#State bank of india

Explore tagged Tumblr posts

Link

Credit cards have become an essential part of our daily lives. They offer several advantages that make them popular among consumers

6 notes

·

View notes

Text

How To Deactivate Auto Debit In SBI Credit Card

Hello friends, through today’s blog we will know, how to deactivate auto debit in SBI credit card in simple language.

You will find the same solution in this blog, in today’s blog we are going to talk about the topic that how to deactivate auto debit in sbi credit card.

Read Full Article;-

How To Deactivate Auto Debit In SBI Credit Card

How To Deactivate Auto Debit In SBI Credit Card

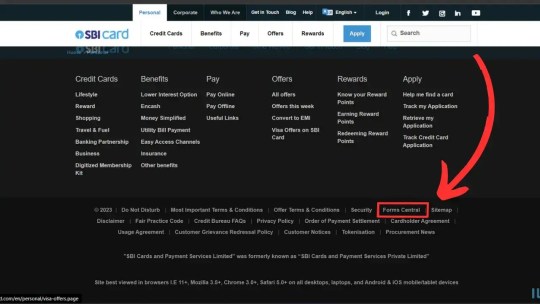

Now let us know how to deactivate the auto debit option of SBI Credit Card. The easiest way to deactivate the auto debit option is by filling out the form and posting it. We have guided you on how you can get the form And where you are posting that form.

Step 1: first a fall open this Website (https://www.sbicard.com/) on your mobile/laptop.

Step 4: Now fill out the form and submit it to the following address.

After you post it, your auto-debit option will be deactivated in a few days.

We mentioned a video in the following for a better explanation. They give step-by-step guidance on how to deactivate the auto debit option of SBI credit card.

youtube

Conclusion

In today’s blog, we know about how to deactivate auto debit in SBI credit card. If this post is informative for you then you can share it with your friends who want to deactivate SBI credit card option. If you have any confusion regarding this topic then you can surely comment to us We are surely trying to find your solution.

2 notes

·

View notes

Text

SBI Recruitment 2025: Apply Online for Latest Bank Jobs

State Bank of India has released SBI Recruitment 2025 notification. Get updates on vacancies, application process, and exam dates.

1 note

·

View note

Text

SBI New Bharti 2025- State Bank of India भर्ती 2025, Authoritative Notice Out

SBI Recruitment 2025: State Bank of India की तरफ से 33,216 पदों पर भर्ती का नोटिस जारी किया गया है जिस भर्ती में Various posts of Grade II, III, IV के साथ-साथ अन्य पदों पर भर्ती होने वाली है सैलरी इसमें 23,700 से ज्यादा ही मिलेंगे। जिस भर्ती में ऑनलाइन के माध्यम से आवेदन कर सकते हैं तो इस भर्ती में क्या योग्यता रखी गई है क्या आयु सीमा रहने वाली है कब से कब तक आवेदन करना होगा| तो इस भर्ती से जुड़ी…

0 notes

Text

"Bank Liability in Fraudulent Transactions: Supreme Court Upholds Customer Protection Under RBI Guidelines"

Image Courtesy TheDigitalArtist

➡️ The petitioner, State Bank of India (SBI), challenged the Gauhati High Court's decision regarding fraudulent online transactions conducted on the account of the respondent (Pallabh Bhowmick-Account Holder). The Gauhati High Court held the bank liable, finding no negligence on the part of the respondent.

#FraudulentTransactions #BankLiability #RBICircular2017

➡️ The primary issue in this *Case was whether the State Bank of India can be held liable for the loss caused by unauthorized and fraudulent online transactions, considering RBI’s Circular dt.06.07.2017 and the absence of negligence by the account holder.

#CustomerProtection #UnauthorizedTransactions

➡️The Counsel for the Petitioner SBI argued that it should not be held liable for the fraudulent transactions, claiming that the customer should bear some responsibility for securing their account and transactions.

