#Subscription Model Fraud

Explore tagged Tumblr posts

Text

FTC Distributes $2.8 Million in Refunds to Victims of Deceptive ‘Free Trial’ Scheme

WASHINGTON, D.C. — The Federal Trade Commission (FTC) announced the distribution of more than $2.8 million in refunds to individuals misled by a fraudulent “free trial” scheme orchestrated by Apex Capital Group and its associates. This initiative marks the culmination of a legal battle that commenced in 2018, targeting deceptive marketing practices in the personal care and dietary supplement sectors.

The FTC’s 2018 complaint against Apex Capital Group, alongside Phillip Peikos, David Barnett, and various affiliated entities, unveiled a complex operation exploiting online consumers. Marketed under the guise of “free trial” offers, the products were instead sold at full price, with consumers unknowingly enrolled in ongoing subscription plans. This deceptive practice ensnared countless individuals into unauthorized financial commitments, leveraging an intricate network of shell companies and straw owners both domestically and internationally to process payments.

The fraudulent operations, which began in early 2014, saw a range of personal care items and supplements pushed onto unsuspecting consumers. The scheme persisted until November 2018, when a court order, prompted by the FTC, effectively halted the deceptive activities.

In the aftermath of this legal victory, the FTC is dispatching 153,940 refund checks to affected consumers. Each recipient is advised to cash their checks within 90 days, as indicated. This refund process is a significant step in providing restitution to those impacted by Apex Capital’s unscrupulous business practices.

#FTC Complaint#Apex Capital Group#Deceptive Practices#Free Trial Scam#Subscription Trap#Consumer Protection#Refunds#Online Fraud#Unsolicited Charges#FTC Enforcement#Phillip Peikos#David Barnett#Consumer Restitution#FTC Refund Checks#Subscription Model Fraud#Fraudulent Business Practices#Shell Companies#False Advertising#Supplement Scams#Personal Care Products Scam#Legal Action

1 note

·

View note

Text

So, let me try and put everything together here, because I really do think it needs to be talked about.

Today, Unity announced that it intends to apply a fee to use its software. Then it got worse.

For those not in the know, Unity is the most popular free to use video game development tool, offering a basic version for individuals who want to learn how to create games or create independently alongside paid versions for corporations or people who want more features. It's decent enough at this job, has issues but for the price point I can't complain, and is the idea entry point into creating in this medium, it's a very important piece of software.

But speaking of tools, the CEO is a massive one. When he was the COO of EA, he advocated for using, what out and out sounds like emotional manipulation to coerce players into microtransactions.

"A consumer gets engaged in a property, they might spend 10, 20, 30, 50 hours on the game and then when they're deep into the game they're well invested in it. We're not gouging, but we're charging and at that point in time the commitment can be pretty high."

He also called game developers who don't discuss monetization early in the planning stages of development, quote, "fucking idiots".

So that sets the stage for what might be one of the most bald-faced greediest moves I've seen from a corporation in a minute. Most at least have the sense of self-preservation to hide it.

A few hours ago, Unity posted this announcement on the official blog.

Effective January 1, 2024, we will introduce a new Unity Runtime Fee that’s based on game installs. We will also add cloud-based asset storage, Unity DevOps tools, and AI at runtime at no extra cost to Unity subscription plans this November. We are introducing a Unity Runtime Fee that is based upon each time a qualifying game is downloaded by an end user. We chose this because each time a game is downloaded, the Unity Runtime is also installed. Also we believe that an initial install-based fee allows creators to keep the ongoing financial gains from player engagement, unlike a revenue share.

Now there are a few red flags to note in this pitch immediately.

Unity is planning on charging a fee on all games which use its engine.

This is a flat fee per number of installs.

They are using an always online runtime function to determine whether a game is downloaded.

There is just so many things wrong with this that it's hard to know where to start, not helped by this FAQ which doubled down on a lot of the major issues people had.

I guess let's start with what people noticed first. Because it's using a system baked into the software itself, Unity would not be differentiating between a "purchase" and a "download". If someone uninstalls and reinstalls a game, that's two downloads. If someone gets a new computer or a new console and downloads a game already purchased from their account, that's two download. If someone pirates the game, the studio will be asked to pay for that download.

Q: How are you going to collect installs? A: We leverage our own proprietary data model. We believe it gives an accurate determination of the number of times the runtime is distributed for a given project. Q: Is software made in unity going to be calling home to unity whenever it's ran, even for enterprice licenses? A: We use a composite model for counting runtime installs that collects data from numerous sources. The Unity Runtime Fee will use data in compliance with GDPR and CCPA. The data being requested is aggregated and is being used for billing purposes. Q: If a user reinstalls/redownloads a game / changes their hardware, will that count as multiple installs? A: Yes. The creator will need to pay for all future installs. The reason is that Unity doesn’t receive end-player information, just aggregate data. Q: What's going to stop us being charged for pirated copies of our games? A: We do already have fraud detection practices in our Ads technology which is solving a similar problem, so we will leverage that know-how as a starting point. We recognize that users will have concerns about this and we will make available a process for them to submit their concerns to our fraud compliance team.

This is potentially related to a new system that will require Unity Personal developers to go online at least once every three days.

Starting in November, Unity Personal users will get a new sign-in and online user experience. Users will need to be signed into the Hub with their Unity ID and connect to the internet to use Unity. If the internet connection is lost, users can continue using Unity for up to 3 days while offline. More details to come, when this change takes effect.

It's unclear whether this requirement will be attached to any and all Unity games, though it would explain how they're theoretically able to track "the number of installs", and why the methodology for tracking these installs is so shit, as we'll discuss later.

Unity claims that it will only leverage this fee to games which surpass a certain threshold of downloads and yearly revenue.

Only games that meet the following thresholds qualify for the Unity Runtime Fee: Unity Personal and Unity Plus: Those that have made $200,000 USD or more in the last 12 months AND have at least 200,000 lifetime game installs. Unity Pro and Unity Enterprise: Those that have made $1,000,000 USD or more in the last 12 months AND have at least 1,000,000 lifetime game installs.

They don't say how they're going to collect information on a game's revenue, likely this is just to say that they're only interested in squeezing larger products (games like Genshin Impact and Honkai: Star Rail, Fate Grand Order, Among Us, and Fall Guys) and not every 2 dollar puzzle platformer that drops on Steam. But also, these larger products have the easiest time porting off of Unity and the most incentives to, meaning realistically those heaviest impacted are going to be the ones who just barely meet this threshold, most of them indie developers.

Aggro Crab Games, one of the first to properly break this story, points out that systems like the Xbox Game Pass, which is already pretty predatory towards smaller developers, will quickly inflate their "lifetime game installs" meaning even skimming the threshold of that 200k revenue, will be asked to pay a fee per install, not a percentage on said revenue.

[IMAGE DESCRIPTION: Hey Gamers!

Today, Unity (the engine we use to make our games) announced that they'll soon be taking a fee from developers for every copy of the game installed over a certain threshold - regardless of how that copy was obtained.

Guess who has a somewhat highly anticipated game coming to Xbox Game Pass in 2024? That's right, it's us and a lot of other developers.

That means Another Crab's Treasure will be free to install for the 25 million Game Pass subscribers. If a fraction of those users download our game, Unity could take a fee that puts an enormous dent in our income and threatens the sustainability of our business.

