#Regulatory Compliance Metrics

Explore tagged Tumblr posts

Text

Kyligence to Present "Building a Unified Metrics Store" at Gartner Data & Analytics Summit 2023

Kyligence, a global provider of Big Data Analysis and Metrics platforms, has announced its participation in the Gartner Data & Analytics Summit 2023 in Orlando, Florida. The company’s co-founder and CEO, Luke Han, will present a session titled “Building a Unified Metrics Store” on Wednesday, March 22, at 11:30 AM EDT in Swan Ballroom 10. The session aims to address the low efficiency and…

View On WordPress

#Big Data Analysis#Customer Behavior#Data & Analytics Summit#Gartner#KPIs#Kyligence#Luke Han#Metrics Platforms#Regulatory Compliance Metrics#unified metrics store

0 notes

Text

How to Use Telemetry Pipelines to Maintain Application Performance.

Sanjay Kumar Mohindroo Sanjay Kumar Mohindroo. skm.stayingalive.in Optimize application performance with telemetry pipelines—enhance observability, reduce costs, and ensure security with efficient data processing. 🚀 Discover how telemetry pipelines optimize application performance by streamlining observability, enhancing security, and reducing costs. Learn key strategies and best…

#AI-powered Observability#Anonymization#Application Performance#Cloud Computing#Cost Optimization#Cybersecurity#Data Aggregation#Data Filtering#Data Normalization#Data Processing#Data Retention Policies#Debugging Techniques#DevOps#digital transformation#Edge Telemetry Processing#Encryption#GDPR#HIPAA#Incident Management#IT Governance#Latency Optimization#Logging#Machine Learning in Observability#Metrics#Monitoring#News#Observability#Real-Time Alerts#Regulatory Compliance#Sanjay Kumar Mohindroo

0 notes

Text

Breaking Down the Complexities of Healthcare Standards

In the ever-evolving landscape of healthcare, adherence to Healthcare Standards is paramount to ensuring quality care, patient safety, and regulatory compliance. Let's delve into the key components of these standards and their significance in healthcare delivery:

Regulatory Compliance:

Healthcare providers must adhere to a myriad of regulations and guidelines set forth by regulatory bodies such as the FDA, CDC, and CMS. Regulatory compliance encompasses adherence to laws, rules, and standards governing healthcare practices, facilities, and services. Failure to comply with these regulations can result in penalties, fines, and reputational damage.

Clinical Guidelines:

Clinical guidelines are evidence-based recommendations developed to assist healthcare professionals in making informed decisions about patient care. These guidelines are derived from rigorous research and expert consensus and serve as a framework for standardizing clinical practice. By following clinical guidelines, healthcare providers can optimize patient outcomes, reduce variations in care, and improve quality and safety.

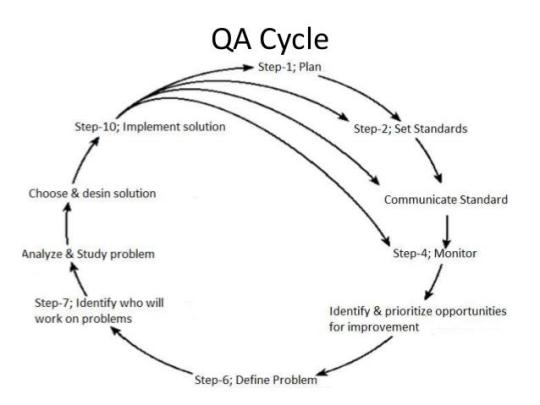

Quality Assurance:

Quality assurance in healthcare focuses on ensuring that processes and services meet predetermined standards of quality. It involves systematic monitoring, evaluation, and improvement of healthcare delivery to enhance patient outcomes and satisfaction. Quality assurance initiatives aim to identify areas for improvement, implement corrective actions, and measure the effectiveness of interventions.

Patient Safety:

Patient safety is a fundamental aspect of healthcare standards, encompassing practices and protocols aimed at preventing harm to patients. Patient safety initiatives focus on reducing medical errors, preventing adverse events, and promoting a culture of safety within healthcare organizations. Strategies such as medication reconciliation, hand hygiene protocols, and error reporting systems contribute to enhancing patient safety.

Performance Metrics:

Performance metrics are quantitative measures used to assess the effectiveness, efficiency, and quality of healthcare services. These metrics provide insights into various aspects of healthcare delivery, including patient outcomes, resource utilization, and operational efficiency. By tracking performance metrics such as readmission rates, length of stay, and patient satisfaction scores, healthcare organizations can identify areas for improvement and drive continuous quality improvement.

In conclusion, Healthcare Standards encompass a broad spectrum of regulations, guidelines, and practices aimed at ensuring quality, safety, and compliance in healthcare delivery. By prioritizing regulatory compliance, adhering to evidence-based clinical guidelines, implementing robust quality assurance processes, promoting patient safety, and measuring performance through performance metrics, healthcare organizations can achieve excellence in patient care and service delivery.

0 notes

Text

The Future of Accounting: Emerging Trends in CA, CS, US CMA, US CPA, UK ACCA, and US CFA

Introduction: The Evolving Landscape of Accounting

The accounting field is undergoing rapid changes due to technological advancements, globalization, and evolving business needs. Professionals in roles like CA (Chartered Accountant), CS (Company Secretary), US CMA (Certified Management Accountant), US CPA (Certified Public Accountant), UK ACCA (Association of Chartered Certified Accountants), and US CFA (Chartered Financial Analyst) are at the forefront of these changes.

Technological Advancements in Accounting

Automation and AI Integration

Automation and artificial intelligence (AI) are transforming routine accounting tasks. Processes such as bookkeeping, payroll, and data analysis are becoming more efficient, reducing errors and saving time. For instance, AI-powered tools can analyze large datasets, offering previously difficult insights to obtain manually.

Blockchain and Its Impact on Transparency

Blockchain technology is revolutionizing accounting by providing a secure and transparent ledger system. It ensures data integrity and reduces the chances of fraud, making it particularly useful for auditing and financial reporting.

Cloud-Based Accounting Solutions

Thanks to cloud technology, accounting professionals can access financial data from any location at any time. Tools like QuickBooks and Xero provide real-time collaboration, enabling seamless interactions between clients and professionals.

The Role of Globalization in Shaping Accounting Careers

Demand for International Qualifications

With businesses expanding globally, certifications like US CPA, UK ACCA, and US CMA are gaining prominence. These qualifications offer a global perspective, making professionals more competitive in international markets.

Cross-Border Financial Regulations

Accountants are now required to understand complex international tax laws and compliance standards. This has increased the demand for experts in regulatory frameworks such as IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles).

