#Spain Wind Power Market

Explore tagged Tumblr posts

Text

In 2023, the cumulative installed capacity for Spain wind power market was 30.9 GW and will grow at a CAGR of more than 6% during 2023-2035. In 2023, onshore wind was the dominant source of wind power generation across the country.

0 notes

Text

Harnessing the Breeze: The Wind Power Market in Spain

Introduction

The Spain Wind Power Market is a pivotal component of the country's renewable energy sector, contributing to sustainable development, decarbonization efforts, and energy transition goals. This article provides insights into the key trends, challenges, and opportunities shaping the wind power market in Spain, including market dynamics, regulatory frameworks, and technological advancements.

Market Dynamics and Landscape

Growth Trajectory

Spain has emerged as a leading player in the global wind power market, with abundant wind resources, favorable climatic conditions, and supportive government policies driving significant growth in wind energy capacity. The country boasts a diverse portfolio of onshore and offshore wind projects, ranging from small-scale installations to utility-scale wind farms, contributing to the expansion of renewable energy generation and reducing dependence on fossil fuels.

Market Competitiveness

The wind power market in Spain is characterized by fierce competition among domestic and international players, including wind turbine manufacturers, project developers, and energy utilities. Industry consolidation, technological innovation, and economies of scale have led to cost reductions and improved efficiency in wind power generation, making wind energy increasingly competitive with conventional forms of electricity generation.

Buy the Full Report for More Insights into the Spain Wind Power Market Forecast

Download a Free Report Sample

Regulatory Environment and Policies

Renewable Energy Targets

Spain has established ambitious renewable energy targets to increase the share of renewables in the energy mix, reduce greenhouse gas emissions, and achieve climate neutrality by 2050. Regulatory frameworks such as the Renewable Energy Plan and the National Energy and Climate Plan (PNIEC) set clear targets for wind energy deployment, grid integration, and market liberalization, providing long-term certainty and stability for investors and developers.

Auction Mechanisms

The Spanish government implements competitive auction mechanisms to allocate renewable energy capacity and incentivize investment in wind power projects. Auctions enable developers to bid for long-term power purchase agreements (PPAs) or feed-in tariffs (FITs), providing revenue certainty and mitigating financing risks for new wind projects. Transparent and competitive auction processes drive down renewable energy costs and facilitate the transition to a low-carbon energy system.

Technological Innovations and Advancements

Offshore Wind Development

Spain is poised to capitalize on its vast offshore wind potential, leveraging technological advancements and expertise in maritime engineering to develop offshore wind farms along its coastal regions. Offshore wind offers significant advantages, including higher wind speeds, larger project scales, and reduced visual impact compared to onshore installations, making it an attractive option for expanding renewable energy capacity and diversifying the energy mix.

Digitalization and Grid Integration

Digital technologies play a crucial role in optimizing wind farm operations, enhancing asset performance, and facilitating grid integration in Spain. Advanced data analytics, predictive maintenance algorithms, and remote monitoring systems enable operators to optimize turbine performance, minimize downtime, and ensure grid stability, enhancing the reliability and efficiency of wind power generation and contributing to grid modernization efforts.

Conclusion

In conclusion, the wind power market in Spain presents significant opportunities for stakeholders to drive sustainable growth, innovation, and investment in renewable energy infrastructure. By leveraging favorable market conditions, supportive regulatory frameworks, and technological advancements, Spain can strengthen its position as a leader in the global wind energy market, accelerate the transition to a low-carbon economy, and achieve its renewable energy and climate goals. Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase.

0 notes

Text

Electricity That Costs Nothing—or Even Less? It’s Happening More and More. (Wall Street Journal)

Excerpt from this Wall Street Journal story:

Most people pay a fixed price for each kilowatt-hour of electricity they consume throughout the day. The price is set by their power company and only changes at infrequent intervals—once a week, a month or even only once a year.

Van Diesen, a software salesman, recently signed up to receive electricity from two providers that charge him the hourly price on the Dutch wholesale power market, rather than a fixed price that resets monthly or annually. When the price of electricity falls low enough, smart meters in his house begin charging his two electric cars.

Wholesale prices swing wildly each hour of the day, and even more so as a larger share of electricity flows from wind and solar installations. Because the generation costs of wind or solar farms are negligible, market prices will be near zero when there is enough renewable power to cover most of a region’s electricity demand.

Electricity market dynamics get weirder when renewable-energy producers don’t have an incentive to stop feeding power into the grid, usually because of government subsidies. Then grids can be flooded with excess power, pushing prices into negative territory.

Van Diesen said he’s made 30 euros, equivalent to around $34, over the past five months charging his car, enough to cover the service fee from his power supplier, a Norwegian company called Tibber.

“I’m charging the car for free,” said van Diesen, who is part of a group of clean-energy enthusiasts in the Netherlands who call themselves green nerds. “To me it’s also like a hobby and a game—how far can I go?”

Doing laundry in the evening? The electricity could be free a few hours later when demand dies down and the wind picks up. Likewise, in regions with lots of solar power, charging an electric vehicle in the morning is usually far more expensive than powering up under the midday sun—or whenever the price is right.

In the U.S., most states don’t currently allow such real-time pricing, but many think that will change. Already, in some of the world’s biggest economies from Western Europe to California, the occurrence of zero and negative wholesale power prices is growing fast.

Wholesale prices across continental Europe have fallen to zero or below in 6% of all hours this year, up sharply from 2.2% in 2023 and just 0.3% in 2022, according to data collected by Entso-E, the group of European transmission system operators. In markets with lots of renewable capacity, this year’s figure was higher: 8% in the Netherlands, 11% in Finland and 12% in Spain. Analysts expect those numbers will grow as more solar panels and wind turbines are installed.