➡️ The Counsel for the Respondent Account Holder contended that the transactions were unauthorized and fraudulent, and no negligence could be attributed to them. They promptly reported the fraudulent activity within 24 hours, fulfilling their obligation under RBI guidelines.

#OnlineBankingSecurity #Negligence #StateBankofIndia

➡️ The Apex Court observed that

🔹The transactions on the respondent’s account were unauthorized and fraudulent.

🔹The bank was unable to establish any negligence on the part of the respondent.

🔹RBI Circular clauses 8 and 9 (dt. 06.07.2017) clarified the bank's liability in such cases.

🔹Banks have access to advanced technology and should remain vigilant to prevent unauthorized transactions.

🔹Customers must also exercise caution and avoid sharing OTPs with third parties.

🔹The bank has a duty to ensure the security of its systems and detect unauthorized transactions.

🔹The respondent reported the fraud within the stipulated time under RBI guidelines, absolving them of liability.

#LegalPrecedent #SupremeCourt #SLPCivil

➡️ The Supreme Court dismissed the Special Leave Petition filed by SBI, upholding the Gauhati High Court's decision as the onus is on the banks to address such fraudulent activities unless negligence on the part of the customer is proven.

*Case SBI v. Pallabh Bhowmick & Ors.

SLP(C) 30677/2024, Before the Supreme Court of India

Heard by Hon'ble Mr. Justice J B Pardiwala & Hon'ble Mr. Justice R Mahadevan J

🔸By Seema Bhatnagar

#Supreme Court#Fraudulent Transactions#Bank Liability#RBI Circular 2017#Customer Protection#Unauthorized Transactions#Online Banking Security#Negligence#State Bank of India#Legal Precedent

1 note

·

View note

Text

0 notes

Text

State Bank of India Balance Checking Number

Checking your bank balance is crucial for managing your finances effectively. The State Bank of India (SBI) offers multiple convenient methods for customers to check their account balance. This article will guide you through these various options, focusing on the SBI balance check number and other helpful services.

State Bank of India Balance Checking Number

Why Knowing Your Balance is Important

Understanding your bank balance helps you keep track of your spending, avoid overdrafts, and ensure that your financial health is in check. It’s essential for budgeting, planning expenses, and avoiding unexpected fees.

Methods to Check SBI Account Balance

1. SBI Balance Check Number

How to Use the SBI Balance Check Number

To check your SBI account balance, dial the SBI balance check number: 09223766666 from your registered mobile number. Within seconds, you’ll receive an SMS with your account balance details.

Benefits of Using the SBI Balance Check Number

This method is quick, easy, and doesn’t require internet access. It’s especially useful for those who need their balance information instantly and for customers who aren’t tech-savvy.

2. SBI Missed Call Service

How to Use the Missed Call Service

Simply give a missed call to 09223766666 from your registered mobile number. You’ll receive an SMS with your account balance shortly after.

Advantages of Missed Call Service

The missed call service is free and convenient, making it accessible to all customers, including those with basic mobile phones.

3. SMS Banking

Steps to Use SMS Banking

Send an SMS in the format BAL to 09223766666 from your registered mobile number. You will get an SMS response with your account balance details.

Pros of SMS Banking

SMS banking is useful for those who prefer texting over calling. It provides a written record of your balance, which can be handy for future reference.

4. Internet Banking

Checking Balance Online

Log in to your SBI Internet banking account using your credentials. Navigate to the ‘Account Summary’ section to view your balance and recent transactions.

Security Tips for Internet Banking

Ensure you use strong passwords, log out after each session, and avoid accessing your account from public Wi-Fi networks to maintain security.

5. SBI YONO App

Using the YONO App to Check Balance

Download the SBI YONO app from the App Store or Google Play. After registering, you can easily check your balance and perform other banking operations through the app.

Features of the SBI YONO App

The YONO app offers a comprehensive range of features, including fund transfers, bill payments, loan applications, and investment services, making it a one-stop solution for all your banking needs.

