#SBI Mutual Funds

Explore tagged Tumblr posts

Text

Best Mutual Funds, Online Investment Platform, Certified Financial Advisor | Sigfyn

https://www.sigfyn.com/ Get Best Mutual Fund Advisory at Sigfyn, we are best AI-powered platforms that provides personalized and holistic financial advisory to grow wealth by SIP. Invest in best mutual funds portfolios such SBI, HDFC, ICICI Prudential, Nippon India curated by expert-built algorithms.

#Best Mutual Funds#Online Investment Platform#Certified Financial Advisor#Financial Advisors#Mutual Funds#SBI Mutual Funds#HDFC Mutual Funds#ICICI Prudential Mutual Funds#Nippon India Mutual Funds#Sigfyn

4 notes

·

View notes

Video

youtube

SBI Mutual Fund SIP at ₹250 | Smart Investment or Just Hype?

0 notes

Text

Maximize Income: Become an SBI Mutual Fund Distributor and Thrive!

If you’re looking for a flexible and rewarding career in the finance industry, becoming an SBI Mutual Fund Distributor could be the perfect opportunity you’ve been searching for. SBI Mutual Fund is one of India’s most reputable mutual fund companies, offering a strong market presence and a wide range of investment products. As a SBI mutual fund distributor, you can position yourself as a trusted financial advisor and earn attractive commissions while helping individuals and businesses achieve their financial goals through mutual fund investments. Here’s how becoming an SBI Mutual Fund distributor can help you maximize your income and build a successful career.

Why Choose SBI Mutual Fund Distribution?

Reputable Brand SBI Mutual Fund is one of India’s most reputed and trusted financial institutions. Associating with such a reputed brand gives you credibility and trust of potential clients, making it easier to build a customer base.

Attractive Earning Potential As an SBI Mutual Fund distributor, your earnings are directly linked to the number of clients you acquire and the value of their investments. You can earn commissions on both upfront and trail commissions, which means you can continue to earn even after the initial investment is made, till the last investment.

Diverse Product Range SBI offers a wide range of mutual fund schemes, which include equity funds, debt funds, hybrid funds, and more. This gives you the flexibility to sell different investment products as per client needs, whether they are looking for high returns or less risky investment options.

Comprehensive Training and Support SBI provides thorough training and resources to ensure that you are equipped with the knowledge you need to succeed. From understanding different fund options to learning how to provide tailored financial advice, the support system is robust for new and experienced distributors alike.

No Fixed Working Hours One of the biggest advantages of being a mutual fund distributor is the flexibility of working hours. You can work from anywhere and at any time that suits you. This flexibility allows you to balance work and personal life, making it an ideal option for those looking for a non-traditional career.

Steps to Become an SBI Mutual Fund Distributor

Pass the NISM Certification The first step to becoming an SBI mutual fund distributor is to pass the NISM Series V-A: Mutual Fund Distributors Certification Exam. This certification is essential for understanding mutual fund schemes, financial markets, and investment strategies. Once you pass the exam, you’ll receive an NISM certificate. You can take the help of NISM Mock test to pass the exam

Register for an ARN Number After passing the NISM exam, you must register for an AMFI Registration Number (ARN) through the Association of Mutual Funds in India (AMFI). This unique number identifies you as an authorized distributor.

Sign Up with an AMC To start marketing SBI Mutual Fund schemes, you’ll need sbi mutual fund distributor login credentials with an Asset Management Company (AMC), like SBI Mutual Fund, and obtain an ARN. AMCs provide training, resources, and support to help you succeed in distributing your funds.

Roles and Responsibilities of an SBI Mutual Fund Distributor

As an SBI mutual fund distributor, you will:

Educate Clients: Help clients understand various mutual fund options, risk factors, and expected returns, ensuring they make informed investment decisions.

Assess Risk Tolerance: Assist investors in determining their risk tolerance and recommend suitable funds (e.g., debt, equity, or hybrid funds).

Offer Personalized Investment Advice: Guide clients in selecting the best mutual fund schemes tailored to their financial goals.

Develop Investment Plans: Create investment strategies for clients that align with their financial objectives, helping them achieve long-term wealth.

Assist with Documentation: Help investors with the necessary paperwork for mutual fund investments, ensuring a smooth and hassle-free process.

Eligibility to Become an SBI Mutual Fund Distributor

Age: You must be at least 18 years old.

Educational Qualification: A minimum qualification of 10+2 (Higher Secondary) is required.

Certification: Passing the NISM va Certification (National Institute of Securities Markets) is mandatory to become a certified mutual fund distributor.

Conclusion

Becoming an SBI Mutual Fund Distributor is an excellent opportunity for those looking to thrive in the financial services industry. With flexible working hours, attractive earning potential, and the backing of a reputable brand, you have the tools you need to build a successful business. By focusing on relationship-building, continuous learning, and adapting to market trends, you can maximize your income and create long-term success as an SBI Mutual Fund distributor.

