, learn to mend and/or make your own clothes, buy fewer clothes less often so you can save up for ethically made quality

Cancel subscriptions - relearn how to pirate media, spend $10/month buying a digital album from a small artist instead of on Spotify, stream on free services since the paid ones make you watch ads anyway

Green your community - there's lots of ways to do this, like seedbombing or joining a community garden or organizing neighborhood trash pickups

Be kind - stop to give directions, check on stopped cars, smile at kids, let people cut you in line, offer to get stuff off the high shelf, hold the door, ask people if they're okay

Intervene - learn bystander intervention techniques and be prepared to use them, even if it feels awkward

Get closer to your food - grow it yourself, can and preserve it, buy from a farmstand, learn where it's from, go fishing, make it from scratch, learn a new ingredient

Use opensource software - try LibreOffice, try Reaper, learn Linux, use a free Photoshop clone. The next time an app tries to force you to pay, look to see if there's an opensource alternative

Make less trash - start a compost, be mindful of packaging, find another use for that plastic, make it a challenge for yourself!

Get involved in local politics - show up at meetings for city council, the zoning commission, the park district, school boards; fight the NIMBYs that always show up and force them to focus on the things impacting the most vulnerable folks in your community

DIY > fashion - shake off the obsession with pristine presentation that you've been taught! Cut your own hair, use homemade cosmetics, exchange mani/pedis with friends, make your own jewelry, duct tape those broken headphones!

Ditch Google - Chromium browsers (which is almost all of them) are now bloated spyware, and Google search sucks now, so why not finally make the jump to Firefox and another search like DuckDuckGo? Or put the Wikipedia app on your phone and look things up there?

Forage - learn about local edible plants and how to safely and sustainably harvest them or go find fruit trees and such accessible to the public.

Volunteer - every week tutoring at the library or once a month at the humane society or twice a year serving food at the soup kitchen, you can find something that matches your availability

Help your neighbors - which means you have to meet them first and find out how you can help (including your unhoused neighbors), like elderly or disabled folks that might need help with yardwork or who that escape artist dog belongs to or whether the police have been hassling people sleeping rough

Fix stuff - the next time something breaks (a small appliance, an electronic, a piece of furniture, etc.), see if you can figure out what's wrong with it, if there are tutorials on fixing it, or if you can order a replacement part from the manufacturer instead of trashing the whole thing

Mix up your transit - find out what's walkable, try biking instead of driving, try public transit and complain to the city if it sucks, take a train instead of a plane, start a carpool at work

Engage in the arts - go see a local play, check out an art gallery or a small museum, buy art from the farmer's market

Go to the library - to check out a book or a movie or a CD, to use the computers or the printer, to find out if they have other weird rentals like a seed library or luggage, to use meeting space, to file your taxes, to take a class, to ask question

Listen local - see what's happening at local music venues or other events where local musicians will be performing, stop for buskers, find a favorite artist, and support them

Buy local - it's less convenient than online shopping or going to a big box store that sells everything, but try buying what you can from small local shops in your area

Become unmarketable - there are a lot of ways you can disrupt your online marketing surveillance, including buying less, using decoy emails, deleting or removing permissions from apps that spy on you, checking your privacy settings, not clicking advertising links, and...

Use cash - go to the bank and take out cash instead of using your credit card or e-payment for everything! It's better on small businesses and it's untraceable

Give what you can - as capitalism churns on, normal shmucks have less and less, so think about what you can give (time, money, skills, space, stuff) and how it will make the most impact

Talk about wages - with your coworkers, with your friends, while unionizing! Stop thinking about wages as a measure of your worth and talk about whether or not the bosses are paying fairly for the labor they receive

Think about wealthflow - there are a thousand little mechanisms that corporations and billionaires use to capture wealth from the lower class: fees for transactions, interest, vendor platforms, subscriptions, and more. Start thinking about where your money goes, how and where it's getting captured and removed from our class, and where you have the ability to cut off the flow and pass cash directly to your fellow working class people

40K notes

·

View notes

Text

Business Registration in Dubai with Gatestone Group: The Key to a Successful Start

Opening a company in Dubai is a step towards new opportunities in the dynamically developing business environment of the UAE. Gatestone Group offers a full range of services for business registration, ensuring fast and legally competent company formation in free economic zones, on the mainland, and in offshore jurisdictions.

Why is it worth opening a business in Dubai?

Dubai attracts entrepreneurs from all over the world due to tax advantages, a stable economy, and high business standards. There is no corporate tax, registration procedures are simplified, and international companies gain access to promising markets in the Middle East, Asia, and Africa.

How does Gatestone Group help register a business?

Our team of experts supports clients at all stages, starting from choosing the appropriate legal form of the company to obtaining a license. We conduct an analysis of business goals, select the optimal jurisdiction, prepare documents, and interact with government authorities.

Our services include:

Consultation on choosing the form of business: free zone, mainland company, or offshore.

Preparation and submission of documents for registration.

Obtaining a license and opening a corporate bank account.

Visa support for owners and employees.

Consultations on tax and legal issues.

Advantages of working with Gatestone Group

Cooperation with us guarantees transparency, efficiency, and compliance with all UAE legal requirements. We take care of all bureaucratic processes, allowing clients to focus on business development.

Start your business in Dubai with a reliable partner! Gatestone Group will ensure you an easy and secure start in one of the most promising business environments.

