#Supply Chain Finance Companies

Explore tagged Tumblr posts

Text

#Tradewind Finance#international trade finance companies#supply chain finance companies#best export factoring companies#trade financing#best factoring companies#export factoring#international trade finance company

0 notes

Text

As exemplified by Tradewind Finance, supply chain finance companies are essential to global trade. They facilitate trade financing and foster connections among businesses of all sizes across continents, driving economic expansion. Nonetheless, growth can be hampered by financial constraints and operational inefficiencies. This is where supply chain financing and optimization come into play.

#Tradewind Finance#international trade finance companies#best export factoring companies#supply chain finance companies

0 notes

Text

Reforms in tax and visa rules to drive UAE’s growth

Dubai, UAE — The UAE has announced several landmark decisions since the beginning of 2022, and the most important is the first-ever corporate tax and changes in the immigration rules by introducing a new visa system.

The introduction of new laws regarding the ownership structure of mainland companies will boost the economy, as it will attract more business investors that wouldn’t need the previous law allowing foreign business people to only have a 49 percent ownership.

The new law allows a foreign investor 100 percent ownership. As seen before, the moves by the UAE will spill over to the remaining GCC countries, boosting their economies.

On January 31, 2022, the UAE Finance Ministry announced the introduction of corporate tax, which represents a significant shift for a country that’s long attracted businesses from around the world thanks to its status as a tax-free commerce hub.

Speaking to TRENDS, industry experts said that tax reforms and changes in immigration rules would attract more people and foreign investment that would further boost the UAE economy in the coming years.

Corporate Tax impact

On June 1, 2023, the UAE is expected to become the fifth country within the Gulf Cooperation Council (GCC) to have a corporate tax regime. The new corporate tax would bring an additional $13 billion in revenue to the government purse.

With the introduction of corporate tax, the UAE has opted to align itself with the global economy and move away from the status of a zero-tax country. Such integration is critical given the ever-increasing global footprints of the UAE businesses.

It is to be noted that the UAE corporate tax rate of 9 percent for taxable income exceeding AED375,000/- ($102,000) on the UAE mainland entities would be the lowest among GCC countries and one of the lowest when compared with other low tax jurisdictions across the globe.

Nimish Goel, Partner at WTS Dhruva Consultants, said, “The UAE should continue to remain an attractive destination within the GCC for doing business even post-introduction of corporate tax. The lower tax rate should help UAE continue attracting large-scale investment from businesses and corporate behemoths across the globe.”

Goel said, “Also, the free zones would be exempt from corporate tax. Thus, the start-up ecosystem largely based out of such free zones and one of the main drivers of growth should remain largely unaffected by the introduction of corporate tax.”

He added: “The corporate tax will also help UAE in diversifying its oil-driven economy. The additional revenue generated could be utilized to create better infrastructure and a more business conducive environment. This should further increase the competitiveness of UAE as a global destination for attracting large-scale investments vis-a-vis other countries in the region.”

Peter Maerevoet, Global CFO and the Regional CEO for Asia, Tradewind Finance, said: The move would further add momentum to the UAE Economy – the major economic engine of the Middle East and North Africa (MENA) region, allowing gradually its dependence on the traditional revenue earned from fossil fuel.”

Rob MacTighearnain, CFO at Bayzat, said, “I see this as a positive step for the UAE and other GCC governments that follow suit with the implementation of corporate income tax laws. The country’s leadership has demonstrated a clear intention to cement the UAE’s position as a global hub for business and innovation. The introduction of corporate income tax strongly aligns with this vision by affirming the country’s credibility in the eyes of the global business community.”

Arun Leslie John, Chief Market Analyst at Century Financial, talked about the new VAT amendments and said these were made in accordance with the GCC Unified VAT Agreement, an effort to adopt best practices and standardize the tax framework. “A streamlined approach enhances the ease of doing business across the UAE and GCC economies through a shared understanding of the rules and provisions within the region, Arun said.

Omer Saleem, Director and Deputy CEO of Proven, said that the impact of corporate tax would be a more sustainable economic growth model whereby resources are invested in maintaining and enhancing long-term competitive factors from today’s economic value creation.

Vikas R Panchal, General Manager – MENA, Tally Solutions, said, “The new tax law will strengthen the UAE and GCC economy and attract well-meaning businesses and corporate giants from across the world. It will also make GCC and UAE a leading hub for business and investment in the world.”

Impact of Visa Changes

The UAE has changed its immigration rules by introducing a new Advanced Visa System from October 3, 2022, to allow longer tourist visits and a simpler application process.

The new Visa System is a significant restructuring of the country’s current immigration policy and aims to boost the number of residents. It comprises many residency types and the addition of new ones to cover all segments of investors, entrepreneurs, scientists, specialists, high-achieving students and graduates, humanitarian pioneers, frontline workers, and skilled labour in all fields, in addition to streamlining procedures.

The new visa system offers 60 days visit visa, a five-year multi-entry tourist visa, a job exploration visa, a five-year green visa, and a 10-year golden visa with more categories and benefits.

Arun Leslie John, Chief Market Analyst at Century Financial, said that the new visa system would positively impact the development of the economy by attracting more talent and investments from GCC countries and the wider international community. Additionally, these visa law changes coincide with the reforms in commercial law, compounding the benefits. The New Law addresses foreign investment and ownership, special purpose vehicles, and general corporate governance issues to improve the business environment for investors, John said.

He added: “The adoption of these progressive reforms enables UAE to fuel a solid business ecosystem and further its mission as one of the world’s leading destinations.”

Peter Maerevoet, Global CFO and the Regional CEO for Asia, Tradewind Finance, said, “With the introduction of longer-term visas for residents, it will boost the economy, as it will attract more new real estate investors and encourage current residents to invest in the competitive real estate market. It will give investors a more feel of security.”

Rob MacTighearnain, CFO at Bayzat, said, “Offering both longer term and non-employer connected visas to qualified professionals is a transformative change which will increase the country’s competitiveness in the global market for top talent and help to shape the UAE as a key economic player well into the future.”

Omer Saleem, Director and Deputy CEO of Proven, said, “The impact of changes in visa and business laws would lead to the region being able to attract foreign capital and talent and utilize these to realize the goals for sustained growth.”

Vikas R Panchal, General Manager – MENA, Tally Solutions, said, “Business and visa laws will strengthen, and the government is doing everything it can to make individuals and businesses feel they belong. In the UAE, the government has started issuing Golden Visas, which are signals for attracting long-term investment. In addition, the green visa, the 60-day tourist visa, job exploration visa, and more will result in simplified requirements and more benefits for visitors and residents.”

To know more: https://www.tradewindfinance.com/news-resources/reforms-in-tax-and-visa-rules-to-drive-uaes-growth-published-in-trends

0 notes

Text

Azentio: Empowering Supply Chain Finance Solutions

"Azentio Factoring & Supply Chain Finance, known as Factor/SQL®, is a top-tier supply chain finance software. It enables companies to offer commercial financing by purchasing accounts receivables. Highly scalable, it's used by factoring businesses of all sizes to manage portfolios, analyze risks, track commissions, monitor investor activities, and optimize income."

0 notes

Text

0 notes

Text

Live Nation/Ticketmaster is buying Congress

I'm touring my new, nationally bestselling novel The Bezzle! Catch me THURSDAY (May 2) in WINNIPEG, then Calgary (May 3), Vancouver (May 4), Tartu, Estonia, and beyond!

Anything that can't go on forever eventually stops. Monopolies are intrinsically destabilizing and inevitably implode…eventually. Guessing which of the loathesome monopolies that make us all miserable will be the first domino is a hard call, but Ticketmaster is definitely high on my list.

It's not that event tickets are the most consequential aspect of our lives. The monopolies over pharma, fuel, finance, tech, and even beer are all more important to our day-to-day. But while Ticketmaster – and its many ramified tentacles, like Live Nation – may not be the most destructive monopoly in our world, but it pisses off people with giant megaphones and armies of rabid fans.