0 notes

Text

SBI SIP Calculator - calculate your investment returns

SBI SIP Calculator - Systematic Investment Plan calculator helps you to determine the returns you can avail while investing funds in such investment tools.

#sbi-sip-calculator#sbi-mutual-fund-calculator#sbi-sip-interest-rate#mutual-fund-calculator-sbi#sip-return-calculator-sbi#sbi-small-cap-fund-calculator

0 notes

Text

SBI Mutual Fund 2025 सिर्फ् ₹2000 कि Investment से बन सकता है 14 लाख रुपया ,क्या है तरीके

SBI Mutual Fund 2025 :क्या आप जानते हैं कि सिर्फ दो हजार रुपये प्रति महीने का निवेश आपको 13 लाख रुपये से अधिक का पैसा दे सकता है? SBI Flexicap Fund Direct Growth के इस बेहतरीन प्लान को जानें और अपने सपनों को साकार करने के लिए तैयार हो जाएं। अब शुरू करें,SBI Flexicap Fund Direct Growth, अगर आप म्यूचुअल फंड में निवेश करने की सोच रहे हैं, एक अच्छा विकल्प हो सकता है। लंबे समय से निवेशकों ने स्थिरता…

#best sbi mutual fund 2025#best sbi mutual fund for 2025#best sbi mutual fund for lumpsum investment 2025#best sbi mutual funds for 2025 in india#is sbi mutual funds safe to invest in#redeem sbi mutual fund units online#sbi best mutual fund 2025#sbi equity fund return#sbi hybrid equity fund#sbi hybrid equity fund 2023#sbi investment plan 2023#sbi low risk mutual fund#sbi mf best fund 2023#sbi mutual fund 2025#sbi mutual fund account#sbi mutual fund apply online#sbi mutual fund best plan 2025#sbi mutual fund best plan 2025 malayalam#sbi mutual fund best plan 2025 tamil#sbi mutual fund dividend#sbi mutual fund exit load#sbi mutual fund explain#sbi mutual fund focused equity fund#sbi mutual fund good or bad#sbi mutual fund news#sbi mutual fund nri#sbi mutual fund one time mandate#sbi mutual fund otm registration#sbi mutual fund plan 2025#sbi mutual fund redemption online

0 notes

Text

Which Loan is Best, FD, Gold Loan, Mutual Fund, Personal Loan

What is Loan

Some Types of Loans

FD (Fixed Deposit) Loan

You can take a loan against bank FD without breaking it. In this way, along with the benefit of maintaining the savings deposited in the bank, one also gets the necessary cash.

The interest rates (12–15%) applicable on FD loans are also lower than personal loans. This loan is also easily available immediately. Also, there is no need to submit many documents to the bank for this. Savings also remain intact along with debt.

Gold Loan

Gold loans have become attractive these days as gold prices have reached Rs 75,000 per 10 grams. Now you will get more loan than before on mortgaging jewellery.

READ MORE>>>>

#which loan is best#Which loan is best in india#Which Bank is best for personal loan with low interest#Which loan is best for bad credit#FD LOAN#Personal Loan#Gold Loan#Mutual Fund#HDFC Personal Loan#Personal loan rate of interest#Personal loan calculator#interest rate#Fd loan sbi#Gold Loan interest rates#Gold loan Calculator#Gold Loan SBI#Mutual fund calculator#Mutual funds India#SBI Mutual Fund#Mutual fund investment#4 types of mutual funds#Mutual Fund Sahi Hai#HDFC Mutual Fund#Mutual Fund investment Plan#SBI Gold Loan interest rate#Gold loan per gram#Gold loan EMI calculator#Gold loan near me#IIFL gold loan#Fd loan calculator

0 notes

Text

Shape your financial Goals with SBI Mutual Fund's Investment Tools & Calculators. These tools do not just help in setting up a financial goal, but also offer potential solutions on how to meet your goals.

1 note

·

View note

Text

Sovereign Gold Bond vs. Gold ETF: A Comprehensive Comparison for Smart Investors

Over the last few years, the concept of digital gold has arrived in a big way. It started off with gold ETFs and then came the highly popular Sovereign Gold Bond scheme. There are also other digital gold holding vehicles like international gold funds, gold futures and digital gold. In this blog, the focus would largely be on understanding the relative merits and demerits of the sovereign gold bond vs gold ETF debate, and which is more suitable and under what circumstances. Also, a comparison of gold ETF vs SGB is provided on parameters like liquidity, flexibility, charges and tax implications.

What are Sovereign Gold Bonds (SGB) all about?

