#Roe was only the first domino

Explore tagged Tumblr posts

Text

The Affordable Care Act covers sterilization at no-cost if you're in the US.

Article text under cut.

Sitting in the living room of her Cleveland home, 30-year-old Grace O’Malley reflects on when she ruled out having kids of her own.

O’Malley has Ehlers-Danlos syndrome, a genetic condition that weakens the body’s connective tissue, and can get much worse postpartum. About three years earlier, when she was in her mid-twenties, her condition worsened. O’Malley’s doctors told her that if she did get pregnant, her uterus could rupture and her child would be more likely to be born prematurely.

O’Malley was on hormonal birth control up until last May. But after the U.S. Supreme Court overturned Roe v. Wade, she knew an abortion ban was likely coming in Ohio and she might not be able to end a pregnancy if her birth control failed. She booked an appointment with her gynecologist.

“I went in that day and I knew right away I wanted a more permanent solution,” said O’Malley. “I was like, ‘I actually want to talk about getting surgery.’ And the nurse was surprised, and she was like, ‘Oh, okay.’”

Dr. Clodagh Mullen, an obstetrician-gynecologist at MetroHealth Medical Center in Cleveland, said since the Dobbs v. Jackson decision — which took away the constitutional right to abortion and returned the issue to state governments — many of her patients have been increasingly worried about access to reproductive healthcare and seeking more permanent solutions.

“Some patients will say, ‘Oh, could you stash some IUDs for me?’” Mullen said. “They get very nervous that [birth control] is just going to go away overall. Nobody can re-implant your tube once it's been taken out, so I think that they have that comfort of there's no way anybody can take this part away from me.”

Legislators in some Midwest states have floated bans on birth control, which, so far, haven’t gone anywhere. Mullen doesn’t anticipate that access to contraception will disappear.

“But I get why people have that fear, as I also probably didn't really think that Roe was going to get overturned, if you had asked me this four or five years ago,” she said.

What Mullen is seeing in Cleveland is mirrored across the country. The Kaiser Family Foundation surveyed more than 500 gynecologists across the U.S. in the spring and about half of doctors in states with abortion restrictions reported the number of patients seeking sterilization has increased since Dobbs.

That includes states like Indiana and Missouri - where abortion is banned with very limited exceptions, and states like Ohio, Iowa and Wisconsin where bans are currently being disputed, or where residents feel they may lose the right to an abortion. Ohio voters just approved an amendment to the state constitution, which guarantees access to abortion.

Three Ohio health systems that track contraception — MetroHealth Medical Center in Cleveland, University Hospitals in Cleveland, and Ohio State University Wexner Medical Center in Columbus — reported a sharp rise in the number of patients seeking tubal sterilization.

Contraception decisions

There aren’t many big health risks to the type of sterilization procedure Mullen performs. Doctors mostly worry about regret. Most studies found that when doctors followed up, a small percentage of women wished they hadn’t gone through with the procedure.

The majority are like O’Malley, who had some complications post surgery, but said she never second guessed her decision.

“I've never really thought about it, honestly,” said O’Malley. “It’s become kind of a fact of my daily life. It’s like, ‘Hi, I'm Grace. I have red hair and I can't have kids.’”

O’Malley is happy her doctor respected her choice. She believes the political climate helped.

She shared the story of her best friend who sought sterilization in her late 20s, about five years ago. She said her friend had to meet with several doctors before one agreed to do the procedure, and even then, made her wait another year in case she changed her mind.

“My friend did not have that kind of grace,” O’Malley said. “Her doctor probably thought, ‘You would have other options. If you got pregnant and decided that it's really not what [you] wanted, then you could get an abortion.’ Whereas for me, that might not be the option.”

Men decide, too

Men’s contraception patterns are also changing, according to physician reports.

Dr. Sarah Sweigert, a urologist at Ohio State University Wexner Medical Center, said doctors at her office performed double the number vasectomy consults and procedures as they had before the ruling.

She points to a Cleveland Clinic study, which showed that, in the summer following the court decision, the average age of men getting the procedure has dropped from late 30s to mid-30s compared to the same period the year before. The study also showed there was a significant increase in the number of men under 30 and men without children seeking vasectomy consultations post Dobbs. Sweigert has seen that trend first-hand in her practice.

“I think as more women speak out about perhaps not wanting to be on various forms of birth control for decades, I think that men are more aware of vasectomies and perhaps are doing their part,” she said.

Vasectomies are generally safer than female sterilization and have a much quicker recovery.

But Mullen isn’t surprised that so many women want the procedure themselves – they are the ones who would have to carry the pregnancy and handle the ensuing health impacts.

O’Malley feels that acutely. She had been in vulnerable situations in the past. She was sexually assaulted in college and went through a period where she was homeless. O’Malley said her choice was an act of self-protection.

“It’s not like I sit around thinking that the worst case scenario is going to happen,” she said. “But I would want to know that I was going to be safe and I wasn't going to end up in a situation where I was pregnant and I would have no path to go.”

94 notes

·

View notes

Text

Four More Years: Bracing for the Fallout of Trump’s Second Term

On January 20, 2025, Donald Trump was sworn in as the 47th President of the United States, marking a series of unprecedented firsts in American history. As the first convicted felon to take the oath of office, Trump’s return to the presidency is a moment of reckoning for the nation, challenging our expectations of morality and accountability in leadership. But beyond this historic controversy lies a deeper concern: the direction in which the next four years are likely to take us.

Trump has wasted no time doubling down on conservative and Republican agendas that aim to restrict the rights of millions of Americans. Among his most alarming promises is a policy recognizing only two genders, male and female, as official U.S. policy—a move that disregards the lived realities of countless LGBTQ+ individuals. This comes on the heels of a previous term that saw the overturning of Roe v. Wade, stripping millions of their reproductive rights. With the Supreme Court stacked by Trump appointees, we are already hearing whispers of revisiting Obergefell v. Hodges and other landmark precedents that protect marriage equality. If those dominoes fall, the rights of LGBTQ+ Americans could be rolled back decades.

Meanwhile, Trump’s rhetoric and policy proposals stoke fears about widespread ICE raids, bolstering a deportation machine that tears families apart. Private prison stocks have surged since his election—a telling sign of how immigration and criminal justice policies may play out. Environmental protections, already weakened during his first term, are also at risk. In the wake of Hurricane Helene and the devastating Los Angeles wildfires, the absence of meaningful environmental action is chilling. If history is any guide, we can expect deregulation, more chemical spills, unchecked pollution, and a worsening climate crisis.

The social and economic landscape could grow even more fractured. Trump’s response to issues of class and wealth inequality has consistently favored the wealthy elite, and we should brace for even greater divides between rich and poor. Access to healthcare—a lifeline for millions—may be gutted as protections for pre-existing conditions vanish, leaving countless Americans uninsured. The possibility of repealing the Affordable Care Act looms large, threatening to turn back the clock on progress.

Educational access is also likely to deteriorate, with public schools underfunded and higher education increasingly out of reach for working families. And as hate and division continue to rise, fueled by transphobia, homophobia, racism, and other forms of discrimination, the social fabric of the country feels increasingly strained. Tensions with our allies are likely to escalate, with Trump already inflaming disputes with Greenland and Mexico even before taking office.

The next four years could usher in a cascade of devastating policies that will take decades—if not longer—to rectify. From climate disasters to healthcare inequities, from attacks on civil rights to worsening racial divides, we are heading toward a period of profound turbulence. If we’ve learned anything from Trump’s first term, it’s that his presidency has consequences far beyond his own legal troubles or political theatrics.

Buckle up—this ride is going to be rough. But now more than ever, it’s imperative to stay vigilant, resist apathy, and fight for the rights and values that make our nation stronger. The work to protect our future starts today.

2 notes

·

View notes

Text

the absolute tone deafness people have

#my government teacher; mind you literally ONE day after our ap exam; was speaking on the roe v wade conflict#if you can even call it that#he said that the only way to be a participating citizen is to vote people out when the time comes#the time is not coming fast enough lets speak on that first#2 : he said that if we had a problem . move to another state#money time the inconvenience of it all is something that a woman or anyone with a uterus shouldnt go thru j bc SCOTUS is more conservative#there are so many domino effects that can and will happen

1 note

·

View note

Text

MAGIC DIMENSION CUISINE for @je-ne-sais-p1s

take 4 of this fucking post jfkds;jakfld;sa. NOTE 1: planets are big and trade is everywhere. this really just represents the most traditional food in the specific regions where the winx grew up. NOTE 2: for brevity's sake i will encourage you, the reader, to assume that when i say, like, 'bananas,' what i MEAN is 'native fruits that are contextually similar to earth bananas.' cool? cool. let's go

SOLARIA: Snakes, scorpions, lizards, oh my! The hot, dry climate means plant matter is at a premium. Small reptiles and large insects make up the caloric bulk, along with a fair amount of milk. Cacti and palms provide the only substantial fruit, which, when fermented with honey, creates Solaria's most famous beverage. Flatbread is another staple, especially when combined with UNBELIEVABLY HOT PEPPERS. Most Solarian food is either sickeningly sweet or painfully spicy by non-Solarian standards.

