#Swing trading stocks

Explore tagged Tumblr posts

Text

Professional Swing Trading Course | Learn Swing Trading

Introduction

In the fast-paced world of financial trading, various strategies cater to different risk appetites and investment goals. One such popular strategy is Swing Trading, which focuses on capturing short to medium-term gains in stock prices. For individuals looking to enhance their trading skills, enrolling in a Swing Trading Course can be a game-changer. This blog explores what swing trading is, its importance, benefits, and how a professional course can help traders excel.

What is Swing Trading?

Swing Trading is a trading strategy that aims to capture price movements or "swings" in a stock, commodity, or currency over a few days to several weeks. Unlike day trading, which involves multiple trades within a single day, swing trading allows for holding positions for a longer duration to maximize profit from market trends.

Key Elements of Swing Trading

Trend Analysis: Identifying short to medium-term trends using technical analysis.

Entry and Exit Strategies: Determining the optimal points to enter and exit trades.

Risk Management: Setting stop-loss and take-profit levels to minimize risks.

Market Indicators: Using tools like moving averages, RSI, and MACD for decision-making.

Patience and Discipline: Holding positions long enough to capture potential gains while managing emotions.

Importance of a Swing Trading Course

1. Building a Strong Foundation

Understanding market dynamics, technical indicators, and chart patterns is crucial for successful swing trading. A structured course provides the foundational knowledge necessary to navigate the markets effectively.

2. Developing Strategic Insight

A swing trading course helps traders develop strategies tailored to different market conditions. Learning when to enter or exit a trade can make the difference between profit and loss.

3. Learning Risk Management

Effective risk management is essential in swing trading. Courses teach how to set stop-loss orders, position sizing, and manage emotions to protect investments.

4. Gaining Practical Experience

Courses often offer practical sessions, real-time trading simulations, and case studies, enabling learners to apply theoretical knowledge in real-world scenarios.

5. Enhancing Confidence

Confidence is key in trading. A professional course equips learners with the confidence to make informed decisions and execute trades with precision.

Benefits of Enrolling in a Swing Trading Course

1. Expert Guidance

Courses are typically led by experienced traders who provide insights based on real market experiences, offering tips and strategies that are not easily accessible elsewhere.

2. Comprehensive Learning Modules

From the basics of technical analysis to advanced trading strategies, a structured course ensures a complete learning experience.

3. Time-Efficient Strategy

Swing trading is ideal for individuals who cannot dedicate an entire day to trading. Courses teach how to maximize returns while minimizing time spent monitoring markets.

4. Flexibility in Learning

Many courses offer flexible schedules, including online and offline options, allowing learners to study at their own pace.

5. Certification for Career Growth

A recognized certification adds value to professional credentials, enhancing career prospects in the financial sector.

How to Choose the Right Swing Trading Course

When selecting a swing trading course, consider the following factors:

Curriculum Depth: Ensure the course covers both basic concepts and advanced strategies.

Qualified Instructors: Learn from seasoned professionals with proven expertise in swing trading.

Practical Exposure: Opt for courses that offer simulations, case studies, and real-time trading practice.

Flexible Learning Options: Choose a course that aligns with your schedule, whether online or offline.

Certification: Ensure the course provides a credible certification upon completion.

Why Choose ICFM for Swing Trading Courses?

The Institute of Career in Financial Market (ICFM) is a leading educational institute offering specialized courses in swing trading. With a focus on practical knowledge and industry-relevant skills, ICFM equips learners to excel in financial markets.

ICFM offers:

Expert-Led Training: Courses conducted by experienced swing traders and financial analysts.

Comprehensive Curriculum: Covering technical analysis, strategy development, risk management, and market psychology.

Hands-On Learning: Practical assignments, live trading simulations, and interactive sessions.

Flexible Schedules: Both online and offline classes to suit different learning needs.

Certification: Recognized certification that enhances professional credentials.

With its commitment to quality education and skill development, ICFM empowers traders to navigate the complexities of swing trading with confidence.

Conclusion

Swing trading is a strategic approach that combines patience, analysis, and timely decision-making to capture market opportunities. For aspiring traders in India, enrolling in a Swing Trading Course can provide the knowledge, skills, and confidence needed to succeed. Institutions like ICFM offer specialized courses designed to turn beginners into proficient traders. Whether you are starting your trading journey or looking to refine your skills, ICFM's expert-led programs provide the ideal platform for mastering swing trading and achieving financial success.

