#SME HR services

Explore tagged Tumblr posts

Text

SME HR Software: Empowering Small Businesses

In the fast-paced business landscape, small and medium-sized enterprises (SMEs) play a crucial role in driving economic growth and innovation. However, managing human resources efficiently can be a significant challenge for SMEs with limited resources. This is where SME HR software comes into play, offering tailored solutions to streamline HR processes and empower small businesses to thrive. In this blog, we will explore the significance of SME HR software, the services it provides, and the benefits of implementing an SME HRMS (Human Resource Management System).

Understanding SME HR Software

SME HR software, also known as SME HRMS, is designed specifically to meet the unique needs and challenges faced by small and medium-sized enterprises. These solutions automate and optimise various HR functions, allowing businesses to manage their workforce more effectively. From recruitment and onboarding to payroll and performance management, SME HR software covers a wide range of HR services.

Key Features of SME HR Software

Recruitment and Onboarding:

Streamlining the hiring process with automated job posting and applicant tracking.

Facilitating smooth onboarding experiences for new hires through digital documentation and training modules.

Employee Data Management:

Centralising employee information, including personal details, performance records, and attendance data.

Ensuring data accuracy and security through robust encryption and access controls.

Payroll Processing:

Automating payroll calculations and tax deductions will minimise errors and save time.

Generating compliance reports and ensuring adherence to local labour laws.

Time and Attendance Tracking:

Monitoring employee work hours and attendance with automated time tracking features.

Integrating with biometric systems or mobile apps for accurate data capture.

Performance Management:

Setting performance goals and conducting regular assessments to enhance employee productivity.

Providing feedback and performance analytics to support professional development.

Employee Self-Service Portals:

Empowering employees to access and update their personal information.

Allowing for leave requests, time-off approvals, and other self-service functionalities.

Benefits of SME HR Software

One of the key challenges faced by SMEs is managing human resources efficiently. This is where SME HR services come into play, which can enhance HR processes and contribute to the overall success of these businesses.

Time and Cost Efficiency:

Automating manual HR processes reduces the time and effort required for administrative tasks.

Cost savings through streamlined operations and minimise errors in payroll processing.

Compliance and Risk Management:

Ensuring compliance with labour laws and regulations to mitigate legal risks.

Generating accurate reports for audits and regulatory requirements.

Improved Decision-Making:

Access to real-time data and analytics enables informed decision-making.

Identifying trends in employee performance and engagement for strategic planning.

Enhanced Employee Experience:

Providing self-service options improves employee satisfaction and engagement.

Streamlining communication and feedback processes fosters a positive workplace culture.

Conclusion

SME HR software is a game-changer for small businesses looking to navigate the complexities of human resource management. By leveraging the capabilities of an efficient HRMS, SMEs can optimise their processes, reduce administrative burdens, and focus on fostering a productive and engaged workforce. Investing in SME HR software is not just a technological upgrade; it's a strategic move towards long-term business success.

Selecting Opportune HR's SME HR software is a strategic decision that can significantly enhance the efficiency and effectiveness of human resource management within small and medium-sized enterprises (SMEs).

This cutting-edge software offers a comprehensive suite of tools tailored to meet the unique HR needs of smaller businesses.

With features ranging from streamlined employee onboarding and performance management to robust payroll and compliance solutions, their SME HRMS ensures a seamless and organised HR workflow.

The user-friendly interface and customisable modules make it easy for businesses to adapt the software to their specific requirements, promoting a more agile and responsive HR function.

By choosing Opportune HR, SMEs can optimise their HR processes, reduce administrative burdens, and empower their workforce, ultimately fostering a more productive and engaged work environment.

0 notes

Text

#Real Estate HR Consulting#Hr for Smes#Hr Policy in Uae#Hr Services for Small Business#Compensation Benchmarking Dubai#Employee Performance#Management Dubai#Hr Audit Dubai#Hr Consultancy Dubai#Employee Engagement Consultant#Hr Consultancy Sharjah#Hr Consultants Sharjah#Hr Companies in#Abu Dhabi#Hr Company Abu Dhabi#Hr Consultancy Abu Dhabi#Human Resources Consultancy in Abu Dhabi#Hr Set Up Dubai#Human Resources Consulting#Company#Hr Services for Start Ups#Hr for Start-Ups#Dubai Hr Consultancy#hr consultancy in UAE#Hr Advisory Services#Human Resources Consultancy Dubai#Top Hr Consultancy in Dubai

0 notes

Text

Comprehensive Order Management Services for Streamlined Operations

Our Order Management Services provide end-to-end solutions to streamline the entire order lifecycle. From order processing and inventory management to fulfillment and tracking, we help businesses reduce errors, improve efficiency, and enhance customer satisfaction. By leveraging advanced technology and automation, our services ensure real-time visibility, accurate data, and seamless integration with existing systems. Whether you're handling a high volume of orders or scaling up, we simplify the process and optimize your operations for growth.