It's been a minute since Ticketmaster was last in the news, so let's recap. Ticketmaster bought out most of its ticketing rivals, then merged with Live Nation, the country's largest concert promoter, and bought out many of the country's largest music, stage and sports venues. They used this iron grip on the entire supply chain for performances and events to pile innumerable junk fees on every ticket sold, while drastically eroding the wages of the creative workers they nominally represented. They created a secret secondary market for tickets and worked with ticket-touts to help them run bots that bought every ticket within an instant of the opening of ticket sales, then ran an auction marketplace that made them gigantic fees on every re-sold ticket – fees the performers were not entitled to share in.

The Ticketmaster/Live Nation/venue octopus is nearly impossible to escape. Independent venues can't book Live Nation acts unless they use Ticketmaster for their tickets. Acts can't get into the large venues owned by Ticketmaster unless they sign up to have Live Nation book their tour. And when Ticketmaster buys a venue, it creams off the most successful acts, starving competing venues of blockbuster shows. They also illegally colluded with their vendors to jack up the price of concerts across the board:

https://pascrell.house.gov/uploadedfiles/ful.pdf

When Rebecca Giblin and I were writing Chokepoint Capitalism, our book about how tech and entertainment monopolies impoverish all kinds of creative workers, we were able to get insiders to go on record about every kind of monopoly, from the labels to Spotify, Kindle to the Big Five publishers and the Google-Meta ad-tech duopoly. The only exception was Ticketmaster/Live Nation: everyone involved in live performance – performers, bookers, club owners – was palpably terrified about speaking out on the record about the conglomerate:

https://chokepointcapitalism.com/

No wonder. The company has a long and notorious history of using its market power to ruin anyone who challenges it. Remember Pearl Jam?

https://www.rollingstone.com/music/music-news/pearl-jam-taking-on-ticketmaster-67440/

But anything that can't go on forever eventually stops. Not only is Ticketmaster a rapacious, vindictive monopolist – it's also an incompetent monopolist, whose IT systems are optimized for rent-extraction first, with ticket sales as a distant afterthought. This is bad no matter which artist it effects, but when Ticketmaster totally, utterly fucked up Taylor Swift's first post-lockdown tour, they incurred the wrath of the Swifties:

https://www.vox.com/culture/2022/11/21/23471763/taylor-swift-ticketmaster-monopoly

All of which explains why I've always given good odds that Ticketmaster would be first up against the wall come the antitrust revolution. It may not be the most destructive monopolist, but it is absurdly evil, and the people who hate it most are the most famous and beloved artists in the country.

For a while, it looked like I was right. Ticketmaster's colossal Taylor Swift fuckup prompted Senator Amy Klobuchar – a leading antitrust crusader – to hold hearings on the company's conduct, and led to the introduction of a raft of bills to rein in predatory ticketing practices. But as David Dayen writes for The American Prospect, Ticketmaster/Live Nation is spreading a fortune around on the Hill, hiring a deep bench of ex-Congressmen and ex-senior staffers (including Klobuchar's former chief of staff) and they've found a way to create the appearance of justice without having to suffer any consequences for their decades-long campaign of fraud and abuse:

https://prospect.org/power/2024-04-30-live-nation-strikes-up-band-washington/

Dayen opens his article with the White House Correspondents’ Dinner, which is always bracketed by a week's worth of lavish parties for Congress and hill staffers. One of the fanciest of these parties was thrown by Axios – and sponsored by Live Nation, with a performance by Jelly Roll (whose touring contract is owned by Live Nation). Attendees at the Axios/Live Nation event were bombarded with messages about the essential goodness of Live Nation (they were even printed on the cocktail napkins) and exhortations to support the Fans First Act, co-sponsored by Klobuchar and Sen John Cornyn (R-TX):

https://www.nytimes.com/2023/12/08/arts/music/fans-first-act-ticket-bill.html

Ticketmaster/Live Nation loves the Fans First Act, because – unlike other bills – it focuses primarily on the secondary market for tickets, and its main measure is a requirement for ticketing companies to disclose their junk fees upfront. Neither of these represents a major challenge to Ticketmaster/Live Nation's control over the market, which gives it the ability to slash performers' wages while jacking up prices for fans.

Fans First represents the triumph of Ticketmaster/Live Nation's media strategy, which is to blame the entire problem on bottom-feeding ticket-touts (who are mostly scum!) instead of on the single monopoly that controls the entire industry and can't stop committing financial crimes.

Axios isn't Live Nation's only partner in selling this distraction tactic. Over the past five years, the company has flushed gigantic sums of money through Washington. Its lobbying spend rose from $240k in 2018 to $1.1m in 2022, and $2.38m in 2023:

https://thehill.com/business/4431886-live-nation-doubled-lobbying-spending-to-2-4m-in-2023-amid-antitrust-threat/

The company has 37 paid lobbyists selling Congress on its behalf. 25 of them are former congressional staffers. Two are former Congressmen: Ed Whitfield (R-KY), a 21 year veteran of the House, and Mark Pryor (D-AR), a two-term senator:

https://www.bhfs.com/people/attorneys/p-s/mark-pryor

But perhaps the most galling celebrant in this lavish hymn to Citizen United is Jonathan Becker, Amy Klobuchar's former chief of staff, who jumped ship to lobby Congress on behalf of monopolists like Live Nation, who paid him $120k last year to sell their story to the Hill:

https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2023&id=D000053134

Not everyone hates Fans First: it's been endorsed by the Nix the Tix coalition, largely on the strength of its regulation of secondary ticket sales. But the largest secondary seller in America by far is Live Nation itself, with a $4.5b market in reselling the tickets it sold in the first place. Fans First shifts focus from this sleazy self-dealing to competitors like Stubhub.

Fans First can be seen as an opening salvo in the long war against Ticketmaster/Live Nation. But compared to more muscular bills – like Klobuchar's stalled-out Unlock Ticketing Markets Act, it's pretty weaksauce. The Unlocking act will "prevent exclusive contracts between ticketing services and venues" – hitting Ticketmaster/Live Nation where it hurts, right in the bank-account:

https://www.klobuchar.senate.gov/public/index.cfm/2023/4/following-senate-judiciary-committee-hearing-klobuchar-blumenthal-introduce-legislation-to-increase-competition-in-live-event-ticketing-markets

It's not all gloom. Dayen reports that Ticketmaster's active lobbying in favor of Fans First has made many in Congress more skeptical of the bill, not less. And Congress isn't the only – or even the best – way to smash Ticketmaster's criminal empire. That's something the DoJ's antitrust division could power through with a lot less exposure to the legalized bribery that dominates Congress.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/30/nix-fix-the-tix/#something-must-be-done-there-we-did-something

Image: Matt Biddulph (modified) https://www.flickr.com/photos/mbiddulph/13904063945/

CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0/

--

Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#live nation#ticketmaster#corruption#amy klobuchar#david dayen#the american prospect#trustbusting#antitrust#monopolies#Ed Whitfield#revolving door#Mark Pryor#Brownstein Hyatt Farber Schreck#Jonathan Becker#fans first#fans first act#axios#resellers#touts#secondary markets#fix the tix#junk fees#boss act#swift act#Unlock Ticketing Markets Act#jelly roll#livenation

