#Bank of Baroda

Explore tagged Tumblr posts

Link

Credit cards have become an essential part of our daily lives. They offer several advantages that make them popular among consumers

6 notes

·

View notes

Text

Bank of Baroda Recruitment 2025: बैंक ऑफ बड़ौदा भर्ती 2025 , Post- 7000

Bank of Baroda Recruitment 2025: बैंक ऑफ बड़ौदा की तरफ से 7000 पदों पर भर्ती का नोटिस जारी किया गया है जिस भर्ती में Agriculture Marketing Officer Scale-2, Manager Sales, Manager Credit Analyst, Various Posts के साथ-साथ अन्य पदों पर भर्ती होने वाली है सैलरी इसमें 25000 से ज्यादा ही मिलेंगे। जिस भर्ती में ऑनलाइन के माध्यम से ��वेदन कर सकते हैं तो इस भर्ती में क्या योग्यता रखी गई है क्या आयु सीमा…

0 notes

Text

Bank of Baroda Expands Presence with 63rd Branch in Jamshedpur

Baridih welcomes new banking facility, boosting financial services in region Key Points: • Bank of Baroda opens 63rd branch in Jamshedpur region at Baridih • Dr. G. Pradeep Kumar, Dean of Manipal Tata Medical College, inaugurates • Branch aims to enhance bank’s service network and accessibility JAMSHEDPUR – Bank of Baroda has expanded its reach in the steel city with the inauguration of its 63rd…

#बिजनेस#Bank of Baroda#banking expansion#Baridih branch#business#Dr. G. Pradeep Kumar#financial services#Jamshedpur#Manipal Tata Medical College#Manish Prakash Sinha

0 notes

Text

Fixed deposit| Simple interest & Compound interest Calculation & their formulas

youtube

Hi everyone, and welcome to my channel. Today, I'm going to talk about fixed deposits. Fixed deposit is the most popular way to invest money. In short, it's called FD, where secure lump sum money is invested at a predetermined rate of interest. At the end of the tenure, you get your invested amount and compound interest. FD interest rates remain unchanged by market fluctuations, but the invested amount is typically locked in until maturity. some banks offer premature withdrawal but they charge a penalty for that. With FD, you invest your lump sum amount for a certain period ranging from as small as 7 days to as high as 10 years. Higher interest rates are generally given for longer time tenure.Generally interest is paid every 3 months from the date of deposit. Let's say you opened fd ac on 8th june you will receive next interest installment on 8th September. Interest is credited to your account. This is case of simple FD. However customers can choose to have his interest reinvested in FD account. In this case This deposit is called compound interest FD. In that case interest is paid with invested amount on maturity of deposit at the end of term. Investing in FD gives higher interest than investing in savings account. The interest rate on fixed deposits may not keep pace with inflation, which means that your money may lose its purchasing power over time.

So in india,minimum tax you pay for fd is 10%.this is the rate of tax deducted at source(TDS) on interest earned on fd, if interest earned exceeds 40000 in a financial year. For senior citizens this tds earned is 50000.If your overall income for a year does not fall within overall tax limits you can submit form15G( <60years of age) and 15H (>60years of age). These forms help you receive interest with tax deducted at source (tds).Tax saving fd provide tax benefits under Section 80C of the Income Tax Act. You can claim a tax deduction of up to Rs 1.5 lakh by investing in the tax saving FDs. You can earn fixed returns while saving on the taxes. This FD can be opened in the same way as a regular FD.

#fixed deposit#mutual funds#finance#banks#bank of baroda#interest rates#rbi#money management#make money online#earn money online#Youtube

0 notes

Text

Bank of Baroda Tabit

In the fast-paced world of banking, where convenience and efficiency are paramount, the emergence of digital banking solutions has been nothing short of transformative. One such innovation that has been making waves in the financial landscape is the Bank of Baroda Tabit – a cutting-edge digital platform that redefines the way customers interact with their bank.

Introduction to Bank of Baroda Tabit

Bank of Baroda Tabit is a comprehensive digital banking platform introduced by Bank of Baroda, one of India's leading public sector banks. It is designed to offer a seamless banking experience to customers, leveraging the power of technology to simplify financial transactions and enhance accessibility.

Key Features and Benefits

The Bank of Baroda Tabit comes equipped with a plethora of features aimed at streamlining banking operations and enhancing customer satisfaction:

User-Friendly Interface: The platform boasts an intuitive interface that ensures ease of navigation, making banking transactions convenient for users of all demographics.

24/7 Accessibility: With Bank of Baroda Tabit, customers have round-the-clock access to their accounts, enabling them to conduct transactions and manage their finances anytime, anywhere.