The changes sweeping Europe’s electricity markets, which were accelerated by the energy crisis brought on by the war in Ukraine, show what could happen in the U.S. in a few years when renewable capacity reaches a similar scale. In 2023, 44% of EU electricity was generated by renewables, compared with 21% in the U.S.

8 notes

·

View notes

Text

At the start of February, Ørsted, the world’s largest offshore wind developer, announced a major scaling back of its operations, exiting wind markets in Portugal, Spain and Norway and cutting both its dividend and its 2030 target for the number of new installations. The announcement followed the firm’s shock decision last November to back out of two major wind projects in New Jersey. Last week, it agreed to sell stakes in four US onshore wind farms for around $300m.

But Ørsted’s troubles are hardly unique. In September 2023, the UK government’s offshore wind auction failed to secure a single project from developers, who argued that the government-guaranteed prices on offer were too low in the face of rising costs. Two months before that, Vattenfall pulled out of a major wind UK development for the same reason. And in February, the German energy giant RWE – which provides 15 per cent of the UK’s power – warned that without more money on offer, the UK’s next auction, opening this month, might just fail again.

These cases are only a handful among many and have come as jarring setbacks for an industry grown accustomed to triumphalism: headlines over recent years have routinely celebrated the plunging cost of renewables and the seemingly unrelenting transition to clean energy advancing around the world. A quick Google of “renewable energy deployment” yields no shortage of charts with impressive upward slopes.

Much of this enthusiasm has centred on a metric called the Levelised Cost of Electricity (LCOE), which represents the average cost per unit of electricity generated over the lifetime of a generator, be it a wind farm or a gas power station. The LCOE has something of a cult status among industry analysts, journalists and even the International Energy Agency as the definitive marker of the transition to clean energy. When the LCOE of renewables falls below that of traditional fossil fuel sources, the logic goes, the transition to clean energy will be unstoppable. If only it was that simple, argues the economic geographer Brett Christophers in his latest book The Price is Wrong: Why Capitalism Won’t Save the Planet.

As Christophers writes: “Everyone, seemingly, has gravitated to the view that, now they are cheaper/cheapest, renewables are primed for an unprecedented golden growth era” that will see them supplant fossil fuels. Doing so will be no mean feat. Despite the vertiginous growth of new renewable capacity in recent years, renewables have scarcely made a dent in the proportion of global power that comes from fossil fuels. The overall share of fossil fuel power in the energy mix has remained broadly stagnant for an astonishing four decades, from 64 per cent in 1985 to 61 per cent in 2022. Critically, the absolute amount of fossil fuel power generated each year – the figure that ultimately matters for the climate – has continued to rise.

In large part, this stems from overall growth in electricity consumption, which will continue apace in the coming decades as millions around the world gain access to electricity and as we race to electrify the economy. Thus, for all their upward momentum, global electricity consumption is still growing faster than solar and wind power is coming online, meaning the gap is widening. To close it, by the IEA’s estimates, the world needs to install 600 GW (gigawatts) of solar and 340 GW of wind capacity every year between 2030 and 2050. By comparison, the UK’s current total installed wind capacity is approximately 30GW, the sixth largest in the world, while Germany’s domestic transition plan implies installing the equivalent of 43 football pitches of solar panels every day to 2050. In short: the task is immense – almost unimaginably so. It is similarly urgent.

Where will the momentum needed to build this clean energy future come from? As Christophers documents in detail, the industry has thus far relied on an array of subsidy and support around the world. Extensive state support is hardly unique to clean energy, much as detractors and climate deniers may like to highlight it: the fossil fuel industry benefited from tax breaks and direct subsidy to the tune of £5.5trn in 2022 according to the IMF. The declining LCOE of renewable energy has been increasingly viewed as an argument for unwinding this government-backed support. As Christophers shows, however, in practice this has proven a near-impossibility. The question he therefore asks is why, in the face of declining costs, subsidies continue to be necessary, and what this tells us about whether the current approach to decarbonisation is fit for purpose.

The answer, Christophers argues, is that we’ve got it all upside down. When it comes to investment in renewable energy, as in anything else, it’s not cheapness that matters. Just take it from the investors themselves, he notes, citing one former JPMorgan investor who described the LCOE as a “practical irrelevance”. What matters instead is profit, and expectations of it.

Despite its simplicity, Christophers’s account is a quietly radical one that contravenes the received wisdom of not only the technocrats, mainstream economists and free marketeers who tout the wonders of the market, but also many on the left, for whom the problem with profits is typically their being far too high. Instead, as he demonstrates, the trouble is that renewable energy is nowhere near profitable enough, and certainly not reliably so, for the market to deliver it with anything like the pace, scale or certainty that is needed.

If the costs of renewables are indeed so low, one might ask, and profits are equal to revenues minus costs, then surely plunging costs should mean higher profits. But Christophers shows that low and unreliable profits are the definitive obstacle to the decarbonisation of the electricity system and, by extension, the wider economy.

The precise answer as to why low costs don’t necessarily translate into high and steady profits in this sector is technically complex and multifaceted, deftly handled by Christophers, a reformed management consultant, over nearly 400 pages of fine detail drawn from company documents, interviews and dense sectoral reports from global energy agencies. Put simply, the core of the problem is that the very features of markets so celebrated by mainstream economics – mediation via the price signal, increasing competition and private investment – are the undoing of a private-sector led transition to clean energy.

For Christophers, the commitment to marketisation in electricity systems is increasingly self-defeating. At the heart of this problem is the so-called “wholesale market” that prevails in many parts of the US and Europe, including the UK. Under this system, generators are paid a single price per unit of electricity for a given period, regardless of whether it is derived from a wind turbine or a coal plant. This price is based on what’s called a “merit order”, with the cheapest sources – generally renewables – being deployed first, followed by as many sources as are needed in order of escalating price. The wholesale is set by the last unit of energy needed to meet demand. In the UK, this is typically gas.