Gatestone Group Website: https://gatestonegroup.com/ Phone: +97144501023 Address: Office 1416, The Binary by Omniyat Marasi Drive Street, Business Bay, Dubai, UAE Open hours: Mon - Fri 08:30–17:30

#business setup in dubai#company formation in dubai#setup a company in uae#setting up a company in dubai#company formation in uae#setup a company in dubai#company formation in dubai mainland#mainland company formation in dubai#mainland business setup in dubai#business setup in dubai free zone#dubai free zone business setup#business setup in uae free zone#offshore company in dubai#offshore company formation in dubai#offshore company formation in uae#business setup in abu dhabi#company formation in abu dhabi#company setup abu dhabi#rak free zone company setup#business setup in rak free zone#company formation in ras al khaimah#sharjah free zone company setup#business setup in sharjah#sharjah free zone company formation#corporate tax registration uae#uae corporate tax registration#vat registration uae#document attestation in dubai#certificate attestation in dubai#attestation services dubai

0 notes

Text

Consult with our Tax Experts in Dubai today and get the best financial advice! With us, you can grow your business in today’s fast-paced world. For more information, you can visit our website https://aoneaccounting.ae/ or call us at 971 - 44221190

0 notes

Text

Determine your business economic value with us! We, at AONE Accounting, are known for providing exceptional Business Valuation Services Dubai to all clients. Contact us today! For more information, you can visit our website https://aoneaccounting.ae/ or call us at 971 - 44221190

0 notes

Text

Key Updates and Compliance Strategies for Economic Substance Regulations from the MoF

The economic substance regulations (ESR) were introduced by the UAE’s Ministry of Finance (MoF) to align with global standards on transparency and prevent harmful tax practices. These regulations ensure that UAE-based businesses conducting certain activities have substantial economic presence in the country, rather than simply benefitting from tax advantages. Adhering to these rules is crucial for avoiding penalties and safeguarding the business’s reputation.

In this comprehensive guide, we will walk you through the MoF Economic Substance Regulations ESR, recent updates, compliance strategies, and the penalties that companies face for non-compliance.

Understanding UAE ESR Compliance Requirements

Under the UAE ESR compliance requirements, businesses that engage in “Relevant Activities” such as banking, insurance, shipping, intellectual property, lease finance, holding companies, and distribution and service center must meet certain economic substance criteria. Companies must demonstrate that they are conducting core income-generating activities (CIGAs) in the UAE, which involves having sufficient employees, physical assets, and incurring expenditure in the UAE proportional to the income generated from these activities.

Businesses are required to:

File an ESR notification annually through the Economic Substance Regulations UAE online MOF portal.

Submit an Economic Substance Report outlining their compliance with the regulations.

Pass the Economic Substance Test in UAE, which assesses whether the company has sufficient economic presence in the UAE.

Non-compliance with these requirements can result in ESR penalties and fines UAE, including the exchange of information with foreign tax authorities, damaging a company’s reputation internationally.

ESR Penalties and Consequences for Non-Compliance

The UAE Economic Substance Regulations impose various penalties for non-compliance, ranging from fines to more serious administrative actions. These include:

Failure to Submit ESR Notification:

Penalty: AED 20,000

Consequence: Non-filing will lead to immediate penalties and increased scrutiny for future compliance.

Failure to Submit the Economic Substance Report:

Penalty: AED 50,000

Consequence: Businesses that fail to submit their Economic Substance Report will not only face penalties but could also be reported to international tax authorities.

Failure to Meet the Economic Substance Test:

Penalty (First Year): AED 50,000

Penalty (Subsequent Year): AED 400,000

Consequence: Failing to meet the Economic Substance Test can result in heavy fines and, in severe cases, the suspension or non-renewal of the company’s business license.

Providing Inaccurate Information:

Penalty: AED 50,000

Consequence: Providing false or misleading information in the ESR notification or Economic Substance Report can result in severe financial penalties and reputational damage.

Failure to Maintain Proper Records:

Penalty: AED 50,000

Consequence: Businesses must keep detailed records of their core income-generating activities (CIGAs). Failure to maintain these records can lead to audits and further penalties.

Other Consequences:

Exchange of Information: If a business is found non-compliant, the Ministry of Finance may exchange information about that company with foreign tax authorities. This could affect a company’s international reputation and operations.

License Suspension or Revocation: The Ministry of Finance may take administrative action, including suspending or revoking business licenses, especially for repeat offenders.

Compliance Strategies for UAE Businesses

To avoid penalties, companies should adopt a proactive approach toward compliance. Here are several strategies that will ensure businesses meet all UAE ESR compliance requirements:

Follow a UAE ESR Compliance Checklist: Having a thorough UAE ESR compliance checklist is essential. The checklist should cover all aspects, from ESR notification filing to passing the Economic Substance Test in UAE. Monitoring submission deadlines and ensuring all relevant documents are prepared is vital to avoiding penalties.

Seek Filing Assistance: ESR filing assistance UAE can ensure that your business submits accurate Economic Substance Reports on time. Assistance can also help mitigate the risk of providing incorrect information, which could otherwise lead to penalties.

Regular Audits: Conduct Economic Substance compliance audits UAE to ensure that your business is consistently meeting the economic substance requirements. This is particularly important for businesses in UAE free zones or offshore entities that are subject to increased scrutiny.

How MBG Can Help: ESR Compliance Services UAE

At MBC Legal Consultants, we provide specialized ESR compliance services to help businesses navigate the complex MoF Economic Substance Regulations framework.

Our services include:

ESR advisory services: Tailored guidance to help businesses understand their obligations.

Filing assistance: Helping companies with timely ESR notification filing UAE and Economic Substance Notification and Report submission.

ESR audit services UAE: Conducting thorough audits to assess compliance with the UAE Economic Substance Regulations.

Legal support: Offering legal advisory services on how to meet ESR compliance requirements UAE, ensuring your business is fully compliant with UAE ESR laws for businesses.

As Economic Substance Regulations continue to evolve, businesses need to stay informed and compliant to avoid penalties and reputational damage. The consequences of non-compliance are severe, with significant fines, administrative actions, and possible international repercussions.

By adopting compliance strategies, including seeking UAE ESR advisory services and leveraging professional help for ESR filing assistance, businesses can ensure they meet the MoF Economic Substance Regulations. Contact MBG Legal Consultants for expert assistance in navigating the complex requirements and ensuring that your business stays compliant.