And that's before we even think about sales on other platforms, or pirated installs of our game, or even multiple installs by the same user!!!

This decision puts us and countless other studios in a position where we might not be able to justify using Unity for our future titles. If these changes aren't rolled back, we'll be heavily considering abandoning our wealth of Unity expertise we've accumulated over the years and starting from scratch in a new engine. Which is really something we'd rather not do.

On behalf of the dev community, we're calling on Unity to reverse the latest in a string of shortsighted decisions that seem to prioritize shareholders over their product's actual users.

I fucking hate it here.

-Aggro Crab - END DESCRIPTION]

That fee, by the way, is a flat fee. Not a percentage, not a royalty. This means that any games made in Unity expecting any kind of success are heavily incentivized to cost as much as possible.

[IMAGE DESCRIPTION: A table listing the various fees by number of Installs over the Install Threshold vs. version of Unity used, ranging from $0.01 to $0.20 per install. END DESCRIPTION]

Basic elementary school math tells us that if a game comes out for $1.99, they will be paying, at maximum, 10% of their revenue to Unity, whereas jacking the price up to $59.99 lowers that percentage to something closer to 0.3%. Obviously any company, especially any company in financial desperation, which a sudden anchor on all your revenue is going to create, is going to choose the latter.

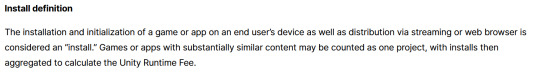

Furthermore, and following the trend of "fuck anyone who doesn't ask for money", Unity helpfully defines what an install is on their main site.

While I'm looking at this page as it exists now, it currently says

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

However, I saw a screenshot saying something different, and utilizing the Wayback Machine we can see that this phrasing was changed at some point in the few hours since this announcement went up. Instead, it reads:

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming or web browser is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

Screenshot for posterity:

That would mean web browser games made in Unity would count towards this install threshold. You could legitimately drive the count up simply by continuously refreshing the page. The FAQ, again, doubles down.

Q: Does this affect WebGL and streamed games? A: Games on all platforms are eligible for the fee but will only incur costs if both the install and revenue thresholds are crossed. Installs - which involves initialization of the runtime on a client device - are counted on all platforms the same way (WebGL and streaming included).

And, what I personally consider to be the most suspect claim in this entire debacle, they claim that "lifetime installs" includes installs prior to this change going into effect.

Will this fee apply to games using Unity Runtime that are already on the market on January 1, 2024? Yes, the fee applies to eligible games currently in market that continue to distribute the runtime. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

Again, again, doubled down in the FAQ.

Q: Are these fees going to apply to games which have been out for years already? If you met the threshold 2 years ago, you'll start owing for any installs monthly from January, no? (in theory). It says they'll use previous installs to determine threshold eligibility & then you'll start owing them for the new ones. A: Yes, assuming the game is eligible and distributing the Unity Runtime then runtime fees will apply. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

That would involve billing companies for using their software before telling them of the existence of a bill. Holding their actions to a contract that they performed before the contract existed!

Okay. I think that's everything. So far.

There is one thing that I want to mention before ending this post, unfortunately it's a little conspiratorial, but it's so hard to believe that anyone genuinely thought this was a good idea that it's stuck in my brain as a significant possibility.

A few days ago it was reported that Unity's CEO sold 2,000 shares of his own company.

On September 6, 2023, John Riccitiello, President and CEO of Unity Software Inc (NYSE:U), sold 2,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 50,610 shares and purchased none.

I would not be surprised if this decision gets reversed tomorrow, that it was literally only made for the CEO to short his own goddamn company, because I would sooner believe that this whole thing is some idiotic attempt at committing fraud than a real monetization strategy, even knowing how unfathomably greedy these people can be.

So, with all that said, what do we do now?

Well, in all likelihood you won't need to do anything. As I said, some of the biggest names in the industry would be directly affected by this change, and you can bet your bottom dollar that they're not just going to take it lying down. After all, the only way to stop a greedy CEO is with a greedier CEO, right?

(I fucking hate it here.)

And that's not mentioning the indie devs who are already talking about abandoning the engine.

[Links display tweets from the lead developer of Among Us saying it'd be less costly to hire people to move the game off of Unity and Cult of the Lamb's official twitter saying the game won't be available after January 1st in response to the news.]

That being said, I'm still shaken by all this. The fact that Unity is openly willing to go back and punish its developers for ever having used the engine in the past makes me question my relationship to it.

The news has given rise to the visibility of free, open source alternative Godot, which, if you're interested, is likely a better option than Unity at this point. Mostly, though, I just hope we can get out of this whole, fucking, environment where creatives are treated as an endless mill of free profits that's going to be continuously ratcheted up and up to drive unsustainable infinite corporate growth that our entire economy is based on for some fuckin reason.

Anyways, that's that, I find having these big posts that break everything down to be helpful.

#Unity#Unity3D#Video Games#Game Development#Game Developers#fuckshit#I don't know what to tag news like this

6K notes

·

View notes

Text

Amazon’s Alexa has been claiming the 2020 election was stolen

The popular voice assistant says the 2020 race was stolen, even as parent company Amazon promotes the tool as a reliable election news source -- foreshadowing a new information battleground

This is a scary WaPo article by Cat Zakrzewski about how big tech is allowing AI to get information from dubious sources. Consequently, it is contributing to the lies and disinformation that exist in today's current political climate.

Even the normally banal but ubiquitous (and not yet AI supercharged) Alexa is prone to pick up and recite political disinformation. Here are some excerpts from the article [color emphasis added]:

Amid concerns the rise of artificial intelligence will supercharge the spread of misinformation comes a wild fabrication from a more prosaic source: Amazon’s Alexa, which declared that the 2020 presidential election was stolen. Asked about fraud in the race — in which President Biden defeated former president Donald Trump with 306 electoral college votes — the popular voice assistant said it was “stolen by a massive amount of election fraud,” citing Rumble, a video-streaming service favored by conservatives.

The 2020 races were “notorious for many incidents of irregularities and indications pointing to electoral fraud taking place in major metro centers,” according to Alexa, referencing Substack, a subscription newsletter service. Alexa contended that Trump won Pennsylvania, citing “an Alexa answers contributor.”

Multiple investigations into the 2020 election have revealed no evidence of fraud, and Trump faces federal criminal charges connected to his efforts to overturn the election. Yet Alexa disseminates misinformation about the race, even as parent company Amazon promotes the tool as a reliable election news source to more than 70 million estimated users. [...] Developers “often think that they have to give a balanced viewpoint and they do this by alternating between pulling sources from right and left, thinking this is going to give balance,” [Prof. Meredith] Broussard said. “The most popular sources on the left and right vary dramatically in quality.” Such attempts can be fraught. Earlier this week, the media company the Messenger announced a new partnership with AI company Seekr to “eliminate bias” in the news. Yet Seekr’s website characterizes some articles from the pro-Trump news network One America News as “center” and as having “very high” reliability. Meanwhile, several articles from the Associated Press were rated “very low.” [...] Yet despite a growing clamor in Congress to respond to the threat AI poses to elections, much of the attention has fixated on deepfakes. However, [attorney Jacob] Glick warned Alexa and AI-powered systems could “potentially double down on the damage that’s been done.” “If you have AI models drawing from an internet that is filled with platforms that don’t care about the preservation of democracy … you’re going to get information that includes really dangerous undercurrents,” he said. [color emphasis added]

#alexa#ai is spreading political misinformation#2020 election lies#the washington post#cat zakrzewski#audio

166 notes

·

View notes

Text

Trans Preparedness

I'm probably not the right kind of blog to be doing this, but I go a little crazy not having a plan. A friend set up a threat model and practical steps that can be made to prepare for it. If this kind of disaster preparedness might be too much for you do not force yourself to read through this. Keeping calm and healthy is paramount above all of this.