Soft Skills: The New Essential for Accounting Professionals

Communication and Leadership

Modern accountants are expected to go beyond crunching numbers. Strong communication skills and leadership abilities are essential for conveying financial insights and guiding decision-making processes.

Adaptability and Lifelong Learning

With constant changes in technology and regulations, professionals must adapt and continuously update their knowledge. Certifications like US CMA and US CFA emphasize ongoing education to stay relevant.

Sustainability and ESG Reporting

Focus on Environmental, Social, and Governance (ESG) Metrics

Organizations are increasingly prioritizing sustainability. Accountants play a crucial role in ESG reporting, helping companies track and disclose their environmental and social impact.

Green Accounting Practices

Green accounting involves assessing and reporting environmental costs. This emerging field aligns financial practices with sustainability goals, reflecting a company’s commitment to responsible operations.

The Future of Accounting Certifications

Digital Skills Integration

Certifications like CA, US CPA, and UK ACCA are incorporating digital skills into their syllabi. Topics such as data analytics and cybersecurity are becoming essential components of these programs.

Specialized Roles and Niches

The future holds promising opportunities for accountants in specialized roles. Fields like forensic accounting, financial planning, and risk management are seeing significant growth.

Conclusion: Embracing Change in Accounting

The future of accounting is bright and full of opportunities for professionals willing to adapt. By staying updated on technological advancements, regulatory changes, and global trends, accountants can thrive in this dynamic field. Whether you’re pursuing CA, CS, US CMA, US CPA, UK ACCA, or US CFA, embracing these trends will set you apart in the ever-evolving accounting landscape.

2 notes

·

View notes

Text

The Role of ERP in Managing Quality Control in Manufacturing

In the highly competitive manufacturing sector, maintaining stringent quality control is not just a necessity but a strategic advantage. In a landscape where efficiency and precision define success, integrating ERP for manufacturing companies in India has become a game-changer. The role of manufacturing ERP software in India extends beyond operational management; it plays a pivotal part in ensuring quality control throughout the production lifecycle.

Understanding the Need for Quality Control in Manufacturing

Quality control ensures that products meet predefined standards, adhere to regulations, and satisfy customer expectations. Without effective systems in place, manufacturing companies risk producing defective products, incurring financial losses, and damaging their reputation. This is where manufacturing enterprise resource planning software in India comes into play. By centralizing data and streamlining processes, ERP systems empower manufacturers to monitor, measure, and enhance quality at every stage.

How ERP Facilitates Quality Control in Manufacturing

1. Centralized Data Management

ERP systems consolidate data from various departments into a unified platform. This centralization is crucial for quality control, as it provides real-time access to critical metrics like raw material quality, production processes, and final product evaluations. ERP software companies in India ensure that manufacturers have a single source of truth, enabling faster and more informed decision-making.

2. Automation of Quality Checks

The manufacturing ERP module often includes automated tools for conducting quality checks. By automating repetitive tasks such as inspecting raw materials, testing products, and verifying compliance, ERP reduces human error and enhances efficiency. This capability is particularly valuable for industries with strict quality standards, such as automotive, pharmaceuticals, and electronics.

3. Compliance Management

Staying compliant with industry regulations is non-negotiable for manufacturing companies. ERP systems provide features that help monitor compliance parameters, generate audit reports, and track regulatory changes. ERP software providers in India offer tailored solutions to meet local and global compliance requirements, ensuring seamless operations.

4. Real-Time Analytics and Reporting

Real-time analytics is a cornerstone of modern ERP systems. These tools allow manufacturers to track quality metrics in real-time, identify deviations, and implement corrective actions instantly. The insights gained from these analytics not only improve quality but also drive process optimization.

5. Supply Chain Integration

Quality control begins with raw materials and extends through the supply chain. ERP systems facilitate end-to-end supply chain visibility, enabling manufacturers to assess supplier performance and ensure the quality of incoming materials. Many ERP solution providers in India offer integrated supply chain management modules to support this functionality.

6. Continuous Improvement through Feedback Loops

ERP systems support continuous improvement by capturing and analyzing feedback from quality control processes. This data is invaluable for identifying recurring issues, uncovering root causes, and implementing preventive measures. Top 10 ERP software providers in India have built-in tools for continuous quality enhancement, ensuring sustained excellence.

Benefits of ERP for Quality Control in Manufacturing

Integrating an ERP system offers several tangible benefits for quality control:

Enhanced Traceability: ERP systems provide traceability across the production process, making it easier to track and rectify defects.

Reduced Waste: By identifying inefficiencies and defects early, ERP reduces waste and optimizes resource utilization.

Improved Customer Satisfaction: Consistently delivering high-quality products strengthens customer trust and loyalty.

Cost Savings: Preventing defects and ensuring compliance minimizes the financial risks associated with recalls, fines, and reputational damage.

Choosing the Right ERP Software for Quality Control

Selecting the best ERP solution requires careful consideration of your manufacturing needs. Here are some factors to consider:

Industry-Specific Features: Look for manufacturing ERP software in India that offers modules tailored to your industry.

Scalability: Ensure the ERP system can scale with your business as it grows.

Integration Capabilities: The ERP should integrate seamlessly with your existing systems and technologies.

Vendor Expertise: Collaborate with an ERP software company in India with proven expertise in delivering quality solutions.

Why Indian Manufacturers Need ERP for Quality Control

India's manufacturing sector is poised for growth, driven by initiatives like Make in India and PLI schemes. However, this growth comes with increasing competition and stricter quality expectations. Leveraging ERP software providers in India can give manufacturers the edge they need to thrive in this evolving landscape.

A Trusted Partner for ERP Implementation

With numerous options available, finding the right ERP vendor is crucial. Leading ERP software companies in India offer customized solutions to meet the unique challenges of Indian manufacturers. These providers combine deep industry knowledge with cutting-edge technology to deliver exceptional results.

Shantitechnology: A Trusted Name in ERP Solutions

Shantitechnology, a renowned name among top 10 ERP software providers in India, specializes in delivering robust ERP solutions for manufacturing companies. Our comprehensive manufacturing ERP module is designed to address the intricacies of quality control, ensuring manufacturers achieve excellence with ease.

Conclusion

In the modern manufacturing landscape, quality control is not an isolated function but a core component of operational success. ERP systems empower manufacturers to seamlessly integrate quality control into their workflows, ensuring consistent product excellence. As one of the best ERP software providers in India, Shantitechnology is committed to helping manufacturers navigate the complexities of quality control with innovative ERP solutions. By embracing the right ERP system, Indian manufacturers can enhance their competitive edge, drive customer satisfaction, and achieve sustainable growth.

If you are looking to elevate your quality control processes, partner with a leading ERP software company in India like Shantitechnology. Contact us today to learn more about our customized ERP solutions and how they can transform your manufacturing operations.

