#Standard Chartered Bank

Explore tagged Tumblr posts

Text

Türkiye Varlık Fonu'ndan Yeni Sukuk İhracı Duyurusu

Türkiye Varlık Fonu’ndan Yeni Sukuk İhracı Türkiye Varlık Fonu, uluslararası finans piyasalarında önemli bir adım atarak, 14 Ekim 2024 tarihinde gerçekleştireceği bir dizi sabit getirili yatırımcı toplantısı ve görüşmesi düzenlemek üzere üç prestijli bankayı görevlendirdi. Emirates NBD Capital, J.P. Morgan ve Standard Chartered Bank, bu süreçte ortak küresel koordinatörler ve talep toplayıcıları…

#Emirates NBD Capital#finansman kaynakları#J.P. Morgan#kredi derecelendirme#Reg S#sabit getirili yatırım#Standard Chartered Bank#sukuk ihracı#Türkiye Varlık Fonu#uluslararası finans#yatırımcı toplantısı

0 notes

Text

Tata Steel and StanChart Launch Watershed Project in Jharkhand

1500 households to benefit from soil and water conservation initiative in Noamundi Tata Steel Foundation and Standard Chartered Bank partner to implement watershed and climate proofing project in West Singhbhum. JAMSHEDPUR – Tata Steel Foundation and Standard Chartered Bank announce collaboration on watershed project in Noamundi Block, West Singhbhum. The Integrated Watershed and Climate Proofing…

#बिजनेस#business#climate resilience#Community Development#Noamundi block#soil conservation#Standard Chartered Bank#sustainable agriculture#Tata Steel Foundation#Water Management#watershed project#West Singhbhum

0 notes

Text

Huge Win for XRP Prompts U.S. Banks to Embrace Ripple Payments Sooner Than Expected!

In a groundbreaking development for the cryptocurrency and financial sectors, six major U.S. banks have confirmed partnerships with Ripple, accelerating the adoption of Ripple’s payment technology across the banking industry. The announcement is based on 2022 data, and the banks involved include HSBC Holdings, Bank of America, J.P. Morgan Chase, CIBC, PNC, and Standard Chartered Bank, among…

#Bank of America#CIBC#DeFi#HSBC#J.P. Morgan Chase#PNC#Ripple [XRP]#Ripple Payments#Standard Chartered Bank#US Banks#XRP

0 notes

Text

#Standard chartered bank dsa partner#standard chartered bank dsa#dsa partner#dsapartnerbenefits#dsa agent#standard chartered bank#onesarvfintech#onesarv#loan#loans#standard chartered bank dsa agent#finance

1 note

·

View note

Text

#Standard chartered bank DSA#Standard chartered bank#loan#dsa partner#dsa#dsapartnerbenefits#dsa agent#standard chartered bank dsa#finance#onesarv fintech#loans#agents#standard chartered bank dsa partner

1 note

·

View note

Text

#British Asian Trust#LiftEd initiative#education#4 million kids#India#literacy#numeracy#foundational skills#consortium#partners#investment#Michael & Susan Dell Foundation#Reliance Foundation#Standard Chartered Bank#EdTech Accelerator#state governments#schools#educator training#digital solutions#at-home learning#low-income communities#social finance#King Charles III#Prince of Wales#British Asian business figures#social finance initiatives#Quality Education India Development Impact Bond#QEI DIB#UK government#Skill Impact Bond

0 notes

Text

Access Bank acquires Stanchart subsidiaries in four African countries

Access Bank has acquired four subsidiaries of Standard Chartered Bank in Angola, Cameroon, The Gambia, and Sierra Leone. Stanchart has also It will also be offloaded its Consumer, Private & Business Banking business in Tanzania. Each transaction remains subject to the approval of the respective local regulators and the banking regulator in Nigeria. The announcement was made today at Standard…

View On WordPress

1 note

·

View note

Text

The Finest Banks in Bangladesh: A Comprehensive Diagram of Extraordinary Money related Educate

Bangladesh’s managing an account segment has experienced noteworthy development and change in later a long time, advertising a wide run of administrations to meet the assorted monetary needs of people, businesses, and businesses. With a solid accentuation on innovation, client benefit, and budgetary incorporation, a few banks have risen as the driving institutions within the country. In this article, we’ll investigate a few of the most excellent banks in Bangladesh, known for their unwavering quality, advancement, and customer-centric approach.