Legal documents

Ban on legal document changes, reversion of previous changes and invalidation of updated documents. This means potentially being outed any time you present your ID. If you do update your documents, this may make it impossible to cross the border and any other checkpoints (legal or extralegal), as your documents could be invalidated. Possible criminal fraud penalty, like in florida, making the continued use of an invalidated ID risky. Risk of revocation of all legal recognition of non-binary gender.

What you can do to prepare: Consider whether it would be best to have your legal documents match your true gender or your agab. If you can’t reliably pass as your true gender, it may be prudent to have your documents reflect your agab, in the event you need to go through a document checkpoint without arousing suspicion. Also, consider that, by changing your documents, you may end up “on a list”.

Anti-trans discrimination

Rollback of anti-discrimination protections in employment, healthcare, and harassment/hate crimes.

What you can do to prepare: If you work at a corporation/franchise/small business with republican ownership or coworkers, consider updating your résumé and looking for new employment. If you do land a new job, think carefully about whether to present as your true gender or your agab while at work. Be extra cautious about coming out at your job — only do so if you can’t reliably pass as either your true gender or your agab.

If possible, save money. Pick up extra shifts. Cut back on discretionary purchases. Cancel unnecessary subscriptions. Meal prep. Organize bulk purchases with your community to share costs and get better prices. Visit your local food pantry instead of the grocery store. Etc.

One possible safeguard against healthcare discrimination is to have your medical records updated to reflect a diagnosis of intersex, rather than transgender, if possible. I’m not privy to the details, but my understanding is that there are certain diagnostic codes, genetic tests, etc that can be used to mask your transgender status while maintaining access to the same treatments.

Healthcare restrictions

Introduction of insurmountable liability for healthcare providers and expansion of malpractice definition/enforcement to make providing trans healthcare impossible. Possible criminalization of doctors prescribing HRT. Possible criminalization of HRT possession/use. It will become impossible to access HRT, except through DIY. Possible discrepancies in enforcement between states, with red states imposing “bounty hunter laws” that allow anyone to sue a person who has taken HRT.

What you can do to prepare: If you have a legal prescription for your HRT, ask your provider for a 90-day prescription. Fill it as soon as possible, and refill it once before inauguration day. Consider rationing to extend your supply.

Start thinking about what you’ll do when your stockpile runs out. Look into DIY method of HRT. Plan how you can share the cost of supplies among your community to build a larger stockpile.

Bathroom bans

National bathroom ban with possible deputized citizenry/tiplines. Could be fines or criminal penalties (jail). Either way, this makes it near impossible to go out in public, even in blue areas, because all it takes is one transphobe to turn your life upside down. This applies whether you’re in the restroom for your true gender or your agab, since we can’t count on transphobes to be consistent with enforcement (i.e. you look visibly queer so someone calls the cops on you, even though you’re in the restroom of your agab).

What you can do to prepare: Consult the Refuge Bathrooms directory to find single-occupant restrooms near you. Also submit any single-occupant restrooms you come across to the Refuge Bathrooms directory to help out others in the future. If you need to go into a gender-segregated multi-occupant restroom, try to go with a buddy or in a group for safety. Choose which restroom to use based on your outward appearance, not your internal gender.

Drag bans

May define transgender people doing any form of performance as drag, including public speaking at an event or protest, or performing live music in a venue or on the street. Possible definition of transgender people merely existing as “sexually explicit drag” in many circumstances. Possible classification of transgender people as sex offenders under this premise. May bar trans people under threat of criminal penalty from entering government buildings, airports, and schools while dressed in accordance with their gender.

What you can do to prepare: If you’re comfortable and capable of doing so, work on “passing“ as your true gender through voice training, clothing choices, hair style, and makeup. If you can’t reliably pass as your true gender, consider wearing less attention-grabbing, looser-fit, gender-neutral clothing and finding other ways to express your gender. Even if you’re wearing more body-conforming clothes, consider carrying a baggy sweatshirt or jacket to conceal your secondary sex characteristics in an emergency. Consider assembling a set of clothes associated with your agab, as well as any accessories such as a binder or packer, in case you need to “stealth” as your agab.

Additional notes

Update your passport, ID, and vaccinations. Drink water. Hug your friends. We get through this together.

9 notes

·

View notes

Text

Benefits of Fast Online Payments — Quick Pay

In today’s digital economy, fast online payments are no longer just a convenience—they are a necessity. From e-commerce stores to freelancers and service providers, everyone is shifting toward quicker, safer, and smarter payment solutions. Among the many options available, Quick Pay has emerged as a leading platform offering seamless online payment experiences for both businesses and customers.

If you're a business owner or entrepreneur looking to scale your operations and improve customer satisfaction, understanding the benefits of fast online payments is crucial. And when it comes to delivering these benefits efficiently, Quick Pay stands out with its cutting-edge features and reliable service.

1. Enhanced Customer Experience

The first and most obvious benefit of fast online payments is an improved customer experience. Today’s consumers expect instant transactions. A slow or complicated checkout process can lead to cart abandonment and loss of revenue.

With Quick Pay, customers can complete payments in just a few clicks. The user-friendly interface, minimal redirects, and fast processing ensure that your clients enjoy a hassle-free payment journey, increasing the chances of repeat business.

Quick Pay Advantage:

One-click checkout

Mobile-optimized experience

Multiple payment options: UPI, cards, wallets, net banking

2. Faster Cash Flow for Businesses

One of the major benefits of fast online payments is accelerated cash flow. Unlike traditional bank transfers that may take days, fast payment systems like Quick Pay ensure that your money reaches you quickly—often on the same day.

For small businesses and startups, this is a game-changer. You no longer have to wait endlessly for payments, allowing better cash management, investment in growth, and operational efficiency.

Quick Pay Benefit:

Same-day settlements (T+0 and T+1 options)

Instant payment notifications

Transparent tracking of incoming funds

3. Higher Conversion Rates

Online businesses thrive on conversion rates. A complicated or slow payment process can discourage potential customers right at the final step. By offering a quick and secure payment gateway like Quick Pay, businesses can increase their checkout success rate dramatically.

Speed combined with security builds trust and reduces the bounce rate.

Quick Pay Features That Help:

Secure payment environment (PCI DSS compliant)

Optimized checkout for mobile and desktop

Auto-fill and tokenized payments for returning users

4. Increased Trust and Credibility

When customers notice that your website or app uses a reputed and fast payment solution like Quick Pay, it instantly boosts your brand’s credibility. Shoppers feel more secure transacting on your platform, knowing that their personal and financial data is in safe hands.

