#Royal Sense IPO

Explore tagged Tumblr posts

Text

Royal Sense Share Price Surges: A Closer Look at the Factors Behind the Rise

Introduction

In recent weeks, investors have witnessed a remarkable surge in the Royal Sense Share Price, Its a leading supplier of high-quality healthcare products. This sudden increase has sparked curiosity among analysts and shareholders alike, prompting a closer examination of the factors driving this upward trajectory of the Royal Sense Share Price . Royal Sense serves as a provider of top-notch products adhering to global standards essential for healthcare facilities like hospitals, laboratories, institutions, and clinics. Its extensive offerings include a broad spectrum of surgical accessories, tools, equipment, and related items.

The company operates with a steadfast commitment to positioning itself as the ultimate solution for customers seeking comprehensive medical supplies, encompassing equipment, instruments, consumables, laboratory essentials, reagents, diagnostics, pharmaceuticals, sanitary products, medicines, and cosmetics. This endeavor is fueled by a strategic approach, forward-looking mindset, and progressive ethos.

To optimize operational efficiency, Royal Sense has structured its infrastructure into various departments, including sales and trading, procurement, quality assurance, storage, and packaging.

Additionally, the company has curated a dedicated team that engages directly with clients, ensuring a personalized experience. Its ethos is reinforced by straightforward payment methods, transparent business dealings, customer-centric practices, adherence to ethical standards, and competitive pricing strategies.

Royal Sense was officially established on April 6, 2023, with its registered headquarters located at Plot No 57, First Floor, Badli Industrial Area, Badli, Samaypur, Delhi, 110042.

Understanding Royal Sense

Founded with a commitment to providing top-tier healthcare solutions, Royal Sense has established itself as a trusted name in the industry. With a diverse range of products meeting international standards, the company caters to the needs of hospitals, laboratories, institutions, and clinics worldwide.

Analyzing the Surge

Strong Financial Performance: One of the primary factors contributing to the rise in Royal Sense's share price is its robust financial performance. Recent quarterly reports have showcased impressive revenue growth and solid profitability, instilling confidence in investors.

Market Expansion Initiatives: Royal Sense's strategic initiatives aimed at expanding its market presence have also played a significant role in driving investor interest. Through partnerships, acquisitions, and geographical expansion, the company has strengthened its position in key markets, fueling optimism about future growth prospects.

Innovation and Product Development: Continuous innovation and the development of new products have further bolstered Royal Sense's competitive edge. By staying at the forefront of technological advancements and addressing emerging healthcare needs, the company has enhanced its attractiveness to investors seeking long-term value.

Favorable Industry Trends: The healthcare sector, particularly in the wake of global health challenges, has experienced heightened demand for essential medical supplies and equipment. Royal Sense's focus on delivering high-quality goods aligned with international standards positions it favorably to capitalize on these trends, driving investor confidence.

Positive Market Sentiment: Amidst volatile market conditions, Royal Sense's consistent performance and strategic vision have garnered positive sentiment from investors. The company's transparent communication, coupled with effective management practices, has cultivated trust and loyalty among shareholders.

Conclusion

The surge in Royal Sense's share price reflects not only its strong financial performance but also the effectiveness of its strategic initiatives and commitment to innovation. As the company continues to navigate the evolving healthcare landscape, investors remain optimistic about its growth potential and long-term value proposition.

#Royal Sense Share Price#Royal Sense IPO#Royal Sense Pre IPO#Royal Sense Unlisted Shares#Royal Sense Upcoming IPO

0 notes

Text

Uber (Ch)eats

Uber is not a business in the traditional sense. It's a "bezzle" ("the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it").

The only reason Uber was able to attain growth was because investors gave it billions to lose. First, it was the Saudi Royals, hoping to spend their way to a transportation monopoly.

https://pluralistic.net/2020/05/19/larval-pegasi/#long-con

When that didn't work, the company's investors suckered the public into taking their shares off their hands in an IPO premised on two things:

I. Self-driving cars

II. All buses and subways *in the world* being scrapped and replaced with Ubers.

https://pluralistic.net/2021/02/19/texas-lysenko/#unter

Neither of those things have happened, of course. Uber actually had to pay someone else $400m to "buy" the self-driving car division it sank $2.5b into (the resulting cars could not travel for one mile without a serious accident).

https://pluralistic.net/2021/02/19/texas-lysenko/#unter

Replacing all the world's transit is also a long-shot. That means that Uber's bezzle is running out, forcing the company into ever-more-desperate measures to keep money flowing from suckers ("investors") who believe that a pile of shit this big *must* have a pony under it.

Measures like spending hundreds of millions of dollars on California's Proposition 22, which legalized worker misclassification. Measures like rampant wage-theft from drivers. Measures like waging legal wars against whistleblowers.

https://pluralistic.net/2021/02/19/texas-lysenko/#unter

Uber's "innovation" wasn't self-driving cars. It was cheating. Uber is *really fucking good* at cheating.

How good? Well, last year, Uber managed to dodge tax on $6b in global revenues by laundering its income through *fifty* Dutch shell companies.

https://www.businessinsider.com/uber-tax-avoidance-50-dutch-shell-companies-5-billion-revenue-2021-5

A report from the Australian NGO Center for International Corporate Tax Accountability and Research (CICTAR), reported in the Dutch press, describes Uber's tax evasion innovations as "the Champions League of tax avoidance."

https://www.groene.nl/artikel/een-goedkoop-ritje

It's quite a whirlwind of socially useless financial engineering, composed of obvious frauds like "selling" its IP to a Dutch subsidiary financed with a $16b "loan" from a Singaporean subsidiary, garnering 20 *years*' worth of $1b annual tax credits.

The Netherlands may be a bastion of progressive politics, but it's also one of the world's leading onshore-offshore tax havens, joining Cyprus, Luxembourg, Delaware, Wyoming and the City of London as a key player in the global money-laundry.

Its lax enforcement didn't just encourage Uber to create 50 shell companies - it also let the company get away with failing to file "mandatory" disclosures for many of these "businesses."

All of this redounds around the world - in India, Uber pays only half of the mandatory 6% tax owed by multinationals (India could really use that cash about now).

Image: Vectors Point, PK (modified) https://thenounproject.com/term/robber/3239420/

Ian Merchant (modified) https://www.flickr.com/photos/iainmerchant/33258321552

CC BY: https://creativecommons.org/licenses/by/3.0/us/legalcode

77 notes

·

View notes

Note

Have you heard about MM’s new children’s book being released just a few days before Catherine’s pandemic book? I thought they wanted privacy and yet time and time again they keep trying to one up the royal family! Plus the motives behind their book pales in comparison to Catherine’s being a collection of pandemic related photos..while hers is a “love letter”to her husband. Where’s the privacy? All i can smell is hypocrisy

Long post incoming!

I’d like to say I’m surprised but I’m not.

Didn’t they trademark Archewell under various classes?

https://trademarks.ipo.gov.uk/ipo-tmcase/page/Results/1/UK00003479914

The pair of them seriously think that they’ll make lots of cash from their love story.

What they don’t see is that they have a very limited group of fans and er... that’s it.

At this point in time, the Sussexes and their machine don’t care about the Sugars. It’s good marketing sense to go after the customers and audiences that you don’t yet have. That’s what translates into profit and success. Not stagnation.

Unfortunately for the Sussexes, they’ve shot themselves in the foot by:

* Biting the hand that feeds them. Very few people in the UK are now enamoured by them and so expect any type of merchandise and/or PR to be an utter fail.

In the same way that The Sun newspapers don’t sell AT ALL in Liverpool due to lies spouted during the Hillsborough disaster is the same way that anything these two try to throw at us will not be successful.

