#Silver Bullion

Explore tagged Tumblr posts

Photo

~ Silver ~

26 notes

·

View notes

Text

The Environmental Impact of Silver Bullion Production

The production of silver bullion has significant environmental implications, from mining to refining. This blog examines the environmental challenges and explores sustainable practices in the silver industry.

Environmental Challenges

Silver mining, especially on a large scale, poses several environmental challenges:

Deforestation: Mining activities often require clearing large areas of forest, leading to habitat destruction and loss of biodiversity.

Water Pollution: The use of toxic chemicals like cyanide and mercury in silver extraction can contaminate water sources, affecting aquatic ecosystems and local communities.

Soil Erosion: Mining operations disturb the soil, leading to erosion and sedimentation in nearby rivers and streams, degrading water quality and harming wildlife.

Waste Management: Silver mining produces significant amounts of waste rock and tailings. Improper disposal can lead to long-term environmental hazards.

Sustainable Practices

To mitigate these impacts, the silver industry is increasingly adopting sustainable practices:

Responsible Mining: Implementing responsible mining techniques involves minimizing land disturbance, protecting water quality, and ensuring the safety of local communities.

Recycling Silver: Recycling scrap silver reduces the need for new mining, conserving natural resources and lowering the environmental footprint. This practice also decreases the demand for energy and chemicals used in extraction.

Eco-Friendly Technologies: Advances in technology are making silver production more environmentally friendly. For example, new methods reduce the use of harmful chemicals and promote water recycling.

Restoration and Rehabilitation: Post-mining land restoration involves rehabilitating mined areas to their natural state, including reforestation and soil stabilization to promote biodiversity recovery.

Conclusion

The environmental impact of silver bullion production is a pressing concern, but sustainable practices are making a difference. By supporting responsible mining and recycling efforts, the silver industry can reduce its ecological footprint and ensure that silver remains a valuable and environmentally conscious asset. As consumers and investors increasingly prioritize sustainability, the shift towards greener silver production aligns with broader environmental and social goals.

0 notes

Text

What impact do market trends have on silver's price?

The price of silver is significantly influenced by market trends. Since silver is both a precious metal and an industrial commodity, positive economic indicators like strong industrial demand or inflationary pressures usually result in higher prices for the metal. On the other hand, market turbulence or economic downturns may cause demand to decline and silver prices to drop. In addition, silver prices are subject to market volatility due to geopolitical events, currency fluctuations, and investor sentiment.

#australia#melbourne#sliver#commercial#entrepreneur#economy#bullion#silver bars#silver coins#silver bullion#silver buyer near me

0 notes

Text

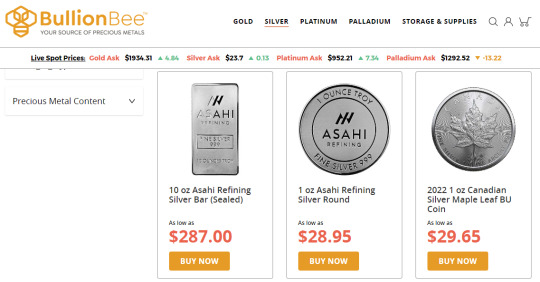

Looking to buy silver bullions, silver coins & silver bars online in New York? BullionBee has the variety of the best silver bullions, coins and bars.

#Silver Bullion#Silver Bullion Bars#NYC#Precious Metals#America#USA#BullionBee#investing#Silver Coins

1 note

·

View note

Video

youtube

FDIC Lied About Banks on Purpose | Exposing Policy Lies and Hidden Agend...

You better pay attention here. Your future depends on it.

0 notes

Text

The Midas Touch: Gold And Silver Bullion From Coventry Gold Bullion Ltd.

Gold and silver bullion have been long-standing investments well-known for their durability, rarity, and value. They are also widely accepted as currency, which makes them a valuable hedge against economic uncertainty. Coventry Gold Bullion Ltd. is one of the top gold bullion dealers UK and offers investors a reliable source for gold and silver bullion.