This trust translates into higher engagement, more referrals, and long-term brand loyalty.

Quick Pay Security Standards:

End-to-end encryption

Two-factor authentication

Fraud detection and chargeback control

5. Support for Recurring Payments

Many businesses today rely on subscription models—whether it's digital services, SaaS platforms, or fitness memberships. A major benefit of fast online payments is the ability to automate recurring billing.

Quick Pay makes recurring payments smooth and effortless. Customers don’t need to re-enter their details every time, and businesses enjoy predictable revenue without delays.

With Quick Pay, You Get:

Automated recurring billing setup

Smart invoicing and reminders

Custom billing cycles

6. Lower Operational Costs

Handling cash or bank transfers manually involves time, risk, and additional staff. Online payments automate this entire process, reducing overhead costs. Quick Pay’s all-in-one dashboard helps manage your transactions, analytics, and customer data in one place.

Over time, businesses save money on labor, reconciliation, and administrative tasks.

Quick Pay’s Business Dashboard Offers:

Real-time transaction tracking

Sales reports and analytics

Easy refund and dispute management

7. Wider Customer Reach

Fast online payments open up a global customer base. Whether you're selling in your local city or shipping products across the world, a payment gateway like Quick Pay ensures that you never miss a sale due to geographical or banking limitations.

Quick Pay supports multi-currency payments and international cards, making it easier to scale your business globally.

Quick Pay Global Features:

Support for major global currencies

Acceptance of Visa, Mastercard, AmEx, and more

Integration with international platforms like Shopify, WooCommerce, and others

8. Seamless Integrations with Online Platforms

The benefits of fast online payments are amplified when your payment gateway easily integrates with your website, mobile app, or POS system. Quick Pay offers ready-made plugins and robust APIs for smooth integration.

This reduces developer time, lowers setup costs, and gets you live faster.

Quick Pay Integration Highlights:

Easy plugins for WordPress, Shopify, Magento

Android/iOS SDKs for mobile apps

API documentation and 24/7 tech support

9. Better Customer Retention

A smooth payment experience not only helps you close a sale but also encourages customers to return. Fast refunds, saved payment options, and friendly interfaces make users feel valued.

Quick Pay includes customer retention features like:

Smart retry on failed transactions

Branded payment pages

Custom thank-you messages and emails

10. Real-Time Analytics and Insights

Understanding how your customers pay can guide better business decisions. Quick Pay’s powerful analytics tools offer deep insights into payment trends, user behavior, and settlement reports—all in real time.

This data can be used to optimize your marketing campaigns, identify high-value customers, and plan inventory.

What Quick Pay Analytics Offers:

Dashboard with payment trends and patterns

Conversion rate tracking

Refund and dispute summary

Why Choose Quick Pay?

When it comes to maximizing the benefits of fast online payments, Quick Pay checks all the boxes:

✅ Fast and secure transactions ✅ Same-day settlements ✅ Easy integrations ✅ Scalable for small to enterprise businesses ✅ Exceptional customer support

Whether you're a growing startup, a large enterprise, or a freelancer, Quick Pay empowers your business to accept payments quickly, securely, and with minimal friction.

Final Thoughts

The world is moving fast, and so should your payments. Embracing the benefits of fast online payments can revolutionize your business operations, boost customer satisfaction, and drive consistent revenue.

With its reliable technology, business-friendly features, and unmatched customer support, Quick Pay is the ideal partner for modern businesses looking to thrive in the digital age.

Ready to Get Started?

Visit www.usequickpay.com to create your free account and start accepting payments within minutes.

#finance#online payments#payments#branding#economy#quickpay#bestpaymentgateway#FastOnlinePayments#QuickPayIndia#DigitalPaymentsSolution

2 notes

·

View notes

Text

Efficient Credit Card Processing for Subscription-Based Models

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the rapidly evolving digital realm, businesses demand a dependable and effective credit card processing system, especially when engaged in subscription-based models. Credit card acceptance isn't just a matter of convenience; it's a strategic necessity that fuels expansion and ensures smooth financial transactions. In this article, we will delve into the universe of credit card processing, with a particular focus on its pivotal role in subscription-based enterprises.

The Significance of Credit Card Processing It's not just a payment choice; it stands as the gateway to success for subscription-based models. Envision a scenario where your customers confront complex payment procedures, leading to exasperation and eventual abandonment. Proficient payment processing eradicates these hurdles, positioning itself as a critical component of your subscription-based business strategy.

Why Credit Card Processing is Crucial Payment processing in subscription-based models is a fundamental element of customer satisfaction and retention. It guarantees seamless transactions, providing your customers with a fuss-free experience when subscribing to your services. Furthermore, modern payment processing systems incorporate robust security measures, safeguarding sensitive customer data and thwarting fraudulent activities. The automation of recurring billing is indispensable for subscription-based models, guaranteeing punctual payments and minimizing churn rates. Additionally, accepting credit cards broadens your business horizons, breaking down geographical barriers and enabling you to tap into a global audience.

Embracing Credit Cards for High-Risk Ventures For high-risk businesses, securing a reliable payment processing solution is of paramount importance. Whether your operations fall within the CBD industry, credit repair services, or e-commerce niches, you need a high-risk credit card processing system capable of addressing the unique challenges posed by your sector.

Merchant Accounts for High-Risk Enterprises High-risk merchant accounts are tailored explicitly for businesses with an elevated likelihood of chargebacks or fraud. If your subscription-based model falls within this category, obtaining a high-risk merchant account becomes indispensable for sustainable growth.

youtube

The E-commerce Advantage In the era of online shopping, e-commerce payment processing is absolutely indispensable. Online enterprises, whether they reside in traditional markets or high-risk domains, rely on efficient e-commerce payment gateways to expedite transactions and ensure customer contentment.

In conclusion, the universe of subscription-based models revolves around proficient credit card processing. It's not just about accepting payments; it's about crafting a smooth and secure experience for your clientele. Whether you operate in a high-risk industry or e-commerce, the right payment processing system can be the cornerstone for sustainable growth and global outreach.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#payment#youtube#Youtube

23 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes

Text

What Are the Key Factors to Consider When Choosing a Payment Solution Provider?

The rapid growth of digital transactions has made choosing the right payment solution provider a crucial decision for businesses. Whether you operate an e-commerce store, a subscription-based service, or a financial institution, selecting the right provider ensures secure and efficient payment processing. With the increasing demand for fintech payment solutions, businesses must evaluate providers based on security, compatibility, scalability, and cost-effectiveness.

1. Security and Compliance

Security is the top priority when selecting a payment solution provider. Since financial transactions involve sensitive customer data, businesses must ensure that their provider follows strict security protocols. Look for providers that comply with PCI DSS (Payment Card Industry Data Security Standard) and offer encryption, tokenization, and fraud prevention measures.

A reputable provider should also offer real-time fraud detection and risk management tools to safeguard transactions. Compliance with regional regulations such as GDPR, CCPA, or PSD2 is also crucial for businesses operating in multiple locations.

2. Integration and Compatibility

Seamless Payment gateway integration is essential for a smooth transaction experience. Businesses should assess whether the provider’s APIs and SDKs are compatible with their existing platforms, including websites, mobile apps, and POS systems. A well-documented API enables easy customization and enhances the overall customer experience.

