#Semiconductor Manufacturing Equipment Market

Explore tagged Tumblr posts

Text

Rivals in the Semiconductor Manufacturing Equipment sector - Expansion, Income and Market Share

To maintain a leading position in the market, research and development are crucial. Applied Materials makes substantial investments in the development of materials engineering technologies to facilitate scaling beyond Moore’s Law. Lam Research is dedicated to the advancement of atomic layer etching (ALE) and atomic layer deposition (ALD) to fulfill the requirements of sub-5nm nodes. ASML dedicates more than 15% of its yearly revenue to research and development, fostering advancements in EUV systems and investigating high-numerical-aperture (High-NA) lithography. Tokyo Electron has bolstered its research and development capabilities through efforts focused on heterogeneous integration and packaging technologies. KLA’s strategy to enhance efficiency in semiconductor manufacturing is demonstrated through its investment in AI-driven process control tools.

#Semiconductor Manufacturing Equipment#Semiconductor Manufacturing Equipment Business Strategies#Semiconductor Manufacturing Equipment Trends#Semiconductor Manufacturing Equipment Application#Semiconductor Manufacturing Equipment Scope#Semiconductor Manufacturing Equipment SWOT analysis#Semiconductor Manufacturing Equipment Growth#Semiconductor Manufacturing Equipment Share#Semiconductor Manufacturing Equipment Size#Semiconductor Manufacturing Equipment Forecast#Semiconductor Manufacturing Equipment Overview#Semiconductor Manufacturing Equipment Industry Growth#Semiconductor Manufacturing Equipment Insights#Semiconductor Manufacturing Equipment Research Insights#Semiconductor Manufacturing Equipment Research Report#Semiconductor Manufacturing Equipment Market

0 notes

Text

Semiconductor Manufacturing Equipment Market by Lithography, Wafer Surface Conditioning, Etching, CMP, Deposition, Wafer Cleaning, Assembly & Packaging, Dicing, Bonding, Metrology, Wafer/IC Testing, Logic, Memory, MPU, Discrete - Global Forecast to 2029

0 notes

Text

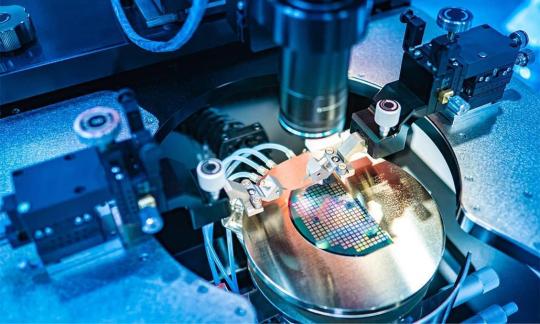

The Evolution and Growth Trajectory of Semiconductor Manufacturing Equipment Market Dynamics

The semiconductor manufacturing equipment market is projected to reach USD 149.8 billion by 2028 from USD 91.2 billion in 2023, at a CAGR of 10.4% from 2023 to 2028.

Need for semiconductor parts in electric and hybrid vehicles and wide adoption of 5G technology are some of the major factors driving the market growth globally.

Tokyo Electron Limited (Japan); Lam Research Corporation (US); ASML (Netherlands); Applied Materials, Inc. (US); KLA Corporation (US); SCREEN Holdings Co., Ltd. (Japan); Teradyne, Inc. (US); Advantest Corporation (Japan); Hitachi, Ltd. (Japan); Plasma-Therm (US).

Download PDF Copy: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263678841

Driver: Adoption of 5G technology and IoT increases demand for advanced semiconductors in US 5G technology has been pushing the boundaries of wireless communications, enabling use cases that rely on ultra-fast speeds, low latency, and high reliability. The necessity of higher data rates, better coverage, greater spectral efficiency demands 5G network infrastructure development. According to the Global System for Mobile Communications Association (GSMA), the number of 5G connections in North America is expected to reach 272 million by 2025. 5G-enabled smartphones play a crucial role in raising the demand for advanced semiconductors. According to GSMA, the 5G smartphone adoption would witness an increase from 82% in 2021 to 85% by 2025 in North America. In this, the US 5G smartphone market will reach 118.1 million units shipped in 2022, up by 27.3% from the 92.8 million units shipped in 2021.

Restraint: Complexity of patterns and functional defects in semiconductor chips A cleanroom and clean equipment is essential for the fabrication of semiconductors. Tiny dust particles can hinder the overall semiconductor manufacturing setup. As a result, the owner plant owner had to face a substantial financial loss. The reduced size and increased density of semiconductor chips have resulted in the complexity of wafers, which decreases lithography wavelength. Moreover, the reduction in node size makes photomasks and wafers more complex, resulting in the need for new semiconductor manufacturing equipment. All these factors inhibit the growth of the semiconductor manufacturing equipment industry.