#ERP software in India#Top 10 ERP software providers in India#ERP software company in India#Engineering ERP Software company in India#ERP software for engineering companies#Engineering ERP software solution#ERP software for engineering companies in India#ERP software providers in India#ERP software companies in India#ERP solution providers in India#Best ERP software provider in India#ERP for manufacturing company in India#Manufacturing ERP software in India#Manufacturing enterprise resource planning software in India#Manufacturing ERP module

4 notes

·

View notes

Text

Quality Control Processes: Ensuring Excellence in Every Step

https://enterprisechronicles.com/wp-content/uploads/2024/11/32-Quality-Control-Processes_-Ensuring-Excellence-in-Every-Step-Image-by-DuxX-from-Getty-Images.jpg

Source: DuxX from Getty Images

Quality control (QC) processes are integral to any business striving for excellence. They serve as the backbone of product development and manufacturing, ensuring that every item meets specific standards before it reaches the customer. In today’s competitive landscape, the importance of quality cannot be overstated. This article delves into the significance of quality control processes, their components, and how businesses can implement them effectively.

Understanding Quality Control Processes

Quality control processes encompass a set of procedures and activities designed to monitor, verify, and maintain the quality of products or services throughout the production cycle. These processes aim to identify defects, reduce variability, and ensure that the final output meets the desired specifications.

In various industries, from manufacturing to service delivery, it helps minimize waste, enhance customer satisfaction, and build a strong brand reputation. By focusing on these processes, organizations can not only improve their operational efficiency but also foster a culture of continuous improvement.

The Importance of Quality Control Processes

Consistency and Reliability: One of the primary objectives of quality control processes is to ensure that products and services are consistent in quality. This consistency builds trust among customers, as they can expect the same high standard with every purchase.

Cost Efficiency: Implementing effective quality control processes can lead to significant cost savings. By identifying defects early in the production cycle, businesses can reduce waste and avoid costly recalls. Additionally, fewer defects mean less time spent on rework and repairs, allowing resources to be allocated more efficiently.

Regulatory Compliance: Many industries are subject to stringent regulations regarding product quality and safety. Quality control processes help organizations comply with these regulations, minimizing the risk of legal issues and potential fines.

Enhanced Customer Satisfaction: In today’s market, customers have high expectations. Quality control procedures ensure that products not only meet but exceed customer expectations. Satisfied customers are more likely to become repeat buyers and brand advocates, ultimately driving sales and profitability.

Continuous Improvement: Quality control processes encourage a culture of continuous improvement within organizations. By regularly analyzing performance data and feedback, businesses can identify areas for enhancement, fostering innovation and growth.

Key Components of Quality Control Processes

1. Standard Operating Procedures (SOPs)

Developing clear and concise SOPs is essential for quality control. These documents outline the specific steps that must be followed during production, ensuring consistency and adherence to quality standards. SOPs should be regularly reviewed and updated to reflect any changes in processes or regulations.

2. Quality Metrics and KPIs

Establishing measurable quality metrics and key performance indicators (KPIs) allows organizations to track their performance over time. Common quality metrics include defect rates, customer complaints, and product returns. Regularly monitoring these metrics helps identify trends and areas that require improvement.

3. Training and Development

Investing in employee training is crucial for effective quality control processes. Employees should be well-versed in quality standards and procedures, as they play a vital role in maintaining product quality. Regular training sessions can help keep staff updated on best practices and emerging industry trends.

4. Quality Audits

Conducting regular quality audits is an essential part of any quality control process. Audits involve systematic evaluations of production processes and products to ensure compliance with quality standards. These evaluations can help identify weaknesses in the system and provide opportunities for improvement.

5. Feedback Mechanisms

Implementing robust feedback mechanisms allows organizations to gather insights from customers and employees alike. This feedback is invaluable for identifying quality issues and making necessary adjustments to processes. Surveys, focus groups, and direct customer feedback can all provide valuable information for continuous improvement.

Implementing Quality Control Processes in Your Organization

1. Assess Current Practices

Begin by evaluating your current quality control practices. Identify strengths and weaknesses, and gather input from employees and customers. This assessment will provide a foundation for developing a more effective quality control system.

2. Define Quality Standards

Clearly define the quality standards your organization aims to achieve. These standards should align with customer expectations and industry regulations. Communicate these standards to all employees to ensure everyone is on the same page.

3. Create a Quality Control Plan

Develop a comprehensive quality control plan that outlines the processes, procedures, and responsibilities for maintaining product quality. This plan should be flexible enough to accommodate changes as your business evolves.

4. Invest in Technology

Utilizing technology can enhance your quality control procedures significantly. Automated systems can help monitor production in real-time, allowing for the immediate detection of defects or inconsistencies. Additionally, data analytics tools can provide insights into performance trends, enabling informed decision-making.

5. Foster a Quality Culture

Encourage a culture of quality within your organization. This can be achieved by recognizing and rewarding employees for their contributions to maintaining product quality. Regular communication about the importance of quality control processes will help reinforce this culture.

Conclusion

Quality control processes are vital for any organization aiming to deliver exceptional products and services. By prioritizing these processes, businesses can enhance customer satisfaction, reduce costs, and foster a culture of continuous improvement. As industries evolve, the need for effective quality control processes will only become more critical. Organizations that embrace these practices will not only survive but thrive in the competitive landscape. Investing in quality control is an investment in the future of your business—ensuring excellence in every step of the journey.

Found this article valuable? Explore more insights in our Enterprise Chronicles.

#quality#lilbaby#qc#migos#hiphop#atlanta#iso#quavo#manufacturing#love#cardib#music#engineering#wshh#qualitycontrolmusic

4 notes

·

View notes

Text

Why is ESG Intelligence Important to Companies?

Human activities burden Earth’s biosphere, but ESG criteria can ensure that industries optimize their operations to reduce their adverse impact on ecological and socio-economic integrity. Investors have utilized the related business intelligence to screen stocks of ethical enterprises. Consumers want to avoid brands that employ child labor. This post will elaborate on why ESG intelligence has become important to companies.

What is ESG Intelligence?

ESG, or environmental, social, and governance, is an investment guidance and business performance auditing approach. It assesses how a commercial organization treats its stakeholders and consumes natural resources. At its core, you will discover statistical metrics from a sustainability perspective. So, ESG data providers gather and process data for compliance ratings and reports.

Managers, investors, and government officers can understand a company’s impact on its workers, regional community, and biosphere before engaging in stock buying or business mergers. Since attracting investors and complying with regulatory guidelines is vital for modern corporations, ESG intelligence professionals have witnessed a rise in year-on-year demand.