Additionally, businesses should consider whether the provider supports multiple payment methods such as credit cards, digital wallets, cryptocurrencies, and bank transfers. The ability to integrate with accounting, CRM, and ERP software is also beneficial for streamlining financial operations.

3. Cost and Pricing Structure

Understanding the pricing structure of payment solution providers is crucial for managing operational costs. Different providers offer various pricing models, including:

Flat-rate pricing – A fixed percentage per transaction

Interchange-plus pricing – A combination of network fees and provider markup

Subscription-based pricing – A fixed monthly fee with lower transaction costs

Businesses should evaluate setup fees, transaction fees, chargeback fees, and any hidden costs that may impact profitability. Opting for a transparent pricing model ensures cost-effectiveness in the long run.

4. Scalability and Performance

As businesses grow, their payment processing needs will evolve. Choosing a provider that offers scalable fintech payment solutions ensures seamless expansion into new markets and accommodates higher transaction volumes without downtime or slow processing speeds.

Look for providers with a robust infrastructure that supports high uptime, fast transaction processing, and minimal payment failures. Cloud-based payment solutions often offer better scalability and reliability for growing businesses.

5. Customer Support and Service Reliability

Reliable customer support is essential when dealing with financial transactions. Payment-related issues can result in revenue loss and customer dissatisfaction. Businesses should opt for providers that offer 24/7 customer support via multiple channels such as phone, email, and live chat.

Additionally, a provider with dedicated account management services can offer personalized solutions and proactive issue resolution, ensuring minimal disruptions to business operations.

6. Multi-Currency and Global Payment Support

For businesses targeting international markets, multi-currency support is a key consideration. The ability to accept payments in different currencies and offer localized payment methods enhances customer satisfaction and expands the business’s global reach.

Providers that support cross-border transactions with competitive exchange rates and minimal conversion fees are ideal for businesses operating in multiple countries.

7. Fintech Payment System Compatibility

A modern fintech payment system should be adaptable to emerging financial technologies. Businesses should evaluate whether the provider supports innovations like blockchain payments, real-time payment processing, and artificial intelligence-driven fraud prevention.

The ability to integrate with open banking solutions and provide seamless transaction experiences across various fintech ecosystems is becoming increasingly important in the digital payment landscape.

8. Reputation and Industry Experience

The credibility of a payment solution provider is another critical factor. Researching customer reviews, case studies, and testimonials can provide insights into the provider’s reliability and performance.

Established providers with years of experience and partnerships with reputable financial institutions are more likely to offer stable and secure payment processing services. Collaborations with fintech leaders, such as Xettle Technologies, demonstrate a provider’s commitment to innovation and excellence in payment solutions.

Conclusion

Choosing the right payment solution provider requires careful consideration of security, integration, pricing, scalability, customer support, and industry experience. Businesses must align their choice with long-term growth objectives and ensure that the provider offers secure, seamless, and cost-effective fintech payment solutions.

With the rise of digital transactions, businesses that invest in a robust fintech payment system with seamless payment gateway integration will gain a competitive edge and enhance customer trust. By partnering with reputable payment solution providers, businesses can ensure secure and efficient transaction experiences for their customers while maximizing operational efficiency.

3 notes

·

View notes

Text

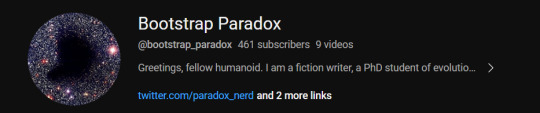

After a small uptick in followers, I am now getting close to 500 subs on YouTube:

[image description: header of a youtube channel titled Bootstrap Paradox; the icon is a photo of the Bootes void surrounded by stars; the text reads 461 subscribers, 9 videos; the channel description cuts out in the middle of the sentence, and reads "Greetings, fellow humanoid. I am a fiction writer, a PhD student of evolution..."]

On this occasion, may I interest you in some of my video essays, which have not much in common other than my utter dedication to the topic and, most of the time, questionable outfits and makeup.

Science Has An Accountability Problem

First in an anthology (that will get done, I promise, as soon as I replace all of my equipment that decided to break) exploring the problems of 21st century academia. I am a PhD student full of righteous rage and I will get to the bottom of every single thing that infuriates me about this system. This one explores scientific fraud: how often it happens, why it happens, and what we can do about it.

Pokemon Evolutions Are Real... Kind Of

Brought to you by my boyfriend's pokemon hyperfixation mixed with my master's in evolutionary biology. It's about metamorphosis, puberty, evo-devo, and, well, Pokemon. Watch it to find out why genetics is less of a computer code and more of an instruction for Ikea furniture.

Disability and Capitalism 2-parter

Two videos that took a monumental amount of research to put together, exploring the history, the reality, and the potential future of disability, as well as it's connection to our current economic systems. If you've heard of the medical model and the social model of disability but have never encountered the economic model of disability, you should probably watch this. Or don't, I'm not your boss. Anyway, there is a fun sci-fi-ish sketch at the beginning.

Representation DIY: Autistic Headcanons

My first ever video essay, so the quality is what it is, but I'm still proud of it. Explores the concept of media representation, my personal experiences as an autistic person, and why I think that autistic headcanons are often better than canon autistic characters written by allistic writers. Also, a lot of Jonathan Creek. For the fans of the incredibly niche British TV and detective magicians.

---

This isn't everything I have, so feel free to click on the channel and check stuff out. I still harbour some hope to maybe eventually some day become a full-time video essayist because with my combination of autism, chronic illness, and existing as a very queer person in a very traditional and catholic Eastern European country, working from home might be my only option of being ok after I get my PhD. So yeah, every subscription helps.

Reblogs do a lot, btw. Even if you have like 3 followers, trust me. Your one reblog just might make this my career in a couple of years. So any interaction is highly appreciated.

24 notes

·

View notes

Text

RegTech Market 2032: Comprehensive Industry Report and Dynamics

RegTech Market size was valued at USD 13.6 billion in 2023 and is expected to grow to USD 88.13 billion by 2032 and grow at a CAGR of 23.1 % over the forecast period of 2024-2032.

The RegTech Market is evolving rapidly as organizations seek smarter, faster, and more efficient ways to manage regulatory compliance and risk management. Fueled by the growing complexity of global regulations and the rising demand for digital transformation, RegTech solutions offer automation, transparency, and accuracy that traditional compliance models cannot match. Businesses across financial services, healthcare, insurance, and beyond are increasingly adopting RegTech to enhance operational resilience and agility.