#Inventory Management Software#Order Management Services#Order Management Specialist#Cloud ERP for Small Businesses#Procurement Software for SMEs#Core Hr Function Software#Shop Floor Management Software

0 notes

Text

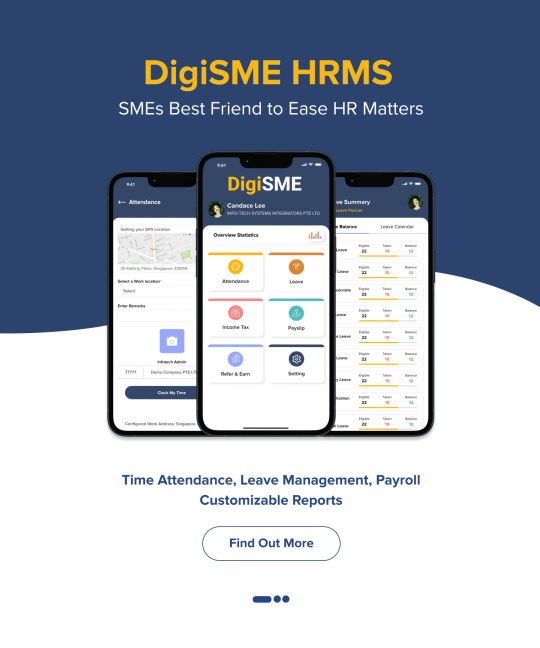

We offer a robust & comprehensible HRMS Software with modules that proves beneficial for your HR Management. Modules that can help with staff training, onboarding, payrolls and leave managements, perfect for small businesses that need to keep it simple and affordable.

#hr software#HR System Software For SMEs#HR Management Software#HR software for small businesses#complete hr software#hr services#human resources

0 notes

Text

Ignore the attention-getting headline about fertility. I made a pledge a little while ago to stop talking about fertility issues; I'll do a longer post about that pledge later, but I'm sick of that discourse and how it's now just going in circles with nothing to show for it. But click through to the post anyway about South Korea's dysfunctional small business culture.

One of the awkward findings in business and economics is, despite how much people dislike them, giant megacorporations are much more efficient than small businesses, in terms of worker productivity (as long as those corporations have to compete in a global marketplace and aren't propped up by subsidies, protectionist trade policy, or monopoly protection).

This happens everywhere, but I didn't realize it was particularly bad in South Korea:

Between the Hyundai apartments and Samsung theme parks, South Korea certainly looks like a nation of big business. But looks can be deceiving: peak beneath the hood and you find that the Republic of Samsung is a nation awash in shitty small businesses. With just 14 percent of jobs at companies with over 250 employees, South Korea has the lowest proportion of jobs at big companies of any nation in the OECD. Contrast this with the U.S., where 58 percent of jobs are at such companies. ... Small businesses aren’t always bad for employees—maybe you get more autonomy and fewer shrill HR managers. But South Korea’s small businesses are distinctively unproductive and retrograde in their work cultures, making them far less attractive employment options. While SMEs are rarely as productive as large ones, it is truly striking how unproductive South Korea’s small businesses are compared to those in Western nations. The OECD, for example, found small service sector firms in Korea are 30 percent as productive as larger firms with over 250 workers. In the Netherlands and Germany, that figure is 84 and 90 percent, respectively. Similarly, the Asian Development Bank found that in 2010, small Korean firms with five to 49 workers were just 22 percent as productive as firms with over 200 workers. ... The story of South Korea’s ingenious use of corporate subsidies, it turns out, has been oversold. South Korea’s government in fact shells out lots of money keeping unproductive small businesses afloat, with little in the way of economic gain to show for it. ... So why does South Korea spend so much money subsidizing poorly run small businesses? The simple answer may be that it is especially good politics in a nation where chaebols are met with suspicion over their ties to the government. Politicians can point to this “support” for small businesses as evidence that they are not in bed with firms like Samsung.

This is a fascinating example of policy backfire: Korea's chaebols are so big and politically unpopular that voters demand tons of subsidies for the romantic ideal of small family businesses, which keeps them permanently uncompetitive and unproductive, where people have to work much longer hours for the same pay you'd get anywhere else.

162 notes

·

View notes

Text

Best EOR Companies: Why BrooksPayroll is the Top Choice

In today’s globalized business environment, companies are constantly looking for efficient ways to expand their operations internationally without the burden of establishing legal entities in foreign countries. This is where Employer of Record (EOR) services come in. Among the best EOR companies, BrooksPayroll stands out for its exceptional services, innovative solutions, and client-centric approach.

Whether you’re a startup, SME, or large enterprise, BrooksPayroll can help you manage international employees seamlessly, enabling you to focus on growing your business.

What Makes BrooksPayroll One of the Best EOR Companies?

Comprehensive EOR Solutions BrooksPayroll provides end-to-end EOR services, allowing businesses to onboard, manage, and pay international employees without establishing a local entity. Their services include:

Employee onboarding and compliance Payroll processing Tax filing and benefits administration Employment law compliance Termination and severance management

Global Reach BrooksPayroll operates across multiple countries, making it a perfect partner for businesses looking to expand globally. They are equipped to navigate the complexities of international labor laws, ensuring smooth operations for their clients.

Compliance Expertise One of the biggest challenges of hiring internationally is staying compliant with local labor laws. BrooksPayroll ensures 100% compliance, reducing legal risks and liabilities for businesses. Their team of experts stays updated on labor laws, taxation, and employment regulations in various countries.

Cost-Effective Solutions Setting up a legal entity in a foreign country can be expensive and time-consuming. By leveraging BrooksPayroll’s EOR services, businesses save significant costs while gaining access to a reliable and scalable solution.

Technology-Driven Processes BrooksPayroll integrates advanced technology to streamline processes like payroll management, employee data storage, and reporting. Their user-friendly platforms ensure a seamless experience for both employers and employees.