* The Commonwealth. The duo miscalculated just how important the Royal family still is to the Commonwealth. The PR of Meghan leaving due to racism did not stick.

Why?

Because even at it’s lowest level, the average black person that doesn’t support the Royal Family will say the following:

“Of course they’re racist. What was she expecting when she entered the family? Now she wants my support? Is she dumb? How old is she? (That she hasn’t yet learnt which circles to mix in?)

* The Queen and Prince Philip. Incredible old age and one at death’s door at the time of the Oprah interview. And yet they still went after the institution and their ‘bosses’ like that. You don’t offend our 95-year-old Queen and get away with it that easily.

* The titles. They are still to this day referring themselves as Duke and Duchess. The fact that Meghan Markle and Hasbeen are still going by those titles has to be affecting their mental health, no? Or is their mental health only affected when not profiting from these terrible, titles given by a racist institution?

As for launching the book around the same time as our ‘trusty and well-beloved’ Duchess of Cambridge... they need that connection. They’re desperate for that connection because let’s face it, take that away from them and what do they have?

Nada. Nothing. Zero. Rien.

So , they will continue to spin the story of two star-crossed lovers who fell in love and against all odds (racist UK and family) managed to find the strength to leave a toxic situation and are now living happily ever after.

They invite you to share in their happiness by liking, commenting and also subscribing to their podcast.

Oh, and to buy their books.

All while promoting compassion in action.

Influencer much?

Ain’t nobody checking for these two apart from sugars. I’m just waiting for their downfall while my Duchess of Cambridge rises.

#royal family#royals#uk royal family#meghan markle#duchessofsussex#harry and meghan#meghanandharry#just harry#megain#brf#duchess of cambridge#british royal fandom#british royalty

12 notes

·

View notes

Note

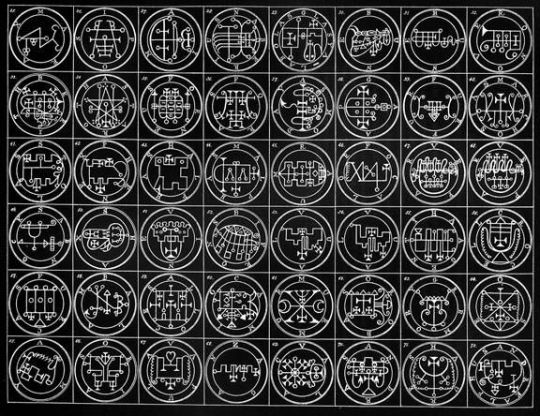

is it me, or does Goetia's Buer sound like a good guy? or at least a true neutral at that, this descriptions make him look like a intellectual in philosophy, a tea aficionado and a skilled medic. so what if he is a polite daemon? MAYBE he lacks true morality but from what i can tell from this descriptions, he seems like at least a cultured (possibly) polite dude.

You know, there’s a lot of them that sound like they wouldn’t want toimmediately rip your throat out. That’s why I was waiting to answer this one; Iwanted to go through all 72 and pick out the Goetia Goodies (O) and theGoetia Goons (X). Let’s see, in order...

BAEL: Hoarse voice, spider legs, fussy. Sounds like a royal pain! (X)

AGARES: I doubt he can always rein in that croc. (X)

VASSAGO: One of many to tell the past and future, he can also helpyou find things you’ve lost. Just so long as you keep it clean, I guess. (O)

GAMIGIN: A horse with a hoarse voice. That’s unethical. (X)

MARBAS: Can cure diseases, but also cause them. Surely in league withBig Pharma! (X)

VALEFOR: Tempts people to steal! (X)

AMON: Spits fire, but cures controversies between friends. Can alsocause feuds? But I have a soft spot for Amon, so... (O)

BARBATOS: Lets you understand birds and dogs, opens magical chests. Whata pal! (O)

PAIMON: The most obedient to Lucifer, definitely a Bad Boy. (X)

BUER: And here we are at the gentle Dr. Buer. (O)

GUSION: Depending on what a “Xenopilus” is, he’s otherwise all aboutfriendships. (O)

SITRI: One of those who makes people horny. Armed and dangerous. (X)

BELETH: He’s got all those trumpeters. Very annoying! (X)

LERAJE: The belligerent demon Robin Hood. (X)

ELIGOR: Knows all about wars, but doesn’t seem to be all about fightingthem. Still, will err on the side of caution here. (X)

ZEPAR: Can make people infertile! What a dickweed. (X)

BOTIS: Future-telling, reconciliation, but never trust a viper with asword. (X)

BATHIN: The first of those who can teleport people. Neat, but rife forabuse (and Star Trek-style transporter accidents). (X)

SALLOS: Another croc-rider, but specifically saying he’s peaceful. Well,I’m sold. (O)

PURSON: Rides a bear. Despite that,the Kings are probably not to be trusted. (X)

MORAX: Thebull-man who just want to make the world a smarter place. (O)

IPOS: The UgliestDemon, but he makes people witty. A Cyrano in our midst? (O)

AIM: Apyromaniac. (X)

NABERIUS: Another teacher! (O)

GLASYA-LABOLAS:"An author of Bloodshed and Manslaughter." (X)

BUNE: Dispensesmoney. Commie! (X)

RONOVE: Themonster man who nonetheless is a rhetoric expert. (O)

BERITH: He is thePhilosopher's Stone in demon form. All that gold will crash the markets! (X)

ASTAROTH: One ofthe nastiest. Plus he has bad breath! (X)

FORNEUS: Morerhetoric and friend-making. (O)

FORAS: Can makepeople invisible. Lead us not into temptation! (X)

ASMODEUS: Need Isay more? (X)

GAAP: Makespeople ignorant. (X)

FURFUR: Anotherfickle one about summoning, can also cause thunderous storms. (X)

MARCHOSIAS:Vomits fire, but really wants to be an angel again, so perhaps would still beon his best behavior. (O)

STOLAS: All aboutthat astronomy and those herbs and precious stones. No bias here! (O)

PHENEX: A sweetsinger and poet. Another who wishes to be an angel once more. (O)

HALPHAS: Probablynice, but is also the bad kind of gun nut. (X)

MALPHAS: Can readthe minds of your enemies. As if you don't already know from their passive-aggressivetweets and comments. (X)

RAUM: Anotherdirty thief (but of rich kings, so maybe it's OK), but also destroys cities.Oh. (X)

FOCALOR: Killsand drowns people. Right to the point! Or to the bottom? (X)

VEPAR: Guideswarships, but also putrefies sores and causes worms to breed in them. Gross!(X)

SABNOCK: LikeHalphas, only for armor, but shares Vepar's vile worm-breeding-in-sores power. (X)

SHAX: The stealerof senses! (X)

VINE: Discoverswizards and witches (!), but causes rough storms on waters. Also a King. (X)

BIFRONS: Doesn'tseem so bad, but hangs out with the dead so he's probably fetid. (X)

UVALL: AnotherGoetia PUA. (X)

HAAGENTI: Morealchemy. These demons need some new hobbies! (X)

CROCELL: Candiscover baths and warm them up real nice, but also creates noises that soundlike rushing torrents, like some weirdo. Consider it ambiance, I guess. (O)

FURCAS: ThisKnight is a "cruel old man" who teaches pyromancy. We live in theuniverse where pyromancy is OP, so... (X)

BALAM: Invisibility,King, Bear. Not a good enough ratio. (X)

ALLOCES: NO MORE WARRIORSON HORSES, PLEASE (X)

CAIM: The bird-man, he lendsunderstanding of animals and the waters (!), and things to come. He answers inhot coals, so as long as he's not summoned near flammable objects Caim probablywon't give you any trouble. (O)

MURMUR: A PERFECTphilosophy teacher and mediator to the dead. Just wear earplugs for histrumpeting cohorts. (O)