The RegTech Market is gaining significant momentum as companies recognize its ability to simplify compliance through cutting-edge technologies like artificial intelligence, blockchain, and machine learning. Instead of manually navigating a maze of regulatory demands, organizations can now leverage intelligent solutions to predict risks, automate audits, and ensure real-time monitoring. As the regulatory landscape becomes more fragmented and enforcement more aggressive, the market for RegTech solutions is no longer a luxury but a necessity.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3725

Market Keyplayers:

CUBE (Automated Regulatory Intelligence, RegPlatform)

Thomson Reuters (Regulatory Intelligence, CLEAR Compliance)

Hummingbird RegTech (Compliance Workflow Tools, Investigation Platform)

Ascent Technologies, Inc. (Compliance Confidence Scorecard, Regulatory Knowledge)

Fenergo (Client Lifecycle Management, Regulatory Rules Engine)

ComplyAdvantage (Transaction Monitoring, Risk Monitoring)

NICE Actimize (Surveillance, AML Solutions)

ClauseMatch (Policy Management, Compliance Workflow)

Trunomi (Data Rights Management, Consent Management)

Chainalysis (Cryptocurrency Transaction Monitoring, KYT – Know Your Transaction)

Market Analysis

The RegTech sector is undergoing dynamic growth driven by the need for faster compliance processes, risk management, and fraud prevention. Increasing scrutiny from regulatory authorities worldwide compels firms to adopt tools that not only ensure compliance but also offer competitive advantages through efficiency gains. Regulatory environments across financial services, healthcare, and data protection are especially catalyzing demand for agile, cloud-based, and AI-powered solutions that provide real-time insights and reporting capabilities.

Scope

RegTech’s reach extends beyond banking and financial institutions. Healthcare, insurance, legal services, energy, and even government agencies are tapping into RegTech platforms for a seamless, automated approach to meeting compliance standards. Its core offerings include anti-money laundering (AML) monitoring, identity verification (KYC/KYB), data protection compliance, risk assessment, transaction monitoring, and regulatory reporting. The technology’s flexibility allows integration with existing enterprise systems, making it a scalable solution for businesses of all sizes.

Market Forecast

As regulatory pressures tighten and digital ecosystems expand, the RegTech Market is poised for robust growth in the coming years. Adoption is expected to surge among mid-sized enterprises and startups, alongside large corporations, as modular, subscription-based models lower barriers to entry. Innovations in predictive analytics, real-time risk intelligence, and integrated compliance dashboards will shape the next wave of RegTech evolution, making it an indispensable pillar of enterprise infrastructure across industries.

Future Prospects

RegTech holds tremendous promise in revolutionizing governance, risk, and compliance (GRC) frameworks. Future advancements will likely focus on proactive compliance—predicting regulatory shifts before they occur. Furthermore, integration with decentralized finance (DeFi) platforms and blockchain-based smart contracts is expected to redefine regulatory reporting and auditing processes. Geographical expansion into emerging markets, where regulatory frameworks are tightening, presents another significant growth avenue.

Trends

AI-Driven Risk Monitoring: Real-time detection of anomalies and predictive compliance alerts are reshaping risk management.

Blockchain Adoption: Smart contracts and decentralized ledgers ensure greater transparency and auditability.

Regulatory Intelligence: Dynamic tools that track and analyze regulatory changes globally are gaining traction.

Cloud-Native Solutions: Cloud-based RegTech platforms offer scalability, speed, and remote access capabilities.

KYC Automation: Advanced biometric and AI technologies are simplifying customer onboarding and verification.

Integrated Compliance Ecosystems: One-stop platforms that unify AML, KYC, GDPR, and cybersecurity compliance are becoming the norm.

Access Complete Report: https://www.snsinsider.com/reports/regtech-market-3725

Conclusion

The RegTech Market is no longer just about automating compliance; it's about enabling organizations to outpace regulatory changes, mitigate risks proactively, and unlock strategic advantages. By blending innovation with necessity, RegTech is set to redefine how industries approach governance, offering smarter, sharper, and faster paths to resilience and growth.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

Why Choosing the Right High-Risk Payment Processor Matters for Adult Businesses

Running a business in the adult industry comes with its unique challenges—especially when it comes to payment processing. Many traditional banks and payment gateways hesitate to work with adult businesses due to reputational risks and regulatory concerns. This is where the need for a high-risk payment processor becomes critical.

Whether you're running a dating website, adult toy store, or subscription-based content platform, you need a payment solution that understands your niche. That’s where an adult payment processor like Offshore Unipay steps in to support businesses just like yours.

Why Is the Adult Industry Considered High-Risk?

Financial institutions classify the adult industry as high-risk due to:

High chargeback rates

Regulatory complications across borders

Subscription billing models

Potential fraud risks

These factors make it nearly impossible to work with traditional processors like PayPal or Stripe.

What to Look for in an Adult Payment Processor

When choosing an adult payment processor, it's essential to find one that offers:

High approval rates for adult businesses

Multi-currency and international payment support

Fraud protection and chargeback management

Fast settlements and transparent fee structures

Offshore Unipay offers all of the above, making it a trusted name in the high-risk payment processor industry.

Why Offshore Unipay is a Smart Choice

At Offshore Unipay, we specialize in supporting adult businesses by offering:

Tailored solutions for adult websites, toy stores, live cams, and content platforms

Global processing capabilities to expand your customer base

Discreet billing options to protect your customers’ privacy

Secure, encrypted payment gateways for fraud-free transactions

If you're tired of facing rejections or constant account freezes, it's time to move to a high-risk payment processor that actually works for you.

Final Thoughts

Your business deserves more than just a payment solution—it needs a partner that understands your industry and helps you grow. Offshore Unipay is more than just an adult payment processor—we’re a trusted ally for adult businesses across the globe.

Ready to Get Started?

Partner with Offshore Unipay and say goodbye to payment roadblocks.

0 notes

Text

Fuel Card Market Overview: Trends, Drivers, and Forecasts

Introduction

The global fuel card market has been evolving rapidly, propelled by technological advancements, digital transformation in fleet management, and increasing demand for efficient expense tracking. A fuel card, also known as a fleet card, is used by businesses for fuel purchases and vehicle maintenance, offering benefits such as real-time transaction monitoring, reduced fuel theft, and simplified expense reporting.

With rising operational costs and an expanding logistics sector, fuel cards have become a crucial tool for companies managing large fleets. This article explores the current trends, key drivers, and forecasts shaping the fuel card market.

Market Trends

1. Digital Integration and Telematics

Modern fuel cards are being integrated with telematics and GPS systems, enabling real-time vehicle tracking and data analytics. This helps fleet managers monitor fuel efficiency, driving behavior, and route optimization — reducing costs and environmental impact.

2. Contactless and Mobile Payments

The rise of contactless payments and mobile wallets is influencing fuel card technology. Many providers are now offering app-based fuel cards and virtual cards, providing convenience and enhanced security to users.

3. Customizable and Sector-Specific Solutions

Fuel card issuers are developing industry-specific offerings tailored for SMEs, large logistics companies, and government fleets. Customizable limits, merchant restrictions, and detailed reporting tools are now standard features.

4. Growing Preference for Subscription-Based Models

Fuel card services are increasingly being bundled with fleet management solutions in a subscription-based model. This helps companies manage multiple aspects of fleet operations through a unified platform.

Market Drivers

1. Growth in the Transportation and Logistics Industry

The surge in e-commerce and supply chain expansion has increased the number of vehicles on the road, driving the demand for efficient fuel management systems.

2. Focus on Operational Efficiency

Fuel cards help businesses reduce manual paperwork, streamline expense reporting, and minimize fraud, contributing significantly to operational efficiency.

3. Regulatory Compliance and Transparency

Many governments are enforcing stricter regulations on fuel use and corporate spending transparency. Fuel cards aid compliance by offering accurate, auditable transaction records.