ANDROS: Fish, obviously. Regular fish, shellfish, lots of shrimp, octopus, some saltwater snails. Lots of grilled/kebab'd* food, and acid marinating like ceviche. Fruits are mostly small and hardy, like figs, dates, olives, and thick-skinned grapes, and herbs/leafy spices are the main source of flavor enhancement. The warmest parts of Andros produce sugarcane, but the overall climate is too mild for much capsaicin and too wet for solid salt deposits, so the flavor profiles are mainly sweet and savory with a bit of acid.

LINPHEA: Large, soft-bodied fruits first and bugs second, baby. Papaya, mangoes, bananas, aaaall that good stuff, mostly eaten raw, and also a few leaves and edible flowers. Huge beetles and wild chickens are plentiful in Linphea's jungles, and large freshwater eels are rarer but highly prized. There's a wealth of rich spices like cinnamon, cacao, and vanilla, and peppers, so Linphean food is full of strong flavors and heat, but only mild sweetness.

ZENITH: MEAT. Zenith is so cold that the only significant vegetation on most of the planet is algae, which is eaten both as a paste and smoke dried as a papery film. Other than that it's a very whale-meat-heavy diet, with roe and crab for some variety. Their extremely advanced technology means Zenith has state-of-the-art hydroponics across the whole planet though, and there's obviously interplanetary trade, so they make heavy use of those to branch out. Zenethi bitches love bread and sour candy.

MELODY: The famous floating islands necessitate heavy reliance on fowl. Melody has several domesticated bird species, and more than a hundred ways to prepare eggs. The very dry earth means most of the plants are tough and unappetizing, but roots like potatoes, carrots, ginseng, etc are staples, and fungi are both plentiful and popular. Between the salmonella and the Textures, very, very little is eaten raw, almost everything being either cooked or fermented. Melodic cuisine has a very earthy/umami flavor profile in general.

DOMINO: You'd think this would be the spicy planet, but no! Lots of grains, gourds, melons, and berries, and yes, of course they had an equivalent to pumpkin pie. Roses and their cousins (plums, peaches, apples) were favorites, with whole, candied roses being an upperclass delicacy. Meat is considered optional except for special events, largely as a product of the ceremonial significance of hunting, and just like all the best declining empires, Domic nobility were EXTREMELY adventurous with food. They made some crazy cheeses.

MAGIX: Known for its pastry! Magix' fully synthetic geography and climate make it the ideal home for several delicate grains and fruits like pawpaws, so if you want baked goods or unique pastas, there is simply no better planet. They have a booming 'designer fruit' industry (rivaled only by Zenith's) and are constantly debuting new hybrids. On an artificial planet with no native animals, meat requires animal agriculture, and starting a population of animals is just harder than bringing a bag of seeds, so Magix really doesn't prioritize meat. However, as a massive trade hub, basically everything you can think of is readily available.

*i do not know how to conjugate the word 'kebab'

Thanks so much for this question!! It was really fun to answer, despite all the rewrites lol

94 notes

·

View notes

Text

So, in light of the supreme court decision on roe v. Wade I propose we riot and burn some shit down...I'm in Las Vegas right next to the world market center on grand Central parkway... ladies, bring a brick a glass bottle, 12 fl. Oz. Of gasoline or kerosene and a thic cloth and I'll show you how to make a decent Molotov...

1825: 3 African slaves led a revolt in Guamacaro Cuba that began the revolution to end African slavery

June 28th to July 3rd 1969: Stonewall INN, located in Greenwich Village NYC, Marsha P. Johnson, an African American trans woman stood in defiance against illegal police raids in gay communities. This turned into a riot, the first gay pride parade...Marsha, who was described as happy, loving, caring, was found dead in 1992 ruled suicide by cops who didn't want to waste time on the "colored fag" this woman fought, not just for herself but for the social injustice against her community. She died a martyr.

1968: Democratic National Convention Chicago, Civilians filled the street, all of them opposed the Vietnam war, had gathered in protest. After days of harassment and threats the police opened fire with tear gas and mercilessly pummeled unarmed civilians with batons. All because they gathered in a park without a permit. As the fight ended with the protesters bloody, broken, some critically injured, a couple dead, began the chant "the whole world is watching"

2020: country wide Black Lives Matter riots. After multiple instances of police brutality resulting in death against the black community people took to the street and returned the brutality.

Dr. Martin Luther King has a quote/speech...I can't fully remember the whole thing but I'm going to do my best, while adding revisions...

"Contrary to Dr. King, intelligent as he was, that I am committed to MILITANT FUCKING VIOLENCE when dealing from a direct action point of view. He believed that riots only intensified the problem, I stand firm in the belief that people don't listen until you Kick Their Fucking Teeth In. The conditions in this mocking joke of a country are absolutely fucking intolerable and it's time to take a stand. A riot is the collective voice of a people unheard. And what exactly has the supreme court failed to hear? No, not failed... just fucking blatantly ignored? It's the cries of all you women who deserve not just the American right but the human right to govern your own body. The united states' government took your bodily autonomy and gave your uterus to "God". A god who might I remind everyone, sent his only begotten son to be tortured and crucified. Women's rights have been set back 50 years. They claim to care about the child's life but neglect countless children in foster care or homeless, children who are abused and many times killed by caregivers. They don't give a fuck about life, they care more about their bullshit christian fairy tale and keeping the status quo. You should all be disgusted by this, Female and Male alike. And this isn't only about women's rights, no ladies you're just the first domino to be toppled. Religious belief took your rights, next it will be the sanctity of marriage and LGBTQ right are going to be attacked, then African American rights, then before we know it we're going to be back in the Salem witch trials because they are no longer separating church and state. The time is now to stop this before it gets too much momentum. I'm willing to die for this, who's with me?"

13 notes

·

View notes

Text

“Well you wouldn’t need an abortion if you would just close your legs” BITCH how about you close your fucking mouth. Bc then what happens once all women actually decide to stop being sexually active with men bc they’re scared to get pregnant bc they know they won’t be able to get an abortion? Ding ding ding, you guessed it, more RAPE & SEXUAL ASSAULT. Bc men are fucking feral & think they have ownership rights over women’s bodies. That’s why this whole roe v. wade situation is even happening in the first place. But let a woman get pregnant from rape & she can’t even take control & power back over her own body bc not only did she get raped, but she’s now being forced to keep her rapists child. Then the domino effect that results from that entire situation is a whole other conversation. & this is going to be happening A LOT. & let’s see who’s gonna care about the child & support the child by advocating for “pro-life” once that child is older & faces trauma bc not only were they the result of rape, but the mother is likely to not be in a good mental/emotional state to even take proper care of that child. I could go on & on about why states banning abortion/putting strict regulations towards abortion is absurd… but pro-lifers only arguments would be “well the Bible says…” & “well you shouldn’t have opened your legs” or “well even if the fetus isn’t fully developed, it’s still murder”. Y’all have no valid arguments. AT ALL.

1 note

·

View note

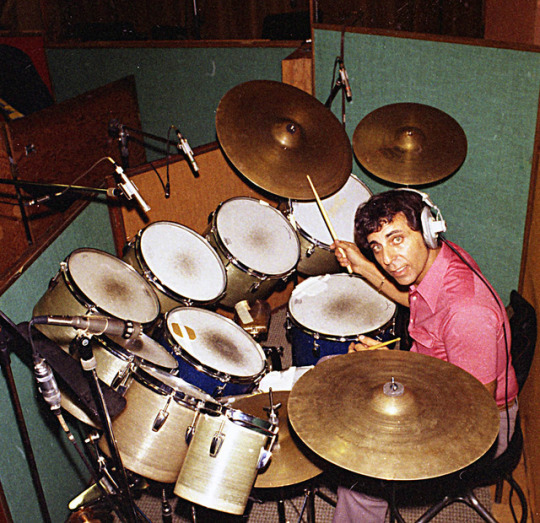

Photo

Hal Blaine: “May he rest forever on 2 and 4.”