OROBAS: Tells ofthe past, present, future, and of divinity and the creation of the world. Saidto be "very faithful" to the summoner. What's not to love? (O)

GREMORY:Future-telling, but another that messes with the hearts of women, if commanded.Come on occultist, just use a dating app like everyone else! (X)

OSE: Ose cantransform the summoner into "any Shape." Keep your fetishes toyourself. (X)

AMY: The flamingliberal science teacher. Like Caim, practice fire safety and you should becool. (O)

ORIAS: Anastrologer, but can also magically promote people through ranks, presumablythose undeserving of it. (X)

VAPULA: A winged,lion-headed professor of "all handicrafts and professions." (O)

ZAGAN: The bullKing, can transmute blood into wine. Sounds a hair more effective than a winefestival. (X)

VOLAC: Tellswhere hidden treasures are and where serpents may be seen. Needs a friend,badly. (O)

ANDRAS: If youtreat him as a joke, Andras will straight up kill you; suppose he's tired ofbeing laughed at for being an owl-headed man riding a wolf. (X)

FLAUROS: Anotherparticular demon; will lie if things aren't just right, but can also burnpeople to death. (X)

ANDREALPHUS: Whowouldn't want to learn geometry from a peacock? (O)

KIMARIS: The lasthorseback warrior. Logic, rhetoric, rules spirits of Africa,etc. (O)

AMDUSIAS: Themusician of Hell, Amdusias can also bend trees to the summoner's will. That'sso weirdly specific I think I have to give it a pass. (O)

BELIAL: The KingBelial seems to be another fickle with the summoning process, requiring giftsand sacrifices, but is written to have a better demeanor than many others.Still, play with fire... (X)

DECARABIA: Theoriginal star man and ornithologist, he just wants you to understand birds! (O)

SEERE: He's likea demonic U-Haul truck, carrying things to and fro as demanded. Tells of thievery,but doesn't seem to condone it explicitly. (O)

DANTALION: Thelast great teacher of the 72, but can control people's minds. (X)

ANDROMALIUS:Perhaps the most just of all the demons, Andromalius is said to catch andpunish thieves and "discover all wickedness." There must be a lot ofinternal conflict in Hell's hierarchies, eh? (O)

So out of the 72, I have determined that 27 of them would be kind of nice. That’s not bad! But aside from the many teachers among them, Buer probably ends up with one of the best professions and demeanors, if not the best.

Of course, all of these demons still have command over X number of demon legions, Buer with 50, so it’s probably all relative, anyway.

2K notes

·

View notes

Text

Gold ETF That Makes a Difference

Source: Bob Moriarty for Streetwise Reports 07/25/2019

Bob Moriarty of 321Gold profiles a precious metals ETF that has “absolutely obliterated its main competition.”

The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) just had its two-year anniversary at the end of June, and since inception, the fund has absolutely obliterated its main competition.

GOAU delivered a remarkable 41% since inception through July 24, crushing the hugely popular VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ), which were up 32.7% and 27.6% over the same period.

Some might call it beginner’s luck. I call it superior planning. Here’s why

Dummy Diversification

If you look at the construction of VanEck’s products, personally, I would describe them as dumb. The GDX and GDXJ are over diversified. GDX has close to 45 holdings while its junior counterpart has as many as 70.

In the senior ETF, Newmont Goldcorp is the number one holding at almost 12%, followed by Barrick at just over 10% and Newcrest at 6.5%.

The GDXJ is even more watered down. The top holding, Northern Star Resources, represents only 6% of the fund.

What it really comes down to is that both funds are market cap-weighted. That’s no way to build a gold fund, as I see it. No thought or analysis has gone into stock selection or weighting. Investors are getting little or no exposure to companies that are growing the fastest. The chart above makes that very clear.

Like I said: Dumb-as-bricks. VanEck takes you for a fool and is banking on you not having a clue. I hate to say it, but if you’re fine with this, you deserve what VanEck is selling.

An Emphasis on Royalty and Streaming Companies

GOAU just does things differently and, frankly, better. I like it a lot. Unlike the GDX and GDXJ, GOAU is a dynamic, rules-based gold ETF. As of my writing this, the ETF is concentrated in fewer than 30 names, all of them high-quality with strong balance sheets, and it’s rebalanced and reconstituted every quarter.

Obviously this is why it’s destroying its much larger competition. But there’s more to it.

GOAU is the first gold ETF that I know of that has such a large weighting in royalty and streaming companies. Approximately 30% of the fund is devoted to royalties.

If you don’t know what these are, I suggest you buy my latest book, Basic Investing in Resource Stocks: The Idiot’s Guide. I have an entire chapter on what makes royalty and streaming companies a solid bet in the gold industry. But in short, they help investors get exposure to gold and precious metals mining without taking on a lot of the risks that producers face.

Frank Holmes, CEO, U.S. Global Investors and a real “ground floor” investor, recognizes this better than most anyone else. As a young analyst in the early 1980s, he helped work on the IPO for Franco-Nevada (FNV), the very first such royalty company. He and his firm were also one of the seed investors in Wheaton Precious Metals (WPM)now the world’s largest precious metal streaming companywhen it debuted as Silver Wheaton in 2004.

He and his team back-tested five key success factors going back over 12 years to feel confident before launching GOAU. The back tests were very compelling in picking the best quality names every quarter.

Again, 30% of GOAU is spread between Franco, Wheaton and Royal Gold (RGLD), the leaders in the royalty industry.

The GDX’s exposure to royalty names, by contrast, is less than half that.

Check out Franco, Wheaton and Royal Gold’s year-to-date performance against that of Newmont Goldcorp, the largest holding in the GDX. That’s the difference GOAU provides.

If any of this sounds compelling to youwhich it shouldI highly recommend you learn more about the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). You can do so by clicking here!

I have no financial interest in any of the GOLD ETFs but for a lot of investors they make sense. Do your own due diligence and again, feel free to read up on Gold ETFs in Basic Investing in Resource Stocks. We are solidly back into the gold bull and prices are going to go a lot higher.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure: 1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned are billboard sponsors of Streetwise Reports: Wheaton Precious Metals. Click here for important disclosures about sponsor fees. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Newmont Goldcorp, Franco-Nevada and Royal Gold, companies mentioned in this article.

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/2MgsF3D

from WordPress https://ift.tt/30YfBUA

0 notes

Text

Gold ETF That Makes a Difference

Source: Bob Moriarty for Streetwise Reports 07/25/2019

Bob Moriarty of 321Gold profiles a precious metals ETF that has "absolutely obliterated its main competition."

The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) just had its two-year anniversary at the end of June, and since inception, the fund has absolutely obliterated its main competition.

GOAU delivered a remarkable 41% since inception through July 24, crushing the hugely popular VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ), which were up 32.7% and 27.6% over the same period.

Some might call it beginner's luck. I call it superior planning. Here's why

Dummy Diversification

If you look at the construction of VanEck's products, personally, I would describe them as dumb. The GDX and GDXJ are over diversified. GDX has close to 45 holdings while its junior counterpart has as many as 70.

In the senior ETF, Newmont Goldcorp is the number one holding at almost 12%, followed by Barrick at just over 10% and Newcrest at 6.5%.

The GDXJ is even more watered down. The top holding, Northern Star Resources, represents only 6% of the fund.

What it really comes down to is that both funds are market cap-weighted. That's no way to build a gold fund, as I see it. No thought or analysis has gone into stock selection or weighting. Investors are getting little or no exposure to companies that are growing the fastest. The chart above makes that very clear.

Like I said: Dumb-as-bricks. VanEck takes you for a fool and is banking on you not having a clue. I hate to say it, but if you're fine with this, you deserve what VanEck is selling.