4. Corporate Adoption of Green Fleet Initiatives

Companies are adopting sustainability strategies, and fuel cards provide valuable data for analyzing fuel consumption patterns and setting eco-friendly targets.

Regional Insights

North America dominates the market due to early technology adoption and a mature fleet industry.

Europe follows closely with widespread use of fuel cards among SMEs and large enterprises.

Asia-Pacific is expected to witness the fastest growth, driven by rapid urbanization, expanding logistics networks, and increased fuel card awareness.

Challenges

Despite growth, the market faces several challenges:

Security concerns related to fraud and data breaches.

Lack of infrastructure in emerging economies.

High competition among fuel card providers driving down margins.

Market Forecast (2025–2030)

The fuel card market is expected to grow at a CAGR of 6–8% from 2025 to 2030. Major growth drivers include increased adoption of digital payment solutions, expansion of fleet sizes across industries, and growing demand for real-time expense management tools.

Key players like WEX Inc., FleetCor Technologies, Shell, BP, and ExxonMobil are investing heavily in R&D to enhance their service offerings and maintain competitiveness.

Conclusion

The fuel card market is poised for significant expansion, driven by digital innovation and the growing need for cost-effective fleet management solutions. Businesses adopting fuel cards not only benefit from financial control but also gain strategic insights into operational efficiency and sustainability.

As the market evolves, we can expect more personalized, integrated, and AI-powered solutions to redefine the way companies manage fuel expenses.

0 notes

Text

Affordable Billing Software

Accounting software is aimed squarely at small businesses and solo entrepreneurs. From e-invoicing to multi-currency accounting to file storage. The information can help you decide where to focus your efforts going forward. Invoice comes with a range of features that will redefine the way your finance teams processes invoices. It’s crucial to find the best billing software to enhance efficiency and boost productivity. A user even raised concerns about the lack of transparent policies and shady support practices. Its additional features, such as automated payment recovery, tax management, and fraud protection, make it a preferable option - Best Restaurant Billing Software.

These tools have been selected after thoroughly researching online resources and user reviews, as well as their scalability and flexibility to support various billing models. Choose a vendor known for responsive customer support, regular updates, and positive client feedback. The software is known for its reliability and security, making it a safe choice for companies that handle sensitive data. Our software is a comprehensive suite of productivity and collaboration tools. It includes everything you need to get work done, from word processing and spreadsheets to project and customer relationship management - online restaurant management software.

There are many reasons to choose Invoices as your online invoicing software. The software is simple to use, efficient, and designed to help businesses save time and money. Well organized and easy to use, Invoice is a comprehensive invoicing software solution for small to medium-sized businesses. It comes with many features that are simple to navigate, and a number of these can be automated to save you time with billing. Additionally, it offers invoicing tools that help simplify your team's billing process.

As the new e-invoicing regulations approach, find out how dematerialization operators are revolutionizing your document management and simplifying your administrative processes. Choose the pricing model whether subscription-based or pay-per-invoice—that will work best for your budget. Effective software automates billing processes, reducing errors and saving time. Think about tasks like invoice generation, payment processing, and recurring billing schedules. For more information, please visit our site https://billingsoftwareindia.in/restaurant-billing-software/

0 notes

Text

Top Payment Gateways for Membership Plugins

Choosing the right payment gateway is crucial for your membership website's success. It ensures smooth transactions, builds trust, and supports recurring billing.

Why Choosing the Right Payment Gateway Matters

A reliable gateway boosts user experience. It minimizes cart abandonment and supports global transactions. It also handles recurring payments securely.

1. Stripe – Best for Global Subscription Management

Stripe is a popular choice among developers and business owners. It supports multiple currencies and recurring billing out of the box.

Key Features:

Seamless integration with WordPress membership plugins

Real-time analytics and reporting

Supports Apple Pay, Google Pay, and major credit cards

Pros:

Developer-friendly API

Supports global payments

Strong fraud detection tools

Cons:

Account approval can take time

Not available in all countries

2. PayPal – Trusted and Widely Used

PayPal remains a top-tier payment solution. It's easy to set up and widely recognized.

Key Features:

Fast checkout with PayPal Express

Handles subscriptions and one-time payments

Accepts credit cards, PayPal Credit, and bank transfers

Pros:

User trust and brand reputation

Available in over 200 countries

Simple for non-tech users

Cons:

Higher transaction fees

Account holds in rare cases

3. Authorize.Net – Powerful for Enterprise Use

Owned by Visa, Authorize.Net is ideal for larger businesses with complex needs.

Key Features:

Advanced fraud detection suite

Supports recurring billing

Integrates with many CRMs and platforms

Pros:

Strong customer support

Highly secure

Long-standing reputation

Cons:

Monthly fees apply

Setup can be technical

4. Razorpay – Perfect for Indian Market

If your audience is primarily in India, Razorpay is an excellent option.

Key Features:

Multiple payment options including UPI and wallets

Supports EMI and subscriptions

Clean dashboard and reports

Pros:

Localized options for Indian users

Easy WordPress integration

No setup fee

Cons:

Primarily focused on Indian merchants

International support is limited

5. Square – Great for Online and In-Store Sync

Square works well if you sell both online and offline.

Key Features:

Unified dashboard for POS and online sales

Supports recurring payments

Built-in fraud prevention

Pros:

Easy to use

Free online store option

Strong analytics tools

Cons:

Limited international support

Not as flexible for developers

6. Mollie – Flexible and Developer-Friendly

Mollie offers a smooth payment experience for European markets.

Key Features:

Works with all major credit cards and local methods

Subscription and installment payment options

Transparent pricing

Pros:

Quick setup

API-first platform

Supports multi-currency

Cons:

Mainly focused on Europe

Less documentation compared to Stripe

7. WooPayments – Built for WooCommerce

WooPayments is ideal if you're running a WooCommerce-based membership site.

Key Features:

Built by WooCommerce team

Supports recurring payments with WooCommerce Subscriptions

Seamless backend experience

Pros:

No third-party redirects

Fully integrated

Free to start

Cons:

Only available in select countries

Not as flexible as Stripe

How to Pick the Best Payment Gateway

Consider your business model and audience location. Look for features like subscription handling, transaction fees, and global reach. Compatibility with your membership plugin is key.

Final Thoughts

Your payment gateway choice can directly impact conversions and member retention. Choose one that fits your goals, tech stack, and customer base. Whether you’re scaling globally or locally, there's a gateway tailored for your needs.

0 notes

Text

Best Payment Gateway In India– Quick Pay

In today's digital era, businesses of all sizes need a reliable, secure, and efficient payment gateway to process online transactions. Whether you're running an e-commerce store, a subscription-based service, or a brick-and-mortar shop expanding to digital payments, choosing the right payment gateway can significantly impact your success. Among the many options available, Quick Pay has emerged as one of the best payment gateways in the industry.

This article explores the features, benefits, security measures, and why Quick Pay is the preferred choice for businesses worldwide.

What is Quick Pay?

Quick Pay is a cutting-edge payment gateway solution that facilitates seamless online transactions between merchants and customers. It offers a secure and user-friendly interface, allowing businesses to accept payments via credit cards, debit cards, mobile wallets, and bank transfers. Quick Pay supports multiple currencies and integrates with various e-commerce platforms, making it a versatile choice for businesses operating locally and globally.