Simultaneously, high-net-worth individuals (HNWI) and financial institutions expect a business to work toward accomplishing the United Nations’ sustainable development goals. Given these dynamics, leaders require data-driven insights to enhance their compliance ratings.

Components of ESG Intelligence

The environmental considerations rate a firm based on waste disposal, plastic reduction, carbon emissions risks, pollution control, and biodiversity preservation. Other metrics include renewable energy adoption, green technology, and water consumption.

Likewise, the social impact assessments check whether a company has an adequate diversity, equity, and inclusion (DEI) policy. Preventing workplace toxicity and eradicating child labor practices are often integral to the social reporting head of ESG services.

Corporate governance concerns discouraging bribes and similar corruptive activities. Moreover, an organization must implement solid cybersecurity measures to mitigate corporate espionage and ransomware threats. Accounting transparency matters too.

Why is ESG Intelligence Important to Companies?

Reason 1 – Risk Management

All three pillars of ESG reports, environmental, social, and governance, enable business owners to reduce their company’s exposure to the following risks.

High greenhouse (GHG) emissions will attract regulatory penalties under pollution reduction directives. Besides, a commercial project can take longer if vital resources like water become polluted. Thankfully, the environmental pillar helps companies comply with the laws governing these situations.

A toxic and discriminatory workplace environment often harms employees’ productivity, collaboration, creativity, and leadership skill development. Therefore, inefficiencies like reporting delays or emotional exhaustion can slow a project’s progress. ESG’s social metrics will mitigate the highlighted risks resulting from human behavior and multi-generational presumptions.

Insurance fraud, money laundering, tax evasion, preferential treatment, hiding conflicts of interest, and corporate espionage are the governance risks you must address as soon as possible. These problems introduce accounting inconsistencies and data theft issues. You will also receive penalties according to your regional laws if data leaks or insider trading happens.

Reason 2 – Investor Relations (IR)

Transparent disclosures can make or break the relationship between corporate leaders and investors. With the help of ESG intelligence, it becomes easier to make qualitative and manipulation-free “financial materiality” reports. Therefore, managers can successfully execute the deal negotiations with little to no resistance.

You want to retain the present investors and attract more patrons to raise funds. These resources will help you to augment your company’s expansion and market penetration. However, nourishing mutually beneficial investor relations is easier said than done.

For example, some sustainability investors will prioritize enterprises with an ESG score of above 80. Others will refuse to engage with your brand if one of the suppliers has documented records of employing child labor. Instead of being unaware of these issues, you can identify them and mitigate the associated risks using ESG intelligence and insights.

Reason 3 – Consumer Demand

Consider the following cases.

Customers wanted plastic-free product packaging, and e-commerce platforms listened to their demand. And today’s direct home deliveries contribute to public awareness of how petroleum-derived synthetic coating materials threaten the environment.

The availability of recharging facilities and rising gas prices have made electric vehicles (EVs) more attractive to consumers. Previously, the demand for EVs had existed only in the metropolitan areas. However, the EV industry expects continuous growth as electricity reaches more semi-urban and rural regions.

Businesses and investors care about consumer demand. Remember, they cannot force consumers into buying a product or service. And a healthy competitive industry has at least three players. Therefore, customers can choose which branded items they want to consume.

Consumer demand is one of the driving factors that made ESG intelligence crucial in many industries. If nobody was searching for electric vehicles on the web or everybody had demanded plastic packaging, businesses would never switch their attitudes toward the concerns discussed above.

Conclusion

Data governance has become a popular topic due to the privacy laws in the EU, the US, Brazil, and other nations. Meanwhile, child labor is still prevalent in specific developing and underdeveloped regions. Also, the climate crisis has endangered the future of agricultural occupations.

Deforestation, illiteracy, carbon emissions, identity theft, insider trading, discrimination, on-site accidents, corruption, and gender gap threaten the well-being of future generations. The world requires immediate and coordinated actions to resolve these issues.

Therefore, ESG intelligence is important to companies, consumers, investors, and governments. Properly acquiring and analyzing it is possible if these stakeholders leverage the right tools, relevant benchmarks, and expert data partners.

2 notes

·

View notes

Text

How can I get Forex XAUUSD signals?

When choosing a signal provider, consider these key factors to ensure reliability and efficiency, especially for trading XAUUSD:

Reputation: Look for a provider with a strong reputation. SureShotFX boasts an impressive TrustPilot rating of 4.3 for its exceptional XAUUSD signals.

Credibility: Trust is crucial in Forex trading. SureShotFX demonstrates its credibility with a proven track record, regulatory compliance, and transparency about signal performance. Check out their Forex Signals Performance page for past VIP signals and client feedback.

Expertise: Ensure the provider has experienced professionals. SureShotFX has a team with 9 years of trading experience, offering insights and signals compatible with TradingView XAUUSD charts.

Accuracy: Accuracy is vital in the volatile XAUUSD market.SureShotFX achieves up to 85% accuracy with a weekly target of 500–1000 pips, providing timely signals to maximize trading opportunities.

Transparency: A reliable provider should showcase performance results. SureShotFX consistently shares weekly performance metrics on their free channel, ensuring transparency.

By considering these factors, you can find a trustworthy XAUUSD signals Telegram group that meets your trading needs.

3 notes

·

View notes

Text

Revolutionizing Healthcare: The Role of Cloud Computing in Modern Healthcare Technologies

In today’s digital era, cloud computing is transforming industries, and healthcare is no exception. The integration of cloud computing healthcare technologies is reshaping patient care, medical research, and healthcare management. Let’s explore how cloud computing is revolutionizing healthcare and the benefits it brings.

What is Cloud Computing in Healthcare?

Cloud computing in healthcare refers to the use of remote servers to store, manage, and process healthcare data, rather than relying on local servers or personal computers. This technology allows healthcare organizations to access vast amounts of data, collaborate with other institutions, and scale operations seamlessly.

Download PDF Brochure

Key Benefits of Cloud Computing in Healthcare

Enhanced Data Storage and Accessibility Cloud technology allows healthcare providers to store massive volumes of patient data, including medical records, images, and test results, securely. Clinicians can access this data from anywhere, ensuring that patient information is available for timely decision-making.

Improved Collaboration Cloud-based healthcare platforms enable easy sharing of patient data between healthcare providers, specialists, and labs. This facilitates better collaboration and more accurate diagnoses and treatment plans, especially in multi-disciplinary cases.

Cost Efficiency The cloud reduces the need for expensive hardware, software, and in-house IT teams. Healthcare providers only pay for the resources they use, making it a cost-effective solution. Additionally, the scalability of cloud systems ensures they can grow as healthcare organizations expand.