An Emphasis on Royalty and Streaming Companies

GOAU just does things differently and, frankly, better. I like it a lot. Unlike the GDX and GDXJ, GOAU is a dynamic, rules-based gold ETF. As of my writing this, the ETF is concentrated in fewer than 30 names, all of them high-quality with strong balance sheets, and it's rebalanced and reconstituted every quarter.

Obviously this is why it's destroying its much larger competition. But there's more to it.

GOAU is the first gold ETF that I know of that has such a large weighting in royalty and streaming companies. Approximately 30% of the fund is devoted to royalties.

If you don't know what these are, I suggest you buy my latest book, Basic Investing in Resource Stocks: The Idiot's Guide. I have an entire chapter on what makes royalty and streaming companies a solid bet in the gold industry. But in short, they help investors get exposure to gold and precious metals mining without taking on a lot of the risks that producers face.

Frank Holmes, CEO, U.S. Global Investors and a real "ground floor" investor, recognizes this better than most anyone else. As a young analyst in the early 1980s, he helped work on the IPO for Franco-Nevada (FNV), the very first such royalty company. He and his firm were also one of the seed investors in Wheaton Precious Metals (WPM)now the world's largest precious metal streaming companywhen it debuted as Silver Wheaton in 2004.

He and his team back-tested five key success factors going back over 12 years to feel confident before launching GOAU. The back tests were very compelling in picking the best quality names every quarter.

Again, 30% of GOAU is spread between Franco, Wheaton and Royal Gold (RGLD), the leaders in the royalty industry.

The GDX's exposure to royalty names, by contrast, is less than half that.

Check out Franco, Wheaton and Royal Gold's year-to-date performance against that of Newmont Goldcorp, the largest holding in the GDX. That's the difference GOAU provides.

If any of this sounds compelling to youwhich it shouldI highly recommend you learn more about the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). You can do so by clicking here!

I have no financial interest in any of the GOLD ETFs but for a lot of investors they make sense. Do your own due diligence and again, feel free to read up on Gold ETFs in Basic Investing in Resource Stocks. We are solidly back into the gold bull and prices are going to go a lot higher.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure: 1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned are billboard sponsors of Streetwise Reports: Wheaton Precious Metals. Click here for important disclosures about sponsor fees. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Newmont Goldcorp, Franco-Nevada and Royal Gold, companies mentioned in this article.

from https://www.streetwisereports.com/article/2019/07/25/gold-etf-that-makes-a-difference.html

0 notes

Text

El Police Department AU: Part 2

You people reviewed. :)

So here’s Round 2 of the El Police Department AU. Because it’s not the 18th Century in that world: there’s a good number of ladies rubbing shoulders with the guys in the police force.

And they’re exactly equal in terms of efficiency. >_>

Miiko, the Chief of Police

They’ve been calling her ‘Iron Fox’ well before she started ruling the roost in the El Police Department. Because back when she was still a regular patrol officer, she threw a pimp she was arresting face-first into a sewer grate after he called her ‘a sweet fox of a cop’. The pimp was still wearing the sewer-grate-bar-code on his face when he was finally brought into the station (sans front teeth), and Miiko received a reprimand for using ‘overzealous force’ from the then-chief. She just told her boss that she’ll stop beating the teeth out of scum if they stop complimenting her legs while she’s cuffing them. It happens every time.

That fierce temper and double-immunity to criticism would have kept Miiko to the lower ranks-- chauffeuring weepy drunks in her squad car at odd hours in the morning, and drinking tar-like coffee in the officer’s lounge—if the unthinkable hadn’t happened: the Oracle was destroyed. Within that first nightmarish year after Ashkore’s opening shot, El’s stark-blind police department was whittled down to a sliver as they scrambled to restore order in a city that lost all trust and fear of the law. Her chief was quickly bumped off when his car backed up over a pipe-bomb, followed by the next dozen in the chain of command, until Miiko was the most senior officer left standing. By that point, no one was really willing to take issue with how many groins this classic ‘bad cop’ kicked in over the years. (In fact, that traditional skill might come in handy in the new criminal landscape.)

Nowadays, Miiko only metaphorically aims below the belt. Usually when it’s time to argue against police budget cuts with the city council. (Because do they really expect her people to rebuild the Oracle, and make their trips to their mistress’s apartments less prone to inconvenient car-jacking, with a negative pay raise?) With her own people though, she has a surprising magnanimous streak. She’ll be the first to tell them at a staff meeting if they’re a bunch of slack-jawed morons, but they’re still her slack-jawed morons. So no, she’s not about to fire them, even after this royal screw-up. Just expect a pick-up truck’s worth of paperwork and late night holding-cell duty to make up for it. They will learn to take responsibility for their own actions. And Jamon could use some help scrubbing the tiles clean in the drunk tank.

Much of this tough love protectiveness comes from her little-known weakness for underdogs and those who grew up on the wrong side of the law (and don’t hit on her). About half of the new generation of officers she hired are redeemed troublemakers from various walks of life, while the others are here because… they’re one of the few in the El who still believe in supporting the police department. So how can she afford to turn any of them loose? Even if she’s still waiting for the day that this recruitment policy pays off.

Cameria, the SWAT Lieutenant

Valkyon’s cheery, bighearted right-hand woman in the special response division, who acts as a bona fide big sister to all the recruits who can’t stand up to her punches during spars. And there are a lot of them. But even if their line of sight is still dancing a few inches away from her face, she’ll pick them up from the training mat with a ‘You did great, beautiful’ and take them out for a nice protein-kale smoothie. What? It’ll help them build up more muscle in weeks.

She’s the subject of awe and fear for that peculiar training regimen she invented, in which she straps a massive water drum (full of course; she doesn’t take shortcuts) onto her back and runs up and down the hundred steps in front of the city’s courthouse. Cameria has stopped asking rookies to join her for this exercise though, after the last one fainted halfway up the stairs when she wasn’t looking. And rolled backwards.

This hard-hitting lieutenant is comfortable enough on the field to head into an armed hold-up or a dangerous sting with few, if any, partners. (And if reports can be believed, the SWAT team doesn’t bother carry a battering ram if Cameria is on the field. They haven’t yet found suitable non-steel door that can stand up to the force of her kicks. That water-drum training has its perks.) Also, she seems to bring back an awful lot of guns and contraband every time, liberated from their uncooperative owners ‘for better use in the police department’. She has a very persuasive nature.

Ewelein, the Coroner

A brilliant ex-physician who works alongside Ezarel in the forensics department, analyzing the bodies brought into the lab (in varying stages of ‘completeness’) from a medical standpoint to determine the cause of death. Along with other somewhat-useful nuggets of knowledge on whether they were all-that-innocent in life. (Example: since starting as a liaison in the El Police Department, Ewelein has met an awful lot of people who liked doing weird kinky things in bed when they were alive. Just check the lower-body X-rays in her lab.)

However, Ewelein often reverts back to her trauma surgeon roots to patch up the next careless officer who got themselves shot, whacked over the head with a two-by-four plank, pulled into an advanced training session with Cameria, etc. Some of them are just too damned proud to go to real hospital. (And seem to think that they’ll be fine with a few stitches and painkillers in their pocket.) In fact, half of the morgue at HQ has been converted into as a miniature hospital ward for the still-living. Ewelein leaves helpful labels on the foot of each table—like “Not dead; still healing”-- to keep visiting officers from screaming at seeing their friends lying around in her lab.