Read More Blog: https://medium.com/@Icfminsttitute/swing-trading-course-master-profitable-stock-trading-with-icfm-ba2178921a2e

#Swing trading strategies#Swing trading stocks#Swing trading for beginners#Swing trading course India#Swing trading course online#Swing Trading course in hindi#Best swing trading courses in India#Swing trading course for beginners#Swing Trading Course near me

0 notes

Text

One thing about the doge cuts that gets to me is the idea that we need to cut government waste, government spending is out of control, blah blah blah. Even the counter-programming org I joined has that framing, "we can agree government waste needs to be reigned in, but this isn't it".

And like..... I cannot for the life of me remember a time when a government program was over funded outside of military ordinance.

Arms spending is out of control, no question, but every social program I've had to interact with was either way underfunded, or just managing to get by. Just absolute shoe string budgets.

And hearing stories about it, like how at the end of the fiscal year departments will just blow through their extra cash b/c if they came in under budget they'd face cuts the next year. An entire government policy of penny wise pound foolish.

But we can spend trillions developing planes that can't fly in the rain, and no one blinks at that

#even military personnel dont get paid a lot#its all bombs and guns#fuck even congress isnt paid that much! most of their money they make via lobbyist donations (bribes) or stock assets (insider trading)#ass backwards government#gonna leave this open but if yall get weird im shutting it down and swinging the ban hammer with abandon

6 notes

·

View notes

Text

Value vs. Growth Stocks: What’s the Difference and Which One Should You Invest ??

When it comes to investing in stocks, there are various strategies and approaches that investors can employ. Two popular investment styles are value investing and growth investing. Understanding the difference between these two approaches is essential for making informed investment decisions. In this blog, we will delve into the characteristics of value and growth stocks, explore their differences, and help you determine which one aligns with your investment goals.

Value Stocks: Uncovering Hidden Gems

Value stocks are companies that are considered undervalued by the market, trading at prices lower than their intrinsic value. These stocks often have stable earnings, pay dividends, and possess solid fundamentals. Value investors typically focus on identifying stocks with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, or other valuation metrics that suggest the stock is priced lower than its actual worth. Value stocks may include mature companies in established industries that may have experienced temporary setbacks or are overlooked by the market.

Top of Form

Bottom of Form

Key Characteristics of Value Stocks:

Low valuation metrics: Value stocks often have low P/E ratios, P/B ratios, or other valuation metrics compared to their industry peers.

Dividend payments: Many value stocks are known for their consistent dividend payments, making them attractive to income-focused investors.

Established companies: Value stocks are typically found in well-established industries, where companies have a long history and solid track records.

Potential for turnaround: Value investing involves identifying companies with potential for a turnaround or market correction, where their true value may be unlocked over time.

Growth Stocks: Investing in the Future

Growth stocks, on the other hand, are companies that exhibit strong growth potential, often characterized by above-average revenue and earnings growth rates. These companies typically reinvest their earnings back into the business to fuel expansion, rather than paying dividends. Growth investors seek companies that are at the forefront of innovation, disruptive technologies, or emerging industries, with the expectation that their earnings and stock prices will rise substantially in the future.

Key Characteristics of Growth Stocks:

High revenue and earnings growth: Growth stocks typically demonstrate above-average revenue and earnings growth rates compared to their peers and the overall market.

Limited or no dividends: Instead of distributing profits as dividends, growth companies reinvest earnings into research, development, and expansion.

Technological or industry disruptors: Growth stocks are often associated with companies leading the charge in innovative sectors or disrupting traditional industries.

High valuations: Due to their growth potential, growth stocks may trade at higher P/E ratios and valuation multiples compared to their current earnings.

Which Should You Invest In: Value or Growth?

Deciding whether to invest in value or growth stocks depends on your investment objectives, risk tolerance, and investment horizon. Both approaches have their merits:

Value stocks can offer stability, income potential, and the opportunity to buy companies at a discount. They are favored by conservative investors seeking established companies with solid fundamentals and attractive dividend yields.

Growth stocks, on the other hand, offer the potential for significant capital appreciation. They are suitable for investors with a higher risk appetite, a long-term investment horizon, and an interest in innovative industries and emerging trends.