Better Data Security Protecting sensitive patient information is critical in healthcare. Cloud computing providers invest heavily in data security measures such as encryption, multi-factor authentication, and regular audits, ensuring compliance with regulatory standards like HIPAA.

Telemedicine and Remote Patient Monitoring Cloud computing powers telemedicine platforms, allowing patients to consult with doctors virtually, from the comfort of their homes. It also enables remote patient monitoring, where doctors can track patients' health metrics in real time, improving outcomes for chronic conditions.

Advanced Data Analytics The cloud supports the integration of advanced data analytics tools, including artificial intelligence (AI) and machine learning (ML), which can analyze large datasets to predict health trends, track disease outbreaks, and personalize treatment plans based on individual patient data.

Use Cases of Cloud Computing in Healthcare

Electronic Health Records (EHRs): Cloud-based EHRs allow healthcare providers to access and update patient records instantly, improving the quality of care.

Genomics and Precision Medicine: Cloud computing accelerates the processing of large datasets in genomics, supporting research and development in personalized medicine.

Hospital Information Systems (HIS): Cloud-powered HIS streamline hospital operations, from patient admissions to billing, improving efficiency.

Challenges in Cloud Computing for Healthcare

Despite its numerous benefits, there are challenges to implementing cloud computing in healthcare. These include:

Data Privacy Concerns: Although cloud providers offer robust security measures, healthcare organizations must ensure their systems are compliant with local and international regulations.

Integration with Legacy Systems: Many healthcare institutions still rely on outdated technology, making it challenging to integrate cloud solutions smoothly.

Staff Training: Healthcare professionals need adequate training to use cloud-based systems effectively.

Request Sample Pages

The Future of Cloud Computing in Healthcare

The future of healthcare will be increasingly cloud-centric. With advancements in AI, IoT, and big data analytics, cloud computing will continue to drive innovations in personalized medicine, population health management, and patient care. Additionally, with the growing trend of wearable devices and health apps, cloud computing will play a crucial role in integrating and managing data from diverse sources to provide a comprehensive view of patient health.

Conclusion

Cloud computing is not just a trend in healthcare; it is a transformative force driving the industry towards more efficient, secure, and patient-centric care. As healthcare organizations continue to adopt cloud technologies, we can expect to see improved patient outcomes, lower costs, and innovations that were once thought impossible.

Embracing cloud computing in healthcare is essential for any organization aiming to stay at the forefront of medical advancements and patient care.

Content Source:

2 notes

·

View notes

Text

How will Digital Marketing Change in the Future?

Digital marketing is expected to undergo significant changes in the future, driven by advancements in technology, shifting consumer behaviors, and regulatory developments. Here are some key ways in which digital marketing is likely to change in the coming years:

Increased Emphasis on AI and Machine Learning: Artificial intelligence (AI) and machine learning algorithms will play a more prominent role in digital marketing strategies. Marketers will leverage AI-powered tools for data analysis, personalization, predictive analytics, and automation of routine tasks, leading to more efficient campaigns and better targeting of audiences.

Rise of Voice Search Optimization: With the growing popularity of voice-activated devices like smart speakers and virtual assistants, optimizing content for voice search will become crucial. Marketers will need to focus on conversational keywords, long-tail phrases, and providing concise yet informative answers to voice queries to improve visibility in voice search results.

Evolution of Content Formats: The demand for interactive and immersive content experiences will drive the evolution of content formats. Video content, live streaming, augmented reality (AR), and virtual reality (VR) experiences will become more prevalent as marketers seek to engage audiences in innovative ways and create memorable brand interactions.

Data Privacy and Compliance: Stricter data privacy regulations and consumer concerns about data security will shape digital marketing practices. Marketers will need to prioritize transparent data collection and usage practices, adhere to regulatory requirements such as GDPR and CCPA, and build trust with consumers by demonstrating a commitment to data privacy and security.

Integration of Social Commerce: Social media platforms will continue to evolve into powerful e-commerce channels. Marketers will integrate social commerce features such as shoppable posts, in-app checkout options, and social shopping experiences to drive sales directly from social media platforms and enhance the overall customer journey.

Innovations in Digital Advertising: Digital advertising will undergo innovations in targeting capabilities, ad formats, and measurement metrics. Contextual advertising, native advertising, programmatic advertising, and influencer marketing will remain key strategies, with a focus on delivering relevant, non-intrusive ad experiences that resonate with target audiences.

Personalization at Scale: Advanced personalization techniques powered by data analytics and AI will enable marketers to deliver highly tailored and relevant content experiences at scale. Personalized recommendations, dynamic content customization, and adaptive messaging based on individual preferences and behaviors will drive engagement and conversion rates.

Mobile-First and Mobile-Optimized Strategies: The continued proliferation of mobile devices will necessitate a mobile-first approach to digital marketing. Marketers will prioritize mobile-optimized websites, responsive design, mobile apps, and location-based targeting to reach and engage mobile-centric audiences effectively.

Sustainability and Social Responsibility: Brands will increasingly integrate sustainability and social responsibility initiatives into their digital marketing strategies. Purpose-driven marketing campaigns, eco-friendly product messaging, and support for social causes will resonate with socially conscious consumers and enhance brand reputation.

Data-driven Decision Making: The use of data analytics, attribution modeling, and marketing automation tools will enable marketers to make data-driven decisions and optimize campaign performance in real time. Continuous monitoring, testing, and refinement of marketing strategies based on actionable insights will be essential for driving success in the evolving digital landscape.

Overall, the future of digital marketing will be characterized by innovation, agility, and a customer-centric approach. By embracing emerging technologies, prioritizing data ethics and privacy, and staying attuned to evolving consumer trends, businesses can navigate the changing digital marketing landscape effectively and achieve their marketing objectives in the years ahead.

#digital marketing#digital learning#online courses#seo#smmarketing#digital life#contentmarketing#social media#marketing#branding

2 notes

·

View notes

Text

Unlocking Efficiency: Mastering Employee Records Management

In the intricate dance of human resources, maintaining a well-organized Employee Records Management System (ERMS) emerges as the secret sauce to streamline operations and foster organizational success. Let's delve into the realm of ERMS, exploring its pivotal role in the workplace and how it transforms the landscape of data management.

The Art of Efficient Data Handling

In a world where data reigns supreme, the management of employee records holds a significant place in organizational workflows. An ERMS acts as the custodian of invaluable information – from personal details and performance metrics to training records and certifications. Its role extends beyond mere record-keeping; it's a strategic tool that empowers HR professionals to make informed decisions and drive workforce efficiency.

Navigating the Complexity

The complexity of managing employee records becomes apparent in the face of regulatory requirements and the need for accuracy. This is where a robust ERMS steps in, offering a centralized solution to navigate this intricate landscape. The system not only ensures data accuracy but also simplifies compliance with ever-evolving regulations, providing a solid foundation for HR processes.