Dutch-Bangla Bank Constrained (DBBL): Dutch-Bangla Bank Constrained is broadly recognized as one of the leading banks in Bangladesh, famous for its imaginative administrations and client fulfillment. The bank has been at the cutting edge of advanced keeping money within the nation, advertising a run of helpful administrations such as online keeping money, versatile apps, and computerized installment arrangements. DBBL’s commitment to technology-driven arrangements, coupled with its center on monetary incorporation, has situated it as a favored choice for numerous people and businesses in Bangladesh.

BRAC Bank Restricted: BRAC Bank Restricted may be a leading private commercial bank in Bangladesh, known for its extraordinary client benefit and broad department organize. The bank offers a comprehensive run of items and administrations, counting retail managing an account, corporate banking, SME managing an account, and settlement arrangements. BRAC Bank’s commitment to advancement is obvious in its computerized managing an account stages, guaranteeing clients have get to to helpful and secure managing an account administrations. The bank’s center on economical hones and social duty encourage improves its notoriety within the money related industry.

Eastern Bank Restricted (EBL): Eastern Bank Restricted may be a unmistakable commercial bank in Bangladesh, recognized for its comprehensive run of managing an account administrations and amazing client back. The bank offers a wide cluster of items, counting retail managing an account, corporate managing an account, SME managing an account, and treasury administrations. EBL has made noteworthy speculations in technology, resulting in user-friendly advanced stages and progressed versatile managing an account applications. With its accentuation on personalized administrations and inventive arrangements, EBL has ended up a trusted choice for clients over different portions.

Standard Chartered Bank: Standard Chartered Bank, an worldwide bank with a solid nearness in Bangladesh, offers a run of budgetary administrations to cater to the wants of people and businesses. The bank is known for its worldwide skill, solid chance administration hones, and a wide network of branches and ATMs in Bangladesh. Standard Chartered Bank gives a comprehensive suite of keeping money items, counting retail keeping money, corporate keeping money, exchange fund, and riches administration administrations. Its commitment to conveying personalized and custom fitted arrangements has earned it a trustworthy position within the keeping money segment.

Islami Bank Bangladesh Constrained (IBBL): Islami Bank Bangladesh Restricted, as the biggest sharia-compliant bank within the nation, is exceedingly respected for its Islamic keeping money administrations. The bank works beneath the standards of Islamic Shariah, advertising a wide run of items and administrations, counting retail keeping money, corporate keeping money, speculation administrations, and settlement arrangements. IBBL’s commitmentto providing ethical managing an account administrations and its center on social duty have made it a favored choice for people looking for Islamic keeping money choices in Bangladesh.

Conclusion: The managing an account division in Bangladesh has seen momentous development, with a few banks developing as industry pioneers. Dutch-Bangla Bank Restricted, BRAC Bank Restricted, Eastern Bank Restricted, Standard Chartered Bank, and Islami Bank Bangladesh Constrained are among the best banks in Bangladesh, known for their reliability, customer-centric approach, and technological innovation. These banks offer comprehensive monetary administrations, counting computerized keeping money arrangements, broad department systems, and a wide run of items custom fitted to distinctive client portions.

When selecting a bank in Bangladesh, it is basic to consider variables such as comfort, innovation, client benefit, and the run of items and administrations offered. By choosing one of these trustworthy banks, people and businesses can appreciate.

0 notes

Text

Moody's Upgrades Standard Chartered Malaysia's Outlook to Positive

Moody’s Investors Service recently announced an affirmation of Standard Chartered Bank Malaysia Berhad’s (SCBM) credit ratings, while upgrading its outlook from stable to positive. This development is noteworthy as it mirrors the rating actions on its parent company, Standard Chartered PLC (SCPLC), which also saw its outlook improved to positive. The move reflects the strong financial position…

0 notes

Text

Westpac's Vern Harvey, now chief general manager, regional offshore banking, and charged with getting rid of the group's Asian network, worked with Standard Chartered PLC on the sales program.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#vern harvey#general manager#offshore#banking#finance#lending#asia#standard chartered plc#sales

0 notes

Text

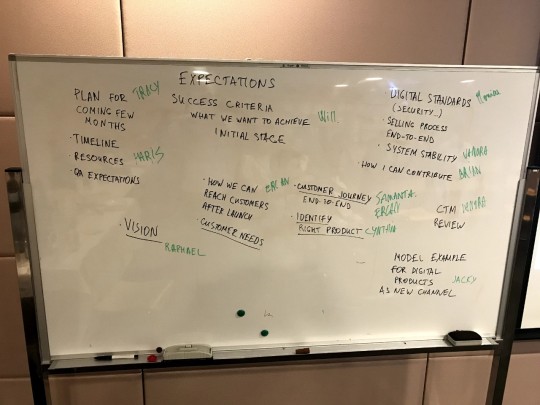

Have you ever run an Inception workshop?