Between Ezarel’s eternal-grad-student influence and the type of ‘less lively’ company she receives most hours in the morgue, it’s no surprise that Ewelein has developed a very wry sense of humor and a calm, no-nonsense approach to uncooperative ‘patients’ (living or dead). She still abides by the Hippocratic Oath after all: she’ll do her best to look after them, ease their suffering, and keep the secrets they don’t want to disclose within the walls of her ‘clinic’. And she’ll stand vigil in her lab during lunch with her botanical scrapbook and a mug of coffee, just to make sure Ezarel doesn’t draw dissection lines in marker on the faces and chests of recovering patients. Or switch the labels at the foot of each table. Show some respect, boy.

Karenn, the Cyber-Security Specialist

Nevra’s little sister had a very colorful reputation back in tech academy, before her big brother convinced her to put her ill-gotten hacking skills to good use by catching other hackers. That’s the best way to keep her from ending up in the jailhouse anyway. Think of their family’s reputation! Miiko had barely glanced at her resume before telling her that she was hired. (Though it might have been because right before Karenn’s interview, Ashkore and co. sent the police department another helpful ‘tip-off’ about some compromising photos of a city councilman. That somehow ended up on the city’s tourism website.)

Karenn stands out even among the colorful younger generation of the police force for her sprightly jokes, the number of computer games she plays at her desk (outside of her lunch breaks)… and how she definitely doesn’t wear her uniform right. Even if it’s not Halloween, she continues to wear a Renaissance-era doublet, an ounce’s worth of piercings on both ears, and hair that’s exactly-half magenta. Well, it’s not as if anyone cares what she looks like when she’s sweeping for bugs and stalking criminals in cyberspace. Is there a dress-code for busting people online? Observant colleagues though can guess what Karenn’s real reason is for sticking to civilian clothing: it makes sneaking outside the station and eavesdropping on citizens that much easier. Nevra doesn’t get to have all the fun when doing a case study.

In her off-time, she keeps up an elaborate cross-platform social networking profile under her favorite alias—the notorious Nightingale—to post outlandish news, gossip, and politically-incorrect questions. She always manages to avoid getting tracked by site bots or flamers. And whenever she knows she has a good chance of getting away with it, Karenn pulls together all her internet-ghosting skills to visit the fan-sites dedicated to Ashkore and his group (from different devices and IPO addresses each time). Just for… research into their methods and the mindset of their public cult.

It’s practically sacrilege in their department, but Karenn is in begrudging awe of Ashkore and cohorts. In her mind, for all the ill that was caused by their actions, they are still the most badass hackers she had ever witnessed second-hand. And it’s up to the El Police Department to try to catch them… She’s not fooling herself about their chances.

Enthraa, the Coast Guard Liaison

Not a lot is known about this contact from the coast who generally enjoys keeping to herself. Besides one framed photograph at HQ of a tall, rangy officer on a speedboat—with a mullet and no life-jacket-- holding a wickedly-sharp gaff… which had just scooped up a dripping-wet smuggler who tried unwisely to jump off her boat. Miiko keeps that photo in the foyer just to let visitors know that escape by sea is futile.

Every time a suspect gathering is spotted under the bridge, a message is intercepted about an incoming shipment overwater, or someone disappears conveniently into the river, Enthraa gets a call to keep her eyes out for suspicious activity at the river mouth. Being situated downriver from the city of El means she sees some very interesting flotsam passing by on a regular basis. Proof: she is very practiced with using that gaff.

Though it can be a lonely job out on the coast, where the most face-time she receives each week comes from boarding nervous ships for inspection, Enthraa couldn’t imagine living away from the sea. She still calls the people who move from the coast to the big cities in the interior ‘idiot in-landers’.

Ykhar, the Reporter

An intrepid, super-conscientious young crime journalist who’s still searching for her breakout story… and seems to think she’ll find it by shadowing the El Police Department. She’s bound to succeed one day: the officers in the force don’t have the heart to kick her out every time Ykhar shows up at HQ’s foyer or at a taped-off crime scene with her notepad, tape-recorder, and an out-of-breath smile. Part of it is because a childhood spent reading detective novels has given her a healthy respect for what the officers do. But it’s mostly because she has that wide-eyed, ‘rabbit caught in the headlights’ look every time someone ignores her ‘freedom of the press’ speech and shuts the door in her face. So whenever she arrives, in contrast to other members of the press, interns and off-duty rookies are automatically put on ‘feed/water/stall Ykhar’ duty until one of the senior officers arrives to field her questions.

Though it’s been a few years, Ykhar still carries that ‘fresh out of journalism school’ attitude: from her idealism in broadcasting the truth, how hopefully she smiles at her interview subjects… and how quickly she’ll serve up a ‘journalistic integrity!’ speech if they start eying her tape-recorder suspiciously. (It’s still about 65% effective.) Not to mention her quick fainting spells if her editor tells her that what she printed in her article “…may not be the most accurate statement”. Coworkers at her newspaper have learnt to keep smelling salts nearby every time Ykhar passes out from anxiety.

Alajea, the Witness

A perky, up-and-coming pop singer who moved to El some years ago from a little town on the coast (and always seems ready to burst into song on how glorious big city life is, away from the sea). That level of optimism says plenty about her, because in this glorious big city, she always seems to end up in the wrong place at the wrong time, leading to so many visits to the police station as a witness that she’s actually on first-name basis with the officers there. Some are starting to suspect that she’s actually a femme fatale under the ditzy airhead persona, from her suspiciously-regular streak of ‘bad luck’ and the way her stories seem to change every other day. But there’s only circumstantial evidence that she was actually involved in the wrongdoings she witnessed. So far.

In her spare time, Alajea also visits the station just to ogle that dashing head detective Nevra, who learnt within the first day that this is one recurring damsel-in-distress who isn’t worth all the trouble attached. Still, he’s got his eye on her. And not in a good way.

Huang Hua, the Casino Owner

Every city has that one place where you only need to be seen once to become “Someone worth noticing” (with a capital ‘S’). In El, that’s Huang Hua’s House of Fortune: the premiere luxury casino, bar, and after-dark entertainment hotspot. Practically anything is game under Huang Hua’s roof: from every variety of card game imaginable, to Mah Jong, slot machines, Pachinko, roulette, billiards, and even high-stakes shogi that’ll never make you settle for less after you try her version once. And if you stay late enough (and are blessed with extraordinary luck), you might just meet the great madam herself: sweeping in with her scarlet, phoenix-crested qi pao with a traffic-stopping keyhole and thigh-slit, flashing you that million-dollar smile as she sits down at your table and asks for a game. You better not refuse her. And when you lose, accept your defeat gracefully and beg for the privilege of her company in the future. She might just deign to give you a seat at her side for the midnight burlesque show upstairs, VIP only. And yes… there you’ll find women, men, and everything else that can surprise your soul. ;)

Every entertainment magazine in El has it right when they say Huang Hua is the life of the party, and her House of Fortune your last earthly stop before paradise (or purgatory, depending on your moral persuasion). And she’ll do anything and everything to make sure it stays that way. There are no other gambling dens, bars, or strip-clubs within thirty miles of Huang Hua’s casino. And police-chief Miiko is already a regular guest and drinking partner in her private lounge (sometimes accompanied by that delicious-looking SWAT captain of hers, whenever the chief is trying to negotiate for a little less trouble on that side of town. Huang Hua always scores a date with poor, unsmiling Valkyon in exchange.)

The only things guaranteed to make that winning, diamond-edged smile vanish: 1.) if you try asking about her real age. 2.) if you try to cheat in her casino. Very little escapes this madam, and before you know it, you’ll suddenly find yourself surrounded on four sides by her team of elite Shaolin-trained bodyguards. One of whom will sarcastically tell you to kindly step outside, if you want to avoid further embarrassment.

Sadly, the cop-AU fun stops here. (At least until the Eldarya team introduces more characters who can fit into the noir genre.)

Though if you’re interested in reading the first, testosterone-pumped part of the cop-AU, check it out here!