Opportunity: Shortage of semiconductors leading to development of new manufacturing facilities Semiconductors are critical components that power all kinds of electronics. Their production involves a complex network of firms that design the chips, companies that manufacture them as well as those that supply the required technologies, materials, and machinery. As the worldwide semiconductor crisis continues to disrupt supply chains and create widespread uncertainty in the automotive and consumer electronics sectors, some manufacturers have announced their expansion plans.

Challenge: Lack of skilled workfoce worldwide The semiconductor manufacturing challenges persist after the completion of semiconductor facilities. One such challenge is the lack of a skilled workforce. The production of semiconductor chips necessitates specialized expertise; it requires professionals with the knowledge and skills to transform raw materials into finished goods utilizing specialized equipment, such as CNC machines. The global talent gap in the semiconductor industry is a widespread concern, as major semiconductor hubs are facing shortages of qualified personnel in varying degrees. According to the Workforce Development Survey, among 95% of the overall graduates, hiring engineering professionals for critical fields in the semiconductor industry proved to be highly challenging.

0 notes

Text

The market for semiconductor manufacturing equipment was estimated to be worth USD 91.20 billion in 2023 and is projected to grow at a compound annual growth rate of 10.4% to reach USD 182.30 billion by 2030.

0 notes

Text

Semiconductor Manufacturing Equipment Market Surges: A Comprehensive Analysis of the $105.1 Billion Landscape in 2024

The global semiconductor manufacturing equipment market is estimated to be US$ 96.7 billion in 2022 and is expected to reach US$ 105.1 billion by 2023. The global market is predicted to grow at a rate of 7.7% from 2023 to 2033, making it a beneficial investment.

By 2033, it is projected to reach a valuation of US$ 220 billion. This growth is due to the increasing demand for semiconductor manufacturing equipment components, driven by the increase in electronics, automotive, and data processing industries.

Request a Sample Copy of the Semiconductor Manufacturing Equipment Market Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-18089

Semiconductor manufacturing equipment is a vital component of the semiconductor industry, covering chip design, wafer manufacturing, packaging, and testing. It is the driving force behind the development of the semiconductor industry, which produces small electronic devices made from semiconductors such as silicon, germanium, or gallium arsenide compounds. The rapid advancement in manufacturing and increasing acceptance of connected devices among consumers.

The consequent increase in fabrication facilities and the expanding usage of semiconductors in EV manufacturing.

Growing adoption of 5G technology and the rising acceptance of autonomous vehicles.

The worldwide digitalization and the advanced use of electronic devices like laptops, smartphones, and televisions have increased demand for semiconductor manufacturing equipment, particularly in emerging economies. The use of silicon wafers has also improved. Despite contributing significantly to global market growth, budgetary and geopolitical constraints may impact the overall growth rate of the semiconductor manufacturing equipment industry.

Asia Pacific is expected to register the highest CAGR during the forecast period due to the presence of rapidly developing economies, the rising demand for semiconductor manufacturing equipment, the presence of major players in Japan, Taiwan, and China, the increasing need for high-quality processing equipment for semi-conductive materials, and growing government initiatives to support semiconductor industries.

The pandemic has caused supply chain disruptions that may limit the market’s growth to a certain extent. Furthermore, creating user-friendly and easy-to-integrate designs is a challenge for market expansion. Nonetheless, government initiatives to promote the semiconductor industry and the growing use of connected devices in home automation are expected to provide substantial opportunities for market development.

“Rapid growth in automotive and industrial electronics and the proliferation of IoT devices is accelerating the market. Room for the advancement in manufacturing integrated silicon chips for consumer electronics and automobiles is catching the eyes of manufacturers and business leaders.” –opines Sudip Saha, managing director at Future Market Insights (FMI) analyst.

Key Takeaways from the Semiconductor Manufacturing Equipment Market

The global semiconductor manufacturing equipment market is estimated to register a CAGR of 7.7% with a valuation of US$ 220 billion by 2033.

The market captured a CAGR of 9.2% in the historical period between 2018 and 2022.

South Korea is anticipated to dominate the global market by registering a 9.8% CAGR during the forecast period.

With an 8.9% CAGR, the United Kingdom is driving the global market by 2033.

Japan is anticipated to secure a CAGR of 8.8% in the global market during the forecast period.

Key Strategies:

Innovation in electronic devices, automation, and automobiles is attracting manufacturers and industry experts. Over the last few decades, the semiconductor industry has made significant progress, creating smaller, faster, and more reliable devices that have replaced the bulky and hefty vacuum tube technology of the past. Moreover, companies rely on their research and development skills, new materials and techniques, and supply chain management to maintain a competitive advantage.

