#Rio Tinto Deals

Explore tagged Tumblr posts

Text

Rio Tinto Deals: Unearthing the Mining Company's Strategic Investments for the Future

Rio Tinto is a global mining and metals corporation renowned for its extensive operations in diverse geological terrains and its commitment to sustainability. This article delves into Rio Tinto's strategic deals and partnerships that have been pivotal in driving the company's growth and maintaining its leadership in the mining industry.

To know about the assumptions considered for the study, Download for Free Sample Report

Introduction to Rio Tinto

Founded in 1873, Rio Tinto has grown into one of the world's largest mining companies, with headquarters in London, UK, and Melbourne, Australia. The company operates in over 35 countries, extracting and processing minerals essential for modern life, including iron ore, aluminum, copper, and diamonds. Rio Tinto's strategic approach to deals and partnerships has significantly contributed to its expansive portfolio and global reach.

Key Strategic Deals and Partnerships

Rio Tinto's success is underpinned by its strategic deals and partnerships that enhance its operational capabilities, technological advancements, and sustainability initiatives. Here, we explore some of the most significant deals and partnerships that have shaped Rio Tinto's journey.

Joint Ventures and Collaborations

Joint ventures and collaborations have been crucial for Rio Tinto to share resources, expertise, and risks, enabling it to undertake large-scale mining projects and expand its market presence.

Oyu Tolgoi (Mongolia)

One of Rio Tinto's most notable joint ventures is the Oyu Tolgoi copper and gold mine in Mongolia. Partnering with the Government of Mongolia and Turquoise Hill Resources, Rio Tinto has developed one of the world's largest known copper and gold deposits. This collaboration has not only boosted Rio Tinto's copper production but also contributed significantly to Mongolia's economy.

Simandou (Guinea)

The Simandou iron ore project in Guinea is another significant venture. Rio Tinto has partnered with Chinese firms, including Chinalco and Baowu Steel Group, to develop this world-class iron ore deposit. This partnership aims to create a fully integrated mine-to-market solution, enhancing Rio Tinto's iron ore production capabilities and contributing to Guinea's economic development.

Technology and Innovation Partnerships

To stay at the forefront of the mining industry, Rio Tinto has formed partnerships focused on technology and innovation, enhancing its operational efficiency and sustainability efforts.

Komatsu and Caterpillar

Rio Tinto's collaboration with heavy equipment manufacturers Komatsu and Caterpillar has led to the development and deployment of autonomous haulage systems (AHS). These automated trucks improve safety and productivity in Rio Tinto's mining operations, reducing costs and environmental impact.

Inmarsat

Partnering with Inmarsat, a global satellite communications company, Rio Tinto has enhanced its remote monitoring and control capabilities. This partnership enables real-time data collection and analysis, optimizing mining operations and ensuring better decision-making processes.

Sustainability and Environmental Initiatives

Rio Tinto is committed to sustainable mining practices, and its partnerships in this area are designed to minimize environmental impact and promote community development.

Tsinghua University

Rio Tinto's partnership with Tsinghua University in China focuses on developing sustainable mining technologies and practices. This collaboration aims to address environmental challenges and improve resource efficiency in mining operations.

Elysis

In a joint venture with Alcoa and with support from the governments of Canada and Quebec, Rio Tinto established Elysis. This initiative aims to develop the world's first carbon-free aluminum smelting process, significantly reducing greenhouse gas emissions and setting new sustainability standards in the aluminum industry.

Acquisitions and Divestments

Strategic acquisitions and divestments have allowed Rio Tinto to optimize its portfolio, focusing on core assets and divesting from non-core operations.

Turquoise Hill Resources

In a strategic move to strengthen its position in the copper market, Rio Tinto increased its stake in Turquoise Hill Resources. This acquisition aligns with Rio Tinto's goal to become a leading copper producer, leveraging the significant potential of the Oyu Tolgoi mine.

Coal Assets Divestment

As part of its commitment to sustainability and reducing its carbon footprint, Rio Tinto divested from its coal assets, including the sale of its stake in the Kestrel and Hail Creek coal mines. This divestment reflects Rio Tinto's strategic shift towards cleaner energy sources and responsible mining practices.

Impact of Strategic Deals on Rio Tinto's Growth

The strategic deals and partnerships pursued by Rio Tinto have had a profound impact on its growth and market position. These initiatives have enabled the company to enhance its production capabilities, adopt cutting-edge technologies, and uphold its commitment to sustainability.

Enhanced Production Capabilities

Joint ventures and acquisitions have expanded Rio Tinto's access to high-quality mineral deposits, boosting its production capabilities and ensuring a steady supply of essential minerals to the global market.