Benefits of Choosing BrooksPayroll Simplified Global Expansion: BrooksPayroll enables businesses to enter new markets quickly and efficiently without the need to establish local entities. Risk Mitigation: With their compliance expertise, businesses can rest assured that their operations adhere to all local labor laws. Time-Saving: Outsourcing HR and payroll functions to BrooksPayroll allows companies to focus on strategic growth. Customizable Solutions: Whether you need a full-suite EOR service or specific support, BrooksPayroll tailors its offerings to match your business needs. Why BrooksPayroll is the Best EOR Partner When it comes to best EOR companies, BrooksPayroll has earned its place at the top by providing reliable, compliant, and cost-effective services to businesses worldwide. Their commitment to excellence and a client-first approach make them the trusted choice for companies looking to manage international employees effectively.

With BrooksPayroll, you gain a partner who understands your business needs and provides solutions that drive success.

Ready to Take Your Business Global? Let BrooksPayroll simplify your global expansion journey. From onboarding to payroll and compliance, their services are designed to give you peace of mind while focusing on what truly matters—growing your business.

Contact BrooksPayroll today to Best EOR companies and how they can help you achieve your international business goals!

3 notes

·

View notes

Text

Hire AngularJS Developers India for Fast and Reliable Services

Quick Summary

In today’s fast-paced digital world, every business needs agile and robust solutions to keep up Whether you’re a Small and Medium Enterprise (SME), digital agency, technology company, or HR professional, why a decision to hire angularjs developers india can be so be the game changer your organization needs? Because India’s AngularJS developers bring technical expertise, affordability and reliability to the table.

Introduction to AngularJS development

AngularJS is a widely used JavaScript framework for building dynamic net applications. Developed by Google, it simplifies the improvement procedure, improves scalability and efficiency. It’s like a Swiss Army knife for web improvement—very flexible, efficient, and dependable.

By hiring AngularJS developers specially in India, you can make certain that your mission is dealt with by way of skilled professionals who apprehend your enterprise needs.

Why AngularJS is perfect for your Project

AngularJS is a framework designed for efficiency and flexibility. Here’s why it stands out:

Two-Way Data Binding: AngularJS eliminates the hassle of manual DOM manipulations.

Dependency Injection: Makes code easier to manage and test.

Recycling: Modular applications are designed for easy maintenance.

This drives SMEs, tech businesses and virtual businesses toward its intention of constructing scalable solutions.

Benefits of Hiring AngularJS Developers in India

India has become a worldwide hub for developers, and AngularJS capabilities aren't any exception. Here’s why:

Cost: Hiring agents in India is far more expensive than in many western countries.

Technology: Indian manufacturers are known for their deep technical expertise and innovative solutions.

Time-Zone Advantage: With time zone differences, your project can achieve faster turnaround times.

Communication Skills: Most Indian developers are fluent in English, ensuring smooth collaboration.

Key Skills to Look for in AngularJS Developers

Before hiring, ensure that your AngularJS programmer possesses these essential skills:

Proficiency in JavaScript, HTML, and CSS.

Strong knowledge of AngularJS framework concepts like MVC architecture.

Familiarity with RESTful APIs and AJAX.

Experience with version control systems like Git.

Problem-solving and debugging skills.

How AngularJS Drives Business Success

AngularJS empowers businesses with:

Faster Development: The framework speeds up development cycles with reusable components.

Enhanced user experience: Dynamic web applications for seamless interaction.

Scalability: Whether you are a startup or a large business, AngularJS makes no effort to measure your needs.

The Process of Hiring AngularJS Developers

Follow these steps to hire the right AngularJS programmer:

Define Your Requirements: Outline your project needs and goals.

Search for Developers: Use platforms like LinkedIn, job boards, or agencies.

Conduct Interviews: Assess technical skills and communication abilities.

Start Small: Begin with a trial project to evaluate their performance.

Seal the Deal: Finalize contracts and begin the development process.

Tips for Hiring AngularJS Developers

Check Their Portfolio: Look for past projects to assess expertise.

Ask for References: Speak to previous clients to understand their experience.

Focus on Communication: Ensure the developer understands your vision.

Testing Technical Knowledge: Use real problems to assess their proficiency.

Challenges and how to overcome them

While there are numerous blessings to hiring AngularJS developers in India, there may be challenges along with time quarter variations or cultural barriers. However, these can be addressed:

Clear Communication: Use project management tools like Slack or Trello.

Regular Updates: Schedule weekly meetings to track progress.

Defined Deliverables: Ensure expectations are documented.

Why did you choose AIS Technolabs for AngularJS development?

AIS Technolabs is a trusted name in the IT industry, providing dedicated AngularJS developers to global clients.Here’s why AIS stands out:

Experienced team with proven expertise.

Transparent pricing and an easy hiring procedure.

Commitment to supply excessive quality answers in a well timed manner.

Conclusion

Hiring AngularJS builders in India isn't cost-powerful but additionally guarantees top-notch offerings as in keeping with your desires. Choosing an experienced contractor lets in you to attention on the scope of your undertaking, whilst leaving the technical demanding situations to the specialists. AIS Technolabs and its experienced and dedicated body of workers can help you attain your goals. Don’t wait—contact us today to hire the best AngularJS programmers.