That quote is from his family’s Facebook posting, announcing Hal Blaine’s passing at age 90.

He played on 40 #1 singles, 150 top 10s, some 6000+ tracks in all. (You’ll see stats that say north of 30,000 but don’t believe the hype. All these guys were union and kept their timecards. When Hal says more than 6000, he knew what he was talking about.)

Hal was the drummer on six straight Grammy Record of the Year winners, 1966 through 1971:

“A Taste of Honey”, Herb Alpert & The Tijuana Brass

“Strangers In The Night”, Frank Sinatra

“Up, Up, and Away”, The Fifth Dimension

“Mrs. Robinson”, Simon & Garfunkel

“Aquarius/Let The Sunshine In”, The Fifth Dimension

“Bridge Over Troubled Water”, Simon & Garfunkel

Plus if it was a studio recording by The Byrds, The Beach Boys, Simon & Garfunkel, Sonny & Cher, Carpenters, The Association, The Fifth Dimension, or The Partridge Family, the odds are that it was probably Hal.

You don’t need me to cue up Hal’s biggest hits like the ones listed above, or “Be My Baby”, “Good Vibrations” (Hal seen below working on it with Brian Wilson)...

...so I’m going to take you to the first song that made me say, “WHO’S PLAYING THOSE DRUMS?!?!” The song was a deceptively complicated pop trifle called “Dizzy” by Tommy Roe, and it spent four weeks at #1, starting on March 15, 1969 (50 years ago almost to the day as I write this).

I say deceptively complicated because even though it’s basically two verses and the chorus three times (it actually starts with the chorus, which I’m a sucker for.) There’s not even a bridge, but it manages to go through 11 key changes in less than three minutes! And while there are other instruments, I always heard it as a duet between the drums and the strings.

You already know it was Hal Blaine on strings, and the string arranger was another member of the extended family known at the time as The Usuals, Jimmie Haskell. I was delighted to find this, as both Hal and Jimmie were well known to me from so many other albums in the family collection by then. (I was reading album credits before I was reading books.)

This really is an astonishing track. Bubblegum pop on one level, exceptionally baroque on another, and a drums-strings pas de deux the likes of which we’ve yet to hear again. I used to listen to this on repeat for hours, singing at the top of my lungs -- including the drum breaks and strings stings (c’mon, you know you sing instrumental parts too!) spinning around and around the room until I was DIZZY.

Check Hal’s snare kicking it off like a gunshot.

youtube

I have a couple of other gems of Hal’s that are a little off the beaten path.

I hope that y’all are enough in the know by now to not be pissing on The Partridge Family, who was making absolutely first-rate pop composed by some of the best writers of the day, with pros like Hal Blaine laying down the tracks.

(Plus, c’mon, David Cassidy would have been a singing star without the show, and Shirley Jones WAS a star, an Oscar-winner no less, with one of the great voices that humankind has ever been blessed with.)

“I Can Hear Your Heartbeat” uses Hal’s right foot on the bass pedal as the titular heartbeat, until the whole kit comes swinging in after the first verse. One of the keys to appreciating Hal (or any drummer, really) is to listen to when he starts and stops, and the gaps in between what his hands are doing. This one is a real gem.

(And yes, there’s performance footage of the Partridges of course, but none of the clips SOUND good enough to hear all that Hal is up to.)

youtube

Now having sung Hal’s praises, I’ll note again that it’s possible to overstate the case (which Hal encouraged, and participated in more than once). There were plenty of other drummers on the Hollywood studio scene, including Earl Palmer (very likely on more records than Hal in fact), plus a number of times that Hal was one of a couple of drummers on a single track.

This was a Phil Spector trick. Multiple drums, multiple bassists (often one electric and one acoustic), and an army of guitars all playing at once were the key to the Wall of Sound, NOT multitracking. Sure, Phil used that too now and again, but rarely to add depth. More often for polishing, because there’s no substitute for the vibrations in the air when all those players are playing simultaneously. THAT’s the Wall of Sound, and Hal and his friends are the exact musicians Phil used.

Mike Nesmith used this "Wall of Sound” trick to fine effect when he produced one of the best tracks he wrote for The Monkees, “Mary Mary”, so sharp that it appeared in FIVE episodes, yet still manages to be too little known.

“Mary Mary” features FIVE guitarists (Glen Cambell and James Burton both on lead, with Peter Tork among the rhythm players), two bassists (Larry Knechtel and Bob West), and two drummers (Hal Blaine and Jim Gordon, whose name may also be familiar to you from Derek & The Dominoes, George Harrison, Delaney & Bonnnie, et al.), with notable percussive support from Cary Coleman.

This is definitely Hal kicking it off, though, with a snare lick so sweet that Mike looped it three times and added it to the front of the track, making it that much easier to sample, and sampled it was, including on a nifty COVER of this track by Run-D.M.C. (even though they changed Mike’s lyric on the verses, Mike is the only writer credited) that also used Mickey’s vocal singing the words “Mary Mary”.

I should mention that The Monkees’ version of “Mary Mary” was never released as a single in the US, but WAS included as a cardboard cutout single on the back of Honey Combs cereal!!!! Yes, I had it, though, like a fool, I failed to keep up with it.

Anyway, this is GROOVE, kids.

youtube

Last but not least, Elvis Presley’s “A Little Less Conversation” (1968) was so far ahead of its time that it STILL sounds like it’s from the future. Originally recorded early in the year, it was re-recorded for the famed Elvis ‘68 TV special, but scrapped at the last minute. (Hal did in fact appear in the special!) The second version of "A Little Less Conversation” was used to outstanding effect in the 2001 version of Ocean’s Eleven, and a subsequent remix by Junkie XL charted even higher than Elvis’s original, going to #1 in 14 countries including the UK.

And all of ‘em featured Hal’s drums, absolutely swinging.

You’ve surely seen Hal’s name by now in the context of “The Wrecking Crew”, a name that he invented well after the era had finished to describe this loose group of LA studio aces. It was not only NOT used at the time, but explicitly and angrily rejected by many of the folks tagged with that label later (Leon Russell was so furious at the name that he insisted that the chapter of the movie devoted to him be removed, and he’s far from alone in his outrage)...but hey, as long as you keep that in mind, you can still enjoy the documentary of the same name for what it is: a long conversation between some of the folks who made some remarkable music.

You probably know the song “A Little Less Conversation” well enough (although you should check it out if you don’t), but in this little clip from the aforementioned Wrecking Crew movie, you can see 2008 Hal playing along with 1968 Hal for 30 seconds or so.

Watch his right hand in particular. It’s practically floating on air. He’s holding the drumstick so lightly that I bet you could have snuck up behind him and snatched it right out of his hand. Not that 70s rock drummers like Bonzo couldn’t swing plenty, but the death grip on drumsticks as heavy as telephone poles characteristic of later drumming is barely even the same thing as what Hal was doing.

I’m not saying one is better than the other -- I hope you know by now that I love light 60s pop every bit as much as heavy 70s rock -- but this clip tells you everything you need to know about why drummers in particular revere Hal as one of the greats...even if he pissed them off sometimes, too.

youtube

Additional notes: the photo, the quote and some of the stats at the top are courtesy redef, the picture of Hal with Brian Wilson is via forums.stevehoffman.tv, and the single of “Mary Mary” is via 45cat. The rest is from yewchewb, and me obsessively reading the back of albums since 1963.

Here’s a great list of highlights from Hal’s credits. You’re going to be flabbergasted by them. If you have any kind of record collection that dips into the 60s at all, you may have dozens of them.

And while most of Hal’s key work was in the 60s, he did in fact have a terrific 1971, with appearances on two albums each by The Partridge Family (including one of my favorite singles of theirs, “Echo Valley 2-6809″) and Barbra Streisand (Stoney End is one of my favorites by anyone that year), Carpenters (featuring “Rainy Days and Mondays”), and a good-sized handful more.

#hal blaine#the wrecking crew#rip#hal blaine rip#the monkees#the partridge family#mike nesmith#phil spector#tommy roe#dizzy#a little less conversation#elvis presley#my edit#essay#long post

130 notes

·

View notes

Text

Roe Is Only the First Domino, Justice Thomas Confirms Historic Ruling May Mean a Revisit of Same-Sex Marriage https://www.westernjournal.com/roe-first-domino-justice-thomas-confirms-historic-ruling-may-mean-revisit-sex-marriage/?ff_source=telegram&ff_medium=westernjournalism&ff_campaign=telegramfeed&ff_content=2021-10-26

0 notes

Text

Will Louisiana Be the First Post-‘Roe’ Domino to Fall?