Recent Developments in the Semiconductor Manufacturing Equipment Market

In 2023, Lam Research India plans to invest US$ 25 million with a US$ 3 million government incentive.

In March 2023, SCREEN PE Solutions Co., Ltd. launched Ledia 7F-L, a direct imaging system designed for high-precision pattern formation on large-sized substrates and metal masks, particularly for telecom and IoT infrastructure.

Leading Key Companies:

Applied Materials Inc.

Lam Research Corporation

KLA Corporation

ASML

Tokyo Electron Limited

Advantest Corporation

SCREEN Holdings Co., Ltd.

Teradyne, Inc.

Hitachi, Ltd.

Plasma-Therm

Seize this Opportunity: Buy Now for a Thorough Report! https://www.futuremarketinsights.com/checkout/18089

Semiconductor Manufacturing Equipment Market Segmentation:

By Equipment Type:

Front-end Equipment

Silicon Wafer Manufacturing

Wafer Processing Equipment

Back-end Equipment

Testing Equipment

Assembling & Packaging Equipment

By Dimension:

2D

2.5D

3D

By Application:

Semiconductor Fabrication Plant/Foundry

Semiconductor Electronics Manufacturing

Test Home

By Region:

North America

Europe

Asia Pacific

Latin America

The Middle East & Africa

0 notes

Text

0 notes

Text

#United Arab Emirates Semiconductor Manufacturing Equipment Market#Market Size#Market Share#Market Trends#Market Analysis#Industry Survey#Market Demand#Top Major Key Player#Market Estimate#Market Segments#Industry Data

0 notes

Text

The Essential Guide to Cleanroom Foam Swabs: Perfect for Precision Cleaning and Electronics Care

When it comes to cleaning delicate equipment, tools, or hard-to-reach surfaces, precision is key. Whether you're working in electronics, automotive care, or semiconductor industries, the right cleaning tool can make all the difference. That’s where YOUSTO's Pointed Cleanroom Foam Swabs come in. These highly reliable and durable foam swabs are designed to meet the stringent requirements of cleanroom environments while offering precision cleaning for a variety of applications.

What Are Cleanroom Foam Swabs?

Cleanroom foam swabs, particularly the pointed versions, are specialized cleaning tools made with high-quality foam tips and sturdy polypropylene (PP) handles. These swabs are built to handle sensitive tasks that require a gentle touch and high absorbency. With their pointed tips, they are perfect for cleaning slots, grooves, and intricate areas where traditional cleaning tools might not reach.

Key Features of Pointed Cleanroom Foam Swabs

Lint-Free Foam One of the standout features of these foam swabs is their lint-free construction. This is particularly important in cleanroom environments, where even the smallest particles can affect the cleanliness of sensitive equipment. The foam material is carefully chosen to ensure no fibers are left behind during cleaning.

Pointed Tip Design The pointed foam tips make it easier to clean tight spaces and grooves in electronics, PCBs, machinery, and even cars. Whether it's a slot in a printer, a groove in a circuit board, or hard-to-reach areas in a car, these foam swabs provide the precision needed for thorough cleaning.

Durability and Absorbency Made with open-cell foam, these swabs offer exceptional absorbency. They can soak up liquids, dust, and other contaminants effectively, leaving surfaces clean without any mess. Their sturdy polypropylene handles ensure they are durable enough to withstand use without bending or breaking.

Certified Cleanroom Quality Manufactured in a Class 1000 cleanroom, these swabs are designed to meet the high standards required for cleanroom environments. They are perfect for industries such as electronics, semiconductor manufacturing, automotive detailing, and any application where cleanliness is critical.

Variety of Applications These foam swabs are not just limited to electronics or cleanrooms. Their versatility makes them ideal for a wide range of applications, including printer cleaning, toner cleaning, mold cleaning, and even automotive detailing. Their ability to clean both delicate electronic components and tougher industrial surfaces makes them an essential tool for professionals across various fields.

The Ideal Tool for Electronics and Semiconductor Industries

In industries like electronics and semiconductors, precision and cleanliness are paramount. The slightest amount of dust or debris can cause significant damage or reduce the performance of sensitive components. Cleanroom foam swabs like those from YOUSUTO are designed to meet these high standards, making them an indispensable tool in these fields.

Electronics: Clean delicate circuit boards, display screens, and other components without leaving any residue.

Semiconductor Manufacturing: Clean chips, wafers, and other sensitive equipment in a controlled, lint-free environment.

Automotive: Remove dust and debris from narrow slots and grooves in vehicles, ensuring a clean finish during detailing.

Why Choose YOUSUTO Foam Swabs?