171 notes

·

View notes

Text

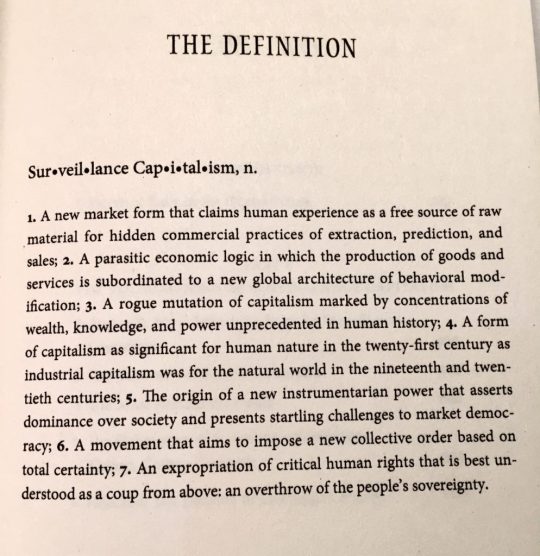

''The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power'' by Shoshana Zuboff, 2018 "I define surveillance capitalism as the unilateral claiming of private human experience as free raw material for translation into behavioral data. These data are then computed and packaged as prediction products and sold into behavioral futures markets — business customers with a commercial interest in knowing what we will do now, soon, and later. It was Google that first learned how to capture surplus behavioral data, more than what they needed for services, and used it to compute prediction products that they could sell to their business customers, in this case advertisers. But I argue that surveillance capitalism is no more restricted to that initial context than, for example, mass production was restricted to the fabrication of Model T’s. Right from the start at Google it was understood that users were unlikely to agree to this unilateral claiming of their experience and its translation into behavioral data. It was understood that these methods had to be undetectable. So from the start the logic reflected the social relations of the one-way mirror. They were able to see and to take — and to do this in a way that we could not contest because we had no way to know what was happening. We rushed to the internet expecting empowerment, the democratization of knowledge, and help with real problems, but surveillance capitalism really was just too lucrative to resist. This economic logic has now spread beyond the tech companies to new surveillance–based ecosystems in virtually every economic sector, from insurance to automobiles to health, education, finance, to every product described as “smart” and every service described as “personalized.” By now it’s very difficult to participate effectively in society without interfacing with these same channels that are supply chains for surveillance capitalism’s data flows." from an interview with Shoshana Zuboff in the Harvard Gazette in March of 2019. It's an interesting interview that I suggest you peruse.

#Shoshana Zuboff#Surveillance Capitalism#data privacy#invasion of privacy#data collection#invasive capitalism

130 notes

·

View notes

Text

In 2013, Weinstein pleaded guilty to running a $200 million real estate Ponzi scheme. In 2012 and 2013, while he was out on bail for that Ponzi scheme, he did another financial scam involving “purported sales of pre-IPO Facebook shares and Florida real estate”; he pleaded guilty to that one in 2014. He was sentenced to a total of 24 years in prison for all of this, but in January 2021 President Donald Trump commuted his sentence and let him out of prison. I don’t know why Trump let him out, but possibly he admired Weinstein’s moxie and sense of humor and wanted to see what else he’d get up to.

That faith in him was richly rewarded yesterday, when Weinstein was charged by the US Securities and Exchange Commission and federal prosecutors in New Jersey with doing a new Ponzi scheme in the two years since he left prison. Pre-IPO Facebook shares were very much the current thing in 2012, before Facebook went public, but in 2021 through 2023 the things were apparently:

» “In or around late 2021, Optimus [one of Weinstein’s companies] started raising money directly from a small number of investors to finance purported transactions related to COVID-19 medical supplies.”

» “In or around May 2022, WEINSTEIN (posing as Mike Konig) asked CC-1 and CC-2 [two unnamed alleged co-conspirators] to raise money from investors to finance the purchase and delivery of three million first-aid kits (‘FAKs’) to USAID to be distributed to the people of Ukraine during the Russia-Ukraine war (the ‘FAK deal’).”

» “In or around May 2022, WEINSTEIN (posing as Mike Konig), asked CC-1 and CC-2 to raise additional money to finance Company-1’s purchase of 100 million N95 masks (the ‘N95 Mask deal’).”

» “Similarly, in or around early August 2022, WEINSTEIN (posing as Mike Konig) asked CC-1 and CC-2 to raise money to finance the purchase of approximately 29 shipping containers of baby formula from [alleged co-conspirator Alaa Mohamed] HATTAB’s company, Hattab Global, in order to capitalize on supply chain issues which had created a shortage in baby formula (the ‘Formula deal’).”

Just pick a thing in the news, and he was allegedly pretending to supply it. Of course prosecutors say he was not actually doing any of these things and was instead stealing the money

– Baby-Formula Ponzi Schemer Does This a Lot, Money Stuff

346 notes

·

View notes

Text

Last February, as the sound of automatic weapons erupted in the early hours before dawn, Amina Museni hurriedly packed a bag while her husband, Joseph, shook their three children awake. They were joining a group of neighbors fleeing their hamlet as the front line between the Congolese army and rebels of the March 23 Movement, or M23, crept closer. For days afterward, they walked across the hilly landscape of Masisi, in eastern Democratic Republic of the Congo, before reaching one of the camps that have sprung up around Goma, the capital of North Kivu province. There, they pitched their tent, a young family of five among more than a million people displaced by the resurgence of a conflict that has ravaged Congo for nearly three decades.

When Foreign Policy visited the camp last July, Museni sat amid an undulating sea of white tarpaulins stretched over eucalyptus sticks. “When I was little, I lived in a tent with my parents,” Museni said, her youngest child, Nestor, cradled into her neck. “Now my children have to endure the same. It feels like a curse.”

Why Congo has been in a perennial state of upheaval since the mid-1990s has been the subject of much debate, but no other narrative has cut through as much as that of so-called conflict minerals. In the 2000s, the link between markets’ demand for minerals and the war in Congo helped bring attention to the conflict in an unprecedented way. Western organizations such as the Enough Project and Global Witness mobilized around the seductive proposition that the solution to one of the world’s deadliest conflicts was within the grasp of consumers and policymakers, triggering a series of laws and regulations beginning with, in the United States in 2010, Section 1502 of the Dodd-Frank Act. The logic behind the legislation was simple. “Armed groups finance themselves through the exploitation of cassiterite, gold, coltan,” Fidel Bafilemba, a Congolese researcher who used to work for the Enough Project, told me at the time. “By stopping the export of these conflict minerals, we dry up their resources and lessen the violence.”

Section 1502 required companies to conduct due diligence checks on their supply chain to disclose their use of minerals originating from Congo and neighboring countries and to determine whether those minerals may have benefited armed groups. The legislation didn’t outright ban the sourcing of minerals from mines contributing to conflict financing but instead intended “this transparency and its attendant reputational risk” to pressure companies to stop buying them voluntarily, according to Toby Whitney, one of the authors of Section 1502.

What followed is an important lesson for a world rushing to secure critical minerals for the energy transition. Western advocacy led to policies focused on derisking supply chains and virtue signaling to consumers, rather than improving artisanal miners’ living conditions or addressing the conflict’s root causes. That narrative continues today: An Apple store in Berlin was vandalized last week by Fridays for Future activists accusing the tech giant of sourcing so-called conflict minerals from Congo.

ITSCI, the region’s leading private traceability scheme, is facing criticism about the validity of its work—and that it has not improved the lives of artisanal miners in the region. ITSCI stresses its limited mandate and that it is working as intended. But in a cruel twist, the cost of the due diligence program has been shouldered by Congolese miners themselves, effectively asking the world’s poorest workers to pay for the right to sell their own resources to Western companies.

This week, industry leaders and activists gathering at the Organization for Economic Cooperation and Development (OECD) in Paris for the annual Forum on Responsible Mineral Supply Chains will need to reassess their approach. “We welcomed Dodd-Frank,” said Alexis Muhima, a Congolese researcher, during a meeting in a cramped office in Goma. “But what it did is outsource complex issues to the private sector, and we’ve been paying for it ever since.”

“The Americans didn’t think this through.”

There was a time in the 1970s when the quarries of Nyabibwe, a mining town in South Kivu province, were run with enough capital to employ 500 workers and to invest in semi-industrial machinery. Every month, the French company in charge shipped 20 metric tons of cassiterite ore—a component of tin—back to Europe for cans, wires, and solder. Safari Kulimuchi was a worker at the mines, starting at age 17, who quickly rose through the ranks to become a manager. “It was an exciting time. … Things seemed to be working out,” Kulimuchi recalled to Foreign Policy over dinner in Nyabibwe. But, he said, “it didn’t last.”

In the years that followed, Kulimuchi witnessed the economic unraveling of Congo (then Zaire), rotten under decades of rule by dictator Mobutu Sese Seko, who presided over the country from 1965 to 1997. Amid a global economic downturn in the mid-1980s, the French company departed, abandoning its workers to fend for themselves. “Overnight, we had no wages, no tools, no structure,” Kulimuchi said. “We used to have a stone crusher. Now we had to crush rocks with a hammer.”