Technological Advancements

Partnerships focused on technology and innovation have positioned Rio Tinto as a leader in the adoption of autonomous systems and remote monitoring technologies. These advancements have improved operational efficiency, safety, and cost-effectiveness.

Sustainability Leadership

By investing in sustainable mining practices and divesting from non-core, high-carbon assets, Rio Tinto has demonstrated its commitment to environmental stewardship. Partnerships like Elysis highlight the company's role in pioneering sustainable technologies that reduce the industry's environmental impact.

Conclusion

Rio Tinto's strategic deals and partnerships have been instrumental in shaping its success and maintaining its leadership in the mining industry. Through joint ventures, technology collaborations, sustainability initiatives, and strategic acquisitions, Rio Tinto has enhanced its operational capabilities, embraced innovation, and reinforced its commitment to responsible mining. These strategic moves continue to drive Rio Tinto's growth, ensuring its position as a global mining powerhouse.

0 notes

Text

Australia’s Aboriginal groups gaining bigger voice in new energy deals

Australia’s Indigenous groups are taking equity stakes in the growing renewable energy industry as they seek to protect their community interests, prevent encroachment and obtain a bigger share of the profits in what is built on their lands. Aboriginal groups have so far had limited say in mega-projects rolled out across Indigenous lands, at times eroding or destroying traditional landscapes, as…

View On WordPress

#aboriginal#australia mining#bullion#copper#energy deals#gold#lithium#metals#mining stocks#new energy#rare-earth#rare-earth metals#rio tinto#silver#uranium

0 notes

Note

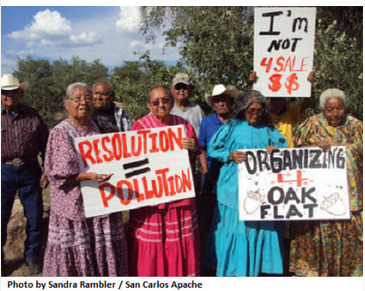

the very Sacred Oak Flat is in danger of becoming an open pit copper mine. turning a sacred site into a 1000-ft pit. Apache Leap, ancient petroglyphs, extremely important rituals since time began; these things are Oak Flat. the federal government is ignoring many legal protections as well, including 200 yr old treaty promising to protect the land forever, national park designation, and on the national register of historic places. this project is so, so evil. I want people to know about it. Please read, talk, care about it.

Nice, thank you. The impending destruction of Chi'chil Bildagoteel by the US government and one of the planet's most infamous mining companies.

Over the past 3 years, I’ve written here about defense of Oak Flat, also called Chi'chil Bildagoteel by Chiricahua Apache from San Carlos reservation. (A summary of the site’s importance and history. A summary of the legal challenges to the mine. A summary of Apache Stronghold and other Indigenous-led campaigns. A photo collection featuring Indigenous-led actions in February 2021.) But all of these posts predate the developments that have occurred from the beginning of 2022 until now (March 2023). And the legal case, the fate of the site, is about to be settled this very month.

Well, then, there’s Rio Tinto, the copper mining leviathan, despised across the planet, bane of Australia, so-called Rhodesia, Latin America, Papua, etc. They're the second-largest metals/mining company on the planet. For well over a century, open-pit copper mines have been infamous for the scale of their destruction and I like how you describe it: giant pits, gaping wounds. Oak Flat is destined to belong to Resolution Copper, a subsidiary of Rio Tinto. Just before widespread news of Rio Tinto’s interest in Oak Flat, Rio Tinto had earned an especially-notorious reputation for destroying Indigenous/Aboriginal sites in Australia. A summary of the news about the “atrocity” at Juukan Gorge, when in May 2020, Rio Tinto destroyed an important sacred cultural site containing Indigenous shelters over 45,000 years old, and Rio Tinto leaders apparently had foreknowledge of the area’s cultural importance. Here’s a look at what is perhaps the oldest surviving human art on the planet, some petroglyphs and shelters up to 50,000 years old, being destroyed by the truly astonishing scale and diversity of destructive mining operations in Western Australia. And here’s a look at many other ancient and modern Indigenous sacred sites being destroyed by mining in that region.

Sacred Land Film Project put together some informational graphics:

Anyway, a basic summary.

Originally, this mine was kinda known as, like, “the John McCain Land-Grab Deal” because Senator McCain sold out the state of Arizona and Indigenous people by basically promising a formal transfer of land and the creation of what would become a major mining site at Oak Flat. Mining in the Oak Flat area was technically prohibited decades earlier by an Eisenhower presidential/executive order, but in December 2014, McCain sneaked a hidden last-minute rider onto a must-pass defense spending bill.