You might be wondering why YOUSUTO’s Pointed Cleanroom Foam Swabs stand out in a market filled with various options. Here are a few reasons why these swabs are the top choice for many professionals:

Affordable Quality: provides these premium foam swabs at an affordable price, making them accessible to both small businesses and large corporations.

High-Quality Materials: Made with premium foam and a robust PP handle, these swabs are durable, effective, and designed to last.

Easy-to-Use Packaging: Each package contains 100 swabs, and with a convenient resealable bag, you can keep your cleaning tools organized and ready for use.

Customization: Need specific sizes or designs? YOUSUTO offers customization options, so you can get the exact foam swabs that best suit your needs.

Applications Beyond Cleanrooms

While cleanroom environments are the primary focus for these foam swabs, their functionality extends to several other industries as well. From cleaning automotive components to delicate optical surfaces, the pointed design makes them an excellent tool for precision work.

Automotive Care

For those in automotive detailing, the tight spaces between vehicle parts can be a challenge. YOUSUTO’s pointed foam swabs can easily reach into these narrow areas to remove dust, dirt, or even fluids without damaging the surface. Whether you’re cleaning air vents, seats, or console grooves, these swabs are a must-have.

Printer and Toner Cleaning

Printers, especially laser printers, accumulate toner and dust in hard-to-reach places. YOUSUTO foam swabs are ideal for gently cleaning these areas without leaving behind any particles. Their absorbent foam can soak up toner, ink, and other residues with ease.

Mold and Slot Cleaning

Whether it's cleaning industrial molds or tiny slots in machinery, the pointed tip of these foam swabs provides the precision needed to effectively remove dirt and debris. Their durability ensures they can handle the tough cleaning tasks that come with these environments.

Easy to Order and Fast Delivery

Ordering YOUSUTO’s Pointed Cleanroom Foam Swabs is simple and efficient. With various packaging options, including bulk buys, you can get as many as you need for your business. And with fast delivery times, you’ll have your cleaning tools on hand when you need them most.

Final Thoughts

Cleanliness is a critical aspect of many industries, especially those working with delicate electronics, semiconductors, and other precision equipment. YOUSUTO’s Pointed Cleanroom Foam Swabs provide the perfect solution for professionals who need to keep their equipment and workspaces spotless. With their lint-free foam tips, ergonomic design, and high absorbency, these swabs offer unmatched precision and efficiency in every cleaning task.

From cleaning narrow grooves in electronics to detailing automotive parts, YOUSUTO’s foam swabs are the go-to choice for professionals across a wide range of industries. Ready to improve your cleaning routine?

Choose YOUSUTO’s Pointed Cleanroom Foam Swabs today and experience the difference in quality and performance.

#foam swabs#cleanroom cleaning supplies#cleaning#electronics cleaning#automotive detailing#lint-free swabs#precision cleaning

2 notes

·

View notes

Text

https://blogzone.hellobox.co/7246743/five-major-players-dominate-the-semiconductor-manufacturing-equipment-market-leading-to-innovation-and-consolidation

Five Dominant Players Control the Semiconductor Manufacturing Equipment Market, Resulting in Innovation and Consolidation

The Semiconductor Manufacturing Equipment Market had a valuation of USD 91.20 billion in 2023 and is projected to attain USD 182.30 billion by 2030, growing at a CAGR of 10.4% over the forecast period.

#Semiconductor Manufacturing Equipment Market#Semiconductor Manufacturing Equipment Share#Semiconductor Manufacturing Equipment Revenue

0 notes

Text

Semiconductor Manufacturing Equipment Market by Lithography, Wafer Surface Conditioning, Etching, CMP, Deposition, Wafer Cleaning, Assembly & Packaging, Dicing, Bonding, Metrology, Wafer/IC Testing, Logic, Memory, MPU, Discrete - Global Forecast to 2029

0 notes

Text

Recent Innovations and Trends in Semiconductor Manufacturing Equipment

The semiconductor industry is continuously evolving, driven by technological advancements and innovations in semiconductor manufacturing equipment. This research article explores the latest trends and innovations in semiconductor manufacturing equipment, supported by qualitative and quantitative data analysis.

Market Size: The semiconductor manufacturing equipment market has witnessed significant growth in recent years, fueled by the increasing demand for semiconductor chips across various industries such as consumer electronics, automotive, and telecommunications. According to recent market reports, the global semiconductor manufacturing equipment market was valued at approximately USD 91.2 billion in 2023. Projections indicate robust growth, with the market of semiconductor manufacturing equipment to reach USD 149.8 billion by 2028, representing a CAGR of 10.4% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263678841

Market Trends: Advanced Process Technologies: The semiconductor industry is transitioning towards advanced process nodes such as 7nm, 5nm, and beyond, driving the demand for cutting-edge manufacturing equipment capable of delivering higher precision and efficiency.