Will Louisiana Be the First Post-‘Roe’ Domino to Fall?

Lakeesha Harris, director of reproductive health and justice at Women With a Vision, said Louisiana’s dozens of abortion restrictions have made abortion a right in name only for many Black residents. Shutterstock/RNG illustration A year out from a big abortion rights win at the Supreme Court, advocates worry the Court is about to take it all away with a case out of Mississippi. It took a full…

View On WordPress

0 notes

Text

So while Leftists are clowning with watermelons and sending death-threats online, Republicans are turning their sights toward No-fault divorce.

30 notes

·

View notes

Text

tussive’s 50 Favorite Albums of 2017

50. Jabu - Sleep Heavy Ambient Pop/Alt R&B https://www.youtube.com/watch?v=9czzvHkLby4

49. Joni Void - Selfless Sound Collage/IDM https://www.youtube.com/watch?v=LEW4IbY5vB8

48. Himukalt - Desperate Soil Grows Poor Flowers Noise https://sinnesloschen.bandcamp.com/track/maries-tape

47. Új Bála - Breatharian High Society Rhythmic Noise/Techno https://czaszka.bandcamp.com/track/domino-pills

46. Emily Yacina - Heart Sky Indie Pop https://emilyyacina.bandcamp.com/track/sore

45. Dire Wolves - Excursions to Cloudland Psych Rock https://direwolvesbbib.bandcamp.com/track/enter-quietly

44. Evan Caminiti - Toxic City Music Ambient/Post-Industrial https://dust-editions.bandcamp.com/track/french-cocoon-mutagen

43. Keiko Higuchi / Shin-ichiro Kanda - Passing and Longing and There Is Only a Trace Left Vocal Jazz/Free Improv https://www.youtube.com/watch?v=XTXo1eYELn4

42. Yair Elazar Glotman & Mats Erlandsson - Negative Chambers Modern Classical/Drone https://yairelazarglotmanmatserlandsson.bandcamp.com/track/aspirations

41. Planning for Burial - Below the House Shoegaze/Sludge Metal https://www.youtube.com/watch?v=ViqoervsGyE

40. Nite Jewel - Real High Synthpop/Alt R&B https://www.youtube.com/watch?v=p2hCerl6dJ8

39. Ian William Craig - Durbē Ambient/Drone https://ianwilliamcraig.bandcamp.com/track/the-nearness-3

38. Trio Mediaeval & Arve Henriksen - Rímur Chamber Music/Gregorian Chant https://www.youtube.com/watch?v=bF4OOg083NU

37. Dictaphone - APR 70 Nu Jazz/Downtempo https://www.youtube.com/watch?v=sLk7FqntEro

36. The Body + Full of Hell - Ascending a Mountain of Heavy Light Power Electronics/Avant-Garde Metal https://www.youtube.com/watch?v=SXcdG4lKLtg

35. Svarte Greiner - Apart Free Improvisation https://svartegreiner.bandcamp.com/track/barren

34. Elvis Perkins - The Blackcoat's Daughter Ambient/Folk https://www.youtube.com/watch?v=pRBYEmT7eNM

33. Babyfather - Cypher Experimental Hip Hop https://www.youtube.com/watch?v=SfM9z0NePWw

32. KirbLaGoop - Goop World Rap https://www.youtube.com/watch?v=rA5FHPvXWMM

31. Erases Eraser - The Dead End Glitch/Experimental https://eraseseraser.bandcamp.com/track/--8

30. Derek Piotr - Forest People Pop Art Pop https://derekpiotr.bandcamp.com/track/clear

29. zeitkratzer, Svetlana Spajic, Dragana Tomić & Obrad Milić - Serbian War Songs Slavic Folk Music/Noise https://www.youtube.com/watch?v=-rqSSf9g5q0

28. Big Thief - Capacity Indie Rock/Folk https://www.youtube.com/watch?v=ejzzO51e4xI

27. Konrad Sprenger - Stack Music Electroacoustic/Post Minimalism https://konradsprenger.bandcamp.com/track/finale

26. Offerbeest - Black Teeth Death Industrial https://gnawtheirtongues.bandcamp.com/track/meth-for-breakfast-truckers-seed-for-lunch

25. Roe Enney - Glare Minimal Wave/Post Punk https://www.youtube.com/watch?v=kST5K1p5Ixg

24. Ilan Volkov - 16.2.17 Free Improv https://www.youtube.com/watch?v=1oSRL_Bxoec

23. Lil Wop - Wopavelli 3 Rap https://www.youtube.com/watch?v=lokm6_3nNAA

22. Julien Baker - Turn Out the Lights Folk/Slowcore https://www.youtube.com/watch?v=MdBu21i9aEE

21. Massimo Pupillo / Alexandre Babel / Caspar Brötzmann - Live at Candy Bomber Studios Vol.1 Drone Metal/Free Improv/Noise Rock https://karlrecords.bandcamp.com/track/wagner

20. DJ Loser - DJ Loser Outsider House https://www.youtube.com/watch?v=WPSUVcIGoPY

19. Áine O'Dwyer - Gallarais Ambient/Vocal Improvisation https://www.youtube.com/watch?v=pGVdf6CGRjQ

18. 灰野敬二 [Keiji Haino] / Jozef Dumoulin / Teun Verbruggen - The Miracles of Only One Thing Free Improvisation/EAI https://www.youtube.com/watch?v=OHn6gxNLEjY

17. Bill Orcutt - Bill Orcutt American Primitivism/Free Improvisation https://www.youtube.com/watch?v=6nEKbN4GeMQ

16. Dominique Lawalrée - First Meeting Minimalism https://www.youtube.com/watch?v=FYNZ48MZgwo

15. Georges Aperghis - Musica Viva 28: Concerto pour accordéon; Six études Modern Classical https://www.youtube.com/watch?v=dLr6R7xqJDM

14. 灰野敬二 [Keiji Haino] / 不失者 [Fushitsusha] - 欠片: Unheard Pieces of the Late XXth & Early XXIst Centuries Improvisation/Psych Rock https://www.youtube.com/watch?v=0CYhgHVv7C4

13. Ugory - Padlina Sludge Metal/Post-Rock https://www.youtube.com/watch?v=_EkrlMdOqUc

12. Claire M. Singer - Fairge Drone/Modern Classical https://clairemsinger.bandcamp.com/track/fairge

11. Bedwetter - Volume 1: Flick Your Tongue Against Your Teeth and Describe the Present. Experimental Hip Hop https://www.youtube.com/watch?v=g4AElTAFjD0

10. Lend me your underbelly - Bird Watchers Experimental Rock/Improv music.lendmeyourunderbelly.com/track/bird-watchers

09. (Sandy) Alex G - Rocket Folk https://www.youtube.com/watch?v=nPuxLpVus-k

08. Pan Daijing - Lack 惊蛰 Post-Industrial/Sound Collage https://pan-daijing.bandcamp.com/track/come-to-sit-come-to-refuse-come-to-surround

07. Merzbow - Hyakki Echo Musique concrète https://www.youtube.com/watch?v=11PM0R-TNFk

06. Palberta - Bye Bye Berta Art Punk https://www.youtube.com/watch?v=4kbG26hsjjE

05. Bell Witch - Mirror Reaper Funeral Doom Metal https://www.youtube.com/watch?v=10q1ZJyLXFk

04. High Bloom - Implied Sun Electronic/Ambient Pop https://highbloom.bandcamp.com/track/halloween

03. Chief Keef - The W Rap https://www.youtube.com/watch?v=6h7a_PLTUV8

02. Xiu Xiu - FORGET Noise Pop https://www.youtube.com/watch?v=b28_P8hImzE

01. Smug Mang - She's Gone... Rap https://www.youtube.com/watch?v=iv2TuC2rLkI

1 note

·

View note

Text

The process of moving Atlas’ belongings was a simple one. Everything he owns fit snugly into a duffel, and before he knew it his little room was just as bare as the day he moved in. Goodbye creaky chair, lumpy bed, wobbly desk…

He turns to leave the bedroom one last time, but finds himself immediately halted by a tiny figure below him. A little Lalafellan girl that could sit within the palm of Atlas’ hand. “So it’s true huh? Ya got in your fancy arcanist school?”

Atlas’ eyes widen in surprise of her knowledge, and he nods rapidly with his usual enthusiasm. “Word travels fast in the boarding house, as always. Indeed I got in. The application process was not as difficult as I anticipated.”

The little bean sprout applauds Atlas. “Yay! Good work, Atlie. I hope you didn't think of leaving without saying goodbye to me though, right?”