Some investors choose to maintain a balanced portfolio that includes both value and growth stocks, diversifying their risk and capitalizing on opportunities across different market segments.

Ultimately, the decision between value and growth investing comes down to your personal financial goals, investment strategy, and risk tolerance. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Conclusion:

Value and growth investing represent distinct approaches to stock selection, each with its own set of characteristics and potential rewards. Value investing focuses on finding undervalued companies with solid fundamentals and stable earnings, while growth investing targets companies with high growth potential and innovation. The choice between value and growth stocks ultimately depends on your investment objectives, risk tolerance, and time horizon.

I hope you have received all of the necessary information, for additional information, please see our blog area

#investment shares StockPicks#stockmarket#Strategy#Stockstobuy#BestStockstobuy#investment#stock market#stockpicks#best stocks for swing trading#crypto#stock market news#stockxpo#stocks#stock

2 notes

·

View notes

Text

Build Smarter Portfolios with SEBI Registered Advisors and Swing Trade Ideas

Navigating the complexities of the stock market isn't easy, especially when you're trying to balance short-term gains with long-term growth. This is where a SEBI registered investment advisor (RIA) becomes a game-changer. Whether you're a beginner or an experienced trader, the right guidance combined with solid trade ideas can make all the difference.

Why Work with a SEBI Registered Investment Advisor?

A SEBI-registered advisor is someone who has been authorized by the Securities and Exchange Board of India to offer investment advice legally and ethically. These professionals follow strict compliance norms and are required to work in your best interest. Unlike unregulated tip providers, SEBI-registered advisors are held accountable and provide transparent advice backed by research.

The Value of Trade Ideas

Everyone wants the next big stock pick—but without proper analysis, a hunch can quickly turn into a loss. That’s where high-quality trade ideas come in. Generated through a mix of technical indicators, fundamental research, and market trends, these ideas can help you identify opportunities that others might miss.

A good trade idea usually includes:

A clear buy/sell signal

Entry and exit levels

Risk-reward ratio

Market context

These insights help you make informed decisions, manage risk, and improve your consistency as a trader.

Best Stocks to Swing Trade

Swing trading is a popular strategy for those who want to hold a position for a few days or weeks, capturing short- to medium-term price movements. Some of the best stocks to swing trade are usually:

Mid-cap stocks with strong momentum

Liquid stocks with consistent volume

Stocks forming technical patterns like flags, wedges, or breakouts

Sector leaders during bullish phases

Your advisor can help you shortlist such stocks based on your risk appetite and market conditions.

Conclusion

A well-informed trader is a successful trader. With a trusted SEBI registered investment advisor and consistent trade ideas, you can identify the best stocks to swing trade and build a smarter portfolio. Instead of going it alone, leverage professional insights and make each trade a calculated move.

0 notes

Text

Forex Trading Trends 2025: What’s Hot and What’s Not!

Forex Trading Trends 2025: What’s Hot and What’s Not! Hey there, fellow currency wranglers! Buckle up, because we’re diving headfirst into the wild world of Forex trading trends for 2025. If you thought 2024 was a rollercoaster, just wait until you see what’s coming around the bend! Grab your favorite beverage, and let’s get this party started! ⚡ Don’t Get Left Behind! Master Next-Gen AI…

View On WordPress

#Best trading apps for passive income#How to trade in volatile markets#Real-time sentiment analysis for traders#Swing trading techniques for stocks and crypto#Tax-efficient trading strategies 2025#Tokenized asset trading explained#Web3 trading strategies for crypto portfolios

1 note

·

View note

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

Join our Stock Market Institute and become an expert in swing trading. Our comprehensive courses are designed to teach you advanced share trading techniques, helping you master key strategies and risk management. Whether you're a beginner or an experienced trader, our training will equip you with the skills needed to make informed decisions in the stock market. Enroll today and take your trading to the next level with our expert-led courses.