Lithography Innovation: Lithography remains a critical process in semiconductor manufacturing, and recent innovations in extreme ultraviolet (EUV) lithography technology have enabled manufacturers to achieve finer feature sizes and higher yields.

3D Packaging and Integration: With the increasing complexity of semiconductor devices, there is a growing trend towards 3D packaging and integration techniques. Advanced equipment for wafer bonding, through-silicon via (TSV) formation, and die stacking are essential for enabling these advanced packaging technologies.

Industry 4.0 and Smart Manufacturing: The adoption of Industry 4.0 principles and smart manufacturing solutions is revolutionizing semiconductor fabs. Equipment with integrated sensors, connectivity, and data analytics capabilities are enhancing operational efficiency, predictive maintenance, and overall productivity.

Environmental Sustainability: There is a growing emphasis on sustainability in semiconductor manufacturing, driving the development of equipment with lower energy consumption, reduced chemical usage, and improved waste management systems.

Semiconductor Manufacturing Equipment

Innovations: Next-Generation Etching Systems: Advanced etching systems with atomic layer etching (ALE) capabilities are enabling precise and uniform etching processes, essential for the fabrication of advanced semiconductor devices.

Metrology and Inspection Solutions: Innovations in metrology and inspection equipment, such as optical and scanning electron microscopes (SEM), are enhancing defect detection and process control at nanoscale resolutions.

Materials Deposition Technologies: Novel deposition techniques, including atomic layer deposition (ALD) and chemical vapor deposition (CVD), are facilitating the deposition of thin films with exceptional uniformity and conformality, crucial for advanced device manufacturing.

Robotic Automation: Robotic automation solutions are increasingly being integrated into semiconductor manufacturing equipment to improve throughput, reduce human error, and enable lights-out manufacturing operations.

AI-Enabled Process Optimization: Artificial intelligence (AI) and machine learning (ML) algorithms are being deployed to optimize semiconductor manufacturing processes, leading to improved yield, reduced cycle times, and enhanced product quality.

The semiconductor manufacturing equipment industry is undergoing rapid transformation driven by technological innovations and emerging trends. Manufacturers must embrace these advancements to stay competitive in an increasingly dynamic market landscape. By leveraging cutting-edge equipment and adopting innovative manufacturing strategies, semiconductor companies can enhance productivity, accelerate time-to-market, and drive sustainable growth in the semiconductor industry.

0 notes

Text

Putting Customers First in the Custom Automation Equipment Development Process

As a leading custom automation equipment solution provider in the semiconductor metrology and inspection, medical devices, and emerging technologies, we have witnessed how the relentless pursuit of technical excellence—prioritizing streamlined processes and criteria fit—can inadvertently overshadow the deeper needs customers.

That is why this article focuses on the importance of understanding customer needs from the beginning. By embracing a holistic approach and redirecting the focus towards customer needs, stronger relationships are developed, exceptional experiences are delivered, and mutual success is achieved.

Exploring Strategic Objectives: The Foundation of Understanding

Steering teams towards a more strategic understanding of our customers, instead of superficial interactions, is an important duty as company leaders. It’s important to inspire teams to learn what customers really need and what is important to them instead of over-focusing on technical specifications. This can be accomplished by, "What do you want to achieve?" or "What would a successful outcome look like?" These answers will reveal a deeper understanding of customer needs, beyond what lies upon the surface.

Typical goals include:

Commercialization of a product concept

Accelerated time-to-market

Scaling manufacturing

Strategic objectives can be broader and include corporate, user or environmental goals. The more all high-level objectives are known, the stronger the potential partnership.

Empathy Is Key

Nurturing an atmosphere of empathy within our institutions is crucial to be effective leaders. We must prioritize customer concerns and fears with sincerity and understanding. Doing so will lead to a comprehensive knowledge of their expectations, build trust, and open the door for tailored solutions.

Asking "What are your biggest concerns or fears regarding this project?" or "What obstacles do you anticipate?" lead to deeper conversations, trust, and pave the way for a more successful outcome.

Customization as a Competitive Advantage

It’s important to remember that the true value lies in tailoring solutions to meet the unique needs of customers, more so than achieving technical excellence. Encourage teams to consider more than just technical specs, including scheduling, budgeting and more is crucial. This sets the stage for proposing solutions that better align with customer specific needs and can lead to a competitive advantage for them.

For example, during one discussion, a client expressed concerns about project timelines and potential delays that they experienced with vendors in the past. Commitments were made to the customer’s customers, so on-time delivery was critical. After engaging in an open and honest dialogue and listening closely to their worries and discussing options and tradeoffs, led to a better understanding so the project could move forward with both parties having more confidence in it.