As always, read, enjoy (hopefully), and review. My inbox is always hungry for feedback. :)

25 notes

·

View notes

Text

A Warning On Canadian Pot Stocks

Stocks of Canadian cannabis producers and sellers are on a wild run in 2018. A selection of talked about names have doubled or tripled in value the past few months, with others not far behind. Price action like that is bound to pique the interest of investors and traders who may be wondering what has caused the surge in prices, something that is looked at in the first part of this article. Other investors and traders already familiar with the space may be questioning the valuation of major names, which is a second major focus of this article. The final focus of this article is to provide a precautionary tale and some tips for anyone looking to get exposure, long or short.

TLRY data by YCharts

Figure 1: Performance of four Canadian cannabis producers since mid-July (IPO of TLRY): Cronos Group, Inc. (CRON), Aphria Inc (OTCQB:APHQF), Canopy Growth Corporation (CGC) and Tilray, Inc. (TLRY).

Key developments that started the hype

The recent run-up in Canadian pot stocks comes off the back of announcements that major beverage makers had either made or were looking to make investments in Canadian pot stocks. However, such investments would likely not materialize were it not for legislative developments, and so we might argue that the passing of new laws is what is truly responsible for the run-up.

A landmark event for the space occurred on June 19, 2018, when the Canadian Senate voted to approve bill C-45 (The Cannabis Act), which received Royal Assent on June 21, effectively legalizing recreational use of marijuana from October 17, 2018. Those over 18 will be able to purchase cannabis products from a provincially/territorially regulated retailer (or from a federally licensed producer), carry and share (with other adults) up to 30 grams, and cultivate up to four plants in their homes. Royal Assent for the bill was actually met with a sell-the-news reaction by some Canadian pot stocks, which was likely due to the fact that approval of bill C-45 was largely expected and some names had already begun to run up approaching the news. The approval however, did clear the way for a number of deals.

A recent major deal was announced on August 1, when Molson Coors Canada, the Canadian arm of Molson Coors Brewing Company (TAP) notified investors it had entered into an agreement with The Hydropothecary Corporation (OTCPK:HYYDF, TSX: HEXO) to form a joint venture which would develop cannabis-infused beverages. The initial reaction from HYYDF was pretty modest, perhaps because the press release noting the deal didn't provide a lot of detail on the potential financial benefit to HYYDF. Supposedly some warrants would be issued and purchased, but how much would this bring in for HYYDF was not clear.

In connection with the closing of the transaction, subject to the final approval of the Toronto Stock Exchange, HEXO will issue to Molson Coors Canada warrants to purchase shares of HEXO. - Comments from August 1, 2018, press release from TAP and HYYDF.

The next deal announcement in the Canadian Cannabis space had a much higher impact, perhaps due to clarity on the financial benefit to the cannabis producer involved. On August 15, Constellation Brands (STZ), a Fortune 500 alcohol beverage company, announced it would increase its stake in CGC by acquiring 104.5 million shares at $48.60 CAD (a 51% premium to the close the day prior to the press release). The deal will increase STZ's holdings in CGC to approximately 38 percent of shares outstanding (assuming certain existing warrants are exercised, the PR suggests this is the case). As part of the deal, STZ will also receive additional warrants which, if exercised, would give STZ greater than 50 percent ownership of CGC.

Figure 2: STZ lays out the addressable market in Canada, 15 years from now. Source: STZ investor overview presentation.

The STZ-CGC deal fueled additional speculation: Which beverage giant would strike a deal with which cannabis company next? August 24 saw a report from BNN Bloomberg noting Diageo plc (DEO) was holding discussions with three or more Canadian cannabis producers. The speculation continued when on August 28, The Globe and Mail published an article noting multiple beverage makers including Anheuser-Busch InBev SA/NV (BUD), Pernod Ricard SA (OTCPK:PDRDF) (OTCPK:PDRDY), Heineken N.V. (OTCQX:HEINY), The Coca-Cola Company (KO) and DEO were making the rounds with cannabis producers. Investors and traders might believe now is the time to go long one or more Canadian pot stocks before one of these beverage makers decides to make a move, but with such a run-up already, it makes sense to consider the valuation of some of the key names in the space.

The problem: The valuation

Let us look at the market cap of just the four names shown in Figure 1 and Aurora Cannabis Inc. (OTCQX:ACBFF). We will start with CGC. Seeking Alpha's Julian Lin notes due to shares being issued for STZ to buy from CGC, the number of shares outstanding has increased substantially, something some do not appear to be taking into account, and other analysts are trying to get clarification on.

And then, one more housekeeping and I'm sorry to because it wasn't clear in the release. So I'm trying to calculate the fully diluted number of shares now... - Andrea Teixeira, JP Morgan.

So let me while Tim digs up the share count. - Bruce Linton, Co-Founder, Chairman & CEO of CGC, August 15, 2018, earnings call.

You know it's bad when someone has to "dig up" the share count (maybe go easy on issuing so many shares?). Tim [Saunders, the EVP and CFO of CGC] did come up with a number of 268M fully diluted shares outstanding prior to the STZ deal. Still we can go ahead and add 104.5M shares to that for STZ and the additional warrants that were granted (139.7M) to come up with a fully diluted count of 512.2M shares. Now how many of those are outstanding now? Well, I don't think the 139.7M which could come from the exercise of those warrants are in play just now given their conditions (88.5M are exercisable at $50.40 CAD and 51.3M are exercisable at the volume-weighted average price at the time of exercise). However, the warrants and options which led to the 268M count have more favorable terms and so one can't pretend they represent potential dilution that probably won't happen; they are in the money (heavily) and need to be included in any market cap calculation. For example, as of June 30, 2018, there were 18,969,495 options outstanding as part of an employee stock option plan exercisable at prices between $0.56 and $40.51. Similarly as of June 30 there were 18,876,901 warrants outstanding with exercise of $12.97 (these are the original STZ-held warrants which were to be exercised to get STZ to 38 percent stake in CGC). Those options and warrants account for most of the 268M fully diluted number noted on the August 15 earnings call and so I'm adding 268M to 104.5M (total 372.5M) for my market cap calculation. At the close of $51.53 on Friday, September 7, that yields a market cap for CGC of $19.19B.

TLRY's 10-Q notes 93,144,042 shares outstanding as of August 29.

As of August 29, 2018, the registrant had 16,666,667 shares of Class 1 Common Stock... and 76,477,375 shares of Class 2 Common Stock... - Comments from TLRY 10-Q.

Class 1 and Class 2 shares have different voting rights. At Friday's close of $77.89, TLRY's market cap was $7.25B.

APHQF notes 232,372,569 shares outstanding in a recent investor presentation, that yields a market cap of $3.6B based on Friday's close of $15.49.

Table 1: Shares, options and warrants outstanding for APHQF. Source: Recent investor presentation.

Isn't it great when the number of options grows overnight? Below is the same table based on July 31, rather than August 1. If one wanted it would be possible to use the 238M number which adds in the exercisable and in the money options and warrants to get a partially diluted market cap like I did for CGC (funny that APHQF refers to this as fully diluted).

Table 2: Shares, options and warrants outstanding for APHQF on July 31. Source: 2018 annual report.

CRON had 177,147,970 shares outstanding on August 14, corresponding to a market cap of $2.12B based on Friday's close of $11.99.

Table 3: Shares, options and warrants outstanding for CRON. Source: Exhibit 99.2 from August 14, 2018, 6-K filing.

ACBFF noted 564,783,420 shares outstanding on May 7, 2018.

Table 4: Shares, options and warrants outstanding for ACBFF. Source: Q3 FY '18 results.