#stock trading courses#financial risk management course#swing trading courses#stock market institute

0 notes

Text

PERFORMANCE OF CALL TRACKER 🤩🤩 Date - 28TH FEB 2025 Profit - 56975/-🔥🔥 Investment- 40 Lac

#banknifty#stockmarket#banking#bankniftytrading#bankniftypattern#tradingreport#my post#market trends#viralpost#trade results#trade war#earnings#people over profit#global#futures#profitability#stocks#share market#ipo#financenews#swing trading#stock trading#investing stocks#shares#like

0 notes

Text

2025’s Best-Performing Stocks – Top 10 High-Growth Stocks

The stock market in 2025 has kicked off with impressive gains, driven by mergers, acquisitions, and innovation in AI, health care, and clean energy. Companies like FuboTV, Oklo, and Akero Therapeutics have seen remarkable growth, with FuboTV leading the pack after a major merger with Hulu + Live TV. Other stocks, such as Tempus AI and Grail, have surged due to advancements in AI-powered health care solutions, while OppFi benefited from favorable financial sector conditions.

Despite strong early-year performance, investors should stay cautious, considering factors like market volatility, competition, and regulatory shifts. While some of these stocks may offer long-term potential, thorough research and monitoring industry trends remain essential for making informed investment decisions.For more information, Please Read https://stockxpo.com/2025s-best-performing-stocks-top-10-high-growth-stocks/

#stockxpo#stock market#best stocks for swing trading#stockpicks#crypto#stocks#stockmarket#investment

0 notes

Text

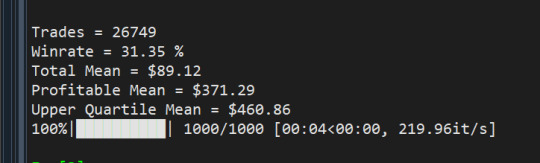

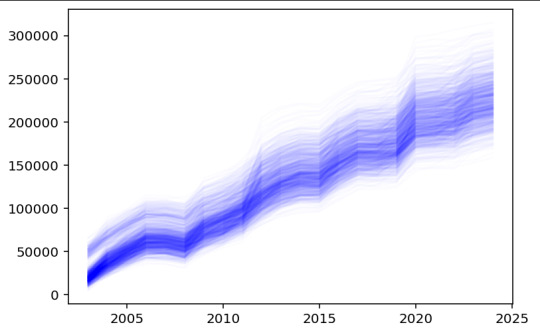

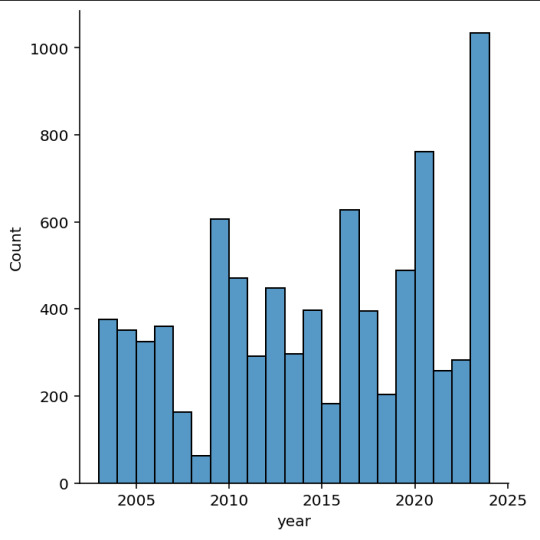

4/9-Weekly EMA Crossover Strategy

I recently came across a reddit post from some random guy in Brazil. He mentioned the 4/9 EMA cross was pretty successfull so I wanted to try it.

Period = Weekly Initial Size = $1000 Stop Loss = -$50 Opening Condition = 4 period EMA > 9 period EMA Closing Conditions = Close < 20EMA

0 notes

Text

Boost Your Trading Skills with the Best Stock Market Institute in Chandigarh

The stock market is an exciting and dynamic world where opportunities for financial growth are abundant. However, navigating the complexities of trading requires a solid foundation of knowledge and practical skills. For aspiring traders and investors in Chandigarh and Mohali, finding the right guidance can make all the difference. If you're looking to enhance your trading skills, enrolling in the best stock market institute in Chandigarh is the perfect starting point.

Why Choose a Stock Market Institute in Chandigarh?

Chandigarh has emerged as a hub for financial education, attracting individuals eager to learn the intricacies of the stock market. A professional institute offers structured courses, experienced mentors, and hands-on training, which are crucial for building a successful trading career. Whether you're a beginner looking to understand the basics or an experienced trader aiming to sharpen your strategies, the right institute can cater to your needs.