By understanding how they felt, we developed a detailed project plan that met their timeline and accounted for potential challenges and risks. This level of proactive engagement addressed their concerns while solidifying our status as a trusted advisor that is invested in their success, which is a higher level relationship than a partnership.

Developing a Customer-Centric Culture

Cultivating a customer-centric culture within our company is critically important as leaders. By encouraging our teams to actively listen, develop a deep understanding of customer needs with empathy, we will be in a much stronger position to serve customers in the way they need and elevate our position to that of an advisor that can be trusted.

6 notes

·

View notes

Text

US launches $1.6B bid to outpace Asia in packaging tech

New Post has been published on https://thedigitalinsider.com/us-launches-1-6b-bid-to-outpace-asia-in-packaging-tech/

US launches $1.6B bid to outpace Asia in packaging tech

.pp-multiple-authors-boxes-wrapper display:none; img width:100%;

The US is betting big on the future of semiconductor technology, launching a $1.6 billion competition to revolutionise chip packaging and challenge Asia’s longstanding dominance in the field. On July 9, 2024, the US Department of Commerce unveiled its ambitious plan to turbocharge domestic advanced packaging capabilities, a critical yet often overlooked aspect of semiconductor manufacturing.

This move, part of the Biden-Harris Administration’s CHIPS for America program, comes as the US seeks to revitalise its semiconductor industry and reduce dependence on foreign suppliers. Advanced packaging, a crucial step in semiconductor production, has long been dominated by Asian countries like Taiwan and South Korea. By investing heavily in this area, the US aims to reshape the global semiconductor landscape and position itself at the forefront of next-generation chip technology, marking a significant shift in the industry’s balance of power.

US Secretary of Commerce Gina Raimondo emphasised the importance of this move, stating, “President Biden was clear that we need to build a vibrant domestic semiconductor ecosystem here in the US, and advanced packaging is a huge part of that. Thanks to the Biden-Harris Administration’s commitment to investing in America, the US will have multiple advanced packaging options across the country and push the envelope in new packaging technologies.”

The competition will focus on five key R&D areas: equipment and process integration, power delivery and thermal management, connector technology, chiplets ecosystem, and co-design/electronic design automation. The Department of Commerce anticipates making several awards of approximately $150 million each in federal funding per research area, leveraging additional investments from industry and academia.

This strategic investment comes at a crucial time, as emerging AI applications are pushing the boundaries of current technologies. Advanced packaging allows for improvements in system performance, reduced physical footprint, lower power consumption, and decreased costs – all critical factors in maintaining technological leadership.

The Biden-Harris Administration’s push to revitalise American semiconductor manufacturing comes as the global chip shortage has highlighted the risks of overreliance on foreign suppliers. Asia, particularly Taiwan, currently dominates the advanced packaging market. According to a 2021 report by the Semiconductor Industry Association, the US accounts for only 3% of global packaging, testing, and assembly capacity, while Taiwan holds a 54% share, followed by China at 16%.

Under Secretary of Commerce for Standards and Technology and National Institute of Standards and Technology (NIST) Director Laurie E. Locascio outlined an ambitious vision for the program: “Within a decade, through R&D funded by CHIPS for America, we will create a domestic packaging industry where advanced node chips manufactured in the US and abroad can be packaged within the States and where innovative designs and architectures are enabled through leading-edge packaging capabilities.”

The announcement builds on previous efforts by the CHIPS for America program. In February 2024, the program released its first funding opportunity for the National Advanced Packaging Manufacturing Program (NAPMP), focusing on advanced packaging substrates and substrate materials. That initiative garnered significant interest, with over 100 concept papers submitted from 28 states. On May 22, 2024, eight teams were selected to submit complete applications for funding of up to $100 million each over five years.

According to Laurie, the goal is to create multiple high-volume packaging facilities by the decade’s end and reduce reliance on Asian supply lines that pose a security risk that the US “just can’t accept.” In short, the government is prioritising ensuring America’s leadership in all elements of semiconductor manufacturing, “of which advanced packaging is one of the most exciting and critical areas,” White House spokeswoman Robyn Patterson said.

The latest competition is expected to attract significant interest from the US semiconductor ecosystem and shift that balance. It promises substantial federal funding and the opportunity to shape the future of American chip manufacturing. As the global demand for advanced semiconductors continues to grow, driven by AI, 5G, and other emerging technologies, the stakes for technological leadership have never been higher.

As the US embarks on this ambitious endeavour, the world will see if this $1.6 billion bet can challenge Asia’s stronghold on advanced chip packaging and restore America’s position at the forefront of semiconductor innovation.