The defining feature of this wholesale pricing system, cast in sharp relief over the period of sky-high energy prices in 2021-2022, is volatility. With a host of factors potentially feeding into the price – from the balance of supply and demand through to global gas prices and geographic location – the swings can be enormous, regularly spiking from double to triple digit prices and back again within a matter of hours. In times of crisis, the figures can become outlandish, with the price of electricity in Texas during the state’s 2021 shock winter storms reaching $9,000 per MWh.

For Christophers, this volatility is nothing short of “an existential threat” to the “bankability” of a renewable project – that is, its ability to secure financing – because it makes profitability so uncertain. Worse still, within a competitive wholesale market, as the proportion of renewable generation in the market grows, and by extension the proportion of time in which renewables drive the wholesale price, the more frequently and strongly prices swing to the lower extreme, a phenomenon known as “price cannibalisation”.

The energy industry and governments rely on an impressive array of methods to circumvent these problems, from financial hedging to feed-in-tariffs, and from mega corporate Power Purchase Agreements with the likes of Amazon and Google to the UK’s “contracts-for-difference”. As Christophers writes: the reality of “liberalised electricity systems such as Europe’s is that, to secure financing, renewables developers ordinarily do everything they can… to avoid selling their output at the market price.”

Thus, despite ultra-high wholesale prices over 2021-2022, many renewables generators failed to enjoy correspondingly high profits, because they had traded the possibility of these certainties in the face of intolerable market volatility. For Christophers, this is the “signal feature” of the liberalised electricity market: that “the hallowed market price… is the one price that renewables operators endeavour not to sell at.”

It is in explaining this apparent contradiction that the book offers its most radical suggestion. Borrowing Karl Polanyi’s concept of a “fictitious commodity”, Christophers ultimately contends that electricity – like land, labour and money, Polanyi’s original trio – is not a commodity in the conventional sense of having been created for sale, and is therefore ill-suited to market exchange and coordination. This incompatibility sits at the root of the spiralling complexity of interventions that policymakers are obligated to make in the name of upholding the freedom of the “market”. The result, in the words of the energy expert Meredith Angwin, is that today’s electricity markets are less market and more “bureaucratic thicket”.

Thankfully, if the forces of capitalism, defined in terms of private ownership and the profit imperative, are fundamentally ill-equipped for this task, then we are not for want of alternatives. Public ownership and financing of energy, if freed from a faux market and the straitjacket of the profit motive, seems an obvious one. Christophers writes that the state is the only actor with “both the financial wherewithal and the logistical and administrative capacity” to take on the challenge of decarbonisation. The trouble though, when all you have is a hammer, is that everything looks like a nail. Thus, in the face of irreconcilable market failures, most policymakers seem only to offer more market-based fudges.

In this context, the tremors in renewable energy investment that we have seen with increasing frequency over the past several months are more than just a blip. They represent a potentially fatal flaw in the prevailing approach to the task of decarbonisation. From the perspective of the climate, every tonne of carbon matters, and every delay is significant. To continue to leave the future of electricity, and by extension global decarbonisation, to the whims of profit-motivated firms, is an intolerable risk. Rome is already burning, and there’s no time left to fiddle.

3 notes

·

View notes

Text

Robot Dreams (2023, Spain/France)

There exists an assumption that one has to be an animator in order to direct an animated film. While most cinephiles might reflexively point to Wes Anderson (2009’s Fantastic Mr. Fox, 2018’s Isle of Dogs), I think Isao Takahata (1988’s Grave of the Fireflies, 1991’s Only Yesterday) the exemplar here. Even so, a non-animator taking the reins of an animated movie is rare. Into that fold steps Pablo Berger, in this adaptation of Sara Varon’s graphic novel Robot Dreams. Moved after reading Varon’s work in 2010, Berger acquired Varon’s “carte blanche” permission to make a 2D animated adaptation however he saw fit. Like the graphic novel, Berger’s Robot Dreams is also dialogue-free.

Beginning production on Robot Dreams proved difficult. Berger originally teamed with Ireland’s Cartoon Saloon (2009’s The Secret of Kells, 2020’s Wolfwalkers) to make Robot Dreams, but these plans fell wayside when the COVID-19 pandemic hit. His schooling in how to make an animated film would come quickly. Despite an increased appetite for Spanish animation worldwide (2019’s Klaus, 2022’s Unicorn Wars), poor distribution and marketing of domestically-made animated movies has often meant Spanish animators have roved around Europe looking for work. With a pandemic sending those Spanish animators home, Berger and his Spanish and French producers set up “pop-up studios” in Madrid and Pamplona, purchased the infrastructure and space needed to make an animated feature, and recruited and hired animators. Berger’s admiration of animated film fuses the lessons of silent film acting (Berger made a gorgeous silent film in 2012’s Blancanieves; in interviews, Berger cites Charlie Chaplin’s movies as having the largest influence on Robot Dreams, alongside Takahata’s films) to result in one of the most emotionally honest films of the decade thus far – animated or otherwise.

Somewhere in Manhattan in the late 1980s in a world populated entirely of anthropomorphized animals, we find ourselves in Dog’s apartment. Dog, alone in this world, consuming yet another TV dinner, is channel surfing late one evening. He stumbles upon a commercial advertising a robot companion. Intrigued, he orders the robot companion and, with some difficulty, assembles Robot. The two become fast friends as they romp about New York City over a balmy summer, complete with walks around their neighborhood and Central Park, street food, trips to Coney Island, and roller blading along to the groovy tunes of Earth, Wind & Fire. At summer’s end, an accident sees the involuntary separation of Dog and Robot, endangering, for all that the viewer can assume, the most meaningful friendship in Dog’s life and Robot’s brief time of existence.

youtube

If you have not seen the film yet, let me address a popular perception early on in this piece. Set in a mostly-analog 1980s, Robot Dreams contains none of the agonizing over artificial intelligence or automatons in fashion in modern cinema. There is no commentary about how technology frays an individual’s connections to others. Robot is a rudimentary creation, closer to a sentient grade school science project than a Data or T-1000.