Nyabibwe was far from an exception. Across the country, as investment dried up and the state abdicated its responsibilities, people resorted to making ends meet any way they could. An informal economy based on débrouillardise, or resourcefulness, sprouted in the ruins of Mobutu’s derelict regime. That informal economy is estimated to account for more than 80 percent of Congolese economic activity today. Nyabibwe grew into a town as people came from far and wide to work in the mines. They replaced the industrial machinery with picks and shovels, a low-capital, labor-intensive extraction called artisanal mining, as opposed to industrial mining. “Artisanal mining is the heart of our economy. It’s the reason Nyabibwe became this big center,” Kulimuchi said. The World Bank estimated in 2008 that up to 16 percent of the Congolese population depended on the sector. “For us, it’s a lifeline,” Kulimuchi added.

Mobutu was finally ousted in 1997 by a coalition helmed by the Rwandan Patriotic Front (RPF), a rebel army led by Paul Kagame. Kagame had just seized power in Rwanda in the aftermath of the genocide there and was intent on chasing after Hutus responsible for the massacres, many of whom had crossed into Zaire. What became the First Congo War brought Laurent-Désiré Kabila, a Congolese rebel, to power.

Kabila’s allies in the RPF quickly turned into foes when they refused to relinquish control over an area where instability threatened their security and interests. The Second Congo War began in 1998 with the creation of the RCD, a Tutsi-led, Rwandan-backed armed group that quickly gained control of a large swath of eastern Congo. The rebels began shipping cargo loads of coltan and cassiterite ores out of mines such as Nyabibwe’s into Rwanda just as the price of coltan, a key component of capacitors used in mobile phones and most electronic devices, soared with the demand for electronic goods at the turn of the century. A 2001 United Nations report estimated that Rwanda made at least $250 million during a temporary spike in prices in late 1999 and 2000. A popular formulation in Western campaigns at the time linked the violence in Congo to “blood phones.”

Many experts have criticized the advocacy of the 2000s for sometimes going so far as to suggest that conflict minerals were the root cause of the violence, painting armed actors as merely bloodthirsty, greedy militias—instead of considering real, historical grievances. The Enough Project campaigns, leaning hard on celebrities such as Robin Wright and Ryan Gosling to spread the group’s message, obfuscated the nuances of the conflict and the vital place of artisanal mining in the local economy. “The ‘conflict minerals’ label was problematic,” said Sophia Pickles, a former Global Witness campaigner and U.N. investigator. “This isn’t just about Congo—it’s a global issue.”

The campaigns succeeded in putting the issue on U.S. legislators’ agenda, but Section 1502 of the Dodd-Frank Act was both too specific—singling out the so-called 3T minerals (tin for cassiterite, tantalum for coltan, and tungsten) in eastern Congo—and extremely vague on execution. It deferred the drafting of rules to the U.S. Securities and Exchange Commission (SEC), leaving companies with no clear guidelines to report on their supply chain.

The law created a panicked scramble in the industry, said William Millman, a former technical director at Kyocera AVX, a leading manufacturer of electronic components and major coltan buyer. “Everybody was ignorant about the specifics. We just relied on our smelters.” Unlike an oil company directly operating its wells or a sneaker company outsourcing production to a sweatshop in Asia, electronics companies have virtually no way of knowing where the minerals in their products come from upstream of the smelters or refiners that have turned them into smooth metal—unless the smelters themselves know. “I visited all my suppliers to gather information. They knew very little because it was all largely bought on the spot market with international brokers,” Millman said. As a result of Section 1502, companies liable to fall under the SEC rule demanded that their suppliers simply stop buying from eastern Congo.

The result? A de facto embargo dropped like a bomb on the mining communities of North and South Kivu, just as the region was emerging from its latest cycle of violence. Nyabibwe had navigated two major wars mostly unscathed, but when I visited in June 2012, the town was in the midst of an existential crisis. Businesses dependent on the cash flow generated by the mines were closing down one by one, unable to sell stockpiles of rubber boots and shovels, blacksmithing services, or simply food. Tellingly, the local nightclub had shut its doors. More concerning were thousands of families’ insufficient funds to access health care, forcing women to give birth at home. One study found that the boycott increased the probability of infant mortality in affected mining communities by at least 143 percent.

Kulimuchi, who was then 54, was still managing a small team of undeterred miners. “The Americans didn’t think this through,” he said. His team had three metric tons of ore stored in a warehouse in Bukavu, South Kivu’s capital, waiting to be bought and shipped. “School is about to start again. Where are we going to find the money to send our children?”

Though U.S. lawmakers had struck out on their own with Section 1502, industrywide talks to create guidelines for the responsible sourcing of minerals in high-risk areas globally were already underway at the OECD. The OECD guidelines, adopted later in 2010, ended up becoming the foundation for the SEC rules, released in 2012. “The choke point in the supply chain is the smelters—everything has to go through them, and there aren’t many smelters in the world,” Millman said. “The OECD came up with a standardized protocol to audit and certify the smelters on an annual basis to know that they have control and knowledge of their supply chain.”

According to Millman, a handful of downstream companies seemed genuinely interested in doing things right and getting involved at the mine level. In 2011, together with Motorola and the Washington-based NGO Resolve, what was then AVX launched Solutions for Hope, a pilot project in Congo’s Katanga (now Tanganyika) province, where there was no conflict. They created a closed-pipe supply chain, sourcing from artisanal mines through a company that sold directly to a Chinese smelter and then onward to AVX, which manufactured components for Motorola and Hewlett-Packard.

Solutions for Hope also decided to hire the services of ITSCI. Its “bag and tag” traceability scheme set up by the International Tin Association (ITA) promised to trace minerals from the mine and guarantee their origin to buyers through a paper trail associated with sealed tags affixed on bags. According to Millman, Solutions for Hope was successful largely because its integrated supply chain bypassed traders and brought end-user companies closer to the miners. Replicating it would take time and effort. But, Millman said, “what other companies who had sat back saw was that, suddenly, with ITSCI there was a way for their CEOs and CFOs to sign off on their SEC statements. … And so everyone piled in, and it became the easy option.” ITSCI’s first project in eastern Congo was implemented in October 2012 in Nyabibwe.

“Do you think these people stopped working?”

Ten years on from when we first met, Kulimuchi came down from the mountainside where he had been working with his son on a sunny day last July, his broad smile still intact. The mining site hadn’t changed much either. Around us, men wearing flip-flops were using the same basic tools to split the earth open, with no protective equipment.

Initially, Kulimuchi recalled, the artisanal miners had been relieved when a large delegation showed up to officially launch the traceability scheme. “It meant we could finally start selling again. All my financial worries would be a thing of the past,” Kulimuchi said he thought at the time.

Instead, an elaborate public-private bureaucracy emerged, driven in part by regional governments intent on bringing the artisanal mining sector under control but quickly superimposed by foreign private sector initiatives like ITSCI, responding to market demand for paperwork required by end-user companies to file their reports to the SEC.

“We started selling again, but it’s a cacophony. There is a ton of admin, taxes after taxes, and prices have gone down. We have been weakened by all this,” Kulimuchi said.

As the de facto embargo on eastern Congo’s minerals lifted, by 2012 thousands of small sites across the region found themselves effectively outlawed by a new mine site validation process. To be able to sell, Congolese mining sites must now be inspected by a delegation of government representatives, NGOs, and U.N. agencies. At sites given the go-ahead from that audit, the Congolese artisanal mining agency carries out its own checks while also tagging and recording the minerals in logbooks for ITSCI. There are other records kept by the provincial government’s Mining Division and a regional body. Many sites are still waiting for an audit. For those that don’t conform, the consequences are devastating: “You are destroying the livelihood of hundreds or thousands of people,” said Maxie Muwonge, who was a program manager for the International Organization for Migration between 2013 and 2018 when it was tasked with coordinating the validation process. “This excludes entire communities. What are they meant to do? Do you think these people stopped working?”