How to Register for SBI Balance Services

Registering Your Mobile Number

Visit your nearest SBI branch or ATM to link your mobile number with your account. This is essential for using SMS banking and missed call services.

Activating Internet Banking

You can activate internet banking by visiting the official SBI website��(State Bank of India (onlinesbi.sbi)) and following the registration process. Alternatively, you can request assistance at your local branch.

Downloading and Setting Up the SBI YONO App

Download the app, complete the registration process by entering your account details and OTP, and set up your login credentials to start using the YONO app.

Troubleshooting Common Issues

Missed Call Service Issues

If you’re not receiving balance updates via missed calls, ensure your mobile number is registered with the bank and check for network issues.

SMS Banking Errors

Double-check the SMS format and ensure your mobile number is correctly registered. If issues persist, contact SBI customer service for assistance.

Internet Banking Login Problems

If you’re facing login issues, try resetting your password or contact SBI customer support for help. Ensure your browser is updated and clear your cache regularly.

Conclusion

SBI offers multiple convenient ways to check your account balance, making banking easy and accessible for everyone. Whether you prefer calling, texting, or using the internet, SBI has got you covered. Keeping track of your balance has never been simpler!

By Paisainvests.com

#balance inquiry SBI#bank balance check#SBI account balance#SBI account details#SBI account management#SBI balance#SBI balance check#SBI balance check number#SBI balance checking number#SBI balance enquiry#SBI balance information#SBI customer service#SBI mobile banking#SBI phone banking#SBI SMS balance check#State Bank of India

0 notes

Text

State Bank of India Balance Checking Number

Checking your bank balance is crucial for managing your finances effectively. The State Bank of India (SBI) offers multiple convenient methods for customers to check their account balance. This article will guide you through these various options, focusing on the SBI balance check number and other helpful services.

State Bank of India Balance Checking Number

https://paisainvests.com/wp-content/uploads/2024/07/sdsfdsfdsf.webp

Why Knowing Your Balance is Important

Understanding your bank balance helps you keep track of your spending, avoid overdrafts, and ensure that your financial health is in check. It’s essential for budgeting, planning expenses, and avoiding unexpected fees.

Methods to Check SBI Account Balance

1. SBI Balance Check Number

How to Use the SBI Balance Check Number

To check your SBI account balance, dial the SBI balance check number: 09223766666 from your registered mobile number. Within seconds, you’ll receive an SMS with your account balance details.

Benefits of Using the SBI Balance Check Number

This method is quick, easy, and doesn’t require internet access. It’s especially useful for those who need their balance information instantly and for customers who aren’t tech-savvy.

2. SBI Missed Call Service

How to Use the Missed Call Service

Simply give a missed call to 09223766666 from your registered mobile number. You’ll receive an SMS with your account balance shortly after.

Advantages of Missed Call Service

The missed call service is free and convenient, making it accessible to all customers, including those with basic mobile phones.

3. SMS Banking

Steps to Use SMS Banking

Send an SMS in the format BAL to 09223766666 from your registered mobile number. You will get an SMS response with your account balance details.

Pros of SMS Banking

SMS banking is useful for those who prefer texting over calling. It provides a written record of your balance, which can be handy for future reference.

4. Internet Banking

Checking Balance Online

Log in to your SBI Internet banking account using your credentials. Navigate to the ‘Account Summary’ section to view your balance and recent transactions.

Security Tips for Internet Banking

Ensure you use strong passwords, log out after each session, and avoid accessing your account from public Wi-Fi networks to maintain security.

5. SBI YONO App

Using the YONO App to Check Balance

Download the SBI YONO app from the App Store or Google Play. After registering, you can easily check your balance and perform other banking operations through the app.

Features of the SBI YONO App

The YONO app offers a comprehensive range of features, including fund transfers, bill payments, loan applications, and investment services, making it a one-stop solution for all your banking needs.