So what is Robot Dreams saying instead? Principally, it is about the loving bonds of friendship – how a friend can provide comfort and company, how they uplift the best parts of your very being. For Robot, the entirety of their life prior to the aforementioned accident (something that I, for non-viewers, am trying not to spoil as Robot Dreams’ emotional power is fully experienced if you know as little as possible) has been one of complete estival bliss. Robot, in due time, discovers that one of the most meaningful aspects of friendship is that such relationships will eventually conclude – a fundamental part of life. And for Dog, Robot’s entrance into his life allows him to realize that, yes, he can summon the courage to connect with his fellow animals, realizing his self-worth. Perhaps Dog gives up addressing the accident a little too easily, but the separation of friends has a way of complicating emotions and provoking peculiar reactions.

On occasion, Robot Dreams’ spirit reminds me of Charlie Chaplin’s silent feature film period (1921-1936) – in which Chaplin, at the height of his filmmaking prowess, most successfully wove together slapstick comedy and pathos. On paper, pathos and slapstick should not mix, but Chaplin was the master of combining the two. No wonder Berger fully acknowledges the influence of his favorite Chaplin work, City Lights (1931), here.

Across Robot Dreams, Berger inserts an absurd visual humor that works both because almost all of the characters are animals and despite the fact almost everyone is an animal. A busking octopus in the New York City subway? Check. The image of pigs playing on the beach while sunburnt to a blazing red? You bet. A dancing dream sequence where one of our lead characters finds himself in The Wizard of Oz performing Busby Berkeley-esque choreography on the Yellow Brick Road? Why not? Much of Chaplin’s silent film humor didn’t come from his Little Tramp character, but the silliness, ego, and/or absentmindedness of all those surrounding the Tramp. In City Lights, humor also came from the rough-and-tumble edges of urban America. Such is the case, too, in Robot Dreams, with its blemished, trash-strewn depiction of late ‘80s New York (credit must also go to the sound mix, as they perfectly capture how ambiently noisy a big city can be).

Amid all that comedy, Berger nails the balance between the pathos and the hilarity – pushing too far in either direction would easily undermine the other. The film’s melancholy shows up in ostensibly happy moments and places of recreation: a realization during a rooftop barbeque lunch, the emptiness of a shuttered Coney Island beach in the winter, and an afternoon of kiting in Central Park. It captures how our thoughts of erstwhile or involuntarily separated friends come to us innocuously, in places that stir memories that we might, in our present company, might not speak of aloud.

As the film’s third character, New York City (where Berger lived for a decade) is a global cultural capital, a citywide theater of dreams, a skyscraper-filled signature to the American Dream. To paraphrase Sinatra, if you can make it there, you can make it anywhere. But it tends to grind those dreams into dust. The city’s bureaucratic quagmire is lampooned here, as is its reputation for mean-spirited or jaded locals. Robot Dreams also depicts the visual and socioeconomic differences between the city’s boroughs. With such a jumble of folks of different life stations mashed together, Dog’s people-watching, er, animal-watching during his loneliest moments makes him feel the full intensity of his social isolation. With Robot, however, Dog has a naïve companion that he can show the best of the city to. Robot has no understanding of passive-aggressive or outright hostile behavior (see: Robot hilariously not understanding what a middle finger salute is – the only objectionable scene if you are considering showing this to younger viewers). Within this city of contradictions, Dog and Robot’s love is here to stay.

Though he is no animator, his experience in guiding Spanish actresses Ángela Molina, Maribel Verdú, and Macarena García in Blancanieves through a silent film was valuable. In animated film, there is a tendency towards overexaggerating emotions. But with Robot Dreams’ close adaptation of the graphic novel’s ligne claire style and the nature of Robot’s face, the typical level of exaggeration in animation could not fly in Robot Dreams. Berger and storyboard artist Maca Gil (2022’s My Father’s Dragon, the 2023 Peanuts special One-of-a-Kind Marcie) made few alterations to the storyboards, fully knowing how they wished to frame the film, and hoping to convey the film’s emotions with the facial subtlety seen in the graphic novel. Character designer Daniel Fernandez Casas (Klaus, 2024’s IF) accomplishes this with a minimum of lines to outline characters’ bodies and faces. Meanwhile, art director José Luis Ágreda (2018’s Buñuel in the Labyrinth of the Turtles) and animation director Benoît Féroumont (primarily a graphic novelist) visually translated Sara Varon’s graphic novel using flat colors and a lack of shading to convey background and character depth (one still needs shading, of course, to convey lights and darks of an interior or exterior).

Robot Dreams’ nomination for the Academy Award for Best Animated Feature this year was one of the most pleasant surprises of the 96th Academy Awards. In North America, Robot Dreams’ distributor, Neon, has pursued an inexplicable distribution and marketing strategy of not allowing the film a true theatrical release until months after the end of the last Oscars. The film was available for a one-night special screening in select theaters in and near major North American cities the Wednesday before the Academy Awards. And only now (as of the weekend of May 31, 2024), Neon will release Robot Dreams this weekend in two New York City theaters, the following weekend in and around Los Angeles, with few other locations confirmed – well after interest to watch the film theatrically piqued in North America.