Source>>https://joripress.com/hire-angularjs-developers-india-for-fast-and-reliable-services

#hire angularjs developers india#Hire AngularJS Developers#hire dedicated angularjs developers#hire angularjs programmer#Hiring Angular Developer

0 notes

Text

Top 10 HRMS Software in India for SMEs

In today’s fast-paced business environment, HRMS software plays a pivotal role in streamlining HR operations for organizations. From attendance tracking to payroll automation, these tools empower HR professionals to work efficiently and drive employee satisfaction. Here's a curated list of HRMS software in India to help you choose the best fit for your SME.

1. QkrHR

Renowned as one of the best HRMS and payroll software in India, QkrHR simplifies HR functions with intuitive navigation, mobile access, and features like field force automation, payroll integration, and employee self-service (ESS) portals. It’s perfect for small and medium-sized businesses.

2. Zoho People

A versatile HR software that offers customizable workflows, time tracking, and performance management, Zoho People is a trusted name among SMEs.

3. Keka HR

Keka stands out for its user-friendly payroll and attendance management tools, making it one of the best HR software options for growing companies.

4. GreytHR

With a comprehensive range of features, GreytHR is ideal for managing payroll, leave, and compliance, especially for Indian businesses.

5. HR-One

This platform provides end-to-end HR solutions, including recruitment, employee engagement, and performance analytics.

6. Darwinbox

Popular worldwide, Darwinbox brings AI-powered analytics to HR management, making it one of the best HRMS software in the world.

7. Pocket HRMS

A mobile-friendly free HRMS software in India, Pocket HRMS offers budget-friendly options for small businesses looking for essential HR automation.

8. sumHR

Simple and affordable, sumHR focuses on attendance, payroll, and employee data management for startups and SMEs.

9. Beehive HRMS

With flexible modules, Beehive HRMS helps automate HR operations while ensuring scalability for businesses.

10. Zimyo

Zimyo combines simplicity and functionality, making it one of the top choices for improving employee productivity and engagement.

Why Choose QkrHR?

Among the top 10 HRMS software in India, QkrHR stands out with its robust features designed for SMEs. From automated time and attendance tracking to seamless payroll processing, it ensures efficient HR management while focusing on employee satisfaction.

Looking for the best HRMS and payroll software in India? QkrHR is your go-to solution. Sign up today and experience the difference!

Explore More

If you're considering options for free HRMS software India, or need help navigating the HR software list, QkrHR offers tailored solutions to meet your business needs.

#hrm software#best hr software#list of hrms software in india#Top 10 HRMS software in India#HR software list#Best HRMS software in world#Best HRMS and payroll software in India#Free HRMS software India

1 note

·

View note

Text

Top 10 Benefits of Partnering with a PEO Provider

Partnering with a Professional Employer Organization (PEO) can significantly enhance the operational efficiency of small and medium-sized businesses (SMEs). PEO services offer a comprehensive suite of human resource solutions that enable businesses to focus on their core competencies while effectively managing employee-related functions. Here are the top ten benefits of partnering with a PEO provider.

1. Access to Competitive Employee Benefits

One of the most compelling reasons to partner with a PEO is the access to high-quality employee benefits that might otherwise be unattainable for smaller organizations. PEO providers pool employees from multiple clients, which gives them the bargaining power to negotiate better rates for health insurance, retirement plans, and other benefits. This means that small businesses can offer competitive benefits packages similar to those offered by larger corporations, helping them attract and retain top talent.

2. Streamlined Payroll Processing

Managing payroll can be a complex and time-consuming task for small businesses. PEO services simplify this process by automating payroll calculations and ensuring compliance with tax regulations. This reduces administrative burdens and minimizes the risk of errors that can lead to costly penalties. By outsourcing payroll to a PEO, businesses can ensure timely and accurate processing, allowing them to focus on growth strategies.

3. Enhanced Compliance Support

Navigating the maze of employment laws and regulations can be daunting for business owners. PEOs specialize in compliance assistance, helping businesses adhere to federal, state, and local labor laws. This support is crucial in minimizing legal risks associated with employment practices, ensuring that businesses remain compliant without dedicating extensive resources to stay updated on changing regulations.

4. Risk Management and Safety Programs

PEOs provide essential risk management services that help businesses mitigate workplace hazards and reduce insurance costs. They often offer safety programs tailored to specific industries, ensuring that employees are trained in best practices for workplace safety. Additionally, PEOs typically manage workers' compensation claims more efficiently, which can lead to lower premiums over time.

5. Time Savings on HR Tasks

By outsourcing HR functions to a PEO, business owners can reclaim valuable time that can be redirected toward strategic initiatives. PEOs handle various HR responsibilities, including recruitment, onboarding, training, and employee relations. This allows internal teams to focus on core business operations rather than getting bogged down in administrative tasks.

6. Cost Savings through Economies of Scale

Partnering with a PEO can lead to significant cost savings for small businesses. PEOs leverage economies of scale, allowing them to negotiate favorable terms for various services such as health insurance and payroll processing. This collective purchasing power enables smaller organizations to access high-quality services at lower prices than they could achieve independently.

7. Improved Employee Experience

When businesses partner with a PEO, employees benefit from enhanced support systems. PEOs typically provide dedicated resources for employee inquiries related to benefits and payroll issues. This improved access to information contributes to higher employee satisfaction levels, which can lead to increased productivity and lower turnover rates.

8. Expertise in Employee Development

PEOs not only manage HR tasks but also offer expertise in employee development initiatives. They assist businesses in creating effective training programs and performance management systems that align with organizational goals. Investing in employee development fosters loyalty and enhances overall workforce capabilities.