#accounting#business#investing#economic substance regulations#ESR#MOF economic substance regulations#MOF#UAE Compliance#Business Regulations#Economic Presence#Tax Transparency#Compliance Strategies#Relevant Activities#Economic Substance Test#ESR Notification#ESR Report#Penalties#Fines#Non-Compliance Consequences#CIGAs#Filing Assistance#Audits#Legal Support#MBG Legal Consultants#Tax Regulations#Business Reputation#UAE Free Zones#Administrative Actions#International Tax Authorities#Reputational Risk

1 note

·

View note

Text

Corporate Tax Registration in UAE: A Comprehensive Guide

The UAE has long been known for its business-friendly environment, attracting entrepreneurs and investors from around the globe. However, with the introduction of corporate tax in the UAE, businesses now need to understand the new regulatory framework and ensure compliance. Corporate tax registration has become a vital step for all businesses, particularly those operating under a general trading license in Dubai or within the free zone company Dubai jurisdictions.

Understanding Corporate Tax in the UAE

Corporate tax in UAE is a direct tax imposed on the net income or profit of businesses. The UAE introduced corporate tax as part of its commitment to global transparency and regulatory standards. It applies to most business activities, except for entities involved in the extraction of natural resources, which are subject to emirate-level taxation.

Who Needs to Register for Corporate Tax?

Any business operating in the UAE, including those in the Dubai trade license system, whether mainland or free zone, must register for corporate tax if their taxable income exceeds a certain threshold.

Why Compliance Matters?

Staying compliant with corporate tax laws in the UAE not only helps businesses avoid penalties but also enhances their reputation in the market. Compliance indicates a company’s commitment to transparent operations and helps attract international investors who prioritize working with businesses that follow global standards.

A few final thoughts

Registering for corporate tax can seem daunting, but with the right guidance, it becomes a manageable process. InZone provides expert services to help businesses register for corporate tax efficiently and ensures that you stay compliant with all tax regulations and continue to enjoy the benefits of operating in the UAE’s thriving economy.

#business setup in dubai#business license#corporate tax in uae#corporate tax in dubai#dubai free zone

0 notes

Text

#corporate tax penalty#business tax in uae#corporate tax in uae#corporate tax uae free zone#corporate tax rate uae

0 notes

Text

Corporate Tax in the UAE: Everything You Need to Know

Corporate tax in UAE is a direct tax imposed on the net income or profit of companies. It is also termed “Business Profits Tax” in some jurisdictions. On 31 January 2022, the UAE Ministry of Finance (MoF) announced a new federal corporate tax (CT) system in the country with effect from 1 June 2023. The new corporate tax was introduced at a standard rate of 9%, the lowest within the GCC region. The key goal of introducing this system was to reduce the compliance burden on businesses and integrate best practices globally. Speak to the experts at Shuraa Tax and see how their services can elevate their business needs.

0 notes

Text

#corporate tax free zone#best corporate tax services in uae#top corporate tax services in uae#corporate tax#corporate tax in uae#corporate tax return#corporate tax services

0 notes

Text

Offshore company setup with DUBIZ

Forming an offshore company in the UAE is easy since only a certificate of incorporation is issued, and operating licenses aren’t required. However, knowing the rules and procedures for offshore company registration is still essential.

DUBIZ provides the fastest and safest solution for offshore company setup UAE. Just contact us, and we’ll handle the process for you!

#List of offshore company in uae#Top offshore company in uae#list of offshore companies in dubai#dubai offshore company requirements#Offshore company in uae for foreigners#offshore company dubai free zone#uae offshore company tax

0 notes

Text

Yes, your business in the free zone can live with 0% taxation only if they meet specific criteria by keeping in mind the new corporate tax law and how Al Zora does that let us explain. Check out the video for more information.

#accounting#corporate tax services in uae#corporate tax in dubai#corporate tax advisors#corporate tax consultants#tax#free zone

0 notes

Text

🍨 svt spoiling their partner.

★ prompt: how ot13 spoils their partner? 🥹🥹🥹 i am just a girl give me treats c/o @shinwonderful

ⓘ established relationship, pet names, fluff. headcanons under the cut. special thanks to @chugging-antiseptic-dye for helping! ♡

🍨 read more?