Account Management: Customers can view their account balance, transaction history, and account statements with just a few taps on their mobile devices, providing them with real-time insights into their financial activities.

Fund Transfers: The platform facilitates seamless fund transfers between Bank of Baroda accounts as well as to accounts in other banks via NEFT, RTGS, and IMPS, making money transfers hassle-free.

Bill Payments: Customers can pay their utility bills, credit card bills, and other recurring payments directly through the Bank of Baroda Tabit, eliminating the need for manual intervention and ensuring timely payments.

Mobile Recharge: The platform allows users to recharge their prepaid mobile phones and DTH connections instantly, providing added convenience.

Investment Services: Bank of Baroda Tabit offers investment services, enabling customers to invest in mutual funds, fixed deposits, and other financial products through a seamless digital interface.

Customer Support: In case of any queries or assistance required, customers can avail themselves of dedicated customer support services through the Bank of Baroda Tabit platform, ensuring prompt resolution of issues.

Security and Reliability

Bank of Baroda Tabit prioritizes the security and confidentiality of customer data, employing robust encryption techniques and multi-factor authentication protocols to safeguard against unauthorized access and fraud. With state-of-the-art security measures in place, customers can rest assured that their financial information is protected at all times.

Future Outlook

As technology continues to evolve and customer expectations evolve with it, the Bank of Baroda Tabit is poised to adapt and innovate further, introducing new features and functionalities to meet the ever-changing needs of modern banking customers. With a commitment to excellence and a focus on customer-centric innovation, Bank of Baroda remains at the forefront of digital banking transformation in India.

In conclusion, the Bank of Baroda Tabit represents a paradigm shift in the way banking services are delivered, offering unparalleled convenience, security, and reliability to customers. As digital banking continues to gain momentum, platforms like Tabit are set to play a pivotal role in shaping the future of banking, driving financial inclusion and empowerment on a global scale.

0 notes

Text

Discover the best Bank of Baroda card offers, deals, vouchers, and promo codes at plutos ONE! Get exciting discounts and benefits on your purchases with these exclusive offers.

#Bank of Baroda offers#Bank of Baroda vouchers#BOB Offers#Bank of baroda deals#Bank of Baroda#plutos ONE

0 notes

Text

Home Loan | Apply Home Loan at low EMI

Explore Bank of Baroda's comprehensive home loan offerings for your dream home. Discover competitive interest rates, flexible repayment options, and a seamless application process. Your path to homeownership begins with Bank of Baroda – where your dream home becomes a reality.

0 notes

Text

Center's key decision removal of 70 lakh mobile numbers Repoted News..

The central government has taken a crucial decision. 70 lakh mobile numbers have been deleted across the country. Financial Services Secretary Vivek Joshi said that suspicious numbers have been suspended to prevent digital fraud. Regarding Aadhaar Enabled Payment System (AEPS) frauds, he said states have been asked to look into the issue and ensure data protection. Joshi expressed the opinion that there should be an increase in the awareness of cyber frauds in the society. On the other hand, it is known that digital frauds have taken place in public sector UCO Bank and Bank of Baroda (BOB) recently. Rs.820 crores were mistakenly transferred from UCO Bank to the accounts of the clients through IMPS, but the bank accounts were immediately identified and blocked and Rs.649 crores were recovered. But it is noteworthy that the bank has not yet given an explanation on how this happened. In this background, the Center has put special focus on suspicious financial transactions.

#central government#Aadhaar Enabled Payment System#UCO Bank#Bank of Baroda#Latest News#Telugu News#Repoted News

0 notes

Text

https://bigul.co/en/index.php/bank-of-baroda-faces-restrictions-on-new-customer-onboarding-through-bob-world-app/

0 notes

Link

0 notes

Text

Bank of Baroda Recruitment 2023, Check Post, Vacancies, Eligibilty, Salary up to 56,000/ Monthly, Apply Online

0 notes

Text

Bank of Baroda Recruitment 2025 - बैंक ऑफ बड़ौदा भर्ती 2025, पद- 7000

Bank of Baroda Recruitment 2025: बैंक ऑफ बड़ौदा के तरफ से नोटिस जारी किया गया जिसमें Agriculture Marketing Officer Scale-2, Manager Sales, Manager Credit Analyst, Various Posts का पद होने वाला है जिसमें 7000 पदों पर भर्ती होगी जिसके लिए ऑनलाइन आवेदन मांगे जा रहे हैं तो इस भर्ती में क्या एजुकेशन क्वालीफिकेशन देखने को मिलेगी क्या आयु सीमा रहने वाली कब से कब तक आवेदन करना होगा सारी जानकारी आगे इस…