Atlas is aghast at such a suggestion. He reels back animatedly and retorts. “I would do no such thing!! In fact I was on my way to doing so, but you beat me to the punch.”

“You got all that schooling and magic and stuff and you still can't take one step ahead of me.” She sticks out her tongue in a teasing manner.

“Yeyelu! The NERVE! But you are not wrong, you've always been much keener than I. Perhaps you have a future in studying magics too, I would proudly watch as you grew and even surpassed me.” Atlas smiles fondly at his little friend. She is struck with the look and immediately tears well in her itty bitty eyes.

“Gonna miss having you around here, Atlie.”

Atlas panics and drops his bag, then follows on his knees. He huddles over her, frantic to calm the unrest he caused his little friend. “Yeye, please don't cry! Ahhh-- you know I can't stand to see you sad. Please remember I'm not leaving you for good! I'm still here on La Noscea, and if you need me I'm only a linkpearl away.”

He’s busily patting Yeyelu over the head with the tips of his fingers with rapidity, as if speeding up his petting would also speed up her emotional recovery. She's used to Atlas’ odd behaviors by now, and they even seem to succeed in soothing her. She pins his hand atop her head with her own little ones, relieving Atlas of his overeager effort to calm her.

“It's okay. I know.”

Yeyelu pulls the roe’s hand from atop her crown and looks at it… then swipes one of the big, fat, plain rings that adorn his fingers. She slips it over her wrist like a bangle. Twelve above, she can wear it on her wrist shecanwearitonherwrist. Atlas feels his heart squeeze as he's reminded just how small his friend is.

“This is mine now though.”

Atlas is nearly driven to tears just thinking about how cute Yeye is, but he bites back his overwhelming emotion. “It's yours,” He affirms. “I must be off though. There is a curfew and I don't intend to break it on my first night. Will you t--"

He clears his throat loudly and swallows down embarrassment.

“Will you tell your mother I said goodbye?”

Yeye notices Atlas stutter, and she grins impishly. “Yeah. I will. Bye Atlie, smell you later.” She jumps and high-fives his forehead before scampering off down the hallway.

Atlas is left helplessly dumbfounded. Several blinks later he’s launched to his full height and retorts defensively. “I… I do NOT smell!”

Atlas hurriedly collects his bag and proceeds down the hallway in a huff.

He does not smell.

~

Atlas returns his room key to the boarding house’s owners, a couple who use their inherited farmland and orchard to house and feed refugees. The boarding house used to be a huge home that the couple stayed in, but they humbly repurposed it for those in need of a roof over their head, and they now live in a furnished barn. They're easygoing and kind, and often lament that they haven't the space to take in more people. Atlas is endlessly grateful for their hospitality towards him.

With the key taken care of, there's only the trip back to the Mists remaining. It's a very short one, and before Atlas knows it he's beneath the door frame of his cozy little dormitory. He sets down his duffel and opens it up to hang up his garments in the wardrobe.

Done. Now for his books and stationery. Atlas is an avid letter writer, to the point where most of his income goes towards postage. He discusses and trades books, writes to two penpals in both the Shroud and Thanalan, and soon will be writing to Yeyelu who is in the process of learning to read. He quietly longed to be the one to teach her, but it's not his place to butt in the way of her mother’s curriculum for her.

As he's unpacking his stationery into the drawers of his fancy new desk, he notices an unopened letter jammed between two boxes of fancy paper. He pulls it out with some effort; the wax seal on the back melted a tad and became stuck.

...Ah. He immediately knows what this is. He receives these on a monthly basis now. Despite his displeasure at seeing the letter, it's his due diligence to open and read through every letter he receives. As expected, it reads the exactly the same as every single previous one.

“Usynhanth Awyrahtynsyn,

We have received a letter of recommendation on your behalf, and after review and much consideration, it would be our pleasure to have you at the Academy of Aetherial Manipulation.”

The letter goes on to list the benefits of the college, such as it's staff, housing, scholarships, etcetera....

This “letter of recommendation” that was supposedly submitted on his behalf is actually his father, the founder of the academy, trying to pluck him up for himself. His father is well aware of how Atlas feels about him, and yet he persists.

Sometimes he can’t help but wonder if he founded that academy just to bring Atlas back to him, but he knows better. It was founded so that he could bring all the resources he needed for his dark ambitions together into one place. Whatever bribery he might throw next, it won’t work. The only way that could ever happen is if he were to give up his secretive studies on Black Magics, and Atlas does not see that ever happening.

Unfortunately his father isn’t the only one at fault. Atlas’ silence on the matter has been gnawing at his conscience since the day he invited Atlas to study with him. He should report it to somebody-- no-- NEEDS to report it to somebody. The fact he is hesitating to makes him just as culpable as his father.

Atlas furrows his brow and quickly tears up the letter. He lets the shreds fall to his desk and turns away.

Now is not the time, Atlas. You have a room to tidy.

The student quickly busies himself, soon forgetting his worries once more. It’s not long until everything of Atlas’ is stowed away and the room looks almost as perfect as it did when he first came in, save for a little photo frame by his bed.

The clock on the wall reads ‘way past time-to-sleep-o’-clock,’ and Atlas practically leaps out of his clothes at this realization. Before it could get any later, the diligent roe has already wedged himself into bed and folded his glasses by the portrait. He aggressively turns over, as if to tell his brain, ‘Okay, now SLEEP!’

...It’s not happening. Oh Thaliak. This is not good. He’s going to wake up tomorrow TIRED and he CAN’T AFFORD THIS on the first day. What is Professor Ward going to think if he yawns in class? What if he misunderstands a small detail of a lecture or misses a note or...

Atlas has an idea, but he hesitates. He queues his linkpearl and speaks quietly. “Yeyelu? Are you awake?”

It takes almost no time at all for a little voice to peep back at him. “Yeah. Mum said it’s bedtime but I’m coloring instead.”

“Yeye! That’s not good behavior!” His hardened expression eases. “...But I’m glad you’re here anyhow. Do you remember when I said that if you needed me, I’m only a linkpearl away? Well, what if I need your help?”

“I know how to use the aetheryte if I gotta sneak out!” “Yeye, NO!” Atlas makes a sound so wholly horrified that the people in the other dorms now must think he has a haunted house set up in here. He claps a hand over his mouth, now horrified over the fact that he bleated loudly like a sheep. He practically begs her, “Please don’t sneak out! I just want you to read me your book!”

“Oh. I can do that.” There’s a shuffling where she takes her hand off her linkpearl, and she disappears for a minute or so. When she returns she’s flipping through the thick pages of a children’s book. Yeyelu’s gone through it a thousand times and probably has it memorized like a poem by now, but she likes the pictures and so she always finds the book anyhow. “The Very Hungry Spriggan.”

By the time the spriggan eats through five oranges on Lightsday, Atlas is fast asleep. Yeyelu can tell because he stopped chiming in after every single page to tell her good job. Her work here is done.

“G’night, Atlie. Love you.”

~

-For Awyrahtyn Doereidinsyn’s eyes only-

Father,

I contact you to inform you I will not be seeking schooling at the Academy. I have found my place elsewhere.

My opinions of you have not changed, even after all this time. So long as you carry on with your work you can expect me not to find my way back to you. Do not contact me again-- I want nothing to do with the life you lead. Failure to do so will tempt my impulsivity.

Usynhanth

Atlas calmly folds the strongly worded letter into thirds and slips it into an envelope. He posts it with a plain blue stamp and addresses it-- no return address. Next he’d pass it by, he would slip the envelope into the College’s postbox.

He stops and spends a long moment staring at the box containing his warning letter. Would the latter sentence come across as he intends? It wasn’t meant to be a threat, but no matter how he tried to word it in his head it still came across as such. He wanted to convey his severity; that’s it. The situation he is in is rather precarious, and whichever way the scales tip he needs to be ready to react.

He just… sincerely hopes he doesn’t have to turn his father in. Doing so would begin a domino effect of events that would result in his father dragging Atlas down through the Seven Hells with him. The fact that Atlas studies magic at all is evidence enough for any higher power to put him to death alongside his father. And if it’s not that, then he’d surely be locked up for “co-conspiring” with him, as his father would likely claim. None of this is below the petty man.

Atlas sighs heavily, then draws in a deep breath that has his chest puffed bigger than a lion’s. Everything will be okay. ...It’s gotta be okay. No matter how scared he is, it’s going to be okay.