How to Register for SBI Balance Services

Registering Your Mobile Number

Visit your nearest SBI branch or ATM to link your mobile number with your account. This is essential for using SMS banking and missed call services.

Activating Internet Banking

You can activate internet banking by visiting the official SBI website (State Bank of India (onlinesbi.sbi)) and following the registration process. Alternatively, you can request assistance at your local branch.

Downloading and Setting Up the SBI YONO App

Download the app, complete the registration process by entering your account details and OTP, and set up your login credentials to start using the YONO app.

Troubleshooting Common Issues

Missed Call Service Issues

If you’re not receiving balance updates via missed calls, ensure your mobile number is registered with the bank and check for network issues.

SMS Banking Errors

Double-check the SMS format and ensure your mobile number is correctly registered. If issues persist, contact SBI customer service for assistance.

Internet Banking Login Problems

If you’re facing login issues, try resetting your password or contact SBI customer support for help. Ensure your browser is updated and clear your cache regularly.

Conclusion

SBI offers multiple convenient ways to check your account balance, making banking easy and accessible for everyone. Whether you prefer calling, texting, or using the internet, SBI has got you covered. Keeping track of your balance has never been simpler!

By Paisainvests.com

#balance inquiry SBI#bank balance check#SBI account balance#SBI account details#SBI account management#SBI balance#SBI balance check#SBI balance check number#SBI balance checking number#SBI balance enquiry#SBI balance information#SBI customer service#SBI mobile banking#SBI phone banking#SBI SMS balance check#State Bank of India

0 notes

Text

Supreme Court Raps SBI For Not Sharing "Complete Data" On Electoral Bonds

The Supreme Court today came down hard on the State Bank of India for not sharing the complete data on electoral bonds, a scheme that allowed individuals and businesses to donate anonymously to political parties. The court had struck down the scheme and directed the bank to share all details on the donations made in the last 5 years.

#amlawfirm#lawfirminchennai#bageerathan#law-frim#family law#writs#bagee#law#criminal law#bestlawfirminchennai#state bank of india#disapproval of petition#supereme court disapproval

0 notes

Text

व्यापारियों को किया ठगों से सावधान, ठगी से बचने बताए तरीके

सिवनी मालवा। पुलिस (Police) ने अनुभाग सिवनी मालवा (Seoni Malwa) के अन्तर्गत थाना डोलरिया (Police Station Dolariya) द्वारा शहर के भारतीय स्टेट बैंक (State Bank of India), सेन्ट्रल बैंक (Central Bank), क्षेत्रीय ग्रामीण बैंक (Regional Rural Bank) में जाकर कैमरे एवं सुरक्षा गार्ड को चेक किया गया एवं बैंकों के मैनेजर से मुलाकत कर बैंकों में सुरक्षा संबंधी विषय पर चर्चा की। अनुभाग के थाना शिवपुर…

View On WordPress

#Central Bank#police#Police Station Dolariya#Police Station Shivpur#Regional Rural Bank#seoni malwa#State Bank of India

0 notes

Text

SBI Chairman Foresees Positive Economic Shift: Upward Trajectory for India's GDP Growth

In a recent statement, State Bank of India (SBI) Chairman Dinesh Khara expressed optimism about India’s economic prospects, predicting an upswing in real GDP growth. Khara highlighted factors such as robust investment demand and improved business and consumer sentiments as key drivers of this positive trend.

Khara outlined SBI’s projections for the financial year 2025, expecting a credit growth of 14–16 percent, driven by momentum in both retail and corporate loans. He emphasized the favorable conditions shaping India’s economic landscape, paving the way for accelerated growth.

According to Khara, the Reserve Bank of India (RBI) has forecasted a real GDP growth of 7 percent for the current financial year. He noted a decline in consumer price index-based inflation (CPI), which is expected to moderate further in the coming months, contributing to a more stable economic environment.