Alongside Neon’s near-nonexistent distribution and marketing of Jonas Poher Rasmussen's animated documentary Flee (2021, Denmark), one has to question Neon’s commitment to animated features and whether the company has a genuine interest in showing their animated acquisitions to people outside major North American cities. This is distributional malpractice and maddeningly disrespectful from one of the most acclaimed independent distributors of the last decade.

In Robot Dreams, Pablo Berger and his crew made perhaps the best animated feature of the previous calendar year. Robot Dreams might not have the artistic sumptuousness of the best anime films today, nor the digital polish one expects from the work of a major American animation studio. By film’s end, its simple, accessible style cannot hide its irrepressible emotional power. Its conclusion speaks to all of us who silently wonder about close friends long left to the past, their absence filled only by memory.

My rating: 8.5/10

^ Based on my personal imdb rating. My interpretation of that ratings system can be found in the “Ratings system” page on my blog. Half-points are always rounded down.

For more of my reviews tagged “My Movie Odyssey”, check out the tag of the same name on my blog.

#Robot Dreams#Pablo Berger#Sara Varon#Fernando Franco#Daniel Fernandez Casas#Benoît Feroumont#José Luis Ágreda#Maca Gil#Ibon Cormenzana#Ignasi Estapé#Sandra Tapia Diaz#Best Animated Feature#Oscars#96th Academy Awards#My Movie Odyssey

2 notes

·

View notes

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

2 notes

·

View notes

Text

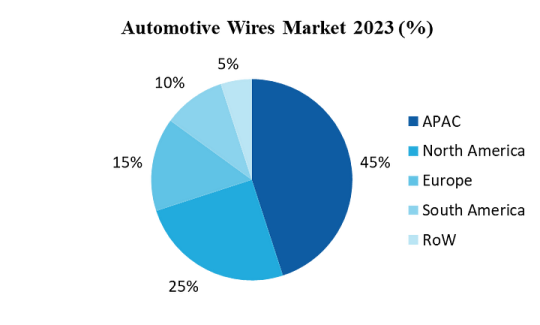

Automotive Wires Market- Opportunity Analysis & Industry Forecast, 2024–2030

Automotive Wires Market Overview:

Request sample :

Automotive wire demand is expected to rise due to the growing trend of lightweight passenger automobiles as a means of reducing carbon emissions. In response to stringent regulations aimed at reducing carbon emissions from automobiles, manufactures will concentrate on producing aluminium automotive wires to reduce the vehicle’s overall weight. This is going to help in achieving the new regulations criteria. The rising focus on enhancing the standards for automotive wire will give opportunities for market expansion. For instance, according to US Auto Outlook 2024, light vehicle sales to grow 3.7% above last year’s level, rising to 16.1 million units. Additionally, the demand for automotive wires is expected to rise in parallel with the volume of vehicles being produced and the increasing demand from customers for better comfort, safety, and convenience.

Market Snapshot

Automotives Wires Market — Report Coverage:

The “Automotive Wires Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Automotives Wires Market.

AttributeSegment

By Material

· Copper

· Aluminium

· Others

By Vehicle Type

· Passenger Vehicles

· Light Commercial Vehicles

· Heavy Commercial Vehicles

By Propulsion

· ICE Vehicles

· Hybrid Vehicles

· Pure Electric Vehicles

By Transmission Type

· Electric wiring

· Data Transmission

By Application

· Engine wires

· Chassis wires

· Body and Lighting wires

· HVAC wires

· Dashboard / Cabin wires

· Battery wires

· Sensor wires

· Others

By End User

· OEM

· Aftermarket

By Geography

· North America (U.S., Canada and Mexico)

· Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

· Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

· South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

· Rest of the World (Middle East and Africa).

Inquiry Before Buying:

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic disrupted global supply chains, leading to delays in production and sales of automobiles which led to decrease in automotive wire manufacturing. Governments worldwide imposed lockdowns and restrictions, which led to shut down of mines, factories, and transportation networks, thus disrupting the supply of raw materials such as copper and aluminum, that are used in making automotive wires.

The Russia-Ukraine war had a huge impact on the global automotive wires market. Ukraine is a major manufacturer of copper, a material used as an automotive wiring component. The war has led to mining disruptions, which in turn has caused the shortages and increase in prices globally.

Key Takeaways:

Copper wires segment is Leading the Market

Copper wires segment holds the largest share in the automotive wires market with respect to market segmentation by material. Electrification will be the biggest driver to copper demand for vehicles. Copper is used throughout electric vehicle powertrains, from foils in each cell of the battery to the windings of an electric motor. In total, each electric vehicle can generate over 30kg of additional copper demand. According to a report by IDTechEx, the demand for copper from the automotive industry was just over 3MT in 2023 but is set to increase to 5MT in 2034. Because of its electrical and chemical characteristics, copper is used in every part of the battery. There are lot of tiny cells in the battery, and each one has a copper foil to carry electricity out of the cell. Large copper bars placed throughout the battery also convey the energy from each cell to the high-voltage connections, which in turn power the motor and electronics. Such parts and components with the copper are driving the market growth of copper wires in automotive wires market.

Passenger Vehicles are Leading the Market

Passenger Vehicles segment is leading the Automotive Wires Market by Application. The passenger vehicle category is currently holding the largest share in the automotive wires market because of a combination of factors including large production volumes, a wide range of wiring requirements, technological developments, and the increasing adoption of electric vehicles. For instance, according to Global and EU Auto industry 2023 report by The European Automobile Manufacturers’ Association (ACEA), European car production grew substantially, reaching nearly 15 million units, marking a significant year-on-year improvement of 12.6%. The growing popularity of electric vehicles (EVs) is also contributing to the growth of the passenger vehicle segment in the automotive wires market. EVs have more complex wiring systems due to the integration of batteries, motors, and charging infrastructure.