In May 2020, Rio Tinto gets caught destroying those sites at Juukan Gorge.

So, in October 2020, Indigenous activists discovered that the supposed date of the land transfer finalization had been quietly and suddenly moved up like a full year, meaning that the site might have become a mine beginning in December 2020 or January 2021.

At this point, the Oak Flat mine was becoming known as, like, “Trump’s Rushed/Hurried Mining Deal,” since the Trump presidential administration seemed to want to quickly act on the mine before any potential presidential transfer of power might occur in January 2021, “just in case” they lost the November 2020 election.

So this is when Apache Stronghold and other Native advocates really started finally getting national recognition in headlines. They organized a Day of Action and statewide events around the Solstice in 2020, and by January 2021, they had forced the case into court.

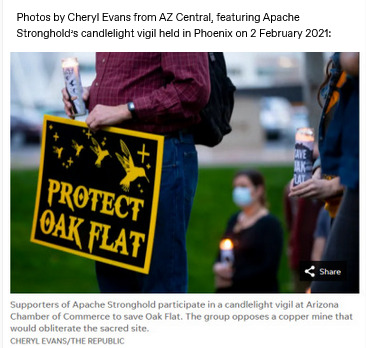

In the January 2021 case of Apache Stronghold v. United States, an Arizona judge ruled against Native advocates, but advocates got the case heard by the 9th Circuit Court of Appeals. While the case was being argued, in February 2021, Apache Stronghold also participated in a newsworthy relay from Oak Flat to the courthouse in Phoenix, when Native advocates held a candlelight vigil.

But in March 2021, the US Forest Service announced that it was temporarily withdrawing its environmental impact assessments for the land transfer, putting the mine on hold.

In October 2021, the three judges on the appeals court ruled against Apache Stronghold again.

Over a year later, in November 2022, the court then announced something unusual: The court was willing to rehear the case en blanc (before a panel of all 11 judges).

And now, “Biden’s attorneys” will be arguing against Apache Stronghold and for the land transfer.

Throughout this entire process, Apache Stronghold has consistently been vocal, active, and dedicated to stopping it.

Here are some headlines from the past couple of years:

And from March 2023, this headline, one more time, for impact:

So, beginning on 21 March 2023, the case is being heard, again, for what is presumably the final time, with US government attorneys arguing that the land will belong to the mining companies by summer 2023.

411 notes

·

View notes

Note

Samantha Cohen is attacked by the sugars as being weak, incapable etc. yet look at her resume

Chief of Staff to the global CEO of Rio Tinto

Co-Founder & Deputy Chair of The Queen's Green Canopy

Director of the Office of the Prime Minister: Downing Street

Chief Executive of Commonwealth Enterprise and Investment Council

Deputy and Assistant Private Secretary to HM The Queen

Communications Secretary to HM The Queen

Deputy Communications Secretary to HM The Queen

Assistant Communications Secretary to The Queen

I haven’t seen those comments. I Donny understand why they would be mad at Sam. Sam keep Meghan’s reputation afloat during her first year, which was an amazing pr feat given all the dad drama and celebrity hijinks.

It was impressive while it was happening and it’s even more impressive now that we know everything Sam had been keeping a lid on. They were planning Megxit since the wedding, and they were negotiating deals with Netflix and the publishers. She was mistreating the staff and fighting with Will and Kate. Plus she was writing her memoir and documenting their lives, plus she was fighting with UN Women, ghosting celebrities, alienating aristos, and causing chaos during the tours. Plus the merching. Plus the drug use.

There were rumors about this all over social media. The reporters had to know about it. Heck, Rebecca English flat out saw Amy Pickering weeping in a car.

And none of it got out! Sam Cohen finessed all of it. We could see there was a problem. We could see Will scarfing Meghan. We could feel the tension during the foundation forum. We could see hatless Meghan flouting protocol. We could see the giggly demeanor and the unfocused pupils. We could see Harry’s friends weren’t invited to the reception. And yet it all got spun by Sam. Sam Cohen won the Olympics of Public Relations during Meghan’s tenure with the royals.

I focus on weird details so my favorite example of this was the Castle Mey visit after the wedding. It was clear to me that Charles called them to Castle Mey to tell they had to deal with her father who was giving post-wedding interviews complaining about how he was treated, but it was spun as Charles being super-supportive and wanting to give Meghan a nice break. It wasn’t until Tom Bowers’ book cam out that we found out that indeed they were scolded at Castle Mey

Ditto Sandringham. We could feel the relationship was breaking down. We could see Meghan leaking Amner Hall details to People. We could practically fell Will’s disdain, and yet Sam got the reporters to focus on the Fab Four nonsense. It wasn’t until the tiara story broke out that reporters confessed they knew there were tensions during Christmas and they just didn’t my tell us about them.