Comprehensive Share Market Training in Chandigarh

Enrolling in share market training in Chandigarh provides a well-rounded understanding of how the stock market operates. The courses cover essential topics such as market fundamentals, technical analysis, fundamental analysis, risk management, and trading psychology. These programs are designed to equip students with the necessary tools to analyze market trends and make informed decisions.

Specialized Courses to Enhance Trading Skills

Swing Trading Course in ChandigarhSwing trading is a popular strategy that focuses on capturing short- to medium-term gains in a stock over a few days to several weeks. A dedicated swing trading course in Chandigarh helps traders understand market trends, identify entry and exit points, and manage risks effectively. This course is ideal for those who prefer a flexible trading style without the pressure of daily market movements.

Option Trading Course in ChandigarhOptions trading can be a powerful tool for maximizing profits and managing risks. An option trading course in Chandigarh covers the fundamentals of options, including calls and puts, option pricing, and advanced strategies like spreads and straddles. With expert guidance, traders can learn how to leverage options to diversify their portfolios and hedge against market volatility.

Forex Trading Course in ChandigarhThe foreign exchange market (forex) offers vast opportunities for traders due to its high liquidity and 24-hour trading cycle. A forex trading course in Chandigarh provides insights into currency pairs, market analysis, and risk management techniques. This course is ideal for individuals interested in global trading and currency speculation.

Why Candila Education Stands Out

Candila Education is recognized as the best stock market institute in Chandigarh for its comprehensive curriculum, expert faculty, and practical learning approach. Here are some reasons why Candila Education is the preferred choice for many aspiring traders:

Experienced Mentors: Learn from industry professionals with years of trading experience.

Hands-On Training: Gain practical knowledge through live trading sessions and real-time market analysis.

Customized Courses: Choose from a range of specialized courses tailored to different trading styles and market segments.

Flexible Learning Options: Benefit from both online and offline classes to suit your schedule.

Community Support: Join a vibrant community of traders and investors for networking and knowledge sharing.

Building a Strong Foundation in Trading

Success in the stock market requires more than just theoretical knowledge. Practical experience and a disciplined approach are key to navigating market fluctuations. By enrolling in the best share market training institute in Chandigarh, you can develop a strong foundation in technical and fundamental analysis, risk management, and trading psychology. These skills are essential for making sound investment decisions and achieving long-term success.

Expanding Opportunities in Mohali

For residents of Mohali, Candila Education also offers top-notch stock market training programs. As the best stock market training institute in Mohali, Candila Education provides easy access to quality education and resources for aspiring traders in the region. The institute's comprehensive courses ensure that students are well-prepared to tackle the challenges of the financial markets.

The Importance of Continuous Learning

The stock market is constantly evolving, and staying updated with the latest trends and strategies is crucial. Continuous learning helps traders adapt to changing market conditions and refine their trading techniques. Candila Education emphasizes ongoing education through workshops, webinars, and advanced courses to keep students ahead of the curve.

Start Your Trading Journey Today

Embarking on a trading career can be both exciting and rewarding. With the right guidance and training, you can turn your passion for the stock market into a successful venture. Candila Education offers the expertise and resources you need to excel in trading. Whether you're interested in swing trading, options, or forex, Candila Education has a course that suits your goals.

Take the first step towards financial independence by joining the best stock market institute in Chandigarh. Enhance your trading skills, gain practical experience, and unlock new opportunities in the world of finance. Your journey to becoming a successful trader starts here.

Visit Candila Education to learn more about available courses and start your path to trading success today.

#best stock share market training institute#best share market training institute chandigarh#best stock market training institute mohali#best stock market training institute chandigarh#forex trading course in chandigarh#option trading course in chandigarh#swing trading course in chandigarh

0 notes

Text

ICT Strategies & Financial Risk Management Course - Winvestly

0 notes

Text

KEEP SIMPLE AND TRADE SIMPLE

0 notes

Text

Top 7 Fidelity Mutual Funds for Long-Term Growth

Investing in mutual funds is a great way to grow wealth while reducing risk. Fidelity offers top funds for a buy-and-hold strategy, such as Fidelity 500 Index Fund (FXAIX) for steady growth and Fidelity Total Market Index Fund (FSKAX) for broader market exposure. For international diversification, Fidelity International Index Fund (FSPSX) and Fidelity ZERO International Index Fund (FZILX) are solid choices. Cost-conscious investors can benefit from Fidelity ZERO Total Market Index Fund (FZROX) with zero fees, while Fidelity Large Cap Growth Index Fund (FSPGX) focuses on high-growth companies. Fidelity Freedom Index 2060 Fund (FDKLX) is ideal for hands-off investors. Choosing the right Fidelity fund and staying invested can help you build long-term wealth.