In fact, even under the de facto embargo, the minerals trade never really stopped. It just went further underground. Rwanda’s export statistics, which experts say don’t match its reserves, suggest that smuggling to neighboring countries spiked during the period. While the volume of trafficked minerals has fallen with the reopening of the legal market in eastern Congo, smuggling is still an issue, not least because of the market distortion caused by heavy regulation and taxation in Congo of small businesses. “Many collapsed because they couldn’t meet the requirements, and the investment in the sector decreased. It broke down artisanal miners even further,” Muwonge said.

Joyeux Mumpenzi followed in his mother’s footsteps when he decided to become a négociant, an intermediary who buys minerals from the creuseurs, or diggers, and transports them to export companies in large cities—a reflection of the highly organized division of labor in the artisanal sector. “To begin with, we have no say regarding the going price—the London Metal Exchange sets it, and it fluctuates constantly,” he said. “Then there are all the taxes, and finally, the export company retains a penalty on my payment for ITSCI.”

Today, 99 percent of ITSCI’s revenue comes from the levies it collects from upstream actors based on the volumes of minerals tagged and exported, ITSCI program manager Mickaël Daudin said in an interview. The organization says artisanal miners are not supposed to pay for the scheme. But the cost, or at least a percentage of it, is passed down the supply chain to the négociants and ultimately to the miners. “I have no choice” in doing so, Mumpenzi said. “I end up earning little more than they do, and I take huge financial risks.” The 33-year-old trader says he earns about $300 a month, while an artisanal miner’s household makes $200 on average.

ITSCI, which operates in both Congo and Rwanda, applies differentiated levies to businesses in the two countries. Daudin said that’s because “the cost of implementation … remains much higher” in Congo than in Rwanda but declined to disclose the levies’ rates; a Congolese government official called it a “conflict tax.” The rate discrepancy effectively encourages trafficking to Rwanda for Congolese mining operators keen to increase their margins.

A report published in 2022 by Global Witness cited “[s]ome industry sources” alleging that ITSCI was in fact set up to facilitate the laundering of Congolese minerals smuggled into Rwanda. Foreign Policy hasn’t been able to confirm the claim, but the tagging system that ITSCI created does offer the perfect cover for smuggling, in Rwanda or Congo. The integrity of the scheme relies entirely on the integrity of the people implementing it; the tags themselves offer no guarantee. In a statement released in response to the report, ITSCI wrote that it “strongly rejects all Global Witness’ stated or implied allegations of wrongdoing, facilitating deliberate misuse of ITSCI systems or illegal activity.” If ITSCI had aimed to maximize smuggling into Rwanda as alleged, a spokesperson wrote to Foreign Policy in an email, “ITSCI would not have launched in Katanga in 2011 nor in any other adjoining locations at other times. During 15 years of implementation, ITSCI has continued to expand the programme in [Congo], now supporting more than 1,500 sites across 8 Provinces.”

The Global Witness report also documented how the system can be breached without ITSCI’s cooperation. For starters, the tagging is not performed by ITSCI but by Congolese government agents who earn less than the miners themselves and sometimes go for months without pay at all. From bribing agents to trading in tags, the number of ways to circumvent the system is almost limitless—as Mumpenzi demonstrated to Foreign Policy. The négociant stood up from the sofa in his living room and walked to a corner where sturdy white plastic bags had been stacked. “See the tags? The bags were sealed by an agent before I picked them up yesterday,” he said. “The mineral sand now has to be washed, so when I’ll bring the bags to the washing station, the tags will be removed. When minerals are washed, the weight goes down, so this is a perfect time to smuggle in minerals before a new tag goes on. As long as the bag weighs less than it did initially, no one will say anything.”

ITSCI doesn’t rebuke such allegations categorically. The organization says it was aware of many of the incidents documented by Global Witness and had already addressed them. “The program isn’t perfect. There are issues, and there always will be,” Daudin told Foreign Policy. “But from my point of view, it wasn’t better before.”

Kulimuchi and other artisanal miners might beg to differ. Rather than improving their living conditions, the “increasing regulation of the artisanal mining sector and responsible sourcing efforts, have rather had a negative overall effect on the socio-economic position of artisanal miners,” analysts at the International Peace Information Service (IPIS), a leading minerals research institute, wrote in 2019. Guillaume de Brier, a researcher at IPIS, told me that “working in an ITSCI or a non-ITSCI site doesn’t change anything. Conditions are dismal in both cases. There’s no difference in terms of child labor, and miners don’t earn more.”

When asked by Foreign Policy about this criticism, an ITSCI spokesperson stressed the organization’s limited mandate as a traceability and due diligence not-for-profit initiative. “It does not function as a certification mechanism,” the spokesperson wrote, and the organization’s focus “does not extend to working conditions.”

However, evidence suggests that responsible sourcing efforts have failed to shift conflict dynamics. A 2022 report by the U.S. Government Accountability Office (GAO), part of its mandate to evaluate the impact of Section 1502, was titled “Conflict Minerals: Overall Peace and Security in Eastern Democratic Republic of the Congo Has Not Improved Since 2014.” Violence has instead risen, remaining “relatively constant from 2014 through 2016 but steadily [increasing] from 2017 through 2021,” GAO wrote.

Arguably, some measure of progress has been achieved at the 3T mining sites targeted by Dodd-Frank, where the presence of armed groups has decreased. But while ITSCI claims to have played a role, de Brier says the scheme merely implanted in sites where the situation was already better. Overall, this demilitarization has largely been the result of Congolese policies and the evolution of conflict dynamics themselves: The defeat of the M23 rebellion in 2013 (the armed group changed names multiple times as it successively integrated into and rebelled against the national army) led to the dismantling of one of the country’s most predatory mafia networks. Today, for instance, Bisie, once an iconic mining site under the control of Bosco “The Terminator” Ntaganda, is operated by the Canadian company Alphamin. (Ntaganda is serving a 30-year prison sentence in Belgium following his conviction by the International Criminal Court for war crimes and crimes against humanity.)

Now though, with the resurgence of the M23 rebellion since November 2021—which has displaced Museni, her family, and more than 2.5 million others—even that small measure of progress is under threat.

“This is how the armed groups are paid.”

Belgian colonial administration profoundly altered the Congolese relationship with the land, introducing private ownership and displacing people for commercial exploitation. Since independence, who has the right to own land—and by extension its resources—has remained an unresolved existential question. “The main resource driving conflict isn’t coltan,” said Onesphore Sematumba, an analyst at the International Crisis Group. “It is the land. It’s material ownership, of course, but also who has a legitimate right to be here.”

In the borderlands of eastern Congo, these questions have been exacerbated by intertwined histories with neighboring countries. Hutus and Tutsis, who arrived from Rwanda in successive waves throughout the 20th century—first brought by Belgian colonialists to work on plantations in the territories of Rutshuru and Masisi—have struggled to find acceptance and secure land rights. Rwanda, meanwhile, a small, densely populated country with little resources of its own, largely depends on economic ties and access to Congo’s resources. These two dynamics have helped create the vicious circle of the last three decades. Backed by Rwanda, the RCD rebellion and its successors claiming to fight for Tutsis’ rights have helped entrench tensions along ethnic lines while facilitating land grab by a small elite.

“Indigenous communities in Masisi were dispossessed of their land during the war,” said Janvier Murairi, a Congolese researcher. “Today’s farm and mine owners are people who had links to the RCD. Everything from Mushaki to Masisi town belongs to hardly more than 10 people.”

One such owner was Edouard Mwangachuchu, an aspiring Tutsi politician and a member of the RCD’s political branch, who was awarded a concession covering seven mines in Rubaya by the rebel administration in 2001. Two years later, the Sun City Agreement, a peace deal negotiated between rebel factions with little regard for social justice or community grievances, endorsed Mwangachuchu’s ownership over the mining sites as a prize of war for the RCD, granting his company, MHI (now SMB), control over what have become the most productive sites at Congo’s largest coltan mine. Today, Rubaya accounts for about 15 percent of global coltan production.

Rubaya is emblematic of the way ITSCI, and more broadly due diligence as it is practiced today, treats “conflictual issues, such as concessions and land ownership, … as a black box,” Christoph N. Vogel writes in his 2022 book, Conflict Minerals Inc., turning a blind eye to political issues around social justice and equity, even as those are drivers of the violence it means to help prevent.