Schedule A Call :

Integration of Smart Systems in Automobiles

Global demand for automotive wires is primarily driven by the integration of smart systems in automobiles. Modern automobiles have more wires because electronic control units (ECUs) are becoming more and more popular. Each ECU has been connected to a variety of sensors, actuators, and other ECUs through a complex network of connections. Automotive manufacturers are using sophisticated wiring solutions, such as light-weight harnesses, insulated cables and high-temperature-resistant wires to manage the rising number of connections and ensure reliable performance. For instance, In July 2024, Compal Electronics Inc, a leading contract electronics manufacturer from Taiwan, announced plans to build its first European factory in Poland. The company intends to invest more than $15.4 million to target automotive electronics clients. This strategic move marks Compal’s expansion into the European market. The need for complex and more advanced wiring solutions will continue to grow as automobiles become more technologically advanced, fueling the worldwide automotive wires market’s expansion.

Buy Now :

Fluctuating cost of materials to hamper the market

For more details on this report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Automotive Wires Market. The top 10 companies in this industry are listed below:

Aptiv plc

Yazaki Corporation

Furukawa Electric Co., Ltd

Sumitomo wiring systems

Nexans SA

Fujikura Ltd

Samvardhana Motherson International Ltd

Leoni AG

Lear Corporation

THB Electronics

Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

5.7%

Market Size in 2030

$ 6.8 Billion

Segments Covered

By Material, By Vehicle Type, By Propulsion, By Transmission Type, By Application, By End User and By Geography.

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

Key Market Players

1. Aptiv plc

2. Yazaki Corporation

3. Furukawa Electric Co., Ltd

4. Sumitomo wiring systems

5. Nexans SA

6. Fujikura Ltd

7. Samvardhana Motherson International Ltd

8. Leoni AG

9. Lear Corporation

10. THB Electronics

For more Automotive Market reports, please click here

0 notes

Text

Global Concentrated Solar Thermal (CST) Market Outlook: Trends, Demand, and Growth Insights 2025-2032

The global Concentrated Solar Thermal (CST) Market is experiencing significant growth, driven by the increasing demand for sustainable energy solutions and the transition toward renewable power generation. Concentrated solar thermal systems, which use mirrors or lenses to concentrate sunlight and generate heat, are increasingly being adopted for industrial, residential, and utility-scale applications. This press release provides a detailed analysis of the market overview, emerging trends, drivers, restraints, segmentation, regional analysis, and future outlook.

Market Overview

The concentrated solar thermal market has grown steadily in response to the global shift towards clean energy and carbon reduction goals. With its ability to store thermal energy for continuous power generation, CST is becoming a critical component in the renewable energy mix. The market is projected to achieve a compound annual growth rate (CAGR) of over 6% during the forecast period.

Free Sample: https://www.statsandresearch.com/request-sample/37692-covid-version-global-concentrated-solar-thermal-market

Emerging Trends

Hybrid Systems: The integration of CST with other renewable energy sources, such as photovoltaic (PV) systems and wind power, is gaining traction.

Advanced Heat Storage Solutions: Innovations in thermal energy storage, such as molten salt and phase-change materials, are enhancing system efficiency.

Decarbonizing Industrial Processes: CST systems are increasingly used to provide high-temperature heat for industries like chemicals, cement, and metallurgy.

Government Incentives: Policies and subsidies promoting renewable energy projects are encouraging CST adoption globally.

Market Drivers

Rising Energy Demand: Growing global energy consumption necessitates sustainable and scalable power generation solutions.

Environmental Regulations: Stricter carbon emission standards are pushing industries to adopt cleaner energy sources like CST.

Technological Advancements: Improvements in optical efficiency, heat transfer fluids, and energy storage systems drive market growth.

Cost-Competitiveness: Declining costs of CST components, such as mirrors and receivers, are making systems more accessible.

Market Restraints

High Initial Investment: The capital-intensive nature of CST projects can be a barrier for widespread adoption.

Land Requirements: CST systems require large areas of land with high solar irradiance, limiting their feasibility in some regions.

Competition from Photovoltaics: The rapid adoption of PV systems, which have lower installation costs, presents a challenge to CST growth.

Request Discount: https://www.statsandresearch.com/check-discount/37692-covid-version-global-concentrated-solar-thermal-market

Market Segmentation

The concentrated solar thermal market is segmented based on technology, application, and end-user.

By Technology:

Parabolic Trough

Solar Tower

Linear Fresnel

Dish/Engine System

By Application:

Power Generation

Process Heating

Desalination

Others

By End-User:

Industrial

Residential

Commercial

Regional Analysis

North America: The United States and Mexico lead the CST market due to high solar irradiance and supportive government policies.

Europe: Countries like Spain and Italy are pioneers in CST adoption, supported by favorable regulations and renewable energy targets.

Asia-Pacific: Rapid industrialization and energy demand in China, India, and Australia drive CST installations in the region.

Latin America: Brazil and Chile are emerging markets for CST, fueled by abundant solar resources and investments in renewable energy.

Middle East & Africa: High solar potential and large-scale projects in Saudi Arabia, South Africa, and the UAE contribute to regional growth.

Future Outlook

The global concentrated solar thermal market is poised for sustained growth, driven by advancements in technology, increasing investments in renewable energy, and the need for sustainable power generation. Manufacturers and developers are expected to focus on cost reduction, efficiency improvements, and hybridization with other energy systems to enhance competitiveness.

As countries intensify efforts to meet climate goals, CST is likely to play a pivotal role in the energy transition. Collaboration among industry stakeholders and supportive policies will be essential in unlocking the full potential of CST technology.

Full report: https://www.statsandresearch.com/report/37692-covid-version-global-concentrated-solar-thermal-market/

0 notes

Text

Who does Miami - Whole

Foods Market - Hire?