Key Features of Quick Pay

1. Multi-Channel Payment Support

One of the standout features of Quick Pay is its ability to support multiple payment channels, including:

Credit and debit card processing (Visa, Mastercard, American Express, etc.)

Mobile wallets (Apple Pay, Google Pay, PayPal, etc.)

Bank transfers and direct debit

QR code payments

Buy Now, Pay Later (BNPL) services

This flexibility ensures that businesses can cater to customers' diverse payment preferences, thereby enhancing the checkout experience and improving sales conversion rates.

2. Seamless Integration

Quick Pay offers seamless integration with major e-commerce platforms like Shopify, WooCommerce, Magento, and BigCommerce. Additionally, it provides APIs and plugins that allow businesses to customize payment processing according to their specific needs. Developers can easily integrate Quick Pay into their websites and mobile applications without extensive coding knowledge.

3. High-Level Security & Fraud Prevention

Security is a top priority for any payment gateway, and Quick Pay excels in this area with:

PCI DSS compliance (Payment Card Industry Data Security Standard)

Advanced encryption technology to protect sensitive data

AI-driven fraud detection and prevention mechanisms

3D Secure authentication for an extra layer of security

By implementing these security measures, Quick Pay minimizes fraudulent transactions and enhances customer trust.

4. Fast and Reliable Transactions

Speed and reliability are crucial in online payments. Quick Pay ensures that transactions are processed swiftly with minimal downtime. It supports instant payment processing, reducing wait times for merchants and customers alike. Businesses can also benefit from automated settlement features that streamline fund transfers to their bank accounts.

5. Competitive Pricing & Transparent Fees

Unlike many payment gateways that have hidden charges, Quick Pay provides transparent pricing models. It offers:

No setup fees

Low transaction fees with volume-based discounts

No hidden maintenance or withdrawal charges

Custom pricing plans for high-volume merchants

This cost-effective approach makes Quick Pay a preferred choice for startups and large enterprises alike.

6. Recurring Payments & Subscription Billing

For businesses offering subscription-based services, Quick Pay provides a robust recurring payment system. It automates billing cycles, reducing manual efforts while ensuring timely payments. Customers can set up autopay, making it convenient for them and improving customer retention rates for businesses.

7. Multi-Currency & Global Payment Support

In an increasingly globalized economy, accepting international payments is vital. Quick Pay supports transactions in multiple currencies and offers dynamic currency conversion. This allows businesses to cater to international customers without dealing with complex exchange rate issues.

Benefits of Using Quick Pay

1. Enhanced Customer Experience

Quick Pay ensures a smooth checkout experience by providing multiple payment options and a user-friendly interface. Faster payment processing reduces cart abandonment and boosts customer satisfaction.

2. Improved Business Efficiency

With automated invoicing, seamless integration, and real-time transaction tracking, businesses can streamline their payment operations, saving time and resources.

3. Higher Security & Reduced Fraud Risk

With its state-of-the-art security measures, Quick Pay minimizes risks associated with fraud and data breaches. This enhances business credibility and customer trust.

4. Increased Sales & Revenue

Supporting multiple payment options and international transactions helps businesses tap into a broader customer base, leading to higher sales and revenue growth.

How to Set Up Quick Pay for Your Business?

Setting up Quick Pay is a straightforward process:

Sign Up – Visit the Quick Pay website and create an account.

Verify Business Details – Submit the required business documents for verification.

Integrate Quick Pay – Use APIs, plugins, or custom scripts to integrate Quick Pay into your website or app.

Configure Payment Options – Select the preferred payment methods you want to offer customers.

Go Live – Once approved, start accepting payments seamlessly.

Why Quick Pay Stands Out Among Competitors

While several payment gateways exist, Quick Pay differentiates itself with:

Superior security measures compared to standard gateways.

Faster payouts than many competitors, ensuring businesses receive funds quicker.

Customer-friendly interface making it easier for both merchants and users.

Scalability, accommodating businesses from small startups to large enterprises.

Conclusion

Quick Pay is undoubtedly one of the best payment gateway in India available today. Its blend of security, efficiency, affordability, and ease of use makes it an ideal choice for businesses across various industries. Whether you run an e-commerce store, a SaaS business, or a global enterprise, Quick Pay ensures smooth, secure, and hassle-free payment processing.

By choosing Quick Pay, businesses can enhance customer experience, reduce fraud risks, and boost revenue. With seamless integration, multi-currency support, and advanced features, Quick Pay is the go-to payment gateway for modern businesses looking for a reliable and future-proof payment solution.

Are you ready to streamline your payments and take your business to the next level? Sign up for Quick Pay today!

2 notes

·

View notes

Text

Online Credit Card Processing: Advanced Tips and Techniques

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-shifting realm of e-commerce, embracing online credit card processing isn't merely a convenience; it's a vital strategy for turbocharging sales and widening your customer reach. As the digital marketplace keeps evolving, so do the methods and technologies underpinning this process. Whether you operate an e-commerce emporium, engage in high-risk ventures, or delve into credit repair or CBD businesses, this article will furnish you with advanced insights and techniques to become a maestro of online credit card processing. From grasping high-risk merchant accounts to harnessing state-of-the-art payment gateways, we've got your back.

DOWNLOAD THE ONLINE CREDIT CARD INFOGRAPHIC HERE

The Potency of Embracing Credit Card Payments At the heart of prosperous online transactions resides the capacity to embrace credit card payments. It's not merely about convenience; it's about catering to the preferences of contemporary consumers who seek seamless and secure payment methods. Integrating credit card processing into your e-commerce platform enhances your credibility and flings open doors to a global clientele.

Unmasking High-Risk Merchant Accounts Steering high-risk industries doesn't entail compromising on payment processing. High-risk merchant accounts are adept at catering to businesses entrenched in sectors prone to chargebacks or legal complexities. These specialized accounts offer bespoke solutions that mitigate risks and ensure fluid transactions, granting you the freedom to concentrate on business growth sans apprehension.

Navigating the High-Risk Payment Terrain When your business falls within the high-risk bracket, conventional payment processors might waver. However, high-risk payment processing is meticulously crafted to address your unique demands. Armed with specialized fraud prevention tools and risk management techniques, you can fortify your transactions and cultivate trust among your clientele.

Advanced Stratagems for Credit Repair Enterprises Credit repair is a noble venture but laden with its share of challenges. Accepting credit card payments in this realm demands finesse. Leveraging credit repair merchant processing and payment gateways bespoke to your industry empowers you to aid clients in revitalizing their credit while ensuring smooth, secure transactions.

Venturing into the CBD Realm The CBD industry is in full bloom, but its association with high-risk factors might make payment processing appear formidable. Fret not, as CBD merchant processing is adept at handling the idiosyncrasies of your enterprise. From CBD payment gateways to high-risk credit card processing, these solutions unveil the potential of your CBD venture.

The Crucial Role of E-Commerce Payment Gateways E-commerce is synonymous with convenience and efficiency. To truly excel in this sphere, you necessitate an e-commerce payment gateway that aligns with your business model. Whether you deal in products or services, subscriptions, or one-off purchases, the right payment gateway augments the user experience and catalyzes conversions.

youtube