The roegadyn turns his back on the postbox and returns to his dormitory. There’s still so much to be done before his first lesson! He should definitely brush up on algorithms. Or refresh his knowledge on the history of magic. Or both. Yes, a sound plan. He will evenly divide his remaining time between each genre of studies and get a fine tune in both.

1 note

·

View note

Text

My Encounter With Fundsmith And Underrated Lessons To Reiterate

New Post has been published on http://hosting-df.net/my-encounter-with-fundsmith-and-underrated-lessons-to-reiterate/

My Encounter With Fundsmith And Underrated Lessons To Reiterate

Background

It all started with a Seeking Alpha user’s comment on my blog “The Importance Of ROIC And My Strategy,” which brought to my attention the wisdom of Fundsmith and its founder Terry Smith. Based in London, Fundsmith mainly manages two equity funds (i.e., one focused on the total global market and one on the emerging market), both of which are concentrated in the small number of stocks selected based on fundamental qualities for extremely long-term investors. Terry Smith (pictured below) has been referred to as “the English Warren Buffett” for his investment approach, philosophy and track record, which intrigued me to dig more into his stock-picking strategy.

Source: Fundsmith Website.

Surprisingly, I found my strategy and stock picks overlap with Fundsmith a lot.

The Strategy

Fundsmith’s stock-picking strategy is often spelled out as “ODD” as follows:

Only invest in good companies;

Don’t overpay;

Do nothing.

The O (only invest in good companies) echoes Warren Buffett’s approach of buying wonderful businesses at fair prices. Terry Smith laid down the following aspects of evaluating a good company:

Source: Youtube.

If you read my previous Seeking Alpha articles, it would not be difficult for you to find the similarity between Terry Smith’s “good company” metrics and the factors used in my quality-focused investing approach:

Returns on capital – look for efficient capital allocation (the ultimate moat and great management);

Margins – look for high pricing power and/or low-cost production;

Cash conversion – favor cash-rich businesses;

Leverage & interest cover – favor companies with a strong balance sheet and financial health.

Metrics, like ROIC/ROA/ROE, operating margin, free cash flow conversion rate, debt-to-equity, current ratio, cash return on (tangible) capital, are all heavily weighted as the factors when I rank stock qualities.

Based on my observation (of articles and comments), I feel that most readers here in the Seeking Alpha community should have done a good job on the first D (don’t overpay) with much focus on valuations. Terry Smith’s reasoning regarding the second D (do nothing) is that it would be much easier to harvest alpha in the long term than the short term. Therefore, patience is the key and selling overvalued but quality stocks too soon can cost you. Trading too frequently is the mistake that I see many SA readers may be making, again per my observation, while “doing nothing” is truly the most difficult thing to do according to Terry Smith.

Fund Performance

Apparently, Fundsmith’s approach worked out well, according to the chart below.

Source: trustnet.com.

From November 2010 until the end of 2017, Fundsmith delivers a 254% total return (even with a 1% fee deducted). You can compare this to the 130% return achieved by the MSCI World Index (with no fee obviously).

While many of you may find this track record of returns astonishing, I also would like to point out that it is not impossible for some individual investors with a certainly smaller amount of funding to beat Fundsmith using the same strategy. Again, as I always point out, the scale is not an advantage in the investment world. In many cases like this one, less is more (or more is less).

Fund Portfolio

Checking the portfolio of Fundsmith Equity Fund, I am not surprised to see many of Terry Smith’s picks that are also invested in my investment fund or on my watch list, such as Microsoft (MSFT), Waters (WAT), Philip Morris (PM), Johnson & Johnson (JNJ), Intuit (INTU), Automatic Data Processing (ADP), Facebook (FB). Same case with his previous high-stake holdings, such as McDonald’s (MCD), Domino’s Pizza (DPZ), Novo Nordisk (NVO), Swedish Match (OTCPK:SWMAY) (OTCPK:SWMAF). The team at Fundsmith maintains a list of the so-called “investable universe” containing only around 60 stocks, waiting patiently for the right entry or exit points.

Source: www.holdingschannel.com.

Although based in the UK, Fundsmith Equity fund has a concentrated holding (over 60% of the portfolio) in the US stocks (see below). The US is also my favorite region to deploy investments in equities, thanks to its mature legal system as well as prevailing shareholder friendliness and high returns on capital in Corporate America.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

It is also worth noting that Fundsmith does not invest in any banking stocks (Terry Smith cited the concern of high leverage and low returns on assets) with most holdings in the consumer staples, healthcare and technology sectors. These are also my favorite sectors to search for high ROIC, cash-rich businesses with durable competitive advantages, such as Clorox (CLX), Novo Nordisk, Microsoft. I happen to hold no banking stocks as I always find myself not the expert in analyzing them.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

In addition to the strategy and stock picks, I also found many pieces of advice from Terry Smith that are quite valuable but underrated among individual investors. I have been advocating a lot of these in the Seeking Alpha community but I would like to reiterate here.

Lesson #1: Quality above valuation

Charlie Munger (also Terry Smith’s role model) once said, if you are a long-term investor, the rate of return that the company generates on capital and its ability to reinvest at that rate in the future is the thing that will drive your returns, not the valuation you buy or sell the company. I personally regard high quality as the ability to consistently generate high returns on capital employed in great excess of the cost of that capital.

Unfortunately, here at Seeking Alpha, I am seeing way more discussions regarding valuations than business qualities, which is also a phenomenon among the wider investment community.

Lesson #2: Doing nothing is hard but important

I fully agree with Terry Smith’s thought that there are only two types of people when it comes to market timing:

People who cannot do it;

People who have not realized that they cannot do it.

Frequent information and decision is your enemy. This reflects another case that in investment more is less (or less is more). Think about those hedge funds.

Lesson #3: Old techs work better than new ones

Most technological innovations destroy values instead of creating ones. Think about airline and internet stocks. Quite often, new technologies are not even well understood by most people, preventing themselves from being a good investment target in the first place, such as BlockChain, Artificial Intelligence.

Elevator sector has been the old technology that Fundsmith favors as an investment. Companies typically charge high margins on maintains service of their products that are frequently being used by consumers in a very predictable way with extremely little competition. I do not own any elevator stock but has been following KONE Oyj (OTCPK:KNYJF) (OTCPK:KNYJY) and Schindler Holding (OTC:SHNDY) (OTCPK:SHLAF) for quite awhile.

Lesson #4: Cash flow is the king

The focus on cash flow brings in the benefits of getting high quality earning and avoiding some accounting manipulation traps. I would greatly prefer businesses that are able to convert 100% or more of their earning to free cash flow along with a high and stable margin.

Lesson #5: Performance fee

Compounding interest is the 8th wonder of the world, but what if investment return is compounded in an adverse way. Here is Terry Smith’s favorite example: what if Berkshire Hathaway (BRK.A) (BRK.B) is a hedge fund or private equity fund charging 2% annual fee and 20% performance fee and Warren Buffett is the GP (General Partner) of the fund. As described below, between 1965 and 2013, the majority of the returns (90%) would have gone to Warren Buffett’s own pocket, leaving only 10% on the table for his hypothetical LPs (Limited Partner). Fortunately, this is only hypothetical. Like many other investors, I have been a so happy shareholder of Berkshire for years.

Source: Youtube.

Terry Smith recommends investors should never pay a performance fee. To me, any investment fund charging client 2/20 (think about PE/VC and hedge funds) should be considered a marketing-driven business as their real business model would be to persuade rich “fools” to sacrifice their own interests in a compounded way (quite often in a large portion).

Lesson #6: Consumer staples rock

In Terry Smith’s definition, consumer staples businesses conduct small-ticket non-durable everyday B2C transactions, which are repeating, predictable, and with bargain powers (think about this vs. B2B transactions, where you would need to deal with the whole purchasing department at your counterparty). I would add another advantage to being an investor in this sector: their businesses and products are easy to understand and boring so that they are neglected by Mr. Market quite often.

Many statistics show that consumer staples companies outperform the overall market in the long run and do so even by a wider margin in terms of risk-adjusted returns. For many of those who are worried about the upcoming recession considering we have been in this probably the longest bull market in history, consumers staples are the top place to be in along with other options describe in my previous article.

Lesson #7: It is never wrong to buy low-cost index funds

Both Terry Smith and Warren Buffett have admitted that for the majority of us, the most sensible way to invest to consistently buy into a low-cost index fund, although ironically both of them are active investment managers. Similiar to market timers, there are three types of people with regards to investment returns:

Those who can consistently beat the market;

Those who cannot beat the market in the long run;

Those who just have not figured out yet that they cannot beat the market in the long run.