In March 2018, key people from our Banca team @Standard Chartered Bank flew from #Singapore to #HongKong to connect with our stakeholders and kick-start a new digital journey.

Yesterday I touch based with my friend Sergey and realized that nearly 5 years ago we got the chance to collaborate together: our main intent was actually to kick start a new Mobile Insurance Journey for Hong Kong market. To reach our target we booked 2 full days with all stakeholders, called back then - Inception Workshop.

Here is the enabling team:

Sergey (Agile Coach): The good.

Ben (Product Owner): The Bad.

Raphaël / myself (Scrum Master): The Ugly.

Hopefully we got good company: our guest star - Rishi Kant (Architect) - would give us precious advices and would help to overview the feasibility of the future journey. Looking at the pictures, my souvenirs and also by experience, I will try to share the key steps and expected outcome we were hoping to achieve:

Key Steps:

1) Define the Scope and Goal:

Identify target audience and their needs.

Set the stage and clear objectives for the workshop, e.g : explore pain points, generate ideas, define MVP.

Establish workshop ground rules and desired outcomes.

2) Stakeholder Mapping:

Identify Key stakeholder.

Prioritize and define level of engagement.

Identify missing group of people.

Align expectation.

Identify collaboration opportunity.

Start to draft people structure.

3) Gather Insights and Inspire:

Facilitate brainstorming sessions on customer motivations, challenges, and desired experiences.

Present relevant industry trends and innovative insurance journeys.

Conduct user research exercises like user personas or empathy mapping.

4) Ideate and Prioritize:

Guide collaborative ideation sessions, encouraging creativity and out-of-the-box thinking.

Use frameworks like design thinking or rapid prototyping to quickly iterate on ideas.

Prioritize concepts based on feasibility, value, and user relevance.

5) Action Planning and Next Steps:

Develop a high-level roadmap for the new digital insurance journey.

Assign ownership and tasks for further development and prototyping.

Identify resources and potential roadblocks.

Provide high level of estimation.

Expected Outcomes:

Shared Vision and high level business objectives.

Shared understanding of target audience and their needs.

Shared understanding of the Stakeholders and their contribution.

Generated pool of creative and user-centric ideas for the new digital journey.

Prioritized concept(s) with a clear direction for further development.

Actionable plan and responsibilities for the next steps.

Identified High Level roadmap.

Potential release plan.

Motivated and inspired team aligned behind the new direction.

Additional Tips:

Prepare your Agenda carefully: WHO, WHAT, WHEN, HOW, think about a logical flow.

One facilitator is not enough, identify who will partner with you.

Identify few stakeholders which will support during the workshop, align on their contributions.

Diversity: Invite a diverse team of stakeholders from different departments.

Create a playful and collaborative environment to spark creativity: the room setting and the activities are primordial.

Utilize visual aids and interactive tools to engage participants.

Be flexible and adapt the workshop based on emergent ideas and group dynamics.

By following these key steps and focusing on the expected outcomes, your inception workshop can lay a strong foundation for designing a successful and impactful new journey (you can probably treat yourself with a nice team lunch by the end of it!!!).

1 note

·

View note

Text

11th Accountancy - Conceptual Framework of Accounting Chapter 2

I. Multiple Choice Questions : Choose the Correct Answer Question 1: The business is liable to the proprietor of the business in respect of capital introduced by the person according to ……………… (a) Money measurement concept (b) Cost concept (c) Business entity concept (d) Dual aspect concept Answer: (c) Business entity concept Question 2: The concept which assumes that a business will…

View On WordPress

#Accounting period#Accounting standard#Bad debt#Depreciation#FYI#Institute of Chartered Accountants of India#Medium of exchange#Money measurement concept#Reserve Bank of India#Revenue recognition#Stock valuation#Supreme Court of India

0 notes

Text

0 notes

Text

HELP!!!

The state of Rio Grande do Sul in Brazil is currently facing a climate catastrophe that resulted in the flooding of several towns, including RS’s capital Porto Alegre, leaving many dead, missing, and displaced after losing everything.