Here are some reasons why you should consider investing in gold and silver bullion from Coventry Gold Bullion Ltd.: Diversification of Investment Portfolio: One of the most important reasons for investing in gold and silver bullion from Coventry Gold Bullion Ltd. is to diversify your investment portfolio. By including gold and silver bullion in your investment portfolio, you can spread your risk across different asset classes and reduce the impact of any potential economic downturns. Stability of Value: Gold and silver bullion have been valued for centuries and have proven to be stable investments. Unlike stocks and bonds, which are subject to market fluctuations, gold and silver bullion from Coventry Gold Bullion Ltd. retain their value over time. This makes them a safe investment choice, particularly during times of economic uncertainty. Inflation Hedge: Inflation is a significant risk to the value of the paper currency, and Coventry Gold Bullion Ltd.’s gold and silver bullion provides an effective hedge against inflation. As the value of paper currency decreases due to inflation, the value of gold and silver bullion increases. This makes them an ideal investment option for investors looking to protect their wealth over the long term. Liquidity: Gold and silver bullion are highly liquid investments, meaning they can be easily bought and sold. Coventry Gold Bullion Ltd. provides a platform for investors to buy and sell gold and silver bullion easily. This means you can easily convert your investment into cash when needed. Trustworthy Dealers: When investing in gold and silver bullion, it is essential to work with trustworthy dealers. Coventry Gold Bullion Ltd. is one of the top gold and silver dealers UK and has a reputation for providing high-quality, authentic bullion. This means you can trust that you are getting a fair deal and investing in genuine bullion. Final Thoughts: Coventry Gold Bullion Ltd. is one of the UK’s most reliable gold bullion dealers. With their reputation for providing high-quality, authentic bullion, you can be sure that your investment is in good hands. So visit https://www.coventrygold.co.uk/ to invest in gold and silver bullion today and secure your financial future. Original Source: https://bit.ly/3KW1mbM

1 note

·

View note

Text

#gold#coins#gold coins#real money#actual money#fiat currency#fiat money#fiat#precious metals#coin collecting#coin coin#cash for gold#wealth#rich life#rich living#invest in precious metals#invest in gold#invest in silver#bullion#I love gold#golden#honey#america#americana#american history

14 notes

·

View notes

Text

Metals: Gold

Gold is forever. It is beautiful, useful, and never wears out. Small wonder that gold has been prized over all else, in all ages, as a store of value that will survive the travails of life and the ravages of time.

#metals#gold#gold moodboard#gold aesthetic#gold metal#elements#gold accessories#gold jewelry#gold bars#gold bullion#metal aesthetic#metal moodboard#elemental metals#moodboard#aesthetic#gold and silver#gold gold gold#gold medal#gold nugget#gold chain#gold coins#colors#color aesthetic#color moodboard#James Blakeley

23 notes

·

View notes

Text

2024 1 Oz Silver Maple Leaf Coin – Royal Canadian Mint

AU Bullion proudly introduces the 2024 1 oz Canadian Silver Maple Leaf Coins. Crafted to perfection, this Brilliant Uncirculated coin encompasses 1 troy ounce of .9999 pure silver. True to the Royal Canadian Mint’s legacy, this silver coin incorporates advanced security elements. This year, too, features the detailed micro-engraved maple leaf and the distinguishing radial lines.

Tracing back to 1908, the Royal Canadian Mint, formerly known as the Ottawa Branch, made its mark as one of the pioneering mints to produce coins with an unparalleled .9999 silver purity. Over the years, RCM has continued its tradition, producing the Silver Maple Leaf along with a diverse range of exquisite silver bullion coins.