That’s an amazing PR job. Literally everyone in London knew there was a problem—aristos, charities, diplomats, brands, celebrities—and yet Sam managed to keep it out of the press. With her dad and sister out there giving interviews at the drop of a hat!

102 notes

·

View notes

Text

Because the mega-merger craze has come to the fore in the mining industry

The Rio Tinto Group logo on the Central Park tower, which houses the company’s offices, in Perth, Australia, Friday, January 17, 2025. Bloomberg | Bloomberg | Getty Images The mining sector looks set for a frenetic year of deals, following market speculation about a potential tie-up between the industry giants. Rio Tinto and Glencore. It comes after Bloomberg News reported British-Australian…

0 notes

Text

Why mega-merger mania is coming to the fore in the mining industry

Rio Tinto Group's logo atop a tower in Central Park, where the company's office is located, in Perth, Australia, Friday, Jan. 17, 2025. Bloomberg | Bloomberg | Getty Images The mining sector appears set for a wild year of deal-making following market speculation about a potential tie-up between industry giants RioTinto AND Glencore. This follows Bloomberg News reported British-Australian…

0 notes

Text

Why mega-merger mania is coming to the fore in the mining industry

Rio Tinto Group's logo atop a tower in Central Park, where the company's office is located, in Perth, Australia, Friday, Jan. 17, 2025. Bloomberg | Bloomberg | Getty Images The mining sector appears set for a wild year of deal-making following market speculation about a potential tie-up between industry giants RioTinto AND Glencore. This follows Bloomberg News reported British-Australian…

0 notes

Text

Why mega-merger mania is coming to the fore in the mining industry

Rio Tinto Group's logo atop a tower in Central Park, where the company's office is located, in Perth, Australia, Friday, Jan. 17, 2025. Bloomberg | Bloomberg | Getty Images The mining sector appears set for a wild year of deal-making following market speculation about a potential tie-up between industry giants RioTinto AND Glencore. This follows Bloomberg News reported British-Australian…

0 notes

Text

Why mega-merger mania is coming to the fore in the mining industry

The Rio Tinto Group logo on the Central Park Tower, home to the company’s offices, in Perth, Australia on Friday, January 17, 2025. Bloomberg | Bloomberg | Getty Images The mining sector looks set for a frenzied year of deal-making following market speculation over a potential merger between the industry giants Rio Tinto and Glencore. It comes after Bloomberg News reported On Thursday,…

0 notes

Text

Rio Tinto and Glencore Spoke for Months About Deal That Was Once Taboo

0 notes

Text

Rio Tinto and Glencore held talks about combining their businesses

Unlock Editor’s Roundup for free Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter. Rio Tinto and Glencore held talks last year about combining some or all of their businesses, in a sign of how the push by mining companies to secure metals needed for the energy transition has focused executives on large-scale deals. wide. The London-listed companies engaged in…

0 notes

Text

Rio Tinto and Glencore held talks about combining their businesses

Unlock Editor’s Roundup for free Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter. Rio Tinto and Glencore held talks last year about combining some or all of their businesses, in a sign of how the push by mining companies to secure metals needed for the energy transition has focused executives on large-scale deals. wide. The London-listed companies engaged in…

0 notes

Text

Rio Tinto and Glencore held talks about combining their businesses | masr356.com

Unlock the Editor’s Digest for free Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter. Rio Tinto and Glencore held talks last year about combining part or all of their businesses, in an indication of how the push by mining companies to secure metals needed for the energy transition has focused executives on large-scale deals. The London-listed companies…

0 notes

Text

Rio Tinto and Glencore have held talks about combining their businesses

Unlock the Editor’s Digest for free Roula Khalaf, Editor of the FT, selects her favorite stories in this weekly newsletter. Rio Tinto and Glencore held talks last year about merging some or all of their businesses, in a sign of how pressure from mining companies to secure metals needed for the energy transition has focused executives on large-scale deals . The London-listed companies held…

0 notes

Text

0 notes

Text

Arcadium Lithium stock jumps on CFIUS approval of Rio Tinto deal via Investing.com

Investing.com — Shares of Arcadium Lithium plc (NYSE: ALTM , ASX: LTM ) are up 8% following the announcement that the Committee on Foreign Investment in the United States (CFIUS) has completed its review of a proposed acquisition of the company by mining giant. Rio Tinto (NYSE: ) and there are no outstanding national security issues. The release represents an important step forward in the…

0 notes