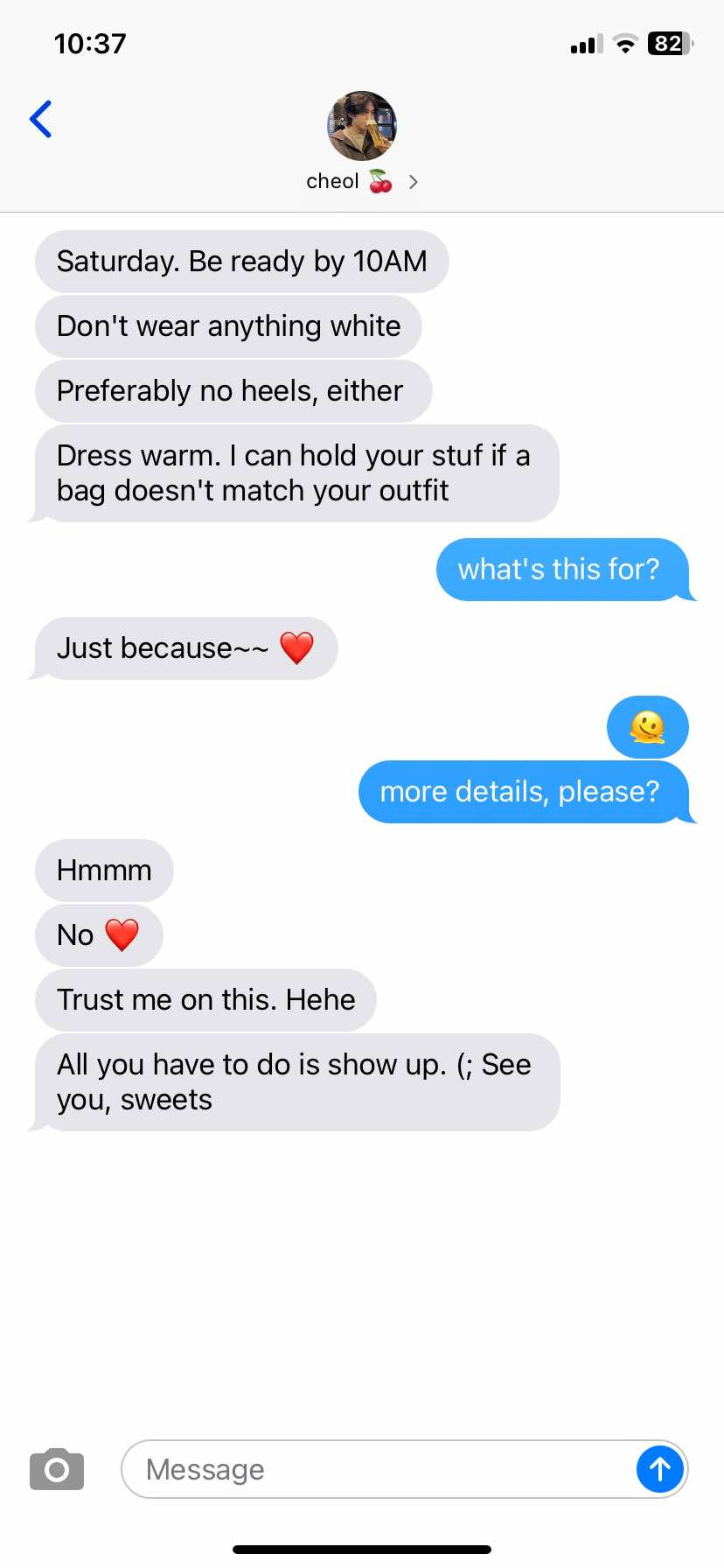

seungcheol 𖹭 planning dates. he will refuse to let you lift a finger for your day out. everything will be meticulously laid out, finetuned to be something that you'll enjoy. his goal is to lessen the mental load of decision-making and planning; he wants you to be able to focus solely on enjoying the surprise, and he'll break his back to make sure that happens.

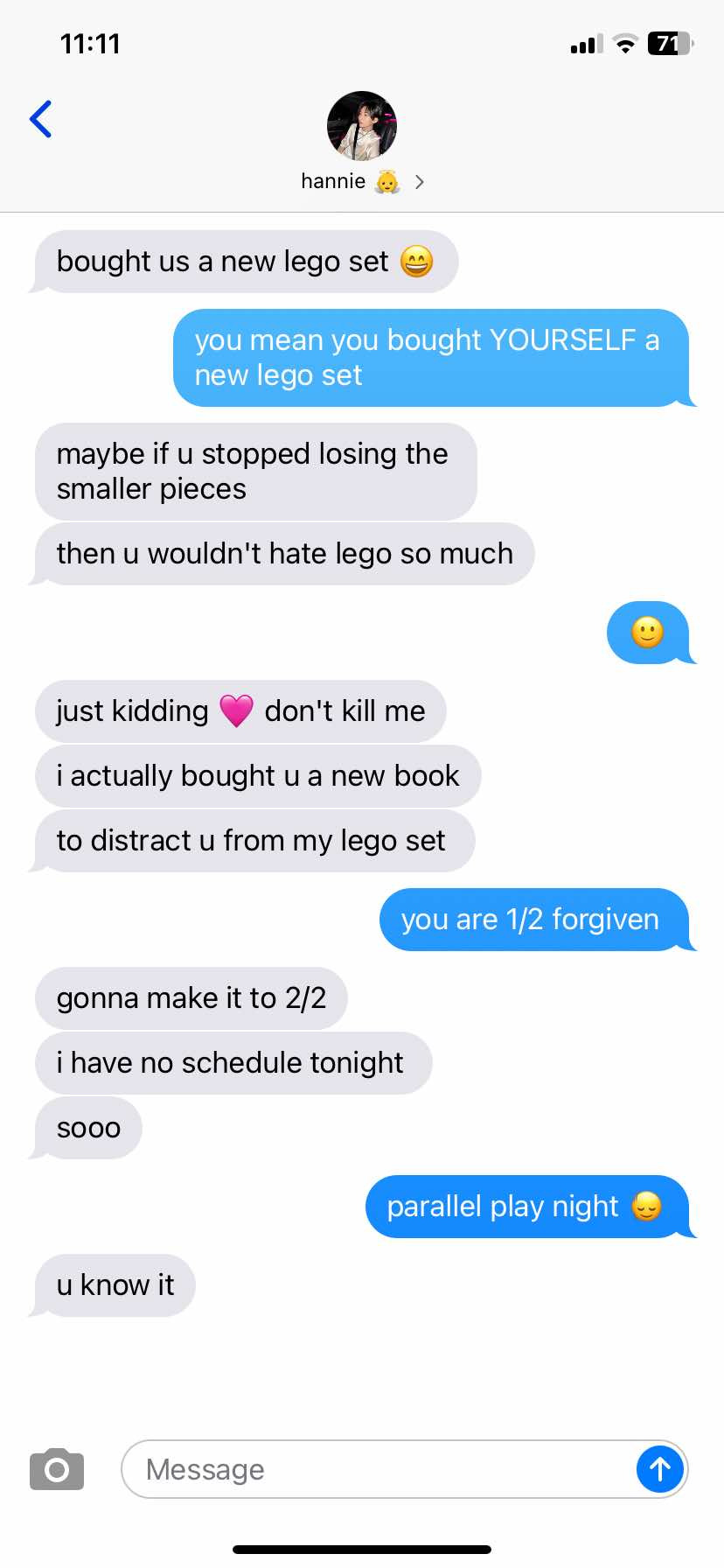

jeonghan 𖹭 'parallel play'. even if the two of you might not be interested in the same things, that's okay. he's happiest to spend quality time with you at home, where the two of you are free to do your own thing within eachother's presence. just being in your vicinity already makes him content, and so he plans everything around the two of you getting to explore and share your respective hobbies.

shua 𖹭 acts of service. need help with your taxes? need someone to fill up your tank? he's already on it. he'll say that these are all 'little things', call it the bare minimum, when it's apparent that he makes it a conscious effort to make your day-to-day easier. his brand of spoiling you comes in the form of quietly doing things that will improve your quality of life.

junhui 𖹭 buying clothes you'll like. he can't help it, really. when he sees an article of clothing that he thinks suits your style? when he finds a local brand that shares your advoacy? he's already pulling out his wallet. he likes the idea of dressing you up. nothing makes him happier than knowing you're wearing an outfit that he entirely picked out for you.