Ugly Retarded - Looking

Black Females

Talkative - Hispanic Girls

Bring Back - Original - FL

Florida - was a - Spanish

Colony - They will never

Have protection of King

And Queen of Spain

Me - Ward of their King

Madrid - Espana Spain

3 months Name change

Petunia

4 - Early mornings - ago

2:30A Est - Ambush

World and US Illegal

United Nations

Execution

Me - Direct Descendant

Queen Mary of Scotts

Scotland

Edinburgh - Highlands

Of - Scotland

Suddenly - Fog Surround

At - Highlands - U - can't

See - Person then - Next

2U - for - Hours

Shared

Miniature Dogs - 2 the

Rescue

Me and My Pinay Maid

Our - Miniature - Male

Dogs Sang - all the way

Musical - Instruments

Kids - Little - Trumpet

Small - Harp

Small - Saxophone

Incase - Others around

Went 2 House - Rental

'Narnia' - The - Final

Back 2 Huge - Fireplace

2 - Greet us

Soon - Other Dogs arrived

At the Door - Cats - Meow

So Dogs - Cats

Was nice - Cozy

Blk Female - Changing

The - Disabled - Order

Showed me - Ma'am

Where I was?

Public Storage

6th Floor

Was trying 2 open

Next 2 Me

Thought I was being

Punished - Re-keyed

My Ownership - Lock

Trash Girl Is Manager

Illegal during Cov-id 19

There is a Guy - there

He ain't Black

Since - Dead - Brains

Right

Amazon Prime

India - Male - answered

Reported them

Blk Female - wanted

2 put - Pizza - Slices

No - 4

Secret - Scans

Total - $483.82

I'm clicking - Scan

No Card - Needed

Clocking - Price

Yelled - 'No'

I never do - 'Auto'

Amazon Fresh Market

Strong Winds outside

Can't get - Refund inside

Fresh Market

Putting in Card

Deducted from Card

Return - Refunded

Greedy Americans

Winds - outside

Refund - Didn't happen

Rare - Rich Accounts

HDG Banks

Excluding

Grocery - Employees

Machine Guns

'Fire at Will'

Poisonous Bullets

Explodes inside

Nuclear - Power

Vanishes - Body

Hispanic - Miami Police

Midget - Under - 6 ft

Told me

'No Ma'am - There's No

Blood on your Face'

Dear Korean Girls,

He Lied

Red Blood - on my Nose

Above - Near - my L eye

Anemia - Anemic

Lack of Blood

Water poured from My

Hair above Face

R and L

Water was pouring from

My Nose - constantly

Anemic - Lack of Blood

Water pours out instead

Not just - Red Blood

Both Looked at Back

Lied and said

'On my Neck'

Light Blue - Puma

Huge Blood - Hood

Near Neck - Area

Hispanic Male

Smiled - 'No - Blood

Comes when People

Box you, Ma'am'

Americans boxing an

Asian Female - Disabled

Other - Hispanic

American Law

Corrected - US Laws

Americans - Make phone

Calls - revised - Don't

Interfere - with - Battery

Corrected

Assault & Battery

Illegal - Ambush

Victoria Osteen

'Leaning toward Smelly

Poor - Non-Virgin - touched

Hispanic Americans'

Pee Pee enjoyed with mouth

(Revised)

In the dark - How did I know

Black Woman Man or White?

Reply - She didn't have a 'D'

Book - 'Moby Dick'

Miami Police

Illegal - Torture - Abuse

Misogyny - Harm Abuse

And - Murder of - Small

Breasted - Females and

Girls - No Breasts

Hispanic Males

American - Misogyny

No Longer - Interested

In - USA - Wix

Just Check - Frequent

Wix - Products

In Stock

Returning 2 Professional

Sports - Getting my Male

Blonde - Rare - Blue Eyes

Personal Trainer can travel

Worldwide - Current

Getting his - Gold Medals

Tokyo Japan

Most Generous on Earth

World - Pro

Skiis - 3 Summersaults

Like - Front - with Skiis

$2.5 Million

Winner Take All

Speed - Agility - Precision

Mastery - Consistent Fast

Strong - Same Time Frame

He gets Gold - USA

Me - Gold - Japan

Multi-Citizenship

Tokyo Deceased Mom - 23

Me today - really - 60

Using - Japanese Woman

Passport - Japanese Kids

Passport - Most Powerful

Passport on Earth

Hiroshima - Nagasaki

World 1st Atomic Bombing

Issued by Whiskey Start of

His Morning Pres - Truman

Consent - Bitter Former

British Empire - England

Most Powerful - Passport

On Earth - Male Japanese

Passport - after - Plastic

Surgery - US Work - Visa

No Jury Duty

Thanks, Mom

Japanese - Female

Passport

Kendo World Champion

Childhood

Pink Black Belt - Unique

Teen Years

Poured - Billions

Our Medical Insurance

From - Age 3

Me - Kendo - World Kids

Champion 2 Consecutive

Years Coed - $500 Million

Jesus is Lord

Getting - Tumblr - Blog

Getting Ad Free - $6.99

mint-moon25 . com

Tumblr - $12 - yearly

Each - Year

Ad Free - $6.99

I'm doing it - won't go

For - ... blog

No - Then they'll know

Blog - Ending already

Com - More Possibilities

Attaching - Others Now

Laptop - Throwing that

Solar - Jesus is Lord KR

1 note

·

View note

Text

Expanding Mica Tape Market: CAGR of 3% Forecast by 2031

Astute Analytica, a prominent market research firm, has recently published a comprehensive report that offers an extensive analysis of the global Mica Tape for Insulation market. This report goes beyond mere statistics, providing deep insights into various critical aspects such as market segmentation, key players, market valuation, and regional overviews. It serves as a valuable resource for businesses and stakeholders seeking to navigate this evolving industry landscape.