In Rubaya, Mwangachuchu’s plan to turn the quarries into an industrial mine spurred a backlash from local communities. “The artisanal miners didn’t accept that this family [the Mwangachuchus] who had come into the possession of the mines through the conflict could take away their livelihood,” Murairi said. The government mediated a deal: The miners were allowed to continue mining SMB sites but had to sell exclusively to the company.

ITSCI began operating in Rubaya in 2014, tagging minerals from both SMB and peripheral sites belonging to a state-owned mining company, SAKIMA. But the situation unraveled as the scheme was embroiled in a tit-for-tat commercial war in the years that followed.

Suspecting that ITSCI’s tags were being used to launder the sale of its minerals to a rival trading company, SMB eventually turned to ITSCI’s main competitor in the tag-and-bag business, Better Mining. The move should have represented a major financial blow to ITSCI, the loss of roughly half its revenues for Congo. Instead, as production at the SAKIMA sites kept growing while SMB’s dwindled, ITSCI’s business was preserved. According to an internal U.N. report provided to Foreign Policy, “Only about seventeen percent of the production that officially originates from the SAKIMA concession has in fact been mined there.” The report noted that “[s]uch discrepancy between official data and reality is only conceivable if a structured mechanism of fraud is established.”

Daudin, the ITSCI program manager, responded that ITSCI is “confident about its data.” He argued that the production increase was due to the higher level of investment going to SAKIMA sites when local miners turned away from SMB.

The M23’s resurgence dealt the last blow to Mwangachuchu, who was arrested in March 2023 and charged with treason after weapons were allegedly found on the grounds of his company’s facilities in Rubaya. According to the prosecutor, Mwangachuchu intended to support the M23 rebellion. The government has since revoked SMB’s mining permits. Few people in North Kivu will feel sorry for Mwangachuchu, “but one of the protagonists was pushed out in favor of the other, and that never works,” said Achile Kitsa, a former private secretary to the provincial mines minister.

The Congolese army took full control of Rubaya last spring, leaving the former SMB concession at the mercy of local armed groups it used as proxies on the front line against the M23. “This is how the armed groups are paid,” said a Congolese researcher who spoke on condition of anonymity. ITSCI resumed its operations in June, tagging minerals from the SAKIMA perimeter up until November, when the road was cut off by the fighting, according to Daudin. “We relaunched our activities after evaluating each site with the government services,” he said in July. “There are no nonstate armed groups in our sites.”

In a December report, the U.N. Group of Experts on Congo contradicted Daudin, establishing that between June and November, the “production from [the former SMB] sites was either smuggled to Rwanda or laundered into the official supply chain using [ITSCI] tags for minerals produced in [the SAKIMA concession], where mining activities were still authorized.”

“ITSCI recognizes that there have been, and remain, ongoing risks regarding fraud and presence of both non-state and state armed groups in the area of Masisi territory, North Kivu,” the ITSCI spokesperson wrote. “These risks are regularly reported through ITSCI’s OECD-aligned systems.”

Muhima, the Congolese researcher, sees the possibility of tainted minerals in the ITSCI supply chain as inevitable, given its built-in conflict of interest. “Their income depends on the volume they export. They cannot stop tagging minerals, or their business will collapse.”

“We don’t need another scheme.”

Congolese activists were not pleased with the Global Witness report exposing the shortcomings of ITSCI when it was published in 2022. They felt that the research mostly rehashed criticisms and evidence that they had presented for many years without being listened to and that the report failed to draw the necessary conclusions, ending with tepid recommendations to reform ITSCI or consider options to replace it with another independent scheme. “We don’t need another scheme,” Murairi said. “We don’t need more foreigners who think Congolese can’t do anything.”

Global Witness’s cautiousness should perhaps not come as a surprise. The activist organization played no small part in paving the way for today’s conundrum, and the risk of triggering another de facto embargo on Congolese minerals hangs heavy. “We’ve learnt some very difficult lessons, and as an activist, I’m not the one who bore the consequences of bad policymaking,” said Pickles, the former Global Witness campaigner.

When I pressed Daudin last July about ITSCI’s resumption of its activities in Rubaya, even as armed groups were swarming the mining area, he dodged: “If we don’t start tagging again, mining communities will be the first ones to suffer from not being able to carry on their activities.”

ITSCI suffered a major setback in October 2022, when the Responsible Minerals Initiative (RMI), a member association of more than 400 of the world’s largest corporations, announced that it was taking the scheme off its list of recognized upstream due diligence mechanisms. ITSCI had failed to submit an independent assessment of its alignment with the OECD guidelines in time. When the organization eventually released an independent audit in June 2023, it failed to assess ITSCI’s activities in Congo, focusing solely on coltan production in Rwanda. The RMI has offered to pay for three site visits in Congo, including in Rubaya, but ITSCI has so far not agreed. (“Site visits outside alignment assessments are not explicitly required,” said the ITSCI spokesperson, who noted the terms of such a visit are nonetheless under negotiation with RMI.)

“They are holding everyone hostage,” an industry insider close to the RMI process told Foreign Policy. “There is so much pressure on the RMI to capitulate and say we need this system. But this isn’t a technical issue.” To many experts and industry insiders, the resurgence of the M23 conflict has at least had the benefit of clarifying the situation. “The system cannot withstand what it was built for. It can’t withstand the conflict. We are back to square one.”

Breaking ITSCI’s quasi-monopoly is often presented as the solution in minerals circles, but SMB’s switch to Better Mining solved none of the problems in Rubaya and only created more confusion. Better Mining’s for-profit business model and its reliance on technology make it hard to scale and mean it is explicitly designed for larger companies with capital, not artisanal miners. “The problem with all these initiatives is that no one is there to control them,” said de Brier, the IPIS researcher.

Who is supposed to exert this control is part of the problem. Much like the fragmented nature of the supply chain, the nebulous ecosystem of public and private actors involved in responsible sourcing means that responsibility befalls no one in particular. In a July 2023 report, the GAO noted that the number of companies filing conflict minerals disclosures to the SEC had been steadily declining year-on-year since 2014, in part because “companies perceive that they are unlikely to face enforcement action by the SEC if they do not comply.”

Pickles noted that, unlike Dodd-Frank, the European Union’s own conflict minerals regulation, which came into force in 2021, avoided the trap of focusing only on Congo but equally fell for industry schemes such as ITSCI. “I’ve spoken to the competent authorities of three member states, and they said that the reports they receive from companies don’t tell them anything. They don’t actually know what’s happening along the supply chain,” she said. “So where does that leave us?”

For Congolese, ending this hypocrisy is a necessary first step but requires trust and support on the part of international partners. “The Congolese government has its own traceability system. All the necessary documents are delivered by Congolese state agencies. They tell you where the minerals come from just as reliably as ITSCI’s tags, which is to say it’s not perfect but it’s no worse,” Muhima said. “The same state agents deliver these documents and implement ITSCI’s program—for free I might add, since ITSCI doesn’t pay for them. What needs to be improved urgently is their payment.”

These lessons are relevant beyond the specifics of the 3T supply chain. The attention around cobalt—the conflict mineral du jour thanks to its use in electric vehicle batteries—is a case in point. While there is no conflict in the area where cobalt is extracted, working conditions and child labor have been discussed in much the same way as conflict minerals were back in the 2000s: in decontextualized and sometimes inaccurate reports that fail to examine the complex ways in which minerals interact with people’s livelihoods. Instead, such reports paint artisanal mining as illegitimate, something to eliminate. They have been used to justify land grab by large mining companies whose supply chains are easily traceable for end-user companies.

“We haven’t learned from our experience with diamonds or 3T minerals. With cobalt, it’s as if those experiences never existed,” said Joanne Lebert, the executive director of IMPACT, a nonprofit organization working on natural resource governance. “Instead of supporting communities, we’re just monitoring. There is no connection in my view between a clean supply chain and governance and security outcomes. Maybe you take kids out of your supply chain, but they’ll go to agriculture, to domestic work. They’ll go to another mine. They’ll sneak in at night. Clean supply chain is about eliminating the risk and not necessarily about doing good. And it’s the doing good we have to get at.”