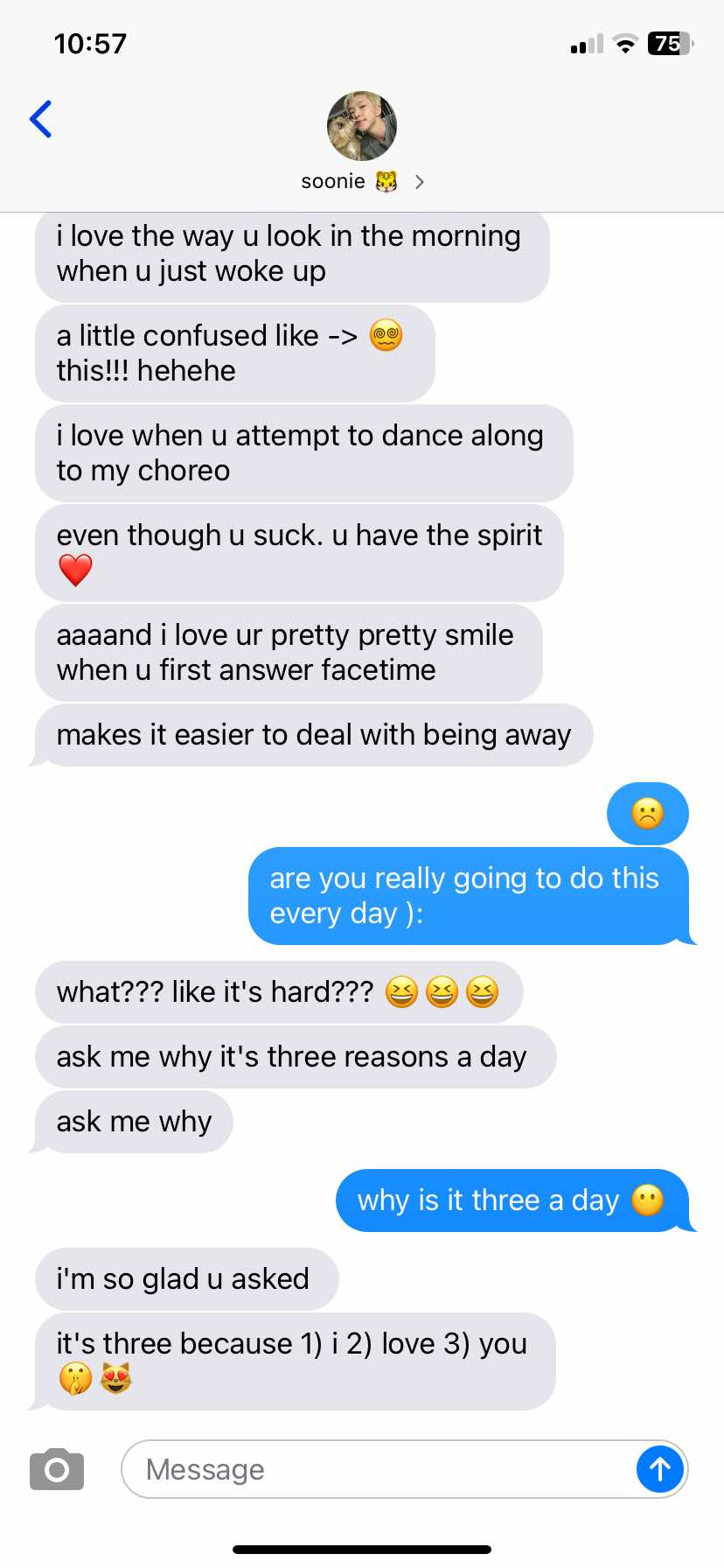

soonyoung 𖹭 daily reasons why he loves you. people always joke that he has a bit of a motormouth, so why shouldn't he use it on talking about you, you, you? he's big on words of affirmation, on making sure you never doubt how he feels for you. he'll point out the little and big things that make him adore you, and it's never the same reason twice.

wonwoo 𖹭 indulging your interests. he may not always understand these trends— blind boxes, must-have fashion pieces, et cetera— but he'll never make you feel bad about it. if there's anything that you want, he's already doing everything within his power to get it. his greatest joy is seeing your face light up once he's gotten you your 'priority' item; it's why he keeps doing it in the first place.