Read more https://stockxpo.com/top-7-fidelity-mutual-funds-for-long-term-growth/

0 notes

Text

Trusted Trade Ideas and Swing Trading Insights from a SEBI Registered Investment Advisor

Introduction

The world of stock trading offers multiple paths to grow wealth, and swing trading is one of the most flexible strategies for short- to medium-term gains. However, identifying the right trades at the right time can be challenging without expert guidance. That’s where the role of a SEBI registered investment advisor becomes crucial—offering reliable trade ideas and helping you focus on the best stocks to swing trade with a data-driven approach.

What Is a SEBI Registered Investment Advisor?

A SEBI registered investment advisor (RIA) is a professional or firm authorized by the Securities and Exchange Board of India (SEBI) to provide financial advice. Unlike self-proclaimed market experts on social media, RIAs operate under strict regulatory guidelines. This ensures that the advice you receive is unbiased, well-researched, and tailored to your investment needs.

Whether you're a beginner or an experienced trader, consulting with a SEBI RIA adds a layer of credibility and trust to your trading journey.

Understanding the Power of Trade Ideas

In the fast-paced stock market, opportunities don’t wait. A well-timed trade idea can make a significant difference. But what defines a good trade idea?

It typically includes:

A strong technical setup

Logical entry and exit levels

Risk management strategies

A clear time horizon (especially for swing trades)

With so much noise in the market, these carefully curated ideas save time and reduce emotional decision-making.

What Makes a Stock Ideal for Swing Trading?

Swing trading involves holding a position for a few days to a few weeks. The best stocks to swing trade usually show the following traits:

Consistent price movement (volatility)

Defined support and resistance zones

Sector strength or relevant news catalysts

Technical patterns like breakouts or reversals

A SEBI registered advisor screens the market to shortlist such stocks, helping traders avoid guesswork and focus only on high-probability setups.

Why Rely on a Registered Advisor for Swing Trade Ideas?

The stock market is filled with unverified tips and self-styled gurus. A SEBI-registered advisor brings professionalism, transparency, and accountability. You get:

Structured reports and analysis

Ongoing support and follow-up

A rational explanation behind each idea

Help with risk control and position sizing

Most importantly, your capital is managed with discipline, not hype.

Conclusion

Successful swing trading isn't about catching every market move—it's about making consistent, calculated decisions. With insights from a SEBI registered investment advisor, you gain access to well-researched trade ideas that improve your chances of success. If you want to find the best stocks to swing trade without gambling your hard-earned money, professional guidance is the smart way forward.

0 notes

Text

How to Trade the Fibonacci Retracement Pattern: Complete Guide with Strategies

Fibonacci retracement is one of the most powerful tools in a technical trader’s toolbox. Derived from the famous Fibonacci sequence, this tool helps traders identify potential reversal levels in trending markets. Whether you’re trading stocks, forex, or cryptocurrencies, learning how to use Fibonacci retracements can significantly enhance your decision-making process. In this blog post, we’ll…

#Best Fibonacci retracement strategy for beginners#Candlestick confirmation#Combining Fibonacci retracement with RSI and moving averages#Entry and exit signals#Fibonacci levels explained#Fibonacci levels for intraday trading#Fibonacci levels in trading#Fibonacci Retracement#Fibonacci retracement confluence strategy#Fibonacci retracement forex#Fibonacci retracement in stock market#Fibonacci retracement indicator#Fibonacci retracement pattern#Fibonacci retracement trading strategies#Fibonacci sequence in trading#Fibonacci trading strategy#Golden ratio trading#How to draw Fibonacci retracement correctly#How to identify Fibonacci retracement levels#How to trade Fibonacci retracement#How to use Fibonacci retracement in day trading#learn technical analysis#Plotting Fibonacci retracement step by step#Risk management in trading#stock markets#stock trading#Stock trading using Fibonacci levels#successful trading#Support and resistance trading#Swing high and swing low

0 notes