3 notes

·

View notes

Photo

~ Silver and Gold ~

132 notes

·

View notes

Video

youtube

Silver and Gold - Unlocking The Secrets And Benefits Part 2 of 3

Unlocking the Secrets and Benefits of Silver And Gold - Part 2 of a 3 part informational and educational series on Gold and Silver. Part 2: Silver vs Gold (The direct correlation) How to benefit from Gold without buying Gold Tips to keep in mind for your next purchase - short and long-term SHOCKING results - Comparing checkout on 5 different companies for purchasing Gold and Silver (you will be shocked with who has the Best price)

Please feel free to reach out with any questions. Thank you - Rick

#youtube#silver#gold#silver vs gold#financial literacy#gold and silver education#silver bullion#gold bullion#American silver eagle#saving for your future#Unlocking the secrets and benefits of silver and gold#rick fronek

0 notes

Text

The Role of Silver Bullion in Portfolio Diversification

Silver bullion plays a pivotal role in diversifying investment portfolios, offering investors a reliable hedge against market volatility and economic uncertainty. Its unique properties and historical performance make it an essential component of diversified investment strategies, providing stability and potential for long-term growth.

One of the key benefits of including silver bullion in a diversified portfolio is its low correlation with traditional asset classes, such as stocks and bonds. This means that silver often behaves differently from other assets, particularly during times of market stress. When stock markets decline or economic uncertainties arise, silver bullion tends to hold its value or even appreciate, providing a buffer against losses in other parts of the portfolio.

Portfolio diversification with silver bullion helps investors reduce overall risk while enhancing long-term returns. By spreading investments across different asset classes, investors can minimize the impact of market downturns and improve the resilience of their portfolios. Silver's ability to perform well in both inflationary and deflationary environments further enhances its appeal as a diversification tool.

Moreover, silver bullion's industrial applications provide additional support for its value, making it a compelling option for investors seeking exposure to sectors such as technology, renewable energy, and healthcare. As societies continue to evolve and innovate, the demand for silver in these industries is expected to grow, driving long-term price appreciation for silver bullion.

Investing in silver bullion offers investors a tangible asset with intrinsic value, immune to the whims of market sentiment and economic fluctuations. Whether used as a hedge against market volatility, inflation, or simply as a diversification tool, silver bullion provides a reliable refuge in uncertain times.

In conclusion, the role of silver bullion in portfolio diversification cannot be overstated. Its low correlation with traditional assets, coupled with its industrial applications, makes it a valuable addition to investment portfolios seeking stability, resilience, and long-term growth potential. As investors navigate an increasingly complex and uncertain economic landscape, the enduring allure of silver bullion shines bright as a reliable diversification tool.

0 notes

Text

What impact do market trends have on the cost of a kilogram of silver?

The one kilo silver price is affected by market trends, which include supply and demand, the state of the economy, and investor sentiment. Demand for silver as a safe-haven asset is usually driven by inflation and economic uncertainty, which raises prices. Prices are also influenced by industrial demand, particularly from the IT and renewable energy sectors. Conversely, as investors move to riskier assets, rapid economic growth may cause silver prices to decline.

0 notes

Text

Is It Better to Buy Gold or Silver Bullion Online?

Now that we've explored the allure of both gold and silver, it's essential to consider the convenience of making these investments online. RPS Bullion offers a seamless and secure platform for enthusiasts to buy gold and silver bullion online.

0 notes

Text

Looking to diversify your portfolio? Gold and silver investing through a Gold IRA can be a solid financial strategy for protecting your wealth. By rolling over your 401k, you gain access to the stability and potential growth of precious metals. Unlike paper assets, gold offers security against market fluctuations. It's more than just an investment – it’s a way to ensure your financial future is grounded in tangible value. Explore how gold investing can work for your retirement strategy.

https://www.northernliongold.com

3 notes

·

View notes

Text

The Details

Year of Issue: 2022 Country of Issue: Palau Mint: Mayer Mint Face Value: 10 Dollars Coin Weight: 2 Troy Ounces Metal Purity: 0.999 Metal Composition: Fine Silver Mintage: 500 Features: Antique Finish For the 120th anniversary of the first ever science fiction film, Trip to the Moon, this 2 oz coin features the Man in the Moon himself! The original quirky film, directed by Georges Méliès, was released in 1902 at about 14 minutes long, completely silent, and all in black and white. Science fiction has made bounds and leaps since, but we love to remember the pioneers of the craft.

0 notes