View On WordPress

0 notes

Text

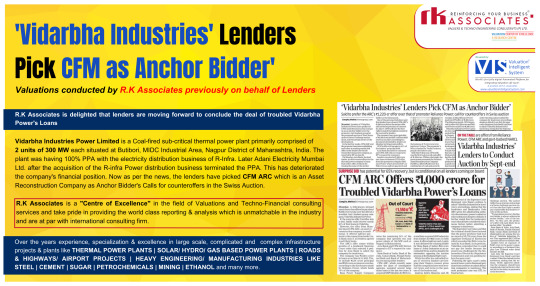

'𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬' nears resolution. 𝐋𝐞𝐧𝐝𝐞𝐫𝐬 𝐏𝐢𝐜𝐤 𝐂𝐅𝐌 𝐚𝐬 𝐀𝐧𝐜𝐡𝐨𝐫 𝐁𝐢𝐝𝐝𝐞𝐫𝐬'.

Valuation of this Power Plant was previously conducted by 𝐑.𝐊 𝐀𝐬𝐬𝐨𝐜𝐢𝐚𝐭𝐞𝐬 𝐨𝐧 𝐛𝐞𝐡𝐚𝐥𝐟 𝐨𝐟 𝐋𝐞𝐧𝐝𝐞𝐫𝐬.

𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬 𝐏𝐨𝐰𝐞𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 which is a Coal-fired sub-critical thermal power plant primarily comprising of 𝟐 𝐮𝐧𝐢𝐭𝐬 𝐨𝐟 𝟑𝟎𝟎 𝐌𝐖 each situated at Butibori, MIDC Industrial Area, Nagpur District of Maharashtra, India. The plant was having 100% PPA with the electricity distribution business of R-Infra. Later Adani Electricity Mumbai Ltd. after the acquisition of the R-infra Power distribution business terminated the PPA. This has deteriorated the company's financial position.

The Loans of 𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐏𝐨𝐰𝐞𝐫 were a distressed asset for the lenders. We are delighted that the lenders have picked CFM ARC as Anchor Bidder for the Calls for counteroffers in the Swiss Auction to conclude the deal of the troubled Vidarbha Power’s Loans.

More Info:

Website: https://www.rkassociates.org/

Facebook: https://www.facebook.com/rkavaluers

Instagram: https://www.instagram.com/rka_valuers/

Linkedin: https://www.linkedin.com/company/rkassociatesvaluers/

Twitter: https://twitter.com/rkavaluers

#valuationservices#valuations#axis bank#idbi bank#hdfc bank#icici bank#sbibank#bank of india#bank of baroda#union bank of india

0 notes

Text

Good News For Bank Of Baroda Share Holders! Full Details Inside

Hi, guys great news for those who own Bank Of Baroda Shares. In this article, we can see the great announcement from India’s leading Private Bank Bank Of Baroda. The Bank announces dividends to its shareholders. Let’s see the full details in detail below. If you see my blog the first time make sure to join my Whatsapp group for the latest news about the stock market. Click Here To JoinWhatsapp…

View On WordPress

0 notes

Text

The Bank of Baroda (BOB) is accepting online applications for 12 contract roles as a Cloud Engineer, Integration Expert, and Others. If they meet the prerequisites, interested and qualified candidates may submit an online application on or before 11-05-2023.

Method of Recruitment:

For the applicable positions, the application evaluation process will be carried out in two stages, beginning with a careful analysis of every application received and concluding with interviews with the shortlisted candidates. Candidates must make sure they have the relevant documentation with them when they go in for the interview.

Dates to Think About:

By: 11-05-2023, electronic application forms will be received.

Fee Schedule:

Free application.

How to Use:

Applications may be submitted online utilizing the facility provided on or before May 11, 2023. Read the instructions thoroughly before completing the application. The candidate must complete the online form with all of their academic and personal information in the fields that match their diplomas. Candidates must upload a scanned copy of their ID and their signature to the online application. It is recommended to print and preserve a copy of the online application for subsequent use.

Send Applications to :

Apply Online.

9 Chief Manager and Senior Manager Positions Open for BOB Recruitment 2023

The Bank of Baroda (BOB) is currently accepting online applications for nine posts as Chief Manager and Senior Manager. If they meet the prerequisites, interested and qualified candidates may submit an online application on or before 11-05-2023.

Dates to Consider:

Online Application forms will be received by: 11-05-2023.

Method of Recruitment: After carefully reviewing all applications, suitable applicants will be called for interviews. The final list of candidates will be chosen based on their academic credentials and performance in the interview.

Fee Structure :

No Application fee.

Send Applications to :

Apply Online.

0 notes