(Photo by Braden Collum)

See also: Global semiconductor shortage: How the US plans to close the talent gap

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with other leading events including Intelligent Automation Conference, BlockX, Digital Transformation Week, and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

Tags: ai, AI semiconductor, artificial intelligence, chips act, law, legal, Legislation, Politics, semiconductor, usa

#2024#5G#Accounts#Administration#ai#ai & big data expo#AI semiconductor#America#amp#applications#Art#artificial#Artificial Intelligence#Asia#automation#betting#biden#Big Data#billion#Business#challenge#China#chip#chip shortage#chips#chips act#Cloud#Commerce#competition#comprehensive

3 notes

·

View notes

Text

Is Mediatek Helio G99 Good For Gaming? Lets Go To Details

Mediatek Helio G99 processor

The DC-1 is the first tablet with a 10.5″ LivePaper Display in the world that, when its LED backlight is turned all the way to amber, can operate without emitting any blue light at all. You can use this innovative display for an extended period of time because it functions at a super-smooth 60 frames per second, is easier on the eyes, and doesn’t flicker or glare outside.

Apart from the powerful, eight-core MediaTek Helio G99 SoC, the DC-1 is equipped with a large 8000mAh battery, fast Wi-Fi 6, Bluetooth 5.0 wireless connectivity, 8GB of RAM, and 128GB of storage. Even better, a USB 3.1 Type-C to Ethernet converter can be used to Ethernet-tether it.

MediaTek Helio G99 6nm

Outstanding 4G gaming smartphones at 6nm with amazing power efficiency

The next generation of 4G gaming smartphones is introduced by the MediaTek Helio G99. This processor, which is based on the incredibly effective TSMC N6 (6nm-class) semiconductor manufacturing process, allows for all-day gaming, large cameras, quick displays, seamless streaming, and dependable international networking. Partners can modify the MediaTek Helio G99 platform to fit particular needs for their markets or devices.

Mediatek Helio G99 phones

The TSMC N6 (6nm-class) chip production process, which we used to enhance the Helio 4G series, allows the G99 to be incredibly power efficient and opens up new possibilities for device makers to produce gaming smartphones that last longer than before.

Mediatek Helio G99 ghz

Fast-moving 120 Hz screens with intelligent display synchronisation

Without the need for additional DSC hardware, device manufacturers may produce gaming smartphones that are lightweight and thin with Full HD+ 120Hz screens that are sharp and clear. Even 4G smartphones are now expected to have 120Hz displays, which offer an incredibly smooth everyday experience with noticeably smoother webpage browsing and app animations.

Through dynamic refresh rate adjustments, MediaTek Intelligent Display Sync technology increases the power economy of these rapid screens by only enabling greater speeds when they are most needed.

108 Megapixel Primary Camera

Large 108MP cameras are available for device makers to employ, enabling users to take the highest detailed pictures. When compared to other MediaTek Helio series chipsets, photographic results are better thanks to dimensity-class picture quality technology. Highly detailed bokeh captures in dual selfie and multi-camera setups are possible with twin cameras up to 16MP with ZSL.

Mediatek Helio G99 octa-core

With two powerful Arm Cortex-A76 processors that can reach 2.2GHz in frequency, the MediaTek Helio G99 is equipped with an octa-core CPU and a powerful Arm Mali G57-class GPU. Accelerated data access using fast UFS 2.2-class storage and high speed LPDDR4X memory up to 2,133MHz maximises performance in games, apps, and daily tasks.

Gaming technology powered by MediaTek HyperEngine 2.0 Lite

2.0 Resource Management Engine

Longer-lasting, more fluid gameplay is ensured by an intelligent resource management engine.

CPU, GPU, and RAM are intelligently and dynamically managed based on active power, thermal, and gameplay measures.

improved performance in difficult scenarios, high-stress games, and game engines that load slowly

High FPS power savings prolong battery life without compromising user experience by combining hardware and software improvements to lower power consumption during high FPS gaming situations.

2.0 Networking Engine

To make sure you’re always connected, the networking engine provides more dependable connectivity and quicker reaction times.

Call and Data Concurrency enables users to postpone conversations while playing games without the data connection failing, and WiFi antenna shifting modifies the signal between antennas to maximise throughput and minimise latency.

Two 4G VoLTE in tandem

For optimal power efficiency, a fast Cat-13 4G LTE modem is built inside the chip. Supported are global bands and IMS services; additionally, cutting-edge features like 4×4 MIMO and 256QAM offer dependable connectivity even in densely populated locations. While VoLTE and ViLTE services offer great call and live video experiences with faster call setup and substantially better quality than conventional calling, essential dual 4G SIM offers a seamless experience with fast data services from both connections.