SGBs or Sovereign Gold Bonds have been around in India since Nov-2015 and have been gradually gaining in heft. These SGBs are central government-backed bonds, denominated in grams of gold. The underlying holding in grams of gold is guaranteed by the central government. In addition, these sovereign gold bonds also bear an interest of 2.50% annually on the issue price, which is paid semi-annually to the investor. Investors also get an upfront discount of Rs. 50/- per gram if the payment mode is digital. SGBs are also advantageous as they do not have the hassles like storing gold, making charges, risk of loss etc.

What really stands out about the SGB is the sovereign guarantee and that the returns are pegged to the price of gold. What the government guarantees is the payment of interest at 2.50% per annum and the holding of gold in grams. Considering that gold has generally given positive returns over longer periods of time, it makes investment in SGBs relatively secure and attractive too.

The SGBs can be held either in physical form or in demat form, as part of the demat account.

Gold ETFs (Exchange Traded Funds)

Unlike SGBs that are issued by the central government, gold ETFs are issued by the mutual fund houses registered with SEBI. They are issued in the form of gold units pegged as equivalent to a certain weight in gold expressed in grams. Gold ETFs are typically closed-ended in that once the NFO period is over, the fund does not offer any purchase or sale of units. However, being Exchange Traded Funds, they are mandatorily listed on the stock exchanges and investors wanting to buy or sell gold ETFs can do so using their existing demat account and trading account.

Gold ETFs are very liquid and hence, entry & exit is hardly a problem without any price damage. You can trade in gold ETFs just as you trade in stocks. It must be noted here that gold ETF issuing mutual funds are required to maintain physical gold equivalent to the units sold with a gold custodian bank as a backing.

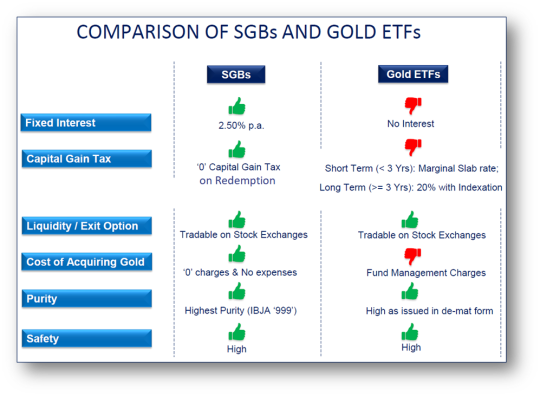

Sovereign Gold Bond VS Gold ETF

Let's compare the sovereign gold bonds and the gold ETFs on a variety of parameters like returns, risk, flexibility, liquidity, taxation, etc. This sovereign gold bond vs gold ETF comparison will allow investors to make the best choice.

Here are the highlights of the gold ETF vs SGB debate.

1. How do SGBs and Gold ETFs compare in returns?

Remember, both SGBs and gold ETFs are linked to the price of gold. If the price of gold goes up, then the capital appreciation will benefit the SGB and also the gold ETFs. The difference lies in the interest paid. For instance, SGBs pay an additional assured interest of 2.50% per annum, but such assured returns do not exist in gold ETFs.

2. How do SGBs and Gold ETFs compare in risk?

One can argue that since both are backed by gold, there is no asset risk; however, there is a difference.

Even though SGBs do not have physical gold backing, the returns on these bonds are pegged to gold prices. And they have an explicit guarantee by the central government regarding the gold holding and the interest payable. In the case of gold ETFs, there is no explicit guarantee (sovereign or otherwise) but they do have the physical gold with the gold custodian bank.

3. How do SGBs and Gold ETFs compare in taxation?

Gold ETFs are treated as non-equity assets and hence the capital gains, if any, would be treated as short-term gains if held for less than 3 years and taxed at the marginal tax rate applicable. If the gold ETFs are held for more than 3 years, they are long-term capital gains and they attract tax at 20% with the benefit of indexation.

In the case of SGBs, the method of taxation is the same, with just one critical difference. If the SGBs are held till redemption, then any capital gains on the SGBs are fully tax-free in the hands of the investor. However, interest on gold bonds is fully taxable.

4. How do SGBs and Gold ETFs compare in costs?

Sovereign gold bonds don’t have any recurring cost of ownership. Gold ETFs on the other hand, have annual charges, including brokerage and expense ratio ranging from 0.50 – 1.00%. The costing of SGBs is a lot more transparent than Gold ETFs.

5. How do SGBs and Gold ETFs compare in liquidity?

Gold ETFs can be bought and sold in the secondary market using your existing trading and demat account with your stock broker. SGBs can be bought at the new issue period, which can be several times during the fiscal year. Outside that, SGBs are listed on the stock exchange, but the liquidity is limited.