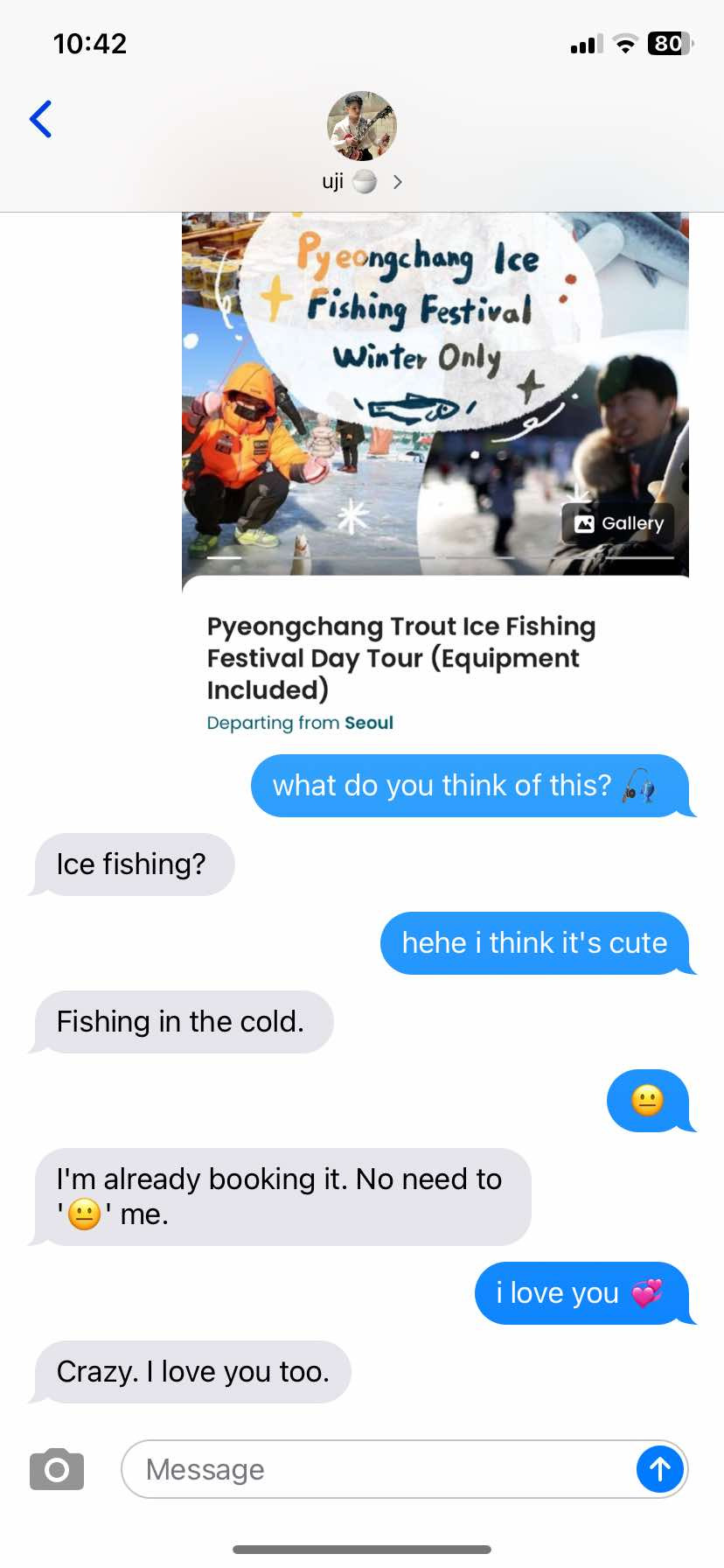

jihoon 𖹭 trying new things for you. there's a long list of things that jihoon never thought he'd do, but then he started dating you. time and time again, he willingly goes out of his comfort zone to accompany you on the little adventures and experiences that you ask to go on. he does these things scared, does them anxious, does them begrudgingly,— does them all for you.

seokmin 𖹭 meals he thinks you'll like. he's the type to have dozens of tabs open for homemade recipes dot com. he knows he's an amateur at this, but he's undeterred in trying. whether it's a trending pastry on tiktok or the comfort meal that your mother makes you, he's determined to learn it so you're always eating well.

mingyu 𖹭 getting-to-know card games. he gives as good as he takes, which means mingyu's way is to listen and remember. a night where the two of you can just have deep conversations with no interruptions is his ideal evening. he will know he succeeded if the two of you end up talking until the sun rises, feeling like the hours haven't passed at all.