Following the same pattern, an EU law aimed at preventing products linked to deforestation from entering the European market is pushing coffee companies toward industrial producers able to generate the paperwork and sidelining small farmers from Ethiopia to Brazil. Private companies will always take the shortcut, while black markets, exploitation, and conflict feed on exclusion.

Whether Western consumers like it or not, artisanally mined minerals will continue to find their way into the supply chains that fuel the energy transition and consumer products. Investing in mining communities’ welfare, education, and businesses is indispensable.

Museni is still living in the refugee camp on the outskirts of Goma with her husband and young children. Surrounded, the provincial capital has been struggling to absorb and provide for the constant new waves of displaced families reaching the city as the M23 is inching closer.

Even as evidence of Rwanda’s support to the rebellion has been mounting, the country has still not been sanctioned. In February, the EU signed an agreement “to nurture sustainable and resilient value chains for critical raw materials” with the Rwandan government, calling the country “a major player on the world’s tantalum extraction.” Congolese President Félix Tshisekedi described the deal as a “provocation in very bad taste.”

In Nyabibwe, Kulimuchi took me on a final walk around the town, waving around at the myriad businesses and hard-working people in the streets. “No one here has a bank account, for example. We can’t save. We can’t build,” he said. “We don’t require much—a road to Bukavu, a little boost, you know. Then, we’ll take it from there.”

13 notes

·

View notes

Text

Brazilian beef and leather companies fall short in tackling deforestation, a study finds

The next United Nations climate conference, COP30, will be held in Belem, the capital of an Amazon region where widespread deforestation mainly driven by cattle farming has turned the surrounding rainforest from a vital carbon sink into a significant carbon source.

Now a new report concludes around 80% of Brazil’s leading beef and cow leather companies and their financiers have made no commitments to stop deforestation.

The study, released Wednesday by the environmental nonprofit group Global Canopy, highlights the country´s most influential beef and leather producers and processors along with financial institutions that have supported them with $100 billion. This amount is one-third of the annual funding that wealthy nations pledged to provide for climate finance in developing countries during COP29 last month in Baku, Azerbaijan.

“Although cattle is the single most influential commodity for deforestation and linked greenhouse gas emissions, the report … reveals a picture of staggering inaction from corporates and financial institutions alike in Brazilian supply chains,” the study said.

Continue reading.

#brazil#brazilian politics#politics#environmentalism#farming#image description in alt#mod nise da silveira

4 notes

·

View notes

Text

#Tradewind Finance#international trade finance companies#supply chain finance companies#best export factoring companies#trade financing#best factoring companies

0 notes

Text

International trade finance companies play a vital role in enabling cross-border trade transactions. They specialize in offering tailored financial solutions to meet the specific needs of businesses operating in emerging markets. From risk management to enhancing cash flow, trade finance solutions provide a wide range of advantages that empower businesses to capitalize on opportunities and navigate challenges in the global marketplace.

#Tradewind Finance#PDF File#international trade finance companies#best export factoring companies#supply chain finance companies

0 notes

Text

Export Finance - Benefits, Eligibility & Application Process

Owing to globalization, companies are now aiming to grow beyond boundaries by taking their business to international markets brimming with rewarding possibilities and opportunities. Needless to say, global aspirations come with certain challenges. However, the benefits effortlessly outweigh the hassles. Moreover, companies belonging to diverse sectors are now seeking quick solutions to grow globally, and make a lasting mark overseas before their competitors do.

When it comes to seamless international trade, tools like Export finance prove to be a blessing. Export finance, also known as factoring finance or account receivable financing, is an excellent solution that exporters can use to conduct trade with international importers or buyers. It gives them easy and quick access to working capital without having to wait for their buyers to clear invoices.

How Does It Work?

Export finance is ideal for SMEs (small- and medium-sized enterprises) that need funds but have limited banking facilities or an undocumented credit history. Chasing late payments becomes the financier’s responsibility, to a great extent.

To attract importers, exporters often draft payment terms stating that buyers can have longer payment cycles. However, this also means that they have to manage a financial gap between shipping the goods and receiving payment for them. To arrange finances to keep the business going during this waiting period, exporters can turn to Export financing.

They can submit unpaid invoices to a finance provider that will grant them a percentage of the total invoice amount as an immediate payment. The buyer is then liable to pay the financier instead of the exporter. Once the invoice is cleared by the importer, the finance provider then pays the remainder of the money to the exporter, minus the service fee that is agreed upon by both parties at the time of contract signing.

Benefits Of Export Finance

Export financing brings a host of benefits to global suppliers. It helps companies maintain a steady cash flow, improve collections, and have preventive measures in place to handle debts. They can make the most of every opportunity that comes their way to generate more sales by offering longer payment terms to buyers without running low on capital. Here are the key benefits:

1. Exporters get quick access to finances that would otherwise be tied up for months on end.

2. They can use these funds to build growth strategies for the company, as well as invest in new tools and technologies to accelerate this growth.

3. The granting of finances is based on individual invoices and not the exporters’ credit history.

4. As soon as invoices are settled, the remainder of the payment is made to them by the financier.

Are You Eligible For Export Financing?

It is important to check the terms and conditions of the financier you are considering to know if you are eligible, as it can vary from provider to provider. To be eligible for Export financing with different lenders, exporters have to meet some criteria. Generally speaking, Export finance is available to exporters who trade globally, and have to grant longer invoice payment terms.

In some instances, exporters also have to provide proof of the minimum percentage of revenue coming from exports or submit unpaid invoices. To qualify for Export finance via conventional means such as banks, exporters may have to meet additional criteria, such as a positive credit score or proof that the company is making enough revenue to repay loans.

Leverage the Power of Export Factoring with Tradewind

Tradewind Finance specializes in cross-border transactions and finances trade globally for sales made on open accounts, letters of credit, and documentary collections payment terms. We solve short-term cash flow issues by purchasing your company’s accounts receivable in exchange for an advance of up to 95% of the total invoice value. We then collect the full amount from your client upon invoice maturity. Once the invoice is paid in full, we send you the remaining balance.

Why Choose Us?

With an emphasis on streamlining company cash flow, Tradewind offers non-recourse financing solutions, providing quick working capital for our clients. You also get the flexibility to choose the best avenue to make the most of Export finance:

1. Export Factoring on Open Account Terms:

We first inspect the creditworthiness of your buyer and set a credit limit on them. Then, we buy your accounts receivable and pay you generally within 24-48 hours of invoice submission. We handle the management of your accounts receivable and the complete dunning process. In case your customer cannot pay due to insolvency, we will pay you (non-recourse).

2. Export Factoring via Payment Against Documents:

If you sell on documentary terms, we will advance the funds and handle the bank collections process.

3. Export Factoring via Letter of Credit:

Your buyer opens a letter of credit with us, which guarantees you are paid if the terms and conditions specified in the letter of credit are fulfilled.

Here are some of the other key advantages of choosing us as your Export financing partner:

1. Our services are not like loans. As such, for most companies, our financing does not show up on your balance sheet as debt.

2. The application and set-up processes are faster and easier than when applying for a bank loan.

3. We primarily finance based on the quality of your customer’s credit, not based on your financials.

4. You have peace of mind as we monitor the creditworthiness of your customers and assume the risk of a shortfall of payment due to their insolvency.

5. You get paid within 24-48 hours of invoice submission instead of in weeks or months, or even faster in some cases.

6. You can offer longer payment terms, and therefore are more likely to attract larger buyers.

7. You have a streamlined workflow as we perform collections, dunning, and bookkeeping on your behalf.

8. Our local experts comply with the regulations of each country we operate in and offer appropriate services such as currency regulation control.

9. Our financing solutions can be tailored to your company’s needs, and can be scaled to keep up with its growth.

In addition to factoring your export accounts receivable, we can also finance your full supply chain. Our global supply chain finance programs can support facilities based on payables, receivables, and inventory. Using purchase order funding, inventory lending, letters of credit, and structured guarantees, our financing helps align the needs of both buyers and sellers.