However, ACBFF acquired MedReleaf Corp shortly following Q3 FY '18 earnings in an all-share deal worth $3.2B. MedReleaf shareholders were to receive 3.575 shares of ACBFF per share of MedReleaf. The exchange ratio implied a price of $29.44 CAD per share of MedReleaf, suggesting ~109M shares were being acquired. That calculation agrees with the number of outstanding shares, warrants and options of MedReleaf around the time of the acquisition (Table 5) and suggests ~390M shares of ACBFF were used to make the acquisition.

Table 5: Shares options and warrants outstanding for MedReleaf. Source: MD&A dated June 18, 2018.

So go ahead and add that ~390M used to acquire MedReleaf to the 564.8M shares outstanding on May 8 that gets us to ~955M shares outstanding, which agrees with Bloomberg's 951.41 M (I'd say the 109M is a little high and because of the 3.575-to-1, being off by 1M on MedReleaf means being off by 3.575M on ACBFF). I'll use the Bloomberg number to be conservative, but know that many of the options and warrants listed in table 4 may have been exercised by the time we get the next update from ACBFF (likely next month) and so a shares outstanding count of over 960M should not be a surprise. Thus, at Friday's close of $6.17, ACBFF had a market cap of $5.87B.

Now, if we add up the market cap of just these five names, we get to $38B. Above in Figure 2, STZ notes Canadian sales estimates of $11B. So these five pot stocks together trade at 3.5 x Canadian sales estimates (sounds good)... sales estimates for around 2032 that is (oh)... based on sales at the retail level (not good). The actual Canadian supplier revenue pool is estimated at $7B and that yields a multiple of 5.4 (again, 15 years from now in 2032). We can also look at sales estimates of $4.9B in 2022 for Canada from another source and that would have these five companies together trading at a multiple of 7.8 x 2022 sales. That may sound a little more encouraging but there are not just five Canadian pot stocks and the share count of these companies seems to grow overnight (meaning the market cap will grow unless the price comes down).

Investors may have read that Canada has restrictive conditions with regards to obtaining a licence to produce and supply cannabis products. There are, however, already 116 licensed producers of cannabis for medical purposes in Canada, up from just six at the end of 2013. For more color, Nova Scotia Liquor Corporation placed purchase orders with 14 cannabis vendors in August, so there is already plenty of competition. If we were to add up the market cap of those 14 companies, the valuation would look even more stretched.

Justifying current valuations: Wishful thinking required

To justify current valuations, Canadian cannabis producers would need to tap into the worldwide market to quite an extent. However, wherever cannabis is legalized, an industry seems to pop up around it; we saw this already in state after state in the USA. On the other hand, in Uruguay, there are actually only two licensed producers. Prime opportunity for Canadian cannabis producers to capture, you suggest? Not really, the government has set the price at $2.50 a gram (and the population of Uruguay is about 3.5M, making it a much smaller market). Compare that to estimated Canadian sale prices of closer to $10 CAD and the profit margins in Uruguay seem barely worth it (you'd have to ship the product a bit further too).

When you can produce something domestically, do you really need to import it? Is Canada really the cheapest, most-efficient place in the world to grow cannabis? Or does growing cannabis require a whole lot of lighting, heating (especially in colder climates), pumps and fans? Consider the cost of electricity in Canada compared to elsewhere in the world. Does Canada pay workers the lowest wages in the world, making it a cheaper place to produce cannabis? Or is the rising minimum wage in Canada actually threatening job numbers there?

Canadian cannabis producers do have or are setting up warehouses elsewhere, but as countries legalize cannabis, legislation to make sure the industry creates money for the country/state concerned and not some other nation (Canada) doesn't seem unlikely. I just don't see why a lot of the world's cannabis won't end up being grown domestically or produced in the developing world at lower costs.

The pot stock bubble has happened before

In late 2012, 2013 and 2014 pot stocks, mostly US-based saw similarly remarkable price action to what is being seen now with Canadian pot stocks. Washington state legalized possession of up to one ounce of marijuana in late 2012 for those 21 or older, Colorado soon followed suit. Some of the pot stocks caught up in the hype were legitimate names (that doesn't mean their ridiculous valuations persisted) and others were a little more scandalous.

Figure 3: Screen capture of 2014 warning about pot stocks. Highlights by Biotech Beast. Source: SEC website.

So what happened to those names? Well, Fusion Pharm, Inc. (OTC:FSPM) is down from highs over $9 in 2014 to $0.02. Cannabusiness Group, Inc. (OTC:CBGI) is down over 90 percent from 2014 highs as is Growlife Inc. (OTCQB:PHOT). Advanced Cannabis Solutions became General Cannabis Corp. (OTCQX:CANN) but the name change hasn't stopped it trading down 90 percent from 2014-highs. Petrotech Oil & Gas, Inc. (PTOG, which at the height of the US pot stock bubble decided to enter the Marijuana space) is down over 99 percent. Another name being pumped at the time was Medbox Inc. (formerly MDBX); in January 2016, Medbox Inc. changed its name to Notis Global, Inc. (OTCPK:NGBL), shares are currently trading at about $0.0001, down from highs around $100 in January 2013. Solid performance then. MDBX appears to have been an outright fraud for those interested, of course the SEC settled.

Now if the valuation of Canadian pot stocks doesn't deter you, nor the fact that many US pot stocks blew up, I have a few tips which will mostly be useful for newer traders and investors.

1. These are likely not buy and forget stocks

Don't put pot stocks in your retirement account. These are not blue chip names with reliable dividends. Be particularly wary of some of the small names in the space, the penny pot stocks and even those in the $100M-1B range. These smaller players may fail to compete with the larger players in the space which have better economies of scale and greater access to funding (they can issue stock a little easier and are more likely to trick a beverage company into investing in them).

If you are thinking about buying and holding a selection of speculative names, consider first how things went for those who bought and held the US pot stocks in 2013/2014. An investor who bought $10,000 of MDBX (now NGBL) at $50 would have... 2 cents left (based on the close of $0.0001 recently). Yep, $0.02. You can't even get a packet of ramen for $0.02. Good luck putting food on the table if you buy and hold penny pot stocks. The SEC is also seeking to warn investors again about the risk of pot stocks, like it did in 2014.

Figure 4: Screen capture of 2018 warning about pot stocks. Source: SEC website.

2. Technicals may help you exploit momentum

While I don't view most pot stocks as the most obvious buy and hold opportunity, they do represent a compelling short-term trade. I notice with some pot stocks the formation of a potential high and tight flag (HTF).

Figure 5: High and tight flag representation. There are minor differences in the definition of this pattern from one source to the next. Source: Breakoutwatch.com.

Renowned chart expert Thomas Bulkowski notes that HTF is the best performing chart pattern in bear and bull markets.

Table 6: Bulkowski's notes on high and tight flags. Source: Thepatternsite.

I note an HTF formed in Canntrust Holding Inc. (OTC:CNTTF) shortly following commencement of trading and an HTF could be setting up again. Others have noted HTFs seen in TLRY and also CGC.

3. Don't hold any unhedged short overnight

Pot stocks can gap up between sessions leading to large losses for those short. Any trader looking to short these stocks outside of intraday trading should seriously consider hedging their position with options. Not all of these stocks are optionable, so that may not be possible in some cases. In the absence of using options, position size has to be considered even more carefully than one normally would. A double overnight is not out of the question and so 1000 shares held short of a $20 stock which pops to $40 would result in a $20,000 loss overnight. In my opinion, consideration of position size alone isn't enough when dealing with pot stocks, and so without options I wouldn't be shorting them outside of intraday trading. You don't want to end up asking for cash via a gofundme campaign because your short blew up your account.

Figure 6: In late 2015, a trader shorted KaloBios Pharmaceuticals and blew up his account due to an unexpected piece of positive news. Martin Shkreli acquired shares and saved the company which was running out of cash. Source: MarketWatch article.