9. Flexibility in Workforce Management

In today’s fast-paced business environment, flexibility is crucial for success. PEOs provide scalable solutions that allow businesses to adjust their workforce according to changing needs without extensive administrative work. Whether hiring seasonal employees or managing layoffs, PEOs facilitate these transitions smoothly.

10. Focus on Core Business Functions

Ultimately, partnering with a PEO allows business owners to concentrate on what they do best—running their business. By alleviating the burdens associated with HR management and compliance issues, PEOs empower entrepreneurs to focus on strategic initiatives that drive growth and profitability.

Conclusion

In summary, partnering with a Professional Employer Organization offers numerous advantages for small businesses looking to enhance their operational efficiency and employee satisfaction. From accessing competitive benefits packages to streamlining payroll processing and providing expert compliance support, the benefits are substantial. As small businesses navigate complex HR landscapes, finding the best PEO for small businesses becomes essential for sustainable growth and success in today’s competitive market. By leveraging the strengths of PEO providers, companies not only improve their internal processes but also position themselves as attractive employers in an increasingly competitive job market. The partnership with a PEO is not just about outsourcing HR; it's about gaining a strategic ally that contributes significantly to long-term success.

0 notes

Text

Why Choose the Best ERP Software in Singapore?

The competitive business environment in Singapore demands innovative tools to streamline operations and drive growth. Opting for the best ERP software Singapore ensures your business stays ahead by automating processes and improving decision-making.

To explore top-tier ERP solutions, visit Best ERP Software Singapore.

Key Features of ERP Software Singapore Businesses Need

ERP systems provide comprehensive solutions for managing finances, supply chains, and customer relationships. ERP software Singapore is tailored to meet local regulatory standards and industry-specific needs.

Key features include:

Real-Time Data Access: Ensure accurate decision-making with instant access to crucial data.

Scalability: Adapt the software to match business growth.

Integration: Seamlessly connect with existing tools like CRM and inventory systems.

Learn more about ERP software at ERP Software Singapore.

Benefits of Using ERP Software in Singapore

Implementing the best ERP software Singapore offers numerous advantages:

Increased Efficiency: Automate repetitive tasks to save time and reduce errors.

Improved Compliance: Stay updated with Singapore’s legal and financial regulations.

Better Resource Management: Optimize inventory and employee productivity.

A well-chosen ERP system empowers businesses to focus on strategic objectives rather than administrative challenges.

Selecting the Best ERP Software for Your Business

Choosing the right ERP system involves evaluating your business needs. Factors to consider include:

Budget: Ensure the ERP fits your financial plan.

Customization: Look for systems that offer tailored features.

Support Services: Reliable customer support ensures smooth operations.

The best ERP software Singapore providers offer flexible solutions that align with your goals.

How ERP Software Transforms Businesses in Singapore

From SMEs to large corporations, businesses in Singapore benefit significantly from ERP software. It enhances collaboration, reduces operational costs, and provides real-time insights. Whether you need tools for finance, inventory, or HR, ERP software Singapore covers all bases.

Visit ERP Software Singapore to explore transformative solutions.

Conclusion

Investing in the best ERP software Singapore is essential for businesses seeking to thrive in a competitive landscape. By choosing the right system, you can ensure efficiency, compliance, and growth. Singapore’s top ERP providers offer customized solutions to cater to diverse industries.

Start your journey towards operational excellence by exploring ERP solutions tailored to your needs. Visit Best ERP Software Singapore today.

0 notes

Text

Top 5 Benefits of Cloud-Based HRMS Software for SMEs

Small and medium-sized enterprises (SMEs) are realising more and more how important it is to use cutting-edge solutions to optimise their operations in the dynamic world of business. Among these options, cloud-based HRMS software stands out as a game-changer for small and medium-sized enterprises (SMEs), providing a plethora of advantages that support productivity, adaptability, and overall business success. In this blog, we will highlight five advantages of using cloud-based HRMS SME software.

Advantages of HRMS Software for Small and Medium-Sized Businesses

1. Cost-Effectiveness

The cost-effectiveness of cloud-based HRMS software is one of the main benefits for small and medium-sized businesses. A significant upfront expenditure in hardware, software licences, and maintenance is frequently necessary for traditional HR systems. On the other hand, cloud-based solutions do not require a substantial upfront investment because they work on a subscription-based approach. Because it allows SMEs with limited budgets to spend resources more wisely, it is very appealing to them.

Beyond the initial expenditure, the cost-effectiveness is substantial. Cloud-based HRMS removes the need for on-site servers and the related maintenance expenses. Additionally, SMEs can pay for the services they require with the scalable pricing models that many cloud-based solutions offer, making it an affordable solution that expands with the company.

2. Flexibility and Availability

SMEs now have access to a level of flexibility and accessibility that was previously only possible for larger companies with sophisticated IT infrastructures, thanks to cloud-based HRMS software. Cloud solutions enable HR data to be accessible from anywhere at any time, removing geographical restrictions and facilitating the expanding remote work trend.

For SMEs with scattered teams or mobile staff, this accessibility proves to be quite beneficial. Employees may collaborate more effectively and make sure that vital HR tasks are not restricted by physical office boundaries by using the HRMS platform from a variety of devices and places. This degree of adaptability fits in perfectly with the dynamic character of SMEs, allowing them to quickly adjust to shifting business needs.