To know more: https://www.tradewindfinance.com/news-resources/export-finance-benefits-eligibility-application-process

0 notes

Text

WASHINGTON, D.C. (KLTV/KTRE) - Congressman Nathaniel Moran (TX-01), member of the House Foreign Affairs Committee, celebrated the passage of his legislation, H.R. 4039, No Dollars to Uyghur Forced Labor Act, which prohibits funds to the Department of State or the United States Agency for International Development (USAID) to finance international projects in partnership with entities that import products mined, produced, or manufactured in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China, commonly known for the genocide and forced labor of the Uyghur people.

On June 21, 2023, H.R. 4039 was marked up in the House Foreign Affairs Committee and was reported favorably out of the committee. This week, the No Dollars to Uyghur Forced Labor Actpassed the House of Representatives by a voice vote.

“The passage of No Dollars to Uyghur Forced Labor Act is an important step in showing the U.S. government’s commitment to confronting the abuses of the Chinese Communist Party. As a Chinese dissidents and human rights activist, I’ve experienced first-hand the extent that the Chinese government is willing to go to maintain power. After years of evidence and brave survivors speaking out, the world can no longer ignore the Uyghur genocide. It is imperative for our consciences to remove all U.S. funding from the Uyghur region. I am grateful for Representative Moran’s leadership on this resolution and the cosponsors who endorsed it,” said Dr. Rev. Bob Fu, Founder and President of ChinaAid.

“Uyghurs worldwide are thankful to Representative Moran and the U.S. Congress for passing a bill which ensures that our tax dollars do not fund ongoing atrocity crimes and modern-day slavery. This bill also sends a powerful message globally that the United States will continue to exercise all options to ensure that we end complicity in forced labor,” said Omer Kanat, Executive Director of the Uyghur Human Rights Project.

Background:

The Chinese Communist Party is committing genocide against the Uyghurs in the Xinjiang Uyghur Autonomous Region (XUAR) of China, repressing ethnic minorities for practicing their faith, detaining people in “reeducation centers” and ultimately using them for forced labor in the XUAR. This region of China is essential to their global supply chain, where many basic goods such as yarn, textiles, bricks, cotton, polysilicon, are produced using forced labor.

While the Uyghur Forced Labor Prevention Act prohibited goods made wholly or partly in the Xinjiang Uyghur Autonomous Region from entering U.S. supply chains, we must ensure that the United States is not developing international contracts for strategic projects with partners overseas that source goods or raw materials from the Xinjiang region.

H.R. 4039 will prohibit funds to the Department of State or the U.S. Agency for International Development (USAID) to finance global projects in partnership with companies or organizations that import products mined, produced, or manufactured wholly or partly from the Xinjiang Uyghur Autonomous Region of the People’s Republic of China.

12 notes

·

View notes

Text

Harris adviser Deese calls for Marshall Plan on clean energy. (Reuters)

Brian Deese, one of my friends from our HIV/AIDS charity work in Africa, is the Institute Innovation Fellow at MIT. He was recently appointed as an economic adviser for Vice President Harris' presidential campaign. Prior to that, he was the 13th director of the National Economic Council for President Biden, and he previously served in several capacities in the administration of President Obama. He also was a key player in negotiating the Paris Climate Accord, working with John Kerry.

His article in Foreign Affairs, which is summarized in this Reuters story, is brilliant. Here's the link to the original article (beware the paywall) entitled, "The Case for Clean Energy Marshall Plan."

Excerpt from this Reuters story:

Brian Deese, an economic adviser for Vice President Kamala Harris' presidential campaign, called on Thursday for an economic program to loan allies money to buy U.S. green energy technologies as part of a wider strategy intended to fight climate change.

Deese, who was an economic adviser under President Joe Biden and former President Barack Obama, billed it as a new version of the Marshall Plan, a mechanism of grants set up by President Harry Truman and Secretary of State George Marshall, to help Europe recover after World War Two.

"It should be as generous to our allies as it is unapologetically pro-American in its interest," Deese told Reuters.

While Deese is promoting the plan independently of his work as a Harris adviser, it could offer insight into potential policies of her presidency should she win on Nov. 5. The Harris campaign did not immediately comment.

Deese helped shape the Inflation Reduction Act, opens new tab, Biden's landmark legislation that contains billions of dollars to help spur clean energy and fight climate change. He said the IRA and other legislation created one of the biggest opportunities to speed clean energy, but the effort needs a mechanism to bring technologies to allies.

To support the plan, the U.S. should create a Clean Energy Finance Authority, with the ability to issue debt and equity for clean energy projects, Deese said in an article in Foreign Affairs published earlier this week. The plan could be part of a U.S. alternative to China's "Belt and Road" infrastructure initiative and assure U.S. leadership in a period of friction between global powers.

The new U.S. agency could draw on expertise of the Department of Energy's Loan Programs Office in assessing the risks and benefits of emerging technologies like advanced nuclear energy, hydrogen power, carbon capture, and geothermal power, Deese said. The LPO issues loan guarantees and low-rate loans to companies with promising technologies that have difficulty getting financing from commercial banks.

To support the plan, Deese also called for tools such as tariffs that favor imports from countries that cut emissions while making steel and other products, and the development of a strategic mineral reserve.

Such reserves would be held by the U.S. and allies to protect against supply chain shortages for the materials key to clean technologies and the domination of critical minerals trade by China.

After Russia's invasion of Ukraine in 2022, Deese helped set up a record sale of oil from the U.S. Strategic Petroleum Reserve to help moderate gasoline prices for U.S. drivers. That experience helped him see the importance of developing reserves for minerals, he said.

"My hope is we were moving out of the idea stage and into the opportunity to experiment and then build," such reserves, Deese said.

Energy Secretary Jennifer Granholm said in a Reuters interview in June that the U.S. has been having conversations with allies in the International Energy Agency about collective reserves for critical minerals.

3 notes

·

View notes

Text

Why Engineering Companies Need Standard ERP Solutions for Successful Implementation

In today’s fast-paced manufacturing industry, the need to streamline operations, improve efficiency, and ensure growth is paramount. Businesses, especially in the engineering and manufacturing sectors, are turning to ERP software to manage their operations effectively. Enterprise Resource Planning (ERP) software is a game-changer for manufacturers looking to grow faster by integrating their processes and providing a comprehensive solution for resource management, decision-making, and scalability. If you are a manufacturer in India or a growing business in Bhopal, partnering with the right ERP software company in Bhopal could be the key to unlocking your potential. This blog explores the benefits of ERP software for manufacturers, the role of local ERP software providers in Bhopal, and why adopting ERP solutions is essential for success in today’s competitive landscape.

What Is ERP Software and Why Does It Matter?

ERP software is an integrated system that unifies core business processes such as procurement, inventory management, production planning, finance, and customer relationship management (CRM) into a centralized platform. This ensures seamless communication between departments, minimizes errors, and optimizes resource usage. For manufacturers, manufacturing enterprise resource planning solutions offer specific functionalities to address production scheduling, supply chain management, and quality control. These features are critical for scaling operations and improving overall business performance.

Benefits of ERP Software for Manufacturers

1. Centralized Operations

Manufacturers handle a wide range of tasks daily, from raw material procurement to final product delivery. ERP software integrates all these processes into a single platform, eliminating silos and ensuring real-time communication. Leading ERP software providers in Bhopal specialize in offering solutions tailored to manufacturing needs, ensuring smoother operations.

2. Enhanced Decision-Making

ERP systems provide accurate, real-time data through intuitive dashboards and analytics tools. This enables business leaders to make informed decisions, whether it is about production schedules, resource allocation, or financial forecasting. Engineering firms, in particular, can benefit from ERP software for engineering companies in India, which offers insights specific to their project-oriented workflows.

3. Optimized Resource Utilization

Effective resource management is critical in manufacturing. ERP software helps monitor and allocate raw materials, workforce, and equipment efficiently, reducing waste and ensuring optimal use of resources. By partnering with an engineering ERP software company in Bhopal, businesses can access customized solutions that cater to their unique requirements.

4. Improved Productivity