Let’s look at the table below to quickly review the gold ETF vs SGB debate

To sum up the sovereign gold bond vs gold ETF debate, both are digital modes of holding gold and are linked to gold prices.

Among 6 key parameters viz. fixed interest, taxation, liquidity, costing, purity and safety, SGB stands out across all. On the other hand, Gold ETFs are highly liquid and do not have a maximum investment limit, allowing investors to buy as much as they want while in case of SGBs maximum investment limit for individual investors is 4kg in a Financial Year

Eventually, investors need to take a call on the gold ETF vs SGB choice based on their financial goals & risk profile; and returns, risk, liquidity, taxation, & convenience the products have to offer.

Source URL: https://www.sbisecurities.in/blog/sovereign-gold-bond-vs-gold-etf

0 notes

Text

#best online coaching for ras#best test series for ras#Daily Current Affairs Capsules 28th December 2023#Daily Current Affairs Capsules 28th December#RBI permits ICICI Pru Mutual Fund to acquire 10% stake in Federal#RBL Bank#SBI#HDFC Bank will need to maintain higher capital from FY25#says RBI#RBI flags concentration risk among govt-NBFCs#RBI approves IDFC-IDFC First Bank merger#Actor-Politician Vijayakanth Dies At 71#Japan lifts operational ban on world's biggest nuclear plant#India Makes Its 1st-Ever Rupee Payment For Crude Oil Purchase From UAE#RBI Unveils Forex Correspondent Scheme to Enhance Foreign Exchange Services#Incident Of Ammonia Gas Leakage Reported#Reliance Jio working on 'Bharat GPT' with IIT-Bombay#The Hindu Newspaper Analysis#Current affairs 2024#Current affairs 2023#Daily Current Affairs Capsules#Weekly Current Affairs 2023#Daily Current Affairs Class 24#Daily Current Affairs#Current affairs#Current Affairs#Today Current Affairs#Latest Current Affairs 2023#Daily Current Affairs Capsule#Current Affairs Capsule

0 notes

Text

বেষ্ট এস বি আই মিউচুয়াল ফান্ড ২০২৩। স্টেট ব্যাঙ্ক অফ ইন্ডিয়া নিফটি ইনডেক্স ফান্ড ২০২৩

এস বি আই বেষ্ট মিউচুয়াল ফান্ড:- বন্ধুরা আজকের এই পোস্টটিতে আমরা এসবিআই অর্থাৎ স্টেট ব্যাঙ্ক অফ ইন্ডিয়া এর একটি অত্যন্ত লাভজনক মিউচুয়াল ফান্ড প্ল্যান সম্বন্ধে জানব। যেখানে আপনার মান্থলি ইনকাম এর পাশাপাশি আপনার মূল ইনভেস্টমেন্টের সাথেও হাই ইন্টারেস্ট যুক্ত হবে। যেটি মূলত পোস্ট অফিস এবং এলআইসি এর মান্থলি ইনকাম স্কিম গুলির ক্ষেত্রে হয় না। তো বন্ধুরা এর আগে আমরা এলআইসি অর্থাৎ ভারতীয় জীবন বীমা…

View On WordPress

0 notes

Video

youtube

Best SBI Mutual Fund for Lumpsum Investment 2024

0 notes

Text

SBI Mutual Fund SIP Calculator – Plan Your Investment Returns

SBI SIP Calculator - Systematic Investment Plan calculator helps you to determine the returns you can avail while investing funds in such investment tools.

#sbi-sip-calculator#sbi-mutual-fund-calculator#sbi-sip-interest-rate#mutual-fund-calculator-sbi#sip-return-calculator-sbi#sbi-small-cap-fund-calculator

0 notes

Text

Is SBI a Safe Bet for Long-Term Investment? Here's What the Experts Say

To make informed decisions, investing in the stock market necessitates careful consideration and analysis. State Bank of India (SBI), being quite possibly of the biggest bank in India, frequently grabs the eye of financial backers looking for long haul speculation open doors. Be that as it may

Read More

0 notes

Text

How to Place an Equity SIP (E-SIP) Order through SBI Securities App?

youtube

Equity-SIP Is A Tool That Helps You Build Your Portfolio Over The Long Run With Consistency & Discipline! Enjoy a Fast, Seamless and Intuitive investing

0 notes

Text

Swipe👉 . . SBI Mutual Fund is launching two new NFOs, offering a great opportunity to invest in India’s top public sector banks.

SBI BSE PSU Bank Index Fund – Passively track the performance of leading PSU banks and grow with them. SBI BSE PSU Bank ETF – Trade directly on NSE and BSE for added flexibility and market exposure.

NFO Details: Open: March 17, 2025 Close: March 20, 2025 Minimum Investment: ₹5,000

Don’t miss this opportunity to invest in India’s banking sector with SBI Mutual Fund.

0 notes