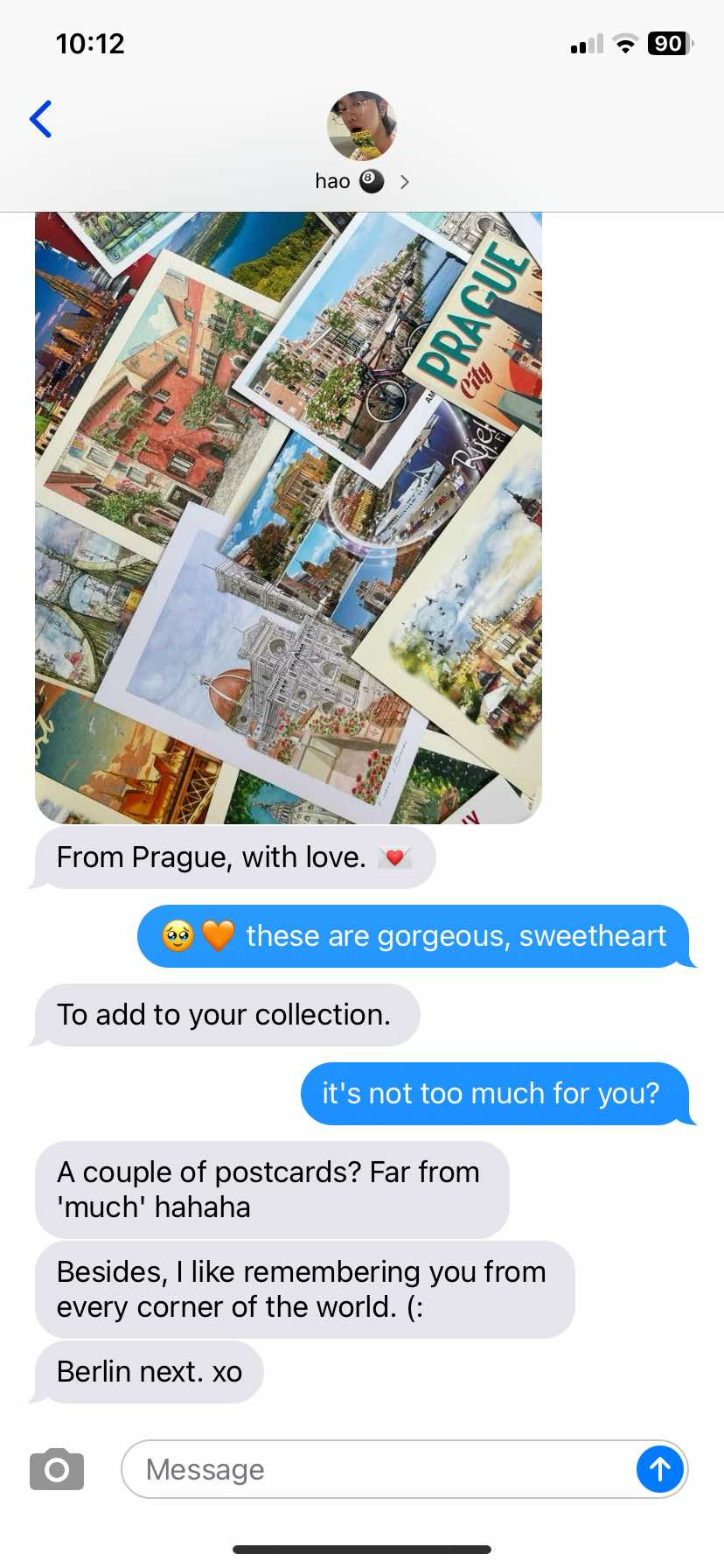

minghao 𖹭 postcards from tour stops. he loves art and he loves you. his postcards are pocket-sized reminders of those facts, always packaged with a few choice words that are sweet and sincere. his trinkets are very "i-got-you-this-because-it-reminded-me-of-you" in nature, and you know each one was purchased with you at the front of mind.

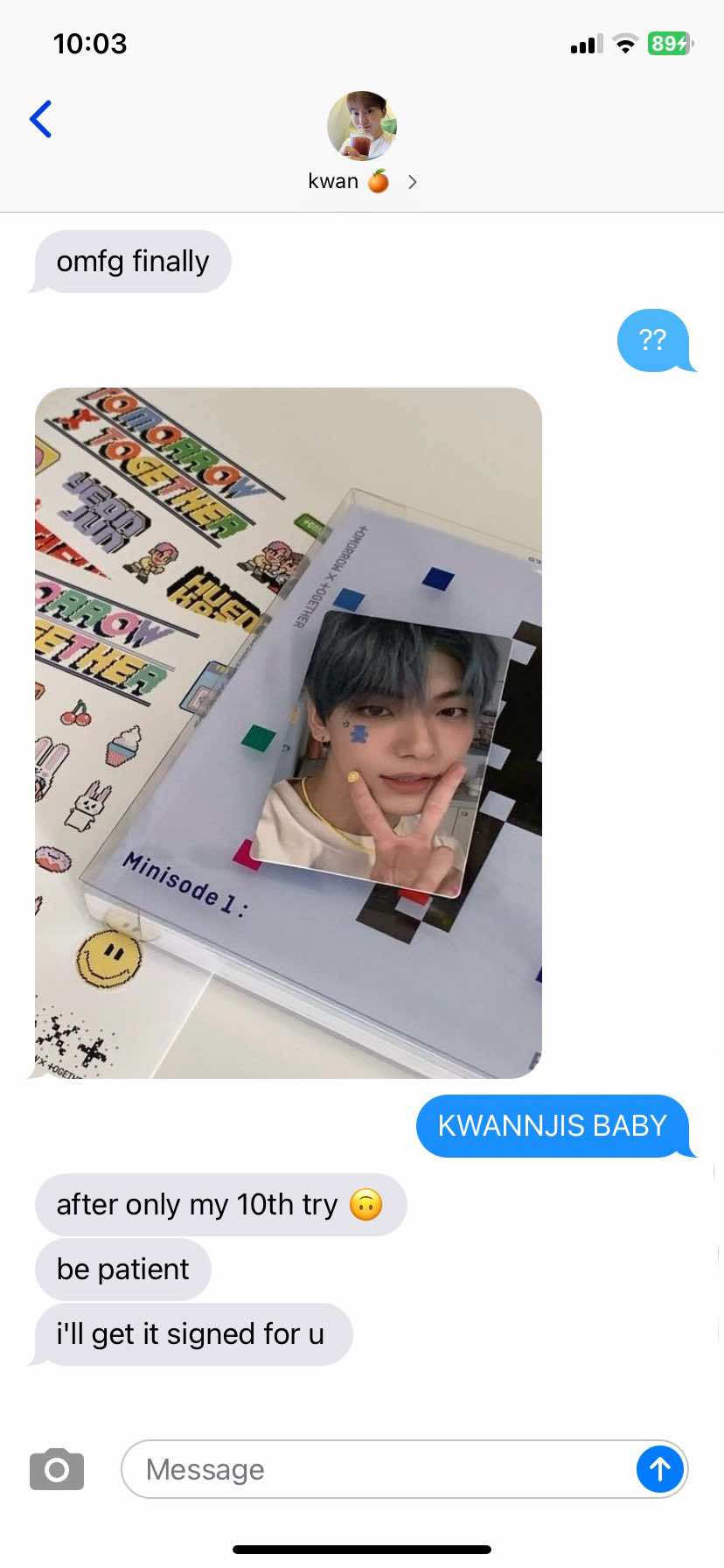

seungkwan 𖹭 getting you your favorites. he figures he should put his industry connections to use somehow. he's always amused by how happy you get over a rare photocard, signed album, or concert tickets, and so he keeps it up. buying dozens of albums, contacting other labels, bearing the arduous ticketing. your excitement at the end of it makes it all worth it.