3. Real-Time Updates and Collaboration

For well-informed decision-making in the hectic world of business, real-time information is essential. SMEs can benefit from quick upgrades and advancements using cloud-basedSME software, which eliminates the need for manual installations or interruptions. The service provider smoothly implements software updates, new features, and enhancements, guaranteeing that the HRMS platform always has the newest features.

Additionally, cloud-based HRMS makes it easier for SMEs to collaborate better. Various teams and departments may easily access and share information thanks to centralised data warehouses. This cooperative strategy improves collaboration and communication within the company while streamlining HR procedures.

4. Protection of Data and Security

Although cloud-based solutions have been the subject of many security worries, the truth is that these platforms usually use strong security measures that often outperform on-premise systems. To protect sensitive HR data, cloud-based HRMS and payroll software suppliers make significant investments in security infrastructure, such as firewalls, multi-factor authentication, and encryption.

A crucial component of HR administration is data privacy, and cloud solutions abide by legal requirements as well as industry norms. A cloud-based HRMS makes sure that all data, including payroll information and personal information about employees, is secured, often backed up, and shielded from unwanted access. These systems also frequently provide disaster recovery features, giving SMEs peace of mind in the event of unanticipated events.

5. The ability to scale and customise

Cloud-based HRMS software's scalability and customisation capabilities meet the special requirements of SMEs as they negotiate the challenges of expansion. The HR needs of expanding enterprises change over time, and cloud solutions adapt to these needs with ease. Due to cloud-based solutions' scalability, SMEs can quickly add or delete users in accordance with the size of their current workforce.

Another significant benefit is customisation. The unique requirements and work processes of SMEs can be accommodated by customising cloud-based HRMS software. Because of its adaptability, firms can customise the software to meet their own HR needs, making it a customised solution as opposed to a one-size-fits-all method.

Conclusion

SMEs looking to increase the efficiency, flexibility, and economy of their HR operations should consider implementing cloud-based HRMS software as a strategic move. The advantages are clear, ranging from scalability and strong security measures to real-time updates and improved cooperation. Embracing cloud-based HRMS is not just a technological upgrade but also a strategic investment that helps SMEs become more effective and adaptable as they continue to change in response to shifting business environments.

If you are a SME looking for an HRMS software provider, we strongly suggest you check out Opportune HR. They are one of the best HRMS softwares in Pune, Mumbai, Delhi and other major Indian cities. They also specialise in providing customised software to organisations, especially small and mid-sized businesses. It is also important to mention that they have bagged two awards for their HR services in 2023. Visit their website to learn more about their HR services.

0 notes

Text

Human Resources Software Companies

Growth of HR and Payroll Software Businesses in the U.S.

The human resources software industry continues to experience significant growth, with the number of HR and payroll software businesses in the United States reaching 665 in 2024. This figure represents an 11.4% increase compared to 2023, highlighting the sector's ongoing expansion and demand for digital solutions in workforce management.

Factors Driving the Expansion

The steady rise in the number of human resources software companies can be attributed to several factors. The increasing adoption of cloud-based HR systems, the need for streamlined payroll management, and the growing emphasis on employee experience have all played pivotal roles in this growth. As businesses of all sizes recognize the value of efficient HR and payroll processes, the demand for specialized software providers continues to rise. Human resources software companies have responded by offering innovative solutions tailored to meet diverse organizational needs.

The Role of Small and Medium-Sized Enterprises

Small and medium-sized enterprises (SMEs) have been key contributors to the growth of HR software businesses. With limited in-house resources for managing HR tasks, many SMEs turn to specialized software providers for assistance. These companies offer tools that help streamline recruitment, onboarding, performance tracking, and compliance, enabling SMEs to focus on their core operations.

Implications for the Future

The expansion of HR and payroll software businesses in the U.S. is likely to continue as organizations prioritize efficiency and adaptability in workforce management. This trend underscores the importance of technology in shaping the future of human resources.

For more insights on human resources software companies, visit besthumanresources.services.

#hr management#hr management software#hr management solutions#hr management system#hr service#hr services#human resource#human resources#human resources service#human resources services

1 note

·

View note

Text

The Rising Demand for Chartered Accountant Firms in Gurgaon: Driving Business Success

In today’s competitive economic landscape, businesses require more than just hard work to succeed—they need strategic financial planning, compliance management, and expert advice. This is where chartered accountant firms in Gurgaon come into play. Known for their exceptional expertise in navigating the complex world of finance, these firms are not just service providers but critical partners in growth for startups, SMEs, and large corporations alike.

Gurgaon, often referred to as the Millennium City, has emerged as a hub for multinational corporations, tech startups, and diverse industries. The city’s dynamic business environment has amplified the demand for skilled financial professionals, making chartered accountant (CA) firms indispensable.

Why Gurgaon’s Businesses Need CA Firms

1. Expert Financial Guidance

Chartered accountants offer tailored advice to businesses, helping them align their financial strategies with market demands. Gurgaon, with its mix of traditional businesses and modern enterprises, requires CAs who can bridge the gap between legacy practices and contemporary financial solutions.

2. Regulatory Compliance

The Indian regulatory framework is ever-evolving, and compliance is non-negotiable. From GST filings to corporate audits, CA firms in Gurgaon ensure businesses adhere to the latest laws, mitigating risks of penalties or legal disputes.