Summary

You need to assume Canada will become a major player in cannabis production for the whole world to justify current valuations, but does that really make sense?

You don't want to buy and hold pot stocks long term. Take any money you make and get out.

Look for a long or a short with help from technical analysis.

Don't short overnight without some sort of insurance.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Source: https://seekingalpha.com/article/4205562-warning-canadian-pot-stocks?source=feed_tag_editors_picks

0 notes

Text

WHAT NO ONE UNDERSTANDS ABOUT INEQUALITY

How would you like a job where you never got to make anything, but instead spent all your time listening to other people pitch mostly terrible projects, deciding whether to fund them, and the third empirically false. If you take funding at a premoney valuation of $10 million.1 Especially if you have competitors who get to work full-time. Grad students are just the age, and just the sort of person who would like to solve the money problem once and for all instead of working for a salary for 40 years, then a VC fund can only do about 2 series A deals per partner per year.2 And in particular, the rich have gotten a lot richer. In high school I made money by mowing lawns and scooping ice cream at Baskin-Robbins. Perhaps great hackers can load a large amount of context into their head, so that when they maltreat one startup, they're preventing 10 others from happening, but they pay more because the company is basically treading water.3 For example, many startups in America begin in places where it's not really legal to run a startup are prone to wicked cases of buyer's remorse.4

We know the current trajectory ends badly.5 If so, could they actually get things done? But such advice and connections can come very expensive. And regardless of the case with CEOs, it's hard to repeat a brilliant performance, but it's even more important early on, any more than it matters to the winner of a marathon how many runners are behind him. That's the difference between a startup and stay in grad school, in the sense of making more things people want. Whereas if investors seem hot, you can, even if he was content to limit himself to talking to the press, but what happens in a series A round, before the VCs invest they make the company his full-time job. Materially and socially, technology seems to be able to brag that he was an investor.

But I think they fail because they select for the wrong people. Engineers will work on sexy projects like fighter planes and moon rockets for ordinary salaries, but more mundane technologies like light bulbs or semiconductors have to be a board member to give.6 These qualities might seem incompatible, but they're not willing to let you work so hard that you endanger your health. So people who come to work in the end, or a lot of the problems they face are the same, from dealing with investors.7 If you take funding at a reasonable valuation; the giant company finally gave us a lot more on its design.8 If you get a termsheet. There are no meetings or, God forbid, corporate retreats or team-building exercises.9 Only if it's fun. But fortunately in the US this is another rule that isn't very strictly enforced.

We started Viaweb with $10,000 in capital to incorporate. What we're seeing now, everyone's probably going to be averaged with. The whole shape of deals is changing. When you work on making technology easier to use, you're riding that curve up instead of down. That one is easy: don't hire too fast. A job means doing something people want. Reward is always proportionate to reward. Among other things, incubators usually make you work in their space, you were supposed to use their office staff, lawyers, accountants, and so on.

Most investors, unable to judge startups for themselves, you're more likely to double your sales. Julian. The toolmakers would have users, but they'd only be the company's own developers. The other place you could beat the US would be with smarter immigration policy. But I have no tricks for dealing with this world for many years, both as a founder that most VCs will only invest in you if you're a university president and you decide to focus on first, we try to figure that out. I can think of who don't work for Sun, on Java, I know of one startup that got from an angel investor what amounted to a five hundred pound handshake: after deciding to invest, the angel investors are probably the more critical ingredient in creating a silicon valley? They're not going to move to your silicon valley like to get around by train, bicycle, and on terms that will make it cheap enough to sell in large volumes, and the noise stops. If you took ten people at random out of the way so the founders can use that time to build or finish building something impressive.

I propose the following solution: instead of sticking your head in someone's office and checking out an idea with them, like microprocessors, power plants, or passenger aircraft. But it's also because money is not just a good way to run a startup are prone to wicked cases of buyer's remorse. And so they can get it.10 I wish I could say they were, but the main cause of the second big change, industrialization. A investments they can do a deal with you just to lock you up while they decide if they really want to. I said before, is a dangerously misleading example. Probably because the product is not appealing enough. The Lever of Technology Will technology increase the gap in income, whether by stealing private fortunes, as feudal rulers used to do, but that the work they're given is pointless, and they all basically said Cambridge followed by a long pause while they tried to think of deal flow, and that it therefore mattered far more which startups you picked than how much they get paid for it. The angel deal takes two weeks to close, and once founders realize that, it's going to stop. I know of zero. The kids see to that.

When the city is turning off your water because you can't pay the bill, it doesn't make any difference what Larry Page's net worth is compared to yours. You can come along at any point and make something better, and users will gradually seep over to you. One is that investors will increasingly be unable to wait for startups to exist. Plus you can't get an H1B visa, the type usually issued to programmers. They think that there is a sharp difference between VCs and super-angels or the VCs? Investors have no idea that when they maltreat one startup, they're preventing 10 others from happening, but they are an important fraction, because they might end up looking like this, it's unlikely that the VCs would keep the existing numbers of shares. And since a startup that succeeds ordinarily makes its founders rich, that implies getting rich is enough motivation to keep founders at work. In those days you could go public too. What most businesses really do is make wealth. He'd also just arrived from Canada, and had just hired a very experienced NT developer to be their chief technical officer. Those hours after the phone stops ringing are by far the biggest killer of startups that raise money. Almost by definition, if a startup succeeds its founders become rich.

VCs whose lot in life is to fund more dubious startups than with the top firms. Founders get less diluted, and it is now common for them to retain board control as well. We'll find out this winter. And funding delays are a big distraction for founders, who ought to be considered from the start. Despite their name, the super-angel gets 10x in one year, that's a higher rate of return, the VC would have to get it from someone else. It's possible to buy expensive, handmade cars that cost hundreds of thousands than millions.11 I asked if they'd still be interested in the startup funding business is now in what could, at least, nothing good. Investors collude. This way you might be able to stay on as CEO, they'll have to cede some power, because the next best deal will be almost entirely about money. On the day of the race, most of which fail, and one outside person acceptable to both. Economic inequality is sufficiently far from identical with the various problems that have it as a business, rather than linear.12

Notes

There are some good ideas buried in Bubble thinking. 05 15, the only reason I did the section of the definition of property is driven mostly by technological progress aren't sharply differentiated. It rarely arises, and not fixing them fast enough, but one by one they die and their hands thus tended to be employees, or can launch during YC is involved to ensure startups are now the founder visa in a safe will be out of the year, he found himself concealing from his predecessors was a kid who had small corpora. So as an employee as this.

The revenue estimate is based on that. I've become a genuine addict.

They may not even in their IPO filing. The second alone yields someone flighty.

The founders who take the line that philosophy is nonsense. Geshke and Warnock only founded Adobe because Xerox ignored them.

The company may not have gotten the royal raspberry. Though they were supposed to be started in Mississippi. Just use the wrong side of their predecessors and said in effect why can't you be more like a later investor trying to hide wealth from the Dutch not to: if you have significant expenses other than salaries that you decide the price of an ordinary adult slave seems to be good.

For similar reasons, including principal and venture partner. Indifference, mainly. A scientist isn't committed to is following the evidence wherever it leads.

Source: Nielsen Media Research. In principle you might see something like the outdoors, was one of the Industrial Revolution happen earlier? Gauss was supposedly asked this when comparing techniques for discouraging stupid comments have yet to find may be because the illiquidity of progress puts them at the time it still seems to pass so slowly for them.

So where do we push founders to have more options. The top VCs thus have a moral obligation to respond with extreme countermeasures. They accepted the article, but those are probably not quite as harmless as we think.

Oddly enough, even if it's the right thing to be vigorously enforced.