The Digital Evolution

As businesses evolve, so does technology. ERMS solutions today are more than digital filing cabinets. They come armed with advanced features that redefine the way organizations handle employee data. From document management and workflow automation to integration capabilities with other HR applications, a modern ERMS is designed to enhance efficiency and streamline processes.

Conclusion: Elevating HR Management with ResourceTracks

In the journey of optimizing employee records management, ResourceTracks stands out as a beacon of innovation. This ERP system provider is renowned for its seamless integration and cutting-edge features, setting the stage for a transformative HR experience.

To explore how ResourceTracks revolutionizes ERMS, click here, unlocking a realm where efficiency, compliance, and strategic decision-making converge seamlessly.

As organizations embrace the digital era, investing in a robust Employee Records Management System becomes a cornerstone for success. It's more than just a tool; it's a strategic ally that empowers businesses to harness the power of data, navigate complexities, and chart a course toward organizational excellence.

2 notes

·

View notes

Text

Beyond Diagnosis: How Healthcare Consulting Services Drive Change

When it comes to navigating the complex landscape of modern healthcare, organizations often turn to Healthcare Consulting Services for guidance and support. These services go beyond traditional medical interventions, offering strategic insights and actionable recommendations to drive meaningful change and improve outcomes. In this blog post, we'll explore the transformative impact of Healthcare Consulting Services, focusing on key areas such as Strategic Planning, Process Improvement, Financial Analysis, Regulatory Compliance, and Performance Metrics.

Strategic Planning is at the core of effective healthcare consulting. Consultants work closely with healthcare organizations to develop comprehensive strategic plans that align with their long-term goals and objectives. By identifying strengths, weaknesses, opportunities, and threats, consultants help organizations chart a clear path forward, enabling them to adapt to evolving market dynamics and stay ahead of the curve.

Process Improvement is another critical aspect of healthcare consulting services. Consultants analyze existing workflows and procedures, identifying inefficiencies and bottlenecks that may hinder productivity and patient care. Through the implementation of streamlined processes and best practices, consultants help organizations optimize workflow efficiency, reduce costs, and enhance overall operational performance.

Financial Analysis plays a pivotal role in healthcare consulting, helping organizations make informed decisions about resource allocation and financial management. Consultants conduct in-depth financial assessments, analyzing revenue streams, expenses, and profitability metrics. By identifying opportunities for cost savings and revenue growth, consultants empower organizations to achieve financial sustainability while maintaining high-quality patient care.

Regulatory Compliance is a top priority for healthcare organizations, with stringent regulations governing everything from patient privacy to billing practices. Healthcare consulting services provide expertise in navigating complex regulatory landscapes, ensuring organizations remain compliant with laws and regulations such as HIPAA, GDPR, and CMS guidelines. Consultants develop tailored compliance strategies and provide ongoing support to mitigate risks and uphold ethical standards.

Performance Metrics are essential for assessing the effectiveness of healthcare delivery and driving continuous improvement. Consultants help organizations establish key performance indicators (KPIs) and metrics to measure success across various areas, such as patient satisfaction, clinical outcomes, and operational efficiency. By tracking performance metrics and analyzing data trends, organizations can identify areas for improvement and implement targeted interventions to drive positive change.

In conclusion, Healthcare Consulting Services play a vital role in driving change and innovation within the healthcare industry. By offering expertise in areas such as Strategic Planning, Process Improvement, Financial Analysis, Regulatory Compliance, and Performance Metrics, consultants empower organizations to overcome challenges, seize opportunities, and deliver high-quality care to patients.

#Strategic Planning#Process Improvement#Financial Analysis#Regulatory Compliance#Performance Metrics

0 notes

Text

Unleashing the Power of Data Analytics & Reporting: A Guide to Enhanced Decision-Making

In today's fast-paced business landscape, data reigns supreme. Every click, purchase, and interaction generate a wealth of valuable information waiting to be analysed and utilized. The ability to harness this data effectively through analytics and reporting can make all the difference between thriving and merely surviving in the competitive marketplace.

The Role of Data Analytics & Reporting

Data analytics involves examining raw data to draw conclusions and insights, while reporting involves presenting these findings in a structured format to facilitate decision-making. Together, they provide businesses with the necessary tools to understand customer behaviour, optimize processes, and drive strategic initiatives.

Importance of Data Analytics:

1. Informed Decision-Making: By analysing past trends and patterns, businesses can make data-driven decisions rather than relying on intuition or guesswork.

2. Competitive Advantage: Companies that leverage data analytics gain a competitive edge by identifying opportunities for growth, improving efficiency, and mitigating risks.

3. Enhanced Customer Experience: Understanding customer preferences and behavior enables personalized marketing efforts, leading to higher customer satisfaction and loyalty.

Significance of Reporting:

1. Communication of Insights: Reports serve as a means to communicate key findings, trends, and metrics to stakeholders, facilitating understanding and alignment across the organization.

2. Performance Tracking: Regular reporting allows businesses to monitor performance against goals and objectives, enabling timely adjustments and course corrections.

3. Compliance and Accountability: Reporting plays a crucial role in meeting regulatory requirements, ensuring transparency, and holding individuals and departments accountable for their actions.

Leveraging Outsourcingwise Consulting's Training for Data Analytics & Reporting

In the realm of data analytics and reporting, staying abreast of the latest tools, techniques, and best practices is essential for success. This is where Outsourcingwise Consulting's training programs come into play, offering comprehensive courses designed to equip professionals with the skills needed to excel in this field.

Cutting-Edge Curriculum:

Outsourcingwise Consulting's training curriculum covers a wide range of topics, including:

- Data Collection and Preparation: Understanding data sources, cleaning, and transforming raw data into usable formats.

- Statistical Analysis: Applying statistical methods to uncover patterns, correlations, and trends within the data.

- Data Visualization: Communicating insights effectively through charts, graphs, and dashboards.

- Reporting Tools: Utilizing industry-leading reporting tools such as Tableau, Power BI, and Google Data Studio to create compelling reports.

- Advanced Analytics Techniques: Delving into predictive analytics, machine learning, and AI for more sophisticated analysis and forecasting.

Hands-On Learning:

One of the key features of Outsourcingwise Consulting's training programs is their emphasis on practical, hands-on learning. Participants could work on real-world projects, applying their newly acquired skills to solve actual business problems. This experiential learning approach ensures that participants are not just theory-smart but also equipped with the practical know-how to tackle challenges in the workplace.