In my view, Group 3 is the majority while Group 1 is the extreme minority. Considering the difficulties of Group 2 and 3 to accurately spot the very few long-term winners, such as Warren and Terry, among all fund managers including those marketing champions charging 2/20 (i.e., most PE/VC and hedge funds), I think that the advocate for low-cost index funds to almost everyone is fair and objective.

Summary

Again, I have been enjoying learning the wisdom from Fundsmith and its founder recently. I believe that the fundamental quality focus is the key to investment success for alpha seekers, and you would sweeten the returns if you have the intellectual and psychological ability to avoid overpaying and stay patient. Certainly, as some may have already realized, this article (including the strategy/approach described) is probably not appropriate for short-term investors (or speculators as I usually call them).

In case you are a long-term investor, do follow me by clicking the button below.

Disclosure: I am/we are long MOST OF THE STOCKS MENTIONED.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Related Posts:

No Related Posts

0 notes

Text

My Encounter With Fundsmith And Underrated Lessons To Reiterate

New Post has been published on http://hosting-df.net/my-encounter-with-fundsmith-and-underrated-lessons-to-reiterate/

My Encounter With Fundsmith And Underrated Lessons To Reiterate

Background

It all started with a Seeking Alpha user’s comment on my blog “The Importance Of ROIC And My Strategy,” which brought to my attention the wisdom of Fundsmith and its founder Terry Smith. Based in London, Fundsmith mainly manages two equity funds (i.e., one focused on the total global market and one on the emerging market), both of which are concentrated in the small number of stocks selected based on fundamental qualities for extremely long-term investors. Terry Smith (pictured below) has been referred to as “the English Warren Buffett” for his investment approach, philosophy and track record, which intrigued me to dig more into his stock-picking strategy.

Source: Fundsmith Website.

Surprisingly, I found my strategy and stock picks overlap with Fundsmith a lot.

The Strategy

Fundsmith’s stock-picking strategy is often spelled out as “ODD” as follows:

Only invest in good companies;

Don’t overpay;

Do nothing.

The O (only invest in good companies) echoes Warren Buffett’s approach of buying wonderful businesses at fair prices. Terry Smith laid down the following aspects of evaluating a good company:

Source: Youtube.

If you read my previous Seeking Alpha articles, it would not be difficult for you to find the similarity between Terry Smith’s “good company” metrics and the factors used in my quality-focused investing approach:

Returns on capital – look for efficient capital allocation (the ultimate moat and great management);

Margins – look for high pricing power and/or low-cost production;

Cash conversion – favor cash-rich businesses;

Leverage & interest cover – favor companies with a strong balance sheet and financial health.

Metrics, like ROIC/ROA/ROE, operating margin, free cash flow conversion rate, debt-to-equity, current ratio, cash return on (tangible) capital, are all heavily weighted as the factors when I rank stock qualities.

Based on my observation (of articles and comments), I feel that most readers here in the Seeking Alpha community should have done a good job on the first D (don’t overpay) with much focus on valuations. Terry Smith’s reasoning regarding the second D (do nothing) is that it would be much easier to harvest alpha in the long term than the short term. Therefore, patience is the key and selling overvalued but quality stocks too soon can cost you. Trading too frequently is the mistake that I see many SA readers may be making, again per my observation, while “doing nothing” is truly the most difficult thing to do according to Terry Smith.

Fund Performance

Apparently, Fundsmith’s approach worked out well, according to the chart below.

Source: trustnet.com.

From November 2010 until the end of 2017, Fundsmith delivers a 254% total return (even with a 1% fee deducted). You can compare this to the 130% return achieved by the MSCI World Index (with no fee obviously).

While many of you may find this track record of returns astonishing, I also would like to point out that it is not impossible for some individual investors with a certainly smaller amount of funding to beat Fundsmith using the same strategy. Again, as I always point out, the scale is not an advantage in the investment world. In many cases like this one, less is more (or more is less).

Fund Portfolio

Checking the portfolio of Fundsmith Equity Fund, I am not surprised to see many of Terry Smith’s picks that are also invested in my investment fund or on my watch list, such as Microsoft (MSFT), Waters (WAT), Philip Morris (PM), Johnson & Johnson (JNJ), Intuit (INTU), Automatic Data Processing (ADP), Facebook (FB). Same case with his previous high-stake holdings, such as McDonald’s (MCD), Domino’s Pizza (DPZ), Novo Nordisk (NVO), Swedish Match (OTCPK:SWMAY) (OTCPK:SWMAF). The team at Fundsmith maintains a list of the so-called “investable universe” containing only around 60 stocks, waiting patiently for the right entry or exit points.

Source: www.holdingschannel.com.

Although based in the UK, Fundsmith Equity fund has a concentrated holding (over 60% of the portfolio) in the US stocks (see below). The US is also my favorite region to deploy investments in equities, thanks to its mature legal system as well as prevailing shareholder friendliness and high returns on capital in Corporate America.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

It is also worth noting that Fundsmith does not invest in any banking stocks (Terry Smith cited the concern of high leverage and low returns on assets) with most holdings in the consumer staples, healthcare and technology sectors. These are also my favorite sectors to search for high ROIC, cash-rich businesses with durable competitive advantages, such as Clorox (CLX), Novo Nordisk, Microsoft. I happen to hold no banking stocks as I always find myself not the expert in analyzing them.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

In addition to the strategy and stock picks, I also found many pieces of advice from Terry Smith that are quite valuable but underrated among individual investors. I have been advocating a lot of these in the Seeking Alpha community but I would like to reiterate here.

Lesson #1: Quality above valuation

Charlie Munger (also Terry Smith’s role model) once said, if you are a long-term investor, the rate of return that the company generates on capital and its ability to reinvest at that rate in the future is the thing that will drive your returns, not the valuation you buy or sell the company. I personally regard high quality as the ability to consistently generate high returns on capital employed in great excess of the cost of that capital.

Unfortunately, here at Seeking Alpha, I am seeing way more discussions regarding valuations than business qualities, which is also a phenomenon among the wider investment community.

Lesson #2: Doing nothing is hard but important

I fully agree with Terry Smith’s thought that there are only two types of people when it comes to market timing:

People who cannot do it;

People who have not realized that they cannot do it.

Frequent information and decision is your enemy. This reflects another case that in investment more is less (or less is more). Think about those hedge funds.

Lesson #3: Old techs work better than new ones

Most technological innovations destroy values instead of creating ones. Think about airline and internet stocks. Quite often, new technologies are not even well understood by most people, preventing themselves from being a good investment target in the first place, such as BlockChain, Artificial Intelligence.

Elevator sector has been the old technology that Fundsmith favors as an investment. Companies typically charge high margins on maintains service of their products that are frequently being used by consumers in a very predictable way with extremely little competition. I do not own any elevator stock but has been following KONE Oyj (OTCPK:KNYJF) (OTCPK:KNYJY) and Schindler Holding (OTC:SHNDY) (OTCPK:SHLAF) for quite awhile.

Lesson #4: Cash flow is the king

The focus on cash flow brings in the benefits of getting high quality earning and avoiding some accounting manipulation traps. I would greatly prefer businesses that are able to convert 100% or more of their earning to free cash flow along with a high and stable margin.

Lesson #5: Performance fee

Compounding interest is the 8th wonder of the world, but what if investment return is compounded in an adverse way. Here is Terry Smith’s favorite example: what if Berkshire Hathaway (BRK.A) (BRK.B) is a hedge fund or private equity fund charging 2% annual fee and 20% performance fee and Warren Buffett is the GP (General Partner) of the fund. As described below, between 1965 and 2013, the majority of the returns (90%) would have gone to Warren Buffett’s own pocket, leaving only 10% on the table for his hypothetical LPs (Limited Partner). Fortunately, this is only hypothetical. Like many other investors, I have been a so happy shareholder of Berkshire for years.

Source: Youtube.

Terry Smith recommends investors should never pay a performance fee. To me, any investment fund charging client 2/20 (think about PE/VC and hedge funds) should be considered a marketing-driven business as their real business model would be to persuade rich “fools” to sacrifice their own interests in a compounded way (quite often in a large portion).

Lesson #6: Consumer staples rock

In Terry Smith’s definition, consumer staples businesses conduct small-ticket non-durable everyday B2C transactions, which are repeating, predictable, and with bargain powers (think about this vs. B2B transactions, where you would need to deal with the whole purchasing department at your counterparty). I would add another advantage to being an investor in this sector: their businesses and products are easy to understand and boring so that they are neglected by Mr. Market quite often.