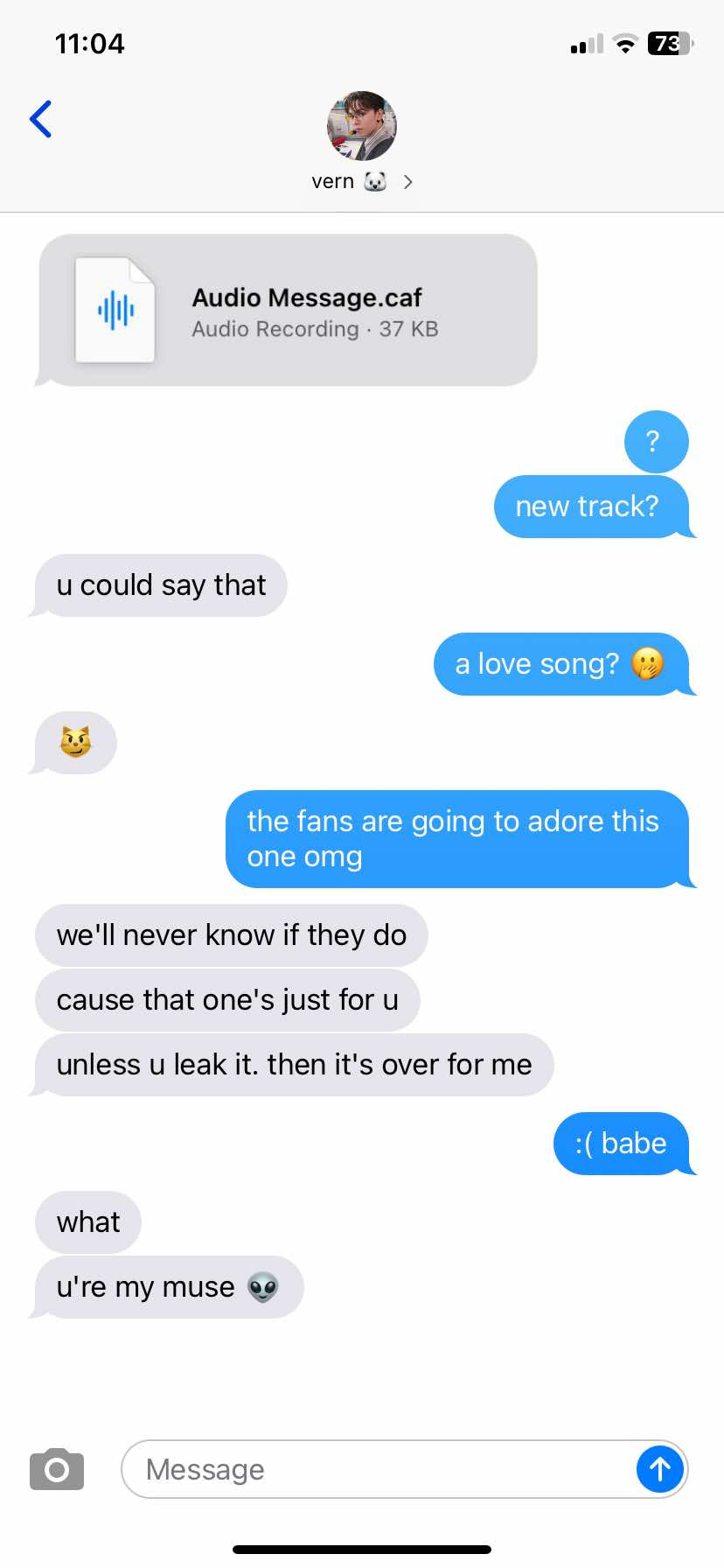

vernon 𖹭 producing songs. he hadn't really pegged himself as the making-music-for-the-sake-of-it type until he met you. now, he revels in getting to send you a track that's for your ears only. all the lyrics just seems to flow naturally when it's you inspiring him, and so he sends you works-in-progress with reminders that you're the only intended audience.

chan 𖹭 at-home massages. he's all too familiar with the aches of an ailing body, so he knows exactly how and where to work on you. he always does what he calls 'the works'— a good bath, scented candles, essential oils. he lets you take your time, and he takes his time with you in helping you unwind.

› scroll through all my work ദ്ദി ˉ͈̀꒳ˉ͈́ )✧ ᶻ 𝗓 𐰁 .ᐟ my masterlist | @xinganhao

#svt x reader#seventeen x reader#svt fluff#seventeen fluff#svt imagines#seventeen imagines#svt smau#seventeen smau#── ᵎᵎ ✦ mine#── ᵎᵎ ✦ reqs#[ need this . Rn . pls ]

2K notes

·

View notes

Text

#business setup in dubai#company formation in dubai#setup a company in uae#setting up a company in dubai#company formation in uae#setup a company in dubai#company formation in dubai mainland#mainland company formation in dubai#mainland business setup in dubai#business setup in dubai free zone#dubai free zone business setup#business setup in uae free zone#offshore company in dubai#offshore company formation in dubai#offshore company formation in uae#business setup in abu dhabi#company formation in abu dhabi#company setup abu dhabi#rak free zone company setup#business setup in rak free zone#company formation in ras al khaimah#sharjah free zone company setup#business setup in sharjah#sharjah free zone company formation#corporate tax registration uae#uae corporate tax registration#vat registration uae#document attestation in dubai#certificate attestation in dubai#attestation services dubai

0 notes

Text

Consult with our Financial Advisors in Dubai and reach your financial goals easily! We, at AONE Accounting, are one of the top companies that help clients make their processes smooth. For more information, you can visit our website https://aoneaccounting.ae/ or call us at 971 - 44221190

0 notes

Text

Hmmm hmmmmm

#If I go for that new job sure I’d spend twice as much getting to work#but I’d get a travel card so all my buses would be free#and I spent some time looking at zone maps#and I genuinely believe I could avoid going into zone 1 stations altogether#like anywhere I tend to go in zone 1 is either a short walk or short bus from a zone2 station that I can reach without much difficulty#I think overall I’d spend around the same maybe potentially less on travel#not 2 mention if I was working in Whitechapel and had a gig in Shoreditch that’s like. rly close#also if I go for the supervisor job. yeh. significant pay rise#i did the after tax calcs#I could live well. spend more than I currently do. and save £500 a month. damn#I could actually afford holidays#😳😳😳

1 note

·

View note