Market Valuation

The report includes a thorough evaluation of the market valuation, drawing from historical data, current trends, and future projections. By employing rigorous analytical methods, it effectively captures the growth trajectory of the market. This detailed assessment allows businesses to understand the factors driving growth and make informed decisions regarding investments and strategic initiatives.

Global mica tape for insulation market is estimated to witness a rise in its revenue from US$ 171.0 Mn in 2022 to US$ 225.2 Mn by 2031 at a CAGR of 3% over the forecast period 2023-2031.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/mica-tape-for-insulation-market

Comprehensive Market Overview

Astute Analytica's report provides a holistic overview of the global Mica Tape for Insulation market. It encapsulates a wide array of information related to market dynamics, including growth drivers, challenges, and opportunities. Stakeholders can leverage these insights to formulate effective strategies and maintain a competitive edge in the market.

Key Players in the Market

The report identifies and profiles the major players who are influencing the global Mica Tape for Insulation market. Through meticulous research, it presents a clear view of the competitive landscape, detailing the strategies, market presence, and significant developments of leading companies. This section is vital for stakeholders who wish to understand the positioning and actions of their competitors.

Key Companies:

Axim Mica Corp

Brantingham and Carroll International, Ltd. (BCI Insulation)

Chhaperia International Company

Cogebi AS

Dongguan Yat Mica Industrial Limited

Elecom Tape Co., Ltd.

Electrolock Inc.

Elkem ASA

Final Advanced Materials Sàrl

Glory Mica Co., Ltd.

Isovolta AG

Jiaxing St New Materials Co., Ltd.

Jyoti Hi-tech, India

Micatapes Europe SPRL

Nippon Rika Kogyosho Co., Ltd.

Okabe Mica Co., Ltd.

Pamica Group Electrical Ltd.

Pittsburgh Electrical Insulation

Ruby Mica Co. Ltd.

Sakti Mica Manufacturing Co.

Shanghai Haiying Insulation Glass Fiber Co., Ltd.

Shaoxing Kaichen Mica Material Co., Ltd.

Shenzhen Ktyu Insulating Co., Ltd.

Sichuan Meifeng Group Co., Ltd.

Sweco Inc.

Von Roll Holding AG

Other Prominent Players

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/mica-tape-for-insulation-market

Segmentation Analysis

A crucial component of the report is the segmentation analysis, which delves into various market segments based on industry verticals, applications, and geographic regions. This detailed examination provides stakeholders with a nuanced understanding of market dynamics, enabling them to identify opportunities for growth and areas for investment.

Market Segmentation:

By Product:

Phlogopite

Muscovite

Synthetic Mica

By Application:

Electrical Insulation

Thermal Insulation

By Industry Vertical:

Industrial / Traction Motor & Coils

Transformer Manufacturing

Locomotive

Wind power/Renewable Energy

Generator Manufacturing

By Region:

North America

The U.S.

Canada

Mexico

Europe

The U.K.

Germany

France

Italy

Spain

Poland

Russia

Rest of Europe

Asia Pacific

China

India

Japan

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

South Africa

Rest of the Middle East & Africa

South America

Argentina

Brazil

Rest of South America

Research Methodology

Astute Analytica is recognized for its rigorous research methodology and dedication to delivering actionable insights. The firm has rapidly established a solid reputation by providing tangible outcomes to clients. The report is built on a foundation of both primary and secondary research, offering a granular perspective on market demand and business environments across various segments.

Beneficiaries of the Report

The insights presented in this report are invaluable for a range of stakeholders, including:

Industry Value Chain Participants: Those directly or indirectly involved in the Mica Tape for Insulation market need to stay informed about leading competitors and current market trends.

Analysts and Suppliers: Individuals seeking up-to-date insights into this dynamic market will find the report particularly beneficial.

Competitors: Companies looking to benchmark their performance and assess their market positions can leverage the data and analysis provided in this research.

Astute Analytica's report on the global Mica Tape for Insulation market is an essential resource that empowers stakeholders with the knowledge needed to navigate and thrive in this competitive landscape.

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/mica-tape-for-insulation-market

About Astute Analytica:

Astute Analytica is a global analytics and advisory company that has built a solid reputation in a short period, thanks to the tangible outcomes we have delivered to our clients. We pride ourselves in generating unparalleled, in-depth, and uncannily accurate estimates and projections for our very demanding clients spread across different verticals. We have a long list of satisfied and repeat clients from a wide spectrum including technology, healthcare, chemicals, semiconductors, FMCG, and many more. These happy customers come to us from all across the globe.

They are able to make well-calibrated decisions and leverage highly lucrative opportunities while surmounting the fierce challenges all because we analyse for them the complex business environment, segment-wise existing and emerging possibilities, technology formations, growth estimates, and even the strategic choices available. In short, a complete package. All this is possible because we have a highly qualified, competent, and experienced team of professionals comprising business analysts, economists, consultants, and technology experts. In our list of priorities, you-our patron-come at the top. You can be sure of the best cost-effective, value-added package from us, should you decide to engage with us.

Get in touch with us

Phone number: +18884296757

Email: [email protected]

Visit our website: https://www.astuteanalytica.com/

LinkedIn | Twitter | YouTube | Facebook | Pinterest

0 notes

Text

Spain Wind Power Market: A Leader in Renewable Energy

Spain is at the forefront of the renewable energy revolution, with wind power playing a pivotal role in the country’s energy mix. As one of Europe’s leading wind energy producers, Spain continues to set benchmarks for innovation, Spain Wind Power Market capacity expansion, and sustainability. This article delves into the dynamics of Spain’s wind power market, examining its growth, technologies, challenges, and future potential.

Introduction