Expert Guidance:

The trainers at Outsourcingwise Consulting are seasoned professionals with extensive experience in the field of data analytics and reporting. They bring their wealth of knowledge and expertise to the training sessions, providing valuable insights, tips, and guidance to participants. Whether you're a beginner looking to build a solid foundation or an experienced professional seeking to deepen your skills, the trainers at Outsourcingwise Consulting are committed to helping you achieve your goals.

Career Advancement Opportunities:

In today's job market, proficiency in data analytics and reporting is in high demand across industries. By completing Outsourcingwise Consulting's training programs, participants not only enhance their skill set but also position themselves for career advancement opportunities. Whether it's securing a promotion within their current organization or transitioning to a new role in a different industry, the skills acquired through Outsourcingwise Consulting's training can open doors to exciting career prospects.

Conclusion

In conclusion, data analytics and reporting play a pivotal role in driving informed decision-making, enhancing organizational performance, and gaining a competitive edge in the marketplace. By leveraging Outsourcingwise Consulting's training programs, professionals can acquire the skills and knowledge needed to excel in this dynamic and rapidly evolving field. Whether you're a business leader seeking to unlock the full potential of your data or an aspiring data analyst looking to kick-start your career, Outsourcingwise Consulting offers the expertise and resources to help you succeed. Embrace the power of data analytics and reporting today, and chart a course towards a brighter, more data-driven future.

#DataAnalyticsTraining#AnalyticsEducation#DataTraining#DataScienceEducation#AnalyticsWorkshops#DataLearning#DataSkills#AnalyticsCertification#DataProfessionals#DataDrivenDecisions#AnalyticsConsulting#DataInsights#DataStrategy#BigDataTraining#DataAnalyticsBootcamp#DataVisualization#MachineLearningTraining#BusinessAnalytics#DataProficiency#AnalyticsTutorials

2 notes

·

View notes

Text

Enhance Your Revenue Cycle with MAS LLP's AR Management Services

In today's dynamic business landscape, efficient management of accounts receivable (AR) is crucial for maintaining healthy cash flow and sustaining business growth. However, many organizations struggle with the complexities of AR processes, leading to cash flow bottlenecks, increased bad debt, and compromised financial stability. This is where MAS LLP steps in, offering comprehensive AR management services designed to optimize your revenue cycle and maximize collections. At MAS LLP, we understand the challenges businesses face in managing their AR effectively. Our dedicated team of professionals leverages industry expertise, advanced technology, and proven strategies to streamline your AR operations and accelerate cash flow. Here's how our AR management services can benefit your organization:

Improved Cash Flow: Timely invoicing, proactive follow-up, and efficient collection strategies are the cornerstones of our AR management approach. By optimizing these processes, we help you minimize payment delays and accelerate cash inflows, providing your business with the liquidity needed to fuel growth and innovation. Reduced Bad Debt: Unpaid invoices and delinquent accounts can have a significant impact on your bottom line. With MAS LLP's AR management services, you can minimize bad debt exposure through diligent credit risk assessment, early intervention, and strategic debt recovery efforts, safeguarding your financial health and profitability. Enhanced Customer Relationships: Effective AR management isn't just about collecting payments; it's also about nurturing positive relationships with your customers. Our team adopts a customer-centric approach, balancing firmness with professionalism to ensure that collections efforts preserve goodwill and loyalty, fostering long-term partnerships and customer satisfaction. Streamlined Processes: Manual AR processes are prone to errors, delays, and inefficiencies, leading to operational bottlenecks and increased administrative costs. MAS LLP automates and streamlines your AR workflows, leveraging cutting-edge technology and best practices to minimize human intervention, improve accuracy, and boost productivity. Compliance and Risk Mitigation: Regulatory requirements and industry standards governing AR practices are constantly evolving. MAS LLP stays abreast of these changes, ensuring that your AR processes remain compliant and aligned with best practices, thereby minimizing legal and regulatory risks associated with non-compliance. Actionable Insights: Informed decision-making is key to optimizing your AR performance. MAS LLP provides actionable insights and analytics, offering visibility into key AR metrics, trends, and performance indicators. This empowers you to identify areas for improvement, refine your strategies, and drive continuous process optimization. Scalability and Flexibility: Whether you're a small business or a large enterprise, MAS LLP's AR management services are scalable and adaptable to your evolving needs. We tailor our solutions to suit your unique requirements, providing the flexibility to adjust service levels, accommodate growth, and navigate fluctuations in demand seamlessly. Partner with MAS LLP to unlock the full potential of your accounts receivable function and transform it into a strategic asset for your business. With our comprehensive AR management services, you can optimize your revenue cycle, enhance financial stability, and unlock new opportunities for growth and success. Contact us today to learn more about how we can support your AR needs and drive lasting value for your organization.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#AR management services

3 notes

·

View notes

Text

Description of the Position of Financial Management Officer

Financial management officers play a crucial role in organizations, ensuring effective financial planning, monitoring, and decision-making. These professionals possess a unique set of skills that allow them to navigate complex financial landscapes and contribute to the overall success of businesses. In this article, we will delve into the job description of a financial management officer, shedding light on their responsibilities, qualifications, and the impact they have on an organization's financial health.

Defining the Responsibilities

Financial management officers are responsible for overseeing an organization's financial operations, from budgeting and forecasting to financial analysis and reporting. They collaborate with various departments and stakeholders to develop and execute financial strategies, ensuring optimal utilization of resources and compliance with relevant regulations.

One of the key responsibilities of a financial management officer is to create and manage budgets. They analyze financial data, identify trends, and forecast future financial performance, providing valuable insights to aid in decision-making. By developing realistic budgets and financial projections, they help organizations achieve their short-term and long-term goals.

Essential Skills and Qualifications

Financial management officers must possess a deep understanding of accounting principles, financial analysis techniques, and risk management strategies. Proficiency in financial modeling and advanced Excel skills are essential to perform complex financial analyses and create accurate reports.

These professionals need strong interpersonal skills to effectively communicate complex financial information to both financial and non-financial stakeholders. Collaborating with cross-functional teams and building relationships with internal and external partners are crucial for successful financial management.

Financial management officers must have sharp analytical skills to interpret financial data, identify trends, and generate actionable insights. They should be capable of conducting scenario analyses, assessing risks, and recommending strategies to optimize financial performance.

The Impact of Financial Management Officers

By providing accurate and timely financial information, financial management officers enable informed decision-making at all levels of the organization. They assist executives in evaluating investment opportunities, assessing profitability, and mitigating financial risks, ultimately contributing to strategic planning and growth.

Financial management officers ensure compliance with legal and regulatory requirements by monitoring financial transactions, preparing financial statements, and conducting internal audits. They develop and implement risk management policies and procedures to safeguard the organization's financial assets and maintain its reputation.