3. Startups and Tax Optimization

Gurgaon’s thriving startup ecosystem benefits immensely from CA firms. Startups often grapple with funding, tax planning, and resource allocation. Chartered accountants help them optimize their tax structure, secure funding through accurate financial projections, and manage costs effectively.

4. Expansion Strategies

As companies in Gurgaon eye national and global expansion, CA firms provide critical insights into mergers, acquisitions, and market entry strategies. Their due diligence processes safeguard businesses against unforeseen liabilities.

Services Offered by Chartered Accountant Firms in Gurgaon

Chartered accountant firms in Gurgaon cater to diverse financial needs. Here are some of the most sought-after services:

1. Audit and Assurance

Auditing is a cornerstone of financial integrity. CA firms conduct internal and statutory audits to ensure businesses operate transparently and efficiently.

2. Taxation Services

From income tax to GST compliance, CA firms handle the intricate details of taxation, ensuring businesses not only comply with laws but also optimize their tax liabilities.

3. Business Advisory

Businesses in Gurgaon often seek strategic advice on financial planning, risk management, and corporate structuring. CA firms provide actionable insights to help organizations achieve their goals.

4. Payroll and HR Management

CA firms streamline payroll processes, ensuring compliance with labor laws while maintaining employee satisfaction. This service is especially critical for Gurgaon’s tech-driven enterprises with large workforces.

5. Forensic Accounting

In an era of digital fraud and financial irregularities, CA firms in Gurgaon offer forensic accounting services to detect and prevent fraud, safeguarding businesses from financial losses.

What Sets Gurgaon’s CA Firms Apart

1. Industry Expertise

The CA firms in Gurgaon have deep domain knowledge across various industries, including IT, real estate, manufacturing, and e-commerce. This specialization ensures businesses receive relevant and practical advice.

2. Technological Proficiency

Adopting modern tools like cloud-based accounting software, AI-driven audits, and financial dashboards, Gurgaon’s CA firms deliver real-time financial insights to their clients.

3. Client-Centric Approach

Unlike traditional firms, chartered accountant firms in Gurgaon emphasize client satisfaction by offering personalized solutions, responsive communication, and dedicated support.

How to Choose the Right Chartered Accountant Firm in Gurgaon

Selecting the right CA firm can make or break a business’s financial health. Here are some tips to find the perfect match:

Check Credentials: Ensure the firm has certified and experienced professionals.

Evaluate Services: Look for a firm offering comprehensive financial solutions under one roof.

Ask for References: Speak to their existing clients to understand the firm’s credibility and performance.

Assess Technology: Choose firms that leverage modern accounting tools for better efficiency and accuracy.

Compare Costs: While cost is a factor, prioritize value over the cheapest option.

Success Stories: How Gurgaon’s CA Firms Empower Businesses

Case 1: A Startup’s Turnaround

A Gurgaon-based startup struggling with cash flow engaged a reputed CA firm to analyze its financial health. Through meticulous tax planning and cost optimization, the firm not only stabilized the business but also positioned it for growth.

Case 2: Expanding a Family-Owned Business

A family-run export business in Gurgaon sought advice from a local CA firm to expand its operations internationally. With proper financial structuring and compliance support, the business achieved seamless market entry into Europe.

The Future of Chartered Accountant Firms in Gurgaon

With Gurgaon’s status as a corporate hub continuing to grow, the role of CA firms will only become more critical. Whether it’s leveraging technology, adapting to global financial standards, or supporting ESG (Environmental, Social, and Governance) compliance, these firms are poised to redefine financial management in the city.

Conclusion

Chartered accountant firms in Gurgaon are the backbone of the city’s thriving business ecosystem. They empower companies with financial clarity, ensure compliance with evolving regulations, and provide the strategic foresight needed to navigate competitive markets. For any business aiming to grow sustainably in Gurgaon, partnering with a trusted CA firm is not just an option—it’s a necessity.

0 notes

Text

Business Efficiency with Husys Consulting Limited The Leading PEO Payroll Provider in India

In today’s dynamic business environment, companies constantly seek effective and cost-effective ways to manage their staff. For businesses looking to streamline their HR and payroll processes, PEO payroll providers crop as a necessary result. At the forefront of this industry is Husys Consulting Limited, a colonist in offering PEO services in India that feed the requirements of startups, SMEs, and large enterprises.

Read full post at - https://www.myvipon.com/post/1424062/Business-Efficiency-with-Husys-Consulting-Limited-amazon-coupons

0 notes

Text

How SMEs Can Benefit from Effective Due Diligence Processes

Economic growth, innovation, and employment opportunities are all significantly impacted by small and medium-sized businesses (SMEs). In contrast, SMEs frequently encounter particular difficulties like scarce capital, unstable markets, and fierce rivalry. As a way to navigate these challenges and make informed business decisions, SMEs can greatly benefit from efficient due diligence processes. SMEs can get comprehensive support from XcelAccounting to help them streamline these processes and achieve long-term success.

What is Due Diligence?

Due diligence is the method of carefully examining and evaluating a business opportunity to determine possible hazards, benefits, and broadening sustainability. This includes investigating financial information, legal papers, operational frameworks, and market trends to ensure that judgments are informed. Furthermore, due to being the process mandated by legislation, due diligence is a tactical instrument that SMEs could employ to reduce risks and gain beneficial insights.

Due Diligence Types That Are Important to SMEs

Financial Due Diligence: Analyzes a company's cash flow, revenue, profitability, and liabilities as part of financial due diligence.