Mediatek Helio G99 Benchmark

AnTuTu Benchmark

Overall Score: Around 350,000 to 400,000

CPU Score: Around 100,000 to 120,000

GPU Score: Around 90,000 to 110,000

Geekbench 5

Single-Core Score: Approximately 500 to 600

Multi-Core Score: Approximately 1500 to 1700

3DMark (Sling Shot Extreme)

Score: Around 1800 to 2200

Mediatek Helio G99 price

Since manufacturers buy the MediaTek Helio G99, its mid-range chipset price is rarely listed. However, cellphones and devices using this chipset can give us an indication of its pricing.

Helio G99 Device Price Range

MediaTek Helio G99 smartphones are inexpensive to mid-range. These gadgets’ estimated prices:

The Helio G99 can be found in $150–200 smartphones. Mid-Range Smartphones: $200–$300 models with this chipset have more features.

Device Examples

Around $250 for Infinix Note 12 Pro. The Tecno Camon 19 Pro costs around $230.

Prices vary by model, RAM and storage configurations, features, regional pricing, and store pricing strategies.

Conclusion

Despite the MediaTek Helio G99 chipset’s price being unknown, devices using it cost $150 to $300. This line matches its mid-level mobile device affordability.

MediaTek Helio G99 Specs

Processor

Processor

2x Arm Cortex-A76 up to 2.2GHz

6x Arm Cortex-A55 up to 2.0GHz

Cores

Octa (8)

CPU Bit

64-bit

Heterogeneous Multi-Processing

Yes

Memory and Storage

Memory Type

LPDDR4X

Max Memory Frequency

4266Mbps

Storage Type

UFS 2.2

Connectivity

Cellular Technologies

4G Carrier Aggregation (CA), CDMA2000 1x/EVDO Rev. A (SRLTE), 4G FDD / TDD, HSPA +

Specific Functions

4X4 MIMO, 2CC CA, 256QAM, TAS 2.0, HPUE, IMS (VoLTE\ViLTE\WoWi-Fi), eMBMS, Dual 4G VoLTE (DSDS), Band 71

LTE Category

Cat-13 DL

GNSS

GPS / QZSS L1+ L5 / Galileo E1 + E5a / BeiDou B1C + B2a / NAVIC

Wi-Fi

Wi-Fi 5 (a/b/g/n/ac)

Bluetooth Version

5.2

Camera

Max Camera Resolution

108MP

16MP + 16MP

Capture FPS

32MP @ 30fps ZSL

16MP + 16MP @ 30fps ZSL

Camera Features

3X ISP; AI Face Detection; HW depth engine; AINR; Single-Cam/Dual-Cam Bokeh; Hardware Warping Engine (EIS); Rolling Shutter Compensation (RSC) engine; MEMA 3DNR; Multi-Frame Noise reduction;

Display

Max Display Resolution

2520 x 1080

Max Refresh Rate

120Hz

Graphics & Video

GPU Type

Arm Mali-G57 MC2

Video Encoding

H.264, H.265 / HEVC

Video Encoding FPS

2K 30fps, FHD 60fps, HD 120fps

Video Playback

H.264, H.265 / HEVC, VP-9

Video Playback FPS

2K 30fps, FHD 60fps, HD 120fps

Read more on govindhtech.com

#Mediatek#Heliog99#Gaming#wifi6#6nm#Mediatekhelio#g99phones#4g#smartphones#Camera#108megapixel#Gamingtechnology#gpu#HyperEngine#g99#Display#Videoplayback#technology#technews#news#govindhtech

2 notes

·

View notes

Text

Global top 13 companies accounted for 66% of Total Frozen Spring Roll market(qyresearch, 2021)

The table below details the Discrete Manufacturing ERP revenue and market share of major players, from 2016 to 2021. The data for 2021 is an estimate, based on the historical figures and the data we interviewed this year.

Major players in the market are identified through secondary research and their market revenues are determined through primary and secondary research. Secondary research includes the research of the annual financial reports of the top companies; while primary research includes extensive interviews of key opinion leaders and industry experts such as experienced front-line staffs, directors, CEOs and marketing executives. The percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

According to the new market research report “Global Discrete Manufacturing ERP Market Report 2023-2029”, published by QYResearch, the global Discrete Manufacturing ERP market size is projected to reach USD 9.78 billion by 2029, at a CAGR of 10.6% during the forecast period.

Figure. Global Frozen Spring Roll Market Size (US$ Mn), 2018-2029

Figure. Global Frozen Spring Roll Top 13 Players Ranking and Market Share(Based on data of 2021, Continually updated)

The global key manufacturers of Discrete Manufacturing ERP include Visibility, Global Shop Solutions, SYSPRO, ECi Software Solutions, abas Software AG, IFS AB, QAD Inc, Infor, abas Software AG, ECi Software Solutions, etc. In 2021, the global top five players had a share approximately 66.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

2 notes

·

View notes