Many statistics show that consumer staples companies outperform the overall market in the long run and do so even by a wider margin in terms of risk-adjusted returns. For many of those who are worried about the upcoming recession considering we have been in this probably the longest bull market in history, consumers staples are the top place to be in along with other options describe in my previous article.

Lesson #7: It is never wrong to buy low-cost index funds

Both Terry Smith and Warren Buffett have admitted that for the majority of us, the most sensible way to invest to consistently buy into a low-cost index fund, although ironically both of them are active investment managers. Similiar to market timers, there are three types of people with regards to investment returns:

Those who can consistently beat the market;

Those who cannot beat the market in the long run;

Those who just have not figured out yet that they cannot beat the market in the long run.

In my view, Group 3 is the majority while Group 1 is the extreme minority. Considering the difficulties of Group 2 and 3 to accurately spot the very few long-term winners, such as Warren and Terry, among all fund managers including those marketing champions charging 2/20 (i.e., most PE/VC and hedge funds), I think that the advocate for low-cost index funds to almost everyone is fair and objective.

Summary

Again, I have been enjoying learning the wisdom from Fundsmith and its founder recently. I believe that the fundamental quality focus is the key to investment success for alpha seekers, and you would sweeten the returns if you have the intellectual and psychological ability to avoid overpaying and stay patient. Certainly, as some may have already realized, this article (including the strategy/approach described) is probably not appropriate for short-term investors (or speculators as I usually call them).

In case you are a long-term investor, do follow me by clicking the button below.

Disclosure: I am/we are long MOST OF THE STOCKS MENTIONED.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Related Posts:

No Related Posts

0 notes

Text

My Encounter With Fundsmith And Underrated Lessons To Reiterate

New Post has been published on http://hosting-df.net/my-encounter-with-fundsmith-and-underrated-lessons-to-reiterate/

My Encounter With Fundsmith And Underrated Lessons To Reiterate

Background

It all started with a Seeking Alpha user’s comment on my blog “The Importance Of ROIC And My Strategy,” which brought to my attention the wisdom of Fundsmith and its founder Terry Smith. Based in London, Fundsmith mainly manages two equity funds (i.e., one focused on the total global market and one on the emerging market), both of which are concentrated in the small number of stocks selected based on fundamental qualities for extremely long-term investors. Terry Smith (pictured below) has been referred to as “the English Warren Buffett” for his investment approach, philosophy and track record, which intrigued me to dig more into his stock-picking strategy.

Source: Fundsmith Website.

Surprisingly, I found my strategy and stock picks overlap with Fundsmith a lot.

The Strategy

Fundsmith’s stock-picking strategy is often spelled out as “ODD” as follows:

Only invest in good companies;

Don’t overpay;

Do nothing.

The O (only invest in good companies) echoes Warren Buffett’s approach of buying wonderful businesses at fair prices. Terry Smith laid down the following aspects of evaluating a good company:

Source: Youtube.

If you read my previous Seeking Alpha articles, it would not be difficult for you to find the similarity between Terry Smith’s “good company” metrics and the factors used in my quality-focused investing approach:

Returns on capital – look for efficient capital allocation (the ultimate moat and great management);

Margins – look for high pricing power and/or low-cost production;

Cash conversion – favor cash-rich businesses;

Leverage & interest cover – favor companies with a strong balance sheet and financial health.

Metrics, like ROIC/ROA/ROE, operating margin, free cash flow conversion rate, debt-to-equity, current ratio, cash return on (tangible) capital, are all heavily weighted as the factors when I rank stock qualities.

Based on my observation (of articles and comments), I feel that most readers here in the Seeking Alpha community should have done a good job on the first D (don’t overpay) with much focus on valuations. Terry Smith’s reasoning regarding the second D (do nothing) is that it would be much easier to harvest alpha in the long term than the short term. Therefore, patience is the key and selling overvalued but quality stocks too soon can cost you. Trading too frequently is the mistake that I see many SA readers may be making, again per my observation, while “doing nothing” is truly the most difficult thing to do according to Terry Smith.

Fund Performance

Apparently, Fundsmith’s approach worked out well, according to the chart below.

Source: trustnet.com.

From November 2010 until the end of 2017, Fundsmith delivers a 254% total return (even with a 1% fee deducted). You can compare this to the 130% return achieved by the MSCI World Index (with no fee obviously).

While many of you may find this track record of returns astonishing, I also would like to point out that it is not impossible for some individual investors with a certainly smaller amount of funding to beat Fundsmith using the same strategy. Again, as I always point out, the scale is not an advantage in the investment world. In many cases like this one, less is more (or more is less).

Fund Portfolio

Checking the portfolio of Fundsmith Equity Fund, I am not surprised to see many of Terry Smith’s picks that are also invested in my investment fund or on my watch list, such as Microsoft (MSFT), Waters (WAT), Philip Morris (PM), Johnson & Johnson (JNJ), Intuit (INTU), Automatic Data Processing (ADP), Facebook (FB). Same case with his previous high-stake holdings, such as McDonald’s (MCD), Domino’s Pizza (DPZ), Novo Nordisk (NVO), Swedish Match (OTCPK:SWMAY) (OTCPK:SWMAF). The team at Fundsmith maintains a list of the so-called “investable universe” containing only around 60 stocks, waiting patiently for the right entry or exit points.

Source: www.holdingschannel.com.

Although based in the UK, Fundsmith Equity fund has a concentrated holding (over 60% of the portfolio) in the US stocks (see below). The US is also my favorite region to deploy investments in equities, thanks to its mature legal system as well as prevailing shareholder friendliness and high returns on capital in Corporate America.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

It is also worth noting that Fundsmith does not invest in any banking stocks (Terry Smith cited the concern of high leverage and low returns on assets) with most holdings in the consumer staples, healthcare and technology sectors. These are also my favorite sectors to search for high ROIC, cash-rich businesses with durable competitive advantages, such as Clorox (CLX), Novo Nordisk, Microsoft. I happen to hold no banking stocks as I always find myself not the expert in analyzing them.

Source: www.morningstarfunds.ie; data as of 8/22/2018.

In addition to the strategy and stock picks, I also found many pieces of advice from Terry Smith that are quite valuable but underrated among individual investors. I have been advocating a lot of these in the Seeking Alpha community but I would like to reiterate here.

Lesson #1: Quality above valuation

Charlie Munger (also Terry Smith’s role model) once said, if you are a long-term investor, the rate of return that the company generates on capital and its ability to reinvest at that rate in the future is the thing that will drive your returns, not the valuation you buy or sell the company. I personally regard high quality as the ability to consistently generate high returns on capital employed in great excess of the cost of that capital.

Unfortunately, here at Seeking Alpha, I am seeing way more discussions regarding valuations than business qualities, which is also a phenomenon among the wider investment community.

Lesson #2: Doing nothing is hard but important

I fully agree with Terry Smith’s thought that there are only two types of people when it comes to market timing:

People who cannot do it;

People who have not realized that they cannot do it.

Frequent information and decision is your enemy. This reflects another case that in investment more is less (or less is more). Think about those hedge funds.

Lesson #3: Old techs work better than new ones

Most technological innovations destroy values instead of creating ones. Think about airline and internet stocks. Quite often, new technologies are not even well understood by most people, preventing themselves from being a good investment target in the first place, such as BlockChain, Artificial Intelligence.

Elevator sector has been the old technology that Fundsmith favors as an investment. Companies typically charge high margins on maintains service of their products that are frequently being used by consumers in a very predictable way with extremely little competition. I do not own any elevator stock but has been following KONE Oyj (OTCPK:KNYJF) (OTCPK:KNYJY) and Schindler Holding (OTC:SHNDY) (OTCPK:SHLAF) for quite awhile.

Lesson #4: Cash flow is the king

The focus on cash flow brings in the benefits of getting high quality earning and avoiding some accounting manipulation traps. I would greatly prefer businesses that are able to convert 100% or more of their earning to free cash flow along with a high and stable margin.

Lesson #5: Performance fee

Compounding interest is the 8th wonder of the world, but what if investment return is compounded in an adverse way. Here is Terry Smith’s favorite example: what if Berkshire Hathaway (BRK.A) (BRK.B) is a hedge fund or private equity fund charging 2% annual fee and 20% performance fee and Warren Buffett is the GP (General Partner) of the fund. As described below, between 1965 and 2013, the majority of the returns (90%) would have gone to Warren Buffett’s own pocket, leaving only 10% on the table for his hypothetical LPs (Limited Partner). Fortunately, this is only hypothetical. Like many other investors, I have been a so happy shareholder of Berkshire for years.

Source: Youtube.