Even if you’re not Brazilian, please consider helping by donating:

➡️ Euro Zone

Standard Chartered Bank Frankfurt Bank

Swift: SCBLDEFX

Bank Account: 007358304

➡️ Dollar Zone

Standard Chartered Bank New York Bank

Swift: SCBLUS33

Bank Account: 3544032986001

⚠️ For both banks, please additionally inform:

IBAN Code: BR5392702067001000645423206C1

Name: Associação dos Bancos no Estado do Rio Grande do Sul

CNPJ: 92.958.800/0001-38

➡️For donations over USD 10,000.00 or operational clarifications, see:

Verno Kirst f. 55 51 32152928

Edoardo Rossi f. 55 51 32152548

➡️ PAYPAL

Fabíola Thiele made her PayPal available to receive donations and pass them on to the RS Civil Defense.

PayPal: [email protected]

If can't help by donating, then help by sharing this please 🙏🏼

#i know i have no reach here and that people worldwide give zero fucks about what goes on here in brazil but it's worth the try#rio grande do sul#brasil#brazil#important#boost#signal boost

508 notes

·

View notes

Text

Standard Chartered Bank launches the 20th edition of the Nairobi marathon

Standard Chartered Bank (Stanchart) has announced the launch of the 20th edition of the Standard Chartered Nairobi marathon. It will be held under the theme ’20 years of running’. This year the bank targets to have 25,000 runners participate in the physical marathon. The marathon marks two decades of the Bank’s commitment to deliver a premier, IAAF accredited international mass participation…

View On WordPress

0 notes

Text

Just a reminder: intent is much, much more important to genocide than the amount of people dying. simply put, the amount of dead civilians isn't what makes a genocide a genocide.

for example, up to 33k bosnians are estimated to have died because of the bosnian genocide. in contrast, the estimated amount of japanese civilians dead during WWII is between 330k and 900k. yet most (serious) people wouldn't ever consider that there was a genocide against the japanese people. why? well, no government wanted to, planned or carried out systematic attacks with the intent of erasing, in whole or in part, the japanese people. yet, however, it is fairly easy to prove that the serbs wanted the bosnians gone and acted accordingly. You can even fullfill the material criteria for the Genocide Convention (ie killing people, or causing body or mental harm to a population) to a certain extent but if the intent behind those actions isn't to destroy a national/ethnic/etc group, then it's not genocide, the fullfilment of the material elements themselves aren't proof that there's a genocide without fullfilment of the mental element.

This isn't to overlook civilian deaths, but truth is, in modern warfare, civilians ARE gonna die, and that sucks massively, but we have a a whole branch of international law that help mitigate a lot of civilian deaths and allow for criminals to be held accountable for violation of civilian rights and livs, without having to erroneously call every single conflict where people die a genocide.

Similarly, it may be true that a lot more people are dying in the Israel-Gaza war than in the 7/10 attacks, but why did Hamas attack Israel in the first place? Why has Israel been attacked fairly frequently since it's independence? Because they want to completely erase Israel as a whole and expel (and kill, or best case scenario, convert) the jewish people out of the Middle East. This is very easy to prove, read Hamas founding charter and literally any history book that talks about wars against Israel or the expulsion of Jews from several ME countries. It's what the whole "from the river to the sea" slogan is about. It's also the very reason Israel needs to exist. But meanwhile, there's little to nothing that points out Israel wants to wipe out Palestinians as a group: 20% of their citizens are Palestinians who enjoy the same rights as Jewish citizens of Israel and aren't targeted, even Palestinians of the West Bank aren't usually targeted in a way that would even imply the IDF wants to erase them as a group, and even considering the Gaza campaign, its objective is to erradicate Hamas, not Palestinians, and nothing in Israel's policy outwardly implicates they want to erradicate all Gazans. Palestine, and especially Gaza, has massive population growth, which wouldn't make sense if there was a genocide campaign against them. This isn't to say the IDF is doing everything perfectly or that there aren't war crimes being commited. But war crimes don't mean genocide.

Calling what's happening in Gaza genocide is antisemitic, because not only are we applying different standards to Israel than we do any other country, we are also saying that Jewish people defending themselves is, inherently, a crime, one of the worst crimes defined at that. But it's also harmful to palestinians, because claiming that Israel's war against Hamas is a war against Palestinians equates Palestinians (many of whom just want to live regular lives, not war) with terrorists (who also target them, by the way), which seems islamophobic as hell if i'm being honest. it is also insensitive and damaging to every group that has been the victim of genocide, and every group which might be a victim of a genocide in the future, because how you're twisting the definition of the word to mean whatever you want it to mean. If everything is a genocide, nothing is.

#sincerely an IR major tired of people not knowing what words mean#i stand with israel#i stand with palestine#israel#israel gaza#palestine#hamas#israel palestine#genocide#hamas is isis#free palestine#free palestine from hamas#antisemitism

456 notes

·

View notes