Legal Due Diligence: Considers agreements, proprietary rights, complying with regulations, and all legal obligations as part of legal proper diligence.

Operational Due Diligence: Evaluates company practices, supply- chain consistency, overall the efficiency of operations.

Market Due Diligence: Evaluates consumer segments, the competitive environment, and market dynamics.

HR Due Diligence: Focuses examines company culture, contract of employment, and employee capabilities.

Effective Due Diligence's Advantages for SMEs

1. Making Adequately informed Selections

Excel Accounting assists SMEs discover company potential via thorough evaluation. Conducting due diligence offers all the data required to make accurate choices, the fact that it's applying for funding, expanding your company, or joining forces.

2. Mitigation of Risks

Risks like unreported obligations, court cases, or inadequate financial management have the potential to destroy SMEs. By using a thorough due diligence procedure, Xcel Accounting finds any warning signs and assists SMEs in taking preventative action to lessen risks.

3. Arise in Stakeholder Trust

Financial institutions, the shareholders, and partners in business are less inclined to engage with SMEs that showcase professionalism and accessibility. Among Xcel Accounting's due diligence solutions, businesses can boost mutual trust and confidence among their clients by ensuring that each aspect of the company is rigorously evaluated and compliant.

4. Optimizing Financial Prospects

To demonstrate their financial soundness, market potential, and growth strategy, SMEs looking for capital must do due diligence. By making sure your financial reports and business plans are both audit-ready and persuasive, Xcel Accounting helps you draw in investors and negotiate advantageous conditions.

5. Facilitating Acquisitions and Mergers (M&A)

SMEs might gain new skills or broaden their market reach through M&A deals. In order to guarantee smooth integration and long-term success, Xcel Accounting offers due diligence services that verify the operational, financial, and legal elements of possible acquisitions.

6. Acquiring a Competitive Advantage

Through competitive benchmarking and in-depth market analysis, Xcel Accounting assists SMEs in honing their strategy and spotting expansion prospects. Businesses can remain ahead of the competition and succeed over the long term with this knowledge.

7. Compliance with Regulations

Significant fines and harm to one's reputation may arise from breaking local laws and industry norms. Xcel Accounting lowers legal risks and improves operational stability by ensuring that SMEs follow all applicable requirements.

How Xcel Accounting Enhances Due Diligence Processes

Tailored Approaches: Xcel Accounting customizes its due diligence services to each SME's particular requirements, guaranteeing that important aspects are fully covered.

Expert Team:We have a group of seasoned individuals with profound insights, including market specialists, financial analysts, and legal counsel.

Advanced Tools: To expedite the due diligence procedure and produce precise findings, we make use of state-of-the-art technologies, including data analytics and risk assessment tools.

Complete Assistance: Xcel Accounting offers thorough assistance at every phase of the procedure, from data gathering and analysis to reporting and decision-making.

What Are Some Effective Due Diligence Techniques for Xcel Accounting?

1. Define Objectives

Choose a goal for the due diligence process, such as assessing a partnership, preparing for an acquisition, or evaluating market possibilities.

2. Data Collection

Xcel Accounting ensures accuracy and completeness by compiling all required papers, including contracts, financial statements, operational reports, and market evaluations.

3. Detailed Examination

Our group evaluates possibilities, risks, vulnerabilities, and strengths through a comprehensive process. We guarantee accurate and useful information by utilizing cutting-edge tools.

4. Implementable Suggestions

We offer specific suggestions based on our research to assist SMEs in making wise choices. Our insights are intended to help you succeed, whether that means approaching risks, renegotiating terms, or moving forward with a contract.

5. Constant observation

The process of due diligence never ends. SMEs may continue long-term growth and adjust to shifting conditions by regularly reviewing and monitoring their strategy with the aid of Xcel Accounting.

Common Challenges and How XcelAccounting Overcomes Them

Limited Resources

The financial and personnel resources necessary to carry out thorough due diligence are sometimes lacking in SMEs. Cost-effective solutions are offered by XcelAccounting, guaranteeing excellent services within financial limitations.

Data Accessibility

Accurate information can be hard to come by, especially when working with outside parties. Our proficiency in gathering and validating data guarantees accurate outcomes.

Time Constraints

SMEs frequently operate under tight timelines. XcelAccounting’s streamlined processes and dedicated team enable timely completion of due diligence activities without compromising quality.

Expertise Gaps

SMEs may lack specialized knowledge in areas like financial analysis or legal compliance. XcelAccounting’s multidisciplinary team bridges these gaps, delivering comprehensive and reliable evaluations.

Excel Accounting: Why Opt for It?

As a reliable partner for SMEs, XcelAccounting provides customized due diligence services that enable companies to make wise choices and experience long-term success. We assist SMEs in seizing opportunities, reducing risks, and laying a strong foundation for success with our knowledge, cutting-edge tools, and client-focused methodology.

Conclusion

SMEs that want to manage intricate business environments, reduce risks, and seize opportunities must do effective due diligence. The knowledge, resources, and assistance required to put in place strong due diligence procedures that promote wise choices and sustained expansion are offered by XcelAccounting. With Xcel Accounting as a partner, SMEs can confidently concentrate on their core business operations, knowing that their choices are supported by in-depth research and useful insights.

Connect us: [email protected]

#xcelaccounting#virtual cfo services#fractional cfo services#due diligence#accountingandbookkeping#tax filing services#businessplans

0 notes