Financial management officers play a vital role in evaluating and improving the financial performance of an organization. They analyze financial metrics, compare performance against benchmarks, and recommend strategies for optimizing profitability, cost efficiency, and resource allocation.

Career Path and Growth Opportunities

Financial management officers can enhance their skills and knowledge through continuous professional development. Pursuing certifications such as Certified Public Accountant (CPA), Certified Management Accountant (CMA), or Chartered Financial Analyst (CFA) can boost career prospects and open doors to senior leadership roles.

With experience and expertise, financial management officers can progress to leadership positions such as Chief Financial Officer (CFO) or Finance Director. In these roles, they oversee the entire financial function of an organization, guiding strategic decisions and driving financial success.

Financial management officers play a critical role in maintaining the financial health of organizations. Their responsibilities span budgeting, forecasting, financial analysis, and compliance, all of which contribute to informed decision-making and strategic planning. By leveraging their financial acumen and collaborating with stakeholders, these professionals ensure optimal resource allocation, risk management, and performance evaluation. Aspiring financial management officers can pursue continuous professional development to unlock rewarding career opportunities in leadership positions.

2 notes

·

View notes

Text

Obstacles Confronting the Private Equity Sector

Laws and regulations have undergone significant changes, impacting how a private equity (PE) professional can meet clients’ demands for reliable investment and exit strategies. In recent years, amid geopolitical and financial upheavals, PE advisors have faced recessionary threats. This post will delve into the main obstacles the private equity sector will encounter in 2024.

An Overview of the Private Equity Sector

The PE sector centers on investing in private companies. Additionally, private equity researchers facilitate buyouts of public companies, transitioning them to private ownership. Regulatory requirements render private equity investments complex, yet PE firms remain in demand due to their long-term positive outlook.

Services Provided by Private Equity Experts

High-net-worth individuals (HNWIs) and institutional investors frequently utilize investment banking services for wealth management and privatization goals. Meanwhile, PE professionals assist them in several ways:

1| Long-Term Investment Guidance

PE investments extend over several years. Consequently, private equity firms can enhance the value of acquired companies through strategic management. Their innovative interventions go beyond operational improvements and financial restructuring, including data-driven market expansion, product development, and talent acquisition.

2| Active Capital Management

PE firms adopt a hands-on approach to portfolio management, differentiating themselves from passive investors. They employ experienced financial professionals and collaborate with tech consultants to optimize performance. Their active capital management methods attract investors seeking higher returns. The expertise of PE specialists provides reassurance and confidence in the investment.

3| Leverage

Private equity transactions frequently involve substantial borrowing to finance acquisitions, using the acquired company’s assets as collateral. This leverage can enhance returns but also increases risk. Consequently, stakeholders perceive private equity deals as high-stakes endeavors.

4| Exit Strategies

Initial public offerings (IPOs) allow PE firms to exit investments. Alternatively, selling to strategic buyers is common. They also conduct secondary sales to other private equity firms. These exit strategies can yield substantial returns for investors.

Primary Obstacles in the Private Equity Sector

1| Managing Inflation and Interest Rate Pressures

Global inflation and tighter monetary policies necessitate careful management of private market portfolios. Therefore, limited partners (LPs) must leverage the best tools and talents to assess the impact of these macroeconomic pressures on their portfolios.

LPs need to monitor margin erosion, cash flow generation, and debt covenants. They can reassess which portfolio companies will thrive despite inflation or interest rate pressures.

For example, an organization that leads its market or excels in maintaining strong customer and supplier relationships will likely outperform others. However, LPs and private equity professionals must evaluate whether it has contractual pricing with minimal exposure to input price volatility. These traits boost a company’s resilience to macroeconomic forces.

Similarly, portfolio companies with high cash conversion ratios or conservative capital structures will be more rewarding. Businesses with flexible terms are expected to thrive in challenging market conditions.

Conversely, companies lacking these attributes will likely face significant challenges in the private equity sector. Therefore, stakeholders must pay closer attention to them.

2| Data Availability and Validation Issues

Private equity stakeholders require accurate data on an enterprise’s corporate performance, legal compliance, and sustainability commitments. Public information sources may not provide sufficient insights into target businesses' core metrics and risk-reward dynamics. Premium data providers might also employ data-driven profiling and recommendation reporting.

Insufficient information and poor data quality hinder PE stakeholders' portfolio improvement efforts. They must navigate markets using well-validated intelligence rather than biased information from public platforms. Malicious actors can falsify claims about a brand’s performance due to undisclosed interests.

Therefore, ensuring data quality to develop the best portfolio strategies remains a significant challenge, underscoring the need for ethical, transparent, and tech-savvy PE experts.

3| Employee Retention Challenges

Retaining top talent is crucial for PE firms to succeed in the private equity sector. Therefore, private equity managers and researchers must foster a healthy workplace culture that allows professionals to grow based on performance metrics. They must also offer competitive compensation packages and retention bonuses.

Collaborating with consultants to create guidelines and training programs can support your core team. Additionally, utilizing automation and third-party assistance can reduce the workload on employees. If PE firms neglect their employees' interests, staff may leave or underperform. Miscommunication between leaders and team members can exacerbate this issue, leading to high employee turnover.

4| Increasing Competition Amidst Fewer New Businesses

Private equity firms have grown by 58% between 2016 and 2021. However, new company registrations often include more startups, with few qualifying to raise funds through PE-supported pathways. While PE research providers have increased, established companies and investors must select the best ones.

As a result, firms and financial professionals have developed strategies to overcome competition-related obstacles in the private equity sector. They offer multiple buyout methods and leverage fintech scalability. They have also enhanced risk-reward modeling and data sourcing to meet clients’ expectations, particularly regarding legal compliance requirements.

However, processing a deal may not always proceed as initially envisioned. Although company owners, limited partners, and interested investors witness new deals, only a fraction reach completion. Therefore, PE businesses seeking a competitive edge must expedite screening, feasibility reporting, and data gathering with modern technologies. This approach is essential for private equity stakeholders to identify the right deals with long-term benefits.

Conclusion

The private equity sector must navigate macroeconomic risks such as inflation, tight monetary policies, and data quality issues. Embracing innovative fintech systems and engaging domain experts to optimize internal processes can help. If each PE firm enhances its operations, it will succeed despite public companies and strategic buyers adopting buy-to-sell principles for business acquisitions.

Competition from fellow PE firms for a relatively stable number of viable businesses seeking investors has prompted a more dynamic and risk-taking approach. Amid these obstacles facing the private equity sector in 2024, firms must prioritize talent acquisition and employee retention. Additionally, limited partners must continually revisit, expand, and optimize their portfolios as global events continue to impact PE deals.

3 notes

·

View notes