In fiscal year 2024, scheduled commercial banks witnessed significant credit growth of around 20 percent, with deposits growing at approximately 13 percent. Khara anticipates this momentum to continue into the current fiscal year, reflecting sustained growth in credit across various sectors.

SBI’s own performance reflects these positive trends, with gross advances growing by 15.24 percent in FY24. Notably, domestic loans saw a notable increase, particularly in SME advances (20.53 percent year-on-year) and agriculture advances (17.92 percent year-on-year).

Looking ahead, Khara remains optimistic about the bank’s growth prospects, especially in corporate lending. With a corporate loan pipeline of Rs 4 lakh crore for FY25, Khara anticipates strong traction in this segment, driven by funding demand from diverse sectors, including infrastructure, electric vehicles (EVs), and semiconductors.

In addition to lending growth, SBI expects a deposit growth of 12–13 percent for FY25, further supporting its expansion plans.

Despite global economic uncertainties, SBI has reported strong financial performance, with standalone net profit reaching a record high in the March 2024 quarter. Key indicators such as net interest income (NII) and gross non-performing assets (GNPAs) also reflect positive trends, underscoring the bank’s resilience amid challenging conditions.

As SBI continues to navigate evolving economic landscapes, its outlook remains optimistic, driven by a proactive approach to lending and a focus on sustainable growth.

0 notes

Text

राजनीतिक दलों ने कैश किए 22030 बॉन्ड, 187 बॉन्ड पीएम रिलीफ फंड में डाले; जानें क्या है 15 दिनों की डेडलाइन का नियम

राजनीतिक दलों ने कैश किए 22030 बॉन्ड, 187 बॉन्ड पीएम रिलीफ फंड में डाले; जानें क्या है 15 दिनों की डेडलाइन का नियम

Electoral Bonds: इलेक्टोरल बॉन्ड्स का डेटा चुनाव आयोग को सौंपने के बाद स्टेट बैंक ऑफ इंडिया ने सुप्रीम कोर्ट को इसकी जानकारी दे दी है. एक हलफनामे में बैंक ने बताया कि कोर्ट के आदेश का परिपालन हो गया है. स्टेट बैंक ने इलेक्टोरल बॉन्ड्स की खरीद-बिक्री का डेटा सुप्रीम कोर्ट की फटकार के बाद 24 घंटे के ��ीतर चुनाव आयोग को सौंप दी है. डेटा में 187 बॉन्ड्स की जानकारी नहीं दी गई है, जिसका पैसा पीएम केयर…

View On WordPress

#bonds#category= news#current affairs#Electoral bonds#electoral bonds case#electoral bonds india#firstpost#india electoral bonds sbi#loksabhaelections2024#palki sharma#PM Relief Fund#political parties#poll bonds case#reporter= sunil prabhu#sbi electoral bonds india#sbi electoral bonds supreme court#state bank of india#state bank of india electoral bonds#sunil prabhu#supreme court deadline sbi bonds#supreme court sbi electoral bonds#supreme court ultimatum sbi#top news#vantage palki sharma

0 notes

Text

Unlock the power of long-term savings with the SBI PPF Calculator. This user-friendly tool helps you efficiently plan your Public Provident Fund investments with the State Bank of India.

Get accurate projections of your PPF contributions, interest earnings, and maturity values. Ideal for savvy investors seeking a reliable way to build a substantial financial nest egg. Plan, project, and prosper with our SBI PPF Calculator!

1 note

·

View note

Text

SBI CBO vacancies 2023: SBI issues notice for 5280 Circle Based Officer posts

The State Bank of India (SBI) has invited applications for the recruitment of circle-based officers or CBOs. The application process will commence on Wednesday, November 22 and the deadline for the submission of the application form is December 12. Interested candidates can apply online through the official website at sbi.co.in. The online test will be conducted in January 2024. SBI announces…

View On WordPress

0 notes